Form N-CSRS Eaton Vance Municipal For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22777

Eaton Vance Municipal Income 2028 Term Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

January 31

Date of Fiscal Year End

July 31, 2022

Date of Reporting Period

Item 1. Reports to Stockholders

| % Average Annual Total Returns1,2 | Inception Date | Six Months | One Year | Five Years | Since

Inception |

| Fund at NAV | 03/28/2013 | (3.49)% | (6.28)% | 3.01% | 4.75% |

| Fund at Market Price | — | 1.70 | (8.60) | 3.99 | 5.17 |

|

| |||||

| Bloomberg 7 Year Municipal Bond Index | — | (1.90)% | (5.18)% | 1.72% | 2.21% |

| Bloomberg 10 Year Municipal Bond Index | — | (2.76) | (6.09) | 2.05 | 2.66 |

| % Premium/Discount to NAV3 | |

| 3.81% |

| Distributions 4 | |

| Total Distributions per share for the period | $0.425 |

| Distribution Rate at NAV | 4.33% |

| Taxable-Equivalent Distribution Rate at NAV | 7.31 |

| Distribution Rate at Market Price | 4.17 |

| Taxable-Equivalent Distribution Rate at Market Price | 7.04 |

| % Total Leverage5 | |

| Residual Interest Bond (RIB) Financing | 35.03% |

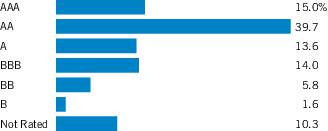

| Credit Quality (% of total investments)*,** |

| * | For purposes of the Fund’s rating restrictions, ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

| ** | The chart includes the municipal bonds held by a trust that issues residual interest bonds, consistent with the Portfolio of Investments. |

| At July 31, 2022, the concentration of the Trust’s investments in the various states and territories, determined as a percentage of total investments, is as follows: |

| New York | 14.7% |

| California | 11.6% |

| Texas | 11.2% |

| Others, representing less than 10% individually | 61.8% |

| The Trust invests primarily in debt securities issued by municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. At July 31, 2022, 9.5% of total investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution or financial guaranty assurance agency ranged from 1.7% to 4.4% of total investments. |

| Abbreviations: | |

| AGM | – Assured Guaranty Municipal Corp. |

| AMBAC | – AMBAC Financial Group, Inc. |

| AMT | – Interest earned from these securities may be considered a tax preference item for purposes of the Federal Alternative Minimum Tax. |

| NPFG | – National Public Finance Guarantee Corp. |

| PSF | – Permanent School Fund |

| July 31, 2022 | |

| Assets | |

| Investments, at value (identified cost $320,847,142) | $ 330,741,998 |

| Cash | 977,250 |

| Interest receivable | 2,705,981 |

| Receivable for investments sold | 100,667 |

| Receivable from the transfer agent | 32,947 |

| Total assets | $334,558,843 |

| Liabilities | |

| Payable for floating rate notes issued | $ 115,486,970 |

| Payable for when-issued securities | 4,375,300 |

| Payable to affiliate: | |

| Investment adviser and administration fee | 167,155 |

| Interest expense and fees payable | 378,377 |

| Accrued expenses | 95,181 |

| Total liabilities | $120,502,983 |

| Net Assets | $214,055,860 |

| Sources of Net Assets | |

| Common shares, $0.01 par value, unlimited number of shares authorized | $ 108,798 |

| Additional paid-in capital | 207,741,277 |

| Distributable earnings | 6,205,785 |

| Net Assets | $214,055,860 |

| Common Shares Issued and Outstanding | 10,879,837 |

| Net Asset Value Per Common Share | |

| Net assets ÷ common shares issued and outstanding | $ 19.67 |

| Six Months Ended | |

| July 31, 2022 | |

| Investment Income | |

| Interest income | $ 6,211,668 |

| Total investment income | $ 6,211,668 |

| Expenses | |

| Investment adviser and administration fee | $ 1,002,740 |

| Trustees’ fees and expenses | 12,348 |

| Custodian fee | 26,608 |

| Transfer and dividend disbursing agent fees | 9,894 |

| Legal and accounting services | 33,848 |

| Printing and postage | 531 |

| Interest expense and fees | 699,141 |

| Miscellaneous | 19,483 |

| Total expenses | $ 1,804,593 |

| Net investment income | $ 4,407,075 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment transactions | $ (900,676) |

| Net realized loss | $ (900,676) |

| Change in unrealized appreciation (depreciation): | |

| Investments | $ (11,313,184) |

| Net change in unrealized appreciation (depreciation) | $(11,313,184) |

| Net realized and unrealized loss | $(12,213,860) |

| Net decrease in net assets from operations | $ (7,806,785) |

| Six

Months Ended July 31, 2022 (Unaudited) |

Year

Ended January 31, 2022 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $ 4,407,075 | $ 9,451,773 |

| Net realized gain (loss) | (900,676) | 722,043 |

| Net change in unrealized appreciation (depreciation) | (11,313,184) | (13,385,838) |

| Net decrease in net assets from operations | $ (7,806,785) | $ (3,212,022) |

| Distributions to shareholders | $ (4,625,774) | $ (9,240,905) |

| Capital share transactions: | ||

| Reinvestment of distributions | $ 201,407 | $ 376,356 |

| Net increase in net assets from capital share transactions | $ 201,407 | $ 376,356 |

| Net decrease in net assets | $ (12,231,152) | $ (12,076,571) |

| Net Assets | ||

| At beginning of period | $ 226,287,012 | $ 238,363,583 |

| At end of period | $214,055,860 | $226,287,012 |

| Six Months Ended | |

| July 31, 2022 | |

| Cash Flows From Operating Activities | |

| Net decrease in net assets from operations | $ (7,806,785) |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by operating activities: | |

| Investments purchased | (35,523,337) |

| Investments sold | 33,175,920 |

| Net amortization/accretion of premium (discount) | (51,171) |

| Increase in interest receivable | (4,918) |

| Increase in receivable from the transfer agent | (32,947) |

| Decrease in payable to affiliate for investment adviser fee | (13,000) |

| Increase in interest expense and fees payable | 187,816 |

| Increase in accrued expenses | 515 |

| Net change in unrealized (appreciation) depreciation from investments | 11,313,184 |

| Net realized loss from investments | 900,676 |

| Net cash provided by operating activities | $ 2,145,953 |

| Cash Flows From Financing Activities | |

| Cash distributions paid | $ (4,424,367) |

| Repayment of secured borrowings | (8,000,000) |

| Net cash used in financing activities | $(12,424,367) |

| Net decrease in cash | $(10,278,414) |

| Cash at beginning of period | $ 11,255,664 |

| Cash at end of period | $ 977,250 |

| Supplemental disclosure of cash flow information: | |

| Noncash financing activities not included herein consist of: | |

| Reinvestment of dividends and distributions | $ 201,407 |

| Cash paid for interest and fees on borrowings | 511,325 |

| Six

Months Ended July 31, 2022 (Unaudited) |

Year Ended January 31, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||

| Net asset value — Beginning of period | $ 20.820 | $ 21.960 | $ 21.880 | $ 20.440 | $ 20.440 | $ 19.980 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $ 0.405 | $ 0.870 | $ 0.876 | $ 0.763 | $ 0.775 | $ 0.829 |

| Net realized and unrealized gain (loss) | (1.130) | (1.159) | 0.048 | 1.528 | 0.076 | 0.482 |

| Total income (loss) from operations | $ (0.725) | $ (0.289) | $ 0.924 | $ 2.291 | $ 0.851 | $ 1.311 |

| Less Distributions | ||||||

| From net investment income | $ (0.425) | $ (0.851) | $ (0.844) | $ (0.851) | $ (0.851) | $ (0.851) |

| Total distributions | $ (0.425) | $ (0.851) | $ (0.844) | $ (0.851) | $ (0.851) | $ (0.851) |

| Net asset value — End of period | $ 19.670 | $ 20.820 | $ 21.960 | $ 21.880 | $ 20.440 | $ 20.440 |

| Market value — End of period | $ 20.420 | $ 20.510 | $ 22.950 | $ 21.370 | $ 19.590 | $ 19.690 |

| Total Investment Return on Net Asset Value(2) | (3.49)% (3) | (1.39)% | 4.45% | 11.46% | 4.46% | 6.69% |

| Total Investment Return on Market Value(2) | 1.70% (3) | (7.03)% | 11.74% | 13.58% | 3.93% | 4.88% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $214,056 | $226,287 | $238,364 | $237,212 | $221,444 | $221,476 |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses excluding interest and fees | 1.03% (4) | 1.03% | 1.04% | 1.04% | 1.08% | 1.07% |

| Interest and fee expense(5) | 0.65% (4) | 0.33% | 0.63% | 1.16% | 1.22% | 0.91% |

| Total expenses | 1.68% (4) | 1.36% | 1.67% | 2.20% | 2.30% | 1.98% |

| Net investment income | 4.11% (4) | 4.02% | 4.10% | 3.58% | 3.84% | 4.01% |

| Portfolio Turnover | 10% (3) | 2% | 3% | 1% | 10% | 8% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Trust’s dividend reinvestment plan. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with residual interest bond transactions (see Note 1G). |

| Aggregate cost | $204,834,384 |

| Gross unrealized appreciation | $ 11,030,144 |

| Gross unrealized depreciation | (609,500) |

| Net unrealized appreciation | $ 10,420,644 |

| • | Level 1 – quoted prices in active markets for identical investments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments) |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Corporate Bonds | $ — | $ 2,394,500 | $ — | $ 2,394,500 |

| Tax-Exempt Municipal Obligations | — | 318,946,003 | — | 318,946,003 |

| Taxable Municipal Obligations | — | 9,401,495 | — | 9,401,495 |

| Total Investments | $ — | $330,741,998 | $ — | $330,741,998 |

| Officers | |

| Eric

A. Stein President |

Jill R.

Damon Secretary |

| Deidre

E. Walsh Vice President and Chief Legal Officer |

Richard F.

Froio Chief Compliance Officer |

| James

F. Kirchner Treasurer |

|

| Trustees |

| * | Interested Trustee |

| ** | Ms. Wiser began serving as a Trustee effective April 4, 2022. |

| Privacy Notice | April 2021 |

| FACTS | WHAT

DOES EATON VANCE DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can include:■ Social Security number and income ■ investment experience and risk tolerance ■ checking account number and wire transfer instructions |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Eaton Vance chooses to share; and whether you can limit this sharing. |

| Reasons

we can share your personal information |

Does

Eaton Vance share? |

Can

you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes — to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

| For our investment management affiliates’ everyday business purposes — information about your transactions, experiences, and creditworthiness | Yes | Yes |

| For our affiliates’ everyday business purposes — information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes — information about your creditworthiness | No | We don’t share |

| For our investment management affiliates to market to you | Yes | Yes |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| To

limit our sharing |

Call toll-free 1-800-262-1122 or email: [email protected]Please note:If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call toll-free 1-800-262-1122 or email: [email protected] |

| Privacy Notice — continued | April 2021 |

| Who we are | |

| Who is providing this notice? | Eaton Vance Management, Eaton Vance Distributors, Inc., Eaton Vance Trust Company, Eaton Vance Management (International) Limited, Eaton Vance Advisers International Ltd., Eaton Vance Global Advisors Limited, Eaton Vance Management’s Real Estate Investment Group, Boston Management and Research, Calvert Research and Management, Eaton Vance and Calvert Fund Families and our investment advisory affiliates (“Eaton Vance”) (see Investment Management Affiliates definition below) |

| What we do | |

| How

does Eaton Vance protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We have policies governing the proper handling of customer information by personnel and requiring third parties that provide support to adhere to appropriate security standards with respect to such information. |

| How

does Eaton Vance collect my personal information? |

We

collect your personal information, for example, when you■ open an account or make deposits or withdrawals from your account ■ buy securities from us or make a wire transfer ■ give us your contact informationWe also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal

law gives you the right to limit only■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to youState laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| Definitions | |

| Investment

Management Affiliates |

Eaton Vance Investment Management Affiliates include registered investment advisers, registered broker- dealers, and registered and unregistered funds. Investment Management Affiliates does not include entities associated with Morgan Stanley Wealth Management, such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.■ Our affiliates include companies with a Morgan Stanley name and financial companies such as Morgan Stanley Smith Barney LLC and Morgan Stanley & Co. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.■ Eaton Vance does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.■ Eaton Vance doesn’t jointly market. |

| Other important information | |

| Vermont: Except as permitted by law, we will not share personal information we collect about Vermont residents with Nonaffiliates unless you provide us with your written consent to share such information.California: Except as permitted by law, we will not share personal information we collect about California residents with Nonaffiliates and we will limit sharing such personal information with our Affiliates to comply with California privacy laws that apply to us. | |

Item 2. Code of Ethics

Not required in this filing.

Item 3. Audit Committee Financial Expert

Not required in this filing.

Item 4. Principal Accountant Fees and Services

Not required in this filing.

Item 5. Audit Committee of Listed Registrants

Not required in this filing.

Item 6. Schedule of Investments

Please see schedule of investments contained in the Report to Stockholders included under Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not required in this filing.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not required in this filing.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

No such purchases this period.

Item 10. Submission of Matters to a Vote of Security Holders

No material changes.

Item 11. Controls and Procedures

(a) It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure.

(b) There have been no changes in the registrant’s internal controls over financial reporting during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

No activity to report for the registrant’s most recent fiscal year end.

Item 13. Exhibits

| (a)(1) | Registrant’s Code of Ethics – Not applicable (please see Item 2). | |

| (a)(2)(i) | Treasurer’s Section 302 certification. | |

| (a)(2)(ii) | President’s Section 302 certification. | |

| (b) | Combined Section 906 certification. | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Eaton Vance Municipal Income 2028 Term Trust | ||

| By: | /s/ Eric A. Stein | |

| Eric A. Stein | ||

| President | ||

Date: September 16, 2022

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ James F. Kirchner | |

| James F. Kirchner | ||

| Treasurer |

Date: September 16, 2022

| By: | /s/ Eric A. Stein | |

| Eric A. Stein | ||

| President | ||

| Date: September 16, 2022 | ||

ATTACHMENTS / EXHIBITS

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AUTODESK ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Autodesk, Inc. and Encourages Investors to Contact the Firm

- Few small SUVs excel in new IIHS front crash prevention test

- Wright Electric Announces First Steps of Electric Propulsion Testing

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share