Form POS AM American Housing Income

As filed with the Securities and Exchange Commission on September 13, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 2

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

AMERICAN HOUSING INCOME TRUST INC.

(Exact name of registrant as specified in its charter)

| Maryland | 333-208287 | 75-3265854 | ||

|

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) |

(PRIMARY STANDARD INDUSTRIAL CODE NUMBER) | (IRS EMPLOYER IDENTIFICATION NO.) |

Copies to:

American Housing Income Trust Inc.

Jeff Howard

Chief Executive Officer

34225 N. 27th Drive, Building 5

Phoenix, AZ 85085

(623) 551-5808

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices and registered agent)

Copies to:

Anthony R. Paesano

Paesano Akkashian Apkarian, PC

7457 Franklin Road, Suite 200

Bloomfield Hills, Michigan 48301

T (248) 796-6886

F (248) 796-6885

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Non-accelerated filer (Do not check if a smaller reporting company)

Accelerated filer Smaller reporting company [x]

| -1- |

CALCULATION OF REGISTRATION FEE CHART

| Common Stock Par Value $0.01 | Amount (1) | Proposed Maximum Registered Per Share (2) | Proposed Maximum Offering Price (1) | Fee Amount (2) | ||||||||||||

| Selling Shareholders | 8,615,680 | $ | 1.00 | $ | 8,615,680 | $ | 867.60 | |||||||||

| Direct Public Offering | 3,000,000 | $ | 1.00 | $ | 3,000,000 | $ | 302.10 | |||||||||

(1) Estimated for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The shares to be sold by the Selling Stockholders will be sold at a fixed price to be determined prior to effectiveness of this Registration Statement. Any increased fees will be paid prior to effectiveness.

(2) Fee paid with initial filing, and an additional fee paid upon prior amendment. On October 16, 2015, $907.06 was paid towards the Company’s S-1 (file number 333-207465). On December 1, 2015, the $907.06 was used as a “fee-offset” from the S-1 to the S-11 with file number 333-208287 because the SEC requested AHIT refile the S-1 as an S-11 via a letter to the Company on November 17, 2016. By January 20, 2016, AHIT had paid in a total of $2,856.86 towards the S-11 (333-208287), including the $907.06 fee off-set, but on July 27, 2016 the initial fee-offset of $907.06 was reversed by the SEC. On August 23, 2016, AHIT requested the withdrawal of the S-1 (333-207465) and that the fee paid in connection to that filing be, once again, made available for a fee-offset towards the S-11. Neither the Company nor the Selling Shareholders sold any shares under the registration statement on Form S-1. The Company ceased further efforts for effectiveness of its Form S-1 in light of the Commission’s comment on November 17, 2015 stating, “Please file your next amendment on Form S-11 as required by General Instruction A to Form S-11.” The Company proceeded to file its amended registration statement on Form S-11 on December 1, 2015. In accordance with Rule 457(p) of the Securities Act, the Company requests that all fees paid to the Commission in connection with its Form S-1 be credited towards the subsequent filing of the registration statement on Form S-11.

Thus, the fee amount as of the last amendment (7th) had been $2,856.86, and the newly calculated fee as of the 8th amendment is reduced to $1,214.83. As a result of this Post-Effective Amendment No. 1, no additional fee due at this time.

EXPLANATORY NOTE

The Company has filed this Post-Effective Amendment No. 2 to properly identify the number of shares being registered herein as Selling Shareholder shares. In addition, this Post-Effective Amendment No. 2 sets forth events subsequent to the effectiveness of its registration statement on Form S-11 on June 22, 2016.

On July 28, 2016, Performance Realty Management, LLC (“Performance Realty”) was issued 439,401 shares of common stock in the Company pursuant to a Designation and Acceptance of Rights (the “Designation”) entered into between Performance Realty, the Company, and the “Designor” under the Designation - Sean Zarinegar, who is the Company’s Chairman of the Board and Chief Financial Officer. The Designation had been unanimously approved by the Company’s Board of Directors with Mr. Zarinegar abstaining from vote. This issuance resulted in Performance Realty owning 1,439,401 shares of issued and outstanding common stock in the Company, of which 1,000,000 shares issued on September 28, 2015 had been registered as part of the Selling Shareholder shares with the Company’s registration statement on Form S-11 with an effective date of June 22, 2016. This issuance did not adjust Mr. Zarinegar’s beneficial ownership in the Company; however, it did increase Performance Realty’s beneficial ownership to 1,439,401, or 16% (based on the adjusted issued and outstanding shares set forth herein).

On August 15, 2016, as part of a restructuring of related parties, Performance Realty and the Company closed on a Stock Exchange and Restructuring Agreement (the “Exchange Agreement”). Pursuant to the Articles of Amendment to Articles of Organization of Performance Realty dated April 1, 2016, the Class A Units have preference over the common units in Performance Realty, on, amongst other things, “…any future reorganization or stock exchange on a pro rata basis, as determined by [Mr. Zarinegar, as Manager].” Furthermore, pursuant to the disclosures in the Private Offering for Performance Realty under Rule 506(b) of Regulation D, which resulted in the issuance of 144 (rounded up) Class A Units to forty-eight holders, and Section 3.3(t) of the Operating Agreement for Performance Realty, which had been attached as an exhibit to the Private Offering, Mr. Zarinegar, as Manager, was granted limited power of attorney by each Class A Unit holder to vote their respective proxy on any future exchange, such as the one agreed to in the Exchange Agreement.

| -2- |

As a result of the closing of the Exchange Agreement, the Company authorized the transfer of 999,504 shares previously registered as Selling Shareholder shares held by Performance Realty to forty-one former members of Performance Realty. The balance of the 496 shares from the previously registered shares titled to Performance Realty and 439,401 shares in restricted common stock of the Company were issued on a pro rata basis to these same forty-one former members of Performance Realty. The 496 shares identified above are considered restricted and not being registered herein. The Company has also reduced its registration price from $3.00 per share to $1.00 per for all shares identified in the Company’s registration statement on Form S-11.

The information in this prospectus is not complete and may be changed. Neither the Selling Shareholder nor the Company may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither the Selling Shareholder nor the Company are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED SEPTEMBER _, 2016

11,615,680 SHARES OF COMMON STOCK

This preliminary prospectus relates to the registration of 11,615,680 shares of our common stock. The Company is registering 8,615,680 shares to "Selling Shareholders," or individually, a "Selling Shareholder." In addition to the registration of the Selling Shareholder shares at $1.00 per share, this preliminary prospectus relates to the registration of 3,000,000 shares of our common stock at $1.00 per share for our direct public offering. All shares being registered have a par value equal to $0.01. Valfre Holdings, LLC, James Valfre and Pamela Valfre, have piggyback registration rights, but these rights do not accrue until August 1, 2016, as disclosed in previous filings with the Commission, and as set forth in the exhibits hereto.

The Selling Shareholders intend on selling their respective shares for the fixed price of $1.00 per share for the duration of the offering. The Selling Shareholders are deemed to be statutory underwriters under Section 2(a)(11) of the Securities Act. The current pricing of the Selling Shareholders’ shares on a fixed price was arbitrarily decided by management. Neither the Company nor the Selling Shareholders have a current arrangement or agreement with any underwriters, broker-dealers or selling agents for the sale of the shares subject to this Prospectus. If the Company or any Selling Shareholder enters into such an arrangement or agreement, the shares of such Selling Shareholder will be sold through such licensed underwriter(s), broker-dealer(s) and/or selling agent(s). The common stock registered herein is being offered by the Company on a "best efforts" basis (the "Offering Period").

The Company may hold a closing at any time after subscriptions have been received and accepted for the entire 3,000,000 shares of common stock, and after other conditions to closing have been satisfied (the "Closing"). The Company currently trades on the OTCQB Marketplace, operated by the OTC Markets Group. There is no minimum number of shares of common stock that must be sold by us to proceed, and we will retain the proceeds from the sale of any shares of the common stock. The sale of the common stock is being conducted on a self-underwritten, best efforts basis, which means our management, will attempt to sell the common stock. There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is traded on the over-the-counter market under the symbol "AHIT". However, there can be no assurance that any market for our stock will develop.

| -3- |

| Selling Shareholders | Offering Price | Underwriting Discounts; Commissions | Net Proceeds | |||||||

| Per Share | $ | 1.00 | None | $ | 0 | |||||

| Total | $ | 1.00 | None | $ | 0 | |||||

| Direct Public Offering | Offering Price | Underwriting Discounts; Commissions | Net Proceeds | |||||||

| Per Share | $ | 1.00 | None | $ | 1.00 | |||||

| Total | $ | 1.00 | None | $ | 3,000,000 | |||||

Any funds that we raise from our offering will be immediately available for our use and will not be returned to investors. The Company will not receive any proceeds from the sale of shares by Selling Shareholders, and will only receive proceeds from the direct public offering. We do not have any arrangements to place the funds received from our offering of the common stock in an escrow, trust or similar account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds associated with the common stock will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. As such, it is possible that a creditor could attach your subscription, which could preclude or delay the return of money to you. If that happens, you will lose your investment and your funds will be used to pay creditors.

As set forth in this prospectus, the Company has previously issued common stock on a restricted basis. For as long as this stock is "restricted" within the meaning of Rule 144(a)(3) under the Securities Act, the Company will, to the extent required, furnish to any shareholder, or to any prospective purchaser designated by such shareholder, upon request of such shareholder, financial and other information described in paragraph (d)(4) of Rule 144 with respect to the Company to the extent required in order to permit such shareholder to comply with Rule 144 with respect to any resale of their stock, unless during that time, the Company is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, or is exempt from reporting pursuant to Rule 12g3-2(b) under the Exchange Act and no such information about the Company is otherwise required pursuant to Rule 144. The Company is seeking registration of these shares, and is of the opinion that it is subject to the reporting requirements under the Exchange Act.

Until ninety business days after the effective date of this prospectus, all dealers that effect transactions in these securities whether or not participating in this offering may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

There are material income tax risks associated with this offering, as set forth in the sections titled "Risk Factors" and "Qualifications and Risks in Operating a REIT and Federal Tax Consequences". The proceeds of the offering might not be sufficient to meet the requirements for funds as set forth in the Company's investment objectives set forth in the "Use of Proceeds" section herein. The operation of the Company, and its subsidiaries and umbrella partnership, may involve conflicts of interest set forth in the sections titled "Description of Business" and "Risk Factors," and as set forth in discussions starting with the section titled "Directors, Executive Officers, Promoters and Control Persons" through "Certain Relationships and Related Transactions".

| -4- |

| -5- |

This Prospectus is dated September __, 2016

| Item | Page |

| Summary | 8 |

| Forward-Looking Statements | 8 |

| Risk Factors | 9 |

| Description of Business | 33 |

| Legal Matters | 48 |

| Qualifications and Risks in Operating a REIT and Federal Tax Consequences | 54 |

| ERISA Considerations | 68 |

| Operating Partnership and The Partnership Agreement | 70 |

| Use of Proceeds | 72 |

| Determination of the Offering Price | 72 |

| Dilution | 72 |

| Selling Shareholders | 73 |

| Plan of Distribution | 75 |

| Description of Securities to be Registered | 76 |

| Interests of Named Experts and Counsel | 76 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 77 |

| Legal Proceedings | 83 |

| Market for Common Equity and Related Stockholder Matters | 83 |

| Directors, Executive Officers, Promoters and Control Persons | 86 |

| Executive Compensation | 88 |

| Security Ownership of Certain Beneficial Owners and Management | 96 |

| Certain Relationships and Related Transactions | 97 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 103 |

| Where You Can Find More Information | 103 |

| Table of Exhibits | 106 |

| Undertakings | 107 |

| Signatures | 108 |

| Financial Statements | 109 |

| -6- |

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date.

PURSUANT TO SECURITIES ACT RELEASE 33-6900 AND CF DISCLOSURE GUIDANCE, TOPIC NO. 6, TO THE EXTENT THE COMPANY WILL REGULARLY UPDATE ITS PROSPECTUS TO COMPLY WITH THE SECURITIES ACT; MORE SPECIFICALLY, THE COMPANY WILL COMPLY WITH THE UNDERTAKINGS OF ITEM 20.D BY PROVIDING STICKER SUPPLEMENTS, POST-EFFECTIVE AMENDMENTS, AND FORM 8-K FILINGS THAT THE COMPANY SHOULD MAKE TO REFLECT THE ACQUISITION OF PROPERTIES WITH THE OFFERING PROCEEDS.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

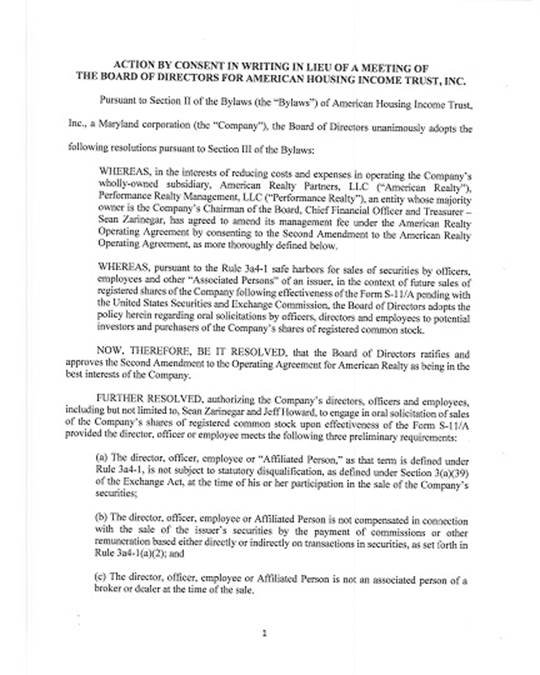

This preliminary prospectus will permit our President and Chief Executive Officer, Jeff Howard, and our Chief Financial Officer and Treasurer, Sean Zarinegar, to sell the common stock directly to the public, friends, family members and business acquaintances with no commission or other remuneration. Mr. Zarinegar and Mr. Howard will be relying on the safe harbor from broker-dealer registration on the basis that, as associated persons of the Company, they are not subject to a statutory disqualification under Rule 3a4-1(a)(1) under the Securities and Exchange Act of 1934, and are not compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities, and at the time of the respective participation, neither of them are associated persons of a broker-dealer. Furthermore, Mr. Zarinegar and Mr. Howard will be relying on Rule 34(a)4-1(a)(ii) and/or (iii) as the final component of the four-prong analysis under the safe harbor rules.

Mr. Zarinegar and Mr. Howard primarily perform, or intend to primarily perform, at the end of the offering, substantial duties for or on behalf of the Company not in connection with transactions in securities. Neither individual is a broker nor dealer, nor associated person of a broker or dealer, within the preceding 12 months, and neither participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Rule 3a4-(a)(iii). Mr. Zarinegar and Mr. Howard will be restricting their participation to preparing written communication or delivering such communications approved by the officers or directors of the Company through the mails or other means, and to specifically exclude any direct oral solicitations that are not considered to be responses to inquiries by potential purchasers under this prospectus. The Resolution of the Board of Directors has been attached hereto as an exhibit.

The Company is an "emerging growth company," as defined in the Jumpstart Our Business Startups Act. Investing in our common stock involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your investment. Neither the Securities and Exchange Commission (the "Commission"), nor any state securities commission or regulatory body, has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS SUMMARY AND RISK FACTORS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors," that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| -7- |

Although management believes that the assumptions underlying the forward looking statements included in this filing are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment.

To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this filing will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Factors that might cause or contribute to such differences include, but are not limited to, those discussed in "Risk Factors" contained in this report. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by law, we expressly disclaim any obligation to update publicly any forward-looking statements for any reason after the date of this report, to conform these statements to actual results, or to changes in our expectations. You should, however, review the factors and risks we describe in the reports we will file from time to time with the United States Securities and Exchange Commission (the "SEC" or the "Commission") after the date of this statement.

AMERICAN HOUSING INCOME TRUST, INC.

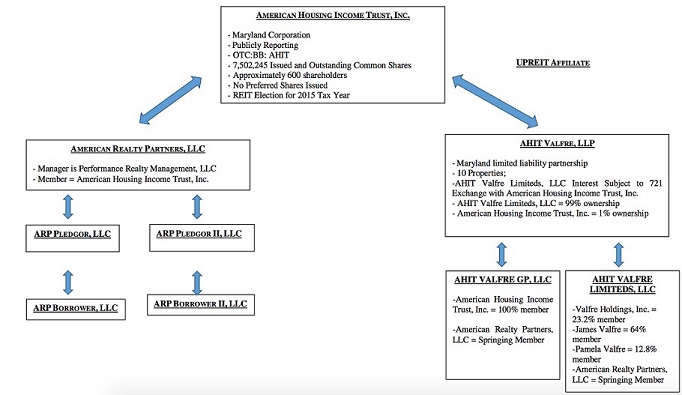

The Company is seeking the registration of 3,000,000 shares of its common stock at $1.00 per share, and the registration of 8,615,680 shares of Selling Shareholder shares at the fixed price of $1.00 per share. The Company is currently in the business of acquiring, renovating, rehabilitating and, in turn, renting single family residence. The Company intends on continuing with this business plan, but with the proceeds from the offering set forth in the Prospectus it intends on growing its portfolio, adding more diversity and independence to its Board of Directors, and securing more favorable terms on its debt service. The Company intends on operating as a REIT in 2016, and if it meets the qualifications of a REIT, as disclosed herein, the Company intends on complying with the dividend policy herein. The Company currently operates through related-party/affiliate entities in holding title to those single family residences in its portfolio – American Realty, ARP Borrower, ARP Borrower II and AHIT Valfre, LLP, a limited liability partnership commonly referred to as an UPREIT, or operating umbrella partnership.

Special Note Regarding Forward-Looking Statements

Information included in this Form S-11/A contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements may contain the words "believes," "project," "expects," "anticipates," "estimates," "forecasts," "intends," "strategy," "plan," "may," "will," "would," "will be," "will continue," "will likely result," and similar expressions, and are subject to numerous known and unknown risks and uncertainties. Additionally, statements relating to implementation of business strategy, future financial performance, acquisition strategies, capital raising transactions, performance of contractual obligations, and similar statements may contain forward-looking statements. In evaluating such statements, prospective investors and shareholders should carefully review various risks and uncertainties identified in this S-11/A, including the matters set forth under the captions "Risk Factors" and in the Company's other SEC filings. These risks and uncertainties could cause the Company's actual results to differ materially from those indicated in the forward-looking statements. The Company disclaims any obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Form S-11/A reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading "Risk Factors Related to Our Business" below, as well as those discussed elsewhere in this registration statement on Form S-11/A. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of registration statement on Form S-11/A. We file reports with the Securities and Exchange Commission ("SEC"). You can read and copy any materials we file with the SEC at the SEC's Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

| -8- |

We disclaim any obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Form S-11/A. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this registration statement, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Before you invest in the Company' securities, you should be aware that there are various risks. These risks must be evaluated in the context of the disclosures made within the section titled "Description of Business." You should consider carefully these risk factors, together with all of the other information included in this prospectus before you decide to purchase our securities. If any of the following risks and uncertainties develops into actual events, our business, financial condition or results of operations could be materially adversely affected.

The stock offered hereby involves a high degree of risk. No one should invest who is not prepared to lose his, her, or its entire investment. There is no public market in the foreseeable future for the resale of the stock. Prospective investors, prior to making an investment, should carefully examine the risk factors set forth in the business plan and the following risk factors, which are inherent in making an investment in, and affecting the business of, the Company, in addition to the other information presented in this prospectus. This prospectus contains certain forward-looking statements. The Company's actual results could differ materially from the results anticipated in these forward-looking statements as a result of various risks and uncertainties, including certain factors set forth in the following risk factors and elsewhere in this prospectus.

The Company intends on pursuing designation as a REIT, and until that time, the Company will continue to operate as an entity focusing on the acquisition and management of single family residences, as identified above. The risks associated with qualifying and operating as a REIT are more fully discussed herein.

An investment in our common stock is subject to significant risks. Listed below are some of the most significant risks relating to an investment in our common stock, which we have organized in descending order starting with those risks that we consider as the most significant. We have a limited operating history and may not be able to successfully operate our business or generate sufficient operating cash flows to make or sustain distributions to our shareholders. We have a history of net operating losses, and we may never achieve profitability from operations.

Our common shares are being offered by our executive officers on a best-efforts basis, which means there is no commitment on the part of anyone to purchase any of the shares, and there can be no assurance we will be able to sell shares in excess of the minimum offering amount. Our common shares are being offered by our executive officers on a best-efforts basis, which means there is no commitment on the part of anyone to purchase any of the shares, and there can be no assurance we will be able to sell shares in excess of the minimum offering amount. Certain of our existing shareholder affiliated with Mr. Zarinegar, such as American Realty, Performance Realty, ARP Borrower, ARP Borrower II and AHIT Valfre, have substantial influence over our company, and their interests may not be aligned with the interests of our other shareholders and sales of their shares could cause the market price of our common stock to decrease.

We do not have any experience operating as a REIT, and we cannot assure you that we will be successful operating as a REIT. Until such time we are successfully operating as a REIT, we will be dependent on our executive officers and dedicated personnel, and the departure of any of our key personnel could materially and adversely affect us. If we cannot obtain financing, our growth may be limited.

Our underwriting criteria and evaluation of properties involves a number of assumptions that may prove inaccurate, which may cause us to overpay for our properties or incur significant costs to operate a property. Operating our business on a larger scale could result in substantial increases in our expenses. If rents in our markets do not increase sufficiently to keep pace with rising costs of operations, we may be unable to generate or sustain cash available for distribution. Declining real estate values and impairment charges could adversely affect our earnings and financial condition.

Our Articles of Incorporation, or commonly referred as our charter, gives significant flexibility to our Board of Directors in determining a suitable business plan and strategy, which might, in the future, deviate from the current business plan and strategy. Our Board of Directors may change our investment strategy, financing strategy or leverage policies, or any of our other major policies, without the consent of shareholders. If due to an adjustment in our strategy, we are unable to qualify as a REIT, it could adversely affect our operations and our ability to make distributions.

| -9- |

The availability and timing of cash distributions are uncertain, and we may make distributions using the proceeds of this offering, which would represent a return of capital. The NASDAQ Capital Market or another nationally recognized stock exchange may not list our securities, which could limit investors' ability to make transactions in our securities and subject us to additional trading restrictions. An active trading market for our common stock may never develop following this offering. There may be limitations on the effectiveness of our internal controls, and a failure of our control systems to prevent error or fraud may materially harm our company.

Risk Factors Applicable To The Company

Our Articles of Incorporation and Bylaws have restrictions on ownership and transfer of our common stock.

Due to limitations on the concentration of ownership of REIT stock imposed by the Internal Revenue Code of 1986, as amended, or the Code, subject to certain exceptions, our charter provides generally that no person may, in the absence of an exemption granted by our Board of Directors, beneficially or constructively own more than 9.8% in value or in number of shares, whichever is more restrictive, of our outstanding shares of common stock or more than 9.8% in value or number of shares, whichever is more restrictive, of the aggregate outstanding shares of all classes and series of our capital stock.

Our charter also prohibits any person from, among other things, beneficially or constructively owning or transferring shares of our capital stock if such ownership or transfer would result in our being "closely held" within the meaning of Section 856(h) of the Code. Our charter also prohibits transferring shares of our capital stock if such transfer would result in our capital stock being owned by fewer than 100 persons.

Our Board of Directors, in its sole discretion, may exempt (prospectively or retroactively) a person from the 9.8% ownership limits and other restrictions in our charter and may establish or increase an excepted holder percentage limit for such person if we obtain such representations and undertakings as our Board of Directors deems appropriate in order to conclude that granting the exemption and/or establishing or increasing the excepted holder percentage limit will not cause us to fail to qualify as a REIT.

Our charter also provides that any ownership or purported transfer of our stock in violation of the foregoing restrictions will result in the shares owned or transferred in such violation being automatically transferred to one or more charitable trusts for the benefit of a charitable beneficiary and the purported owner or transferee acquiring no rights in such shares, except that any transfer that results in the violation of the restriction relating to shares of our capital stock being beneficially owned by fewer than 100 persons will be null and void. If the transfer to the trust is ineffective for any reason to prevent a violation of the restriction, the transfer that would have resulted in such violation will also be null and void.

As a company intending to qualify as a REIT, our Articles of Incorporation and Bylaws have a distribution policy intended to comply with the applicable rules.

To qualify as a REIT, we must distribute annually to our shareholders an amount equal to at least 90% of our REIT taxable income, determined without regard to the deduction for dividends paid and excluding any net capital gain. We intend to make distributions that will enable us to meet the distribution requirements applicable to REITs and to eliminate or minimize our obligation to pay income and excise taxes. Distributions declared by us will be authorized by our Board of Directors in its sole discretion out of funds legally available for such and will depend upon a number of factors, including restrictions under applicable law and the requirements for our qualification as a REIT for federal income tax purposes. We do not currently generate taxable income and we cannot guarantee whether or when we will be able to make distributions or that any such distributions will be sustained over time. There can be no assurance we will be able to generate sufficient operating cash flows to make or sustain distributions to our shareholders.

As a company intending to qualify as a REIT, we are taking measures to comply with certain tax restrictions and requirements.

We intend to elect and qualify to be taxed as a REIT for federal income tax purposes commencing with our taxable year ending December 31, 2015; however, to the extent management does not believe it can do so consistent with the Code, we intend to take all necessary steps to elect and qualify by the conclusion of our taxable year ending December 31, 2016. We believe that we have been organized and have operated in a manner that will allow us to qualify as a REIT for federal income tax purposes commencing with such taxable year, and we intend to continue operating in such a manner. To qualify and maintain our qualification as a REIT, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute to our stockholders at least 90% of our REIT taxable income, determined without regard to the dividends paid deduction and excluding any net capital gain.

| -10- |

Pursuant to the terms of his Employment Agreement dated February 25, 2016, Mr. Zarinegar is entitled to the issuance of future common stock, which once issued and granted, will dilute all shareholder's respective holdings and might impair the Company's ability to secure and maintain REIT status.

On February 25, 2016, Jeff Howard executed the Employment Agreement with Mr. Zarinegar on behalf of the Company (the “Employment Agreement”). As a result, Mr. Zarinegar became a full-time employee of the Company. The Employment Agreement is for a period of three years (the “Initial Term”). At the expiration of the Initial Term, the Employment Agreement shall be automatically extended for additional successive one (1) year terms (the “Renewal Term”) unless either party gives written notice of its intention to the other party not less than sixty (60) days prior to the expiration of the then current term and any renewal term.

The Company agrees to pay Mr. Zarinegar an annual salary equal to $120,000 during the Initial Term or any Renewal Term and on the dates consistent with the Company’s payroll schedule, or 1% of the Company’s assets as reported on its year-end balance sheet, whichever is greater, unless, an opinion of counsel or the Company’s auditors conclude that the asset-based compensation limits or impairs the Company’s intent of becoming a real estate investment trust or impairs the Company’s status as a publicly reporting company in good standing under the rules promulgated by the Commission.

The Company recognizes that Mr. Zarinegar is a significant employee to the Company, and has incurred and continues to incur risk and exposure in guaranteeing the FirstKey debt service of the Company and the debt of its subsidiaries, which ultimately benefits the Company and its shareholders. Recognizing that the consideration above does not completely compensate Mr. Zarinegar, the Company has agreed to issue Mr. Zarinegar or his designee a total of 3,000,000[1] shares of the Company’s common stock on the first, second and third anniversary of the Employment Agreement.

Mr. Zarinegar shall be entitled to participate in the Employee Stock Option Plan of the Company, once the Board of Directors for the Company ratifies and approves. The Company and Mr. Zarinegar acknowledge and agree that modification of any compensation structure requires a written document signed by both parties. If for any reason the Agreement is terminated, all compensation and commission due to Mr. Zarinegar, either earned directly or indirect, shall be paid by the Company in full to Mr. Zarinegar in accordance with this schedule and the laws of Arizona, and shall be paid in the usual course of Company’s payroll. The balance of the terms of Mr. Zarinegar’s employment are set forth in the exhibits, below. Mr. Zarinegar is bound by the fiduciary duties of a director and officer under Maryland law.

Pursuant to the First Amended Operating Agreement for American Realty, Performance Realty held title to 1,000,000 shares of common stock in the Company. These shares of common stock have since been conveyed to the former Class A Unit holders of Performance Realty Pursuant to a Stock Exchange Agreement.

Following the reverse merger of the Company, the Company had agreed that Performance Realty would continue to operate as the Manager for American Realty pursuant to the terms of the American Realty Operating Agreement, subject to the following amendment to Section 3.10 of the American Realty Operating Agreement, which was approved by a Resolution of the Board of Directors:

The Member acknowledges and agrees that, as the sole member of the Company, it and its shareholders directly benefit from the management services provided by Manager under this Article III. The Member further recognizes that any capital expenditures made for the benefit of the Company derive directly from the Member, as opposed to the Company itself. Therefore, in consideration for the services to be rendered to or on behalf of the Company by the Manager, the Member shall issue 1,000,000 shares of common stock in the Member, i.e. American Housing Income Trust, Inc., into the Member's treasury for future issuance upon written notice by PRM to Member's Secretary electing to issue the shares through the Member's transfer agent within a reasonably commercial period of time under the same or similar circumstances, but in no event greater than three business days from exercising the option, and future issuance on the annual anniversary of the issuance out of treasury, shares of common stock valued at one-percent (1%) of the net assets of the Company being managed by Manager under this Operating Agreement, unless otherwise agreed upon by Member and Manager, or unless doing so impairs or restricts the Member's intent of operating as a real estate investment trust. In the event such structure impairs or restricts the Member's intent of operating as a real estate investment trust, the Member and Manager agree to work in good faith to restructure compensation for Manager in performing under this Article 3. The fee paid to Manager hereunder is intended to constitute a guaranteed payment within the meaning of IRS Code §707(c), and will be treated as an expense of the Company and deducted in determining Profits and Losses.

| -11- |

The aforementioned amendment was executed on September 18, 2015. On September 22, 2015, the Company authorized the issuance of 1,000,000 shares of common stock to Performance Realty upon receipt of the written notice of exercise of the option by Performance Realty. The shares were issued on September 28, 2015. On December 21, 2015, Performance Realty and American Realty agreed that this stock issuance constituted all compensation to be paid to Performance Realty in serving as manager of American Realty. Although Performance Realty is the manager of American Realty, the business and operations of American Realty are dictated by the Board of Directors of the Company in order to meet the requirements of serving as a REIT. On August 19, 2016, the Company and Performance Realty closed on its Stock Exchange Agreement dated August 1, 2016 resulting in 1,439,401 shares of common stock in the Company being conveyed to former members of Performance Realty as part of a restructuring of this related party.

We anticipate being involved in a variety of litigation.

Other than as set forth below, there are not presently any material pending legal proceedings to which the Company is a party or as to which any of its property is subject, and no such material proceedings are known to the Company to be threatened or contemplated against it. The Company is a defendant in a civil matter pending in San Joaqin County, California brought by a current shareholder - Ronald Trinchitella and Billie Jean Trinchitella TTEE Trinchitella Family Trust DTD 7/15/1999. The plaintiff was a member in American Realty prior to the Share Exchange Agreement with the Company was effectuated, as discussed above. The plaintiff is seeking rescission damages against American Realty, i.e. a return of his investment, on the premise that Performance Realty was required to honor his demand for redemption of his units when, according to American Realty, honoring the redemption was at the sole discretion of Performance Realty. The Company is a defendant by virtue of its relationship with American Realty. The Company has denied all allegations and is defending the case.

Although we have not been subject to any other litigation to date, we anticipate being involved in a range of court proceedings in the ordinary course of business as we continue to operate our business. These actions may include eviction proceedings and other landlord-tenant disputes, challenges to title and ownership rights (including actions brought by prior owners alleging wrongful foreclosure by their lender or loan servicer) and issues with local housing officials arising from the condition or maintenance of a property. While we intend to vigorously defend any non-meritorious action or challenge, no assurance can be given that we will not incur significant expense relating to these matters or that they will not require significant management attention and adversely affect us.

Although we consider ourselves an operating company following the acquisitions identified herein, we have limited operating history, so it will be difficult for potential investors to judge our prospects for success.

We have a limited operating history based solely on the financial history of American Realty through the reverse merger disclosed herein from which to evaluate our business and prospects. We have earned little to no revenue since inception. There can be no assurance that our future proposed operations will be implemented successfully or that we will ever have profits. If we are unable to sustain our operations, investors may lose their entire investment. The Company plans to increase significantly its expenditures on sales and marketing, technology and infrastructure, expand administrative resources to support the enlarged organization, maintain brand identity, broaden its customer support capabilities, and pursue strategic alliances. To the extent that revenues do not grow at anticipated rates or that increases in such operating expenses precede or are not subsequently followed by commensurate increases in revenues, the Company's business, results of operations and financial condition will be materially and adversely affected. There can be no assurance that the Company will achieve or sustain the substantial revenue growth needed in order to reach profitability.

We may experience potential fluctuations in results.

The Company's operating results may fluctuate significantly in the future as a result of a variety of factors, some of which are outside of the Company's control. These factors include: general economic conditions, specific economic conditions in the transportation industry, demand for transportation products/services, usage and growth of transportation products/services, seasonal sales trends, budget cycles of individual customers, the mix of products or services sold by the Company or the Company's competitors, lengthy sales cycles for Company's products or services, changes in costs of expenses or capital expenditures relating to the Company's expansion of operations, the introduction of new products or services by the Company or its competitors, change in the sales mix, distribution channels or pricing for the Company's products or services. In the future, strategic partners may require payments or other consideration in exchange for providing access to the Company's products or services. As a strategic response to a changing competitive environment, the Company may elect from time to time to make certain pricing, service or marketing decisions or acquisitions that could have a material adverse effect on its results.

| -12- |

The company's auditor has substantial doubts as to the Company's ability to continue as a going concern.

Our auditor's report on our 2015 and 2014 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. The Company has suffered recurring losses and generated negative cash flows from operations. These raise substantial doubt about our ability to continue as a going concern. The accompanying audited financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this uncertainty.

Because the Company has been issued an opinion by its auditors that substantial doubt exists as to whether the company can continue as a going concern, it may be more difficult for the company to attract investors. Our future is dependent upon our ability to obtain financing to continue operations and attain profitable operations. We will seek additional funds through private placements of our common stock. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence.

If we complete a financing through the sale of additional shares of our common stock in the future, or we acquire property through the issuance of shares of our common stock in the future, then shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. We might also incorporate the issuance of our common stock as consideration for the purchase of properties, such as in the case of the Manley transaction set forth above. Any sale of common stock, or issuance of our common stock as consideration for the purchase of property, will result in dilution of equity ownership to existing shareholders. This means that, if we sell shares of our common stock or issue stock as consideration for a purchase, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, or to expand our portfolio of properties we might issue shares of common stock as consideration, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

As of the date of this filing, we have earned revenue. However, we cannot guarantee we will be successful in continuing to generate revenue or be successful in raising funds through the sale of shares to pay for the Company's business plan and expenditures. Failure to generate revenue or to raise funds could cause us to go out of business, which would result in the complete loss of your investment.

Because we do not have an audit committee, shareholders will have to rely on the directors, who are not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. The board of directors as a whole performs these functions. The members of the Board of Directors are not independent. Thus, there is a potential conflict in that the board members are also engaged in management and participates in decisions concerning management compensation and audit issues that may affect management performance.

We have not developed independent corporate governance.

We do not presently have audit, compensation, or nominating committees. This lack of independent controls over our corporate affairs may result in conflicts of interest between our officers, directors and our stockholders. We presently have no policy to resolve such conflicts. As a result, our directors have the ability to, among other things, determine their own level of compensation. Until we comply with such corporate governance measures to form audit and other board committees in a manner consistent with rules of a national securities exchange, there is no assurance that we will not be subject to any conflicts of interest. As a result, potential investors may be reluctant to provide us with funds necessary to expand our operations.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an "emerging growth company."

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

| -13- |

As a public company, we are subject to the reporting requirements of the Exchange Act, and requirements of the Sarbanes-Oxley Act of 2002 ("SOX"). The cost of complying with these requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. SOX require that we maintain effective disclosure controls and procedures and internal controls over financial reporting. To maintain and improve the effectiveness of our disclosure controls and procedures, we must commit significant resources, may be required to hire additional staff and need to continue to provide effective management oversight. We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join the Company and to maintain appropriate operational and financial systems to adequately support expansion. These activities may divert management's attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. We cannot predict or estimate the amount of additional costs we may incur as a result of becoming a public company or the timing of such costs.

We will be obligated to develop and maintain proper and effective internal controls over financial reporting.

We may not complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may have one or more material weaknesses, which may adversely affect investor confidence in our company and, as a result, the value of our common stock.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls and attestations of the effectiveness of internal controls by independent auditors. We will be required to perform the annual review and evaluation of our internal controls no later than for the fiscal year ending January 31st on any given year. However, we initially expect to qualify as a smaller reporting company and as an emerging growth company, and thus, we would be exempt from the auditors' attestation requirement until such time as we no longer qualify as a smaller reporting company and an emerging growth company. We would no longer qualify as a smaller reporting company if the market value of our public float exceeded $75 million as of the last day of our second fiscal quarter in any fiscal year following this offering. We would no longer qualify as an emerging growth company at such time as described in the risk factor immediately below.

We are in the early stages of the costly and challenging process of compiling the system and processing documentation necessary to evaluate our internal controls needed to comply with Section 404. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to assert that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our common stock to decline.

We have not achieved profitable operations and continue to operate at a loss.

From incorporation to date, we have not achieved profitable operations and continue to operate at a loss. Our present business strategy is to improve cash flow by adding to our existing product line and expanding our sales and marketing efforts, including the addition of in-house sales personnel. There can be no assurance that we will ever be able to achieve profitable operations or that we will not require additional financing to fulfill our business plan.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our management team lacks significant public company experience, which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

| -14- |

Our profitability depends upon achieving success in our future operations through implementing our business plan, increasing sales, and expanding our customer and distribution bases, for which there can be no assurance given.

Profitability depends upon many

factors, including the success of the Company's marketing program, the Company's ability to identify and obtain the rights to additional

products to add to its existing product line, expansion of its distribution and customer base, maintenance or reduction of expense

levels and the success of the Company's business activities. The Company anticipates that it will continue to incur operating losses

in the future. The Company's ability to achieve profitable operations will also depend on its ability to develop and maintain an

adequate marketing and distribution system.

There can be no assurance that the Company will be able to develop and maintain adequate marketing and distribution resources. If adequate funds are not available, the Company may be required to materially curtail or cease its operations.

We are highly dependent on our directors and executive officers.

We depend heavily on our directors and executive officers, and more specifically, Mr. Howard and Mr. Zarinegar. Mr. Zarinegar has also personally guaranteed the debt of our wholly-owned subsidiary, American Realty, and its special purpose entities, ARP Borrower and ARP Borrower II, held by FirstKey. We have written board or executive agreements with these directors and officers. The loss of services of any of these personnel could impede the achievement of the Company's objectives. There can be no assurance that the Company will be able to attract and retain qualified executive or technical personnel on acceptable terms.

Our insurance policies may be inadequate and potentially expose us to unrecoverable risks.

On April 13, 2016, the Company secured executive and corporate securities liability coverage through XL Specialty Insurance Company. The limits are $1,000,000 maximum aggregate limit of liability each policy period (with an initial period of April 13, 2016 through April 13, 2017) for all loss from claims, investigation demands and interview. Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations. Insurance availability, coverage terms and pricing continue to vary with market conditions. We endeavor to obtain appropriate insurance coverage for insurable risks that we identify; however, we may fail to correctly anticipate or quantify insurable risks. Additionally, we may not be able to obtain appropriate insurance coverage, and insurers may not respond as we intend to cover insurable events that may occur. We have observed rapidly changing conditions in the insurance markets relating to nearly all areas of traditional corporate insurance. Such conditions have resulted in higher premium costs, higher policy deductibles, and lower coverage limits. For some risks, we may not have or maintain insurance coverage because of cost or availability.

We have no dividend history.

We have never paid dividends on or in connection with our common stock. In connection with our intention to operate as a REIT in the future, we intend on issuing dividends to common stockholders, but have not done so to date. Ownership of our common stock has not provided dividend income to the holder, and holders should not rely on investment in our common stock for dividend income, unless we are able to issue dividends in operating as a REIT in the future. Any increase in the value of investment in our common stock could come only from a rise in the market price of our common stock, which is uncertain and unpredictable, and there can be no guarantee that our stock price will rise to provide any such increase.

We face competition from established as well as other emerging companies, which could divert customers to our competitors and significantly reduce our revenue and profitability.

We expect existing competitors and new entrants to the market to constantly revise and improve their business models in response to challenges from competing businesses, including ours. If these or other participants introduce changes or developments that we cannot meet in a timely or cost-effective manner, our revenue and profitability could be reduced. In addition, consolidation among our competitors may give them increased negotiating leverage and greater marketing resources, thereby providing corresponding competitive advantages over us. Consolidation among other companies may increase competition from a small number of very prominent companies in the market place. If we are unable to compete effectively, competitors could divert our customers away from our products.

Regulations, including those contained in and issued under the Sarbanes-Oxley Act of 2002 ("SOX") and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank"), increase the cost of doing business and may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our common stock.

| -15- |

We are subject to the reporting obligations under the Exchange Act. We are a publicly reporting company. The current regulatory climate for publicly reporting companies, even small and emerging growth companies such as ours, may make it difficult or prohibitively expensive to attract and retain qualified officers, directors and members of board committees required to provide for our effective management in compliance with the rules and regulations which govern publicly-held companies, including, but not limited to, certifications from executive officers and requirements for financial experts on boards of directors. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. For example, the enactment of the Sarbanes-Oxley Act of 2002 has resulted in the issuance of a series of new rules and regulations and the strengthening of existing rules and regulations by the SEC. Further, recent and proposed regulations under Dodd-Frank heighten the requirements for board or committee membership, particularly with respect to an individual's independence from the corporation and level of experience in finance and accounting matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business could be adversely affected.

If we are unable to obtain adequate insurance, our financial condition could be adversely affected in the event of uninsured or inadequately insured loss or damage. Our ability to effectively recruit and retain qualified officers and directors could also be adversely affected if we experience difficulty in obtaining adequate directors' and officers' liability insurance.

We have officer and director liability insurance or general liability insurance for our business, as set forth above, i.e. policy with XL Specialty Insurance Company. We may be unable to maintain sufficient insurance to cover liability claims made against us or against our officers and directors. If we are unable to adequately insure our business or our officers and directors, our business will be adversely affected and we may not be able to retain or recruit qualified officers and directors to manage the Company.

Limitations on director and officer liability and our indemnification of our officers and directors may discourage stockholders from bringing suit against a director.

Our Certificate of Incorporation and By-Laws provide, with certain exceptions as permitted by Maryland law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, our Certificate of Incorporation and By-Laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, or persons controlling the registrant, the Company has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is therefore unenforceable.

Our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

Our culture is important to us, and we anticipate that it will be a major contributor to our success. As we grow, however, we may have difficulty maintaining our culture or adapting it sufficiently to meet the needs of our operations. Failure to maintain our culture could negatively impact our operations and business results. Additionally, expansion increases the complexity of our business and places a significant strain on our management, operations, technical performance, financial resources and internal control over financial reporting functions.

There can be no assurance that we will be able to manage our expansion effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel in multiple geographic locations. We may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

We cannot assure that our marketing and sales efforts will be successful.

Management believes that its marketing and development programs will sustain the business. Additionally, we intend to invest substantial financial resources in the marketing and sales of our business concept. We cannot assure you that our marketing and sales efforts will be successful and that we will be able to capture sufficient market share to realize our financial projections.

The Company's operating results may fluctuate significantly from period to period as a result of a variety of factors, including purchasing patterns of customers, competitive pricing, debt service and principal reduction payments, and general economic conditions. There is no assurance that the Company will be successful in marketing any of its products, or that the revenues from the sale of such products will be significant. Consequently, the Company's revenues may vary by quarter, and the Company's operating results may experience fluctuations.

| -16- |

We cannot assure that acceptance of products and services will be successful. There is no assurance that customers will accept our product offer. Risks of borrowing might adversely impact us.

If the Company incurs additional indebtedness, a portion of its cash flow will have to be dedicated to the payment of principal and interest on such indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair the Company's operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of members of the Company. A judgment creditor would have the right to foreclose on any of the Company's assets resulting in a material adverse effect on the Company's business, operating results or financial condition.

Changes in or missteps in the execution of our business plan may adversely impact operations.

The Company's business plans may

change significantly. Many of the Company's potential business endeavors are capital intensive and may be subject to statutory

or regulatory requirements. Management believes that the Company's chosen activities and strategies are achievable in light of

current economic and legal conditions with the skills, background, and knowledge of the Company's principals and advisors. Management

reserves the right to make significant modifications to the Company's stated strategies depending on future events.

Need for Future Funding.

The Company anticipates that its existing capital resources, together with the net proceeds from the sale of its stock under any future prospectus, interest earned thereon and expected future revenues will enable it to maintain its current operations into the first quarter of 2016. There can be no assurance that the Company will be able to develop, produce or market products or services on a profitable basis. The Company may have underestimated the costs necessary to achieve sustainable revenues. The Company will need to raise additional funding thereafter in order to continue operations. No party is obligated to provide financing to the Company. It is possible that such external financing may not be obtainable. No assurances can be given that the Company will be able to raise cash from additional financing efforts and, even if such cash is raised, that it will be sufficient to satisfy the Company's anticipated capital requirements, or on what terms such capital will be available. Future equity financing is likely to result in ownership dilution to existing investors. If the Company is unable to obtain sufficient funds from future financings, the Company will need to curtail certain development efforts and operating plans, which would have a material adverse effect on its business, results of operations and financial condition.

Changes in laws or regulations may adversely impact our business.

National, regional and local governments may enact laws that we may be subject to that may adversely impact our operations. In particular, we will be required to comply with certain SEC, state and other legal requirements. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied could have a material adverse effect on our business and results of operations.

A downturn in general economic conditions could cause adverse consequences for the Company operations.

The financial success of the Company may be sensitive to adverse changes in general economic conditions in the United States, and any States in which we do business, such as recession, inflation, unemployment, and interest rates. Such changing conditions could reduce demand in the marketplace for the Company's services and products. Management believes that the impending growth of the market, mainstream market acceptance and the targeted product line of the Company will insulate the Company from excessive reduced demand. Nevertheless, the Company has no control over these changes.

We have not obtained an opinion of counsel as to the tax treatment of certain material federal tax issues potentially affecting the Company, the management, and/or the shareholders, as set forth herein as an exhibit, however, the opinion provided as an exhibit herein does not constitute a full comprehensive opinion on all tax-related matters.

Moreover, any such opinion, if we obtained one, would not be binding upon the IRS, and the IRS could challenge our position on such issues. Also, rulings on such a challenge by the IRS, if made, could have a negative effect on the tax results of ownership of the Company's securities.

| -17- |

Dependence on Strategic Relationships.

The Company believes that its success in penetrating markets for its investment and services will depend in part on its ability to develop and maintain strategic relationships, such as those relationships with American Realty, Performance Realty and AHIT Valfre. The Company further believes that such relationships are important in order to expand the functionality of the Company's services and products. No assurance can be given that the Company will be successful in entering into any strategic alliances on acceptable terms or, if any such strategic alliance is entered into, that the Company will realize any anticipated benefits from it, or at all. In addition, the alliance of strategic partners with competitors, or the termination of one or more successful relationships, could have a material adverse effect on the Company's business, results of operations and financial condition.

Dependence on Key Personnel.

The Company's success significantly depends on reputation and the continued services of the Company's key management; more specifically, the employment of Sean Zarinegar pursuant to the terms of his employment agreement discussed above. The Company intends to maintain a key man life insurance on Mr. Zarinegar. There is no assurance that the Company will be able to insure the aforementioned employee or that such amount will be adequate to compensate the Company in event of his death. The loss of this individual or other key personnel would likely harm the Company's business.