Form DEF 14A STEELCASE INC For: Feb 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | |||||||||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||

| ý | Definitive Proxy Statement | |||||||||||||

| o | Definitive Additional Materials | |||||||||||||

| o | Soliciting Material under § 240.14a-12 | |||||||||||||

| Steelcase Inc. | ||||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| ý | No fee required. | |||||||||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| o | Fee paid previously with preliminary materials. | |||||||||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

NOTICE OF ANNUAL MEETING

The Board of Directors of Steelcase Inc. (the “Company”) cordially invites all shareholders to attend the Company’s 2021 Annual Meeting of Shareholders as follows:

| Date and Time: | July 14, 2021 at 11:00 a.m. EDT | ||||

| Location: | via live webcast at www.virtualshareholdermeeting.com/scs2021 | ||||

The Annual Meeting is being held to allow you to vote on the following proposals and any other matter properly brought before the shareholders:

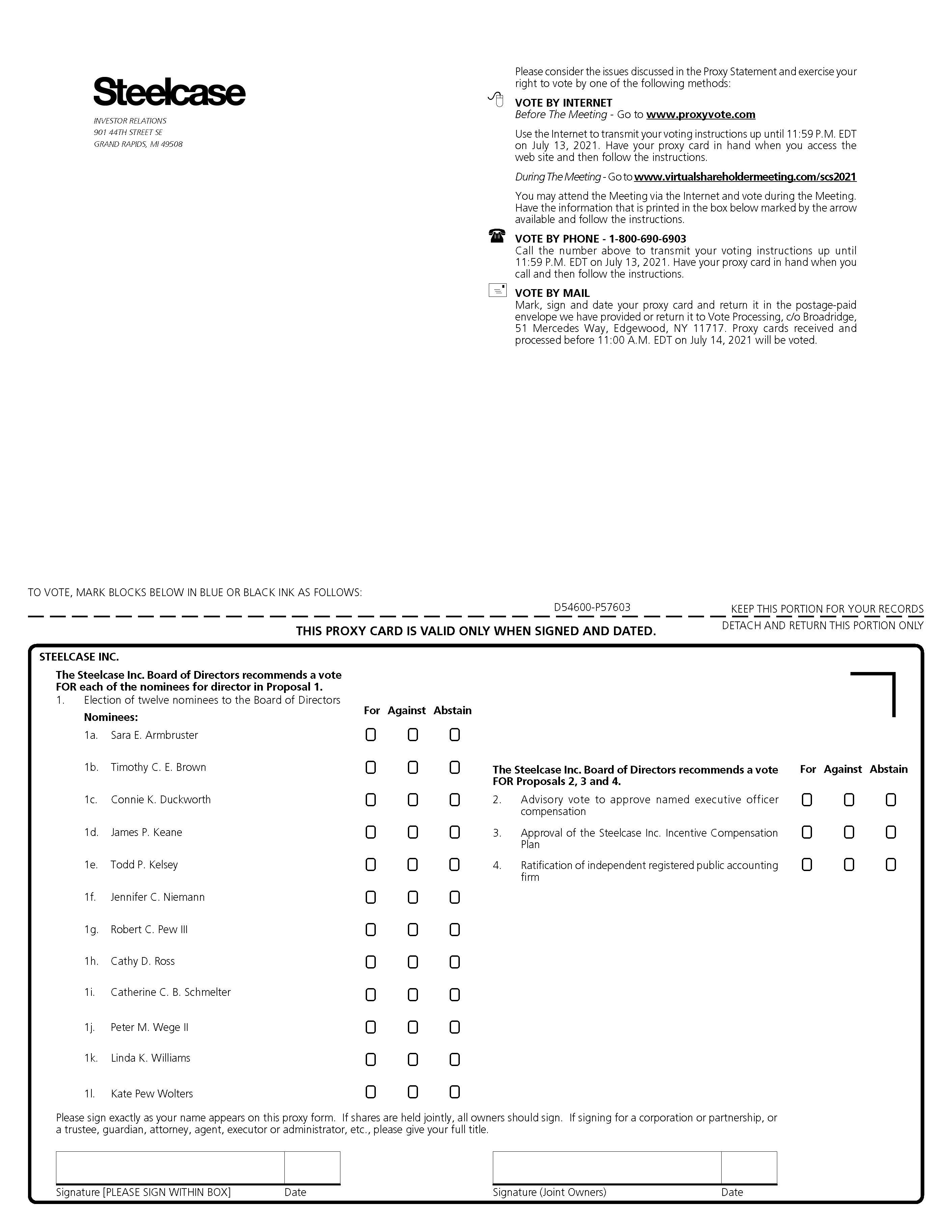

1. Election of twelve nominees to the Board of Directors

2. Advisory vote to approve named executive officer compensation

3. Approval of the Steelcase Inc. Incentive Compensation Plan

4. Ratification of our independent registered public accounting firm

If you were a shareholder of record as of the close of business on May 17, 2021, you are eligible to vote. You may either vote online during the meeting or by proxy, which allows your shares to be voted at the meeting even if you are not able to participate. If you choose to vote by proxy:

•Please carefully review the enclosed proxy statement and proxy card.

•Select your preferred method of voting: by telephone, Internet or signing and mailing the proxy card.

•You can withdraw your proxy and vote your shares at the meeting if you decide to do so.

Every vote is important, and we urge you to vote your shares as soon as possible.

These proxy materials are being sent and made available to shareholders beginning June 2, 2021.

By Order of the Board of Directors,

Lizbeth S. O’Shaughnessy

Senior Vice President, Chief Administrative Officer,

General Counsel and Secretary

June 2, 2021

| ||||||||

| P.O. Box 1967 | Steelcase.com | |||||||

| Grand Rapids, MI 49501-1967 | ||||||||

| United States | ||||||||

PROXY STATEMENT

TABLE OF CONTENTS

| Page No. | |||||

QUESTIONS AND ANSWERS

How can I attend the Meeting, and can I ask questions during the Meeting?

Our 2021 Annual Meeting of Shareholders (the “Meeting”) will be a virtual meeting, conducted via live webcast only, to allow all of our shareholders the opportunity to participate in the Meeting no matter where they are located. No physical meeting will be held. Shareholders of record of Class A Common Stock or Class B Common Stock at the close of business on May 17, 2021 (the “Record Date”) will be able to attend the Meeting by logging in at www.virtualshareholdermeeting.com/scs2021 at 11:00 a.m. EDT on July 14, 2021 via an Internet web browser. In order to vote or ask a question during the Meeting, shareholders must log into the Meeting using their 16-digit Control Number provided with the notice of the Meeting. If you encounter any difficulties accessing the Meeting, please call the technical support number that will be posted on the Meeting login page.

The Board of Directors has adopted procedures to provide for a fair and orderly proceeding, and these procedures will be accessible during the Meeting. These procedures include guidelines for the submission of questions, and all questions that meet the stated guidelines will be answered during the Meeting, time permitting.

Can I listen to the Meeting if I cannot attend it live?

If you are not able to attend the Meeting while it is being conducted, an audio replay of the Meeting will be available on our website shortly after the conclusion of the Meeting and for at least 90 days thereafter. You will be able to find the replay under “News & Events - Events & Presentations” in the Investor Relations section of our website, located at ir.steelcase.com.

On what am I voting?

You are being asked to vote on the following matters and any other business properly coming before the Meeting:

Proposal 1: Election of twelve nominees to the Board of Directors

Proposal 2: Advisory vote to approve named executive officer compensation

Proposal 3: Approval of the Steelcase Inc. Incentive Compensation Plan

Proposal 4: Ratification of our independent registered public accounting firm

The Board of Directors recommends that you vote FOR each of the nominees listed in Proposal 1 and FOR Proposals 2, 3 and 4. As of June 2, 2021, we do not know of any other matter to be considered at the Meeting.

Who is entitled to vote, and how many votes does each shareholder have?

Shareholders of record of Class A Common Stock or Class B Common Stock at the close of business on the Record Date may vote at the Meeting. At the close of business on the Record Date, there were 90,100,905 shares of Class A Common Stock and 25,563,494 shares of Class B Common Stock outstanding. Each shareholder has one vote per share of Class A Common Stock and ten votes per share of Class B Common Stock owned.

1

How can I vote?

If you are a registered shareholder (that is, you hold your Steelcase stock directly in your name), you may vote by telephone, mail, Internet or attending and voting online during the Meeting.

To vote by telephone: Please follow the instructions on the proxy card. The deadline for voting by telephone is 11:59 p.m. Eastern Daylight Time on July 13, 2021.

To vote by mail: Please complete, sign and date the accompanying proxy card and return it in the enclosed postage-paid envelope. If you have not received a proxy card, you will need to request one be sent to you by following the instructions included in the Meeting notice. Only proxy cards received and processed before 11:00 a.m. Eastern Daylight Time on July 14, 2021 will be voted.

To vote by Internet: Please follow the instructions on the proxy card. The deadline for voting by Internet before the Meeting is 11:59 p.m. Eastern Daylight Time on July 13, 2021.

To vote online during the Meeting: Please log on to www.virtualshareholdermeeting.com/scs2021 at 11:00 a.m. Eastern Daylight Time on July 14, 2021, using your 16-digit Control Number provided with the Meeting notice, and follow the instructions for voting shares.

Whether you vote by telephone, mail, Internet or online during the Meeting, you may specify how your shares should be voted with respect to each of the proposals. If you use the proxy card provided by us and you do not specify a choice, your shares will be voted FOR the election of each of the nominees listed in Proposal 1 and FOR each of Proposals 2, 3 and 4. For any other matter that properly comes before the Meeting, your shares will be voted in the discretion of the proxy holders.

If you hold your stock in “street name” (that is, your shares are registered in the name of a bank, broker or other nominee, which we will collectively refer to as your “broker”), you must vote your shares in the manner required by your broker. If you do not provide voting instructions to your broker, the rules of the New York Stock Exchange (“NYSE”) provide that your broker may not vote your shares on Proposals 1, 2 or 3 but may vote your shares on Proposal 4.

What should I do if I received more than one proxy card?

If you received more than one proxy card, it is likely that your shares are registered differently or are in more than one account. You should complete, sign and return all proxy cards, or make sure that you complete the voting instructions for each card if voting by telephone or Internet, to ensure all of your shares are voted.

May I revoke my proxy?

If you appoint a proxy, you may revoke it at any time before it is exercised by notifying our corporate secretary in writing, by delivering a later-dated proxy to our corporate secretary or by attending and voting online during the Meeting.

What is the quorum requirement for the Meeting?

Michigan law and our By-laws require a quorum for the Meeting, which for our company means that holders of a majority of the voting power entitled to vote at the Meeting must be present or represented by proxy in order to transact business at the Meeting. Abstentions will be counted in determining whether a quorum has been reached.

2

How many votes are needed to approve the proposals?

Assuming a quorum has been reached, the following votes are needed to approve each of the proposals:

•For Proposal 1, in order to be elected, a nominee must receive the affirmative vote of a majority of the votes cast at the Meeting with respect to such nominee. If any incumbent director receives more “against” than “for” votes, our By-laws require the director to tender their resignation, and the Nominating and Corporate Governance Committee must make a recommendation to the Board of Directors to consider whether or not to accept such resignation.

•In order to be approved, Proposals 2, 3 and 4 must receive the affirmative vote of the majority of the votes cast at the Meeting for that proposal. Proposals 2 and 4 are advisory votes which are not binding on our company or our Board of Directors.

How will broker non-votes and abstentions be treated?

Under NYSE rules, brokers who hold shares on behalf of their customers (i.e., shares held in street name) can vote on certain items when they do not receive instructions from their customers. However, brokers are not authorized to vote on non-routine matters if they do not receive instructions from their customers. Proposals 1, 2 and 3 are non-routine matters under NYSE rules; therefore, if you do not give your broker voting instructions on those proposals, your shares will not be treated as votes cast in determining the outcome of those matters. Proposal 4 is considered a routine matter under NYSE, and therefore, your broker may vote your shares on that proposal if it does not receive instructions from you.

If you abstain from voting on a matter other than Proposal 3, your shares will not be counted as voting for or against that matter, and therefore abstentions will have no effect on the adoption of the proposal. If you abstain from voting on Proposal 3, your shares will be treated as voting against that Proposal.

Why didn’t I receive printed copies of this proxy statement and the annual report?

We make our proxy materials available to our shareholders electronically via the Internet and send you a notice which lists the address of a website where you can view, print or request printed copies of our proxy materials and submit your voting instructions. The notice also provides an email address and toll-free telephone number that you can use to request printed copies of our proxy materials. Unless you request otherwise, you will not receive a printed copy of our proxy materials. If you wish to receive printed copies of these materials each year, you can make a permanent request.

What if I have the same address as another shareholder?

We send a single copy of our notice to any household at which two or more shareholders reside if they appear to be members of the same family. This practice is known as “householding” and helps reduce our printing and mailing costs. Any shareholder residing at the same address as another shareholder who wishes to receive a single document or separate documents should call 1-866-540-7095 or write to Broadridge Financial Solutions, Householding Department, 51 Mercedes Way, Edgewood, New York 11717, to express their preference, and we will deliver any requested documents promptly.

Who will pay for this proxy solicitation?

We will bear the cost of soliciting proxies, which may be done by e-mail, mail, telephone or in person by our directors, officers and employees, who will not be additionally compensated for those activities. We may also reimburse brokers and other fiduciaries for reasonable expenses they incur in forwarding these proxy materials at our request to the beneficial owners of Class A Common Stock and Class B Common Stock. Proxies will be solicited on behalf of our Board of Directors.

3

When and how are shareholder proposals for next year’s Annual Meeting to be submitted?

We must receive any shareholder proposals to be included in our proxy statement for the 2022 Annual Meeting of Shareholders by February 2, 2022. Other shareholder proposals to be presented during the 2022 Annual Meeting must be received no earlier than April 15, 2022 and no later than May 5, 2022. All shareholder proposals must be sent in the manner and meet the requirements specified in our By-laws.

4

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Board of Directors currently has thirteen members, and all of our directors are elected annually. One of our directors, Lawrence J. Blanford, is retiring from the Board when his term expires at the Meeting. Upon his retirement, the size of the Board will be reduced to twelve members.

There are twelve nominees for election this year, each of whom is currently a member of the Board. The Board of Directors recommends that you vote FOR each of the nominees.

| Sara E. Armbruster Director since 2021 Ms. Armbruster has been Executive Vice President of Steelcase Inc. since April 2021, and she has been appointed to become President and Chief Executive Officer, effective October 4, 2021. She served as our Vice President, Strategy, Research and Digital Transformation from 2018 to April 2021 and Vice President, Strategy, Research and New Business Innovation from 2014 to 2018, and she joined Steelcase in 2007. Ms. Armbruster is a director of Winnebago Industries, Inc. Age 50. Ms. Armbruster’s appointment as our President and Chief Executive Officer and her experience in various leadership roles at our company led the Board of Directors to recommend she serve as a director. | |||||||

| Timothy C. E. Brown Director since 2016 Mr. Brown has been Executive Chair of IDEO LP, a global innovation and design firm, since August 2019. He served as Chief Executive Officer and President of IDEO from 2000 to 2019. Age 58. Mr. Brown’s global experience, background with innovation and technology and experience as the chief executive officer of a global company led the Board of Directors to recommend he serve as a director. | |||||||

| Connie K. Duckworth Director since 2010 Ms. Duckworth was Chairman and Chief Executive Officer of ARZU, Inc., a non-profit organization that empowers Afghan women weavers by sourcing and selling the rugs they weave, from 2003 to 2019. She is a trustee of Equity Residential and a director of MP Materials Corp., and she was a trustee of The Northwestern Mutual Life Insurance Company from 2004 to 2017. Age 66. Ms. Duckworth’s experience as a former partner and managing director of Goldman Sachs, serving on the boards of directors of other public companies and as a non-profit entrepreneur led the Board of Directors to recommend she serve as a director. | |||||||

5

| James P. Keane Director since 2013 Mr. Keane has been President and Chief Executive Officer of Steelcase Inc. since 2014. He has been appointed to become Vice Chair, effective October 4, 2021, and he intends to retire from our company and the Board on January 7, 2022. Mr. Keane joined Steelcase in 1997. Mr. Keane is a director of Rockwell Automation, Inc. Age 61. Mr. Keane’s role as our President and Chief Executive Officer and his experience in various leadership roles at our company led the Board of Directors to recommend he serve as a director. | |||||||

| Todd P. Kelsey Director since 2017 Mr. Kelsey has been President and Chief Executive Officer and a director of Plexus Corp., an electronics design, manufacturing and aftermarket services company, since 2016. He joined Plexus in 1994 and served as Executive Vice President and Chief Operating Officer from 2013 to 2016. Age 56. Mr. Kelsey’s global experience, technology background and current role as the chief executive officer of a global company led the Board of Directors to recommend he serve as a director. | |||||||

| Jennifer C. Niemann Director since 2017 Ms. Niemann has been the President and Chief Executive Officer of Forward Space, LLC, an independent Steelcase dealership, since 2014. From 1992 to 2014, she held various positions at Steelcase, including Chief Executive Officer of Red Thread, a Steelcase-owned dealership, from 2011 to 2014. Age 52. Ms. Niemann’s experience with our company, having served as an employee for more than 20 years and as current owner of a Steelcase dealership, and her understanding of and commitment to creating long-term, sustainable value for our company and our various stakeholders as a member of one of the founding families of our company led the Board of Directors to recommend she serve as a director. | |||||||

| Robert C. Pew III Director since 1987 Mr. Pew has been a private investor since 2004. From 1974 to 1984 and from 1988 to 1995, he held various positions at Steelcase, including President, Steelcase North America and Executive Vice President, Operations. From 1984 to 1988, Mr. Pew was a majority owner of an independent Steelcase dealership. Age 70. Mr. Pew’s experience with our company, having served as a director for more than 30 years, as an employee for more than 15 years and as an owner of a Steelcase dealership for four years, and his understanding of and commitment to creating long-term, sustainable value for our company and our various stakeholders as a member of one of the founding families of our company led the Board of Directors to recommend he serve as a director. Mr. Pew is the brother of Kate Pew Wolters. | |||||||

6

| Cathy D. Ross Director since 2006 Ms. Ross was Executive Vice President and Chief Financial Officer of Federal Express Corporation, an express transportation company and subsidiary of FedEx Corporation, from 2010 to 2014. She is a director of Ball Corporation and was a director of Avon Products, Inc. from 2016 to 2018. Age 63. Ms. Ross’s experience in senior management of a global public company, her experience serving on the boards of directors of other public companies and her qualification as an audit committee financial expert led the Board of Directors to recommend she serve as a director. | |||||||

| Catherine C. B. Schmelter Director since 2019 Ms. Schmelter has been Senior Vice President, Chief Transformation Officer of TreeHouse Foods, Inc., a manufacturer of packaged food and beverages, since February 2020. She joined TreeHouse in 2016 and served as Senior Vice President, Division President, Meal Solutions from 2019 to 2020, President, Condiments and Head of Sales - Foodservice & Canada from 2017 to 2019 and President, Meals from 2016 to 2017. Age 52. Ms. Schmelter’s experience in strategy, branding, sales, marketing, innovation and finance led the Board of Directors to recommend she serve as a director. | |||||||

| Peter M. Wege II Director since 1979 Mr. Wege has been President of Moodoos Inc., a family-owned investment firm, since 2000. From 1981 to 1989, he held various positions at Steelcase, including President of Steelcase Canada Ltd. Age 72. Mr. Wege’s experience with our company, having served as a director for more than 40 years and as an employee for 8 years, and his understanding of and commitment to creating long-term, sustainable value for our company and our various stakeholders as a member of one of the founding families of our company led the Board of Directors to recommend he serve as a director. | |||||||

| Linda K. Williams Director since 2020 Ms. Williams has been named Vice President, Global Head of Go-to-Market Finance, Google Cloud, of Google LLC, effective June 2021. Prior to joining Google, she was with Hewlett Packard Enterprise, serving as Senior Vice President, HPE Products and Services Chief Financial Officer from February to May 2021, Chief Audit Executive and Vice President of Enterprise Risk Management from 2019 to February 2021 and Vice President and Chief Financial Officer, HPE Pointnext Services Division from 2015 to 2019. Age 51. Ms. Williams’ experience in a variety of financial, audit and risk management roles at a global public company and her qualification as an audit committee financial expert led the Board of Directors to recommend she serve as a director. | |||||||

7

| Kate Pew Wolters Director since 2001 Ms. Wolters has been engaged in philanthropic activities since 1996. She is President of the KRW Foundation and a community volunteer and advisor. She serves as Chair of the Board of Trustees of the Steelcase Foundation. Age 64. Ms. Wolters’ experience in philanthropic activities and community involvement and her understanding of and commitment to creating long-term, sustainable value for our company and our various stakeholders as a member of one of the founding families of our company led the Board of Directors to recommend she serve as a director. Ms. Wolters is the sister of Robert Pew. | |||||||

DIRECTOR INDEPENDENCE

Our Board of Directors has determined that all of our director nominees other than Sara Armbruster, James Keane and Jennifer Niemann are independent. Ms. Armbruster and Mr. Keane are not considered independent because they are executive officers of Steelcase. Ms. Niemann is not considered independent because she is the majority owner of an independent Steelcase dealership, as described in Related Person Transactions. In addition, our Board of Directors has determined that Lawrence Blanford, who is currently a director but is not standing for reelection, is independent.

On an annual basis, the Nominating and Corporate Governance Committee assesses the independence of our directors by reviewing and considering all relevant facts and circumstances and presents its findings and recommendations to our Board of Directors. The independence of our directors is assessed using the listing standards of the NYSE, and our Board adopted categorical standards to guide the determination of each director’s independence. A copy of these categorical standards for director independence is also available in the Investor Relations section of our website, located at ir.steelcase.com, and found under “ESG - Corporate Governance.” For fiscal year 2021, the Committee considered that, during the year:

•Timothy Brown, Todd Kelsey, Catherine Schmelter and Linda Williams were executive officers of, or employed by, companies which purchased products and/or services from us or our dealers and/or from which we purchased services; and

•immediate family members of Lawrence Blanford, Timothy Brown, Todd Kelsey, Robert Pew, Catherine Schmelter, Peter Wege and Linda Williams were employees, directors and/or owners of companies which purchased products and/or services from us or our dealers and/or from which we purchased services.

In each case, the transactions were conducted in the ordinary course of business on an arm’s-length basis and involved less than the greater of $1 million or 1% of the other company’s annual gross revenues. The Committee determined that each such relationship fell within the categorical standards adopted by the Board and, as a result, the relationships were not considered material.

The Steelcase Foundation

The Steelcase Foundation is a charitable organization operating under Section 501(c)(3) of the Internal Revenue Code which was established in 1951 by our company to give back to the communities that have been instrumental to our operations and growth by making grants to non-profit organizations, projects and programs in those communities. From time to time, we donate a portion of our earnings to the Foundation, as determined by our Board of Directors. The following directors also serve as Foundation trustees: James Keane, Robert Pew and Kate Pew Wolters, who serves as Chair of the

8

Board of Trustees. The other trustees of the Foundation are Brian Cloyd, Mary Anne Hunting, Craig Niemann (husband of Jennifer Niemann), Cary Pew (son of Robert Pew) and Elizabeth Welch.

RELATED PERSON TRANSACTIONS

Related Person Transactions Policy

We have a written Related Person Transactions Policy under which the Nominating and Corporate Governance Committee is responsible for reviewing and approving transactions with us in which certain “related persons,” as defined in the policy, have a direct or indirect material interest. Related persons include our directors and executive officers, members of their immediate family and persons who beneficially own more than 5% of any class of our voting securities. A copy of our Related Person Transactions Policy is posted in the Investor Relations section of our website, located at ir.steelcase.com, and found under “ESG - Corporate Governance.”

Under the policy, our General Counsel determines whether any identified potential related person transaction requires review and approval by the Committee, in which case the transaction is presented at the next Committee meeting for approval, ratification or other action. In those instances where it is not practicable or desirable to wait until the next meeting, the Committee has delegated authority to the Committee Chair to consider the transaction in accordance with the policy. If management becomes aware of an existing related person transaction which has not been approved by the Committee, the transaction is presented for appropriate action at the next Committee meeting.

The Committee is authorized to approve related person transactions which are in, or are not inconsistent with, the best interests of our company and our shareholders. Certain categories of transactions have been identified as permissible without approval by the Committee, as the transactions involve no meaningful potential to cause disadvantage to us or to give advantage to the related person. These categories of permissible transactions include, for example, the sale or purchase of products or services at prevailing prices in the ordinary course of business if (1) the amount involved does not exceed 5% of our gross revenues or the gross revenues of the related person, (2) our sale or purchase decision is not influenced by the related person while acting in any capacity for us and (3) the transaction does not result in a commission, enhancement or bonus or other direct benefit to an individual related person.

In considering any transaction, the Committee considers all relevant factors, including, as applicable:

•the benefits to us;

•the impact on a director’s independence;

•the availability of other sources for comparable products or services;

•the terms of the transaction; and

•the terms available to unrelated third parties, or to employees generally, for comparable transactions.

Related Person Transactions

Related person employee

We employ Mary-Louise Hooker as a Senior Consultant, Channel Development, which is not an executive officer position. Ms. Hooker is the sister of Lizbeth O’Shaughnessy, our Senior Vice President, Chief Administrative Officer, General Counsel and Secretary. For fiscal year 2021, Ms. Hooker earned $131,188 in total compensation, which included her base salary, an annual cash award under our Employee Bonus Plan, company retirement plan contributions and life insurance premiums paid by us.

9

She also participated in other benefit programs on the same terms as other U.S. employees of Steelcase in comparable positions. We continue to employ Ms. Hooker in fiscal year 2022.

Sales to and purchases from Forward Space, LLC

Forward Space, LLC is an independent Steelcase dealer, and Jennifer Niemann is the majority owner, President and Chief Executive Officer (“CEO”) of Forward Space. Our transactions with Forward Space during fiscal year 2021 consisted of (1) the sale by us of approximately $41.8 million in products and services to Forward Space, (2) the purchase by us of approximately $2,000 in delivery, installation and repair services from Forward Space and (3) the payment by us of approximately $1.2 million in commissions, incentives and rebates to Forward Space. Our transactions with Forward Space were made in the ordinary course of business on terms substantially similar to those offered to other independent dealers in the U.S. This dealer relationship is continuing in fiscal year 2022.

Sales to shareholders

The following companies are, or were during fiscal year 2021, beneficial owners of more than 5% of our Class A Common Stock, and they or their respective affiliates purchased products and related services from us or our dealers, in the following amounts, during fiscal year 2021:

•BlackRock, Inc. - approximately $400,000;

•Fifth Third Bancorp - approximately $1.3 million; and

•The Vanguard Group - approximately $469,000.

In each case, the purchases represent less than 5% of our annual revenues and the applicable shareholder’s annual revenues, and the purchases were made in the ordinary course of business at prevailing prices not more favorable to the shareholder than those available to other customers for similar purchases.

Other transactions

In addition to the transactions detailed above, during fiscal year 2021 we entered into commercial transactions, either directly or indirectly through our dealers, with companies of which our directors, executive officers or their respective family members serve as directors, executive officers or employees. All of such transactions were entered into in the ordinary course of business on an arm’s‑length basis and represented an immaterial percentage of both our and the other party’s revenues, and the applicable related person did not receive any direct personal benefit from the transaction. Accordingly, we do not believe that any of the applicable related persons had a material interest in any of these transactions.

Review and Approval of Transactions

The Nominating and Corporate Governance Committee reviewed each of the transactions detailed above, and following such review, the Committee approved the employment of Mary-Louise Hooker, the payment of related compensation to her and the transactions with Forward Space, LLC. Pursuant to our Related Person Transactions Policy, approval of the transactions with BlackRock, Inc., Fifth Third Bancorp and The Vanguard Group was not required because such parties are institutional shareholders holding our stock with no apparent purpose or effect of changing or influencing control of our company.

10

BOARD MEETINGS

Our Board of Directors met fifteen times during fiscal year 2021. Each of our directors attended at least 75% of the total number of meetings of the Board and the committees on which they served during the year. Our Board’s policy is that each director is expected to attend our annual meeting of shareholders, and each of our directors attended our 2020 Annual Meeting.

COMMITTEES OF THE BOARD OF DIRECTORS

Five standing committees assist our Board of Directors in fulfilling its responsibilities: Audit, Compensation, Corporate Business Development, Executive and Nominating and Corporate Governance. The Audit, Compensation, Corporate Business Development and Nominating and Corporate Governance Committees operate under written charters adopted by the Board of Directors that are reviewed and assessed at least annually. Their current charters are available in the Investor Relations section of our website, located at ir.steelcase.com, and found under “ESG - Corporate Governance.”

The following table indicates the current membership of each of the Board of Directors’ committees and the number of meetings held during fiscal year 2021. All of the members of the Audit, Compensation and Nominating and Corporate Governance Committees are independent.

| Director | Audit Committee | Compensation Committee | Corporate Business Development Committee | Executive Committee | Nominating and Corporate Governance Committee | ||||||||||||

| Sara E. Armbruster | |||||||||||||||||

| Lawrence J. Blanford | Chair | X | |||||||||||||||

| Timothy C. E. Brown | X | Chair | X | ||||||||||||||

| Connie K. Duckworth | X | X | Chair | ||||||||||||||

| James P. Keane | X | ||||||||||||||||

| Todd P. Kelsey | X | X | |||||||||||||||

| Jennifer C. Niemann | X | ||||||||||||||||

| Robert C. Pew III | Chair | ||||||||||||||||

| Cathy D. Ross | X | Chair | X | ||||||||||||||

| Catherine C. B. Schmelter | X | X | |||||||||||||||

| Peter M. Wege II | X | X | X | ||||||||||||||

| Linda K. Williams | X | ||||||||||||||||

| Kate Pew Wolters | X | X | |||||||||||||||

| Meetings held in fiscal year | 9 | 12 | 4 | 0 | 4 | ||||||||||||

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The principal responsibilities of the Audit Committee are:

•appointing the independent auditor and reviewing and approving its services and fees in advance;

•reviewing the performance of our independent auditor and, if circumstances warrant, making decisions regarding its replacement or termination;

•evaluating the independence of the independent auditor;

11

•reviewing and concurring with the appointment, replacement, reassignment or dismissal of the head of our internal audit group, reviewing their annual performance evaluation and reviewing the group’s budget and staffing;

•reviewing the scope of the internal and independent annual audit plans and monitoring progress and results;

•reviewing our critical accounting policies and practices;

•reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures;

•reviewing our financial reporting, including our annual and interim financial statements, as well as the type and presentation of information included in our earnings press releases;

•reviewing the process by which we monitor, assess and manage our exposure to risk;

•reviewing compliance with our Global Business Standards, as well as legal and regulatory compliance; and

•overseeing our information technology systems and security.

The Board of Directors has designated Lawrence Blanford, Cathy Ross and Linda Williams as audit committee financial experts, as defined by the rules and regulations of the Securities and Exchange Commission (the “SEC”), based on their respective financial and accounting education and experience. Mr. Blanford, Ms. Ross, Ms. Williams and the other members of the Audit Committee are independent, as independence of audit committee members is defined by the listing standards of the NYSE.

Compensation Committee

The principal responsibilities of the Compensation Committee are:

•establishing our executive compensation philosophy;

•reviewing and approving the compensation of our executive officers, and submitting the compensation of our CEO to the Board of Directors for ratification;

•reviewing executive and non-executive compensation programs and benefit plans to assess their competitiveness, reasonableness and alignment with our compensation philosophy;

•making awards, approving performance targets, certifying performance compared to targets and taking other actions under our incentive compensation programs; and

•reviewing the Compensation Discussion and Analysis and other executive compensation disclosures contained in our annual proxy statements.

Delegation of Authority

Pursuant to its charter, the Compensation Committee may delegate its authority to subcommittees, provided that any such subcommittee must consist of at least two members, and may delegate appropriate responsibilities associated with our benefit and compensation plans to members of management.

The Compensation Committee has delegated to our CEO the authority to grant stock options, restricted stock and restricted units to employees. Under this delegated authority, our CEO cannot grant options to acquire more than 5,000 shares, more than 2,000 shares of restricted stock or more than 2,000 restricted units in any year to any one individual, and he cannot grant, in the aggregate, options to acquire more than 100,000 shares, more than 40,000 shares of restricted stock or more than 40,000 restricted units in any year. For fiscal year 2021 only, the Compensation Committee increased our CEO’s delegated

12

authority to grant restricted units up to a limit of 60,000 units. Our CEO cannot grant any stock options, restricted stock or restricted units to any executive officer.

Our CEO has the authority to designate those employees who will participate in our Management Incentive Plan; however, the Committee is required to approve participation in such plan by any executive officer or anyone else who directly reports to our CEO. In addition, the Compensation Committee delegated to our CEO the authority to modify the size of the target awards granted under our Management Incentive Plan in fiscal years 2021 and 2022 to each of the other named executive officers by up to 10% of the officer’s base salary, positively or negatively, at the end of the fiscal year based on his assessment of the officer’s performance during the year.

The Committee has delegated certain responsibilities with regard to our Retirement Plan to an investment committee and an administrative committee, each consisting of members of management. The Committee also has delegated to our executive officers all responsibilities associated with our broad-based health and welfare and retirement plans, including without limitation amending, merging and terminating plans and declaring discretionary, non-discretionary and matching contributions under our Retirement Plan.

Role of Executive Officers in Determining or Recommending Compensation

Our CEO develops and submits to the Compensation Committee his recommendation for the compensation of each of the named executive officers, other than himself, in connection with annual reviews of their performance. The Compensation Committee reviews and discusses the recommendations made by our CEO, approves the compensation for each named executive officer for the coming year and approves and submits the compensation of our CEO to the Board of Directors for ratification. In addition, our Chief Financial Officer and other members of our finance, internal audit, human resources and compensation teams assist the Committee with establishing performance targets and payout scales for performance-based compensation, as well as with the calculation of actual financial performance and comparison to the performance targets, each of which requires the Committee’s approval. See Compensation Discussion and Analysis for more discussion regarding the role of our CEO in determining or recommending the amount or form of executive compensation.

Role of Compensation Consultants

Pursuant to its charter, the Compensation Committee has the sole authority to retain and terminate independent compensation consultants of its choosing to assist the Committee in carrying out its responsibilities. The Committee has appointed Exequity LLP (“Exequity”) to serve as its independent compensation consultant reporting directly to the Committee. Exequity is responsible for providing information, insight and perspective for the Compensation Committee’s use in making decisions on all elements of executive compensation. See Compensation Discussion and Analysis for more detail regarding the nature and scope of Exequity’s assignment and the material elements of the instructions or directions given to them with respect to the performance of their duties. We have not purchased any additional services from Exequity beyond those provided to the Compensation Committee.

Exequity also serves as the independent compensation consultant for the compensation committee of a company of which one of the members of our Compensation Committee is an executive officer. That relationship was reviewed by our Compensation Committee and is not considered to be a conflict of interest, and no other potential conflicts of interest have been identified with regard to the work performed by Exequity for our Compensation Committee.

Compensation Risk Assessment

During fiscal year 2021, our management conducted an assessment of our employee compensation policies and practices and concluded that any risks arising from such policies and practices are not

13

reasonably likely to have a material adverse effect on our company. The assessment was reviewed and discussed with the Compensation Committee, which concurred with management’s conclusions.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee was an officer or employee of our company during the fiscal year or was formerly an officer of our company, and none of our executive officers served on (1) the compensation committee (or its equivalent) or board of directors of another entity whose executive officer served on our Compensation Committee or (2) the compensation committee (or its equivalent) of another entity whose executive officer served on our Board of Directors. James Keane serves on the Board of Managers of IDEO GP LLC, which is the general partner of IDEO LP, and Timothy Brown is Executive Chair of IDEO LP, but the Board of Managers of IDEO GP LLC has agreed that Mr. Keane will be excluded from any decision-making related to management compensation.

Corporate Business Development Committee

The principal responsibilities of the Corporate Business Development Committee are (1) reviewing and overseeing the development and implementation of our growth strategies; and (2) reviewing and making recommendations to our Board of Directors with respect to investments in our growth strategies and business acquisitions or divestitures for which Board approval is required.

Executive Committee

The Executive Committee is authorized to exercise the powers of our Board of Directors when necessary between regular meetings, subject to any legal or regulatory limitations, and performs such other duties as assigned by the Board of Directors from time to time. The members of the Executive Committee consist of the Board Chair, the Chairs of each of the Audit, Compensation, Corporate Business Development and Nominating and Corporate Governance Committees and our CEO.

Nominating and Corporate Governance Committee

The principal responsibilities of the Nominating and Corporate Governance Committee are:

•establishing procedures for identifying and evaluating potential director nominees and recommending nominees for election to our Board of Directors;

•reviewing the suitability for continued service of directors when their terms are expiring or a significant change in responsibility occurs, including a change in employment;

•reviewing annually the composition of our Board to ensure it reflects an appropriate balance of knowledge, experience, skills, expertise and diversity;

•making recommendations to our Board regarding its size, the frequency and structure of its meetings and other aspects of its governance procedures;

•making recommendations to our Board regarding the functioning and composition of Board committees;

•reviewing our Corporate Governance Principles at least annually and recommending appropriate changes to our Board;

•overseeing our strategy and policies with respect to environmental, social and governance (“ESG”) matters, including sustainability and corporate social responsibility factors, and periodically reviewing our performance against our ESG goals;

•considering and making recommendations to the Board regarding any corporate governance issues that may arise from time to time;

14

•overseeing the annual self-evaluation of our Board and annual evaluation of our CEO;

•reviewing director compensation and recommending appropriate changes to our Board;

•administering our Related Person Transactions Policy and the Board’s policy on disclosing and managing conflicts of interest, including reviewing and approving any related person transactions under our Related Person Transactions Policy;

•considering any waiver requests under our Code of Ethics and Code of Business Conduct; and

•reviewing the annual budget established for the Board and monitoring the spending against such budget.

OTHER CORPORATE GOVERNANCE MATTERS

Corporate Governance Principles

Our Board of Directors is committed to monitoring the effectiveness of policy- and decision-making at the Board and management levels. Fundamental to its corporate governance philosophy is the Board’s commitment to upholding our reputation for honesty and integrity. Equally fundamental is its commitment to serving as an independent overseer of our management and operations. Our Board adopted a set of Corporate Governance Principles, a copy of which can be found in the Investor Relations section of our website, located at ir.steelcase.com, and found under “ESG - Corporate Governance.”

Board of Directors Leadership Structure

The leadership structure of our Board of Directors involves a Board Chair who is not our principal executive officer. Robert Pew serves as non-executive Chair of the Board, and James Keane serves as our CEO. Our Board of Directors has chosen to keep the roles of Chair of the Board and CEO separate as a matter of sound corporate governance practices and a balance of responsibilities, with an independent director serving as Chair of the Board. This structure allows Mr. Keane to focus on the day-to-day leadership of our business, while Mr. Pew is able to focus on the leadership of our Board of Directors and its oversight of our company.

Executive Sessions of Non-Management Directors

Our Board regularly meets in executive session without any members of management present. During these sessions, Robert Pew, as Chair of the Board, presides. Our Corporate Governance Principles provide that if the Chair of the Board is a member of management, the outside directors will designate a member to preside at executive sessions.

Risk Oversight

Our risk assessment and management practices are led by our Enterprise Risk Management (“ERM”) Committee, which includes our CEO, our Chief Financial Officer, our General Counsel, our Chief Information Officer and other senior members of our finance, legal and strategy teams. Our Board of Directors administers its oversight of risk assessment and management practices in several ways. On a quarterly basis, the Audit Committee reviews a report from our ERM Committee which details the key risks we face, as well as any significant changes in the risk profile from the previous assessment. On an annual basis, the Compensation Committee reviews a risk assessment of our employment compensation policies and practices prepared by management. In addition, risk identification and risk management are discussed by the Board of Directors on a regular basis as part of its review of our financial performance and business and strategic planning. We believe our Board of Directors’ oversight of risk management is strengthened by having an independent director serve as Chair of the Board.

15

One area of risk management that is a particular area of focus for our Board of Directors is information security risk. Our Audit Committee receives an update on cybersecurity risk management at least twice each year, and any significant cybersecurity events are reviewed with our Board of Directors as appropriate. We use a cybersecurity scorecard that follows the National Institute of Standards and Technology’s Cybersecurity framework to identify and mitigate our information security risks. We have a dedicated team that oversees and implements our cybersecurity management, compliance with applicable legal and third party data protection and data privacy requirements, and our incident response and crisis management plans. The team also provides ongoing information security awareness education and annual cybersecurity training for our employees.

Environmental, Social and Governance (ESG) Matters

We focus not only on generating long-term value for our shareholders but also on providing long-term value for all stakeholders, including our customers, employees, suppliers, partners and local communities. This inclusive, sustainable approach reaffirms our long-held commitment that business can be a force for good in the world and that we all have an important role to play. To that end, the Nominating and Corporate Governance Committee has oversight over our ESG strategy and policies, as well as our progress against our goals, including our recently adopted science-based targets for reducing greenhouse gas emissions and the expansion of our social innovation practice to drive scalable, systemic and sustainable social change by reducing inequity, ensuring inclusive and equitable quality education and combating climate change and its impact. More information about our goals and progress can be found in our Impact Report, which is available on our website at ir.steelcase.com, and found under “ESG - Environmental Sustainability.”

Consideration of Candidates for Director

The Nominating and Corporate Governance Committee considers candidates suggested by its members, other directors and senior management in anticipation of potential or expected Board vacancies. After identifying a potential candidate, the Committee collects and reviews publicly available information to assess whether they should be considered further. If the candidate warrants further consideration, the Chair or another member of the Committee will initiate contact. Generally, if the person expresses a willingness to be considered, the Committee requests information from the candidate, reviews their qualifications and accomplishments and conducts one or more interviews with the candidate. Committee members may also contact references or others who have personal knowledge of the candidate’s accomplishments.

Nominees for director are selected on the basis of several criteria, the most fundamental of which is integrity. Directors are expected to be curious and demanding independent thinkers who possess appropriate business judgment and are committed to representing the interests of our shareholders. Directors must possess knowledge, experience, skills or expertise that will enhance our Board’s ability to direct our business. Our Board is committed to diversity, and a candidate’s ability to add to the diversity of our Board is also considered. Directors must be willing and able to spend the time and effort necessary to effectively perform their responsibilities, and they should volunteer to resign from our Board in the event they have a significant change in responsibilities, including a change in employment, in accordance with our Corporate Governance Principles.

The Committee will consider candidates recommended by shareholders for nomination by the Board, taking into consideration the needs of the Board and the qualifications of the candidate. Shareholders must submit recommendations to our corporate secretary in writing and include the following information:

•the recommending shareholder’s name and evidence of ownership of our stock, including the number of shares owned and the length of time owned; and

16

•the candidate’s name, résumé or a listing of qualifications to be a director of our company and the candidate’s consent to be named as a director if selected by the Nominating and Corporate Governance Committee and nominated by the Board.

Shareholders may also make their own nominations for director by following the process specified in our By-laws. Any shareholder who intends to nominate a director to be elected at our 2022 Annual Meeting of Shareholders must give written notice of such intent, delivered no earlier than April 15, 2022 and no later than May 5, 2022.

Linda Williams was recommended as a nominee by a non-management director, and her nomination was approved by the Nominating and Corporate Governance Committee and the Board of Directors.

Shareholder Communications

Our Board has adopted a process for interested parties to send communications to the Board. To contact the Board, any of its committees, the Chair of the Board (or the lead non-management director, if one is subsequently appointed) or any of our other directors, please send a letter addressed to: Board of Directors, c/o Lizbeth S. O’Shaughnessy, Secretary, Steelcase Inc., P.O. Box 1967, Grand Rapids, MI 49501-1967.

All such letters will be opened by the corporate secretary. Any contents that are not advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any committee or group of directors, the corporate secretary will make sufficient copies of the contents and send them to each director who is a member of the committee or group to which the envelope is addressed.

Code of Ethics and Code of Business Conduct

Our Board adopted a Code of Ethics applicable to our chief executive and senior financial officers, as well as a Code of Business Conduct that applies to all of our employees and directors. Only our Nominating and Corporate Governance Committee may grant any waivers of either code for a director or executive officer. Each of these codes is available in the Investor Relations section of our website, located at ir.steelcase.com, and found under “ESG - Corporate Governance.” If any amendment to, or waiver from, a provision of our Code of Ethics is made for our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, we will also post such information in the Corporate Governance section of our website. To date, no such waivers have been requested or issued.

Available Information

The following materials are available on our website at ir.steelcase.com, and found under “ESG - Corporate Governance”:

•Code of Ethics for Chief Executive and Senior Financial Officers;

•Code of Business Conduct;

•Corporate Governance Principles; and

•the charters of our Audit, Compensation, Corporate Business Development and Nominating and Corporate Governance Committees.

We will send you a copy of any of these materials upon request and without charge. Please send any such request to us either by email at ir@steelcase.com or by mail at: Steelcase Inc., Investor Relations, P.O. Box 1967, Grand Rapids, MI 49501-1967.

17

DIRECTOR COMPENSATION

Standard Arrangements

During fiscal year 2021, in response to the COVID-19 crisis, the Board of Directors implemented temporary reductions to director compensation that were similar to the temporary salary reductions of the Company’s executive officers. The table below sets forth the annualized rates of compensation of our non-employee directors which applied during the year.

| Type of Compensation | February 29, 2020 to March 29, 2020; August 31, 2020 to February 26, 2021 (1) | March 30, 2020 to May 30, 2020 (2) | May 31, 2020 to August 30, 2020 (3) | |||||||||||||||||

| Board Annual Retainer | $ | 215,000 | $ | 129,000 | $ | 172,000 | ||||||||||||||

| Board Chair Annual Retainer | $ | 322,500 | $ | 193,500 | $ | 258,000 | ||||||||||||||

| Committee Chair Annual Retainers: | ||||||||||||||||||||

| Audit Committee | $ | 20,000 | $ | 12,000 | $ | 16,000 | ||||||||||||||

| Compensation Committee | $ | 15,000 | $ | 9,000 | $ | 12,000 | ||||||||||||||

| Corporate Business Development Committee | $ | 15,000 | $ | 9,000 | $ | 12,000 | ||||||||||||||

| Nominating and Corporate Governance Committee | $ | 15,000 | $ | 9,000 | $ | 12,000 | ||||||||||||||

| Audit Committee Member Annual Retainer | $ | 10,000 | $ | — | $ | 5,000 | ||||||||||||||

_____________

(1)The board, board chair and committee chair retainers were payable 40% in cash and 60% in shares of our Class A Common Stock, and Audit Committee member retainers were payable in cash.

(2)The board, board chair and committee chair retainers were payable 100% in shares of our Class A Common Stock.

(3)The board, board chair and committee chair retainers were payable 25% in cash and 75% in shares of our Class A Common Stock, and Audit Committee member retainers were payable in cash.

Each director was permitted to elect to receive all or a part of the cash portion of their board, board chair and committee chair retainers in shares of our Class A Common Stock. All shares granted to our directors as part of their non-cash director compensation were granted in the form of our Class A Common Stock under our Incentive Compensation Plan. The number of shares issued was based on the fair market value of the Class A Common Stock on the date the shares were issued.

James Keane did not receive additional compensation for his service as a director or committee member because he is an employee.

All directors are reimbursed for reasonable out-of-pocket expenses incurred to attend board and committee meetings.

Outside directors who are not retirees of our company are eligible to participate in our Benefit Plan for Outside Directors, which provides access to medical, dental and vision coverage for the directors and their qualifying dependents that is comparable to the health insurance benefits provided to U.S. employees under our Employee Benefit Plan. Participating directors are responsible for paying the applicable premiums for all coverage elected under the plan.

18

The Nominating and Corporate Governance Committee reviews and evaluates the reasonableness and competitiveness of our compensation and benefit programs and practices for our non-employee directors on an annual basis, utilizing data from peer groups of similar sized companies. The data includes information regarding board annual retainers, committee chair annual retainers and other fees as well as prevalence of amounts paid in shares or cash and benefits provided. The Committee reviews the comparison data to assess whether or not the non-employee director compensation and benefits are within a competitive range and also determines if the structure is reasonable. The Committee’s recommendations with regard to non-employee director compensation and benefits are reviewed and approved by the full Board of Directors.

Non-Employee Director Deferred Compensation Plan

Each of our outside directors is eligible to participate in our Non-Employee Director Deferred Compensation Plan. Under this plan, directors may defer all or part of their retainers until they no longer serve on our board. A participating director may elect to have the deferred amount deemed invested in Class A Common Stock or several other investment funds, but any portion which would have otherwise been payable in shares of our Class A Common Stock must be deferred as a deemed investment in Class A Common Stock.

Director Stock Ownership Guidelines

Each non-employee director is required to own and maintain shares of our Class A Common Stock, Class B Common Stock or deemed shares invested in our Class A Common Stock under our Non-Employee Director Deferred Compensation Plan equal in value to at least five times the portion of the board annual retainer which is payable in cash. This requirement must be achieved within five years from the director’s initial appointment to the board. All of our non-employee directors who have served on the board for five years or more are in compliance with the stock ownership guidelines.

Director Compensation Table

The following table shows the compensation earned by each of our non-employee directors in fiscal year 2021.

Fiscal Year 2021 Director Compensation Table

| Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total | ||||||||||||||

| Lawrence J. Blanford | $ | 66,583 | $ | 141,000 | $ | 207,583 | |||||||||||

| Timothy C. E. Brown | $ | 65,167 | $ | 138,000 | $ | 203,167 | |||||||||||

| Connie K. Duckworth | $ | 65,167 | $ | 138,000 | $ | 203,167 | |||||||||||

| Todd P. Kelsey | $ | 68,000 | $ | 129,000 | $ | 197,000 | |||||||||||

| Jennifer C. Niemann | $ | 60,917 | $ | 129,000 | $ | 189,917 | |||||||||||

| Robert C. Pew III | $ | 91,375 | $ | 193,500 | $ | 284,875 | |||||||||||

| Cathy D. Ross | $ | 72,250 | $ | 138,000 | $ | 210,250 | |||||||||||

| Catherine C. B. Schmelter | $ | 67,167 | $ | 129,000 | $ | 196,167 | |||||||||||

| Peter M. Wege II | $ | 68,000 | $ | 129,000 | $ | 197,000 | |||||||||||

| Linda K. Williams | $ | 48,000 | $ | 64,500 | $ | 112,500 | |||||||||||

| Kate Pew Wolters | $ | 60,917 | $ | 129,000 | $ | 189,917 | |||||||||||

_____________

(1)The amounts shown in this column reflect the portion of the directors’ retainers payable in cash, including any of such amounts which our directors elected to defer under our Non-Employee Director Deferred Compensation Plan.

19

(2)The amounts shown in this column reflect the portion of the directors’ retainers payable in shares of our Class A Common Stock, including any of such amounts which our directors elected to defer under our Non-Employee Director Deferred Compensation Plan.

The following table shows:

•the number of shares of our Class A Common Stock issued to those directors who received all or a part of this portion of their retainers in the form of shares; and

•the number of shares deemed credited under the Non-Employee Director Deferred Compensation Plan to those directors who elected to defer all or a part of this portion of their retainers as a deemed investment in Class A Common Stock.

The grant date fair value of the shares of Class A Common Stock issued was calculated using the closing price of our Class A Common Stock on the payment date multiplied by the number of shares issued in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC Topic 718”). The assumptions made in the valuation of such awards are disclosed in Note 18 to the consolidated financial statements included in our annual report on Form 10-K for fiscal year 2021 filed with the SEC on April 20, 2021.

| Director | Shares Issued | Deferred Stock Credited | |||||||||

| Lawrence J. Blanford | — | 11,571 | |||||||||

| Timothy C. E. Brown | — | 11,325 | |||||||||

| Connie K. Duckworth | 11,321 | — | |||||||||

| Todd P. Kelsey | — | 10,586 | |||||||||

| Jennifer C. Niemann | 10,584 | — | |||||||||

| Robert C. Pew III | 15,877 | — | |||||||||

| Cathy D. Ross | — | 11,325 | |||||||||

| Catherine C. B. Schmelter | — | 10,586 | |||||||||

| Peter M. Wege II | 10,584 | — | |||||||||

| Linda K. Williams | 5,157 | — | |||||||||

| Kate Pew Wolters | 10,584 | — | |||||||||

Holdings of Deferred Stock

The following table indicates the total number of shares deemed credited under our Non-Employee Director Deferred Compensation Plan as of the end of fiscal year 2021 to those directors who have deferred all or a portion of their retainer as a deemed investment in Class A Common Stock:

| Director | Deferred Stock as of Fiscal Year End | ||||

| Lawrence J. Blanford | 108,339 | ||||

| Timothy C. E. Brown | 39,826 | ||||

| Todd P. Kelsey | 35,848 | ||||

| Cathy D. Ross | 116,405 | ||||

| Catherine C. B. Schmelter | 12,388 | ||||

| Peter M. Wege II | 5,985 | ||||

| Kate Pew Wolters | 2,180 | ||||

20

STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The tables on this page and the following pages show the amount of Class A Common Stock and Class B Common Stock beneficially owned by certain persons. Generally, a person “beneficially owns” shares if the person has or shares with others the right to vote or dispose of those shares, or if the person has the right to acquire voting or disposition rights within 60 days (for example, by exercising options). Except as stated in the notes following the tables, each person has the sole power to vote and dispose of the shares shown in the tables as beneficially owned.

Each share of Class B Common Stock can be converted into one share of Class A Common Stock at the option of the holder. Ownership of Class B Common Stock is, therefore, deemed to be beneficial ownership of Class A Common Stock under the SEC’s rules and regulations. However, the number of shares of Class A Common Stock and the percentages shown for Class A Common Stock in the following tables do not account for this conversion right in order to avoid duplications in the number of shares and percentages that would be shown in the tables.

Directors and Executive Officers

This table shows the amount of common stock beneficially owned as of May 17, 2021 by (a) each director, (b) each of the executive officers named in the Summary Compensation Table and (c) all of our directors and executive officers as a group. The address of each director and executive officer is 901 44th Street SE, Grand Rapids, MI 49508.

In addition to the amounts shown below, certain of our directors also have deemed investments in our Class A Common Stock under our Non-Employee Director Deferred Compensation Plan, as discussed in Director Compensation under the heading “Holdings of Deferred Stock.”

| Name | Class A Common Stock (1) | Class B Common Stock | ||||||||||||

| Shares Beneficially Owned | Percent of Class | Shares Beneficially Owned | Percent of Class | |||||||||||

| Sara E. Armbruster | 50,426 | * | — | — | ||||||||||

| Lawrence J. Blanford | — | — | — | — | ||||||||||

| Timothy C. E. Brown | 265 | * | — | — | ||||||||||

| Connie K. Duckworth | 78,924 | * | — | — | ||||||||||

| James P. Keane (2) | 800,071 | * | — | — | ||||||||||

| Todd P. Kelsey | — | — | — | — | ||||||||||

| Jennifer C. Niemann (3) | 18,006 | * | 2,079,131 | 8.1 | % | |||||||||

| Lizbeth S. O’Shaughnessy | 214,975 | * | — | — | ||||||||||

| Robert C. Pew III (4) | 282,688 | * | 4,821,714 | 18.9 | % | |||||||||

| Cathy D. Ross | 3,611 | * | — | — | ||||||||||

| Catherine C. B. Schmelter | — | — | — | — | ||||||||||

| Allan W. Smith, Jr. | 31,694 | * | — | — | ||||||||||

| David C. Sylvester | 416,197 | * | — | — | ||||||||||

| Peter M. Wege II | 224,111 | * | — | — | ||||||||||

| Linda K. Williams | 7,150 | * | — | — | ||||||||||

| Kate Pew Wolters (5) | 222,309 | * | 5,731,354 | 22.4 | % | |||||||||

| Directors and executive officers as a group (23 persons) (6) | 2,664,766 | 3.0 | % | 12,632,199 | 49.4 | % | ||||||||

_____________

* Less than 1%

21

(1)If the number of shares each director or executive officer could acquire upon conversion of their Class B Common Stock were included as shares of Class A Common Stock beneficially owned, the following directors and executive officers would be deemed to beneficially own the number of shares of Class A Common Stock and the percentage of the total shares of Class A Common Stock listed opposite their names:

| Name | Number of Shares | Percent of Class A | ||||||

| Jennifer C. Niemann | 2,097,137 | 2.3 | % | |||||

| Robert C. Pew III | 5,104,402 | 5.4 | % | |||||

| Kate Pew Wolters | 5,953,663 | 6.2 | % | |||||

| Directors and executive officers as a group (23 persons) | 15,296,965 | 14.9 | % | |||||

________________

* Less than 1%

(2)Includes 396,360 shares of Class A Common Stock of which Mr. Keane shares the power to vote and dispose.

(3)Includes 100 shares of Class A Common Stock and 98,813 shares of Class B Common Stock of which Ms. Niemann shares the power to vote and dispose.

(4)Includes (a) 500 shares of Class A Common Stock which Mr. Pew shares the power to vote and dispose and (b) 3,073,618 shares of Class B Common Stock of which Mr. Pew shares the power to dispose.

(5)Includes 2,931,428 shares of Class B Common Stock of which Ms. Wolters shares the power to dispose.

(6)Includes all thirteen directors (two of whom are executive officers) and all ten other executive officers, only three of whom are named in the table. The numbers shown include the shares described in notes 2 through 5 above and 30,000 shares of Class A Common Stock of which one of the other executive officers shares the power to vote and dispose.

Beneficial Owners of More than Five Percent of Our Common Stock

The following table shows the amount of common stock beneficially owned as of May 17, 2021 by each person, other than our directors and executive officers, who is known by us to beneficially own more than 5% of our Class A Common Stock or more than 5% of our Class B Common Stock. The information set forth in this table is based on the most recent Schedule 13D or 13G filing made by such persons with the SEC, except as otherwise noted.

The percentages listed in the Percent of Class column for Class B Common Stock set forth in the tables on the previous and following page add up to more than 100% because (1) as described in the notes to the tables, some of the persons listed in the tables share the power to vote and dispose of shares of Class B Common Stock with one or more of the other persons listed and (2) for many persons listed in the tables, the number of Shares Beneficially Owned is based on filings by such persons with the SEC as of December 31, 2020 or earlier but the Percent of Class is calculated based on the total number of shares of Class B Common Stock outstanding on May 17, 2021.

22

| Name | Class A Common Stock (1) | Class B Common Stock | ||||||||||||

| Shares Beneficially Owned | Percent of Class | Shares Beneficially Owned | Percent of Class | |||||||||||

Fifth Third Bancorp, Fifth Third Financial Corporation and Fifth Third Bank, National Association (2) | 1,472,328 | 1.6 | % | 15,448,902 | 60.4 | % | ||||||||

| The Vanguard Group (3) | 8,632,354 | 9.6 | % | — | — | |||||||||

| BlackRock, Inc. (4) | 7,678,349 | 8.5 | % | — | — | |||||||||

| EARNEST Partners, LLC (5) | 7,641,956 | 8.5 | % | — | — | |||||||||

| P. Craig Welch, Jr. (6) | 467,082 | * | 5,407,852 | 21.2 | % | |||||||||

| Pzena Investment Management, LLC (7) | 4,984,569 | 5.5 | % | — | — | |||||||||

| Cooke & Bieler LP (8) | 4,980,478 | 5.5 | % | — | — | |||||||||

| LSV Asset Management (9) | 4,806,409 | 5.3 | % | — | — | |||||||||

| Anne Hunting (10) | 242,487 | * | 4,351,970 | 17.0 | % | |||||||||

| ABJ Investments, Limited Partnership and Olive Shores Del, Inc. (11) | 1,258,491 | 1.4 | % | 3,000,000 | 11.7 | % | ||||||||

| James T. Osborne (12) | — | — | 1,574,468 | 6.2 | % | |||||||||

| CRASTECOM B Limited Partnership (13) | — | — | 1,459,753 | 5.7 | % | |||||||||

_____________

* Less than 1%

(1)If the number of shares each shareholder could acquire upon conversion of their Class B Common Stock were included as shares of Class A Common Stock beneficially owned, the following holders of Class B Common Stock would be deemed to beneficially own the number of shares of Class A Common Stock and the percentage of the total shares of Class A Common Stock listed opposite their names:

| Name | Number of Shares | Percent of Class A | ||||||

Fifth Third Bancorp, Fifth Third Financial Corporation and Fifth Third Bank, National Association | 16,921,230 | 16.0 | % | |||||

| P. Craig Welch, Jr. | 5,874,934 | 6.2 | % | |||||

| Anne Hunting | 4,594,457 | 4.9 | % | |||||

| ABJ Investments, Limited Partnership and Olive Shores Del, Inc. | 4,258,491 | 4.6 | % | |||||

| James T. Osborne | 1,574,468 | 1.7 | % | |||||

| CRASTECOM B Limited Partnership | 1,459,753 | 1.6 | % | |||||

(2)The address of Fifth Third Bancorp, Fifth Third Financial Corporation and Fifth Third Bank, National Association (collectively, “Fifth Third”) is Fifth Third Center, Cincinnati, OH 45263. Includes (a) 339,700 shares of Class A Common Stock and 1,423,699 shares of Class B Common Stock which Fifth Third has the sole power to vote, (b) 306,986 shares of Class A Common Stock and 3,845,783 shares of Class B Common Stock which Fifth Third shares the power to vote and (c) 1,233,586 shares of Class A Common Stock and 11,712,359 shares of Class B Common Stock of which Fifth Third shares the power to dispose.

We believe there is substantial duplication between the shares which Fifth Third beneficially owns and the shares which are beneficially owned by some of the other persons listed in this table and the previous table, because, among other reasons, Fifth Third or its affiliates serves as a co-trustee of a number of trusts of which our directors and other beneficial owners of more than 5% of our common stock serve as co-trustees; however, we are not able to determine the extent of such duplication based on the information reported by Fifth Third.

23

(3)The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group has the sole power to vote no shares of Class A Common Stock, the shared power to vote 87,312 shares of Class A Common Stock and the shared power to dispose of 158,233 shares of Class A Common Stock.

(4)The address of BlackRock, Inc. is 55 East 52nd St., New York, NY 10055. BlackRock, Inc. has the sole power to vote only 7,254,915 shares of Class A Common Stock.

(5)The address of EARNEST Partners, LLC is 1180 Peachtree Street NE, Suite 2300, Atlanta, GA 30309. EARNEST Partners, LLC has the sole power to vote only 4,820,162 shares of Class A Common Stock.

(6)The address of Mr. Welch is 901 44th Street SE, Grand Rapids, MI 49508. Includes (a) 2,374,351 shares which Mr. Welch shares the power to vote, (b) 5,824,852 shares of which Mr. Welch shares the power to dispose and (c) 10,000 shares of Class A Common Stock which Mr. Welch could acquire within 60 days of December 31, 2020 through the exercise of stock options.

(7)The address of Pzena Investment Management, LLC is 320 Park Avenue, 8th Floor, New York, NY 10022. Pzena Investment Management, LLC has the sole power to vote only 4,043,092 shares of Class A Common Stock.

(8)The address of Cooke & Bieler LP is 2001 Market Street, Suite 4000, Philadelphia, PA 19103. Cooke & Bieler LP has the sole power to vote no shares of Class A Common Stock, the shared power to vote 3,905,178 shares of Class A Common Stock and the shared power to dispose of 4,980,478 shares of Class A Common Stock.

(9)The address of LSV Asset Management is 1 N. Wacker Drive, Suite 4000, Chicago, IL 60606.

(10)The address of Ms. Hunting is 1421 Lake Road, Lake Forest, IL 60045. Includes 4,476,971 shares of which Ms. Hunting shares the power to vote and dispose. The information reported for Ms. Hunting is based upon a Schedule 13G amendment dated December 31, 2001 and a subsequent conversion of Class B Common Stock into Class A Common Stock. No further shareholding information has been reported by Ms. Hunting after December 31, 2001.

(11)The address of ABJ Investments, Limited Partnership (“ABJ”) and Olive Shores Del, Inc. (“Olive Shores”) is P.O. Box 295, Cimarron, CO 81220. Olive Shores is the sole general partner of ABJ. The information reported for ABJ and Olive Shores is based upon a Schedule 13G amendment dated December 31, 2007 in which those entities reported that they had ceased to be the beneficial owner of more than 5% of our Class A Common Stock and thus were no longer subject to reporting on Schedule 13G. No further shareholding information has been reported by ABJ or Olive Shores after December 31, 2007.

(12)The address of James T. Osborne is 881 Private Rd., Winnetka, IL 60093. Mr. Osborne has the sole power to vote and dispose of 82,926 shares of Class B Common Stock and the shared power to vote and dispose of 165,900 shares of Class B Common Stock. The information provided for Mr. Osborne is based upon a Schedule 13G dated December 31, 1998. No further shareholding information has been reported by Mr. Osborne after such date.

(13)The address of CRASTECOM B Limited Partnership is 1134 Taylorsport Ln., Winnetka, IL 60093.

24

PROPOSAL 2 – ADVISORY VOTE

TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION