Form N-CSRS Northern Lights Fund For: Oct 31

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21720

Northern Lights Fund Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 4/30

Date of reporting period: 10/31/20

Item 1. Reports to Stockholders.

| |

| Semi-Annual Report | |

| October 31, 2020 | |

| CMG MAULDIN CORE FUND | |

| CLASS A SHARES – GEFAX | CLASS I SHARES – GEFIX |

| CMG TACTICAL BOND FUND | |

| CLASS A SHARES – CHYAX | CLASS I SHARES - CHYOX |

| CMG TACTICAL ALL ASSET STRATEGY FUND | |

| CLASS A SHARES – CMGQX | CLASS I SHARES - CMGHX |

| 1-866-CMG-9456 | |

| www.cmgmutualfunds.com | |

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of CMG Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. | |

| Distributed

by Northern Lights Distributors, LLC Member FINRA | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.cmgmutualfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

Dear Shareholder,

The purpose of this letter is to review performance, provide a comparison of performance vs. appropriate benchmarks, and discuss our outlook for the CMG Mauldin Core Fund, the CMG Tactical All Asset Strategy Fund and the CMG Tactical Bond Fund.

CMG Mauldin Core Fund

The Fund returned +3.41% (Class A Shares) and +3.48% (Class I Shares) over the past six months (May 1, 2020 through October 31, 2020), net of fees. The Morningstar Tactical Allocation Category, the Fund’s peer group, returned +7.61% over the past six months (May 1, 2020 through October 31, 2020). The benchmark for the Fund, the Morningstar Moderate Target Risk Index, returned +8.81% over the past six months (May 1, 2020 through October 31, 2020).

The Fund began the second quarter of 2020 in a conservative risk position after reducing risk in February ahead of the sharp market decline in March. The market crash in response to the coronavirus pandemic dramatically reversed technical and fundamental market indicators that were, just a couple months earlier, signaling a bullish year for equities.

The Fund was positioned as follows at the beginning of May: 27.44% equities, 65.47% fixed income, 6.78% commodities and 0.31% cash. Equity positions were allocated as follows: 73.40% U.S. equities, 19.85% international developed and 6.75% emerging market equities. Fixed income holdings were still predominately in ultrashort bonds (80.44% of the portfolio’s fixed income allocation) with long and intermediate government bonds accounting for the next two largest allocations at 11.36% and 8.20%, respectively.

After the crash in March, equity markets rebounded sharply in April, setting off a rally that continued through the second and into the third quarter. Unprecedented support by the Federal Reserve and a historic amount of fiscal stimulus put a floor under equity markets while at the same time driving bond yields lower. The Fund added risk exposure slowly in April and May while also taking more credit and duration risk in the portfolio’s fixed income holdings. The Fund reduced domestic equity positions in favor of holdings in German equities while also adding modestly to a diversified emerging markets position. The Fund’s fixed income positions held steady through April, favoring ultrashort duration, intermediate and long government bonds over riskier credits. In May, ultrashort bonds were reduced in favor of long government bonds and a small allocation to corporate bonds. The Fund further added risk to its fixed income positions, again reducing ultrashort duration positions in favor of corporate, high yield, emerging market and world bonds. The Fund also increased its allocation to long government bonds. The Fund also increased and diversified its equity positions in May and June. By the end of the quarter, the Fund had doubled its equity exposure (from previous quarter-end). Domestic equity positions, primarily in large caps, still accounted for the overwhelming majority of equity exposure but by June, the portfolio held some small cap and emerging market exposure.

The Fund began the third quarter in a moderate risk position and remained similarly positioned throughout the quarter. Equity markets continued to recover and trend higher while bond markets remained strong, backed by

1

the strong tailwind of accommodative Fed policy. The Fund’s equity allocation reached the highest level since February. Although the portfolio embraced more risk, fixed income holdings outweighed equities and bonds remained attractive from a risk-reward standpoint, especially against a backdrop of ultra-accommodative central bank policy. The asset class mix of the portfolio remained consistent throughout the quarter, but the underlying mix of equity and fixed income funds adapted to a change in investor preferences over the past several months. Specifically, domestic equities were reduced from 86% in June to 68% in September, reflecting the relative slowdown of the U.S. recovery as compared to Asia and Europe. The U.S. has had one of the least effective health policy responses to the pandemic and, although the Fed and fiscal stimulus helped stave off a greater decline in GDP earlier in the year, the economy looked to be running on fumes. In this context, Asia and Europe looked comparatively better. The Fund’s equity holdings reflected this change in sentiment and, while international developed positions remained roughly 8% (of equity exposure) throughout the quarter, emerging market exposure increased significantly to 23% of the Fund’s total equity exposure by the end of the third quarter, the highest level since January 2019.

The mix of fixed income positions in the portfolio also reflected an increased risk appetite, especially early in the quarter. Ultrashort bond holding reached a peak of 80% of the Fund’s fixed income holdings in March and April but bottomed out during July and August at around 30% before rising back to 56% in reaction to the market decline in September. Nonetheless, the reduction in short duration bond positions reflects the market appetite for increased risk with the reallocation out of short duration bonds going to high yield bonds in July and August.

After dropping slightly in the second quarter, commodity exposure increased in the third quarter. The Fund’s commodity exposure has been almost exclusively in gold over the past six months ended October 31, 2020 holding between 4-8% in gold related funds. Gold, continues to perform well as investors seek portfolio diversification to offset potential tail risks like currency devaluations. Specifically, the U.S. dollar, which historically has been inversely correlated to the price of gold, will likely continue to be under pressure during the economic recovery.

As the budget deficit has exploded, the Fed’s printing press has many investors, domestic and foreign, concerned and seeking exposure to gold. We believe that gold can and will continue to play a meaningful role in the portfolio as a number of macroeconomic factors (including massive monetary and fiscal stimulus, pressure on currencies and global trade and low bond yields) support further price appreciation. The Fund also added exposure to a basket of commodities, particularly energy. Oil prices remain range bound but well off the lows from the year and could be further helped by dollar weakness.

At end of October, the Fund remained in a moderate risk position and was allocated as follows: 47.16% equities, 46.36% fixed income, 5.02% commodities, and 1.47% cash. Equity positions were allocated as follows: 68.20% U.S. equities, 13.17% international developed, and 18.62% emerging market equities. Fixed income holdings were still predominately in ultrashort bonds (61.79% of the portfolio’s fixed income allocation) with long government bonds and corporate bonds accounting for the next two largest allocations at 26.06% and 6.47%, respectively.

CMG Tactical All Asset Strategy Fund

The Fund returned +2.93% (Class A Shares) and +2.93% (Class I Shares) over the past six months (May 1, 2020 through October 31, 2020), net of fees. The Morningstar Multialternative Category, the Fund’s peer group,

2

returned +3.20% over the past six months (May 1, 2020 through October 31, 2020). The benchmark for the Fund, the Morningstar Moderate Target Risk TR Index, returned +8.81% over the past six months (May 1, 2020 through October 31, 2020).

The Fund began the second quarter of 2020 in an extremely conservative risk position with zero exposure to equities. During the market crash in the first quarter, the Fund moved entirely to fixed income and gold. As equity markets responded to fiscal and monetary stimulus, the Fund slowly added risk exposure over the quarter. In April, the Fund was primarily allocated to ultrashort duration bonds, long government bonds and gold. In May, the portfolio increased risk, rotating out of ultrashort duration bonds and into investment grade corporate bonds, mortgage backed securities and equities, specifically, healthcare and large caps. The Fund continued to add risk to the portfolio in June, further adding equity exposure. The portfolio held positions in technology and large caps. The fixed income allocations also reflected an increased appetite for risk, adding exposure to convertible bonds and longer duration government bonds at the expense of a reduction in ultrashort bonds. The Fund’s holdings in technology funds and its position in gold were strong contributors to positive performance, particularly at the end of the quarter and into July.

The Fund began the third quarter conservatively positioned but quickly added equity risk in early July. The portfolio shifted out of short and intermediate government bonds, reallocating in favor of technology and gold miner positions. As equity markets trended higher in July and August, the Fund was able to capture upside due to increased equity exposure. The Fund has held gold-related positions for much of the year and in August increased that exposure in two ways: increasing exposure in gold to 20% of the portfolio while also adding a position in gold miners. Fixed income exposure, early in the quarter also signaled an increased appetite for risk as holdings in government bonds were moved to corporate bonds. In September, the Fund was positioned in technology, transportation, consumer discretionary, and emerging markets equities, reflecting the increased risk appetite of the overall market entering the month. Bond exposure was diversified across international developed and emerging bonds and long government bonds and helped offset declines in the equity portion of the portfolio. The Fund continued to overweight equity exposure in October, holding a diversified mix of utilities, technology and emerging market positions. Fixed income holdings were allocated across convertible, international and emerging market bond funds. Gold, despite strong performance throughout the year, was a drag on performance as prices pulled back from multi-year highs after reaching $2,000/ounce. However, equity markets peaked and then drew down in September as negotiations over fiscal stimulus stalled. Although the Fund trended down with the market due to its increased equity exposure in September, most of those positions rebounded nicely in October and have continued to perform well through November.

CMG Tactical Bond Fund

The Fund returned -1.28% (Class A Shares) over the past six months (May 1, 2020 through October 31, 2020) and -0.82% (Class I Shares) over the past six months (May 1, 2020 through October 31, 2020), net of fees. The Morningstar Nontraditional Bond Category, the Fund’s peer group, returned +6.00% over the past six months (May 1, 2020 through October 31, 2020). The benchmark for the Fund, the Bloomberg Barclays U.S. Corporate High Yield Bond Index, returned +10.83% over the past six months (May 1, 2020 through October 31, 2020).

3

The Fund began the second quarter of 2020 in a defensive position after a difficult first quarter for high yield bonds. The Fund moved back into high yield bonds in June and remained invested for the balance of the quarter. The Fed relieved pressure on corporate debt markets, announcing a range of liquidity programs at the end of the first quarter. In some cases, the Fed was buying ETFs, including high yield bond ETFs seeking to provide liquidity and avoid the large dislocations that occurred during the worst moments of panic selling in March. For example, the iShares iBoxx Investment Grade Corporate Bond ETF traded at a 5% discount to NAV, the widest spread since 2008. Investors who were selling into that market were receiving 5% less than the actual value of the underlying bonds due to a liquidity mismatch (the ETF trades while the underlying bonds do not). The Fed stepped in to prevent contagion to credit markets. If investment grade bonds could trade that wide, the risk to lesser credits like high yield bonds was dangerously severe. The resulting impact has been a rally in high yield bonds, back to spreads that mask the underlying economic risk to the bond issuers. Much of that rally occurred in just a few trading days after the Fed announced its interventions. While this strategy can pay off in the short term, the Fed risks attempting to prop up the entire credit market if an economic recovery does not pick up steam. High yield bonds’ prices reflect this rose colored view as spreads have come back down to levels more indicative of a stable economic expansion.

The Fund began the third quarter invested in high yield bonds. July was a particularly strong month for high yields and the strategy was able to capture significant upside, posting its strongest monthly return for the year. The high yield rally stalled out in August, barely posting a positive return. After a strong second quarter across most asset classes a pullback was expected, especially heading into what is historically the most difficult period for markets. In September, high yield bonds declined modestly dragged down along with equity markets fretting about additional economic stimulus. As a result, the Fund moved out of high yields and into a defensive position in early September. High yields rebounded late in the month and, by early October, the Fund was again invested in high yield bonds.

Since high yield spreads spiked to 1,100 bps in March, the second widest spread in history, spread levels have continued to tighten, coming back to levels we’ve seen over the past couple of years. At 500-600 bps over Treasuries, high yield bonds continue to lure investors seeking additional yield from their fixed income portfolios. This appetite for yield, combined with a Fed bond buying backstop, will likely limit short-term drawdowns in the near future as investors are keen to “buy the dips.” However, there are some interesting cross-currents in the market with respect to issuance and default rates.

In September, annual issuance in the primary high yield bond market reached a new annual record. Issuance reached $339 billion, surpassing the previous annual record set in 2012. A larger part of new issuance this year has been for refinancing purposes, as companies are preparing for the worst by getting ahead of upcoming maturities and moving their debt further out in time. While many companies are refinancing, on the other end of the high yield spectrum we’re starting to see an uptick in defaults. Historically, default cycles typically peak about a year after a big blow out in spreads like we had in March. Default rates in March were just under 5% but in August the rate hit 8.7%. History would suggest that we are still several months away from a peak in defaults. The divergence within the high yield market is indicative of the larger economy: some sectors, such as technology, are thriving while others, such as service and hospitality or energy, are barely hanging on. For those barely hanging on, two factors will play an additional role that is likely to drive the default rate higher: a second wave of COVID-19 and a lack of or undersized stimulus. Just when high yields claw their way back to break even, it appears that there are more storm clouds on the horizon.

4

Market Outlook

Bar Rescue and Restaurant Impossible

Jon Taffer knows about bars. He’s been in the bar, restaurant, and club business since the early 70’s and Taffer is also credited for creating the NFL’s Sunday Ticket, a pay programming package that has helped bars attract patrons and boost revenues. Taffer is most famous for his television show “Bar Rescue,” which much like restaurant-themed shows from Chef Robert Irvine (“Restaurant Impossible”) and Chef Gordon Ramsey (“Kitchen Nightmares”), tells the story of a turnaround in a failing business. Given the state of the restaurant and hospitality business during the pandemic, I imagine that Mr. Taffer is receiving more than his normal volume of requests for help. On the show, Taffer brings his strong personality, tough love based on a reality-based view of the world and industry best practices to struggling business owners. His recent observations on the bar and restaurant sector are troubling: the economics of running a bar or restaurant can’t work at the reduced capacity levels caused by the pandemic and many owners are better off temporarily closing down than bleeding money. Furthermore, he doesn’t believe that the situation is going to change barring a vaccine. In his estimation, a solid 30% of people will not go out until there is certainty, which means a widely distributed vaccine. At 70% capacity, the economics simply don’t work for most bar and restaurant owners.

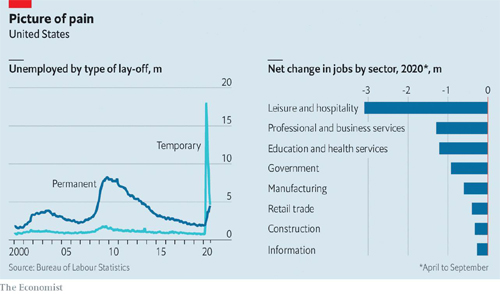

While the retail sector suffered during the early months of the pandemic in the spring, companies with strong e-commerce strategies have managed to adapt. For bars and restaurants, the closest equivalent is takeout and, while takeout business is helping some businesses to survive, many are just barely hanging on. Moreover, as we head into the fall and winter, businesses that were able to use outdoor seating will no longer have that option available. Additional stimulus is needed across most of the economy to buy more time for additional therapeutics and, ultimately, a vaccine, but for bars, restaurants, and the leisure and hospitality businesses, it cannot come soon enough. The chart below shows how the sector has been disproportionately impacted by the pandemic, easily outpacing the rest of the economy in job losses. Those lay-offs have been temporary in most cases but, as the pandemic grinds on and positive cases increase, many of those lay-offs will become permanent. In the past several weeks alone, airlines have announced another 30,000 job cuts, Disney is planning 28,000 lay-offs and movie theaters, led by Regal Cinemas, which announced it plans to close most of its largest theaters, are fighting an existential crisis as they seek to adapt to a new world.

5

Macroeconomic Tasseomancy

While stocks continue to hover around their highs of the year, the disconnect between Wall Street and Main Street has widened. Equity markets have been buoyed by aggressive Fed policy and low interest rates and, although accommodative policy combined with the CARES Act earlier this year helped Main Street, the disconnect in economic fundamentals raises questions about the sustainability of the market rally that started in April. The first quarter was likely the trough for most economies including the U.S. market but the recovery, much like after the financial crisis a decade ago, is stalling out. There is reason for optimism that the worst is possibly behind us but, without better policies to contain the pandemic and more economic stimulus, the recovery will be longer and more difficult. A quick look at the some of the most recent vital signs for the economy should sound alarm bells for investors and begs the question: are Wall Street and the stock market correctly predicting a rebound or do the fundamentals on Main Street signal a more difficult period ahead? Let’s read some of the tea leaves.

| ● | The IMF forecasts that, by the end of 2020, global output will be 8% lower than it would have been without the pandemic, reflecting the difference in a forecast of +3% growth vs. a -5% decline. To put this in perspective, the global economy declined by -0.1% during the financial crisis in 2009. |

| ● | The World Bank forecasts that 89 million people will be pushed into extreme poverty, a rise of 15%. |

| ● | The second quarter saw the lowest level of workforce participation amongst Americans aged 25-54 in 50 years. One-sixth of young people worldwide lost their jobs. |

| ● | Mortgage delinquencies reached a 21-year high in July as the 120-day delinquency rate hit 1.4%. The 90-day delinquency rate hit 4.1%, up from 1.3% for the same period last year and highest level since 2014. All 50 states saw an uptick. |

6

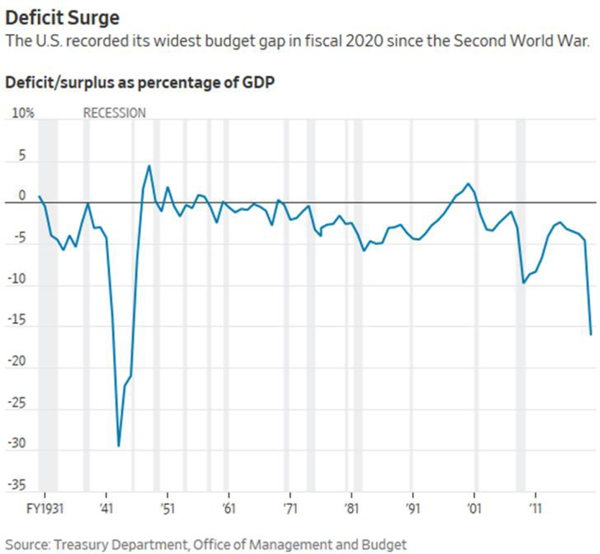

| ● | The U.S. budget deficit hit a record $3.1 trillion in September, representing 16.1% of economic output, the largest percentage since 1945. Federal debt represented 102% of GDP, a level not seen for over 70 years. Although the Fed’s aggressive policies have kept interest rates down, sustaining this level of spending and accommodation will put pressure on the dollar down the road. |

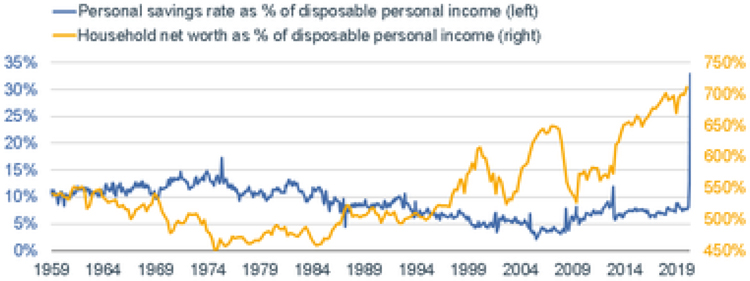

| ● | The personal savings rate hit 33% in early 2020, illustrating American’s uncertainty about the near future. Many recipients of stimulus checks have been able to get through the spring and summer but are concerned about the next several quarters. Mortgage forbearance and moratoriums on evictions could also be a factor here as unemployed Americans are saving money and/or using it to live day-to-day but may ultimately have to be use those funds to catch up on payments. Conversely, if the pandemic slows or a vaccine is available, there is a lot of dry powder available, in savings and investment accounts, that could push consumer spending and equity markets higher. |

7

| * | Source: Charles Schwab, Bloomberg, BEA, Federal Reserve. Personal savings rate as of 4/30/20. Household net worth as of 12/31/2019. |

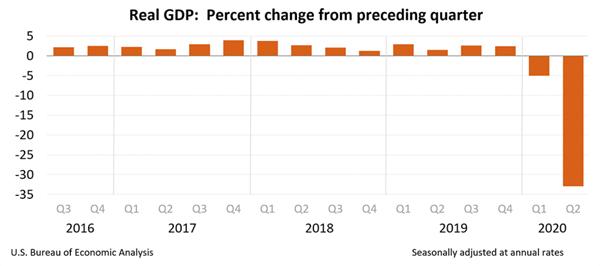

| ● | U.S. GDP declined at an annual rate of 31.4% in the second quarter 2020. The U.S. economy has never shrunk by more than 10% on an annualized basis in any quarter since World War II (when the government started keeping track). The third quarter is expected to expand by approximately 25%. Consumer spending and business investment contracted by over 30% in the spring, both record declines. While the economy is showing signs of recovery, it is likely to be slower than expected as the second and third waves of the pandemic emerge in Europe and the U.S. (see more below). |

Reopening Catch-22

Reopening has created optimism about the economic recovery but, as of the time of this writing, as the school year has started and we head into the fall, cases are rising across Europe and the U.S., forcing governments to lockdown again. After managing the spread of the virus relatively well after the initial outbreak, Europe is facing

8

a quickly rising second wave and, with the exception of Germany, most European countries are imposing wide-ranging lockdowns again. The outbreak in Europe was a harbinger for the U.S. in the spring and the current outbreak looks like an omen again. The U.S. is facing a third wave of rising infections with just a handful of states showing declining cases. The daily number of cases is breaking daily highs from earlier in the year. While lockdowns were effective at slowing the spread of the virus earlier in the year, a second wave of lockdowns without a comprehensive strategy for testing and tracing outbreaks seems absurd. Unfortunately, on both sides of the Atlantic, governments have fallen woefully short. The result is that the economic recovery is undercut by the inadequacy of each government’s response. The situation looks even more troubling when compared to Asia where aggressive testing and tracing policies have kept daily cases low.

Each subsequent wave and missed opportunity to take the necessary steps to control outbreaks is straining the mental health of citizens across the globe. In our view it makes absolutely no sense to buy more time by stimulating the economy and locking down areas if there is no strategy for how that extra time will be used to make our policies more effective. Hoping the virus will go away or a vaccine will be available and distributed soon is not a strategy and will lead to further economic pain and a likely market pullback, or something worse. The good news is that we know more about the virus and how to treat it than six months ago and despite the rising number of positive cases, we are likely to see fewer deaths.

Resilient Portfolios for Uncertain Times

For investors trying to make heads or tails of the market, we believe it’s important to fall back on two principles: diversification and patience. Investors with long horizons should try to avoid chasing a market due to a fear of missing out where a handful of stocks (i.e., FAANG stocks) are creating the impression of a raging bull market. Assessing the market based on an equal-weighted index tells a dramatically different story as most investors are not invested in just five stocks. Having a plan and being patient enough to stick to it should help most investors avoid emotional whiplash and withstand the volatility of markets driven by irrational positive (i.e., good clinical trial or stimulus is coming) and negative (i.e., side effects of a bad clinical trial and no stimulus is coming) sentiments. To facilitate that patience, we believe that investors should remain well diversified across stocks, bonds, and commodities, especially gold. Furthermore, investor portfolios should blend active with passive strategies seeking to facilitate automatic de-risking of portfolios during sell-offs. By reducing overall portfolio volatility, investors are more likely to manage emotions and stay on plan. We think an open mind and a well-diversified portfolio is more important than ever as we expect the next several quarters to be extremely challenging.

Kindest regards,

PJ Grzywacz

President

November 30, 2020

8181-NLD-12/3/2020

9

Additional Index Disclosure: The Bloomberg Barclays U.S. Corporate High Yield Bond Index: The Bloomberg Barclays U.S. Corporate High Yield Bond Index is an unmanaged index that covers the universe of fixed-rate, noninvestment grade debt. The Morningstar Moderate Target Risk Index: The Moderate Target Risk Index is a rules-based index based on a well-established asset allocation methodology from Ibbotson Associates, a Morningstar company. The index seeks to provide both capital appreciation and income. This index tends to hold larger positions in stocks than conservative-allocation portfolios. The index typically has 50-70% of assets in equities. The index is rebalanced annually. The Morningstar Multialternative Category: The Multialternative Category contains funds that offer investors exposure to several different alternative investment tactics. Funds in this category have a majority of their assets exposed to alternative strategies. An investor’s exposure to different tactics may change slightly over time in response to market movements. Funds in this category include both funds with static allocations to alternative strategies and funds tactically allocating among alternative strategies and asset classes. The gross short exposure is greater than 20%. The Morningstar Nontraditional Bond Category: The Nontraditional Bond Category contains funds that pursue strategies divergent in one or more ways from conventional practice in the broader bond-fund universe. Many funds in this group describe themselves as “absolute return” portfolios, which seek to avoid losses and produce returns uncorrelated with the overall bond market; they employ a variety of methods to achieve those aims. Another large subset are self-described “unconstrained” portfolios that have more flexibility to invest tactically across a wide swath of individual sectors, including high-yield and foreign debt, and typically with very large allocations. Funds in the latter group typically have broad freedom to manage interest-rate sensitivity, but attempt to tactically manage those exposures in order to minimize volatility. The category is also home to a subset of portfolios that attempt to minimize volatility by maintaining short or ultra-short duration portfolios, but explicitly court significant credit and foreign bond market risk in order to generate high returns. Funds within this category often will use credit default swaps and other fixed income derivatives to a significant level within their portfolios. The Morningstar Tactical Allocation Category: The Tactical Allocation Category contains funds that seek to provide capital appreciation and income by actively shifting allocations across investments. These funds have material shifts across equity regions, and bond sectors on a frequent basis. To qualify for the tactical allocation category, a fund must have minimum exposures of 10% in bonds and 20% in equity. Next, a fund must historically demonstrate material shifts in sector or regional allocations either through a gradual shift over three years or through a series of material shifts on a quarterly basis. Within a three year period, typically the average quarterly changes between equity regions and bond sectors exceeds 15% or the difference between the maximum and minimum exposure to a single equity region or bond sector exceeds 50%.

10

| CMG Mauldin Core Fund |

| PORTFOLIO REVIEW (Unaudited) |

| October 31, 2020 |

| Annualized Total Returns as of October 31, 2020 | ||||||||

| Annualized Since | ||||||||

| CMG Mauldin Core Fund: | Six Months | One Year | Five Year | Inception * | ||||

| Class A | ||||||||

| Without sales charge | 3.41% | (0.86)% | 1.00% | 2.11% | ||||

| With sales charge | (2.50)% | (6.55)% | (0.19)% | 1.30% | ||||

| Class I | 3.48% | (0.62)% | 1.22% | 2.34% | ||||

| MSCI AC World Index Gross | 13.88% | 5.42% | 8.70% | 7.85% | ||||

| Morningstar Moderate Target Risk TR Index | 8.81% | 4.52% | 6.95% | 6.08% | ||||

| * | Class A and Class I shares commenced operations on May 15, 2013. |

The MSCI All Country World Index is a free float-adjusted market capitalization weighted equity index designed to measure the performance of equities in developed and emerging markets. Investors cannot invest directly in an index or benchmark.

The Morningstar Moderate Target Risk Index is a rules-based index based on a well-established asset allocation from Ibbotson Associates, a Morningstar company. The index seeks to provide both capital appreciation and income. This index tends to hold larger positions in stocks than conservative-allocation portfolios. The index typically has 50-70% of assets in equities. The index is rebalanced annually.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions, if any. Class A shares are subject to a sales charge of 5.75% imposed on purchases. The Fund’s total annual operating expenses, including underlying funds, are 1.89% for Class A and 1.65% for Class I per the Fund’s prospectus dated August 28, 2020. The performance data does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions, if any, or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-866-CMG-9456.

| Portfolio Composition as of October 31, 2020 (Unaudited) | ||||

| Percent of | ||||

| Net Assets | ||||

| Exchange Traded Funds: | 100.0 | % | ||

| Equity Funds | 47.9 | % | ||

| Debt Funds | 47.0 | % | ||

| Commodity Fund | 5.1 | % | ||

| Short-Term Investments | 1.5 | % | ||

| Liabilities In Excess of Other Assets | (1.5 | )% | ||

| Total | 100.0 | % | ||

Please refer to the Portfolio of Investments in this semi-annual report for a detailed listing of the Fund’s holdings.

11

| CMG Tactical Bond Fund |

| PORTFOLIO REVIEW (Unaudited) |

| October 31, 2020 |

| Annualized Total Returns as of October 31, 2020 | ||||||||

| Annualized Since | ||||||||

| CMG Tactical Bond Fund: | Six Months | One Year | Five Year | Inception * | ||||

| Class A | ||||||||

| Without sales charge | (1.28)% | (0.91)% | 1.77% | 0.94% | ||||

| With sales charge | (6.97)% | (6.60)% | 0.58% | (0.16)% | ||||

| Class I | (0.82)% | (0.29)% | 2.24% | 1.61% | ||||

| Bloomberg Barclays US Corporate High Yield Index | 10.83% | 3.49% | 6.32% | 4.90% | ||||

| * | Class I shares commenced operations on October 6, 2014. Class A shares commenced operations on May 29, 2015. Barclays U.S. Corporate High Yield Index since inception performance is as of October 6, 2014. |

The Barclays U.S. Corporate High Yield Index is a market value-weighted index which covers the U.S. non-investment grade fixed-rate debt market. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions, if any. Class A shares are subject to a sales charge of 5.75% imposed on purchases. The Fund’s total annual operating expenses, including underlying funds, are 2.13% for Class A and 1.72% for Class I per the Fund’s prospectus dated August 28, 2020. The performance data does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions, if any, or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-866-CMG-9456.

| Portfolio Composition as of October 31, 2020 (Unaudited) | ||||

| Percent of | ||||

| Net Assets | ||||

| Exchange Traded Funds: | 95.0 | % | ||

| Short-Term Investments | 23.7 | % | ||

| Liabilities In Excess of Other Assets | (18.7 | )% | ||

| Total | 100.0 | % | ||

Please refer to the Portfolio of Investments in this semi-annual report for a detailed listing of the Fund’s holdings.

12

| CMG Tactical All Asset Strategy Fund |

| PORTFOLIO REVIEW (Unaudited) |

| October 31, 2020 |

| Annualized Total Returns as of October 31, 2020 | ||||||||

| Annualized Since | ||||||||

| CMG Tactical All Asset Strategy Fund: | Six Months | One Year | Three Year | Inception * | ||||

| Class A | ||||||||

| Without sales charge | 2.93% | (5.19)% | (2.56)% | (0.14)% | ||||

| With sales charge | (2.97)% | (10.64)% | (4.46)% | (1.44)% | ||||

| Class I | 2.93% | (4.94)% | (2.29)% | 0.11% | ||||

| Morningstar Moderate Target Risk TR Index | 8.81% | 4.52% | 5.46% | 7.37% | ||||

| * | Class A and Class I shares commenced operations on May 2, 2016. |

The Morningstar Moderate Target Risk Index is a rules-based index based on a well-established asset allocation methodology from Ibbotson Associates, a Morningstar company. The index seeks to provide both capital appreciation and income. This index tends to hold larger positions in stocks than conservative-allocation portfolios. The index typically has 50-70% of assets in equities. The index is rebalanced annually. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions, if any. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. Class A shares are subject to a sales charge of 5.75% imposed on purchases. The Fund’s total annual operating expenses, including underlying funds, are 1.55% for Class A and 1.41% for Class I per the Fund’s prospectus dated August 28, 2020. The performance data does not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions, if any, or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-866-CMG-9456.

| Portfolio Composition as of October 31, 2020 (Unaudited) | ||||

| Percent of | ||||

| Net Assets | ||||

| Exchange Traded Funds: | 103.9 | % | ||

| Commodity Fund | 11.7 | % | ||

| Equity Funds | 60.7 | % | ||

| Debt Funds | 31.5 | % | ||

| Assets In Excess of Other Liabilities | (3.9 | )% | ||

| Total | 100.0 | % | ||

Please refer to the Portfolio of Investments in this semi-annual report for a detailed listing of the Fund’s holdings.

13

| CMG Mauldin Core Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| October 31, 2020 |

| Shares | Security | Fair Value | ||||||

| EXCHANGE-TRADED FUNDS - 100.0% | ||||||||

| COMMODITY FUND - 5.1% | ||||||||

| 137,386 | SPDR Gold MiniShares Trust ETF * | $ | 2,570,492 | |||||

| TOTAL COMMODITY FUNDS (Cost - $2,129,687) | ||||||||

| DEBT FUNDS - 47.0% | ||||||||

| 75,335 | Invesco Treasury Collateral ETF | 7,964,416 | ||||||

| 4,691 | iShares 20+ Year Treasury Bond ETF | 739,161 | ||||||

| 10,735 | iShares 7-10 Year Treasury Bond ETF | 1,288,844 | ||||||

| 11,478 | iShares iBoxx $ Investment Grade Corporate Bond ETF | 1,534,953 | ||||||

| 5,255 | iShares JP Morgan USD Emerging Markets Bond ETF | 578,155 | ||||||

| 132,735 | Janus Henderson Short Duration Income ETF | 6,692,499 | ||||||

| 92,053 | SPDR Portfolio Long Term Treasury ETF | 4,154,353 | ||||||

| 6,637 | Vanguard Total International Bond ETF | 387,202 | ||||||

| 7,956 | Xtrackers USD High Yield Corporate Bond ETF | 382,604 | ||||||

| TOTAL DEBT FUNDS (Cost - $23,959,853) | 23,722,187 | |||||||

| EQUITY FUNDS - 47.9% | ||||||||

| 33,478 | Invesco S&P 500 Low Volatility ETF | 1,741,860 | ||||||

| 40,357 | Invesco S&P 500 Quality ETF | 1,497,648 | ||||||

| 84,042 | iShares Core MSCI Emerging Markets ETF | 4,493,726 | ||||||

| 54,587 | iShares MSCI Japan ETF | 3,179,147 | ||||||

| 8,364 | iShares MSCI USA Momentum Factor ETF | 1,181,248 | ||||||

| 36,645 | Schwab U.S. Large-Cap Value ETF | 1,872,926 | ||||||

| 15,894 | Schwab U.S. Small-Cap ETF | 1,109,719 | ||||||

| 52,925 | Vanguard Utilities ETF | 7,166,574 | ||||||

| 65,707 | Xtrackers S&P 500 ESG ETF | 1,888,406 | ||||||

| TOTAL EQUITY FUNDS (Cost - $23,373,444) | 24,131,254 | |||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost - $49,462,984) | 50,423,933 | |||||||

| SHORT-TERM INVESTMENT - 1.5% | ||||||||

| MONEY MARKET FUND - 1.5% | ||||||||

| 749,379 | Federated Institutional Prime Obligations Fund, Institutional Shares, 0.10% ^ | 749,754 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $749,754) | ||||||||

| TOTAL INVESTMENTS - 101.5% (Cost - $50,212,738) | $ | 51,173,687 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (1.5)% | (745,665 | ) | ||||||

| NET ASSETS - 100.0% | $ | 50,428,022 | ||||||

ETF - Exchange-Traded Fund

| * | Non-income producing security. |

| ^ | Floating rate, rate shown represents the rate at October 31, 2020. |

The accompanying notes are an integral part of these financial statements.

14

| CMG Tactical Bond Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| October 31, 2020 |

| Shares | Security | Fair Value | ||||||

| EXCHANGE-TRADED FUNDS - 95.0% | ||||||||

| DEBT FUNDS - 95.0% | ||||||||

| 151,343 | Invesco Treasury Collateral ETF | $ | 15,999,982 | |||||

| 317,208 | Janus Henderson Short Duration Income ETF | 15,993,627 | ||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost - $32,008,537) | 31,993,609 | |||||||

| SHORT-TERM INVESTMENT - 23.7% | ||||||||

| MONEY MARKET FUND - 23.7% | ||||||||

| 7,991,565 | Federated Institutional Prime Obligations Fund, Institutional Shares, 0.10% ^ | 7,995,561 | ||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $7,995,561) | ||||||||

| TOTAL INVESTMENTS - 118.7% (Cost - $40,004,098) | $ | 39,989,170 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (18.7)% | (6,305,535 | ) | ||||||

| NET ASSETS - 100.0% | $ | 33,683,635 | ||||||

ETF - Exchange-Traded Fund

| ^ | Floating rate, rate shown represents the rate at October 31, 2020. |

The accompanying notes are an integral part of these financial statements.

15

| CMG Tactical All Asset Strategy Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| October 31, 2020 |

| Shares | Security | Fair Value | ||||||

| EXCHANGE-TRADED FUNDS - 103.9% | ||||||||

| COMMODITY FUND - 11.7% | ||||||||

| 41,287 | SPDR Gold MiniShares Trust ETF * | $ | 772,480 | |||||

| TOTAL COMMODITY FUND (Cost - $850,698) | ||||||||

| DEBT FUNDS - 31.5% | ||||||||

| 11,143 | SPDR Bloomberg Barclays Convertible Securities ETF | 767,864 | ||||||

| 7,437 | Vanguard Emerging Markets Government Bond ETF | 582,317 | ||||||

| 12,698 | Vanguard Total International Bond ETF | 740,801 | ||||||

| TOTAL DEBT FUNDS (Cost - $2,119,727) | 2,090,982 | |||||||

| EQUITY FUNDS - 60.7% | ||||||||

| 2,748 | Invesco QQQ Trust Series 1 | 740,257 | ||||||

| 29,000 | iShares Latin America 40 ETF | 610,450 | ||||||

| 12,704 | iShares MSCI Emerging Markets ETF | 567,996 | ||||||

| 2,074 | SPDR S&P 500 ETF Trust | 677,244 | ||||||

| 11,735 | Utilities Select Sector SPDR Fund | 732,029 | ||||||

| 5,137 | Vanguard Utilities ETF | 695,601 | ||||||

| TOTAL EQUITY FUNDS (Cost - $3,948,625) | 4,023,577 | |||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost - $6,919,050) | 6,887,039 | |||||||

| TOTAL INVESTMENTS - 103.9% (Cost - $6,919,050) | $ | 6,887,039 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (3.9)% | (259,315 | ) | ||||||

| NET ASSETS - 100.0% | $ | 6,627,724 | ||||||

ETF - Exchange-Traded Fund

| * | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

16

| CMG Funds |

| STATEMENTS OF ASSETS AND LIABILITIES (Unaudited) |

| October 31, 2020 |

| CMG Tactical All | ||||||||||||

| CMG Mauldin | CMG Tactical | Asset Strategy | ||||||||||

| Core Fund | Bond Fund | Fund | ||||||||||

| Assets: | ||||||||||||

| Investments at Value (identified cost $50,212,738, $40,004,098, and $6,919,050, respectively) | $ | 51,173,687 | $ | 39,989,170 | $ | 6,887,039 | ||||||

| Receivable for Securities Sold | 6,607,576 | 25,696,528 | — | |||||||||

| Dividends and Interest Receivable | 15,944 | 24,560 | 12 | |||||||||

| Receivable for Fund Shares Sold | 7,650 | 34,639 | 93 | |||||||||

| Prepaid Expenses | 8,029 | 7,604 | 15,757 | |||||||||

| Total Assets | 57,812,886 | 65,752,501 | 6,902,901 | |||||||||

| Liabilities: | ||||||||||||

| Payable for Securities Purchased | 7,276,016 | 32,008,537 | — | |||||||||

| Payable for Fund Shares Redeemed | 26,651 | 9,500 | 278 | |||||||||

| Due to Custodian | — | — | 260,824 | |||||||||

| Accrued Advisory Fees | 49,076 | 28,461 | 4,558 | |||||||||

| Accrued Distribution Fees | 535 | 737 | 20 | |||||||||

| Payable to Related Parties | 29,451 | 18,488 | 6,236 | |||||||||

| Accrued Expenses and Other Liabilities | 3,135 | 3,143 | 3,261 | |||||||||

| Total Liabilities | 7,384,864 | 32,068,866 | 275,177 | |||||||||

| NET ASSETS | $ | 50,428,022 | $ | 33,683,635 | $ | 6,627,724 | ||||||

| Composition of Net Assets: | ||||||||||||

| Paid-in-Capital | $ | 48,494,885 | $ | 36,158,874 | $ | 8,069,041 | ||||||

| Accumulated Earnings (Losses) | 1,933,137 | (2,475,239 | ) | (1,441,317 | ) | |||||||

| Net Assets | $ | 50,428,022 | $ | 33,683,635 | $ | 6,627,724 | ||||||

| Net Asset Value, Offering and Redemption Price Per Share | ||||||||||||

| Class A Shares: | ||||||||||||

| Net Assets | $ | 2,452,267 | $ | 2,115,176 | $ | 92,176 | ||||||

| Shares of beneficial interest outstanding (unlimited shares of no par beneficial interest authorized) | 224,409 | 222,802 | 9,714 | |||||||||

| Net Asset Value (Net Assets ÷ Shares Outstanding) and Redemption Price Per Share | $ | 10.93 | $ | 9.49 | $ | 9.49 | ||||||

| Maximum Offering Price Per Share (Maximum sales charge of 5.75%) | 11.60 | 10.07 | 10.07 | |||||||||

| Class I Shares: | ||||||||||||

| Net Assets | $ | 47,975,755 | $ | 31,568,459 | $ | 6,535,548 | ||||||

| Shares of beneficial interest outstanding (unlimited shares of no par beneficial interest authorized) | 4,367,545 | 3,338,772 | 690,189 | |||||||||

| Net Asset Value (Net Assets ÷ Shares Outstanding), Offering and Redemption Price Per Share | $ | 10.98 | $ | 9.46 | $ | 9.47 | ||||||

The accompanying notes are an integral part of these financial statements.

17

| CMG Funds |

| STATEMENTS OF OPERATIONS (Unaudited) |

| For the Six Months Ended October 31, 2020 |

| CMG Tactical All | ||||||||||||

| CMG Mauldin | CMG Tactical Bond | Asset Strategy | ||||||||||

| Core Fund | Fund | Fund | ||||||||||

| Investment Income: | ||||||||||||

| Dividend Income | $ | 408,090 | $ | 393,168 | $ | 50,129 | ||||||

| Interest Income | 670 | 3,367 | 432 | |||||||||

| Total Investment Income | 408,760 | 396,535 | 50,561 | |||||||||

| Expenses: | ||||||||||||

| Investment Advisory Fees | 296,380 | 174,862 | 27,697 | |||||||||

| Administration Fees | 155,272 | 91,000 | 23,480 | |||||||||

| Distribution Fees- Class A | 3,265 | 4,067 | 131 | |||||||||

| Third Party Administrative Servicing Fees | 6,280 | 1,184 | 3,200 | |||||||||

| Total Expenses | 461,197 | 271,113 | 54,508 | |||||||||

| Net Investment Income (Loss) | (52,437 | ) | 125,422 | (3,947 | ) | |||||||

| Net Realized and Unrealized Gain (Loss) on Investments: | ||||||||||||

| Net Realized Gain (Loss) From: | ||||||||||||

| Investments | 1,626,460 | (502,767 | ) | 391,819 | ||||||||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||||||||||

| Investments | 407,666 | (42,113 | ) | (143,473 | ) | |||||||

| Foreign Currency Translations | 876 | — | — | |||||||||

| Net Realized and Unrealized Gain (Loss) on Investments | 2,035,002 | (544,880 | ) | 248,346 | ||||||||

| Net Increase (Decrease) in Net Assets Resulting From Operations | $ | 1,982,565 | $ | (419,458 | ) | $ | 244,399 | |||||

The accompanying notes are an integral part of these financial statements.

18

| CMG Funds |

| STATEMENTS OF CHANGES IN NET ASSETS |

| CMG Mauldin Core Fund | CMG Tactical Bond Fund | |||||||||||||||

| For the Six Months | For the Year | For the Six Months | For the Year | |||||||||||||

| Ended | Ended | Ended | Ended | |||||||||||||

| October 31, 2020 | April 30, 2020 | October 31, 2020 | April 30, 2020 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Operations: | ||||||||||||||||

| Net Investment Income (Loss) | $ | (52,437 | ) | $ | 429,511 | $ | 125,422 | $ | 885,721 | |||||||

| Net Realized Gain (Loss) on Investments | 1,626,460 | (247,047 | ) | (502,767 | ) | 975,485 | ||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | 408,542 | (1,240,108 | ) | (42,113 | ) | (1,602,813 | ) | |||||||||

| Net Increase (Decrease) in Net Assets Resulting From Operations | 1,982,565 | (1,057,644 | ) | (419,458 | ) | 258,393 | ||||||||||

| Distributions to Shareholders from: | ||||||||||||||||

| Total Distributions Paid | ||||||||||||||||

| Class A | — | (42,157 | ) | (1,966 | ) | (13,309 | ) | |||||||||

| Class I | — | (993,184 | ) | (139,718 | ) | (891,631 | ) | |||||||||

| Total Distributions to Shareholders | — | (1,035,341 | ) | (141,684 | ) | (904,940 | ) | |||||||||

| Beneficial Interest Transactions: | ||||||||||||||||

| Class A Shares: | ||||||||||||||||

| Proceeds from Shares Issued | 247,794 | 528,298 | 1,540,653 | 1,668,569 | ||||||||||||

| Distributions Reinvested | — | 40,660 | 85 | 5,755 | ||||||||||||

| Cost of Shares Redeemed | (444,112 | ) | (2,528,315 | ) | (1,401,748 | ) | (208,759 | ) | ||||||||

| Total Class A Transactions | (196,318 | ) | (1,959,357 | ) | 138,990 | 1,465,565 | ||||||||||

| Class I Shares: | ||||||||||||||||

| Proceeds from Shares Issued | 4,741,393 | 14,267,697 | 5,845,128 | 12,864,349 | ||||||||||||

| Distributions Reinvested | — | 903,700 | 139,449 | 872,280 | ||||||||||||

| Cost of Shares Redeemed | (14,049,051 | ) | (23,322,923 | ) | (9,520,755 | ) | (14,398,268 | ) | ||||||||

| Total Class I Transactions | (9,307,658 | ) | (8,151,526 | ) | (3,536,178 | ) | (661,639 | ) | ||||||||

| Net Increase (Decrease) in Net Assets Resulting from Beneficial Interest Transactions | (9,503,976 | ) | (10,110,883 | ) | (3,397,188 | ) | 803,926 | |||||||||

| Increase (Decrease) in Net Assets | (7,521,411 | ) | (12,203,868 | ) | (3,958,330 | ) | 157,379 | |||||||||

| Net Assets: | ||||||||||||||||

| Beginning of Period | 57,949,433 | 70,153,301 | 37,641,965 | 37,484,586 | ||||||||||||

| End of Period | $ | 50,428,022 | $ | 57,949,433 | $ | 33,683,635 | $ | 37,641,965 | ||||||||

| Share Activity: | ||||||||||||||||

| Class A Shares: | ||||||||||||||||

| Shares Issued | 23,001 | 48,659 | 160,732 | 41,998 | ||||||||||||

| Shares Reinvested | — | 3,630 | 9 | 588 | ||||||||||||

| Shares Redeemed | (40,628 | ) | (230,048 | ) | (145,545 | ) | (45,912 | ) | ||||||||

| Net increase (decrease) in shares of beneficial interest outstanding | (17,627 | ) | (177,759 | ) | 15,196 | (3,326 | ) | |||||||||

| Class I Shares: | ||||||||||||||||

| Shares Issued | 438,467 | 1,293,578 | 612,478 | 4,404,352 | ||||||||||||

| Shares Reinvested | — | 80,472 | 14,492 | 60,422 | ||||||||||||

| Shares Redeemed | (1,288,547 | ) | (2,127,913 | ) | (1,000,333 | ) | (1,984,200 | ) | ||||||||

| Net increase (decrease) in shares of beneficial interest outstanding | (850,080 | ) | (753,863 | ) | (373,363 | ) | 2,480,574 | |||||||||

The accompanying notes are an integral part of these financial statements.

19

| CMG Funds |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| CMG Tactical All Asset Strategy Fund | ||||||||

| For the Six Months | For the Year | |||||||

| Ended | Ended | |||||||

| October 31, 2020 | April 30, 2020 | |||||||

| (Unaudited) | ||||||||

| Operations: | ||||||||

| Net Investment Income (Loss) | $ | (3,947 | ) | $ | 285,062 | |||

| Net Realized Gain (Loss) on Investments | 391,819 | (1,062,032 | ) | |||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | (143,473 | ) | 49,487 | |||||

| Net Increase (Decrease) in Net Assets Resulting From Operations | 244,399 | (727,483 | ) | |||||

| Distributions to Shareholders from: | ||||||||

| Total Distributions Paid | ||||||||

| Class I | — | (246,298 | ) | |||||

| Total Distributions to Shareholders | — | (246,298 | ) | |||||

| Beneficial Interest Transactions: | ||||||||

| Class A Shares: | ||||||||

| Proceeds from Shares Issued | 13 | 100,424 | ||||||

| Cost of Shares Redeemed | (100,846 | ) | (2,885,400 | ) | ||||

| Total Class A Transactions | (100,833 | ) | (2,784,976 | ) | ||||

| Class I Shares: | ||||||||

| Proceeds from Shares Issued | 647,179 | 11,449,324 | ||||||

| Distributions Reinvested | — | 245,370 | ||||||

| Cost of Shares Redeemed | (1,317,702 | ) | (33,775,701 | ) | ||||

| Total Class I Transactions | (670,523 | ) | (22,081,007 | ) | ||||

| Net Decrease in Net Assets Resulting from Beneficial Interest Transactions | (771,356 | ) | (24,865,983 | ) | ||||

| Decrease in Net Assets | (526,957 | ) | (25,839,764 | ) | ||||

| Net Assets: | ||||||||

| Beginning of Period | 7,154,681 | 32,994,445 | ||||||

| End of Period | $ | 6,627,724 | $ | 7,154,681 | ||||

| Share Activity: | ||||||||

| Class A Shares: | ||||||||

| Shares Issued | 2 | 10,936 | ||||||

| Shares Redeemed | (10,902 | ) | (291,659 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (10,900 | ) | (280,723 | ) | ||||

| Class I Shares: | ||||||||

| Shares Issued | 68,524 | 1,121,582 | ||||||

| Shares Reinvested | — | 24,488 | ||||||

| Shares Redeemed | (135,737 | ) | (3,352,989 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (67,213 | ) | (2,206,919 | ) | ||||

The accompanying notes are an integral part of these financial statements.

20

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Mauldin Core Fund | ||||||||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| Six Months | Year | Year | Year | Year | Year | |||||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | Ended | |||||||||||||||||||

| October 31, 2020 | April 30, 2019 | April 30, 2019 | April 30, 2018 | April 30, 2017 | April 30, 2016 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 10.57 | $ | 10.92 | $ | 10.79 | $ | 10.40 | $ | 10.23 | $ | 11.00 | ||||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||||||

| Net investment income (loss) (a) | (0.02 | ) | 0.05 | 0.05 | 0.08 | (0.13 | ) | (0.16 | ) | |||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | 0.38 | (0.25 | ) | 0.12 | 0.45 | 0.38 | (0.56 | ) | ||||||||||||||||

| Total from operations | 0.36 | (0.20 | ) | 0.17 | 0.53 | 0.25 | (0.72 | ) | ||||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||||||

| Net investment income | — | (0.14 | ) | — | (0.00 | ) (g) | — | (0.05 | ) | |||||||||||||||

| Net realized gains | — | (0.01 | ) | (0.04 | ) | (0.14 | ) | (0.08 | ) | — | ||||||||||||||

| Total distributions | — | (0.15 | ) | (0.04 | ) | (0.14 | ) | (0.08 | ) | (0.05 | ) | |||||||||||||

| Net Asset Value, End of Period | $ | 10.93 | $ | 10.57 | $ | 10.92 | $ | 10.79 | $ | 10.40 | $ | 10.23 | ||||||||||||

| Total Return (b) | 3.41 | % (f) | (1.93 | )% | 1.60 | % | 5.06 | % | 2.50 | % | (6.57 | )% | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 2,452 | $ | 2,559 | $ | 4,586 | $ | 4,649 | $ | 3,049 | $ | 3,757 | ||||||||||||

| Ratio of expenses to average net assets (c) | 1.87 | % (e) | 1.75 | % | 1.66 | % | 1.52 | % | 3.40 | % | 2.95 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | (0.44 | )% (e) | 0.49 | % | 0.48 | % | 0.76 | % | (1.26 | )% | (1.44 | )% | ||||||||||||

| Portfolio turnover rate | 232 | % (f) | 278 | % | 324 | % | 220 | % | 248 | % | 20 | % | ||||||||||||

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

| (g) | Amount is less than $0.005 per share. |

The accompanying notes are an integral part of these financial statements.

21

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Mauldin Core Fund | ||||||||||||||||||||||||

| Class I | ||||||||||||||||||||||||

| Six Months | Year | Year | Year | Year | Year | |||||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | Ended | |||||||||||||||||||

| October 31, 2020 | April 30, 2020 | April 30, 2019 | April 30, 2018 | April 30, 2017 | April 30, 2016 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 10.62 | $ | 10.98 | $ | 10.82 | $ | 10.46 | $ | 10.26 | $ | 11.04 | ||||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||||||

| Net investment income (loss) (a) | (0.01 | ) | 0.08 | 0.08 | 0.04 | (0.08 | ) | (0.13 | ) | |||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | 0.37 | (0.25 | ) | 0.13 | 0.50 | 0.36 | (0.58 | ) | ||||||||||||||||

| Total from operations | 0.36 | (0.17 | ) | 0.21 | 0.54 | 0.28 | (0.71 | ) | ||||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||||||

| Net investment income | — | (0.18 | ) | (0.01 | ) | (0.04 | ) | — | (0.07 | ) | ||||||||||||||

| Net realized gains | — | (0.01 | ) | (0.04 | ) | (0.14 | ) | (0.08 | ) | — | ||||||||||||||

| Total distributions | — | (0.19 | ) | (0.05 | ) | (0.18 | ) | (0.08 | ) | (0.07 | ) | |||||||||||||

| Net Asset Value, End of Period | $ | 10.98 | $ | 10.62 | $ | 10.98 | $ | 10.82 | $ | 10.46 | $ | 10.26 | ||||||||||||

| Total Return (b) | 3.48 | % (f) | (1.69 | )% | 1.93 | % | 5.13 | % | 2.78 | % | (6.43 | )% | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 47,976 | $ | 55,390 | $ | 65,567 | $ | 68,814 | $ | 7,669 | $ | 4,776 | ||||||||||||

| Ratio of expenses to average net assets (c) | 1.62 | % (e) | 1.51 | % | 1.41 | % | 1.33 | % | 2.98 | % | 2.70 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | (0.17 | )% (e) | 0.69 | % | 0.73 | % | 0.37 | % | (0.81 | )% | (1.18 | )% | ||||||||||||

| Portfolio turnover rate | 232 | % (f) | 278 | % | 324 | % | 220 | % | 248 | % | 20 | % | ||||||||||||

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

| (g) | The realized and unrealized gain or loss from securities and futures does not accord with the amounts reported on the Statement of Operations due to timing of subscriptions and/or redemptions of Fund |

The accompanying notes are an integral part of these financial statements.

22

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Tactical Bond Fund | ||||||||||||||||||||||||

| Class A | ||||||||||||||||||||||||

| Six Months | Year | Year | Year | Year | Period | |||||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | Ended | |||||||||||||||||||

| October 31, 2020 | April 30, 2020 | April 30, 2019 | April 30, 2018 | April 30, 2017 | April 30, 2016 * | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 9.63 | $ | 9.82 | $ | 9.42 | $ | 9.75 | $ | 9.60 | $ | 9.96 | ||||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||||||

| Net investment income (a) | 0.01 | 0.16 | 0.22 | 0.18 | 0.23 | 0.12 | ||||||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | (0.14 | ) | (0.13 | ) | 0.37 | (0.33 | ) | 0.12 | (0.33 | ) | ||||||||||||||

| Total from operations | (0.13 | ) | 0.03 | 0.59 | (0.15 | ) | 0.35 | (0.21 | ) | |||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||||||

| Net investment income | (0.01 | ) | (0.22 | ) | (0.19 | ) | (0.18 | ) | (0.20 | ) | (0.11 | ) | ||||||||||||

| Return of Capital | — | — | — | — | — | (0.04 | ) | |||||||||||||||||

| Total distributions | (0.01 | ) | (0.22 | ) | (0.19 | ) | (0.18 | ) | (0.20 | ) | (0.15 | ) | ||||||||||||

| Net Asset Value, End of Period | $ | 9.49 | $ | 9.63 | $ | 9.82 | $ | 9.42 | $ | 9.75 | $ | 9.60 | ||||||||||||

| Total Return (b) | (1.28 | )% (f) | 0.27 | % | 6.31 | % | (1.57 | )% | 3.73 | % (f) | (2.07 | )% (f) | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 2,115 | $ | 1,999 | $ | 548 | $ | 557 | $ | 1,042 | $ | 305 | ||||||||||||

| Ratio of expenses to average net assets (c) | 1.85 | % (e) | 1.79 | % | 1.74 | % | 1.78 | % | 1.82 | % | 1.76 | % (e) | ||||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | 0.28 | % (e) | 1.69 | % | 2.26 | % | 1.91 | % | 2.38 | % | 1.41 | % (e) | ||||||||||||

| Portfolio turnover rate | 599 | % (f) | 959 | % | 433 | % | 886 | % | 12.68 | 1,413 | % (f) | |||||||||||||

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

23

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Tactical Bond Fund | ||||||||||||||||||||||||

| Class I | ||||||||||||||||||||||||

| Six Months | Year | Year | Year | Year | Year | |||||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | Ended | |||||||||||||||||||

| October 31, 2020 | April 30, 2020 | April 30, 2019 | April 30, 2018 | April 30, 2017 | April 30, 2016 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 9.60 | $ | 9.78 | $ | 9.42 | $ | 9.75 | $ | 9.62 | $ | 9.97 | ||||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||||||

| Net investment income (a) | 0.03 | 0.24 | 0.27 | 0.22 | 0.25 | 0.17 | ||||||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | (0.13 | ) | (0.17 | ) | 0.35 | (0.33 | ) | 0.14 | (0.32 | ) | ||||||||||||||

| Total from operations | (0.10 | ) | 0.07 | 0.62 | (0.11 | ) | 0.39 | (0.15 | ) | |||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||||||

| Net investment income | (0.04 | ) | (0.25 | ) | (0.26 | ) | (0.22 | ) | (0.26 | ) | (0.16 | ) | ||||||||||||

| Return of Capital | — | — | — | — | — | (0.04 | ) | |||||||||||||||||

| Total distributions | (0.04 | ) | (0.25 | ) | (0.26 | ) | (0.22 | ) | (0.26 | ) | (0.20 | ) | ||||||||||||

| Net Asset Value, End of Period | $ | 9.46 | $ | 9.60 | $ | 9.78 | $ | 9.42 | $ | 9.75 | $ | 9.62 | ||||||||||||

| Total Return (b) | (0.82 | )% (f) | 0.73 | % | 6.68 | % | (1.18 | )% | 4.13 | % | (1.44 | )% | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 31,568 | $ | 35,643 | $ | 36,937 | $ | 12,197 | $ | 18,120 | $ | 33,290 | ||||||||||||

| Ratio of expenses to average net assets (c) | 1.45 | % (e) | 1.38 | % | 1.32 | % | 1.35 | % | 1.47 | % | 1.36 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | 0.71 | % (e) | 2.51 | % | 2.87 | % | 2.25 | % | 2.61 | % | 1.81 | % | ||||||||||||

| Portfolio turnover rate | 599 | % (f) | 959 | % | 433 | % | 886 | % | 1,268 | % | 1,413 | % | ||||||||||||

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

24

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Tactical All Asset Strategy Fund | ||||||||||||||||||||

| Class A | ||||||||||||||||||||

| Six Months | Year | Year | Year | Period | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| October 31, 2020 | April 30, 2020 | April 30, 2019 | April 30, 2018 | April 30, 2017 * | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 9.22 | $ | 10.06 | $ | 10.19 | $ | 10.32 | $ | 10.00 | ||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||

| Net investment income (loss) (a) | (0.02 | ) | 0.12 | 0.07 | 0.02 | 0.03 | ||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | 0.29 | (0.96 | ) | (0.20 | ) | 0.26 | 0.37 | |||||||||||||

| Total from operations | 0.27 | (0.84 | ) | (0.13 | ) | 0.28 | 0.40 | |||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | — | — | — | (0.06 | ) | (0.03 | ) | |||||||||||||

| Net realized gains | — | — | — | (0.35 | ) | (0.05 | ) | |||||||||||||

| Total distributions | — | — | — | (0.41 | ) | (0.08 | ) | |||||||||||||

| Net Asset Value, End of Period | $ | 9.49 | $ | 9.22 | $ | 10.06 | $ | 10.19 | $ | 10.32 | ||||||||||

| Total Return (b) | 2.93 | % (f) | (8.35 | )% | (1.28 | )% | 2.61 | % | 4.00 | % (f) | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 92 | $ | 190 | $ | 3,033 | $ | 18,338 | $ | 38,741 | ||||||||||

| Ratio of expenses to average net assets (c) | 1.72 | % (e) | 1.39 | % | 1.43 | % | 1.30 | % | 1.53 | % (e) | ||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | (0.38 | )% (e) | 1.25 | % | 0.72 | % | 0.22 | % | 0.32 | % (e) | ||||||||||

| Portfolio turnover rate | 362 | % (f) | 563 | % | 400 | % | 627 | % | 451 | % (f) | ||||||||||

| * | Commencement of Operations on May 2, 2016. |

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

25

| CMG Funds |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year/period presented.

| CMG Tactical All Asset Strategy Fund | ||||||||||||||||||||

| Class I | ||||||||||||||||||||

| Six Months | Year | Year | Period | Period | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| October 31, 2020 | April 30, 2020 | April 30, 2019 | April 30, 2018 | April 30, 2017 * | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 9.20 | $ | 10.11 | $ | 10.20 | $ | 10.34 | $ | 10.00 | ||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||

| Net investment income (a) | — | 0.12 | 0.10 | 0.04 | 0.06 | |||||||||||||||

| Net gain (loss) from investments (both realized and unrealized) | 0.27 | (0.92 | ) | (0.19 | ) | 0.25 | 0.37 | |||||||||||||

| Total from operations | 0.27 | (0.80 | ) | (0.09 | ) | 0.29 | 0.43 | |||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | — | (0.11 | ) | — | (0.08 | ) | (0.04 | ) | ||||||||||||

| Net realized gains | — | — | — | (0.35 | ) | (0.05 | ) | |||||||||||||

| Total distributions | — | (0.11 | ) | — | (0.43 | ) | (0.09 | ) | ||||||||||||

| Net Asset Value, End of Period | $ | 9.47 | $ | 9.20 | $ | 10.11 | $ | 10.20 | $ | 10.34 | ||||||||||

| Total Return (b) | 2.93 | % (f) | (8.02 | )% | (0.88 | )% | 2.68 | % | 4.29 | % (f) | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 6,536 | $ | 6,965 | $ | 29,962 | $ | 13,354 | $ | 5,956 | ||||||||||

| Ratio of expenses to average net assets (c) | 1.47 | % (e) | 1.25 | % | 1.06 | % | 1.21 | % | 1.28 | % (e) | ||||||||||

| Ratio of net investment income (loss) to average net assets (c)(d) | (0.10 | )% (e) | 1.25 | % | 1.04 | % | 0.34 | % | 0.58 | % (e) | ||||||||||

| Portfolio turnover rate | 362 | % (f) | 563 | % | 400 | % | 627 | % | 451 | % (f) | ||||||||||

| * | Commencement of Operations on May 2, 2016. |

| (a) | Per share amounts are calculated using the average shares method, which appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and excludes sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (c) | Does not include the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

26

| CMG Funds |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

| October 31, 2020 |

| 1. | ORGANIZATION |

CMG Mauldin Core Fund (the “Mauldin Fund”), CMG Tactical Bond Fund, (the “Bond Fund”) and CMG Tactical All Asset Strategy Fund (“Tactical Fund”) (each a “Fund”, collectively, the “Funds”) are each a diversified series of shares of beneficial interest of the Northern Lights Fund Trust (the “Trust”), a Delaware statutory trust organized on January 19, 2005. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Funds currently offer Class A shares and Class I shares. Class I shares are offered at net asset value. Class A shares for all Funds are offered at net asset value plus a maximum sales charge of 5.75%. Each class represents an interest in the same assets of the Funds and classes are identical except for their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to the respective class’ service and/or distribution plans. Each Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class. The Mauldin Fund seeks capital appreciation as its investment objective. Class A and Class I of the Mauldin Fund commenced operations on May 15, 2013. The Bond Fund seeks to generate total returns over a complete market cycle through capital appreciation and income. Class I of the Bond Fund commenced operations on October 6, 2014. Class A of the Bond Fund commenced operations on May 29, 2015. The Tactical Fund’s investment objective is to generate capital appreciation. Class A and Class I of the Tactical Fund commenced operations on May 2, 2016.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Funds in preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update (“ASU”) 2013-08.