Form POS AM Butterfly Network, Inc.

Exhibit 4.2

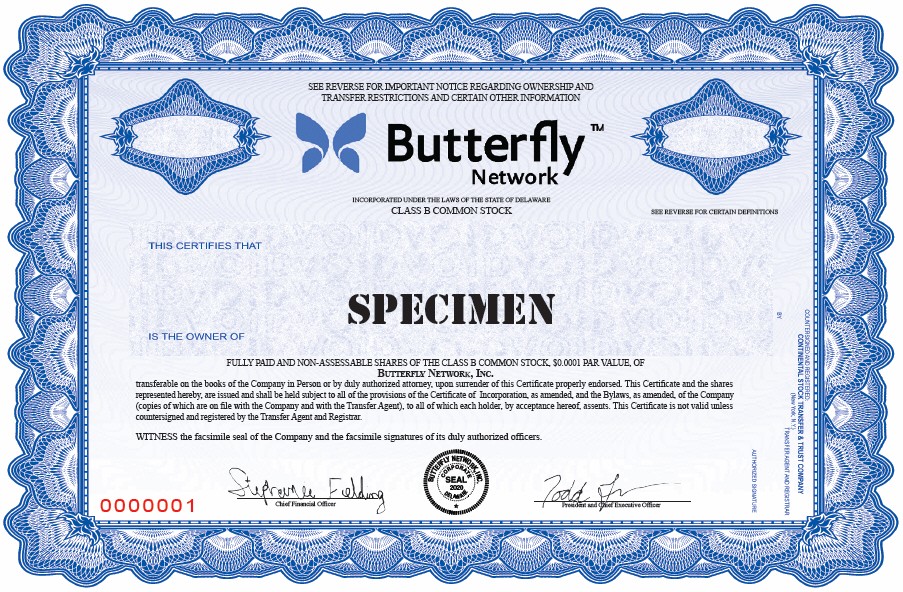

| SEE REVERSE FOR IMPORTANT NOTICE REGARDING OWNERSHIP AND TRANSFER RESTRICTIONS AND CERTAIN OTHER INFORMATION INCORPORATED UNDER THE LAWS OF THE STATE OF DELAWARE CLASS B COMMON STOCK SEE REVERSE FOR CERTAIN DEFINITIONS SPECIMEN FULLY PAID AND NON-ASSESSABLE SHARES OF THE CLASS B COMMON STOCK, $0.0001 PAR VALUE, OF Butterfly Network, INc. transferable on the books of the Company in Person or by duly authorized attorney, upon surrender of this Certificate properly endorsed. This Certificate and the shares represented hereby, are issued and shall be held subject to all of the provisions of the Certificate of Incorporation, as amended, and the Bylaws, as amended, of the Company (copies of which are on file with the Company and with the Transfer Agent), to all of which each holder, by acceptance hereof, assents. This Certificate is not valid unless countersigned and registered by the Transfer Agent and Registrar. WITNESS the facsimile seal of the Company and the facsimile signatures of its duly authorized officers. 2020 0000001 Chief Financial Officer President and Chief Executive Officer . |

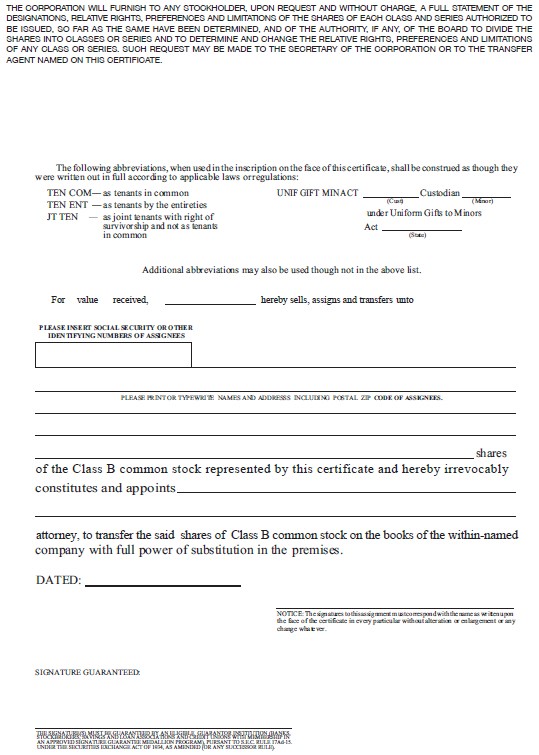

| THE CORPORATION WILL FURNISH TO ANY STOCKHOLDER, UPON REQUEST AND WITHOUT CHARGE, A FULL STATEMENT OF THE DESIGNATIONS, RELATIVE RIGHTS, PREFERENCES AND LIMITATIONS OF THE SHARES OF EACH CLASS AND SERIES AUTHORIZED TO BE ISSUED, SO FAR AS THE SAME HAVE BEEN DETERMINED, AND OF THE AUTHORITY, IF ANY, OF THE BOARD TO DIVIDE THE SHARES INTO CLASSES OR SERIES AND TO DETERMINE AND CHANGE THE RELATIVE RIGHTS, PREFERENCES AND LIMITATIONS OF ANY CLASS OR SERIES. SUCH REQUEST MAY BE MADE TO THE SECRETARY OF THE CORPORATION OR TO THE TRANSFER AGENT NAMED ON THIS CERTIFICATE. T# !*''*1$)" abb, 0$a.$*)-, 1# ) /-d $) .# $)-c,$+.$*) *) .# !ac *! .#$-c ,.$!$ca. , -#a'' b c*)-.,/ d a-.#*/"# .# 2 1 , 1,$.. ) */. $) !/'' acc*,d$)" .* a++'$cab' 'a1-*, , "/'a.$*)-: UNIF GIFT M IN ACT C/-.*d$a) TEN COM 3 a-. )a).-$) c*((*) TEN ENT 3 a-. )a).-b2 .# ).$, .$ - (C/-.) (M$)*,) /)d , U)$!*,( G$!.-. * M$)*,-Ac. JT TEN 3 a-%*$). . )a).-1$.# ,$"#. *! -/,0$0*,-#$+ a)d )*. a-. )a).-$) c*((*) (S.a. ) Add$.$*)a' abb, 0$a.$*)-(a2 a'-* b /-d .#*/"# )*. $) .# ab*0 '$-. . Forvalue received, hereby sells, assigns and transfers unto PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBERS O F ASSIGNEES PLEASE PRINT OR TYPEWRITE NAMES AND ADDRESSS INCLUDING POSTAL ZIP CODE OF ASSIGNEES. -#a, - of the Class B common stock represented by this certificate and he reby irrevocably c*)-.$./. - a)d a++*$).-attorney, to transfer the said shares of Class B common stock on the books of the within-named c*(+a)2 1$.# !/'' +*1 , *! -/b-.$./.$*) $) .# +, ($--. DATED: NOTICE: T# -$")a./, - .* .#$-a--$")( ). (/-. c*,, -+*)d 1$.# .# )a( a-1,$.. ) /+*) .# !ac *! .# c ,.$!$ca. $) 0 ,2 +a,.$c/'a, 1$.#*/. a'. ,a.$*) *, )'a," ( ). *, a)2 c#a)" 1#a . 0 ,. SIGNATURE GUARANTEED: THE SIGNATURE(S) MUST BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (BANKS, STOCKBROKERS, SAVINGS AND LOAN ASSOCIATIONS AND CREDIT UNIONS WITH MEMBERSHIP IN AN APPROVED SIGNATURE GUARANTEE MEDALLION PROGRAM), PURSANT TO S.E.C. RULE 17Ad-15. UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED (OR ANY SUCCESSOR RULE). |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the use in this Registration Statement No. 333-254836 on Form S-1 of our reports dated February 28, 2022, relating to the financial statements of Butterfly Network, Inc. and the effectiveness of Butterfly Network, Inc.’s internal control over financial reporting. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/Deloitte & Touche LLP

New York, New York

April 19, 2022

Exhibit 107

Calculation of Filing Fee Table

Form S-1

(Form Type)

Butterfly Network, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| ||||||||||||||||

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee | ||||||||

Fees Previously Paid | Equity | | Class A common stock, par value $0.0001 per share | | 457(c) | | 128,740,887(2) | | $11.55 – $18.77(3) | | $2,400,042,060.87(3) | | $0.0001091 | | $261,844.59 | |

Fees Previously Paid | Equity | | Class B common stock, par value $0.0001 per share | | 457(i) | | 26,426,937(4) | | — | | — | | — | | — (5) | |

Fees Previously Paid | Equity | | Warrant to purchase Class A common stock | | 457(i) | | 6,853,333(6) | | — | | — | | — | | — (7) | |

Total Fees Previously Paid | | | | | | | | $261,844.59(8) | ||||||||

Total Fee Offsets | — | |||||||||||||||

Net Fee Due | $0.00 | |||||||||||||||

(1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), Butterfly Network, Inc. (the “Registrant”) is also registering an indeterminate number of additional shares of Class A common stock, par value $0.0001 per share, of the Registrant (“Class A common stock”) and Class B common stock, par value $0.0001 per share, of the Registrant (“Class B common stock”) that may become issuable as a result of any stock dividend, stock split, recapitalization or other similar transaction. |

(2) | Consists of (i) 114,940,887 shares of Class A common stock registered for sale by the selling securityholders named in this registration statement (the “Selling Securityholders”) (including the shares referred to in the following clause (ii)), (ii) 6,853,333 shares of Class A common stock issuable upon the exercise of 6,853,333 Private Placement Warrants (as defined in this registration statement), and (iii) 13,800,000 shares of Class A common stock issuable upon the exercise of 13,800,000 Public Warrants (as defined in this registration statement). |

(3) | Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price is calculated as the product of (x)(i) 2,274,846 shares of Class A common stock |

and (ii) $11.55, which is the average of the high and low prices of the Class A common stock on May 10, 2021 on the New York Stock Exchange (the “NYSE”) (such date being within five business days prior to the date that pre-effective amendment no. 1 to this registration statement was filed with the Securities and Exchange Commission (the “SEC”) on May 12, 2021) plus (y)(i) 126,466,041 shares of Class A common stock and (ii) $18.77, which is the average of the high and low prices of the Class A common stock on March 24, 2021 on the NYSE (such date being within five business days prior to the date that the original registration statement was filed with the SEC on March 29, 2021).

(4) | Represents the potential resale of 26,426,937 shares of Class B common stock held by the Selling Securityholders, which are convertible into 26,426,937 shares of Class A common stock. |

(5) | In accordance with Rule 457(i), the entire registration fee for the Class B common stock is allocated to the shares of Class A common stock into which the Class B common stock are convertible, and no separate fee is payable for the Class B common stock. |

(6) | Represents the potential resale of 6,853,333 Private Placement Warrants held by the Selling Securityholders, which represent warrants to acquire 6,853,333 shares of Class A common stock. |

(7) | In accordance with Rule 457(i), the entire registration fee for the Private Placement Warrants is allocated to the shares of Class A common stock underlying such warrants, and no separate fee is payable for the Private Placement Warrants. |

(8) | On March 29, 2021, the Registrant paid $258,978.04 in connection with the original registration statement relating to the total proposed maximum offering price of $2,373,767,589.57. An additional registration fee of $2,866.55 was previously paid with respect to the additional 2,274,846 shares of Class A common stock listed in the calculation of the registration fee table for amendment no. 1 to the registration statement filed by the Registrant on May 12, 2021. |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ThinkSono Releases Real-Time DVT AI Training Solution for Butterfly Network's Handheld Ultrasound Devices

- Wondra: Reshaping the Future Blueprint of Metaverse 2.0

- Beyond Oil Announces Voting Results of Annual and Special Meeting of Shareholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share