Form S-1 RumbleOn, Inc.

As filed with the Securities and Exchange Commission on August 12, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 7371 | 46-3951329 | |||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

901 W. Walnut Hill Lane

Irving, TX 75038

Telephone: (214) 771-9952

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael Francis, Esq.

General Counsel

RumbleOn, Inc.

901 W. Walnut Hill Lane

Irving, TX 75038

Telephone: (214) 771-9952

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send a copy of all communications to:

Christina C. Russo, Esq.

Akerman LLP

201 East Las Olas Boulevard

Suite 1800

Fort Lauderdale, Florida 33301

Telephone: (954) 463-2700

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement on Form S-1 replaces our previously filed Registration Statements on Form S-3 (File No. 333-260151, File No. 333-259337, File No. 333-239285, File No. 333-231631, File No. 333-228483, and File No. 333-226514) (collectively, the “Prior Registration Statements”). The Prior Registration Statements are no longer effective. We are filing this Registration Statement on Form S-1 pursuant to agreements with the Selling Securityholders, though we are not aware of the current intention of any Selling Securityholder included in this Registration Statement on Form S-1 with regard to the sale of any of their securities. No director or executive officer of the Company is included as a Selling Securityholder in this Registration Statement on Form S-1.

|

The information in this prospectus is not complete and may be changed. The selling securityholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION DATED AUGUST 12, 2022.

PRELIMINARY PROSPECTUS

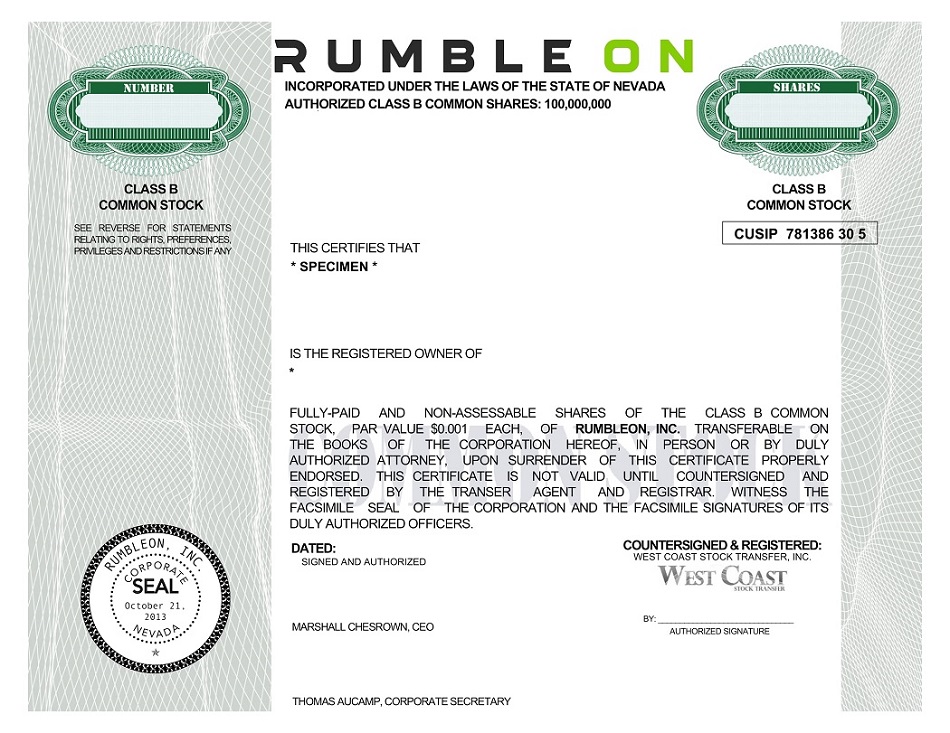

6,837,761 shares of Class B Common Stock

1,217,738 Shares to Purchase Class B Common Stock underlying Warrants

6.75% Convertible Senior Notes due 2025 and

968,750 Shares of Class B Common Stock Issuable Upon Conversion of the Notes

RumbleOn, Inc. (the “Company”) is not selling any securities under this prospectus and will not receive any proceeds from the sale of the shares of the Company’s Class B common stock, par value $0.001 per share (“Class B Common Stock”), pursuant to this prospectus. The selling securityholders listed herein may offer and sell from time to time up to an aggregate of 9,024,249 shares (the “Shares”) of Class B Common Stock, consisting of 6,837,761 shares of Class B Common Stock, 968,750 shares of Class B Common Stock issuable upon conversion of the Notes (as defined below), and 1,217,738 shares of Class B Common Stock issuable upon conversion of Warrants (as defined below). Also, the selling securityholders listed herein may offer and sell from time to time $38,750,000 of Notes. For information concerning the selling securityholders and the manner in which they may offer and sell shares of our Class B Common Stock and Notes (as defined below), see “Selling Securityholders” and “Plan of Distribution” in this prospectus.

1,046,272 of the Shares were issued to the equity holders of Freedom Powersports, LLC (“FPS”) and Freedom Powersports Real Estate LLC (“FPS-RE,” and together with FPS, the “Freedom Companies”) in connection with the Company’s acquisition of the Freedom Companies that closed on February 18, 2022 (the “Freedom Transaction”). 5,791,489 of the Shares were issued to the equity holders of RideNow in connection with the Company’s business combination with RideNow that closed on August 31, 2021 (the “RideNow Transaction”). 1,212,121 of the Shares represent shares of Class B Common Stock underlying outstanding warrants (the “Oaktree Warrants”) issued to Oaktree Capital Management, L.P. (“Oaktree”) in connection with debt financing provided to the Company and subsequently assigned to the selling securityholders, see “Selling Securityholders.” 968,750 of the Shares represent shares of Class B Common Stock to be issued if the 6.75% Convertible Senior Notes due 2025 (the “Notes”) are converted into Class B Common Stock. 5,617 of the Shares represent shares of Class B Common Stock underlying outstanding warrants issued to Hercules Capital, Inc. (“Hercules”) in connection with debt financing provided to the Company (“Hercules Warrants” together with the Oaktree Warrants, the “Warrants”).

Our Class B Common Stock trades on the NASDAQ Capital Market (“NASDAQ”) under the trading symbol “RMBL”. On August 11, 2022, the last reported sales price of our Class B Common Stock on the NASDAQ was $26.28 per share. The Notes and Warrants are not listed on any securities exchange or included in any automated quotation system. We do not intend to apply to list the Notes and Warrants on any securities exchange or any automated dealer quotation system.

Investing in our securities involves substantial risks. See “Risk Factors” on page 3 and in the documents we file with the Securities and Exchange Commission that are incorporated by reference into this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any Warrants, Notes or shares of Class B Common Stock. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August ___, 2022

TABLE OF CONTENTS

i

PROSPECTUS SUMMARY

This summary does not contain all of the information that is important to you. You should read the entire prospectus carefully, including the “Risk Factors” section and the consolidated financial statements and related notes included in this prospectus or incorporated by reference into this prospectus, before making an investment decision.

Our Business

RumbleOn, Inc. (the “Company,” “RumbleOn,” “we,” “us,” or “our”) is the nation’s first technology-based Omnichannel marketplace in powersports, leveraging proprietary technology to transform the powersports supply chain from acquisition of supply through distribution of retail and wholesale. RumbleOn provides an unparalleled technology suite and ecommerce experience, national footprint of physical locations, and full-line manufacturer representation to transform the entire customer experience. Our goal is to integrate the best of both the physical and the digital, and make the transition between the two seamless.

We buy and sell new and used vehicles through multiple company-owned websites and affiliate channels, as well as via our proprietary cash offer tool and network of 55 company-owned retail locations at the date of this prospectus, primarily located in the Sunbelt. Deepening our presence in existing markets and expanding into new markets through strategic acquisitions helps perpetuate our flywheel. Our cash offer technology brings in high quality inventory, which attracts more riders and drives volume in used unit sales. This flywheel enables us to quickly and effectively gain market share. As a result of our growth to date, RumbleOn enjoys a leading, first-mover position in the highly fragmented $100 billion+ powersports market.

RumbleOn’s powersports business offers motorcycles, all-terrain vehicles, utility terrain vehicles, personal watercraft, and all other powersports products, parts, apparel, and accessories. Facilitating our platform, RumbleOn’s retail distribution locations represent all major OEMs and their representative brands.

Corporate Information

We were incorporated as a development stage company

in the State of Nevada as Smart Server, Inc. in October 2013. In February 2017, we changed our name to RumbleOn, Inc. Our principal executive

offices are located at 901 W. Walnut Hill Lane, Irving, Texas 75038 and our telephone number is (214) 771-9952. Our Internet website is www.rumbleon.com.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed or furnished

pursuant to Sections 13(a) and 15(d) of the Exchange Act are available, free of charge, under the Investors tab of our website as soon

as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the

“SEC”). The information on our website, however, is not, and should not be, considered part of this prospectus, is not incorporated

by reference into this prospectus, and should not be relied upon in connection with making any investment decision with respect to our

securities. The SEC also maintains an Internet website located at www.sec.gov that contains the information we file or furnish electronically

with the SEC.

1

THE OFFERING

| Class B Common Stock outstanding prior to the offering: | 15,953,090 shares(1) | |

| Class B Common Stock to be issued upon exercise of Warrants: | 1,217,738 shares | |

| Class B Common Stock to be issued upon conversion of all Notes: | 968,750 shares | |

| Class B Common Stock to be offered by the selling securityholders: | 9,024,249 shares | |

| Class B Common Stock outstanding immediately following the offering: | 18,139,578 shares(1) | |

| Use of Proceeds: | We will not receive any proceeds from the resale of any securities sold under this prospectus by the selling securityholders. With respect to the shares of Class B Common Stock underlying the Warrants, we will not receive any proceeds from such shares except with respect to amounts received by us upon exercise of such Warrants to the extent such Warrants are exercised. We intend to use any such proceeds for working capital and general corporate purposes. See “Use of Proceeds.” | |

| Risk Factors | See “Risk Factors” on page 3 of this prospectus and the documents referenced in that section and incorporated by reference into this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our Notes and our Class B Common Stock. | |

| Stock Symbol: |

NASDAQ: “RMBL”

|

(1) As August 11, 2022, the number of shares of our Class B Common Stock outstanding excludes:

| ● | 832,509 shares of Class B Common Stock underlying outstanding restricted stock units and options to purchase 2,420 shares of Class B Common Stock granted under the RumbleOn, Inc. 2017 Stock Incentive Plan, as amended; |

| ● | 1,059,042 shares of Class B Common Stock reserved for issuance under the 2017 Stock Incentive Plan; and |

| ● | 10,913 shares of Class B Common Stock underlying outstanding warrants, excluding the 1,217,738 shares underlying warrants registered for resale pursuant to this Registration Statement. |

2

RISK FACTORS

Investing in our securities involves significant risks. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors described under “Risk Factors” in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, and in other documents which are incorporated by reference into this prospectus. The Risk Factors discussed under the caption “Item 1A. Risk Factors” in Part I of our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on April 8, 2022, are hereby incorporated by reference in its entirety.

If any of these risks were to occur, our business, affairs, prospects, assets, financial condition, results of operations and cash flow could be materially and adversely affected. If this occurs, the market or trading price of our securities could decline, and you could lose all or part of your investment. In addition, please read “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference into this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

This prospectus and the documents incorporated by reference in this prospectus contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements, which in some cases, you can identify by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements, relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These statements include statements regarding our operations, cash flows, financial position and economic performance including, in particular, future sales, competition and the effect of economic conditions. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties.

Although we believe that these statements are based upon reasonable assumptions, these statements expressing opinions about future outcomes and non-historical information, are subject to a number of risks and uncertainties, many of which are beyond our control, and reflect future business decisions that are subject to change and, therefore, there is no assurance that the outcomes expressed in these statements will be achieved. Some of the assumptions, future results and levels of performance expressed or implied in the forward-looking statements we have made or may make in the future inevitably will not materialize, and unanticipated events may occur which will affect our results. Investors are cautioned that forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the expectations expressed in forward-looking statements contained herein. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks and uncertainties in greater detail under “Risk Factors” discussed under the caption “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption “Item 1A. Risk Factors” in Part II of our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus. You should read this prospectus completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus by these cautionary statements. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required under the securities laws of the United States. You are advised, however, to consult any additional disclosures we make in our reports filed with the SEC.

3

USE OF PROCEEDS

We will not receive any proceeds from the resale

of any securities sold under this prospectus by the selling securityholders. With respect to the shares of Class B Common Stock underlying

the Warrants, we will not receive any proceeds from such shares except with respect to amounts received by us upon exercise of such Warrants

to the extent such Warrants are exercised. We intend to use any such proceeds for working capital and general corporate purposes.

SELLING SECURITYHOLDERS

We do not know when or in what amounts the selling securityholders may offer securities for sale. The selling securityholders may choose not to sell any or all of the securities offered by this prospectus. Because the selling securityholders may offer all or some of the securities, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the securities, we cannot accurately report the number of the securities that will be held by the selling securityholders after completion of the offering. However, for purposes of this table, we have assumed that, after completion of the offering, all of the securities covered by this prospectus will be sold by the selling securityholders.

The following table contains information as of August 11, 2022 with respect to: the selling securityholders and (1) the principal amount of Notes and the underlying shares of Class B Common Stock beneficially owned by each selling securityholder that may be offered using this prospectus, (2) shares of Class B Common Stock directly held by each selling securityholder that may be offered using this prospectus, and (3) shares of Class B Common Stock beneficially owned by each selling securityholder underlying the Warrants. The number of shares outstanding, and the percentage of beneficial ownership, post-offering are based on 15,953,090 shares of Class B Common Stock issued and outstanding as of August 11, 2022.

4

For the purposes of the following table, the number of shares of Class B Common Stock beneficially owned has been determined in accordance with Rule 13d-3 under the Exchange Act, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under Rule 13d-3, beneficial ownership includes any shares as to which the selling securityholders have sole or shared voting power or investment power and also any shares which each selling shareholder, respectively, has the right to acquire within 60 days of the date of this prospectus through the exercise of any stock option, warrant or other rights.

Shares Owned

Offering | Shares Being | Principal Owned | Principal Amount of Notes Being | Shares Owned After the Offering | ||||||||||||||||||||||||

| Name of Selling Securityholder | Shares | % |

Offered |

Offering |

Offered | Shares | % | |||||||||||||||||||||

| 2025 Convertible Notes Offering | ||||||||||||||||||||||||||||

| Nineteen77 Global Multi-Strategy Alpha Master Limited(2) | 500,000 | (1) | 3.1 | % | $ | 20,000,000 | $ | 20,000,000 | – | – | ||||||||||||||||||

| Silverback Asset Management, LLC(3) | 312,500 | (1) | 2.0 | % | $ | 12,500,000 | $ | 12,500,000 | – | – | ||||||||||||||||||

| Geode Capital Management, LLC(4) | 156,250 | (1) | * | $ | 6,250,000 | $ | 6,250,000 | – | – | |||||||||||||||||||

| RideNow Transaction | ||||||||||||||||||||||||||||

| William Coulter | 2,591,028 | (5)(6) | 16.2 | % | 2,591,028 | – | – | |||||||||||||||||||||

| Mark Tkach | 2,591,028 | (5)(6) | 16.2 | % | 2,591,028 | – | – | |||||||||||||||||||||

| Robert Dodson | 146,917 | (5) | * | % | 146,917 | – | – | |||||||||||||||||||||

| Richard Sidabras | 59,237 | (5) | * | % | 59,237 | – | – | |||||||||||||||||||||

| BDJ II Holdings LLC | 84,507 | (5) | * | % | 84,507 | – | – | |||||||||||||||||||||

| Dominic Vannucci | 10,303 | (5) | * | % | 10,303 | – | – | |||||||||||||||||||||

| Chris Chestnut | 11,940 | (5) | * | % | 11,940 | – | – | |||||||||||||||||||||

| Brett Dickinson | 9,227 | (5) | * | % | 9,227 | – | – | |||||||||||||||||||||

| Lyle Kramper | 135,191 | (5) | * | % | 135,191 | – | – | |||||||||||||||||||||

| Craig Keating | 10,677 | (5) | * | % | 10,677 | – | – | |||||||||||||||||||||

| Paul Langford | 61,861 | (5) | * | % | 61,861 | – | – | |||||||||||||||||||||

| Paul Griffith | 47,690 | (5) | * | % | 47,690 | – | – | |||||||||||||||||||||

| Ikon Motorsports Management & Consulting, LLC | 17,138 | (5) | * | % | 17,138 | – | – | |||||||||||||||||||||

| Iron Sled Powersports Consulting & Ventures, LLC | 14,745 | (5) | * | % | 14,745 | – | – | |||||||||||||||||||||

| Oaktree Warrants | ||||||||||||||||||||||||||||

| Oaktree-TCDRS Strategic Credit, LLC | 17,520 | (7) | * | % | 17,520 | – | – | |||||||||||||||||||||

| Oaktree-NGP Stategic Credit, LLC | 17,845 | (7) | * | % | 17,845 | – | – | |||||||||||||||||||||

| Oaktree-Minn Strategic Credit, LLC | 8,661 | (7) | * | % | 8,661 | – | – | |||||||||||||||||||||

| Oaktree-Forrest Multi-Strategy, LLC – Series A | 14,099 | (7) | * | % | 14,099 | – | – | |||||||||||||||||||||

| Oaktree-TBMR Strategic Credit Fund C, LLC | 8,451 | (7) | * | % | 8,451 | – | – | |||||||||||||||||||||

| Oaktree-TBMR Strategic Credit Fund F, LLC | 13,251 | (7) | * | % | 13,251 | – | – | |||||||||||||||||||||

| Oaktree-TBMR Strategic Credit Fund G, LLC | 21,628 | (7) | * | % | 21,628 | – | – | |||||||||||||||||||||

| Oaktree-TSE 16 Strategic Credit, LLC | 19,256 | (7) | * | % | 19,256 | – | – | |||||||||||||||||||||

| INPRS Strategic Credit Holdings, LLC | 5,375 | (7) | * | % | 5,375 | – | – | |||||||||||||||||||||

| Oaktree Gilead Investment Fund AIF (Delaware), L.P. | 55,118 | (7) | * | % | 55,118 | – | – | |||||||||||||||||||||

| Oaktree Huntington-GCF Investment Fund (Direct Lending AIF), L.P. | 15,972 | (7) | * | % | 15,972 | – | – | |||||||||||||||||||||

| Oaktree GCP Fund Delaware Holdings, L.P. | 10,490 | (7) | * | % | 10,490 | – | – | |||||||||||||||||||||

| Oaktree Strategic Income II, Inc. | 39,794 | (7) | * | % | 39,794 | – | – | |||||||||||||||||||||

| Oaktree Specialty Lending Corporation | 164,660 | (7) | 1.0 | % | 164,660 | – | – | |||||||||||||||||||||

| Oaktree Opportunities Fund Xb Holdings (Delaware), L.P. | 30,323 | (7) | * | % | 30,323 | – | – | |||||||||||||||||||||

| Oaktree Opportunities Fund XI Holdings (Delaware), L.P. | 127,253 | (7) | * | % | 127,253 | – | – | |||||||||||||||||||||

| Oaktree MMDL Unpledged Assets, LLC | 39,397 | (7) | * | % | 39,397 | – | – | |||||||||||||||||||||

| Oaktree Mezzanine Fund V Holdings (Delaware), L.P. | 118,179 | (7) | * | % | 118,179 | – | – | |||||||||||||||||||||

| DBAH Capital LLC | 181,819 | (7) | 1.1 | % | 181,819 | – | – | |||||||||||||||||||||

| CPPIB Credit Investments III Inc. | 151,515 | (7) | * | % | 151,515 | – | – | |||||||||||||||||||||

| CION Investment Corp | 60,606 | (7) | * | % | 60,606 | – | – | |||||||||||||||||||||

| Brookfield Reinsurance Investments LP | 24,242 | (7) | * | % | 24,242 | – | – | |||||||||||||||||||||

| Brookfield Annuity Company | 36,364 | (7) | * | % | 36,364 | – | – | |||||||||||||||||||||

| OFSCC-FS, LLC | 18,182 | (7) | * | % | 18,182 | – | – | |||||||||||||||||||||

| Hancock Park Corporate Income, Inc. | 4,545 | (7) | * | % | 4,545 | – | – | |||||||||||||||||||||

| CIM REAL ASSETS AND CREDIT FUND | 7,576 | (7) | * | % | 7,576 | – | – | |||||||||||||||||||||

| Hercules Capital | ||||||||||||||||||||||||||||

| Hercules Capital, Inc. | 5,617 | (8) | * | % | 5,617 | – | – | |||||||||||||||||||||

5

|

Shares Owned Prior to the Offering |

Shares Being |

Principal Amount of Notes Owned Prior to |

Principal Amount of Notes Being |

Shares Owned After the Offering |

||||||||||||||||||||||||

| Name of Selling Securityholder | Shares | % | Offered | Offering | Offered | Shares | % | |||||||||||||||||||||

| Freedom Powersports Transaction | ||||||||||||||||||||||||||||

| TPEG Freedom Powersports Investors, LLC(9) | 550,355 | (10) | 3.5 | % | 550,355 | – | – | |||||||||||||||||||||

| Kevin Ryan Lackey(9) | 249,538 | (10) | 1.6 | % | 249,538 | – | – | |||||||||||||||||||||

| Thomas J. Zelewski(9) | 13,078 | (10) | * | % | 13,078 | – | – | |||||||||||||||||||||

| Mark Daniel Arriaga | 20,925 | (10) | * | % | 20,925 | – | – | |||||||||||||||||||||

| Sarah McVean Brown | 5,493 | (10) | * | % | 5,493 | – | – | |||||||||||||||||||||

| Sean Chandler | 20,925 | (10) | * | % | 20,925 | – | – | |||||||||||||||||||||

| Sanjay Chandra(9) | 159,540 | (10) | 1.0 | % | 159,540 | – | – | |||||||||||||||||||||

| Natalie D. Nelson | 5,493 | (10) | * | % | 5,493 | – | – | |||||||||||||||||||||

| Chase Clifford Vance | 20,925 | (10) | * | % | 20,925 | – | – | |||||||||||||||||||||

| * | Represents less than 1% |

| (1) | Represents the shares of Class B Common Stock to be issuable upon conversion of the Notes at an initial conversion rate of 25 shares of Class B Common Stock per $1,000 principal amount of the Notes, which is equal to a conversion price of approximately $40.00 per share of Class B Common Stock. |

| (2) | UBS O’Connor LLC (“O’Connor”) is the investment manager of Nineteen77 Global Multi-Strategy Alpha Master Limited (“GLEA”) and, accordingly, has voting control and investment discretion over the securities described herein held by GLEA. Kevin Russell, the Chief Investment Officer of O’Connor, also has voting control and investment discretion over the securities described herein held by GLEA. As a result, each of O’Connor and Mr. Russell may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities described herein held by GLEA. |

| (3) | Elliot Bossen, the chief executive officer of Silverback Asset Management, LLC, has the power to vote and dispose of the shares held by Silverback Asset Management, LLC and may be deemed to be the beneficial owner of these shares. The address for Silverback Asset Management, LLC, is 1414 Raleigh Road, Suite 250, Chapel Hill, North Carolina 27517. |

| (4) | Geode Capital Management LP (“Geode”) serves as investment manager of Geode Diversified Fund, a segregated account of Geode Capital Master Fund Ltd. (the “Fund”), and accordingly has voting control and investment discretion over the securities described herein held by the Fund. Bobe Simon and Ted Blake, portfolio managers of the Fund, may be deemed to exercise ultimate investment power of the securities held by the Fund. Geode and each of Mr. Simon and Mr. Blake disclaim beneficial ownership of such securities except to the extent of their pecuniary interest therein. |

| (5) | Represents shares of Class B Common Stock issued in connection with the RideNow Transaction. |

| (6) | William Coulter served as Executive Vice Chairman and as a Director of the Company from August 2021 to February 2022. |

| Mark Tkach served as Chief Operating Officer and as a Director of the Company from August 2021 to February 2022. |

| (7) | Represents shares of Class B Common Stock underlying the Oaktree Warrants issued in connection with the debt financing provided to the Company by Oaktree and subsequently assigned to the selling securityholders. As of August 12, 2022, the Oaktree Warrants have an exercise price of $31.64 per share, subject to a reduction by an amount equal to one percent of such exercise price for each thirty-day period a resale registration statement is not effective pursuant to the Oaktree Warrant, and pro rata for any period less than thirty-days. The Oaktree Warrants are immediately exercisable and initially were scheduled to expire on February 28, 2023, subject to extension by the number of trading days a resale registration statement is not effective pursuant to the Oaktree Warrant. Since the Prior Registration Statement with respect to the Oaktree Warrants was no longer effective as of April 1, 2022, the expiration date of the Oaktree Warrants as of the date of filing this Registration Statement on Form S-1 is July 12, 2023 and such date will be further extended by the number of trading days from the date of filing this Registration Statement until this Registration Statement becomes effective. |

| (8) | Represents shares of Class B Common Stock underlying Hercules Warrants issued in connection with the debt financing provided by to the Company. The Hercules Warrants consist of (i) warrants to purchase 4,117 shares of Class B Common Stock at an exercise price of $110 per share, which warrants are immediately exercisable and expire on April 30, 2023, and (ii) warrant to purchase 1,500 shares of Class B Common Stock at an exercise price of $143.13 per share, which warrants are immediately exercisable and expire on October 30, 2023. |

| (9) | These individuals agreed, subject to certain customary exceptions, not to sell, transfer or dispose of any Company common stock until August 17, 2022, pursuant to the registration rights and lock-up agreement, dated November 8, 2021, as described above under Prospectus Summary. |

| (10) | Represents shares of Class B Common Stock issued in connection

with the Freedom Transaction. |

6

PLAN OF DISTRIBUTION

We are registering the Notes, the shares of Class B Common Stock and the shares of Class B Common Stock underlying the Notes and Warrants to permit the resale or transfer of these Notes or the shares of Class B Common Stock by the holders of the Notes or the shares of Class B Common Stock from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling securityholders of the Notes or the shares of Class B Common Stock. We will bear all fees and expenses incident to our obligation to register the Notes or the shares of Class B Common Stock.

The selling securityholders, or their pledgees, donees, transferees, or any of their successors in interest selling shares received from a named selling securityholder as a gift, partnership distribution or other non-sale-related transfer after the date of this prospectus (all of whom may be selling securityholders), may sell or transfer the securities from time to time on any stock exchange or automated interdealer quotation system on which the securities are listed, in the over-the-counter market, in privately negotiated transactions or otherwise, at fixed prices that may be changed, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at prices otherwise negotiated. The selling securityholders may sell or transfer the securities by one or more of the following methods, without limitation:

| (a) | block trades in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| (b) | underwritten transactions; |

| (c) | purchases by a broker or dealer as principal and resale by the broker or dealer for its own account pursuant to this prospectus; |

| (d) | an exchange distribution in accordance with the rules of any stock exchange on which the securities are listed; |

| (e) | ordinary brokerage transactions and transactions in which the broker solicits purchases; |

| (f) | privately negotiated transactions; |

| (g) | through the distribution of the securities by any selling securityholders to its partners, members or stockholders; |

| (h) | one or more underwritten offerings on a firm commitment or best efforts basis; and |

| (i) | any combination of any of these methods of sale. |

In addition, a selling securityholder that is an entity may elect to make a pro rata in-kind distribution of securities to its members, partners or stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. Such members, partners or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration statement. To the extent a distributee is an affiliate of ours (or to the extent otherwise required by law), we may file a prospectus supplement in order to permit the distributees to use the prospectus to resell the securities acquired in the distribution.

The selling securityholders may also transfer the securities by gift. We do not know of any arrangements by the selling securityholders for the sale of any of the securities. The selling securityholders may engage brokers and dealers, and any brokers or dealers may arrange for other brokers or dealers to participate in effecting sales of the securities. These brokers, dealers or underwriters may act as principals, or as an agent of a selling securityholder. Broker-dealers may agree with a selling securityholder to sell a specified number of the securities at a stipulated price per security. If the broker-dealer is unable to sell securities acting as agent for a selling securityholder, it may purchase as principal any unsold securities at the stipulated price. Broker-dealers who acquire securities as principals may thereafter resell the securities from time to time in transactions in any stock exchange or automated interdealer quotation system on which the securities are then listed, at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. Broker-dealers may use block transactions and sales to and through broker-dealers, including transactions of the nature described above. The selling securityholders may also sell the securities in accordance with Rule 144 under the Securities Act, rather than pursuant to this prospectus, regardless of whether the securities are covered by this prospectus.

7

From time to time, one or more of the selling securityholders may pledge, hypothecate or grant a security interest in some or all of the securities owned by them. The pledgees, secured parties or persons to whom the securities have been hypothecated will, upon foreclosure in the event of default, be deemed to be selling securityholders. The number of a selling securityholders' securities offered under this prospectus will decrease as and when it takes such actions. The plan of distribution for that selling securityholders' securities will otherwise remain unchanged.

To the extent required under the Securities Act, the aggregate amount of selling securityholders' securities being offered and the terms of the offering, the names of any agents, brokers, dealers or underwriters and any applicable commission with respect to a particular offer will be set forth in an accompanying prospectus supplement. Any underwriters, dealers, brokers or agents participating in the distribution of the securities may receive compensation in the form of underwriting discounts, concessions, commissions or fees from a selling securityholder and/or purchasers of selling securityholders' securities of securities, for whom they may act (which compensation as to a particular broker-dealer might be in excess of customary commissions).

The selling securityholders and any underwriters, brokers, dealers or agents that participate in the distribution of the securities may be deemed to be “underwriters” within the meaning of the Securities Act, and any discounts, concessions, commissions or fees received by them and any profit on the resale of the securities sold by them may be deemed to be underwriting discounts and commissions.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert named in this registration statement as having prepared or certified any part hereof, nor any counsel for the registrant or selling securityholders named in this prospectus as having given an opinion upon the validity of the securities being registered hereunder or other legal matters in connection with the registration or offering of such securities, who was employed for such purpose on a contingent basis, or at the time of preparation, certification or opinion or at any time thereafter, through the state of effectiveness of the registration statement or that part of the registration statement to which such preparation, certification or opinion relates, had, or is to receive in connection hereunder, a substantial interest, direct or indirect, in the registrant or was connected with the registrant as a promoter, managing underwriter, voting trustee, director, officer or employee.

LEGAL MATTERS

The validity of the securities offered through this prospectus has been passed on by Akerman LLP, Fort Lauderdale, Florida and Snell & Wilmer L.L.P., Las Vegas, Nevada.

EXPERTS

The audited consolidated financial statements of RumbleOn, Inc. and subsidiaries as of December 31, 2021 and for the year then ended, and the combined financial statements of RideNow Group and affiliates as of December 31, 2020, 2019, and 2018, and for each of the three years ended, incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports of Dixon Hughes Goodman LLP, predecessor firm to FORVIS, LLP, an independent registered public accounting firm, given the authority of said firm as experts in accounting and auditing.

The audited financial statements of RumbleOn, Inc. and subsidiaries incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

8

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information about us by referring to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus. This prospectus incorporates by reference the documents and reports listed below other than portions of these documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on Form 8–K:

| ● | Our Annual Report on Form 10-K that contains financial statements for the year ended December 31, 2021, filed on April 8, 2022, including the information specifically incorporated by reference into such Annual Report on Form 10-K from our definitive proxy statement for our 2022 Annual Meeting of Stockholders filed with the SEC on May 2, 2022; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 10, 2022; | |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, filed with the SEC on August 9, 2022; | |

| ● | Our Current Reports on Form 8-K filed on September 7, 2021, February 1, 2022, February 4, 2022, February 7, 2022, February 14, 2022, March 31, 2022, April 22, 2022, May 27, 2022, June 14, 2022 and June 24, 2022; | |

| ● | The description of the Company’s common stock contained in the Company’s registration statement on Form 8-A, filed with the SEC on October 18, 2017, as updated by the description of the registrant’s securities contained in Exhibit 4.11 to the Annual Report on Form 10-K for the year ended December 31, 2019, filed on May 29, 2020, and the Certificate of Amendment filed as Exhibit 3.1 to the Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed on August 4, 2021; | |

| ● | The description of the Oaktree Warrants contained or incorporated in its Registration Statement on Form S-3 (Registration No. 333-259337), initially filed with the SEC on September 3, 2021, including any amendments or reports filed for the purpose of updating such description; | |

| ● | The description of the Hercules Warrants contained in Note 12 of the consolidated financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2021, filed on April 8, 2022; | |

| ● | The description of the Notes contained or incorporated in its Registration Statement on Form S-3/A (Registration No. 333-239285), initially filed with the SEC on June 26, 2020, including any amendments or reports filed for the purpose of updating such description. |

We incorporate by reference any filings made with the SEC in accordance with Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and the date all of the securities offered hereby are sold or the offering is otherwise terminated, with the exception of any information furnished under Item 2.02 and Item 7.01 of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings shall be deemed to be incorporated by reference and to be a part of this prospectus from the respective dates of filing of those documents.

We will provide, without charge, to any person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon oral or written request of such person, a copy of any or all of the documents that have been incorporated by reference in this prospectus but not delivered with the prospectus, including any exhibits to such documents that are specifically incorporated by reference in those documents.

Please make your request by writing or telephoning us at the following address or telephone number:

RumbleOn, Inc.

901 W. Walnut Hill Lane

Irving, Texas 75038

Attention: Investor Relations

Tel: (214) 771-9952

Our Internet website is www.rumbleon.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available, free of charge, under the Investor Relations tab of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Additionally, the SEC maintains a website located at www.sec.gov that contains the information we file or furnish electronically with the SEC.

9

PART II – INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth all expenses to be paid by the registrant, other than underwriting discounts and commissions, in connection with this offering. All amounts shown are estimates except for the registration fee.

| SEC registration fee | $ | 21,381 | ||

| Legal fees and expenses | $ | 35,000 | * | |

| Accounting fees and expenses | $ | 35,000 | * | |

| Miscellaneous expenses | $ | 8,619 | * | |

| Total | $ | 100,000 | * |

*All amounts are estimates, other than the SEC's registration fee.

Item 14. Indemnification of Officers and Directors

No director of RumbleOn will have personal liability to us or any of our stockholders for monetary damages for breach of fiduciary duty as a director involving any act or omission of any such director since provisions have been made in our Articles of Incorporation limiting such liability. The foregoing provisions shall not eliminate or limit the liability of a director for:

| ● | any breach of the director’s duty of loyalty to us or our stockholders; |

| ● | acts or omissions not in good faith or, which involve intentional misconduct or a knowing violation of law; |

| ● | the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes; or |

| ● | for any transaction from which the director derived an improper personal benefit. |

We are a corporation organized under the laws of the State of Nevada. Section 78.138 of the Nevada Revised Statutes (“NRS”) provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will not be individually liable unless it is proven that (i) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud, or a knowing violation of the law.

Section 78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the officer or director (i) is not liable pursuant to NRS 78.138, or (ii) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful. Section 78.7502 of the NRS requires a corporation to indemnify a director or officer that has been successful on the merits or otherwise in defense of any action or suit. Section 78.7502 of the NRS precludes indemnification by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses and requires a corporation to indemnify its officers and directors if they have been successful on the merits or otherwise in defense of any claim, issue, or matter resulting from their service as a director or officer.

Section 78.751 of the NRS permits a Nevada company to indemnify its officers and directors against expenses incurred by them in defending a civil or criminal action, suit, or proceeding as they are incurred and in advance of final disposition thereof, upon determination by the stockholders, the disinterested board members, or by independent legal counsel. If so provided in the corporation’s articles of incorporation, bylaws, or other agreement, Section 78.751 of the NRS requires a corporation to advance expenses as incurred upon receipt of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that such officer or director is not entitled to be indemnified by the company. Section 78.751 of the NRS further permits the company to grant its directors and officers additional rights of indemnification under its articles of incorporation, bylaws, or other agreement.

II-1

Section 78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Article VI of our amended Bylaws provide for indemnification of our directors, officers, and employees in most cases for any liability suffered by them or arising out of their activities as directors, officers, and employees if they were not engaged in willful misfeasance or malfeasance in the performance of his or her duties; provided that in the event of a settlement the indemnification will apply only when the Board of Directors approves such settlement and reimbursement as being for our best interests. Our Bylaws, therefore, limit the liability of directors to the maximum extent permitted by Nevada law (Section 78.751).

Our officers and directors are accountable to us as fiduciaries, which means they are required to exercise good faith and fairness in all dealings affecting RumbleOn. In the event a stockholder believes the officers or directors have violated their fiduciary duties, the stockholder may, subject to applicable rules of civil procedure, be able to bring a class action or derivative suit to enforce the stockholder’s rights, including rights under certain federal and state securities laws and regulations to recover damages from and require an accounting by management. Stockholders who have suffered losses in connection with the purchase or sale of their interest in RumbleOn in connection with such sale or purchase, including the misapplication by any such officer or director of proceeds from a sale of securities may be able to recover such losses from us.

At present, there is no pending litigation or proceeding involving any of our directors or officers in which indemnification or advancement is sought. We are not aware of any threatened litigation that may result in claims for advancement or indemnification.

We have been advised that in the opinion of the SEC, insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and other persons pursuant to the foregoing provisions, or otherwise, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event a claim for indemnification against such liabilities (other than payment of expenses incurred or paid by a director or officer in the successful defense of any action, suit or proceeding) is asserted by such director, officer or other person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 15. Recent Sales of Unregistered Securities

Since August 12, 2019, we have issued the following securities in unregistered transactions:

| ● | On February 18, 2021, we issued 1,048,717 shares of Class B Common Stock in connection with the Freedom Transaction. | |

| ● | On September 30, 2021, we issued 154,731 shares of Class B Common Stock as a gift of a death benefit to the estate of Steven R. Berrard, the Company’s former Chief Financial Officer and a director, or as instructed by the estate of Mr. Berrard. | |

| ● | On August 31, 2021, we issued 5,833,333 shares of Class B Common Stock in connection with the RideNow Transaction. | |

| ● | On March 12, 2021, we issued a warrant for 1,212,121 shares of Class B Common Stock underlying the Oaktree Warrants. | |

| ● | On September 16, 2020, we issued 2,506 shares of Class B Common Stock in connection with a director’s departure from the Board of Directors. | |

| ● | On January 14, 2020, we issued $38,750,000 of Notes which bear an interest of 6.75% per annum. | |

| ● | On January 14, 2020, we issued 968,750 shares of Class B Common Stock issuable upon conversion of the Notes. |

None of the foregoing transactions involved any underwriters, underwriting discounts or commissions, or any public offering. We believe the offer, sale, and issuance of the shares in each of the transactions described above was exempt from registration under the Securities Act by virtue of Section 4(a)(2) of the Securities Act and Regulation D thereunder as an issuance of securities not involving a public offering.

II-2

Item 16. Exhibits and Financial Statement Schedules

The exhibits listed on the Index to Exhibits of this Registration Statement are filed herewith or are incorporated herein by reference to other filings.

(a) Exhibits

II-3

| * | Filed herewith. |

II-4

Item 17. Undertakings

The undersigned registrant hereby undertakes:

| (a)(1) | To file, during any period in which offers or sales are being made, a post–effective amendment to this registration statement: |

| (i) | To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in the volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in the registration statement; |

Provided, however, that:

paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-1 and the information required to be included in a post–effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post–effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post–effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

(b) That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling persons of the registrant pursuant to

the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer, or controlling person of the registrant in the successful defense of any action, suit, or proceeding) is asserted by such director,

officer, or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-1 and that it has duly caused this Registration Statement to be filed on behalf of the undersigned, thereunto authorized, in the City of Irving, state of Texas, on the 12th day of August, 2022.

| RUMBLEON, INC. | ||

|

By: |

/s/ Marshall Chesrown | |

| Marshall Chesrown | ||

| Chief Executive Officer and Chairman | ||

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Marshall Chesrown and Michael Francis and each of them, his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons, in the capacities and on the dates indicated.

| Signature | Title | Date | ||

| /s/ Marshall Chesrown | Chief Executive Officer and Chairman | August 12, 2022 | ||

| Marshall Chesrown | (Principal Executive Officer) | |||

| /s/ Narinder Sahai |

Chief Financial Officer |

August 12, 2022 | ||

| Narinder Sahai | (Principal Financial Officer and Principal Accounting Officer) | |||

|

/s/ Peter Levy |

Chief Operating Officer, President, and Director | August 12, 2022 | ||

| Peter Levy | ||||

|

/s/ Adam Alexander |

Director | August 12, 2022 | ||

| Adam Alexander | ||||

| /s/ Denmar Dixon | Director | August 12, 2022 | ||

| Denmar Dixon | ||||

|

/s/ Shin Lee |

Director | August 12, 2022 | ||

| Shin Lee | ||||

|

/s/ Michael Marchlik |

Director | August 12, 2022 | ||

| Michael Marchlik | ||||

|

/s/ Kevin Westfall |

Director | August 12, 2022 | ||

| Kevin Westfall |

II-6

Exhibit 4.4

Exhibit 5.1

|

Akerman LLP 201 East Las Olas Boulevard Suite 1800 Fort Lauderdale, FL 33301-2999

T: 954 463 2700 F: 954 463 2224 |

August 12, 2022

RumbleOn, Inc.

901 W Walnut Hill Lane

Irving, Texas 75038

Re: Registration Statement on Form S-1

Ladies and Gentlemen:

We have acted as counsel to RumbleOn, Inc., a Nevada corporation (the "Company"), in connection with the preparation and filing with the Securities and Exchange Commission (the "Commission") of a Registration Statement on Form S-1 (such registration statement, as amended, is herein referred to as the “Registration Statement”), pursuant to which the Company is registering for resale under the Securities Act of 1933, as amended, an aggregate of $38,750,000 principal amount of the Company’s 6.75% Convertible Senior Notes due 2025 (the “Notes”) and up to 968,750 shares of the Company's Class B Common Stock issuable upon conversion thereof (the “Shares”), on behalf of the holders of the Notes. The Notes were issued pursuant to the Indenture dated January 14, 2020 between the Company and Wilmington Trust, N.A., Trustee (the “Indenture”).

In connection with this opinion, we have examined copies of the Indenture, the Notes and such other documents and have made such other inquiries and investigations of law as we have deemed necessary or appropriate to enable us to render the opinion expressed below. We have assumed the genuineness and authenticity of all documents submitted to us as originals and the conformity to originals of all documents submitted to us as copies thereof and the due authorization, execution and delivery of all documents where authorization, execution and delivery are prerequisites to the effectiveness of such documents.

Our opinion is expressed only with respect to the laws of the State of New York and the federal laws of the United States of America. We are not rendering any opinion as to compliance with any antifraud law, rule or regulation relating to securities, or to the sale or issuance thereof.

On the basis of the foregoing and in reliance thereon, we are of the opinion that the Notes constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, fraudulent transfer or conveyance, reorganization, moratorium or other similar laws affecting creditors’ rights generally and by general principles of equity and limitations on availability of equitable relief, including specific performance (regardless of whether such enforceability is considered in a proceeding in equity or at law).

We assume no obligation to update or supplement this opinion if any applicable laws change after date of this opinion or if we become aware after the date of this opinion of any facts, whether existing before or arising after the date hereof, that might change the opinions expressly so stated. Without limiting the generality of the foregoing, we neither express nor imply any opinion regarding the contents of the Registration Statement, other than as expressly stated herein with respect to the Notes.

We are opining only as to matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is rendered as of the date hereof and is based upon currently existing statutes, rules, regulations and judicial decisions. We disclaim any obligation to advise you of any change in any of these sources of law or subsequent legal or factual developments that affect any matters or opinions set forth herein.

We understand that you wish to file this opinion as an exhibit to the Registration Statement, and we hereby consent thereto. We hereby further consent to the reference to us under the caption "Legal Matters" in the prospectus included in the Registration Statement. In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

Very truly yours,

/s/ AKERMAN LLP

Exhibit 5.2

Snell & Wilmer L.L.P.

Hughes Center

3883 Howard Hughes Parkway, Suite 1100

Las Vegas, NV 89169-5958

TELEPHONE: 702.784.5200

FACSIMILE: 702.784.5252

August 12, 2022

RumbleOn Inc.

901 W. Walnut Hill Lane

Irving, Texas 75038

Re: Registration Statement on Form S-1

Ladies and Gentlemen:

We have acted as Nevada counsel to RumbleOn, Inc., a Nevada corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”) of a Registration Statement on Form S-1 on the date hereof (as amended from time to time, the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”).

The Registration Statement relates to the registration and sale by the selling securityholders named in the Registration Statement of (1) an aggregate of 5,791,489 shares (the “RideNow Shares”) of the Company’s Class B common stock, $0.001 par value per share (the “Common Stock”), issued by the Company on August 31, 2021 in connection with the acquisition of RideNow (as described in the Registration Statement); (2) an aggregate of 1,046,272 shares of Common Stock (the “Freedom Shares,” and together with the RideNow Shares, the “Shares”) issued by the Company on February 18, 2022 in connection with the acquisition of Freedom (as described in the Registration Statement); (3) an aggregate of 1,212,121 shares (the “Oaktree Warrant Shares”) of Common Stock that are underlying certain outstanding warrants to purchase an aggregate of $40 million shares of Common Stock (the “Oaktree Warrants”) issued by the Company on March 12, 2021 to Oaktree Capital Management, L.P. (“Oaktree”) and subsequently assigned to certain affiliates of Oaktree on August 31, 2021; (4) an aggregate of 5,617 shares of Common Stock (the “Hercules Warrant Shares,” and together with the Oaktree Warrant Shares, the “Warrant Shares”) that are underlying certain outstanding warrants in connection with debt financing provided by Hercules Capital Inc., (“Hercules Warrants,” and together with the Oaktree Warrants, the “Warrants”); (5) an aggregate of $38,750,000 aggregate principal amount of the Company’s 6.75% Convertible Senior Notes due 2025 (the “Notes”); and (6) 968,750 shares (the “Note Shares”) of the Common Stock, issuable upon conversion of the Notes.

This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act in connection with the filing of the Registration Statement. All capitalized terms used herein and not otherwise defined shall have the respective meanings given to them in the Registration Statement.

In connection with this opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of (i) the Registration Statement and exhibits thereto, including the prospectus comprising a part thereof; (ii) the Articles of Incorporation of the Company, as amended, as currently in effect; (iii) the Amended Bylaws of the Company, as amended, as currently in effect; (iii) copies of the Notes; (iv) copies of the Warrants; and (v) certain resolutions and minutes of meetings of the Board of Directors of the Company relating to (A) the issuance and sale of the Shares, (B) the issuance and sale of the Warrant Shares and the Warrants, (B) the issuance and sale of the Note Shares and Notes, (C) the specimen Common Stock certificate, and (C) other related matters. For the purpose of rendering this opinion, we have made such factual and legal examinations as we deemed necessary under the circumstances, and in that connection therewith we have examined, among other things, originals or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials, certificates of officers or other representatives of the Company, and other instruments and have made such inquiries as we have deemed appropriate for the purpose of rendering this opinion.

In our examination, we have assumed without independent verification the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified, conformed or photostatic copies, and the authenticity of the originals of such copies. In making our examination of executed documents, we have assumed that the parties thereto, other than the Company, had the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties. Our opinions are subject to applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and similar laws affecting creditors’ rights and remedies generally, and subject, as to enforceability, to general principles of equity, including principles of commercial reasonableness, good faith and fair dealing (regardless of whether enforcement is sought in a proceeding at law or in equity). As to any facts material to the opinions expressed herein which were not independently established or verified, we have relied upon oral or written statements and representations of officers or other representatives of the Company and others.

On the basis of, and in reliance on, the foregoing examination and subject to the assumptions, exceptions, qualifications and limitations contained herein, we are of the opinion that the Shares to be resold by the selling securityholders, are duly and validly issued, fully paid and non-assessable shares of Common Stock of the Company.

On the basis of, and in reliance on, the foregoing examination and subject to the assumptions, exceptions, qualifications and limitations contained herein, we are of the opinion that the Warrant Shares to be resold by the selling securityholders, have been duly and validly authorized for issuance, and, if and when certificates representing such Shares underlying the Warrants have been duly executed, countersigned, registered and delivered upon exercise of such issued Warrants in accordance with the terms of such Warrants, as described in the Registration Statement, then such Warrant Shares will be validly issued, fully paid and non-assessable.

Based upon our examination, subject to the assumptions stated above and relying on the statements in the documents we have examined, we are of the opinion that, when issued upon the conversion of the Notes in accordance with the terms of the Notes, the Note Shares will be validly issued, fully paid and non-assessable.

We render this opinion only with respect to the general corporate law of the State of Nevada as set forth in Chapter 78 of the Nevada Revised Statutes. We neither express nor imply any obligation with respect to any other laws or the laws of any other jurisdiction or of the United States. For purposes of this opinion, we assume that the Shares will be issued in compliance with all applicable state securities or blue sky laws.

We assume no obligation to update or supplement this opinion if any applicable laws change after date of this opinion or if we become aware after the date of this opinion of any facts, whether existing before or arising after the date hereof, that might change the opinions expressly so stated. Without limiting the generality of the foregoing, we neither express nor imply any opinion regarding the contents of the Registration Statement, other than as expressly stated herein with respect to the Shares.

We are opining only as to matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is rendered as of the date hereof and is based upon currently existing statutes, rules, regulations and judicial decisions. We disclaim any obligation to advise you of any change in any of these sources of law or subsequent legal or factual developments that affect any matters or opinions set forth herein.

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.2 to the Registration Statement. We also consent to the reference to our firm under the heading “Legal Matters” in the Registration Statement. In giving such consent, we do not thereby concede that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

| Very truly yours, | |

|

/s/ Snell & Wilmer L.L.P. |

|

| Snell & Wilmer L.L.P. |

Exhibit 21.1

Subsidiaries

(as of August 12, 2022)

| Subsidiary Name | Jurisdiction | DBA’s | ||||||

| America's PowerSports, Inc. | Delaware | |||||||

| APS Austin Holdings, LLC | Texas | |||||||

| APS of Georgetown, LLC | Delaware | RideNow Georgetown | ||||||

| APS of Ohio, LLC | Delaware | Powder Keg Harley-Davidson | ||||||

| APS of Oklahoma LLC | Delaware | Fort Thunder Harley-Davidson | ||||||

| APS of Texas LLC | Delaware | Central Texas Harley Davidson | ||||||

| APS Texas Holdings, LLC | Texas | |||||||

| Autosport USA, Inc. | Delaware | |||||||

| Bayou Motorcycles LLC | Louisiana | Baton Rouge Harley-Davidson | ||||||

| Hammond Harley-Davidson | ||||||||

| BJ Motorsports, LLC | Nevada | RideNow Powersports on Boulder | ||||||

| C&W Motors, Inc. | Arizona | RideNow Powersports Chandler | ||||||

| RideNow Euro | ||||||||

| Victory BMW | ||||||||

| RideNow Powersports Goodyear | ||||||||

| CMG Powersports, Inc. | Delaware | |||||||

| Coyote Motorsports-Allen, Ltd. | Texas | Black Gold Harley-Davidson | ||||||

| Coyote Motorsports-Garland, Ltd. | Texas | Dallas Harley-Davidson | ||||||

| DHD Allen, LLC | Texas | |||||||

| DHD Garland, LLC | Texas | |||||||

| DLV Motorcycle, LLC | Nevada | Ducati Las Vegas | ||||||

| East Valley Motorcycles, LLC | Arizona | Chandler Harley-Davidson | ||||||

| ECHD Motorcycles, LLC | California | El Cajon Harley-Davidson | ||||||

| Fort Thunder 355 Holdings, Inc. | Delaware | |||||||

| Fun Center 355 Holdings, Inc. | Delaware | |||||||

| Georgetown 355 Holdings, Inc. | Delaware | |||||||

| Glendale Motorcycles, LLC | Arizona | Arrowhead Harley-Davidson | ||||||

| Roadrunner Harley-Davidson | ||||||||

| INDTUC, LLC | Arizona | Indian Motorcycle Tucson | ||||||

| IOT Motorcycles, LLC | Arizona | Sin City Indian Motorcycle | ||||||

| J.J.B. Properties, LLC | Arizona | RideNow Powersports Surprise | ||||||

| Metro Motorcycle, Inc. | Arizona | RideNow Powersports Peoria | ||||||

| Indian Motorcycle of Peoria | ||||||||

| NextGen Pro, LLC | Delaware | |||||||

| North County 355 Holdings, Inc. | Delaware | |||||||

| Powder Keg 355 Holdings, Inc. | Delaware | |||||||

| Subsidiary Name | Jurisdiction | DBA’s | ||||||

| RHND Ocala, LLC | Florida | War Horse Harley-Davidson | ||||||

| Ride Now 5 Allen, LLC | Texas | RideNow Powersports Forney | ||||||

| Ride Now, LLC | Nevada | RideNow Powersports on Rancho I | ||||||

| RideNow Powersports on Rancho II | ||||||||

| Ride Now-Carolina, LLC | North Carolina | RideNow Powersports Concord | ||||||

| Indian Motorcycle Concord | ||||||||