Form S-1 Hoth Therapeutics, Inc.

As filed with the Securities and Exchange Commission on August 30, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hoth Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

| Nevada | 2834 | 82-1553794 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1 Rockefeller Plaza, Suite 1039

New York, New York 10020

(646)

756-2997

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Robb Knie

Chief Executive Officer

1 Rockefeller Plaza, Suite 1039

New York, New York 10020

(646) 756-2997

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard A. Friedman, Esq. Nazia Khan, Esq. Sheppard,

Mullin, Richter & Hampton LLP |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Proposed | Proposed | |||||||||||||||

| Maximum | Maximum | |||||||||||||||

| Amount | Offering | Aggregate | Amount of | |||||||||||||

| Title of Each Class of Securities to be Registered (1) | to be Registered | Price Per Share (2) | Offering Price (2) | Registration Fee | ||||||||||||

| Common Stock, par value $0.0001 per share | 407,424 | $ | 5.12 | $ | 2,086,011 | $ | 252.82 | |||||||||

| Common Stock, par value $0.0001 per share (3) | 921,579 | $ | 5.12 | $ | 4,718,485 | $ | 571.88 | |||||||||

| Total | 1,329,003 | $ | 6,804,496 | $ | 824.70 | |||||||||||

| (1) | The shares of our common stock being registered hereunder are being registered for sale by the selling security holders named in the prospectus. Under Rule 416 of the Securities Act of 1933, as amended, the shares being registered include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered in this registration statement as a result of any stock splits, stock dividends or other similar event. |

| (2) | The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on The Nasdaq Capital Market on August 28, 2019. |

| (3) | Represents shares of common stock issuable upon exercise of outstanding warrants to purchase shares of common stock offered by the selling stockholders. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state where the offer or sale is not permitted

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED AUGUST 30, 2019

Hoth Therapeutics Inc.

1,329,003 Shares of Common Stock

This prospectus relates to the resale by certain selling stockholders of Hoth Therapeutics, Inc., a Nevada corporation (the “Company”) identified in this prospectus of up to 1,329,003 shares (the “Resale Shares”) of our common stock, par value $0.0001 per share, including 407,424 outstanding shares of common stock and 921,579 shares of common stock issuable upon exercise of outstanding warrants. All of the Resale Shares were purchased from the Company in private placement transactions and are being offered for resale by the selling stockholders only.

The Resale Shares may be sold by the selling stockholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

The prices at which the selling stockholders may sell the Resale Shares will be determined by the prevailing market price for shares of the Company’s common stock or in privately negotiated transactions. We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; provided, however, we will receive the proceeds from any cash exercise of warrants.

We will bear all costs relating to the registration of the Resale Shares, other than any selling stockholders legal or accounting costs or commissions.

Our common stock is presently listed on The Nasdaq Capital Market under the symbol “HOTH.” The closing price of our common stock on August 29, 2019, as reported on The Nasdaq Capital Market was $5.50 per share.

Investing in our common stock involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 7 of this prospectus and elsewhere in this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”). For more information, see the sub-section titled “Implications of Being an Emerging Growth Company.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is_________, 2019.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed a registration statement on Form S-1, of which this prospectus forms a part, under the Securities Act of 1933, as amended (the “Securities Act”), with the SEC with respect to the securities being offered pursuant to this prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us and the securities being offered pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed rates at the offices of the SEC listed above in “Where You Can Find More Information.” We are incorporating by reference the documents listed below, which we have already filed with the SEC, and all documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except as to any portion of any future report or document that is not deemed filed under such provisions:

| 1. | The Company’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on April 1, 2019; |

| 2. | The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019 and June 30, 2019 filed with the SEC on May 15, 2019 and August 14, 2019, respectively; |

| 3. | The Company’s Current Reports on Form 8-K (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) filed with the SEC on February 20, 2019, March 7, 2019, April 29, 2019, August 21, 2019 and August 23, 2019; and |

| 4. | The description of the Company’s common stock contained in the registration statement on Form 8-A filed with the SEC on February 6, 2019, including any amendment or report filed for the purpose of updating that description. |

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement.

You may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (646) 756-2997 or by writing to us at the following address:

Hoth Therapeutics, Inc.

1 Rockefeller Plaza, Suite 1039

New York, New York 10020

Attn.: Secretary

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of these securities.

i

The following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless context requires otherwise, references to “we,” “us,” “our,” “Hoth” or “the Company” refer to Hoth Therapeutics, Inc.

Overview

We are a development stage biopharmaceutical company incorporated in May 2017 focused on targeted therapeutics for patients suffering from conditions such as atopic dermatitis, also known as eczema.

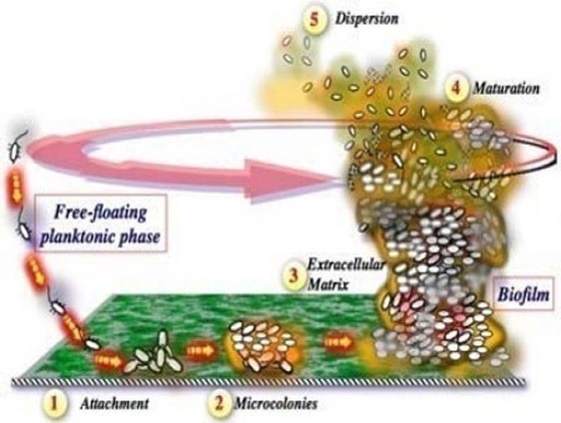

Our primary asset is a sublicense agreement with Chelexa Biosciences, Inc. (“Chelexa”) pursuant to which Chelexa has granted us an exclusive sublicense to use its BioLexa Platform (as defined herein), a proprietary, patented, drug compound platform developed at the University of Cincinnati. The license enables us to develop the platform for any indications in humans. Our initial focus will be on the treatment of eczema through the application of a topical cream. Although our initial focus will be on the treatment of eczema, we intend to develop a second topical cream which, upon application, is intended to reduce post-procedure infections, accelerate healing and improve clinical outcomes for patients undergoing aesthetic dermatology procedures. The BioLexa Platform combines a U.S. Food and Drug Administration (“FDA”) approved zinc chelator with one or more approved antibiotics in a topical dosage form to address unchecked eczema flare-ups by preventing the formation of infectious biofilms and the resulting clogging of sweat ducts which trigger symptoms. To our knowledge, it is the first product candidate intended to prevent the symptom triggering flare-ups rather than simply treating symptoms when they occur.

On May 26, 2017, we entered into a sublicense agreement with Chelexa, as amended on August 22, 2018 and August 29, 2018, pursuant to which Chelexa granted us an exclusive sublicense to make, use, have made, import, offer for sale, and sell products based upon or involving the use of (i) topical compositions comprising a zinc chelator and gentamicin and (ii) zinc chelators to inhibit biofilm formation (the “BioLexa Platform” or “BioLexa”), which rights were originally granted to Chelexa pursuant to an exclusive license agreement with the University of Cincinnati. In addition, Chelexa granted us the right to issue exclusive and nonexclusive sublicenses (with the right to further sublicense to third parties) to make, use, have made, import, offer for sale, and sell products based upon the BioLexa Platform.

We intend to use the BioLexa Platform to develop two different topical cream products: (i) a product to treat eczema and (ii) a product that reduces post-procedure infections, accelerates healing and improves clinical outcomes for patients undergoing aesthetic dermatology procedures. Our initial focus will be on eczema. Eczema is a disease that results in inflammation of the skin and is characterized by rash, red skin, and itchiness. Eczema is also referred to as atopic dermatitis (“AD”). According to the National Eczema Association, eczema affects approximately 32 million Americans and, at $300 per annum per patient, represents an approximate $9.5 billion market in the U.S. alone.

BioLexa’s formulation is a new topical dosage form “repurposing” the antibiotic, enabling it to be developed for use in patients following a special regulatory pathway codified in Section 505(b)(2) of the FDA rules. Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act was enacted to enable sponsors to seek New Drug Application (“NDA”) approval for novel repurposed drugs without the need for such sponsors to undertake time consuming and expensive pre-clinical safety studies and Phase 1 safety studies. Proceeding under this regulatory pathway, we will be able to rely upon all of the publicly available safety and toxicology data with respect to gentamicin and zinc chelator in our FDA submissions. We will be required to conduct a Phase 2 study to show the safety of the combination in humans and after such Phase 2 study will be required to proceed to Phase 3 pivotal clinical trials. We believe that this path will dramatically reduce the required clinical development effort, costs and risks as compared to what would be required of us if we were required to conduct pre-clinical safety, toxicology and animal studies together with Phase 1 human safety trials required for new chemical entities which are not eligible to be reviewed pursuant to the Section 505(b)(2) regulatory pathway. We estimate that by using the Section 505(b)(2) regulatory pathway, that the clinical development process may be five to six years shorter than is required for a new chemical entity, and the FDA approval process may be six to nine months shorter than the typical eighteen month period, which we believe may result in lower development costs and shorter development time. As of the date of this prospectus, we have not submitted an NDA to the FDA. In September 2018, we attended the first of a planned series of meetings with the FDA to review the requirements for submission and activation of an investigational new drug application (“IND”) with respect to the BioLexa Platform for use in eczema. In preparation for such pre-IND meeting, we prepared and presented to the FDA our proposed Phase 2 clinical trial plan for the treatment of eczema in patients over the age of one year old. As part of our pre-IND meeting, the FDA provided us with general guidance with respect to specific animal studies, dosing schedules and suggested human safety studies before we commence clinical trials in pediatric or adult patients. We are currently investigating multiple potential venues for conducting such trial both in and outstand of the U.S. We have engaged Camargo Pharmaceutical Services, LLC (“Camargo”) to assist us with the FDA process required for Section 505(b)(2) applications and with the evaluation of potential clinical trial venues for the proof of concept study should we determine to undertake such study. Specifically, Camargo has provided and will continue to provide advice and guidance relative to the IND preparation phase for the BioLexa platform. Camargo will assist us with the refinement of our non-clinical, clinical, clinical pharmacology and biopharmaceutics strategy incorporating the preliminary feedback we received from the FDA during our pre-IND meeting.

-1-

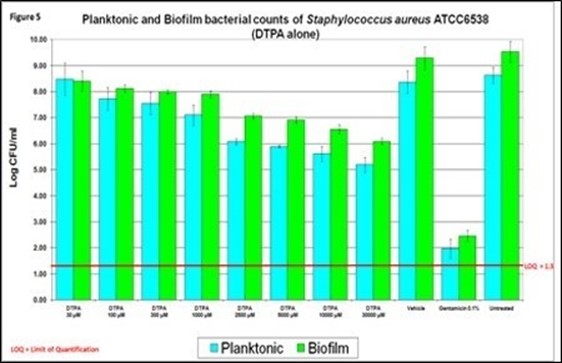

We intend to conduct our first Phase 1 study in healthy adults with an immediate transition to a randomized, vehicle controlled Phase 1b trial in adolescent eczema patients comparing BioLexa to the base vehicle. This Phase 1b trial is intended to examine both safety and efficacy. We will assess the formulation of Ca-DTPA and Gentamicin 0.1% in our proprietary topical lotion delivered by a metered pump system. We will also assess the ability of BioLexa to clear harmful staph aureus bacterial from the skin of atopic dermatitis patients.

Following our Phase 1b trial, we intend to conduct up to two Phase 2 trials in atopic dermatitis patients comparing BioLexa to the base vehicle. Subject numbers and allocation will be informed by the results of the Phase 1b trial. We expect the clinical program to be completed, subject to receipt of funding by us, by the end of 2020 or early 2021 with an NDA submission targeted for mid to late 2021.

In addition, we conducted an initial pilot study on the efficacy of BioLexa to accelerate diabetic wound healing and intend to conduct additional studies with respect to the regenerative effects of the BioLexa Platform in the context of chronic diabetic ulcers, with and without substantial bacterial burden.

We believe that the key elements for our market success include:

| ● | the proprietary formulation of two FDA-approved drugs to treat bacterial proliferation reduces development time and costs by giving us the ability to rely on safety and efficacy data from the two approved drugs; |

| ● | our proprietary formulation is not a topical corticosteroid, and may not be subject to the same FDA black box warning issues as most commonly prescribed treatments currently in use; and |

| ● | recent peer-reviewed publications highlight that staph-induced biofilms are the root cause of flare-ups in eczema. Our BioLexa product candidate has been demonstrated to prevent the formation of these biofilms with the promise of delaying or completely arresting flare-ups, rather than merely treating symptoms of a flare-up already underway. |

In addition to our sublicense agreement with Chelexa, we entered into an exclusive license agreement with the University of Cincinnati for a patented, novel genetic marker for food allergies. The genetic marker licensed by us from the University of Cincinnati (i) may be used to identify at risk infants in predicting food allergies, including peanut and milk allergies, (ii) may be used to identify a person’s predisposition to an allergic reaction, thereby avoiding such reaction and (iii) may also determine an individual’s propensity to develop AD, such as eczema. We intend to utilize the genetic marker for purposes of determining an individual’s propensity to develop eczema as well as to identify and treat allergies in at-risk infants.

-2-

We also entered into an exclusive sublicense agreement (the “Sublicense Agreement”) with Zylö Therapeutics, Inc. (“Zylö”) pursuant to which Zylö granted us an exclusive sublicense to certain patent rights and technology to, among other things, develop, make and sell the certain licensed products and to practice certain licensed technology in the United States and Canada for all therapeutic uses related to lupus in human beings.

Our Product Pipeline

The following table summarizes the BioLexa expected product development pipeline.

There is currently no active IND for our product candidate in the United States.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our common shares. These risks are discussed more fully in the “Risk Factors” section of this prospectus. These risks include the following:

| ● | We were formed in May 2017 and have a limited operating history. Since inception, we have incurred losses and expect to continue to operate at a net loss for at least the next several years as we commence our research and development efforts, conduct clinical trials and develop manufacturing, sales, marketing and distribution capabilities. Our net losses for the year ended December 31, 2018 and for the period from May 16, 2017 (inception) through December 31, 2017 were $2,495,525 and $2,015,481, respectively. Our net losses for the three and six months ended June 30, 2019 were $1,267,586 and $2,096,951, respectively. |

| ● | We have generated no revenue from commercial sales to date and our future profitability is uncertain. |

| ● | If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment. |

-3-

| ● | We may expand our business through the acquisition of rights to new drug candidates that could disrupt our business, harm our financial condition and may also dilute current shareholders’ ownership interests in our Company. |

| ● | Our management team lacks experience in the pharmaceutical field. |

| ● | The marketing approval process of the FDA is lengthy, time consuming and inherently unpredictable, and if we ultimately are unable to obtain marketing approval for the product candidates we intend to develop, our business will be substantially harmed. |

| ● | There is no guarantee that the FDA will grant NDA approval of our future products, and failure to obtain necessary clearances or approvals for our future products would adversely affect our ability to grow our business. |

| ● | There can be no assurance that the data generated from our clinical trials will be acceptable to FDA. |

| ● | Even if our products are approved by regulatory authorities, if we or our suppliers fail to comply with ongoing FDA regulation or if we experience unanticipated problems with our products, these products could be subject to restrictions or withdrawal from the market. |

| ● | Our products will face significant competition in the markets for such products, and if they are unable to compete successfully, our business will suffer. |

| ● | Our business depends upon securing and protecting critical intellectual property. |

| ● | We may undertake international operations, which will subject us to risks inherent with operations outside of the United States. |

| ● | Market and economic conditions may negatively impact our business, financial condition and share price. |

| ● | Future sales and issuances of our securities could result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall. |

Corporate Information

We were incorporated as a Nevada corporation on May 16, 2017. Our principal executive offices are located at 1 Rockefeller Plaza, Suite 1039, New York, New York 10020 and our telephone number is (646) 756-2997. Our website address is www.hoththerapeutics.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common shares.

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as defined in the JOBS Act because we had less than $1.07 billion in revenues during our last fiscal year. As an emerging growth company, we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus; |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”); |

-4-

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

As an emerging growth company, we intend to take advantage of an extended transition period for complying with new or revised accounting standards as permitted by the JOBS Act. To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (ii) scaled executive compensation disclosures; and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

August 2019 Private Placement

On August 16, 2019 (the “Closing Date”), we sold an aggregate of $2,037,120 of units (the “Units”), each Unit consisting of (i) one share of the Company’s common stock and (ii) a warrant to purchase one-half share pursuant to a private placement offering (the “August 2019 Private Placement”) at a purchase price of $5.00 per Unit. Each warrant is exercisable for a period of two years beginning six months from the Closing Date at an exercise price of $8.00 per whole share, subject to adjustment.

In connection with the August 2019 Private Placement, we agreed to (i) pay Laidlaw and Company (UK) Ltd., a U.S. registered broker-dealer (“Laidlaw”) a cash commission of 10% of the gross proceeds raised from investors in the August 2019 Private Placement introduced by them, and (ii) issued to Laidlaw, warrants to purchase that number of shares of common stock equal to 10% of the number of shares of common stock sold to investors (including shares of common stock issuable upon exercise of the warrants) in the August 2019 Private Placement introduced by them, with a term of five years from the closing date of the August 2019 Private Placement, and an exercise price of $5.00 per share (the “Placement Agent Warrants”).

As a result of the foregoing, we paid Laidlaw an aggregate commission of approximately $0.2 million and issued Laidlaw Placement Agent Warrants to purchase up to an aggregate of 61,113 shares of our common stock in connection with the August 2019 Private Placement. We also paid Laidlaw a one time fee of $50,000 and reimbursed the Laidlaw for approximately $0.4 million of expenses incurred in connection with the August 2019 Private Placement. In the event that the investors exercise their warrants, we will also be required to pay Laidlaw a cash fee of 5% of the gross proceeds received from the exercise of such warrants.

-5-

THE OFFERING

| Common stock offered by selling stockholders: | 1,329,003 shares of common stock including 407,424 outstanding shares of common stock and 921,579 shares of common stock issuable upon exercise of the warrants. | |

| Offering price: | Market price or privately negotiated prices. | |

| Common stock outstanding after the offering: | 10,077,068 | |

| Use of proceeds: | We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; however, we will receive the proceeds from any cash exercise of warrants. | |

| Risk factors: | An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate the risk factors set forth under the caption “Risk Factors” beginning on page 7. | |

| Nasdaq Capital Market Symbol: | HOTH |

The number of shares of common stock to be outstanding immediately after this offering is based on 10,077,068 shares of common stock outstanding as of August 27, 2019 and excludes:

| ● | 717,870 shares of common stock issuable upon exercise of warrants with an exercise price of $1.00 per share; |

| ● | 203,709 shares of common stock issuable upon exercise of warrants with an exercise price of $8.00 per share; |

| ● | 50,000 shares of common stock issuable upon exercise of warrants with a weighted average exercise price of $7.00 per share; and |

| ● | 830,683 shares of common stock reserved for future issuance under our 2018 Equity Incentive Plan. |

-6-

Any investment in our common stock involves a high degree of risk. Before deciding whether to purchase our common stock, investors should carefully consider the risks described below together with the “Risk Factors” described in our most recent Annual Report on Form 10-K, which are incorporated herein by reference, as may be amended, supplemented or superseded from time to time by other reports we file with the SEC. Our business, financial condition, operating results and prospects are subject to the following material risks as well as those material risks incorporated by reference. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in the shares of our common stock.

Risks Related to Our Financial Position and Need for Capital

We have generated no revenue from commercial sales to date and our future profitability is uncertain.

We were incorporated in May 2017 and have a limited operating history and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. Since inception, we have incurred losses and expect to continue to operate at a net loss for at least the next several years as we commence our research and development efforts, conduct clinical trials and develop manufacturing, sales, marketing and distribution capabilities. Our net losses for the year ended December 31, 2018 and for the period from May 16, 2017 (inception) through December 31, 2017 were $2,495,525 and $2,015,481, respectively, and our accumulated deficit as of December 31, 2018 and 2017 was $4,511,006 and $2,015,481, respectively. Our net losses for the three and six months ended June 30, 2019 were $1,267,586 and $2,096,951, respectively, and our accumulated deficit as of June 30, 2019 was $6,607,957. There can be no assurance that the products under development by us will be approved for sale in the U.S. or elsewhere. Furthermore, there can be no assurance that if such products are approved they will be successfully commercialized, and the extent of our future losses and the timing of our profitability are highly uncertain. If we are unable to achieve profitability, we may be unable to continue our operations.

If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment.

We will need to continue to seek capital from time to time to continue development of our lead drug candidate beyond the initial Phase 2 clinical trial and to acquire and develop other product candidates. Our first product is not expected to be commercialized until at least 2022 and we cannot provide any assurances that any revenues it may generate in the future will be sufficient to fund our ongoing operations. We believe that we will need to raise substantial additional capital to fund our continuing operations and the development and commercialization of our product candidate.

Our business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhanced products, acquire complementary products, business or technologies or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a change in preferred eczema treatment modalities. In addition, we may need to accelerate the growth of our sales capabilities and distribution beyond what is currently envisioned, and this would require additional capital. However, we may not be able to secure funding when we need it or on favorable terms. We may not be able to raise sufficient funds to commercialize the product candidates we intend to develop.

If we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development activities, clinical studies or future operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights to future product candidates or certain major geographic markets. This could result in sharing revenues which we might otherwise retain for ourselves. Any of these actions may harm our business, financial condition and results of operations.

-7-

The amount of capital we may need depends on many factors, including the progress, timing and scope of our product development programs; the progress, timing and scope of our preclinical studies and clinical trials; the time and cost necessary to obtain regulatory approvals; the time and cost necessary to further develop manufacturing processes and arrange for contract manufacturing; our ability to enter into and maintain collaborative, licensing and other commercial relationships; and our partners’ commitment of time and resources to the development and commercialization of our products.

Even if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

The capital markets have been unpredictable in the recent past for unprofitable companies such as ours. In addition, it is generally difficult for early stage companies to raise capital under current market conditions. The amount of capital that a company such as ours is able to raise often depends on variables that are beyond our control. As a result, we may not be able to secure financing on terms attractive to us, or at all. If we are able to consummate a financing arrangement, the amount raised may not be sufficient to meet our future needs. If adequate funds are not available on acceptable terms, or at all, our business, including our results of operations, financial condition and our continued viability will be materially adversely affected.

Risks Related to Product Development, Regulatory Approval, Manufacturing and Commercialization

We depend upon the success of the BioLexa Platform, which has not yet demonstrated efficacy in Phase 2 clinical trials and the genetic marker for food allergies which is in the pre-clinical stage, the use of which we licensed from the University of Cincinnati. If we are unable to generate revenues from the BioLexa Platform or the genetic marker, our ability to create stockholder value will be limited.

We intend to conduct an initial Phase 2 study for our lead product candidate, the BioLexa Platform, which is a new topical dosage form “repurposing” the antibiotic, enabling it to be developed for use in patients following a special regulatory pathway codified in Section 505(b)(2) of the FDA rules. In addition, the genetic marker for food allergies which we licensed from the University of Cincinnati is in the pre-clinical stage. We do not generate revenues from any approved drug products and have no other product candidates in development. We may not be successful in obtaining acceptance from the regulatory authorities to start our clinical trials. If we do not obtain such acceptance, the time in which we expect to commence clinical programs for any product candidate will be extended and such extension will increase our expenses and increase our need for additional capital. Moreover, there is no guarantee that our clinical trials will be successful or that we will continue clinical development in support of an approval from the regulatory authorities for any indication. We note that most drug candidates never reach the clinical stage and even those that do commence clinical development have only a small chance of successfully completing clinical development and gaining regulatory approval. Therefore, our business currently depends entirely on the successful development, regulatory approval and commercialization of our product candidates, which may never occur.

Members of our management team lack experience in the pharmaceutical field.

Members of our management team lack experience in the pharmaceutical field. This lack of experience may impair our ability to commercialize our pharmaceutical products and attain profitability. We will need to hire or engage managerial personnel with relevant experience in the pharmaceutical field; however, there can be no assurance that such personnel will be available to us or, that once engaged, will be retained by us. Failure to establish and maintain an effective management team with experience in the pharmaceutical field and commercialization of pharmaceuticals products would have a material adverse effect on our business and results of operations.

-8-

The marketing approval process of the FDA is lengthy, time consuming and inherently unpredictable, and if were ultimately are unable to obtain marketing approval for the product candidates we intend to develop, our business will be substantially harmed.

None of the product candidates we intend to develop have gained marketing approval in the U.S. and we cannot guarantee that we will ever have marketable products. Our business is substantially dependent on our ability to complete the development of, obtain marketing approval for, and successfully commercialize our product candidates in a timely manner. We cannot commercialize our product candidates in the United States without first obtaining approval from the FDA to market each product candidate. Our product candidates could fail to receive marketing approval for many reasons, including among others:

| ● | the FDA may disagree with the design or implementation of our clinical trials; |

| ● | the FDA could determine that we cannot rely on Section 505(b)(2) for any or all of our product candidates; and |

| ● | the FDA may determine that we have identified the wrong reference listed drug or drugs or that approval of our Section 505(b)(2) application for any of our product candidates is blocked by patent or non-patent exclusivity of the reference listed drug or drugs. |

In addition, the process of seeking regulatory clearance or approval to market the product candidates we intend to develop is expensive and time consuming and, notwithstanding the effort and expense incurred, clearance or approval is never guaranteed. If we are not successful in obtaining timely clearance or approval of our product candidates from the FDA, we may never be able to generate significant revenue and may be forced to cease operations. The NDA process is costly, lengthy and uncertain. Any NDA application filed by the Company will have to be supported by extensive data, including, but not limited to, technical, preclinical, clinical trial, manufacturing and labeling data, to demonstrate to the FDA’s satisfaction the safety and efficacy of the product for its intended use.

Obtaining clearances or approvals from the FDA and from the regulatory agencies in other countries is an expensive and time consuming process and is uncertain as to outcome. The FDA and other agencies could ask us to supplement our submissions, collect non-clinical data, conduct additional clinical trials or engage in other time-consuming actions, or it could simply deny our applications. In addition, even if we obtain an NDA approval or pre-market approvals in other countries, the approval could be revoked or other restrictions imposed if post-market data demonstrates safety issues or lack of effectiveness. We cannot predict with certainty how, or when, the FDA will act. If we are unable to obtain the necessary regulatory approvals, our financial condition and cash flow may be adversely affected, and our ability to grow domestically and internationally may be limited. Additionally, even if cleared or approved, the Company’s products may not be approved for the specific indications that are most necessary or desirable for successful commercialization or profitability.

We may encounter substantial delays in completing our clinical studies which in turn will require additional costs, or we may fail to demonstrate adequate safety and efficacy to the satisfaction of applicable regulatory authorities.

It is impossible to predict if or when any of our product candidates, will prove safe or effective in humans or will receive regulatory approval. Before obtaining marketing approval from regulatory authorities for the sale of our product candidates, we must conduct extensive clinical studies to demonstrate the safety and efficacy of the product candidates in humans. Clinical testing is expensive, time-consuming and uncertain as to outcome. We cannot guarantee that any clinical studies will be conducted as planned or completed on schedule, if at all. A failure of one or more clinical studies can occur at any stage of testing. Events that may prevent successful or timely completion of clinical development include:

| ● | delays in reaching, or failing to reach, a consensus with regulatory agencies on study design; | |

| ● | delays in reaching, or failing to reach, agreement on acceptable terms with a sufficient number of prospective contract research organizations (“CROs”) and clinical study sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; | |

| ● | delays in obtaining required IRB or Ethics Committee (“EC”) approval at each clinical study site; | |

| ● | delays in recruiting a sufficient number of suitable patients to participate in our clinical studies; | |

| ● | imposition of a clinical hold by regulatory agencies, after an inspection of our clinical study operations or study sites; | |

| ● | failure by our CROs, other third parties or us to adhere to clinical study, regulatory or legal requirements; |

-9-

| ● | failure to perform in accordance with the FDA’s GCPs or applicable regulatory guidelines in other countries; | |

| ● | delays in the testing, validation, manufacturing and delivery of sufficient quantities of our product candidates to the clinical sites; | |

| ● | delays in having patients complete participation in a study or return for post-treatment follow-up; | |

| ● | clinical study sites or patients dropping out of a study; | |

| ● | delay or failure to address any patient safety concerns that arise during the course of a trial; | |

| ● | unanticipated costs or increases in costs of clinical trials of our product candidates; | |

| ● | occurrence of serious adverse events associated with the product candidate that are viewed to outweigh its potential benefits; or | |

| ● | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols. |

We could also encounter delays if a clinical trial is suspended or terminated by us, by the IRBs or ECs of the institutions in which such trials are being conducted, by an independent Safety Review Board (“SRB”) for such trial or by the FDA, EMA, or other regulatory authorities. Such authorities may suspend or terminate a clinical trial due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA, EMA, or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

Any inability to successfully complete preclinical and clinical development could result in additional costs to us or impair our ability to generate revenues from product sales, regulatory and commercialization milestones and royalties. In addition, if we make manufacturing or formulation changes to our product candidates, we may need to conduct additional studies to bridge our modified product candidates to earlier versions.

Clinical study delays could also shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize our product candidates. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. Any of these occurrences may significantly harm our business, financial condition and prospects. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

The outcome of preclinical studies and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. Further, preclinical and clinical data are often susceptible to various interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval. If the results of our clinical studies are inconclusive or if there are safety concerns or adverse events associated with our other product candidates, we may:

| ● | be delayed in obtaining marketing approval for our product candidates, if approved at all; |

| ● | obtain approval for indications or patient populations that are not as broad as intended or desired; | |

| ● | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; | |

| ● | be required to change the way the product is administered; |

-10-

| ● | be required to perform additional clinical studies to support approval or be subject to additional post-marketing testing requirements; | |

| ● | have regulatory authorities withdraw their approval of a product or impose restrictions on its distribution in the form of a modified risk evaluation and mitigation strategy; | |

| ● | be sued; or | |

| ● | experience damage to our reputation. |

Additionally, our product candidates could potentially cause other adverse events that have not yet been predicted. The inclusion of ill patients in our clinical studies may result in deaths or other adverse medical events due to other therapies or medications that such patients may be using. As described above, any of these events could prevent us from achieving or maintaining market acceptance of our product candidates and impair our ability to commercialize our products.

If we are not able to obtain any required regulatory approvals for our product candidates, we will not be able to commercialize our product candidates and our ability to generate revenue will be limited.

We must successfully complete clinical trials for our product candidates before we can apply for marketing approval. Even if we complete our clinical trials, it does not assure marketing approval. Our preclinical trials may be unsuccessful, which would materially harm our business. Even if our initial preclinical trials are successful, we are required to conduct clinical trials to establish our product candidates’ safety and efficacy, before a marketing application (NDA or Biologics License Application, or BLA, or their foreign equivalents) can be filed with the FDA, the European Medicines Agency (“EMA”), or comparable foreign regulatory authorities for marketing approval of our product candidates.

Clinical testing is expensive, is difficult to design and implement, can take many years to complete and is uncertain as to outcome. Success in early phases of pre-clinical and clinical trials does not ensure that later clinical trials will be successful, and interim results of a clinical trial do not necessarily predict final results. A failure of one or more of our clinical trials can occur at any stage of testing. We may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent our ability to receive regulatory approval or commercialize our product candidates. The research, testing, manufacturing, labeling, packaging, storage, approval, sale, marketing, advertising and promotion, pricing, export, import and distribution of drug products are subject to extensive regulation by the FDA, EMA, and other regulatory authorities in the United States, European Union, and other countries, where regulations differ from country to country. We are not permitted to market our product candidates as prescription pharmaceutical products in the United States until we receive approval of an NDA from the FDA, or in any foreign countries until we receive the requisite approval from such countries. In the United States, the FDA generally requires the completion of clinical trials of each drug to establish its safety and efficacy and extensive pharmaceutical development to ensure its quality before an NDA is approved. Regulatory authorities in other jurisdictions impose similar requirements. Of the large number of drugs in development, only a small percentage result in the submission of an NDA to the FDA or other regulatory authorities and even fewer are eventually approved for commercialization. We have not submitted an NDA to the FDA or comparable applications to other regulatory authorities. If our development efforts for our product candidates, including regulatory approval, are not successful for their planned indications, or if adequate demand for our product candidates is not generated, our business will be materially adversely affected.

Our success depends on the receipt of regulatory approval and the issuance of such regulatory approvals is uncertain and subject to a number of risks, including the following:

| ● | the results of nonclinical or toxicology studies may not support the filing of an IND or foreign equivalent for our eczema product candidate; | |

| ● | the FDA, EMA, or comparable foreign regulatory authorities or IRBs or ECs may disagree with the design or implementation of our clinical trials; |

-11-

| ● | we may not be able to provide acceptable evidence of our product candidates’ safety and efficacy; | |

| ● | the results of our clinical trials may not be satisfactory or may not meet the level of statistical or clinical significance required by the FDA, EMA, or other regulatory agencies for marketing approval; | |

| ● | the dosing of our product candidates in a particular clinical trial may not be at an optimal level; | |

| ● | patients in our clinical trials may suffer adverse effects for reasons that may or may not be related to our product candidates; | |

| ● | the data collected from clinical trials may not be sufficient to support the submission of an NDA, BLA or other marketing application or to obtain regulatory approval in the United States or elsewhere; | |

| ● | the requirement for additional studies, including a second phase 3 study for the PRV-031 program in T1D; | |

| ● | the FDA, EMA, or comparable foreign regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; | |

| ● | the approval policies or regulations of the FDA, EMA, or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval; | |

| ● | the FDA, EMA, or comparable foreign regulatory authorities may disagree on the design or implementation of our clinical trials, including the methodology used in our studies, our chosen endpoints, our statistical analysis, or our proposed product indication; | |

| ● | our failure to demonstrate to the satisfaction of the FDA, EMA, or comparable regulatory authorities that a product candidate is safe and effective for its proposed indication; | |

| ● | we may fail to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; | |

| ● | immunogenicity might affect a product candidate efficacy and/or safety; | |

| ● | the FDA, EMA, or comparable foreign regulatory authorities may disagree with our interpretation of data from nonclinical studies or clinical trials; | |

| ● | data collected from clinical trials of our product candidates may be insufficient to support the submission and filing of a marketing application or to obtain marketing approval. For example, the FDA may require additional studies to show that our product candidates are safe or effective; | |

| ● | we may fail to obtain approval of the manufacturing processes or facilities of third-party manufacturers with whom we contract for clinical and commercial supplies; | |

| ● | there may be changes in the approval policies or regulations that render our nonclinical and clinical data insufficient for approval; or | |

| ● | the FDA, EMA or comparable foreign regulatory authority may require more information, including additional nonclinical or clinical data to support approval, which may delay or prevent approval and our commercialization plans, or we may decide to abandon the development program. |

Failure to obtain regulatory approval for our product candidates for the foregoing, or any other reasons, will prevent us from commercializing our product candidates, and our ability to generate revenue will be materially impaired. We cannot guarantee that regulators will agree with our assessment of the results of the clinical trials we intend to conduct in the future or that such trials will be successful. The FDA, EMA and other regulators have substantial discretion in the approval process and may refuse to accept any application or may decide that our data is insufficient for approval and require additional clinical trials, or pre-clinical or other studies. In addition, varying interpretations of the data obtained from pre-clinical and clinical testing could delay, limit or prevent regulatory approval of our product candidates.

-12-

We have not submitted an IND or received regulatory approval to commence clinical trials for our product candidates in any jurisdiction. We have only limited experience in filing the applications necessary to gain regulatory approvals and expect to rely on consultants and third party CROs with expertise in this area to assist us in this process. Securing regulatory approvals to market a product requires the submission of pre-clinical, clinical, and/or pharmacokinetic data, information about product manufacturing processes and inspection of facilities and supporting information to the appropriate regulatory authorities for each therapeutic indication to establish a product candidate’s safety and efficacy for each indication. Our product candidates may prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude us from obtaining regulatory approval or prevent or limit commercial use with respect to one or all intended indications.

The process of obtaining regulatory approvals is expensive, often takes many years, if approval is obtained at all, and can vary substantially based upon, among other things, the type, complexity and novelty of the product candidates involved, the jurisdiction in which regulatory approval is sought and the substantial discretion of the regulatory authorities. Changes in regulatory approval policies during the development period, changes in or the enactment of additional statutes or regulations, or changes in regulatory review for a submitted product application may cause delays in the approval or rejection of an application. Regulatory approval obtained in one jurisdiction does not necessarily mean that a product candidate will receive regulatory approval in all jurisdictions in which we may seek approval, but the failure to obtain approval in one jurisdiction may negatively impact our ability to seek approval in a different jurisdiction. Failure to obtain regulatory marketing approval for our product candidates in any indication will prevent us from commercializing the product candidate, and our ability to generate revenue will be materially impaired.

If we are unable to submit an application for approval under Section 505(b)(2) of the FDCA or if we are required to generate additional data related to safety and efficacy in order to obtain approval under Section 505(b)(2), we may be unable to meet our anticipated development and commercialization timelines.

Our current strategy for seeking marketing authorization in the United States for our product candidates relies primarily on Section 505(b)(2) of the FDCA which permits use of a marketing application, referred to as a 505(b)(2) application, where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference or use. The FDA interprets this to mean that an applicant may rely for approval on such data as that found in published literature or the FDA’s finding of safety or effectiveness, or both, of a previously approved drug product owned by a third party. There is no assurance that the FDA would find third-party data relied upon by us in a 505(b)(2) application sufficient or adequate to support approval and may require us to generate additional data to support the safety and efficacy of our intended product candidates. Consequently, we may need to conduct substantial new research and development activities beyond those we currently plan to conduct. Such additional new research and development activities would be costly and time consuming and there is no assurance that such data generated from such additional activities would be sufficient to obtain approval.

If the data to be relied upon in a 505(b)(2) application is related to drug products previously approved by the FDA and covered by patents that are listed in the FDA’s Orange Book, we would be required to submit with our 505(b)(2) application a Paragraph IV Certification in which we must certify that we do not infringe the listed patents or that such patents are invalid or unenforceable, and provide notice to the patent owner or the holder of the approved NDA. The patent owner or NDA holder would have 45 days from receipt of the notification of our Paragraph IV Certification to initiate a patent infringement action against us. If an infringement action is initiated, the approval of our NDA would be subject to a stay of up to 30 months or more while we defend against such a suit. Approval of our product candidates under Section 505(b)(2) may therefore be delayed until patent exclusivity expires or until we successfully challenge the applicability of those patents to our product candidates. Alternatively, we may elect to generate sufficient clinical data so that we would no longer need to rely on third-party data, which would be costly and time consuming and there would be no assurance that such data generated from such additional activities would be sufficient to obtain approval.

-13-

We may not be able to obtain shortened review of our applications, and the FDA may not agree that our product candidates qualify for marketing approval. If we are required to generate additional data to support approval, we may be unable to meet anticipated or reasonable development and commercialization timelines, may be unable to generate the additional data at a reasonable cost, or at all, and may be unable to obtain marketing approval of our product candidates. If the FDA changes its interpretation of Section 505(b)(2) allowing reliance on data in a previously approved drug application owned by a third party, or there is a change in the law affecting Section 505(b)(2), this could delay or even prevent the FDA from approving any Section 505(b)(2) application that we submit.

Modifications to our products may require new NDA approvals.

Once a particular product receives FDA approval or clearance, expanded uses or uses in new indications of our products may require additional human clinical trials and new regulatory approvals or clearances, including additional IND and NDA submissions and premarket approvals before we can begin clinical development, and/or prior to marketing and sales. If the FDA requires new clearances or approvals for a particular use or indication, we may be required to conduct additional clinical studies, which would require additional expenditures and harm our operating results. If the products are already being used for these new indications, we may also be subject to significant enforcement actions. Conducting clinical trials and obtaining clearances and approvals can be a time consuming process, and delays in obtaining required future clearances or approvals could adversely affect our ability to introduce new or enhanced products in a timely manner, which in turn would harm our future growth.

Conducting successful clinical studies may require the enrollment of large numbers of patients, and suitable patients may be difficult to identify and recruit.

Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population; the nature of the trial protocol; the attractiveness of, or the discomforts and risks associated with, the treatments received by enrolled subjects; the availability of appropriate clinical trial investigators; support staff; and proximity of patients to clinical sites and ability to comply with the eligibility and exclusion criteria for participation in the clinical trial and patient compliance. For example, patients may be discouraged from enrolling in our clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures or follow-up to assess the safety and effectiveness of our products or if they determine that the treatments received under the trial protocols are not attractive or involve unacceptable risks or discomforts. Patients may also not participate in our clinical trials if they choose to participate in contemporaneous clinical trials of competitive products.

Additional delays to the completion of clinical studies may result from modifications being made to the protocol during the clinical trial, if such modifications are warranted and/or required by the occurrences in the given trial.

Each modification to the protocol during a clinical trial has to be submitted to the FDA. This could result in the delay or halt of a clinical trial while the modification is evaluated. In addition, depending on the quantity and nature of the changes made, the FDA could take the position that the data generated by the clinical trial is not poolable because the same protocol was not used throughout the trial. This might require the enrollment of additional subjects, which could result in the extension of the clinical trial and the FDA delaying clearance or approval of a product. Any such delay could have a material adverse effect on our business and results of operations.

There can be no assurance that the data generated from our clinical trials using modified protocols will be acceptable to FDA.

There can be no assurance that the data generated using modified protocols will be acceptable to the FDA or that if future modifications during the trial are necessary, that any such modifications will be acceptable to the FDA. If the FDA believes that its prior approval is required for a particular modification, it can delay or halt a clinical trial while it evaluates additional information regarding the change.

Serious injury or death resulting from a failure of one of our drug candidates during current or future clinical trials could also result in the FDA delaying our clinical trials or denying or delaying clearance or approval of a product.

-14-

Even though an adverse event may not be the result of the failure of our drug candidate, the FDA or an IRB could delay or halt a clinical trial for an indefinite period of time while an adverse event is reviewed, and likely would do so in the event of multiple such events.

Any delay or termination of our current or future clinical trials as a result of the risks summarized above, including delays in obtaining or maintaining required approvals from IRBs, delays in patient enrollment, the failure of patients to continue to participate in a clinical trial, and delays or termination of clinical trials as a result of protocol modifications or adverse events during the trials, may cause an increase in costs and delays in the filing of any product submissions with the FDA, delay the approval and commercialization of our products or result in the failure of the clinical trial, which could adversely affect our business, operating results and prospects.

If the third parties on which we rely to conduct our clinical trials and to assist us with preclinical development do not perform as contractually required or expected, we may not be able to obtain regulatory approval for or commercialize our products.

We do not have the ability to independently conduct our pre-clinical and clinical trials for our products and we must rely on third parties, such as CROs, medical institutions, clinical investigators and contract laboratories to conduct such trials. If these third parties do not successfully carry out their contractual duties or regulatory obligations, meet expected deadlines or need to be replaced, or if the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons, our pre-clinical development activities or clinical trials may be extended, delayed, suspended or terminated, and we may not be able to obtain regulatory approval for, or successfully commercialize, our products on a timely basis, if at all. Furthermore, our third-party clinical trial investigators may be delayed in conducting our clinical trials for reasons outside of their control. The occurrence of any of the foregoing may adversely affect our business, operating results and prospects.

The future results of our current or future clinical trials may not support our product candidate claims or may result in the discovery of unexpected adverse side effects.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support our drug candidate claims or that the FDA or foreign authorities will agree with our conclusions regarding them. Success in preclinical studies and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the later trials will replicate the results of prior trials and preclinical studies. The clinical trial process may fail to demonstrate that our drug candidates are safe and effective for the proposed indicated uses. If the FDA concludes that the clinical trials for BioLexa, or any other product for which we might seek clearance, has failed to demonstrate safety and effectiveness, we would not receive FDA clearance to market that product in the United States for the indications sought.

In addition, such an outcome could cause us to abandon the product candidate and might delay development of others. Any delay or termination of our clinical trials will delay the filing of any product submissions with the FDA and, ultimately, our ability to commercialize our product candidates and generate revenues. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product candidate’s profile. In addition, our clinical trials for BioLexa involve a relatively small patient population. Because of the small sample size, our results may not be indicative of future results.

BioLexa and future products may never achieve market acceptance.

BioLexa and future products that we may develop may never gain market acceptance among physicians, patients and the medical community. The degree of market acceptance of any of our products will depend on a number of factors, including the actual and perceived effectiveness and reliability of our products; the results of any long-term clinical trials relating to use of our products; the availability, relative cost and perceived advantages and disadvantages of alternative technologies; the degree to which treatments using our products are approved for reimbursement by public and private insurers; the willingness of patients to pay out of pocket in the absence of government or third-party coverage; the strength of our marketing and distribution infrastructure; the level of education and awareness among physicians and hospitals concerning our products; and prevalence and severity of any side effects. Failure of BioLexa or any of our other products to significantly penetrate current or new markets would negatively impact our business, financial condition and results of operations.

-15-

To be commercially successful, physicians must be persuaded that using our products for treatment of eczema are effective alternatives to existing therapies and treatments.

We believe that physicians will not widely adopt our products unless they determine, based on experience, clinical data, and published peer-reviewed journal articles, that the use of our products provides an effective alternative to other means of treating eczema. Patient studies or clinical experience may indicate that treatment with our products does not provide patients with sufficient benefits in quality of life. We believe that recommendations and support for the use of our products from influential physicians will be essential for widespread market acceptance. Our products are still in development and it is premature to attempt to gain support from physicians at this time. We can provide no assurance that such support will ever be obtained. If our products do not receive such support from these physicians and from long-term data, physicians may not use or continue to use, and hospitals may not purchase or continue to purchase, our products.

Even if our products are approved by regulatory authorities, if we or our suppliers fail to comply with ongoing FDA regulation or if we experience unanticipated problems with our products, these products could be subject to restrictions or withdrawal from the market.

Any product for which we obtain clearance or approval, and the manufacturing processes, reporting requirements, post-approval clinical data and promotional activities for such product, will be subject to continued regulatory review, oversight and periodic inspections by the FDA. In particular, we and our suppliers are required to comply with FDA’s Quality System Regulations, or QSR, and International Standards Organization, or ISO, regulations for the manufacture of our products and other regulations which cover the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging, storage and shipping of any product for which we obtain clearance or approval. Regulatory bodies, such as the FDA, enforce these regulations through periodic inspections. The failure by us or one of our suppliers to comply with applicable statutes and regulations administered by the FDA and other regulatory bodies, or the failure to timely and adequately respond to any adverse inspectional observations or product safety issues, could result in, among other things, enforcement actions by the FDA.

If any of these actions were to occur it would harm our reputation and cause our product sales and profitability to suffer and may prevent us from generating revenue. Furthermore, our key component suppliers may not currently be or may not continue to be in compliance with all applicable regulatory requirements which could result in our failure to produce our products on a timely basis and in the required quantities, if at all.

Even if regulatory clearance or approval of a product is granted, such clearance or approval may be subject to limitations on the intended uses for which the product may be marketed and reduce the potential to successfully commercialize the product and generate revenue from the product. If the FDA determines that the product promotional materials, labeling, training or other marketing or educational activities constitute promotion of an unapproved use, it could request that we or our commercialization partners cease or modify our training or promotional materials or subject us to regulatory enforcement actions. It is also possible that other federal, state or foreign enforcement authorities might take action if they consider such training or other promotional materials to constitute promotion of an unapproved use, which could result in significant fines or penalties under other statutory authorities, such as laws prohibiting false claims for reimbursement.