Form DEF 14A TEVA PHARMACEUTICAL INDU For: Jun 14

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||||

| ☐ | Definitive Additional Materials | |||||

| ☐ | Soliciting Material under §240.14a-12 |

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction: | |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.: | |||

|

| ||||

| (3) | Filing Party: | |||

|

| ||||

| (4) | Date Filed: | |||

|

| ||||

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Notice of 2021 Annual Meeting of Shareholders

| DATE AND TIME: | Monday, June 14, 2021, at 4:00 p.m., Israel time, 9:00 a.m., Eastern time | |

| VIRTUAL MEETING: | In the interest of the health and safety of our shareholders, directors, officers and employees, in light of the ongoing COVID-19 pandemic, the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of Teva Pharmaceutical Industries Limited (“we,” “us,” “our,” “Teva” or the “Company”) will be conducted in a virtual format. | |

| ITEMS OF BUSINESS: | Proposal 1: To appoint the following persons to Teva’s Board of Directors: Rosemary A. Crane, Abbas Hussain, Gerald M. Lieberman and Prof. Ronit Satchi-Fainaro to serve until our 2024 annual meeting of shareholders.

Proposal 2: To approve, on a non-binding advisory basis, the compensation for Teva’s named executive officers.

Proposal 3: To appoint Kesselman & Kesselman, a member of PricewaterhouseCoopers International Ltd., as Teva’s independent registered public accounting firm until Teva’s 2022 annual meeting of shareholders.

In addition, shareholders will consider Teva’s annual consolidated financial statements for the year ended December 31, 2020.

The Board of Directors recommends that you vote FOR all proposals.

Teva urges all of its shareholders to review its annual report (“Annual Report”) on Form 10-K for the year ended December 31, 2020. | |

| RECORD DATE: | Only holders of ordinary shares (or American Depositary Shares representing such ordinary shares) of record at the close of business on May 5, 2021 will be entitled to vote at the Annual Meeting. Two holders of ordinary shares who are present at the Annual Meeting, in person or by proxy or represented by their authorized persons, and who hold in the aggregate twenty-five percent or more of such ordinary shares, shall constitute a legal quorum. Should no legal quorum be present one-half hour after the scheduled time, the Annual Meeting shall be adjourned to one week from that day, at the same time and in virtual format. | |

By Order of the Board of Directors,

Dov Bergwerk

Senior Vice President,

Company Secretary

April 21, 2021

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 14, 2021

The accompanying Proxy Statement and our Annual Report are available at www.tevapharm.com/2021proxymaterials. We expect the proxy materials to be mailed and/or made available on or before April 30, 2021.

Table of Contents

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 26 | ||||

| 29 | ||||

| HR and Compensation Committee Interlocks and Insider Participation |

78 | |||

| Proposal 2: Advisory Vote on Compensation of Named Executive Officers |

79 | |||

| Proposal 3: Appointment of Independent Registered Public Accounting Firm |

80 | |||

| 82 | ||||

| 83 | ||||

| Securities Authorized for Issuance Under Equity Compensation Plans |

85 | |||

| 86 | ||||

| Shareholder Proposals for the 2021 Annual Meeting and the 2022 Annual Meeting |

88 | |||

| 89 | ||||

| 89 | ||||

| 90 | ||||

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | i | |

Table of Contents

Teva is a leading global pharmaceutical company. In 2020, we continued helping patients around the world to access affordable medicines and benefit from innovations to improve their health. Despite the COVID-19 pandemic challenges, we saw minimal impact on our supply chain, R&D programs and product launches. Our key growth drivers delivered promising results and milestones, and we met all components of our 2020 financial guidance.

Looking ahead, we will continue to optimize our manufacturing network, portfolio and pipeline, improve our profitability and generate cash, as we remain on track to repay our debt and achieve our long-term financial targets.

2020 Financial Results

|

|

| ||

| Revenue | EPS | Cash | ||

| $16.7 billion | $(3.64)

(GAAP) |

$1.2 billion

(cash flow from operating activities) | ||

| $2.57 (non-GAAP*) |

$2.1 billion

(free cash flow**) | |||

| * | For a reconciliation of non-GAAP EPS to GAAP EPS, see Teva’s press release filed on Form 8-K on February 10, 2021. |

| ** | Free cash flow includes cash flow generated from operating activities net of capital expenditures and deferred purchase price cash component collected for securitized trade receivables. For a reconciliation of free cash flow to cash flow from operating activities, see Teva’s press release filed on Form 8-K on February 10, 2021. |

Key Product Updates—Leveraging Our Growth Engines

|

AUSTEDO® Continued strong growth in the U.S. Launched in China in early 2021. Submissions continue in various other countries around the world.

|

AJOVY® Global sales bolstered by launch of auto-injector. Launched throughout the EU and in certain international markets.

|

Biosimilars Truxima® achieved ~24% of U.S. market share. We strengthened our pipeline with a new biosimilar commercialization agreement.

| ||||||

|

Generics Launched first generic versions of HIV-1 treatments Truvada® and Atripla® in the U.S. Launched generic version of NuvaRing® in the U.S. in January 2021.

|

Digihaler® Launched three digital inhalers in the U.S.: ProAir®, ArmonAir® and AirDuo® with built-in sensors that track inhaler events and measure inspiratory flow.

|

Risperidone LAI Announced positive phase 3 results for risperidone LAI for patients with schizophrenia in January 2021.

|

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 1 | |

Table of Contents

2020 Overview

Teva’s Response to COVID-19

For further details, see “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—The COVID-19 Pandemic” in our Annual Report on Form 10-K for the year ended December 31, 2020.

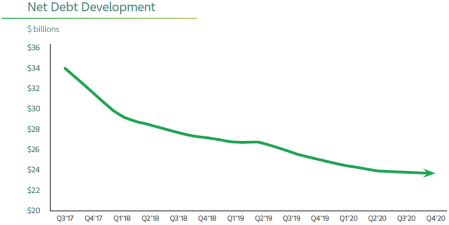

Continuing to Reduce our Debt

|

In the past three years, we have reduced our net debt by approximately $10 billion. As of December 31, 2020, our net debt was $23.7 billion. |

| 2 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Board and Corporate Governance Highlights

Our Board of Directors (the “Board of Directors” or the “Board”) continually evaluates Teva’s corporate governance policies and practices, focusing on ensuring effective oversight of Teva’s business and management. We have established a strong and effective framework to monitor the risks of our business.

Board and Corporate Governance

| ∎ | Board refreshment and succession planning—seven new directors appointed over the last five years |

| ∎ | 11 out of 12 directors are independent |

| ∎ | All members of our committees are independent |

| ∎ | 25% female directors serving on the Board |

| ∎ | Annual Board and committees evaluation process |

Board Oversight of Risk

| ∎ | Full Board and individual Committees focus on understanding and assessing Company risks, including the oversight of risks related to the COVID-19 pandemic |

| ∎ | Board reviews risk management policies of our operations and business strategy and Board committees review risk in their areas of expertise |

| ∎ | The Audit Committee assists the Board with our financial reporting, independent auditors, internal controls, internal audit function, risk assessment and risk management and cybersecurity risks |

| ∎ | The Compliance Committee oversees our policies and practices for legal, regulatory and internal compliance (other than regarding financial reporting), our strategy and governance of environmental, social and governance matters (“ESG”) and our culture of integrity and also reviews policies and practices that may seriously impact our reputation |

| ∎ | The Finance and Investment Committee reviews our financial risk management policies, including our investment guidelines, financings and foreign exchange and currency hedging, as well as financial risk of certain transactions |

| ∎ | The Human Resources and Compensation Committee (the “HR and Compensation Committee”) oversees compensation, retention, succession and other human resources-related issues and risks, as well as initiatives to promote inclusion and diversity |

| ∎ | The Science and Technology Committee oversees risks relating to our intellectual property and research and development activities |

| ∎ | The Corporate Governance and Nominating Committee oversees risks relating to governance policies and initiatives |

Director Alignment with Shareholder Interests

| ∎ | In 2020, directors had an outstanding meeting attendance rate of 100% |

| ∎ | We maintain director stock ownership guidelines requiring stock ownership of five times the annual cash fee (excluding committees fees) paid to directors, which must be achieved within a certain timeframe |

Shareholder Engagement

| ∎ | Active shareholder engagement efforts, led by our Chairman of the Board and other Board members. Discussions are focused on responding to feedback received from shareholders on corporate governance, executive compensation and ESG matters |

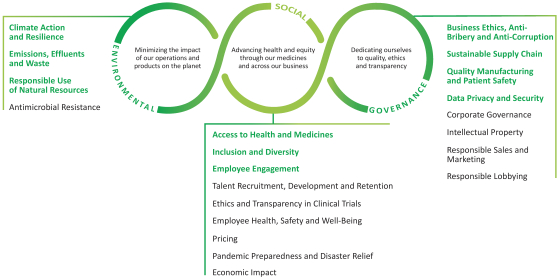

Our Environmental, Social and Governance Priorities and Accomplishments

| ∎ | In 2020, Teva renewed its ESG strategy, which is core to our business and reflects how we address environmental and social issues, while also bringing value to Teva. Our assessment identified topics that we believe matter most to our stakeholders and our business, including access to health and medicines, inclusion and diversity, ethics and climate action and resilience |

| ∎ | Teva set new long-term environmental targets to help advance climate action and resilience, responsible use of natural resources and reductions in emissions, effluents and waste |

| ∎ | We continue to enhance ESG transparency, which has already resulted in steady improvements in ESG ranking indices |

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 3 | |

Table of Contents

Proposal 1: Election of Directors

We continue our efforts to attract the highest quality talent to our Board, by adding diverse and highly qualified directors with global pharmaceutical experience and other qualifications.

Dr. Barer, our Chairman of the Board, is an independent director under NYSE regulations. Kåre Schultz, our President and Chief Executive Officer (the “President and CEO”) serves on the Board, which facilitates collaboration between the Board of Directors and management. Corporate governance remains a high priority and we continue to evaluate the size and composition of the Board to ensure that it maintains dynamic, exceptionally qualified leadership.

Following the recommendation of our Corporate Governance and Nominating Committee, the Board of Directors recommends that shareholders approve the appointment of Rosemary A. Crane, Abbas Hussain, Gerald M. Lieberman and Prof. Ronit Satchi-Fainaro to serve as directors until our 2024 annual meeting of shareholders. All nominees are currently members of the Board of Directors and qualify as independent directors under NYSE regulations.

In accordance with the Israeli Companies law, 5759-1999 (as amended from time to time, the “Israeli Companies Law”), all nominees for election as directors at the Annual Meeting have declared in writing that they possess the requisite skills and expertise, as well as sufficient time, to perform their duties as directors.

|

|

The Board of Directors recommends that shareholders vote FOR the appointment of Rosemary A. Crane, Abbas Hussain, Gerald M. Lieberman and Prof. Ronit Satchi-Fainaro, each to serve as directors until Teva’s 2024 annual meeting of shareholders. |

The following table sets forth information regarding the directors and director nominees of Teva as of April 10, 2021:

| Name |

Age |

Director Since |

Term Ends |

|||||||||

| Dr. Sol J. Barer—Chairman |

73 | 2015 | 2023 | |||||||||

| Kåre Schultz |

59 | 2017 | (1) | |||||||||

| Rosemary A. Crane |

61 | 2015 | 2021 | |||||||||

| Amir Elstein |

65 | 2009 | 2022 | |||||||||

| Jean-Michel Halfon |

69 | 2014 | 2023 | |||||||||

| Abbas Hussain (2) |

56 | 2020 | 2021 | |||||||||

| Gerald M. Lieberman |

74 | 2015 | 2021 | |||||||||

| Roberto A. Mignone |

49 | 2017 | 2022 | |||||||||

| Dr. Perry D. Nisen |

65 | 2017 | 2022 | |||||||||

| Nechemia (Chemi) J. Peres |

62 | 2017 | 2023 | |||||||||

| Prof. Ronit Satchi-Fainaro |

49 | 2018 | 2021 | |||||||||

| Janet S. Vergis |

56 | 2020 | 2023 | |||||||||

| (1) | Mr. Schultz’s term ends contemporaneously with his term as President and CEO. |

| (2) | Mr. Hussain was appointed in September 2020 by the Board to serve until the Annual Meeting, where his nomination will be presented to shareholders for approval. |

| 4 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Proposal 1: Election of Directors

Persons Being Considered for Election at the Annual Meeting

|

Rosemary A. Crane Independent Director

Committees: – Human Resources and Compensation (Chair) – Science and Technology |

Ms. Crane joined the Board of Directors in 2015. Ms. Crane served as President and Chief Executive Officer of MELA Sciences, Inc. from 2013 to 2014. Ms. Crane was Head of Commercialization and a partner at Appletree Partners from 2011 to 2013. From 2008 to 2011, she served as President and Chief Executive Officer of Epocrates Inc. Ms. Crane served in various senior executive positions at Johnson & Johnson from 2002 to 2008, including as Group Chairman, OTC & Nutritional Group from 2006 to 2008, as Group Chairman, Consumer, Specialty Pharmaceuticals and Nutritionals from 2004 to 2006, and as Executive Vice President of Global Marketing for the Pharmaceutical Group from 2002 to 2004. Prior to that, she held various positions at Bristol-Myers Squibb from 1982 to 2002, including as President of U.S. Primary Care from 2000 to 2002 and as President of Global Marketing and Consumer Products from 1998 to 2000. Ms. Crane has served on the board of directors of Catalent Pharma Solutions, Inc. since 2018. From 2015 to 2019, she served as Vice Chairman of the Board of Zealand Pharma A/S. From 2017 to March 2019, she served on the board of directors of Edge Therapeutics. Ms. Crane received an M.B.A. from Kent State University and a B.A. in communications and English from the State University of New York.

| |

|

Qualifications:

With over 30 years of experience in commercialization and business operations, primarily in the pharmaceutical and healthcare industries, and more than 25 years of therapeutic and consumer drug launch expertise, Ms. Crane provides broad experience and knowledge of the global pharmaceutical business and industry.

|

|

Abbas Hussain Independent Director

Committees: – Audit – Finance and Investment – Science and Technology |

Mr. Hussain joined the Board of Directors in September 2020. Mr. Hussain has served on the board of directors of Cochlear Limited and CSL Limited, both since 2018. From 2008 to 2017, Mr. Hussain held senior executive positions at GlaxoSmithKline plc (“GSK”), including Global President, Pharmaceuticals and Vaccines from 2013 to 2017, President, Europe and Emerging Markets, Pharmaceuticals from 2011 to 2013 and President, Emerging Markets, Pharmaceuticals from 2008 to 2011. Prior to joining GSK, he held senior roles with global responsibility at Eli Lilly and Company from 1998 to 2008, including President, European Operations from 2006 to 2008. Mr. Hussain has Joint Honors in medicinal chemistry and pharmacology from Loughborough Institute of Technology.

| |

|

Qualifications:

With his executive experience in the biopharmaceutical industry and deep biotechnology insight, and through his executive and non-executive roles, Mr. Hussain will provide the Board with a broad global perspective and understanding of pharmaceutical manufacturing, product development, risk, health, safety, environment and corporate responsibility.

|

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 5 | |

Table of Contents

Proposal 1: Election of Directors

|

Gerald M. Lieberman Independent Director

Committees: – Audit (Chair) – Human Resources and Compensation – Finance and Investment |

Mr. Lieberman joined the Board of Directors in 2015. Mr. Lieberman is currently a special advisor at Reverence Capital Partners, a private investment firm focused on the middle-market financial services industry. From 2000 to 2009, Mr. Lieberman was an executive at AllianceBernstein L.P., where he served as President and Chief Operating Officer from 2004 to 2009, as Chief Operating Officer from 2003 to 2004 and as Executive Vice President, Finance and Operations from 2000 to 2003. From 1998 to 2000, he served as Senior Vice President, Finance and Administration at Sanford C. Bernstein & Co., Inc., until it was acquired by Alliance Capital in 2000, forming AllianceBernstein L.P. Prior to that, he served in various c-suite executive positions at Fidelity Investments and at Citicorp. Prior to joining Citicorp, he was a certified public accountant with Arthur Andersen. Mr. Lieberman has served as chairman of the board of directors of Entera Bio Ltd. since 2018. He previously served on the board of directors of Forest Laboratories, LLC from 2011 to 2014, Computershare Ltd. from 2010 to 2012 and AllianceBernstein L.P. from 2004 to 2009. Mr. Lieberman received a B.S. Beta Gamma Sigma with honors in business from the University of Connecticut.

| |

|

Qualifications:

With his many years of experience as an executive in leading financial services companies, including his knowledge and experience in human capital development, succession planning and compensation, Mr. Lieberman provides finance, risk management, operating and human capital expertise for large, complex organizations.

|

|

Prof. Ronit Satchi-Fainaro Independent Director

Committees: – Science and Technology – Compliance |

Prof. Satchi-Fainaro joined the Board of Directors in 2018. Prof. Satchi-Fainaro is a Full Professor at Tel Aviv University, where she has served as Head of the Cancer Research and Nanomedicine Laboratory since 2006, Chair of the Department of Physiology and Pharmacology at the Sackler Faculty of Medicine since 2014, The Kurt and Herman Lion Chair in Nanosciences and Nanotechnologies since 2017, Director of the Cancer Biology Research Center since 2020 and a member of the Preclinical Dean’s Committee since 2015. She served as President of The Israel Controlled Release Society from 2010 to 2014. In 2003, she was appointed Instructor in Surgery at Children’s Hospital in Boston and Harvard Medical School, where she has been a Visiting Professor since 2005. Prof. Satchi-Fainaro also serves as a consultant to several biotech and pharmaceutical companies, and is a member of the scientific advisory board of the Blavatnik Center for Drug Discovery, The Israel Cancer Association and Vall d’Hebron University Hospital Foundation—Research Institute. She is also a member of several editorial boards of scientific journals. Prof. Satchi-Fainaro received her B.Pharm. from the Hebrew University in Jerusalem in 1995 and her Ph.D. in Polymer Chemistry and Cancer Nanomedicine from the University of London in 1999. She spent two years as a postdoctoral research fellow on biochemistry and protein delivery at Tel Aviv University and two years as a postdoctoral research fellow on vascular and cancer biology at Harvard University and Children’s Hospital in Boston.

| |

|

Qualifications:

With extensive experience in clinical medicine and research, Prof. Satchi-Fainaro provides in-depth knowledge of medicine and science.

|

| 6 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Proposal 1: Election of Directors

|

Dr. Sol J. Barer Chairman of the Board Independent Director |

Dr. Barer became Chairman of the Board of Directors in 2017, after joining Teva’s Board of Directors in January 2015. Dr. Barer is Managing Partner at SJ Barer Consulting. He also serves as an advisor to the Israel Biotech Fund. From 1987 to 2011, he served in top leadership roles at Celgene Corporation, including as Executive Chairman from 2010 to 2011, Chairman and CEO from 2007 to 2010, CEO from 2006 to 2010, President and Chief Operating Officer from 1994 to 2006 and President from 1993 to 1994. Prior to that, he was a founder of the biotechnology group at the chemical company Celanese Corporation, which was later spun off as Celgene. Dr. Barer has served on the board of directors of Cerecor, Inc. (formerly Aevi Genomic Medicine, Inc.) as lead director from 2020, on the board of directors of Contrafect as lead independent director from 2011 and as chairman of the board of directors of NexImmune, Inc. since 2019, which became a public company in February 2021. He served as Chairman of the Board of Edge Therapeutics from 2013 to March 2019, on the board of Aegerion Pharmaceuticals from 2011 to 2016, on the board of Amicus Therapeutics from 2009 to February 2017 and as Chairman of the Board of InspireMD from 2011 to June 2017. Dr. Barer is Founding Chair of the Center for Innovation and Discovery at the Hackensack Meridian Medical School. Dr. Barer received his Ph.D. in organic and physical chemistry from Rutgers University and his B.S. in chemistry from Brooklyn College of the City University of New York.

| |

|

Qualifications:

With his long career as a senior pharmaceutical executive and leadership roles in various biopharmaceutical companies, Dr. Barer provides broad and experienced knowledge of the global pharmaceutical business and industry as well as extensive scientific expertise.

|

|

Kåre Schultz Director and President and Chief Executive Officer |

Mr. Schultz became Teva’s President and CEO and a member of the Board of Directors on November 1, 2017. From May 2015 to October 2017, Mr. Schultz served as President and Chief Executive Officer of H. Lundbeck A/S. Prior to that, Mr. Schultz worked for nearly three decades at Novo Nordisk, where he served in a number of leadership roles, including Chief Operating Officer, Vice President of Product Supply and Director of Product Planning and Customer Services in the Diabetes Care Division. Mr. Schultz has also held positions at McKinsey and Anderson Consulting. Mr. Schultz has served as a member of the board of directors of International Flavors and Fragrances Inc. since February 2021. Mr. Schultz served as a member of the board of directors of LEGO A/S from 2007 to 2020, as chairman of the board of directors of Royal Unibrew A/S from 2010 to 2017 and on the board of directors of Bitten og Mads Clausens Fond, the holding vehicle for Danfoss A/S during 2017. Mr. Schultz received a master’s degree in economics from the University of Copenhagen.

| |

|

Qualifications:

With his leadership positions in various healthcare corporations, including his experience as a chairman and a director of several international corporations and his service as the President and Chief Executive Officer of Teva, Mr. Schultz provides unique global perspective on the healthcare and pharmaceutical industries.

|

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 7 | |

Table of Contents

Proposal 1: Election of Directors

|

Amir Elstein Independent Director

Committees: – Corporate Governance and Nominating (Chair) – Audit – Finance and Investment |

Mr. Elstein rejoined the Board of Directors in 2009. From January 2014 to July 2014, he served as Vice Chairman of the Board of Directors of Teva. Mr. Elstein has served as Chairman of the Board of Tower Semiconductor Ltd. since 2009 and Chairman of the Israel Democracy Institute since 2012. Mr. Elstein also serves as Chairman or as a member of the board of directors of several academic, scientific, educational, social and cultural institutions. Mr. Elstein served as Chairman of the Board of Governors of the Jerusalem College of Engineering from 2009 to 2018 and as Chairman of the Board of Directors of Israel Corporation from 2010 to 2013. From 2004 to 2008, Mr. Elstein was a member of Teva’s senior management, most recently as Executive Vice President, Global Pharmaceutical Resources. From 1995 to 2004, Mr. Elstein served on Teva’s Board of Directors. Prior to joining Teva as an executive in 2004, Mr. Elstein held a number of executive positions at Intel Corporation, most recently as General Manager of Intel Electronics Ltd., an Israeli subsidiary of Intel Corporation. Mr. Elstein received a B.Sc. in physics and mathematics from the Hebrew University in Jerusalem, an M.Sc. in solid state physics from the Hebrew University and a diploma in senior business management from the Hebrew University.

| |

|

Qualifications:

With leadership positions in various international corporations, including his experience as chairman of international public companies and his service as an executive officer at Teva and other companies, Mr. Elstein provides global business management and pharmaceutical expertise.

|

|

Jean-Michel Halfon Independent Director

Committees: – Compliance (Chair) – Corporate Governance and Nominating |

Mr. Halfon joined the Board of Directors in 2014. He currently serves as an independent consultant, providing consulting services to pharmaceutical, distribution, healthcare IT and R&D companies. From 2008 to 2010, Mr. Halfon served as President and General Manager of Emerging Markets at Pfizer Inc., after serving in various senior management positions since 1989. From 1987 to 1989, Mr. Halfon served as Director of Marketing in France for Merck & Co., Inc. Mr. Halfon received a B.S. from Ecole Centrale des Arts et Manufactures and an M.B.A. from Institut Supérieur des Affaires.

| |

|

Qualifications:

With his years of experience in senior management at leading pharmaceutical companies, particularly his experience with emerging markets, Mr. Halfon provides expertise in international pharmaceutical operations and marketing.

|

| 8 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Proposal 1: Election of Directors

|

Roberto A. Mignone Independent Director

Committees: – Finance and Investment (Chair) – Audit – Corporate Governance and Nominating |

Mr. Mignone joined the Board of Directors in 2017. Mr. Mignone is the Founder and Managing Partner of Bridger Management LLC, a multi-billion dollar investment management firm founded in 2000 and specializing in long-term equity strategies. Since inception, Bridger Management has focused on the healthcare sector and has developed considerable research expertise in support of its investments. In addition to healthcare, Bridger Management invests in global consumer, technology and financial services companies. Prior to Bridger Management, Mr. Mignone co-founded and served as a partner of Blue Ridge Capital LLC from 1996 to 2000, an investment management firm specialized in health care, technology, media, telecommunications and financial services. Mr. Mignone serves as a co-Vice Chairman and member of the Finance Committee and Nominating Committee of the New York University Langone Medical Center. He received a Bachelor of Arts degree in Classics from Harvard College and an M.B.A. from Harvard University Graduate School of Business Administration.

| |

|

Qualifications:

With his long career as a global investment professional focused on healthcare, Mr. Mignone provides the Board with finance and management expertise with respect to large, complex pharmaceutical organizations.

|

|

Dr. Perry D. Nisen Independent Director

Committees: – Science and Technology (Chair) – Compliance |

Dr. Nisen joined the Board of Directors in 2017. In 2018 he joined Soffinova Investments as Executive Partner, Private Equity. From 2014 to 2017, Dr. Nisen served as Chief Executive Officer and the Donald Bren Chief Executive Chair of Sanford Burnham Prebys Medical Discovery Institute. From 2004 to 2014, Dr. Nisen held various roles at GlaxoSmithKline, most recently as Senior Vice President, Science and Innovation. From 1997 to 2004, Dr. Nisen served as Divisional Vice President, Global Oncology Development, and as Divisional Vice President, Cancer Research, at Abbott Laboratories. Previously, he was the Lowe Foundation Professor of Neuro-Oncology at the University of Texas Southwestern Medical Center. Dr. Nisen has served as a director of Mirna Therapeutics since 2016. He received a B.S. from Stanford University, a Master’s degree in molecular biology, and an M.D. and PhD from Albert Einstein College of Medicine.

| |

|

Qualifications:

With extensive experience in medical research and development and management positions in leading pharmaceutical companies, Dr. Nisen provides a unique perspective on business and R&D activities.

|

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 9 | |

Table of Contents

Proposal 1: Election of Directors

|

Nechemia (Chemi) J. Peres Independent Director

Committees: – Corporate Governance and Nominating – Human Resources and Compensation |

Mr. Peres joined the Board of Directors in 2017. Mr. Peres serves as managing partner and co-founder of Pitango, Israel’s largest venture capital group. Pitango invests in technology companies across technology sectors, from IT to healthcare, with over 230 portfolio company investments since its inception in 1996. Mr. Peres serves on the board of directors of numerous Pitango portfolio companies. Mr. Peres is also the founder of Mofet Israel Technology Fund, one of Israel’s first venture capital funds, founded in 1992. Mr. Peres is chairman of the Peres Center for Peace and Innovation, and a board member at Social Finance Israel. He co-founded and chaired the Israel Venture Association (IATI—Israel Advanced Technology Industries) and he chaired the Israel America Chamber of Commerce from 2008 to 2011. Mr. Peres is a member of the Ethics and Sustainability committee at Geox S.p.A since 2020. In 2020, he co-founded the Israel Solidarity Fund to provide economic relief to those suffering from severe economic crisis due to the COVID-19 pandemic. He received a Bachelor of Science in industrial engineering and management and an M.B.A. from Tel Aviv University.

| |

|

Qualifications:

With his pioneering financial and entrepreneurial background, Mr. Peres provides the Board with a forward-thinking view on financial and strategic matters.

|

|

Janet S. Vergis Independent Director

Committees: – Human Resources and Compensation – Compliance |

Ms. Vergis joined the Board of Directors in June 2020. She served as a retained executive advisor to various private equity firms from 2013 to 2019. From 2011 to 2012, she served as the Chief Executive Officer of OraPharma, Inc., a specialty pharmaceutical company. From 2004 to 2009, she served as President of Janssen Pharmaceuticals LP, McNeil Pediatrics, Inc. and Ortho-McNeil Neurologics, Inc., subsidiaries of Johnson & Johnson. Ms. Vergis contributed to a number of Johnson & Johnson companies during her career, holding positions of increasing responsibility in research and development, new product development, sales and marketing. Ms. Vergis has served on the board of directors of Church and Dwight Co., Inc. since 2014, Dentsply-Sirona, Inc. since 2019 and SGS SA since March 2021. She previously served on the board of directors of MedDay Pharmaceuticals from 2016 to 2021, Amneal Pharmaceutical from 2015 to 2019, Lumara Health from 2013 to 2014 and OraPharma, Inc. from 2011 to 2012. Ms. Vergis received a Bachelor of Science in Biology and a Master’s of Science in Physiology from The Pennsylvania State University.

| |

|

Qualifications:

With over 30 years of experience in many aspects of the healthcare industry, including research and development, new product development, sales, and various executive roles, as well as her experience as a board member of public pharmaceutical companies, Ms. Vergis provides the Board with broad global business experience in the pharmaceutical industry.

|

Family Relationships

There are no family relationships among any of our executive officers or directors.

| 10 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

Under our Articles of Association, the Board of Directors must consist of three to 18 directors (including our President and CEO and two statutory independent directors, if required). Our Board of Directors consists of 12 persons, including our President and CEO. The Board of Directors has determined that all of the directors that currently serve and that will serve on the Board of Directors following the Annual Meeting are independent, except for Kåre Schultz, our President and CEO.

We currently maintain a policy to have at least two directors qualify as financial and accounting experts under Israeli law. Accordingly, the Board of Directors has determined that Gerald M. Lieberman and Roberto A. Mignone are financial and accounting experts under such criteria.

Our directors are generally entitled to review and retain copies of our documentation and examine our assets, as required to perform their duties as directors and to receive assistance, in special cases, from outside experts at our expense.

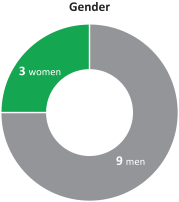

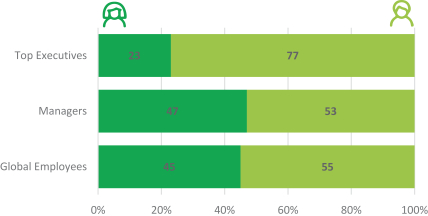

Over the course of 2020, inclusion and diversity was a point of emphasis for our Board and our management team. Teva believes that inclusion and diversity are essential to its ability to innovate and grow its business. It is our desire to create and sustain an inclusive and diverse work environment.

|

|

|

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 11 | |

Table of Contents

Corporate Governance and Director Compensation

The chart below summarizes the notable skills, qualifications and experience of each of our directors and director nominees (in addition to requisite skills and expertise to perform their duties as directors) and highlights the balanced mix of skills, qualifications and experience of the Board as a whole. These are the same attributes that the Board considers as part of its ongoing director succession planning process. This high-level summary is not intended to be an exhaustive list of each director’s and director nominee’s skills or contributions to the Board.

| SKILLS/QUALIFICATIONS/

|

S.

|

K.

|

R.

|

A.

|

J. M.

|

A.

|

G.

|

R.

|

P.

|

N.

|

R.

|

J.

| ||||||||||||

| Accounting and financial reporting experience

|

✓

|

✓

|

✓

|

|||||||||||||||||||||

| CEO / executive management leadership skills

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||

| Human resource management and executive comp. knowledge and experience

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||||||

| Pharmaceutical industry

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||||

| Commercial and operations management

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||||

| Risk oversight and risk management

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||||||

| Science / medical

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||||||

| Finance and investment markets

|

✓

|

✓

|

✓

|

✓

|

✓

|

|||||||||||||||||||

| ESG

|

✓

|

✓

|

✓

| |||||||||||||||||||||

| Academia/Education

|

✓

|

✓

|

||||||||||||||||||||||

| Global perspective, international

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| ||||||||||||||

| ADDITIONAL QUALIFICATIONS AND INFORMATION

| ||||||||||||||||||||||||

| Audit committee financial expert / financial expert under Israeli law

|

✓

|

✓

|

||||||||||||||||||||||

| Other public boards

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||||

Director Terms and Education. Our directors are generally elected in three classes for terms of approximately three years. Due to the complexity of our businesses and our extensive global activities, we value the insight and familiarity with our operations that a director is able to develop over his or her service on the Board of Directors. Because we believe that extended service on our Board enhances a director’s ability to make significant contributions to Teva, we do not believe that arbitrary term limits on directors’ service are appropriate. At the same time, it is the policy of the Board that directors should not expect to be renominated automatically.

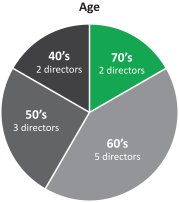

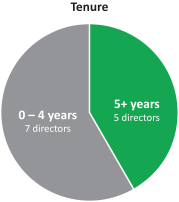

In recent years, we strengthened our Board of Directors with the addition of new highly qualified and talented directors, adding expertise as well as diversity to our Board of Directors. The average tenure of our

| 12 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

current directors is 4.8 years of service and the average age is 61.5 years. We currently have three female directors out of 12 members serving on our Board of Directors. Our Chairman of the Board is independent under NYSE regulations, and 11 out of 12 of our directors are independent under NYSE regulations. Our only non-independent director is our President and CEO, which facilitates collaboration between the Board of Directors and management. We continue to evaluate the size and composition of our Board of Directors to ensure it maintains dynamic, exceptionally qualified members.

We provide an orientation program and a continuing education process for our directors, which include business and industry briefings, provision of materials, sessions from leading experts and professionals, meetings with key management and visits to Teva facilities. We evaluate and improve our education and orientation programs on an ongoing basis to ensure that our directors have the knowledge and background needed for them to best perform their duties.

Board Meetings. The Board of Directors holds at least six meetings each year to review significant developments affecting Teva and to consider matters requiring approval of the Board, with additional meetings scheduled when important matters require Board of Directors action between scheduled meetings. In consideration of the health and safety of our directors, executive officers and other employees, our Board and Committees meetings were conducted virtually in 2020, due to the COVID-19 pandemic. Members of senior management regularly attend Board meetings to report on and discuss their areas of responsibility. Information regarding the number of Board committee meetings and attendance rates for 2020 is presented in the table below under “—Committee Composition and Board and Committee Attendance in 2020.”

Executive Sessions of the Board. Our directors meet in executive session (i.e., without the presence of management, including our President and CEO) generally in connection with each regularly scheduled Board meeting and additionally as needed. Executive sessions are chaired by Dr. Barer, the Chairman of the Board.

Annual Meetings. We do not have a formal policy requiring members of the Board to attend our annual meetings, although all directors are strongly encouraged to attend. All of our directors attended the 2020 annual meeting of shareholders, which was held virtually.

Board Leadership. The Board of Directors recognizes that one of its key responsibilities is to establish and evaluate an appropriate leadership structure for the Board of Directors so as to provide effective oversight of management. The Board of Directors has separate roles for the Chief Executive Officer and Chairman of the Board of Directors, with Dr. Barer serving as independent Chairman and Mr. Kåre Schultz as President and CEO. Dr. Barer’s long career as a senior pharmaceutical executive and leadership roles in various biopharmaceutical companies, as well as his extensive scientific expertise and knowledge of the global pharmaceutical business, have made him an invaluable resource to both the Board of Directors and the Chief Executive Officer. The Board of Directors has determined that this leadership structure is appropriate for Teva at this time because it ensures that the appropriate level of oversight, independence and responsibility is applied to all Board decisions.

Board of Directors Role in Risk Oversight. Management is responsible for assessing and managing risk, subject to oversight by the Board of Directors. Our annual risk assessment process includes both a top-down review of strategic risks and a bottom-up review of operational risks, which are presented to the Board of Directors. The Board of Directors fulfills its oversight responsibility for risk assessment and management by reviewing risk management policies and the risk appetite of our operations and business strategy and by instructing its committees to assist and advise in their areas of expertise, as described below. Each committee provides regular updates to the full Board regarding its activities.

| ∎ | The Board oversees our risk management policies and risk appetite, including operational risks and risks relating to our business strategy and transactions. Various committees of the Board assist the Board in this oversight responsibility in their respective areas of expertise. |

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 13 | |

Table of Contents

Corporate Governance and Director Compensation

| ∎ | The Audit Committee assists the Board with the oversight of our financial reporting, independent auditors, internal controls, internal audit function and cybersecurity risks. It is charged with identifying any flaws in business management and recommending remedies, detecting fraud risks and implementing anti-fraud measures. The Audit Committee further discusses our policies with respect to risk assessment and management regarding financial reporting, cyber risks and other material risks. |

| ∎ | The Compliance Committee oversees our policies and practices for legal, regulatory and internal compliance (other than regarding financial reporting) and reviews policies and practices that may seriously impact our reputation. |

| ∎ | The Finance and Investment Committee reviews our financial risk management policies, including our investment guidelines, financings and foreign exchange and currency hedging, as well as financial risk of certain transactions. |

| ∎ | The HR and Compensation Committee oversees compensation, retention, succession and other human resources-related issues and risks. |

| ∎ | The Science and Technology Committee oversees risks relating to our intellectual property and research and development activities. |

| ∎ | The Corporate Governance and Nominating Committee oversees risks relating to our governance policies and initiatives. |

During 2020, the Board and the HR and Compensation Committee closely monitored our performance in light of the COVID-19 pandemic. This included review of the effects the COVID-19 pandemic had on our business performance and operations, as well as on the safety, morale and engagement of our employees.

Cybersecurity Risk Management. The Audit Committee assists the Board with the oversight of cybersecurity risks. As part of its risk oversight function, the Audit Committee reviews our cyber risk assessment and management policies and receives briefings concerning Teva’s information security and technology risks, including cybersecurity. During 2020, the Audit Committee received four periodic briefings on Teva’s information security and risk management programs, including with respect to cyber security, global cyber threat trends, SAP implementation, threats arising from the COVID-19 pandemic and privacy controls. Teva’s information security office leads our cybersecurity risk management program. We also maintain cyber risk insurance coverage.

Director Service Contracts. Except for equity awards that accelerate upon termination, we do not have any contracts with any of our non-employee directors that provide for benefits upon termination of services. Information regarding director compensation can be found under “Non-Employee Director Compensation” below.

Communications with the Board. Shareholders, employees and other interested parties can contact any director or committee of the Board of Directors by writing to them care of Teva Pharmaceutical Industries Ltd., 124 Dvora HaNevi’a Street, Tel Aviv, 6944020, Israel, Attn: Company Secretary or Internal Auditor or by email to [email protected]. Comments or complaints relating to our accounting, internal controls or auditing matters may also be referred to members of the Audit Committee, as well as other appropriate Teva departments. The Board of Directors has adopted a global “whistleblower” policy, which provides employees and others with an anonymous means of communicating with the Audit Committee.

Nominees for Directors. In accordance with the Israeli Companies Law, a nominee for service as a director must submit a declaration to us, prior to his or her election, specifying that he or she has the requisite qualifications to serve as a director and the ability to devote the appropriate time to performing his or her duties as such and that he or she is not restricted from serving as director under the Israeli Companies Law. All of our directors, including those nominated for appointment as directors at the Annual Meeting, have provided such declaration. A director who ceases to meet the statutory requirements to serve as a director must notify us to that effect immediately and his or her service as a director will terminate upon submission of such notice.

| 14 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

Our Board of Directors believes that it should be composed of directors with diverse, complementary backgrounds and that directors should, at a minimum, exhibit proven leadership capabilities and possess experience at a high level of responsibility within their chosen fields. When considering a candidate for director, our Corporate Governance and Nominating Committee considers whether the directors, both individually and collectively, can and do provide the experience, judgment, commitment, skills and expertise appropriate to lead Teva in the context of its industry. In addition, our Corporate Governance and Nominating Committee considers a nominee’s expected contribution to the diversity of skills, background, experiences and perspectives, as well as whether such nominee could provide added value to any of the committees of the Board of Directors, given the then existing composition of the Board of Directors as a whole. When seeking new candidates, the Corporate Governance and Nominating Committee also considers candidates representing a diversity of backgrounds, perspectives, ethnicities, races and genders. Our Corporate Governance and Nominating Committee also provides input and guidance regarding the independence of directors, for formal review and approval by our Board of Directors.

When seeking candidates for directorships, our Corporate Governance and Nominating Committee may solicit suggestions from incumbent directors, management, shareholders and others. Additionally, the Board of Directors has in the past used and may continue to use the services of third party search firms to assist in the identification and analysis of appropriate candidates. After conducting an initial evaluation of a prospective candidate, members of the Board of Directors will interview that candidate if they believe the candidate may be suitable. The Chairman of the Board of Directors may also ask the candidate to meet with certain members of executive management.

If our Corporate Governance and Nominating Committee believes a director should be re-approved or a candidate would be a valuable addition to the Board of Directors, it may recommend to the Board of Directors that candidate’s appointment or election, who, in turn, can submit the candidate for consideration by the shareholders.

The Israeli Companies Law provides a process by which one or more shareholders holding 1% or more of the voting rights of Teva may propose the nomination of a candidate to the Board of Directors. See “Shareholder Proposals for the 2021 Annual Meeting and the 2022 Annual Meeting” below.

Non-Employee Director Compensation

As required by the Israeli Companies Law, we have adopted a Compensation Policy for Executive Officers and Directors (the “Compensation Policy”), which is presented for shareholder approval at least once every three years. Pursuant to the Israeli Companies Law and regulations promulgated thereunder, any arrangement between Teva and a director relating to his or her compensation as a director or other position with Teva must generally be consistent with Teva’s Compensation Policy and approved by the HR and Compensation Committee, the Board and by a simple majority of Teva’s shareholders.

As approved at our 2019 annual general meeting of shareholders, our non-employee director annual compensation program (applicable to all non-employee directors except for the Chairman of the Board) is comprised of:

| (i) | an annual Board membership fee of $130,000 paid in cash; |

| (ii) | additional annual cash fees for service on Board committees: |

| a. | $20,000 per annum to serve as a member of the Audit Committee; and $40,000 per annum to serve as chairperson of the Audit Committee; |

| b. | $15,000 per annum to serve as a member of the HR and Compensation Committee; and $30,000 per annum to serve as chairperson of the HR and Compensation Committee; |

| c. | $20,000 per annum to serve as a member on a special or ad-hoc committee of the Board; and $30,000 to serve as chairperson of such special or ad-hoc committee; and |

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 15 | |

Table of Contents

Corporate Governance and Director Compensation

| d. | $10,000 per annum to serve as a member of any other standing Board committee that is not listed in sub-sections (a)-(b); and $20,000 per annum to serve as chairperson on such committee; and |

| (iii) | an annual equity-based award in the form of restricted share units (“RSUs”) with an approximate aggregate grant date fair value of $160,000 and a one year cliff vesting. |

As approved at our 2019 annual general meeting of shareholders, the annual compensation for the Chairman of the Board is comprised of:

| (i) | an annual Board membership fee of $255,000 paid in cash; |

| (ii) | an annual equity-based award in the form of RSUs with an approximate aggregate grant date fair value of $285,000 and a one year cliff vesting; and |

| (iii) | office and secretarial services at Teva’s offices. |

The Chairman of the Board is not entitled to additional annual cash fees for service on Board Committees.

Fees for Board and committee service are payable over the period of time during which the individual serves as a non-employee director. In the event that a non-employee director serves as a member of the Board during only part of the year, a pro-rated amount of the annual board membership fee and standing committee fees will be paid. In the event of an appointment to the Board between annual meetings of shareholders, the annual equity-based award shall be pro-rated. Upon completion of a non-employee director’s service as a director, other than removal pursuant to a shareholder resolution due to a breach of fiduciary duties, any unvested awards granted to such director by virtue of such position and held by such director will immediately become vested.

We purchase directors’ and officers’ liability insurance for our directors and executive officers, as approved by our shareholders and consistent with the Compensation Policy. In addition, we release our directors from liability and indemnify them to the fullest extent permitted by law and our Articles of Association, and provide them with indemnification and release agreements for this purpose, substantially in the form approved by our shareholders at our 2012 annual meeting.

In addition, Teva reimburses or covers its non-employee directors’ expenses (including travel expenses) incurred in connection with attending meetings of the Board and its committees or in performing other services for Teva in their capacity as non-employee directors, in accordance with Israeli law and the Compensation Policy.

Any director elected to serve as a member of our Board and all directors currently serving on our Board will be compensated in the manner described above and will benefit from the insurance, indemnification and release discussed above.

No additional compensation is received for attendance at a Board or committee meeting.

Director Stock Ownership Guidelines

In 2019, we established director stock ownership guidelines requiring ownership of five times the annual cash fee paid to directors for board membership (excluding committees fees), which must be achieved within the later of six years of first becoming subject to these guidelines and January 1, 2025.

| 16 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

| Name |

Fees Earned or Paid in Cash ($) (1) |

Stock Awards ($) (2) |

Total ($) | ||||||||||||

| Dr. Sol J. Barer (3) |

255,000 | 284,996 | 539,996 | ||||||||||||

| Rosemary A. Crane |

170,000 | 159,997 | 329,997 | ||||||||||||

| Amir Elstein |

180,000 | 159,997 | 339,997 | ||||||||||||

| Murray A. Goldberg (4) |

72,608 | 0 | 72,608 | ||||||||||||

| Jean-Michel Halfon |

160,000 | 159,997 | 319,997 | ||||||||||||

| Abbas Hussain (5) |

50,000 | 122,670 | 172,670 | ||||||||||||

| Gerald M. Lieberman |

195,000 | 159,997 | 354,997 | ||||||||||||

| Roberto A. Mignone |

180,000 | 159,997 | 339,997 | ||||||||||||

| Dr. Perry D. Nisen |

160,000 | 159,997 | 319,997 | ||||||||||||

| Nechemia (Chemi) J. Peres |

155,000 | 159,997 | 314,997 | ||||||||||||

| Prof. Ronit Satchi-Fainaro |

150,000 | 159,997 | 309,997 | ||||||||||||

| Janet S. Vergis (6) |

86,007 | 159,997 | 246,004 | ||||||||||||

| (1) | The amounts shown include the paid cash portion of the annual fee for the Chairman of the Board and Board membership fees and committee service fees for other non-employee directors. |

| (2) | In June 2020, each non-employee director serving at that time was granted 12,668 RSUs, and the Chairman of the Board was granted 22,565 RSUs, based on the grant date fair value of a share of $12.63. Non-employee directors that join between annual general meetings are eligible for an equity grant value that is pro-rated in an amount equal to the difference between (i) an annual grant of $160,000 (for non-employee directors other than the chairman) and (ii) the product of (x) an annual grant ($160,000) divided by 12 and (y) the number of months (including partial months) in the period between the last annual meeting of shareholders and the date of such appointment. Accordingly, in September 2020, Abbas Hussain was granted 13,050 RSUs based on the grant date fair value of a share of $9.40. The amounts shown in the Stock Awards column represent the aggregate grant date fair values of RSUs computed in accordance with FASB Accounting Standards Codification Topic 718 (“Topic 718”). Valuations of RSUs were determined based on the fair market value of a Teva share on the grant date, less the net present value of dividends, as relevant. For information regarding assumptions, factors and methodologies used in our computations pursuant to Topic 718, see note 14c. to our consolidated financial statements set forth in our Annual Report on Form 10-K for the year ended December 31, 2020. These RSUs vest one year from the grant date. As of December 31, 2020, the aggregate number of unvested RSUs held by each current non-employee director was as follows: Dr. Sol J. Barer: 40,130; Rosemary A. Crane: 18,709; Amir Elstein: 18,709; Jean-Michel Halfon: 18,709; Abbas Hussain: 13,050; Gerald M. Lieberman: 18,709; Roberto A. Mignone: 18,709; Dr. Perry D. Nisen: 18,709; Nechemia J. Peres: 18,709; Prof. Ronit Satchi-Fainaro: 18,709; and Janet S. Vergis: 12,668. Upon completion or termination of a non-employee director’s service as a director, other than removal pursuant to a shareholder resolution due to a breach of fiduciary duties, any unvested awards granted to such director in virtue of such position and held by such director will immediately become vested. In 2020, Murray A. Goldberg received accelerated vesting of equity in connection with his completion of Board service. |

| (3) | During his service as Chairman of the Board, Dr. Barer is entitled to an annual fee of $255,000 and an annual equity-based award with an approximate grant date fair value of $285,000. |

| (4) | Mr. Goldberg’s term expired in June 2020. |

| (5) | Mr. Hussain was appointed to the Board on September 1, 2020. |

| (6) | Ms. Vergis was elected to the Board at the 2020 annual meeting on June 9, 2020. |

Mr. Schultz was not and will not be entitled to any compensation in his capacity as a member of the Board or any committee thereof.

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 17 | |

Table of Contents

Corporate Governance and Director Compensation

Our Articles of Association provide that the Board of Directors may delegate its powers to one or more committees as it deems appropriate to the extent such delegation is permitted under the Israeli Companies Law. The Board of Directors has appointed the standing committees listed below, as well as ad-hoc committees appointed from time to time for specific purposes determined by the Board.

We have adopted charters for all of our standing committees, formalizing the committees’ procedures and duties. These committee charters are available on our website at www.tevapharm.com.

Committee Composition and Board and Committee Attendance in 2020

| Name |

Audit | Human and |

Corporate Governance and Nominating |

Finance and |

Compliance | Science and | ||||||

| Rosemary A. Crane |

|

Chair |

|

|

|

∎ | ||||||

| Amir Elstein |

∎ |

|

Chair | ∎ |

|

| ||||||

| Jean-Michel Halfon |

|

|

∎ |

|

Chair |

| ||||||

| Abbas Hussain |

∎ |

|

|

∎ |

|

∎ | ||||||

| Roberto A. Mignone |

∎ |

|

∎ | Chair |

|

| ||||||

| Dr. Perry D. Nisen |

|

|

|

|

∎ | Chair | ||||||

| Nechemia (Chemi) J. Peres |

|

∎ | ∎ |

|

|

| ||||||

| Gerald M. Lieberman |

Chair | ∎ |

|

∎ |

|

| ||||||

| Prof. Ronit Satchi-Fainaro |

|

|

|

|

∎ | ∎ | ||||||

| Janet S. Vergis |

|

∎ |

|

|

∎ |

| ||||||

| No. of meetings in 2020 |

7 | 6 | 5 | 4 | 4 | 4 | ||||||

| Average attendance rate |

100% | 100% | 100% | 100% | 100% | 100% | ||||||

In 2020, our Board of Directors met 10 times. In 2020, each of our current directors attended 100% of the meetings of the Board and Board committees on which he or she served. In consideration of the health and safety of our directors, executive officers and other employees, our Board and Committees meetings were conducted virtually in 2020, due to the COVID-19 pandemic.

In addition to the above, during 2020, the Chairman of the Board and various Committee chairpersons held discussions focusing on pending litigation matters.

Audit Committee

The Israeli Companies Law requires publicly held Israeli companies to appoint an audit committee. As a NYSE-listed company, Teva’s Audit Committee must be comprised solely of independent directors, as defined by the Securities and Exchange Commission (the “SEC”) and NYSE regulations.

The responsibilities of our Audit Committee include, among others: (a) identifying flaws in the management of our business and making recommendations to the Board of Directors as to how to correct them and providing for arrangements regarding employee complaints with respect thereto; (b) making determinations and considering providing approvals concerning certain related party transactions and certain actions involving conflicts of interest; (c) reviewing the internal auditor’s performance and approving the internal audit work program and examining our internal control structure and processes; (d) examining the independent auditor’s scope of work and fees; and (e) providing for arrangements regarding employee complaints regarding questionable accounting or auditing matters and monitoring compliance with and investigating alleged violations and enforcing provisions of Teva’s Code of Conduct. Furthermore, the Audit Committee discusses the financial statements and the disclosure under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (the “MD&A”) and presents to the Board of Directors its recommendations with respect to the proposed financial statements and MD&A.

| 18 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

In accordance with the Sarbanes-Oxley Act and NYSE requirements, the Audit Committee is directly responsible for the appointment, compensation and oversight of the work of our independent auditors. In addition, the Audit Committee is responsible for assisting the Board of Directors in monitoring our financial statements, the effectiveness of our internal controls and our compliance with legal and regulatory requirements. The Audit Committee also discusses our policies with respect to risk assessment and risk management regarding financial reporting and risks that may be material to us and major legislative and regulatory developments that could materially impact Teva’s contingent liabilities and risks.

The Audit Committee charter sets forth the scope of the committee’s responsibilities, including its structure, processes and membership requirements; the committee’s purpose; its specific responsibilities and authority with respect to, among others, registered public accounting firms; complaints relating to accounting, internal accounting controls or auditing matters; and its authority to engage advisors as determined by the Audit Committee.

The Audit Committee also reviews and receives briefings concerning Teva’s information security and technology risks, including cybersecurity, and has been briefed on Teva’s information security and risk management programs. Teva’s information security office leads our cybersecurity risk management program.

All of the Audit Committee members have been determined to be independent as defined by SEC and NYSE regulations.

The Board of Directors has determined that, of the directors on this committee, Gerald M. Lieberman (chair) and Roberto A. Mignone are “audit committee financial experts” as defined by applicable SEC regulations.

Human Resources and Compensation Committee

The Israeli Companies Law requires publicly held Israeli companies to appoint a compensation committee. As a NYSE-listed company, Teva’s HR and Compensation Committee must be comprised solely of independent directors, as defined by the SEC and NYSE regulations.

The HR and Compensation Committee is responsible for establishing annual and long-term performance goals and objectives for our executive officers, as well as reviewing our compensation philosophy and policies (including our Compensation Policy).

The HR and Compensation Committee is responsible for reviewing plans for the succession of our chief executive officer and other senior members of executive management.

The HR and Compensation Committee also evaluates the performance of our chief executive officer and other executive officers, makes recommendations to the Board of Directors regarding the compensation of our executive officers and directors, reviews any organizational restructuring pertaining to the roles, responsibilities and selection of executive officers and oversees our labor practices.

All of the HR and Compensation Committee members have been determined to be independent as defined by SEC and NYSE regulations.

Corporate Governance and Nominating Committee

The NYSE Listed Company Manual requires publicly listed companies to appoint a corporate governance / nominating committee composed entirely of independent directors, as defined by NYSE regulations.

The role of our Corporate Governance and Nominating Committee is to (i) identify individuals who are qualified to become directors; (ii) recommend to the Board of Directors director nominees for each annual meeting of shareholders; and (iii) assist the Board of Directors in establishing and reviewing Teva’s statement of corporate governance principles and promoting good corporate governance in Teva.

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 19 | |

Table of Contents

Corporate Governance and Director Compensation

All of the Corporate Governance and Nominating Committee members have been determined to be independent as defined by NYSE regulations.

Finance and Investment Committee

The role of our Finance and Investment Committee is to assist the Board of Directors in fulfilling its responsibilities with respect to our financial and investment strategies and policies, including determining policies on these matters and monitoring implementation. It is also authorized to approve certain financial transactions (such as material loans and other financing arrangements), review our financial risk management policies and evaluate the execution, financial results and integration of Teva’s completed acquisitions, as well as various other finance-related matters, including our global tax structure and allocation policies. According to the committee’s charter, at least one of the committee’s members must be qualified as a financial and accounting expert under SEC regulations and/or the Israeli Companies Law.

The Board of Directors has determined that, of the directors on this committee, Gerald M. Lieberman and Roberto A. Mignone (chair) are financial and accounting experts under Israeli law.

A majority of committee members must be determined to be independent as defined by NYSE regulations.

Compliance Committee

The role of our Compliance Committee is to oversee our: (i) policies and practices for complying with laws, regulations and internal procedures; (ii) policies and practices regarding issues that have the potential to seriously impact our business and reputation; (iii) global public policy positions; (iv) strategy and governance of ESG matters and to advise the Board on ESG matters; and (v) implementation of our culture of integrity.

A majority of committee members must be determined to be independent as defined by NYSE regulations. The chairperson of the Audit Committee shall be invited by the committee chairperson to participate in the Compliance Committee, as deemed relevant to the committee’s agenda.

Science and Technology Committee

The Science and Technology Committee oversees our overall strategic direction and investment in research and development and technological and scientific initiatives. As part of this responsibility, it reviews scientific and R&D strategy and priorities, scientific aspects of business development activities and technological trends. It assists the Board of Directors in risk management oversight relating to R&D and our intellectual property, advises on our intellectual property strategy, reviews new technology in which Teva is, or is considering, investing and reviews the efficacy and safety profile of new pharmaceuticals.

All of the committee members must be determined to have scientific, medical or other related expertise. A majority of committee members must be determined to be independent as defined by NYSE regulations.

Code of Business Conduct

Teva has adopted a code of business conduct applicable to its directors, executive officers, and all other employees. A copy of the code is available to every Teva employee on Teva’s internet site, upon request to its human resources department, and to investors and others on Teva’s website at www.tevapharm.com or by contacting Teva’s investor relations department, legal department or the internal auditor. If we make any amendment or grant any waiver to this code that applies to our chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions, and that relates to an element of the SEC’s “code of ethics” definition, then we will disclose the nature of the amendment or waiver on Teva’s website. The Board of Directors has approved a whistleblower policy which functions in coordination with Teva’s code of business conduct and provides an anonymous means for employees and others to communicate with various departments of Teva, including the Audit Committee. Teva has also implemented a training program for new and existing employees concerning the code of business conduct and whistleblower policy.

| 20 | Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | |

Table of Contents

Corporate Governance and Director Compensation

Principles of Corporate Governance

We have adopted a set of corporate governance principles, which is available on our website at www.tevapharm.com. We place great emphasis on maintaining high standards of corporate governance and continuously evaluate and seek to improve our governance standards. These efforts are expressed in our corporate governance principles, our committee charters and the policies of our Board of Directors. Teva is in compliance with all corporate governance standards currently applicable to Teva under Israeli and U.S. laws, SEC regulations and NYSE listing standards.

Insider Trading Policy

Our directors, executive officers and employees, as well as their immediate family members, persons living in their home and entities controlled by any of the foregoing persons are subject to Teva’s insider trading policy (the “Policy”). The Policy prohibits insider trading and certain speculative transactions (including short sales, buying put and selling call options and other hedging or derivative transactions in Teva’s securities), and establishes a regular blackout period schedule during which directors, executive officers and certain employees may not trade in Teva’s securities. In addition, the Policy establishes pre-clearance procedures that directors and executive officers must observe prior to effecting any transaction in Teva’s securities. The Policy applies not only to Teva’s ADSs and ordinary shares, but also to its debt securities and other securities for which Teva securities serve as underlying assets.

Board Evaluation Process

Our Board of Directors is committed to continuous improvement and recognizes the fundamental role a robust Board of Directors and committee evaluation process play in ensuring that our Board of Directors maintains optimal composition and functions effectively.

In the annual self-evaluation process, the members of the Board of Directors conduct a confidential oral assessment of the performance, risk oversight and composition of the Board and any committees of which he or she is a member with the Company Secretary. As part of the evaluation process, the Board of Directors, in conjunction with the Corporate Governance and Nominating Committee, reviews the effectiveness and overall composition, including director tenure, board leadership structure, diversity and skill sets, of the Board of Directors to ensure the Board of Directors serves the best interests of shareholders and positions the company for future success. The results of the oral assessments are then summarized and communicated back to each committee, committee chair and the entire Board of Directors. After the evaluations, each committee, committee chair and the entire Board of Directors and management work to improve upon any issues presented during the evaluation process and to identify opportunities that may lead to further improvement. The Corporate Governance and Nominating Committee also uses this process to assess and determine the characteristics and skills required of prospective candidates for election to the Board of Directors.

| Teva Pharmaceutical Industries Ltd. 2021 Proxy Statement | 21 | |

Table of Contents

In late 2020 and early 2021, the Board conducted discussions with our shareholders as part of our ongoing commitment to strengthen our corporate governance and to gather input from our stakeholders, which we believe enables us to better understand their perspectives. During this time, we contacted shareholders representing approximately 50% of our outstanding shares. Our Chairman of the Board, the Chair of our HR and Compensation Committee and another member of the Board who presented on ESG matters participated in discussions with shareholders representing approximately 22% of our outstanding shares. In addition, we engaged with the research teams at proxy advisory firms Institutional Shareholder Services Inc. and Glass Lewis & Co.

The discussions covered a broad array of matters, including:

| ∎ | the COVID-19 pandemic and its impact on our human capital; |

| ∎ | our ESG materiality assessment, our enhanced ESG transparency and the resulting improvements in ESG ranking indices; |

| ∎ | inclusion and diversity at Teva; |

| ∎ | executive succession planning; and |

| ∎ | changes to our executive compensation program over recent years. |

Feedback from our shareholders was shared and discussed with the HR and Compensation Committee, the Corporate Governance and Nominating Committee and the Board.