Form N-CSR FORUM FUNDS II For: Sep 30

| Annual Report | |

| September 30, 2018 | |

| Advised by: | |

| SKBA Capital Management, LLC | |

| www.baywoodfunds.com |

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

Dear Shareholders,

During the year ended September 30, 2018, the Baywood ValuePlus Fund (“The Fund”) meaningfully outperformed its primary benchmark. In a year that would qualify as above normal from a stock market return standpoint, we are very pleased with the way in which we accomplished our returns. We outperformed by purchasing decidedly out-of-favor securities. This gives us comfort that should markets struggle going forward, our characteristics are also capable of providing downside protection.

Sector selection accounted for approximately one third of the Fund’s excess return and was driven by our decision to underweight consumer staples, telecom and utilities and overweight energy and information technology. The reason for our aversion to the former group has neither been thematic nor “macro”. It has simply been based on a combination of poor fundamentals and elevated valuations, the latter had, until recently, been driven to levels not seen in decades. Paying high prices for struggling businesses is rarely a recipe for success and is not an activity we care to partake in. Our viewpoint was significantly unpopular when we first raised this issue a few years ago. As many of these companies increased in value in the face of deteriorating fundamentals, we held to our outlook despite criticism; our cautious viewpoints fell mostly on deaf ears. This, in and of itself helped confirm our belief that we were correct in our assessment. Since our last report to shareholders, perceptions have markedly changed as it has become broadly accepted that middling fundamentals within these groups did not warrant recent valuations. Given the recent valuation compression, when we now look back a few years, consumer staples, utilities, telecom and REIT’s have been significant underperformers. One thing we know for certain, whether looking at this example or others, overvalued businesses rarely remain so forever. It is our job, desire and responsibility to not put our shareholders’ capital (of which we count ourselves) at risk in such securities.

The continued decline in these former highflyers has rekindled our interest in selectively searching for new investment opportunities. Over the last year we have tripled our exposure to what is now defined as communications, we have increased our exposure to consumer staples by 25% and from having no exposure to real estate in the form of REIT’s we are now meaningfully overweight. Utilities, on the other hand, we still don’t like.

About two thirds of the strategy’s excess returns resulted from security selection. Some of the largest contributors included Encompass Health (up 65%), ConocoPhillips (up 57%), Valero (up 52%), Union Pacific (up 43%), Boeing (up 34%), Tapestry (up 28%), WalMart (up 23%), and Nutrien (up 8%). In a strong market we also had a few disappointments that included Nielsen Holdings (down 41%), LBrands (down 22%), Schlumberger (down 10%) and MetLife (down 7%).

During the year a number of new securities were purchased. The common thread within these additions is that they have all performed poorly of late despite the enduring nature of their businesses. Some of them clearly have issues they need to work through—if they did not, we wouldn’t be able to buy them at depressed prices!

Many of the areas we generally avoided are no longer exorbitantly priced. Within consumer staples, we eliminated Procter & Gamble yet initiated a position in Kimberly Clark which we detailed to you six months ago and reiterate in this letter. Incontinence may be inconvenient for many, but as the global population ages, it is a boon for Kimberly Clark. We are aware of input and transportation cost pressures which may continue to compress margins somewhat, an issue not unique to Kimberly Clark. Yet there is a price for everything. The company’s stock is priced at levels similar to 2013 while earnings and dividends have increased between 6-7% per year. As a result, valuation has declined significantly to levels we are finding attractive. Because of its high returns on capital, it has excess funds with which to support and grow its dividend as well as to repurchase its own shares, a feat it has accomplished for years. We love “dividend aristocrats”; it’s just that we prefer to pay “pauper” prices. We may be somewhat early (although we’ve been waiting at least five years!) however its attractive and sustainable fundamentals and financials will only make us want to purchase more should shares continue to decline. We have owned Kimberly Clark numerous times in the past, an investment which has proven to be profitable. We expect the same this time around.

In addition to Kimberly Clark, we initiated positions in Molson Coors and Mondelez. We are familiar with Molson Coors, having owned and profited from being shareholders in the past. We believe our experience this time around will be similar. Shares have declined approximately 40% over the last two years and once again offer a combination of attractive valuation and reasonably attractive fundamentals. On many metrics, the shares are more attractively valued than they were the last time we were owners. Once again, it appears that the short term consensus is clouding the company’s reasonably strong “premium” fundamentals. Excess cash, an attractive attribute, is likely to be redeployed in maintaining its market share as well as to reduce debt and increase its dividend, all desirable attributes as equity investors. The forthcoming increase in the payout is not properly being considered by the investment community, a point that gives us the ability to re-purchase shares in this premium brewer at discount prices. While our exposure is recent and fairly small, should existing market conditions prevail, we are likely to increase our investment.

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

Mondelez was spun off of Kraft a few years ago as its international snack business. Our experience with and ownership in PepsiCo has over time informed us of the attraction of snacks relative to the food category in general. We do not want to gloss over the issues packaged foods are experiencing yet the sector in general has gone from frighteningly overvalued to generally fairly valued; this for a sector whose fundamentals are less volatile than most. Mondelez has been one of the better performing food companies; it has simply been too richly valued for our taste until recently as its earnings have grown while its shares have declined.

REIT’s (Real Estate Investment Trust), another area we’ve avoided for years also due to valuation and fundamental concerns, became much more attractive over the last few months. In particular, for being supposedly defensive stocks, mall REIT’s have not acted as such whatsoever. For years we have believed that the U.S. has been “over-malled”. Based on changing consumer purchasing habits, many lower class malls have struggled for at least a decade with abysmal occupancy rates. Retail has been under the greatest assault ever with more bankruptcies than during most downturns, despite the U.S. not being in a recession. These are some of the reasons, all rational, for the decline in the prices of mall REIT’s. The pendulum never stops swinging at fair value, however, and in this case as well, valuations now appear attractive for some companies with few significant tenant issues. We purchased Taubman Centers, one of the largest Class A mall owners during the period. Shares have declined for at least six years finally rendering its 4.5% dividend yield attractive based on our belief that funds from operations will be able to sustain such a payout. While the retail landscape is changing rapidly, certain high foot-traffic properties will always be more desirable to rent from than others. Taubman is one such company, though we cannot say the same for all mall operators. We also initiated a position in Weyerhaeuser, a company we’ve owned in the past prior to it becoming a REIT. Weyerhaeuser is heavily exposed to the housing market, which we believe will continue to improve over the next few years. At current prices, we are receiving 3.6% in dividends for the privilege of owning its shares. Weyerhaeuser belongs in the desirable and rare category of having its tangible assets increase in value over time. Even if housing and construction slow, its timberlands will only become more valuable. We are happy to be paid to wait while either outcome is realized.

We increased our exposure to communications by adding to Verizon and initiating a position in CenturyLink. Continuing on the theme of owning companies we are familiar with, CenturyLink makes it back in the portfolio after an extended hiatus; its new moniker is suggestive of a change in its business mix. CenturyLink was born of the combination of Centurytel, a former “RLEC”, what used to be called Rural Local Exchange Carriers, and Level 3 Communications. During the merger completed earlier this year, shares declined by over 50%. As a result, the dividend yield at our time of purchase was in excess of 10%. Dividend yields of such a level tend to convey financial difficulties as well as a likelihood of a cut in the near future. Even though we do not think a cut is necessary, it is a possibility and included in our investment hypothesis. Such an action would not necessarily result in us eliminating the position as we have at times owned companies subsequent to a dividend cut in this strategy. We are attracted to the company’s fundamentals going forward and would not be surprised should a cut occur, yet are more than pleased to collect in excess of 10% in the meantime. 10% is far above what our market expectations are in general. If we can accomplish this simply via a company’s dividend, then we do not need to capture much capital appreciation to make this an outstanding investment. Most importantly, however we believe that shares are currently undervalued. The company has a number of levers at its disposal. It generates excess cash with which it plans to reduce its heavy debt burden. As it does so, interest expense will shrink and a virtuous cycle of cash flows may take place leading to accretion to common equity shareholders.

Some of our decidedly out-of-favor additions at time of purchase include Medtronic, AIG, Target, Nutrien, Johnson Controls, General Electric and DowDupont. While we don’t always seek near term catalysts in order to make an investment, many of these have experienced recent changes that should improve our odds of being correct in our fair value estimations. Due to recent struggles, AIG, GE and Johnson Controls have each experienced management changes that are likely to heighten operational focus. Each owns and runs leading businesses within their respective areas and in all cases we believe that an emphasis on improving asset productivity will result in greater recognition of fair value.

Nutrien, the former Potash, effected a name change subsequent to acquiring Agrium, another fertilizer company. Fertilizers, as with many commodities, have gone through the downturn of last decade’s super cycle. By definition, however, cyclical industries do experience upturns, not simply downturns. Nutrien is consolidating within its industry at what we believe to be close to the bottom of the cycle. By next year, its earning power should be significantly greater than its recently reported earnings. It is also in process of shedding non-core assets that will result in cash proceeds with which to reward shareholders. We expect much of these actions to take place at some point this year.

We exited a number of positions, many of which contributed significantly to overall returns over time. Eli Lilly, Encompass Health, Boeing, Republic Services, Stanley Black & Decker, Lyondell Basel and Packaging Corp were all in this category. We also exited positions that were not so successful and to source cash for investment alternatives. Those were Cardinal Health, Nielsen, and Qualcomm.

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

Our expectations going into 2018 were that market returns could be only half what they had been until recently. In the fiscal year just ended, those expectations were exceeded. We would not however change our outlook and believe that prospective return expectations should be more modest. We have positioned the portfolio in a way that expectations for our holdings are already low and likely to surprise to the upside. As active managers, we are more interested in what opportunities we may find in individual securities should market conditions change. We are just as focused on companies that we should own as we are on those we shouldn’t. Nor are we fearful of heightened volatility. This state of flux, should it ever return, will create opportunities for us to purchase companies at attractive prices with excess cash to reward shareholders.

We look forward to reporting to you in another six months.

Current and future portfolio holdings are subject to change and risk.

The Morningstar category is used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

SEPTEMBER 30, 2018

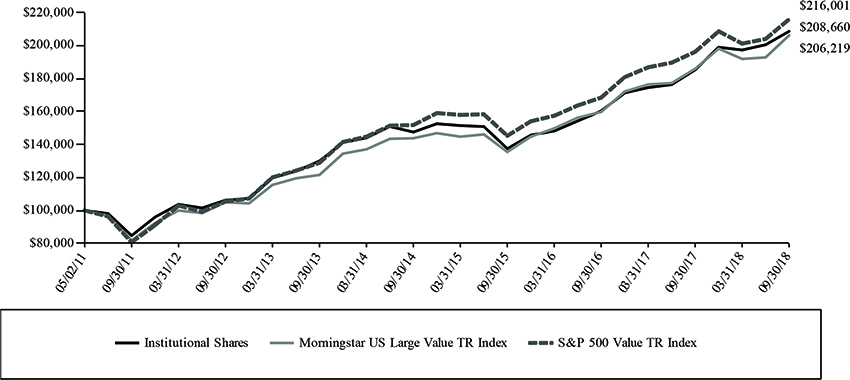

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood ValuePlus Fund (the “Fund”) compared with the performance of the benchmarks, Morningstar US Large Value TR Index, and the secondary benchmark, S&P 500 Value TR Index (the “indices”), since inception. The Morningstar US Large Value TR Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The S&P 500 Value TR Index is a market capitalization weighted index. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar US Large Value TR Index and S&P 500 Value TR Index

| Average Annual Total Returns Periods Ended September 30, 2018 |

One Year | Five Year | Ten Year |

| Baywood ValuePlus Fund Investor Shares* | 12.35% | 9.66% | 10.17% |

| Morningstar US Large Value TR Index | 10.89% | 11.15% | 9.05% |

| S&P 500 Value TR Index | 10.06% | 10.88% | 9.62% |

| * | The Fund’s Investor Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Investor Shares of the collective investment trust commenced operations on June 27, 2008. |

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

SEPTEMBER 30, 2018

Comparison of Change in Value of a $100,000 Investment

Institutional Shares vs. Morningstar US Large Value TR Index and S&P 500 Value TR Index

| Average Annual Total Returns Periods Ended September 30, 2018 |

One Year | Five Year | Since Inception (05/02/11) |

| Baywood ValuePlus Fund Institutional Shares* | 12.57% | 9.93% | 10.43% |

| Morningstar US Large Value TR Index | 10.89% | 11.15% | 10.26% |

| S&P 500 Value TR Index | 10.06% | 10.88% | 10.95% |

| * | The Fund’s Institutional Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Institutional Shares of the collective investment trust commenced operations on May 2, 2011. |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 7.67% and 11.16%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 0.95% and 0.70% for Investor Shares and Institutional Shares, respectively, through January 31, 2019 (the “Expense Cap”). The advisor may be reimbursed by the Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

BAYWOOD VALUEPLUS FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2018

| Shares | Security Description | Value | ||||||

| Common Stock - 96.0% | ||||||||

| Basic Materials - 4.8% | ||||||||

| 600 | DowDuPont, Inc. | $ | 38,586 | |||||

| 1,360 | Nutrien, Ltd. | 78,472 | ||||||

| 400 | WestRock Co. | 21,376 | ||||||

| 138,434 | ||||||||

| Capital Goods / Industrials - 5.9% | ||||||||

| 400 | Cummins, Inc. | 58,428 | ||||||

| 500 | Eaton Corp. PLC | 43,365 | ||||||

| 100 | Harris Corp. | 16,921 | ||||||

| 1,500 | Johnson Controls International PLC | 52,500 | ||||||

| 171,214 | ||||||||

| Communication Services - 2.9% | ||||||||

| 1,400 | CenturyLink, Inc. | 29,680 | ||||||

| 1,000 | Verizon Communications, Inc. | 53,390 | ||||||

| 83,070 | ||||||||

| Consumer Discretionary - 4.7% | ||||||||

| 900 | L Brands, Inc. | 27,270 | ||||||

| 1,100 | Tapestry, Inc. | 55,297 | ||||||

| 600 | Target Corp. | 52,926 | ||||||

| 135,493 | ||||||||

| Consumer Staples - 8.5% | ||||||||

| 400 | Kimberly-Clark Corp. | 45,456 | ||||||

| 700 | Molson Coors Brewing Co., Class B | 43,050 | ||||||

| 600 | Mondelez International, Inc., Class A | 25,776 | ||||||

| 400 | PepsiCo., Inc. | 44,720 | ||||||

| 900 | Walmart, Inc. | 84,519 | ||||||

| 243,521 | ||||||||

|

Energy - 15.5% |

||||||||

| 900 | BP PLC, ADR | 41,490 | ||||||

| 600 | Chevron Corp. | 73,368 | ||||||

| 1,600 | ConocoPhillips | 123,840 | ||||||

| 300 | Helmerich & Payne, Inc. | 20,631 | ||||||

| 900 | Occidental Petroleum Corp. | 73,953 | ||||||

| 1,100 | Schlumberger, Ltd. | 67,012 | ||||||

| 400 | Valero Energy Corp. | 45,500 | ||||||

| 445,794 | ||||||||

| Financials - 20.8% | ||||||||

| 1,300 | American International Group, Inc. | 69,212 | ||||||

| 500 | BB&T Corp. | 24,270 | ||||||

| 600 | BOK Financial Corp. | 58,368 | ||||||

| 440 | Chubb, Ltd. | 58,802 | ||||||

| 900 | FNF Group | 35,415 | ||||||

| 500 | JPMorgan Chase & Co. | 56,420 | ||||||

| 400 | M&T Bank Corp. | 65,816 | ||||||

| 1,100 | MetLife, Inc. | 51,392 | ||||||

| 1,400 | Morgan Stanley | 65,198 | ||||||

| 400 | Prosperity Bancshares, Inc. | 27,740 | ||||||

| 1,600 | U.S. Bancorp | 84,496 | ||||||

| 597,129 | ||||||||

| Health Care - 12.6% | ||||||||

| 300 | AbbVie, Inc. | 28,374 | ||||||

| 300 | Amgen, Inc. | 62,187 | ||||||

| 800 | AstraZeneca PLC, ADR | 31,656 | ||||||

| 700 | Gilead Sciences, Inc. | 54,047 | ||||||

| 2,000 | Koninklijke Philips NV, ADR | 91,020 | ||||||

| 600 | Medtronic PLC | 59,022 | ||||||

| 800 | Novo Nordisk A/S, ADR | 37,712 | ||||||

| 364,018 | ||||||||

| Real Estate - 3.1% | ||||||||

| 900 | Taubman Centers, Inc. REIT | 53,847 | ||||||

| 1,100 | Weyerhaeuser Co. REIT | 35,497 | ||||||

| 89,344 | ||||||||

| Shares | Security Description | Value | ||||||

| Technology - 14.4% | ||||||||

| 2,500 | Cisco Systems, Inc. | $ | 121,625 | |||||

| 2,100 | HP, Inc. | 54,117 | ||||||

| 1,600 | Intel Corp. | 75,664 | ||||||

| 700 | International Business Machines Corp. | 105,847 | ||||||

| 300 | Microsoft Corp. | 34,311 | ||||||

| 200 | Texas Instruments, Inc. | 21,458 | ||||||

| 413,022 | ||||||||

| Transportation - 1.7% | ||||||||

| 300 | Union Pacific Corp. | 48,849 | ||||||

| Utilities - 1.1% | ||||||||

| 700 | Exelon Corp. | 30,562 | ||||||

| Total Common Stock (Cost $2,254,070) | 2,760,450 | |||||||

| Shares | Security Description | Value | ||||||

| Money Market Fund - 4.1% | ||||||||

| 119,474 | Federated Government Obligations Fund,Institutional Class, 1.96% (a) (Cost $119,474) |

119,474 | ||||||

| Investments, at value - 100.1% (Cost $2,373,544) | $ | 2,879,924 | ||||||

| Other Assets & Liabilities, Net - (0.1)% | (3,753 | ) | ||||||

| Net Assets - 100.0% | $ | 2,876,171 | ||||||

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of September 30, 2018. |

The following is a summary of the inputs used to value the Fund's instruments as of September 30, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | Investments in Securities | |||

| Level 1 - Quoted Prices | $ | 2,760,450 | ||

| Level 2 - Other Significant Observable Inputs | 119,474 | |||

| Level 3 - Significant Unobservable Inputs | – | |||

| Total | $ | 2,879,924 | ||

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended September 30, 2018.

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2018

| PORTFOLIO HOLDINGS (Unaudited) | ||||

| % of Total Investments | ||||

| Basic Materials | 4.8 | % | ||

| Capital Goods / Industrials | 6.0 | % | ||

| Communication Services | 2.9 | % | ||

| Consumer Discretionary | 4.7 | % | ||

| Consumer Staples | 8.5 | % | ||

| Energy | 15.5 | % | ||

| Financials | 20.7 | % | ||

| Health Care | 12.6 | % | ||

| Real Estate | 3.1 | % | ||

| Technology | 14.3 | % | ||

| Transportation | 1.7 | % | ||

| Utilities | 1.1 | % | ||

| Money Market Fund | 4.1 | % | ||

| 100.0 | % | |||

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2018

| ASSETS | ||||

| Investments, at value (Cost $2,373,544) | $ | 2,879,924 | ||

| Receivables: | ||||

| Fund shares sold | 1,777 | |||

| Dividends | 5,440 | |||

| From investment advisor | 5,612 | |||

| Prepaid expenses | 11,403 | |||

| Total Assets | 2,904,156 | |||

| LIABILITIES | ||||

| Accrued Liabilities: | ||||

| Fund services fees | 4,728 | |||

| Other expenses | 23,257 | |||

| Total Liabilities | 27,985 | |||

| NET ASSETS | $ | 2,876,171 | ||

| COMPONENTS OF NET ASSETS | ||||

| Paid-in capital | $ | 2,255,007 | ||

| Undistributed net investment income | 5,683 | |||

| Accumulated net realized gain | 109,101 | |||

| Net unrealized appreciation | 506,380 | |||

| NET ASSETS | $ | 2,876,171 | ||

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | ||||

| Investor Shares | 104,590 | |||

| Institutional Shares | 50,255 | |||

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | ||||

| Investor Shares (based on net assets of $1,939,673) | $ | 18.55 | ||

| Institutional Shares (based on net assets of $936,498) | $ | 18.63 |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2018

| INVESTMENT INCOME | ||||

| Dividend income (Net of foreign withholding taxes of $728) | $ | 75,729 | ||

| Total Investment Income | 75,729 | |||

| EXPENSES | ||||

| Investment advisor fees | 13,547 | |||

| Fund services fees | 63,059 | |||

| Transfer agent fees: | ||||

| Investor Shares | 18,180 | |||

| Institutional Shares | 18,180 | |||

| Distribution fees: | ||||

| Investor Shares | 4,645 | |||

| Custodian fees | 5,000 | |||

| Registration fees: | ||||

| Investor Shares | 14,311 | |||

| Institutional Shares | 14,308 | |||

| Professional fees | 27,096 | |||

| Trustees' fees and expenses | 1,829 | |||

| Other expenses | 21,214 | |||

| Total Expenses | 201,369 | |||

| Fees waived and expenses reimbursed | (177,757 | ) | ||

| Net Expenses | 23,612 | |||

| NET INVESTMENT INCOME | 52,117 | |||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| Net realized gain on investments | 113,563 | |||

| Net change in unrealized appreciation (depreciation) on investments | 143,093 | |||

| NET REALIZED AND UNREALIZED GAIN | 256,656 | |||

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 308,773 | ||

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Years Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| OPERATIONS | ||||||||

| Net investment income | $ | 52,117 | $ | 48,347 | ||||

| Net realized gain | 113,563 | 93,135 | ||||||

| Net change in unrealized appreciation (depreciation) | 143,093 | 192,429 | ||||||

| Increase in Net Assets Resulting from Operations | 308,773 | 333,911 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||

| Net investment income: | ||||||||

| Investor Shares | (31,550 | ) | (32,969 | ) | ||||

| Institutional Shares | (16,732 | ) | (13,855 | ) | ||||

| Net realized gain: | ||||||||

| Investor Shares | (51,277 | ) | (29,530 | ) | ||||

| Institutional Shares | (22,602 | ) | (9,288 | ) | ||||

| Total Distributions to Shareholders | (122,161 | ) | (85,642 | ) | ||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Investor Shares | 12,064 | 38,459 | ||||||

| Institutional Shares | 137,213 | 94,402 | ||||||

| Reinvestment of distributions: | ||||||||

| Investor Shares | 82,750 | 62,499 | ||||||

| Institutional Shares | 39,334 | 23,143 | ||||||

| Redemption of shares: | ||||||||

| Investor Shares | (1,103 | ) | (265,416 | ) | ||||

| Institutional Shares | (8,552 | ) | (7,818 | ) | ||||

| Increase (Decrease) in Net Assets from Capital Share Transactions | 261,706 | (54,731 | ) | |||||

| Increase in Net Assets | 448,318 | 193,538 | ||||||

| NET ASSETS | ||||||||

| Beginning of Year | 2,427,853 | 2,234,315 | ||||||

| End of Year (Including line (a)) | $ | 2,876,171 | $2,427,853 | |||||

| SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Investor Shares | 649 | 2,354 | ||||||

| Institutional Shares | 7,574 | 5,685 | ||||||

| Reinvestment of distributions: | ||||||||

| Investor Shares | 4,630 | 3,784 | ||||||

| Institutional Shares | 2,189 | 1,392 | ||||||

| Redemption of shares: | ||||||||

| Investor Shares | (62 | ) | (16,185 | ) | ||||

| Institutional Shares | (474 | ) | (474 | ) | ||||

| Increase (Decrease) in Shares | 14,506 | (3,444 | ) | |||||

| (a) Undistributed net investment income | $ | 5,683 | $ | 2,112 | ||||

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| For the Year Ended September 30, 2018 | For the Year Ended September 30, 2017 | For the Period Ended September 30, 2016 (a) | For the Year Ended November 30, 2015 | December 2, 2013 (b) Through November 30, 2014 | ||||||||||||||||

| INVESTOR SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Period | $ | 17.28 | $ | 15.52 | $ | 16.90 | $ | 19.28 | $ | 17.47 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment income (c) | 0.33 | 0.33 | 0.26 | 0.34 | 0.36 | |||||||||||||||

| Net realized and unrealized gain (loss) | 1.77 | 2.02 | 0.93 | (1.06 | ) | 1.49 | ||||||||||||||

| Total from Investment Operations | 2.10 | 2.35 | 1.19 | (0.72 | ) | 1.85 | ||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net investment income | (0.31 | ) | (0.32 | ) | (2.20 | ) | (0.26 | ) | (0.04 | ) | ||||||||||

| Net realized gain | (0.52 | ) | (0.27 | ) | (0.37 | ) | (1.40 | ) | – | |||||||||||

| Total Distributions to Shareholders | (0.83 | ) | (0.59 | ) | (2.57 | ) | (1.66 | ) | (0.04 | ) | ||||||||||

| NET ASSET VALUE, End of Period | $ | 18.55 | $ | 17.28 | $ | 15.52 | $ | 16.90 | $ | 19.28 | ||||||||||

| TOTAL RETURN | 12.35 | % | 15.32 | % | 8.40 | %(d) | (3.86 | )% | 10.59 | %(d) | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Year (000s omitted) | $ | 1,940 | $ | 1,717 | $ | 1,699 | $ | 1,362 | $ | 1,471 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment income | 1.84 | % | 2.03 | % | 2.07 | %(e) | 1.97 | % | 1.98 | %(e) | ||||||||||

| Net expenses | 0.95 | % | 0.95 | % | 0.95 | %(e) | 0.95 | % | 0.95 | %(e) | ||||||||||

| Gross expenses (f) | 6.79 | % | 7.67 | % | 9.43 | %(e) | 5.80 | % | 4.54 | %(e) | ||||||||||

| PORTFOLIO TURNOVER RATE | 34 | % | 48 | % | 22 | %(d) | 32 | % | 35 | %(d) | ||||||||||

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 through September 30, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| For the Year Ended September 30, 2018 | For the Year Ended September 30, 2017 | For the Period Ended September 30, 2016 (a) | For the Year Ended November 30, 2015 | December 2, 2013 (b) Through November 30, 2014 | ||||||||||||||||

| INSTITUTIONAL SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Period | $ | 17.36 | $ | 15.59 | $ | 17.00 | $ | 19.42 | $ | 17.56 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment income (c) | 0.38 | 0.38 | 0.29 | 0.39 | 0.41 | |||||||||||||||

| Net realized and unrealized gain (loss) | 1.76 | 2.02 | 0.94 | (1.06 | ) | 1.50 | ||||||||||||||

| Total from Investment Operations | 2.14 | 2.40 | 1.23 | (0.67 | ) | 1.91 | ||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net investment income | (0.35 | ) | (0.36 | ) | (2.27 | ) | (0.35 | ) | (0.05 | ) | ||||||||||

| Net realized gain | (0.52 | ) | (0.27 | ) | (0.37 | ) | (1.40 | ) | – | |||||||||||

| Total Distributions to Shareholders | (0.87 | ) | (0.63 | ) | (2.64 | ) | (1.75 | ) | (0.05 | ) | ||||||||||

| NET ASSET VALUE, End of Period | $ | 18.63 | $ | 17.36 | $ | 15.59 | $ | 17.00 | $ | 19.42 | ||||||||||

| TOTAL RETURN | 12.57 | % | 15.60 | % | 8.65 | %(d) | (3.58 | )% | 10.87 | %(d) | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Period (000s omitted) | $ | 936 | $ | 711 | $ | 536 | $ | 426 | $ | 11,067 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment income | 2.10 | % | 2.28 | % | 2.30 | %(e) | 2.23 | % | 2.26 | %(e) | ||||||||||

| Net expenses | 0.70 | % | 0.70 | % | 0.70 | %(e) | 0.70 | % | 0.70 | %(e) | ||||||||||

| Gross expenses (f) | 8.83 | % | 11.16 | % | 14.43 | %(e) | 2.09 | % | 2.50 | %(e) | ||||||||||

| PORTFOLIO TURNOVER RATE | 34 | % | 48 | % | 22 | %(d) | 32 | % | 35 | %(d) | ||||||||||

| (a) | Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the periodDecember 1, 2015 through September 30, 2016. |

| (b) | Commencement of operations. |

| (c) | Calculated based on average shares outstanding during each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

Dear Shareholder,

We are pleased to report our economic and financial market perspectives and the investment activities for the Baywood SociallyResponsible Fund (the “Fund”) for the 12 months ended September, 2018. The Fund is a mid-to-large capitalization value-oriented portfolio of stock holdings selected from a universe of stocks created through the application of inclusionary and exclusionary social screens and assessments of the ESG profile of each company. Among these stocks, we further evaluate and assess each prospective holding’s valuation and fundamental business attraction to determine the current portfolio holdings. In selecting investments, we consider social criteria such as an issuer’s community relations, corporate governance, employee diversity, employee relations, environmental impact and sustainability, human rights record and product safety. Using both quantitative and qualitative data, we also evaluate an issuer’s involvement in specific revenue generating activities to determine whether the issuer’s involvement was meaningful or incidental with respect to that activity.

SKBA’s overall goal with our SociallyResponsible strategy is always to serve the investment needs and objectives of our shareholders, and in the midst of all the changes occurring in the market, we will begin with a quick discussion on the meaning of Socially Responsible investing. We speak in broad terms given the varying viewpoints. Its definition is truly “in the eye of the beholder” and can often appear nebulous. In the United States, “responsible” investing is often discussed through the lens of three pillars: Environmental, Social, and Governance, or ESG. This differs from the mostly European focus on transparency and best-in-class. Through ESG investing, most portfolios exclude companies or sectors that generally violate the idea of good environmental, social or governance practices while some work to include those that exhibit positive ESG attributes.

While excluding stocks from purchase for SRI/ESG reasons can at times result in higher volatility of returns compared to the broader stock market indexes, over the last fiscal year the benefits to total portfolio return of our SR strategy have been demonstrated relative to our primary value-style benchmarks and has outperformed them by a significant margin.

We manage the strategy pragmatically, with an eye to achieving appropriate sector diversification. We applaud transparency—it is an important one of many components to our investment decision—and we are members of UNPRI, the world’s largest organization to pursue transparency. We also tend to focus on ESG investing with an emphasis on the ‘G’ or governance. We will generally not exclude sectors from our investment universe based on ideological beliefs but do avoid some industries, such a tobacco and firearms among others, which provide an overwhelming dis-benefit to society. This is regardless of whether or not such stocks might produce periods of excess return. Such “hard” exclusionary screens continue to reflect the commonly-held desires of nearly all SRI/ESG investors. Otherwise, we seek the benefits of sector diversification even while we exclude stocks within a sector that we believe do not fit our ESG criteria.

If at any point in time we exclude a sector for a particular reason, rest assured it is likely for temporary reasons, such as our decision to not own companies in the utility sector. Certain utilities that derive their revenues from nuclear power are generally excluded in the strategy, however, that is not the only reason we currently do not own any in the portfolio. No, the secondary reason is less “noble” than the first; it’s simply because we think their valuations are not reflective of the poor fundamentals that most appear to exhibit. For the year, the decision to underweight those “bond proxy” sectors is responsible for nearly half of relative returns.

As stated we still maintain the most commonly desired exclusionary screens in the strategy, yet exclusionary screens are a small part of how we manage the strategy. It is our informed opinion that companies with strong governance practices are much less likely to pursue value-destroying acts as compared to those with less than ideal governance practices. What do we mean by value-destroying? We define it as destruction of all capital, including that of both stakeholders and shareholders. The concept of a stakeholder can be far-reaching, much more so than to think that one can take all stakeholders into account for every investment decision, so we limit our definition to generally include direct stakeholders. This generally encompasses those directly affected by a company’s labor practices, supply chain and positive and negative environmental impacts. The pros and cons of each are measured against each other which help inform our investment decision, though generally speaking, the most informative data we can acquire is that of a company’s governance practices, because governance may tell you more about what to expect from a company than its past will. Our process is forward-looking. We only care for the past if we have reason to think it is indicative of some future result or trend. For example, if a company has poor governance practices, its board is entrenched, its CEO is the chairman and is not likely going to change in the near future then yes, its past and all its transgressions and virtues (if any) are likely to persist into the future until meaningful changes to its governance and corporate bylaws are enacted. Generally speaking however, a company’s past is a relatively small input in determining the likelihood of forward looking events.

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

As value investors we tend to purchase companies that are out-of-favor, yet with generally predictable and strong or improving fundamentals that suggest a reversion to an in-favor status over our investment horizon. Similarly, companies we purchase from an ESG perspective can also be out-of-favor, we like to call these companies reformers. We would rather own a company on its way to meaningful positive reform than be lulled into purchasing a good perceived reputation on its way down. A short list of former “good” companies gone bad, none of which we owned at the time the negative headlines surfaced, can provide some insight into how the strategy is managed. Companies like Wells Fargo, which we owned in 2008 due to conservative lending practices yet exited in 2016 due to aggressive lending practices, Volkswagen (named best “green company” weeks before its diesel scandal hit headlines), BP, Enron, WorldCom and Valeant area a few examples. We don’t profess to have the ability to avoid all bad actors in the future. However, contrary to overwhelming consensus and popular belief, none of these companies had exemplary governance practices prior the issues responsible for their downfall.

Now that we’ve had a chance to discuss the Socially Responsible aspect of the strategy, we will discuss the investments. During the period we found significant opportunities to take advantage of what we believe was a widening of our investment universe, most notably in sectors that we haven’t seen many opportunities in over the last several years. Sector weights in real estate went from zero to almost 4%, communications nearly doubled from 3.5% and consumer staples increased by a third. For the most part we have avoided companies in these sectors because their high valuations were unjustified in our opinion. However, as interest rates have increased dramatically over the last year, these sectors fell out-of-favor and we have been able to selectively add what we believe are the better operators in each industry. Weyerhaeuser and Brookfield Property Partners in real estate, Verizon and Century Link in communications and Mondelez in consumer staples. Furthermore, as the retail sector continued to struggle and decline even further, we added Tapestry (formerly known as Coach and Kate Spade) to the portfolio; in short order Tapestry was one of the top performers returning over 25% compared against the benchmark’s sector return of under 2%.

CenturyLink likewise has performed well returning nearly 16% compared against the benchmark’s less than 4% sector return since our purchase. CenturyLink is emblematic of a company whose past may not be indicative of its future. It acquired Level 3 Communications last year and as a result its former CEO, responsible for much of the capital destroying activities of its past, was replaced by the CEO of Level 3, Jeff Storey, earlier this year. Mr. Storey is a sort of reformer himself, having transformed Level 3 from a profit-less company into a major competitor in his time as a CEO of Level 3. Now serving as the CEO of CenturyLink, we have expectations that he will do the same.

Other top contributors for the period include Discovery, Mosaic, Encompass Health, and Union Pacific; companies we have held for a longer period of time and in the case of Discovery and Mosaic our patience paid off, each returning close to 50% after an ample period of volatility in the early stages of our holdings.

In favor of the increases in the real estate, consumer staples and communications sectors we lowered our holdings in the industrial and consumer discretionary sectors. In industrials we exited successful investments in Kansas City Southern Railroad and Pentair and exited an unsuccessful investment in Nielsen as its troubles got progressively worse and the “crown jewel” watch segment appears to be at the beginning stages of a decline. In the consumer discretionary sector we exited L Brands, the parent company to Victoria Secret, Pink and Bath and Body Works after its fundamentals began to deteriorate beyond our expectations. We initially assumed a certain level of sales declines as foot traffic declines at traditional mall setting where the majority of its stores are located, however management has been slow to change its retail strategy and develop its e-commerce solutions, leading to worse-than-expected declines in sales. Unfortunately the company has begun to rely on discounts which negatively affects both profitability and its brand perception. Both Nielsen and L Brands represent some of the top detractors for the period; others includes Cabot Oil and Gas, Lithia Motors and LionsGate.

Sector allocation accounts for nearly half of the outperformance in the period where the underweight position in utilities, real estate, consumer staples and communication services sectors added over 200 basis points of outperformance and was partially offset by the underweight in energy and overweight in consumer discretionary.

We have been managing to Socially Responsible mandates for over 25 years where our goal has been to align our investment interests with the values and interests of our shareholders. It is our hope to continue to do so in the years to come.

Current and future portfolio holdings are subject to change and risk.

The MSCI KLD 400 Social Index and the Morningstar Category are used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

SEPTEMBER 30, 2018

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. Socially responsible investment criteria may limit the number of investment opportunities available to the Fund or it may invest a larger portion of its assets in certain sectors which could be more sensitive to market conditions, economic, regulatory and environmental developments. These factors could negatively impact the Fund’s returns. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

SEPTEMBER 30, 2018

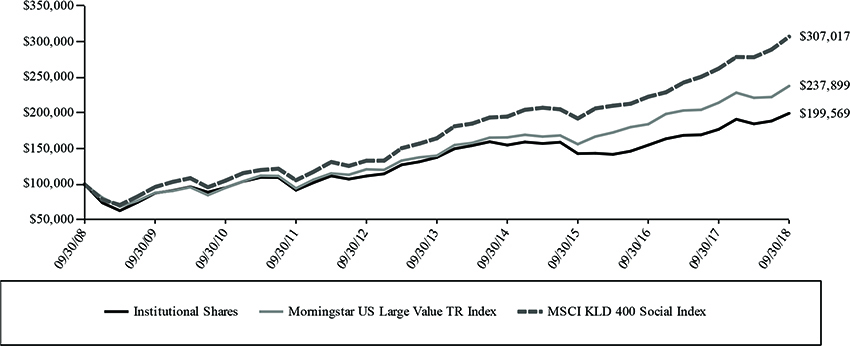

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood SociallyResponsible Fund (the “Fund”) compared with the performance of the primary benchmark, Morningstar US Large Value TR Index, and the secondary benchmark, MSCI KLD 400 Social Index (the "Indices"), over the past ten fiscal years. The Morningstar US Large Value TR Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance ratings and excludes companies whose products have negative social or environmental impacts. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar US Large Value TR Index and MSCI KLD 400 Social Index

|

Average Annual Total Returns Periods Ended September 30, 2018 |

One Year | Five Year | Ten Year |

| Baywood SociallyResponsible Fund Investor Shares* | 12.29% | 7.44% | 6.90% |

| Morningstar US Large Value TR Index | 10.89% | 11.15% | 9.05% |

| MSCI KLD 400 Social Index | 17.03% | 13.27% | 11.87% |

| * | Performance for Investor Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”). |

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

SEPTEMBER 30, 2018

Comparison of Change in Value of a $100,000 Investment

Institutional Shares vs. Morningstar US Large Value TR Index and MSCI KLD 400 Social Index

|

Average Annual Total Returns Periods Ended September 30, 2018 |

One Year | Five Year | Ten Year |

| Baywood SociallyResponsible Fund Institutional Shares* | 12.66% | 7.68% | 7.15% |

| Morningstar US Large Value TR Index | 10.89% | 11.15% | 9.05% |

| MSCI KLD 400 Social Index | 17.03% | 13.27% | 11.87% |

| * | Performance for Institutional Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”). |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 2.64% and 2.64%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.14% and 0.89% for Investor Shares and Institutional Shares, respectively, through January 31, 2019 (the “Expense Cap”) (the “Expense Cap”). The advisor may be reimbursed by each Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

BAYWOOD SOCIALLYRESPONSIBLE FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2018

| Shares | Security Description | Value | ||||||

| Common Stock - 96.5% | ||||||||

| Basic Materials - 5.1% | ||||||||

| 1,900 | Nutrien, Ltd. | $ | 109,630 | |||||

| 3,500 | The Mosaic Co. | 113,680 | ||||||

| 223,310 | ||||||||

| Capital Goods / Industrials - 4.1% | ||||||||

| 600 | Johnson Controls International PLC | 21,000 | ||||||

| 3,200 | Sensata Technologies Holding PLC (a) | 158,560 | ||||||

| 179,560 | ||||||||

| Communication Services - 6.3% | ||||||||

| 4,300 | CenturyLink, Inc. | 91,160 | ||||||

| 4,100 | Discovery, Inc., Class C (a) | 121,278 | ||||||

| 1,200 | Verizon Communications, Inc. | 64,068 | ||||||

| 276,506 | ||||||||

| Consumer Discretionary - 5.3% | ||||||||

| 1,000 | AutoNation, Inc. (a) | 41,550 | ||||||

| 1,500 | Tapestry, Inc. | 75,405 | ||||||

| 9,300 | TRI Pointe Group, Inc. (a) | 115,320 | ||||||

| 232,275 | ||||||||

| Consumer Staples - 4.8% | ||||||||

| 2,300 | Mondelez International, Inc., Class A | 98,808 | ||||||

| 1,000 | PepsiCo., Inc. | 111,800 | ||||||

| 210,608 | ||||||||

| Energy - 6.6% | ||||||||

| 3,100 | Centennial Resource Development, Inc., Class A (a) | 67,735 | ||||||

| 3,000 | Devon Energy Corp. | 119,820 | ||||||

| 1,700 | Schlumberger, Ltd. | 103,564 | ||||||

| 291,119 | ||||||||

| Financials - 24.8% | ||||||||

| 4,700 | Air Lease Corp. | 215,636 | ||||||

| 1,500 | American Express Co. | 159,735 | ||||||

| 700 | American International Group, Inc. | 37,268 | ||||||

| 5,800 | Bank of America Corp. | 170,868 | ||||||

| 1,500 | BOK Financial Corp. | 145,920 | ||||||

| 3,750 | Brookfield Asset Management, Inc., Class A | 166,987 | ||||||

| 800 | M&T Bank Corp. | 131,632 | ||||||

| 3,000 | Radian Group, Inc. | 62,010 | ||||||

| 1,090,056 | ||||||||

| Health Care - 18.6% | ||||||||

| 700 | AbbVie, Inc. | 66,206 | ||||||

| 2,000 | AstraZeneca PLC, ADR | 79,140 | ||||||

| 800 | Becton Dickinson and Co. | 208,800 | ||||||

| 700 | Encompass Health Corp. | 54,565 | ||||||

| 4,400 | Koninklijke Philips NV, ADR | 200,244 | ||||||

| 300 | Laboratory Corp. of America Holdings (a) | 52,104 | ||||||

| 1,600 | Medtronic PLC | 157,392 | ||||||

| 818,451 | ||||||||

| Real Estate - 3.6% | ||||||||

| 5,300 | Brookfield Property Partners LP | 110,717 | ||||||

| 1,500 | Weyerhaeuser Co. REIT | 48,405 | ||||||

| 159,122 | ||||||||

| Technology - 13.2% | ||||||||

| 3,100 | Cisco Systems, Inc. | 150,815 | ||||||

| 3,000 | Corning, Inc. | 105,900 | ||||||

| 3,400 | HP, Inc. | 87,618 | ||||||

| 2,500 | Intel Corp. | 118,225 | ||||||

| 800 | International Business Machines Corp. | 120,968 | ||||||

| 583,526 | ||||||||

| Transportation - 4.1% | ||||||||

| 9,500 | AP Moller - Maersk A/S, ADR | 66,738 | ||||||

| 700 | Union Pacific Corp. | 113,981 | ||||||

| 180,719 | ||||||||

| Total Common Stock (Cost $3,221,819) | 4,245,252 | |||||||

| Shares | Security Description | Value | ||||||

| Money Market Fund - 3.6% | ||||||||

| 160,237 | Morgan Stanley Institutional Liquidity | |||||||

| Funds Government Portfolio, Institutional | ||||||||

| Class, 2.01% (b) | ||||||||

| (Cost $160,237) | $ | 160,237 | ||||||

| Investments, at value - 100.1% (Cost $3,382,056) | $ | 4,405,489 | ||||||

| Other Assets & Liabilities, Net - (0.1)% | (4,566 | ) | ||||||

| Net Assets - 100.0% | $ | 4,400,923 | ||||||

| ADR | American Depositary Receipt |

| LP | Limited Partnership |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of September 30, 2018. |

The following is a summary of the inputs used to value the Fund's instruments as of September 30, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | Investments in Securities | |||

| Level 1 - Quoted Prices | $ | 4,245,252 | ||

| Level 2 - Other Significant Observable Inputs | 160,237 | |||

| Level 3 - Significant Unobservable Inputs | – | |||

| Total | $ | 4,405,489 | ||

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended September 30, 2018.

| PORTFOLIO HOLDINGS (Unaudited) | ||||

| % of Total Investments | ||||

| Basic Materials | 5.1 | % | ||

| Capital Goods / Industrials | 4.1 | % | ||

| Communication Services | 6.3 | % | ||

| Consumer Discretionary | 5.3 | % | ||

| Consumer Staples | 4.8 | % | ||

| Energy | 6.6 | % | ||

| Financials | 24.7 | % | ||

| Health Care | 18.6 | % | ||

| Real Estate | 3.6 | % | ||

| Technology | 13.2 | % | ||

| Transportation | 4.1 | % | ||

| Money Market Fund | 3.6 | % | ||

| 100.0 | % | |||

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2018

| ASSETS | ||||

| Investments, at value (Cost $3,382,056) | $ | 4,405,489 | ||

| Cash | 99 | |||

| Receivables: | ||||

| Fund shares sold | 1,141 | |||

| Dividends | 8,274 | |||

| From investment advisor | 7,131 | |||

| Prepaid expenses | 7,985 | |||

| Total Assets | 4,430,119 | |||

| LIABILITIES | ||||

| Payables: | ||||

| Fund shares redeemed | 3 | |||

| Accrued Liabilities: | ||||

| Fund services fees | 5,083 | |||

| Other expenses | 24,110 | |||

| Total Liabilities | 29,196 | |||

| NET ASSETS | $ | 4,400,923 | ||

| COMPONENTS OF NET ASSETS | ||||

| Paid-in capital | $ | 3,186,881 | ||

| Undistributed net investment income | 1,735 | |||

| Accumulated net realized gain | 188,874 | |||

| Net unrealized appreciation | 1,023,433 | |||

| NET ASSETS | $ | 4,400,923 | ||

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | ||||

| Investor Shares | 214,114 | |||

| Institutional Shares | 134,912 | |||

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | ||||

| Investor Shares (based on net assets of $2,701,499) | $ | 12.62 | ||

| Institutional Shares (based on net assets of $1,699,424) | $ | 12.60 | ||

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2018

| INVESTMENT INCOME | ||||

| Dividend income (Net of foreign withholding taxes of $2,710) | $ | 140,887 | ||

| Total Investment Income | 140,887 | |||

| EXPENSES | ||||

| Investment advisor fees | 51,892 | |||

| Fund services fees | 71,942 | |||

| Transfer agent fees: | ||||

| Investor Shares | 18,180 | |||

| Institutional Shares | 18,180 | |||

| Distribution fees: | ||||

| Investor Shares | 6,899 | |||

| Custodian fees | 5,000 | |||

| Registration fees: | ||||

| Investor Shares | 12,246 | |||

| Institutional Shares | 12,246 | |||

| Professional fees | 27,622 | |||

| Trustees' fees and expenses | 2,013 | |||

| Other expenses | 24,561 | |||

| Total Expenses | 250,781 | |||

| Fees waived and expenses reimbursed | (177,904 | ) | ||

| Net Expenses | 72,877 | |||

| NET INVESTMENT INCOME | 68,010 | |||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| Net realized gain on investments | 890,310 | |||

| Net change in unrealized appreciation (depreciation) on investments | (186,732 | ) | ||

| NET REALIZED AND UNREALIZED GAIN | 703,578 | |||

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 771,588 | ||

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Years Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| OPERATIONS | ||||||||

| Net investment income | $ | 68,010 | $ | 85,258 | ||||

| Net realized gain | 890,310 | 1,077,354 | ||||||

| Net change in unrealized appreciation (depreciation) | (186,732 | ) | 408,585 | |||||

| Increase in Net Assets Resulting from Operations | 771,588 | 1,571,197 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||

| Net investment income: | ||||||||

| Investor Shares | (14,499 | ) | (57,751 | ) | ||||

| Institutional Shares | (45,236 | ) | (72,531 | ) | ||||

| Net realized gain: | ||||||||

| Investor Shares | (36,997 | ) | – | |||||

| Institutional Shares | (75,417 | ) | – | |||||

| Total Distributions to Shareholders | (172,149 | ) | (130,282 | ) | ||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Investor Shares | 48,352 | 451,332 | ||||||

| Institutional Shares | 190,483 | 285,008 | ||||||

| Reinvestment of distributions: | ||||||||

| Investor Shares | 48,772 | 56,463 | ||||||

| Institutional Shares | 120,102 | 72,083 | ||||||

| Redemption of shares: | ||||||||

| Investor Shares | (542,020 | ) | (8,327,460 | ) | ||||

| Institutional Shares | (4,342,445 | ) | (1,145,359 | ) | ||||

| Decrease in Net Assets from Capital Share Transactions | (4,476,756 | ) | (8,607,933 | ) | ||||

| Decrease in Net Assets | (3,877,317 | ) | (7,167,018 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of Year | 8,278,240 | 15,445,258 | ||||||

| End of Year (Including line (a)) | $ | 4,400,923 | $ | 8,278,240 | ||||

| SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Investor Shares | 3,910 | 41,978 | ||||||

| Institutional Shares | 15,647 | 25,941 | ||||||

| Reinvestment of distributions: | ||||||||

| Investor Shares | 4,058 | 5,238 | ||||||

| Institutional Shares | 10,021 | 6,593 | ||||||

| Redemption of shares: | ||||||||

| Investor Shares | (44,965 | ) | (771,560 | ) | ||||

| Institutional Shares | (363,462 | ) | (107,029 | ) | ||||

| Decrease in Shares | (374,791 | ) | (798,839 | ) | ||||

| (a) Undistributed net investment income | $ | 1,735 | $ | 1,691 | ||||

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each year.

| For the Years Ended September 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| INVESTOR SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Year | $ | 11.45 | $ | 10.14 | $ | 10.16 | $ | 11.42 | $ | 12.26 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment income (a) | 0.09 | 0.06 | 0.08 | 0.11 | 0.18 | |||||||||||||||

| Net realized and unrealized gain (loss) | 1.30 | 1.35 | 0.71 | (0.98 | ) | 1.15 | ||||||||||||||

| Total from Investment Operations | 1.39 | 1.41 | 0.79 | (0.87 | ) | 1.33 | ||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net investment income | (0.06 | ) | (0.10 | ) | (0.28 | ) | (0.10 | ) | (0.15 | ) | ||||||||||

| Net realized gain | (0.16 | ) | – | (0.53 | ) | (0.29 | ) | (2.02 | ) | |||||||||||

| Total Distributions to Shareholders | (0.22 | ) | (0.10 | ) | (0.81 | ) | (0.39 | ) | (2.17 | ) | ||||||||||

| NET ASSET VALUE, End of Year | $ | 12.62 | $ | 11.45 | $ | 10.14 | $ | 10.16 | $ | 11.42 | ||||||||||

| TOTAL RETURN | 12.29 | % | 13.98 | % | 8.28 | % | (7.86 | )% | 12.11 | % | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Year (000s omitted) | $ | 2,701 | $ | 2,874 | $ | 9,890 | $ | 23,045 | $ | 26,763 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment income | 0.76 | % | 0.60 | % | 0.77 | % | 0.99 | % | 1.55 | % | ||||||||||

| Net expenses | 1.14 | % | 1.14 | % | 1.28 | % | 1.14 | % | 1.14 | % | ||||||||||

| Gross expenses (b) | 3.98 | % | 2.64 | % | 1.84 | % | 1.37 | % | 1.46 | % | ||||||||||

| PORTFOLIO TURNOVER RATE | 31 | % | 42 | % | 57 | % | 29 | % | 34 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

BAYWOOD SOCIALLYRESPONSIBLE FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each year.

| For the Years Ended September 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| INSTITUTIONAL SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Year | $ | 11.43 | $ | 10.15 | $ | 10.18 | $ | 11.45 | $ | 12.28 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment income (a) | 0.12 | 0.10 | 0.14 | 0.14 | 0.19 | |||||||||||||||

| Net realized and unrealized gain (loss) | 1.31 | 1.33 | 0.66 | (0.99 | ) | 1.18 | ||||||||||||||

| Total from Investment Operations | 1.43 | 1.43 | 0.80 | (0.85 | ) | 1.37 | ||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net investment income | (0.10 | ) | (0.15 | ) | (0.30 | ) | (0.13 | ) | (0.18 | ) | ||||||||||

| Net realized gain | (0.16 | ) | – | (0.53 | ) | (0.29 | ) | (2.02 | ) | |||||||||||

| Total Distributions to Shareholders | (0.26 | ) | (0.15 | ) | (0.83 | ) | (0.42 | ) | (2.20 | ) | ||||||||||

| NET ASSET VALUE, End of Year | $ | 12.60 | $ | 11.43 | $ | 10.15 | $ | 10.18 | $ | 11.45 | ||||||||||

| TOTAL RETURN | 12.66 | % | 14.18 | % | 8.40 | % | (7.70 | )% | 12.46 | % | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Year (000s omitted) | $ | 1,699 | $ | 5,404 | $ | 5,555 | $ | 238,379 | $ | 172,830 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment income | 1.01 | % | 0.92 | % | 1.35 | % | 1.22 | % | 1.62 | % | ||||||||||

| Net expenses | 0.89 | % | 0.89 | % | 0.89 | % | 0.89 | %(c) | 0.89 | % | ||||||||||

| Gross expenses (b) | 3.03 | % | 2.64 | % | 1.00 | % | 0.87 | % | 0.96 | % | ||||||||||

| PORTFOLIO TURNOVER RATE | 31 | % | 42 | % | 57 | % | 29 | % | 34 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| (c) | Ratio includes waivers and previously waived investment advisory fees recovered. The impact of the recovered fees may cause a higher net expense ratio. |

See Notes to Financial Statements.

BAYWOOD FUNDS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2018

Note 1. Organization

Baywood ValuePlus Fund and Baywood SociallyResponsible Fund (individually, a “Fund” and collectively, the “Funds”) are diversified portfolios of Forum Funds II (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund’s shares of beneficial interest without par value. The Baywood ValuePlus Fund commenced operations on December 2, 2013, through a reorganization of a collective investment trust into the Baywood ValuePlus Fund. The collective investment trust was previously managed by the Baywood ValuePlus Fund’s Advisor and portfolio management team. This collective investment trust was organized and commenced operations on June 27, 2008. The Baywood ValuePlus Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood ValuePlus Fund seeks to achieve long-term capital appreciation by investing in undervalued equity securities. The Baywood SociallyResponsible Fund commenced operations on January 3, 2005. The Baywood SociallyResponsible Fund currently offers two classes of shares: Investor Shares and Institutional Shares. The Baywood SociallyResponsible Fund seeks to provide long-term capital growth.

On December 7, 2015, at a special meeting of shareholders of Baywood SociallyResponsible Fund, formerly City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the "Predecessor Fund"), the shareholders approved a proposal to reorganize the Predecessor Fund into the Baywood SociallyResponsible Fund, a newly created series of the Forum Funds II. The Predecessor Fund was sub-advised by the Fund's Advisor, SKBA Capital Management, LLC, with the same portfolio managers as Baywood SociallyResponsible Fund. The Baywood SociallyResponsible Fund is managed in a manner that is in all material respects equivalent to the management of the Predecessor Fund, including the investment objective, strategies, guidelines and restrictions. The primary purpose of the reorganization was to move the Predecessor Fund to a newly created series of Forum Funds II. As a result of the reorganization, the Baywood SociallyResponsible Fund is now operating under the supervision of a different board of trustees. On January 8, 2016, the Baywood SociallyResponsible Fund acquired all of the assets, subject to liabilities, of the Predecessor Fund. The shares of the Predecessor Fund were, in effect, exchanged on a tax-free basis for Shares of the Baywood SociallyResponsible Fund with the same aggregate value. No commission or other transactional fees were imposed on shareholders in connection with the tax-free exchange of their shares.

Note 2. Summary of Significant Accounting Policies

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of each Fund:

Security Valuation – Securities are valued at market prices using the last quoted trade or official closing price from the principal exchange where the security is traded, as provided by independent pricing services on each Fund business day. In the absence of a last trade, securities are valued at the mean of the last bid and ask price provided by the pricing service. Shares of non-exchange traded open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

Each Fund values its investments at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are not readily available or (2) the Advisor, as defined in Note 3, believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in each Fund’s registration statement, performs certain functions as they relate to the administration and oversight of each Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Advisor to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics that may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Advisor inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any

BAYWOOD FUNDS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2018

restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

GAAP has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical assets and liabilities.

Level 2 - Prices determined using significant other observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Short-term securities with maturities of sixty days or less are valued at amortized cost, which approximates market value, and are categorized as Level 2 in the hierarchy. Municipal securities, long-term U.S. government obligations and corporate debt securities are valued in accordance with the evaluated price supplied by the pricing service and generally categorized as Level 2 in the hierarchy. Other securities that are categorized as Level 2 in the hierarchy include, but are not limited to, warrants that do not trade on an exchange, securities valued at the mean between the last reported bid and ask quotation and international equity securities valued by an independent third party with adjustments for changes in value between the time of the securities respective local market closes and the close of the U.S. market.

Level 3 - Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments).

The aggregate value by input level, as of September 30, 2018, for each Fund’s investments is included at the end of each Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after determining the existence of a dividend declaration after exercising reasonable due diligence. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid at least annually. Distributions to shareholders of net capital gains, if any, are declared and paid at least at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by each Fund, timing differences and differing characterizations of distributions made by each Fund.

Federal Taxes – Each Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended (“Code”), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Funds will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. Each Fund files a U.S. federal income and excise tax return as required. Each Fund’s federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of September 30, 2018, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

Each Fund's class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of each Fund.

BAYWOOD FUNDS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2018