Form PREC14A Adverum Biotechnologies, Filed by: Sonic Fund II, L.P.

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant [ ]

Filed by a Party Other than the Registrant [X]

Check the Appropriate Box:

[X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

ADVERUM BIOTECHNOLOGIES, INC.

(Name of registrant as specified in its charter)

THE SONIC FUND II, L.P.

JEAN BENNETT

JODI COOK

BARD GEESAMAN

ANNAHITA KERAVALA

HERBERT HUGHES

(Name of person(s) filing proxy statement, if other than the registrant)

Copies to:

Christopher P. Davis, Esq.

Kleinberg, Kaplan, Wolff & Cohen, P.C.

500 Fifth Avenue, New York, New York 10110

(212) 986-6000

Payment of Filing Fee (Check the Appropriate Box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it is determined):

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it is determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement no.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION DATED APRIL 7, 2021

THE SONIC FUND II, L.P.

April ___, 2021

Dear Fellow Stockholder:

The Sonic Fund II, L.P., together with the other participants in this solicitation (collectively, “Sonic” or “we”), is a significant stockholder of

Adverum Biotechnologies, Inc., a Delaware corporation (“Adverum” or the “Company”), beneficially owning a total of [6,637,932]1 shares of Common Stock, $0.0001 par value per

share, representing approximately [6.8]% of the shares outstanding. We have owned shares of Adverum continuously for three years. Sonic

focuses on a long-term value investing strategy based on buying companies at a discount to their intrinsic value. While Sonic sometimes engages with management teams to effect positive change, we rarely push for board changes. In the case of Adverum,

however, we feel board changes are absolutely necessary to unlock the value we believe is trapped at the Company.

We are seeking your support for the election of our five highly-qualified nominees to Adverum’s Board of Directors (the “Board”) at the 2021 annual meeting of

stockholders, currently scheduled to be held on [ ], 2021, at _:__ _.M., local time, at ______________________________ (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”).

At the Annual Meeting, stockholders are being asked:

|

1.

|

to elect Sonic’s five director nominees (the “Nominees”)2 to serve until the 2024 annual meeting of stockholders or until their successors are elected and duly qualified;

|

|

2.

|

to ratify the selection, by the Audit Committee of the Board, of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2021;

|

|

3.

|

to approve, on an advisory basis, the compensation of the Company’s named executive officers;

|

|

4.

|

to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

|

This Proxy Statement and enclosed GREEN proxy card is

soliciting proxies to elect our Nominees. We are seeking your support at the Annual Meeting to elect all of our five nominees. Our Nominees are all highly accomplished, and we believe that they will be important additions to the Board both

individually and collectively.

We urge you to consider carefully the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the

enclosed GREEN proxy card today. The attached proxy statement and the enclosed GREEN proxy card are first being furnished to the stockholders on or about [ ], 2021.

Please do not vote for the Company’s slate of directors. If you have already submitted a

proxy in relation to the Annual Meeting, you have every right to revoke or change the voting instructions set out therein by signing, dating and returning a later dated GREEN proxy card or by voting in person at the Annual Meeting. We encourage you to do so.

If you have any questions or require any assistance with your vote, please contact Saratoga Proxy Consulting, LLC, which is assisting us, at its address and toll-free number listed

on the following page.

Thank you for your support.

The Sonic Fund II, L.P.

1 Inclusive of shares owned by Nominees.

2 Based on the public record, we believe that Adverum’s Class I Director class currently has five seats available and Sonic has nominated a highly qualified candidate for each.

1

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

The attached Proxy Statement and GREEN proxy card are available at:

[ ]

|

If you have any questions regarding your GREEN consent card or need assistance in

executing your consent, please contact

Saratoga Proxy Consulting, LLC

520 8th Avenue

New York, NY 10018

Stockholders may call toll-free: (888) 368-0379

Banks and brokers call: (212) 257-1311

|

2

PRELIMINARY COPY SUBJECT TO COMPLETION DATED APRIL 7, 2021

---------------------------

ANNUAL MEETING OF STOCKHOLDERS

OF

ADVERUM BIOTECHNOLOGIES, INC.

---------------------------

PROXY STATEMENT

OF

THE SONIC FUND II, L.P.

---------------------------

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GREEN PROXY CARD TODAY

The Sonic Fund II, L.P., together with the other participants in this proxy solicitation (collectively, “Sonic” or “we”) is a significant and

longstanding stockholder of Adverum Biotechnologies, Inc., a Delaware corporation (“Adverum” or the “Company”), beneficially owning a total of [6,637,932]3 shares of Common

Stock, $0.0001 par value per share (the “Common Stock”), representing approximately [6.8]% of the shares outstanding. We have owned shares of Adverum continuously for three years. We are writing to you because we believe that the Company is

significantly undervalued and have serious doubts that the Board of Directors (the “Board”) as currently constituted can unlock this value. We have nominated five highly-qualified, capable and committed individuals who have the relevant skill sets we

believe are key to unlocking the Company’s potential. If you agree, you can send a powerful message to Adverum’s Board and management. We are seeking

your support and your vote at the annual meeting of stockholders currently scheduled to be held on [ ], 2021, at _:__ _.M., local time, at ______________________________ (including any adjournments or postponements thereof and any meeting which may

be called in lieu thereof, the “Annual Meeting”), for the following:

|

1.

|

to elect all five of Sonic’s director nominees—Jean Bennett, Jodi Cook, Bard Geesaman, Annahita Keravala and Herbert Hughes (the “Nominees”)—to the Board to serve until the 2024 annual meeting

of stockholders or until their successors are elected and duly qualified;

|

|

2.

|

to ratify the selection, by the Audit Committee of the Board of Directors of the Company, of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal

year ending December 31, 2021;

|

|

3.

|

to approve, on an advisory basis, the compensation of the Company’s named executive officers;

|

|

4.

|

to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

|

The participants in this proxy solicitation are The Sonic Fund II, L.P. (“Sonic”) and Lawrence Kam (together with Sonic, the “Sonic Entities”) and the Nominees.

This Proxy Statement and the enclosed GREEN proxy card are first being furnished to stockholders on or about April [ ], 2021. As of the

date hereof, Sonic collectively beneficially owns an aggregate of [6,552,068] shares of Common Stock.4 We intend to vote such shares of Common Stock FOR the

election of our Nominees, FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the

fiscal year ending December 31, 2021, AGAINST the approval, on an advisory basis, of the compensation of the Company’s named executive officers, and in the

discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

The Board has reserved with Broadridge [April 14, 2021] as the record date for determining holders of Common Stock who are entitled to vote at the Annual Meeting (the “Record

Date”). According to the Company, as of the Record Date the Company had approximately [ ] shares of Common Stock outstanding and entitled to be voted. Each share of Common Stock entitles the record holder to one vote on each matter to be voted upon

at the Annual Meeting. The mailing address of the principal executive offices of the Company is 800 Saginaw Drive, Redwood City, California 94063. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual

Meeting.

THIS SOLICITATION IS BEING MADE BY SONIC AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE

ANNUAL MEETING, OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GREEN PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

SONIC URGES YOU TO SIGN, DATE AND RETURN THE GREEN PROXY CARD IN FAVOR OF THE ELECTION OF OUR NOMINEES.

PLEASE DO NOT VOTE FOR THE COMPANY’S SLATE OF DIRECTORS. IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON

EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GREEN PROXY CARD. WE ENCOURAGE YOU TO DO SO. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY

MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

This Proxy Statement and our proxy card are available at:

[ ]

3 Inclusive of shares owned by Nominees.

4 As described elsewhere in this Proxy Statement, Mr. Kam personally owns an additional [57,984] shares of Common Stock, and an additional [21,380] shares of Common Stock are held in an IRA in Mr. Kam’s name,

such that Mr. Kam may be deemed to beneficially own a total of [6,631,432] shares of Common Stock.

1

IMPORTANT

Your vote is important, no matter how many or how few shares of Common Stock you own. Your vote matters. Sonic urges you to sign, date, and return the

enclosed GREEN proxy card today to vote FOR our Nominees.

|

•

|

If you are a “registered stockholder”, please sign and date the enclosed GREEN proxy card and return it to Sonic, c/o Saratoga Proxy Consulting, LLC, in the enclosed

postage-paid envelope today.

|

|

•

|

If you own shares in a brokerage account or through a bank, you are considered a “beneficial stockholder”, and the Sonic proxy materials, together with a voting instruction form (VIF), are being forwarded to

you by your broker or bank. As a “beneficial owner”, you must instruct your broker, trustee or other representative on how to vote your shares. Your broker cannot vote your shares on your behalf without receiving instructions from you.

|

|

•

|

Depending upon your broker or custodian’s voting policy, you may be able to vote either by toll-free telephone or by using the Internet. Please refer to the enclosed voting form for instructions on how to vote

electronically. You may also vote by signing, dating and returning the enclosed voting form in the pre-paid envelope provided to you.

|

|

•

|

Please do not sign or return any WHITE proxy card you may receive from the Company. If you have already submitted a WHITE proxy card, you have every right to change your vote and we encourage you to do so.

Please use the GREEN proxy card to vote by Internet or telephone or simply sign, date and return the GREEN proxy card. Only your latest dated proxy will be

counted.

|

|

If you have any questions regarding your GREEN consent card or need assistance in

executing your consent, please contact

Saratoga Proxy Consulting, LLC

520 8th Avenue

New York, NY 10018

Stockholders may call toll-free: (888) 368-0379

Banks and brokers call: (212) 257-1311

|

2

BACKGROUND TO THE SOLICITATION

A chronology of our interactions with the Company is as follows:

|

•

|

On March 15, 2021, Sonic sent letters to the Board, outlining its concerns with the management and oversight of the Company (the “March 15 Letters”).

|

|

•

|

On March 15, 2021, Kleinberg, Kaplan, Wolff & Cohen, P.C. (“Kleinberg”), counsel to Sonic, emailed Cooley LLP (“Cooley”), counsel to the Company, requesting a discussion regarding the contents of the March

15 Letters. Cooley responded that it was not available on March 15 for such a call, and proposed a March 16 call.

|

|

•

|

On March 16, 2021, Kleinberg had a call with Cooley and Skadden, Arps, Slate, Meagher & Flom LLP (“Skadden”), co‑counsel to the Company, discussing the contents of the March 15 Letters and the upcoming

Annual Meeting. During the call, co-counsel indicated that based on recent public disclosure the Company intended to run only two directors at the Annual Meeting, although they understood why Sonic nominated five candidates. On March 17, the

Company announced that it was running three directors.

|

|

•

|

On March 16, 2021, Lawrence Kam (“Mr. Kam”) had a call with James Scopa (“Mr. Scopa”), a director of the Company, during which Mr. Kam and Mr. Scopa discussed the contents of the March 15 Letters. Mr. Scopa

indicated that the Company would be running only two directors at the Annual Meeting, and indicated that the Company would like to set up a call with Mr. Kam for Monday, March 22, 2021, whereby certain directors would share important

confidential information that would make Mr. Kam reconsider running a proxy fight. While Mr. Kam agreed to schedule this call, the Company never followed up.

|

|

•

|

On March 16, 2021, Sonic sent a request for books and records under Section 220 of the Delaware General Corporation Law (the “220 Demand”) to the Company requesting information related to Dr. Mehdi Gasmi, a

director and former President and former CSO of the Company.

|

|

•

|

On March 17, 2021, the Company made the unilateral decision to publicly filed the March 15 Letters, and indicated its intent to run three candidates at the Annual Meeting—Dawn Svoronos, Reed Tuckson, and Thomas

Woiwode, despite contrary disclosure in its recent 10-K that Adverum would be running only two directors.

|

|

•

|

On March 17, 2021, Kleinberg sent a letter to Skadden and Cooley advising that, because the Company has not taken any specific action to shrink the size of the Board and reduce the current legally available

number of five available seats, Sonic intended to run all five of its Nominees, and requesting that the Company take no defensive actions that might impair the ability of stockholders to vote on all five of the highly qualified Nominees.

|

|

•

|

On March 24, 2021, Sonic sent to Peter Soparkar (“Mr. Soparkar”), Secretary of the Company, its formal nomination letter as required by the bylaws of the Company, formally nominating four of its Nominees—Jean

Bennett, Jodi Cook, Bard Geesaman and Annahita Keravala.

|

|

•

|

On March 25, 2021, Sonic sent to Mr. Soparkar a supplement to its nomination letter, formally nominating Herbert Hughes. Collectively with the four candidates nominated by Sonic on March 24, Sonic has

successfully nominated five highly qualified Nominees.

|

|

•

|

On March 25, 2021, Skadden sent Sonic a letter declining to provide the documents requested by the 220 Demand.

|

3

REASONS FOR SONIC’S PROXY SOLICITATION

Sonic Believes That Its Five Highly Qualified Nominees Are Well Suited to Provide Independent Oversight

Sonic encourages you, the true owners of Adverum, to look at our five highly credentialed Nominees and reach your own determination of whether they are better suited than the Company’s nominees to

provide effective oversight over management and the drug development process. We nominated each of our Nominees because of their deep experience, their impressive qualifications and their scientific and medical knowledge, which we think will be helpful

in addressing challenges that management and the current directors have not been able to solve. If you believe that, on the basis of a direct comparison of Sonic’s Nominees to the Board’s nominees, our Nominees are superior, then we encourage you to

vote in favor of each of our Nominees on the GREEN proxy card today.

Sonic Is Dissatisfied with the Oversight Provided by the Current Directors

Effective oversight of management and the drug development process are critical Board roles at a publicly listed biopharmaceutical company. On May 1, 2019, Sonic signed a long-term cooperation

agreement with Adverum to give its Board and its newly minted Chair a fair amount of time to exercise such oversight for the measurable benefit of all stockholders. Are you satisfied with the results? We definitely are not. Accordingly, we believe that

you, as stockholders, are entitled to hold the Board accountable at this year’s upcoming Annual Meeting. We are giving you a choice to instead elect our slate of well qualified Nominees, who can bring fresh perspective to the Board, and who are

committed to providing effective, fact-based oversight to both management and the drug development process.

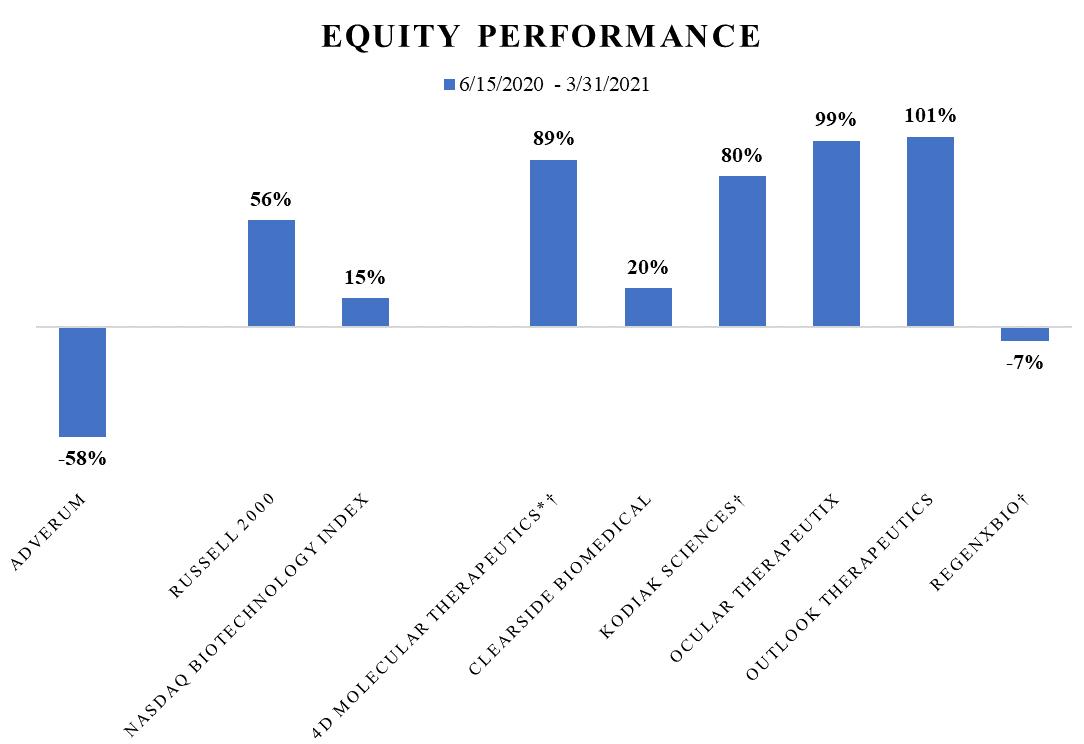

* Since IPO †Listed as Competitor in Adverum’s 10-K

4

Adverum’s Equity Returns in Recent Months Have Been Abysmal

Since CEO Laurent Fischer’s hiring on June 15, 2020, Adverum stock has plummeted by more than half, vastly underperforming all relevant peers and indices. We believe that this evaporation of

stockholder value is in large part the result of poor decisions by management as to how and when to present information to the market about the drug development process, compounded by inept and ill-timed capital raising.

Given the Company’s unfortunate experience with similar instances of stock price destruction in the past, it was incumbent on the Board to be thoroughly satisfied with management’s information

delivery before it was initiated. Similarly, it was just as incumbent on the Board to guide a successful rehabilitation plan to undo the damage to the stock price and the market’s view of the drug once the value destruction occurred.

Sonic does not believe that this Board provided the critical oversight that was needed. Stockholders are entitled to hold the Board accountable by rejecting its nominees in favor of electing our

entire slate of independent, highly skilled Nominees. We believe that fresh oversight is justified, and only stockholders voting for change can ensure it.

This Board Has Failed to Provide the Necessary Oversight to Address Long-Standing Stockholder Concerns About Inflammation

We believe that Adverum’s depressed market value is due in meaningful part to the company’s refusal to address the ocular inflammation caused by ADVM-022, its gene therapy treatment for wet AMD.

Reputed to be a turnaround artist, CEO Laurent Fischer has instead continued prior management’s blunder in failing to effectively tackle the issue to the satisfaction of the market. While repeatedly asserting to Sonic that tackling inflammation was his

top priority, has CEO Laurent Fischer done enough to address this problem to satisfy you as a stockholder? Sonic believes the answer is a resounding “no.” Sonic also believes that the existing Board has failed to provide the necessary oversight to

create and sustain the market’s confidence in the process.

The Adverum Board Has Exercised Poor Management Oversight and Has Failed Its Fiduciary Obligation to Stockholders

In September 2019, former CEO Leone Patterson presided over an approximate halving of Adverum’s stock price by delivering a lackluster presentation on the clinical results of ADVM-022. That same

month, the Board began soliciting Laurent Fischer to become the next CEO.

Within two months of his hiring in June 2020, CEO Laurent Fischer has similarly presided over yet another approximate halving of Adverum’s stock price. This time, however, the Board has done nothing

to remedy the situation and repair the loss of stockholder value.

Adverum’s Board Nominees Lack the Requisite Independence and Experience to Hold Management Accountable

Dawn Svoronos has no drug development, ophthalmology, or gene therapy experience. She does not hold a degree in the biological sciences. Ms. Svoronos has longstanding business ties to Board Chair

Patrick Machado, having served as director and chief commercial officer of Medivation, a company that Mr. Machado co-founded. She has a director interlock with Mr. Machado, also serving with him on the board of Xenon Pharmaceuticals. Stockholders are

entitled to question her true independence from Mr. Machado, regardless of whether she technically meets a Nasdaq standard.

Reed Tuckson has no drug development, ophthalmology, or gene therapy experience. He has a director interlock with CEO Laurent Fischer, also serving as a director of CTI Biopharma, where Dr. Fischer is

the Board Chair. Stockholders are entitled to question his true independence from Dr. Fischer, regardless of whether he technically meets a Nasdaq standard.

On Adverum’s 10-K, filed March 1, 2021, the company noted its intent to nominate a slate consisting of Ms. Svoronos and Dr. Tuckson at the Annual Meeting. Thomas Woiwode, a current director of

Adverum, is a representative of Versant Ventures Capital IV, a 2008 vintage venture capital fund. On December 14, 2020, Versant Ventures Capital IV reduced its ownership in Adverum by distributing two million shares to its partners. On March 16, 2021,

Sonic was explicitly notified by a company representative that Dr. Woiwode would not be running for election as a director. The following day, on March 17, 2021, Adverum announced in a press release a Board slate consisting of Ms. Svoronos, Dr.

Tuckson, and Dr. Woiwode. Sonic does not believe that the Company’s disclosure on this subject has been helpful to stockholders trying to understand the overnight change of heart. Stockholders should be free to draw their own conclusions about the

commitment of a sitting director who intended not to stand for re-election, only to overturn the official position conveyed to Sonic by the Board’s selected spokesperson less than 24 hours earlier.

Compensation is Excessive Compared to Results

Sonic believes that the Company’s overall compensation arrangements are unjustifiably generous. Stockholders will recall that twice within the last two years the stock price has nose-dived by more

than half following poorly received Company announcements. Stockholders are painfully aware that the Company still has not submitted a drug candidate for regulatory approval. Against this backdrop, stockholders would be justified in objecting to the

compensation arrangements in general, and to Dr. Fischer’s large options grant in particular. A vote against Proposal No. 3 (advisory vote on executive compensation) is one of the few ways that stockholders have to register their displeasure with

Company performance, and to measure whether the Board get that message.

5

PROPOSAL NO.1

ELECTION OF DIRECTORS

We are seeking your support at the Annual Meeting to elect our five Nominees. The Nominees are all highly accomplished, and we believe them to be independent of the

Company within the meaning of applicable Federal and Nasdaq rules. Your vote to elect the Nominees will have the legal effect of replacing up to three incumbent directors, and filling two additional vacancies on the Board, with the Nominees. The

Company has indicated that it intends to shrink the size of the Board and that it has received resignations from two of its directors. Because those resignations are ineffective until a future date, and the decision to shrink the size of the Board is

not currently effective, we believe that the Board is currently composed of eleven directors, five of whom have terms expiring at the Annual Meeting. If all of our Nominees are elected, such Nominees will

represent a minority of the members of the Board and there can be no assurance that any actions or changes proposed by our Nominees will be adopted or supported by the full Board. There is no assurance that any of the candidates who have been nominated

by the Company will serve as directors if our Nominees are elected. Sonic believes that any attempt to increase or decrease the size of the current Board or the number of directors up for election at the Annual Meeting would constitute an improper

manipulation of the Company’s corporate machinery.

Our Nominees:

Jean Bennett, M.D., Ph.D., 66, Dr. Bennett currently serves as Professor of Ophthalmology and Cell and Developmental Biology and a Senior

Investigator in the F. M. Kirby Center for Molecular Ophthalmology at the University of Pennsylvania (UPenn) School of Medicine. She also has an appointment as a Senior Investigator at the Center for Cellular and Molecular Therapeutics, The Children’s

Hospital of Philadelphia (CHOP). Dr. Bennett’s research on gene therapy delivery of RPE65 led to the approval of Luxturna, the first gene therapy for a genetic disease approved by the FDA and the first approved gene therapy worldwide. Dr. Bennett is

director of the Center for Advanced Retinal and Ocular Therapeutics at UPenn, co-founder of GenSight Biologics, Spark Therapeutics, and Limelight Bio, and member of the Scientific Advisory Boards at Akouos and Sparing Vision. Dr. Bennett received her

B.S. from Yale University and Ph.D. from University of California, Berkeley. She received her M.D. from Harvard Medical School and received postdoctoral training at University of California, San Francisco, Yale University and Johns Hopkins School of

Medicine before joining the faculty at UPenn.

We believe that Dr. Bennett’s extensive experience in the gene therapy field, and her experience with the business and regulatory hurdles to drug development, make her a valuable

addition to the Board.

Jodi Cook, Ph.D., 53, Dr. Cook has extensive experience in gene therapy development from initial research development through

commercialization. She previously served as Head of Gene Therapy Strategy at PTC Therapeutics, Inc. from 2018 until 2020. Prior to joining PTC Therapeutics, she was one of the founding members and Chief Operating Officer of Agilis Biotherapeutics, a

clinical stage AAV gene therapy company, from 2013 until its acquisition by PTC Therapeutics in 2018. While at Agilis, she led the sale of the company to PTC Therapeutics in a deal that has represented significant value to all parties. She has more

than 20 years of senior executive experience in the life-sciences industry and held leadership positions in several successful biotech start-up companies. Prior to her work in industry, Dr. Cook was an Assistant Professor at Arizona State University

and the Mayo Clinic, Rochester, MN. Dr. Cook earned a B.A. from Loyola College in Maryland, M.Aud. from the University of South Carolina, and a Ph.D. from Arizona State University. Dr. Cook currently serves as a director of Fennec Pharmaceuticals.

We believe that Dr. Cook’s extensive experience in the field of gene therapy, and her valuable industry knowledge and executive experience, make her a positive addition to the

Board.

Bard Geesaman, M.D., Ph.D., 53, Dr. Geesaman currently serves as the CEO and Chairman of Altissimo

Therapeutics. Previously, Dr. Geesaman served as a managing director at University Innovation Partners. Before University Innovation Partners, Dr. Geesaman served as a managing director at MPM Capital for over a decade before leaving in December 2018.

He has broad experience investing, operating and facilitating business development globally, including in Japan, China and Israel. Prior to joining MPM, Dr. Geesaman founded Catalyst Medical Solutions, a medical documentation and billing eHealth

company in Boston where he served as the Chief Technology Officer through the company’s acquisition. After Catalyst, Dr. Geesaman joined Centagenetix, an MPM-founded company exploring the genetics of successful aging. In 2006, Dr. Geesaman joined MPM

as a Venture Partner with a major focus on founding Solasia Pharmaceuticals, based in Tokyo, Japan which listed on the Tokyo Mothers exchange in March 2017. Dr. Geesaman is also the co-founder and a board member of MPM healthcare IT startup TriNetX

(big data analytics for clinical trials). In the past five years, he also held board seats in the companies ReKindle Therapeutics, Maverick Pharmaceuticals, and IOMX AG. Dr. Geesaman is passionate about innovation in health care, and in 2008 took a

two-year sabbatical from MPM to do non-profit work in Los Angeles at the X-Prize Foundation, where he worked on alternative models for motivating life sciences innovation. Dr. Geesaman currently serves as a director of Chiasma. Dr. Geesaman received

his undergraduate degree in neuroscience from the University of California, Berkeley, his graduate degree (Ph.D.) from M.I.T. in computational and systems neurobiology, and a M.D. from Harvard Medical School.

We believe that Dr. Gessaman’s extensive biopharmaceutical and corporate governance experience make him a beneficial addition to the Board.

6

Annahita Keravala, Ph.D., 46, Dr. Keravala has more than two decades of experience in gene therapy using viral and non-viral vectors, with

extensive expertise in discovering novel vector technologies and gene therapy drug development for ophthalmic, systemic, neurological, and inflammatory diseases. She is currently Senior Vice President, Gene Therapy at CODA Biotherapeutics, where she

provides strategic and scientific leadership for the gene transfer mediated chemogenetics programs for neurological diseases. Previously, Dr. Keravala was Associate Vice President, AAV Platform at Rocket Pharmaceuticals. At Rocket, she provided

strategic, scientific, and operational leadership, and oversaw all aspects of discovery research, assay development, and preclinical studies of the adeno-associated virus (AAV) programs. She led IND-enabling pre-clinical development for the Danon

disease program, which culminated in a successful Investigational New Drug (IND) filing. Earlier, Dr. Keravala was Director of Adverum’s Novel Vector Technology group, leading the team to discover and optimize novel AAV vectors to support the company’s

pipeline. She also led the identification and optimization of the regulatory cassette for ADVM-022 and was deeply involved in the preclinical development of ADVM-022 for wet age-related macular degeneration. Dr. Keravala earned a Ph.D. in molecular

genetics and biochemistry from the University of Pittsburgh, a M.Sc. in life sciences & biotechnology from the University of Bombay, India, and a B.Sc. with honors in life sciences & biochemistry from St. Xavier’s College, Bombay, India. She

completed a post-doctoral fellowship in the department of genetics at Stanford University School of Medicine.

We believe that Dr. Keravala’s familiarity with the Company and its drug candidates, and her extensive experience in the gene therapy field, will make her a beneficial addition to

the Board.

Herbert Hughes, 61, Mr. Hughes has over 30 years of experience in the financial industry as an advisor and leader of a diverse range of

businesses. Since March 2017, Mr. Hughes has been the Chief Financial Officer of Wormhole Labs, a technology company in augmented reality and gaming industry and serves on its board of directors. Since 2005, Mr. Hughes has been a managing director of

HHM Capital, a financial institution which provides investment banking and advisory services to ultra-high net worth individuals and families. From March 2015 to June 2019, Mr. Hughes was the Chief Executive Officer of Domino Sands, an oil service

business. Mr. Hughes also served as the Head of Derivatives and Capital Allocation at Bass Brothers Investments from 1995 to 2003, Portfolio Manager at Weston Capital of Paloma Partners from 1991 to 1995, Partner at Paramount Capital Group from 1985 to

1991, and trader at Kidder Peabody from 1982 to 1985. Since July 2019, Mr. Hughes has served on the board of directors of Byrna Technologies, Inc. Mr. Hughes received a B.A. in 1982 from Harvard University.

We believe that Mr. Hughes’s extensive experience in financial services and executive leadership will make him a valuable addition to the Board.

The principal business address of Dr. Bennett is 310 Stellar-Chance Labs, 422 Curie Blvd., Philadelphia, PA 19104. The principal business address of Dr. Cook is PO Box 816,

Newtown, PA 18940. The principal business address of Dr. Geesaman is 2306 Parkview Lane, Marlborough, MA 01752. The principal business address of Dr. Keravala is 151 Oyster Point Boulevard South San Francisco, CA 94080. The principal business address

of Mr. Hughes is 4901 Engineer Drive, Huntington Beach CA 92649. Each of the Nominees is a citizen of the United States of America.

As described more fully in the “ADDITIONAL PARTICIPANT INFORMATION” section below, as

of the date hereof, Dr. Keravala beneficially owns [6,500] shares of Common Stock held directly by her. For information regarding transactions during the past two years by Dr. Keravala in securities of the Company that she may be deemed to beneficially

own, see Schedule I. As of the date hereof, none of the other Nominees own any shares of Common Stock.

Other than as stated herein, there are no arrangements or understandings between members of Sonic or any other person or persons pursuant to which the nomination of the Nominees

described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of our Nominees are a party adverse to the

Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Sonic believes that each Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director” within the meaning of (i)

applicable Nasdaq listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. It is in this context that Sonic uses the word “independent” in describing its Nominees.

7

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common

Stock represented by the enclosed GREEN proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s bylaws and applicable law. In addition, we reserve the right

to nominate substitute person(s) if the Company makes or announces any changes to its bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited

under the Company’s bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Company’s bylaws and shares of Common Stock represented by the enclosed GREEN proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Company’s bylaws and applicable law, if the

Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Sonic

that any attempt to increase or decrease the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

Please see the Company’s proxy statement for further information and background on the Company’s nominees.

Required Vote

Company directors are elected by a plurality of the votes cast. If a stockholder is voting by submitting a proxy card and a choice is specified on the proxy card by a stockholder,

the shares will be voted as specified. If a choice is not specified on the proxy card, and authority to do so is not withheld, the shares will be voted “FOR” the election of the Nominees. If any of the Nominees becomes unavailable for election as a

result of an unexpected occurrence, shares that would have been voted for the nominee may instead be voted for the election of a substitute nominee proposed by Sonic. Each Nominee has agreed to serve if elected. Sonic has no reason to believe that any

Nominee will be unable to serve.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED GREEN PROXY CARD.

WE INTEND TO VOTE OUR SHARES “FOR” THE ELECTION OF THE NOMINEES.

SHARES OF STOCK REPRESENTED BY PROPERLY EXECUTED GREEN PROXY CARDS WILL BE VOTED AT THE ANNUAL MEETING AS MARKED AND, IN THE ABSENCE OF SPECIFIC INSTRUCTIONS, “FOR”

THE NOMINEES.

8

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has selected Ernst & Young LLP to audit the accounts of the Company for fiscal

year 2021.

Required Vote

The affirmative vote of a majority of the shares cast in person or by proxy at the Annual Meeting (excluding abstentions and broker non-votes, if any) will be required to ratify

the selection of Ernst & Young LLP.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

SHARES OF COMMON STOCK REPRESENTED BY PROPERLY EXECUTED GREEN PROXY CARDS WILL BE VOTED AT THE ANNUAL MEETING AS MARKED AND, IN THE ABSENCE OF SPECIFIC

INSTRUCTIONS, “FOR” WITH RESPECT TO THE APPROVAL OF THIS PROPOSAL

9

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement and pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, stockholders are being asked to

approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement in accordance with the rules of the Securities and Exchange Commission.

Specifically, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the compensation paid to Adverum’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including

the compensation tables and narrative discussion, is hereby APPROVED.”

We believe that the proposed compensation is excessive when compared with the performance of the Company and the benefits flowing to the stockholders who have experienced

meaningful stock price declines. Sonic believes that stockholders who agree should send a message to the Company by joining Sonic in voting against this proposal.

Required Vote

Advisory approval of this proposal requires “FOR” votes from the holders of a majority of the shares cast in person or by proxy (excluding abstentions and broker non-votes, if

any).

WE RECOMMEND VOTING “AGAINST” ON THE ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

SHARES OF COMMON STOCK REPRESENTED BY PROPERLY EXECUTED GREEN PROXY CARDS WILL BE VOTED AT THE ANNUAL MEETING AS MARKED AND, IN THE ABSENCE OF SPECIFIC INSTRUCTIONS,

“AGAINST” WITH RESPECT TO THE APPROVAL OF THIS PROPOSAL

10

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sold their shares of Common Stock before the Record

Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock

after the Record Date. Based on publicly available information, Sonic believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed GREEN proxy cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted FOR the election of our Nominees, FOR the ratification of the appointment of Ernst & Young LLP

as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021, AGAINST the approval, on an advisory basis, of the compensation of the Company’s named

executive officers, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting and other public disclosure, the current Board intends to nominate three candidates for election at the Annual

Meeting. This Proxy Statement is soliciting proxies to elect our Nominees instead of such Company candidates. Sonic intends to vote all of its shares of Common Stock in favor of the Nominees. Stockholders should refer to the Company’s proxy statement

for the names, backgrounds, qualifications and other information concerning the Company’s nominees. In the event that some of our Nominees are elected, there can be no assurance that the Company nominee(s) who get the most votes and are elected to the

Board will choose to serve on the Board with the Nominees who are elected.

Quorum; Broker Non-Votes; Discretionary Voting

The presence in person or by proxy of the holders of a majority of the shares of Common Stock outstanding on the record date will constitute a quorum at the Annual Meeting.

According to the Company’s proxy statement, because there will be a “contest” at the Annual Meeting and, in the event of a contest, banks, brokers, and other nominees may not exercise discretionary voting authority on behalf of such beneficial owners

on any matters to be presented at the Annual Meeting, including “routine matters” such as the ratification of the selection of Ernst & Young LLP as the Company’s independent public accountants for the 2021 fiscal year (Proposal No. 2), shares held

by such banks, brokers, or other nominees for which no instructions have been provided cannot be included in the number of shares present and entitled to vote at the Annual Meeting for the purposes of establishing a quorum.

While there is no definite statutory or case law authority in Delaware as to the proper treatment of abstentions, according to the Company’s proxy statement the Company believes

that abstentions should be counted for purposes of determining the presence or absence of a quorum for the transaction of business. However, abstentions are not treated as “votes cast” with respect to a proposal, therefore, an abstention has no effect

on any proposal requiring the approval of a majority of the votes cast with respect to the proposal.

According to the Company’s proxy statement, “broker non-votes” are shares held by brokers or nominees who are present by virtually attending the Annual Meeting or represented by

proxy, but who have not voted on a particular matter because instructions have not been received from the beneficial owner. There will be a “contest” with respect to the election of directors at the Annual Meeting. In the event of a contest, banks,

brokers, and other nominees may not exercise discretionary voting authority on behalf of such beneficial owners on any matters to be presented at the Annual Meeting, including “routine matters” such as the ratification Proposal No. 2 (to ratify the

selection of Ernst & Young LLP as the independent registered public accounting firm for Adverum for the fiscal year ending December 31, 2021).

It is important that you provide instructions to your broker if your shares are held by a broker so that your votes are counted.

Votes Required for Approval

Election of Directors ─ To elect [five] Class I directors to hold office until the 2024

annual meeting of stockholders or until their successors are elected, the [five] nominees receiving the most “FOR” votes (from the votes of shares cast in person or by proxy) will be elected. Broker non-votes will not be counted towards the vote

total for this proposal. As discussed further in this Proxy Statement, we are nominating five director nominees.

Ratification of Selection of Independent Registered Public Accounting Firm ─ To ratify the selection of Ernst & Young

LLP as the independent registered public accounting firm of Adverum for the fiscal year ending December 31, 2021, “FOR” votes from the holders of a majority of the votes cast in person or by proxy (excluding abstentions and broker non-votes, if any)

are required to approve this proposal.

11

Advisory Vote on Executive Compensation ─ To approve, on an advisory basis, the compensation of the Company’s named

executive officers as disclosed in this proxy statement, “FOR” votes from the holders of a majority of the votes cast in person or by proxy (excluding abstentions and broker non-votes, if any) are required to approve this proposal.

To vote, please complete, sign, date and return the enclosed GREEN proxy card or, to appoint a proxy over the Internet or by telephone, follow the instructions provided herein. If you attend the Annual Meeting and wish to vote in person, you may withdraw your proxy and vote in person. If your shares of

Common Stock are held in the name of your broker, bank or other nominee, as it appears from public information that most shares of Common Stock are, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the

Annual Meeting. Sonic’s proxy solicitors at Saratoga Proxy Consulting LLC can help answer your voting and proxy questions.

Appraisal Rights

Under Delaware law, stockholders are not entitled to appraisal or dissenters’ rights with respect to the proposals presented in this Proxy Statement.

Revocation of Proxies

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although

attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any

earlier proxy. The revocation may be delivered either to us in care of Saratoga Proxy Consulting LLC at 520 8th Avenue, 14th Floor, New York, NY 10018 or to the Company at 800 Saginaw Drive, Redwood City,

California 94063, or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to us in care of Saratoga

Proxy Consulting LLC at 520 8th Avenue, 14th Floor, New York, NY 10018. IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES FOR ELECTION TO THE BOARD, PLEASE SIGN,

DATE AND RETURN PROMPTLY THE ENCLOSED GREEN PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

To ensure that your shares are voted in accordance with your wishes, you should also contact the person responsible for your account and give

instructions for a GREEN proxy card to be issued representing your shares of Common Stock.

12

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Sonic. Proxies may be solicited by mail, facsimile, telephone, Internet, in person

and by advertisements.

We have entered into an agreement with Saratoga Proxy Consulting LLC for solicitation and advisory services in

connection with this solicitation, for which Saratoga Proxy Consulting LLC will receive a fee not to exceed $[ ], together with reimbursement for its reasonable out-of-pocket expenses. Saratoga Proxy

Consulting LLC will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all

solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. We will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Saratoga Proxy

Consulting LLC will employ approximately [ ] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by us. Costs of this solicitation of proxies are currently estimated to be approximately $[ ]. We

estimate that through the date hereof, its expenses in connection with this solicitation are approximately $[ ].

Sonic will initially pay all costs associated with the solicitation of proxies, but we will seek reimbursement of such costs from the Company and will not submit such reimbursement to

a vote of stockholders.

ADDITIONAL PARTICIPANT INFORMATION

The Sonic Entities and our Nominees are participants in this solicitation (the “Participants”). The principal business of Sonic is that of a private fund engaged

in investment in securities for its own account. The principal business of Mr. Kam is serving as the general partner of the Fund. The principal business address of each of the Sonic Entities is 400 Hobron Lane, Suite 3709, Honolulu, HI 96815.

As of the date hereof, Sonic beneficially owned [6,552,068] shares of Common Stock. Mr. Kam, as the General Partner of Sonic, may be deemed the beneficial owner

of [6,631,432] shares of Common Stock, consisting of (i) [57,984] shares owned directly, (ii) [21,380] shares held in Mr. Kam’s personal IRA, and (ii) the [6,552,068] shares own by Sonic.

Dr. Keravala is the beneficial owner of the [6,500] shares owned by her directly.

The shares of Common Stock beneficially owned by Sonic were purchased with working capital (which may, at any given time, include margin loans

made by brokerage firms in the ordinary course of business) in open market purchases, except as otherwise noted. As of the date hereof, none of the shares of Common Stock held in margin accounts were pledged as collateral

security. The Shares purchased by Mr. Kam and Dr. Keravala were purchased using personal funds.

Each Participant in this solicitation is a member of a “group” with the other Participants for the purposes of Section 13(d)(3) of the Exchange Act. The group may

be deemed to beneficially own the [6,637,932] shares of Common Stock owned in the aggregate by all of the Participants in this solicitation. Each Participant in this solicitation disclaims beneficial ownership of the shares of Common Stock she, he or

it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the Participants in this solicitation, see Schedule I.

Except as set forth in this Proxy Statement (including the Schedules hereto) and based on information provided by the Participants, (i) during the past 10 years,

no Participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant in this solicitation directly or indirectly beneficially owns any securities of the Company;

(iii) no Participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v)

no part of the purchase price or market value of the securities of the Company owned by any Participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no

Participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option

arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any Participant in this solicitation owns beneficially, directly or

indirectly, any securities of the Company; (viii) no Participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant in this solicitation or any of his or its

associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any

of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future

employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no Participant in this solicitation has a substantial interest, direct or indirect,

by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any Participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its

subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, except as otherwise described herein, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the

Exchange Act occurred during the past 10 years.

13

OTHER MATTERS AND ADDITIONAL INFORMATION

We are unaware of any other matters to be considered at the Annual Meeting other than as set forth in this Proxy Statement. However, should other matters, which

we are not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GREEN proxy card will vote on such matters in their

discretion.

STOCKHOLDER PROPOSALS

Stockholder Proposals for Inclusion in the Company’s Proxy Materials Pursuant to Rule 14a-8

According to the Company’s proxy statement, proposals of stockholders for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2022

annual meeting of stockholders submitted pursuant to Rule 14a-8 under the Exchange Act must be received in writing by the Company at its corporate office no later than [ ], 2021. Notice of a stockholder proposal submitted outside the processes of

Rule 14a-8 with respect to the Company’s 2022 annual meeting of stockholders will be considered untimely if received by the Company after [ ], 2021.

Stockholder Proposals Not Intended for Inclusion in the Company’s Proxy Materials Pursuant to Rule 14a-8

According to the Company’s proxy statement, if a stockholder wishes to submit a proposal before the stockholders or nominate a director at the 2022 annual meeting of

stockholders, but such stockholder is not requesting that such proposal or nomination be included in the proxy materials for that meeting, then such stockholder must follow the procedures set forth in the Company’s bylaws and, among other things,

notify the Corporate Secretary in writing between [ ], 2022 and [ ], 2022. However, if the date of the 2022 annual meeting of stockholders is more than 30 days before or more than 60 days after [ ], 2022, then such stockholder must give notice

not later than the 90th day prior to that meeting or, if later, the 10th day following the day on which public disclosure of that annual meeting date is first made. We also advise any stockholder considering a nomination review the Company’s bylaws,

which contain additional requirements regarding advance notice of stockholder proposals and director nominations.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the Company’s 2022 annual meeting of

stockholders is based on information contained in the Company’s proxy statement and organizational documents. The incorporation of this information in this Proxy Statement should not be construed as an admission or acknowledgment by Sonic that such

procedures are legal, valid or binding.

14

ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING

TO THE ANNUAL MEETING. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR

INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE COMMON STOCK AND THE OWNERSHIP OF COMMON STOCK BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

The Sonic Fund II, L.P.

April [ ], 2021

15

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

DURING THE PAST TWO YEARS

TRANSACTIONS IN SECURITIES OF THE CORPORATION

|

Nature of Transaction

|

Number of Shares Purchased/(Sold)

|

Date of Purchase/Sale

|

|

|

The Sonic Fund II, L.P.

|

|||

|

Purchase of Common Stock

|

500,000

|

3/19/2021

|

|

|

Purchase of Common Stock

|

150,000

|

3/8/2021

|

|

|

Purchase of Common Stock

|

50,000

|

3/4/2021

|

|

|

Purchase of Common Stock

|

150,000

|

3/3/2021

|

|

|

Purchase of Common Stock

|

100,000

|

3/2/2021

|

|

|

Purchase of Common Stock

|

139,632

|

2/26/2021

|

|

|

Purchase of Common Stock

|

173,295

|

2/25/2021

|

|

|

Purchase of Common Stock

|

22,480

|

2/23/2021

|

|

|

Purchase of Common Stock

|

65,143

|

2/22/2021

|

|

|

Purchase of Common Stock

|

50,000

|

2/12/2021

|

|

|

Purchase of Common Stock

|

49,731

|

2/1/2021

|

|

|

Sale of Common Stock

|

(100,000)

|

1/28/2021

|

|

|

Purchase of Common Stock

|

100,000

|

12/29/2020

|

|

|

Purchase of Common Stock

|

100,000

|

12/28/2020

|

|

|

Purchase of Common Stock

|

200,000

|

12/17/2020

|

|

|

Purchase of Common Stock

|

200,000

|

12/16/2020

|

|

|

Purchase of Common Stock

|

11,711

|

11/17/2020

|

|

|

Purchase of Common Stock

|

380,209

|

11/16/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

10/1/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

9/25/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

9/24/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

9/22/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

9/21/2020

|

|

|

Sale of Common Stock

|

(50,000)

|

8/24/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

8/21/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

8/20/2020

|

|

|

Sale of Common Stock

|

(2,488)

|

8/19/2020

|

|

|

Purchase of Common Stock

|

100,000

|

8/11/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

7/31/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

7/20/2020

|

|

|

Purchase of Common Stock

|

200,000

|

7/16/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

7/8/2020

|

|

|

Sale of Common Stock

|

(50,000)

|

7/7/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

5/14/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

5/13/2020

|

|

I - 1

|

Sale of Common Stock

|

(100,000)

|

5/6/2020

|

|

|

Purchase of Common Stock

|

200,000

|

4/29/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/28/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/27/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/24/2020

|

|

|

Purchase of Common Stock

|

200,000

|

4/23/2020

|

|

|

Purchase of Common Stock

|

200,000

|

4/22/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/9/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/8/2020

|

|

|

Purchase of Common Stock

|

100,000

|

4/7/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

4/3/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

4/2/2020

|

|

|

Sale of Common Stock

|

(199,600)

|

4/1/2020

|

|

|

Purchase of Common Stock

|

50,000

|

3/31/2020

|

|

|

Purchase of Common Stock

|

50,000

|

3/26/2020

|

|

|

Purchase of Common Stock

|

100,000

|

3/25/2020

|

|

|

Sale of Common Stock

|

(100,000)

|

3/23/2020

|

|

|

Sale of Common Stock

|

(500,000)

|

3/19/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

3/18/2020

|

|

|

Sale of Common Stock

|

(300,000)

|

3/17/2020

|

|

|

Sale of Common Stock

|

(330,857)

|

3/13/2020

|

|

|

Sale of Common Stock

|

(200,000)

|

3/9/2020

|

|

|

Sale of Common Stock

|

(400,000)

|

3/6/2020

|

|

|

Purchase of Common Stock

|

400,000

|

2/12/2020

|

|

|

Purchase of Common Stock

|

95,000

|

9/12/2019

|

|

|

Purchase of Common Stock

|

300,000

|

7/18/2019

|

|

|

Purchase of Common Stock

|

100,000

|

4/16/2019

|

|

|

Purchase of Common Stock

|

200,000

|

4/15/2019

|

|

|

Lawrence Kam

|

|||

|

Sale of Common Stock

|

(15,000)

|

1/8/2021

|

|

|

Sale of Common Stock

|

(10,000)

|

1/7/2021

|

|

|

Sale of Common Stock

|

(10,000)

|

1/4/2021

|

|

|

Sale of Common Stock

|

(5,000)

|

12/30/2020

|

|

|

Sale of Common Stock

|

(15,000)

|

10/8/2020

|

|

|

Sale of Common Stock

|

(41,320)

|

3/16/2020

|

|

|

Purchase of Common Stock

|

10,000

|

8/5/2019

|

|

|

Lawrence Kam (IRA)

|

|||

|

Purchase of Common Stock

|

18,330

|

9/10/2019

|

|

|

Annahita Keravala

|

|||

|

Sale of Common Stock

|

(1,000)

|

06/17/2020

|

|

|

Sale of Common Stock

|

(1,000)

|

05/06/2020

|

|

|

Sale of Common Stock

|

(1,000)

|

07/09/2019

|

|

|

Sale of Common Stock

|

(1,269)

|

05/30/2019

|

|

|

Sale of Common Stock

|

(1,000)

|

05/17/2019

|

|

|

Sale of Common Stock

|

(1,500)

|

05/16/2019

|

|

|

Sale of Common Stock

|

(2,217)

|

05/07/2019

|

|

I - 2

SCHEDULE II

The following table is reprinted from the preliminary proxy statement filed by Adverum Biotechnologies, Inc. with the Securities and Exchange Commission on April 5, 2021.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT5

The following table sets forth the amount and percentage of the outstanding shares of our common stock that, according to the information supplied to us, are beneficially owned by (i) each person who is the beneficial owner

of more than 5% of our outstanding common stock, (ii) each person who is currently a director, (iii) each named executive officer and (iv) all current directors and executive officers as a group. Unless otherwise indicated, the address for each of the

stockholders in the table below is c/o Adverum Biotechnologies, Inc., 800 Saginaw Drive, Redwood City, California 94063. Except for information based on Schedules 13G and 13D, as indicated in the footnotes, beneficial ownership is stated as of April

15, 2021.

The number of shares beneficially owned by each entity, person, director or executive officer is determined in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership

for any other purpose. Under such rules, beneficial ownership includes any shares over which the individual has sole or shared voting power or investment power as well as any shares that the individual has the right to acquire within 60 days of April

15, 2021 through the exercise of any stock option, warrants or other rights. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all

shares of common stock held by that person.

The percentage of shares beneficially owned is based on [ ] shares of our common stock outstanding as of April 15, 2021. Shares of our common stock subject to options that are currently vested or exercisable or that

will become vested or exercisable within 60 days after April 15, 2021, as well as RSUs that will vest within 60 days after April 15, 2021, are deemed to be beneficially owned by the person holding such options for the purpose of computing the

percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage of any other person.

|

Name of Beneficial Owner

|

|

|

Total Beneficial

Ownership

|

|

|

Percentage

of

Common

Stock

Beneficially

Owned

|

|||

|

5% and Greater Stockholders

|

|

|

|

|

|||||

|

Entities affiliated with RA Capital Management, L.P.(1)

|

|

|

9,502,383

|

|

|

[ ]%

|

|||

|

Avoro Capital Advisors LLC(2)

|

|

|

8,000,000

|

|

|

[ ]%

|

|||

|

Entities affiliated with RTW Investments, LP(3)

|

|

|

7,227,364

|

|

|

[ ]%

|

|||

|

Entities affiliated with BlackRock, Inc.(4)

|

|

|

7,042,768

|

|

|

[ ]%

|

|||

|

Entities affiliated with The Sonic Fund II, L.P.(5)

|

|

|

6,131,432

|

|

|

[ ]%

|

|||

|

Entities affiliated with OrbiMed Capital LLC(6)

|

|

|

5,501,144

|

|

|

[ ]%

|

|||

|

Entities affiliated with Versant Ventures IV, LLC(7)

|

|

|

5,068,233

|

|

|

[ ]%

|

|||

|

Executive Officers and Directors

|

|

|

|

|

|||||

|

Laurent Fischer(8)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Leone Patterson(9)

|

|

|

[ ]

|

|

|

[ ]%

|

|||

|

Aaron Osborne, MBBS(10)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Angela Thedinga(11)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Eric G. Carter, M.D., Ph.D.(12)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Mehdi Gasmi, Ph.D.(13)

|

|

|

[ ]

|

|

|

[ ]%

|

|||

|

Rekha Hemrajani(14)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Mark Lupher, Ph.D.(15)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Patrick Machado(16)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

James Scopa(17)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Dawn Svoronos(18)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Reed V. Tuckson(19)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Scott M. Whitcup, M.D.(20)

|

|

|

[ ]

|

|

|

[ ]

|

|||

|

Thomas Woiwode, Ph.D.(21)

|

|

|

[ ]

|

|

|

%

|

|||

|

All directors and current executive officers as a group (14 persons)(22)

|

|

|

[ ]

|

|

|

[ ]%

|

|||

|

*

|

Indicates beneficial ownership of less than 1% of the total outstanding common stock.

|

||||||||

II - 1

|

(1)

|

Based on a Schedule 13G filed with the SEC on February 16, 2021 (the “RA 13G”), each of RA Capital Management, L.P. (“RA Capital”), Peter Kolchinsky and Rajeev Shah may be deemed to beneficially own all of the shares,

and RA Capital Healthcare Fund, L.P. (the “Fund”) beneficially owns 8,647,957 of the shares. RA Capital Healthcare Fund GP, LLC is the general partner of the Fund.

|

|

The general partner of RA Capital is RA Capital Management GP, LLC, of which Dr. Kolchinsky and Mr. Shah are the controlling persons. RA Capital serves as investment adviser for the Fund and a separately managed

account that holds 854,426 of the shares. The Fund disclaims beneficial ownership of the shares it holds, and each of RA Capital, Dr. Kolchinsky and Mr. Shah disclaims ownership of the shares. The address for each of the reporting persons is RA

Capital Management, L.P., 200 Berkeley Street, 18th Floor, Boston MA 02116. The RA 13G provides information only as of December 31, 2020 and, consequently, the beneficial ownership information identified in the RA 13G may have changed since

December 31, 2020.

|

|

(2)

|

Based on a Schedule 13G/A filed with the SEC on February 12, 2021 (the “Avoro 13G”), Avoro Capital Advisors LLC and Behzad Aghazadeh may each be deemed to beneficially own all of the shares and each have sole voting

and dispositive power over all of the shares. Avoro Capital Advisors, LLC provides investment advisory and management services and acquired the shares on behalf of Avoro Life Sciences Fund, LLC and certain managed accounts. Behzad Aghazadeh is

the portfolio manager and controlling person of Avoro Capital Advisors LLC. The address for each of the reporting persons is 110 Greene Street, Suite 800, New York, NY 10012. The Avoro 13G provides information only as of December 31, 2020 and,

consequently, the beneficial ownership information identified in the Avoro 13G may have changed since December 31, 2020.

|

|

(3)

|

Based on a Schedule 13G filed with the SEC on February 12, 2021 (the “RTW 13G”), each of RTW Investments, LP and Roderick Wong may be deemed to beneficially own all of the shares, and RTW Master Fund, Ltd. may be

deemed to beneficially own 5,518,874 of the shares. Each of RTW Investments, LP, Roderick Wong and RTW Master Fund, Ltd. have shared voting power and shared dispositive power over the shares they are deemed to beneficially own. The shares are

held by RTW Master Fund, Ltd. and one or more other funds (together the “Funds”), which are managed by RTW Investments, LP (the “Adviser”). The Adviser, in its capacity as the investment manager of Funds, has the power to vote and the power to

direct the disposition of the shares held by the Funds. Accordingly, for the purposes of Reg. Section 240.13d-3, the Adviser may be deemed to beneficially own the shares. Roderick Wong is the Managing Partner of the Adviser. The address of RTW