Form 8-K Brookdale Senior Living For: Nov 04

Exhibit 99.1

Brookdale Announces Third Quarter 2020 Results

Nashville, Tenn., Nov 4, 2020 - Brookdale Senior Living Inc. (NYSE: BKD) ("Brookdale" or the "Company") announced results for the quarter ended September 30, 2020.

THIRD QUARTER 2020 HIGHLIGHTS

•During the quarter, the Company completed a lease restructuring transaction with Ventas, Inc. ("Ventas") and reduced its expected aggregate cash rent by approximately $500 million over the remaining, unchanged initial lease term ending December 31, 2025.

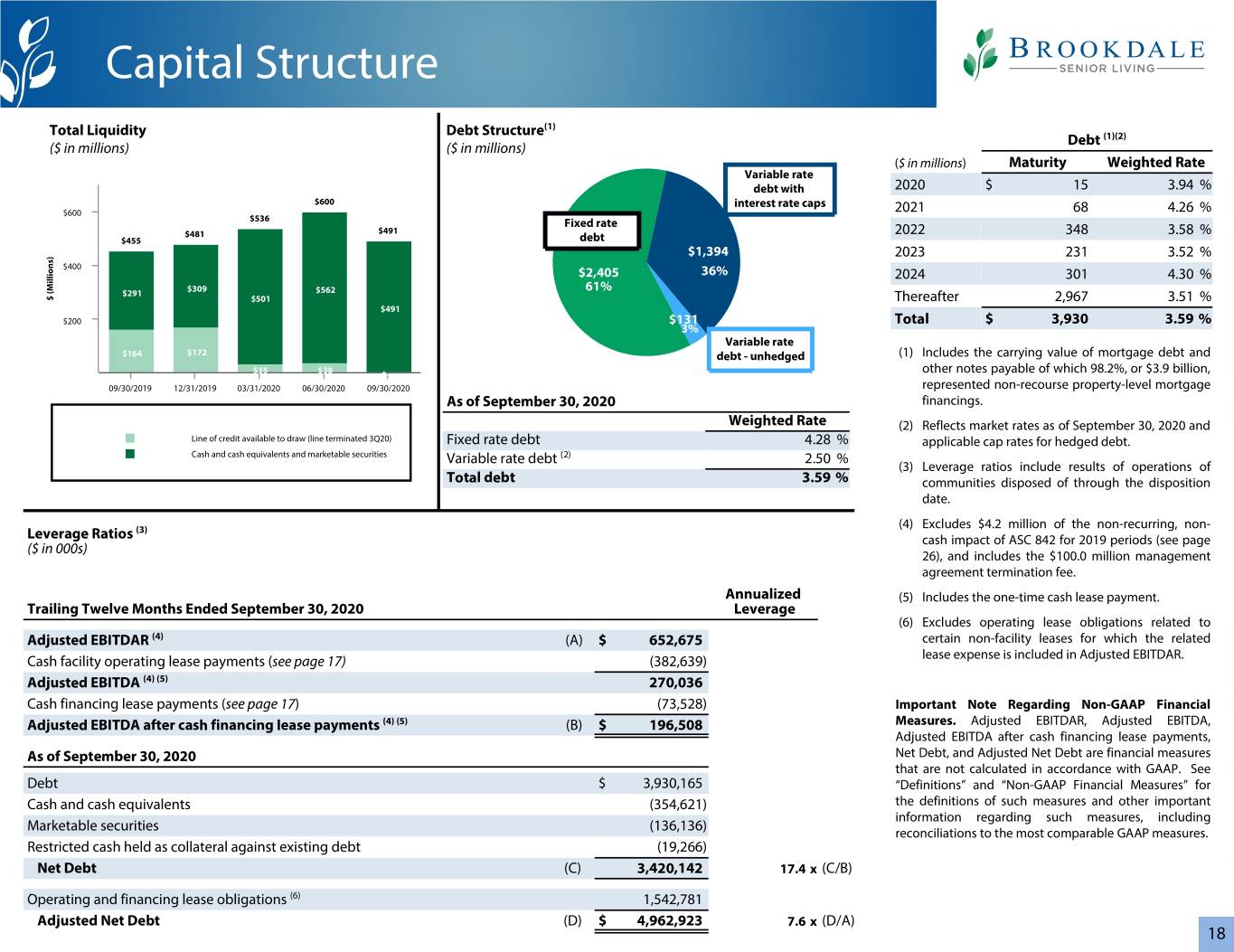

•Liquidity was $491 million at September 30, 2020, and the Company completed two refinancing transactions during the quarter resulting in no significant debt maturities until 2022.

•95% of the Company’s communities are open for move-ins on October 31, 2020, reflecting the Company’s strong infection control protocols and focus on testing.

•Same community RevPOR increased sequentially by 60 basis points.

Lucinda ("Cindy") Baier, Brookdale’s President and CEO, said, "During the third quarter, we built upon our prior successful efforts to effectively navigate through the pandemic with operational improvements and transactions to strengthen our financial position. We’ve been an agile, learning organization and continue our efforts to innovate for our residents’ enjoyment and to welcome more seniors into our communities. On October 31, 2020, 95% of our communities were open to move-ins and approximately 1% of our residents had current COVID-19 positive test results. During the quarter, we completed the most significant lease improvement in our history as well as two important refinancing transactions. We have no large debt maturities until 2022. We have been focused on both mission and margin and I am very proud of our associates’ dedication to the health and well-being of our residents, patients and each other."

SUMMARY OF THIRD QUARTER RESULTS

Consolidated

The table below presents a summary of consolidated operating results.

| Year-Over-Year Increase / (Decrease) | Change Attributable To: | ||||||||||||||||||||||||||||

| ($ in millions) | 3Q 2020 | 3Q 2019 | Amount | Percent | COVID-19 | Transactions | Lease Standard | ||||||||||||||||||||||

Resident fee revenue | $ | 700.8 | $ | 801.2 | $ | (100.4) | (12.5) | % | See note (1) | $ | (20.0) | $ | (8.0) | ||||||||||||||||

| Management fee revenue | $ | 5.7 | $ | 13.6 | $ | (7.9) | (58.1) | % | — | $ | (7.1) | — | |||||||||||||||||

| Other operating income | $ | 10.8 | — | $ | 10.8 | NM | $ | 10.8 | — | — | |||||||||||||||||||

| Facility operating expense | $ | 570.5 | $ | 615.7 | $ | (45.2) | (7.3) | % | $ | 24.5 | $ | (19.3) | $ | (14.0) | |||||||||||||||

| General and administrative expense | $ | 54.1 | $ | 56.4 | $ | (2.3) | (4.1) | % | — | — | — | ||||||||||||||||||

| Net income (loss) | $ | (125.0) | $ | (78.5) | $ | 46.5 | 59.2 | % | See note (1) | See note (1) | $ | 6.0 | (1) | ||||||||||||||||

Adjusted EBITDA (2) | $ | (64.0) | $ | 80.4 | $ | (144.4) | NM | See note (1) | $ | (102.1) | $ | 6.0 | |||||||||||||||||

| One-time cash lease payment | $ | 119.2 | $ | — | $ | 119.2 | NM | — | $ | 119.2 | $ | — | |||||||||||||||||

| Adjusted EBITDA, excluding one-time cash lease payment | $ | 55.2 | $ | 80.4 | $ | (25.2) | (31.3) | % | See note (1) | $ | 17.1 | $ | 6.0 | ||||||||||||||||

(1) Estimated lost resident fee revenue attributable to COVID-19 was $91.6 million for the third quarter of 2020. The change in net income (loss) attributable to COVID-19 and transactions and the change in Adjusted EBITDA attributable to COVID-19 are not presented as certain impacts are not available without unreasonable effort. The change attributable to the lease standard represents the 2019 impact of the timing of the revenue and cost recognition associated with residency agreements related to the adoption of ASC 842.

(2) Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. See "Reconciliations of Non-GAAP Financial Measures" for the Company's definition of such measure, reconciliations to the most comparable GAAP financial measures, and other important information regarding the use of the Company's non-GAAP financial measures. Unless otherwise indicated, Adjusted EBITDA for the third quarter of 2020 includes the $119.2 million one-time cash lease payment made to Ventas in connection with the Company’s lease restructuring transaction effective July 26, 2020 ("one-time cash lease payment").

Page 1

•Resident fee revenue.

•Excluding the impact of transactions and the lease accounting standard, consolidated resident fee revenue decreased 9.4% over the prior year quarter.

•Consolidated RevPAR decreased $303, or 7.4%, to $3,806 compared to the prior year third quarter as a result of a decrease in consolidated weighted average occupancy of 890 basis points, offset by an increase in consolidated RevPOR of $176, or 3.6%, to $5,056.

•Consolidated senior housing occupancy was 75.0% as of September 30, 2020 compared to 77.8% as of June 30, 2020. The Company estimates that the COVID-19 pandemic resulted in $76.5 million and $15.1 million of lost resident fee revenue for its consolidated senior housing and Health Care Services segments, respectively, for the third quarter of 2020, based on its pre-COVID-19 expectations.

•The implementation of the Patient-Driven Grouping Model ("PDGM") resulted in an additional decrease to revenue for home health services.

•Management fee revenue. The decrease was primarily due to the transition of management arrangements on 64 net communities since July 1, 2019, generally for management arrangements on certain former unconsolidated ventures in which the Company sold its interest and interim management arrangements on formerly leased communities.

•Other operating income.

•During the second quarter and third quarter of 2020, the Company accepted $33.5 million and $2.6 million, respectively, of cash for grants from the Public Health and Social Services Emergency Fund administered by the U.S. Department of Health & Human Services (the "Provider Relief Fund"). The grants are subject to the terms and conditions of the program, including that such funds may only be used to prevent, prepare for, and respond to COVID-19 and will reimburse only for healthcare related expenses or lost revenues that are attributable to COVID-19.

•The Company recognized $8.6 million of grants from the Provider Relief Fund and $2.2 million from other government grants as other operating income during the third quarter of 2020.

•Facility operating expense.

•Excluding the impact of transactions, the lease accounting standard, and incremental direct COVID-19 costs, facility operating expense decreased $36.4 million, or 6.3%, primarily due to decreases in certain costs as the Company intentionally scaled back certain activities in response to the COVID-19 pandemic and a decrease in labor costs for home health services as a result of the lower census and as the Company adjusted its home health services operational structure, to better align its facility operating expenses and business model with the new payment model. The decreases were partially offset by the impact of wage rate increases on labor expenses.

•The Company incurred $24.5 million of incremental direct costs during the third quarter of 2020 to address the COVID-19 pandemic, including costs for: acquisition of personal protective equipment ("PPE"), medical equipment, and cleaning and disposable food service supplies, enhanced cleaning and environmental sanitation, increased labor, increased workers compensation and health plan expense, consulting and professional services, and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources.

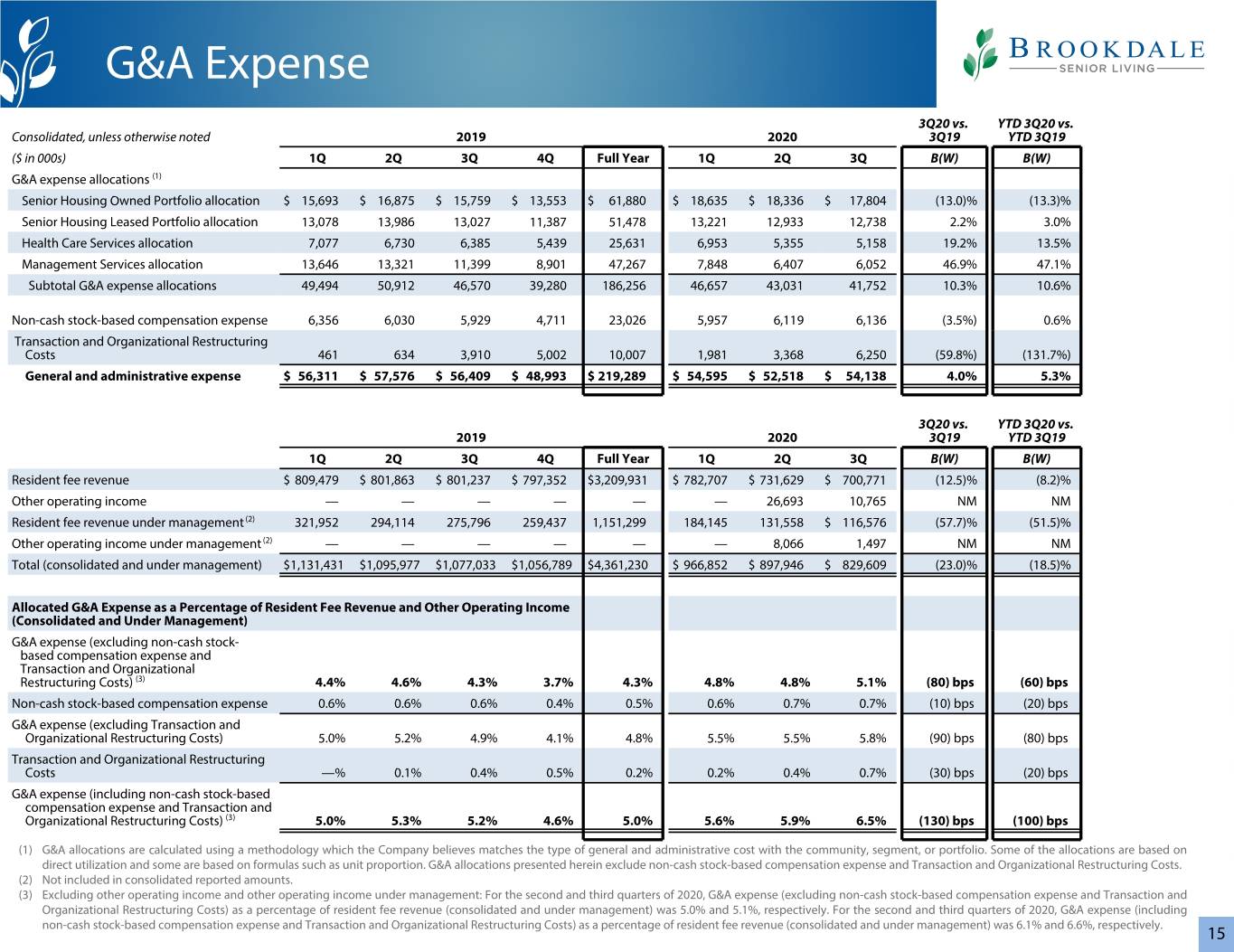

•General and administrative expense. The decrease in general and administrative expense was primarily attributable to a reduction in the Company's travel costs as it intentionally scaled back such activities and a reduction in the Company's corporate headcount, as it scaled its general and administrative costs in connection with community dispositions. The decrease was partially offset by a $2.3 million increase in transaction and organizational restructuring costs compared to the prior year quarter.

•Net income (loss). The decrease in net income (loss) compared to the prior year quarter was primarily attributable to the revenue and facility operating expense factors previously discussed.

•Adjusted EBITDA. The decrease in Adjusted EBITDA compared to the prior year quarter was primarily attributable to the $119.2 million one-time cash lease payment, as well as the revenue and facility operating expense factors previously discussed.

•COVID-19 Impact.

•The Company has adopted a framework for determining when to ease restrictions at each of its communities based on several criteria, including regulatory requirements and guidance, completion of baseline testing at the community, and the community having no current confirmed positive COVID-19 cases. Under this framework, the Company began easing restrictions on a community-by-community basis in July 2020 where regulatory requirements and guidance allow, which easing may have included permitting outdoor, and in some cases, indoor visits with families, reduced capacity communal dining, and limited communal activities programming. During the third quarter of 2020, the Company also returned to using in-person prospective resident visits for a majority of its communities. However, several large markets continue with virtual-only prospective resident visits. Approximately

Page 2

98% of the Company's communities were accepting new residents by the end of September 2020 compared to 86% of its communities as of June 30, 2020.

•In July 2020, the Company completed proactive baseline testing of residents and associates at all of its communities. Through October 31, 2020, the Company's testing program has accumulated over 185,000 test results. Approximately 1% of the Company’s residents on October 31, 2020 are currently confirmed positive for COVID-19.

•The number of move-ins increased as the third quarter of 2020 progressed, lessening the decline in occupancy in sequential months. The year-over-year decrease in monthly move-ins of the Company's same community portfolio has moderated from 64.2% in April 2020 to 22.9% in September 2020, and move-ins for the third quarter of 2020 improved 38.0% sequentially from the second quarter of 2020. Despite the improvement in move-ins, the Company's same community weighted average occupancy has declined in each month of the pandemic, from 83.0% in March 2020 to 74.4% in September 2020, and was 74.0% in October 2020.

•The Company's home health average daily census increased sequentially from the second quarter of 2020 after decreasing in March and April 2020 due to lower occupancy in its communities and fewer elective medical procedures and hospital discharges, resulting in a 14.4% year-over-year decline in home health average daily census for the third quarter of 2020.

Same Community Senior Housing (Independent Living (IL), Assisted Living and Memory Care (AL/MC), and CCRCs)

The table below presents a summary of same community operating results and metrics of the Company's consolidated senior housing portfolio.(3)

| Year-Over-Year Increase / (Decrease) | Sequential Increase / (Decrease) | ||||||||||||||||||||||

| ($ in millions, except RevPAR and RevPOR) | 3Q 2020 | 3Q 2019 | Amount | Percent | 2Q 2020 | Amount | Percent | ||||||||||||||||

| RevPAR | $ | 3,821 | $ | 4,141 | $ | (320) | (7.7)% | $ | 3,979 | $ | (158) | (4.0)% | |||||||||||

| Weighted average occupancy | 75.6 | % | 84.8 | % | (920) | bps | n/a | 79.1 | % | (350) | bps | n/a | |||||||||||

| RevPOR | $ | 5,057 | $ | 4,885 | $ | 172 | 3.5% | $ | 5,028 | $ | 29 | 0.6% | |||||||||||

| Facility operating expense | $ | 435.1 | $ | 434.0 | $ | 1.1 | 0.3% | $ | 462.0 | $ | (26.9) | (5.8)% | |||||||||||

(3) The same community portfolio includes operating results and data for 631 communities utilizing the Company's methodology for determining same store communities, which excludes communities acquired or disposed of since the beginning of the prior year, communities classified as assets held for sale, certain communities planned for disposition, certain communities that have undergone or are undergoing expansion, redevelopment, and repositioning projects, certain communities that have expansion, redevelopment, and repositioning projects that are anticipated to be under construction in the current year, and certain communities that have experienced a casualty event that significantly impacts their operations. To aid in comparability, same community operating results and data exclude (i) hurricane and other natural disaster expense of $2.3 million, $0.2 million, and $1.2 million for the third and second quarters of 2020 and third quarter of 2019, respectively, and (ii) for the 2019 period the additional resident fee revenue and facility operating expense recognized as a result of the application of the lease accounting standard ASC 842 of approximately $7.3 million and $12.8 million, respectively. As presented herein, same community facility operating expense includes the direct costs incurred to respond to the COVID-19 pandemic.

•Resident fees. Same community resident fees decreased $47.4 million to $565.9 million attributable to the decrease in occupancy, partially offset by the increase in RevPOR.

•Facility operating expense.

•The year-over-year increase was primarily due to $20.4 million of incremental direct costs incurred during the third quarter of 2020 to respond to the COVID-19 pandemic.

•The increase in same community facility operating expense compared to the prior year quarter was partially offset by decreases in repairs and maintenance costs and food and supplies costs due to the reduced occupancy during the period.

Health Care Services

| Increase / (Decrease) | ||||||||||||||

| ($ in millions) | 3Q 2020 | 3Q 2019 | Amount | Percent | ||||||||||

| Resident fee revenue | $ | 89.9 | $ | 111.8 | $ | (21.9) | (19.6) | % | ||||||

| Other operating income | 5.9 | — | 5.9 | NM | ||||||||||

| Facility operating expense | 94.3 | 107.0 | (12.7) | (11.9) | % | |||||||||

Page 3

•Resident fee revenue.

•Health Care Services revenue decreased primarily due to the decline in the Company's home health average daily census as a result of lower occupancy in the Company's communities and fewer elective medical procedures and hospital discharges.

•The implementation of the PDGM, an alternate home health case mix adjustment methodology with a 30-day unit of payment, beginning January 1, 2020, also resulted in a decrease in revenue for home health services.

•Facility operating expense.

•The year-over-year decrease in facility operating expense was primarily attributable to a decrease in labor costs for home health services as a result of the lower census and as the Company adjusted its home health services operational structure, to better align its facility operating expenses and business model with the new payment model.

•The decrease in facility operating expenses was partially offset by $2.4 million of incremental direct costs to respond to the COVID-19 pandemic incurred during the third quarter of 2020.

LIQUIDITY

The table below presents a summary of the Company’s net cash provided by (used in) operating activities, Adjusted Free Cash Flow, and liquidity.

| Increase / (Decrease) | ||||||||||||||

| ($ in millions) | 3Q 2020 | 3Q 2019 | Amount | Percent | ||||||||||

| Net cash provided by (used in) operating activities | $ | (77.2) | $ | 69.2 | $ | (146.4) | NM | |||||||

Adjusted Free Cash Flow (4) | (114.3) | (13.6) | (100.7) | NM | ||||||||||

| Increase / (Decrease) | ||||||||||||||

| ($ in millions) | September 30, 2020 | June 30, 2020 | Amount | Percent | ||||||||||

| Unrestricted cash and cash equivalents | $ | 354.6 | $ | 452.4 | $ | (97.8) | (21.6) | % | ||||||

| Marketable securities | 136.1 | 109.9 | 26.2 | 23.8 | % | |||||||||

| Availability on secured credit facility | — | 37.9 | (37.9) | NM | ||||||||||

| Total Liquidity | $ | 490.7 | $ | 600.2 | $ | (109.5) | (18.2) | % | ||||||

(4) Adjusted Free Cash Flow is a financial measure that is not calculated in accordance with GAAP. See "Reconciliations of Non-GAAP Financial Measures" for the Company's definition of such measure, reconciliations to the most comparable GAAP financial measure and other important information regarding the use of the Company's non-GAAP financial measures. Adjusted Free Cash Flow for the third quarter of 2020 includes the $119.2 million one-time cash lease payment.

•Net cash provided by (used in) operating activities. The year-over-year decrease in net cash provided by (used in) operating activities was primarily attributable to the $119.2 million one-time cash lease payment and a decrease in same community revenue compared to the prior year period.

•Adjusted Free Cash Flow. The decrease in Adjusted Free Cash Flow compared to the prior year third quarter was attributable to the decrease in net cash provided by (used in) operating activities partially offset by a $36.2 million decrease in non-development capital expenditures, net compared to the prior year period.

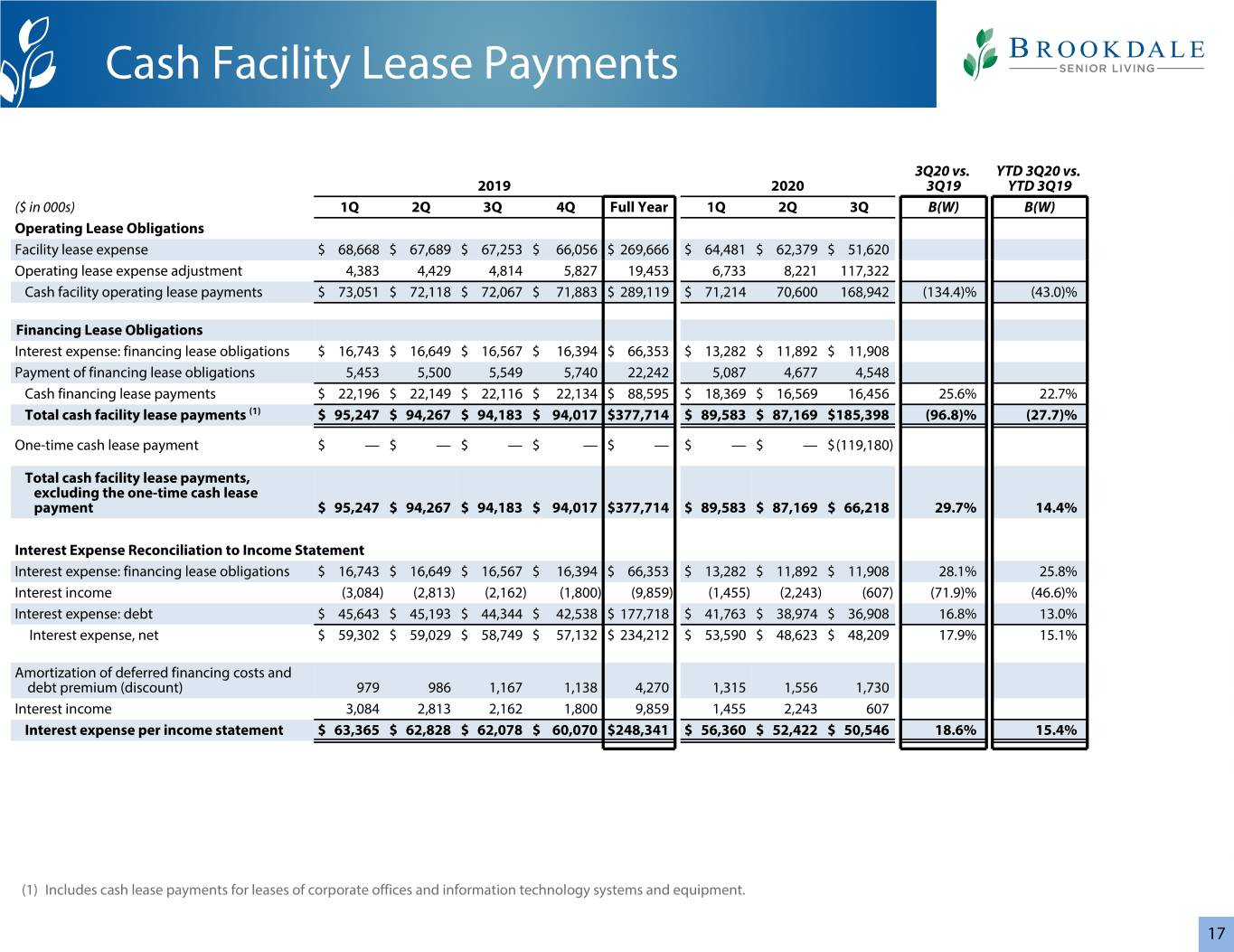

•Total Liquidity. Total liquidity as of September 30, 2020, decreased $109.5 million from June 30, 2020, primarily attributable to the $119.2 million one-time cash lease payment. On August 31, 2020, the Company terminated its $250 million revolving credit facility and obtained $266.9 million of non-recourse mortgage financing on 16 communities, most of which had secured the credit facility prior to its termination. At the closing, the Company repaid the $166.4 million outstanding principal amount under the credit facility, together with accumulated interest, without payment of any termination fee or penalty, and the Company cash collateralized the letters of credit outstanding under the credit facility.

TRANSACTION AND FINANCING UPDATE

•Ventas Transaction: On July 26, 2020, the Company entered into definitive agreements with Ventas to restructure its 120 community (10,174 units) triple-net master lease arrangements, as further described in the press release issued on July 27, 2020. In addition, the Company conveyed to Ventas five communities in full satisfaction of $78.4 million principal amount of indebtedness secured by the communities and manages the communities subsequent to the closing. Pursuant to the multi-part transaction, the Company paid a $119.2 million one-time cash payment to Ventas on July 27, 2020 and reduced the Company's annual rent under the amended and restated master lease.

•Refinancing Activity: During August and September 2020, the Company closed on two non-recourse mortgage debt financing transactions totaling $487.4 million, with the proceeds used to refinance the majority of the Company's

Page 4

remaining 2021 maturities and repay the outstanding amount on the Company's former revolving credit facility as described above.

•Community Dispositions: During the third quarter of 2020, the Company completed the sale of one owned community (297 units) for total cash proceeds of $32.6 million, net of transaction costs, and terminated the lease on two communities (148 units).

•Leased Community Acquisition: On August 31, 2020, the Company acquired one formerly leased community (103 units) pursuant to the exercise of a purchase option for a purchase price of $25.0 million.

OUTLOOK

Given the unprecedented nature of COVID-19 and rapidly changing developments, the Company will continue to be agile and adjust its local community response to help protect its residents, associates, and patients. As the Company cannot predict the ultimate impact of the duration, severity, and breadth of the pandemic for the United States, key factors that may impact the Company's financial performance and liquidity for the remainder of 2020 include:

•The Company’s consolidated weighted average occupancy was 73.8% for October 2020 and 95% of communities were accepting move-ins on October 31, 2020. On average, the Company has seen move-in volume at communities with fewer restrictions fare better than those with higher restrictions.

•The Company is pleased that it has welcomed new residents into its communities during the pandemic and is monitoring the current resurgence. Barring a severe resurgence, the Company expects the sequential decline in quarterly consolidated occupancy will again moderate.

•The Company expects to increase its marketing investments for communities that are able to welcome visitors and move-ins to drive future resident awareness and referrals.

•Communities impacted by COVID-19 infections are likely to incur increased costs for the use of a higher volume of PPE and medical supplies and other related expenses.

•The Company’s census for Health Care Services is expected to move directionally with elective medical procedure and hospital discharge trends and the occupancy trend within the Company’s senior housing segment.

•The Company has applied for additional grants made available pursuant to the Provider Relief Fund's Phase 2 General Distribution, generally related to the Company's senior housing segments. The amount of such grants are expected to be based on 2% of a portion of the Company's 2018 revenues from patient care, and the Company expects to receive up to approximately $50 million of grants from this allocation. There can be no assurance that the Company will qualify for, or receive, grants in the amount it expects.

•In response to the COVID-19 pandemic, the Company delayed or canceled a number of elective capital expenditure projects. As a result, the Company expects the fourth quarter non-development capital expenditures, net of anticipated lessor reimbursements, to be approximately $35 million, and development capital expenditures to be approximately $5 million. For the full year, this reflects a $50 million and $15 million reduction to pre-pandemic non-development and development plans, respectively.

•The Company expects that changes in working capital will require the use of approximately $25 million of cash in the fourth quarter of 2020.

SUPPLEMENTAL INFORMATION

The Company will post on its website at www.brookdale.com/investor supplemental information relating to the Company's third quarter 2020 results, an updated investor presentation, and a copy of this earnings release. The supplemental information and a copy of this earnings release will also be furnished in a Form 8-K to be filed with the SEC.

EARNINGS CONFERENCE CALL

Brookdale's management will conduct a conference call to review the financial results for the third quarter of 2020 on November 5, 2020 at 9:00 AM ET. The conference call can be accessed by dialing (866) 900-2996 (from within the U.S.) or (706) 643-2685 (from outside of the U.S.) ten minutes prior to the scheduled start and referencing "Brookdale".

A webcast of the conference call will be available to the public on a listen-only basis at www.brookdale.com/investor. Please allow extra time prior to the call to visit the site and download the necessary software required to listen to the internet broadcast. A replay of the webcast will be available through the website following the call.

For those who cannot listen to the live call, a replay will be available until 11:59 PM ET on November 19, 2020 by dialing (855) 859-2056 (from within the U.S.) or (404) 537-3406 (from outside of the U.S.) and referencing access code "3699832".

Page 5

ABOUT BROOKDALE SENIOR LIVING

Brookdale Senior Living Inc. is the leading operator of senior living communities throughout the United States. The Company is committed to providing senior living solutions primarily within properties that are designed, purpose-built, and operated to provide the highest-quality service, care, and living accommodations for residents. Brookdale operates and manages independent living, assisted living, memory care, and continuing care retirement communities, with 726 communities in 44 states and the ability to serve approximately 65,000 residents as of September 30, 2020. The Company also offers a range of home health, hospice, and outpatient therapy services to over 17,000 patients as of that date. Brookdale's stock is traded on the New York Stock Exchange under the ticker symbol BKD.

DEFINITIONS OF RevPAR AND RevPOR

RevPAR, or average monthly senior housing resident fee revenue per available unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding Health Care Services segment revenue and entrance fee amortization, and, for the 2019 periods, the additional resident fee revenue recognized as a result of the application of the lease accounting standard ASC 842), divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period.

RevPOR, or average monthly senior housing resident fee revenue per occupied unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding Health Care Services segment revenue and entrance fee amortization, and, for the 2019 periods, the additional resident fee revenue recognized as a result of the application of the lease accounting standard ASC 842), divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period.

SAFE HARBOR

Certain statements in this press release and the associated earnings conference call may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to various risks and uncertainties and include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including those related to the COVID-19 pandemic. Forward-looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "could," "would," "potential," "intend," "expect," "endeavor," "seek," "anticipate," "estimate," "believe," "project," "predict," "continue," "plan," "target," or other similar words or expressions. These forward-looking statements are based on certain assumptions and expectations, and the Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Although the Company believes that expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that its assumptions or expectations will be attained, and actual results and performance could differ materially from those projected. Factors which could have a material adverse effect on the Company’s operations and future prospects or which could cause events or circumstances to differ from the forward-looking statements include, but are not limited to: the impacts of the COVID-19 pandemic, including the response efforts of federal, state, and local government authorities, businesses, individuals and the Company, on the Company’s business, results of operations, cash flow, liquidity, and strategic initiatives, including plans for future growth, which will depend on many factors, some of which cannot be foreseen, including the duration, severity, and breadth of the pandemic and any resurgence of the disease, the impact of COVID-19 on the nation's economy and debt and equity markets and the local economies in the Company’s markets, the development and availability of COVID-19 testing, therapeutic agents, and vaccines and the prioritization of such resources among businesses and demographic groups, government financial and regulatory relief efforts that may become available to business and individuals, including our ability to qualify for and satisfy the terms and conditions of financial relief; perceptions regarding the safety of senior living communities during and after the pandemic, changes in demand for senior living communities and the Company’s ability to adapt its sales and marketing efforts to meet that demand, changes in the acuity levels of the Company’s new residents, the disproportionate impact of COVID-19 on seniors generally and those residing in the Company’s communities, the duration and costs of the Company’s response efforts, including increased equipment, supplies, labor, litigation, testing, and other expenses, the impact of COVID-19 on the Company’s ability to complete financings, refinancings, or other transactions (including dispositions) or to generate sufficient cash flow to cover required interest and lease payments and to satisfy financial and other covenants in the Company’s debt and lease documents, increased regulatory requirements, including unfunded mandatory testing, increased enforcement actions resulting from COVID-19, including those that may limit the Company’s collection efforts for delinquent accounts and the frequency and magnitude of legal actions and liability claims that may arise due to COVID-19 or the Company’s response efforts; events which adversely affect the ability of seniors to afford resident fees, including downturns in the economy, housing markets, consumer confidence or the equity markets and unemployment among family members, which may be adversely impacted by the pandemic; changes in reimbursement rates, methods or timing under governmental reimbursement programs including the Medicare and Medicaid programs; the impact of ongoing healthcare reform efforts; the effects of senior housing construction and development, oversupply and increased competition; disruptions in the financial markets, including those related to the pandemic, that affect the Company’s ability to obtain financing or extend or refinance debt as it matures and the Company’s financing costs; the risks associated with current global economic conditions, including changes related to the pandemic, and general economic factors such as inflation, the consumer price index, commodity costs, fuel and other energy costs, costs of salaries, wages, benefits, and insurance, interest rates, and tax rates; the impact of seasonal contagious illness or an outbreak of

Page 6

COVID-19 or other contagious disease in the markets in which the Company operates; the Company’s ability to generate sufficient cash flow to cover required interest and long-term lease payments and to fund its planned capital projects, which may be adversely affected by the pandemic; the effect of the Company’s indebtedness and long-term leases on its liquidity; the effect of the Company’s non-compliance with any of its debt or lease agreements (including the financial covenants contained therein), including the risk of lenders or lessors declaring a cross default in the event of non-compliance with any such agreements and the risk of loss of the Company’s property securing leases and indebtedness due to any resulting lease terminations and foreclosure actions; the potential phasing out of LIBOR which may increase the costs of the Company’s debt obligations; increased competition for or a shortage of personnel or wage pressures resulting from increased competition, low unemployment levels, minimum wage increases and changes in overtime laws, and union activity; failure to maintain the security and functionality of the Company’s information systems, to prevent a cybersecurity attack or breach, or to comply with applicable privacy and consumer protection laws, including HIPAA; the Company’s inability to achieve or maintain profitability; the Company’s ability to complete pending or expected disposition, acquisition, or other transactions on agreed upon terms or at all, including in respect of the satisfaction of closing conditions, the risk that regulatory approvals are not obtained or are subject to unanticipated conditions, and uncertainties as to the timing of closing, and the Company’s ability to identify and pursue any such opportunities in the future; the Company’s ability to obtain additional capital on terms acceptable to the Company; the Company’s ability to complete its capital expenditures in accordance with its plans; the Company’s ability to identify and pursue development, investment, and acquisition opportunities and its ability to successfully integrate acquisitions; competition for the acquisition of assets; delays in obtaining regulatory approvals; terminations, early or otherwise, or non-renewal of management agreements; conditions of housing markets, regulatory changes, acts of nature, and the effects of climate change in geographic areas where the Company is concentrated; terminations of the Company’s resident agreements and vacancies in its living spaces, which may be adversely impacted by the pandemic; departures of key officers and potential disruption caused by changes in management; risks related to the implementation of the Company’s strategy, including initiatives undertaken to execute on its strategic priorities and their effect the Company’s results; actions of activist stockholders, including a proxy contest; market conditions and capital allocation decisions that may influence the Company’s determination from time to time whether to purchase any shares under its existing share repurchase program and the Company’s ability to fund any repurchases; the Company’s ability to maintain consistent quality control; a decrease in the overall demand for senior housing, which may be adversely impacted by the pandemic; environmental contamination at any of the Company’s communities; failure to comply with existing environmental laws; costs to defend against, or an adverse determination or resolution of, complaints filed against the Company; the cost and difficulty of complying with increasing and evolving regulation; costs to respond to, and adverse determinations resulting from, government reviews, audits and investigations; unanticipated costs to comply with legislative or regulatory developments; as well as other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission ("SEC"), including those set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in such SEC filings. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect management's views as of the date of this press release and/or associated earnings call. The Company cannot guarantee future results, levels of activity, performance or achievements, and, except as required by law, the Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations with regard thereto or change in events, conditions, or circumstances on which any statement is based.

Page 7

Condensed Consolidated Statements of Operations

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in thousands, except per share data) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Revenue and other operating income | |||||||||||||||||||||||

| Resident fees | $ | 700,771 | $ | 801,237 | $ | 2,215,107 | $ | 2,412,579 | |||||||||||||||

| Management fees | 5,669 | 13,564 | 120,460 | 44,756 | |||||||||||||||||||

| Reimbursed costs incurred on behalf of managed communities | 90,775 | 194,148 | 315,003 | 613,115 | |||||||||||||||||||

| Other operating income | 10,765 | — | 37,458 | — | |||||||||||||||||||

| Total revenue and other operating income | 807,980 | 1,008,949 | 2,688,028 | 3,070,450 | |||||||||||||||||||

| Expense | |||||||||||||||||||||||

| Facility operating expense (excluding facility depreciation and amortization of $81,854, $86,213, $253,126, and $261,110, respectively) | 570,530 | 615,717 | 1,765,046 | 1,792,057 | |||||||||||||||||||

| General and administrative expense (including non-cash stock- based compensation expense of $6,136, $5,929, $18,212, and $18,315, respectively) | 54,138 | 56,409 | 161,251 | 170,296 | |||||||||||||||||||

| Facility operating lease expense | 51,620 | 67,253 | 178,480 | 203,610 | |||||||||||||||||||

| Depreciation and amortization | 87,821 | 93,550 | 271,713 | 284,462 | |||||||||||||||||||

| Asset impairment | 8,213 | 2,094 | 96,729 | 6,254 | |||||||||||||||||||

| Loss (gain) on facility lease termination and modification, net | — | — | — | 2,006 | |||||||||||||||||||

| Costs incurred on behalf of managed communities | 90,775 | 194,148 | 315,003 | 613,115 | |||||||||||||||||||

| Total operating expense | 863,097 | 1,029,171 | 2,788,222 | 3,071,800 | |||||||||||||||||||

| Income (loss) from operations | (55,117) | (20,222) | (100,194) | (1,350) | |||||||||||||||||||

| Interest income | 607 | 2,162 | 4,305 | 8,059 | |||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||

| Debt | (36,908) | (44,344) | (117,645) | (135,180) | |||||||||||||||||||

| Financing lease obligations | (11,908) | (16,567) | (37,082) | (49,959) | |||||||||||||||||||

| Amortization of deferred financing costs and debt discount | (1,730) | (1,167) | (4,601) | (3,132) | |||||||||||||||||||

| Gain (loss) on debt modification and extinguishment, net | (7,917) | (2,455) | 11,107 | (5,194) | |||||||||||||||||||

| Equity in earnings (loss) of unconsolidated ventures | (293) | (2,057) | (863) | (3,574) | |||||||||||||||||||

| Gain (loss) on sale of assets, net | 2,209 | 579 | 374,019 | 2,723 | |||||||||||||||||||

| Other non-operating income (loss) | 948 | 3,763 | 4,598 | 9,950 | |||||||||||||||||||

| Income (loss) before income taxes | (110,109) | (80,308) | 133,644 | (177,657) | |||||||||||||||||||

| Benefit (provision) for income taxes | (14,884) | 1,800 | (7,560) | 488 | |||||||||||||||||||

| Net income (loss) | (124,993) | (78,508) | 126,084 | (177,169) | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interest | 18 | 50 | 55 | 646 | |||||||||||||||||||

| Net income (loss) attributable to Brookdale Senior Living Inc. common stockholders | $ | (124,975) | $ | (78,458) | $ | 126,139 | $ | (176,523) | |||||||||||||||

| Net income (loss) per share attributable to Brookdale Senior Living Inc. common stockholders: | |||||||||||||||||||||||

| Basic | $ | (0.68) | $ | (0.42) | $ | 0.69 | $ | (0.95) | |||||||||||||||

| Diluted | $ | (0.68) | $ | (0.42) | $ | 0.69 | $ | (0.95) | |||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic | 183,244 | 185,516 | 183,535 | 186,130 | |||||||||||||||||||

| Diluted | 183,244 | 185,516 | 183,668 | 186,130 | |||||||||||||||||||

Page 8

Condensed Consolidated Balance Sheets

| (in thousands) | September 30, 2020 | December 31, 2019 | |||||||||

| Cash and cash equivalents | $ | 354,621 | $ | 240,227 | |||||||

| Marketable securities | 136,136 | 68,567 | |||||||||

| Restricted cash | 35,206 | 26,856 | |||||||||

| Accounts receivable, net | 113,820 | 133,613 | |||||||||

| Assets held for sale | 8,324 | 42,671 | |||||||||

| Prepaid expenses and other current assets, net | 73,977 | 84,241 | |||||||||

| Total current assets | 722,084 | 596,175 | |||||||||

| Property, plant and equipment and leasehold intangibles, net | 5,127,167 | 5,109,834 | |||||||||

| Operating lease right-of-use assets | 843,265 | 1,159,738 | |||||||||

| Other assets, net | 315,411 | 328,686 | |||||||||

| Total assets | $ | 7,007,927 | $ | 7,194,433 | |||||||

| Current liabilities | $ | 719,010 | $ | 1,046,972 | |||||||

| Long-term debt, less current portion | 3,857,820 | 3,215,710 | |||||||||

| Financing lease obligations, less current portion | 547,922 | 771,434 | |||||||||

| Operating lease obligations, less current portion | 874,657 | 1,277,178 | |||||||||

| Other liabilities | 164,348 | 184,414 | |||||||||

| Total liabilities | 6,163,757 | 6,495,708 | |||||||||

| Total Brookdale Senior Living Inc. stockholders' equity | 841,856 | 696,356 | |||||||||

| Noncontrolling interest | 2,314 | 2,369 | |||||||||

| Total equity | 844,170 | 698,725 | |||||||||

| Total liabilities and equity | $ | 7,007,927 | $ | 7,194,433 | |||||||

Page 9

Condensed Consolidated Statements of Cash Flows

| Nine Months Ended September 30, | |||||||||||

| (in thousands) | 2020 | 2019 | |||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net income (loss) | $ | 126,084 | $ | (177,169) | |||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Loss (gain) on debt modification and extinguishment, net | (11,107) | 5,194 | |||||||||

| Depreciation and amortization, net | 276,314 | 287,594 | |||||||||

| Asset impairment | 96,729 | 6,254 | |||||||||

| Equity in (earnings) loss of unconsolidated ventures | 863 | 3,574 | |||||||||

| Distributions from unconsolidated ventures from cumulative share of net earnings | 766 | 2,388 | |||||||||

| Amortization of entrance fees | (1,606) | (1,172) | |||||||||

| Proceeds from deferred entrance fee revenue | 118 | 2,902 | |||||||||

| Deferred income tax (benefit) provision | (2,727) | (1,216) | |||||||||

| Operating lease expense adjustment | (132,276) | (13,626) | |||||||||

| Loss (gain) on sale of assets, net | (374,019) | (2,723) | |||||||||

| Loss (gain) on facility lease termination and modification, net | — | 2,006 | |||||||||

| Non-cash stock-based compensation expense | 18,212 | 18,315 | |||||||||

| Non-cash management contract termination gain | — | (640) | |||||||||

| Other | (1,965) | (7,173) | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable, net | 19,678 | (6,756) | |||||||||

| Prepaid expenses and other assets, net | 27,504 | 50,387 | |||||||||

| Prepaid insurance premiums financed with notes payable | (5,823) | (5,875) | |||||||||

| Trade accounts payable and accrued expenses | 17,002 | (21,970) | |||||||||

| Refundable fees and deferred revenue | 64,763 | (24,007) | |||||||||

| Operating lease assets and liabilities for lessor capital expenditure reimbursements | 13,640 | 12,043 | |||||||||

| Net cash provided by (used in) operating activities | 132,150 | 128,330 | |||||||||

| Cash Flows from Investing Activities | |||||||||||

| Change in lease security deposits and lease acquisition deposits, net | 3,399 | (430) | |||||||||

| Purchase of marketable securities | (255,373) | (137,786) | |||||||||

| Sale and maturities of marketable securities | 188,750 | 104,000 | |||||||||

| Capital expenditures, net of related payables | (140,690) | (206,385) | |||||||||

| Acquisition of assets, net of related payables and cash received | (472,193) | (453) | |||||||||

| Investment in unconsolidated ventures | (1,809) | (4,294) | |||||||||

| Distributions received from unconsolidated ventures | — | 7,454 | |||||||||

| Proceeds from sale of assets, net | 331,103 | 53,430 | |||||||||

| Proceeds from notes receivable | 2,849 | 34,109 | |||||||||

| Net cash provided by (used in) investing activities | (343,964) | (150,355) | |||||||||

| Cash Flows from Financing Activities | |||||||||||

| Proceeds from debt | 961,833 | 318,491 | |||||||||

| Repayment of debt and financing lease obligations | (518,700) | (404,152) | |||||||||

| Proceeds from line of credit | 166,381 | — | |||||||||

| Repayment of line of credit | (166,381) | — | |||||||||

| Purchase of treasury stock, net of related payables | (18,123) | (18,401) | |||||||||

| Payment of financing costs, net of related payables | (18,141) | (6,357) | |||||||||

| Payments of employee taxes for withheld shares | (4,012) | (3,242) | |||||||||

| Other | 335 | 827 | |||||||||

| Net cash provided by (used in) financing activities | 403,192 | (112,834) | |||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 191,378 | (134,859) | |||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | 301,697 | 450,218 | |||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 493,075 | $ | 315,359 | |||||||

Page 10

Reconciliations of Non-GAAP Financial Measures

This earnings release contains the financial measures Adjusted EBITDA and Adjusted Free Cash Flow, which are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, or net cash provided by (used in) operating activities. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the reconciliations included below of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP.

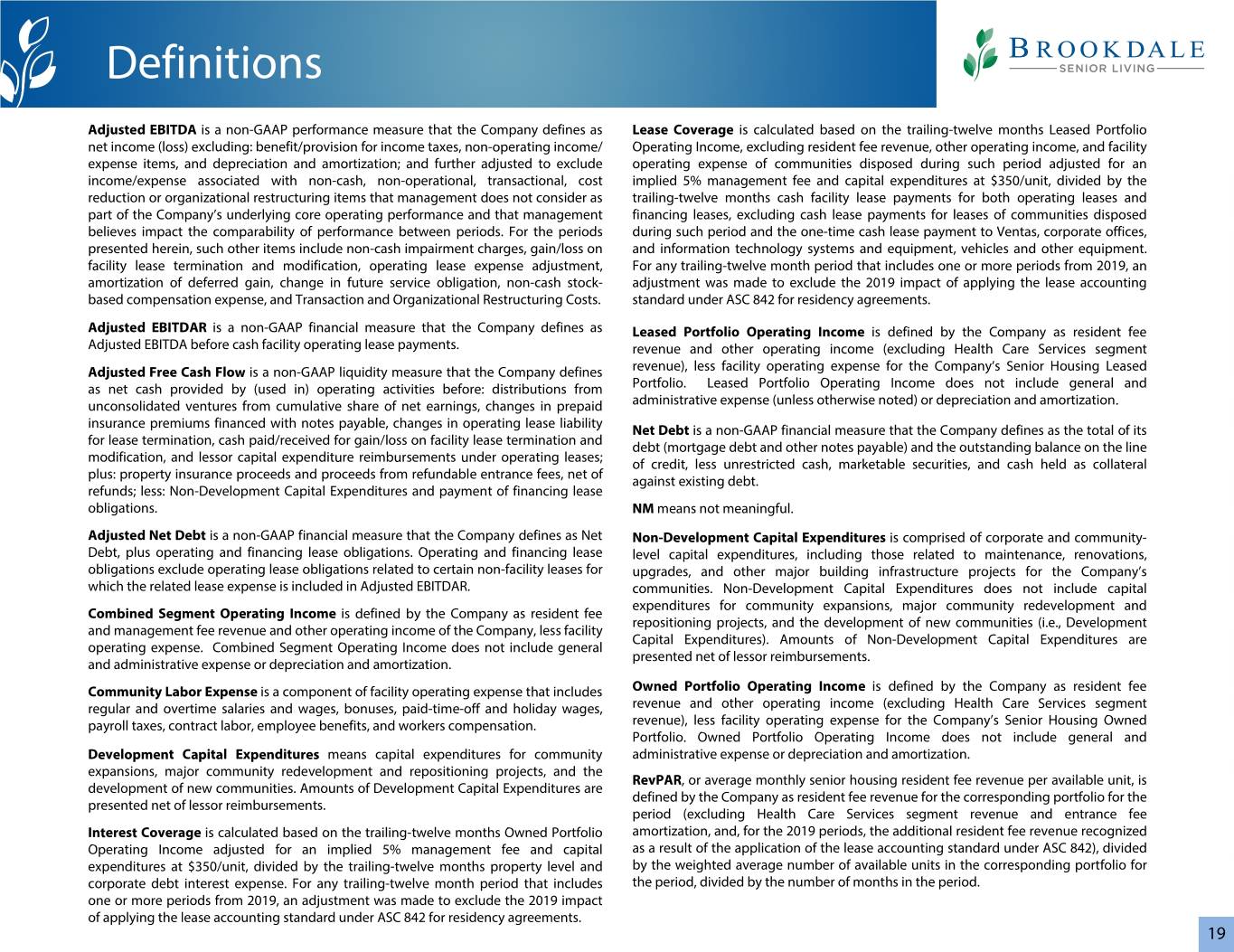

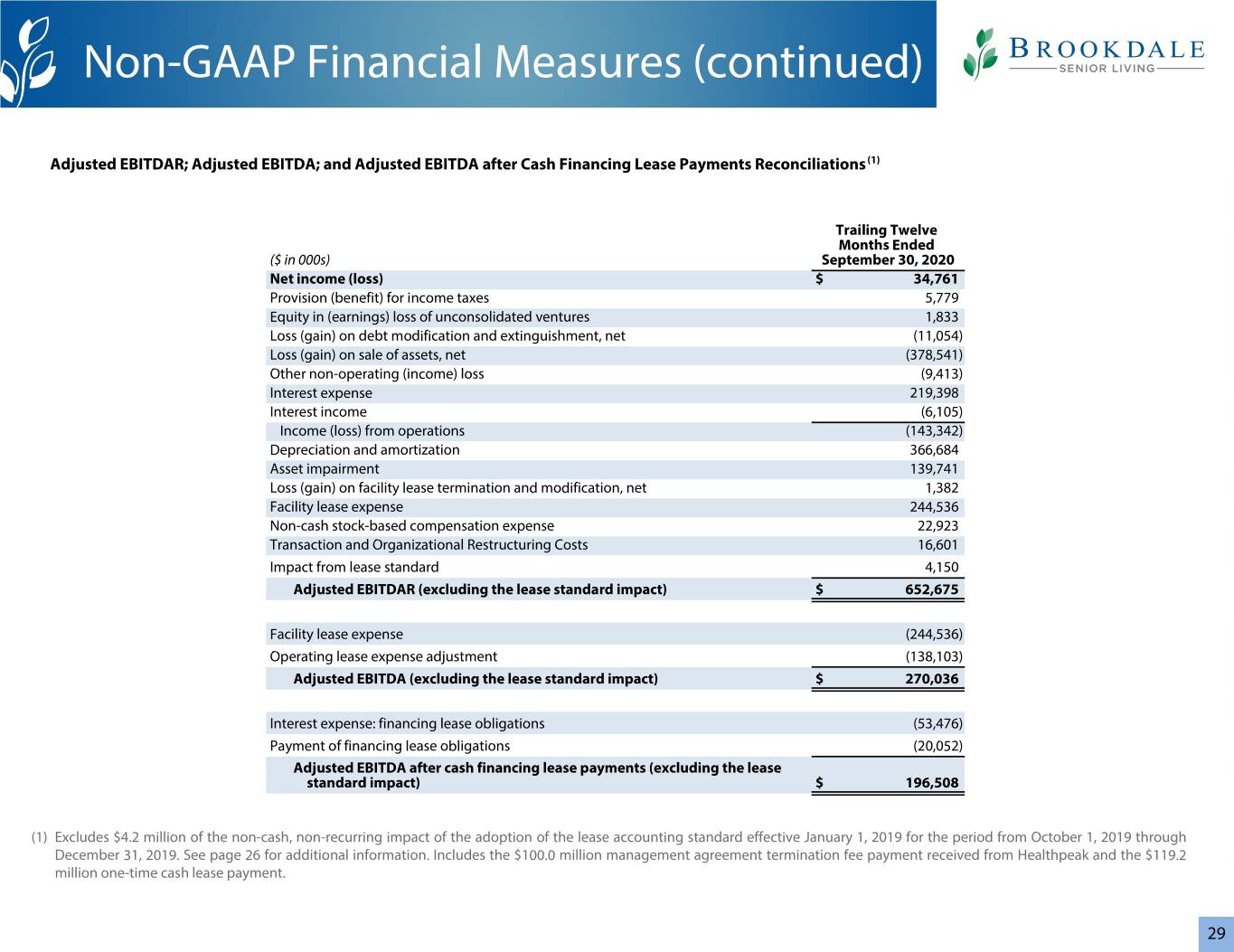

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net income (loss) excluding: benefit/provision for income taxes, non-operating income/expense items, and depreciation and amortization; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, cost reduction, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include non-cash impairment charges, gain/loss on facility lease termination and modification, operating lease expense adjustment, amortization of deferred gain, change in future service obligation, non-cash stock-based compensation expense, and transaction and organizational restructuring costs. Transaction costs include those directly related to acquisition, disposition, financing, and leasing activity, and stockholder relations advisory matters, and are primarily comprised of legal, finance, consulting, professional fees, and other third party costs. Organizational restructuring costs include those related to the Company’s efforts to reduce general and administrative expense and its senior leadership changes, including severance and retention costs.

The Company believes that presentation of Adjusted EBITDA as a performance measure is useful to investors because (i) it is one of the metrics used by the Company’s management for budgeting and other planning purposes, to review the Company’s historic and prospective core operating performance, and to make day-to-day operating decisions; (ii) it provides an assessment of operational factors that management can impact in the short-term, namely revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods; and (iii) the Company believes that this measure is used by research analysts and investors to evaluate the Company’s operating results and to value companies in its industry.

Adjusted EBITDA has material limitations as a performance measure, including: (i) excluded interest and income tax are necessary to operate the Company’s business under its current financing and capital structure; (ii) excluded depreciation, amortization and impairment charges may represent the wear and tear and/or reduction in value of the Company’s communities, goodwill and other assets and may be indicative of future needs for capital expenditures; and (iii) the Company may incur income/expense similar to those for which adjustments are made, such as gain/loss on sale of assets, facility lease termination and modification, or debt modification and extinguishment, non-cash stock-based compensation expense, and transaction and other costs, and such income/expense may significantly affect the Company’s operating results.

Page 11

The table below reconciles the Company's Adjusted EBITDA from its net income (loss).

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Net income (loss) | $ | (124,993) | $ | (78,508) | $ | 126,084 | $ | (177,169) | |||||||||||||||

| Provision (benefit) for income taxes | 14,884 | (1,800) | 7,560 | (488) | |||||||||||||||||||

| Equity in (earnings) loss of unconsolidated ventures | 293 | 2,057 | 863 | 3,574 | |||||||||||||||||||

| Loss (gain) on debt modification and extinguishment, net | 7,917 | 2,455 | (11,107) | 5,194 | |||||||||||||||||||

| Loss (gain) on sale of assets, net | (2,209) | (579) | (374,019) | (2,723) | |||||||||||||||||||

| Other non-operating (income) loss | (948) | (3,763) | (4,598) | (9,950) | |||||||||||||||||||

| Interest expense | 50,546 | 62,078 | 159,328 | 188,271 | |||||||||||||||||||

| Interest income | (607) | (2,162) | (4,305) | (8,059) | |||||||||||||||||||

| Income (loss) from operations | (55,117) | (20,222) | (100,194) | (1,350) | |||||||||||||||||||

| Depreciation and amortization | 87,821 | 93,550 | 271,713 | 284,462 | |||||||||||||||||||

| Asset impairment | 8,213 | 2,094 | 96,729 | 6,254 | |||||||||||||||||||

| Loss (gain) on facility lease termination and modification, net | — | — | — | 2,006 | |||||||||||||||||||

| Operating lease expense adjustment | (117,322) | (4,814) | (132,276) | (13,626) | |||||||||||||||||||

| Non-cash stock-based compensation expense | 6,136 | 5,929 | 18,212 | 18,315 | |||||||||||||||||||

| Transaction and organizational restructuring costs | 6,250 | 3,910 | 11,599 | 5,005 | |||||||||||||||||||

Adjusted EBITDA(1) | $ | (64,019) | $ | 80,447 | $ | 165,783 | $ | 301,066 | |||||||||||||||

| $100.0 million management termination fee | — | — | (100,000) | — | |||||||||||||||||||

| $119.2 million one-time cash lease payment | 119,180 | — | 119,180 | ||||||||||||||||||||

| Adjusted EBITDA, excluding $100.0 million management termination fee and $119.2 million one-time cash lease payment | $ | 55,161 | $ | 80,447 | $ | 184,963 | $ | 301,066 | |||||||||||||||

(1) Adjusted EBITDA includes:

•$6.0 million and $19.0 million, respectively, of a negative, non-recurring net impact for the three and nine months ended September 30, 2019 from the application of the lease accounting standard effective January 1, 2019

•$100.0 million benefit for the nine months ended September 30, 2020 for the management agreement termination fee payment received from Healthpeak Properties, Inc. (“Healthpeak”) in connection with closing of the multi-part transaction on January 31, 2020

•$119.2 million for the three and nine months ended September 30, 2020 for the one-time cash lease payment

•$10.8 million and $37.5 million, respectively, benefit for the three and nine months ended September 30, 2020 of Provider Relief Funds and other government grants recognized in other operating income

Adjusted Free Cash Flow

Adjusted Free Cash Flow is a non-GAAP liquidity measure that the Company defines as net cash provided by (used in) operating activities before: distributions from unconsolidated ventures from cumulative share of net earnings, changes in prepaid insurance premiums financed with notes payable, changes in operating lease liability for lease termination, cash paid/received for gain/loss on facility lease termination and modification, and lessor capital expenditure reimbursements under operating leases; plus: property insurance proceeds and proceeds from refundable entrance fees, net of refunds; less: non-development capital expenditures and payment of financing lease obligations. Non-development capital expenditures are comprised of corporate and community-level capital expenditures, including those related to maintenance, renovations, upgrades, and other major building infrastructure projects for the Company’s communities and is presented net of lessor reimbursements. Non-development capital expenditures do not include capital expenditures for community expansions, major community redevelopment and repositioning projects, and the development of new communities.

The Company believes that presentation of Adjusted Free Cash Flow as a liquidity measure is useful to investors because (i) it is one of the metrics used by the Company’s management for budgeting and other planning purposes, to review the Company’s historic and prospective sources of operating liquidity, and to review the Company’s ability to service its outstanding indebtedness, pay dividends to stockholders, engage in share repurchases, and make capital expenditures, including development capital expenditures; (ii) it is used as a metric in the Company’s performance-based compensation programs; and (iii) it provides an indicator to management to determine if adjustments to current spending decisions are needed.

Adjusted Free Cash Flow has material limitations as a liquidity measure, including: (i) it does not represent cash available for dividends, share repurchases, or discretionary expenditures since certain non-discretionary expenditures, including mandatory debt principal payments, are not reflected in this measure; (ii) the cash portion of non-recurring charges related to gain/loss on

Page 12

facility lease termination generally represent charges/gains that may significantly affect the Company’s liquidity; and (iii) the impact of timing of cash expenditures, including the timing of non-development capital expenditures, limits the usefulness of the measure for short-term comparisons.

The table below reconciles the Company's Adjusted Free Cash Flow from its net cash provided by (used in) operating activities.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | (77,169) | $ | 69,211 | $ | 132,150 | $ | 128,330 | |||||||||||||||

| Net cash provided by (used in) investing activities | (48,554) | (70,056) | (343,964) | (150,355) | |||||||||||||||||||

| Net cash provided by (used in) financing activities | 96,668 | (8,755) | 403,192 | (112,834) | |||||||||||||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | $ | (29,055) | $ | (9,600) | $ | 191,378 | $ | (134,859) | |||||||||||||||

| Net cash provided by (used in) operating activities | $ | (77,169) | $ | 69,211 | $ | 132,150 | $ | 128,330 | |||||||||||||||

| Distributions from unconsolidated ventures from cumulative share of net earnings | (766) | (858) | (766) | (2,388) | |||||||||||||||||||

| Changes in prepaid insurance premiums financed with notes payable | (5,841) | (6,215) | 5,823 | 5,875 | |||||||||||||||||||

| Changes in assets and liabilities for lessor capital expenditure reimbursements under operating leases | (3,131) | (11,043) | (13,640) | (12,043) | |||||||||||||||||||

| Non-development capital expenditures, net | (22,872) | (59,121) | (104,949) | (180,187) | |||||||||||||||||||

| Payment of financing lease obligations | (4,548) | (5,549) | (14,312) | (16,502) | |||||||||||||||||||

Adjusted Free Cash Flow (1) | $ | (114,327) | $ | (13,575) | $ | 4,306 | $ | (76,915) | |||||||||||||||

(1) Adjusted Free Cash Flow includes transaction and organizational restructuring costs of $6.3 million and $3.9 million for the three months ended September 30, 2020 and 2019, respectively, and $11.6 million and $5.0 million for the nine months ended September 30, 2020 and 2019, respectively. Additionally, Adjusted Free Cash Flow includes:

For the three months ended September 30, 2020:

•$119.2 million one-time cash lease payment

•$2.5 million benefit from accelerated/advanced Medicare payments received

•$4.4 million benefit from Provider Relief Funds and other government grants accepted

•$23.6 million benefit from payroll taxes deferred

For the nine months ended September 30, 2020:

•$119.2 million one-time cash lease payment

•$100.0 million benefit from management agreement termination fee payment received from Healthpeak

•$87.5 million benefit from accelerated/advanced Medicare payments received

•$38.6 million benefit from Provider Relief Funds and other government grants accepted

•$50.1 million benefit from payroll taxes deferred

Contact:

Kathy MacDonald

SVP Investor Relations

(615) 505-1968

Kathy.MacDonald@brookdale.com

Page 13

Exhibit 99.2 Supplemental Information 3rd Quarter 2020

Table of Contents COVID-19 Financial Impact 4 Overview 5 Segment Overview 8 Senior Housing 9 Health Care Services 14 G&A Expense 15 Capital Expenditures 16 Cash Facility Lease Payments 17 Capital Structure 18 Definitions 19 Appendices: Pro-Forma Financial Information 22 2019 Lease Accounting Standard (ASC 842) Impact 26 Non-GAAP Financial Measures 27 2

SAFE HARBOR Certain statements in this Supplemental Information may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to various risks and uncertainties and include all statements regarding the Company’s intent, expectations and assumptions related to the various pending and expected transactions outlined herein and any other statements that are not historical statements of fact. Forward- looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "could," "would," "potential," "intend," "expect," "endeavor," "seek," "anticipate," "estimate," "believe," "project," "predict," "continue," "plan," "target," or other similar words or expressions. These forward-looking statements are based on certain assumptions and expectations, and the Company's ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Although the Company believes that expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its assumptions or expectations will be attained, and actual results and performance could differ materially from those projected. Factors which could cause events or circumstances to differ from the forward-looking statements include, but are not limited to: the impacts of the COVID-19 pandemic, including the response efforts of federal, state, and local government authorities, businesses, individuals and the Company, on the Company's business, results of operations, cash flow, and liquidity, and strategic initiatives; the Company’s ability to complete pending or expected disposition, acquisition or other transactions on agreed upon terms or at all, including in respect of the satisfaction of closing conditions, the risk that regulatory approvals are not obtained or are subject to unanticipated conditions, and uncertainties as to the timing of closing, and the Company’s ability to identify and pursue any such opportunities in the future; delays in obtaining regulatory approvals; terminations, early or otherwise, or non-renewal of management agreements; regulatory changes in geographic areas where the Company is concentrated; disruptions in the financial markets, including those related to the pandemic, that affect the Company’s ability to obtain financing or extend or refinance debt as it matures and the Company’s financing costs; a decrease in the overall demand for senior housing, which may be adversely impacted by the pandemic; environmental contamination at any of the Company’s communities; failure to comply with existing environmental laws; unanticipated costs to comply with legislative or regulatory developments; as well as other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission (SEC), including those contained in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in such SEC filings. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect management's views as of the date of this Supplemental Information. The Company cannot guarantee future results, levels of activity, performance or achievements, and, except as required by law, it expressly disclaims any obligation to release publicly any updates or revisions to any of these forward-looking statements to reflect any change in its expectations with regard thereto or change in events, conditions or circumstances on which any statement is based. This Supplemental Information should be read in conjunction with the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other information filed with the SEC. 3

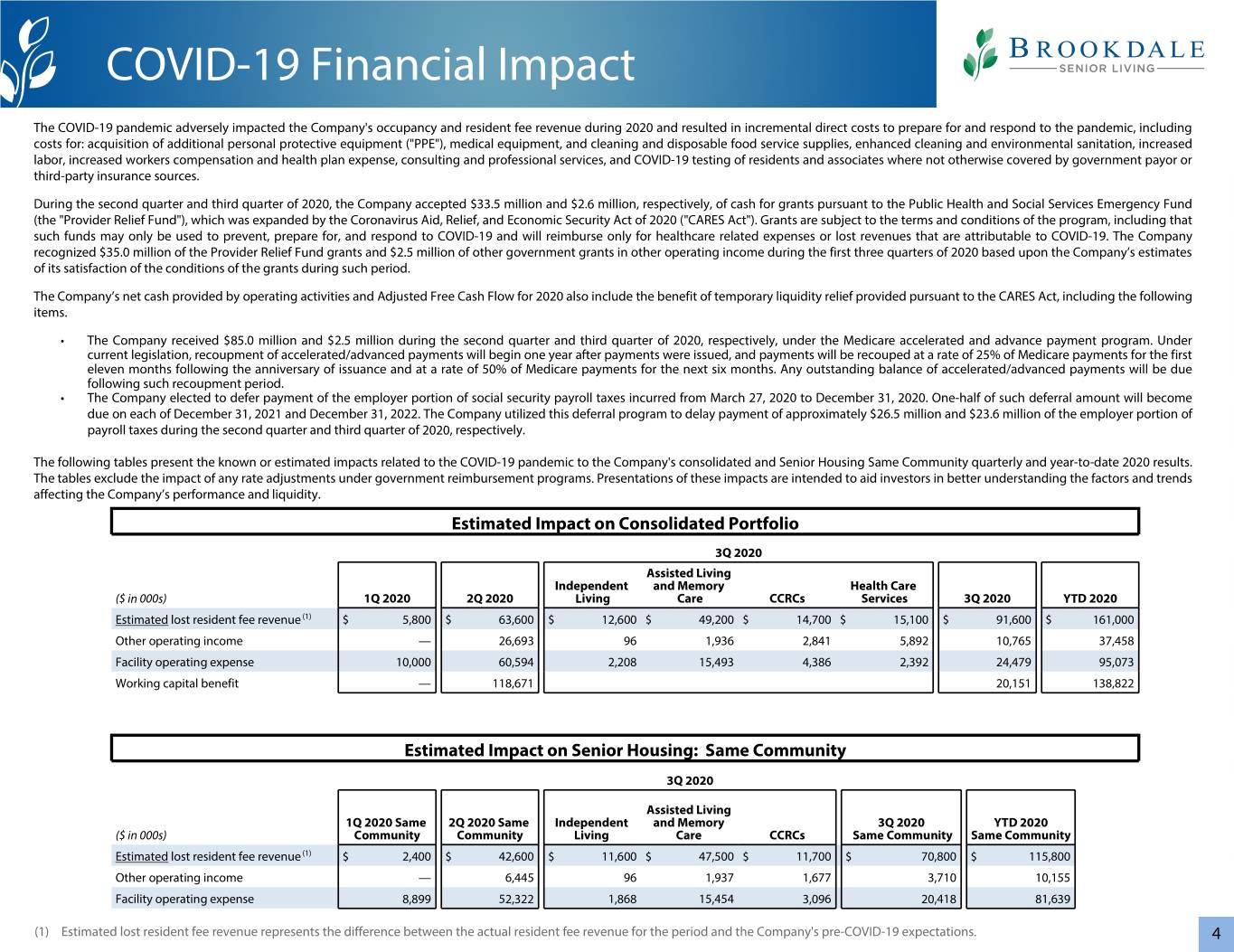

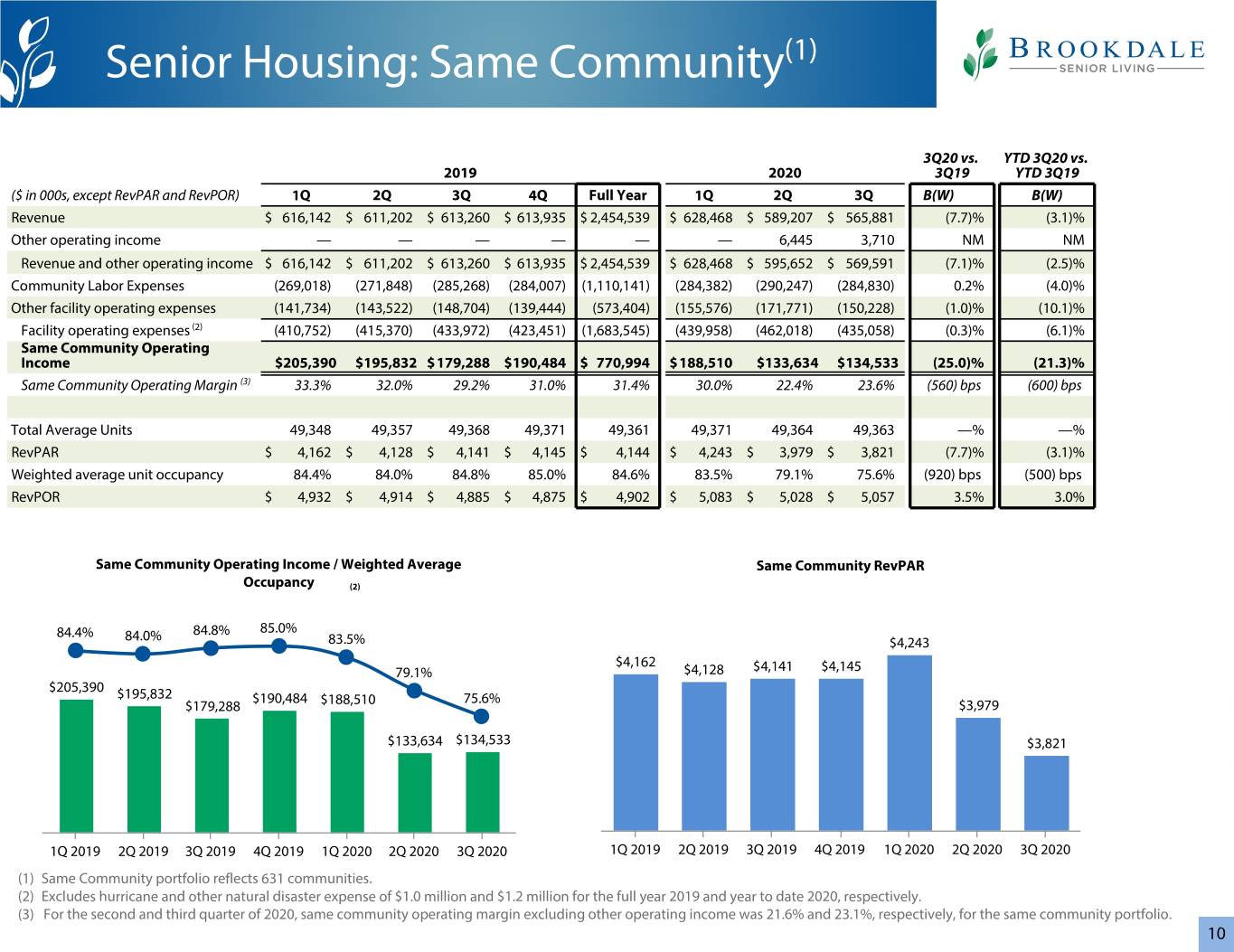

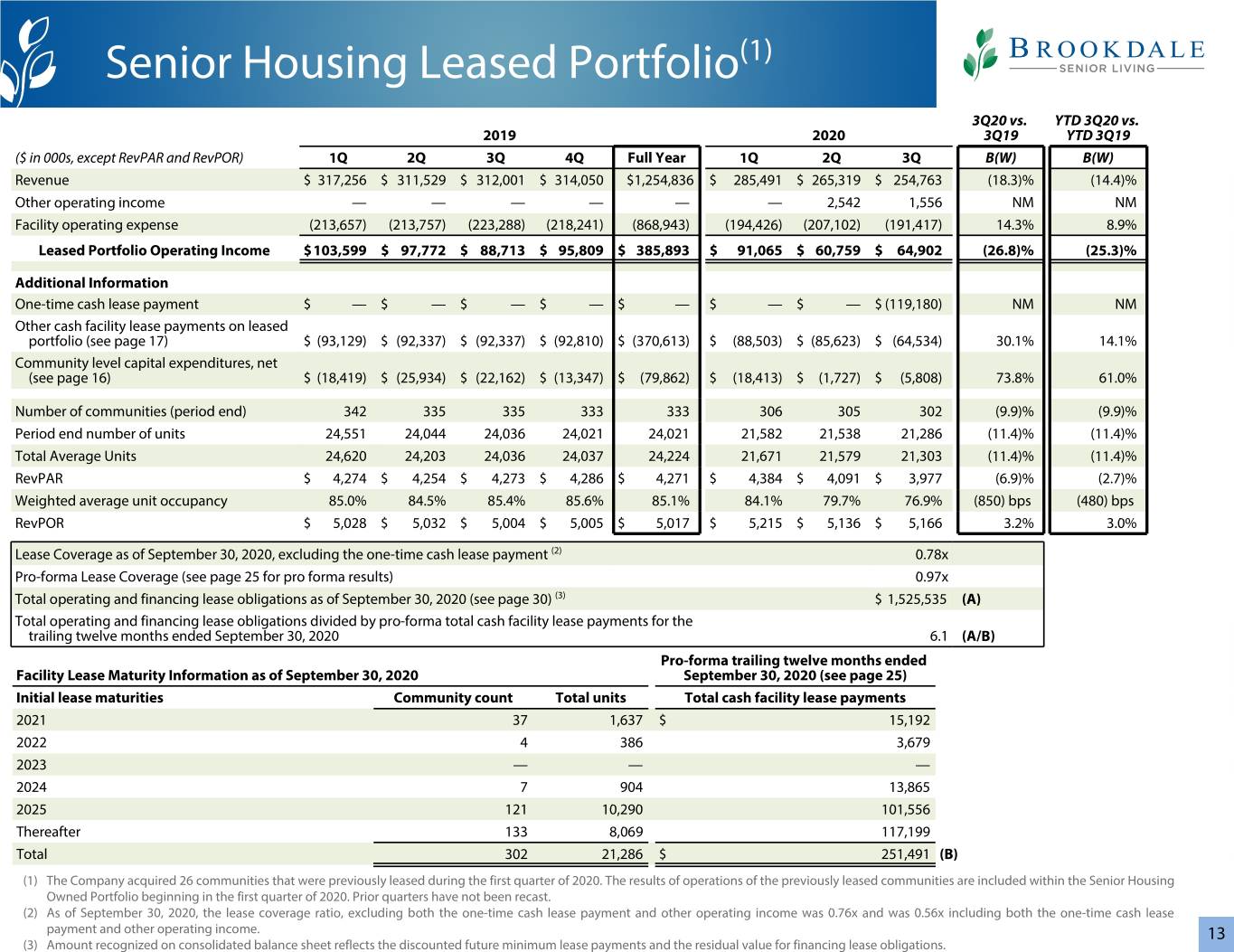

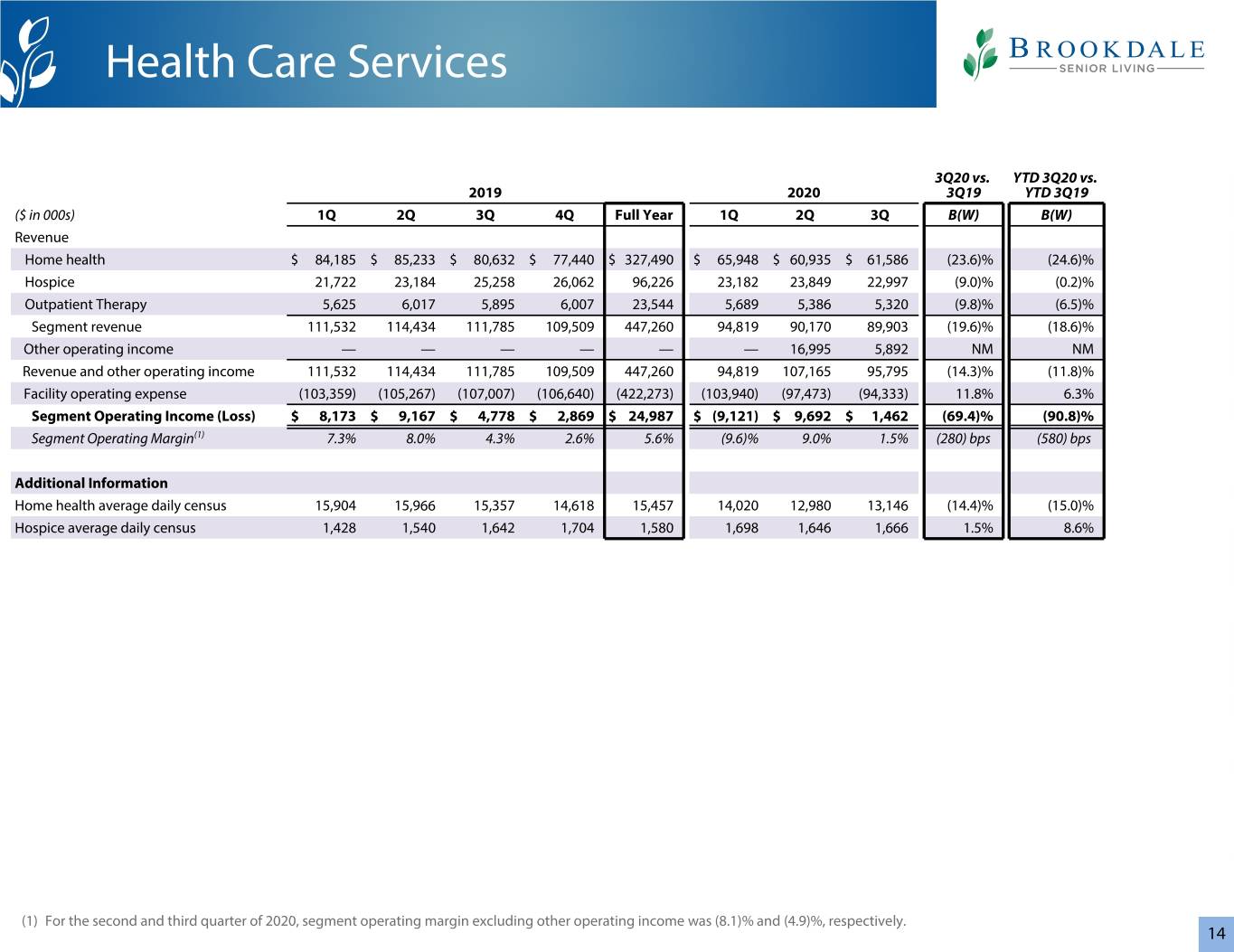

COVID-19 Financial Impact The COVID-19 pandemic adversely impacted the Company's occupancy and resident fee revenue during 2020 and resulted in incremental direct costs to prepare for and respond to the pandemic, including costs for: acquisition of additional personal protective equipment ("PPE"), medical equipment, and cleaning and disposable food service supplies, enhanced cleaning and environmental sanitation, increased labor, increased workers compensation and health plan expense, consulting and professional services, and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources. During the second quarter and third quarter of 2020, the Company accepted $33.5 million and $2.6 million, respectively, of cash for grants pursuant to the Public Health and Social Services Emergency Fund (the "Provider Relief Fund"), which was expanded by the Coronavirus Aid, Relief, and Economic Security Act of 2020 ("CARES Act"). Grants are subject to the terms and conditions of the program, including that such funds may only be used to prevent, prepare for, and respond to COVID-19 and will reimburse only for healthcare related expenses or lost revenues that are attributable to COVID-19. The Company recognized $35.0 million of the Provider Relief Fund grants and $2.5 million of other government grants in other operating income during the first three quarters of 2020 based upon the Company’s estimates of its satisfaction of the conditions of the grants during such period. The Company’s net cash provided by operating activities and Adjusted Free Cash Flow for 2020 also include the benefit of temporary liquidity relief provided pursuant to the CARES Act, including the following items. • The Company received $85.0 million and $2.5 million during the second quarter and third quarter of 2020, respectively, under the Medicare accelerated and advance payment program. Under current legislation, recoupment of accelerated/advanced payments will begin one year after payments were issued, and payments will be recouped at a rate of 25% of Medicare payments for the first eleven months following the anniversary of issuance and at a rate of 50% of Medicare payments for the next six months. Any outstanding balance of accelerated/advanced payments will be due following such recoupment period. • The Company elected to defer payment of the employer portion of social security payroll taxes incurred from March 27, 2020 to December 31, 2020. One-half of such deferral amount will become due on each of December 31, 2021 and December 31, 2022. The Company utilized this deferral program to delay payment of approximately $26.5 million and $23.6 million of the employer portion of payroll taxes during the second quarter and third quarter of 2020, respectively. The following tables present the known or estimated impacts related to the COVID-19 pandemic to the Company's consolidated and Senior Housing Same Community quarterly and year-to-date 2020 results. The tables exclude the impact of any rate adjustments under government reimbursement programs. Presentations of these impacts are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. Estimated Impact on Consolidated Portfolio 3Q 2020 Assisted Living Independent and Memory Health Care ($ in 000s) 1Q 2020 2Q 2020 Living Care CCRCs Services 3Q 2020 YTD 2020 Estimated lost resident fee revenue (1) $ 5,800 $ 63,600 $ 12,600 $ 49,200 $ 14,700 $ 15,100 $ 91,600 $ 161,000 Other operating income — 26,693 96 1,936 2,841 5,892 10,765 37,458 Facility operating expense 10,000 60,594 2,208 15,493 4,386 2,392 24,479 95,073 Working capital benefit — 118,671 20,151 138,822 Estimated Impact on Senior Housing: Same Community 3Q 2020 Assisted Living 1Q 2020 Same 2Q 2020 Same Independent and Memory 3Q 2020 YTD 2020 ($ in 000s) Community Community Living Care CCRCs Same Community Same Community Estimated lost resident fee revenue (1) $ 2,400 $ 42,600 $ 11,600 $ 47,500 $ 11,700 $ 70,800 $ 115,800 Other operating income — 6,445 96 1,937 1,677 3,710 10,155 Facility operating expense 8,899 52,322 1,868 15,454 3,096 20,418 81,639 (1) Estimated lost resident fee revenue represents the difference between the actual resident fee revenue for the period and the Company's pre-COVID-19 expectations. 4

Overview 3Q20 vs. YTD 3Q20 vs. 2019 2020 3Q19 YTD 3Q19 Better (B)/ ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q (Worse) (W) B/(W) Resident fee revenue (1) $ 809,479 $ 801,863 $ 801,237 $ 797,352 $ 3,209,931 $ 782,707 $ 731,629 $ 700,771 (12.5) % (8.2) % Management fee revenue $ 15,743 $ 15,449 $ 13,564 $ 12,352 $ 57,108 $ 108,715 $ 6,076 $ 5,669 (58.2) % 169.1 % Other operating income $ — $ — $ — $ — $ — $ — $ 26,693 $ 10,765 NM NM Net income (loss) (1) $ (42,606) $ (56,055) $ (78,508) $ (91,323) $ (268,492) $ 369,497 $ (118,420) $ (124,993) (59.2) % NM Net cash provided by (used in) operating activities $ (5,009) $ 64,128 $ 69,211 $ 88,082 $ 216,412 $ 57,479 $ 151,840 $ (77,169) NM 3.0 % Adjusted EBITDA(1) (2) $ 116,583 $ 104,036 $ 80,447 $ 100,103 $ 401,169 $ 185,069 $ 44,733 $ (64,019) NM (44.9) % Adjusted EBITDA, excluding $100.0 million management termination fee and $119.2 million one-time cash lease payment $ 116,583 $ 104,036 $ 80,447 $ 100,103 $ 401,169 $ 85,069 $ 44,733 $ 55,161 (31.4) % (38.6) % Adjusted Free Cash Flow $ (46,971) $ (16,369) $ (13,575) $ 511 $ (76,404) $ 5,182 $ 113,451 $ (114,327) NM NM Period end consolidated number of units 55,948 55,209 55,262 54,181 54,181 54,037 54,019 53,110 (3.9) % (3.9) % As of September 30, 2020 3Q 2020 weighted average occupancy Consolidated: Consolidated: (consolidated communities) 652 53,110 Community % of Period End Occupancy Band Count Communities Greater than 95% 43 7% 90% > 95% 64 10% Leased 85% > 90% 76 12% Leased 21,286 Owned 726 302 80% > 85% 69 11% Owned 63,090 350 communities 75% > 80% 95 15% 31,824 units 70% > 75% 90 14% Less than 70% 215 31% Total 652 100% Managed Managed Consolidated Portfolio Average 9,980 Asset Age ~ 23 years 74 (1) The 2019 periods presented include the non-recurring, non-cash revenue and expense associated with the Company's adoption of the lease accounting standard effective January 1, 2019. See page 26 for additional information. (2) Adjusted EBITDA for the first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak Properties Inc. ("Healthpeak") related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. Adjusted EBITDA for the second quarter, third quarter, and year-to-date of 2020 includes $26.7 million, $10.8 million, and $37.5 million of government grants recognized in other operating income during the respective period. Adjusted EBITDA for the third quarter and year-to-date of 2020 includes the $119.2 million one-time cash lease payment made to Ventas, Inc. ("Ventas") in connection with the Company's lease restructuring transaction effective July 26, 2020 ("one-time cash lease payment"). Important Note Regarding Non-GAAP Financial Measures • Adjusted EBITDA and Adjusted Free Cash Flow are financial measures that are not calculated in accordance with GAAP. See “Definitions” and “Non-GAAP Financial Measures” for the 5 definitions of such measures and other important information regarding such measures, including reconciliations to the most comparable GAAP measures.

Adjusted EBITDA and Adjusted Free Cash Flow 3Q20 vs. YTD 3Q20 vs. 2019 2020 3Q19 YTD 3Q19 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q B(W) B(W) Resident fee revenue $ 809,479 $ 801,863 $ 801,237 $ 797,352 $ 3,209,931 $ 782,707 $ 731,629 $ 700,771 (12.5) % (8.2) % Management fee revenue 15,743 15,449 13,564 12,352 57,108 108,715 6,076 5,669 (58.2) % 169.1 % Other operating income — — — — — — 26,693 10,765 NM NM Facility operating expense (586,094) (590,246) (615,717) (598,438) (2,390,495) (588,482) (606,034) (570,530) 7.3 % 1.5 % Combined Segment Operating Income 239,128 227,066 199,084 211,266 876,544 302,940 158,364 146,675 (26.3) % (8.6) % General and administrative expense (1) (49,494) (50,912) (46,570) (39,280) (186,256) (46,657) (43,031) (41,752) 10.3 % 10.6 % Cash facility operating lease payments (see page 17) (73,051) (72,118) (72,067) (71,883) (289,119) (71,214) (70,600) (168,942) (134.4) % (43.0) % Adjusted EBITDA (2) 116,583 104,036 80,447 100,103 401,169 185,069 44,733 (64,019) NM (44.9) % $100.0 million management termination fee — — — — — (100,000) — — NM NM $119.2 million one-time cash lease payment — — — — — — — 119,180 NM NM Adjusted EBITDA, excluding management termination fee and one-time cash lease payment 116,583 104,036 80,447 100,103 401,169 85,069 44,733 55,161 (31.4) % (38.6) % $100.0 million management termination fee — — — — — 100,000 — — NM NM $119.2 million one-time cash lease payment — — — — — — — (119,180) NM NM Transaction and Organizational Restructuring Costs (461) (634) (3,910) (5,002) (10,007) (1,981) (3,368) (6,250) (59.8) % (131.7) % Interest expense, net (see page 17) (59,302) (59,029) (58,749) (57,132) (234,212) (53,590) (48,623) (48,209) 17.9 % 15.1 % Payment of financing lease obligations (5,453) (5,500) (5,549) (5,740) (22,242) (5,087) (4,677) (4,548) 18.0 % 13.3 % Changes in working capital (3) (43,405) 9,620 31,439 20,410 18,064 (53,902) 149,055 33,794 7.5 % NM Other (4) (331) 1,602 1,868 3,482 6,621 (4,771) (2,148) (2,223) NM NM Non-Development Capital Expenditures, net (see page 16) (54,602) (66,464) (59,121) (55,610) (235,797) (60,556) (21,521) (22,872) 61.3 % 41.8 % Adjusted Free Cash Flow $ (46,971) $ (16,369) $ (13,575) $ 511 $ (76,404) $ 5,182 $ 113,451 $ (114,327) NM NM (1) Excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs, see page 15. (2) Adjusted EBITDA for the first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. Adjusted EBITDA for the second quarter, third quarter, and year-to-date 2020 includes $26.7 million, $10.8 million, and $37.5 million, respectively, of government grants recognized in other operating income. Adjusted EBITDA for the third quarter and year- to-date of 2020 includes the $119.2 million one-time cash lease payment. (3) Excludes changes in prepaid insurance premiums financed with notes payable, changes in operating lease liability for lease termination and modification, and lessor capital expenditure reimbursements under operating leases and includes $118.7 million and $20.2 million impact related to CARES Act programs for the second quarter and third quarter of 2020, respectively. (4) Primarily consists of proceeds from property insurance and cash paid for state income taxes. 6

Adjusted EBITDA and Adjusted Free Cash Flow Distribution 3Q 2020 Senior Senior Housing Housing Owned Leased Health Care Management ($ in 000s) Total Portfolio Portfolio Services Services Other (1) Resident fee revenue $ 700,771 $ 356,105 $ 254,763 $ 89,903 $ — $ — Management fee revenue 5,669 — — — 5,669 — Other operating income 10,765 3,317 1,556 5,892 — — Facility operating expense (570,530) (284,780) (191,417) (94,333) — — Combined Segment Operating Income 146,675 74,642 64,902 1,462 5,669 — General and administrative expense (excluding non-cash stock-based compensation expense and transaction costs) (41,752) (17,804) (12,738) (5,158) (6,052) — Cash facility operating lease payments (2) (168,942) — (167,393) — — (1,549) Adjusted EBITDA (3) (64,019) 56,838 (115,229) (3,696) (383) (1,549) $119.2 million one-time cash lease payment 119,180 — 119,180 — — — Adjusted EBITDA, excluding one-time cash lease payment 55,161 56,838 3,951 (3,696) (383) (1,549) $119.2 million one-time cash lease payment (119,180) — (119,180) — — — Transaction and Organizational Restructuring Costs (6,250) — — — — (6,250) Interest expense, net (48,209) (36,908) (11,908) — — 607 Payment of financing lease obligations (4,548) (4,413) — — (135) Changes in working capital (4) 33,794 — — — — 33,794 Other (2,223) (648) — — — (1,575) Non-Development Capital Expenditures, net (22,872) (12,236) (5,808) — — (4,828) Adjusted Free Cash Flow $ (114,327) $ 7,046 $ (137,358) $ (3,696) $ (383) $ 20,064 (1) Primarily consists of changes in working capital, Transaction and Organizational Restructuring Costs, corporate capital expenditures, lease payments for corporate offices and information technology systems and equipment, cash paid for state income taxes, and interest income. (2) The Senior Housing Leased Portfolio amount includes the $119.2 million one-time cash lease payment. (3) Adjusted EBITDA for the third quarter of 2020 includes $10.8 million of government grants recognized in other operating income and the one-time cash lease payment. (4) Excludes changes in prepaid insurance premiums financed with notes payable and lessor capital expenditure reimbursements under operating leases and includes $20.2 million impact related to CARES Act programs for the third quarter of 2020. 7

Segment Overview 3Q20 vs. YTD 3Q20 vs. 2019 2020 3Q19 YTD 3Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q B(W) B(W) Total Senior Housing, Health Care Services, and Management Services Revenue (1) $ 825,222 $ 817,312 $ 814,801 $ 809,704 $ 3,267,039 $ 891,422 $ 737,705 $ 706,440 (13.3) % (5.0) % Other operating income $ — $ — $ — $ — $ — $ — $ 26,693 $ 10,765 NM NM Combined Segment Operating Income $ 239,128 $ 227,066 $ 199,084 $ 211,266 $ 876,544 $ 302,940 $ 158,364 $ 146,675 (26.3) % (8.6) % Combined Segment Operating Margin (2) 29.0 % 27.8 % 24.4 % 26.1 % 26.8 % 34.0 % 20.7 % 20.5 % (390) bps (150) bps Senior Housing (see page 9) Revenue $ 697,947 $ 687,429 $ 689,452 $ 687,843 $ 2,762,671 $ 687,888 $ 641,459 $ 610,868 (11.4) % (6.5) % Other operating income $ — $ — $ — $ — $ — $ — $ 9,698 $ 4,873 NM NM Senior Housing Operating Income $ 215,212 $ 202,450 $ 180,742 $ 196,045 $ 794,449 $ 203,346 $ 142,596 $ 139,544 (22.8) % (18.9) % Senior Housing Operating Margin (2) 30.8 % 29.5 % 26.2 % 28.5 % 28.8 % 29.6 % 21.9 % 22.7 % (350) bps (400) bps Number of communities (period end) 680 671 671 663 663 661 660 652 (2.8) % (2.8) % Period end number of units 55,948 55,209 55,262 54,181 54,181 54,037 54,019 53,110 (3.9) % (3.9) % Total Average Units 56,460 55,465 55,258 54,821 55,501 54,184 54,040 53,440 (3.3) % (3.3) % RevPAR $ 4,102 $ 4,097 $ 4,109 $ 4,116 $ 4,106 $ 4,229 $ 3,954 $ 3,806 (7.4) % (2.6) % Weighted average unit occupancy 83.6 % 83.5 % 84.2 % 84.5 % 83.9 % 83.2 % 78.7 % 75.3 % (890) bps (460) bps RevPOR $ 4,909 $ 4,909 $ 4,880 $ 4,871 $ 4,893 $ 5,085 $ 5,022 $ 5,056 3.6 % 3.1 % Health Care Services Segment (see page 14) Revenue $ 111,532 $ 114,434 $ 111,785 $ 109,509 $ 447,260 $ 94,819 $ 90,170 $ 89,903 (19.6) % (18.6) % Other operating income $ — $ — $ — $ — $ — $ — $ 16,995 $ 5,892 NM NM Segment Operating Income $ 8,173 $ 9,167 $ 4,778 $ 2,869 $ 24,987 $ (9,121) $ 9,692 $ 1,462 (69.4) % (90.8) % Segment Operating Margin (2) 7.3 % 8.0 % 4.3 % 2.6 % 5.6 % (9.6) % 9.0 % 1.5 % (280) bps (580) bps Management Services Segment Segment Operating Income (comprised solely of management fees) $ 15,743 $ 15,449 $ 13,564 $ 12,352 $ 57,108 $ 108,715 $ 6,076 $ 5,669 (58.2) % 169.1 % Resident fee revenue under management (3) $ 321,952 $ 294,114 $ 275,796 $ 259,437 $ 1,151,299 $ 184,145 $ 131,558 $ 116,576 (57.7) % (51.5) % Number of communities (period end) (3) 164 138 123 100 100 80 77 74 (39.8) % (39.8) % Period end number of units (3) 23,742 21,451 20,168 18,086 18,086 11,033 10,694 9,980 (50.5) % (50.5) % Total Average Units (3) 25,047 22,464 20,730 18,836 21,769 13,325 10,905 10,446 (49.6) % (49.2) % Weighted average unit occupancy (3) 82.9 % 82.8 % 83.4 % 84.6 % 83.3 % 84.0 % 78.0 % 74.6 % (880) bps (370) bps (1) Excludes reimbursed costs on behalf of managed communities. (2) For the second quarter of 2020, segment operating margin excluding other operating income was 17.8% for Total Senior Housing, Health Care Services and Management Services; 20.7% for Senior Housing; and (8.1)% for Health Care Services. For the third quarter of 2020, segment operating margin excluding other operating income was 19.2% for Total Senior Housing, Health Care Services, and Management Services; 22.0% for Senior Housing; and (4.9)% for Health Care Services. (3) Not included in consolidated reported amounts. 8