Form N-CSR Starboard Investment For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22298

Starboard Investment Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

116 South Franklin Street, Rocky Mount, North Carolina 27802

(Address of principal executive offices) (Zip code)

Paracorp Inc.

2140 South Dupont Hwy., Camden, DE 19934

(Name and address of agent for service)

Registrant's telephone number, including area code: 252-972-9922

Date of fiscal year end: March 31

Date of reporting period: March 31, 2021

Item 1. REPORTS TO STOCKHOLDERS.

Annual Report 2021

For the fiscal year ended March 31, 2021

Matisse Discounted Closed-End Fund

Strategy

Institutional Class Shares

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Matisse Discounted Closed-End Fund Strategy (the “Fund”). The Fund’s shares are not

deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount

invested. Neither the Fund nor the Fund’s distributor is a bank.

The Matisse Discounted Closed-End Fund Strategy is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Matisse

Discounted Closed-End Fund Strategy, including its principals, and Capital Investment Group, Inc.

|

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Matisse Discounted Closed-End Fund Strategy (“Fund”) and of the market in

general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed

or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic

conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully

before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at https://docs.nottinghamco.com/Matisse or by calling Shareholder Services at 800-773-3863. The prospectus

should be read carefully before investing.

|

For More Information on the Matisse Discounted Closed-End Fund Strategy:

See Our Web sites @ matissefunds.com

or

Call Our Shareholder Services Group at 800-773-3863.

(Unaudited)

Dear MDCEX Shareholder:

Enclosed please find the Annual Report for the Matisse Discounted Closed-End Fund Strategy (MDCEX; hereafter the “Fund”) for the period ending March 31st, 2021. The Fund formally

launched on October 31st, 2012.

What a difference a year makes! As we wrote this annual letter one year ago, the global financial markets had just fallen sharply, and discounts on closed-end funds had widened dramatically, as

investors panicking about COVID-19 sold just about everything. At the widest point (March 18th, 2020), discounts in the Fund’s underlying portfolio averaged 31%, and the average closed-end fund was trading at a 21% discount. Oil prices

were in the tank. The Fund’s performance---both on an absolute and relative basis---was lagging its benchmarks.

Fast forward to today:

| • | Major stock markets have jumped 80+% from those March 2020 lows, with small caps, energy, and tech stocks leading the way. |

| • | Oil prices are near multi-year highs, over $60 a barrel, and many other commodities are at or near new records. |

|

•

|

The US economy is likely in its fourth straight quarter of strong recovery, with first quarter GDP clocking in at over 6%, and the unemployment rate back down to 6% (a level it took until late 2014 to move below coming out of the 2008/2009 recession) even with many retail establishments still at least partially closed due to COVID-19 restrictions. |

|

•

|

Democrats are now in control of both the executive and legislative branches, and the rate of government spending---already high coming into 2021---looks set to gap even higher, with tax cuts for the middle class, stimulus checks, and trillions in infrastructure spending. |

|

•

|

Though the Fund’s portfolio remains very attractively discounted---at 17.5% as of quarter end---the average closed-end fund is now slightly less discounted than its long-run average discount. |

In brief, we believe the reopening trade is alive and well, as pent-up demand from the American consumer---juiced by government largesse and perpetually low interest rates---is driving up

profits, prices, and asset values simultaneously.

As you can see from the nearby table, the Fund performed very well over the past 12 months, both absolutely and in relative terms. Digging into this further, we find that we benefitted from the

reversal of nearly all the factors that negatively impacted us from 3/31/19-3/31/20.

Specifically, from 3/31/20-3/31/21:

|

1.

|

Most closed-end fund discounts narrowed and NAVs increased. For the 12-month period, the average closed-end fund saw its discount narrow by 4.7%. Our trading and fund selection (which has led our

discount-movement-attributed performance to exceed the closed-end fund universe’s in 80% of rolling quarters since we launched the Fund) was a strong positive factor, as discount movement/capture within the Fund contributed 822 bps to our

total return.

|

|

2.

|

Offsetting the benefit from closed-end fund discounts and trading, our exposures to Foreign and Value were a negative, as the Russell 1000 Value lost to the Russell 1000 Growth by about

7 percentage points, and the MSCI EAFE index lost to the S&P 500 by about 12 percentage points for the period 3/31/20-3/31/21. Ballpark, our overweight to these areas cost us approximately 2 percentage points of relative performance.

It is worth noting that, for the second half of the period (9/30/20-3/31/21), Value beat Growth and the MSCI EAFE beat the S&P 500, as the reopening trade took firmer hold.

|

|

3.

|

Our exposure to the Energy sector, unlike 3/31/19-3/31/20, was a major positive factor. A strong rebound in oil prices helped lead to a 78% gain for large-cap energy names, and a 99%

gain for MLPs from 3/31/20-3/31/21. Discounts on our MLP CEFs narrowed considerably (though they remain extremely attractive at over a 20% discount), adding to the performance contribution. Our energy and commodity holdings as a group

contributed about 10 percentage points to our return for the 12 months.

|

Average Annual Total Returns

|

Period ended

March 31, 2021

|

One Year

|

Five Year Annualized

|

Annualized Since

Inception 10/31/2012

|

|

MDCEX

|

+64.68%

|

+9.73%

|

+7.17%

|

|

S&P 500 Index

|

+56.35%

|

+16.28%

|

+15.40%

|

|

S-Network Composite

Closed-End Fund Total

Return Index

|

+43.58%

|

+9.81%

|

+7.36%

|

|

S&P Target Risk

Moderate Index

|

+21.79%

|

+7.50%

|

+6.53%

|

|

MSCI EAFE Total Return

Index

|

+44.57%

|

+8.85%

|

+7.33%

|

|

Barclays US Aggregate

Bond Total Return Index

|

+0.71%

|

+3.10%

|

+2.72%

|

The performance information quoted represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by

calling 1-800-773-3863. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus is 3.48% dated August 1, 2020. The Total Annual Fund Operating Expense is required to

include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies. The Advisor has entered into an expense limitation agreement with the Fund under which it has agreed to waive or reduce its

fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of (i) any 12b-1 fees; (ii) any front-end or contingent deferred loads; (iii) brokerage fees and commissions, (iv)

acquired fund fees and expenses; (v) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (vi) borrowing costs (such as interest

and dividend expense on securities sold short); (vii) taxes; and (viii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers

(other than the Advisor)) to not more than 1.25% of the average daily net assets of the Fund. The Expense Limitation Agreement runs through July 31, 2021 and may be terminated by the Board of Trustees of the Fund at any time. “Acquired Fund Fees

and Expenses” include expenses incurred indirectly by the Fund through its investments in closed-end funds and other investment companies, do not affect a Fund’s actual operating costs, and therefore are not included in the Fund’s financial

statements, which provide a clearer picture of a Fund’s actual operating costs. The Advisor cannot recoup from the fund any amounts paid to the Advisor under the expense limitation agreement. However, net annual operating expenses for the Fund may

exceed those contemplated by the waiver due to expenses that are not waived under the Expense Limitation Agreement.

Management Outlook

Right now, we continue to maintain a highly diversified portfolio with 77 holdings as of quarter-end. We began tactically increasing the Fund’s energy exposure during the second half of 2020,

which now stands at 15% of the overall portfolio. Healthcare, financial services, and consumer cyclical are our next largest equity sectors, each at 9% to 10% of our portfolio. Overall, our equity exposure is right at 80%, with about one-third of

that foreign.

Although the underlying portfolio of the Fund is full of closed-end funds whose discounts are still large (both in absolute terms and compared to their long-term average discount levels), we are

slowly building some cash in the Fund given that discount opportunities are neither as large (nor as common) as they were throughout much of 2020. As we move forward with this process, we expect to eventually hold somewhat fewer names (perhaps

50-60 instead of 70-80), and we expect to potentially realize some long-term gains on holdings whose discounts have narrowed substantially.

To provide more color – going forward we intend to focus on reducing downside volatility by building some cash (and possibly hedging the Fund’s portfolio in various ways), so that we are prepared

with more cash to potentially take advantage of any compelling discount opportunities that may arise. We believe this more conservative and cautious approach is appropriate given that most of our shareholders place MDCEX into a tactical,

opportunistic bucket. After such a significant performance run-up over the last 12 months, we are now willing to give up some upside return at the expense of having more cash or for the cost of hedging. We believe that this adjusted approach may

help reduce stress for our shareholders, and potentially help them avoid making any poor decisions around investment timing.

Historically speaking, discount tops in the closed-end fund market have typically manifested as long periods of meandering, narrower-than-average discounts followed by a sharp discount blowout

which has tended to coincide with downside volatility across several other risk markets. Discount bottoms, on the other hand, have tended to be sharp and short-lived, and have typically been marked by major socio-economic events (the tech wreck of

the early 2000s, the mortgage crisis of 2008, and the more recent COVID-19 crisis). Our primary takeaway is that holding much more than 20% cash within the Fund is not usually a wise decision. We have explored other ways to hedge the Fund as well,

and may implement some of them, at low levels, at various points going forward (if or when we feel discounts are very unattractive).

But note this is not the situation we find ourselves in today. While the average discount in the entire CEF universe is 3.8% as of quarter-end (compared to a trailing 10-year average discount of

5.4%), we do not believe we are near a discount top. As a point of emphasis, the average closed-end fund discount in the entire universe has been narrower than 3.8% approximately one-third of the time. So, we believe there is still room for

discounts to run barring any significant market changes. Consider that the average discount to NAV in the underlying portfolio of the Fund is 17.5% as of quarter-end.

We have previously noted and continue to believe that one important advantage for closed-end funds, in general (as we consider the overall outlook for the Fund) is today’s low interest rates.

Back in 2008, the 10-year US treasury yield never fell below 2.00%. As of quarter-end, the 10-year US treasury yield was 1.74%. More importantly, the Fed has committed itself to zero rates for the foreseeable future, even stating explicitly that

they will allow inflation to run above two percent “for a time” (should that ever come to pass). In our view, the structural advantages of closed-end funds (easy and cheap borrowing paired with high and largely sustainable cash distributions) will

eventually be found by an increasing number of investors who ignore closed-end funds now. Investors desire yield, and closed-end funds may eventually become a mainstream and common option to satisfy investor’s income needs. If this trend is

realized, then discounts could ultimately narrow for secular reasons for years to come. In our opinion, it makes closed-end fund investing that much more exciting.

Despite COVID-19, the US stock market had a great year in 2020 and has continued to move higher in 2021 (as it anticipates the reopening of the economy). The forward PE of the S&P 500 now

stands at 24, well above its average of 18 over the past 30 years (and the trailing PE is an astonishing 33). The open question is whether the strong economic growth that could occur in the second half of 2021 (due to the anticipated reopening of

the economy, along with record-low interest rates that could persist for many years) is sufficient to support stock prices at current levels or potentially drive them higher.

Our largest position continues to be Pershing Square Holdings, an 8.7% position for the Fund at quarter-end. This closed-end fund’s shares trade overseas (London and Amsterdam), but it is managed

by US hedge fund manager Bill Ackman and contains mostly high-quality US stocks. Despite excellent underlying performance (a 110% at-NAV return over the past two years, helped by some timely March 2020 hedging), fund and manager share purchases,

and a regular quarterly dividend, the fund still traded at a very high 27% discount to NAV at quarter-end. We expect this discount will not persist for long.

There are other, similar deals across the Fund’s underlying portfolio, including one trading at less than half of its NAV.

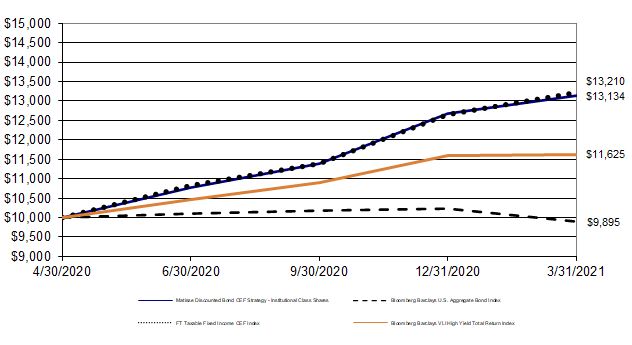

A New Fund in the Matisse Funds Family

Effective April 30th, 2020, Matisse launched our second mutual fund, the Matisse Discounted Bond CEF Strategy (MDFIX). Within it, we apply our discount-focused strategy to Bond CEFs

specifically. See the new Fund’s prospectus for more information. We appreciate your interest in, and investment in, the Fund. We’ll continue to keep you updated on the important developments we see in the misunderstood, retail-dominated world of

closed-end funds. Check out https://matissefunds.com/ for updates, and feel free to contact us at 503-210-3005 to discuss the Matisse Discounted Closed-End Fund Strategy and our investment approach.

Sincerely,

|

|

|

Eric Boughton, CFA

Portfolio Manager

Matisse Funds

|

Bryn Torkelson

Founder & CIO

Matisse Funds

|

(RCMAT0321008)

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||||||||||

|

Institutional Class Shares

|

|||||||||||||||||

|

Performance Update (Unaudited)

|

|||||||||||||||||

|

For the period from October 31, 2012 (Date of Initial Public Investment) through March 31, 2021

|

|||||||||||||||||

|

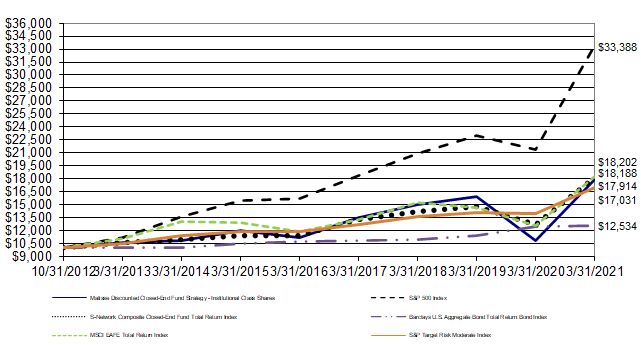

Comparison of the Change in Value of a $10,000 Investment

|

|||||||||||||||||

|

This graph assumes an initial investment of $10,000 at October 31, 2012 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Matisse Discounted Closed-End Fund

Strategy versus the Fund's benchmark index, the S&P 500 Index. Other indices shown are the S-Network Composite Closed-End Fund Total Return Index, the Barclays U.S. Aggregate Total Return Bond Index, the S&P Target Risk Moderate

Index, and the MSCI EAFE Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative

purposes only.

|

||||||||||||||||||

|

Average Annual Total Returns

|

||||||||||||||||||

|

For the Fiscal Year Ended

|

One

|

Five

|

Since

|

|||||||||||||||

|

March 31, 2021

|

Year

|

Years

|

Inception*

|

|||||||||||||||

|

Institutional Class Shares

|

64.68%

|

9.73%

|

7.17%

|

|||||||||||||||

|

S&P 500 Index

|

56.35%

|

16.28%

|

15.40%

|

|||||||||||||||

|

S-Network Composite Closed-End Fund Total

|

||||||||||||||||||

|

Return Index

|

43.58%

|

9.81%

|

7.36%

|

|||||||||||||||

|

S&P Target Risk Moderate Index

|

21.79%

|

7.50%

|

6.53%

|

|||||||||||||||

|

MSCI EAFE Total Return Index

|

44.57%

|

8.85%

|

7.33%

|

|||||||||||||||

|

Barclays U.S. Aggregate Total Return Bond Index

|

0.71%

|

3.10%

|

2.72%

|

|||||||||||||||

|

*

|

The Inception Date of the Fund is October 31, 2012.

|

|||||||||||||||||

|

(Continued)

|

||||||||||||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||||||||||

|

Institutional Class Shares

|

|||||||||||||||||

|

Performance Update (Unaudited)

|

|||||||||||||||||

|

For the period from October 31, 2012 (Date of Initial Public Investment) through March 31, 2021

|

|||||||||||||||||

|

Performance quoted in the previous graph represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance data quoted. The Advisor has entered into an Expense Limitation Agreement with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce

its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund’s total operating expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired

fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest

and dividend expense on securities sold short); (vi) taxes and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service

providers (other than the Advisor)) to not more than 1.25% of the average daily net assets of the Fund for the current fiscal year. The Expense Limitation Agreement remains in effect through July 31, 2021. The Expense Limitation Agreement

may be terminated by the Board of Trustees of the Trust at any time. Without the waiver, the expenses would be 3.48% per the Fund’s most recent prospectus dated August 1, 2020. An investor may obtain performance data, current to the most

recent month-end, by visiting ncfunds.com.

|

|||||||||||||||||

|

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure

net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

|

|||||||||||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||

|

Schedule of Investments

|

|||||||||

|

As of March 31, 2021

|

|||||||||

|

Shares

|

Value (Note 1)

|

||||||||

|

CLOSED-END FUNDS - 101.00%

|

|||||||||

|

Aberdeen Asia-Pacific Income Fund, Inc.

|

725,213

|

$

|

2,966,121

|

||||||

|

Aberdeen Emerging Markets Equity Income Fund, Inc.

|

117,348

|

1,015,060

|

|||||||

|

Aberdeen Japan Equity Fund, Inc.

|

270,018

|

2,435,562

|

|||||||

|

Aberdeen Standard Global Infrastructure Income Fund

|

61,670

|

1,233,400

|

|||||||

|

(a)

|

Adams Diversified Equity Fund, Inc.

|

653,582

|

11,934,407

|

||||||

|

Apollo Senior Floating Rate Fund, Inc.

|

74,404

|

1,105,643

|

|||||||

|

ASA Gold and Precious Metals Ltd.

|

341,298

|

6,808,929

|

|||||||

|

Blackrock Health Sciences Trust II

|

125,000

|

3,287,500

|

|||||||

|

BlackRock Science & Technology Trust II

|

98,000

|

3,497,620

|

|||||||

|

(a)

|

Boulder Growth & Income Fund, Inc.

|

400,525

|

5,038,605

|

||||||

|

Calamos Long/Short Equity & Dynamic Income Trust

|

446,000

|

8,969,060

|

|||||||

|

CBRE Clarion Global Real Estate Income Fund

|

581,001

|

4,537,618

|

|||||||

|

Center Coast Brookfield MLP & Energy Infrastructure Fund

|

147,000

|

1,609,650

|

|||||||

|

(a)

|

Central and Eastern Europe Fund, Inc.

|

49,985

|

1,203,639

|

||||||

|

Central Securities Corp.

|

292,000

|

11,069,720

|

|||||||

|

(a)

|

ClearBridge Energy Midstream Opportunity Fund, Inc.

|

295,271

|

5,515,662

|

||||||

|

Clough Global Equity Fund

|

396,000

|

6,015,240

|

|||||||

|

Clough Global Opportunities Fund

|

53,146

|

651,039

|

|||||||

|

Dividend and Income Fund

|

370,000

|

4,754,500

|

|||||||

|

*

|

Duff & Phelps Select MLP and Midstream Energy Fund, Inc.

|

13,022

|

95,712

|

||||||

|

Eagle Capital Growth Fund, Inc.

|

86,401

|

721,448

|

|||||||

|

First Eagle Senior Loan Fund

|

222,000

|

3,183,480

|

|||||||

|

First Trust Dynamic Europe Equity Income Fund

|

73,522

|

933,729

|

|||||||

|

First Trust Energy Infrastructure Fund

|

30,000

|

371,400

|

|||||||

|

General American Investors Co., Inc.

|

152,128

|

6,060,780

|

|||||||

|

(a)

|

Goldman Sachs MLP Energy and Renaissance Fund

|

147,902

|

1,431,691

|

||||||

|

Highland Global Allocation Fund

|

681,000

|

5,250,510

|

|||||||

|

Highland Income Fund

|

1,377,000

|

15,270,930

|

|||||||

|

(a)

|

Japan Smaller Capitalization Fund, Inc.

|

392,925

|

3,654,203

|

||||||

|

Kayne Anderson Energy Infrastructure Fund

|

343,603

|

2,463,634

|

|||||||

|

Kayne Anderson NextGen Energy & Infrastructure, Inc.

|

1,227,602

|

8,175,829

|

|||||||

|

Macquarie Global Infrastructure Total Return Fund, Inc.

|

136,000

|

2,972,960

|

|||||||

|

Miller/Howard High Dividend Fund

|

560,000

|

5,376,000

|

|||||||

|

(a)

|

Morgan Stanley China A Share Fund, Inc.

|

551,000

|

12,425,050

|

||||||

|

(a)

|

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

|

1,493,000

|

8,987,860

|

||||||

|

(a)

|

Morgan Stanley India Investment Fund, Inc.

|

275,901

|

6,431,915

|

||||||

|

Neuberger Berman MLP & Energy Income Fund, Inc.

|

1,223,585

|

5,139,057

|

|||||||

|

NexPoint Strategic Opportunities Fund

|

751,600

|

8,560,724

|

|||||||

|

Nuveen Diversified Dividend and Income Fund

|

93,813

|

889,347

|

|||||||

|

Pershing Square Holdings Ltd.

|

790,000

|

28,297,800

|

|||||||

|

PIMCO Energy & Tactical Credit Opportunities Fund

|

564,558

|

5,843,175

|

|||||||

|

Principal Real Estate Income Fund

|

148,877

|

2,010,584

|

|||||||

|

RiverNorth Specialty Finance Corp.

|

85,746

|

1,534,845

|

|||||||

|

RMR Mortgage Trust

|

297,923

|

3,575,076

|

|||||||

|

Royce Micro-Cap Trust, Inc.

|

413,000

|

4,666,900

|

|||||||

|

Royce Value Trust, Inc.

|

114,207

|

2,068,289

|

|||||||

|

(Continued)

|

|||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||

|

Schedule of Investments

|

|||||||||

|

As of March 31, 2020

|

|||||||||

|

Shares

|

Value (Note 1)

|

||||||||

|

CLOSED-END FUNDS - Continued

|

|||||||||

|

(a)

|

Salient Midstream & MLP Fund

|

531,000

|

$

|

2,708,100

|

|||||

|

Tekla Healthcare Investors

|

169,541

|

4,138,496

|

|||||||

|

Tekla Life Sciences Investors

|

319,311

|

6,293,620

|

|||||||

|

Templeton Emerging Markets Income Fund

|

140,531

|

1,035,714

|

|||||||

|

Tetragon Financial Group Ltd.

|

1,027,007

|

9,982,508

|

|||||||

|

(a)

|

The China Fund, Inc.

|

119,170

|

3,488,106

|

||||||

|

The Cushing MLP & Infrastructure Total Return Fund

|

66,000

|

1,643,400

|

|||||||

|

The Cushing NextGen Infrastructure Income Fund

|

11,226

|

453,306

|

|||||||

|

The Gabelli Dividend & Income Trust

|

165,002

|

3,953,448

|

|||||||

|

The Gabelli Global Small and Mid Cap Value Trust

|

222,047

|

3,239,666

|

|||||||

|

The Gabelli Healthcare & WellnessRx Trust

|

206,220

|

2,569,501

|

|||||||

|

The GDL Fund

|

205,769

|

1,837,517

|

|||||||

|

The Herzfeld Caribbean Basin Fund, Inc.

|

105,933

|

622,886

|

|||||||

|

The India Fund, Inc.

|

24,081

|

516,537

|

|||||||

|

(a)

|

The New Ireland Fund, Inc.

|

149,000

|

1,680,720

|

||||||

|

The Swiss Helvetia Fund, Inc.

|

303,803

|

2,670,428

|

|||||||

|

(a)

|

The Taiwan Fund, Inc.

|

93,000

|

2,627,250

|

||||||

|

*

|

Third Point Investors Ltd.

|

770,000

|

17,941,000

|

||||||

|

*

|

Tortoise Energy Independence Fund, Inc.

|

55,000

|

951,500

|

||||||

|

(a)

|

Tortoise Energy Infrastructure Corp.

|

284,517

|

6,953,595

|

||||||

|

Tortoise Essential Assets Income Term Fund

|

331,170

|

4,748,978

|

|||||||

|

(a)

|

Tortoise Midstream Energy Fund, Inc.

|

189,000

|

4,859,190

|

||||||

|

Tortoise Pipeline & Energy Fund, Inc.

|

11,721

|

240,046

|

|||||||

|

Tortoise Power and Energy Infrastructure Fund, Inc.

|

2,035

|

24,603

|

|||||||

|

Vertical Capital Income Fund

|

311,000

|

3,203,300

|

|||||||

|

Virtus AllianzGI Convertible & Income Fund II

|

170,010

|

846,650

|

|||||||

|

(a)

|

Voya Global Advantage and Premium Opportunity Fund

|

464,610

|

4,446,318

|

||||||

|

Voya Global Equity Dividend and Premium Opportunity Fund

|

783,000

|

4,463,100

|

|||||||

|

Total Closed-End Funds (Cost $235,468,875)

|

328,181,386

|

||||||||

|

EXCHANGE-TRADED PRODUCTS - 1.28%

|

|||||||||

|

Energy - 1.28%

|

|

||||||||

|

Alerian MLP ETF

|

100,000

|

$

|

3,050,000

|

||||||

|

Global X MLP & Energy Infrastructure ETF

|

35,000

|

1,106,000

|

|||||||

|

Total Exchange-Traded Products (Cost $3,928,414)

|

4,156,000

|

||||||||

|

PREFERRED STOCK - 1.72%

|

|||||||||

|

Financials - 1.72%

|

|

||||||||

|

NexPoint Strategic Opportunities Fund

|

262,656

|

5,576,187

|

|||||||

|

Total Preferred Stock (Cost $5,556,697)

|

5,576,187

|

||||||||

|

SHORT-TERM INVESTMENT - 0.23%

|

|||||||||

|

§

|

Fidelity Institutional Money Market Funds - Government Portfolio, 0.01%

|

751,805

|

|

751,805

|

|||||

|

Total Short-Term Investment (Cost $751,805)

|

751,805

|

||||||||

|

(Continued)

|

|||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||

|

Schedule of Investments

|

|||||||||

|

As of March 31, 2020

|

|||||||||

|

Value (Note 1)

|

|||||||||

|

Investments, at Value (Cost $245,705,791) - 104.23%

|

$

|

338,665,378

|

|||||||

|

Liabilities in Excess of Other Assets - (4.23)%

|

(13,744,379)

|

||||||||

|

Net Assets - 100.00%

|

$

|

324,920,999

|

|||||||

|

(a)

|

Securities pledged as collateral for margin/borrowings.

|

||||||||

|

*

|

Non-income producing investment

|

||||||||

|

§

|

Represents 7 day effective SEC yield

|

||||||||

|

The following acronyms or abbreviations are used in this Schedule:

|

|||||||||

|

MLP - Master Limited Partnership

|

|||||||||

|

ETF - Exchange-Traded Fund

|

|||||||||

|

Summary of Investments

|

|||||||||

|

% of Net

|

|||||||||

|

Assets

|

Value

|

||||||||

|

Closed-End Funds

|

101.00%

|

$

|

328,181,386

|

||||||

|

Exchange-Traded Products:

|

|||||||||

|

Energy

|

1.28%

|

4,156,000

|

|||||||

|

Preferred Stock:

|

|||||||||

|

Financials

|

1.72%

|

5,576,187

|

|||||||

|

Short-Term Investment

|

0.23%

|

751,805

|

|||||||

|

LIabilities in Excess of Other Assets

|

-4.23%

|

(13,744,379)

|

|||||||

|

Total Net Assets

|

100.00%

|

$

|

324,920,999

|

||||||

|

See Notes to Financial Statements

|

|||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||

|

Statement of Assets and Liabilities

|

|||

|

As of March 31, 2021

|

|||

|

Assets:

|

|||

|

Investments, at value (cost $245,705,791)

|

$

|

338,665,378

|

|

|

Receivables:

|

|||

|

Investments sold

|

2,137,391

|

||

|

Fund shares sold

|

83,220

|

||

|

Dividends and interest

|

365,277

|

||

|

Prepaid Expenses:

|

|||

|

Registration and filing expenses

|

21,851

|

||

|

Fund accounting fees

|

2,392

|

||

|

Trustee fees and meeting expenses

|

959

|

||

|

Total assets

|

341,276,468

|

||

|

Liabilities:

|

|||

|

Due to broker

|

15,744,824

|

||

|

Payables:

|

|||

|

Fund shares repurchased

|

262,039

|

||

|

Accrued expenses:

|

|||

|

Advisory fees

|

287,255

|

||

|

Professional fees

|

33,019

|

||

|

Shareholder fulfillment expenses

|

11,077

|

||

|

Interest expense

|

7,371

|

||

|

Custody fees

|

6,525

|

||

|

Administration fees

|

1,276

|

||

|

Miscellaneous expenses

|

911

|

||

|

Security pricing fees

|

599

|

||

|

Insurance fees

|

518

|

||

|

Compliance fees

|

55

|

||

|

Total liabilities

|

16,355,469

|

||

|

Net Assets

|

$

|

324,920,999

|

|

|

Net Assets Consist of:

|

|||

|

Paid in Interest

|

$

|

239,568,306

|

|

|

Distributable earnings

|

85,352,693

|

||

|

Net Assets

|

$

|

324,920,999

|

|

|

Institutional Class shares outstanding, no par value (unlimited authorized shares)

|

35,742,092

|

||

|

Net Assets

|

$

|

324,920,999

|

|

|

Net Asset Value, Maximum Offering Price, and Redemption Price Per Share

|

$

|

9.09

|

|

|

See Notes to Financial Statements

|

|||

|

Matisse Discounted Closed-End Fund Strategy

|

|||

|

Statement of Operations

|

|||

|

For the fiscal year ended March 31, 2021

|

|||

|

Investment Income:

|

|||

|

Dividends

|

$

|

8,404,060

|

|

|

Total Investment Income

|

8,404,060

|

||

|

Expenses:

|

|||

|

Advisory fees (note 2)

|

2,556,521

|

||

|

Administration fees (note 2)

|

241,496

|

||

|

Professional fees

|

78,455

|

||

|

Interest expenses (note 8)

|

61,720

|

||

|

Custody fees (note 2)

|

60,254

|

||

|

Fund accounting fees (note 2)

|

52,750

|

||

|

Registration and filing expenses

|

39,722

|

||

|

Shareholder fulfillment expenses

|

24,960

|

||

|

Transfer agent fees (note 2)

|

20,999

|

||

|

Trustee fees and meeting expenses (note 3)

|

14,912

|

||

|

Compliance fees (note 2)

|

12,011

|

||

|

Security pricing fees

|

9,350

|

||

|

Insurance fees

|

5,243

|

||

|

Miscellaneous expenses (note 2)

|

4,668

|

||

|

Total Expenses

|

3,183,061

|

||

|

Advisor fees waived (note 2)

|

(9)

|

||

|

Net Expenses

|

3,183,052

|

||

|

Net Investment Income

|

5,221,008

|

||

|

Realized and Unrealized Gain on Investments:

|

|||

|

Net realized gain from:

|

|||

|

Investments

|

16,837,682

|

||

|

Capital gain distributions from underlying funds

|

3,975,077

|

||

|

Total net realized gain

|

20,812,759

|

||

|

Net change in unrealized appreciation on investments

|

98,792,615

|

||

|

Net Realized and Unrealized Gain on Investments

|

119,605,374

|

||

|

Net Increase in Net Assets Resulting from Operations

|

$

|

124,826,382

|

|

|

See Notes to Financial Statements

|

|||

|

Matisse Discounted Closed-End Fund Strategy

|

||||||||||||

|

Statements of Changes in Net Assets

|

||||||||||||

|

For the fiscal years ended March 31,

|

2021

|

2020

|

||||||||||

|

Operations:

|

||||||||||||

|

Net investment income

|

$

|

5,221,008

|

$

|

1,434,275

|

||||||||

|

Net realized gain (loss) from investment transactions

|

16,837,682

|

(206,926)

|

||||||||||

|

Capital gain distributions from underlying funds

|

3,975,077

|

234,857

|

||||||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

98,792,615

|

(6,749,546)

|

||||||||||

|

Net Increase (Decrease) in Net Assets Resulting from Operations

|

124,826,382

|

(5,287,340)

|

||||||||||

|

Distributions to Shareholders:

|

||||||||||||

|

Institutional Class Shares

|

(29,796,628)

|

(7,325,465)

|

||||||||||

|

Decrease in Net Assets Resulting from Distributions

|

(29,796,628)

|

(7,325,465)

|

||||||||||

|

Beneficial Interest Transactions:

|

||||||||||||

|

Shares sold

|

51,612,347

|

148,694,852

|

||||||||||

|

Reinvested dividends and distributions

|

28,368,892

|

7,085,028

|

||||||||||

|

Shares repurchased

|

(25,496,026)

|

(16,995,487)

|

||||||||||

|

Increase from Beneficial Interest Transactions

|

54,485,213

|

138,784,393

|

||||||||||

|

Net Increase in Net Assets

|

149,514,967

|

126,171,588

|

||||||||||

|

Net Assets:

|

||||||||||||

|

Beginning of Year

|

175,406,032

|

49,234,444

|

||||||||||

|

End of Year

|

$

|

324,920,999

|

$

|

175,406,032

|

||||||||

|

March 31,

|

March 31,

|

|||||||||||

|

2021

|

2020

|

|||||||||||

|

Share Information:

|

||||||||||||

|

Institutional Class Shares

|

Shares

|

Amount

|

Shares

|

Amount

|

||||||||

|

Shares sold

|

7,037,331

|

$

|

51,612,347

|

24,497,198

|

$

|

148,694,852

|

||||||

|

Reinvested dividends and distributions

|

3,504,888

|

|

28,368,892

|

933,567

|

|

7,085,028

|

||||||

|

Shares repurchased

|

(3,296,988)

|

|

(25,496,026)

|

(1,814,014)

|

|

(16,995,487)

|

||||||

|

Net Increase in Shares of

|

||||||||||||

|

Beneficial Interest

|

7,245,231

|

$

|

54,485,213

|

23,616,751

|

$

|

138,784,393

|

||||||

|

See Notes to Financial Statements

|

||||||||||||

|

Matisse Discounted Closed-End Fund Strategy

|

|||||||||||||||

|

Financial Highlights

|

|||||||||||||||

|

For a share outstanding during each

|

Institutional Class Shares | ||||||||||||||

|

of the fiscal years ended March 31,

|

2021

|

2020

|

2019

|

2018

|

2017

|

||||||||||

|

Net Asset Value, Beginning of Year

|

$ 6.16

|

$ 10.09

|

$ 11.10

|

$ 10.36

|

$ 8.88

|

||||||||||

|

Income (Loss) from Investment Operations

|

|||||||||||||||

|

Net investment income (e)

|

0.16

|

0.28

|

0.20

|

0.13

|

0.29

|

||||||||||

|

Net realized and unrealized gain (loss)

|

|||||||||||||||

|

on investments

|

3.67

|

(3.19)

|

0.31

|

0.99

|

1.48

|

||||||||||

|

Total from Investment Operations

|

3.83

|

(2.91)

|

0.51

|

1.12

|

1.77

|

||||||||||

|

Less Distributions:

|

|||||||||||||||

|

Dividends (from net investment income)

|

(0.67)

|

(0.39)

|

(0.38)

|

(0.20)

|

(0.29)

|

||||||||||

|

Distributions (from capital gains)

|

(0.23)

|

(0.63)

|

(1.14)

|

(0.18)

|

-

|

||||||||||

|

Total Distributions

|

(0.90)

|

(1.02)

|

(1.52)

|

(0.38)

|

(0.29)

|

||||||||||

|

Net Asset Value, End of Year

|

$ 9.09

|

$ 6.16

|

$ 10.09

|

$ 11.10

|

$ 10.36

|

||||||||||

|

Total Return (a)

|

64.68%

|

(32.01)%

|

6.53%

|

10.89%

|

20.27%

|

||||||||||

|

Net Assets, End of Year (in thousands)

|

$324,921

|

$175,406

|

$ 49,234

|

$94,049

|

$104,448

|

||||||||||

|

Ratios of:

|

|||||||||||||||

|

Interest Expense to Average Net Assets

|

0.02%

|

0.13%

|

0.14%

|

-

|

0.00%

|

(d)

|

|||||||||

|

Gross Expenses to Average Net Assets (b)

|

1.23%

|

(c)

|

1.66%

|

(c)

|

1.55%

|

(c)

|

1.33%

|

1.50%

|

(c)

|

||||||

|

Net Expenses to Average Net Assets (b)

|

1.23%

|

(c)

|

1.37%

|

(c)

|

1.38%

|

(c)

|

1.25%

|

1.25%

|

(c)

|

||||||

|

Net Investment Income to Average

|

|||||||||||||||

|

Net Assets (b)

|

2.02%

|

3.04%

|

2.02%

|

1.19%

|

2.98%

|

||||||||||

|

Portfolio turnover rate

|

42.63%

|

101.38%

|

55.00%

|

71.82%

|

99.61%

|

||||||||||

|

(a)

|

Includes adjustments in accordance with accounting principles generally accepted in the United States, and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ

from the net asset values and returns from shareholder transactions.

|

||||||||||||||

|

(b)

|

Recognition of the Fund's net investment income is affected by the timing of dividend declarations of underlying funds. The expenses of the underlying funds are excluded from the Fund's expense ratio.

|

||||||||||||||

|

(c)

|

Includes interest expense.

|

||||||||||||||

|

(d)

|

Less than 0.01% per share.

|

||||||||||||||

|

(e)

|

Calculated using the average shares method.

|

||||||||||||||

|

See Notes to Financial Statements

|

|||||||||||||||

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

1. Organization and Significant Accounting Policies

The Matisse Discounted Closed-End Fund Strategy (“Fund”) is a series of the Starboard Investment Trust (“Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company

Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is a separate diversified series of the Trust.

The Fund’s investment advisor, Deschutes Portfolio Strategies, LLC, dba Matisse Capital, (the “Advisor”), seeks to achieve the Fund’s investment objective of long-term capital appreciation and income by investing in

unaffiliated closed-end funds that pay regular periodic cash distributions, the interests of which typically trade at substantial discounts relative to their underlying net asset values. The Fund will invest, under normal circumstances, at least

80% of net assets, plus borrowings, for investment purposes, in discounted closed-end funds.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America

(“GAAP”). The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and

Financial Accounting Standards Update (“ASU”) 2013-08.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities

traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the mean

of the most recent bid and ask prices. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their respective net asset values as

reported by such investment companies. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the security is principally traded closes early or if trading of the particular

security is halted during the day and does not resume prior to the Fund’s net asset value calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under

policies approved by the Trustees. A security’s “fair value” price may differ from the price next available for that security using the Fund’s normal pricing procedures. The shares of many closed-end investment companies, after their initial

public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or

market premium on shares of any closed-end investment company purchased by the Funds will not change.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: Unadjusted quoted prices in active markets for identical securities

Level 2: Other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established

in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value

requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement

falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of March 31, 2021 for

the Fund’s investments measured at fair value:

|

Investments in Securities (a)

|

Total

|

Level 1

|

Level 2

|

Level 3

|

||||

|

Closed-End Funds

|

$

|

328,181,386

|

$

|

328,181,386

|

$

|

-

|

$

|

-

|

|

Exchange-Traded Products

|

4,156,000

|

4,156,000

|

-

|

-

|

||||

|

Preferred Stock

|

5,576,187

|

5,576,187

|

-

|

-

|

||||

|

Short-Term Investment

|

751,805

|

751,805

|

-

|

-

|

||||

|

Total Assets

|

$

|

338,665,378

|

$

|

338,665,378

|

$

|

-

|

$

|

-

|

|

(a)

|

The Fund had no Level 3 securities as of the fiscal year ended March 31, 2021.

|

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as

the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Distributions

The Fund may declare and distribute dividends from net investment income, if any, quarterly. Distributions from capital gains, if any, are generally declared and distributed annually. Dividends and distributions to

shareholders are recorded on ex-date.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of general expenses, which are allocated according to methods reviewed annually by the Trustees.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with

Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Because the underlying funds have varied expense and fee levels and the Fund may own different proportions of underlying funds at different times, the amount of fees and expense incurred indirectly by the Fund will

vary.

Risk Considerations

Closed-End Fund Risk. Closed-end funds involve investment risks different from those associated with other investment companies. First, the shares of closed-end funds

frequently trade at a premium or discount relative to their net asset value. When the Fund purchases shares of a closed-end fund at a discount to its net asset value, there can be no assurance that the discount will decrease, and it is possible

that the discount may increase and affect whether the Fund will a realize gain or loss on the investment. Second, many closed-end funds use leverage, or borrowed money, to try to increase returns. Leverage is a speculative technique and its use by

a closed-end fund entails greater risk and leads to a more volatile share price. If a close-end fund uses leverage, increases and decreases in the value of its share price will be magnified. The closed-end fund will also have to pay interest or

dividends on its leverage, reducing the closed-end fund's return. Third, many closedend funds have a policy of distributing a fixed percentage of net assets regardless of the fund’s actual interest income and capital gains. Consequently,

distributions by a closed-end fund may include a return of capital, which would reduce the fund’s net asset value and its earnings capacity. Finally, closed-end funds are allowed to invest in a greater amount of illiquid securities than open-end

mutual funds. Investments in illiquid securities pose risks related to uncertainty in valuations, volatile market prices, and limitations on resale that may have an adverse effect on the ability of the fund to dispose of the securities promptly or

at reasonable prices. Fund of Funds Risk. The Fund is a “fund of funds.” The term “fund of funds” is typically used to describe investment companies, such as the Fund, whose principal investment strategy involves investing in other investment

companies, including closed-end funds and money market mutual funds. Investments in other funds subject the Fund to additional operating and management fees and expenses. For instance, investors in the Fund will indirectly bear fees and expenses

charged by the funds in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund’s performance depends in part upon the performance of the funds’ investment advisor, the strategies and instruments used by the funds, and

the Advisor's ability to select funds and effectively allocate Fund assets among them.

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

Fund of Funds Risk. The Fund is a “fund of funds.” The term “fund of funds” is typically used to describe investment companies, such as the Fund, whose principal investment

strategy involves investing in other investment companies, including closed-end funds and money market mutual funds. Investments in other funds subject the Fund to additional operating and management fees and expenses. For instance, investors in

the Fund will indirectly bear fees and expenses charged by the funds in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund’s performance depends in part upon the performance of the funds’ investment advisor, the

strategies and instruments used by the funds, and the Advisor's ability to select funds and effectively allocate Fund assets among them.

COVID-19 and Other Infectious Illnesses Risk. An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 was first detected in China in

December 2019 and has now been detected globally. COVID-19 has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and

delivery, prolonged quarantines, cancellations, supply chain disruptions, and lower consumer demand, as well as general concern and uncertainty. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could

adversely affect the economies of many countries or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. In addition, the impact of infectious illnesses in emerging market countries may be

greater due to generally less established healthcare systems. Public health crises caused by the COVID-19 outbreak, or other infectious illness outbreaks that may arise in the future, may exacerbate other pre-existing political, social and economic

risks in certain countries or globally. As such, issuers of debt securities with operations, productions, offices, and/or personnel in (or other exposure to) areas affected with the virus may experience significant disruptions to their business

and/or holdings. The potential impact on the credit markets may include market illiquidity, defaults and bankruptcies, among other consequences, particularly on issuers in the airline, travel and leisure and retail sectors. The extent to which

COVID-19 or other infectious illnesses will affect the Fund, the Fund’s service providers’ and/or issuer’s operations and results will depend on future developments, which are highly uncertain and cannot be predicted, including new information that

may emerge concerning the severity of COVID19 or other infectious illnesses and the actions taken to contain COVID-19 or other infectious illnesses. Economies and financial markets throughout the world are becoming increasingly interconnected. As a

result, whether or not the Fund invests in securities of issuers located in or with significant exposure to countries experiencing economic, political and/or financial difficulties, the value and liquidity of the Fund’s investments may be

negatively affected by such events. If there is a significant decline in the value of the Fund’s portfolio, this may impact the Fund’s asset coverage levels for certain kinds of derivatives and other portfolio transactions. The duration of the

COVID-19 outbreak, or any other infectious illness outbreak that may arise in the future, and its impact on the global economy cannot be determined with certainty.

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

2. Transactions with Related Parties and Service Providers

Advisor

The Fund pays a monthly fee to the Advisor calculated at the annual rate of 0.99% of the Fund’s average daily net assets. For the fiscal year ended March 31, 2021, $2,556,521 in advisory fees were incurred, $9 of

which were waived by the Advisor.

The Advisor has entered into a contractual agreement (the “Expense Limitation Agreement”) with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of

the Fund, if necessary, in amounts that limit the Fund’s total operating expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and expenses

associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi)

taxes and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees and contractual indemnification of Fund service providers (other than the Advisor)) to not more than 1.25% of the

average daily net assets of the Fund. The current term of the Expense Limitation Agreement remains in effect until July 31, 2021. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected

to continue from year-to-year thereafter. The Advisor cannot recoup from the Fund any expenses paid by the Advisor under the Expense Limitation Agreement.

Administrator

The Fund pays a monthly fee to the Fund’s administrator, The Nottingham Company (“the Administrator”), based upon the average daily net assets of the Fund and calculated at the annual rates as shown in the schedule

below which is subject to a minimum of $2,000 per month. The Administrator also receives a fee to procure and pay the Fund’s custodian, additional compensation for fund accounting and recordkeeping services, and additional compensation for certain

costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. The Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $350 per

month. As of March 31, 2021, the Administrator received $4,668 in miscellaneous expenses.

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

A breakdown of these fees is provided in the following table:

|

Administration Fees*

|

Custody Fees*

|

Fund

Accounting

Fees

|

Fund Accounting Fees

(asset-based fee)

|

Blue Sky

Administration

Fees (annual) |

|||||

|

Average Net

Assets

|

Annual

Rate

|

Average Net

Assets

|

Annual

Rate

|

(Average

monthly)

|

Net Assets

|

Annual

Rate

|

Per state

|

||

|

First $100 million

|

0.100%

|

First $200 million

|

0.020%

|

$2,250

|

First $50 million

|

0.02%

|

$150

|

||

|

Next $100 million

|

0.090%

|

Over $200 million

|

0.009%

|

$500/

additional

class

|

Next $50

million

|

0.015%

|

|||

|

Next $100 million

|

0.080%

|

Over $100

million

|

0.01%

|

||||||

|

Next $100 million

|

0.070%

|

*Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively.

|

|||||||

|

Next $100 million

|

0.060%

|

||||||||

|

Over $500 million

|

0.050%

|

||||||||

|

Over $750 million

|

0.040%

|

||||||||

|

Over $1 billion

|

0.030%

|

||||||||

The Fund incurred $241,496 in administration fees, $60,254 in custody fees, and $52,750 in fund accounting fees for the fiscal year ended March 31, 2021.

Compliance Services

The Nottingham Company, Inc. serves as the Trust’s compliance services provider including services as the Trust’s Chief Compliance Officer. The Nottingham Company, Inc. is entitled to receive customary fees from the

Fund for its services pursuant to the Compliance Services Agreement with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation

from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund.

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. For its services, the Distributor is entitled to receive compensation from the Fund pursuant to the

Distributor’s fee arrangements with the Fund.

3. Trustees and Officers

The Trust is governed by the Board of Trustees, which is responsible for the management and supervision of the Fund. The Trustees meet periodically throughout the year to review contractual agreements with companies

that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from

the Trust. Each Trustee who is not an “interested person” of the Trust or the Advisor within the meaning of the Investment Company Act of 1940, as amended (the “Independent Trustee”) receives $2,000 per series per year, $200 per meeting attended,

and $500 per series per special meeting related to contract renewal issues. The Trust reimburses each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. The Trust reimbursed each

Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings. Additional fees were incurred during the year as special meetings were necessary in addition to the regularly scheduled meetings of

the Board of Trustees. Certain officers of the Trust may also be officers of the Administrator.

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

4. Purchases and Sales of Investment Securities

For the fiscal year ended March 31, 2021, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

|

Purchases of Securities

|

Proceeds from

Sales of Securities

|

|

$172,199,268

|

$110,447,927

|

5. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which may differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized

gains for financial reporting purposes. The general ledger is adjusted for permanent book/tax differences to reflect tax character but is not adjusted for temporary differences.

Management has reviewed the Fund’s tax positions to be taken on the federal income tax returns during the open years ended March 31, 2018 through March 31, 2021 and determined that the Fund does not have a liability

for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year, the Fund did not incur any interest or penalties.

Distributions during the year or period ended were characterized for tax purposes as follows:

|

March 31, 2021

|

March 31, 2020 | |

|

Ordinary Income

|

$ 29,772,933 | $ 4,669,512 |

|

Tax-Exempt Income

|

23,695 | 10,812 |

|

Long-Term Capital Gain

|

- |

2,645,141 |

|

Total Distribution

|

$ 29,796,628 |

$ 7,325,465 |

At March 31, 2021, the tax-basis cost of investments and components of distributable earnings were as follows:

|

Cost of Investments

|

$

|

270,198,417

|

|

Unrealized Appreciation

|

69,344,891

|

|

|

Unrealized Depreciation

|

(877,930)

|

|

|

Net Unrealized Appreciation

|

$

|

68,466,961

|

|

Ordinary Income Spillback

|

14,069,491

|

|

|

Long-Term Capital Gain Spillback

|

2,816,241

|

|

|

Distributable Earnings

|

$

|

85,352,693

|

|

|

(Continued) |

| Matisse Discounted Closed-End Fund Strategy |

| Notes to Financial Statements |

| As of March 31, 2021 |

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As

of March 31, 2021, Pershing LLC held 75.45% of the Fund. The Fund has no knowledge as to whether all or any portion of the shares of record owned by Pershing LLC are also owned beneficially.

7. Commitments and Contingencies

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of

business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future

claims that may be made against the Fund. The Fund expects risk of loss to be remote.

8. Borrowings

The Fund established a borrowing agreement with Interactive Brokers LLC for investment purposes subject to the limitations of the 1940 Act for borrowings by registered investment companies.

Interest is based on the Federal Funds rate plus 1.50% on the first $100,000, the Federal Funds rate plus 1.00% on the next $900,000, the Federal Funds rate plus 0.50% on balances between $1,000,000 and $3,000,000,

and the Federal Funds rate plus 0.30% on balances greater than $3,000,000. The average borrowing during the fiscal year ended March 31, 2021 was $3,089,125, and the average interest rate during the same period was 1.07%.

Interest expense is charged directly to the Fund based upon actual amounts borrowed by the Fund. The Fund had $15,744,824 in borrowings as of the fiscal year ended March 31, 2021. Total interest expense for the

fiscal year was $61,720 as reflected in the Statement of Operations.

9. Subsequent Events

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has concluded

there are no additional matters, other than those noted above, requiring recognition or disclosure.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Starboard Investment Trust

and the Shareholders of Matisse Discounted Closed-End Fund Strategy

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Matisse Discounted Closed-End Fund Strategy, a series of shares of beneficial interest in Starboard Investment Trust (the “Fund”), including the schedule of investments, as of March 31, 2021, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the

years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial

statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, and the results of its operations for the year then ended, the changes in its net