Form DEF 14A Silvergate Capital Corp For: Apr 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | |||||||||||

Filed by a Party other than the Registrant ☐ | |||||||||||

Check the appropriate box:

☐ | Preliminary Proxy Statement | ||||

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

☒ | Definitive Proxy Statement | ||||

☐ | Definitive Additional Materials | ||||

☐ | Soliciting Material Pursuant to §240.14a-12 | ||||

Silvergate Capital Corporation

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||||||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

☐ | Fee paid previously with preliminary materials. | |||||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

4250 Executive Square, Suite 300

La Jolla, California 92037

April 15, 2021

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of Silvergate Capital Corporation (the “Company”), you are cordially invited to attend the Annual Meeting of Stockholders of the Company (“Annual Meeting”). The Annual Meeting will be held online at www.virtualshareholdermeeting.com/SI2021, on Friday, June 11, 2021, at 8:00 A.M., Pacific Time.

The attached Notice of the Annual Meeting (“Notice”) and Proxy Statement describe in greater detail all of the formal business that will be transacted at the Annual Meeting. There will not be a physical meeting at the Company’s headquarters office. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/SI2021. Directors and officers of the Company will be available at the Annual Meeting to respond to any questions that you may have regarding the business to be transacted.

The Company’s Board of Directors has determined that each of the proposals that will be presented to the stockholders for their consideration at the Annual Meeting are in the best interests of the Company and its stockholders, and unanimously recommends and urges you to vote “FOR” each director nominee, and “FOR” ratifying the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. If any other business is properly presented at the Annual Meeting, the proxies will be voted in accordance with the recommendations of the Company’s Board of Directors.

We are distributing our proxy materials to stockholders via the Internet under the “Notice and Access” rules of the U.S. Securities and Exchange Commission. We believe this expedites stockholders’ receipt of proxy materials, lowers the Annual Meeting costs and conserves natural resources. As a result, we are mailing to many stockholders a Notice of Internet Availability of Proxy Materials (“Notice of Availability”), rather than a paper copy of the Notice and Proxy Statement and 2020 Annual Report to Stockholders, which includes the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020. The Notice of Internet Availability contains instructions on how to access the proxy materials online, vote online and obtain, if desired, a paper copy of our proxy materials. The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. You will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability or on the website referred to in the Notice.

We encourage you to attend the Annual Meeting online, but if you are unable to attend, it is important that you vote in advance via the Internet, by telephone, or sign, date and return the enclosed proxy card in the enclosed postage-paid envelope. Your cooperation is appreciated since a majority of the Class A common stock must be represented, either in person or by proxy, to constitute a quorum for the transaction of business at the Annual Meeting.

On behalf of the Board of Directors and all of the employees of the Company, we thank you for your continued support.

Sincerely,

Alan J. Lane

President and Chief Executive Officer

President and Chief Executive Officer

Silvergate Capital Corporation

4250 Executive Square, Suite 300

La Jolla, California 92037

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Silvergate Capital Corporation (the “Company”) will be held online at www.virtualshareholdermeetin.com/SI2021, on Friday, June 11, 2021, at 8:00 A.M., Pacific Time, for the following purposes:

1.To elect three Class III directors to serve for a three-year term ending at the 2024 annual meeting of stockholders or until their successor is duly elected and qualified.

2.To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

The Board of Directors (the “Board”) is not aware of any other business that will be presented for consideration at the Annual Meeting. If any other matters should be properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting for action by stockholders, the persons named in the form of proxy will vote the proxy in accordance with their best judgment on that matter.

The Board recommends that you vote “FOR” each of the director nominees, and “FOR” ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm.

Only stockholders of record as of the close of business on April 9, 2021 are entitled to receive notice of, to attend and to vote at the Annual Meeting. If you are a beneficial owner as of that date, you will receive communications from your broker, bank or other nominee about the Annual Meeting and how to direct the vote of your shares, and you are welcome to attend the Annual Meeting online, all as described in more detail in the attached Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Friday, June 11, 2021. The Proxy Statement, form of Proxy, and our 2020 Annual Report to Stockholders, which includes the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, are available on the Internet at www.proxyvote.com and on our corporate website at www.silvergate.com under the “Investor Relations” link.

By Order of the Board of Directors,

Dennis S. Frank

Chairman of the Board of Directors

April 15, 2021

TABLE OF CONTENTS | |||||

Silvergate Capital Corporation

4250 Executive Square, Suite 300

La Jolla, California 92037

4250 Executive Square, Suite 300

La Jolla, California 92037

PROXY STATEMENT

GENERAL INFORMATION

For the 2021 Annual Meeting of Stockholders

To Be Held on June 11, 2021

For the 2021 Annual Meeting of Stockholders

To Be Held on June 11, 2021

Our Board of Directors is soliciting proxies to be voted at our 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on Friday, June 11, 2021, at 8:00 A.M., Pacific Time, for the purposes set forth in the attached Notice of Annual Meeting of Stockholders (the “Notice”) and in this Proxy Statement.

As used in this Proxy Statement, the terms “Company,” “we,” “us” and “our” refer to Silvergate Capital Corporation, the term “Bank” refers to Silvergate Bank and the terms “Board of Directors” and “Board” refers to the Board of Directors of the Company or the Bank, as the case may be.

Questions and Answers about these Proxy Materials and the Annual Meeting

Question: What is the Notice of Internet Availability of Proxy Materials that I received in the mail and why am I receiving it?

Answer: In accordance with rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), except for stockholders who have requested otherwise, we have generally mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”). The Notice of Internet Availability provides instructions either for accessing our proxy materials, including this Proxy Statement, the form of Proxy, and the 2020 Annual Report to Stockholders, which includes the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “2020 Annual Report”), at the website address referred to in the Notice of Internet Availability, or for requesting printed copies of the proxy materials by mail or electronically by e-mail. If you would like to receive a paper or e-mail copy of our proxy materials either for this Annual Meeting or for all future meetings, you should follow the instructions for requesting such materials included in the Notice of Internet Availability we mailed to you.

Our Board of Directors provided the Notice of Internet Availability and is making the proxy materials available to you in connection with the Annual Meeting, to be held on Friday, June 11, 2021. As a stockholder of record as of April 9, 2021 (the “Record Date”), you are invited to attend the Annual Meeting, and are entitled to and requested to vote on the items of business described in this Proxy Statement.

Question: What information is contained in this Proxy Statement?

Answer: This information relates to the proposals to be voted on at the Annual Meeting, the voting process, compensation of our directors and most highly paid executives, and certain other required information.

Question: Can I access the Company’s proxy materials and 2020 Annual Report electronically?

Answer: Yes. The Proxy Statement, form of Proxy and 2020 Annual Report are available at www.proxyvote.com. To view this material, you must have available the 16-digit control number located on the proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

2

Question: What does it mean if I receive more than one Notice of Internet Availability or set of the proxy materials?

Answer: It means your shares are registered differently or are in more than one account. Please provide voting instructions for each account for which you have received a Notice of Internet Availability or set of proxy materials.

Question: Who is soliciting my vote pursuant to this Proxy Statement?

Answer: Our Board of Directors is soliciting your vote at the Annual Meeting.

Question: Who is entitled to vote?

Answer: Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting.

Question: How many shares are eligible to be voted?

Answer: As of the Record Date, we had 24,819,968 shares of Class A common stock issued and outstanding. Each outstanding share of our Class A common stock will entitle its holder to one vote on each of the three (3) director nominees to be elected and one vote on each other matter to be voted on at the Annual Meeting.

Question: What am I voting on?

Answer: You are voting on the following matters:

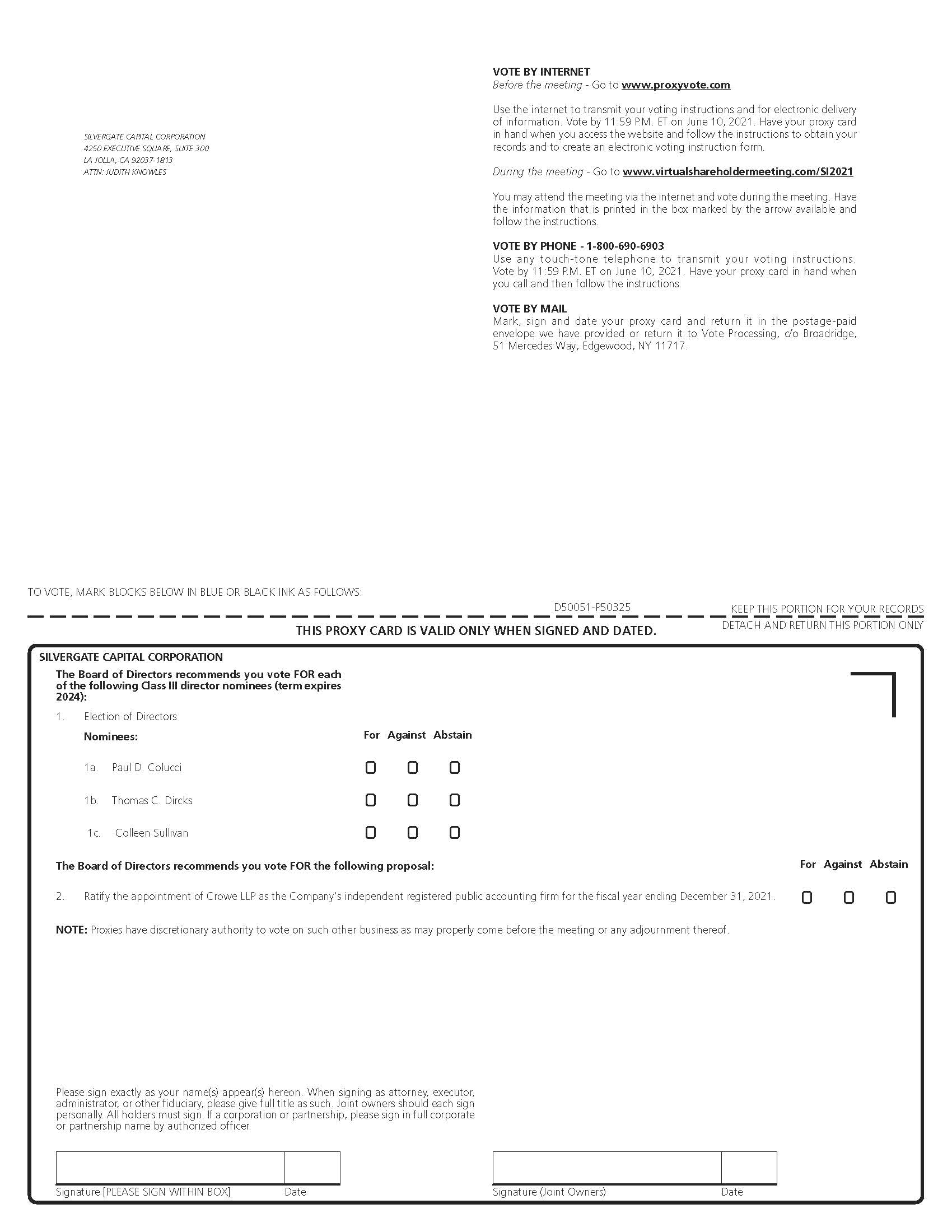

•The election of three (3) Class III director nominees. Our director nominees are Paul D. Colucci, Thomas C. Dircks and Colleen Sullivan; and

•The ratification of the appointment of Crowe LLP as the Company’s independent registered auditor for the fiscal year ending December 31, 2021.

Question: How does our Board of Directors recommend that I vote?

Answer: Our Board recommends that stockholders vote their shares as follows:

•“FOR” each director nominee; and

•“FOR” the ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

Question: How many votes are required to hold the Annual Meeting and what are the voting procedures?

Answer: Quorum Requirement: As of the Record Date, 24,819,968 shares of the Company’s Class A common stock were issued and outstanding. A majority of the outstanding shares entitled to vote at the Annual Meeting, present or represented by proxy, constitutes a quorum for the purpose of adopting proposals at the Annual Meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

Required Votes: Each outstanding share of our Class A common stock is entitled to one vote on each proposal at the Annual Meeting.

If there is a quorum at the Annual Meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

•Election of Directors. Directors are elected by a plurality of the votes cast by the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. As a result, any shares not voted “FOR” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be

3

counted in such nominee’s favor and will have no effect on the outcome of the election. Votes of “WITHHOLD” and broker non-votes have no legal effect on the election of directors due to the fact that such elections are by a plurality. Abstentions will have no effect on the outcome of this proposal. Broker non-votes will have no effect on the outcome of this proposal.

•Ratification of Independent Auditors. The affirmative vote of a majority of all votes cast at the Annual Meeting is required for ratification of the appointment of Crowe LLP as our independent registered auditor for the fiscal year ending December 31, 2021. Abstentions will not be counted as votes cast and, therefore, will not affect the outcome.

If a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in “street name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in “street name” on particular proposals under the rules of the New York Stock Exchange, and the “beneficial owner” of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee is permitted to vote your shares for or against “routine” matters such as Item 2, the ratification of the appointment of our independent registered public accounting firm. Brokers are not permitted to exercise discretionary voting authority to vote your shares for or against “non-routine” matters. Item 1, the election of directors, is a “non-routine” matter.

Question: How can I vote my shares in person and participate at the Annual Meeting?

Answer: This year’s Annual Meeting will be held entirely online. Stockholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/SI2021. To participate in the Annual Meeting, you will need the 16‐digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the stockholder of record also may be voted electronically during the Annual Meeting in accordance with the instructions from your broker, bank or other nominee. However, even if you plan to attend the Annual Meeting online, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

Question: How can I vote my shares without attending the Annual Meeting?

Answer: If you are the stockholder of record, you may vote by one of the following three methods as instructed on the Notice of Internet Availability:

•Via the Internet;

•By telephone; or

•By mail.

If you elect to vote by mail and you requested and received a printed set of proxy materials, you may mark, sign, date and mail the proxy card you received from us in the return envelope. If you did not receive a printed proxy card and wish to vote by mail, you may do so by requesting a paper copy of the proxy materials (as described below), which will include a proxy card.

Whichever method of voting you use, the proxies identified on the proxy card will vote the shares of which you are the stockholder of record in accordance with your instructions. If you submit a proxy card properly voted and returned through available channels without giving specific voting instructions, the proxies will vote the shares as recommended by our Board.

4

If you own your shares in “street name,” that is, through a brokerage account or in another nominee form, you must provide instructions to the broker or nominee as to how your shares should be voted. Your broker or nominee will usually provide you with the appropriate instruction forms at the time you receive the proxy materials. If you own your shares in this manner, you cannot vote in person at the Annual Meeting unless you receive a proxy to do so from the broker or the nominee.

Question: How may I cast my vote over the Internet or by telephone?

Answer: Voting over the Internet: If you are a stockholder of record, you may use the Internet to transmit your vote up until 11:59 P.M., Eastern Time, June 10, 2021 (the day before the Annual Meeting). Visit www.proxyvote.com and have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Voting by Telephone: If you are a stockholder of record, you may call 1-800-690-6903, toll-free in the United States and Canada, and use any touch-tone telephone to transmit your vote up until 11:59 P.M., Eastern Time, June 10, 2021 (the day before the Annual Meeting). Have your proxy card in hand when you call and then follow the instructions.

If you hold your shares in “street name,” that is through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available.

Question: How may a stockholder nominate someone at the Annual Meeting to be a director or bring any other business before the Annual Meeting?

Answer: The Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”) require advance notice to the Company if a stockholder intends to attend an annual meeting of stockholders in person and to nominate someone for election as a director or to bring other business before the meeting. Such a notice may be made only by a stockholder of record within the time period established in the Articles of Incorporation and described in each year’s Proxy Statement. See “Stockholder Proposals for the 2022 Annual Meeting” beginning on page 34.

Question: How may I revoke or change my vote?

Answer: If you are the record owner of your shares, and you completed and submitted a proxy card, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

•submitting a new proxy card with a later date,

•delivering written notice to our Secretary on or before June 11, 2021 (the Annual Meeting date), stating that you are revoking your proxy,

•attending the Annual Meeting and voting your shares in person, or

•If you are a record owner of your shares and you submitted your proxy by telephone or via the Internet, you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be.

Please note that attendance at the Annual Meeting will not, in itself, constitute revocation of your proxy.

If you own your shares in “street name,” you may later revoke your voting instructions by informing the bank, broker or other holder of record in accordance with that entity’s procedures.

Question: Who is paying for the costs of this proxy solicitation?

Answer: The Company will bear the cost of preparing, printing and mailing the materials in connection with this solicitation of proxies. In addition to mailing these materials, officers and regular employees of the Company may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication.

5

Question: Who will count the votes?

Answer: Broadridge will receive and tabulate the ballots and voting instruction forms.

Question: Where do I find the voting results of the Annual Meeting?

Answer: The voting results will be disclosed in a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

Question: How can I obtain the Company’s Corporate Governance information?

Answer: Our Corporate Governance information is available on our website at www.silvergate.com under the Investor Relations section. Our stockholders may also obtain written copies at no cost by writing to us at Silvergate Capital Corporation, 4250 Executive Square, Suite 300, La Jolla, California 92037, Attention: Corporate Secretary, or by calling (858) 362-6300.

Question: How do I request electronic or printed copies of this and future proxy materials?

Answer: You may request and consent to delivery of electronic or printed copies of this and future proxy statements, annual reports and other stockholder communications by

•visiting www.proxyvote.com;

•calling 1-800-690-6903, toll-free in the United States and Canada;

•sending an email to sendmaterial@proxyvote.com.

When requesting copies of proxy materials and other stockholder communications, you should have available the 16-digit control number located on the Notice of Internet Availability or proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

6

PROPOSAL 1: ELECTION OF DIRECTORS

Classification of the Company’s Directors

The Company’s Board of Directors is currently composed of nine (9) members and is divided into three classes of directors serving staggered three-year terms. One class of directors is elected by our stockholders at each annual stockholders’ meeting for a term of three years, and the elected directors hold office until their successors are elected and qualified or until such director’s earlier death, resignation or removal.

•The Class I directors are Dennis S. Frank, Alan J. Lane and Robert C. Campbell, and their terms will expire at the 2022 Annual Meeting;

•The Class II directors are Karen F. Brassfield, Michael T. Lempres and Scott A. Reed, and their terms will expire at the 2023 Annual Meeting; and

•The Class III directors are Paul D. Colucci, Thomas C. Dircks and Colleen Sullivan, and their terms will expire at this 2021 Annual Meeting.

Election Procedures; Term of Office

At each annual meeting of stockholders, or special meeting in lieu thereof, upon the expiration of the term of a class of directors, the successors to such directors will be elected to serve from the time of election and qualification until the third annual meeting following his or her election and the election and qualification of his or her successor. Any change in the Board resulting from an increase or decrease in the number of directors will be distributed by the Board among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Nominees for Election as Directors

Our Board has approved the nomination of Paul D. Colucci, Thomas C. Dircks and Colleen Sullivan for election as Class III directors.

Information about the principal occupations, business experience and qualifications of these nominees is provided below under the heading “Qualifications of 2021 Director Nominees and Continuing Directors.”

7

QUALIFICATIONS OF 2021 DIRECTOR NOMINEES AND CONTINUING DIRECTORS

Class III Director Nominees: | ||||||||

Paul D. Colucci Age: 47 | Mr. Colucci owns and operates a private real estate company focused on the investment, management, and development of real estate opportunities in Southern California. Portfolio asset types include multi-family, office, industrial and single-family housing. He previously worked for Goldman Sachs, Inc. in the real estate investment-banking group in New York City. He also worked for Batchelder and Partners, a boutique investment bank focusing on mergers and acquisitions and corporate finance advisory services. Mr. Colucci earned a Bachelor of Arts degree in Business Administration from the University of San Diego. In nominating Mr. Colucci, the Nominating and Corporate Governance Committee considered as important factors Mr. Colucci's investment banking, financial advisory, and real estate investment experience. | |||||||

Director Since: 2013 | ||||||||

Committees: Audit; Compensation | ||||||||

Thomas C. Dircks Age: 63 | Mr. Dircks is a Managing Director of Charterhouse Strategic Partners, a provider of strategically focused investments in growth companies in the United States. Mr. Dircks was previously Managing Partner of Charterhouse Equity Partners and was responsible for managing and overseeing the investment of Charterhouse’s multi billion dollars of North America focused institutional private equity funds. Prior to joining Charterhouse, he was employed by PricewaterhouseCoopers as a certified public accountant. He holds a Bachelor of Science in Accounting and a Masters of Business Administration from Fordham University. In nominating Mr. Dircks, the Nominating and Corporate Governance Committee considered as important factors Mr. Dircks’s public accounting background and 36 years of experience in making and managing substantial private equity investments. | |||||||

Director Since: 2003 | ||||||||

Committees: Audit; Nominating and Corporate Governance (Chair) | ||||||||

Colleen Sullivan Age: 48 | Ms. Sullivan is the CEO of CMT Digital, a division of the CMT Group, where she has been a partner since 2013. CMT Digital is focused on digital asset trading, blockchain technology investments, and legal/policy engagement in the digital asset/blockchain technology industry. She also serves on the Advisory Board of the Chamber of Digital Commerce, has practiced law in Illinois since 2001, and was one of the founding members of the female-run law firm, Sullivan Wolf Kailus LLC. Ms. Sullivan holds a Bachelor of Science in Accounting from the University of St. Francis and Juris Doctor from the DePaul University College of Law. In nominating Ms. Sullivan, the Nominating and Corporate Governance Committee considered as important factors Ms. Sullivan's significant expertise in the digital asset/blockchain technology industry. | |||||||

Director Since: 2020 | ||||||||

Committees: Compensation | ||||||||

8

Continuing Directors: | ||||||||

Class I Directors: | ||||||||

Robert C. Campbell Age: 71 | Mr. Campbell is an attorney who has specialized in corporate and commercial law. Through his ownership of Hendron Holding Corporation (the successor company to Charterhouse Canada). Mr. Campbell has engaged in the business of merchant banking and venture capital investing. He was one of the initial investors in Coastal Savings Bank (Houston, Texas), which was the first financial institution purchased under the Southwest Plan in the wake of the savings and loan crisis in the U.S. Subsequently he was one of the investors involved in the 1996 recapitalization of the Company and Silvergate Bank, where he currently serves as Lead Director for each, as well as a member of several board committees. He is also an experienced investor in real estate properties in Canada and the U.S. Mr. Campbell holds a Bachelor of Arts degree from York University as well as a law degree from Osgood Hall Law School and practiced corporate commercial law in Toronto for 10 years until 1986. Mr. Campbell’s qualifications to serve on our Board include his diverse legal, financial, real estate, and investment experience over four decades. | |||||||

Director Since: 1996 | ||||||||

Committees: Audit; Compensation (Chair); Nominating and Corporate Governance | ||||||||

Dennis S. Frank Age: 65 | Mr. Frank has been Chairman of the Board of both the Bank and the Company since November 1996 and served as Chief Executive Officer of the Company from November 1996 until December 2017. He also served as Chief Executive Officer of the Bank from November 1996 until July 2007. Mr. Frank is also President of PDL Management LLC, Houston, Texas, a private investment company. From 1988 to 1993, Mr. Frank was a Managing Director and major shareholder of Coastal Banc SSB, Houston, Texas, and he served as director of Coastal Banc from 1988 until its sale to Hibernia Bancorp in May of 2004. From 1980 through 1987, Mr. Frank was a Vice President of Goldman, Sachs & Co. in New York. He has a Master of Business Administration and a Bachelor of Science degree in Business from New York University. Mr. Frank’s qualifications to serve on our Board include extensive financial services industry experience and his roles as an executive manager and director of banking companies since 1988, including over 20 years as Chairman and Chief Executive Officer of the Company and the Bank. | |||||||

Director since: 1996 | ||||||||

Committees: None | ||||||||

Alan J. Lane Age: 58 | Mr. Lane has been with the Company since December 2008. He is Director and Chief Executive Officer of the Bank and is Director, Chief Executive Officer and President of the Company. Mr. Lane has 40 years of corporate and financial institution leadership experience. He formerly held the positions of Director, President and Chief Operating Officer of Southwest Community Bancorp; Vice-Chairman and Chief Executive Officer of Financial Data Solutions, Inc.; and Director and Chief Executive Officer of Business Bancorp. In addition to his financial institution experience, Mr. Lane has served as President/CEO or Chief Financial Officer of both manufacturing and retail companies. Mr. Lane serves on the Board of Directors of Natural Alternatives International, Inc. He earned his Bachelor of Arts in Economics from San Diego State University. Mr. Lane’s qualifications to serve on our Board include his broad background in the banking industry since the 1980s and executive management experience with multiple banking institutions and other companies over this period. | |||||||

Director Since: 2008 | ||||||||

Committees: None | ||||||||

Class II Directors: | ||||||||

Karen F. Brassfield Age: 73 | Ms. Brassfield joined the Bank in March 2009 as Senior Vice President and Chief Financial Officer and served as Executive Vice President and Chief Banking Officer from September 2011 to December 2013. She previously was Chief Administrative Officer for San Diego National Bank. Prior to San Diego National Bank, Ms. Brassfield was Chief Financial Officer for Fallbrook National Bank, Temecula, California, and Chief Administrative Officer for First National Bank, San Diego. Ms. Brassfield received a Bachelor of Arts in Economics from Lawrence University, Appleton, Wisconsin. She is a graduate of LEAD San Diego. Ms. Brassfield's qualifications to serve on our Board include her extensive experience in the Southern California banking industry over several decades in administrative, financial, and senior management roles with several institutions. | |||||||

Director Since: 2013 | ||||||||

Committees: Audit (Chair) | ||||||||

Michael T. Lempres Age: 61 | Mr. Lempres brings deep experience in both digital assets and traditional financial services. He serves as an advisor and director on numerous digital asset and financial technology projects and companies. He served as executive in residence at venture capital firm Andreessen Horowitz and worked as chief legal and risk officer of Coinbase, Inc., the nation’s leading digital currency exchange, general counsel of BitNet, Inc., an early digital currency company, and the senior attorney at Silicon Valley Bank. Earlier in his career he served as general counsel to the Pacific Exchange, a national securities exchange. In the public sector, Mr. Lempres has been appointed by three presidential administrations; he served as a White House Fellow and held several positions in the U.S. Department of Justice, including deputy associate attorney general. Mr. Lempres holds an A.B. degree from Dartmouth College and a law degree from Boalt Hall School of Law, University of California, Berkeley. Mr. Lempres's qualifications to serve on our Board include his extensive legal experience, including his service as chief legal and risk officer with one of the nation's largest digital currency exchanges, his role as the senior attorney at a major California bank with a special technology focus, and his continuing activities and roles in venture capital and with other digital currency companies. | |||||||

Director Since: 2019 | ||||||||

Committees: Nominating and Corporate Governance | ||||||||

Scott A. Reed Age: 50 | Mr. Reed is partner, director and co-founder of BankCap Partners. Mr. Reed was recently CEO of LF Capital Acquisition Corp., a publicly-traded special purpose acquisition corporation. Mr. Reed’s previous positions include derivatives trader with Swiss Bank Corporation, a consultant with Bain & Company, an investment banker in the Bear Stearns Financial Institutions Group, and Senior Vice President, Director of Corporate Strategy and Planning for Carreker Corporation. In addition to serving on the board of the Company, he also serves as a director of Vista Bankshares, Inc., a Dallas, Texas, based commercial bank and InBankshares Corp., a Raton, New Mexico, based commercial bank. He also serves as a director of Landsea Home (LSEA), a publicly traded homebuilder based in Newport Beach, California. Additionally, Mr. Reed serves as a director of Uncommon Giving, a private Scottsdale, Arizona based technology company. Mr. Reed is a graduate of the University of Virginia with a Bachelor of Science in Commerce and a Bachelor of Arts in History. He received his Masters of Business Administration from the Amos Tuck School of Business at Dartmouth College, where he was an Edward Tuck Scholar. Mr. Reed's qualifications to serve on our Board include his service as a director of banking institutions and other companies, his broad overall financial services industry experience, including as an investment banker and consultant, and his role as a co-founder and director of a firm having made a series of substantial and successful equity investments in commercial banking companies. | |||||||

Director Since: 2015 | ||||||||

Committees: Compensation; Nominating and Corporate Governance | ||||||||

9

EXECUTIVE OFFICERS WHO ARE NOT SERVING AS DIRECTORS

Below is information regarding each of our current executive officers who are not directors of the Company, including their title, age and brief biography describing each executive officer’s business experience. No executive officer has any family relationship with any other executive officer or any of our current directors, other than Mr. Eisele and Mr. Frank, our Chairman of the Board, who are siblings.

Name | Age | Position | ||||||||||||

Kathleen M. Fraher | 42 | Chief Operating Officer of the Company and the Bank | ||||||||||||

Benjamin C. Reynolds | 44 | Chief Strategy Officer of the Company and the Bank | ||||||||||||

Antonio Martino | 53 | Chief Financial Officer of the Company and the Bank | ||||||||||||

Derek J. Eisele | 55 | Executive Vice President of the Company and Chief Credit Officer of the Bank | ||||||||||||

John M. Bonino | 72 | Chief Legal Officer of the Company and the Bank | ||||||||||||

| Son-Jai Paik | 48 | Chief Human Resources Officer of the Company and the Bank | ||||||||||||

Kathleen M. Fraher. Ms. Fraher joined the Bank in 2006 as Vice President, Compliance and BSA Officer; she was named Senior Vice President / Enterprise Risk Manager in 2013, Executive Vice President in 2015, Chief Administrative Officer in 2016, and Executive Vice President and Chief Administrative Officer of the Company in 2018. In connection with a management realignment in 2018, Ms. Fraher was promoted to Chief Operating Officer of the Company and the Bank. Ms. Fraher’s broad-based banking background includes emphasis on managing regulatory relationships, examinations, and compliance with banking laws and regulations. Ms. Fraher’s previous positions include Operations Administrative Officer for Community National Bank, and Senior Compliance Risk Specialist for Imperial Capital Bank. Ms. Fraher holds a Bachelor of Science degree in Business Administration from Mount St. Mary’s College in Los Angeles, California, and completed the ABA Graduate School of Compliance Management.

Benjamin C. Reynolds. Mr. Reynolds joined the Bank in January 2016 and became an Executive Vice President of the Company and Executive Vice President and Director of Corporate Development of the Bank in February 2019, and was appointed Chief Strategy Officer of the Company and Bank in January 2021. Mr. Reynolds and his team are responsible for helping entrepreneurs within the digital currency, blockchain and Fintech ecosystem to realize their goals by providing banking, technology and consulting services that are on the cutting edge of the financial services industry. Customers include some of the most recognized and well-funded digital currency exchanges, institutional investors and software developers in Fintech. Over the past 20 years, Mr. Reynolds has developed expertise within product development, marketing, strategy, risk and accounting functions for both Fortune 100 firms and companies that he has founded. Prior to joining Silvergate, Mr. Reynolds served as the Chief Marketing Officer for Carsinia Software from 2014-2016, as Chief Financial Officer of Henry Clay Motors from 2009-2014, as Vice President of Marketing and Product Management at HSBC Auto Finance from 2006-2008, and as Senior Associate at KPMG from 1999 to 2002. Mr. Reynolds earned a Bachelor of Science in Accounting from San Diego State University, a Master of Business Administration from Pepperdine University, and is a certified public accountant in California.

Antonio Martino. Mr. Martino joined the Bank and the Company in September 2019 as the Chief Financial Officer. Mr. Martino has 30 years of financial services and public accounting experience. Prior to joining Silvergate, Mr. Martino served as the Chief Financial Officer of LendingPoint, an Atlanta-based privately held fintech lender, from 2017 to 2019. He began his professional career at Ernst & Young where he was responsible for audit, tax and consulting services. Mr. Martino

10

then transitioned to a senior manager role at Bank of Montreal from 1998 to 2000, followed by 17 years with Citigroup, Inc. in various senior finance and chief financial officer roles in North America, Europe, and the Middle East from 2000 to 2017. He holds a Bachelor of Commerce Degree in Accounting from the University of Ottawa and is a Chartered Professional Accountant and Chartered Accountant certified by the Chartered Professional Accountants of Canada.

Derek J. Eisele. Mr. Eisele has served as an executive officer of the Bank and the Company since the recapitalization of the Bank in 1996. Mr. Eisele was also an active partner in DSF Management Corporation, a real estate investment and management company, from 1994-2000. From November 1989 to April 1994, Mr. Eisele was a Vice President of Coastal Realty Partners, Houston, Texas, where he was responsible for managing and disposing of real estate and real estate related assets on behalf of governmental agencies and private investors, and he oversaw asset resolutions from over 100 failed financial institutions through contract work for the Federal Deposit Insurance Corporation, Resolution Trust Corporation, and Federal and Savings Loan Insurance Corporation. Mr. Eisele has a Master of Business Administration from the University of Houston and a Bachelor of Science in Business Administration from the University of Delaware. Mr. Eisele is also a graduate of the American Bankers Association Stonier Graduate School of Banking at the University of Pennsylvania.

John M. Bonino. Mr. Bonino has been associated with the Bank and the Company as a consultant or employee since 1996. He was in a consultant capacity from 1996 to 2003, at which point he joined the Bank as President and Chief Operating Officer. In 2006 he went back to a consultant role, and then returned in 2009 as Senior Vice President of Corporate Development. He was then promoted to Executive Vice President in 2015, and Chief Operating Officer in 2016. In connection with a management realignment in 2018, Mr. Bonino became the Chief Legal Officer for both the Company and the Bank. Mr. Bonino’s prior positions include Executive Vice President, Chief Administrative and Financial Officer of Imperial Thrift and Loan, Senior Vice President of Wedbush, Noble, Cooke, Inc., Executive Vice President and Director of securities firm Bateman Eichler, Hill Richards, Inc., and Corporate Counsel of TransTechnology Corporation. Mr. Bonino is a graduate of the University of Southern California School of Business and Stanford Law School, and a member of the California State Bar..

Son-Jai Paik. Mr. Paik joined Silvergate in April 2020 as Chief Human Resources Officer. With over 20 years of human resources experience nationally and internationally, Mr. Paik brings to Silvergate's management team his past leadership through fast-paced growth, acquisitions, dispositions, reorganizations, and large-scale change initiatives. Prior to joining Silvergate Mr. Paik served as Executive Vice President, Chief Human Resources Officer for Commonwealth Business Bank, and he was previously Senior Vice President, Human Resources of Alexander & Baldwin Mr. Paik earned his Bachelor of Arts degree in Economics from Syracuse University, and a Master of Management in Hospitality and a Master of Professional Studies in Industrial and Labor Relations, both from Cornell University.

11

CORPORATE GOVERNANCE

Corporate Governance Principles and Board Matters

Corporate Governance Guidelines.

We are committed to sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. Our Board has adopted Corporate Governance Guidelines, which set forth the framework within which our Board, assisted by the committees of our Board, directs the affairs of our organization. The Corporate Governance Guidelines address, among other things, the composition and functions of our Board, director independence, compensation of directors, management succession and review, committees of our board of directors and selection of new directors. Our Corporate Governance Guidelines are available on our website at www.silvergate.com under the “Investor Relations” tab.

Director Qualifications.

We believe that our directors should have the highest professional and personal ethics and values. They should have broad experience at the policy-making level in business, banking, real estate, or technology. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on boards of other companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all shareholders. When considering potential director candidates, our Board also considers the candidate’s character, judgment, diversity, skill set, specific business background and global or international experience in the context of our needs and those of the Board.

Director Independence.

Under the rules of the New York Stock Exchange, independent directors must comprise a majority of our Board. The rules of the New York Stock Exchange, as well as those of the SEC, impose several other requirements with respect to the independence of our directors. Our Board has evaluated the independence of its members based upon the rules of the New York Stock Exchange and the SEC. Applying these standards, our Board has affirmatively determined that Messrs. Campbell, Dircks, Colucci, Reed and Lempres and Mses. Brassfield and Sullivan are “independent directors” under the applicable rules of the New York Stock Exchange and the SEC. We have determined that Messrs. Frank and Lane do not qualify as independent directors because each is or was an executive officer of either the Company or the Bank.

Leadership Structure.

The boards of directors of the Company and the Bank have nine regularly scheduled meetings per year. Our Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the board of directors, as the Board believes that it is in the best interests of our organization to make that determination from time to time based on the position and direction of our organization and the membership of our Board.

Currently, Mr. Frank serves as Chairman of the board of directors of the Company and the Bank, while Mr. Lane is the Chief Executive Officer of both the Company and the Bank. We believe this structure (as opposed to combining the positions of chairman and chief executive officer) is appropriate for us for two primary reasons. First, having a separate board chairman allows Mr. Lane to completely focus on his primary responsibilities which are implementing our strategic plans and managing the day-to-day operations of the Company and the Bank. Second, we believe that having the board chairman position separate from the Chief Executive Officer position allows the boards of directors to more effectively fulfill their obligation to oversee the management of the Company and the Bank. In addition, due to our Chairman of the board of directors not being an independent director, we have a separate independent Lead Director, Robert C. Campbell. The Lead

12

Director serves as a liaison between the Chairman and the independent directors and has the authority to call and chair meetings or executive sessions of the independent directors. The Lead Director also chairs full board of directors’ meetings in the absence of the Chairman.

Code of Business Conduct and Ethics.

Our Board has adopted a Code of Business Conduct and Ethics that applies to all our directors and employees. This code provides fundamental ethical principles to which these individuals are expected to adhere and operates as a tool to help our directors, officers and employees understand the high ethical standards required for employment by, or association with, our Company. Our Code of Business Conduct and Ethics is available on our website at www.silvergate.com under the “Investor Relations” tab. Any amendments to our Code of Business Conduct and Ethics, or any waivers of its requirements, will be disclosed on our website, as well as by any other means required by New York Stock Exchange rules, including by filing a Current Report on Form 8-K.

Compensation Committee Interlocks and Insider Participation.

None of the members of our Compensation Committee are or have been one of our officers or employees. In addition, none of our executive officers serve or have served as a member of the compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Risk Management and Oversight.

Our Board oversees our risk management process, which is a company-wide approach to risk management that is carried out by our management. Our full Board determines the appropriate risk for us generally, assesses the specific risks faced by us, and reviews the steps taken by management to manage those risks. While our full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk within their specific area of concern. Our Board monitors capital adequacy in relation to risk. Pursuant to our Board’s instruction, management regularly reports on applicable risks to the relevant committee or the full Board, as appropriate, with additional review or reporting on risks conducted as needed or as requested by our Board and its committees.

Communications with the Board and Annual Meeting Attendance

All interested parties who wish to contact our Board or an individual director may do so by writing to: Board of Directors, Silvergate Capital Corporation, 4250 Executive Square, Suite 300, La Jolla, CA 92037, Attention: Corporate Secretary. Interested parties who wish to communicate directly with the Lead Director of the Board or with the Company’s non-management directors as a group may do so by writing to the address listed above, but by addressing such communication to the attention of the Chair of the Nominating and Corporate Governance Committee. The letter should indicate if the author is a stockholder of Silvergate, and, if shares are not held of record, should include appropriate evidence of stock ownership. Communications are reviewed by the Corporate Secretary and are then distributed to the Board or the individual director, as appropriate, depending on the facts and circumstances outlined in the communications received. The President and CEO, however, may directly respond at his discretion. If appropriate, the Corporate Secretary may (1) handle an inquiry directly, or (2) forward a communication for response by another employee of Silvergate. A copy of any such communication and response is forwarded to the Board at the next scheduled Board meeting. The Corporate Secretary has the authority not to forward a communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

The Board members are not required to attend our annual meetings of stockholders. However, all directors are encouraged to attend every annual meeting of stockholders as we believe that the annual meeting is an opportunity for

13

stockholders to communicate directly with directors. If you would like an opportunity to discuss issues directly with the members of the Board, please consider attending this year’s Annual Meeting.

COMMITTEES OF THE BOARD OF DIRECTORS

Our Board has established standing committees to assist the discharge of its responsibilities. These committees include the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Our Board also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents.

Nominating | ||||||||||||||||||||

& | ||||||||||||||||||||

Corporate | ||||||||||||||||||||

Audit | Compensation | Governance | ||||||||||||||||||

Dennis S. Frank | ||||||||||||||||||||

Alan J. Lane | ||||||||||||||||||||

Karen F. Brassfield | Chair | |||||||||||||||||||

Robert C. Campbell | X | Chair | X | |||||||||||||||||

Paul D. Colucci | X | X | ||||||||||||||||||

Thomas C. Dircks | X | Chair | ||||||||||||||||||

Michael T. Lempres | X | |||||||||||||||||||

Scott A. Reed | X | X | ||||||||||||||||||

| Colleen Sullivan | X | |||||||||||||||||||

Number of Meetings in 2020 | 9 | 7 | 3 | |||||||||||||||||

Audit Committee. The members of our Audit Committee are Ms. Brassfield (Chair), and Messrs. Campbell, Colucci, and Dircks. Our Board has evaluated the independence of each of the members of our Audit Committee and has affirmatively determined that (1) each of the members of our Audit Committee is an “independent director” under the New York Stock Exchange rules, (2) each of the members satisfies the additional independence standards under applicable SEC rules for audit committee service, and (3) each of the members can read and understand fundamental financial statements. In addition, our Board has determined that each of Ms. Brassfield and Mr. Campbell is a financial expert and has the financial sophistication required by the rules of the New York Stock Exchange due to their experience and background. Our Board has also determined that each of Ms. Brassfield and Mr. Campbell satisfies the requirements established by the SEC for qualification as an “audit committee financial expert.”

The Audit Committee assists the Board in its oversight of the integrity of our financial statements, the selection, engagement, management and performance of our independent auditor that audits and reports on our consolidated financial statements, the performance of our internal audit function, the review of reports of bank regulatory agencies, monitoring management’s compliance with the recommendations contained in those reports and our compliance with legal and regulatory requirements related to our financial statements and reporting. Among other things, our Audit Committee has responsibility for:

•selecting and reviewing the performance of our independent auditor and approving, in advance, all engagements and fee arrangements;

14

•reviewing reports from the independent auditor regarding its internal quality control procedures and any material issues raised by the most recent internal quality-control or peer review or by governmental or professional authorities, and any steps taken to deal with such issues;

•reviewing the independence of our independent auditor and setting policies for hiring employees or former employees of our independent auditor and for audit partner rotation and independent auditor rotation in accordance with applicable laws, rules and regulations;

•resolving any disagreements regarding financial reporting between management and the independent auditor;

•overseeing our internal audit function;

•reviewing operating and control issues identified in internal audit reports, management letters, examination reports of regulatory agencies and monitoring management’s compliance with recommendations contained in those reports;

•meeting with management and the independent auditor to review the effectiveness of our system of internal controls and internal audit procedures, and to address any deficiencies in such procedures;

•monitoring management’s compliance with all applicable laws, rules and regulations;

•reviewing our earnings releases and reports filed with the SEC;

•preparing the Audit Committee report required to be included in our annual report by SEC rules;

•reviewing the adequacy and effectiveness of our accounting and financial controls, including guidelines and policies for assessing and managing our risk exposure;

•establishing and overseeing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and for the confidential anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters;

•reviewing actions by management on recommendations of the independent auditors and internal auditors;

•reviewing and approving or ratifying related party transactions; and

•handling such other matters as are specifically delegated to the Audit Committee by our Board from time to time.

Our Audit Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Audit Committee is available on our website at www.silvergate.com under the “Investor Relations” tab.

Compensation Committee. The members of our Compensation Committee are Messrs. Campbell (Chairman), Colucci, and Reed and Ms. Sullivan. Our Board has evaluated the independence of each of the members of our Compensation Committee and has affirmatively determined that each of the members of our Compensation Committee meets the definition of an “independent director” under the New York Stock Exchange rules.

Our Board has also determined that each of the members of the Compensation Committee qualifies as a “nonemployee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended ("Exchange Act").

The Compensation Committee assists the Board in its oversight of our overall compensation structure, policies and programs and assessing whether such structure meets our corporate objectives, the compensation of our named executive officers and the administration of our compensation and benefit plans.

Among other things, our Compensation Committee has responsibility for:

•reviewing and determining, and recommending to the board of directors for its confirmation, the annual compensation, annual incentive compensation and any other matter relating to the compensation of our named

15

executive officers; all employment agreements, severance or termination agreements, change in control agreements to be entered into between any executive officer and us; and modifications to our philosophy and compensation practices relating to compensation of our directors and management;

•reviewing and determining, and recommending to the board of directors for its confirmation, the establishment of performance measures and the applicable performance targets for each performance-based cash and equity incentive award to be made under any benefit plan;

•taking all actions required or permitted under the terms of our benefit plans, with separate but concurrent authority;

•reviewing, approving and administering each of our benefit plans, and performing such other duties and responsibilities as may be assigned to the Compensation Committee under the terms of such plans;

•reviewing with our Chief Executive Officer the compensation payable to employees other than the named executive officers, including equity and non-equity incentive compensation and other benefits and our total incentive compensation program envisioned for each fiscal year;

•consulting with our Chief Executive Officer regarding a succession plan for our executive officers, including our Chief Executive Officer, and the review of our leadership development process for senior management positions;

•reviewing the performance of our named executive officers;

•reviewing and discussing with management any compensation discussion and analysis included in our annual meeting proxy statements and any other reports filed with the SEC and determining whether or not to recommend to our Board that such compensation discussion and analysis be so included;

•preparing the Compensation Committee report required by SEC rules to be included in our annual report;

•overseeing the administration of our equity plans and other incentive compensation plans and programs and preparing recommendations and periodic reports to our Board relating to these matters;

•overseeing and making recommendations to the Board regarding the Company’s compliance with SEC rules and regulations regarding stockholder approval of certain executive compensation matters, including advisory votes on executive compensation and golden parachute compensation and approval of equity compensation plans;

•conducting an annual evaluation of the performance of the Compensation Committee and the adequacy of its charter and recommending to the Board any changes that it deems necessary; and

•handling such other matters as are specifically delegated to the Compensation Committee by our Board from time to time.

Our Compensation Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Compensation Committee is available on our website at www.silvergate.com under the “Investor Relations” tab.

Nominating and Corporate Governance Committee. The members of our Nominating and Corporate Governance Committee are Messrs. Dircks (Chairman) Campbell, Lempres, and Reed. Our Board has evaluated the independence of each of the members of our Nominating and Corporate Governance Committee and has affirmatively determined that each of the members of our Nominating and Corporate Governance Committee meets the definition of an “independent director” under the New York Stock Exchange rules.

The Nominating and Corporate Governance Committee assists the Board in its oversight of identifying and recommending persons to be nominated for election as directors and to fill any vacancies on the Board of the Company and each of our subsidiaries, monitoring the composition and functioning of the standing committees of the Board of the

16

Company and each of our subsidiaries, developing, reviewing and monitoring the corporate governance policies and practices of the Company and each of our subsidiaries.

Among other things, our Nominating and Corporate Governance Committee has responsibility for:

•reviewing the performance of our boards of directors of the Company and each of our subsidiaries;

•identifying, assessing and determining the qualification, attributes and skills of, and recommending, persons to be nominated by our Board for election as directors and to fill any vacancies on the boards of directors of the Company and each of our subsidiaries;

•reviewing the background, qualifications and independence of individuals being considered as director candidates, including persons proposed by our stockholders;

•reviewing and recommending to our Board each director’s suitability for continued service as a director upon the expiration of his or her term and upon any material change in his or her status;

•reviewing the size and composition of the Board of the Company and each of our subsidiaries as a whole, and recommend any appropriate changes to reflect the appropriate balance of required independence, knowledge, experience, skills, expertise and diversity;

•monitoring the function of our standing committees and recommending any changes, including the director assignments, creation or elimination of any committee;

•developing, reviewing and monitoring compliance with our corporate governance guidelines and the corporate governance provisions of the federal securities laws and the listing rules applicable to us;

•investigating any alleged violations of such guidelines and the applicable corporate governance provisions of federal securities laws and listing rules, and reporting such violations to our Board with recommended corrective actions;

•reviewing our corporate governance practices in light of best corporate governance practices among our peers and determining whether any changes in our corporate governance practices are necessary;

•considering any resignation tendered to our Board by a director and recommend the acceptance of such resignation if appropriate;

•considering questions of possible conflicts of interest involving directors, including operations that could be considered competitive with our operations or otherwise present a conflict of interest;

•overseeing our director orientation and continuing education programs for the Board;

•reviewing its charter and recommending to our Board any modifications or changes; and

•handling such other matters as are specifically delegated to the Nominating and Corporate Governance Committee by our Board from time to time.

Our Nominating and Corporate Governance Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Nominating and Corporate Governance Committee is available on our website at www.silvergate.com under the “Investor Relations” tab.

In carrying out its functions, the Nominating and Corporate Governance Committee develops qualification criteria for all potential nominees for election, including incumbent directors, board nominees and stockholder nominees to be included in the Company’s future proxy statements. These criteria may include the following attributes:

•adherence to high ethical standards and high standards of integrity;

17

•sufficient educational background, professional experience, business experience, service on other boards of directors and other experience, qualifications, diversity of viewpoints, attributes and skills that will allow the candidate to serve effectively on the Board and the specific committee for which he or she is being considered;

•evidence of leadership, sound professional judgment and professional acumen;

•evidence the nominee is well recognized in the community and has a demonstrated record of service to the community;

•a willingness to abide by any published code of conduct or ethics for the Company and to objectively appraise management performance;

•the ability and willingness to devote sufficient time to carrying out the duties and responsibilities required of a director;

•any related party transaction in which the candidate has or may have a material direct or indirect interest and in which we participate; and

•the fit of the individual’s skills and personality with those of other directors and potential directors in building a board of directors that is effective, collegial and responsive to the needs of the Company and the interests of our stockholders.

The Nominating and Corporate Governance Committee also evaluates potential nominees for the Company’s Board to determine if they have any conflicts of interest that may interfere with their ability to serve as effective Board members and to determine whether they are “independent” in accordance with applicable SEC and New York Stock Exchange rules (to ensure that, at all times, at least a majority of our directors are independent). Although we do not have a separate diversity policy, the Nominating and Corporate Governance Committee considers the diversity of the Company’s directors and nominees in terms of knowledge, experience, skills, expertise and other factors that may contribute to the effectiveness of the Company’s Board. The Nominating and Corporate Governance Committee and the Board believe that it is important that the Board is adequately diverse and inclusive in various respects, and are particularly mindful of this need for diversity as candidates are considered to fill Board vacancies.

Prior to nominating or, if applicable, recommending an existing director for re-election to the Company’s Board, the Nominating and Corporate Governance Committee considers and reviews the following attributes with respect to each sitting director:

•attendance and performance at meetings of the Company’s Board and the committees on which such director serves;

•length of service on the Company’s Board;

•experience, skills and contributions that the sitting director brings to the Company’s Board;

•independence and any conflicts of interest; and

•any significant change in the director’s status, including with respect to the attributes considered for initial membership on the Company’s Board.

Board and Committee Meetings and Executive Sessions

Our Board held 11 meetings during fiscal year 2020. During fiscal year 2020, the Board had three separately designated standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

18

In fiscal year 2020, each incumbent director attended at least 80% of the aggregate of (1) the total number of meetings of the Board (held during the period for which that person served as a director) and (2) the total number of meetings held by all committees of the Board on which that person served (held during the period served).

It is the Company’s policy that the independent directors of the Company meet in executive sessions without management at least once on an annual basis in conjunction with regularly scheduled board meetings

BENEFICIAL OWNERSHIP OF CLASS A COMMON STOCK

The following table sets forth information as of the Record Date relating to the beneficial ownership of Class A common stock by (i) each of our directors and executive officers named in the Summary Compensation Table (such executive officers are referred to herein as the “Named Executive Officers”); and (ii) all of our directors and executive officers as a group; and includes all shares of common stock that may be acquired within 60 days of the Record Date. The address of each of the persons named below is the address of the Company except as otherwise indicated. As of the Record Date, no person or group is known by us to own beneficially more than five percent (5%) of the outstanding shares of Class A common stock.

Number of | Percent of | ||||||||||||||||

Shares | Class | ||||||||||||||||

Beneficially | Beneficially | ||||||||||||||||

Name | Owned | Owned | |||||||||||||||

Directors, Director Nominees and Named Executive Officers | |||||||||||||||||

Dennis S. Frank(1) | 202,344 | * | |||||||||||||||

Alan J. Lane(2) | 403,113 | 1.62 | |||||||||||||||

Karen F. Brassfield | 28,242 | * | |||||||||||||||

Robert C. Campbell | 3,352 | * | |||||||||||||||

Paul D. Colucci(3) | 92,706 | * | |||||||||||||||

Thomas C. Dircks(4) | 178,147 | * | |||||||||||||||

Michael T. Lempres | 1,833 | * | |||||||||||||||

Scott A. Reed(5) | 939,700 | 3.79% | |||||||||||||||

| Colleen Sullivan | 461 | * | |||||||||||||||

| Kathleen M. Fraher | 20,084 | * | |||||||||||||||

Benjamin C. Reynolds(6) | 12,248 | * | |||||||||||||||

All Directors, Nominees and Named Executive Officers as a Group (11 Persons) | 2,130,228 | 8.5% | |||||||||||||||

* Denotes less than 1%

(1)Includes 10,710 shares held by the Dennis Frank IRA.

(2)Includes 230,750 shares held by the Lane Family Trust, Alan Lane IRA and Alan Lane 401(k), and 172,363 shares of our common stock underlying options that are currently exercisable or are exercisable within 60 days of April 9, 2021.

(3)Includes 47,728 shares held in custodial accounts for Paul and Maureen Colucci.

(4)Includes 46,299 shares held by Dircks Family LLC, 23,183 shares held by Dircks Family Foundation, and 95,900 shares held by Charter Digital..

(5)Includes 935,000 shares held by BankCap Partners Opportunity Fund, L.P., of which Mr. Reed is a principal of the general partner of such fund, and as to which Mr. Reed disclaims beneficial ownership except to the extent of his pecuniary interest. Also includes 2,200 shares owned by Mr. Reed's four sons.

(6)Includes 7,500 shares of our common stock underlying options that are currently exercisable or are exercisable within 60 days of April 9, 2021.

19

COMPENSATION OF NON-EMPLOYEE DIRECTORS

The table below summarizes the total compensation paid by the Company to those persons who served as our non-employee directors for the fiscal year ended December 31, 2020.

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | |||||||||||||||||

| Dennis S. Frank | $ | 142,000 | $ | 29,997 | $ | 171,997 | ||||||||||||||

| Robert C. Campbell | 250,000 | 29,997 | 279,997 | |||||||||||||||||

| Karen F. Brassfield | 58,000 | 29,997 | 87,997 | |||||||||||||||||

| Paul D. Colucci | 68,000 | 29,997 | 97,997 | |||||||||||||||||

| Thomas C. Dircks | 63,000 | 29,997 | 92,997 | |||||||||||||||||

| Michael T. Lempres | 40,000 | 29,997 | 69,997 | |||||||||||||||||

| Scott A. Reed | 40,000 | 29,997 | 69,997 | |||||||||||||||||

| Colleen Sullivan | 18,478 | 26,323 | 44,801 | |||||||||||||||||

________________________

(1)These amounts reflect the aggregate grant date fair value of stock awards computed in accordance with FASB ASC Topic 718, "Accounting for Stock Compensation." ("ASC 718"). See Note 12 to the consolidated audited financial statements contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2020 regarding assumptions underlying valuation of equity awards.

For the year ended December 31, 2020, our directors who are not also our employees or employees of our subsidiaries, referred to as “outside directors,” received an annual retainer fee of $40,000 per director for their service on the board the directors. The annual retainer is paid quarterly in cash. No fees were paid for attending board meetings.

Mr. Frank, as the Chairman of the Board, received an annual retainer of $65,000. Mr. Campbell, as the Lead Director, received a monthly retainer of $20,833 in lieu of the outside director’s annual retainer and all fees for his services on the committees of the board of directors.

The directors on the Company’s Audit Committee, other than the Lead Director, received a quarterly retainer of $4,500 in cash. The Chair of the Nominating and Corporate Governance Committee received a quarterly retainer of $1,250 in cash.

Mr. Frank, as Chairman of the Bank’s Loan Committee, received a quarterly retainer of $7,500 and other directors on the committee, other than the Lead Director and Chief Executive Officer, received a quarterly retainer of $2,500 in cash. Mr. Frank, as Chairman of the Bank's Enterprise Risk Committee, received a quarterly retainer of $1,750 in cash.

In addition, for the year ended December 31, 2020, our non-employee directors were each awarded 2,056 restricted stock units (prorated for directors that were appointed during 2020). The awards were granted on May 29, 2020 and vest fully on May 29, 2021. Vested shares will be delivered within thirty days following the vesting of the restricted stock units, when, subject to any trading restriction, the reporting person will receive the number of Class A Common Stock shares that corresponds to the number of restricted stock units that vest on the vesting date.

20

EXECUTIVE COMPENSATION

Our named executive officers for 2020, which consist of our principal executive officer and the Company’s two other most highly compensated executive officers, are:

•Alan J. Lane, President and Chief Executive Officer of the Company and Chief Executive Officer of the Bank;

•Kathleen M. Fraher, Chief Operating Officer of the Company and the Bank; and

•Benjamin C. Reynolds, Chief Strategy Officer of the Company and the Bank.

Summary Compensation Table

The following table sets forth a summary of certain information concerning the compensation paid by the Company for services rendered in all capacities during the fiscal years ended December 31, 2020 and 2019 to our principal executive officer and our two other most highly compensated executive officers who were serving as executive officers as of December 31, 2020. We refer to these three executives as our Named Executive Officers.

| Name and Principal Position | Fiscal Year | Salary | Bonus | Stock Awards(1) | Option Awards(1) | Non-Equity Incentive Plan Compensation | All Other Compensation(2) | Total | ||||||||||||||||||||||||||||||||||||||||||

Alan J. Lane | 2020 | $ | 492,003 | $ | 411,435 | $ | — | $ | — | $ | — | $ | 48,824 | $ | 952,262 | |||||||||||||||||||||||||||||||||||

Chief Executive Officer and President of the Company and Chief Executive Officer of the Bank | 2019 | 450,008 | 311,687 | 178,486 | 177,127 | — | 50,812 | 1,168,120 | ||||||||||||||||||||||||||||||||||||||||||

| Kathleen M. Fraher | 2020 | 345,010 | 166,898 | — | — | — | 30,482 | 542,390 | ||||||||||||||||||||||||||||||||||||||||||

Chief Operating Officer of the Company and the Bank | ||||||||||||||||||||||||||||||||||||||||||||||||||

Benjamin C. Reynolds | 2020 | 275,195 | 116,726 | — | — | 202,487 | 29,642 | 624,050 | ||||||||||||||||||||||||||||||||||||||||||

Chief Strategy Officer of the Company and the Bank | 2019 | 128,750 | — | 37,490 | 37,208 | 869,525 | 19,112 | 1,092,085 | ||||||||||||||||||||||||||||||||||||||||||

(1)The amounts reflect the aggregate grant date fair value of stock awards and options computed in accordance with ASC 718. See Note 12 to the consolidated audited financial statement contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2020 regarding assumptions underlying valuation of equity awards.

(2)“All Other Compensation” for the named executive officers is further described below.

401(k) | Health & | |||||||||||||||||||||||||||||||

Name | Year | Match | Welfare | Other | Total | |||||||||||||||||||||||||||

Alan J. Lane | 2020 | $ | 7,125 | $ | 34,956 | $ | 6,743 | $ | 48,824 | |||||||||||||||||||||||

| 2019 | 6,250 | 33,597 | 10,965 | 50,812 | ||||||||||||||||||||||||||||

| Kathleen M. Fraher | 2020 | 7,125 | 22,722 | 635 | 30,482 | |||||||||||||||||||||||||||

Benjamin C. Reynolds | 2020 | 6,879 | 20,928 | 1,835 | 29,642 | |||||||||||||||||||||||||||

| 2019 | 1,931 | 17,181 | — | 19,112 | ||||||||||||||||||||||||||||

Narrative Discussion of Summary Compensation Table