Form N-CSR NORTHERN LIGHTS FUND For: Oct 31

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22549

Northern Lights Fund Trust II

(Exact name of registrant as specified in charter)

225 Pictoria Dr, Ste 450 Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

Kevin E. Wolf, Gemini Fund Services, LLC.

80 Arkay Drive, Suite 110., Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 10/31

Date of reporting period: 10/31/20

Item 1. Reports to Stockholders.

|

| F/m Investments European L/S Small Cap Fund |

| Institutional Class |

| BESMX |

| Investor Class |

| BESRX |

| Annual Report |

| October 31, 2020 |

| 1-844-322-8112 |

| www.fm-invest.com |

| Distributed by Northern Lights Distributors, LLC |

| Member FINRA |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.fm-invest.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

Dear Shareholder,

We hope that each of you and your families have stayed safe and well, and continue to do so, during a turbulent, trying year. With renewed optimism for the new year we deliver to you this letter about performance of the prior fiscal year and current outlook of the F/m Investments European Small Cap Long / Short Fund (the “Fund”).

For the 12-month period ending October 31, 2020, the Fund returned -4.50%, which lagged its index, the MSCI Europe Small Cap Net Return USD Index1, which returned -2.41%.

At the start of the fiscal year, European economies and markets rode positive momentum as the major headwinds, e.g., fear of a hard Brexit, passed. This was quickly derailed as the impacts of COVID-19 imposed unprecedented lockdowns across the Continent and abroad as well as stoppages to movements of goods and people.

The Fund performed in line with its beta until the start of the broad market collapse in early February. The Fund positioned itself well for that sudden decline, losing 30.68% peak to trough intra-year whilst the benchmark losing 44.89% peak to trough. The Fund’s return during this period would have been greater had various European regulators not imposed bans on short sales. In prior years we have highlighted the short book’s alpha generation capabilities; this year is a good reminder that the short book also buffers volatility during sudden drops.

Additionally, currency trends reversed course. Calls for Euro- US dollar parity and Pound Sterling bearish eroded with massive US stimulus and calls for long term near zero interest rates. Both made steady gains versus the US dollar throughout that the year. The Euro ended the year up +4.01% and Sterling +1.91%. At the time of this writing, this trend has continued, with the Euro, Sterling, and other European currencies approximately double that margin.

Our view that economic trends favored small caps was confirmed early in the year. As COVID-19 related shutdown impacted economies and markets, small and large caps performed similarly.

European equities continue to trade at significant and near historic discounts to their US counterparts. Fueled in part by the US Federal Reserve’s rate cuts to effectively zero, US large cap stocks’ continued price increase without commensurate increases in fundamentals compounds this difference. Indeed, early in the fiscal year European small cap outperformed US large caps – a realization of thesis that fiscal stimulus programs run by each State would favor domestic firms, which tend to be small cap names. All focus was shifted towards averting complete meltdown during the worst of the COVID-19, injuring small cap. As stability was regained in at the end of July 2020, European Small caps again outperformed their large cap cousins. (On a currency adjusted basis, European large caps lagged US large caps by -18.41% for the fiscal year, and European small caps lagged US small caps by only -2.38%.)

As noted above, our thesis that the US dollar bull market would relax has played out. We expect this trend to continue early into the term of Janet Yellen, the presumptive Treasury Secretary. Although Ms. Yellen espoused dovish tones, we recognize her hawkish past, and note that she and the Biden administration may need to pursue strong dollar policies.

Volatile markets and a slow return to “normal”, we believe the Fund is positioned well to continue to buffer large market swings and provide robust risk adjusted returns.

Over the course of its history, the Fund and its strategy have experienced periodic drawdowns, as Fund holdings have at times fallen out of favor. While the Fund has recently been in such a period, the Fund has recovered from such periods in the past. Each time, the sub- adviser remained disciplined and committed to the three pillars of their European small cap strategy: seek companies with good management, sound cash flow, and a catalyst to compound or unlock value (and the inverse for short positions). Over time, this discipline has generated “double alpha,” or cumulative positive alpha2 for both long and short positions. Moreover, returns in a recovery after a performance downdraft have been significantly positive. We continue to believe our defensive approach provides a balanced way to invest in the specialized opportunities of European small cap stocks.

On behalf of all of my colleagues, thank you for your continued investment in BESMX.

Sincerely,

Alexander Morris

The commentary represents the opinion of F/m Investments as of December 2020 and is subject to change based on market and other conditions. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. Any statistics contained here have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.7552-NLD-12/23/2020

| 1 | MSCI Europe Small Net Return USD Index measures a basket of small capitalization stocks from developed European countries converted to US dollar and reinvesting after tax dividends. Investors are not able to invest directly in the indices referenced and unmanaged index returns do not reflect any fees, expenses, or sales charges. The referenced indices are shown for general market comparisons. |

| 2 | Alpha is a measure of a security’s outperformance versus its benchmark. |

1

| F/m Investments European L/S Small Cap Fund |

| PORTFOLIO REVIEW (Unaudited) |

| October 31, 2020 |

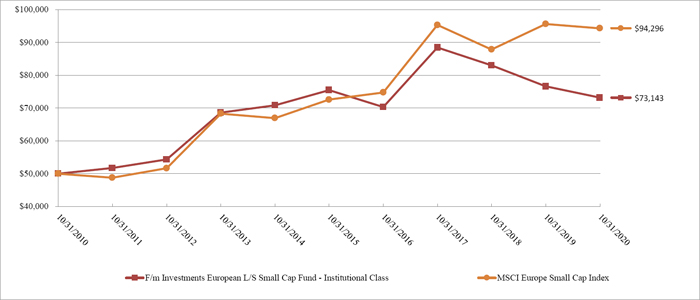

The fund’s performance figures* for the periods ended October 31, 2020, compared to its benchmark:

| Annualized | Annualized | Annualized | Annualized | ||

| One Year | Five Year | Ten Year | Since Inception ** | Since Inception *** | |

| F/m Investments European L/S Small Cap Fund Investor Class | (4.93)% | N/A | N/A | (0.95)% | N/A |

| F/m Investments European L/S Small Cap Fund Institutional Class | (4.50)% | (0.62)% | 3.88% | N/A | 6.21% |

| MSCI Europe Small Cap Index (a) | (2.41)% | 4.08% | 6.73% | 4.03% | 3.05% |

Comparison of the Change in Value of a $50,000 Investment

| * | The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are annualized. The total operating expenses as stated in the fee table to the Fund’s prospectus dated March 1, 2020 is 3.85% and 4.15% for the Institutional Class and Investor Class. For performance information current to the most recent month-end, please call 1-844-322-8112. |

| ** | Inception date is December 30, 2015. |

| *** | Inception date is October 31, 2007. Performance data for Institutional Class shares includes the Fund’s predecessor hedge fund. |

| (a) | The MSCI Europe Small Cap Index captures small cap representation across the 15 Developed Markets countries in Europe. With 918 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in the European equity universe. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses. |

| Holdings By Industry/Asset Type (1) | % of Net Assets | |||

| Money Market Funds | 15.5 | % | ||

| Software | 5.8 | % | ||

| Commercial Support Services | 5.7 | % | ||

| Health Care Facilities & Services | 4.5 | % | ||

| Containers & Packaging | 4.3 | % | ||

| Chemicals | 4.1 | % | ||

| Insurance | 3.8 | % | ||

| Technology Services | 3.5 | % | ||

| Transportation & Logistics | 2.9 | % | ||

| Food | 2.8 | % | ||

| Other Assets Less Liabilities | 47.1 | % | ||

| 100.0 | % | |||

| (1) | Does not include securities sold short in which the fund invests. |

Please refer to the Portfolio of Investments in this annual report for a detailed analysis of the Fund’s holdings.

2

| F/m Investments European L/S Small Cap Fund |

| PORTFOLIO OF INVESTMENTS |

| October 31, 2020 |

| Shares | Fair Value | |||||||

| COMMON STOCK - 80.4% | ||||||||

| ASSET MANAGEMENT - 2.3% | ||||||||

| 136,154 | IP Group PLC * ^ | $ | 139,958 | |||||

| 220,000 | Stirling Industries PLC * # | 19,912 | ||||||

| 159,870 | ||||||||

| AUTOMOTIVE - 1.9% | ||||||||

| 43,520 | Gestamp Automocion SA ^ | 133,022 | ||||||

| BEVERAGES - 1.9% | ||||||||

| 5,839 | Coca-Cola HBC AG | 132,500 | ||||||

| CABLE & SATELLITE - 1.5% | ||||||||

| 42,158 | Tele Columbus AG * | 103,863 | ||||||

| CHEMICALS - 4.1% | ||||||||

| 4,962 | Imerys SA | 148,199 | ||||||

| 8,980 | Tikkurila Oyj | 143,725 | ||||||

| 291,924 | ||||||||

| COMMERCIAL SUPPORT SERVICES - 5.7% | ||||||||

| 2,562 | Befesa SA | 105,347 | ||||||

| 20,791 | Caverion Oyj * | 136,350 | ||||||

| 22,756 | Marlowe PLC * | 161,829 | ||||||

| 403,526 | ||||||||

| CONSTRUCTION MATERIALS - 2.3% | ||||||||

| 178,463 | Breedon Group PLC * | 162,912 | ||||||

| CONSUMER SERVICES - 2.2% | ||||||||

| 7,135 | Instalco AB ^ | 157,912 | ||||||

| CONTAINERS & PACKAGING - 4.3% | ||||||||

| 5,563 | Aluflexpack AG * | 154,772 | ||||||

| 10,406 | Zignago Vetro SpA | 150,306 | ||||||

| 305,078 | ||||||||

| E-COMMERCE DISCRETIONARY - 2.0% | ||||||||

| 4,563 | Westwing Group AG * | 140,003 | ||||||

| ELECTRIC UTILITIES- 1.5% | ||||||||

| 19,607 | Falck Renewables SpA | 106,386 | ||||||

| FOOD - 2.8% | ||||||||

| 164,748 | Premier Foods PLC * | 196,830 | ||||||

| FORESTRY, PAPER & WOOD PRODUCTS - 1.9% | ||||||||

| 12,027 | Corticeira Amorim SGPS SA ^ | 138,135 | ||||||

| HEALTH CARE FACILITIES & SERVICES - 4.5% | ||||||||

| 9,629 | CVS Group PLC | 153,761 | ||||||

| 7,203 | Musti Group Oyj * | 165,039 | ||||||

| 318,800 | ||||||||

| HOME CONSTRUCTION - 1.6% | ||||||||

| 18,438 | Victoria PLC * | 112,050 | ||||||

| INDUSTRIAL INTERMEDIATE PRODUCTS - 2.0% | ||||||||

| 6,286 | SAES Getters SpA | 143,516 | ||||||

| INSURANCE - 3.8% | ||||||||

| 5,749 | Grupo Catalana Occidente SA ^ | 132,595 | ||||||

| 16,194 | Lancashire Holdings Ltd. ^ | 133,276 | ||||||

| 265,871 | ||||||||

| INTERNET MEDIA & SERVICES - 1.8% | ||||||||

| 105,160 | GoCo Group PLC | 130,941 | ||||||

| LEISURE FACILITIES & SERVICES - 2.0% | ||||||||

| 9,550 | Gamesys Group PLC | 143,486 | ||||||

| LEISURE PRODUCTS - 1.7% | ||||||||

| 2,723 | MIPS AB ^ | 117,227 | ||||||

| MACHINERY - 2.2% | ||||||||

| 29,931 | Deutz AG * | 153,686 | ||||||

| MEDICAL EQUIPMENT & DEVICES - 2.0% | ||||||||

| 19,619 | Arjo AB | 139,409 | ||||||

| OIL & GAS SERVICES & EQUIPMENT - 1.3% | ||||||||

| 158,856 | CGG SA * | 88,747 | ||||||

| REAL ESTATE SERVICES - 2.4% | ||||||||

| 15,829 | Savills PLC * ^ | 170,182 | ||||||

| RENEWABLE ENERGY - 1.5% | ||||||||

| 2,484 | SMA Solar Technology AG * | 107,522 | ||||||

| RETAIL - DISCRETIONARY - 0.8% | ||||||||

| 15,316 | Fourlis Holdings SA * | 59,142 | ||||||

| SEMICONDUCTORS - 2.4% | ||||||||

| 5,058 | ams AG * | 108,439 | ||||||

| 15,799 | X-Fab Silicon Foundries SE * | 58,799 | ||||||

| 167,238 | ||||||||

See accompanying notes to financial statements.

3

| F/m Investments European L/S Small Cap Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| October 31, 2020 |

| Shares | Fair Value | |||||||

| COMMON STOCK (Continued) - 80.4% | ||||||||

| SOFTWARE - 5.8% | ||||||||

| 4,934 | Fortnox AB | $ | 154,098 | |||||

| 2,282 | Mynaric AG * | 153,112 | ||||||

| 3,805 | PSI Software AG | 106,374 | ||||||

| 413,584 | ||||||||

| SPECIALTY FINANCE - 2.1% | ||||||||

| 31,703 | Banca Farmafactoring SpA - 144A * ^ | 146,055 | ||||||

| TECHNOLOGY HARDWARE - 1.7% | ||||||||

| 44,095 | Bang & Olufsen A/S * | 122,941 | ||||||

| TECHNOLOGY SERVICES - 3.5% | ||||||||

| 20,597 | Indra Sistemas SA * | 123,561 | ||||||

| 2,588 | QT Group Oyj * ^ | 125,107 | ||||||

| 248,668 | ||||||||

| TRANSPORTATION & LOGISTICS - 2.9% | ||||||||

| 21,364 | Goodbulk Ltd. # | 202,982 | ||||||

| TOTAL COMMON STOCK (Cost - $5,596,816) | 5,684,008 | |||||||

| SHORT-TERM INVESTMENTS - 15.5% | ||||||||

| MONEY MARKET FUNDS - 15.5% | ||||||||

| 546,006 | Fidelity Institutional Money Market Funds - Government Portfolio, Institutional Class, 0.16% ** | 546,006 | ||||||

| 546,007 | Invesco STIT - Treasury Portfolio, Institutional Class, 0.10%** | 546,007 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost - $1,092,013) | 1,092,013 | |||||||

| TOTAL INVESTMENTS - 95.9% (Cost - $6,688,829) | $ | 6,776,021 | ||||||

| SECURITIES SOLD SHORT - (24.3)% (Proceeds - $1,832,693) | (1,716,311 | ) | ||||||

| OTHER ASSETS LESS LIABILITIES - 28.4% | 2,008,999 | |||||||

| NET ASSETS - 100.0% | $ | 7,068,709 | ||||||

| SECURITIES SOLD SHORT - (24.3)% | ||||||||

| AUTOMOTIVE - (2.3)% | ||||||||

| -16,439 | ElringKlinger AG * | $ | 166,213 | |||||

| BIOTECH & PHARMACEUTICALS - (1.0)% | ||||||||

| 1,500 | BioGaia AB | 71,367 | ||||||

| CABLE & SATELLITE - (1.9)% | ||||||||

| 14,438 | Euskaltel SA | 137,404 | ||||||

| INDUSTRIAL INTERMEDIATE PRODUCTS - (1.0)% | ||||||||

| 4,197 | Troax Group AB | 68,369 | ||||||

| LEISURE FACILITIES & SERVICES - (3.6)% | ||||||||

| 3,001 | CTS Eventim AG & Co. KGaA * | 132,977 | ||||||

| 27,741 | Domino’s Pizza Group PLC | 118,870 | ||||||

| 251,847 | ||||||||

| LEISURE PRODUCTS - (1.1)% | ||||||||

| 10,281 | Technogym SpA * | 76,406 | ||||||

| MACHINERY - (4.5)% | ||||||||

| 1,707 | Krones AG | 97,471 | ||||||

| 293 | Rational AG | 219,627 | ||||||

| 317,098 | ||||||||

| PUBLISHING & BROADCASTING - (1.7)% | ||||||||

| 18,442 | Pearson PLC | 121,612 | ||||||

| REIT - (1.5)% | ||||||||

| 8,207 | Klepierre SA | 103,964 | ||||||

| RETAIL - DISCRETIONARY - (2.0)% | ||||||||

| 1,898 | Sixt SE * | 143,708 | ||||||

| SOFTWARE - (1.7)% | ||||||||

| 5,896 | Blue Prism Group plc * | 117,708 | ||||||

| TECHNOLOGY SERVICES - (1.0)% | ||||||||

| 4,799 | Softcat PLC | 69,808 | ||||||

| TRANSPORTATION EQUIPMENT - (1.0)% | ||||||||

| 1,779 | Stadler Rail AG | 70,807 | ||||||

| TOTAL SECURITIES SOLD SHORT (Proceeds - $1,832,693) | 1,716,311 | |||||||

PLC - Public Limited Company

144A - Securities exempt from registration under Rule 144A of Securities Act of 1933. These securities may be resold in transaction exempt from registration to qualified institutional buyers. At October 31, 2020, these securities amounted to $146,055 or 2.04% of net assets.

| * | Non-income producing security. |

| ^ | All or a portion of these securities are held as collateral for securities sold short. |

| # | Fair valued security, the value of this security has been determined in good faith under the policies of the Board of Trustees. |

| ** | Money market fund; interest rate reflects effective yield on October 31, 2020. |

See accompanying notes to financial statements.

4

| F/m Investments European L/S Small Cap Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| October 31, 2020 |

| Unrealized | ||||||||||||||||

| Foreign Currency | Settlement Date | Counterparty | Local Currency | U.S. Dollar Value | Appreciation/(Depreciation) | |||||||||||

| To Buy: | ||||||||||||||||

| Swedish Krona | 11/12/2020 | Goldman Sachs | 153,109 | $ | 167,092 | $ | (1,836 | ) | ||||||||

| Swiss Franc | 11/12/2020 | Goldman Sachs | 1,633,673 | 183,553 | (3,893 | ) | ||||||||||

| $ | 350,645 | $ | (5,729 | ) | ||||||||||||

| To Sell: | ||||||||||||||||

| British Pound | 11/12/2020 | Goldman Sachs | 734,908 | $ | 950,290 | $ | 7,079 | |||||||||

| British Pound | 11/12/2020 | Goldman Sachs | 206,454 | 266,961 | 2,245 | |||||||||||

| Danish Krone | 11/12/2020 | Goldman Sachs | 687,083 | 107,522 | 1,379 | |||||||||||

| Euro | 11/12/2020 | Goldman Sachs | 1,313,842 | 1,530,731 | 19,671 | |||||||||||

| Euro | 11/12/2020 | Goldman Sachs | 159,118 | 185,385 | 2,759 | |||||||||||

| Norwegian Krone | 11/12/2020 | Goldman Sachs | 3,791,288 | 396,606 | 17,687 | |||||||||||

| Swedish Krona | 11/12/2020 | Goldman Sachs | 6,008,193 | 675,057 | 10,480 | |||||||||||

| Swiss Franc | 11/12/2020 | Goldman Sachs | 126,156 | 137,678 | 1,096 | |||||||||||

| $ | 4,250,230 | $ | 62,396 | |||||||||||||

| Total | $ | 56,667 | ||||||||||||||

See accompanying notes to financial statements.

5

| F/m Investments European L/S Small Cap Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| October 31, 2020 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 6,688,829 | ||

| At value | $ | 6,776,021 | ||

| Cash collateral segregated for short sales | 2,387,799 | |||

| Cash held for collateral at custodian | 215,095 | |||

| Receivable for securities sold | 296,001 | |||

| Unrealized appreciation on foreign currency contracts | 56,667 | |||

| Dividends and interest receivable | 25,617 | |||

| Receivable due from advisor | 10,556 | |||

| Prepaid expenses and other assets | 21,063 | |||

| TOTAL ASSETS | 9,788,819 | |||

| LIABILITIES | ||||

| Securities sold short (Proceeds - $1,832,693) | 1,716,311 | |||

| Due to Custodian - Foreign Currency (Cost - $458,957) | 458,000 | |||

| Payable for investments purchased | 490,125 | |||

| Payable for Fund shares redeemed | 9,297 | |||

| Payable to related parties | 9,015 | |||

| Shareholder service fees | 2,152 | |||

| Distribution (12b-1) fees payable | 372 | |||

| Accrued expenses and other liabilities | 34,838 | |||

| TOTAL LIABILITIES | 2,720,110 | |||

| NET ASSETS | $ | 7,068,709 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | $ | 19,826,945 | ||

| Accumulated loss | (12,758,236 | ) | ||

| NET ASSETS | $ | 7,068,709 | ||

| NET ASSET VALUE PER SHARE: | ||||

| Institutional Class: | ||||

| Net Assets | $ | 5,425,242 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 726,687 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 7.47 | ||

| Investor Class: | ||||

| Net Assets | $ | 1,643,467 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 221,062 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 7.43 | ||

| (a) | Redemptions made within 60 days of purchases may be assessed a redemption fee of 1.00%. |

See accompanying notes to financial statements.

6

| F/m Investments European L/S Small Cap Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended October 31, 2020 |

| INVESTMENT INCOME | ||||

| Dividends (net of foreign tax withheld of $10,539) | $ | 122,333 | ||

| Interest | 4,799 | |||

| TOTAL INVESTMENT INCOME | 127,132 | |||

| EXPENSES | ||||

| Investment advisory fees | 165,384 | |||

| Distribution (12b-1) fees: | ||||

| Investor Class | 4,072 | |||

| Administration fees | 86,798 | |||

| Interest expense | 45,232 | |||

| Dividends on securities sold short | 45,392 | |||

| Custodian fees | 43,203 | |||

| Registration fees | 33,043 | |||

| Compliance officer fees | 32,608 | |||

| Trustees fees and expenses | 28,499 | |||

| Legal fees | 26,501 | |||

| Audit fees | 18,999 | |||

| Printing expense | 14,499 | |||

| Insurance expense | 3,200 | |||

| Third party administrative servicing fees | 958 | |||

| Shareholder service fees - Investor Class | 814 | |||

| Other expenses | 5,507 | |||

| TOTAL EXPENSES | 554,709 | |||

| Less: Fees waived by the Advisor | (165,384 | ) | ||

| Service fees waived | (108,777 | ) | ||

| NET EXPENSES | 280,548 | |||

| NET INVESTMENT LOSS | (153,416 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized loss on: | ||||

| Investments | (453,816 | ) | ||

| Foreign currency contracts | (275,394 | ) | ||

| Securities sold short | (96,248 | ) | ||

| (825,458 | ) | |||

| Net change in unrealized appreciation on: | ||||

| Investments | 94,027 | |||

| Foreign currency contracts | 136,163 | |||

| Foreign currency translations | 8,360 | |||

| Securities sold short | 91,480 | |||

| 330,030 | ||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (495,428 | ) | ||

| NET DECREASE IN NET ASSETS | $ | (648,844 | ) | |

See accompanying notes to financial statements.

7

| F/m Investments European L/S Small Cap Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| October 31, 2020 | October 31, 2019 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (153,416 | ) | $ | (865,358 | ) | ||

| Net realized loss from investments, foreign currency contracts, and securities sold short | (825,458 | ) | (8,074,699 | ) | ||||

| Net change in unrealized appreciation on investments, securities sold short, foreign currency contracts and foreign currency translations | 330,030 | 4,320,779 | ||||||

| Net decrease in net assets resulting from operations | (648,844 | ) | (4,619,278 | ) | ||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Return of capital | ||||||||

| Institutional Class | (241,087 | ) | — | |||||

| Investor Class | (45,549 | ) | — | |||||

| Distributions Paid: | ||||||||

| Institutional Class | (766,612 | ) | (4,332,627 | ) | ||||

| Investor Class | (141,159 | ) | (71,987 | ) | ||||

| Net decrease in net assets resulting from distributions to shareholders | (1,194,407 | ) | (4,404,614 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Institutional Class | 3,818,584 | 11,095,003 | ||||||

| Investor Class | 1,022,075 | 1,334,417 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Institutional Class | 760,571 | 3,407,875 | ||||||

| Investor Class | 186,708 | 71,987 | ||||||

| Redemption fee proceeds: | ||||||||

| Institutional Class | 335 | 6,116 | ||||||

| Investor Class | 450 | 869 | ||||||

| Payments for shares redeemed: | ||||||||

| Institutional Class | (6,307,319 | ) | (82,249,649 | ) | ||||

| Investor Class | (787,502 | ) | (1,150,915 | ) | ||||

| Net decrease in net assets from shares of beneficial interest | (1,306,098 | ) | (67,484,297 | ) | ||||

| TOTAL DECREASE IN NET ASSETS | (3,149,349 | ) | (76,508,189 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of Year | 10,218,058 | 86,726,247 | ||||||

| End of Year | $ | 7,068,709 | $ | 10,218,058 | ||||

| SHARE ACTIVITY | ||||||||

| Institutional Class: | ||||||||

| Shares Sold | 496,484 | 1,170,894 | ||||||

| Shares Reinvested | 98,138 | 377,395 | ||||||

| Shares Redeemed | (834,396 | ) | (8,784,764 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (239,774 | ) | (7,236,475 | ) | ||||

| Investor Class: | ||||||||

| Shares Sold | 137,913 | 143,293 | ||||||

| Shares Reinvested | 24,123 | 7,981 | ||||||

| Shares Redeemed | (106,368 | ) | (123,270 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 55,668 | 28,004 | ||||||

See accompanying notes to financial statements.

8

| F/m Investments European L/S Small Cap |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Institutional Class | ||||||||||||||||||||

| For the | For the | For the | For the | For the | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| October 31, 2020 | October 31, 2019 | October 31, 2018 | October 31, 2017 | October 31, 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.03 | $ | 10.40 | $ | 11.67 | $ | 9.27 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (2) | (0.13 | ) | (0.17 | ) | (0.25 | ) | (0.21 | ) | (0.18 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments | (0.23 | ) | (0.63 | ) | (0.43 | ) | 2.61 | (0.55 | ) | |||||||||||

| Total from investment operations | (0.36 | ) | (0.80 | ) | (0.68 | ) | 2.40 | (0.73 | ) | |||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.91 | ) | (0.25 | ) | (0.31 | ) | — | — | ||||||||||||

| Net realized gains | — | (0.32 | ) | (0.28 | ) | — | — | |||||||||||||

| Return of capital | (0.29 | ) | — | — | — | — | ||||||||||||||

| Total distributions | (1.20 | ) | (0.57 | ) | (0.59 | ) | — | — | ||||||||||||

| Paid-in-Capital From Redemption Fees | 0.00 | (3) | 0.00 | (3) | 0.00 | (3) | 0.00 | (3) | — | |||||||||||

| Net asset value, end of period | $ | 7.47 | $ | 9.03 | $ | 10.40 | $ | 11.67 | $ | 9.27 | ||||||||||

| Total return (4) | (4.50 | )% (9) | (7.69 | )% | (6.18 | )% | 25.89 | % | (7.30 | )% (5) | ||||||||||

| Net assets, at end of period (000’s) | $ | 5,425 | $ | 8,730 | $ | 85,302 | $ | 69,368 | $ | 24,654 | ||||||||||

| Ratio of gross expenses to average net assets (6,8) | 6.63 | % | 3.83 | % | 3.97 | % | 2.71 | % | 2.87 | % (7) | ||||||||||

| Ratio of net expenses to average net assets (8) | 3.32 | % | 3.33 | % | 3.73 | % | 2.46 | % | 2.45 | % (7) | ||||||||||

| Ratio of net investment loss to average net assets | (1.75 | )% | (1.81 | )% | (2.24 | )% | (1.99 | )% | (2.18 | )% (7) | ||||||||||

| Portfolio Turnover Rate | 152 | % | 141 | % | 194 | % | 154 | % | 168 | % (5) | ||||||||||

| (1) | The Fund commenced operations on December 30, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Represents less than $0.01 per share. |

| (4) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (5) | Not Annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor. |

| (7) | Annualized. |

| (8) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived | 5.55 | % | 2.74 | % | 2.48 | % | 2.49 | % | 2.66 | % (7) | ||||||||||

| After fees waived | 2.24 | % | 2.24 | % | 2.24 | % | 2.24 | % | 2.24 | % (7) | ||||||||||

| (9) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

9

| F/m Investments European L/S Small Cap |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Investor Class | ||||||||||||||||||||

| For the | For the | For the | For the | For the | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| October 31, 2020 | October 31, 2019 | October 31, 2018 | October 31, 2017 | October 31, 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.00 | $ | 10.37 | $ | 11.66 | $ | 9.27 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (2) | (0.17 | ) | (0.17 | ) | (0.29 | ) | (0.27 | ) | (0.18 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investments | (0.23 | ) | (0.66 | ) | (0.42 | ) | 2.66 | (0.55 | ) | |||||||||||

| Total from investment operations | (0.40 | ) | (0.83 | ) | (0.71 | ) | 2.39 | (0.73 | ) | |||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.88 | ) | (0.23 | ) | (0.30 | ) | — | — | ||||||||||||

| Net realized gains | — | (0.32 | ) | (0.28 | ) | — | — | |||||||||||||

| Return of capital | (0.29 | ) | — | — | — | — | ||||||||||||||

| Total distributions | (1.17 | ) | (0.55 | ) | (0.58 | ) | — | — | ||||||||||||

| Paid-in-Capital From Redemption Fees | 0.00 | (3) | 0.01 | 0.00 | (3) | — | — | |||||||||||||

| Net asset value, end of period | $ | 7.43 | $ | 9.00 | $ | 10.37 | $ | 11.66 | $ | 9.27 | ||||||||||

| Total return (4) | (4.93 | )% (10) | (7.92 | )% | (6.44 | )% | 25.78 | % | (7.30 | )% (5) | ||||||||||

| Net assets, at end of period (000’s) | $ | 1,643 | $ | 1,488 | $ | 1,425 | $ | 517 | $ | 0 | (8) | |||||||||

| Ratio of gross expenses to average net assets (6,9) | 6.93 | % | 4.13 | % | 4.27 | % | 3.01 | % | 3.17 | % (7) | ||||||||||

| Ratio of net expenses to average net assets (9) | 3.62 | % | 3.63 | % | 4.03 | % | 2.76 | % | 2.75 | % (7) | ||||||||||

| Ratio of net investment loss to average net assets | (2.28 | )% | (1.85 | )% | (2.56 | )% | (2.39 | )% | (2.48 | )% (7) | ||||||||||

| Portfolio Turnover Rate | 152 | % | 141 | % | 194 | % | 154 | % | 168 | % (5) | ||||||||||

| (1) | The Fund commenced operations on December 30, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Represents less than $0.01 per share. |

| (4) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (5) | Not Annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor. |

| (7) | Annualized. |

| (8) | Less than $1,000. |

| (9) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived | 5.85 | % | 3.04 | % | 2.78 | % | 2.79 | % | 2.96 | % (7) | ||||||||||

| After fees waived | 2.54 | % | 2.54 | % | 2.54 | % | 2.54 | % | 2.54 | % (7) | ||||||||||

| (10) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

10

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS |

| October 31, 2020 |

| 1. | ORGANIZATION |

The F/m Investments European L/S Small Cap Fund (the “Fund”) is a diversified series of shares of beneficial interest of Northern Lights Fund Trust II (the “Trust”), a statutory trust organized under the laws of the State of Delaware on August 26, 2010, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund commenced operations on December 30, 2015.

The investment objective of the Fund is to generate absolute returns by investing both long and short in European Companies. The Fund offers two classes of shares: Institutional Class shares and Investor Class shares. Each class of shares is offered at their net asset value. Each class of shares of the Fund has identical rights and privileges with respect to arrangements pertaining to shareholder servicing or distribution, class-related expenses, voting rights on matters affecting a single class of shares, and the exchange privilege of each class of shares. The Fund’s share classes differ in the fees and expenses charged to shareholders. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”.

Securities valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase may be valued at amortized cost. Forward foreign currency exchange contracts (‘forward contracts”) are valued at the forward rate. Investments values in currencies other than the U.S. dollar are converted to U.S. dollars using exchange rates obtained from pricing services. Investments in open-end investment companies are valued at net asset value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third party valuation firm to attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the advisor the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”)

11

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of October 31, 2020 for the Fund’s investments measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock | $ | 5,461,114 | $ | 19,912 | $ | 202,982 | $ | 5,684,008 | ||||||||

| Money Market Funds | 1,092,013 | — | — | 1,092,013 | ||||||||||||

| Forward Currency Contracts | — | 56,667 | — | 56,667 | ||||||||||||

| Total | $ | 6,553,127 | $ | 76,579 | $ | 202,982 | $ | 6,832,688 | ||||||||

| Liabilities* | ||||||||||||||||

| Securities Sold Short | $ | 1,716,311 | $ | — | $ | — | $ | 1,716,311 | ||||||||

| Total | $ | 1,716,311 | $ | — | $ | — | $ | 1,716,311 | ||||||||

It is the Fund’s policy to recognize transfers into or out of Level 2 and Level 3 at the end of the reporting period.

| * | Refer to the Portfolio of Investments for industry classification. |

12

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

The following is a reconciliation for which Level 3 inputs were used in determining value:

| Goodbulk Ltd. | ||||

| Beginning Balance November 1, 2019 | $ | — | ||

| Transfers from level 2 * | 497,327 | |||

| Purchases | — | |||

| Proceeds from Sales | (220,640 | ) | ||

| Total realized gain/(loss) | 46,851 | |||

| Change In Unrealized Depreciation | (120,556 | ) | ||

| Ending balance October 31, 2020 | 202,982 | |||

| * | Transfer into level 3 was the result of the use of a significant unobservable input in valuing the Fund’s investment in Goodbulk Ltd. |

The total change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments still held at October 31, 2020, was $(120,556).

Quantitative disclosures of unobservable inputs and assumptions used by the Fund are below.

| Common Stock | Fair Value | Valuation Techniques | Unobservable Input | |||||

| Goodbulk Ltd. | $ | 202,982 | Last price and index performance | Application of beta factor to other observable inputs ** | ||||

| ** | A decrease to the beta factor used would result in an increase to the value of the position categorized as level 3. |

Security transactions and related income – Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and distributions to shareholders – Dividends from net investment income, if any, are declared and paid annually. Distributable net realized capital gains, if any, are declared and distributed annually. Dividends from net investment income and distributions from net realized gains are recorded on ex dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. These reclassifications have no effect on net assets, results from operations or net asset value per share of the Fund.

Forward Currency Contracts – As foreign securities are purchased, a Fund generally enters into forward currency exchange contracts in order to hedge against foreign currency exchange rate risks. The market value of the contract fluctuates with changes in currency exchange rates. The contract is marked-to-market daily and the change in market value is recorded by a Fund as an unrealized gain or loss. As foreign securities are sold, a portion of the contract is generally closed and the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. A Fund may also enter into forward currency contracts as an investment strategy consistent with that Fund’s investment objective. Realized gains and losses from contract transactions are included as a component of net realized gains (losses) from investments and foreign currency in the Statements of Operations.

Foreign Currency Translations – The accounting records of the Fund is maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency, and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade.

Short Sales – A “short sale” is a transaction in which the Fund sells a security it does not own but has borrowed in anticipation that the market price of that security will decline. The Fund is obligated to replace the security borrowed by purchasing it on the open market at a later date. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss, unlimited in size. Conversely, if the price declines, the Fund will realize a gain, limited to the price at which the Fund sold the security short. Certain cash and securities are held as collateral.

13

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

Federal income tax – It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized gains to shareholders. Therefore, no federal income tax provision is required. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended October 31, 2017 to October 31, 2019, or expected to be taken in the Fund’s October 31, 2020 year end tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal and Ohio (Nebraska in years prior to 2019), and foreign jurisdictions where the Fund makes significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses which are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | INVESTMENT TRANSACTIONS |

For the year ended October 31, 2020, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments and securities sold short, amounted to the following:

| Purchases | Sales | |||||

| $ | 20,008,043 | $ | 23,089,261 | |||

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

F/m Investments LLC serves as the Fund’s investment advisor to the Fund. Pursuant to an Investment Advisory Agreement with the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor an investment advisory fee, computed and accrued daily and paid monthly, at an annual rate of 2.00%. The Advisor, on behalf of the Fund, has entered into a Sub-Advisory agreement with S.W. Mitchell Capital LLP and the Advisor compensates the Sub-Advisor out of the investment Advisory fee it receives from the Fund. For the year ended October 31, 2020, the Fund incurred advisory fees in the amount of $165,384.

The Fund’s Advisor has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least February 28, 2022 to ensure that Total Annual Fund Operating Expenses after fee waiver and/or reimbursement (excluding interest and tax expenses, dividends on short positions and Acquired Fund Fees and Expenses) for the Fund do not exceed 2.24% and 2.54% of the Fund’s average net assets, for Institutional Class and Investor Class shares, respectively; subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the foregoing expense limits. During the year ended October 31, 2020 the amount of advisory fees waived was $165,384, and other expenses in the amount of $108,777 were reimbursed. As of October 31, 2020, the total amount of expense reimbursement subject to recapture is $282,874, of which $8,713 will expire on October 31, 2022 and $274,161 will expire on October 31, 2023.

Distributor – The distributor of the Fund is Northern Lights Distributors, LLC (the “Distributor”). The Board of Trustees of the Northern Lights Fund Trust II has adopted, on behalf of the Fund, the Trust’s Master Distribution and Shareholder Servicing Plan (the “Plan”), as amended, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to pay for certain distribution activities and shareholder services. Under the Plan, the Fund’s Investor Class may pay 0.25% per year of the average daily net assets of Investor Class shares for such distribution and shareholder service activities. For the year ended October 31, 2020, the Fund incurred distribution fees in the amount of $4,072.

14

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

In addition, certain affiliates of the Distributor provide services to the Fund(s) as follows:

Gemini Fund Services, LLC (“GFS”), an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with GFS, the Fund pays GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of GFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of GFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”), an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

| 5. | DERIVATIVE TRANSACTIONS |

The following is a summary of the effect of derivative instruments on the Fund’s Statement of Assets and Liabilities as of October 31, 2020.

| Contract Type/Primary Risk Exposure | Statements of Assets and Liabilities | Value | ||||

| Foreign currency contracts/Currency Risk | Unrealized appreciation on foreign currency contracts | $ | 56,667 | |||

The following is a summary of the effect of derivative instruments on the Fund’s Statement of Operations for the year ended October 31, 2020.

| Change in Unrealized | ||||||||

| Contract type/ | Realized Gain/(Loss) | Appreciation/(Depreciation) | ||||||

| Primary Risk Exposure | On Foreign Currency Contracts | on Foreign Currency Contracts | ||||||

| Currency contracts/Currency risk | $ | (275,394 | ) | $ | 136,163 | |||

The notional value and contracts of the derivative instruments outstanding as of October 31, 2020 as disclosed in the Portfolio of Investments and the amounts realized and changes in unrealized gains and losses on derivative instruments during the period as disclosed above and within the Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

| 6. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of October 31, 2020, TD Ameritrade, Inc. held approximately 82.97% of the voting securities of the Fund for the benefit of others. The Fund has no knowledge as to whether all or any portion of the shares owned on record by TD Ameritrade, Inc. are also owned beneficially by any party who would be presumed to control the Fund.

| 7. | REDEMPTION FEES |

The Fund may assess a short-term redemption fee of 1.00% of the total redemption amount if a shareholder sells his shares after holding them for less than 60 days. The redemption fee is paid directly to the Fund. For the year ended October 31, 2020 the fund assessed redemption fees in the amount of $335 and $450 for the Institutional Class and Investor Class, respectively.

15

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

| 8. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

The identified cost of investments in securities owned by the Fund for federal income tax purposes, and its respective gross unrealized appreciation and depreciation at October 31, 2020, was as follows:

| Gross | Gross | Net Unrealized | ||||||||||||

| Tax | Unrealized | Unrealized | Appreciation | |||||||||||

| Cost | Appreciation | Depreciation | (Depreciation) | |||||||||||

| $ | 5,080,347 | $ | 935,384 | $ | (899,354 | ) | $ | 36,030 | ||||||

| 9. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of distributions paid during the period ended October 31, 2020 and October 31, 2019 was as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| October 31, 2020 | October 31, 2019 | |||||||

| Ordinary Income | $ | 907,771 | $ | 4,404,614 | ||||

| Long-Term Capital Gain | — | — | ||||||

| Return of Capital | 286,636 | — | ||||||

| $ | 1,194,407 | $ | 4,404,614 | |||||

As of October 31, 2020, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Unrealized | Total | ||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Appreciation/ | Accumulated | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | (Depreciation) | Earnings/(Deficits) | ||||||||||||||||||||

| $ | — | $ | — | $ | (147,930 | ) | $ | (12,648,388 | ) | $ | — | $ | 38,082 | $ | (12,758,236 | ) | ||||||||||

The difference between book basis and tax basis accumulated net investment income/(loss), accumulated net realized gain/(loss), and unrealized appreciation from investments is primarily attributable to the tax deferral of losses on wash sales, and the mark-to-market treatment of passive foreign investment companies, and foreign exchange contracts.

The unrealized appreciation in the table above includes unrealized foreign currency gains of $2,052.

Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such late year losses of $147,930.

At October 31, 2020, the Funds had capital loss carry forwards for federal income tax purposes available to offset future capital gains, as follows:

| Non-Expiring | Non-Expiring | |||||||||||||

| Short-Term | Long-Term | Total | CLCF Utilized | |||||||||||

| $ | 10,473,696 | $ | 2,174,692 | $ | 12,648,388 | $ | — | |||||||

Permanent book and tax differences, primarily attributable to the book/tax basis treatment of net operating losses, and distributions in excess, resulted in reclassifications for the Fund for the fiscal year ended October 31, 2020 as follows:

| Paid | ||||||

| In | Accumulated | |||||

| Capital | Earnings (Losses) | |||||

| $ | (369,340 | ) | $ | 369,340 | ||

16

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2020 |

| 10. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees

of Northern Lights Fund Trust II and

Shareholders of

F/m Investments European L/S Small Cap Fund

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of F/m Investments European L/S Small Cap Fund (the “Fund”), a series of Northern Lights Fund Trust II (the “Trust”), including the schedules of investments, as of October 31, 2020, and the related statements of operations for the year ended October 31, 2020, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the periods indicated in the table below, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated in the table below, in conformity with accounting principles generally accepted in the United States of America.

| Individual Funds | ||||||

| constituting | Statement of | Statements of | ||||

| F/m Investments | operations | changes in net assets | Financial highlights | |||

| F/m Investments European L/S Small Cap Fund | For the year ended October 31, 2020 | For each of the two years in the period ended October 31, 2020 | For each of the four years in the period ended October 31, 2020 and the period from December 30, 2015 (commencement of operations) through October 31, 2016. |

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor of one or more of the funds in the Trust since 2012.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2020 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

| Philadelphia, Pennsylvania |

| December 30, 2020 |

18

| F/m Investments European L/S Small Cap Fund |

| EXPENSE EXAMPLE (Unaudited) |

| October 31, 2020 |

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemptions; and redemption fees; (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as noted below.

Actual Expenses

The “Actual Expenses” line in the table below provides information about actual account values and actual expenses. You may use the information below; together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line in the table below provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | Expenses Paid | Expense Ratio During | |

| Account Value | Account Value | During Period | the Period | |

| Actual | 5/1/20 | 10/31/20 | 5/1/20 – 10/31/20* | 5/1/20 – 10/31/20* |

| Institutional Class | $1,000.00 | $1,105.10 | $11.85 | 2.24% |

| Investor Class | $1,000.00 | $1,104.00 | $13.43 | 2.54% |

| Beginning | Ending | Expenses Paid | Expense Ratio During | |

| Hypothetical ** | Account Value | Account Value | During Period | the Period |

| (5% return before expenses) | 5/1/20 | 10/31/20 | 5/1/20 – 10/31/20* | 5/1/20 – 10/31/20* |

| Institutional Class | $1,000.00 | $1,013.88 | $11.34 | 2.24% |

| Investor Class | $1,000.00 | $1,012.37 | $12.85 | 2.54% |

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (366). |

| ** | The hypothetical example assumes that the Fund was in operation for the full six months ended October 31, 2020. |

19

| F/m Investments European L/S Small Cap Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| October 31, 2020 |

LIQUIDITY RISK MANAGEMENT PROGRAM

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources.

During the fiscal year ended October 31, 2020, the Trust’s Liquidity Risk Management Program Committee (the “Committee”) reviewed the Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. Accordingly, the Committee concluded that (i) the Fund’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program has been effectively implemented.

20

| F/m Investments European L/S Small Cap Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| October 31, 2020 |

The Trustees and the officers of the Trust are listed below with their present positions with the Trust and principal occupations over at least the last five years. The business address of each Trustee and Officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. All correspondence to the Trustees and Officers should be directed to c/o Gemini Fund Services, LLC, P.O. Box 541150, Omaha, Nebraska 68154.

Independent Trustees

| Name

and Year of Birth |

Position/Term

of Office* |

Principal

Occupation During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by Trustee *** |

Other

Directorships held by Trustee During the Past Five Years |

| Thomas

T. Sarkany 1946 |

Trustee Since October 2011 | President, TTS Consultants, LLC (financial services) (since 2010). | 1 | Director, Aquila Distributors; Trustee, Arrow ETF Trust; Trustee, Arrow Investments Trust; Trustee, Northern Lights Fund Trust IV |

| Anthony

H. Lewis 1946 |

Trustee Since May 2011 | Chairman and CEO of The Lewis Group USA (executive consulting firm) (since 2007). | 1 | Director, Member of the Compensation Committee and Member of the Risk Committee of Torotel Inc. (Magnetics, Aerospace and Defense), Trustee, Chairman of the Fair Valuation Committee and Member of the Audit Committee of the Wildermuth Endowment Strategy Fund |

| Keith

Rhoades 1948 |

Trustee Since May 2011 | Retired since 2008. | 1 | NONE |

| Randal

D. Skalla 1962 |

Trustee Since May 2011 | President, L5 Enterprises, Inc. (financial services company) (since 2001). | 1 | Board Member, Orizon Investment Counsel (financial services company) (from 2001 to 2017) |

10/31/20 – NLII v1

21

| F/m Investments European L/S Small Cap Fund |

| SUPPLEMENTAL INFORMATION (Unaudited)(Continued) |

| October 31, 2020 |

Interested Trustees and Officers

| Name

and Year of Birth |

Position/Term

of Office* |

Principal

Occupation During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by Trustee *** |

Other

Directorships held by Trustee During the Past Five Years |

| Brian

Nielsen** 1972 |

Trustee Since May 2011 | Trustee of Northern Lights Fund Trust II (since 2011); Special Projects Counsel of NorthStar Financial Services Group, LLC (from 2018 to 2019); Secretary of CLS Investments, LLC (from 2001 to 2018); Secretary of Orion Advisor Services, LLC (from 2001 to 2018); Manager (from 2012 to 2015), General Counsel and Secretary (from 2003 to 2018) of NorthStar Financial Services Group, LLC; CEO (from 2012 to 2018), Secretary (from 2003 to 2018) and Manager (from 2005 to 2018) of Northern Lights Distributors, LLC; Director, Secretary and General Counsel of Constellation Trust Company (from 2004 to 2018); CEO (from 2015 to 2018), Manager (from 2008 to 2015), General Counsel and Secretary (from 2011 to 2018) of Northern Lights Compliance Services, LLC; General Counsel and Secretary of Blu Giant, LLC (from 2011 to 2018); Secretary of Gemini Fund Services, LLC (from 2012 to 2018); Manager of Arbor Point Advisors, LLC (from 2012 to 2018); Secretary and General Counsel of NorthStar Holdings, LLC (from 2013 to 2015); Director, Secretary and General Counsel of NorthStar CTC Holdings, Inc. (from 2015 to 2018) and Secretary and Chief Legal Officer of AdvisorOne Funds (from 2003 to 2018). | 1 | Manager of Northern Lights Distributors, LLC (from 2005 to 2018); Manager of NorthStar Financial Services Group, LLC (from 2012 to 2015); Manager of Arbor Point Advisors, LLC (from 2012 to 2018); Director of Constellation Trust Company (from 2004 to 2018) |

| Kevin

E. Wolf 1969 |

President Since January 2013 | Vice President of The Ultimus Group, LLC and Executive Vice President, Head of Fund Administration and Product, Gemini Fund Services, LLC (since 2019), President, Gemini Fund Services, LLC (2012 - 2019). | N/A | N/A |

| Richard

Malinowski 1983 |

Secretary Since January 2018 | Senior Vice President and Senior Managing Counsel, Gemini Fund Services, LLC, (since February 2020); Senior Vice President Legal Administration, Gemini Fund Services, LLC (since April 2017); Vice President and Counsel (April 2016 to 2017) and AVP and Staff Attorney (September 2012 to March 2016). | N/A | N/A |

| Erik

Naviloff 1968 |

Treasurer Since January 2013 | Vice President of Gemini Fund Services, LLC (since 2011). | N/A | N/A |

| Emile

R. Molineaux 1962 |

Chief Compliance Officer and Anti Money Laundering Officer Since May 2011 | Senior Compliance Officer and CCO of Various clients of Northern Lights Compliance Services, LLC (since 2011). | N/A | N/A |

| * | The term of office for each Trustee and Officer listed above will continue indefinitely. |

| ** | Brian Nielsen is an “interested person” of the Trust as that term is defined under the 1940 Act, because of his prior affiliation with Northern Lights Distributors, LLC (the Fund’s Distributor). |

| *** | As of October 31, 2020, the Trust was comprised of 18 active portfolios managed by unaffiliated investment advisers. The term “Fund Complex” applies only to the Fund, and not to any other series of the Trust. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series. |

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-844-322-8112.

10/31/20 – NLII v1

22

Privacy Policy

Rev. May 2019

| FACTS | WHAT DOES NORTHERN LIGHTS FUND TRUST II (“NLFT II”) DO WITH YOUR PERSONAL INFORMATION? | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. | |

| What? | The

types of personal information we collect and share depend on the product or service you have with us. This information can

include: | |

● Social Security number

● Employment information

● Account balances |

● Account transactions

● Income

● Investment experience | |

When you are no longer our customer, we continue to share your information as described in this notice. | ||

| How? | All financial companies need to share a customer’s personal information to run their everyday business - to process transactions, maintain customer accounts, and report to credit bureaus. In the section below, we list the reasons financial companies can share their customer’s personal information; the reasons NLFT II chooses to share; and whether you can limit this sharing. | |

| Reasons we can share your personal information | Does

NLFT II share? |

Can

you limit this sharing? |

For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

Yes | No |

For our marketing purposes — to offer our products and services to you |

Yes | No |

For joint marketing with other financial companies |

Yes | No |

For our affiliates’ everyday business purposes — information about your transactions and experiences |

Yes | No |

For our affiliates’ everyday business purposes — information about your creditworthiness |

No | We don’t share |

For nonaffiliates to market to you |

No | We don’t share |

| Questions? | Call 1-402-493-4603 |

23

| Who we are | ||

| Who is providing this notice? | Northern Lights Fund Trust II | |

| What we do | ||