Form N-CSR CUSHING MLP & INFRASTRUC For: Nov 30

As filed with the Securities and Exchange Commission on February 8, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22072

The Cushing MLP & Infrastructure Total

Return Fund

(Exact name of registrant as specified in charter)

300 Crescent Court, Suite 1700

Dallas, TX 75201

(Address of principal executive offices) (Zip code)

Jerry V. Swank

300 Crescent Court, Suite 1700

Dallas, TX 75201

(Name and address of agent for service)

214-692-6334

(Registrant's telephone number, including area code)

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Updated June 15, 2015

Item 1. Reports to Stockholders.

|

|

|

|

Annual Report |

|

|

The Cushing® MLP & Infrastructure Total Return Fund

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports are no longer sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports are made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary or, if you invest directly with the Fund, calling 800-236-4424 to let the Fund know of your request. Your election to receive shareholder reports in paper will apply to all funds held in your account. |

|

|

|

|

|

|

Investment Adviser

Cushing® Asset Management, LP |

Table of Contents

Shareholder Letter (Unaudited) |

1 |

Allocation of Portfolio Assets (Unaudited) |

5 |

Key Financial Data (Unaudited) |

6 |

Schedule of Investments |

7 |

Statement of Assets & Liabilities |

10 |

Statement of Operations |

11 |

Statements of Changes in Net Assets |

12 |

Statement of Cash Flows |

13 |

Financial Highlights |

14 |

Notes to Financial Statements |

16 |

Report of Independent Registered Public Accounting Firm |

24 |

Trustees and Executive Officers (Unaudited) |

25 |

Additional Information (Unaudited) |

27 |

The Cushing® MLP & Infrastructure Total Return Fund Shareholder Letter |

Dear Fellow Shareholder,

For the twelve month fiscal period ended November 30, 2020 (the “period”), the Cushing® MLP & Infrastructure Total Return Fund (the “Fund”) delivered a Net Asset Value Total Return (equal to the change in net asset value (“NAV”) per share plus reinvested cash distributions from underlying Fund investments during the period) of –24.87%, versus a total return of +17.46% for the S&P 500® Index (Total Return) (“S&P 500”). The Fund’s Share Price Total Return (equal to the change in market price per share plus reinvested cash distributions from underlying Fund Investments paid during the period) was –38.76% for the period and differs from the Net Asset Value Total Return due to fluctuations in the discount of share price to NAV. The Fund’s shares traded at a -25.33% discount to NAV as of the end of the period, compared to an -8.60% discount at the end of the Fund’s last fiscal year and a -20.65% discount as of May 31, 2020. As measured by the Alerian MLP Index (Total Return) (“AMZ”), the performance of master limited partnerships (“MLPs”) decreased by –24.50% for the period.

Industry Overview and Themes

There were numerous concurrent developments during the period that materially altered the current state and outlook for the energy markets and related equities. These events, including an OPEC price war (and subsequent agreement), initial realization of a global pandemic and the resulting negative impact to hydrocarbon demand, forced producer curtailments and a negative crude oil price, among others, led to unprecedented volatility and negative absolute equity price movements for the energy complex, including midstream energy equities.

Midstream management teams were proactive in an attempt to quickly preserve financial flexibility and endure the distressed environment. In response to the volatility, most publicly traded midstream companies announced remedial updates, including slashing capital expenditure forecasts, deferring projects, cutting operating costs and, in select cases, voluntarily reducing distributions / dividends. These revisions resulted in several billion dollars of capital savings and even higher free cash flow (FCF) yields, despite reduced earnings projections.

However, the massive underperformance of the beleaguered midstream sector versus the broader market took its toll during the period. Shareholder fatigue and frustration culminated into unprecedented outflows from investment funds and strategies focused on publicly traded midstream equities. Positive earnings and beneficial management actions were largely met with investor indifference. Valuation multiples approached record lows on an absolute and relative basis.

Investor malaise sharply reversed for the final month of the fiscal year, aided by both macro- and micro-level developments. On a macro-level, positive news on several COVID-19 vaccines led to a strong rally for the broader equity markets, including energy commodity prices. And despite rising COVID-19 cases and hospitalizations across the U.S. and Europe, increasing optimism of an economic recovery led to a sharp rotation out of more expensive growth and tech sectors – the beneficiaries of the “work from home” trend – and into much cheaper value and cyclical sectors, with energy a key component of both.

On a micro-level, third calendar quarter 2020 earnings for the midstream energy sector were surprisingly strong, beating consensus estimates across the board. In general, hydrocarbon volumes and cash flows were either more resilient than expected or recovered faster than expected. As a result, 2020 company outlooks stabilized and generally trended higher.

1

Fund Performance and Strategy

While selling was generally broad-based across all midstream companies and subsectors, the Fund benefitted from holdings in companies where we believed cash flows would be more resilient given the commodity downturn. Additionally, companies with conservative leverage profiles, and the ability to cancel capital expenditures projects to enhance financial flexibility (to further de-lever or conduct stock buybacks) generally outperformed during the volatile period.

At the subsector level, the Fund benefitted from underweight exposure to holdings in the Crude Oil & Refined Products, Large Cap Diversified Master Limited Partnerships (“MLPs”) and Natural Gas Gatherers & Processors subsectors. These three subsectors were the top three detractors of the AMZ’s performance for the period. The Fund also benefitted from exposure to holdings in the YieldCo subsector, the holdings of which are not included in the AMZ. The Fund was negatively impacted by the performance of holdings in the Large Cap Diversified C-Corps subsector, the holdings of which are also not included in the AMZ. Midstream companies positioned “closer to the wellhead” (typically gathering and processing companies), performed poorly for the period, as did companies with higher leverage than their peers.

On an absolute basis, the top contributors in order of greatest contribution to least were: 1) Clearway Energy, Inc. (NYSE: CWEN); 2) Brookfield Renewable Partners, LP (NYSE: BEP); and 3) NextEra Energy Partners, LP (NYSE: NEP). All three companies are renewable infrastructure/energy YieldCos, which benefitted from positive renewable energy sentiment and growth. All three of these holdings had positive absolute performance for the period.

On an absolute basis, the bottom contributors in order of most negative to least negative performance were: 1) Plains GP Holdings, LP (NYSE: PAGP); 2) Energy Transfer, LP (NYSE: ET); and 3) ONEOK, Inc. (NYSE: OKE). All three companies were top weights in the Fund during the period and were negatively impacted by weak commodity prices and broad-based selling in midstream energy equities. ONEOK was further negatively impacted by investor concerns on Bakken production growth. All three companies remained top weightings in the Fund as of the end of the period. We believe all three companies will benefit from their integrated value chains across multiple geographies and products, as well as the ability to better withstand changing/slowing activity levels with exploration & production (“E&P”) company customers.

Although we remained constructive on the midstream sector overall, we took a more defensive posture in the Fund over the latter portion of the fiscal period to address ongoing concerns regarding the impact of crude oil price volatility. We significantly reduced the Fund’s exposure to more commodity-sensitive names and companies positioned closer to the wellhead (i.e. gatherers and processors). We also increased the Fund’s exposure to overly discounted natural gas midstream companies, which may benefit from the decline (or flattening) of crude oil production (e.g. less associated gas supply) and whose outlook has structurally improved.

In addition, we positioned the Fund in companies where we believe cash flows to be more resilient given the commodity downturn. We also prefer companies with conservative leverage profiles and the ability to cancel or defer capital projects to enhance financial flexibility (enabling further leverage reductions or stock buybacks).

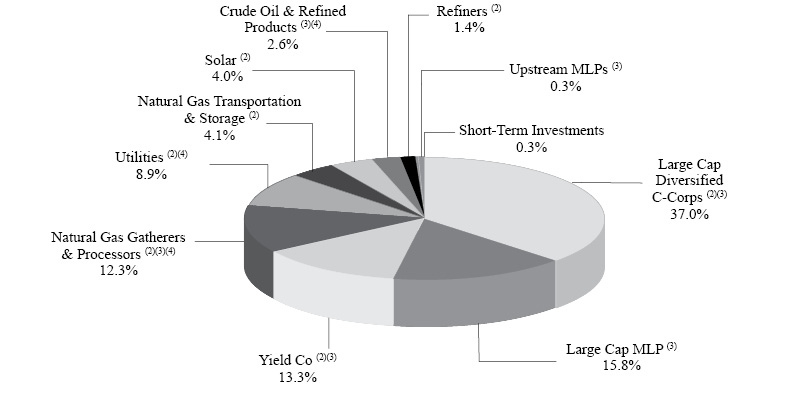

At the end of the fiscal period, the three largest subsector exposures, in order of size, were: 1) Large Cap Diversified C-Corps; 2) Large Cap MLPs; and 3) YieldCos.

Leverage

The Fund’s investment strategy focuses on holding core positions in companies with cash flow generating business models and long-term growth prospects. We also work diligently to optimize the use of leverage for additional income and total return potential. This involves leveraging investments when the probabilities of positive total return are deemed to be skewed favorably. As the prices of the Fund’s investment increase or decline, there is a risk that the impact to the Fund’s NAV and total return will be negatively impacted by leverage, but this strategy is designed to have a positive impact over the longer term.

2

At the end of the period, the Fund had a leverage ratio of approximately 123%, which compares to an average 138% leverage ratio in the prior fiscal year. While we had repositioned the Fund into more defensive companies with less commodity-sensitivity prior to the period, this leverage combined with the sharp market decline of March negatively impacted the Fund’s NAV performance for the period. Average leverage for the period was 123%.

Closing

The Fund’s merger with The Cushing® Energy Income Fund (NYSE: SRF) was completed on Friday, May 29, 2020, after the closing of trading on the New York Stock Exchange. In the merger, Common Shareholders of SRF received newly-issued Common Shares of the Fund in a tax-free transaction having an aggregate net asset value equal to the aggregate net asset value of their holdings of SRF Common Shares, as determined at the close of business on May 29, 2020.

In addition, John Musgrave joined the Fund’s portfolio management team and Paul Euseppi no longer serves as a portfolio manager of the Fund. Jerry Swank and John Musgrave are now jointly and primarily responsible for the day-to-day management of the Fund’s portfolio.

We believe the midstream sector has been oversold and maintain our view that select company valuations are compelling. The extreme downside moves during the period were likely excessive, driven by indiscriminate or forced selling. In our view, this creates long-term buying opportunities for investors with the wherewithal to step in.

It is important to remember that most midstream companies have taken great strides in the last few years by increasing distribution coverage, eliminating reliance on public equity funding, self-financing capital projects, improving governance structures and decreasing leverage.

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Jerry V. Swank

Chairman, Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change.

The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. Investment return, net asset value and common share market price will fluctuate so that you may have a gain or loss when you sell shares. Since the Fund is a closed-end management investment company, shares of the Fund may trade at a discount or premium from net asset value. This characteristic is separate and distinct from the risk that net asset value could decrease as a result of investment activities and may be a greater risk to investors expecting to sell their shares after a short time. The Fund cannot predict whether shares will trade at, above or below net asset value. The Fund should not be viewed as a vehicle for trading purposes. It is designed primarily for risk-tolerant long-term investors.

3

An investment in the Fund involves risks. Leverage creates risks which may adversely affect returns, including the likelihood of greater volatility of net asset value and market price of the Fund’s common shares. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

The Fund will invest in energy companies, including Master Limited Partnerships (MLPs), which concentrate investments in the natural resources sector. Energy companies are subject to certain risks, including, but not limited to the following: fluctuations in the prices of commodities; the highly cyclical nature of the natural resources sector may adversely affect the earnings or operating cash flows of the companies in which the Fund will invest; a significant decrease in the production of energy commodities could reduce the revenue, operating income, operating cash flows of MLPs and other natural resources sector companies and, therefore, their ability to make distributions or pay dividends and a sustained decline in demand for energy commodities could adversely affect the revenues and cash flows of energy companies. Holders of MLP units are subject to certain risks inherent in the structure of MLPs, including tax risks; the limited ability to elect or remove management or the general partner or managing member; limited voting rights and conflicts of interest between the general partner or managing member and its affiliates, on the one hand, and the limited partners or members, on the other hand. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. Investors in MLP funds incur management fees from underlying MLP investments. Small- and mid-cap stocks are often more volatile and less liquid than large-cap stocks. Smaller companies generally face higher risks due to their limited product lines, markets, and financial resources. Funds that invest in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner. High yield securities have speculative characteristics and present a greater risk of loss than higher quality debt securities. These securities can also be subject to greater price volatility. An investment in the Fund will involve tax risks, including, but not limited to: The portion, if any, of a distribution received by the Fund as the holder of an MLP equity security that is offset by the MLP’s tax deductions or losses generally will be treated as a return of capital to the extent of the Fund’s tax basis in the MLP equity security, which will cause income or gain to be higher, or losses to be lower, upon the sale of the MLP security by the Fund. Changes in tax laws, regulations or interpretations of those laws or regulations in the future could adversely affect the Fund or the energy companies in which the Fund will invest.

The potential tax benefits of investing in MLPs depend on them being treated as partnerships for federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation at the entity level, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

The Fund incurs operating expenses, including advisory fees, as well as leverage costs. Investment returns for the Fund are shown net of fees and expenses.

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance. The Alerian MLP Index is a capitalization-weighted index of prominent energy master limited partnerships. Neither of these indices includes fees or expenses. It is not possible to invest directly in an index.

4

The Cushing® MLP & Infrastructure Total Return Fund Allocation of Portfolio Assets (Unaudited) November 30, 2020 |

|

(2) |

Common Stock |

|

(3) |

Master Limited Partnerships and Related Companies |

|

(4) |

Preferred Stock |

5

The Cushing® MLP & Infrastructure Total Return Fund Key Financial Data (Supplemental Information) |

The Information presented below regarding Distributable Cash Flow is supplemental non-GAAP financial information, which we believe is meaningful to understanding our operating performance. Supplemental non-GAAP measures should be read in conjunction with our full financial statements.

Fiscal Year |

Fiscal Year |

Fiscal Year |

Fiscal Year |

Fiscal Year |

||||||||||||||||

FINANCIAL DATA |

||||||||||||||||||||

Total income from investments |

||||||||||||||||||||

Distributions and dividends received, net of foreign taxes withheld |

$ | 4,819,519 | $ | 6,545,077 | $ | 7,605,948 | $ | 9,481,830 | $ | 9,454,162 | ||||||||||

Interest |

133,422 | 358,546 | 188,009 | 15,536 | 68,490 | |||||||||||||||

Other |

0 | 300 | 16,592 | 1,093 | 27,378 | |||||||||||||||

Total income from investments |

$ | 4,952,941 | $ | 6,903,923 | $ | 7,810,549 | $ | 9,498,459 | $ | 9,550,030 | ||||||||||

Adviser fee and operating expenses |

||||||||||||||||||||

Adviser fees, less reimbursement by |

||||||||||||||||||||

Adviser |

$ | 708,002 | $ | 1,066,046 | $ | 1,232,758 | $ | 1,362,722 | $ | 1,009,528 | ||||||||||

Operating expenses(b) |

495,171 | 729,812 | 547,309 | 565,496 | 671,117 | |||||||||||||||

Interest and dividends |

328,065 | 1,026,987 | 1,108,640 | 1,028,222 | 907,714 | |||||||||||||||

Other |

0 | 0 | 0 | 0 | 1,097 | |||||||||||||||

Total Adviser fees and operating expenses |

$ | 1,531,238 | $ | 2,822,845 | $ | 2,888,707 | $ | 2,956,440 | $ | 2,589,456 | ||||||||||

Distributable Cash Flow (DCF)(c) |

$ | 3,421,703 | $ | 4,081,078 | $ | 4,921,842 | $ | 6,542,019 | $ | 6,960,574 | ||||||||||

Distributions paid on common stock |

$ | 5,418,435 | $ | 7,297,290 | $ | 7,297,290 | $ | 7,293,250 | $ | 7,273,047 | ||||||||||

Distributions paid on common stock per share |

$ | 2.81 | $ | 4.32 | $ | 4.32 | $ | 4.32 | $ | 4.32 | ||||||||||

Distribution Coverage Ratio |

||||||||||||||||||||

Before Adviser fee and operating expenses |

0.9x | 0.9x | 1.1x | 1.3x | 1.3x | |||||||||||||||

After Adviser fee and operating expenses |

0.6x | 0.6x | 0.7x | 0.9x | 1.0x | |||||||||||||||

OTHER FUND DATA (end of period) |

||||||||||||||||||||

Total Assets, end of fiscal year |

73,831,898 | 99,026,398 | 103,494,265 | 114,917,830 | 149,772,615 | |||||||||||||||

Unrealized appreciation (depreciation), net of income taxes |

(4,849,090 | ) | 852,192 | (2,847,325 | ) | (5,855,903 | ) | 21,588,546 | ||||||||||||

Short-term borrowings |

13,915,000 | 28,915,000 | 26,050,000 | 33,650,000 | 49,454,119 | |||||||||||||||

Short-term borrowings as a percent of total assets |

19 | % | 29 | % | 25 | % | 29 | % | 33 | % | ||||||||||

Net Assets, end of fiscal year |

59,659,139 | 69,717,658 | 76,381,982 | 81,002,320 | 99,969,625 | |||||||||||||||

Net Asset Value per common share |

$ | 27.32 | $ | 41.41 | $ | 45.37 | $ | 48.11 | $ | 59.38 | ||||||||||

Market Value per share |

$ | 20.40 | $ | 37.84 | $ | 38.88 | $ | 42.92 | $ | 50.76 | ||||||||||

Market Capitalization |

$ | 44,541,176 | $ | 254,825,988 | $ | 261,829,662 | $ | 289,036,242 | $ | 341,833,170 | ||||||||||

Shares Outstanding |

2,183,391 | 6,734,302 | 6,734,302 | 6,734,302 | 6,734,302 | |||||||||||||||

|

(a) |

Per share data adjusted for 1:4 reverse stock split completed as of June 12, 2020. |

|

(b) |

Excludes expenses related to capital raising. |

|

(c) |

“Net Investment Loss, before Income Taxes” on the Statement of Operations is adjusted as follows to reconcile to Distributable Cash Flow: increased by the return of capital on MLP distributions. |

6

The Cushing® MLP & Infrastructure Total Return Fund Schedule of Investments |

November 30, 2020 |

Common Stock — 69.9% |

Shares |

Fair Value |

||||||

Large Cap Diversified C Corps — 35.9% |

||||||||

Canada — 16.7% |

||||||||

Enbridge, Inc.(1) |

104,520 | $ | 3,262,069 | |||||

Pembina Pipeline Corporation(1) |

137,420 | 3,502,836 | ||||||

TC Energy Corporation(1) |

72,040 | 3,164,717 | ||||||

United States — 19.2% |

||||||||

Kinder Morgan, Inc.(1) |

244,050 | 3,509,439 | ||||||

ONEOK, Inc.(1) |

129,020 | 4,627,947 | ||||||

Williams Companies, Inc.(1) |

158,750 | 3,330,575 | ||||||

| 21,397,583 | ||||||||

Natural Gas Gatherers & Processors — 8.9% |

||||||||

United States — 8.9% |

||||||||

Targa Resources Corporation(1) |

226,950 | 5,333,325 | ||||||

Natural Gas Transportation & Storage — 5.0% |

||||||||

United States — 5.0% |

||||||||

Equitrans Midstream Corporation |

367,710 | 3,000,514 | ||||||

Refiners — 1.7% |

||||||||

United States — 1.7% |

||||||||

Marathon Petroleum Corporation |

26,580 | 1,033,430 | ||||||

Solar — 5.0% |

||||||||

United Kingdom — 5.0% |

||||||||

Atlantica Sustainable Infrastructure plc |

86,180 | 2,963,730 | ||||||

Utilities — 7.2% |

||||||||

Canada — 1.3% |

||||||||

Algonquin Power & Utilities Corporation |

50,000 | 784,000 | ||||||

United States — 5.9% |

||||||||

Dominion Energy, Inc.(1) |

30,600 | 2,401,794 | ||||||

NextEra Energy, Inc. |

15,400 | 1,133,286 | ||||||

| 4,319,080 | ||||||||

Yield Co — 6.2% |

||||||||

United States — 6.2% |

||||||||

Clearway Energy Inc.(1) |

125,700 | 3,679,239 | ||||||

Total Common Stocks (Cost $43,333,662) |

$ | 41,726,901 | ||||||

See Accompanying Notes to the Financial Statements.

7

The Cushing® MLP & Infrastructure Total Return Fund Schedule of Investments |

November 30, 2020 — (Continued) |

MLP Investments and |

Units |

Fair Value |

||||||

Crude Oil & Refined Products — 2.8% |

||||||||

United States — 2.8% |

||||||||

Magellan Midstream Partners, L.P.(1) |

40,250 | $ | 1,656,288 | |||||

Large Cap Diversified C Corps — 9.7% |

||||||||

United States — 9.7% |

||||||||

Plains GP Holdings, L.P. |

728,300 | 5,775,419 | ||||||

Large Cap MLP — 19.5% |

||||||||

United States — 19.5% |

||||||||

Energy Transfer, L.P.(1) |

407,377 | 2,517,590 | ||||||

Enterprise Products Partners, L.P.(1) |

262,850 | 5,099,290 | ||||||

MPLX, L.P. |

190,960 | 4,017,798 | ||||||

| 11,634,678 | ||||||||

Natural Gas Gatherers & Processors — 4.9% |

||||||||

United States — 4.9% |

||||||||

Hess Midstream, L.P. |

87,057 | 1,569,638 | ||||||

Rattler Midstream, L.P. |

165,000 | 1,367,850 | ||||||

| 2,937,488 | ||||||||

Upstream MLPs — 0.4% |

||||||||

United States — 0.4% |

||||||||

Mid-Con Energy Partners L.P. |

74,845 | 224,535 | ||||||

Yield Co — 10.2% |

||||||||

Bermuda — 4.4% |

||||||||

Brookfield Renewable Partners, L.P.(1) |

41,236 | 2,621,785 | ||||||

United States — 5.8% |

||||||||

NextEra Energy Partners, L.P.(1) |

54,658 | 3,469,143 | ||||||

| 6,090,928 | ||||||||

Total MLP Investments and Related Companies (Cost $31,738,126) |

$ | 28,319,336 | ||||||

Preferred Stock — 5.5% |

|

|

||||||

Crude Oil & Refined Products — 0.4% |

||||||||

United States — 0.4% |

||||||||

NGL Energy Partners L.P.(1) |

20,313 | $ | 223,037 | |||||

Natural Gas Gatherers & Processors — 1.3% |

||||||||

United States — 1.3% |

||||||||

Crestwood Equity Partners L.P. |

112,800 | 792,984 | ||||||

Utilities — 3.8% |

||||||||

United States — 3.8% |

||||||||

NextEra Energy Capital Holdings Inc.(1) |

81,000 | 2,255,040 | ||||||

Total Preferred Stock (Cost $3,094,600) |

$ | 3,271,061 | ||||||

See Accompanying Notes to the Financial Statements.

8

The Cushing® MLP & Infrastructure Total Return Fund Schedule of Investments |

November 30, 2020 — (Continued) |

Short-Term Investments — |

Shares |

Fair Value |

||||||

United States — 0.4% |

||||||||

First American Government Obligations Fund - Class X, 0.05% (2) |

107,613 | $ | 107,613 | |||||

First American Treasury Obligations Fund - Class X, 0.05% (2) |

107,613 | 107,613 | ||||||

Total Short-Term Investments - Investment Companies (Cost $215,226) |

$ | 215,226 | ||||||

Total Investments — 123.3% (Cost $78,381,614) |

$ | 73,532,524 | ||||||

Liabilities in Excess of Other Assets — (23.3)% |

(13,873,385 | ) | ||||||

Net Assets Applicable to Common Stockholders — 100.0% |

$ | 59,659,139 | ||||||

|

(1) |

All or a portion of these securities are held as collateral pursuant to the loan agreements. |

|

(2) |

Rate reported is the current yield as of November 30, 2020. |

See Accompanying Notes to the Financial Statements.

9

The Cushing® MLP & Infrastructure Total Return Fund Statement of Assets & Liabilities November 30, 2020 |

Assets |

||||

Investments, at fair value (cost $78,381,614) |

$ | 73,532,524 | ||

Distributions and dividends receivable |

209,596 | |||

Interest receivable |

19 | |||

Prepaid expenses and other receivables |

89,759 | |||

Total assets |

73,831,898 | |||

Liabilities |

||||

Short-term borrowings |

13,915,000 | |||

Payable to Adviser, net of waiver |

57,844 | |||

Accrued interest expense |

13,421 | |||

Accrued expenses and other liabilities |

186,494 | |||

Total liabilities |

14,172,759 | |||

Net assets applicable to common stockholders |

$ | 59,659,139 | ||

Components of Net Assets |

||||

Capital stock, $0.001 par value; 2,183,391 shares issued and outstanding (unlimited shares authorized) |

$ | 2,183 | ||

Additional paid-in capital |

136,018,119 | |||

Accumulated net losses |

(76,361,163 | ) | ||

Net assets applicable to common stockholders |

$ | 59,659,139 | ||

Net asset value per common share outstanding (net assets applicable to common shares divided by common shares outstanding) |

$ | 27.32 |

See Accompanying Notes to the Financial Statements.

10

The Cushing® MLP & Infrastructure Total Return Fund Statement of Operations Fiscal Year Ended November 30, 2020 |

Investment Income |

||||

Distributions and dividends received, net of foreign taxes withheld of $88,898 |

$ | 4,819,519 | ||

Less: return of capital on distributions |

(3,649,467 | ) | ||

Distribution and dividend income |

1,170,052 | |||

Interest income |

133,422 | |||

Total Investment Income |

1,303,474 | |||

Expenses |

||||

Adviser fees |

884,834 | |||

Professional fees |

153,526 | |||

Administrator fees |

96,792 | |||

Trustees’ fees |

83,335 | |||

Reports to stockholders |

52,011 | |||

Fund accounting fees |

42,331 | |||

Transfer agent fees |

28,229 | |||

Insurance expense |

25,768 | |||

Custodian fees and expenses |

7,272 | |||

Other expenses |

5,907 | |||

Total Expenses before Interest |

1,380,005 | |||

Interest expense |

328,065 | |||

Total Expenses |

1,708,070 | |||

Less: expense waived by Adviser |

(176,832 | ) | ||

Net Expenses |

1,531,238 | |||

Net Investment Loss |

(227,764 | ) | ||

Realized and Unrealized Gain (Loss) on Investments |

||||

Net realized loss on investments |

(11,009,242 | ) | ||

Net realized gain on written options |

60,392 | |||

Net realized loss on investments |

(10,948,850 | ) | ||

Net change in unrealized depreciation of investments |

(6,164,606 | ) | ||

Net change in unrealized depreciation of options |

(2,580 | ) | ||

Net change in unrealized depreciation of investments |

(6,167,186 | ) | ||

Net Realized and Unrealized Gain (Loss) on Investments |

(17,116,036 | ) | ||

Net Decrease in Net Assets Applicable to Common Stockholders Resulting from Operations |

$ | (17,343,800 | ) |

See Accompanying Notes to the Financial Statements.

11

The Cushing® MLP & Infrastructure Total Return Fund Statements of Changes in Net Assets |

Fiscal |

Fiscal |

|||||||

Operations |

||||||||

Net investment loss |

$ | (227,764 | ) | $ | (795,197 | ) | ||

Net realized loss on investments and options |

(10,948,850 | ) | (2,271,266 | ) | ||||

Net change in unrealized appreciation/depreciation of investments and options |

(6,167,186 | ) | 3,699,429 | |||||

Net increase (decrease) in net assets applicable to common stockholders resulting from operations |

17,343,800 | 632,966 | ||||||

Distributions and Dividends to Common Stockholders |

||||||||

Distributable earnings |

(5,418,435 | ) | (7,297,290 | ) | ||||

Total distributions and dividends to common stockholders |

(5,418,435 | ) | (7,297,290 | ) | ||||

Capital Share Transactions |

||||||||

Issuance of 1,999,261 in connection with the merger with Cushing Energy Income Fund |

12,798,769 | |||||||

Underwriting discounts and offering expenses associated with the issuance of common shares |

(95,053 | ) | — | |||||

Net increase in net assets applicable to common stockholders from capital share transactions |

12,703,716 | — | ||||||

Total decrease in net assets applicable to common stockholders |

(10,058,519 | ) | (6,664,324 | ) | ||||

Net Assets |

||||||||

Beginning of fiscal year |

69,717,658 | 76,381,982 | ||||||

End of fiscal year |

$ | 59,659,139 | $ | 69,717,658 | ||||

See Accompanying Notes to the Financial Statements.

12

The Cushing® MLP & Infrastructure Total Return Fund Statement of Cash Flows Fiscal Year Ended November 30, 2020 |

OPERATING ACTIVITIES |

||||

Net Decrease in Net Assets Applicable to Common Stockholders Resulting from Operations |

$ | (17,343,800 | ) | |

Adjustments to reconcile decrease in the net assets applicable to common stockholders resulting from operations to net cash provided by operating activities |

||||

Net change in unrealized depreciation of investments |

6,167,186 | |||

Purchases of investments |

(53,697,995 | ) | ||

Proceeds from sales of investments |

69,429,130 | |||

Proceeds from option transactions, net |

1,434,065 | |||

Return of capital on distributions |

3,649,467 | |||

Net realized loss on sales of investments |

10,948,850 | |||

Net purchases of short-term investments |

(204,040 | ) | ||

Net accretion/amortization of senior notes’ premiums/discounts |

(3,261 | ) | ||

Changes in operating assets and liabilities |

||||

Interest receivable |

93,427 | |||

Distributions and dividends receivable |

72,231 | |||

Prepaid expenses and other receivables |

77,185 | |||

Distributions and dividends payable |

(10,334 | ) | ||

Payable to Adviser, net of waiver |

(25,556 | ) | ||

Current tax expense |

(150,142 | ) | ||

Accrued interest expense |

13,421 | |||

Accrued expenses and other liabilities |

51,125 | |||

Net cash provided by operating activities |

20,500,959 | |||

FINANCING ACTIVITIES |

||||

Proceeds from borrowing facility |

10,400,000 | |||

Repayment of borrowing facility |

(25,400,000 | ) | ||

Common stock issuance |

(99,604 | ) | ||

Distributions and dividends paid to common stockholders |

(5,418,435 | ) | ||

Net cash used in financing activities |

(20,518,039 | ) | ||

INCREASE IN CASH AND CASH EQUIVALENTS |

(17,080 | ) | ||

CASH AND CASH EQUIVALENTS: |

||||

Beginning of fiscal year |

17,080 | |||

End of fiscal year |

$ | — | ||

SUPPLEMENTAL DISCLOSURE OF CASH FLOW AND NON-CASH INFORMATION |

||||

Interest Paid |

$ | 315,017 | ||

Net assets and liabilities received from merger |

$ | 12,798,769 |

See Accompanying Notes to the Financial Statements.

13

The Cushing® MLP & Infrastructure Total Return Fund Financial Highlights |

Fiscal |

Fiscal |

Fiscal |

Fiscal |

Fiscal |

||||||||||||||||

Per Common Share Data (2) |

||||||||||||||||||||

Net Asset Value, beginning of fiscal year |

$ | 41.40 | $ | 45.36 | $ | 48.12 | $ | 59.36 | $ | 55.04 | ||||||||||

Income from Investment Operations: |

||||||||||||||||||||

Net investment income (loss) |

(6.67 | ) | (0.48 | ) | (0.16 | ) | (1.68 | ) | (1.16 | ) | ||||||||||

Net realized and unrealized gain (loss) on investments |

(4.60 | ) | 0.84 | 1.72 | (5.24 | ) | 9.80 | |||||||||||||

Total increase (decrease) from investment operations |

(11.27 | ) | 0.36 | 1.56 | (6.92 | ) | 8.64 | |||||||||||||

Less Distributions and Dividends to Common Stockholders: |

||||||||||||||||||||

Net investment income |

(2.81 | ) | (4.32 | ) | (0.04 | ) | — | — | ||||||||||||

Return of capital |

— | — | (4.28 | ) | (4.32 | ) | (4.32 | ) | ||||||||||||

Total distributions and dividends to common stockholders |

(2.81 | ) | (4.32 | ) | (4.32 | ) | (4.32 | ) | (4.32 | ) | ||||||||||

Net Asset Value, end of fiscal year |

$ | 27.32 | $ | 41.40 | $ | 45.36 | $ | 48.12 | $ | 59.36 | ||||||||||

Per common share fair value, end of fiscal year |

$ | 20.40 | $ | 37.84 | $ | 38.88 | $ | 42.92 | $ | 50.76 | ||||||||||

Total Investment Return Based on Fair Value (3) |

(38.76 | )% | 8.51 | % | (0.58 | )% | (8.05 | )% | 15.98 | % | ||||||||||

See Accompanying Notes to the Financial Statements.

14

The Cushing® MLP & Infrastructure Total Return Fund Financial Highlights — (Continued) |

Fiscal |

Fiscal |

Fiscal |

Fiscal |

Fiscal |

||||||||||||||||

Supplemental Data and Ratios |

||||||||||||||||||||

Net assets applicable to common stockholders, end of fiscal year (000’s) |

$ | 59,659 | $ | 69,718 | $ | 76,382 | $ | 81,002 | $ | 99,970 | ||||||||||

Ratio of expenses (including current and deferred income tax benefit/expense) to average net assets after waiver (4) (5) |

2.81 | % | 3.73 | % | 3.35 | % | 4.04 | % | 3.14 | % | ||||||||||

Ratio of net investment income (loss) to average net assets before waiver (6) (7) |

(0.74 | )% | (1.40 | )% | (0.63 | )% | (2.60 | )% | (2.85 | )% | ||||||||||

Ratio of net investment income (loss) to average net assets after waiver (6) (7) |

(0.42 | )% | (1.05 | )% | (0.27 | )% | (2.16 | )% | (2.08 | )% | ||||||||||

Ratio of net investment income (loss) to average net assets after current and deferred income tax benefit/expense, before waiver |

(0.74 | )% | (1.40 | )% | (0.63 | )% | (3.60 | )% | (3.01 | )% | ||||||||||

Ratio of net investment income (loss) to average net assets after current and deferred income tax benefit/expense, after waiver |

(0.42 | )% | (1.05 | )% | (0.27 | )% | (3.16 | )% | (2.24 | )% | ||||||||||

Portfolio turnover rate |

77.57 | % | 44.67 | % | 95.57 | % | 62.87 | % | 97.78 | % | ||||||||||

Total borrowings outstanding (in thousands) |

$ | 13,915 | $ | 28,915 | $ | 26,050 | $ | 33,650 | $ | 49,454 | ||||||||||

Asset coverage, per $1,000 of indebtedness(8) |

$ | 5,287 | $ | 3,411 | $ | 3,932 | $ | 3,407 | $ | 3,021 | ||||||||||

|

(1) |

Per share data adjusted for 1:4 reverse stock split completed as of June 12, 2020. |

|

(2) |

Information presented relates to a share of common stock outstanding for the entire fiscal year. |

|

(3) |

The calculation assumes reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

|

(4) |

For the fiscal year ended November 30, 2020, the Fund accrued $0 in net current and deferred tax expense. |

|

|

For the fiscal year ended November 30, 2019, the Fund accrued $0 in net current and deferred tax expense. |

|

|

For the fiscal year ended November 30, 2018, the Fund accrued $0 in net current and deferred tax expense. |

|

|

For the fiscal year ended November 30, 2017, the Fund accrued $972,195 in net current and deferred tax expense. |

|

|

For the fiscal year ended November 30, 2016, the Fund accrued $141,294 in net current and deferred tax expense. |

|

(5) |

The ratio of expenses (including current and deferred income tax benefit/expense) to average net assets before waiver was 3.13%, 4.08%, 3.71%, 4.48%, and 3.91% for the fiscal years ended November 30, 2020, 2019, 2018, 2017, and 2016, respectively. |

|

(6) |

The ratio of expenses (excluding current and deferred income tax expense) to average net assets before waiver was 3.13%, 4.08%, 3.71%, 3.48%, and 3.75% for the fiscal years ended November 30, 2020, 2019, 2018, 2017, and 2016, respectively. The ratio of expenses (excluding current and deferred income tax expense) to average net assets after waiver was 2.81%, 3.73%, 3.35%, 3.04%, and 2.97% for the fiscal years ended November 30, 2020, 2019, 2018, 2017, and 2016, respectively. |

|

(7) |

This ratio excludes current and deferred income tax benefit/expense on net investment income. |

|

(8) |

Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total borrowings. |

See Accompanying Notes to the Financial Statements.

15

The Cushing® MLP & Infrastructure Total Return Fund Notes to Financial Statements November 30, 2020 |

1. Organization

The Cushing® MLP & Infrastructure Total Return Fund (the “Fund”) was formed as a Delaware statutory trust on May 23, 2007, and is a non-diversified, closed-end investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is managed by Cushing® Asset Management, LP (the “Adviser”). The Fund’s investment objective is to obtain a high after-tax total return from a combination of capital appreciation and current income. The Fund commenced operations on August 27, 2007. The Fund’s shares are listed on the New York Stock Exchange under the symbol “SRV.”

Pursuant to on agreement and plan of merger approved by the shareholders of the Fund and Cushing Energy Income Fund (“SRF”), SRF merged with and into the Fund on May 29, 2020. A total of 1,999,261 common shares of the Fund were issued in exchange for 2,474,989 common shares of SRF as of the closing date of the merger. Net Asset Value (“NAV”) per share and SRF’s share conversion ratio of the merger were as follows:

NAV/Share |

Conversion Ratio |

|||||||

The Fund |

$ | 6.40 | N/A | |||||

SRF |

$ | 5.17 | 0.80778543 | |||||

Management of the Fund performed an analysis and determined that the merger was an asset acquisition and that the Fund is the accounting survivor of the merger. Therefore, the merger has been accounted for under the asset acquisition method of accounting by the Fund in accordance with ASC 805-50, Business Combinations—Related Issues. SRF’s assets were recognized based on their cost to the Fund, which included transaction costs of the asset acquisition of $267,007 that were capitalized in the cost of investments acquired, and no gain or loss was recognized. No cash consideration was given for SRF’s assets. As such, Management determined that the most reliable measure of cost was net asset value of SRF on the date of merger. SRF’s net assets included $467,690 of net unrealized appreciation on investments and $7,391,827 of net realized loss on investments. The net assets of the Fund prior to the merger were $42,849,689, and following the merger, the combined net assets of the Fund totaled $55,648,458.

The merger qualified as a “reorganization” under Section 368(a) of the Internal Revenue Code. As such, no gain or loss was recognized by the Fund. Additionally, the historical cost of investment securities was carried forward to the Fund.

Capital loss carryovers are favorable tax assets that can be used to offset gains in future taxable periods. As of the date of the merger, SRF had the following estimated capital loss carryovers for federal income tax purposes.

SRF Fiscal Year Ended Capital Losses |

Amount |

Expiration |

||||||

November 30, 2015 |

$ | 89,036,198 | November 30, 2020 | |||||

November 30, 2016 |

39,588,381 | November 30, 2021 | ||||||

November 30, 2019 |

3,090,987 | Unlimited | ||||||

Total |

$ | 131,715,566 | ||||||

The Statement of Operations, Statement of Changes in Net Assets, and the Financial Highlights for the current period do not include any pre-merger activity of SRF and prior reporting periods of the Fund are not restated.

16

2. Significant Accounting Policies

A. Use of Estimates

The following is a summary of significant accounting policies, consistently followed by the Fund in preparation of the financial statements. The Fund is considered an investment company and accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946, Financial Services — Investment Companies, which is part of U.S. Generally Accepted Accounting Principles (“U.S. GAAP”).

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of distribution income and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

B. Investment Valuation

The Fund uses the following valuation methods to determine fair value as either fair value for investments for which market quotations are available, or if not available, the fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Fund’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

(i) The market value of each security listed or traded on any recognized securities exchange or automated quotation system will be the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”). Securities traded on NASDAQ will be valued at the NASDAQ official closing price. If no sale is reported on that date, the closing price from the prior day may be used.

(ii) Listed options on debt securities are valued at the last sale price, or if there are no trades for the day, the mean of the bid price and the ask price. Unlisted options on debt or equity securities are valued based upon their composite bid prices if held long, or their composite ask prices if held short. Futures are valued at the settlement price. Premiums for the sale of options written by the Fund will be included in the assets of the Fund, and the market value of such options will be included as a liability.

(iii) The Fund’s non-marketable investments will generally be valued in such manner as the Adviser determines in good faith to reflect their fair values under procedures established by, and under the general supervision and responsibility of, the Board of Trustees. The pricing of all assets that are fair valued in this manner will be subsequently reported to and ratified by the Board of Trustees.

(iv) An equity security of a publicly traded company acquired in a private placement transaction without registration under the Securities Act of 1933, as amended (the “1933 Act”), is subject to restrictions on resale that can affect the security’s liquidity and fair value. If such a security is convertible into publicly traded common shares, the security generally will be valued at the common share market price adjusted by a percentage discount due to the restrictions and categorized as Level 2 in the fair value hierarchy.

To the extent that such securities are convertible or otherwise become freely tradable within a time frame that may be reasonably determined, an amortization schedule may be used to determine the discount. If the security has characteristics that are dissimilar to the class of security that trades on the open market, the security will generally be valued and categorized as Level 3.

The Fund may engage in short sale transactions. For financial statement purposes, an amount equal to the settlement amount, if any, is included in the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the fair value of the short positions. Subsequent fluctuations in market prices of securities sold short may require purchasing the securities at prices which may differ from the fair value reflected on the Statement of Assets and Liabilities. When the Fund sells a security short, it must

17

borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized under the termination of a short sale. The Fund is also subject to the risk that it may be unable to reacquire a security to terminate a short position except at a price substantially in excess of the last quoted price. The Fund is liable for any distributions and dividends (collectively referred to as “Distributions”) paid on securities sold short and such amounts, if any, are reflected as a Distribution expense in the Statement of Operations. The Fund’s obligation to replace the borrowed security is secured by collateral deposited with the broker-dealer. The Fund also is required to segregate similar collateral to the extent, if any, necessary so that the value of both collateral amounts in the aggregate is at all times equal to at least 100% of the fair value of the securities sold short. The Fund did not participate in short selling activities for the year ended November 30, 2020.

C. Security Transactions, Investment Income and Expenses

Security transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on an accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”) generally are comprised of ordinary income, capital gains and return of capital from the MLPs. The Fund records investment income on the ex-date of the distributions. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund estimates the allocation of investment income and return of capital for the distributions received from its portfolio investments within the Statement of Operations. For the fiscal year ended November 30, 2020, the Fund has estimated approximately 78% of the distributions received from its portfolio investments to be return of capital.

Expenses are recorded on an accrual basis.

D. Distributions to Shareholders

Distributions to common shareholders are recorded on the ex-dividend date. The character of Distributions to common shareholders made during the year may differ from their ultimate characterization for federal income tax purposes. For the fiscal year ended November 30, 2019, the Fund’s Distributions were 100%, or $7,297,290, ordinary income. For the fiscal year ended November 30, 2020, the Fund’s Distributions were expected to be 100%, or $5,418,435, ordinary income. The final character of Distributions paid for the fiscal year ended November 30, 2020 will be determined in early 2021.

E. Federal Income Taxation

The Fund intends to qualify each year for special tax treatment afforded to a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (“IRC”). In order to qualify as a RIC, the Fund must, among other things, satisfy income, asset diversification and distribution requirements. As long as it so qualifies, the Fund will not be subject to U.S. federal income tax to the extent that it distributes annually its investment company taxable income (which includes ordinary income and the excess of net short-term capital gain over net long-term capital loss) and its “net capital gain” (i.e., the excess of net long-term capital gain over net short-term capital loss). The Fund intends to distribute at least annually substantially all of such income and gain. If the Fund retains any investment company taxable income or net capital gain, it will be subject to U.S. federal income tax on the retained amount at regular corporate tax rates. In addition, if the Fund fails to qualify as a RIC for any taxable year, it will be subject to U.S. federal income tax on all of its income and gains at regular corporate tax rates.

18

The Fund recognizes in the financial statements the impact of a tax position, if that position is more-likely-than-not to be sustained on examination by the taxing authorities, based on the technical merits of the position. Tax benefits resulting from such a position are measured as the amount that has a greater than fifty percent likelihood on a cumulative basis to be sustained on examination.

F. Cash and Cash Equivalents

The Fund considers all highly liquid investments purchased with initial maturity equal to or less than three months to be cash equivalents.

G. Cash Flow Information

The Fund makes Distributions from investments, which include the amount received as cash distributions from MLPs, common stock dividends and interest payments. These activities are reported in the Statement of Changes in Net Assets, and additional information on cash receipts and payments is presented in the Statement of Cash Flows.

H. Indemnification

Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under such indemnification arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

I. Derivative Financial Instruments

The Fund provides disclosure regarding derivatives and hedging activity to allow investors to understand how and why the Fund uses derivatives, how derivatives are accounted for, and how derivative instruments affect the Fund’s results of operations and financial position.

The Fund occasionally purchases and sells (“writes”) put and call equity options as a source of potential protection against a broad market decline. A purchaser of a put option has the right, but not the obligation, to sell the underlying instrument at an agreed upon price (“strike price”) to the option seller. A purchaser of a call option has the right, but not the obligation, to purchase the underlying instrument at the strike price from the option seller. Options are settled for cash.

Purchased Options — Premiums paid by the Fund for purchased options are included in the Statement of Assets and Liabilities as an investment. The option is adjusted daily to reflect the fair value of the option and any change in fair value is recorded as unrealized appreciation or depreciation of investments. If the option is allowed to expire, the Fund will lose the entire premium paid and record a realized loss for the premium amount. Premiums paid for purchased options which are exercised or closed are added to the amounts paid or offset against the proceeds on the underlying investment transaction to determine the realized gain/loss or cost basis of the security.

Written Options — Premiums received by the Fund for written options are included in the Statement of Assets and Liabilities. The amount of the liability is adjusted daily to reflect the fair value of the written option and any change in fair value is recorded as unrealized appreciation or depreciation of options. Premiums received from written options that expire are treated as realized gains. The Fund records a realized gain or loss on written options based on whether the cost of the closing transaction exceeds the premium received. If a call option is exercised by the option buyer, the premium received by the Fund is added to the proceeds from the sale of the underlying security to the option buyer and compared to the cost of the closing transaction to determine whether there has been a realized gain or loss. If a put option is exercised by an option buyer, the premium received by the option seller reduces the cost basis of the purchased security.

19

Written uncovered call options subject the Fund to unlimited risk of loss. Written covered call options limit the upside potential of a security above the strike price. Put options written subject the Fund to risk of loss if the value of the security declines below the exercise price minus the put premium.

The Fund is not subject to credit risk on written options as the counterparty has already performed its obligation by paying the premium at the inception of the contract.

The Fund has adopted the disclosure provisions of Financial Accounting Standards Board (“FASB”) Accounting Standard Codification 815, Derivatives and Hedging (“ASC 815”). ASC 815 requires enhanced disclosures about the Fund’s use of and accounting for derivative instruments and the effect of derivative instruments on the Fund’s results of operations and financial position. Tabular disclosure regarding derivative fair value and gain/loss by contract type (e.g., interest rate contracts, foreign exchange contracts, credit contracts, etc.) is required and derivatives accounted for as hedging instruments under ASC 815 must be disclosed separately from those that do not qualify for hedge accounting. Even though the Fund may use derivatives in an attempt to achieve an economic hedge, the Fund’s derivatives are not accounted for as hedging instruments under ASC 815 because investment companies account for their derivatives at fair value and record any changes in fair value in current period earnings.

There were no transactions in purchased options during the fiscal year ended November 30, 2020.

The average monthly fair value of written options during the fiscal year ended November 30, 2020 was $2,996.

The effect of derivative instruments on the Statement of Operations for the fiscal year ended November 30, 2020

Amount of Realized Gain on Derivatives Recognized in Income |

||||||||||||

Derivatives not accounted for as hedging instruments under ASC 815 |

Purchased |

Written |

Total |

|||||||||

Equity Contracts |

$ | — | $ | 60,392 | $ | 60,392 | ||||||

Net Change in Unrealized Appreciation of Derivatives Recognized as a Result from Operations |

||||||||||||

Derivatives not accounted for as hedging instruments under ASC 815 |

Purchased |

Written |

Total |

|||||||||

Equity Contracts |

$ | — | $ | (2,580 | ) | $ | (2,580 | ) | ||||

J. Recent Accounting Pronouncements

In March 2017, FASB issued ASU 2017-08, Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”). The amendments in the ASU 2017-08 shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. ASU 2017-08 is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Effective December 1, 2019, the Fund adopted ASU 2017-08 and the adoption did not have a material impact on the financial statements.

In March 2020, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2020-04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The amendments in the ASU provides optional temporary financial reporting relief from the effect of certain types of contract modifications due to the planned discontinuation of LIBOR and other interbank-offered based reference rates as of the end of 2021. The ASU is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. Management is currently evaluating the impact, if any, of applying this ASU.

20

3. Concentrations of Risk

The Fund, under normal market conditions, invests at least 80% of its assets (net assets plus any borrowings for investment purposes) in a portfolio of MLPs and MLP-related investments. Therefore, the Fund may be subject to more risks than if they were more broadly diversified over numerous industries and sectors of the economy. General changes in market sentiment towards companies in the sectors in which they invest may adversely affect the Fund, and the performance of such sectors may lag behind the broader market as a whole.

The Fund is also subject to MLP structure risk. Holders of MLP units are subject to certain risks inherent in the structure of MLPs, including (i) tax risks, (ii) the limited ability to elect or remove management or the general partner or managing member, (iii) limited voting rights, except with respect to extraordinary transactions, and (iv) conflicts of interest between the general partner or managing member and its affiliates, on the one hand, and the limited partners or members, on the other hand, including those arising from incentive distribution payments or corporate opportunities.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, and negatively impact the Fund’s performance.

4. Agreements and Related Party Transactions

The Fund has entered into an Investment Management Agreement with the Adviser (the “Agreement”). Under the terms of the Agreement, the Fund will pay the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average weekly value of the Fund’s Managed Assets during such month for the services and facilities provided by the Adviser to the Fund. The Fund’s Board of Trustees approved a waiver of the advisory fees to be paid to the Adviser in the amount of 0.25% of the Fund’s Managed Assets through March 6, 2021. The Adviser earned $884,834 and waived $176,832 in advisory fees for the fiscal year ended November 30, 2020. The Adviser will not recoup any of the waived expenses from the Fund.

The Fund has engaged U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bancorp Global Fund Services (“Fund Services”) to serve as the Fund’s administrator. The Fund pays the administrator a monthly fee computed at an annual rate of 0.08% of the first $100,000,000 of the Fund’s average daily net assets, 0.05% on the next $200,000,000 of average daily net assets and 0.04% on the balance of the Fund’s average daily net assets, with a minimum annual fee of $45,000.

Fund Services serves as the Fund’s transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan.

U.S. Bank, N.A. serves as the Fund’s custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.004% of the Fund’s average daily market value, with a minimum annual fee of $4,800.

Fees paid to trustees for their services to the Fund are reflected as Trustees’ fees on the Statement of Operations.

5. Income Taxes

It is the Fund’s intention to continue to qualify as a RIC under Subchapter M of the IRC and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in its financial statements.

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. These differences are primarily due to differences in the timing of recognition of gains or losses on investments. Permanent book and tax basis differences resulted in the reclassifications of $38,977,410 to accumulated net losses and $38,977,410 from additional paid-in capital.

21

The following information is provided on a tax basis as of November 30, 2020:

Cost of investments |

$ | 75,356,242 | ||

Gross unrealized appreciation |

13,608,549 | |||

Gross unrealized depreciation |

(15,431,483 | ) | ||

Net unrealized depreciation |

(1,822,934 | ) | ||

Undistributed ordinary income |

2,381 | |||

Undistributed long-term gains |

— | |||

Other temporary differences |

(74,540,610 | ) | ||

Accumulated net losses |

$ | (76,361,163 | ) |

As of November 30, 2020, for federal income tax purposes, capital loss carryforwards of $72,515,084 were available as shown in the table below, to the extent provided by the Internal Revenue Code, to offset future realized capital gains through the years indicated.

Fiscal year Ended Capital Losses |

Amount |

Expiration |

||||||

November 30, 2016 |

$ | 35,612,716 | November 30, 2021 | |||||

November 30, 2017 |

2,137,180 | November 30, 2022 | ||||||

May 29, 2020* |

10,776,682 | Unlimited | ||||||

November 30, 2020 |

23,988,506 | Unlimited | ||||||

Total |

$ | 72,515,084 | ||||||

|

* |

Losses acquired from The Cushing Energy Income Fund are subject to Sec. 382 annual limits of $188,142. |

Current year capital loss carryforward is comprised of short-term capital loss of $6,556,042 and long-term capital loss of $17,432,464.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Fund. No income tax returns are currently under examination. All tax years beginning with November 30, 2017 remain subject to examination by the tax authorities in the United States. Due to the nature of the Fund’s investments, the Fund may be required to file income tax returns in several states. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

6. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

|

● |

Level 1 — quoted prices in active markets for identical securities |

|

● |

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

|

● |

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

22

These inputs are summarized in the three levels listed below.

Fair Value Measurements at Reporting Date Using |

||||||||||||||||

Description |

Fair Value at |

Quoted Prices in |

Significant |

Significant |

||||||||||||

Assets |

||||||||||||||||

Equity Securities |

||||||||||||||||

Common Stock(a) |

$ | 41,726,901 | $ | 41,726,901 | $ | — | $ | — | ||||||||

Master Limited Partnerships and Related Companies(a) |

28,319,336 | 28,319,336 | — | — | ||||||||||||

Preferred Stock(a) |

3,271,061 | 3,271,061 | — | — | ||||||||||||

Total Equity Securities |

73,317,298 | 73,317,298 | — | — | ||||||||||||

Other |

||||||||||||||||

Short-Term Investments(a) |

215,226 | 215,226 | — | — | ||||||||||||

Total Assets |

$ | 73,532,524 | $ | 73,532,524 | $ | — | $ | — | ||||||||

|

(a) |

All other industry classifications are identified in the Schedule of Investments. The Fund did not hold Level 3 investments at any time during the fiscal year ended November 30, 2020. |

7. Investment Transactions

For the fiscal year ended November 30, 2020, the Fund purchased (at cost) and sold securities (proceeds) in the amount of $53,697,995 and $69,429,130 (excluding short-term securities), respectively. The Fund sold written options (proceeds) and covered written options (at cost) in the amount of $55,504 and $1,489,569 respectively.

8. Common Shares

The Fund had unlimited common shares of beneficial interest authorized and 2,183,391 shares outstanding as of November 30, 2020. Transactions in common shares for the fiscal years ended November 30, 2019 and 2020 were as follows:

Shares at November 30, 2018 |

6,734,302 | |||

Shares at November 30, 2019 |

6,734,302 | |||

Issuance of common shares in connection with merger |

1,999,261 | |||

Share reduction due to reverse stock split |

(6,550,172 | ) | ||

Shares at November 30, 2020 |

2,183,391 |

9. Borrowing Facilities

The Fund maintained a margin account arrangement with ScotiabankTM during the period. The interest rate charged on margin borrowing is tied to the cost of funds for ScotiabankTM (which approximates LIBOR plus 1.00%). Proceeds from the margin account arrangement are used to execute the Fund’s investment objective.

The average principal balance and interest rate for the period during which the credit facilities were utilized during the fiscal year ended November 30, 2020 was $16,057,350 and 1.65%, respectively. At November 30, 2020, the principal balance outstanding was $13,915,000 and accrued interest expense was $13,421.

10. Subsequent Events

Subsequent to November 30, 2020, the Fund declared monthly distributions to common shareholders in the amounts of $0.1200 per share, payable on December 31, 2020 and January 29, 2021, to shareholders of record on December 14, 2020 and January 19, 2021, respectively.

23

The Cushing® MLP & Infrastructure Total Return Fund Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Trustees of

The Cushing MLP & Infrastructure Total Return Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of The Cushing MLP & Infrastructure Total Return Fund (the “Fund”), including the schedule of investments, as of November 30, 2020, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at November 30, 2020, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2020, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Cushing investment companies since 2011.

Dallas, Texas

January 29, 2021

24

The Cushing® MLP & Infrastructure Total Return Fund Trustees and Executive Officers (Unaudited) November 30, 2020 |

Set forth below is information with respect to each of the Trustees and executive officers of the Trust, including their principal occupations during the past five years. The business address of the Fund, its Trustees and executive officers is 300 Crescent Court, Suite 1700, Dallas, Texas 75201.

Board of Trustees

Name and |

Position(s) Held |

Term of |

Principal Occupations |

Number of |

Other Directorships Held by Trustee |

Independent Trustees |

|||||

Brian R. Bruce |

Lead Independent Trustee |

Trustee |

Chief Executive Officer, Hillcrest Asset Management, LLC (2008 – present) (registered investment adviser). Previously, Director of Southern Methodist University’s Encap Investment and LCM Group Alternative Asset Management Center (2006 – 2011). Chief Investment Officer of Panagora Asset Management, Inc. (1999 – 2007) (investment management company). |

5 |

CM Advisers Family of Funds (2 series) (2003 – present). |

Brenda A. Cline |

Trustee and Chair of the Audit Committee |

Trustee |

Chief Financial Officer, Secretary and Treasurer of Kimbell Art Foundation (1993 – present) |

5 |

American Beacon Funds (34 Series) (2004 – present); Tyler Technologies, Inc. (2014 – present) (software); Range Resources Corporation (2015 – present) (natural gas and oil exploration and production). |

Ronald P. Trout |

Trustee and Chairman of the Nominating and Corporate Governance Committee |

Trustee |

Retired. Previously, founding partner and Senior Vice President of Hourglass Capital Management, Inc. (1989 – 2002) (investment management company). |

5 |

Dorchestor Minerals, L.P. (2008 – present) (acquisition, ownership and administration of natural gas and crude oil royalty, net profits and leasehold interests in the U.S.) |

Interested Trustees |

|||||

Jerry V. Swank |

Trustee, Chairman of the Board, Chief Executive Officer and President |

Trustee |

Managing Partner of the Adviser and founder of Swank Capital, LLC (2000 – present). |

5 |

E-T Energy Ltd. (2008 – 2014) (developing, operating, producing and selling recoverable bitumen). |

|

(1) |

After a Trustee’s initial term, each Trustee is expected to serve a three-year term concurrent with the class of Trustees for which he serves. Ms. Cline and Mr. Swank are expected to stand for re-election in 2021, Mr. Trout in 2022, and Mr. Bruce in 2023. |

|

(2) |

The “Fund Complex” includes each registered investment company for which the Adviser serves as investment adviser. As of November 30, 2020, there were five funds in the Fund Complex. |

|

(3) |

Mr. Swank is an “interested person” of the Fund, as defined under the 1940 Act, by virtue of his position as Managing Partner of the Adviser. |

25

Executive Officers

The following provides information regarding the executive officers of the Fund who are not Trustees. Officers serve at the pleasure of the Board of Trustees and until his or her successor is appointed and qualified or until his or her earlier resignation or removal.

Name and |

Position(s) Held |

Term of |

Principal Occupations During Past Five Years |

Jerry V. Swank |

Chief Executive Officer and President |

Officer since 2007 |

Managing Partner of the Adviser and founder of Swank Capital, LLC (2000 – present). |

John H. Alban |

Chief Financial Officer and Treasurer |

Officer since 2010 |