Form 10-Q Cell Source, Inc. For: Mar 31

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Nevada

|

32-0379665

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

57 West 57th Street, Suite 400

New York, New York

|

10019

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

None

|

N/A

|

N/A

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| Emerging growth company | ☐ |

|

PART I - FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

Item 1. Financial Statements.

|

|

3

|

|

Condensed Consolidated Balance Sheets as of

March 31, 2019 (Unaudited) and December 31, 2018

|

|

3

|

|

Unaudited Condensed Consolidated Statements of Operations for the

Three Months Ended March 31, 2019 and 2018

|

|

4

|

|

Unaudited Condensed Consolidated Statements of Changes in Stockholders’ Deficiency for the

Three Months Ended March 31, 2019 and 2018

|

5

|

|

|

Unaudited Condensed Consolidated Statements of Cash Flows for the

Three Months Ended March 31, 2019 and 2018

|

|

6

|

|

Notes to Unaudited Condensed Consolidated Financial Statements

|

|

7

|

|

|

|

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations.

|

|

12

|

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

|

|

14

|

|

|

|

|

|

Item 4. Controls and Procedures.

|

|

14

|

|

|

|

|

|

PART II - OTHER INFORMATION

|

|

15

|

|

|

|

|

|

Item 1. Legal Proceedings.

|

|

15

|

|

|

|

|

|

Item 1A. Risk Factors.

|

15

|

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

|

|

15

|

|

|

|

|

|

Item 3. Defaults Upon Senior Securities.

|

|

15

|

|

|

|

|

|

Item 4. Mine Safety Disclosures.

|

|

15

|

|

|

|

|

|

Item 5. Other Information.

|

|

15

|

|

|

|

|

|

Item 6. Exhibits.

|

|

16

|

|

|

|

|

|

SIGNATURES

|

|

17

|

|

March 31,

|

December 31,

|

|||||||

|

2019

|

2018

|

|||||||

|

(Unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current Assets:

|

||||||||

|

Cash

|

$

|

13,490

|

$

|

18,934

|

||||

|

Prepaid expenses

|

34,917

|

38,926

|

||||||

|

Other current assets

|

10,492

|

7,932

|

||||||

|

Total Assets

|

$

|

58,899

|

$

|

65,792

|

||||

|

Liabilities and Stockholders' Deficiency

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$

|

770,287

|

$

|

277,786

|

||||

|

Accrued expenses

|

726,221

|

532,790

|

||||||

|

Accrued expenses - related parties

|

97,000

|

72,000

|

||||||

|

Accrued interest

|

285,025

|

345,948

|

||||||

|

Accrued interest - related parties

|

28,299

|

27,559

|

||||||

|

Accrued compensation

|

616,427

|

587,734

|

||||||

|

Accrued compensation - related party

|

79,603

|

55,083

|

||||||

|

Advances payable

|

175,000

|

100,000

|

||||||

|

Advances payable - related party

|

100,000

|

100,000

|

||||||

|

Notes payable

|

1,063,000

|

1,463,000

|

||||||

|

Notes payable - related parties

|

150,000

|

150,000

|

||||||

|

Convertible notes payable

|

545,000

|

835,000

|

||||||

|

Convertible notes payable - related parties

|

225,000

|

225,000

|

||||||

|

Derivative liabilities

|

147,900

|

200,500

|

||||||

|

Accrued dividend payable

|

161,598

|

13,563

|

||||||

|

Total Liabilities

|

5,170,360

|

4,985,963

|

||||||

|

Commitments and contingencies (Note 8)

|

-

|

-

|

||||||

|

Stockholders' Deficiency:

|

||||||||

|

Convertible Preferred Stock, $0.001 par value, 10,000,000 shares authorized; Series A Convertible Preferred Stock,

1,335,000 shares designated, 1,048,989 and 860,291 shares

issued and outstanding as of March 31, 2019 and

December

31, 2018, respectively; liquidation preference of $8,029,016 and $6,465,745as of March 31, 2019 and

December 31, 2018, respectively

|

1,048

|

860

|

||||||

|

Common Stock, $0.001 par value, 200,000,000 shares authorized, 26,077,611 shares issued and outstanding as of

March

31, 2019 and December 31, 2018

|

26,078

|

26,078

|

||||||

|

Additional paid-in capital

|

12,990,255

|

11,723,224

|

||||||

|

Accumulated deficit

|

(18,128,842

|

)

|

(16,670,333

|

)

|

||||

|

Total Stockholders' Deficiency

|

(5,111,461

|

)

|

(4,920,171

|

)

|

||||

|

Total Liabilities and Stockholders' Deficiency

|

$

|

58,899

|

$

|

65,792

|

||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

(Unaudited)

|

For the Three Months Ended March 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Operating Expenses:

|

||||||||

|

Research and development

|

$

|

724,742

|

$

|

77,616

|

||||

|

Research and development - related party

|

25,000

|

225,139

|

||||||

|

Selling, general and administrative

|

421,290

|

357,357

|

||||||

|

Total Operating Expenses

|

1,171,032

|

660,112

|

||||||

|

Loss From Operations

|

(1,171,032

|

)

|

(660,112

|

)

|

||||

|

Other (Expense) Income:

|

||||||||

|

Interest expense

|

(76,867

|

)

|

(30,265

|

)

|

||||

|

Interest expense - related parties

|

(740

|

)

|

(740

|

)

|

||||

|

Amortization of debt discount

|

-

|

(137,974

|

)

|

|||||

|

Amortization of debt discount - related parties

|

-

|

(18,493

|

)

|

|||||

|

Change in fair value of derivative liabilities

|

52,600

|

135,400

|

||||||

|

Loss on exchange of notes payable for Series A Convertible Preferred Stock

|

(262,470

|

)

|

-

|

|||||

|

Total Other Expense

|

(287,477

|

)

|

(52,072

|

)

|

||||

|

Net Loss

|

(1,458,509

|

)

|

(712,184

|

)

|

||||

|

Dividend attributable to Series A preferred stockholders

|

(148,035

|

)

|

(107,496

|

)

|

||||

|

Net Loss Applicable to Common Stockholders

|

$

|

(1,606,544

|

)

|

$

|

(819,680

|

)

|

||

|

Net Loss Per Common Share - Basic and Diluted

|

$

|

(0.06

|

)

|

$

|

(0.03

|

)

|

||

|

Weighted Average Common Shares Outstanding -

|

||||||||

|

Basic and Diluted

|

28,121,446

|

27,393,071

|

||||||

(Unaudited)

|

|

FOR THE THREE MONTHS ENDED MARCH 31, 2019

|

|||||||||||||||||||||||||||

|

|

Convertible Preferred

|

Total

|

||||||||||||||||||||||||||

|

|

Stock - Series A

|

Common Stock

|

Additional

|

Accumulated

|

Stockholders'

|

|||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Paid-In Capital

|

Deficit

|

Deficiency

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance, January 1, 2019

|

860,291

|

$

|

860

|

26,077,611

|

$

|

26,078

|

$

|

11,723,224

|

$

|

(16,670,333

|

)

|

$

|

(4,920,171

|

)

|

||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Issuance of Series A

Convertible

Preferred Stock for cash

|

43,331

|

43

|

-

|

-

|

324,957

|

-

|

325,000

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Issuance of Series

A Convertible Preferred

Stock in exchange for notes payable

|

145,367

|

145

|

-

|

-

|

1,090,109

|

-

|

1,090,254

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Series A Convertible

Preferred Stock dividends:

Accrual of earned dividends

|

-

|

-

|

-

|

-

|

(148,035

|

)

|

-

|

(148,035

|

)

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss

|

-

|

-

|

-

|

-

|

-

|

(1,458,509

|

)

|

(1,458,509

|

)

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance, March 31, 2019

|

1,048,989

|

$

|

1,048

|

26,077,611

|

$

|

26,078

|

$

|

12,990,255

|

$

|

(18,128,842

|

)

|

$

|

(5,111,461

|

)

|

||||||||||||||

|

|

FOR THE THREE MONTHS ENDED MARCH 31, 2018

|

|||||||||||||||||||||||||||

|

|

Convertible Preferred

|

Total

|

||||||||||||||||||||||||||

|

|

Stock - Series A

|

Common Stock

|

Additional

|

Accumulated

|

Stockholders'

|

|||||||||||||||||||||||

|

|

Shares

|

Amount

|

Shares

|

Amount

|

Paid-In Capital

|

Deficit

|

Deficiency

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance, January 1, 2018

|

643,790

|

$

|

644

|

25,349,236

|

$

|

25,349

|

$

|

9,969,520

|

$

|

(14,552,887

|

)

|

$

|

(4,557,374

|

)

|

||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Issuance of Series A

Convertible

Preferred Stock for cash

|

6,667

|

6

|

-

|

-

|

49,994

|

-

|

50,000

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Series A Convertible

Preferred Stock dividends:

Accrual of earned dividends

|

-

|

-

|

-

|

-

|

(107,496

|

)

|

-

|

(107,496

|

)

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss

|

-

|

-

|

-

|

-

|

-

|

(712,184

|

)

|

(712,184

|

)

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance, March 31, 2018

|

650,457

|

$

|

650

|

25,349,236

|

$

|

25,349

|

$

|

9,912,018

|

$

|

(15,265,071

|

)

|

$

|

(5,327,054

|

)

|

||||||||||||||

CELL SOURCE, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

For The Three Months Ended March 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Cash Flows From Operating Activities:

|

||||||||

|

Net loss

|

$

|

(1,458,509

|

)

|

$

|

(712,184

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Change in fair value of derivative liabilities

|

(52,600

|

)

|

(135,400

|

)

|

||||

|

Amortization of debt discount

|

-

|

156,467

|

||||||

|

Loss on exchange of notes payable for preferred shares

|

262,470

|

-

|

||||||

|

Stock-based compensation:

|

||||||||

|

Warrants

|

33,007

|

-

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Prepaid expenses

|

4,009

|

(47,082

|

)

|

|||||

|

Other current assets

|

(2,560

|

)

|

7,923

|

|||||

|

Accounts payable

|

492,501

|

394

|

||||||

|

Accrued expenses

|

193,431

|

(18,476

|

)

|

|||||

|

Accrued expenses - related parties

|

25,000

|

25,000

|

||||||

|

Accrued interest

|

76,861

|

12,220

|

||||||

|

Accrued interest - related parties

|

740

|

740

|

||||||

|

Accrued compensation

|

20,206

|

424

|

||||||

|

Net Cash Used In Operating Activities

|

(405,444

|

)

|

(709,974

|

)

|

||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Proceeds from cash advances

|

75,000

|

-

|

||||||

|

Proceeds from issuance of notes payable

|

-

|

500,000

|

||||||

|

Proceeds from issuance of preferred stock - Series A

|

325,000

|

50,000

|

||||||

|

Net Cash Provided By Financing Activities

|

400,000

|

550,000

|

||||||

|

Net Decrease In Cash

|

(5,444

|

)

|

(159,974

|

)

|

||||

|

Cash - Beginning of Period

|

18,934

|

371,048

|

||||||

|

Cash - End of Period

|

$

|

13,490

|

$

|

211,074

|

||||

|

Supplemental Disclosures of Cash Flow Information:

|

||||||||

|

Cash paid for:

|

||||||||

|

Interest

|

$

|

-

|

$

|

18,030

|

||||

|

Non-cash investing and financing activities:

|

||||||||

|

Preferred

stock issued in exchange for notes and advances payable

|

$

|

1,090,254

|

$

|

-

|

||||

|

Accrual of earned preferred stock dividends

|

$

|

(148,035

|

)

|

$

|

(107,496

|

)

|

||

|

Warrants

and conversion options issued in connection with issuance and extension of notes payable

|

$

|

-

|

$

|

49,600

|

||||

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, such statements include all adjustments (consisting only of normal recurring items) which are considered necessary for a fair presentation of the condensed consolidated financial position of the Company as of March 31, 2019 and the condensed consolidated results of its operations and cash flows for the three months ended March 31, 2019 and 2018. The results of operations for the three months ended March 31, 2019 are not necessarily indicative of the operating results for the full year ending December 31, 2019 or any other period. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related disclosures of the Company as of December 31, 2018 and for the year then ended which were included in the Company's Annual Report on Form 10-K that was filed with the Securities and Exchange Commission (“SEC”) on April 1, 2019.

Note 2- Going Concern and Management Plans

During the three months ended March 31, 2019, the Company had not generated any revenues, had a net loss of approximately $1,459,000 and had used cash in operations of approximately $405,000. As of March 31, 2019, the Company had a working capital deficiency of approximately $5,111,000 and an accumulated deficit of approximately $18,129,000. Subsequent to March 31, 2019 and as more fully described in Note 9, Subsequent Events, the Company received aggregate proceeds of $573,308 through the sale of 76,437 shares of Series A Convertible Preferred Stock at $7.50 per share and $70,000 through the issuance of a short term note payable. These conditions raise substantial doubt about the Company’s ability to continue as a going concern within twelve months from the date these financial statements are issued.

The Company is currently funding its operations on a month-to-month basis. While there can be no assurance that it will be successful, the Company is in active negotiations to raise additional capital. The Company’s primary source of operating funds since inception has been equity and debt financings. Management’s plans include continued efforts to raise additional capital through debt and equity financings. There is no assurance that these funds will be sufficient to enable the Company to fully complete its development activities or attain profitable operations. If the Company is unable to obtain such additional financing on a timely basis or, notwithstanding any request the Company may make, if the Company’s debt holders do not agree to convert their notes into equity or extend the maturity dates of their notes, the Company may have to curtail its development, marketing and promotional activities, which would have a material adverse effect on the Company’s business, financial condition and results of operations, and ultimately the Company could be forced to discontinue its operations and liquidate.

|

March 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Warrants

|

6,374,157

|

11,915,481

|

||||||

|

Convertible notes

|

1,069,101

|

1,520,732

|

||||||

|

Convertible preferred stock

|

10,489,890

|

6,504,570

|

||||||

|

Total

|

17,933,148

|

19,940,783

|

||||||

| Level 1 |

Inputs use quoted prices in active markets for identical assets or liabilities that the Company has the ability to access.

|

| Level 2 |

Inputs use directly or indirectly observable inputs. These inputs include quoted prices for similar assets and liabilities in active markets as well as

other inputs such as interest rates and yield curves that are observable at commonly quoted intervals.

|

| Level 3 |

Inputs are unobservable inputs, including inputs that are available in situations where there is little, if any, market activity for the related asset or

liability.

|

|

|

Quoted Prices

|

|||||||||||||||

|

In Active

|

Significant

|

|||||||||||||||

|

Markets for

|

Other

|

Significant

|

||||||||||||||

|

Identical

|

Observable

|

Unobservable

|

||||||||||||||

|

Liabilities

|

Inputs

|

Inputs

|

||||||||||||||

|

Total

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

|||||||||||||

|

Accrued compensation - common stock

|

$

|

37,500

|

$

|

-

|

$

|

-

|

$

|

37,500

|

||||||||

|

Accrued compensation - warrants

|

33,228

|

-

|

-

|

33,228

|

||||||||||||

|

Accrued compensation - warrants - related party

|

79,603

|

-

|

-

|

79,603

|

||||||||||||

|

Derivative liabilities

|

147,900

|

-

|

-

|

147,900

|

||||||||||||

|

Balance - March 31, 2019

|

$

|

298,231

|

$

|

-

|

$

|

-

|

$

|

298,231

|

||||||||

|

Accrued compensation - common stock

|

$

|

37,500

|

$

|

-

|

$

|

-

|

$

|

37,500

|

||||||||

|

Accrued compensation - warrants

|

24,741

|

-

|

-

|

24,741

|

||||||||||||

|

Accrued compensation - warrants - related party

|

55,083

|

-

|

-

|

55,083

|

||||||||||||

|

Derivative liabilities

|

200,500

|

-

|

-

|

200,500

|

||||||||||||

|

Balance - December 31, 2018

|

$

|

317,824

|

$

|

-

|

$

|

-

|

$

|

317,824

|

||||||||

|

Accrued

|

Derivative

|

|||||||||||

|

Compensation

|

Liabilities

|

Total

|

||||||||||

|

Balance - December 31, 2018

|

$

|

117,324

|

$

|

200,500

|

$

|

317,824

|

||||||

|

Accrued compensation - warrants

|

8,560

|

-

|

8,560

|

|||||||||

|

Accrued compensation - warrants - related party

|

24,683

|

-

|

24,683

|

|||||||||

|

Change in fair value

|

(236

|

)

|

(52,600

|

)

|

(52,836

|

)

|

||||||

|

Balance - March 31, 2019

|

$

|

150,331

|

$

|

147,900

|

$

|

298,231

|

||||||

|

For the Three Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Risk-free interest rate

|

2.21% - 2.44

|

%

|

1.73% - 2.69

|

%

|

||||

|

Expected term (years)

|

0.02 - 5.00

|

0.25 - 5.00

|

||||||

|

Expected volatility

|

110

|

%

|

110

|

%

|

||||

|

Expected dividends

|

0.00

|

%

|

0.00

|

%

|

||||

|

March 31,

|

December 31,

|

|||||||

|

2019

|

2018

|

|||||||

|

(unaudited)

|

||||||||

|

Cash

|

$

|

13,490

|

$

|

18,934

|

||||

|

Working capital deficiency

|

$

|

(5,111,461

|

)

|

$

|

(4,920,171

|

)

|

||

|

Exhibit

|

||||

|

Number

|

Description

|

|||

|

10.39(a)

|

Amendment No. 1 to Veto Cell Production and Clinical Trial Program Agreement dated as of April 4, 2019 between Cell Source

Limited and The University of Texas M.D. Anderson Cancer Center (1)

|

|||

|

31

|

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of the Chief

Executive Officer and Chief Financial Officer

|

||

|

32

|

*

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of the Chief

Executive Officer and Chief Financial Officer

|

||

|

101.INS

|

|

XBRL Instance Document

|

||

|

101.SCH

|

|

XBRL Schema Document

|

||

|

101.CAL

|

|

XBRL Calculation Linkbase Document

|

||

|

101.DEF

|

|

XBRL Definition Linkbase Document

|

||

|

101.LAB

|

|

XBRL Label Linkbase Document

|

||

|

101.PRE

|

|

XBRL Presentation Linkbase Document

|

| (1) |

Certain

information has been excluded from this exhibit because (i) it is not material and (ii) would be competitively harmful if publicly disclosed.

|

|

| * |

This certification is being furnished and shall not be deemed "filed" with the SEC for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference. |

|

|

CELL SOURCE, INC.

|

|

|

|

|

|

|

|

|

Dated: May 20, 2019

|

By:

|

/s/ Itamar Shimrat

|

|

|

|

|

Name: Itamar Shimrat

|

|

|

|

|

Title: Chief Executive Officer and

Chief Financial Officer (Principal

Executive, Financial and Accounting

Officer)

|

|

| A. |

Cell Source and MD Anderson entered into a Veto Cell Production and Clinical Trial Program Agreement dated February 19, 2019 (the “Agreement”).

|

| B. |

Cell Source and MD Anderson wish to amend the terms of the Agreement as set forth below.

|

| 1. |

Exhibit B of the Agreement shall be revised in its entirety with the attached Amended Exhibit B.

|

| 2. |

Except as expressly provided in this Amendment, all other terms, conditions and provisions of the Agreement shall continue in full force and effect as

provided therein.

|

|

CELL SOURCE

|

THE UNIVERSITY OF TEXAS

|

||

| |

M.D. ANDERSON CANCER CENTER | ||

|

By /s/ Itamar Shimrat

|

By /s/ Nyma Shah

|

||

|

Itamar Shimrat

|

Name: Nyma Shah

|

||

|

Chief Executive Officer

|

Title: Director, Research Funding Programs

|

||

|

Date: April 4, 2019

|

Date: April 19, 2019

|

||

|

Read & Understood:

|

|||

|

/s/ Richard Champlin

|

|||

|

Dr. Richard Champlin

|

|||

|

Principal Investigator

|

|

·

|

the name of the bank submitting the payment,

|

|

·

|

RCTS number : [ ]

|

|

·

|

amount of the payment,

|

|

·

|

MD Anderson Principal Investigator Richard Champlin MD

|

|

·

|

Sponsor contact name or email regarding Payments

|

|

·

|

Sponsor Protocol number 2018-0221

|

|

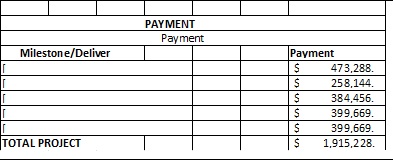

EXHIBIT B- BUDGET

Funding Agency:

|

Cell Source Limited

|

|

|

Principal Investigator:

|

Champlin, Richard

|

|

|

Title:

|

Role of Veto Cells in Haploidentical Transplantation for Myeloma

|

|

|

Project Dates:

|

TBD

|

|

|

Protocol(s)

|

2018-0221

|

3% increase

|

|

Total Patients

|

[_____]

|

|

|

*

|

|

|

Year 1

|

Year 2

|

|||||||||||||||||||||||||||||||||

|

Personnel

|

Base Salary

|

Cal Mths.

|

Effort

|

Salary

|

Fringe

|

Total

|

Total

|

Grand Total

|

||||||||||||||||||||||||||

|

[

|

]

|

[ |

]

|

[ |

]

|

[[

|

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

|||||||||||||||||

| [ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

|||||||||||||||||

| [ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

|||||||||||||||||

| [ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

|||||||||||||||||

| [ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

[ |

]

|

|||||||||||||||||

|

Salary Total

|

$

|

[ |

] |

$

|

[ |

]

|

[ |

]

|

||||||||||||||||||||||||||

|

Equipment

|

$

|

--

|

$

|

--

|

--

|

|||||||||||||||||||||||||||||

|

Consultant Costs

|

$

|

$ | ||||||||||||||||||||||||||||||||

|

Total

|

$

|

--

|

$

|

--

|

$

|

--

|

||||||||||||||||||||||||||||

|

Supplies

|

||||||||||||||||||||||||||||||||||

|

Travel

|

||||||||||||||||||||||||||||||||||

|

Total

|

||||||||||||||||||||||||||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]***

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

| [ |

]

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

||||||||||||

|

Total

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

|||||||||||

|

Direct Costs

|

|||||||||||||||||

|

Indirect Costs [ ]%

|

$

|

[________]

|

$

|

[_________]

|

$

|

[_________]

|

|||||||||||

|

Total Costs

|

$1,103,978.68

|

$811,249.33

|

$1,915,228.01

|

||||||||||||||

|

***[ ].

|

|||||||||||||||||

|

1.

|

I have reviewed this Quarterly Report on Form 10-Q of Cell Source, Inc.;

|

|

2.

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in

light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

|

|

3.

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

|

|

4.

|

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act

Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

|

|

a)

|

designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

|

|

b)

|

designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

|

|

c)

|

evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the

disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

|

|

d)

|

disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the

registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

|

|

5.

|

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the

registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

|

|

a)

|

all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely

affect the registrant’s ability to record, process, summarize and report financial information; and

|

|

b)

|

any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial

reporting.

|

Itamar Shimrat

(Principal Executive, Financial, and Accounting Officer)

Itamar Shimrat

(Principal Executive, Financial, and Accounting Officer)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- TotalEnergies BWF Thomas & Uber Cup Finals 2024 to Kick Off in Chengdu

- International Horticultural Exhibition 2024 Chengdu Opens

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share