Form SC 13E3 Yintech Investment Holdi Filed by: Yintech Investment Holdings Ltd

Use these links to rapidly review the document

TABLE OF CONTENTS

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Rule 13e-100)

Rule 13e-3 Transaction Statement under Section 13(e)

of the Securities Exchange Act of 1934

Yintech Investment Holdings Limited

(Name of the Issuer)

Yintech Investment Holdings Limited

Yinke Holdings Ltd

Yinke Merger Co. Ltd

Wenbin Chen

Coreworth Investments Limited

Ming Yan

Harmony Creek Investments Limited

Ningfeng Chen

Rich Horizon Investments Limited

Sina Corporation

MeMeStar Limited

Sino August Investment Limited

Bingsen Chen

Pan Hou Capital Management Limited

Lanxiang Wang

Chang Qing Investment Management Company Limited

Juehao Li

Orchid Asia VI, L.P.

Orchid Asia V Co-Investment, Limited

OAVI Holdings, L.P.

Orchid Asia VI GP, Limited

Orchid Asia V Group Management, Limited

Orchid Asia V Group, Limited

AREO Holdings Limited

YM Investment Limited

The Li Family (PTC) Limited

Lam Lai Ming

Fanghai Yu

Yu Zou

Dongda Zou

Qin Wang

Youbin Leng

Jigeng Chen

Pingsen Chen

Dikuo Bo

Xinzhou Tang

(Name of Person(s) Filing Statement)

Ordinary Shares, par value US$0.00001 per share*

American Depositary Shares, each representing twenty Ordinary Shares

(Title of Classes of Securities)

98585M108**

(CUSIP Number of Classes of Securities)

| Yintech Investment Holdings Limited 3rd Floor, Lujiazui Investment Tower No.360 Pudian Road, Pudong District, Shanghai, 200125, People's Republic of China Attention: Di Qian Tel: +86 (21) 2028 8020 |

Yinke Holdings Ltd Yinke Merger Co. Ltd Wenbin Chen Coreworth Investments Limited Ming Yan Harmony Creek Investments Limited Ningfeng Chen Rich Horizon Investments Limited Sina Corporation MeMeStar Limited Sino August Investment Limited Bingsen Chen Pan Hou Capital Management Limited Lanxiang Wang |

| Chang Qing Investment Management Company Limited Juehao Li Orchid Asia VI, L.P. Orchid Asia V Co-Investment, Limited OAVI Holdings, L.P. Orchid Asia VI GP, Limited Orchid Asia V Group Management, Limited Orchid Asia V Group, Limited AREO Holdings Limited YM Investment Limited The Li Family (PTC) Limited Lam Lai Ming Fanghai Yu Yu Zou Dongda Zou Qin Wang Youbin Leng Jigeng Chen Pingsen Chen Dikuo Bo Xinzhou Tang c/o 3rd Floor, Lujiazui Investment Tower, 360 Pudian Road Pudong New Area, Shanghai, 200122, People's Republic of China Attention: Wenbin Chen Tel: +86 (21) 2028 8020 |

||

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement) |

||

With copies to:

| David T. Zhang, Esq. Xiaoxi Lin, Esq. Kirkland & Ellis 26th Floor, Gloucester Tower The Landmark 15 Queen's Road, Central Hong Kong Tel: +852 3761 3300 |

Howard Zhang, Esq. Davis Polk & Wardwell LLP 2201, China World Office 2 No. 1, Jian Guo Men Wai Avenue Beijing 100004, China Tel: +86 10 8567 5000 Li He, Esq. Davis Polk & Wardwell LLP 18th Floor, The Hong Kong Club Building 3A Chater Road Hong Kong Tel: +852 2533 3300 |

Peter X. Huang Skadden, Arps, Slate, Meagher & Flom LLP 30/F, China World Office 2 No. 1, Jian Guo Men Wai Avenue Beijing 100004, China Tel: +86-10-6535-5500 |

This statement is filed in connection with (check the appropriate box):

oThe filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934.

oThe filing of a registration statement under the Securities Act of 1933.

oA tender offer.

ýNone of the above.

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: o

Check the following box if the filing is a final amendment reporting the results of the transaction: o

Calculation of Filing Fee

| Transaction Valuation*** |

Amount of Filing Fee**** |

|

|---|---|---|

| US$49,023,307.18 | US$6,363.23 | |

- *

- Not

for trading, but only in connection with the listing on the Nasdaq Global Select Market of the American depositary shares ("ADSs"),

each representing twenty (20) ordinary shares, par value US$0.00001 per share, of the Company (the "Ordinary Shares").

- **

- CUSIP

number of the ADSs.

- ***

- Calculated

solely for the purpose of determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934. The filing fee

is calculated based on the sum of (a) the aggregate cash payment for the proposed per share cash payment of US$0.365 for 123,903,040 outstanding Ordinary Shares of the issuer (including shares

represented by ADSs) subject to the transaction, plus (b) the product of 16,510,740 Ordinary Shares underlying the outstanding options multiplied by US$0.202 per option share (which is the

difference between the US$0.365 per Ordinary Share merger consideration and the exercise price of the options of US$0.163 per Ordinary Share), and plus (c) the product of 1,269,940 Ordinary

Shares underlying the outstanding restricted share units multiplied by US$0.365 per Ordinary Share ((a), (b) and (c) together, the "Transaction Valuation").

- ****

- The

amount of the filing fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange Commission Fee Rate Advisory #1 for

Fiscal Year 2020, was calculated by multiplying the Transaction Valuation by 0.0001298.

- o

- Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing.

| Amount Previously Paid: N/A | Filing Party: N/A | |

| Form or Registration No.: N/A | Date Filed: N/A |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on schedule 13e-3. Any representation to the contrary is a criminal offense.

i

This transaction statement pursuant to Rule 13e-3, together with the exhibits hereto (this "Transaction Statement"), is being filed with the Securities and Exchange Commission (the "SEC") pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), jointly by the following Persons (each separately, a "Filing Person," and collectively, the "Filing Persons"): (a) Yintech Investment Holdings Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (the "Company"), the issuer of the Ordinary Shares, including the Ordinary Shares represented by ADSs, that is subject to the transaction pursuant to Rule 13e-3 under the Exchange Act; (b) Yinke Holdings Ltd, an exempted company with limited liability incorporated under the laws of the Cayman Islands ("Parent"); (c) Yinke Merger Co. Ltd, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly-owned subsidiary of Parent ("Merger Sub"); (d) Mr. Wenbin Chen, co-founder, chairman of the board of the directors and chief executive officer of the Company, and Coreworth Investments Limited ("Coreworth Investments"), a company incorporated under the laws of the British Virgin Islands and wholly-owned by Mr. Wenbin Chen; (e) Mr. Ming Yan, co-founder and director of the Company, and Harmony Creek Investments Limited ("Harmony Creek"), a company incorporated under the laws of the British Virgin Islands and wholly-owned by Mr. Ming Yan; (f) Ms. Ningfeng Chen, co-founder and director of the Company, and Rich Horizon Investments Limited ("Rich Horizon"), a company incorporated under the laws of the British Virgin Islands and wholly-owned by Ms. Ningfeng Chen; (g) Sina Corporation ("SINA"), a company incorporated under the laws of the Cayman Islands, and MeMeStar Limited ("MeMeStar"), a company incorporated under the laws of the British Virgin Islands and wholly-owned by SINA, (h) Sino August Investment Limited ("Sino August"), a company incorporated under the laws of the British Virgin Islands, and Bingsen Chen who beneficially owns 100% equity interest in Sino August; (i) Pan Hou Capital Management Limited ("PHC"), a company incorporated under the laws of the British Virgin Islands, and Lanxiang Wang who beneficially owns 100% equity interests in PHC; (j) Chang Qing Investment Management Company Limited ("Chang Qing"), a company incorporated under the laws of the British Virgin Islands, and Juehao Li who beneficially owns 100% equity interest in Chang Qing, (k) Orchid Asia VI, L.P., a Cayman Islands exempted limited partnership, Orchid Asia V Co-Investment, Limited, a company organized and existing under the law of Cayman Islands, OAVI Holdings, L.P., a Cayman Islands exempted limited partnership and the general partner of Orchid Asia VI, L.P., Orchid Asia VI GP, Limited, a Cayman Islands company and the general partner of OAVI Holdings, L.P. and a wholly owned subsidiary of Orchid Asia V Group Management, Limited., Orchid Asia V Group Management, Limited, a Cayman Islands limited company and a wholly-owned subsidiary of Orchid Asia V Group, Limited and also the investment manager of Orchid Asia VI, L.P., Orchid Asia V Group, Limited, a Cayman Islands company and a wholly-owned subsidiary of AREO Holdings Limited, AREO Holdings Limited, a British Virgin Islands company, the controlling shareholder of Orchid Asia V Co-Investment, Limited and wholly-owned by Ms. Lam Lai Ming, YM Investment Limited, a British Virgin Islands company and wholly-owned by The Li 2007 Family Trust. The Li 2007 Family Trust is a revocable trust established under the laws of the British Virgin Islands with Ms. Lam Lai Ming as the settlor, The Li Family (PTC) Limited as trustee and Ms. Lam Lai Ming and her family members as the beneficiaries, and Ms. Lam Lai Ming; (l) Fanghai Yu; (m) Yu Zou; (n) Dongda Zou; (o) Qin Wang; (p) Youbin Leng; (q) Jigeng Chen, vice president of the Company; (r) Pingsen Chen, vice president of the Company; (s) Dikuo Bo, vice president of the Company; and (t) Xinzhou Tang, vice president of the Company. Filing Persons (b) through (t) are collectively referred to herein as the "Buyer Group." Mr. Wenbin Chen, Mr. Ming Yan and Ms. Ningfeng Chen are collectively referred to herein as the "Founders." Coreworth Investments, Harmony Creek, Rich Horizon, MeMeStar, Sino August, PHC, Chang Qing, Orchid Asia VI, L.P., Orchid Asia V Co-Investment, Limited, YM Investment Limited, Fanghai Yu, Yu Zou, Dongda Zou, Qin Wang, Youbin Leng, Jigeng Chen, Pingsen Chen, Dikuo Bo and Xinzhou Tang are collectively referred to as the "Rollover Shareholders".

1

The Items specified by Schedule 13E-3, with page references to the locations where the information required by such Items can be found, are enumerated beginning on page 72 of this Transaction Statement.

This summary, together with the "Questions and Answers about the Merger" below, highlights selected information contained in the remainder of this Transaction Statement. This summary does not contain all of the information that may be important to an Unaffiliated Security Holder (as defined below) of the Company. Unaffiliated Security Holders should read this entire Transaction Statement and the other documents to which this Transaction Statement refers for a more complete understanding of the Merger (as defined below) and the related transactions and how they affect Unaffiliated Security Holders.

The terms "we," "us," "our," and the "Company" as used in this Transaction Statement refer to Yintech Investment Holdings Limited and/or its direct and indirect subsidiaries as the context may require. The term "Yintech Board" refers to the board of directors of the Company. The term "Special Committee" refers to a special committee of independent, disinterested directors of the Company that was formed by the Yintech Board. The term "Unaffiliated Security Holders" is used in this Transaction Statement as such term is defined in Rule 13e-3(a)(4) under the Exchange Act, and refers to holders of Ordinary Shares and ADSs (both as defined below) other than Merger Sub and Parent, and directors and executive officers of the Company and of members of the Buyer Group. The term "Person" refers to a natural person, a partnership, a corporation, a limited liability company, a business trust, a joint share company, a trust, an unincorporated association, a joint venture, a governmental entity or another entity or organization. References to "dollars" and "US$" in this Transaction Statement are to U.S. dollars and references to "RMB" in this Transaction Statement are to Renminbi, the lawful currency of the People's Republic of China (the "PRC" or "China").

The Parties Involved in the Merger

The Company

The Company is a leading provider of investment and trading services for individual investors in China. The Company strives to provide best-in-class financial information, investment tools and services to its customers by leveraging financial technology and mobile platforms. Currently, the Company is focused on the provision of gold and other commodities trading services, securities advisory services, securities information platform services, overseas securities trading services and asset management services.

The Company's principal executive offices are located at 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200125, People's Republic of China.

The Company is the issuer of the Ordinary Shares, par value US$0.00001 per share, including the Ordinary Shares represented by ADSs, each representing twenty (20) Ordinary Shares. ADSs are traded on the NASDAQ Global Select Market ("NASDAQ") under the symbol "YIN." As of September 15, 2020, there were a total of 1,462,138,915 Ordinary Shares issued and outstanding (which, for the avoidance of doubt, exclude 2,885,280 Ordinary Shares that are held by the Company as treasury shares and 4,032,040 Ordinary Shares issued to the Depositary (as defined below) and reserved for issuance upon exercise or vesting of Company Options (as defined below) or Company RSUs (as defined below)).

For a more complete description of the Company's business, history, and organizational structure, please see the Company's Annual Report on Form 20-F for the year ended December 31, 2019 filed with the SEC on April 27, 2020 (the "Yintech 2019 Form 20-F"), which is incorporated by reference

2

herein. See "Where You Can Find More Information" for instructions on obtaining a copy of the Yintech 2019 Form 20-F.

Parent

Parent is an exempted company with limited liability incorporated under the laws of the Cayman Islands and wholly owned by Mr. Wenbin Chen. Parent is a holding company formed solely for the purpose of holding the equity interest in Merger Sub and completing the transactions contemplated under the Merger Agreement, including the Merger (each as defined below). The principal business address and telephone number of Parent are c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020. The registered office of Parent is located at the offices of Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111 Cayman Islands. Each member of the Buyer Group has entered into that certain Rollover and Contribution Agreement (the "Rollover Agreement") dated as of August 17, 2020 with Parent and Merger Sub, pursuant to which each member of the Buyer Group has irrevocably agreed to contribute their respective Ordinary Shares in the Company to Merger Sub immediately prior to the completion of the Merger (the "Closing") in exchange for newly issued ordinary shares of Parent, such that Merger Sub will hold 1,338,235,875 Ordinary Shares prior to Closing, representing over 90% of the voting power of the Ordinary Shares exercisable in a general meeting of the Company.

Merger Sub

Merger Sub is an exempted company with limited liability incorporated under the laws of the Cayman Islands and wholly owned by Parent. Merger Sub is a holding company formed solely for the purpose of completing the transactions contemplated under the Merger Agreement, including the Merger (each as defined below). Merger Sub will directly hold 1,338,235,875 Ordinary Shares immediately prior to the Closing. The principal business address and telephone number of Merger Sub are c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020. The registered office of Merger Sub is located at the offices of Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111 Cayman Islands.

Wenbin Chen and Coreworth Investments

Mr. Wenbin Chen is the co-founder, chairman of the board of the directors and chief executive officer of the Company. Mr. Wenbin Chen is a citizen of Hong Kong Special Administrative Region of the PRC. Coreworth Investments is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. Mr. Wenbin Chen is the sole shareholder of Coreworth Investments. The principal business address and telephone number of each of Mr. Wenbin Chen and Coreworth Investments is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

Ming Yan and Harmony Creek

Mr. Ming Yan is the co-founder and director of the Company. Mr. Ming Yan is a citizen of Hong Kong Special Administrative Region of the PRC. Harmony Creek is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. Mr. Ming Yan is the sole shareholder of Harmony Creek. The principal business address and telephone number of each of Mr. Ming Yan and Harmony Creek is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

3

Ningfeng Chen and Rich Horizon

Ms. Ningfeng Chen is the co-founder and director of the Company. Ms. Ningfeng Chen is a citizen of Canada. Rich Horizon is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. Ms. Ningfeng Chen is the sole shareholder of Rich Horizon. The principal business address and telephone number of each of Ms. Ningfeng Chen and Rich Horizon is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

SINA and MeMeStar

SINA is an exempted company with limited liability incorporated under the laws of the Cayman Islands. SINA is a leading online media company serving China and the Chinese communities. MeMeStar Limited, a wholly-owned subsidiary of SINA, is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. The principal business address and telephone number of SINA and MeMeStar Limited is c/o 7/F, SINA Plaza, No. 8, Courtyard 10, West Xibeiwang E. Road, Haidian District Beijing 100193, People's Republic of China, +86 (10) 8262 8888.

Bingsen Chen and Sino August

Bingsen Chen is the sole director and sole shareholder of Sino August and a citizen of the People's Republic of China. Sino August is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. The principal business address and telephone number of each of Bingsen Chen and Sino August is c/o Sino August Investment Limited, Room 1706, Shangnan Building, No. 111 Yuntai Road, Pudong New District, Shanghai, P.R. China 200126, +86 (591) 8783 1989.

Lanxiang Wang and PHC

Lanxiang Wang has served as a director of Shanghai Zhanshan Marketing Center from December 2018. Shanghai Zhanshan Marketing Center is principally engaged in the business of providing marketing strategy and planning services with its business address at No.59 Xibei Road, Lvxiang Town, Jinshan District, Shanghai, P.R. China. Lanxiang Wang has also served as a deputy general manager of Fuzhou Jin Li Da Jewelry Co., Ltd. from January 2015. Fuzhou Jin Li Da Jewelry Co., Ltd. is principally engaged in the production and distribution of gold and silver jewelry with its business address at No.92 Xue Jun Road, Taijiang District, Fuzhou, Fujian, P.R. China. Lanxiang Wang is a citizen of the People's Republic of China. PHC is principally an investment holding vehicle and a company organized and existing under the laws of the British Virgin Islands. Lanxiang Wang is the sole shareholder of PHC. The principal business address and telephone number of each of Lanxiang Wang and PHC is c/o 29th Floor, Building 2, 759 Yanggao South Road, Pudong New Area, Shanghai, P.R. China 200090, +86 (21) 6837 3062.

During the last five years, neither Lanxiang Wang nor PHC has been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Juehao Li and Chang Qing

Juehao Li is the sole director and sole shareholder of Chang Qing and a citizen of Hong Kong Special Administrative Region of the PRC. Chang Qing is principally an investment holding vehicle and

4

a company organized and existing under the laws of the British Virgin Islands. The principal business address and telephone number of each of Juehao Li and Chang Qing is c/o Room 202, Building 6, No. 3539 Dongfang Road, Pudong New Area, Shanghai, P.R. China 200134, +86 132 4838 6650.

Orchid Filing Persons

Orchid Asia VI, L.P. is an exempted limited partnership, organized and existing under the laws of the Cayman Islands, which is principally engaged in acquiring, holding and disposing of interests in various companies for investment purposes. OAVI Holdings, L.P., a Cayman Islands exempted limited partnership, is the general partner of Orchid Asia VI, L.P.. Orchid Asia VI GP, Limited, a Cayman Islands company, is the general partner of OAVI Holdings, L.P., which is in turn a wholly owned subsidiary of Orchid Asia V Group Management, Limited. Orchid Asia V Group Management, Limited, a Cayman Islands limited company, is a wholly-owned subsidiary of Orchid Asia V Group, Limited and is also the investment manager of Orchid Asia VI, L.P.. Orchid Asia V Group, Limited, a Cayman Islands company, is a wholly-owned subsidiary of AREO Holdings Limited. AREO Holdings Limited, a British Virgin Islands company, is wholly-owned by Ms. Lam Lai Ming, a citizen of Hong Kong Special Administrative Region of the PRC. AREO Holdings Limited is also the controlling shareholder of Orchid Asia V Co-Investment, Limited. Orchid Asia V Co-Investment, Limited is an investment holding vehicle and a company organized and existing under the law of Cayman Islands.

The principal business address and telephone number of Orchid Asia VI, L.P., OAVI Holdings, L.P., Orchid Asia VI GP, Limited, Orchid Asia V Group Management, Limited, Orchid Asia V Group, Limited is: c/o Maples Corporate Services Limited PO Box 309, Ugland House Grand Cayman, KY1-1104 Cayman Islands, +852 2115 8121. The principal business address and telephone number of Orchid Asia V Co-Investment, Limited is: c/o Corporate Management Solutions (Cayman) ltd. Two Artillery Court, 2/F, 161 Shedden Road PO box 799, George Town Grand Cayman, KY1-1103 Cayman Islands, +852 2115 8121. The principal business address and telephone number of AREO Holdings Limited is c/o Vistra Corporate Services Centre Wickhams Cay II, Road Town Tortola, VG 1110, British Virgin Islands, +852 2115 8121.

YM Investment Limited is an investment holding vehicle and a company organized and existing under the law of British Virgin Islands. YM Investment Limited is wholly-owned by The Li 2007 Family Trust. The Li 2007 Family Trust is a revocable trust established under the laws of the British Virgin Islands with Ms. Lam Lai Ming as the settlor, The Li Family (PTC) Limited as trustee and Ms. Lam Lai Ming and her family members as the beneficiaries.

The principal business address and telephone number of YM Investment Limited is: c/o Vistra Corporate Services Center, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands, +852 2115 8121. The principal business office and telephone number of The Li Family (PTC) Limited is c/o 80 Main Street, P.O. Box 3200, Road Town, Tortola, VG 1110, British Virgin Islands, +852 2115 8121.

The principal business address and telephone number of Ms. Lam Lai Ming is c/o V&G Global Fund Services (Hong Kong) Limited, Suite 2901, 29th Floor, The Center 99 Queen's Road Central, Central, Hong Kong, +852 2115 8121.

Fanghai Yu

Fanghai Yu is a citizen of the People's Republic of China. Fanghai Yu has served as the director of Beijing Hui Tong Fang De Asset Management Co., Ltd. since June 2019. Beijing Hui Tong Fang De Asset Management Co., Ltd. is principally engaged in the business of asset management, with its principal business address at Room 1806, 15F, Building 1, No.12, Guanghua Road (Bing), Chaoyang District, P.R. China. Fanghai Yu served as a general manager of Jin Qiu Department Store from February 2015 to December 2018. Jin Qiu Department Store is principally engaged in the business of

5

sales with its principal business address at No.3, 1/F, Building 5, No.588 Hongwu Road, District A, Hongcheng Market, Nanchang, Jiangxi, P.R. China. The principal business address and telephone number of Fanghai Yu is Room 1806, 15F, Building 1, No.12, Guanghua Road (Bing), Chaoyang District, P.R. China, +86 186 0708 8775.

During the last five years, Fanghai Yu has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Yu Zou

Yu Zou is a citizen of the People's Republic of China. Yu Zou has served as the finance director of Jingde Town Huaming Cultural Development Co., Ltd. since September 2019. Prior to that, Yu Zou was an investor. Jingde Town Huaming Cultural Development Co., Ltd. is principally engaged in the business of the sales and distribution of china produced in Jingde Town with its principal business address at Mingfang Road, Mingfang Yuan, Changnan New District, Jingde Town, Jiangxi, P.R. China. The principal business address and telephone number of Yu Zou is Mingfang Road, Mingfang Yuan, Changnan New District, Jingde Town, Jiangxi, P.R. China, +86 186 0700 8630.

During the last five years, Yu Zou has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Dongda Zou

Dongda Zou is a citizen of the People's Republic of China. Dongda Zou has served as the director of Bo Yi Cultural Development Co., Ltd. since April 2017. Bo Yi Cultural Development Co., Ltd. is principally engaged in the business of the sales and distribution of cultural products with its principal business address at Room105, No.6 Baohua Road, Hengqing New District, Zhuhai, P.R. China. Dongda Zou served as the general manager of Jin Hua He Tai Plastic Products Production Co., Ltd. from March 2014 to December 2016. Jin Hua He Tai Plastic Products Production Co., Ltd. is principally engaged in the business of production of plastic products with its principal business address at Zhuma Industrial Park, Jinhua, Zhejiang, P.R. China. The principal business address and telephone number of Dongda Zou is Room105, No.6 Baohua Road, Hengqing New District, Zhuhai, P.R. China, +86 139 1135 5133.

During the last five years, Dongda Zou has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Qin Wang

Qin Wang is a citizen of the People's Republic of China. Qin Wang has served as the director of Jingde Town Huaming Cultural Development Co., Ltd. since November 2019. Jingde Town Huaming Cultural Development Co., Ltd. is principally engaged in the business of the sales and distribution of china produced in Jingde Town, with its principal business address at Mingfang Road, Mingfang Yuan,

6

Changnan New District, Jingde Town, Jiangxi, P.R. China. Qin Wang served as the general manager of Guangdong Jin Xiang Yin Rui Precious Metals Management Co., Ltd., Beijing Branch, a company principally engaged in the brokerage business with its principal business address at Room 1608, Derun Tower B, Jia No.3 Yong An Dong Li, Chaoyang District, Beijing, P.R. China, from July 2012 to June 2017. The principal business address and telephone number of Qin Wang is Mingfang Road, Mingfang Yuan, Changnan New District, Jingde Town, Jiangxi, P.R. China, +86 134 3688 1745.

During the last five years, Qin Wang has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Youbin Leng

Youbin Leng is a citizen of the People's Republic of China. Youbin Leng has served as the chairman of Heilongjiang Feihe Dairy Co., Ltd. for the last five years. Heilongjiang Feihe Dairy Co., Ltd. is principally engaged in the business of manufacturing and distribution of dairy products. The principal business address and telephone number of each of Heilongjiang Feihe Dairy Co., Ltd. and Youbin Leng is Star City Int'l Bldg., 10 Jiuxianqiao Road, C-16th Floor, Chaoyang District, Beijing, P.R. China 100016, +86 (452) 6107 006.

During the last five years, Youbin Leng has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Jigeng Chen

Jigeng Chen is a citizen of the People's Republic of China. Jigeng Chen has served as the vice president of the Company for the last five years. The principal business address and telephone number of Jigeng Chen and the Company is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

During the last five years, Jigeng Chen has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Pingsen Chen

Pingsen Chen is a citizen of the People's Republic of China. Pingsen Chen has served as the vice president of the Company since April 2017. Before co-founding Gold Master (HK) Company Limited ("Gold Master"), Mr. Chen served as manager of Fuzhou Ruixin Investment Management Co., Ltd. during 2011 to 2012. Mr. Chen served as general manager when the Company acquired Gold Master in August 2016. He also studied Finance at Xiamen University during March 2013 to July 2015. The principal business address and telephone number of Pingsen Chen and the Company is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

7

During the last five years, Pingsen Chen has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Dikuo Bo

Dikuo Bo is a citizen of the People's Republic of China. Dikuo Bo has served as the vice president of the Company for the last five years. The principal business address and telephone number of Dikuo Bo and the Company is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

During the last five years, Dikuo Bo has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

Xinzhou Tang

Xinzhou Tang is a citizen of the People's Republic of China. Xinzhou Tang has served as the vice president of the Company since April 2019. Prior to being promoted to the vice president of the Company, Mr. Tang served as the Company's general manager of Ronghui business unit from March 2013 to April 2019. The principal business address and telephone number of Xinzhou Tang and the Company is c/o 3rd Floor, Lujiazui Investment Tower, No.360 Pudian Road, Pudong New Area, Shanghai 200122, the PRC, +86 (21) 2028 8020.

During the last five years, Xinzhou Tang has not been (a) convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors) or (b) a party to any judicial or administrative proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment or decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws.

The Merger Agreement and the Plan of Merger

On August 17, 2020, the Company, Parent and Merger Sub entered into an agreement and plan of merger (the "Merger Agreement"), which includes a plan of merger required to be filed with the Registrar of Companies of the Cayman Islands substantially in the form attached as Exhibit A to the Merger Agreement (the "Plan of Merger"). Following satisfaction of the conditions under the Merger Agreement, Merger Sub will merge with and into the Company (the "Merger") through a "short-form" merger in accordance with Part XVI and in particular Section 233(7) of the Companies Law, Cap. 22 (Law 3 of 1961, as consolidated and revised) of the Cayman Islands (the "Cayman Islands Companies Law"), with the Company continuing as the surviving company (as defined in the Cayman Islands Companies Law, the "Surviving Company") resulting from the Merger.

The following summary describes the material terms of the Merger Agreement, including the Plan of Merger, but does not purport to describe all of the terms of the Merger Agreement and is qualified in its entirety by reference to the complete text of the Merger Agreement, which is attached as Exhibit (d)(1) to this Transaction Statement. Unaffiliated Security Holders should read the Merger

8

Agreement and the Plan of Merger in their entirety because they, and not this Transaction Statement, are the legal documents that govern the Merger.

The Merger

At the Effective Time (as defined below), Merger Sub will merge with and into the Company through a statutory short-form merger in accordance with section 233(7) of the Cayman Islands Companies Law. We expect the Merger to take place soon after twenty (20) days following the date of the mailing of this Transaction Statement, or such later date as may be required to comply with Rule 13e-3 under the Exchange Act and all other applicable laws, after all the closing conditions to the Merger have been satisfied or waived in accordance with the Merger Agreement (the effective date of the Merger, the "Effective Time"). Following the Effective Time of the Merger, ADSs will no longer be listed on NASDAQ, and the Company will cease to be a publicly-traded company and will be a privately-held, direct wholly-owned subsidiary of Parent.

Merger Consideration

Under the terms of the Merger Agreement and the Plan of Merger, at the Effective Time, (i) each Ordinary Share issued and outstanding immediately prior to the Effective Time (other than the Excluded Shares (as defined below) and Ordinary Shares represented by ADSs) will be cancelled in exchange for the right to receive US$0.365 in cash per Ordinary Share without interest (subject to adjustment as described below) (the "Per Share Merger Consideration"); (ii) each ADS issued and outstanding immediately prior to the Effective Time, together with the underlying Ordinary Shares represented by such ADSs, will be cancelled in exchange for the right to receive US$7.30 in cash per ADS without interest (subject to adjustment as described below) (the "Per ADS Merger Consideration"), (less US$0.05 per ADS cancellation fees and US$0.04 per ADS depositary advices fees, if that fees have not already been collected pursuant to the terms of the deposit agreement (the "Deposit Agreement"), dated as of March 24, 2016, by and among the Company, The Bank of New York Mellon, as depositary for ADSs (the "Depositary"), and all owners and holders from time to time of ADSs issued thereunder).

The Per Share Merger Consideration and the Per ADS Merger Consideration, as applicable, will be adjusted appropriately to reflect the effect of any share split, reverse share split, share dividend (including any dividend or other distribution of securities convertible into Ordinary Shares or ADSs, as applicable), reorganization, recapitalization, reclassification, combination, exchange of shares or other like change with respect to the Ordinary Shares or ADSs, as applicable, effectuated after the date of the Merger Agreement and prior to the Effective Time, so as to provide the holders of Ordinary Shares or ADSs, as applicable, with the same economic effect as contemplated by the Merger Agreement prior to such event and as so adjusted will, from and after the date of such event, be the Per Share Merger Consideration or the Per ADS Merger Consideration, as applicable (the "Consideration Adjustment").

The "Excluded Shares" include (a) 1,338,235,875 Ordinary Shares held by the members of the Buyer Group which will be contributed to Merger Sub prior to the Closing, (b) any other Ordinary Shares (including Ordinary Shares represented by ADSs) held by Parent, Merger Sub, the Company (as treasury shares, if any) or any of their respective subsidiaries, and (c) Ordinary Shares (including Ordinary Shares represented by ADSs) held by the Depositary, the Company and the Company's representatives, and reserved for issuance, settlement and allocation upon exercise or vesting of Company Options (as defined below) or Company RSUs (as defined below).

9

Treatment of Company Options

Each option to purchase the Ordinary Shares granted under the Company's Second Amended and Restated 2013 Share Option Scheme and Fourth Amended and Restated 2014 Share Option Scheme in accordance with the terms thereof (each a "Company Option") that is outstanding and unexercised immediately prior to the Effective Time, whether or not vested or exercisable, will be cancelled as of the Effective Time, automatically and without action by the holder of such granted Company Option, and immediately converted into the right to receive in exchange therefor an amount of cash equal to (i) the excess, if any, of (A) the Per Share Merger Consideration over (B) the exercise price per Ordinary Share subject to such Company Option (the "Exercise Price"), multiplied by (ii) the number of Ordinary Shares underlying such Company Option (the "Option Consideration"), which amount will be paid as promptly as practicable following the Effective Time by the Surviving Company; provided that if the Exercise Price of any such Company Option is equal to or greater than the Per Share Merger Consideration, such Company Option will be cancelled without any payment therefor.

Treatment of Company RSUs

Each restricted share unit granted under the Company's Third Amended and Restated Pre-IPO RSU Scheme (together with the Company's Second Amended and Restated 2013 Share Option Scheme and Fourth Amended and Restated 2014 Share Option Scheme, collectively, the "Company Equity Plans") in accordance with the terms thereof (each a "Company RSU") that is outstanding and unexercised immediately prior to the Effective Time, whether or not vested or exercisable, will be cancelled as of the Effective Time, automatically and without action by the holder of such granted Company RSU, and immediately converted into the right to receive in exchange therefor an amount of cash equal to (i) the Per Share Merger Consideration, multiplied by (ii) the number of the Ordinary Shares underlying such Company RSU (the "RSU Consideration"), which amount will be paid as promptly as practicable following the Effective Time by the Surviving Company.

Representations and Warranties

The Merger Agreement contains representations and warranties made by the Company to Merger Sub and Parent and representations and warranties made by Merger Sub and Parent to the Company as of specific dates. The statements embodied in those representations and warranties were made for purposes of the Merger Agreement and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the terms of the Merger Agreement. In addition, some of those representations and warranties may be subject to a contractual standard of materiality different from that generally applicable to Unaffiliated Security Holders, and may have been made for the principal purposes of establishing the circumstances in which a party to the Merger Agreement may have the right not to close the Merger if the representations and warranties of the other party prove to be untrue due to a change in circumstance or otherwise and allocating risks between the parties to the Merger Agreement rather than establishing matters as facts. Moreover, the representations and warranties made by the Company were qualified by (a) reference to its public disclosures with the SEC since January 1, 2018 and prior to the date of the Merger Agreement and (b) any matters with respect to which any of Mr. Wenbin Chen, Mr. Ming Yan and Ms. Ningfeng Chen (each a "Founder" and collectively "Founders") has actual knowledge of, or after reasonable inquiry and investigation would reasonably be expected to have actual knowledge of.

"Material Adverse Effect" as used in the Merger Agreement means any change, effect, development, circumstance, condition, state of facts, event or occurrence (each an "Effect" and collectively "Effects") that, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on the financial condition, business or results of operations of the Company and its subsidiaries, taken as a whole, or materially delay or prevent the consummation of the Merger and the other transactions contemplated by the Merger Agreement. However, no Effects to the

10

extent resulting or arising from the following, either alone or in combination, will be deemed to constitute a Material Adverse Effect or will be taken into account when determining whether a Material Adverse Effect has occurred or would reasonably be expected to occur: (a) conditions (or changes therein) that are the result of factors generally affecting any industry or industries in which the Company operates; (b) general economic, political and/or regulatory conditions (or changes therein), including any changes affecting financial, credit or capital market conditions, including changes in interest or exchange rates; (c) any change in GAAP or interpretation thereof; (d) any adoption, implementation, promulgation, repeal, modification, amendment, reinterpretation, or other change in any applicable law of or by any governmental entity; (e) any actions taken, or the failure to take any action, as required by the terms of the Merger Agreement or at the request or with the consent of Parent or Merger Sub and any Effect directly attributable to the negotiation, execution or announcement of the Merger Agreement and the transactions contemplated under the Merger Agreement (including the Merger), including any litigation arising therefrom (including any litigation arising from allegations of a breach of duty or violation of applicable law), and any adverse change in customer, employee (including employee departures), supplier, financing source, lessee, licensor, licensee, sub-licensee, shareholder, joint venture partner or similar relationship resulting therefrom; (f) decline in the price or trading volume of the Ordinary Shares and/or ADSs (provided that the facts or occurrences giving rise or contributing to such decline that are not otherwise excluded from the definition of a "Material Adverse Effect" may be taken into account); (g) any failure by the Company to meet any internal or published projections, budgets, plans or forecasts, estimates, predictions or expectations of the Company's revenue, earnings or other financial performance or results of operations for any period (provided that the facts or occurrences giving rise or contributing to such failure that are not otherwise excluded from the definition of a "Material Adverse Effect" may be taken into account); (h) Effects arising out of changes in geopolitical conditions, acts of terrorism or sabotage, war (whether or not declared), the commencement, continuation or escalation of a war, acts of armed hostility, earthquakes, tornados, hurricanes, or other weather conditions or natural calamities or other force majeure events, any epidemic, pandemic, or disease outbreak (including the COVID-19 virus), including any material worsening of such conditions threatened or existing as of the date of the Merger Agreement; and (i) any reduction in the credit rating of the Company or its subsidiaries (provided that the facts or occurrences giving rise or contributing to such reduction or any consequences resulting from such reduction that are not otherwise excluded from the definition of a "Material Adverse Effect" may be taken into account); provided that if any Effect described in clauses (a), (b), (c), (d), and (h) has had a materially disproportionate adverse impact on the Company relative to other companies of comparable size to the Company operating in the industry or industries in which the Company operates, then the incremental impact of such event will be taken into account for the purpose of determining whether a Material Adverse Effect has occurred.

The representations and warranties made by the Company to Merger Sub and Parent include representations and warranties relating to, among other matters:

- •

- the due organization, existence, good standing, and authority to carry on the businesses of the Company and its subsidiaries;

- •

- the capitalization of the Company, including with respect to the number and type of shares;

- •

- the due execution of the Merger Agreement by the Company, and the power and authority of the Company to execute and deliver, and perform its

obligations under, the Merger Agreement and the Plan of Merger;

- •

- the Yintech Board having approved the Merger Agreement, the Plan of Merger, and the related transactions;

11

- •

- there being no required consents and approvals relating to the Company's execution and delivery, or performance of its obligations under, the

Merger Agreement and the Plan of Merger, other than certain enumerated consents and filings;

- •

- the Company having filed with or furnished to the SEC since January 1, 2018 all documents required under the Exchange Act, the

Securities Act of 1933, as amended (the "Securities Act"), and the rules and regulations of the SEC thereunder;

- •

- as of the date of the Merger Agreement, the Company having not received any comments from the staff of SEC with respect to any of the documents

filed with or furnished to the SEC by the Company that remain unresolved, or received any inquiry or information request from the staff of the SEC as of the date of the Merger Agreement as to any

matters affecting the Company that has not been adequately addressed;

- •

- the Company's audited and unaudited financial statements filed with or furnished to the SEC since January 1, 2018 having been prepared

in accordance with generally accepted accounting principles in the United States ("GAAP") and having presented fairly, in all material respects, the financial position,

results of operations, shareholders' equity, and cash flows of the Company as of and for the periods presented;

- •

- the Company having conducted its business in the ordinary course and consistent with past practice, and no event having occurred that had or

would be reasonably expected to have a Material Adverse Effect, since January 1, 2020 through the date of the Merger Agreement;

- •

- none of the information supplied or to be supplied in writing by or on behalf of the Company or any of its subsidiaries for inclusion or

incorporation by reference in this Transaction Statement will, at the time such document is filed with the SEC and at any time such document is amended or supplemented, contain any untrue statement of

a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading;

- •

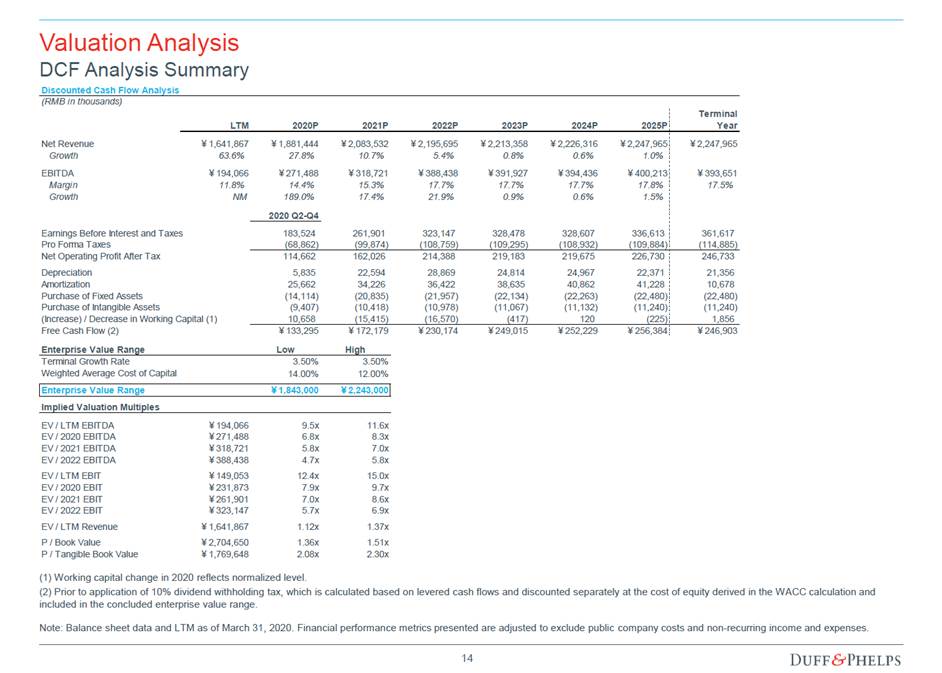

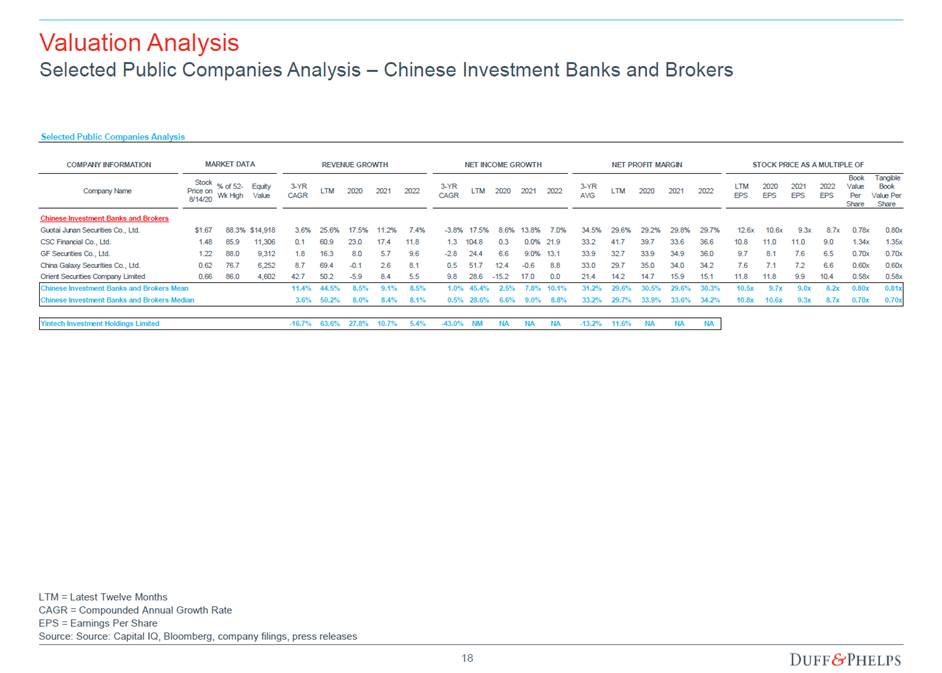

- the Special Committee having received the opinion of Duff & Phelps, LLC ("Duff & Phelps") to

the effect that, as of the date of the Merger Agreement and based on and subject to the assumptions, qualifications, limitations and other matters set forth therein, the Per Share Merger Consideration

and the Per ADS Merger Consideration to be received by holders of the Ordinary Shares (other than the Excluded Shares) and ADSs (other than ADSs representing the Excluded Shares), as applicable, is

fair, from a financial point of view, to such holders; and

- •

- the absence of any broker's, finder's, or financial advisory fees, other than the fees of Duff & Phelps.

The representations and warranties made by Merger Sub and Parent to the Company include representations and warranties relating to, among other matters:

- •

- their due organization, existence and good standing;

- •

- the capitalization of Parent and Merger Sub, including with respect to the number and type of shares, and absence of prior activities;

- •

- their due execution of the Merger Agreement and their power and authority to execute and deliver, and perform their obligations under, the

Merger Agreement and the Plan of Merger;

- •

- there being no required consents and approvals relating to Merger Sub's or Parent's execution and delivery of, or performance of their obligations under, the Merger Agreement and the Plan of Merger, other than certain enumerated consents and filings;

12

- •

- the sufficiency of funds for Merger Sub and the Surviving Company to pay (i) the merger consideration, the aggregate Option

Consideration and RSU Consideration and (ii) any other amounts required to be paid in connection with the consummation of the Merger and the other transactions contemplated by the Merger

Agreement and all related fees and expenses;

- •

- delivery by the Founders of the duly executed Limited Guarantee (as defined below);

- •

- the absence of litigation, judicial or administrative proceedings, or governmental orders that would reasonably be expected to prevent or

impair the completion of the Merger;

- •

- none of the information supplied or to be supplied in writing by or on behalf of Parent or Merger Sub for inclusion or incorporation by

reference in this Transaction Statement will, at the time such document is filed with the SEC and at any time such document is amended or supplemented, contain any untrue statement of a material fact

or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading;

- •

- the absence of any broker's, finder's, or financial advisory fees; and

- •

- other than the Merger Agreement, a limited guarantee in favor of the Company pursuant to which each Founder is guaranteeing certain obligations of Parent and Merger Sub under the Merger Agreement (the "Limited Guarantee"), a confidentiality agreement, dated as of July 7, 2020 by and between the Company and Parent (the "Confidentiality Agreement"), the Rollover Agreement, and a consortium agreement, dated as of August 17, 2020, by and among the Rollover Shareholders (the "Consortium Agreement"), there are no agreements, arrangements or understandings (whether oral or written) (i) between Parent, Merger Sub or any of their affiliates (excluding the Company and its subsidiaries), on the one hand, and any directors, officers, employees or shareholders of the Company or any subsidiary of the Company, on the other hand, that relate in any way to the transactions contemplated by the Merger Agreement (other than any agreements, arrangements or understandings entered into after the date of the Merger Agreement that solely relate to matters as of or following the Effective Time and do not in any way affect the securities of the Company outstanding prior to the Effective Time); or (ii) to which Parent or Merger Sub is a party and pursuant to which any management member, director or shareholder of the Company would be entitled to receive consideration in respect of the Company's equity interests of a different amount or nature than the consideration that is provided under the Merger Agreement.

Conduct of Business Pending the Merger

The Company has agreed that between the date of the Merger Agreement and the Effective Time or the date, if any, on which the Merger Agreement is terminated, except (a) as expressly required by the Merger Agreement; (b) as required by applicable law; or (c) as consented to in writing by Parent (which consent will not be unreasonably withheld, delayed or conditioned), the Company (i) will (and will cause its subsidiaries to) conduct its business in all material respects in the ordinary course of business and use reasonable best efforts to preserve its business organization intact, and maintain its existing relations and goodwill with customers, suppliers and creditors; (ii) will (and will cause its subsidiaries to) use reasonable best efforts to, keep available the services of their current officers and key employees; and (iii) will not (and will not permit any of its subsidiaries to) take any action that is intended or would reasonably be expected to, result in any of the additional conditions to the Merger under the Merger Agreement not being satisfied or fail to make in a timely manner any filings with the SEC required under the Securities Act or the Exchange Act or the rules and regulations promulgated thereunder.

13

No Solicitation

The Company has agreed that the Company will, and will cause each of its subsidiaries and instruct each of their respective directors, officers, financing sources, employees, consultants, financial advisors, accountants, legal counsel, investment bankers, and other agents, advisors and representatives (the "Representatives") acting in such capacity, (i) to immediately cease any solicitation, encouragement, discussions or negotiations with any persons that may be ongoing in furtherance or for the purpose of encouraging or facilitating a Competing Proposal (as defined below); (ii) not to release any third party from, or waive any provisions of, any confidentiality or standstill agreement to which the Company is a party with respect to any Competing Proposal; and (iii) not to (A) solicit, initiate, knowingly encourage or facilitate any inquiries or the making of any proposal or offer that constitutes or would reasonably be expected to lead to a Competing Proposal (including by way of furnishing nonpublic information with respect to the Company); (B) engage in or continue any discussions or negotiations with the intent of encouraging a Competing Proposal, or furnish to any other person nonpublic information in furtherance or with the intent of encouraging a Competing Proposal; (C) approve, endorse or recommend any Competing Proposal or authorize or execute or enter into any letter of intent, option agreement, agreement or agreement in principle contemplating or otherwise relating to a Competing Proposal; or (D) propose or agree to do any of the foregoing.

The Company has also agreed that neither the Yintech Board nor the Special Committee may take any formal action or make any recommendation or public statement in connection with a tender offer or exchange offer other than a recommendation against such offer.

Notwithstanding the foregoing restrictions, if, the Company or any of its Representatives receives an unsolicited, bona fide written Competing Proposal from any person or group of persons, which Competing Proposal did not arise or result from the Company's breach of the Merger Agreement, if the Special Committee has determined in good faith, after consultation with such independent financial advisors and outside legal counsels as it considers (in its sole discretion) as appropriate or desirable, that such Competing Proposal constitutes or could lead to a Superior Proposal (as defined below) or that failure to take such action would be inconsistent with the directors' fiduciary duties under applicable law, then the Yintech Board or the Special Committee may directly or indirectly through the Company Representatives (A) furnish, pursuant to a confidentiality agreement entered into by and between the Company and such person or group of persons who has made such Competing Proposal which contains terms that are no less favorable in the aggregate to the Company than those contained in the Confidentiality Agreement, information (including non-public information) with respect to the Company and its subsidiaries to the person or group of persons who has made such Competing Proposal; provided that the Company will provide to Parent any nonpublic information concerning the Company or any of its subsidiaries that is provided to any person given such access which was not previously provided to Parent or its Representatives as soon as reasonably practicable after providing such information to such third party, and (B) engage in or otherwise participate in discussions or negotiations with the person or group of persons making such Competing Proposal.

The Company has agreed to notify Parent promptly (but in no event later than forty-eight (48) hours) after its receipt of any written Competing Proposal, or any written request for nonpublic information relating to the Company or any of its subsidiaries by any person that informs the Company or any of its subsidiaries that it is considering making, or has made, a Competing Proposal, or any written inquiry from any person seeking to have discussions or negotiations with the Company or any of its subsidiaries relating to a possible Competing Proposal, or any material change to any terms of a Competing Proposal previously disclosed to Parent. Such notice will be in writing, and will indicate the identity of the person making the Competing Proposal, inquiry or request and providing copies of such written Competing Proposal, inquiry, request or offer. The Company has agreed that it and its subsidiaries will not enter into any confidentiality agreement with any person subsequent to the date of

14

the Merger Agreement which prohibits it from providing any information to Parent in accordance with the Merger Agreement.

A "Competing Proposal" means any proposal or offer from any person (other than the Founders, Parent and Merger Sub) or "group," within the meaning of Section 13(d) of the Exchange Act, relating to, in a single transaction or series of related transactions, any (i) acquisition of assets of the Company and its subsidiaries equal to 20% or more of the Company's consolidated assets or to which 20% or more of the Company's revenues or earnings on a consolidated basis are attributable; (ii) acquisition of 20% or more of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs); (iii) tender offer or exchange offer that if consummated would result in any person beneficially owning 20% or more of the outstanding Ordinary Shares (including Ordinary Shares represented by ADSs); (iv) merger, consolidation, share exchange, business combination, recapitalization, liquidation, dissolution or similar transaction involving the Company or any of its subsidiaries which, in the case of a merger, consolidation, share exchange or business combination, would result in any person acquiring assets, individually or in the aggregate, constituting 20% or more of the Company's consolidated assets or to which 20% or more of the Company's revenues or earnings on a consolidated basis are attributable; or (v) any combination of the foregoing types of transactions if the sum of the percentage of consolidated assets, consolidated revenues or earnings and Ordinary Shares involved is 20% or more; in each case, other than the transactions contemplated under the Merger Agreement.

Notwithstanding the foregoing restrictions, prior to the Closing, the Yintech Board (upon the recommendation of the Special Committee) may change, withhold, withdraw, qualify or modify, or resolve to change, withhold, withdraw, qualify or modify, in a manner may be adverse to Parent or Merger Sub, any recommendation or approval that the Yintech Board or the Special Committee has previously made or resolved (a "Change in Recommendation"), or terminate the Merger Agreement to enter into an Alternative Acquisition Agreement in response to a Competing Proposal not solicited in violation of the Merger Agreement, if the Special Committee has determined in good faith, after consultation with such independent financial advisors and outside legal counsels as it considers (in its sole discretion) as appropriate or desirable, that (i) failure to take such action would be inconsistent with the directors' fiduciary duties under applicable law or (ii) such Competing Proposal constitutes a Superior Proposal; provided that (A) the Yintech Board (or any committee thereof, including the Special Committee) has given Parent at least three (3) business days' prior written notice of its intention to take such action (which notice will include an unredacted copy of the Competing Proposal, an unredacted copy of the relevant proposed transaction agreements and a copy of any financing commitments relating thereto and a written summary of the material terms of any Superior Proposal not made in writing), (B) during such three (3) business day period, the Special Committee will have considered in good faith and, if requested by Parent, engaged in good faith discussions with Parent regarding, any revisions to the Merger Agreement proposed in writing by Parent, (C) following the end of such notice period, the Special Committee will have determined in good faith, after consultation with such independent financial advisors and outside legal counsels as it considers (in its sole discretion) as appropriate or desirable, that the Competing Proposal would continue to constitute a Superior Proposal if such revisions were to be given effect; provided, further, that in the event of any material change to the material terms of such Superior Proposal, the Company will, in each case, have delivered to Parent an additional notice consistent with that described in clause (A) above and the notice period in clause (A) will have recommenced and the condition in clauses (B) and (C) will have occurred again, except that the notice period will be at least two (2) business days (rather than the three (3) business days otherwise contemplated by clause (A) above).

A "Superior Proposal" means any bona fide written Competing Proposal that the Yintech Board (acting upon the recommendation of the Special Committee) has determined in good faith, after consultation with such independent financial advisors and outside legal counsels as it considers (in its sole discretion) as appropriate or desirable, and taking into account such factors as the Special

15

Committee considers appropriate, which may include the legal, regulatory and other aspects of the proposal and the person making the proposal, is more favorable to the Company's shareholders (other than the holders of the Excluded Shares) than the transactions contemplated under the Merger Agreement (taking into account, as the case may be, any revisions to the terms of the Merger Agreement proposed by Parent in response to such proposal or otherwise); provided for purposes of the definition of "Superior Proposal," the references to "20%" in the definition of Competing Proposal will be deemed to be references to "50%;" provided, further, that any such offer will not be deemed to be a "Superior Proposal" if any financing required to consummate the transaction contemplated by such proposal is not then fully committed to the person making such proposal and non-contingent.

An "Alternative Acquisition Agreement" means any letter of intent, memorandum of understanding, acquisition agreement, merger agreement or other similar agreement (other than a confidentiality agreement that contains terms that are no less favorable in the aggregate to the Company than those contained in the Confidentiality Agreement; provided that such agreement and any related agreements shall not include any provision calling for any exclusive right to negotiate with such party or having the effect of prohibiting the Company from satisfying its obligations under the Merger Agreement) (A) constituting or that would reasonably be expected to lead to any Competing Proposal or (B) requiring the Company to abandon, terminate or fail to consummate the Merger and the other transactions contemplated by the Merger Agreement.

Notwithstanding anything to the contrary under the Merger Agreement, prior to the Closing, the Yintech Board (acting upon recommendation of the Special Committee) or the Special Committee may effect a Change in Recommendation or direct the Company to terminate the Merger Agreement (other than in response to a Superior Proposal) (such a termination, the "Intervening Event Termination") if and only if (i) any material development, fact, event, change, effect, occurrence or circumstance that was not known to, or, if known, the consequences of which were not reasonably foreseeable by, the Special Committee prior to execution of the Merger Agreement, that becomes known to the Yintech Board or the Special Committee after execution of the Merger Agreement and prior to the Closing (an "Intervening Event"); provided that in no event will the following developments or changes in circumstances constitute an Intervening Event: (x) the receipt, existence, or terms of a Competing Proposal or any matter relating thereto or (y) any change in the price of the Ordinary Shares or ADSs (provided that the exception to this clause (y) will not apply to the underlying causes giving rise to or contributing to such change or prevent any of such underlying causes from being taken into account in determining whether an Intervening Event has occurred), (ii) the Yintech Board has first reasonably determined in good faith, after consultation with outside legal counsels it considers (in its sole discretion) as appropriate or desirable, that failure to do so would reasonably be expected to be inconsistent with the directors' fiduciary duties under applicable law, (iii) at least three (3) business days have elapsed since the Company has given notice of such Intervening Event Termination to Parent advising that it intends to take such action which notice will contain reasonably sufficient information about the Intervening Event to enable Parent to propose revisions to the terms of the Merger Agreement in such a manner that would obviate the need for taking such action, (iv) during such three (3) business day period, the Special Committee will have considered in good faith and, if requested by Parent, engaged in good faith discussions with Parent regarding, any revisions to the Merger Agreement proposed in writing by Parent, and (v) the Yintech Board (acting upon recommendation of the Special Committee) or the Special Committee, following such notice period, again will have determined in good faith, after consultation with such independent financial advisors and outside legal counsels as it considers (in its sole discretion) as appropriate or desirable, that failure to do so would be inconsistent with the directors' fiduciary duties under applicable law.

16

Directors' and Officers' Indemnification and Insurance

Parent has agreed that it will, and will cause the Surviving Company to, for a period of six (6) years after the Effective Time (and until such later date as of which any matter covered hereby commenced during such six (6) year period has been finally disposed of), honor and fulfill in all respects the obligations of the Company and each of its subsidiaries to the fullest extent permissible under applicable law, under the organizational or governing documents of the Company and such subsidiary, in each case, as in effect on the date of the Merger Agreement and under any indemnification or other similar agreements in effect on the date thereof (the "Indemnification Agreements") to the individuals entitled to indemnification, exculpation and/or advancement of expenses under such organizational or governing documents or Indemnification Agreements (including each member of the Special Committee and each other present and former director and officer of the Company) (the "Covered Persons") arising out of or relating to actions or omissions in their capacity as such occurring at or prior to the Effective Time, including in connection with the consideration, negotiation and approval of the Merger Agreement and the transaction contemplated under the Merger Agreement.

Parent has agreed that, for a period of six (6) years after the Effective Time (and until such later date as of which any matter covered hereby commenced during such six (6) year period has been finally disposed of), Parent will, and will cause the Surviving Company to, comply with all of the Company's obligations to: (i) indemnify and hold harmless each Covered Person against and from any costs or expenses (including attorneys' fees), judgments, fines, losses, claims, damages, liabilities and amounts paid in settlement in connection with any claim, action, suit, proceeding or investigation, whether civil, criminal, administrative or investigative, to the extent such claim, action, suit, proceeding or investigation arises out of or pertains to: (A) any action or omission or alleged action or omission in such Covered Person's capacity as such prior to the Effective Time, or (B) the Merger Agreement and any of the transaction contemplated under the Merger Agreement; and (ii) pay in advance of the final disposition of any such claim, action, suit, proceeding or investigation the expenses (including attorneys' fees) of any Covered Person upon receipt of an undertaking by or on behalf of such Covered Person to repay such amount if it is ultimately determined that such Covered Person is not entitled to be indemnified. Parent and the Surviving Company (x) will not be liable for any settlement effected without their prior written consent (which consent will not be unreasonably withheld, delayed or conditioned); (y) will not have any obligation under the Merger Agreement to any Covered Person to the extent that a court of competent jurisdiction will determine in a final and non-appealable order that such indemnification is prohibited by applicable law, in which case the Covered Person will promptly refund to Parent or the Surviving Company the amount of all such expenses theretofore advanced pursuant thereto (unless such court orders otherwise); and (z) will not settle or compromise or consent to the entry of any judgment or otherwise seek termination with respect to any claim, action, suit, proceeding or investigation of a Covered Person for which indemnification may be sought unless such settlement, compromise, consent or termination includes an unconditional release of such Covered Person from all liability arising out of such claim, action, suit, proceeding or investigation and does not include any admission of liability with respect to such Covered Person or such Covered Person consents in writing.

For a period of six (6) years after the Effective Time (and until such later date as of which any matter covered hereby commenced during such six (6) year period has been finally disposed of), the organizational and governing documents of the Surviving Company will, to the extent consistent with applicable law, contain provisions no less favorable with respect to indemnification, advancement of expenses and exculpation of Covered Persons for periods prior to and including the Effective Time than are currently set forth in the organizational and governing documents of the Company in effect on the date of the Merger Agreement and will not contain any provision to the contrary. The

17

Indemnification Agreements with Covered Persons that survive the Merger will continue in full force and effect in accordance with their terms.

For a period of six (6) years after the Effective Time (and until such later date as of which any matter covered hereby commenced during such six (6) year period has been finally disposed of), Parent will cause to be maintained in effect the current policies of directors' and officers' liability insurance maintained by the Company (provided that Parent may substitute therefor policies with reputable and financially sound carriers of at least the same coverage and amounts containing terms and conditions which are no less advantageous) with respect to claims arising from or related to facts or events which occurred at or before the Effective Time; provided that Parent will not be obligated to make annual premium payments for such insurance to the extent such premiums exceed 300% of the annual premiums paid as of the date of the Merger Agreement by the Company for such insurance (such 300% amount, the "Base Premium"); provided, further, that if such insurance coverage cannot be obtained at all, or can only be obtained at an annual premium in excess of the Base Premium, Parent will maintain the most advantageous policies of directors' and officers' insurance obtainable for an annual premium equal to the Base Premium; provided, further, that if the Company in its sole discretion elects, by giving written notice to Parent at least five (5) business days prior to the Effective Time, then, in lieu of the foregoing insurance, effective as of the Effective Time, the Company will purchase a directors' and officers' liability insurance "tail" or "runoff" insurance program for a period of six (6) years after the Effective Time with respect to wrongful acts and/or omissions committed or allegedly committed at or prior to the Effective Time (such coverage will have an aggregate coverage limit over the term of such policy in an amount not to exceed the annual aggregate coverage limit under the Company's existing directors' and officers' liability policy, and in all other respects will be comparable to such existing coverage); provided, further, that the annual premium may not exceed the Base Premium.

No Amendment to Rollover Agreement

Parent and Merger Sub will not, and will cause its respective affiliates not to (a) amend, modify, withdraw, waive or terminate the Rollover Agreement or (b) enter into or modify any other contract relating to the transactions contemplated under the Merger Agreement.

Other Covenants

The Merger Agreement also contains covenants of the Company, on the one hand, and Merger Sub and Parent, on the other hand, relating to, among other matters:

- •