Form POS AM UWM Holdings Corp

As filed with the Securities and Exchange Commission on May 13, 2022

Registration No. 333-252422

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

ON

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UWM Holdings Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 6162 | 82-2124167 | ||||||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||||||

585 South Boulevard E

Pontiac, Michigan 48341

(800) 981-8898

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Timothy Forrester

Executive Vice President and Chief Financial Officer

UWM Holdings Corporation

585 South Boulevard E

Pontiac, Michigan 48341

(800) 981-8898

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Kara L. MacCullough, Esq.

Greenberg Traurig, P.A.

401 E Las Olas Boulevard, Suite 2000

Fort Lauderdale, Florida

Tel: (954) 765-0500

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instructions I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ☐ | ||||||||

Non-accelerated filer | o | Smaller reporting company | ☐ | ||||||||

Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

On January 26, 2021, the registrant filed a Registration Statement on Form S-1 (Registration No. 333-252422) (the “Initial Registration Statement”), which was subsequently declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on February 5, 2021 (as amended by the Post-Effective Amendment dated March 25, 2021, as further amended by the Post-Effective Amendment dated May 18, 2021, each of which, a “Post-Effective Amendment” and together the “Post-Effective Amendments” and together with the Initial Registration Statement, and as further amended and supplemented from time to time thereto, the “Registration Statement”).

This Post-Effective Amendment No. 1 to Form S-1 on Form S-3 (“Post-Effective Amendment No. 1”) is being filed by the registrant to convert the registration statement on Form S-1 into a registration statement on Form S-3 and to reduce the number of shares covered by the registration statement due to prior sales.

No additional securities are being registered under this Post-Effective Amendment No. 1. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 13, 2022

PRELIMINARY PROSPECTUS

UWM HOLDINGS CORPORATION

15,874,987 SHARES OF CLASS A COMMON STOCK

and

83,951,346 SHARES OF CLASS A COMMON STOCK

Offered by Selling Securityholders

This prospectus relates to the issuance by us of (i) 10,624,987 shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”), that may be issued upon exercise of the Warrants included in the publicly sold units (the “Public Warrants”) to purchase Class A common stock at an exercise price of $11.50 per share and (ii) 5,250,000 shares of our Class A common stock that may be issued upon exercise of the Warrants issued to Gores Sponsor IV, LLC in a private placement (the “Private Placement Warrants”) to purchase Class A common stock at an exercise price of $11.50 per share. We refer to the Public Warrants and the Private Placement Warrants together as the “Warrants.”

This prospectus also relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or their permitted transferees, of (i) up to 83,951,346 shares of Class A common stock, which includes (a) a portion of the 10,625,000 shares of Class A common stock that were exchanged for Class F Stock in connection with the closing of the Business Combination amongst our predecessor Gores Holdings IV, Inc., SFS Holding Corp. (“SFS Corp.”) United Wholesale Mortgage, LLC (“UWM”) and UWM Holdings, LLC (“UWM LLC”) (the “Business Combination”) that remain unsold, (b) 50,000,000 shares of Class A common stock issuable upon exchange or conversion of the Common Units in UWM LLC held by SFS Corp. and (c) 28,208,349 shares of Class A common stock beneficially held by a limited number of qualified institutional buyers and accredited investors (the “Private Placement Investors”) which were issued upon the closing of the Business Combination. We will not receive any proceeds from the sale of shares of Class A common stock or Warrants by the Selling Securityholders pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Warrants to the extent such Warrants are exercised for cash. However, we will pay the expenses, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our Class A common stock and Warrants are listed on the New York Stock Exchange under the symbols “UWMC” and “UWMCWS,” respectively. On May 12, 2022, the closing price of our Class A common stock was $3.70 per share and the closing price for our Warrants was $0.22 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 6 of this prospectus. You should carefully read and consider these risk factors and the risk factors included in the reports that we file under the Securities Exchange Act of 1934, as amended, in any prospectus supplement relating to specific offerings of securities and in other documents that we file with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

Table of Contents

About This Prospectus

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we and the Selling Securityholders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. We may use the shelf registration statement to issue (i) 10,624,987 shares of our Class A common stock that may be issued upon exercise of the Public Warrants to purchase Class A common stock at an exercise price of $11.50 per share and (ii) 5,250,000 shares of our Class A common stock that may be issued upon exercise of Warrants held by the Private Placement Investors to purchase Class A common stock at an exercise price of $11.50 per share. The Selling Securityholders may, from time to time, use the shelf registration statement to sell up to an aggregate of 83,951,346 shares of Class A common stock including, (i) a portion of the 10,625,000 shares of Class A common stock that were exchanged for Founder Shares in connection with the Business Combination which remain unsold, (ii) up to 50,000,000 shares of Class A common stock that are beneficially held by SFS Corp. and (iii) up to 28,208,349 shares of Class A common stock that were originally issued to the Private Placement Investors, through any means described in the section entitled “Plan of Distribution.”

The registration statement of which this prospectus forms a part originally registered (1) up to 115,875,000 shares of Class A common stock, including (i) up to 10,625,000 shares of Class A common stock that were exchanged for the Founder Shares in connection with the Business Combination, (ii) up to 50,000,000 shares of Class A common stock that are beneficially held by SFS Corp., (iii) up to 50,000,000 shares of Class A common stock that were originally issued to the Private Placement Investors and (iv) up to 5,250,000 shares of Class A Common Stock that could have been received by Gores Sponsor IV, LLC upon exercise of the Private Placement Warrants, and (2) 5,250,000 Private Placement Warrants. Subsequent to the effectiveness of this registration statement, Gores Sponsor IV, LLC distributed its 5,250,000 Private Placement Warrants in a pro rata in-kind distribution to its members and certain of the selling securityholders named in the original registration statement transferred 27,041,651 shares of Class A common stock.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On January 21, 2021 (the “Closing Date”), Gores Holdings IV, Inc., our predecessor company (“Gores IV”), consummated the previously announced business combination (the “Business Combination”) pursuant to the terms of the Business Combination Agreement, dated September 22, 2020 (as amended by Amendment No. 1 thereto, dated December 14, 2020, the “Business Combination Agreement”) with SFS Holding Corp., a Michigan corporation (“SFS Corp.”), United Wholesale Mortgage, LLC (f/k/a United Shore Financial Services, LLC), a Michigan limited liability company (“UWM LLC”), and UWM Holdings, LLC, a Delaware limited liability company (“UWMH”). Immediately upon the completion of the Business Combination and the other transactions contemplated by the Business Agreement (the “Transactions”, and such completion, the “Closing”), UWM became an indirect subsidiary of Gores IV. In connection with the Transactions, Gores IV changed its name to UWM Holdings Corporation. Unless otherwise indicated or the context otherwise requires, when used in this prospectus, the term “UWMC” means UWM Holdings Corporation, “UWM” means United Wholesale Mortgage, LLC and “we,” “our” and “us” refer to UWM Holdings Corporation and our subsidiaries.

1

Prospectus Summary

Overview

We are the second largest direct residential mortgage lender and the largest wholesale mortgage lender in the United States, originating mortgage loans exclusively through the wholesale channel. With approximately 7,400 team members (as of April 30, 2022) and a culture of continuous innovation of technology and enhanced client experience, we lead our market by building upon our proprietary and exclusively licensed technology platforms, superior service and focused partnership with the Independent Mortgage Advisor community. We originate primarily conforming and government loans across all 50 states and the District of Columbia.

For the last seven years including the year ended December 31, 2021, we have been the largest wholesale mortgage lender in the United States by closed loan volume. For the three months ended March 31, 2022, we originated $38.8 billion in residential mortgage loans, which was a decrease of $10.3 billion, or 21%, from the three months ended March 31, 2021. We generated $453.3 million of net income during the three months ended March 31, 2022, which was a decrease of $406.7 million, or 47.3%, compared to net income of $860.0 million for the three months ended March 31, 2021. For the year ended December 31, 2021, we originated $226.5 billion in residential mortgage loans, and closed approximately 654,000 home loans. As a result, we generated $1.57 billion of net income for the year ended December 31, 2021. Our 2021 mortgage production of $226.5 billion represented a 4.7% market share of all residential mortgage loans originated in the United States.

Founded in 1986 and headquartered in Pontiac, Michigan, we have built a client-focused, team-oriented culture that strives to bring superior customer service, efficiency and operational stability to our clients, the Independent Mortgage Advisors. We were named as a "Best Places to Work in Financial Services and Insurance" by Fortune and a Top Work Place in Metro Detroit by the Detroit Free Press in 2021. We were ranked the #1 training team in the nation by Training Magazine in 2021.

On January 21, 2021, Gores IV, consummated the previously announced Business Combination Agreement with SFS Corp. and UWM LLC. Immediately upon the completion of the Business Combination and the other transactions contemplated by the Business Combination Agreement, UWM became an indirect subsidiary of Gores IV. In connection with the Transactions, Gores IV changed its name to UWM Holdings Corporation. We began trading on the New York Stock Exchange on January 22, 2021 under the ticker symbol UWMC.

Strategy

Our principal strategy that has driven our substantial growth over the past years, is our strategic decision to operate solely as a Wholesale Mortgage Lender – thereby avoiding conflict with our partners, the Independent Mortgage Advisors and their direct relationship with borrowers. We believe that by not competing for the borrower connection and relationship, we are able to generate significantly higher loyalty and satisfaction from our clients (i.e., Independent Mortgage Advisors) who, in turn, armed with our partnership tools are positioned to direct a growing share of the residential mortgage volume nationwide.

Corporate Information

Our principal executive offices are located at 585 South Boulevard E, Pontiac, Michigan 48341. Our telephone number is (800) 981-8898, and our website address is www.UWM.com. Information contained on our website or connected thereto is provided for textual reference only and does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

2

The Offering

We are registering the issuance by us of up to 15,874,987 shares of our Class A common stock that may be issued upon exercise of Warrants at an exercise price of $11.50 per share.

We are also registering the resale by the Selling Securityholders or their permitted transferees of up to 83,951,346 shares of Class A common stock. Subsequent to the original effective date of this registration statement, Gores Sponsor IV, LLC distributed its 5,250,000 Private Placement Warrants in a pro rata in-kind distribution to its members and certain of the selling securityholders named in the original registration statement previously sold 27,041,651 shares of Class A common stock.

Issuance of Class A common stock

| Shares of our Class A common stock outstanding prior to exercise of all Warrants | 92,531,737 shares (1)(2) | ||||

| Shares of Class A common stock to be issued upon exercise of all Warrants | 15,874,987 shares | ||||

| Use of proceeds | We will receive up to an aggregate of $182,562,351 if all Warrants are exercised. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. | ||||

Resale of Class A common stock

| Shares of Class A common stock offered by the Selling Securityholders | 83,951,346 shares(3) | ||||

| Use of proceeds | We will not receive any proceeds from the sale of the Class A common stock to be offered by the Selling Securityholders. | ||||

| Ticker symbols | Our Class A common stock and Warrants trade on the NYSE under the following ticker symbols: “UWMC” – Class A common stock “UWMCWS”—Warrants, respectively. | ||||

| Risk Factors | Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 6. | ||||

(1) | As of April 30, 2022 | ||||

(2) | Excludes (i) 1,502,069,787 UWM LLC Class B Units issued and outstanding that convert into Class A common stock (including the 50,000,000 offered hereby), (ii) 15,874,987 shares exercisable upon conversion of our outstanding Warrants and (iii) up to 79,074,138 shares of Class A common stock that may be issued pursuant to our 2020 Omnibus Incentive Plan. | ||||

(3) | Includes 50,000,000 shares of Class A common stock offered by SFS Corp. In connection with any sale of shares of Class A common stock hereunder, SFS Corp. will convert an equivalent number of UWM LLC Class B Units (and the stapled Class D common stock) for Class A common stock for delivery pursuant to this prospectus. | ||||

3

Cautionary Note Regarding Forward-Looking Statements;

This prospectus contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. Specifically, forward-looking statements in this prospectus may include statements relating to:

•the future financial performance of our business;

•changes in the market for our services;

•expansion plans and opportunities;

•our future growth, including our pace of loan originations;

•our ability to implement our corporate strategy, including retaining our leading position in the wholesale lending channel, and the impact of such strategy on our future operations and financial and operational results;

•our strategic advantages and the impact that those advantages will have on future financial and operational results;

•the advantages of the wholesale market;

•industry growth and trends in the wholesale mortgage market and in the mortgage industry generally;

•our approach and goals with respect to technology;

•our current infrastructure, client-based business strategies, strategic initiatives and product pipeline;

•the impact of various interest rate environments and changes in LIBOR on our future financial results of operations;

•our evaluation of competition in our markets and our relative position;

•our accounting policies;

•macroeconomic conditions that may affect our business and the mortgage industry in general;

•the impact of COVID-19 pandemic, or any other similar pandemic or public health situation, on our business and the mortgage industry in general; and

•other statements preceded by, followed by or that includes the words "may," "can," "should," "will," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "target," or similar expressions

These forward-looking statements involve estimates and assumptions which may be affected by risks and uncertainties in our business, as well as other external factors, which could cause future results to materially differ from those expressed or implied in any forward-looking statement including those risks set forth below in Risk Factor Summary and the other risks and uncertainties indicated in this prospectus, including those set forth under the section entitled “Risk Factors.”

All forward-looking statements speak only as of the date of this prospectus and should not be relied upon as representing our views as of any subsequent date. We do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

4

Risk Factor Summary

An investment in our securities involves substantial risk. Our ability to execute on our strategy also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following the Summary below may cause us not to realize the full benefits of our competitive strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks we face include the following:

•our dependence on macroeconomic and U.S. residential real estate market conditions, including changes in U.S. monetary policies that affect interest rates;

•our reliance on our warehouse facilities to fund mortgage loans and otherwise operate our business, leveraging of assets under these facilities and the risk of a decrease in the value of the collateral underlying certain of our facilities causing an unanticipated margin call;

•our ability to sell loans in the secondary market, including to government sponsored enterprises, and to securitize our loans into mortgage-backed securities through the GSEs and Ginnie Mae;

•our dependence on the GSEs and the risk changes to these entities and their roles, including, as a result of GSE reform, termination of conservatorship or efforts to increase the capital levels of the GSEs;

•changes in the GSEs', FHA, USDA and VA guidelines or GSE and Ginnie Mae guarantees;

•our dependence on licensed residential mortgage officers or entities, including brokers that arrange for funding of mortgage loans, or banks, credit unions or other entities that use their own funds or warehouse facilities to fund mortgage loans, but in any case do not underwrite or otherwise make the credit decision with regard to such mortgage loans to originate mortgage loans;

•the unique challenges posed to our business by the COVID-19 pandemic and the impact of governmental actions taken in response to the pandemic on our ability to originate mortgages, our servicing operations, our liquidity and our team members;

•the risk that an increase in the value of the MBSs we sell in forward markets to hedge our pipeline may result in unanticipated margin call;

•our inability to continue to grow, or to effectively manage the growth of, our loan origination volume;

•our ability to continue to attract and retain our Independent Mortgage Broker relationships;

•the occurrence of a date breach or other failure of our cybersecurity;

•loss of key management;

•reliance on third-party software and services;

•reliance on third-party sub-servicers to service our mortgage loans or our mortgage servicing rights;

•intense competition in the mortgage industry;

•our ability to implement technological innovation;

•our ability to continue to comply with the complex state and federal laws, regulations or practices applicable to mortgage loan origination and servicing in general, including maintaining the appropriate state licenses, managing the costs and operational risk associated with material changes to such laws;

•fines or other penalties associated with the conduct of Independent Mortgage Brokers;

•errors or the ineffectiveness of internal and external models or data we rely on to manage risk and make business decisions;

•loss or inability to enforce intellectual property rights or contractual rights;

•risk of counterparty terminating servicing rights and contracts;

•the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and

•the requirements of being a public company may strain our resources, divert management's attention and affect our ability to attract and retain qualified board members and team members.

5

Risk Factors

An investment in our securities involves risks and uncertainties. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K for the year ended December 31, 2021, our Quarterly Report on Form 10-Q for the period ended March 31, 2022, any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement before making an investment decision. The risks described in these documents are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially adversely affected. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment.

6

Use of Proceeds

All of the shares of Class A common stock offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective amounts. We will not receive any of the proceeds from these sales. We did not receive any proceeds from the prior distribution of the Private Placement Warrants.

We will receive up to an aggregate of approximately $182,562,500 from the exercise of Warrants, assuming the exercise in full of all such Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. Our management will have broad discretion over the use of proceeds from the exercise of the Warrants.

There is no assurance that the holders of the Warrants will elect to exercise any or all of the Warrants. To the extent that the Warrants are exercised on a “cashless basis,” the amount of cash we would receive from the exercise of the Warrants will decrease.

7

Description of Securities

The following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such securities. The full text of our Charter and amended and restated bylaws are included as exhibits to the registration statement of which this prospectus is a part. You are encouraged to read the applicable provisions of Delaware law, our Charter and amended and restated bylaws in their entirety for a complete description of the rights and preferences of our securities. See “Where You Can Find More Information.”

Authorized and Outstanding Stock

Our authorized capital stock consists of:

•4,000,000,000 shares of Class A common stock, par value $0.0001 per share;

•1,700,000,000 shares of Class B common stock, par value $0.0001 per share;

•1,700,000,000 shares of Class C common stock, par value $0.0001 per share;

•1,700,000,000 shares of Class D common stock, par value $0.0001 per share; and

•100,000,000 shares of Preferred Stock, par value $0.0001 per share.

Collectively we refer to our Class A common stock, our Class B common stock, our Class C common stock and our Class D common stock as our Common Stock.

As of April 30, 2022, there were 92,531,737 shares of Class A common stock issued and outstanding, 1,502,069,787 shares of Class D common stock outstanding, no shares of Class B common stock, no shares of Class C common stock and no shares of Preferred Stock outstanding. We are authorized, without stockholder approval except as required by the listing rules of the NYSE, to issue additional shares of our capital stock.

Voting Rights

Our Charter provides that, subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of our outstanding shares of Common Stock will vote together as a single class on all matters with respect to which our stockholders are entitled to vote under applicable law, our Charter or the Amended and Restated Bylaws or upon which a vote of stockholders generally entitled to vote is otherwise called for by us, except that, except as may otherwise be required by applicable law, each holder of Common Stock will not be entitled to vote on any amendment to our Charter that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either voting separately as a single class or together as a class with the holders of any other outstanding series of Preferred Stock, to vote thereon pursuant to our Charter or the DGCL.

Our Charter provides that at each annual or special meeting of stockholders (or action by consent in lieu of a meeting),

•each holder of record of Class A common stock and Class C common stock on the relevant record date will be entitled to cast one vote for each share held; and

•each holder of record of Class B common stock and Class D common stock on the relevant record date will be entitled to cast ten votes for each share held.

Our Charter provides that, in no event shall a holder of Common Stock, together with one or more other “includable corporations” (as defined in the Internal Revenue Code of 1986, as amended (the "Code")) of such holder or entities disregarded as separate from such holder for U.S federal income tax purposes, be entitled to vote in excess of 79% of the voting power of the holders of the outstanding shares then voting together as a single class on such matter.

Our Charter provides for a classified board of directors (the "Board") that is divided into three classes with staggered three-year terms. Except for any directors elected by the holders of any of our outstanding series of Preferred Stock then outstanding as provided for or fixed pursuant to the provisions of our Charter, and with respect to newly created directorships resulting from an increase in the authorized number of directors or any vacancies on our Board resulting from death, disqualification, removal or other cause, each director will be elected by a plurality of the votes cast at any meeting of stockholders at which directors are to be elected by the stockholders generally entitled to vote and a quorum is present. Our Charter does not provide for cumulative voting for the election of directors.

8

Conversion/Exchange

Our Charter provides that each share of Class B common stock is convertible at any time, at the option of the holder, into one share of Class A common stock. Additionally, the Second Amended and Restated Limited Liability Company of our subsidiary, UWM Holdings LLC ("UWM LLC") provides that each UWM LLC Class B Unit along with the stapled Class D common stock.

Our Charter further provides that each share of Class B common stock will automatically convert into one share of Class A common stock, and each share of Class D common stock will automatically convert into one share of Class C common stock, upon the transfer of such share, except for transfers to (i) a direct or indirect holder of equity of SFS Holding Corp. (an “SFS Equityholder”), (ii) the spouse, parents, grandparents, lineal descendants or siblings of an SFS Equityholder, the parents, grandparents, lineal descendants or siblings of such holder’s spouse, or lineal descendants of such holder’s siblings or such holder’s spouse’s siblings (each, a “Family Member”), (iii) a Family Member of any SFS Equityholder, (iv) a trust, family-partnership or estate-planning vehicle, so long as one or more of such holder, a Family Member of such holder, an SFS Equityholder or a Family Member of an SFS Equityholder is/are the sole economic beneficiaries of such trust, family-partnership or estate-planning vehicle, (v) a partnership, corporation or other entity controlled by, or a majority of which is beneficially owned by, such holder or any one or more person described in the foregoing clauses “(i)” through “(iv),” (vi) a charitable trust or organization that is exempted from taxation under Section 501(c)(3) of the Code and controlled by such holder or any one or more of the persons described in the foregoing clauses “(i)” through “(iv)”, (vii) an individual mandated under a qualified domestic relations order to which such holder is subject, or (viii) a legal or personal representative of such holder, any Family Member of such holder, an SFS Equityholder or a Family Member of an SFS Equityholder in the event of death or disability of such holder that is an individual.

Dividends

Our Charter provides that, subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of Class A common stock and holders of Class B common stock are entitled to receive dividends when, as and if declared by our Board out of legally available funds. Under our Charter, dividends may not be declared or paid in respect of Class A common stock unless they are declared or paid in the same amount and same type of cash or property (or combination thereof) in respect of Class B common stock, and vice versa, unless such dividend is approved by holders of a majority of the shares of Class A common stock then outstanding and a majority of the shares of Class B common stock then outstanding, each voting as separately as a single class.

Our Charter provides that the holders of Class C common stock and the holders of Class D common stock will not have any right to receive dividends (including cash, stock or property).

In connection with the declaration of a dividend on our shares of Class A common stock and share of Class B common stock (if any are outstanding), the Board, in its capacity as the Manager of UWM LLC, is required pursuant to the terms of the UWM LLC Second Amended and Restated Operating Agreement, to determine whether to (a) make distributions from UWM LLC to only UWM Holdings Corporation (“UWMC” or the “Company”), as the owner of the Class A Units of UWM LLC with the proportional amount due to SFS Holding Corp. as the owner of the Class B Units of UWM LLC, being distributed upon the sooner to occur of (i) the Board making a determination to do so or (ii) the date on which Class B Units of UWM LLC are converted into shares of Class B common stock of UWMC or (b) make proportional and simultaneous distributions from UWM LLC to both UWMC, as the owner of the Class A Units of UWM LLC and to SFS Holding Corp. as the owner of the Class B Units of UWM LLC.

No Preemptive Rights

Our Charter does not provide the holders of Class A common stock, Class B common stock, Class C common stock and Class D common stock with preemptive rights.

Merger or Consolidation

Our Charter provides that, in the event of a merger or consolidation of our Company with or into another entity, the holders of shares of Class A common stock and Class B common stock will be converted into the right to receive the same consideration per share, provided that if the shares of Class A common stock and Class B common stock are converted into the right to receive shares or other securities, the holders of shares of Class A common stock and Class B common stock will be deemed to have received the same consideration per share if the voting power of the shares or other securities received per share of Class B common stock is ten times the voting power of the shares or other securities received per share of Class A common stock.

9

Our Charter provides that, in the event of a merger or consolidation of our Company with or into another entity, the holders of shares of Class C common stock and Class D common stock will be converted into the right to receive the same consideration per share, provided that the shares of Class C common stock and Class D common stock may be converted into the right to receive the same shares or securities per share, provided, further, that the holders of shares of Class C common stock and Class D common stock will be deemed to have received the same consideration per share if the voting power of the shares or other securities received per share of Class D common stock is ten times the voting power of the shares or other securities received per share of Class C common stock.

Liquidation, Dissolution or Winding Up

Our Charter provides that upon the liquidation, dissolution or winding up of our Company (either voluntary or involuntary), the holders of Class A common stock and holders of Class B common stock will be entitled to share ratably in the assets and funds of our Company that are available for distribution to our stockholders. The holders of Class C common stock and the holders of Class D common stock will not have any right to receive a distribution upon a liquidation, dissolution or winding up of our Company.

Preferred Stock

Our Charter provides that shares of preferred stock may be issued from time to time in one or more series. Our Board is authorized to fix the voting rights, if any, designations, powers, preferences and relative, participating, optional, special and other rights, if any, and any qualifications, limitations and restrictions thereof, applicable to the shares of each series. Our Board is able, without stockholder approval, to issue preferred stock with voting and other rights that could adversely affect the voting power and other rights of the holders of the Common Stock and could have anti-takeover effects. The ability of our Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. We have no preferred stock outstanding at the date hereof. Although we do not currently intend to issue any shares of preferred stock, we cannot assure you that we will not do so in the future.

Our Charter provides that, subject to applicable law and the rights, if any, of the holders of any outstanding series of Preferred Stock, the holders of Class A common stock and holders of Class B common stock are entitled to receive dividends when, as and if declared by our Board out of legally available funds. Under our Charter, dividends may not be declared or paid in respect of Class A common stock unless they are declared or paid in the same amount and same type of cash or property (or combination thereof) in respect of Class B common stock, and vice versa, unless such dividend is approved by holders of a majority of the shares of Class A common stock then outstanding and a majority of the shares of Class B common stock then outstanding, each voting as separately as a single class.

Warrants

Public Warrants

Each of our whole Public Warrants entitles the registered holder to purchase one share of our Class A common stock at a price of $11.50 per share, subject to adjustment as discussed below, at any time commencing on the later of 12 months from the closing of the IPO or 30 days after the completion of our initial business combination (each individually, a “Public Warrant” and collectively, the “Public Warrants”). Our initial business combination was completed on January 20, 2021; consequently the Public Warrants became exercisable on February 20, 2021.

Pursuant to the Warrant Agreement dated January 23, 2020, between the Company and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agreement”), a warrant holder may exercise its Public Warrants only for a whole number of shares of Class A common stock. This means that only a whole Public Warrant may be exercised at any given time by a warrant holder. No fractional Public Warrants will be issued upon separation of the units and only whole Public Warrants will trade. The Public Warrants will expire five years after the completion of our initial business combination on January 21, 2026, at 5:00 p.m., New York City time, or earlier upon redemption or liquidation.

We are not obligated to deliver any shares of Class A common stock pursuant to the exercise of a Public Warrant and will have no obligation to settle such Public Warrant exercise unless a registration statement under the Securities Act with respect to the shares of Class A common stock underlying the Public Warrants is then effective and a prospectus relating thereto is current, subject to our satisfying our obligations described below with respect to registration. No Public Warrant will be exercisable for cash or on a cashless basis, and we will not be obligated to issue any shares to holders seeking to exercise their Public Warrants, unless the issuance of the shares upon such exercise is registered or qualified under the securities laws of the state of the exercising holder, or an exemption is available. In the event that the conditions in the two immediately preceding sentences are not satisfied with respect to a Public Warrant, the holder of such Public Warrant will not be entitled to exercise such Public Warrant and such

10

Public Warrant may have no value and expire worthless. In the event that a registration statement is not effective for the exercised Public Warrants, the purchaser of a unit containing such Public Warrant will have paid the full purchase price for the unit solely for the share of Class A common stock underlying such unit.

Pursuant to the Warrant Agreement, we filed a registration statement with the Securities and Exchange Commission (the “SEC”) covering the registration, under the Securities Act, of the shares of Class A common stock issuable upon exercise of the Public Warrants. That registration statement became effective on February 5, 2021. We will use our best efforts to maintain the effectiveness of such registration statement, and a current prospectus relating thereto, until the expiration of the Public Warrants in accordance with the provisions of the Warrant Agreement. Notwithstanding the above, if our Class A common stock is at the time of any exercise of a Public Warrant not listed on a national securities exchange such that it satisfies the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of Public Warrants who exercise their Public Warrants to do so a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act (or any successor rule) and, in the event we so elect, we will not be required to file or maintain in effect a registration statement, but will use our best efforts to register the shares under applicable blue sky laws to the extent an exemption is not available.

Redemption of Warrants for Cash. Once the Public Warrants became exercisable, we may call the Public Warrants for redemption:

•in whole and not in part;

•at a price of $0.01 per Public Warrant;

•upon not less than 30 days’ prior written notice of redemption to each warrant holder; and

•if, and only if, the last reported sale price of the Class A common stock equals or exceeds $18.00 per share for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date we send to the notice of redemption to the warrant holder.

If and when the Public Warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws.

We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the Public Warrants, each warrant holder will be entitled to exercise his, her or its Public Warrant prior to the scheduled redemption date. However, the price of the Class A common stock may fall below the $18.00 redemption trigger price as well as the $11.50 warrant exercise price after the redemption notice is issued.

Redemption of Warrants for Class A common stock. Commencing ninety days after the Public Warrants became exercisable (or May 21, 2021), we may redeem the outstanding Public Warrants:

•in whole and not in part;

•at a price equal to a number of shares of Class A common stock to be determined by reference to the table below, based on the redemption date and the “fair market value” of our Class A common stock except as otherwise described below;

•upon a minimum of 30 days’ prior written notice of redemption; and

•if, and only if, the last reported sale price of our Class A common stock equals or exceeds $10.00 per share (as adjusted per share splits, share dividends, reorganizations, reclassifications, recapitalizations and the like) on the trading day prior to the date on which we send the notice of redemption to the warrant holders.

The numbers in the table below represent the “redemption prices,” or the number of shares of Class A common stock that a warrant holder will receive upon redemption by us pursuant to this redemption feature, based on the “fair market value” of our Class A common stock on the corresponding redemption date, determined based on the average of the last reported sales price for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of Public Warrants, and the number of months that the corresponding redemption date precedes the expiration date of the Public Warrants, each as set forth in the table below.

The share prices set forth in the column headings of the table below will be adjusted as of any date on which the number of shares issuable upon exercise of a Public Warrant is adjusted as set forth below. The adjusted stock prices in the column headings will equal the stock prices immediately prior to such adjustment, multiplied by a fraction, the numerator of which is the number of shares deliverable upon exercise of a Public Warrant immediately prior to such adjustment and the denominator of which is the number of shares deliverable upon exercise of a Public Warrant as

11

so adjusted. The number of shares in the table below shall be adjusted in the same manner and at the same time as the number of shares issuable upon exercise of a Public Warrant.

| Redemption Date (period to expiration of Warrants) | Fair Market Value of Class A common stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $10.00 | $11.00 | $12.00 | $13.00 | $14.00 | $15.00 | $16.00 | $17.00 | $18.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

57 months | 0.257 | 0.277 | 0.294 | 0.310 | 0.324 | 0.337 | 0.348 | 0.358 | 0.365 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

54 months | 0.252 | 0.272 | 0.291 | 0.307 | 0.322 | 0.335 | 0.347 | 0.357 | 0.365 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

51 months | 0.246 | 0.268 | 0.287 | 0.304 | 0.320 | 0.333 | 0.346 | 0.357 | 0.365 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

48 months | 0.241 | 0.263 | 0.283 | 0.301 | 0.317 | 0.332 | 0.344 | 0.356 | 0.365 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

45 months | 0.235 | 0.258 | 0.279 | 0.298 | 0.315 | 0.330 | 0.343 | 0.356 | 0.365 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

42 months | 0.228 | 0.252 | 0.274 | 0.294 | 0.312 | 0.328 | 0.342 | 0.355 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

39 months | 0.221 | 0.246 | 0.269 | 0.290 | 0.309 | 0.325 | 0.340 | 0.354 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

36 months | 0.213 | 0.239 | 0.263 | 0.285 | 0.305 | 0.323 | 0.339 | 0.353 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

33 months | 0.205 | 0.232 | 0.257 | 0.280 | 0.301 | 0.320 | 0.337 | 0.352 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

30 months | 0.196 | 0.224 | 0.250 | 0.274 | 0.297 | 0.316 | 0.335 | 0.351 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

27 months | 0.185 | 0.214 | 0.242 | 0.268 | 0.291 | 0.313 | 0.332 | 0.350 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

24 months | 0.173 | 0.204 | 0.233 | 0.260 | 0.285 | 0.308 | 0.329 | 0.348 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

21 months | 0.161 | 0.193 | 0.223 | 0.252 | 0.279 | 0.304 | 0.326 | 0.347 | 0.364 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

18 months | 0.146 | 0.179 | 0.211 | 0.242 | 0.271 | 0.298 | 0.322 | 0.345 | 0.363 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

15 months | 0.130 | 0.164 | 0.197 | 0.230 | 0.262 | 0.291 | 0.317 | 0.342 | 0.363 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

12 months | 0.111 | 0.146 | 0.181 | 0.216 | 0.250 | 0.282 | 0.312 | 0.339 | 0.363 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9 months | 0.090 | 0.125 | 0.162 | 0.199 | 0.237 | 0.272 | 0.305 | 0.336 | 0.362 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6 months | 0.065 | 0.099 | 0.137 | 0.178 | 0.219 | 0.259 | 0.296 | 0.331 | 0.362 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 months | 0.034 | 0.065 | 0.104 | 0.150 | 0.197 | 0.243 | 0.286 | 0.326 | 0.361 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

0 months | — | — | 0.042 | 0.115 | 0.179 | 0.233 | 0.281 | 0.323 | 0.361 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The “fair market value” of our Class A common stock shall mean the average last reported sale price of our Class A common stock for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of Public Warrants.

The exact fair market value and redemption date may not be set forth in the table above, in which case, if the fair market value is between two values in the table or the redemption date is between two redemption dates in the table, the number of shares of Class A common stock to be issued for each Public Warrant redeemed will be determined by a straight-line interpolation between the number of shares set forth for the higher and lower fair market values and the earlier and later redemption dates, as applicable, based on a 365- or 366-day year, as applicable. For example, if the average last reported sale price of our Class A common stock for the 10 trading days ending on the third trading date prior to the date on which the notice of redemption is sent to the holders of the Public Warrants is $11.00 per share, and at such time there are 57 months until the expiration of the Public Warrants, we may choose to, pursuant to this redemption feature, redeem the Public Warrants at a “redemption price” of 0.277 shares of Class A common stock for each whole Public Warrant. For an example where the exact fair market value and redemption date are not as set forth in the table above, if the average last reported sale price of our Class A common stock for the 10 trading days ending on the third trading date prior to the date on which the notice of redemption is sent to the holders of the Public Warrants is $13.50 per share, and at such time there are 38 months until the expiration of the Public Warrants, we may choose to, pursuant to this redemption feature, redeem the Public Warrants at a “redemption price” of 0.298 Class A common stock for each whole Public Warrant. Finally, as reflected in the table above, we can redeem the Public Warrants for no consideration in the event that the Public Warrants are “out of the money” (i.e., the trading price of our Class A common stock is below the exercise price of the Public Warrants) and about to expire.

Any Public Warrants held by our officers or directors will be subject to this redemption feature, except that such officers and directors shall only receive “fair market value” for such Public Warrants so redeemed (“fair market value” for such Public Warrants held by our officers or directors being defined as the last reported sale price of the Public Warrants on such redemption date).

This redemption feature differs from the typical warrant redemption features used in other blank check offerings, which typically only provide for a redemption of Public Warrants for cash (other than the Private Placement Warrants (as defined below)) when the trading price for the Class A common stock exceeds $18.00 per share for a

12

specified period of time. This redemption feature is structured to allow for all of the outstanding Public Warrants to be redeemed when the shares of Class A common stock are trading at or above $10.00 per share, which may be at a time when the trading price of our Class A common stock is below the exercise price of the Public Warrants. We have established this redemption feature to provide the Public Warrants with an additional liquidity feature, which provides us with the flexibility to redeem the Public Warrants for shares of Class A common stock, instead of cash, for “fair value” without the Public Warrants having to reach the $18.00 per share threshold set forth above. Holders of the Public Warrants will, in effect, receive a number of shares representing fair value for their Public Warrants based on an option pricing model with a fixed volatility input as of September 6, 2018. This redemption right provides us not only with an additional mechanism by which to redeem all of the outstanding Public Warrants, in this case, for Class A common stock, and therefore have certainty as to (i) our capital structure as the Public Warrants would no longer be outstanding and would have been exercised or redeemed and (ii) to the amount of cash provided by the exercise of the Public Warrants and available to us, and also provides a ceiling to the theoretical value of the Public Warrants as it locks in the “redemption prices” we would pay to warrant holders if we chose to redeem Public Warrants in this manner. We will effectively be required to pay fair value to warrant holders if we choose to exercise this redemption right and it will allow us to quickly proceed with a redemption of the Public Warrants for Class A common stock if we determine it is in our best interest to do so. As such, we could redeem the Public Warrants in this manner when we believe it is in our best interest to update our capital structure to remove the Public Warrants and pay fair value to the warrant holders. In particular, it would allow us to quickly redeem the Public Warrants for Class A common stock, without having to negotiate a redemption price with the warrant holders, which in some situations, may allow us to more quickly and easily close an initial business combination. In addition, the warrant holders will have the ability to exercise the Public Warrants prior to redemption if they should choose to do so.

As stated above, we can redeem the Public Warrants when the shares of Class A common stock are trading at a price starting at $10.00, which is below the exercise price of $11.50, because it will provide certainty with respect to our capital structure and cash position while providing warrant holders with fair value (in the form of Class A common stock). If we choose to redeem the Public Warrants when the Class A common stock are trading at a price below the exercise price of the Public Warrants, this could result in the warrant holders receiving fewer Class A common stock than they would have received if they had chosen to wait to exercise their Public Warrants for Class A common stock if and when such Class A common stock were trading at a price higher than the exercise price of $11.50.

No fractional shares of Class A common stock will be issued upon redemption. If, upon redemption, a holder would be entitled to receive a fractional interest in a share, we will round down to the nearest whole number of the number of shares of Class A common stock to be issued to the holder.

Redemption procedures and cashless exercise. If we call the Public Warrants for redemption as described above, our management will have the option to require any holder that wishes to exercise his, her or its Public Warrant to do so on a “cashless basis.” In determining whether to require all holders to exercise their Public Warrants on a “cashless basis,” our management will consider, among other factors, our cash position, the number of Public Warrants that are outstanding and the dilutive effect on our stockholders of issuing the maximum number of shares of Class A common stock issuable upon the exercise of our Public Warrants. If our management takes advantage of this option, all holders of Public Warrants would pay the exercise price by surrendering their Public Warrants for that number of shares of Class A common stock equal to the quotient obtained by dividing (i) the product of the number of shares of Class A common stock underlying the Public Warrants, multiplied by the difference between the exercise price of the Public Warrants and the “fair market value” (defined below) by (ii) the fair market value. The “fair market value” shall mean the average reported last sale price of the Class A common stock for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of Public Warrants. If our management takes advantage of this option, the notice of redemption will contain the information necessary to calculate the number of shares of Class A common stock to be received upon exercise of the Public Warrants, including the “fair market value” in such case. Requiring a cashless exercise in this manner will reduce the number of shares to be issued and thereby lessen the dilutive effect of a warrant redemption. We believe this feature is an attractive option to us if we do not need the cash from the exercise of the Public Warrants after our initial business combination. If we call our Public Warrants for redemption and our management does not take advantage of this option, Gores Sponsor IV, LLC and its permitted transferees would still be entitled to exercise their Private Placement Warrants for cash or on a cashless basis using the same formula described above that other warrant holders would have been required to use had all warrant holders been required to exercise their Public Warrants on a cashless basis, as described in more detail below.

A holder of a Public Warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such Public Warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the warrant agent’s actual knowledge, would beneficially own in excess of 9.8% (or such other amount as a holder may specify) of the shares of Class A common stock outstanding immediately after giving effect to such exercise.

Anti-dilution Adjustments. If the number of outstanding shares of Class A common stock is increased by a stock dividend payable in shares of Class A common stock, or by a split-up of shares of Class A common stock or other

13

similar event, then, on the effective date of such stock dividend, split-up or similar event, the number of shares of Class A common stock issuable on exercise of each Public Warrant will be increased in proportion to such increase in the outstanding shares of Class A common stock. A rights offering to holders of Class A common stock entitling holders to purchase shares of Class A common stock at a price less than the fair market value will be deemed a stock dividend of a number of shares of Class A common stock equal to the product of (i) the number of shares of Class A common stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for Class A common stock) multiplied by (ii) one minus the quotient of (a) the price per share of Class A common stock paid in such rights offering divided by (b) the fair market value. For these purposes (1) if the rights offering is for securities convertible into or exercisable for Class A common stock, in determining the price payable for Class A common stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (2) fair market value means the volume weighted average price of Class A common stock as reported during the 10 trading day period ending on the trading day prior to the first date on which the shares of Class A common stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time while the Public Warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to the holders of Class A common stock on account of such shares of Class A common stock (or other shares of our capital stock into which the Public Warrants are convertible), other than (i) as described above; (ii) certain ordinary cash dividends; or (iii) to satisfy the redemption rights of the holders of Class A common stock in connection with a proposed initial business combination, then the warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each share of Class A common stock in respect of such event.

If the number of outstanding shares of our Class A common stock is decreased by a consolidation, combination, reverse stock split or reclassification of shares of Class A common stock or other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification or similar event, the number of shares of Class A common stock issuable on exercise of each Public Warrant will be decreased in proportion to such decrease in outstanding shares of Class A common stock.

Whenever the number of shares of Class A common stock purchasable upon the exercise of the Public Warrants is adjusted, as described above, the warrant exercise price will be adjusted by multiplying the warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of shares of Class A common stock purchasable upon the exercise of the Public Warrants immediately prior to such adjustment, and (y) the denominator of which will be the number of shares of Class A common stock so purchasable immediately thereafter.

In case of any reclassification or reorganization of the outstanding shares of Class A common stock (other than those described above or that solely affects the par value of such shares of Class A common stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our outstanding shares of Class A common stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the Public Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the Public Warrants and in lieu of the shares of our Class A common stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the Public Warrants would have received if such holder had exercised their Public Warrants immediately prior to such event. However, if such holders were entitled to exercise a right of of election as to the kind or amount of securities, cash or other assets receivable upon such consolidation or merger, then the kind and amount of securities, cash or other assets for which each Public Warrant will become exercisable will be deemed to be the weighted average of the kind and amount received per share by such holders in such consolidation or merger that affirmatively make such election, and if a tender, exchange or redemption offer has been made to and accepted by such holders (other than a tender, exchange or redemption offer made by the Company in connection with redemption rights held by stockholders of the Company as provided for in the Company’s current certificate of incorporation or as a result of the repurchase of shares of Class A common stock by the company if a proposed initial business combination is presented to the stockholders of the company for approval) under circumstances in which, upon completion of such tender or exchange offer, the maker thereof, together with members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange Act (or any successor rule)) of which such maker is a part, and together with any affiliate or associate of such maker (within the meaning of Rule 12b-2 under the Exchange Act (or any successor rule)) and any members of any such group of which any such affiliate or associate is a part, own beneficially (within the meaning of Rule 13d-3 under the Exchange Act (or any successor rule)) more than 50% of the outstanding shares of Class A common stock, the holder of a Public Warrant will be entitled to receive the highest amount of cash, securities or other property to which such holder would actually have been entitled as a stockholder if such warrant holder had exercised the Public Warrant prior to the expiration of such tender or

14

exchange offer, accepted such offer and all of the Class A common stock held by such holder had been purchased pursuant to such tender or exchange offer, subject to adjustments (from and after the consummation of such tender or exchange offer) as nearly equivalent as possible to the adjustments provided for in the Warrant Agreement. Additionally, if less than 70% of the consideration receivable by the holders of Class A common stock in such a transaction is payable in the form of Class A common stock in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the Public Warrant properly exercises the Public Warrant within 30 days following public disclosure of such transaction, the warrant exercise price will be reduced as specified in the Warrant Agreement based on the per share consideration minus Black-Scholes Warrant Value (as defined in the Warrant Agreement) of the Public Warrant.

The Public Warrants have been issued in registered form under the Warrant Agreement. The Warrant Agreement provides that the terms of the Public Warrants may be amended without the consent of any holder to cure any ambiguity or correct any defective provision, but requires the approval by the holders of at least 50% of the then outstanding Public Warrants to make any change that adversely affects the interests of the registered holders of Public Warrants.

The Public Warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number of Public Warrants being exercised. The warrant holders do not have the rights or privileges of holders of Class A common stock and any voting rights until they exercise their Public Warrants and receive shares of Class A common stock. After the issuance of shares of Class A common stock upon exercise of the Public Warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Warrants may be exercised only for a whole number of shares of Class A common stock. No fractional shares will be issued upon exercise of the Public Warrants. If, upon exercise of the Public Warrants, a holder would be entitled to receive a fractional interest in a share, we will, upon exercise, round down to the nearest whole number the number of shares of Class A common stock to be issued to the warrant holder.

Private Placement Warrants

Gores Sponsor IV, LLC purchased 5,250,000 warrants at a price of $2.00 per warrant for an aggregate purchase price of $10,500,000 in a private placement that occurred on the IPO closing date (the “Private Placement Warrants” and together with the Public Warrants, the “Warrants”). The Private Placement Warrants (including the Class A common stock issuable upon exercise of the Private Placement Warrants) were not be transferable, assignable or salable until 30 days after the completion of our initial business combination (or February 21, 2021) and they may be physical (cash) or net share (cashless) settled and will not be redeemable by us so long as they are held by Gores Sponsor IV, LLC or its permitted transferees. Otherwise, the Private Placement Warrants have terms and provisions that are identical to those of the Public Warrants. If the Private Placement Warrants are held by holders other than Gores Sponsor IV, LLC or its permitted transferees, the Private Placement Warrants will be redeemable by us and exercisable by the holders on the same basis as the Public Warrants.

If holders of the Private Placement Warrants elect to exercise their Private Placement Warrants on a cashless basis, they would pay the exercise price by surrendering his, her or its Private Placement Warrants for that number of shares of Class A common stock equal to the quotient obtained by dividing (x) the product of the number of shares of Class A common stock underlying the Private Placement Warrants, multiplied by the difference between the exercise price of the Private Placement Warrants and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the Class A common stock for the 10 trading days ending on the third trading day prior to the date on which the notice of warrant exercise is sent to the warrant agent.

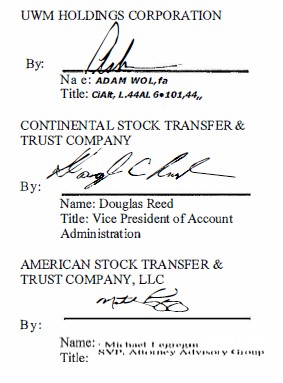

Transfer Agent and Warrant Agent

The Transfer Agent for our Class A common stock and the Warrant Agent for our Warrants is American Stock Transfer & Trust Company, LLC.

Certain Anti-Takeover Provisions of Delaware Law, Our Charter and the Amended and Restated Bylaws

Some provisions of the DGCL, our Charter and the Amended and Restated Bylaws contain or will contain provisions that could make the following transactions more difficult: (i) an acquisition of us by means of a tender offer; (ii) an acquisition of us by means of a proxy contest or otherwise; or (iii) the removal of incumbent officers and directors. It is possible that these provisions could make it more difficult to accomplish or could deter

15

transactions that stockholders may otherwise consider to be in their best interest or in our best interests, including transactions that provide for payment of a premium over the market price for our shares.

These provisions, summarized below, are intended to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of our business to first negotiate with our Board. We believe that the benefits of the increased protection of our business’ potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our business outweigh the disadvantages of discouraging these proposals because negotiation of these proposals could result in an improvement of their terms.

Delaware Law