Form DEF 14A Vitamin Shoppe, Inc. For: Jun 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14 A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

|

(1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: | |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: | |

|

VITAMIN SHOPPE, INC. 300 Harmon Meadow Blvd. Secaucus, New Jersey 07094 |

|

To

Our

Stockholders

Alexander W. Smith

Chairman of the Board

April 25, 2019

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of Vitamin Shoppe, Inc., which will be held at our headquarters, 300 Harmon Meadow Blvd., Secaucus, NJ 07094, on Wednesday, June 5, 2019, beginning at 10:00 a.m., Eastern Daylight Time.

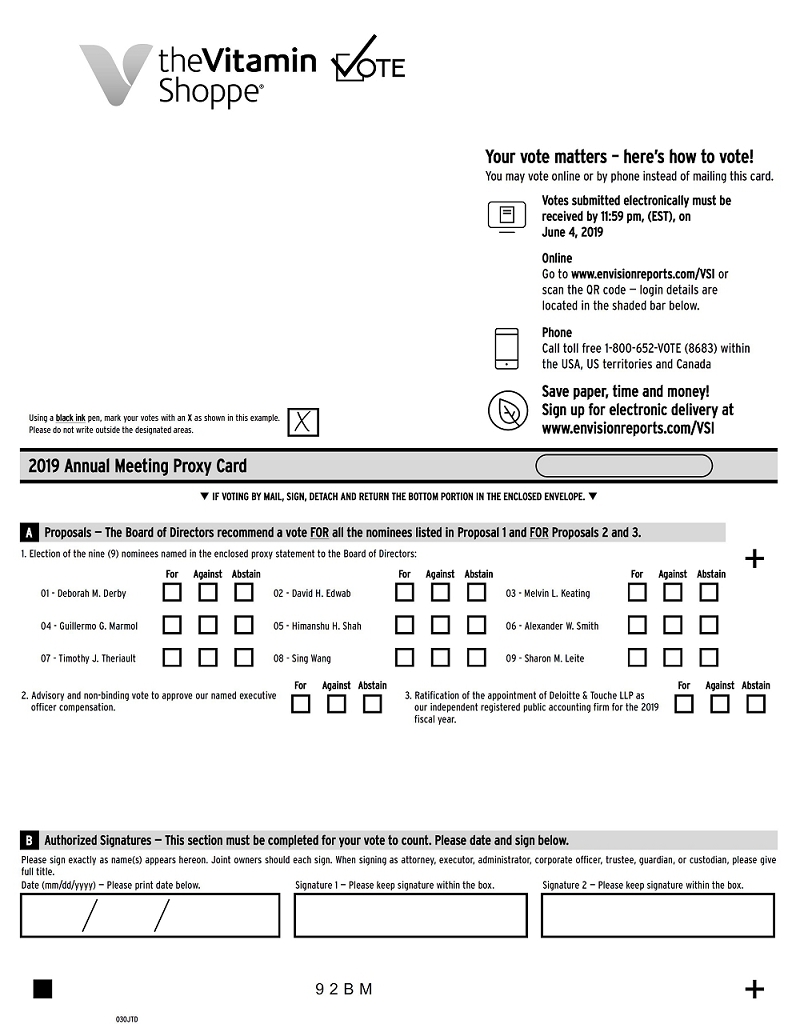

The formal notice of the 2019 Annual Meeting is provided in the enclosed proxy statement. At the 2019 Annual Meeting, stockholders will vote on the following:

| 1. | Election of the nine (9) nominees named in the enclosed proxy statement to the Board of Directors; |

| 2. | Advisory and non-binding vote to approve Named Executive Officer compensation; |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2019 fiscal year; and |

| 4. | Transaction of such other business that may properly come before the 2019 Annual Meeting. |

The enclosed proxy statement provides you with detailed information regarding the business to be considered at the 2019 Annual Meeting. Your vote is important. We urge you to please vote your shares now whether or not you plan to attend the 2019 Annual Meeting. You may revoke your proxy at any time before the proxy is voted by following the procedures described in the enclosed proxy statement.

The rules of the Securities and Exchange Commission allow us to furnish our proxy materials over the internet. We are sending stockholders a notice with instructions for accessing the materials and voting via the internet, rather than mailing a full paper set of the materials. The notice of availability contains instructions on how to access our proxy materials on the internet, as well as instructions on obtaining a paper copy of the proxy materials. All stockholders who do not receive such a notice of availability will receive a full set of paper proxy materials by U.S. mail. This process will reduce our costs to print and distribute our proxy materials.

Voting by the internet or telephone is fast and convenient, and your vote is immediately confirmed and tabulated. If you receive a paper copy of the proxy materials, you may also vote by completing, signing, dating and returning the accompanying proxy card in the enclosed return envelope furnished for that purpose. By using the internet or telephone, you help us reduce postage and proxy tabulation costs.

Sincerely,

|

|

|

Notice of Annual Meeting of Stockholders

Meeting Information

WEDNESDAY, JUNE 5, 2019

10:00 a.m., Eastern Daylight Time

Vitamin Shoppe, Inc.

300 Harmon Meadow Blvd

Secaucus, NJ 07094

Items of Business

| 1. | Election of the nine (9) nominees to the Board of Directors. |

| 2. | Advisory and non-binding vote to approve the compensation to our Named Executive Officers. |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2019 fiscal year. |

| 4. | Transaction of such other business as may properly come before the 2019 Annual Meeting and any adjournment or postponement. |

Record Date

You can vote if you were a stockholder of record at the close of business on Friday, April 12, 2019.

Internet Availability

We are using the internet as our primary means of furnishing our proxy materials to our stockholders. Rather than sending stockholders a paper copy of our proxy materials, we are sending them a notice with instructions for accessing the materials and voting via the internet. We believe this method of distribution makes the proxy distribution process more efficient and less costly and will limit our impact on the environment. This notice of the 2019 Annual Meeting, the proxy statement and our annual report to stockholders, which includes our Annual Report on Form 10-K, are available at www.envisionreports.com/VSI and www.vitaminshoppe.com in the investor relations section.

Proxy Voting

It is important that your shares be present or represented and voted at the 2019 Annual Meeting. You can vote your shares on the internet at www.envisionreports.com/VSI, by telephone by calling 1-800-652-8683, or by completing and returning your proxy card. Voting instructions are printed on your proxy card or included with your proxy materials. You can revoke a proxy before its exercise at the 2019 Annual Meeting by following the instructions in the accompanying proxy statement.

By order of the Board of Directors,

Alexander W. Smith

Chairman of the Board

Review your proxy statement and vote in one of four ways:

|

|

|

| |||

| INTERNET | BY TELEPHONE | BY MAIL | IN PERSON | |||

| We encourage you to vote and submit your proxy over the internet at www.envisionreports.com/VSI. | You may vote by telephone by calling 1-800-652-8683. | If you received paper copies of the Proxy Materials, you may vote by completing, signing and dating your proxy card and returning it in the enclosed envelope. | All stockholders may vote in person at the 2019 Annual Meeting. You may also be represented by another person at the 2019 Annual Meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspector of election with your ballot to be able to vote at the 2019 Annual Meeting. |

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

| Table |

|

of Contents

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 5 | |

Information About the Annual Meeting and Voting

Why did I receive these Proxy Materials?

We are providing this notice of our annual meeting of stockholders, proxy statement, voting instructions and annual report to stockholders (the “Proxy Materials”) in connection with the solicitation by the board of directors (the “Board”) of Vitamin Shoppe, Inc. (“Vitamin Shoppe,” the “Company,” “we,” “us” or “our”), a Delaware corporation, of proxies to be voted at our 2019 annual meeting of stockholders and at any adjournment or postponement (the “2019 Annual Meeting”).

We anticipate that the notice of internet availability of Proxy Materials will first be sent to stockholders on or about April 25, 2019. The proxy statement and the form of proxy relating to the 2019 Annual Meeting are first being made available to stockholders on or about April 25, 2019.

You are invited to attend the 2019 Annual Meeting on June 5, 2019, beginning at 10:00 a.m., Eastern Daylight Time. The 2019 Annual Meeting will be held at our headquarters, 300 Harmon Meadow, Blvd., Secaucus, NJ 07094. Stockholders will be admitted to the 2019 Annual Meeting beginning at 9:30 a.m., Eastern Daylight Time. Seating will be limited.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Computershare Shareowner Services, you are considered the “stockholder of record” with respect to those shares. If you are a stockholder of record, we are sending the Proxy Materials directly to you.

If your shares are held in a stock brokerage account or by a bank or other holder of record, those shares are held in “street name.” You are considered the “beneficial owner” of shares held in street name. The Proxy Materials have been forwarded to you by your broker, bank or other holder of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the proxy or voting instructions included in the mailing or by following their instructions for voting by telephone or on the internet.

Why did I receive in the mail a Notice of Internet Availability of Proxy Materials?

Under rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing access to our Proxy Materials over the internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to many of our stockholders. If you received a notice by mail, you will not receive a printed copy of the Proxy Materials unless you request one. The notice tells you how to access and review the Proxy Materials over the internet at www.envisionreports.com/VSI. The notice also tells you how to access your proxy card to vote on the internet. If you received a notice by mail and would like to receive a printed or email copy of the Proxy Materials, please follow the instructions included in the notice.

What should I bring with me to attend the 2019 Annual Meeting?

Stockholders must present a form of personal identification to be admitted to the 2019 Annual Meeting.

If your shares are held beneficially in the name of a broker, bank or other holder of record and you plan to attend the 2019 Annual Meeting, you must also present proof of your ownership of Vitamin Shoppe common stock, such as a brokerage or bank account statement, to be admitted to the 2019 Annual Meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the 2019 Annual Meeting.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 6 | |

Who is entitled to vote at the 2019 Annual Meeting?

Stockholders of record at the close of business on April 12, 2019, the record date for the 2019 Annual Meeting, are entitled to receive notice of and vote at the 2019 Annual Meeting. You are entitled to one vote on each matter presented at the 2019 Annual Meeting for each share of common stock you owned at that time. Stockholders have no right to cumulative voting as to any matter, including the election of directors. At the close of business on April 12, 2019, there were 23,995,670 shares of our common stock outstanding.

How do I vote?

You may vote using any of the following methods:

|

|

|

| |||

| INTERNET | BY TELEPHONE | BY MAIL | IN PERSON | |||

| We encourage you to vote and submit your proxy over the internet at www.envisionreports.com/VSI. | You may vote by telephone by calling 1-800-652-8683. | If you received paper copies of the Proxy Materials, you may vote by completing, signing and dating your proxy card and returning it in the enclosed envelope. | All stockholders may vote in person at the 2019 Annual Meeting. You may also be represented by another person at the 2019 Annual Meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspector of election with your ballot to be able to vote at the 2019 Annual Meeting. |

What can I do if I change my mind after I vote my shares?

If you are a stockholder of record, you can revoke your proxy before it is exercised by:

| • | written notice of revocation to our Corporate Secretary at Vitamin Shoppe, Inc., 300 Harmon Meadow Blvd., Secaucus, New Jersey 07094; |

| • | timely submission of a valid, later-dated proxy via mail, the internet or the telephone; or |

| • | voting by ballot at the 2019 Annual Meeting. |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other holder of record. You may also vote in person at the 2019 Annual Meeting if you obtain a legal proxy as described in the answer to the previous question.

Can I vote if my shares are held in “street name”?

If the shares you own are held in “street name” by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of voting over the internet or by telephone, instructions for which would be provided by your brokerage firm on your voting instruction form.

Under the current rules of the New York Stock Exchange (“NYSE”), if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm (Proposal Three) is considered to be a discretionary item under the NYSE rules, and your brokerage firm will thus be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name. The election of directors (Proposal One) and the “say-on-pay” proposal (Proposal Two) are “non-discretionary” items; therefore if you do not instruct your broker how to vote with respect to these proposals, your broker is not permitted to vote with respect to these proposals and those votes will thus be considered “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

If your shares are held in street name, you must bring an account statement or letter from your bank or brokerage firm showing that you are the beneficial owner of the shares as of the record date (April 12, 2019) to be admitted to the 2019 Annual Meeting on June 5, 2019. To be able to vote your shares held in street name at the 2019 Annual Meeting, you will need to obtain a proxy card from the holder of record.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 7 | |

How will votes be counted?

Each share of common stock will be counted as one vote according to the instructions contained on a proper proxy card, whether submitted in person, by mail, over the internet or by telephone, or on a ballot voted in person at the 2019 Annual Meeting.

What constitutes a quorum?

For business to be conducted at the 2019 Annual Meeting, a quorum must be present in person or represented by valid proxies. For each of the proposals to be presented at the 2019 Annual Meeting, a quorum consists of the holders of a majority of the shares of common stock issued and outstanding on April 12, 2019, the record date, or at least 11,997,836 shares. Shares of common stock present in person or represented by proxy (including “broker non-votes” and shares that abstain or do not vote with respect to a particular proposal) will be counted for purposes of determining whether a quorum exists at the 2019 Annual Meeting.

If a quorum is not present, the 2019 Annual Meeting will be adjourned until a quorum is obtained.

What vote is required for each item and how does the Board recommend that I vote?

Proposal One – Election of Directors

Under our bylaws, a nominee for director will be elected to the Board if the votes cast “for” the nominee’s election exceed the votes cast “against” the nominee’s election. Abstentions and broker non-votes are not considered votes cast for or against the nominee and will have no effect on the proposal. If you do not instruct your broker how to vote with respect to this proposal, your broker cannot vote your shares with respect to the election of directors.

Our bylaws provide further that if an incumbent director is not elected by a majority of votes cast, the incumbent director shall promptly tender his or her resignation to the Board for consideration. The Nomination and Governance Committee will make a recommendation to the Board on whether to accept or reject the director’s resignation, or whether other action should be taken. The Board will act on the Nomination and Governance Committee’s recommendation and publicly disclose its decision within 90 days from the date of the certification of the election results. An incumbent director who tenders his or her resignation for consideration will not participate in the Nomination and Governance Committee’s recommendation, the Board’s decision or any related deliberations.

|

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE NINE (9) NOMINEES NAMED IN THE ENCLOSED PROXY MATERIALS TO THE BOARD |

Proposal Two – Say-on-Pay

The Board is seeking a non-binding advisory vote to approve the compensation paid to our named executive officers (“NEOs” or “Named Executive Officers”), as described in the Compensation Discussion and Analysis section (“CD&A”), executive compensation tables and accompanying narrative disclosures contained in this proxy statement. Under our bylaws, the affirmative vote of the holders of a majority of the total number of votes of our common stock present in person or represented by proxy and entitled to vote on the proposal is needed to approve this proposal. Abstentions count as votes against the proposal. Because shares treated as “broker non-votes” are not entitled to vote on the proposal, they will have no effect on the vote on the proposal. If you do not instruct your broker how to vote with respect to this proposal, your broker cannot vote with respect to this proposal.

The vote is advisory and non-binding in nature, but the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

|

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ADVISORY AND NON-BINDING VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

Proposal Three – Ratification of Independent Registered Public Accounting Firm

Under our bylaws, the affirmative vote of the holders of a majority of the total number of votes of our common stock present in person or represented by proxy and entitled to vote on the proposal is needed to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm. Abstentions count as votes against the proposal. If you do not provide instructions to your brokerage firm regarding how to vote your shares on this proposal, your broker may (a) vote your shares on your behalf (because this proposal is a “discretionary” item) or (b) leave your shares unvoted. Our bylaws do not require that stockholders ratify the appointment of Deloitte & Touche LLP as our independent auditors. However, we are submitting the appointment of Deloitte & Touche LLP to the stockholders for ratification as a matter of

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 8 | |

good corporate governance. If our stockholders fail to ratify the selection, we will consider that failure as a direction to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm, at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

|

THE BOARD RECOMMENDS THAT YOU VOTE FOR RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

Where can I find the voting results?

We will report the voting results in a Current Report on Form 8-K within four business days after the end of our 2019 Annual Meeting.

Could other matters be decided at the 2019 Annual Meeting?

At the date this proxy statement went to press, we did not know of any matters to be raised at the 2019 Annual Meeting other than those described in this proxy statement.

If other matters are properly presented at the 2019 Annual Meeting for consideration, the proxies appointed by the Board will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay for the cost of this proxy solicitation. We do not intend to solicit proxies other than by use of the mail or website posting, but certain of our directors, officers and other employees, without additional compensation, may solicit proxies personally or by telephone, facsimile or email on our behalf.

Who will count the vote?

Computershare Shareowner Services, the inspector of elections appointed for the 2019 Annual Meeting, will tabulate all votes.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of the Proxy Materials, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy cards. Also, householding will not in any way affect dividend check mailings, if any.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Proxy Materials, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please make a written request to the: Corporate Secretary, Vitamin Shoppe, Inc., 300 Harmon Meadow Blvd., Secaucus, New Jersey 07094 or call (201) 868-5959. If multiple stockholders of record who have the same address received only one copy of the Proxy Materials and would like to receive additional copies, or if they would like to receive a copy for each stockholder living at that address in the future, send a written request to the address above. Upon such written request, we will promptly deliver separate Proxy Materials to any stockholders who receive one paper copy at a shared address.

Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Other information

Our annual report to stockholders, which includes our Annual Report on Form 10-K for the 52-week fiscal year ended December 29, 2018, accompanies this proxy statement. No material contained in the annual report to stockholders is to be considered a part of the Proxy Materials. “Fiscal 2018” refers to the 52-week fiscal year that ended December 29, 2018, “Fiscal 2017” refers to the 52-week fiscal year that ended on December 30, 2017 and “Fiscal 2016” refers to the 53-week fiscal year that ended on December 31, 2016. The contents of our corporate website (http://www.vitaminshoppe.com) are not incorporated by reference into this proxy statement.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 9 | |

Proposal One Election of Directors

The Board proposes that the nine (9) nominees described below, be elected for a new term of one year expiring at the Company’s 2020 annual meeting of stockholders (the “2020 Annual Meeting”) or until their successors are duly elected and qualified. All nominees currently serve as directors. Proxies cannot be voted for more than the number of nominees proposed for election.

Each of the nominees has consented to be named as a nominee. If any of them should become unavailable to serve as a director (which is not currently expected), the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

The Board believes that it is necessary for each of our directors to possess many qualities and skills. When searching for new candidates, the Nomination and Governance Committee considers the evolving needs of the Board and searches for candidates with the mix of skills, experience and diversity that the Board values that fill any current or anticipated future gap. The Board also believes that all directors must possess a considerable amount of business management experience (such as experience as a chief executive officer or chief financial officer). The Nomination and Governance Committee first considers a candidate’s management experience and then considers issues of judgment, diversity, background, stature, conflicts of interest, integrity, ethics and commitment to the goal of maximizing stockholder value. The Board and the Nomination and Governance Committee believe that it is desirable to have a variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experience. In considering candidates for the Board, the Nomination and Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered.

All of our directors bring to the Board extensive executive leadership and board experience derived from their service as executives and, in many cases, service as chief executive officers. We describe the process undertaken by the Nomination and Governance Committee in recommending qualified director candidates below under “Corporate Governance – Director Nomination Process.” We also describe some of the individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole.

On March 9, 2018, Vintage Capital Management, LLC, Kahn Capital Management, LLC and Brian R. Kahn (together “Vintage Capital”) delivered a director nomination notice to nominate a slate of ten nominees for election as directors at the 2018 Annual Meeting in opposition to director nominees recommended by the Board.

On April 20, 2018, the Company entered into a cooperation agreement with Shah Capital Management, Inc., Shah Capital Opportunity Fund LP and Himanshu H. Shah (together “Shah Capital” and such agreement the “Shah Capital Agreement”) regarding, among other things, the membership and composition of the Board. On the same date, the Company also entered into a cooperation agreement with Vintage Capital (such agreement, the “Vintage Capital Agreement,” and together with the Shah Capital Agreement, the “Cooperation Agreements”) regarding, among other things, the membership and composition of the Board.

Pursuant to the Vintage Capital Agreement, Mr. Kahn irrevocably withdrew his director nomination notice for the 2018 Annual Meeting.

Pursuant to the Cooperation Agreements, the Company appointed each of Himanshu H. Shah and Sing Wang (collectively, the “Shah Designees”) and Melvin L. Keating (the “Vintage Designee” and, together with the Shah Designees, the “Cooperation Directors”) to the Board, on April 24, 2018.

The Cooperation Agreements provide that the Board was required to be expanded by up to five members in order to appoint up to five new directors at the 2018 Annual Meeting and the 2019 Annual Meeting. Pursuant to the departure of the Company’s chief executive officer, Colin Watts, the size of the Board was reduced by one member; however, upon the appointment of Sharon M. Leite as Chief Executive Officer in August, 2018, the Company increased the size of the Board by one member. Pursuant to the Cooperation Agreements, prior to the completion of the 2019 Annual Meeting, the size of the Board will be no more than 11 directors. Before the completion of the 2019 Annual Meeting, Shah Capital and Vintage Capital will have customary replacement rights with respect to the Cooperation Directors, and Shah Capital, Vintage Capital and the Company must mutually agree on any replacements for any Company Designee or Independent Designee.

Shah Capital’s right to designate or replace one of the Shah Designees expires at the time that Shah Capital’s aggregate net long position in the Company’s common stock is less than 10%. Shah Capital’s right to designate or replace the second Shah Designee expires at the time that Shah Capital’s aggregate net long position in the Company’s common stock is less than 5%. Vintage Capital’s right to designate or replace the Vintage Designee expires at the time that Vintage Capital’s aggregate net long position in the Company’s common stock is less than 5%. At any time Shah Capital or Vintage Capital lose the right to designate a director as set forth above, the applicable Cooperation Director will immediately resign from the Board and all of its committees upon the Board’s request.

From the date of the Cooperation Agreements until the 15th day prior to the advance notice deadline for making director nominations at the Company’s 2020 annual meeting of stockholders (the “Standstill Period”), each of Shah Capital and Vintage Capital have agreed to abide by certain standstill provisions. The standstill provisions provide, among other things, that each of Shah Capital and Vintage Capital cannot: (1) solicit proxies of stockholders or participate in or assist any third party in any solicitation of proxies to vote any shares of the Company’s common stock; (2) join or

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 10 | |

form a group with respect to the Company’s common stock; (3) present any proposal for consideration at any stockholders’ meeting or propose any nominee for election to the Board; or (4) institute, solicit or join any litigation against the Company or its present or former directors, officers or employees (other than pursuant to customary exceptions, such as to enforce the applicable Cooperation Agreement).

Each of Shah Capital and Vintage Capital have agreed at the 2019 Annual Meeting to vote all shares the Company’s common stock beneficially owned by them in favor of the Company’s director nominees and otherwise in accordance with the Board’s recommendation for any other matter. Shah Capital has further agreed to vote in favor of the Company’s director nominees and otherwise in accordance with the Board’s recommendation for any other matter at any meeting of stockholders held during the Standstill Period. Vintage Capital has further agreed to vote in favor of the Company’s director nominees at any meeting of stockholders held during the Standstill Period.

Please see “Certain Relationships and Related Person Transactions.”

During 2018, Mr. Keating reached retirement age. The Nomination and Governance Committee discussed this matter in February, 2019 and agreed that Mr. Keating’s extensive experience in technology, his successes as an executive and his corporate governance experience developed while serving on the boards of other publicly traded companies is critical to the successful operations of the Company. As a result, upon the recommendation of the Nomination and Governance Committee, the Board of Directors approved Mr. Keating’s continued service beyond age 72 and nominated him to continue serving as a director for a term expiring in 2020.

The names of the nine (9) nominees, along with their present positions, their principal occupations and directorships held with other public corporations during the past five years, their ages and the month and year first elected as a director, are provided below. No directors or executive officers have any family relationship to any other director, nominee for director or executive officer.

| DEBORAH M. DERBY | |||

| INDEPENDENT | Biography: | ||

Age 55 Director since: December 2012

|

Deborah M. Derby has served as President of the Horizon Group USA since April 2016, prior to which she was a consultant to them since November 2015. She served as Vice Chairman, Executive Vice President of Toys “R” Us from March 2013 to August 2015. Prior to her rejoining Toys “R” Us in March 2013, she consulted for Kenneth Cole Productions, Inc., beginning in September 2012. She previously served as Chief Administrative Officer for Toys “R” Us from February 2009 to February 2012. Ms. Derby joined Toys “R” Us in 2000 as Vice President, Human Resources and held positions of increasing responsibility during her 11 years there, including Corporate Secretary, Executive Vice President, Human Resources, Legal & Corporate Communications and President, Babies “R” Us. Prior to joining Toys “R” Us, she spent eight years at Whirlpool Corporation with her last position there as Corporate Director Compensation & Benefits. Ms. Derby currently serves as a director and member of the compensation committee of Carrols Restaurant Group, Inc. Ms. Derby also has experience as an attorney specializing in employment law and as a financial analyst with The Goldman Sachs Group, Inc. | ||

| Skills and Qualifications: | |||

| The Board selected Ms. Derby as a director nominee based on her breadth of experience in retailing, human resources, legal and financial analysis, as well as her experience as the executive vice president of a large global retailer. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Carrols Restaurant Group, Inc. | • Compensation (Chair) | |

| • Independent Director | • Nomination and Governance | ||

| • Senior Leadership | |||

| • Branding/Marketing | |||

| • Compensation/ Human Resources | |||

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 11 | |

| DAVID H. EDWAB | |||

| INDEPENDENT | Biography: | ||

Age 64 Director since: November 2005 |

David H. Edwab served the Company as Lead Director from April 4, 2011 until December 29, 2015. Mr. Edwab has served as an officer and director of Tailored Brands, Inc. (formerly The Men’s Wearhouse, Inc.) for approximately 25 years, starting as Vice President of Finance and Director in 1991, serving as Chief Operating Officer from 1993 to 1997, as President in 1997 and as Executive Vice Chairman. Mr. Edwab currently serves as Non-Executive Vice Chairman of the Board of Directors of Tailored Brands, Inc. Mr. Edwab also currently serves as a director and member of the audit committee and is chairman of the nomination and governance committee of RTW Retailwinds, Inc. Mr. Edwab previously served as lead director and chairman of the audit committee of Aeropostale, Inc., chairman of the nomination and governance committee of New York & Company, Inc. and was a partner with Deloitte & Touche LLP where he was responsible for the southwest corporate finance and retail practice. Mr. Edwab was a Senior Managing Director at Bear Stearns & Co. and served as head of the Retail Group. Mr. Edwab also served as an operating partner of Bear Stearns Merchant Banking. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Edwab as a director nominee based on his extensive retail and financial background and his experience having served on the boards of directors of retailers. Mr. Edwab is an inactive CPA and has experience in investment banking and private equity. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Tailored Brands, Inc. | • Audit (Chair) | |

| • Independent Director | • RTW Retailwinds, Inc. | • Nomination and Governance | |

| • Senior Leadership | |||

| • Branding/Marketing | |||

| • Financial | |||

| • Risk Management | |||

| • Compensation/ Human Resources | |||

| MELVIN L. KEATING | |||

| INDEPENDENT | Biography: | ||

Age 72 Director since: April 2018

|

Melvin L. Keating has served as a consultant, providing investment advice and other services to private equity firms, since November 2008. Mr. Keating serves as a director of Agilysys Inc., a leading technology company that provides innovative software for point-of-sale, property management, inventory and procurement, workforce management, analytics, document management and mobile and wireless solutions and services to the hospitality industry, MagnaChip Semiconductor Corp., a designer and manufacturer of analog and mixed-signal semiconductor products for consumer, communication, computing, industrial, automotive and IoT applications (and is chair of its audit committee since August 2016), SPS Commerce, a provider of cloud based supply chain management solutions, and, Harte Hanks, Inc., a provider of multichannel marketing services. During the past five years, Mr. Keating also served on the Boards of Directors of the following public companies: Red Lion Hotels Corporation (2010-2017); API Techonologies Corp.; and ModSys International Ltd. (formerly BluePhoenix Solutions Ltd.), a legacy platform modernization provider. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Keating as a director nominee because of his extensive experience in technology, his successes as an executive and his corporate governance experience developed while serving on the boards of other publicly-traded companies. He is recognized as a financial expert. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Agilysys, Inc. | • Audit | |

| • Independent Director | • MagnaChip Semiconductor Corp. | ||

| • Senior Leadership | • SPS Commerce | ||

| • Digital/Technology | • Harte Hanks, Inc. | ||

| • Financial | |||

| • Compensation/ Human Resources | |||

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 12 | |

| SHARON M. LEITE | |||

| Biography: | |||

Age 56 Director since: August 2018 |

Sharon M. Leite has served as our Chief Executive Officer since August 27, 2018. Prior to joining us, Ms. Leite was President of Godiva Chocolatier in North America since October, 2017. Prior to Godiva, Ms. Leite was the president of Sally Beauty, US and Canada, and spent close to a decade at Pier 1 Imports, with her last position in 2016 as executive vice president of sales, customer experience and real estate. Earlier in her career, Ms. Leite held various executive leadership roles at Bath and Body Works as well as various sales and operations positions with other retailers, including Gap Inc., The Walt Disney Company and Express. Ms. Leite has been a director of Tandy Leather Factory, Inc. since June 6, 2017 and is also a member of the Audit and Compensation Committees | ||

| Skills and Qualifications: | |||

| Pursuant to Ms. Leite’s employment agreement, the Board selected Ms. Leite as a director nominee because she brings significant experience in retail operations to shape the customer experience, sales, digital, E-commerce, real estate, merchandising, and marketing strategies. | |||

| Experience: | Current Directorships: | ||

| • Public Company Board | • Tandy Leather Factory, Inc. | ||

| • Senior Leadership | |||

| • Digital/Technology | |||

| • Branding/ Marketing | |||

| • Financial | |||

| • Compensation/ Human Resources | |||

| GUILLERMO G. MARMOL | |||

| INDEPENDENT | Biography: | ||

Age 66 Director since: February 2016 |

Guillermo G. Marmol has served as President of Marmol & Associates since March 2007 and, prior to that, from October 2000 to 2003. He served as Division Vice President and a member of the Executive Committee of Electronic Data Systems Corporation from 2003 to 2007, and as a director and Chief Executive Officer of Luminant Worldwide Corporation from 1998 to 2000. He served as Vice President and Chair of the Operating Committee of Perot Systems Corporation from 1995 to 1998. He began his career at McKinsey & Company rising to increasingly senior positions with the firm, including the positions of Director and Senior Partner from 1990 to 1995. Mr. Marmol is a director and chair of the audit committee of Foot Locker Inc., and he is a member of the Board of Trustees and Chair of the Finance Committee of the Center for a Free Cuba in Arlington, Virginia. Mr. Marmol was a director of Information Services Group, Inc. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Marmol as a director nominee because he has a significant background in information technology and systems, and because of his experience having served on the boards of other publicly-traded companies. Through his long tenure as a management consultant focusing on strategic analysis and business processes, Mr. Marmol brings valuable knowledge and expertise to his service on the Board. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Foot Locker, Inc. | • Compensation | |

| • Independent Director | • Nomination and Governance (Chair) | ||

| • Senior Leadership | |||

| • Digital/Technology | |||

| • Risk Management | |||

| • Compensation/ Human Resources | |||

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 13 | |

| HIMANSHU H. SHAH | |||

| INDEPENDENT | Biography: | ||

Age 52 Director since: April 2018

|

Himanshu H. Shah has served as Founder, President and Chief Investment Officer of Shah Capital since January 2005, and Managing General Partner of Shah Capital Opportunity Fund LP since July 2006 and, prior to that, Mr. Shah served as Vice President and Senior Portfolio Manager at PMP, UBS Financial Services, Inc. He serves as a Chairman of Marius Pharmaceuticals Inc. since January 2017. He has been the Chairman of UTStarcom Holdings Corp., since June 2014 and Director since November 2013. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Shah as a director nominee because he has a significant background in capital markets, and because of his extensive experience consulting other companies. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • UTStarcom Holdings Corp. | • Nomination and Governance | |

| • Independent Director | • Marius Pharmaceuticals Inc. | ||

| • Financial | |||

| • Compensation/ Human Resources | |||

| ALEXANDER W. SMITH | |||

| INDEPENDENT | Biography: | ||

Age 66 Director since: April 2017

|

Alexander W. Smith became our Non-Executive Chairman in August 2018. He previously served as our Executive Chairman from February 2018 until July 2018 and Non-Executive Chairman from December 2017 until February 2018. From February 2007 until December 2016, Mr. Smith served as President, Chief Executive Officer and a member of the board of Pier 1 Imports, Inc. (“Pier 1 Imports”). Prior to joining Pier 1 Imports, from 1995 until 2007, Mr. Smith was employed by TJX Companies, Inc. where he was instrumental in the development of TJ Maxx in the U.K, and served as Group President, where his responsibilities included Winners in Canada, Home Goods, TJ Maxx and Marshalls, plus a number of corporate functions. Mr. Smith currently serves as a director of Art Van Furniture, LLC and as a director and member of the Audit Committee of Bluestem Group Inc. From December, 2013 to July 2016, Mr. Smith served as a director of Tumi, Inc., including as chairman of its nominating and governance committee and a member of its audit committee. From June, 2007 to April, 2011 Mr. Smith also served as a director of Papa John’s International, Inc., including as chairman of its compensation committee and as a member of its audit committee. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Smith as a director nominee due to his experience in retailing and brand management, including his extensive public company experience as a senior executive and director. | |||

| Experience: | Current Directorships: | ||

| • Public Company Board | • Art Van Furniture, LLC | ||

| • Independent Director | • Bluestem Group Inc. | ||

| • Senior Leadership | |||

| • Digital/Technology | |||

| • Branding/ Marketing | |||

| • Financial | |||

| • Risk Management | |||

| • Compensation/Human Resources | |||

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 14 | |

| TIMOTHY J. THERIAULT | |||

| INDEPENDENT | Biography: | ||

Age 58 Director since: March 2016 |

Timothy J. Theriault served as an advisor to the Chief Executive Officer of Walgreens Boots Alliance, Inc. from June 2015 until December 2016 and as executive vice president and global chief information officer from 2014–2015. He served in leadership positions with increasing responsibility at Walgreen Company from 2009 to 2014, including as senior vice president and chief information, innovation and improvement officer from 2012–2014 and as senior vice president and chief information officer from 2009–2012. Additionally, Mr. Theriault served in various executive and management positions at Northern Trust Corporation from 1991 to 2009. Mr. Theriault served as director of end user computing and advanced technologies for S. C. Johnson & Son, Inc., from 1989 to 1991. He currently serves as a director and member of the audit and Nomination/Corporate Governance committees of Alliance Data Systems Corporation. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Theriault as a director nominee due to his extensive experience in senior management positions at retailers and his extensive knowledge in operational and information systems. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Alliance Data Systems Corporation | • Audit | |

| • Independent Director | • Compensation | ||

| • Senior Leadership | |||

| • Digital/Technology | |||

| • Financial | |||

| • Risk Management | |||

| • Compensation/ Human Resources | |||

| SING WANG | |||

| INDEPENDENT | Biography: | ||

Age 55 Director since: April 2018

|

Sing Wang has served as the Chairman of TKK Capital since 2015. He also has served as the chairman and Chief Executive Officer and Director of TKK Symphony Acquisition Corporation since February 2018, the chairman and Chief Executive Officer and Director of TKK Symphony Acquisition Corporation II since October 2018, the Chief Executive Officer and Director of CM Seven Star Acquisition Corporation since February 2018 and Vice General Manager (non-executive) of CMIG Capital Company Limited since May 2017. Previously, he served as the Chief Executive Officer and Executive Director of China Minsheng Financial Holding Corporation Limited from February 2016 to May 2017. From September 2015 until December 2017, he was a Senior Advisor to TPG China, Limited and from 2016 until November 2017, Mr. Wang served as the Chairman of Evolution Media China. He served as a partner at TPG, Co-Chairman of TPG Greater China and the Head of TPG Growth North Asia from May 2006 until August 2015. Prior to joining TPG, Mr. Wang was the Chief Executive Officer and Executive Director of TOM Group Limited from mid-2000 to early 2006. From mid-1993 until mid- 2000 he served in various positions at Goldman Sachs Hong Kong / New York. In July 2017 until October 2018, he was appointed as the Independent Non- Executive Director and member of the Audit Committee of Sands China Limited. Mr. Wang also serves as the Chairman of his personal investment companies including Amerinvest group of companies since 1991 and Texas Kang Kai (TKK) group of companies since 2015. Mr. Wang was the Non-Executive Director of China Renewable Energy Investment Limited (June 2011 - October 2015) and MIE Holdings Corporation (June 2010 - November 2015). From August 2018, Mr. Wang was appointed as the Director and served as non-executive chairman of Grindr Inc. | ||

| Skills and Qualifications: | |||

| The Board selected Mr. Wang as a director nominee due to his extensive experience in executive leadership positions at various companies. | |||

| Experience: | Current Directorships: | Committee Memberships: | |

| • Public Company Board | • Grindr Inc. | • Audit | |

| • Independent Director | • TKK Symphony Acquisition Corporation | ||

| • Financial | • TKK Symphony Acquisition Corporation II | ||

| • CM Seven Star Acquisition Corporation | |||

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 15 | |

The matrix below summarizes what our Board believes are desirable types of experiences, qualifications, and skills that are possessed by one or more of our directors that qualify them for service on the Board. Our directors have diverse backgrounds and experience and may possess many skills and qualifications which are not reflected in this matrix.

| Director Qualifications | Alexander | Melvin | Himanshu | Deb | Sing | David | Gil | Sharon | Tim |

| and Experience | Smith | Keating | Shah | Derby | Wang | Edwab | Marmol | Leite | Theriault |

| Public Company Board Experience Experience serving on the boards of other publicly traded companies |

|

|

|

|

|

|

|

|

|

| Independent Director Satisfy the independence requirements of the NYSE and SEC |

|

|

|

|

|

|

|

| |

| Senior Leadership Experience Experience as a Chief Executive or other senior executive at a public company |

|

|

|

|

|

|

| ||

| Digital / Technology Expertise Leadership and understanding of technology, digital platforms and cybersecurity risk |

|

|

|

|

| ||||

| Branding / Marketing Experience Possess experience in developing and marketing consumer products and creating and expanding private label brands awareness |

|

|

|

|

|||||

| Financial Experience Background, knowledge and experience with finance, accounting and/or financial reporting |

|

|

|

|

|

|

| ||

| Risk Management Expertise Experience understanding with respect the identification, assessment and oversight of risk management programs and practices |

|

|

|

| |||||

Compensation / Human Resources Expertise Experience with issues involved with executive compensation, succession planning, human resource management and talent management and development |

|

|

|

|

|

|

|

|

Board Diversity

Our directors represent a range of backgrounds and overall experience. Our director nominees range from 52 to 72 years of age, with the average age being 60.4 years as of the 2019 Annual Meeting.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 16 | |

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which are available on the Investor Relations page of our website, www.vitaminshoppe.com. The Corporate Governance Guidelines describe our corporate governance practices and address corporate governance areas such as Board composition and responsibilities, compensation of directors and executive succession planning.

Based on the NYSE and SEC’s director independence requirements, the Corporate Governance Guidelines provide certain guidelines to assist the Board in its determination of director independence. Our Corporate Governance Guidelines provide that a majority of the members of the Board, and each member of the Audit, Compensation and Nomination and Governance Committees, must meet certain criteria for independence.

The Nomination and Governance Committee reviews the independence of all members of the Board, based on the director independence listing standards of the NYSE and the Corporate Governance Guidelines, for purposes of determining which Board members are deemed independent. The Nomination and Governance Committee and the Board affirmatively determined that each of Ms. Derby, Mr. Edwab, Mr. Keating, Mr. Marmol, Mr. Shah, Mr. Smith (except for the time he served as Executive Chairman), Mr. Theriault and Mr. Wang is independent. In addition, the Nomination and Governance Committee and the Board affirmatively determined that each of B. Michael Becker, John D. Bowlin, Tracy Dolgin and Beth M. Pritchard who served on the Board in 2018, is independent. Mr. Becker, Mr. Bowlin, Mr. Dolgin and Ms. Pritchard did not stand for re-election at the 2018 Annual Meeting. None of the non-employee directors has any material relationship with us other than being a director and stockholder, or any transaction or arrangement that interferes with each director’s independence.

Policies with Respect to Transactions with Related Persons

The Nomination and Governance Committee and the Board have adopted Standards of Business Conduct, which set forth various policies and procedures intended to promote the ethical behavior of all of our employees, officers and directors. The Standards of Business Conduct describe our policy on conflicts of interest. The Company distributes the Standards of Business Conduct to all of its employees, officers and directors. The conflicts of interest policy in the Standards of Business Conduct describes the types of relationships that may constitute a conflict of interest with us. All employees, officers and directors are required to annually complete a questionnaire about potential conflicts of interest and certify compliance with our policy.

The NEOs and the Board are also required to complete a questionnaire on an annual basis that requires them to disclose any related person transactions and potential conflicts of interest. The General Counsel reviews the responses to the questionnaires and, if a related person transaction or potential conflict of interest is reported by an independent director or Named Executive Officer, the questionnaire is submitted to the Chairman of the Audit Committee for review. If necessary, the Audit Committee will determine whether the relationship is material and will have any effect on the director’s independence. After making that determination, the Audit Committee will report its recommendation on whether the entire Board should approve or ratify the transaction.

The Nomination and Governance Committee is responsible for, among other things, screening potential director candidates and recommending qualified candidates to the Board for nomination.

When identifying and evaluating candidates, the Nomination and Governance Committee first determines whether there are any evolving needs of the Board that require an expert in a particular field. The Nomination and Governance Committee may retain a third-party search firm to assist the committee in locating qualified candidates that meet the needs of the Board at that time. The search firm provides information on a number of candidates, which the Nomination and Governance Committee considers. The Chairman of the Nomination and Governance Committee and

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 17 | |

some or all of the members of the Nomination and Governance Committee, as well as the Non-Executive Chairman and our Chief Executive Officer, will interview potential candidates that the Nomination and Governance Committee deems appropriate. If the Nomination and Governance Committee determines that a potential candidate meets the needs of the Board, has the qualifications, and meets the independence standards required by the NYSE and as set forth in the Corporate Governance Guidelines, it will recommend the nomination of the candidate to the Board.

The Nomination and Governance Committee’s policy is to consider director candidates recommended by stockholders, if those recommendations are properly submitted to us. Stockholders wishing to recommend persons for consideration by the Nomination and Governance Committee as nominees for election to the Board can do so by writing to the Corporate Secretary at Vitamin Shoppe, Inc., 300 Harmon Meadow Blvd., Secaucus, New Jersey 07094. Recommendations must include the proposed nominee’s name, detailed biographical data outlining the candidate’s relevant background, professional and business experience and other significant accomplishments, a statement outlining the reasons why the candidate’s skills, experience and background would make a valuable contribution to the Board, a minimum of two references who have either worked with the candidate, served on a board of directors or board of trustees with the candidate (or can otherwise provide relevant perspective on the candidate’s capabilities as a potential Board member), as well as a notarized letter from the candidate consenting to be named and, if nominated and elected, to serve as a director. Recommendations must also follow our procedures for nomination of directors by stockholders as provided in our charter and bylaws. The Nomination and Governance Committee will consider the candidate and the candidate’s qualifications in the same manner in which it evaluates nominees identified by the Nomination and Governance Committee. The Nomination and Governance Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the stockholder’s reasons for making the nomination. The Nomination and Governance Committee may then interview the candidate if it deems the candidate to be appropriate. The Nomination and Governance Committee may use the services of a third-party search firm to provide additional information about the candidate before making a recommendation to the Board.

The Nomination and Governance Committee’s nomination process is designed to ensure that the Nomination and Governance Committee fulfills its responsibility to recommend candidates who are properly qualified to serve us for the benefit of all of our stockholders, consistent with the standards established by the Nomination and Governance Committee under the Corporate Governance Guidelines.

The Board encourages communication from our stockholders. Any interested parties who wish to communicate with the non-management directors should send any such communication to the General Counsel in care of the Company’s executive offices at 300 Harmon Meadow Blvd. Secaucus, New Jersey 07094. All such stockholder communication will be reviewed by the General Counsel who will determine the appropriate response or course of action.

Board Leadership

The Company appointed Alexander Smith as Executive Chairman on February 27, 2018. Prior to Mr. Smith’s appointment as our Executive Chairman, he was serving as our Non-Executive Chairman since January 1, 2018. Our Chief Executive Officer, Colin Watts, departed the Company in May, 2018; thus, Mr. Smith continued to serve as our Executive Chairman until the appointment of Ms. Leite as Chief Executive Officer on August 27, 2018, after which, he resumed his role as Non-Executive Chairman.

The Chief Executive Officer is responsible for setting our strategic direction and our day-to-day leadership and performance, while our Non-Executive Chairman of the Board sets the agenda for Board meetings and presides over meetings of the full Board. In addition, the Non-Executive Chairman of the Board had the responsibility of consulting with our Chief Executive Officer on Board and committee meeting agendas, acting as a liaison between management and the non-management directors, including maintaining frequent contact with our Chief Executive Officer and advising her on the efficiency of the Board meetings, facilitating teamwork and communication between the non-management directors and management, as well as additional responsibilities that are more fully described in the Corporate Governance Guidelines.

Two of the key responsibilities of the Board are to develop and approve strategic direction and hold management accountable for the execution of strategy once it is developed. Independent directors and management have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside the Company and industry, while our Chief Executive Officer brings company-specific experience and expertise.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 18 | |

The Board believes that having separate roles of Non-Executive Chairman and our Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and the Board, which are essential to effective governance. The Board believes that this structure is in the best interests of stockholders because it provides the appropriate balance between strategy development and oversight of management.

Executive Sessions

Pursuant to the Corporate Governance Guidelines, non-management directors of the Board are required to meet on a regularly scheduled basis without the presence of management. The Board generally holds executive sessions at each regular Board meeting. Executive sessions are chaired by the Chairman of the Board.

Meeting Attendance

The Board met fifteen (15) times in 2018. Each director attended at least 75% of the total meetings of the Board and committees of the Board of which the director was a member. In addition to participation in Board and committee meetings, our directors discharge their responsibilities throughout the year through personal meetings and other communications, including telephone contact with our Non-Executive Chairman and Chief Executive Officer and others regarding matters of interest and concern to us.

We do not have a formal policy requiring members of the Board to attend the annual meeting, although all directors are strongly encouraged to attend. All of our directors attended the 2018 Annual Meeting.

Self-Evaluations

The Board and each committee of the Board conduct an annual self-evaluation, which considers a number of elements, such as the performance of the Chief Executive Officer and NEOs, each committee and the Board as a whole. The self-evaluation also provides a forum for the Board and committee members to address specific concerns regarding how the Board and/or committees function, the level of participation from its respective members, and actions to be taken to improve the Board and/ or committee’s effectiveness. The results of these evaluations are discussed with the Board and committee members once completed.

Risk Management

The Board has an active role, as a whole and at the committee level, in overseeing management of our risks. The Board regularly reviews information regarding our credit, liquidity, operations and cybersecurity, as well as the risks associated with each. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee oversees management of financial risks. The Nomination and Governance Committee manages risks associated with the independence of the Board and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about those risks. The Board seeks to ensure that management has in place processes for dealing appropriately with risk. It is the responsibility of our senior management to develop and implement our short- and long-term objectives and to identify, evaluate, manage and mitigate the risks inherent in seeking to achieve those objectives. Management is responsible for identifying risks and risk controls related to significant business activities and Company objectives and developing programs to determine the sufficiency of risk identification, the balance of potential risk to potential reward and the appropriate manner in which to control risk.

The Board has established an Audit Committee, a Compensation Committee and a Nomination and Governance Committee. The Audit, Compensation and Nomination and Governance Committees are composed entirely of independent directors, as defined under applicable SEC rules, NYSE listing standards and the Corporate Governance Guidelines. The charters of each committee are available on the Investor Relations section of our website, www.vitaminshoppe.com.

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 19 | |

A list of current Committee memberships can be found on the Investor Relations section of our website, www.vitaminshoppe.com. The Committee memberships as of the date of this proxy statement are listed below:

| Name | Audit Committee |

Compensation Committee |

Nomination and Governance Committee | |||

| Alexander W. Smith* | ||||||

| Deborah M. Derby |  |

| ||||

| David H. Edwab |  |

| ||||

| Mel Keating |  |

|||||

| Sharon Leite | ||||||

| Guillermo G. Marmol |  |

| ||||

| Himanshu Shah |  | |||||

| Timothy J. Theriault |  |

|

||||

| Sing Wang |  |

| * | Mr. Smith is the Chairman of the Board. |

An “ ” indicates membership on the committee. ” indicates membership on the committee. | |

A “ ” indicates that the director serves as the chairman of the committee. ” indicates that the director serves as the chairman of the committee. |

Audit Committee

The Audit Committee held five (5) meetings in 2018. The Audit Committee annually reviews and reassesses the adequacy of its charter. In December 2018, the Audit Committee reviewed and approved the Audit Committee Charter and determined that no changes need to be made. As more fully described in its charter, the primary responsibilities of the Audit Committee are to:

| • | oversee our accounting and financial reporting processes, including the review of our quarterly and annual financial results; |

| • | select, retain, evaluate and terminate when appropriate, our independent registered public accounting firm, and oversee the relationship, including monitoring the independent registered public accounting firm’s independence and reviewing the scope of the independent registered public accounting firm’s work, including preapproval of audit and non-audit services; |

| • | review reports and recommendations of our independent registered public accounting firm; |

| • | review accounting principles and financial statement presentation; |

| • | oversee our internal audit function, including review of the scope of all internal audits and related reports and recommendations; |

| • | review management’s assessment of the effectiveness of our internal control over financial reporting and the independent registered public accounting firm’s related attestation; |

| • | monitor the integrity of our financial statements; |

| • | monitor compliance with financial reporting requirements; |

| • | monitor compliance with internal control over financial reporting; |

| • | evaluate the performance of our independent registered public accounting firm, including the lead partner, and the performance of our internal auditors; |

| • | discuss our financial statements and our quarterly and annual reports to be filed with the SEC with management and the independent registered public accounting firm; |

| • | review our policies regarding the assessment of financial risk; |

| • | review our compliance programs; |

| • | review and approve related person transactions and conflicts of interest involving directors and executive officers; |

| • | review our procedures for receiving and responding to concerns regarding accounting and auditing matters; and |

| • | review and approve the Audit Committee report to be included in the proxy statement. |

Each member of the Audit Committee is financially literate and has accounting or financial management expertise. The Board has determined that Mr. Edwab has financial management expertise and, based upon his education and experience as a public accountant and experience in advising, auditing and reporting on the financial statements and on internal control over financial reporting of large publicly held companies, including retail companies, the Board has determined that Mr. Edwab is an audit committee financial experts as defined in Item 407(d)(5) (ii) and (iii) of Regulation S-K. The Board has also determined that each Audit Committee member is independent under the listing standards of the NYSE, the Corporate Governance Guidelines and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 20 | |

Compensation Committee

The Compensation Committee held seven (7) meetings in 2018. The Compensation Committee annually reviews and reassesses the adequacy of its charter. In December 2018, the Compensation Committee reviewed and approved the Compensation Committee Charter, and determined that no changes needed to be made. The Compensation Committee’s primary functions are to:

| • | develop and approve the Company’s executive compensation philosophy and strategy, including the balance between or mix of base salaries, cash and equity-based incentive compensation and other compensation components for our Chief Executive Officer, other executive officers and the Board; |

| • | review and approve compensation and goals for our Chief Executive Officer and evaluate his or her performance; |

| • | review and approve compensation and goals for our other executive officers and review our Chief Executive Officer’s evaluation of the performance of those executive officers; |

| • | approve the Company’s cash-based incentive plans for executive officers, including the performance measures to be applied in determining incentive awards; |

| • | review and make recommendations to the Board for approval with respect to the types and structures of employee retirement plans for our Chief Executive Officer, other executive officers and other employees; |

| • | establish and periodically review Company policies with respect to perquisites and other non-cash benefits for executive officers; |

| • | periodically review the operation of the Company’s broad-based programs and overall compensation programs for key employees; |

| • | designate key employees who may be granted stock options, performance awards and other stock based awards, and determine the number of shares that are granted to such key employees; |

| • | determine stock ownership guidelines and monitor compliance with such guidelines; |

| • | review the annual Compensation Committee report on executive compensation and the compensation discussion and analysis section included in the proxy statement; |

| • | review the Company’s incentive compensation arrangements to determine whether they encourage excessive risk-taking, review and discuss at least annually the relationship between risk management policies and practices and compensation and evaluate compensation policies and practices that could mitigate any such risk; |

| • | work with our Chief Executive Officer and our Non-Executive Chairman to develop succession plans for our Chief Executive Officer for an emergency situation and over the longer term; and |

| • | recommend to the full Board for its approval the amount and form of compensation to be paid to Company non-employee directors. |

The Board has determined that each Compensation Committee member is (i) independent under the listing standards of the NYSE, the Corporate Governance Guidelines and Rule 10C-1 under the Exchange Act, (ii) a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act and (iii) an “outside director” within the meaning of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986 (the “Code”); provided, that in light of the Tax Act (discussed below), the importance of being an outside director for purposes of Section 162(m) will generally be limited to the administration of certain performance-based compensation amounts that are maintained under written binding contracts dated on or prior to November 2, 2017.

Compensation Committee Procedures

The Compensation Committee directs management to prepare financial data used by the Compensation Committee in determining executive compensation. In addition, members of our human resources department assist in providing historical information on compensation paid to executives. Management provides recommendations to the Compensation Committee regarding the level and type of compensation to provide to officers who hold the office of Vice President or higher. Members of our legal department provide the Compensation Committee with general advice on laws applicable to executive compensation and the directors’ fiduciary duties in setting compensation, and the Compensation Committee may from time to time consult with outside legal counsel.

In accordance with its charter, the Compensation Committee has the authority to engage, retain and terminate a compensation consultant. In 2018, the Compensation Committee retained Frederic W. Cook & Co, Inc., (“FW Cook”), as an independent consultant with respect to executive and director compensation matters. FW Cook focuses on advising boards on executive compensation and provides executive compensation advisory services. The Compensation Committee assesses the independence of a consultant from management, taking into consideration all factors relevant to the advisor’s independence, including the factors specified in the listing standards of the NYSE and Rule 10C-1 under the Exchange Act. The Compensation Committee believes that FW Cook has been independent throughout its service to the Compensation Committee and there is no conflict of interest between FW Cook and the Compensation Committee. Additional information regarding the Compensation Committee’s engagement of FW Cook can be found in the section below entitled “Compensation Discussion and Analysis – Compensation Determinations and the Role of Consultants.”

Our Chief Executive Officer, Executive Vice President, Chief Financial Officer, Senior Vice President, General Counsel/ Corporate Secretary, Senior Vice President, Human Resources and other officers have attended Compensation Committee meetings from time to time as the Compensation Committee

| VITAMIN SHOPPE | 2019 PROXY STATEMENT 21 | |

deems appropriate. Our Chief Executive Officer’s feedback about each officer’s performance is considered by the Compensation Committee in their determination of the officer’s salary and incentive compensation.

The Compensation Committee may delegate all or any part of its authority and powers under the Vitamin Shoppe 2018 Long-Term Incentive Plan to one or more members of the Board and/or our officers, except that the Compensation Committee may not delegate its authority or power if prohibited by law, or if the delegation would cause the awards or other transactions under the plan to cease to be exempt from Section 16(b) of the Exchange Act or not qualify for, or, as applicable, cease to qualify for, a grandfathered exemption under Section 162(m).

Nomination and Governance Committee

The Nomination and Governance Committee met five (5) times in 2018. The Nomination and Governance Committee annually reviews and reassesses the adequacy of its charter. In December 2018, the Nomination and Governance Committee reviewed and approved an updated Nomination and Governance Committee Charter, which was submitted to, and approved by, the Board. The Nomination and Governance Committee’s primary functions are to:

| • | identify, recruit and screen potential director nominees and recommend such nominees for election as members of the Board; |

| • | review criteria and policies relating to director independence, service and tenure; |

| • | review any director resignation letter tendered and evaluate and recommend to the Board whether such resignation shall be accepted; |

| • | recommend directors for membership on the Audit, Compensation and Nomination and Governance Committees, including their Chairmen; |

| • | recommend directors and executive officers for membership on other committees established by the Board; |

| • | develop and recommend a set of corporate governance principles designed to foster an effective corporate governance environment; |

| • | review the Company’s charter, bylaws and charters of Board committees; and |

| • | manage the performance review process of the Board, its committees and our Chief Executive Officer. |

The Board has determined that each Nomination and Governance Committee member is independent under the listing standards of the NYSE and the Corporate Governance Guidelines.

Compensation Committee Interlocks and Insider Participation