Form DEF 14A Titan Machinery Inc. For: Jun 06

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ý | |||||||||||

Filed by a Party other than the Registrant o | |||||||||||

| Check the appropriate box: | |||||||||||

| o | Preliminary Proxy Statement | ||||||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||||

| ý | Definitive Proxy Statement | ||||||||||

| o | Definitive Additional Materials | ||||||||||

| o | Soliciting Material under §240.14a-12 | ||||||||||

| TITAN MACHINERY INC. | |||||||||||||||||

| (Name of Registrant as Specified In Its Charter) | |||||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | |||||||||||||||||

| ý | No fee required. | ||||||||||||||||

| o | Fee paid previously with preliminary materials. | ||||||||||||||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||||||||||

TITAN MACHINERY INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of Titan Machinery Inc. will, due to public health concerns related to the COVID-19 pandemic and to support the health and well-being of our stockholders, services providers, personnel and other stakeholders, be held in a virtual meeting only format over the Internet at www.virtualshareholdermeeting.com/TITN2022 beginning at 9:00 a.m., Central Time, on June 6, 2022, for the following purposes:

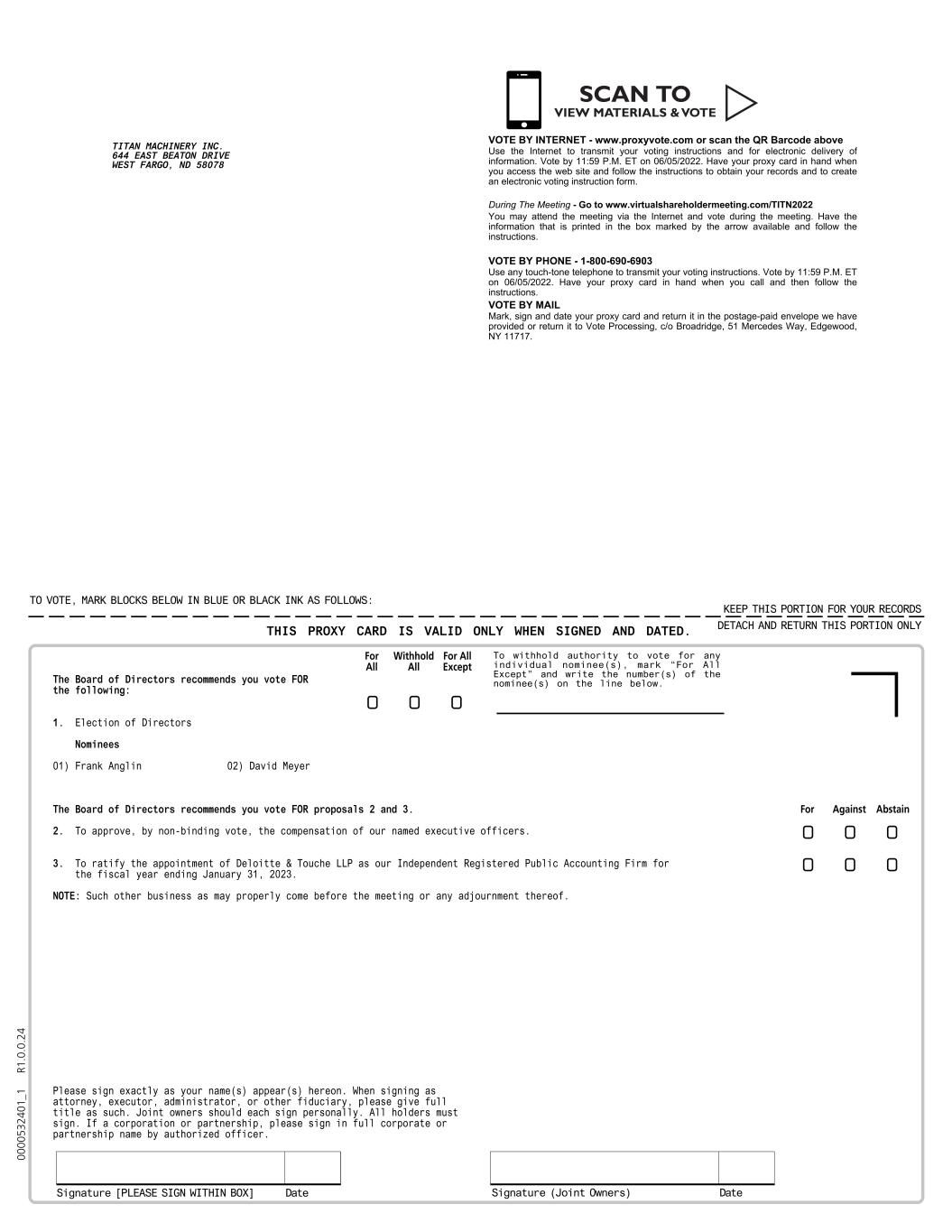

1. To elect two directors each for a three-year term.

2. To conduct an advisory vote on a non-binding resolution to approve the compensation of our named executive officers.

3. To ratify the appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for the fiscal year ending January 31, 2023.

4. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on April 8, 2022 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting or any adjournment or postponement thereof.

Your vote is important. You are cordially invited to attend the virtual Annual Meeting. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/TITN2022. Whether or not you plan to attend the virtual Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or by mail as described in the Notice of Internet Availability, first sent to stockholders on or about April 25, 2022, containing instructions on how to access our proxy materials.

Important Notice Regarding the Availability of Proxy Materials for the Upcoming Annual Meeting of Stockholders To Be Held on June 6, 2022: The Proxy Statement, Proxy Card, and Annual Report on Form 10-K are available in the Investor Relations section of the Titan Machinery Inc. website at http://www.titanmachinery.com.

| BY ORDER OF THE BOARD OF DIRECTORS | ||||||||

| ||||||||

David J. Meyer Board Chair and Chief Executive Officer | ||||||||

West Fargo, North Dakota

April 25, 2022

TITAN MACHINERY INC.

Annual Meeting of Stockholders

June 6, 2022

PROXY STATEMENT

INTRODUCTION

Your proxy is solicited by the Board of Directors (the "Board") of Titan Machinery Inc. ("we," "us," "our," or the "Company") for our Annual Meeting of Stockholders to be held at 9:00 a.m. , Central Time, on June 6, 2022 (the "Annual Meeting"), in a virtual meeting only format over the Internet at www.virtualshareholdermeeting.com/TITN2022 and for the purposes set forth in the Notice of Annual Meeting of Stockholders, and at any adjournment or postponement thereof. The Company is holding the Annual Meeting in a virtual only format over the Internet due to public health concerns related to the COVID-19 pandemic and to support the health and well-being of our stockholders, service providers, personnel and other stakeholders. The proposals to be voted on at the Annual Meeting are described in this Proxy Statement.

The mailing address of our principal executive offices is Titan Machinery Inc., 644 East Beaton Drive, West Fargo, North Dakota 58078. We expect that this Proxy Statement, the related Proxy Card, Notice of Annual Meeting of Stockholders, and the Notice of Internet Availability (the "Notice") will first be made available to our stockholders on or about April 25, 2022.

GENERAL INFORMATION

| Purpose of the Annual Meeting | At the Annual Meeting, our stockholders will act upon the following proposals outlined in the Notice of Annual Meeting of Stockholders: | |||||||

| Proposal 1 - Election of Directors | ||||||||

| Proposal 2 - Advisory Vote to Approve the Compensation of our Named Executive Officers | ||||||||

| Proposal 3 - Ratification of Independent Registered Public Accounting Firm | ||||||||

| Following the formal portion of the Annual Meeting, management of the Company will be available to respond to appropriate questions from stockholders. | ||||||||

1

| What is the format for this year's Annual Meeting? | Due to public health concerns related to the COVID-19 pandemic and to support the health and well-being of our stockholders, services providers, personnel and other stakeholders, this year’s Annual Meeting will be held in a virtual only format over the Internet. We have structured our virtual Annual Meeting to provide stockholders with substantially the same opportunities to participate in the Annual Meeting as if it were held in person, including the ability to vote shares electronically during the meeting and to ask questions during the meeting. To attend the virtual Annual Meeting over the Internet, please visit www.virtualshareholdermeeting.com/TITN2022. We recommend that you log in at least 15 minutes before the Annual Meeting begins to ensure ample time to complete the check-in procedures and test your computer audio system. We will have technicians ready to assist you with any technical difficulties that you may encounter accessing the virtual meeting platform. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, in your proxy card (if applicable) or on the instructions that accompanied your proxy material. You may also login as a guest in the event that you do not have a 16-digit control number. However, if you participate as a guest through the virtual meeting platform, you will not be able to vote your shares or submit questions during the Annual Meeting. Although you may vote online during the virtual Annual Meeting, we encourage you to vote via the Internet, by telephone or by mail as outlined in the Notice or on your proxy card to ensure that your shares are represented and voted. | |||||||

| What is a Proxy? | It is your legal designation of another person to vote the stock you own in the manner you direct. That other person is called a proxy. You may designate someone as your proxy in a written document, typically with a proxy card. We have authorized members of our senior management designated by the Board and named in your proxy card to represent you and to vote your shares as instructed. The proxies also may vote your shares at any adjournments or postponements of the Annual Meeting. | |||||||

| What is a Proxy Statement? | It is a document we give you when we are soliciting your designation of a proxy pursuant to Securities and Exchange Commission ("SEC") rules and regulations. | |||||||

| How is the Company distributing the proxy materials? | Consistent with the approach taken for last year's Annual Meeting, this year, to expedite delivery, reduce costs and decrease the environmental impact of our proxy materials, we are using an SEC rule that allows us to furnish proxy materials primarily over the internet instead of mailing paper copies of those materials to each stockholder. As a result, beginning on or about April 25, 2022, we will send to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including this Proxy Statement, over the Internet. If you receive the Notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions in the Notice. The Notice is not a proxy card that can be submitted to vote your shares. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy materials. The Notice also instructs you on how you may submit your proxy via the Internet or by telephone. | |||||||

| Stockholder of Record | If your shares were registered in your name with our transfer agent as of the record date, April 8, 2022, you are a stockholder of record with respect to those shares. | |||||||

2

| Shares held in "Street Name" | If you hold your shares in an account at a bank, broker or other intermediary, then you are the beneficial owner of shares held in "street name" and the bank, broker or other intermediary is considered to be the stockholder of record. This bank, broker or other intermediary will send the Notice to you (or will send the printed proxy materials with the intermediary’s voting instruction card, as requested). As the beneficial owner of the Company’s shares, you have the right to direct your intermediary on how to vote and you are also invited to attend the virtual Annual Meeting. However, if you are a beneficial owner, you are not the stockholder of record and in order to vote your shares during the Annual Meeting you must follow the instructions from your bank, broker or other intermediary. Please refer to the information your bank, broker or other intermediary provided to you. Stock exchange rules do not permit a bank, broker or other intermediary to vote "street name" shares on “non-routine” matters, such as the election of directors and approval of the compensation of our named executive officers, unless it has received voting instructions from the beneficial holder. The Company encourages beneficial holders to promptly direct their bank, broker or other intermediary on how to vote for the agenda items. | |||||||

| Number of Shares Required to be Present to Hold the Annual Meeting | In order to conduct the Annual Meeting, holders of a majority of the shares outstanding and entitled to vote as of the close of business on the record date, April 8, 2022, must be present electronically or by proxy at the virtual Annual Meeting. This constitutes a quorum. Your shares are counted as present if you attend the virtual Annual Meeting and vote electronically, or if you vote by proxy. Shares represented by proxies that include abstentions and broker non-votes (described below) will be counted as present for purposes of establishing a quorum. If a quorum is not present, we will adjourn the Annual Meeting until a quorum is obtained. | |||||||

| Proxy Solicitation and Cost | The cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding that material to beneficial owners and record holders of the Company's common stock ("Common Stock"), will be borne by the Company. Directors, officers and employees of the Company may, without compensation other than their regular remuneration, solicit proxy votes personally or by telephone. | |||||||

| VOTING INFORMATION | ||||||||

| Voting Methods | Shares Held of Record. All stockholders of record may vote by telephone, internet, or mail as described in the Notice or may vote electronically at the Annual Meeting. Shares Held In Street Name. If your shares are held in "street name" you must instruct the record holder of your shares (i.e., your broker, bank or other intermediary) how to vote your shares. If your shares are held in "street name" and you want to attend the virtual Annual Meeting and vote electronically, you will need to log in to the virtual Annual Meeting platform using your 16-digit control number and have a valid legal proxy for the Annual Meeting from the record holder of the shares. | |||||||

| Revoking Your Proxy or Changing Your Vote | Any stockholder giving a proxy designation may revoke it at any time prior to its use at the Annual Meeting by giving written notice of such revocation to the Corporate Secretary of the Company, at 644 East Beaton Drive, West Fargo, ND 58078, or by attending and voting electronically at the virtual Annual Meeting. A beneficial owner of shares held in street name must follow the instructions from his or her bank, broker or other intermediary to revoke his or her previously given proxy. | |||||||

3

| Proposal 1 - Election of Directors (page 11) | The Board has nominated two candidates for election to our Board. On the vote to elect directors, stockholders may: •Vote "FOR" one or more of the nominees; or •"WITHHOLD" votes as to one or more of the nominees. Directors will be elected by a plurality of the votes of stockholders present electronically or represented by proxy at the virtual Annual Meeting. This means that the two nominees who receive the greatest number of "FOR" votes cast will be elected as directors. If you "WITHHOLD" authority to vote with respect to any director nominee, your shares will be counted for purposes of establishing a quorum, but will have no effect on the election of that nominee. The Board recommends that stockholders vote "FOR" the election of each nominee. | |||||||

| Proposal 2 - Advisory Vote to Approve the Compensation of our Named Executive Officers (page 33) | The Board is holding a non-binding advisory vote to approve the compensation of our named executive officers (commonly referred to as the "Say-on-Pay Vote"). Stockholders may: •Vote "FOR" the proposal; •Vote "AGAINST" the proposal; or •"ABSTAIN" from voting on the proposal. The affirmative vote of a majority of the shares present electronically or by proxy at the virtual Annual Meeting and entitled to vote on the matter is required to approve Proposal 2 (meaning that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “FOR” the proposal for it to be approved). An "ABSTAIN" vote has the same effect as an "AGAINST" vote on Proposal 2. Your vote on Proposal 2 is a non-binding advisory vote to approve the compensation of our named executive officers (as defined below under "Compensation Discussion and Analysis"). The Board will consider the results of this advisory vote when considering future executive compensation decisions, but it will not be binding. The Board recommends that stockholders vote "FOR" the approval of the compensation of our named executive officers. | |||||||

Proposal 3 - Ratification of Independent Registered Public Accounting Firm (page 35) | The Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2023. The Board is seeking stockholder ratification of this appointment. On the vote to ratify the appointment of Deloitte & Touche LLP, stockholders may: • Vote "FOR" the proposal; • Vote "AGAINST" the proposal; or • "ABSTAIN" from voting on the proposal. The affirmative vote of a majority of the shares present electronically or by proxy at the virtual Annual Meeting and entitled to vote on the matter is required to approve Proposal 3 (meaning that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “FOR” the proposal for it to be approved). An "ABSTAIN" vote has the same effect as an "AGAINST" vote on Proposal 3. The Board recommends that stockholders vote "FOR" ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2023. | |||||||

4

| What if I do not specify a choice for a matter when returning a proxy? | Stockholders should specify their choice for each proposal when returning a proxy. If no specific voting instructions are given, proxies that are returned will be voted as follows: •"FOR" the election of all director nominees; •"FOR" the advisory approval of the compensation of our named executive officers; and •"FOR" the ratification of the appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for the fiscal year ending January 31, 2023. | |||||||

| Broker Non-Votes | A "broker non-vote" occurs when a broker has not received voting instructions from the beneficial owners of shares held in street name, and the broker does not have, or declines to exercise, discretionary authority to vote those shares. Brokers generally have authority to vote on "routine matters," as determined by applicable self-regulatory organizations governing that broker. Of the proposals presented at the Annual Meeting, only Proposal 3, the ratification of an independent registered public accounting firm, is considered to be a "routine matter." "Broker non-votes" have the following effect: •Your shares will be counted as present for the purposes of determining whether there is a quorum at the Annual Meeting. •Your shares will not be counted as votes "FOR" or "WITHHOLD" authority for the election of the director nominees at the Annual Meeting. •Your shares will not be counted as votes "FOR", "AGAINST", or "ABSTAIN" on Proposal 2 ("Say-on-Pay Vote") or Proposal 3 ("Ratification of Auditor"), as applicable. | |||||||

OUTSTANDING SHARES AND VOTING RIGHTS

The Board has fixed April 8, 2022 as the record date for determining stockholders entitled to vote at the Annual Meeting. Persons who were not stockholders at the close of business on such date will not be allowed to vote at the Annual Meeting. There were 22,570,359 shares of Common Stock issued and outstanding at the close of business on April 8, 2022. Common Stock is the only outstanding class of capital stock of the Company entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter to be voted upon at the Annual Meeting. No holders of any capital stock of the Company are entitled to cumulative voting rights.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth, as of April 8, 2022, information regarding beneficial ownership of our Common Stock by:

•Each person known to us to beneficially own 5% or more of our Common Stock;

•Each executive officer (as that term is defined under the rules and regulations of the SEC) named in the Summary Compensation Table on page 28, who are collectively referred to herein as our "named executive officers";

•Each of our directors (including director nominees); and

•All of our executive officers and directors as a group.

We have determined beneficial ownership in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended. Beneficial ownership generally means having sole or shared voting or investment power with respect to securities. Unless otherwise indicated in the footnotes to the table, each stockholder named in the table has sole voting and investment power with respect to the shares of Common Stock set forth opposite the stockholder's name. We have calculated the percentage of Common Stock owned based on 22,570,359 shares of Common Stock outstanding on April 8, 2022. Unless otherwise noted below, the address of each beneficial owner listed on the table is c/o Titan Machinery Inc., 644 East Beaton Drive, West Fargo, North Dakota 58078.

5

| Name of Beneficial Owner | Number | Percent of Class | ||||||||||||

| 5% Beneficial Owners: | ||||||||||||||

| Dimensional Fund Advisors LP | 1,657,803 | 7.35 | % | |||||||||||

| Building One | ||||||||||||||

| 6300 Bee Cave Road | ||||||||||||||

| Austin, TX 78746 (1) | ||||||||||||||

| BlackRock, Inc. | 1,422,258 | 6.30 | % | |||||||||||

| 55 East 52nd Street | ||||||||||||||

| New York, NY 10055 (2) | ||||||||||||||

| The Vanguard Group | 1,221,355 | 5.41 | % | |||||||||||

| 100 Vanguard Blvd. | ||||||||||||||

| Malvern, PA 19355 (3) | ||||||||||||||

| Names of Named Executive Officers and Directors/Nominees: | ||||||||||||||

| David Meyer (4) | 1,862,864 | 8.25 | % | |||||||||||

| Mark Kalvoda (5) | 179,119 | * | ||||||||||||

| Bryan Knutson (6) | 61,659 | * | ||||||||||||

| Tony Christianson (7) | 230,325 | 1.02 | % | |||||||||||

| Stanley Dardis (8) | 43,968 | * | ||||||||||||

| Stanley Erickson (9) | 33,142 | * | ||||||||||||

| Christine Hamilton (10) | 17,549 | * | ||||||||||||

| Jody Horner (11) | 31,329 | * | ||||||||||||

| Richard Mack (12) | 31,875 | * | ||||||||||||

| Frank Anglin (13) | 745 | * | ||||||||||||

| All executive officers and directors/nominees as a group (10 persons) (14) | 2,492,575 | 11.04 | % | |||||||||||

* Less than one percent.

(1)This information is based on the Schedule 13G/A filed with the SEC by Dimensional Fund Advisors LP ("Dimensional") on February 8, 2022. Dimensional, an investment advisor registered under Section 203 of the Investment Advisers Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-advisor to certain other commingled funds, group trusts and separate accounts (the “Dimensional Funds”). In its role as investment advisor, sub-advisor or manager, Dimensional may possess investment and/or voting power over the securities of the Company that are owned by the Dimensional Funds, and may be deemed to be the beneficial owner of the shares of Common Stock held by the Dimensional Funds. However, Dimensional reports that all such Common Stock is owned by the Dimensional Funds and disclaims beneficial ownership of such Common Stock.

(2)This information is based on the Schedule 13G/A filed with the SEC by BlackRock, Inc. on February 7, 2022. BlackRock, Inc., as parent company of various subsidiaries listed in the Schedule 13G/A, may be deemed to beneficially own the shares held by such subsidiaries. BlackRock, Inc. reported that, as of December 31, 2021, it had sole voting power over 1,392,922 shares of Common Stock and sole dispositive power over 1,422,258 shares of Common Stock.

(3)This information is based on the Schedule 13G filed with the SEC by The Vanguard Group on February 10, 2022. The Vanguard Group reported that, as of December 31, 2021, it had shared voting power over 22,478 shares of Common Stock, sole dispositive power over 1,221,355 shares of Common Stock, and shared dispositive power over 25,862 shares of Common Stock.

(4)Includes 1,750,000 shares of Common Stock held by the Meyer Family Investment Limited Liability Limited Partnership, over which Mr. Meyer has shared voting and investment control.

(5)Includes 57,558 restricted shares held by Mr. Kalvoda that are subject to risk of forfeiture.

(6)Includes 31,068 restricted shares held by Mr. Knutson that are subject to risk of forfeiture.

6

(7)Includes 180,000 shares of Common Stock beneficially owned by Adam Smith Companies, LLC. Mr. Christianson may be deemed to share beneficial ownership of shares of Common Stock held beneficially by Adam Smith Companies, LLC by virtue of his status as a controlling owner of this entity. Mr. Christianson expressly disclaims beneficial ownership of any shares held by Adam Smith Companies, LLC, except to the extent of his pecuniary interest in such entity. Also includes 2,146 restricted shares held by Mr. Christianson that are subject to risk of forfeiture.

(8)Includes 1,500 shares held by Mr. Dardis' revocable living trust. Also includes 2,146 restricted shares held by Mr. Dardis that are subject to risk of forfeiture.

(9)Includes 2,146 restricted shares held by Mr. Erickson that are subject to risk of forfeiture.

(10)Includes 2,146 restricted shares held by Ms. Hamilton that are subject to risk of forfeiture.

(11)Includes 2,146 restricted shares held by Ms. Horner that are subject to risk of forfeiture.

(12)Includes 2,146 restricted shares held by Mr. Mack that are subject to risk of forfeiture.

(13)Includes 745 restricted shares held by Mr. Anglin that are subject to risk of forfeiture.

(14)Includes 102,247 restricted shares held by our executive officers and directors that are subject to risk of forfeiture.

BOARD OF DIRECTORS

The Board consists of three classes of directors, which classes are, as of the date of this Proxy Statement, composed of:

•three Class III directors who hold office until the 2022 Annual Meeting;

•two Class I directors who hold office until the 2023 Annual Meeting; and

•three Class II directors who hold office until the 2024 Annual Meeting

or, in all cases, until their successors are elected and qualified.

Stan Dardis, a current Class III director, has decided not to stand for re-election to the Board at the Annual Meeting, and his director service will terminate as of the Annual Meeting. Given Mr. Dardis is not standing for re-election, the Board has decided to reduce the size of the Board from eight members to seven members and the number of Class III directors from three to two, as of the Annual Meeting.

As a result, the Governance/Nominating Committee has recommended, and the Board has approved, Frank Anglin and David Meyer as director nominees for the two Class III director positions to be elected at the 2022 Annual Meeting.

The following information states the principal occupations for at least the past five years of the 2022 director nominees and the remaining directors whose terms will continue beyond the Annual Meeting:

| 2022 Nominees Upon election, these Directors will Hold Office Until the 2025 Annual Meeting | Age | Position/Committee Membership/Biography | ||||||||||||

| David Meyer | 69 | Board Chair and Chief Executive Officer | ||||||||||||

| Mr. Meyer is our Board Chair and Chief Executive Officer. Mr. Meyer worked for JI Case Company in 1975. From 1976 to 1980, Mr. Meyer was a partner in a Case/New Holland Dealership with locations in Lisbon, North Dakota and Wahpeton, North Dakota. In 1980, Mr. Meyer, along with a partner, founded Titan Machinery Inc. Mr. Meyer has served on both the Case CE and CaseIH Agriculture Dealer Advisory Boards. Mr. Meyer is the past chairman and past board member of the North Dakota Implement Dealers Association. Mr. Meyer currently serves as a Director on the North Dakota Community Foundation and Director on the Evans Scholars Foundation (ESF) of the Western Golf Association (WGA). Among other attributes, skills and qualifications, the Board believes that Mr. Meyer is uniquely qualified to serve as a director and the Board's Chair because he is the person most familiar with the Company's history, business and industry, and is capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. | ||||||||||||||

7

| Frank Anglin | 59 | Director | ||||||||||||

Mr. Anglin has been a director of Titan Machinery since February 1, 2022. Mr. Anglin has served as the Vice President, West and South Regions, for Istate Truck Centers since September 2019. Previously, Mr. Anglin served as Chief Executive Officer, President and Director for Boyer Trucks from July 2018 to August 2019 and as CEO and Board Director for Midwest Can and Container Specialties Inc. from January 2017 to May 2018. He also served as CEO, President, and Director for Western Peterbilt and Western Truck Centers. Prior to that he held a variety of management positions during his tenure at General Electric and CNH Industrial (“CNH”). Among other attributes, skills and qualifications, the Board believes that Mr. Anglin is uniquely qualified to serve as a director based on his substantial leadership experience in the equipment manufacturing and truck dealership industries, which provides the Board with a seasoned perspective on dealership operations, equipment manufacturing, operating strategies, financing, and investment strategies. | ||||||||||||||

| Directors Who Hold Office Until the 2023 Annual Meeting | Age | Position/Committee Membership/Biography | ||||||||||||

| Tony Christianson | 69 | Director; Governance/Nominating Committee; Compensation Committee | ||||||||||||

| Mr. Christianson has been a director of Titan Machinery since January 2003. Since 1981, Mr. Christianson has been the Chairman of Cherry Tree Companies, an affiliated group of investment banking and wealth management firms in Minneapolis, Minnesota. Mr. Christianson served as a director of the following public company during the last 5 years: AmeriPride, Inc. Mr. Christianson also currently serves as managing partner of Adam Smith Companies, LLC, a holding company with investments in several companies, and as a director of MetaFarms, Inc., a privately-held SAS provider of information management for animal protein production. Among other attributes, skills and qualifications, the Board believes that Mr. Christianson is uniquely qualified to serve as a director based on his experience in the financial services and investment industries, as well as his experience as a public and private company director, which provides the Board with a seasoned view on financing, investment, acquisition and operating strategies, public company regulatory compliance issues, and investor relations. | ||||||||||||||

| Christine Hamilton | 66 | Director; Chair of Governance/Nominating Committee; Audit Committee | ||||||||||||

| Ms. Hamilton has been a director of Titan Machinery since March 1, 2018. Ms. Hamilton is the co-owner and managing partner of Christiansen Land and Cattle, Ltd., a large diversified farming and ranching operation in central South Dakota, and is also the co-owner of Dakota Packing, Inc., a wholesale meat distribution business. Ms. Hamilton is a former director for the Federal Reserve Bank, Ninth District, located in Minneapolis, Minnesota, and is a current director of SAb Biotherapeutics, a publicly-traded clinical stage biopharmaceutical company, where she serves as chair of its compensation committee and a member of its nominating and corporate governance committee. Among other attributes, skills and qualifications, the Board believes that Ms. Hamilton is uniquely qualified to serve as a director based on her extensive experience in the agri-business sector and in management roles and her knowledge of operating strategies and priorities and challenges facing our customers in the agri-business sector. | ||||||||||||||

| Directors Who Hold Office Until the 2024 Annual Meeting | Position/Committee Membership/Biography | |||||||||||||

| Stan Erickson | 71 | Lead Independent Director; Audit Committee; Compensation Committee | ||||||||||||

| Mr. Erickson has been a director of Titan Machinery since March 1, 2017. Mr. Erickson currently serves as the President and Chief Executive Officer of Liberty Capital, Inc., which provides capital and investment services. Mr. Erickson co-founded Liberty Capital in 2013 after retiring from a 32-year career at Ziegler Inc., a Caterpillar dealer, where he most recently served as President and Chief Operating Officer. Mr. Erickson is a veteran of the United States Marine Corps and currently serves on the board of directors of Electromed, Inc., a publicly-traded company, where he serves as chair of the audit committee and a member of the nominating and governance committee. Among other attributes, skills and qualifications, the Board believes that Mr. Erickson is uniquely qualified to serve as a director based on his experience in the equipment industry, as well as his experience as a public company director, which provides the Board with a seasoned view on financing, investment, acquisition and operating strategies, public company regulatory compliance issues, and investor relations. | ||||||||||||||

8

| Jody Horner | 60 | Director; Chair of Compensation Committee; Governance/Nominating Committee | ||||||||||||

| Ms. Horner has been a director of Titan Machinery since August 1, 2015. In February 2015, Ms. Horner was appointed President of Midland University, a private liberal arts college located in Fremont, Nebraska. Prior to joining Midland University, Ms. Horner spent over 30 years at Cargill, Inc., holding several leadership positions including President of Cargill Meat Solutions, President of Cargill Case Ready, President of Cargill Salt, Vice President - Corporate Global Diversity, and Vice President - Human Resources. At Cargill, Ms. Horner was a member of several corporate committees including the Global Business Conduct & Ethics Committee and the Global Enterprise Process, Data and Technology Committee. Among other attributes, skills and qualifications, the Board believes Ms. Horner is uniquely qualified to serve as a director based on her 30 years of experience in leadership positions and her knowledge of financial matters, operating strategies, agri-business markets, and human resources. | ||||||||||||||

| Richard Mack | 54 | Director; Chair of Audit Committee | ||||||||||||

| Mr. Mack has been a director of Titan Machinery since June 4, 2015. From June 2014 through his retirement in January 2018, Mr. Mack served as Executive Vice President and Chief Financial Officer for The Mosaic Company, a leading international producer and marketer of phosphate and potash crop nutrients. Prior to that, Mr. Mack held the position of Senior Vice President, General Counsel and Corporate Secretary for Mosaic from the date of its initial public offering in 2004 until his promotion to Executive Vice President in 2009. In the decade prior to Mosaic's formation, he served in various legal capacities at Cargill, Inc., and was a founding executive of Mosaic and Cargill Ventures. Mr. Mack was also the founder of the Streamsong Resort, which is owned by Mosaic. Mr. Mack currently serves as a director and audit committee chair of Anuvia Plant Nutrient Holdings, Inc., which is a privately-held crop nutrient company; and a director and finance committee chair of H.J. Baker & Bro., LLC, a privately-held sulphur and animal nutrition industry company. Among other attributes, skills and qualifications, the Board believes that Mr. Mack is uniquely qualified to serve as a director based on his experience as a public company executive, his familiarity with public company finance, financial statements, and capital markets, and his knowledge of corporate governance, agri-business markets, mergers and acquisitions, operating strategies, and international business. | ||||||||||||||

9

Board Skills and Experience Matrix

The following matrix provides information regarding the members of our Board, including certain types of knowledge, skills, experiences and attributes possessed by one or more of our directors, which our Board believes are relevant to our business and industry structure, and the tenure of our directors. The matrix does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, the absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of the Board. As shown by the tenure of our directors below, the Board also believes it is desirable to maintain a mix of experienced, longer-tenured directors who possess deep institutional knowledge along with newer directors who have different expertise, backgrounds and fresh perspectives.

| F. Anglin | T. Christianson | S. Erickson | C. Hamilton | J. Horner | R. Mack | D. Meyer | |||||||||||||||||

| Knowledge, Skills and Experience | |||||||||||||||||||||||

| Other Public Company Board Experience | X | X | X | ||||||||||||||||||||

| Executive Leadership | X | X | X | X | X | X | X | ||||||||||||||||

| Industry Knowledge | X | X | X | X | X | X | |||||||||||||||||

| Finance and Accounting | X | X | X | X | X | X | |||||||||||||||||

| Corporate Strategy and Execution | X | X | X | X | X | X | X | ||||||||||||||||

| Sales and Marketing | X | X | X | ||||||||||||||||||||

| Corporate Governance and Compliance | X | X | X | X | X | X | X | ||||||||||||||||

| Operations and Supply Chain | X | X | X | X | X | ||||||||||||||||||

| International Operations | X | X | X | X | |||||||||||||||||||

| Human Capital and Executive Compensation | X | X | X | X | X | X | |||||||||||||||||

| Risk Management | X | X | X | X | X | X | X | ||||||||||||||||

| Technology and Data Security | X | X | X | ||||||||||||||||||||

| Director Independence | X | X | X | X | X | X | |||||||||||||||||

| Board Tenure | |||||||||||||||||||||||

| Years | 1 | 15 | 5 | 4 | 7 | 7 | 15 | ||||||||||||||||

Board Diversity Matrix

The Company is committed to diversity and inclusion, and believes it is important that the Board is composed of individuals representing the diversity of the communities and customers we serve. The Governance/Nominating Committee seeks director nominees with a diverse range of experience, skills, knowledge and backgrounds. The Board Diversity Matrix set forth below reports self-identified diversity statistics for the current Board as of the date of this proxy statement in the format required by Nasdaq’s rules. As noted above, Mr. Dardis, a current director, is not standing for re-election at the Annual Meeting, and his director service will terminate as of the Annual Meeting resulting in the Board size being reduced to seven members.

10

| Board Diversity Matrix (As of April 25, 2022) | ||||||||||||||

| Board Size: | ||||||||||||||

| Total Number of Directors | 8 | |||||||||||||

| Gender: | Female | Male | Non-Binary | Gender Undisclosed | ||||||||||

| Number of Directors Based on Gender Identity | 2 | 6 | 0 | 0 | ||||||||||

| Number of Directors Who Identify in Any of the Categories Below: | ||||||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or American Indian | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 2 | 5 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ+ | 0 | |||||||||||||

| Demographic Background Undisclosed | 0 | |||||||||||||

ELECTION OF DIRECTORS

(PROPOSAL 1)

2022 Director Nominees

The Governance/Nominating Committee recommended to the Board that the following persons be nominated and elected as directors at the Annual Meeting, which persons were then formally nominated by the Board:

| Frank Anglin | ||||||||||||||

| David Meyer | ||||||||||||||

The nominees are currently Class III Directors whose terms expire at the upcoming 2022 Annual Meeting. Mr. Anglin was elected as a director of the Company with a term commencing on February 1, 2022, and was initially recommended for election by the Company's Chief Executive Officer. Each of the nominees has consented to being named as a nominee. If elected, each nominee will serve a three-year term until the 2025 Annual Meeting or until his successor is elected and qualified. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies that are returned and signed will be voted for the nominee designated by the Board to fill the vacancy.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS SET FORTH IN THIS PROPOSAL 1.

NON-EMPLOYEE DIRECTOR COMPENSATION

Our non-employee directors receive cash and restricted stock awards as compensation for their service as directors pursuant to our Non-Employee Director Compensation Plan, which, for fiscal 2022, was as follows:

| Cash Retainer ($) | Restricted Stock Awards ($) | |||||||||||||

| Compensation for each non-employee director | 50,000 | 70,000 | ||||||||||||

| Additional cash retainers: | ||||||||||||||

| Audit Committee Chair | 25,000 | |||||||||||||

| Compensation Committee Chair | 10,000 | |||||||||||||

| Governance/Nominating Committee Chair | 10,000 | |||||||||||||

| Lead Independent Director | 15,000 | |||||||||||||

We also reimburse our non-employee directors for reasonable expenses incurred in connection with their service as directors. The restricted stock awards are granted on the date of the annual meeting of stockholders each year, and vest on the date of the next annual meeting of stockholders. Directors who are appointed to the Board during the year receive a prorated cash retainer and restricted stock award, the equity component of which is granted on the director's effective start date and has the same vesting date as awards to directors who serve for the full year.

11

Upon review and recommendation of the Compensation Committee, the Board approved changes to our Non-Employee Director Compensation Plan (the “Updated Director Compensation Plan”), effective February 1, 2022. Beginning for fiscal 2023, the compensation to be paid to our non-employee directors for their service as directors under the Updated Director Compensation Plan is as follows:

| Cash Retainer ($) (1) | Restricted Stock Awards ($) (2) | |||||||||||||

| Compensation for each non-employee director | 55,000 | 80,000 | ||||||||||||

| Additional cash retainers: | ||||||||||||||

| Audit Committee Chair | 25,000 | |||||||||||||

| Compensation Committee Chair | 10,000 | |||||||||||||

| Governance/Nominating Committee Chair | 10,000 | |||||||||||||

| Lead Independent Director | 15,000 | |||||||||||||

(1) The new cash retainer amount is effective as of February 1, 2022.

(2) The new restricted stock award value is effective as of the June 6, 2022 equity grant to directors.

Under the terms of the Updated Director Compensation Plan, the cash portion of the non-employee director retainer (both the Board annual retainer and any committee or lead independent director retainer) is to be paid in arrears in equal quarterly installments on the first day of each fiscal quarter. As under the prior Non-Employee Director Compensation Plan, restricted stock awards under the Updated Director Compensation Plan are granted on the date of the annual meeting of stockholders each year, and vest on the date of the next annual meeting of stockholders or such other date as determined by the Compensation Committee. Directors who are appointed to the Board during the year will continue to receive a prorated cash retainer and restricted stock award, the equity component of which is granted on the director's effective start date and has the same vesting date as awards to directors who serve for the full year.

In addition, pursuant to the Updated Director Compensation Plan, unvested restricted stock awarded to a director is forfeited upon termination from service, unless the reason for termination from service is as a result of death, permanent disability (as determined by the Compensation Committee) or mandatory retirement pursuant to the Board’s retirement policy, in which case the unvested restricted stock award will vest on a prorated basis based upon the term of service as compared to the vesting period.

The following table provides compensation information for our non-employee directors during fiscal 2022:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Total ($) | |||||||||||||||||

| Tony Christianson | 50,000 | 70,000 | 120,000 | |||||||||||||||||

| Stan Dardis | 65,000 | 70,000 | 135,000 | |||||||||||||||||

| Stan Erickson | 50,000 | 70,000 | 120,000 | |||||||||||||||||

| Christine Hamilton | 60,000 | 70,000 | 130,000 | |||||||||||||||||

| Jody Horner | 60,000 | 70,000 | 130,000 | |||||||||||||||||

| Richard Mack | 75,000 | 70,000 | 145,000 | |||||||||||||||||

(1)These amounts represent the grant date fair value for each grant awarded in fiscal 2022, valued in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 718, Compensation—Stock Compensation. Each director received an award of 2,146 restricted shares based on the $32.62 closing price for our Common Stock on the grant date of June 7, 2021.

STOCK OWNERSHIP AND RETENTION GUIDELINES

Stock Ownership Guidelines

In order to align the interests of senior officers and directors of the Company with the interests of our stockholders and to promote our commitment to sound corporate governance, our Compensation Committee has adopted stock ownership guidelines for senior officers and directors of the Company (the “Stock Ownership Guidelines”). The Stock Ownership Guidelines require that the officers of the Company listed below hold the following dollar value of shares of our Common Stock during their employment with the Company:

•Chief Executive Officer - 3x annual base salary

12

•Chief Financial Officer and Chief Operating Officer - 2x annual base salary

•All other executive leadership team members - 50% of annual base salary

In addition, the Stock Ownership Guidelines require that each non-employee director of the Company must hold shares of Common Stock with a dollar value equal to four times the annual cash retainer paid to non-employee directors (excluding, for purposes of this calculation, any cash retainer paid to a non-employee director for purposes of serving as the lead independent director or as a committee chair). Also, to further align director and stockholder interests, our restricted stock award agreements with our non-employee directors require that the restricted stock received thereunder must be held by the non-employee director and not sold during his or her term of service as a director, provided that, under the terms of the Updated Director Compensation Plan, a director is permitted to sell a number of shares of Common Stock sufficient to cover state and federal tax liabilities arising from the current year's vesting of such Director's restricted stock award at the highest applicable federal and state marginal tax rates (not to exceed 50%).

For purposes of measuring compliance with the Stock Ownership Guidelines, shares of Common Stock owned directly or indirectly by the officer or director or his or her immediate family members residing in the same household and unvested time-based restricted stock are considered “owned” shares. Shares underlying unexercised stock options, unvested performance-based restricted stock and unvested restricted stock units do not count towards satisfying the Stock Ownership Guidelines requirements. The Compensation Committee reviews and reports to the Board on an annual basis regarding the stock ownership levels of our senior officers and directors. In connection with receipt and consideration of such reports, the Board expects to see meaningful progress towards the achievement of the Stock Ownership Guidelines as compared to ownership by our senior officers and directors as of the date of the previous report.

Each of the officers and directors of the Company subject to the Stock Ownership Guidelines is afforded a reasonable period of time to achieve these minimum ownership levels. As of April 25, 2022, all executive officers and directors, other than Mr. Anglin who joined our Board as of February 1, 2022, had satisfied the Stock Ownership Guidelines. Mr. Anglin is making meaningful progress toward meeting the requirements of the Stock Ownership Guidelines.

Trading Restrictions and Hedging Policy

Our insider trading policy prohibits our directors and officers from trading our securities on a short-term basis and requires that any of our Common Stock purchased in the open market be held for a minimum of six months. This policy also requires that directors and officers not "pledge" or "sell short" our Common Stock or buy or sell put or call options on our Common Stock. In addition, pursuant to this policy, we also prohibit directors, officers and employees from engaging in any speculative transactions or hedging transactions with respect to Company securities, including forward sale or purchase contracts, equity swaps, collars and exchange funds.

SUSTAINABILITY

Our mission at Titan Machinery is to serve the farmers and contractors who feed and build our world. This mission requires that we focus on environmental, social and governance issues. We are committed to conducting our business operations and activities in a manner that maintains the health and safety of our employees, customers, visitors and contractors, protects the environment, conserves natural resources, positions us as a responsible and engaged partner in communities where we operate, and promotes an inclusive and engaged workforce. For more information on our commitment to sustainability matters, please visit the Investor Relations section of Titan Machinery Inc. website at http://www.titanmachinery.com.

Health and Safety

We believe it is our responsibility to maintain a safe and healthy workplace in each of our business locations and to seek to make continuous improvements in this area. We strive to embed safety into every level of the organization as a top priority. We ensure that safety performance data is tracked, aggregated, and reviewed on an ongoing basis. Our department of Human Resources oversees our health and safety programs for our workplaces.

Our corporate safety team collects data on recordable injury rates, serious injury rates, and near misses from each of our facilities, and engages in a root cause analysis and identifies corrective action to reduce the risk of future occurrences. This data is reviewed at least monthly by the executive leadership team and shared with the Board on a quarterly basis. Regular safety meetings are held at our facilities for store employees.

We are also committed to improving the health and well-being of our employees. Our U.S. wellness program is continuously evolving to better educate, motivate and reward our employees for maintaining and achieving healthy measures.

13

Environmental Sustainability

We work to be a positive force in protecting the environment by continually looking for ways to conserve water, minimize energy consumption, lower emissions and reduce waste, and safely handle hazardous substances. As we design, build and operate our stores and other facilities, we are focused on conserving natural resources.

As a retail distributor, we do not make the products we sell. However, we are in a position to collaborate with and encourage our suppliers to develop equipment that is more energy efficient and has lower emissions of greenhouse gases. We believe that our primary supplier of equipment, CNH Industrial, is a global leader in environmental sustainability, and we share its values in this area. CNH Industrial has been at the forefront of sustainable product innovation as evidenced by its introduction of advanced precision solutions to our customers in order to allow them to maximize their acreage yields and minimize time spent using machinery. In addition, we partner with suppliers and customers to promote precision farming products and farm management services, which enable growers to reduce the use of fertilizer, chemicals, water, and other inputs.

Community Engagement

As a Company, we are committed to the communities we serve. As busy as our employees are, they make time to help their neighbors and support charities across our footprint. Across our Company, we offer all regular employees up to 12 hours of paid time off each calendar year for volunteer firefighting and emergency medical assistance, and an additional 16 hours of paid time off each calendar year for other community service activities.

Commitment to Inclusive Workplace

We are committed to an inclusive workplace where all employees are valued and have the opportunity to reach their full potential. We utilize a variety of initiatives across our footprint to recruit minorities, women, and veterans, as we attempt to diversify our workforce. We know that having a diverse workforce is not enough, we also need to build a culture of inclusion that leverages the strengths of all of our employees. From new hire orientation to management and leadership training provided through an online portal accessible to all employees, we are focused on developing global mindsets, breaking unconscious biases and demonstrating the business case for diversity across the organization.

Our Compensation Committee has included, as part of its core agenda, an annual review of our diversity and inclusion strategy. The Compensation Committee will review data from engagement surveys; industry benchmarks; the number of employees and managers trained on unconscious bias and inclusive behaviors; and measurement of key metrics of gender and ethnic representation throughout our Company. Our Compensation Committee is focused on seeing continuous improvements by the Company in these areas.

We conduct periodic comprehensive employee engagement surveys designed to measure organizational culture, monitor overall employee engagement, identify actions that can be taken to improve our employee engagement and motivation, and to take steps to improve employee retention. Data collected in each employee engagement survey is maintained and used to track our progress against our internal goals. Company management continually monitors employee turnover data, which is supplemented with additional data from exit surveys to assist in determining the reasons for voluntary employee terminations. We welcome this transparent process and are committed to empowering our employees to express their views on relevant workplace matters.

Commitment to Ethical Culture

In every business decision and transaction, we endeavor to act ethically – and we expect our employees and business partners to share in this effort. This means conducting business with integrity, while complying with all laws, rules and standards of conduct that apply to us in the many countries where we do business. We promote our commitment to ethics and compliance among our global workforce through our Code of Ethics and related policies, and training programs.

CORPORATE GOVERNANCE

Corporate Governance Highlights

We believe that good corporate governance promotes the long-term interests of our stockholders, strengthens Board accountability, and leads to stronger business performance. We are committed to maintaining robust corporate governance practices and will evaluate these practices going forward on a regular basis.

The following summarizes certain highlights of our governance policies and practices:

•6 out of 7 continuing directors and director nominees are independent; only non-independent director is CEO

14

•Audit Committee, Governance/Nominating Committee and Compensation Committee each composed entirely of independent directors

•Lead Independent Director

•Independent directors meet regularly in private executive sessions without management present

•Director attendance at >75% of Board and committee meetings in fiscal 2022

•Diverse Board in terms of gender, skills, experiences and qualifications

•Balance of new and experienced directors on Board

•Mandatory retirement at age 75

•Code of Ethics and Business Conduct applies to all employees, directors, consultants and officers

•Annual say-on-pay vote

•Robust stock ownership guidelines for senior officers and directors

•Risk oversight by full Board and committees

•Annual review of committee charters

•No stockholder rights plan (i.e., no "poison pill")

•Insider Trading Policy prohibits hedging and pledging of Company securities

•CEO evaluation process

•Annual board evaluation

Board Leadership Structure

David J. Meyer serves in the combined role of Board Chair and Chief Executive Officer. The Board believes that Mr. Meyer's service in this combined role is in the best interests of the Company and its stockholders for the reasons discussed below.

Mr. Meyer possesses unique familiarity with the Company's history, business and industry, making him capable of effectively leading discussions among directors of diverse backgrounds and experience regarding the Company's operations and strategy. As the Chief Executive Officer, Mr. Meyer has responsibility for overseeing the Company’s day-to-day operations and must continually possess a comprehensive knowledge of the Company’s business, including the Company’s opportunities and challenges. Mr. Meyer is in the best position to prioritize the Board's agenda items, to identify issues to bring to the Board, and to lead the development of the Board’s strategic plans. We feel that certain other practices initiated by the Board secure independent oversight of management without the need to separate the roles of Chief Executive Officer and Board Chair. These include our appointment of a Lead Independent Director, our policy requiring that all members of our standing committees be independent, and our policy that the independent directors of the Board and the committees of the Board hold regular executive sessions outside the presence of the Chief Executive Officer and other management.

Stan Dardis, an independent director, was selected by the Board to continue to serve as the Lead Independent Director during fiscal 2022. Mr. Dardis is not standing for re-election to the Board, and his director service will terminate as of the Annual Meeting. The Board has elected Stan Erickson, an independent director, as the Lead Independent Director, effective as of February 1, 2022. The Lead Independent Director has the responsibility of presiding at all executive sessions of the Board, consulting with the Board Chair and Chief Executive Officer on Board and committee meeting agendas, maintaining frequent contact with the Board Chair and Chief Executive Officer, advising the Board Chair and Chief Executive Officer on the efficiency of the Board meetings, and facilitating teamwork and communication among the non-employee directors and management.

Independence

Our Board has determined that seven of our eight current directors are independent directors, as defined by Rule 5605(a)(2) of the listing standards of the Nasdaq Stock Market, including Mr. Dardis who is not standing for re-election. The seven current independent directors are: Frank Anglin, Tony Christianson, Stan Dardis, Stan Erickson, Christine Hamilton, Jody Horner, and Richard Mack. In making this determination, the Board considered the analysis and recommendations of the Governance/Nominating Committee, as well as any related person transactions and other relationships with the Company.

15

Code of Ethics and Business Conduct

In December 2018, the Board approved an updated Code of Ethics and Business Conduct that applies to all employees, directors, consultants and officers, including the principal executive officer, principal financial officer, principal accounting officer and controller. The Code of Ethics and Business Conduct addresses such topics as protection and proper use of our assets, compliance with applicable laws and regulations, accuracy and preservation of records, accounting and financial reporting, conflicts of interest and insider trading. The Code of Ethics and Business Conduct is available under "Corporate Governance" on the "Investor Relations" page of the Company's website at www.titanmachinery.com. The Company intends to include on its website at www.titanmachinery.com any amendment to, or waiver from, a provision of its Code of Ethics and Business Conduct that applies to the principal executive officer, principal financial officer, principal accounting officer or controller that relates to any element of the code of ethics definition enumerated in Item 406(b) of SEC Regulation S-K.

Board's Oversight of Risk Management

We believe that a structured, conscientious approach to risk management is a top priority for our Company. Our Board, both directly and through its committees, reviews and oversees our Enterprise Risk Management (“ERM”) program, which is an enterprise-wide program designed to identify critical enterprise risks and to develop mitigation plans to manage those risks.

While the Board and its committees exercise oversight of risk management, the executive team is responsible for implementing and supervising day-to-day risk management processes and reporting to the Board and its committees. In fulfilling its responsibilities, management has developed a formal ERM process which includes the preparation of a written ERM Report.

The ERM Report describes specific risks within the following categories: Operations, International, Financial, Legal and Compliance, IT Systems, and Strategic. Each of these categories is assigned to a member of the executive team, who maintains primary responsibility for management of the applicable risks and updating the ERM Report no less than semi-annually. The ERM Report includes management’s assessment of the likelihood and potential impact of each identified risk, management’s assessment of the Company’s current capability to manage the risk, any risk mitigation plans in place or being developed, tracking of key risk indicators, and the future outlook for the risks.

On a semi-annual basis, management presents to the Board the ERM Report as updated by management. In addition, the Board’s standing committees support the Board by regularly addressing various risks in their respective areas of oversight as discussed below.

We believe that our ERM program accomplishes the following:

•Clearly defines risk management roles and responsibilities;

•Brings together senior management to discuss risk;

•Promotes visibility and constructive dialogue around risk; and

•Facilitates appropriate risk response strategies at the Board, committee, and management levels.

In addition to the regular processes related to the ERM Report, management has established working committees that meet regularly to assess risks in certain areas, including an International Risk Committee that reviews all aspects of our international business risks and a Finance Risk Committee that reviews the Company’s derivative instruments, interest rate risk, and foreign currency exposures.

Audit Committee’s Role in Oversight of Risk Management

The Audit Committee receives regular reports from: the corporate controller on significant accounting matters; the financial reporting manager on periodic Exchange Act reports and related financial disclosures; the outside auditor on financial reporting matters; the internal audit department on audit results and internal control matters; and the General Counsel regarding compliance, legal and regulatory risks. In addition, the Audit Committee receives in depth reports no less than annually on the audit plan of the internal audit department, tax matters affecting the Company, cybersecurity and data security risks, treasury and banking operations, and credit department operations.

Day-to-day management of data security and cybersecurity is the responsibility of our Vice President, Information Technology, who reports directly to our Chief Executive Officer. At least annually, the Vice President, Information Technology, presents to the Audit Committee a formal report on cybersecurity and data security risks. This report includes the results of the IT Department’s self-evaluation of vulnerability to cyber risks, using the Center for Internet Security (“CIS”) framework. The Company has implemented an IT/Cyber Risk learning program under which all employees are required to view periodic on-demand webinars including quizzes following the presentations. The Company is covered by a cybersecurity insurance policy.

16

The Audit Committee reserves time at each meeting for private sessions with the Chief Financial Officer, General Counsel, head of the internal audit department, and outside auditors.

Compensation Committee’s Role in Oversight of Risk Management

The Compensation Committee assists the Board in fulfilling its risk management oversight responsibilities with respect to risks arising from compensation policies and programs and other employment programs. On an annual basis, the Compensation Committee reviews and addresses risks arising out of the Company’s executive compensation programs, cash incentive programs for other groups of employees, and sales commission plans. In establishing and reviewing the Company’s compensation programs, the Compensation Committee evaluates whether the design and operation of the compensation programs encourage our executive officers or our employees to take unnecessary or excessive risks.

Governance/Nominating Committee’s Role in Oversight of Risk Management

The Governance/Nominating Committee assists the Board in fulfilling its risk management oversight responsibilities with respect to risks related to Board structure and composition, succession planning, and corporate governance. In addition, the Governance/Nominating Committee oversees the Board's annual self-evaluation process.

Our Leadership Structure is Supportive of Board Oversight of Risk Management

We believe that our leadership structure supports the risk oversight function of the Board in the following respects:

•With our Chief Executive Officer serving on the Board, he promotes open communication between management and directors relating to risk.

•Each of the committee chairs reports to the full Board at regular meetings concerning the activities of the committee, including the matters discussed above that involve risk management.

•Each Board committee is comprised solely of independent directors, and all directors are actively involved in the risk oversight function.

•The Lead Independent Director promotes communication and consideration of matters presenting significant risks to the Company through his role in developing the Board’s meeting agendas, advising committee chairs, attending committee meetings, chairing meetings of the independent Directors and facilitating communications between independent Directors and the Chief Executive Officer.

Stockholder Communications with the Board of Directors

Stockholders may communicate directly with the Board of Directors. All communications should be directed to the Company's Corporate Secretary at the address below:

Titan Machinery Inc. Board of Directors

Attention: Corporate Secretary

644 East Beaton Drive

West Fargo, North Dakota 58078

The communication should prominently indicate on the outside of the envelope the director or directors to whom it is directed. The Company's Corporate Secretary will forward the communications to all specified directors or, if no directors are specified, to the entire Board.

Directors' Attendance at Annual Meetings

Directors' attendance at annual meetings of stockholders can provide stockholders with an opportunity to communicate with directors about issues affecting the Company. The Board's policy is that, subject to unavoidable personal or business conflicts, directors shall attend stockholders meetings. All of our directors attended the Annual Meeting of Stockholders held virtually on June 7, 2021.

Board and Committees Meetings

During fiscal 2022, the Board held eight meetings. The directors also participate in periodic virtual and/or telephonic conference calls with management for the purpose of reviewing updates on financial performance and business operations. The independent directors met in executive session at least quarterly during fiscal 2022. When appropriate, the Board takes formal action by written consent of all directors, in accordance with the Company's Certificate of Incorporation, Bylaws and the General Corporation Law of the State of Delaware.

Our Board has three standing committees: the Audit Committee, the Compensation Committee, and the Governance/Nominating Committee. Members of such committees met formally and informally from time to time throughout fiscal 2022 on committee matters.

17

During fiscal 2022, all directors attended 75% or more of the aggregate number of meetings of the Board and of committees of which each respective director was a member.

Committee Membership

The following table sets forth the membership of each of the Company's committees during fiscal 2022.

| Audit Committee | Governance/Nominating Committee | Compensation Committee | |||||||||

| Richard Mack (Chair) | Christine Hamilton (Chair) | Jody Horner (Chair) | |||||||||

| Stan Erickson | Tony Christianson | Tony Christianson | |||||||||

| Christine Hamilton | Jody Horner | Stan Erickson | |||||||||

Audit Committee

The Audit Committee acts pursuant to a written charter. The charter, which is reviewed annually by the Audit Committee, may be amended upon approval of the Board. The Audit Committee charter is available under "Corporate Governance" on the "Investor Relations" page of our website at www.titanmachinery.com. Among other matters, our Audit Committee:

•assists the Board in fulfilling its oversight responsibility to our stockholders and other constituents with respect to the integrity of our financial statements;

•appoints and has oversight over our independent auditors, approves the compensation of our independent auditors, reviews the independence and the experience and qualifications of our independent auditors' lead partner, and pre-approves the engagement of our independent auditors for audit and permitted non-audit services;

•meets with the independent auditors and reviews the scope and significant findings of audits and meets with management and internal financial personnel regarding these findings;

•reviews the performance of our independent auditors;

•discusses with management, the director of internal audit, and our independent auditors the adequacy and effectiveness of our financial and accounting controls, practices and procedures, the activities and recommendations of our auditors and our reporting policies and practices, and makes recommendations to the Board for approval;

•establishes procedures for the receipt, retention and treatment of complaints regarding internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and

•prepares the audit committee report required by the SEC rules to be included in our annual proxy statement.

Our independent auditors, internal audit director, General Counsel, and management have regular contact with our Audit Committee. The Audit Committee regularly reports to our Board regarding its actions, decisions and recommendations.

Our Board of Directors determined that the following members who served on the Audit Committee in fiscal 2022 qualified as an "audit committee financial expert" (as defined under SEC rules): Christine Hamilton, Stan Erickson, and Richard Mack. Each member of our Audit Committee satisfied the Nasdaq Stock Market independence standards and the independence standards of Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended. Each member of our Audit Committee during fiscal 2022 possessed the financial qualifications required of audit committee members set forth in the Nasdaq Stock Market listing rules.

The Audit Committee met eight times in fiscal 2022.

Governance/Nominating Committee

The Governance/Nominating Committee acts pursuant to a written charter. The charter, which is reviewed annually by the Governance/Nominating Committee, may be amended upon approval of the Board. The Governance/Nominating Committee charter is available under "Corporate Governance" on the "Investor Relations" page of our website at www.titanmachinery.com.

18

Our Governance/Nominating Committee makes recommendations to our Board regarding candidates for directorships, the size and composition of our Board of Directors, desired director attributes and diversity, and the organization and membership of our committees. In addition, our Governance/Nominating Committee oversees our Code of Ethics and Business Conduct, related party transactions, and other governance policies and matters. The Governance/Nominating Committee regularly reports to the Board regarding its actions, decisions and recommendations.

The Governance/Nominating Committee will review director nominees proposed by stockholders. Stockholders may recommend a nominee to be considered by the Governance/Nominating Committee by submitting a written proposal to the Chair of the Board of Directors at Titan Machinery Inc., 644 East Beaton Drive, West Fargo, North Dakota 58078. A consent signed by the proposed nominee agreeing to be considered as a director should accompany the written proposal. The proposal should include the name and address of the nominee, in addition to the qualifications and experience of the nominee. Please see the section below entitled "Stockholder Proposals" with regard to timing requirements for nominations made directly by a stockholder for consideration at an annual meeting of stockholders.

When selecting candidates for recommendation to the Board, the Governance/Nominating Committee will consider the attributes of the candidates and the needs of the Board and its committees and will review all candidates in the same manner, regardless of the source of the recommendation, including nominees proposed by stockholders. In evaluating director nominees, a candidate should have certain minimum qualifications, including the ability to read and understand basic financial statements, familiarity with our business and industry, high moral character and mature judgment, and the ability to work collegially with others. In addition, factors such as the following are also considered:

•diversity of the Board;

•needs of the Board with respect to particular talent and experience;

•knowledge, skills and experience of a nominee;

•legal and regulatory requirements;

•appreciation of the relationship of our business to the changing needs of society; and

•desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by a new member.

The Company values diversity among its Board members. Our Board and Governance/Nominating Committee believe that a Board comprised of directors with diverse backgrounds, unique skill sets and experiences, and individual perspectives improves the discussions and decision-making process, which contributes to overall Board effectiveness. Although gender and diversity characteristics, such as race, ethnicity and nationality, are important considerations in the Governance/Nominating Committee’s process, the Governance/Nominating Committee and the Board do not have a formal policy with regard to the

consideration of gender and/or diversity in identifying director nominees at this time. However, as described above, the Governance/Nominating Committee seeks to nominate candidates with a diverse range of background, knowledge, experience, skills, expertise, and other qualities that will contribute to the overall effectiveness of the Board.

Each member of the Governance/Nominating Committee satisfies the Nasdaq Stock Market independence standards.

The Governance/Nominating Committee met four times in fiscal 2022.

Compensation Committee

The Compensation Committee acts pursuant to a written charter. The charter, which is reviewed annually by the Compensation Committee, may be amended by approval of the Board. The Compensation Committee charter is available under "Corporate Governance" on the "Investor Relations" page of our website at www.titanmachinery.com.

The primary duties and responsibilities of the Compensation Committee include the following:

•develop and periodically review with management the Company's philosophy of compensation, taking into consideration enhancement of stockholder value and the fair and equitable compensation of all employees;

•review and approve corporate goals and objectives relevant to the compensation of our Chief Executive Officer, Chief Financial Officer and other executive officers, evaluate the performance of these officers in light of those goals and objectives, and set the compensation of these officers based on such evaluations;

•determine and approve equity awards to directors and employees made pursuant to the Company's equity incentive plans;

•establish and monitor minimum stock ownership guidelines for executive officers and directors;

19

•develop, recommend to the Board, review and administer senior management compensation policy and plans, including incentive plans, benefits and perquisites;

•develop, recommend, review and administer compensation plans for non-employee directors;

•annually consider the relationship between the Company's strategic and operating plans and the various compensation plans for which the Committee is responsible;

•periodically review with management, and advise the Board with respect to, employee deferred compensation plans;

•periodically review with management and advise the Board with respect to employee benefits;

•review annually with management the Company's diversity and inclusion initiatives and related accomplishments;

•conduct periodic compensation risk assessments, as further discussed below; and