Form N-CSR WESMARK FUNDS For: Dec 31

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-07925

(Investment Company Act file number)

WesMark Funds

(Exact name of registrant as specified in charter)

One Bank Plaza, 5th floor

Wheeling, WV 26003

(Address of principal executive offices)

(304) 234-9000

(Registrant’s telephone number)

Karen Gilomen, Esq.

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

(Name and address of agent for service)

Date of fiscal year end: December 31

Date of reporting period: January 1 – December 31, 2018

Item 1. Reports to Stockholders.

President’s Message

| December 31, 2018 |

Dear Fellow Shareholders:

After starting on a positive note, 2018 moved to a year of uncertainty including concern as to the sustainability of the current economic cycle as it approached a ten-year mark. We are able to recite the common list of worries and look at a number of these as expected at this point in the economic cycle; manageable from a policy standpoint and, while impacting financial market volatility, perhaps creating opportunities for investors.

After what had become a rather predictable pattern of low first quarter Gross Domestic Product (GDP) growth, second quarter GDP growth was reported at a 4.2% annual rate surpassing consensus estimates and setting the stage for full year growth that would significantly exceed the average annual increase in GDP over the past nine years. As it became evident that the third quarter would show a deceleration in growth, investors became concerned with the timing of the arrival of the next domestic recession. A Federal Reserve that continued to move rates higher on a schedule that seemed to ignore economic fundamentals, decelerating earnings growth for 2019, and tariffs and trade were among a growing litany of issues that preoccupied investors who began to view even favorable earnings results and outlooks with skepticism.

The year brought few economic surprises as job growth continued with an average monthly increase in non-farm payrolls of 223,000, the unemployment rate and weekly unemployment claims remained at multi-decade lows, inflation remained constrained, increased discretionary income supported a consumer ready and willing to spend, and fiscal policy provided an offset to tightening monetary policy. This environment was expected to provide continued support for equity markets but a look forward late in the year brought a sudden change in the attitude for risk.

All major equity indexes were negative for the year. U.S. large capitalization outperformed mid-capitalization which outperformed small capitalization all of whom outperformed international equities, both developed and emerging. Defensive sectors were strong in the fourth quarter as investors reduced portfolio risk. The full year saw three periods of declines in equity prices that exceeded 10% from recent highs culminating in a 19.8% drop in the Standard & Poor 500 Index from late September to late December. Fixed income indexes that included corporate or foreign debt were also negative for the year. U.S. Government Debt indexes provided positive returns in the low single digits as the risk off trade intensified. Portfolio duration remained key as interest rate increases reduced the value of fixed income securities. Credit spreads widened as the year progressed as demand for higher rates accompanied fears of declining credit worthiness of corporate and foreign debt. The calm of 2017 was replaced with volatility. A volatility more typical of equity markets, although usually not concentrated in the short time periods that were witnessed in 2018.

A discussion of the volatility in the U.S. financial markets for 2018 is not complete without a review of the events that occurred beginning with the meeting of the Federal Reserve on December 19, 2018. The increase in the target Federal Funds rate was expected but the responses to questions at the press conference, the composition of the now famous “dot plot”, forward guidance that included “some” further gradual rate increases will still be needed and unchanged plans for the pace of reduction of the more than $4 trillion balance sheet sent investors rushing to the sidelines. Treasury Secretary Mnuchin attempted to reassure financial markets by answering the unasked question confirming that there was ample liquidity to stave off any shocks to the system. Mnuchin called the chief executives of the nation’s six largest banks and they confirmed that they have ample liquidity to lend to consumers, businesses and perform other market operations. He followed this by convening a call of officials from the Federal Reserve, the Securities and Exchange Commission and the Commodities Futures Trading Commission to discuss any unusual liquidity problems. Mnuchin then reassured the public that the President was not going to fire Fed Chair Jerome Powell. Then late in December the U.S. government entered a partial shutdown when Congress failed to appropriate funds needed to fully operate the government. We strongly believe that a period of economic growth does not just die of old age but is ended by policy errors such as the ones that were witnessed leading up to December 24, 2018.

As 2018 ended, the Federal Reserve devoted a significant amount of public time to clarifying their current policy position making sure that investors knew they were in fact cognizant of a slowing global economy, that an extended battle over tariffs would indeed have a negative impact on growth and that their actions would definitely be data dependent.

Corporations have used the extended period of low interest rates to increase debt and accelerate capital spending, increase dividends, and repurchase shares. Capital spending needs to remain a focus as the tight employment markets have begun to cause an acceleration in wage rates. There becomes a need to enhance productivity through plant and equipment spending in order to maintain the current near record operating margins. The consumer’s support of the economy needs a greater contribution from corporate spending in order to maintain growth at levels consistent with the current economic cycle. This push from the fiscal policy changes, including lower tax rates, provided needed support as an offset to the Federal Reserve’s continuing policy of interest rate normalization. However, we continue our view that the current Fed policy is one of being less accommodative, not restrictive.

The Funds ended the year with net assets of $840.8 million. Fund flows and investment performance resulted in a decline in assets under management for the Fund complex. The WesMark Tactical Opportunity Fund, established on March 1, 2017, continued to experience positive fund flows.

Your investment in and support of the WesMark Funds is important to us and, as always, we thank you. Our processes are always changing striving to provide a competitive result to you, our investors. Our investment in the resources necessary to execute a successful investment plan for all of our funds is always top of mind. Your support is instrumental to this success. Should you have any questions or need additional information about the Funds, please visit our website www.wesmarkfunds.com or call 1-800-864-1013.

| Sincerely, | |

|

|

| David B. Ellwood, CFA | |

|

President, WesMark Funds |

| www.wesmarkfunds.com |  |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.wesmarkfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at www.wesmarkfunds.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-800-864-1013 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with a Fund.

Table of Contents

| December 31, 2018 |

| Management’s Discussion of Fund Performance | |

| Small Company Growth Fund | 2 |

| Growth Fund | 5 |

| Balanced Fund | 8 |

| Government Bond Fund | 11 |

| West Virginia Municipal Bond Fund | 14 |

| Tactical Opportunity Fund | 17 |

| Small Company Growth Fund | |

| Portfolio of Investments Summary Table | 20 |

| Portfolio of Investments | 21 |

| Growth Fund | |

| Portfolio of Investments Summary Table | 23 |

| Portfolio of Investments | 24 |

| Balanced Fund | |

| Portfolio of Investments Summary Table | 26 |

| Portfolio of Investments | 27 |

| Government Bond Fund | |

| Portfolio of Investments Summary Table | 32 |

| Portfolio of Investments | 33 |

| West Virginia Municipal Bond Fund | |

| Portfolio of Investments Summary Table | 39 |

| Portfolio of Investments | 40 |

| Tactical Opportunity Fund | |

| Portfolio of Investments Summary Table | 45 |

| Portfolio of Investments | 46 |

| Statements of Assets and Liabilities | 47 |

| Statements of Operations | 49 |

| Statements of Changes in Net Assets | 50 |

| Financial Highlights | 53 |

| Notes to Financial Statements | 59 |

| Report of Independent Registered Public Accounting Firm | 71 |

| Shareholder Expense Example | 72 |

| Board of Trustees and Trust Officers | 73 |

| Additional Information | 75 |

| Glossary of Terms | 76 |

| Annual Report » December 31, 2018 |  |

Management’s Discussion of Fund Performance

| WesMark Small Company Growth Fund | December 31, 2018 (Unaudited) |

Equity markets started 2018 off on a positive note, led by changes in corporate and personal taxes and their hopeful impact on the overall economy. Small cap companies, who typically have higher tax rates relative to their larger peers, saw expectations for earnings forecasts move well above long-term average growth rates. The initial optimism was reflected in equity markets as indexes moved to all-time highs within the first month of the year. However, the positivity did not last long as a number of issues pushed equity indexes lower in February. The nearly 10% decline in the S&P 500 ended the record streak without a 3% correction. The 448 calendar days without a 3% correction easily surpassed the prior record of 370 days set in 1996. Small cap indexes dropped nearly 9% during this period. It was our view at the time that the steep drop in indexes was not a signal for a bear market, but a return to more normal equity volatility. Our thesis was verified as equity markets recovered, led by strong earnings growth and sustained economic growth, moving to near highs in mid-September. Small cap equity indexes reached their near-term peak earlier in the month. At this point fears of an aggressive Federal Reserve, slowing global economic growth and slowing earnings growth in 2019 caused many investors to attitude for riskier asset classes. Small cap indexes tumbled in September and October, getting a slight reprieve in November, before falling further in December. The largest decline posted on December 24th, brought coal instead of gifts for investors. From the near-term peak to the December 24th close, the Russell 2000 Index dropped 27.2% and stood at levels on par with 2016 closing prices. Following the holiday, equity prices moved higher, but still finished the year negative. For 2018, the WesMark Small Company Growth Fund returned -13.7%, compared to the Russell 2000 Index drop of 11.0%, and the Lipper Small-Cap Core Fund category decline of 12.7%. Over the past five years, the WesMark Small Company Growth Fund earned an average annual total return of 1.7%, versus 4.4% and 3.4% for the Russell 2000 Index and Lipper Small-Cap Core Fund, respectively.

The strong momentum from the first half of 2018 allowed growth indexes to post results that were slightly better than their value focused peers over the full year. The Russell 2000 Growth Index dropped 9.3%, while the Russell 2000 Value Index fell by 12.9% for the full year. During the final quarter of the year, value indexes performed better relative to growth, but both were down nearly 20% for the quarter. The fourth quarter declines erased all of the positive returns generated to that point. The results were similar for the WesMark Small Company Growth Fund, gaining 6.2% in the first nine months of 2018 compared to a return of -19.5% posted for the final quarter of the year. Once again larger cap counterparts outperformed their smaller peers, with the S&P 500 Index declining by 4.4% and the S&P Mid Cap Index dropping 11.1% for 2018.

The Fund’s relative performance for the period was affected by both sector allocation decisions and stock selection. From a sector perspective, returns were negative across all sectors except for the healthcare index. For 2018, the S&P 600 Health Care Index posted a gain of 9.8%. Even the more defensive sectors like utilities and consumer staples posted declines for the year. The S&P 600 Utilities Index fell by 3.2% and the S&P 600 Consumer Staples dropped by 6.4%, leaving very few sectors where small cap investors could have sought shelter in the volatile year. The more cyclical and commodity focused sectors produced the largest declines for the years, with the S&P 600 Energy and S&P 600 Materials sectors falling by 23.1% and 43.0%, respectively. As a result, sector selection was as important as stock selection. Going forward, we will continue to monitor our sector decisions over the next year, particularly given world economic growth projections and the outlook for earnings.

Our decision to overweight the health care sector proved correct; however, stock selection was not as helpful to performance. Our holdings within the sector dropped by 2.8%. For the year our approach was find companies with a specific product set that would either improve productivity within hospitals or medical offices, or services that would help companies maximize research and development budgets. For the year, slightly less than half the companies posted positive returns, led by CareDx, Align Technology and Icon Plc.

The largest absolute weighting for the Fund was in the Industrial sector, at 24.7% compared to the 14.7% for the benchmark. The decision to overweight the sector did not help performance, as the sector return trailed the benchmark. Selection was also hindrance as our holdings dropped 20.4% compared to a decline of 12.9% for the S&P 600 Industrials. With half the holdings posting results that were below the sector benchmark, with two holdings positive for the year led by Lennox International and Forward Air Corp. It was our expectation that the changes in corporate tax policy, paired with rising labor costs, would lead to an acceleration in capital expenditures during the year. In addition, a number of our holdings were focused in the transportation space. Our thesis was the tight market and the shift in consumer preferences would lead to strong earnings growth for the space.

Closely following our Industrial exposure was the Health Care weighting at 24.6% and the Information Technology at 23.6%. Our allocation to the Information Technology sector, is well above the 14.9% for the benchmark. Our selections within the sector was more accretive to overall performance than was our overweight to the sector. For the full year, our holdings posted a return of 8.0%, well above the S&P 600 Information Technology Index’s -9.4% return. The decision to overweight the sector in 2018 was grounded in our belief that valuations were attractive and earnings growth should accelerate given the anticipated global economic growth rates. Nearly half of our Information technology holdings reported positive returns, led by Tableau Software, Rapid7, and Nutanix, up 73.8%, 67.8% and 63.6%, respectively.

Financials account for the largest weighting within the benchmark. However, the Fund was underweight the benchmark with a 13.0% allocation. This marked a slight increase from the prior year, as several of our holdings were acquired by other companies. Our focus for the year was a shift into more regional banks, as we felt the increasing short-term rates would also help push borrowing rates higher. Instead, the yield curve flattened during much of 2018. And while net interest margins moved higher, they were not as strong as we initial expected. In addition, the market volatility and concerns about an aggressive Federal Reserve slowed loan demand in the first quarter. However, as economic growth accelerated in the second and third quarters, lending activity improved. While, the demand for loans improved, many other borrowers were paying off loans more quickly than expected. The result was flat or low increases in loan balances outstanding. The downturn accelerated following the election as concerns about increased regulation gathered momentum.

| 2 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Small Company Growth Fund |

Two of our more disappointing sectors within the Fund for the year were Energy and Consumer Discretionary. Our decision to underweight the Energy sector helped as the returns were significantly under that of the benchmark. For much of the middle part of 2018, we maintained a 0% weight in the space, as falling energy prices weighed on the underlying companies. Supporting the returns was an acquisition of one of our holdings during the year. The premium paid allowed us to post a modest gain in that position, still for the year our holdings were down 17.3%. Toward the end of 2018 we build a small position in the energy space in an effort take advantage of rising energy prices and the expected increase in earnings. Within the Consumer Discretionary space both weighting and selection were incorrect for the year. Our underweight in Consumer Discretionary, a sector that outperformed the broad benchmark, combined with poor stock selection resulted in returns that were not as accretive to the Fund as they should have been. Still we managed to report positive returns in Freshpet and Foot Locker, up 93.4% and 16.9%, respectively for 2018.

Our top ten holdings accounted for 36.1% of the overall market value of the Fund. The average performance for these holdings were solid for 2018, with seven of the top ten posting returns that exceed the benchmark and five with positive returns.

TOP 10 EQUITY HOLDINGS

| Security Name | % of Total Net Assets |

| Integrated Device Technology, Inc. | 4.7% |

| Hexcel Corp. | 4.4% |

| Quanta Services, Inc. | 4.1% |

| Allscripts Healthcare Solutions, Inc. | 3.9% |

| Lennox International, Inc. | 3.8% |

| Hill-Rom Holdings, Inc. | 3.6% |

| Pure Storage, Inc., Class A | 3.5% |

| Moog, Inc., Class A | 2.8% |

| Syneos Health, Inc. | 2.7% |

| Foot Locker, Inc. | 2.6% |

| Total Net Assets | 36.1% |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| Annual Report | December 31, 2018 |  |

3 |

Management’s Discussion of Fund Performance

| WesMark Small Company Growth Fund | December 31, 2018 (Unaudited) |

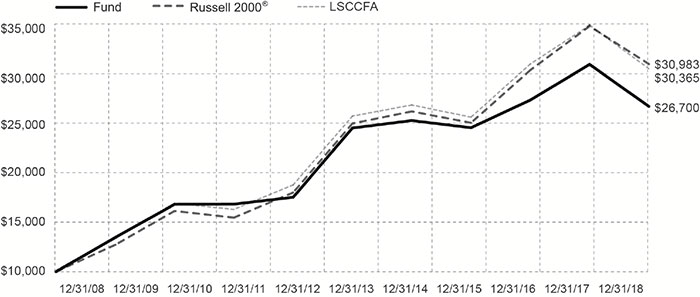

GROWTH

of $10,000 invested in WesMark Small Company Growth Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark Small Company Growth Fund (the “Fund”)

from December 31, 2008 to December 31, 2018, compared to the Russell 2000® Index (“Russell 2000®”)** and the

Lipper Small Cap Core Funds Average (“LSCCFA”).***

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years |

| -13.72% | 1.73% | 10.32% |

Total Annual Fund Operating Expense (as of most current Prospectus): 1.25%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Small-company stocks may be less liquid and subject to greater price volatility than large capitalization stocks.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The Russell 2000® and LSCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| ** | The Russell 2000® is not adjusted to reflect sales charges, expenses, or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The Russell 2000® measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 10% of the total market capitalization of the Russell 3000® Index. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| *** | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the respective categories indicated. These figures do not reflect sales charges. It is not possible to invest directly in an average. |

| 4 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Growth Fund |

The WesMark Growth Fund provided a total return of -6.19% for the year ended December 31, 2018 as compared to the Lipper Large-Cap Core Funds Average of -5.64% placing the Fund in the third quartile of the Lipper Large-Cap Core Funds peer group. After experiencing a year of low volatility, 2018 returned to more normal trading patterns with twenty 2% daily moves in stocks (Standard & Poor 500 Index) including six with moves greater than 3%. All major equity markets were negative for the full year and there were three market declines greater than 10% from near-term highs.

The equity markets began the year with positive momentum but this was short lived as February experienced the first decline of the year of greater than 10%, declining 10.1% from the high reached in late January. The concluding greater than 10% decline of the year resulted in a -19.8% move from September 20, 2018 to December 24, 2018. Market leadership shifted as the year progressed and investors became more defensive and removed risk from their portfolios. Healthcare and Utilities provided the strongest returns, 6.5% and 4.1%, respectively, for the full year with Energy and Materials experiencing the lowest returns -18.1 and -14.7%, respectively. Leadership in the first nine months of the year was found in Information Technology and Consumer Discretionary. As concerns regarding slowing global economic growth became more apparent, energy prices continued to decline, and trade and tariffs impacted corporate spending plans, the tone of the market began to change.

The Fund maintained an overweight position in Healthcare and Information Technology. Healthcare, the largest sector allocation, provided a positive full year portfolio return of 11.9%, exceeding the sector benchmark return of 6.5%. Information Technology provided a positive full year portfolio return of 6.9%, exceeding the benchmark return of -0.3%. In both cases sector allocation and security selection provided positive value to Fund’s 2018 total return. Positive contributions to the return in Healthcare were found in Merck, Abbott Labs and Zoetis as successful research and development efforts resulted in the approval and introduction of a number of new drugs that are expected to provide upside to the revenue and earnings growth of these companies as the development of humanized antibodies and biologics propel drug therapies to a new level. Zoetis focuses on the growing demand for healthcare for both companion and production animals. Negative to the Healthcare portfolio return were Celgene, whose acquisition by Bristol-Myers Squibb was announced in early 2019, and CVS Health Corp. who is digesting the acquisition of Aetna Inc. which created a healthcare powerhouse. Strength in salesforce.com, Adobe, and MasterCard contributed to the Information Technology return offset in part by weakness in Apple Inc. and Skyworks Solutions, a supplier to Apple Inc. Cloud data storage and software subscriptions are two of the forces driving change in the Information Technology sector. Demand from products that just a few years ago were considered technology deficient have come to the forefront of technology demand. Subscription services from the installed base of hardware has become a key element of growth for many content and software providers. Energy was maintained at a below market weighting in the Fund but a focus on Exploration and Production resulted in a portfolio sector return below that of the sector benchmark. The Fund’s underweight allocation to Consumer Staples was a positive contributor to performance but security selection eliminated any benefit of that allocation decision.

The year brought much volatility and change to the equity markets, with significant price declines witnessed in nearly all sectors as the year ended, which resulted in a challenging year for equity fund performance in general. As the fourth quarter progressed, the Fund maintained an increased cash position and reduced allocations to higher beta and higher valuation securities in an effort to maintain value and lessen the downside risk. Nearly every cyclical sector reached its 2018 low on December 24th and quickly began to move higher as the year came to an end. We maintain a long-term outlook in our portfolio management discipline and believe with volatility comes opportunities.

TOP 10 EQUITY HOLDINGS

| Security Name | % of Total Net Assets |

| Amazon.com, Inc. | 5.4% |

| UnitedHealth Group, Inc. | 4.3% |

| Apple, Inc. | 3.8% |

| Zoetis, Inc. | 3.7% |

| SPDR® S&P 500® ETF Trust | 3.1% |

| Raytheon Co. | 3.1% |

| salesforce.com, Inc. | 3.0% |

| Abbott Laboratories | 2.8% |

| Broadcom, Ltd. | 2.8% |

| Mastercard, Inc., Class A | 2.5% |

| Total Net Assets | 34.5% |

| Annual Report | December 31, 2018 |  |

5 |

Management’s Discussion of Fund Performance

| WesMark Growth Fund | December 31, 2018 (Unaudited) |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

Diversification does not eliminate the risk of experiencing investment losses.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

Lipper, Inc., a Reuters company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical and are based on total returns with capital gains and dividends reinvested. For the 10-, 5-, 3- and 1- year periods, the Growth Fund was ranked 403 out of 408, 532 out of 536, 573 out of 596, and 643 out of 674 as of 12/31/18 in the Large Cap Core Funds category. Lipper does not guarantee the accuracy of the information. Lipper rankings are not intended to predict future results.

| 6 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Growth Fund |

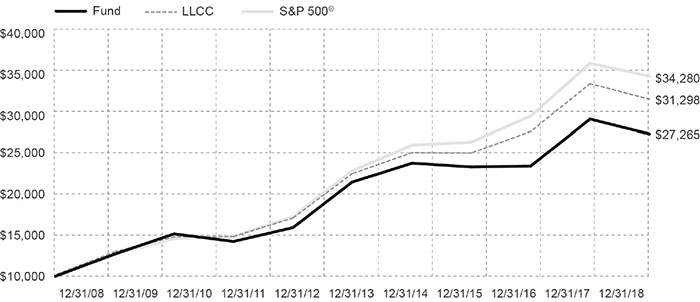

GROWTH of $10,000 invested in WesMark Growth Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark Growth Fund (the “Fund”) from December 31, 2008 to December 31, 2018, compared to the Standard and Poor’s 500® Index (“S&P 500®”)** and Lipper Large Cap Core Funds Average (“LLCC”).***

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years |

| -6.19% | 4.91% | 10.55% |

Total Annual Fund Operating Expense (as of most current Prospectus): 1.14%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500® and LLCC have been adjusted to reflect reinvestment of dividends on securities in the indexs and average. |

| ** | The S&P 500® is not adjusted to reflect sales charges, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and unlike the Fund, it is not affected by cash flows. It is not possible to invest directly in an index. |

| *** | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the respective category indicated. These figures do not reflect sales charges. It is not possible to invest directly in an average. |

| Annual Report | December 31, 2018 |  |

7 |

Management’s Discussion of Fund Performance

| WesMark Balanced Fund | December 31, 2018 (Unaudited) |

The WesMark Balanced Fund provided a total return of -4.58% for the year ended December 31, 2018 compared to the Lipper Balanced Fund Average of -5.52%, placing the Fund in the second quartile for the year. The Fund seeks to achieve capital appreciation and income by allocating its assets primarily among fixed income and equity securities. The asset allocation at year-end was 38.6% fixed income, 54.7% common equity, and 6.7% cash equivalents. The fixed income allocation was increased during the year as interest rates moved higher primarily in response to the actions of the Federal Reserve to normalize their interest rate policy. The Fund continued to maintain a relatively short fixed income structure with a modified duration of 3.58 years compared to the prior period duration of 4.50 years. All fixed income securities held in the Fund at year-end remained investment grade as determined by a Nationally Recognized Statistical Rating Organization. The largest exposure in the fixed income allocation was U.S. Corporate debt which provided a return for the Fund’s fixed income sector of 1.2% compared to the Lipper Core Bond Funds Index return of -0.69%. Taxable municipal bonds provided a return of 2.1% compared to the benchmark 1.3%. The Fund’s income structure remained in a position to benefit from a rising interest rate environment and a steeper yield curve. Interest rates did increase as the year progressed but the slope of the yield curve remained unusually flat. Four increases in the target Federal Funds rate drove short-term rates higher and a view of contained inflation caused intermediate and long-term rates to decline. As the year ended there was an inversion in the yield curve between one and three years with a positive slope as we extended our look farther along the curve. The rate spread between the 3 month Treasury bill and the 10 year Treasury note ended the year at 31 basis points compared to a 10 year average spread of 213 basis points. This flattening has caused concern regarding the sustainability of the current economic cycle.

The equity markets focus in 2018 remained on Growth in the first three quarters of the year at which time economic uncertainty, among other issues, brought a focus to value in an effort to reduce risk and volatility. Higher equity yields did receive competition from higher fixed income yields resulting in period of decline for those higher yield sectors including Utilities and Consumer Staples. Utilities managed to end the year with a positive total return of 4.11%. Deterioration in operating results drove the normally defensive Consumer Staples sector to a negative total return of -8.39%

Within the S&P 500, Value total return for the year was -8.97% compared to Growth total return of -0.01%. The Balanced Fund’s equity total return was -6.8% heavily impacted by the-9.2% return in December. The portfolio’s largest equity allocation was Information Technology and Healthcare with a bias to those companies having a current dividend and a history of increasing the dividend on a regular basis. Healthcare provided a positive absolute and relative contribution to the Fund’s return while Information Technology was negative in both absolute and relative terms. Positive contributions to the equity performance was driven by individual company contribution and not overall sector allocation. Boeing, Merck and Verizon led on the upside for the full year and Hanesbrands and Arthur J. Gallagher & Co. provided a positive contribution for the relatively short period that they were a part of the portfolio. AT&T Inc. underperformed rival Verizon with returns of -24.7% and 11.1%, respectively. Each has chosen a different path to participate in the rapidly changing telecommunication and content acquisition strategy with Verizon being viewed as the leader at this time. Lockheed Martin and United Parcel Service were notable negatives to performance. Lockheed Martin was damaged by Defense Department budget uncertainty and United Parcel Service has felt the margin pressure of rapidly growing demand on its infrastructure.

Higher available cash flow as a result of the Tax Cuts and Jobs Act brought dividend increases to a significant number of stocks held in the portfolio. This combined with share repurchases to enhance full year total return. While the year-over-year benefit of the tax changes will not repeat in 2019, the benefit of higher cash flow remains.

TOP 10 EQUITY HOLDINGS

| Security Name | % of Total Net Assets |

| Apple, Inc. | 4.0% |

| Pfizer, Inc. | 2.6% |

| AbbVie, Inc. | 2.3% |

| Cisco Systems, Inc. | 2.1% |

| Chevron Corp. | 2.0% |

| Discover Financial Services | 2.0% |

| DowDuPont, Inc. | 1.9% |

| Merck & Co., Inc. | 1.9% |

| Texas Instruments, Inc. | 1.9% |

| Amgen, Inc. | 1.8% |

| Total Net Assets | 22.5% |

| 8 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Balanced Fund |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

Lipper, Inc., a Reuters company, is a nationally recognized organization that ranks the performance of mutual funds within a universe of funds that have similar investment objectives. Rankings are historical and are based on total return with capital gains and dividends reinvested. For the 10-, 5-, 3-, and 1-year periods, the Balanced Fund was ranked 231 out of 431, 162 out of 511, 157 out of 544, and 182 out of 584 as of 12/31/18 in the Balanced Funds category. Lipper does not guarantee the accuracy of this information. Lipper rankings are not intended to predict future results.

| Annual Report | December 31, 2018 |  |

9 |

Management’s Discussion of Fund Performance

| WesMark Balanced Fund | December 31, 2018 (Unaudited) |

GROWTH of $10,000 invested in WesMark Balanced Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark Balanced Fund (the “Fund”) from December 31, 2008 to December 31, 2018, compared to the Standard and Poor’s 500® Index (“S&P 500®”)**, the Barclays Capital Intermediate U.S. Government/Credit Index (“BCIGCI”)***, the Lipper Balanced Funds Average (“LBFA”) ††, and a combined index consisting of 60% S&P 500® and 40% BCIGCI (“Balanced Composite Index”)†.

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years |

| -4.58% | 4.09% | 7.79% |

Total Annual Fund Operating Expense (as of most current Prospectus): 1.24%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P 500®, BCIGCI, LBFA, and Balanced Composite Index have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| ** | The S&P 500® is not adjusted to reflect sales charges, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and unlike the Fund, it is not affected by cash flows. It is not possible to invest directly in an index. |

| *** | The BCIGCI is not adjusted to reflect sales charges, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The BCIGCI is an unmanaged market value weighted performance index for government and corporate fixed rate debt issues with maturities between one and ten years. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| † | The Balanced Composite Index is not adjusted to reflect sales charges, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The Balanced Composite Index is an unmanaged index, comprised 60% S&P 500® and 40% BCIGCI, and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index or average. |

| †† | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the respective category indicated. These figures do not reflect sales charges. It is not possible to invest directly in an average. |

| 10 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Government Bond Fund |

Global financial market volatility picked up in calendar year 2018 (the “report period”), pointing to investor anxiety of a more serious deterioration in global macroeconomic conditions. Overall, fixed income assets delivered unexceptional performance but still bested their equity brethren. The two main risk variables for fixed income securities of rising interest rates and widening credit spreads occurred simultaneously within the period.

The Federal Reserve is three years into a tightening monetary policy cycle, making this the second longest such cycle in the last 50 years. The average tightening cycle over this time period has been approximately 15 months. The Federal Reserve’s monetary policy is critical for the current business cycle. Out of the 12 previous US interest rate hike cycles since 1955, eight have resulted in a recession for the US economy. As 2018 progressed, the question became whether the Federal Reserve could normalize monetary policy without derailing domestic and international growth expectations.

Within the report period, the transition toward a less accommodative central bank stance and higher federal funds rate had lessened investors’ appetite for risk. The report period began with investor optimism, fueled by domestic tax cuts, expecting the US economy to continue its expansion despite a less accommodative central bank and also expecting the European Union to follow suit.

In the fourth quarter of 2018, uncertainty related to the direction of the Federal Reserve’s policy on interest rates, global and Chinese economic growth expectations, the outlook for corporate earnings, trade disputes and the ongoing federal government shutdown instilled a flight to quality. The flight to quality trade in the fourth quarter of 2018 induced a rally in Treasury prices, as the 10 year US Treasury Yield declined from a peak of 3.24% on November 8, 2018 to close 2018 at 2.69%, a 55 basis point rally. The yield on the 10 year US Treasury began the year at 2.41%. The overall bond market performance, as measured by the Bloomberg Barclays Aggregate Index provided a total return of 0.01% for the period, predominantly due to the late fourth quarter rate rally. Within the fixed income sector for 2018, the degree of relative performance was driven by credit quality. For the report period, the top performer was the three month US Treasury Bill at 1.96%, followed by the US Government Sponsored Agency Securities at 1.24% and short duration Mortgage Backed Securities at 1.01%. The 10 year US Treasury had a return of 0.85% for the period. The laggards were high yield debt at -2.11%, corporate debt -2.52% and emerging markets -4.15%. Credit risk assets underperformed due in part to a shift in investor sentiment following the fourth quarter decline in the equity markets as credit spreads widened relative to US Treasury securities.

The slope of the US yield curve flattened in 2018. Historically, as the Federal Open Market Committee raises short term interest rates, the yield curve flattens as short term rates rise more than longer term rates. The Federal Open Market Committee increased the Federal Funds rate with four 25 basis point moves in 2018 ending the period at 2.50%.

The yield on the 10 year US Treasury began 2018 at 2.40%, peaked at 3.24% on November 8, 2018 and ended the year at 2.68%. Within the fourth quarter of 2018 investors overestimated the resilience of global growth in the face of tighter domestic monetary policy, international headwinds and investor sentiment shifting from equity securities. In the fourth quarter of 2018, as macroeconomic conditions slowed, inflation expectations plummeted on a combination of Consumer Price Index (CPI) releases that were below expectations and a 37% decline in the price of oil. Changes in inflation had the largest impact on the short end of the yield curve. As the Federal Reserve maintained its policy of increasing short-term interest rates, while inflation remained below their 2% target rate, the short end of the yield curve inverted in the fourth quarter. At the end of the report period, the yield on the one year US Treasury was 2.59% and the yield on the three year US Treasury was 2.45%. The spread between the 2 year US Treasury and the 10 year US Treasury began the period at 52 basis points and ended the period at 20 basis points. During this time, the yield on the 2 year US Treasury increased 60 basis points while the yield on the 10 year US Treasury increased 28 basis points.

For 2018, non-farm payrolls increased on-average by 220,000 per month with an unemployment rate of 3.9% at the end of the report period as compared to 4.1% in December 2017. The labor force participation rate ended the period at 63.1% compared to 62.7% at the end of 2017. Real average hourly earnings increased 3.2% in the period as compared to 2.5% in the prior period. The rate of inflation, as measured by the Consumer Price Index, ended the reporting period at 1.9% compared to 0.1% at the end of the prior report period. Given economic headwinds, both domestically and internationally in the fourth quarter, inflation expectations declined approximately 50 basis points while real interest rates surged at the short end of the yield curve given the Federal Reserve continued tightening of interest rates. Core prices, which exclude food and energy, increased 2.2% in the period as compared to 0.3% the prior period. Within the period, energy prices declined 0.3% while food prices increased 1.6%.

The ISM Manufacturing Index ended 2018 on a relatively soft note at 54.1 as compared to the year ago level of 59.3. The ISM Non-Manufacturing Index was 57.6 at the end of the report period compared to 56.0 at the end of the prior report period, but below its November 2018 peak of 60.0. Total mortgage securities guaranteed by Fannie Mae and Freddie Mac represented 73% of the Fund as of December 31, 2018 as compared to 74% on December 31, 2017. Within the mortgage allocation, Fannie Mae and Freddie Mac guaranteed mortgage pools (MBS) comprised 11% with Collateralized Mortgage Obligations (CMO) comprising 62%. The average interest rate for the mortgage pools were 2.79% while the average interest rate for the CMO’s was 2.45%. US Treasury securities accounted for 5% of the portfolio with Small Business Administration securities accounting for 2%. Taxable municipal securities accounted for 20% of the portfolio and the average interest rate was 3.94%. Mortgage related securities within the fund had a total return of 1.7% compared to the Lipper US Government Mortgage Index return of 1.0%. Taxable municipal securities had a total return of 3.1% compared to the Lipper Intermediate Municipal Fund Index return of 1.1%.

| Annual Report | December 31, 2018 |  |

11 |

Management’s Discussion of Fund Performance

| WesMark Government Bond Fund | December 31, 2018 (Unaudited) |

The WesMark Government Bond Fund provided a total return of 1.15% for the report period. The Lipper General US Government Fund Average return was -0.02% and the Barclay US Government/Credit Bond Index was -0.42% for the same period. The duration of the securities held in the fund was 5.0 years on December 31, 2018, compared to 5.1 years on December 31, 2017.

Entering 2018, expectations of increased Mortgage Backed Securities (MBS) supply, as the Federal Reserve began to reduce its $4.5 trillion balance sheet, dominated investor sentiment. Through the first three quarters of 2018 current coupon MBS spreads to the comparable US Treasury trended slightly upward. However, as interest rate volatility spiked in the fourth quarter, the spread widened and reached 98 basis points. Despite the widening of MBS spreads to the comparable US Treasury, MBS outperformed most fixed income asset classes during the year. MBS provided greater liquidity, a solid credit rating, and experienced strong foreign and domestic demand. As economic uncertainty developed in the fourth quarter and fundamental risks in credit sector assets increased, US Agency MBS provided strong relative performance. Within the report period, MBS had a positive return of 1.0%, outperforming investment grade corporate securities and high yield securities.

As the year came to a close and economic uncertainty and interest rate volatility increased, the short duration and high credit quality of the WesMark Government Bond fund enhanced its performance relative to its benchmark.

TOP 10 BOND HOLDINGS

| Name | Rate | Maturity | % of Total Net Assets |

| U.S. Treasury Bond US TREASURY N/B T 7 5/8 02/15/25 | 7.625% | DUE 2/15/2025 | 4.5% |

| Government National Mortgage Association GNR 2016-154 UP GNR 2016-154 UP | 3.000% | DUE 5/20/2045 | 2.8% |

| Government National Mortgage Association GNR 2014-25 PA GNR 2014-25 PA | 2.250% | DUE 1/20/2044 | 2.2% |

| Government National Mortgage Association GNR 2016-77 MB GNR 2016-77 MB | 2.000% | DUE 9/20/2045 | 2.2% |

| Fannie Mae REMICS FNR 2018-3 LD FNR 2018-3 LD | 3.000% | DUE 8/25/2046 | 2.0% |

| Fannie Mae REMICS FNR 2017-89 PL FNR 2017-89 PL | 3.000% | DUE 6/25/2043 | 2.0% |

| Government National Mortgage Association GNR 2005-26 ZA GNR 2005-26 ZA | 5.500% | DUE 1/20/2035 | 1.9% |

| Freddie Mac REMICS FHR 4629 QG FHR 4629 QG | 2.500% | DUE 11/15/2046 | 1.9% |

| Fannie Mae REMICS FNR 2012-134 AE FNR 2012-134 AE | 1.750% | DUE 7/25/2040 | 1.8% |

| Fannie Mae REMICS FNR 2016-90 DA FNR 2016-90 DA | 3.000% | DUE 8/25/2046 | 1.8% |

| Total Net Assets | 23.1% |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| 12 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Government Bond Fund |

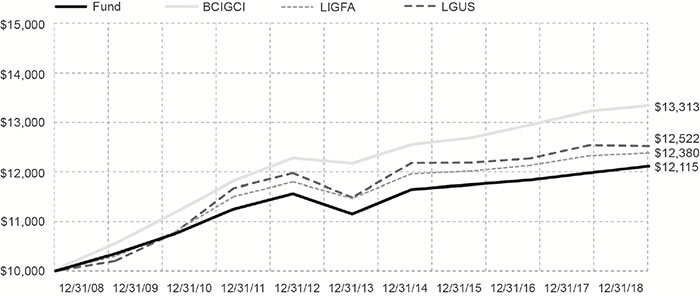

GROWTH of $10,000 invested in WesMark Government Bond Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark Government Bond Fund (the “Fund”) from December 31, 2008 to December 31, 2018, compared to the Barclays Capital Intermediate U.S. Government/Credit Index (“BCIGCI”)**, the Lipper Intermediate U.S. Government Funds Average (“LIGFA”)***, and the Lipper General U.S. Government Funds Average (“LGUS”).***

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years |

| 1.15% | 1.67% | 1.94% |

Total Annual Fund Operating Expense (as of most current Prospectus): 1.00%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices. The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligations.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The BCIGCI, LIGFA and the LGUS have been adjusted to reflect reinvestment of dividends on securities in the index and averages. |

| ** | The BCIGCI is an unmanaged market value weighted performance index for government and corporate fixed rate debt issues with maturities between one and ten years. BCIGCI is not adjusted to reflect sales charges, expenses, or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| *** | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the respective categories indicated. These figures do not reflect sales charges. It is not possible to invest directly in an average. |

| Annual Report | December 31, 2018 |  |

13 |

Management’s Discussion of Fund Performance

| WesMark West Virginia Municipal Bond Fund | December 31, 2018 (Unaudited) |

The Tax Cuts and Jobs Act of 2017 (TCJA) set the stage for the municipal market in 2018. By eliminating the use of tax- free municipal bonds to advance refund outstanding debt, Congress effectively reduced new municipal issue supply. The TCJA also reduced demand for municipal tax- free debt due to the reduction in the corporate income tax rate from 35% to 21%, limiting the incentive for bank and insurance companies to own municipal bonds. New municipal debt issuance for 2018 was $329.2 billion, down 20% from the 2017 level of $411 billion. Advanced refunding issuance declined more than 50% for the year, as compared to 2017. In 2018, retail investors focused on the shorter end of the municipal yield curve with maturities of 10 years or less, while institutional demand was negative on the longer end of the municipal yield curve as institutional investors reduced holdings by $25 billion year-over-year.

West Virginia’s economy, after a period of decline, has returned to a period of economic growth driven by the energy markets and the contribution from natural gas and a stabilization of the coal industry. Employment increases in the service sectors have provided an offset to job losses in other industries resulting in a notable decline in the state’s unemployment rate. The state of West Virginia’s unemployment rate at the end of 2018 was 5.1%, a decline of 0.3% from the December 2017 unemployment rate of 5.4%.

West Virginia’s Gross Domestic Product has begun to increase. Natural gas markets benefit from an ongoing buildout of the pipeline network moving an abundance of natural gas and natural gas byproducts to markets where demand and pricing is stronger. Exports are an important part of West Virginia’s economy and are not limited to energy but include chemicals, machinery, and auto components, among others.

In 2018, there was limited issuance of West Virginia municipal securities, with three competitive issues and 26 negotiated transactions. In May 2018, the State of West Virginia sold two series of general obligation bonds for highways totaling approximately $632 million. This was the largest competitive sale for the state and the second largest sale on record. The negotiated calendar was heavily weighted towards health care with Cabell General Hospital issuing $240 million and the United Group, led by West Virginia University Medical Center, issuing $218 million. The West Virginia Parkway Authority issued $166 million.

In 2017, Moody’s Investors Service downgraded the State of West Virginia’s general obligation debt to Aa2 from Aa1. Within the current report period, the state took steps to improve its credit worthiness. For example, Moody’s Investor Service noted the state maintained a healthy liquidity position, which can provide financial flexibility to weather a slower than expected economic rebound. In addition, Standard and Poor’s noted that the state made progress in addressing its underfunded pension liabilities.

The Federal Reserve is three years into a tightening monetary policy cycle, making this the second longest tightening cycle in the last 50 years. The average tightening cycle over this time period has been approximately 15 months. Of the 12 previous US interest rate hike cycles since 1955, eight have resulted in a recession for the US economy. As 2018 progressed, the market questioned whether the Federal Reserve could normalize monetary policy without derailing domestic and international growth expectations.

Within the report period, as the Federal Reserve continued its policy of increasing short -term interest rates, the US Treasury yield curve flattened with short- term interest rates increasing more than longer term interest rates. The municipal bond yield curve did not flatten to the same degree as the US Treasury yield curve within the period, as individual investor demand for short maturity securities increased while institutional demand for longer dated maturities waned. The spread between the 2 year municipal bond and the 15 year municipal bond ended the report period at 79 basis points while the spread between the 2 year US Treasury and the 15 year US Treasury ended the period at 26 basis points. The ratio of the Thomson Reuters Municipal Market Data (MMD) AAA rated municipal yield compared to the comparable US Treasury yield is an industry barometer used to evaluate the relative value of AAA rated municipal securities compared to the comparable US Treasury. The 10 year MMD AAA rated municipal yield to the 10- year US Treasury yield ratio began the report period at 82% and ended the report period at 85%. The 2 year MMD AAA rated municipal yield to the 2- year US Treasury yield ratio began the period at 80% and ended the report period at 70%. Within the report period, as individual investors demand for short term municipal securities increased and institutional investors demand for longer dated municipal securities declined, shorter term municipal bonds performed well relative to longer term municipal bonds and appreciated in value relative to their US Treasury counterparts.

The WesMark West Virginia Municipal Bond Fund had a total return of 0.47% in 2018. The Fund’s benchmark, the Barclays Municipal Bond 5 year index total return was 1.69% for the report period and the Lipper Other States Municipal Debt Fund average was 0.68%. The duration of the fund was 4.1 years as of December 31, 2018, as compared to 4.5 years on December 31, 2017. The net investment income dividend (excluding capital gain distribution) was $0.21 per share for the report period compared to $0.21 per share for the prior report period. Approximately 97.63% of the dividend was derived from West Virginia Municipal Securities and was exempt from federal and state income tax for West Virginia residents. The portfolio did not contain any securities subject to Alternative Minimum Tax. At the end of the report period, 85% of the portfolio securities were BBB rated or higher with 5% rated AAA. The securities within the fund had an average maturity of 8.25 years, which exceeded the Barclay Municipal 5 Year Index. The funds longer average maturity structure limited its performance relative to the benchmark, as municipal credit spreads relative to US Treasuries widened to a greater degree on longer dated maturities.

| 14 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark West Virginia Municipal Bond Fund |

TOP 10 BOND HOLDINGS

| Name | % of Total Net Assets |

| Preston County Board of Education General Obligation Unlimited Bonds | 3.2% |

| West Virginia Building Commission Lease Revenue Bonds (West Virginia Regional Jail) | 2.8% |

| West Virginia Water Development Authority Infrastructure Revenue Bonds (West Virginia Infrastructure Jobs Program) | 2.6% |

| West Virginia Building Commission Lease Revenue Bonds (West Virginia Regional Jail) | 2.3% |

| West Virginia Higher Education Policy Commission Revenue Bonds (Higher Education Facilities) | 1.7% |

| West Virginia Economic Development Authority Lease Revenue Bonds (Correctional Juvenile & Public) | 1.6% |

| Parkersburg, West Virginia, Waterworks & Sewer System Revenue Bonds | 1.6% |

| Hampshire County, West Virginia, Building Commission Revenue Bonds | 1.5% |

| West Virginia Economic Development Authority Lease Revenue Bonds (State Office Building & Parking Lot) | 1.5% |

| West Virginia Economic Development Authority Lease Revenue Bonds (State Office Building) | 1.5% |

| Total Net Assets | 20.3% |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| Annual Report | December 31, 2018 |  |

15 |

Management’s Discussion of Fund Performance

| WesMark West Virginia Municipal Bond Fund | December 31, 2018 (Unaudited) |

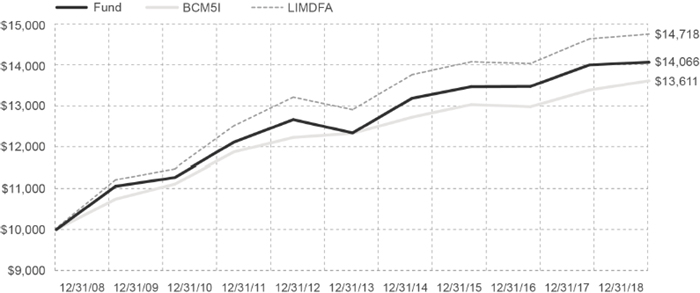

GROWTH of $10,000 invested in WesMark West Virginia Municipal Bond Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark West Virginia Municipal Bond Fund (the “Fund”) from December 31, 2008 to December 31, 2018, compared to the Barclays Capital Municipal Bond 5 Year Total Return Index (“BCM5I”)** and the Lipper Intermediate Municipal Debt Funds Average (“LIMDFA”).***

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | 5 Years | 10 Years |

| 0.47% | 2.66% | 3.47% |

Total Annual Fund Operating Expense (as of most current Prospectus): 1.08%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The BCM5I and the LIMDFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| ** | The BCM5I is an unmanaged market value weighted performance index for major municipal bonds of all quality ratings with an average maturity of approximately five years. BCM5I is not adjusted to reflect sales charges, expenses, or other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| *** | Lipper figures represent the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the respective category indicated. These figures do not reflect sales charges. It is not possible to invest directly in an average. |

| 16 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Tactical Opportunity Fund |

We began 2018 with an allocation to equity markets that was slightly below the upper end of our range. In addition, the fixed income allocation was slightly below our neutral allocation. Within the fixed income allocation we had a larger exposure to short-term and floating rate debt. Our view was that the Federal Reserve would continue to increase rates, particularly if employment trends persisted. Our equity holdings had larger allocations to more cyclical sectors, such as Consumer Discretionary and Information Technology sectors. Our reasoning was that the changes to corporate and personal tax rates would help boost domestic consumption. While optimistic, we were guarded given the strong run equity markets had, thus we wrote a number of call options on existing positions which has the effect of capping the gains in the securities in exchange for a premium payment from a counterparty. As equity markets suffered their largest decline in over a year in late January and early February, we added to our equity positions. We felt the selloff was not driven by changes in the underlying fundamentals. At such time we felt that domestic economic growth would likely accelerate in the following quarters and a number of our leading economic indicators were pointing to improving economic conditions. As equity markets recovered a number of our equity positions subject to written call options were called away. As a result, we saw our cash position increase.

As we began the second quarter, we felt that higher quality names would benefit from the expected economic and market conditions. In addition, some of our work in the alternative investment space brought to our attention the CBOE PutWrite Index. Over a thirty year period, this index has generated slightly higher annualized returns with lower standard deviations, relative to other equity and covered call portfolios. Also, our view was for equity market volatility to be more in line with historical averages, rather than what was experienced in 2017. As a result, we sought ways to reduce our volatility while maintaining our equity market exposure. Thus, we build a position in an ETF that tracks the above mentioned Index.

Our strategy held for most of the second and third quarters. However, as equity markets recovered and the number of economic headwinds increased, we moved to be more in line with our neutral weights. The equity holdings also shifted to income more defensive sectors like Health Care and Consumer Staples and value focused holdings. In addition, we used a number of written call options to help hedge our holdings. Within our fixed income holdings we increased the duration to be more in line with the overall benchmark, as rates moved closer to 3%. We still maintained a sizable position in floating rate bonds, as the Federal Reserve continued to suggest they would increase short term rates in upcoming meetings.

Equity markets reached their near-term peak toward the end of the third quarter. At that point the ongoing rhetoric regarding trade and tariffs with China, concerns regarding slowing economic and earnings growth lead many investors to reassess their risk tolerance. However, based on our view of economic conditions we remained steadfast in our allocations. The equity position in the Fund remained at our neutral target, with modest international exposure and domestic holdings that were more defensive. Within our alternative strategies we held our PutWrite holding, a Long/Short equity position and a smaller allocation to gold. With fixed yields closer to 3.2%, our floating rate allocation performed well, but we were slightly early on intermediate duration bonds. Returns on a year-to-date basis were positive, and we remained well above our Lipper category average return. However, equity markets dropped in October as trade and tariff issues accelerated. Markets recovered modestly in November as there was a temporary stay in increased tariffs. In the interim, we used the cash to increase equites that declined. Within fixed income we closed out our floating rate allocation, instead adding to fixed rate, intermediate term duration holdings. It was our belief that the Federal Reserve would soon paused its path of rate hikes.

As we closed out 2018, we slightly increased our fixed income holdings and remained slightly above the neutral target. Our equity allocation remained primarily domestic focused with a preference for quality, value and defensive positions. Cash remained a little higher, as we remained focused on using pullbacks to add to holdings.

Since the Fund’s inception, March 1, 2017, the WesMark Tactical Opportunity Fund posted a total return of 2.7%. That compared to the MSCI All World Index of 6.4% and the U.S. BarCap Aggregate Bond Index of 3.2% for same period. Since inception period, our Tactical Composite Index, consisting of 60% MSCI All World Index, 30% U.S. BarCap Aggregate Bond Index and 10% HFRI Fund of Funds Composite Index posted a return of 4.9%. For 2018, the WesMark Tactical Opportunity Fund return was -5.2%, compared to the Lipper Flexible Portfolio category’s return of -7.23%.

For the year, several of our industry specific holdings posted solid returns. Our decision to focus on global technology and internet-focuses holdings, iShares Global Technology ETF (+27.1%) and First Trust Dow Jones Internet Index ETF (+27.2%) helped performance during the period. The S&P 500 Health Care Index was one of the best performing sectors for the year. As a result, our iShares US Medical Devices ETF (+15.4%) and the SPDR Health Care ETF (+4.1%) helped performance for the year. The majority of our holdings that posted positive returns for 2018 were in the fixed income and non-traditional asset classes. As the yields on the 10-year Treasury moved closer to 3%, we modified our fixed income allocation to include more intermediate duration holdings. The Vanguard Total Bond Market ETF rose 1.9% during our holding period. Our positions in the U.S. dollar and gold related products also added to our returns for the year, while the diversified commodity ETF gained 5.8% for the holding period. Several of our largest underperforming holdings were offset by options written on the positions or used to offset gains.

Our top ten holdings accounted for 82.1% of the overall market value of the Fund. The average performance for these holdings were mixed for 2018, with four of the top ten posting positive returns.

| Annual Report | December 31, 2018 |  |

17 |

Management’s Discussion of Fund Performance

| WesMark Tactical Opportunity Fund | December 31, 2018 (Unaudited) |

TOP 10 EQUITY HOLDINGS

| Security Name | % of Total Net Assets |

| SPDR® S&P 500® ETF Trust | 17.3% |

| Vanguard® Total Bond Market ETF | 16.8% |

| Vanguard® Mega Cap Value ETF | 12.0% |

| iShares® Floating Rate Bond ETF | 10.6% |

| iShares® Core U.S. Aggregate Bond ETF | 5.4% |

| iShares® Edge MSCI USA Quality Factor ETF | 4.9% |

| Health Care Select Sector SPDR® Fund | 4.6% |

| Consumer Staples Select Sector SPDR Fund | 4.6% |

| SPDR® Gold Shares | 3.0% |

| iShares® Russell 2000® ETF | 2.9% |

| Total Net Assets | 82.1% |

Also see Glossary of Terms on page 76.

Performance data quoted represents past performance which is no guarantee of future results.

An investment in the Funds involves risk, including loss of principal. Investment in the Funds is subject to investment risks, including, without limitation, market risk, credit risk, interest rate risk, risks related to ETF net asset value and market price, foreign securities risk, commodity risk, manager risks, risks of investing in real estate investment trust (REITs), and risks related to company size.

The views in this report were those of the Fund Managers as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| 18 |  |

www.wesmarkfunds.com |

Management’s Discussion of Fund Performance

| December 31, 2018 (Unaudited) | WesMark Tactical Opportunity Fund |

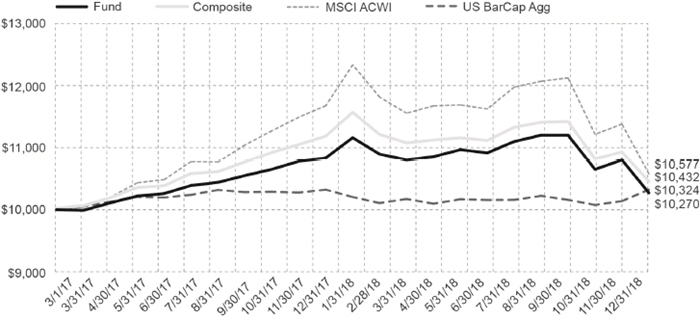

GROWTH of $10,000 invested in WesMark Tactical Opportunity Fund

The graph below illustrates the hypothetical investment of $10,000* in the WesMark Tactical Opportunity Fund (the “Fund”) from March 1, 2017 to December 31, 2018, compared to the Tactical Composite Index (“Composite”)**, the Morgan Stanley Capital International All Country World Index (“MSCI ACWI”)***, and the Barclays US Aggregate Index (“US BarCap Agg”).****

AVERAGE ANNUAL TOTAL RETURN for the periods ended December 31, 2018

| 1 Year | Since Inception (3/1/17) |

| -5.20% | 1.46% |

Total Annual Fund Operating Expense (as of most current Prospectus): 2.24%

Total Annual Fund Operating Expense After Fee Waiver (as of most current Prospectus): 2.01%

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month end performance and after-tax returns call 1-800-864-1013. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

| * | Represents a hypothetical investment of $10,000 in the Fund. The Fund’s performance assumes the reinvestment of all dividends and distributions. The Composite, the MSCI ACWI and the US BarCap Agg have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| ** | The Tactical Composite Index is comprised of a combination of 60% MSCI ACWI, 30% Barclays US Aggregate Index and 10% HFRI Fund^ of Funds Composite Index. |

| *** | The MSCI ACWI is a market capitalization weighted index designed to provide a broad measure of equity market performance throughout the world and is comprised of stocks from both developed and emerging markets. |

| **** | The US BarCap Agg measures the performance of the U.S. investment grade bond market. |

| ^ | The Hedge Fund Research, Inc. (HFRI) Fund of Funds Composite Index is an equal weighted index that consists of over 800 constituent hedge funds, including both domestic and offshore funds. |

| Annual Report | December 31, 2018 |  |

19 |

Portfolio of Investments Summary Table

| WesMark Small Company Growth Fund | December 31, 2018 (Unaudited) |

At December 31, 2018, the Fund's Portfolio Composition(1) was as follows:

| Portfolio Composition | Percentage of Total Net Assets |

| COMMON STOCKS | 96.2% |

| SHORT TERM INVESTMENTS(2) | 0.2% |

| OTHER ASSETS AND LIABILITIES - NET(3) | 3.6% |

| TOTAL NET ASSETS | 100.0% |

At December 31, 2018, the Fund's Sector composition(4) was as follows:

| Sector Composition | Percentage of Total Net Assets |

| Health Care | 23.7% |