Form DEF 14A ROPER TECHNOLOGIES INC For: Jun 14

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material Pursuant to § 240.14a-12 |

ROPER TECHNOLOGIES, INC.

(Formerly Roper Industries, Inc.)

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

| 6901 Professional Parkway |

|

Telephone (941) 556-2601 | ||

| Suite 200 | Fax (941) 556-2670 | |||

| Sarasota, Florida 34240 | ||||

| Roper Technologies, Inc. |

April 29, 2021

Dear Fellow Shareholders:

As your Board of Directors, we oversee Roper’s efforts to continually create long-term value for you by efficiently executing our strategy through sound risk management, disciplined capital deployment, sound strategic thinking, operational rigor, performance-driven compensation programs, effective talent and succession planning, adherence to the highest ethical standards and levels of integrity, and continual review and refinement of the Board’s governance practices.

As detailed below, despite the unique challenges 2020 presented all companies, the resilience of our business model enabled us to deliver revenue and earnings growth and significant growth in both operating cash flow and free cash flow. Accordingly, Roper is poised to deliver further growth in 2021, while many companies are merely seeking to return to their pre-COVID-19 levels of performance. Though we are extremely proud of our accomplishments in 2020, we recognize and empathize with those who lost family members and friends since the onset of the pandemic.

Our Strategy for Long-Term and Elite Value Creation for Shareholders

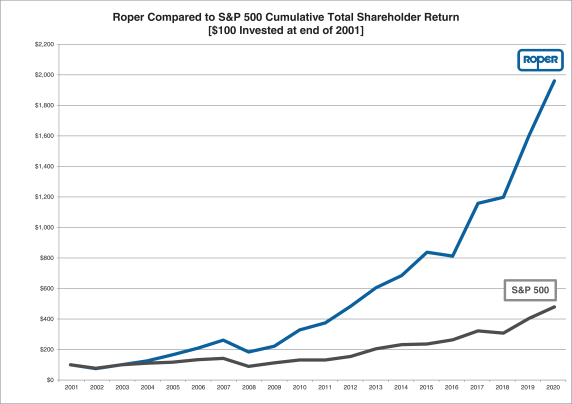

Over the past fifteen years, our shareholders earned a compound annual return of 18.0% and a total shareholder return of 1091.6%, about three and a half times the total return of the S&P 500 of 311.0%. Over the past decade, Roper has delivered an even better 19.6% compound annual return to shareholders and delivered a strong 22.4% return in 2020.

Our long history of superior shareholder returns is the result of Roper’s simple, yet powerful strategy:

| • | Cash Generation Through Operating Excellence: Our enterprise consists of niche, asset-light businesses with leading solutions and technologies that generate significant free cash flow, enabling future investments for sustainable growth. Operating excellence, underpinned by our strategic focus on intellectual capital, product development, go-to-market strategies, and a high degree of customer intimacy drives cash generation which, in 2020, resulted in another year of record performance for adjusted operating cash flow and adjusted free cash flow, which increased 14% and 16%, respectively. |

| • | Disciplined Capital Deployment: We have a unique and disciplined capital deployment model that has guided the successful investment of billions of dollars into new businesses. Unlike many companies that use cash to pay large dividends and buy back shares, Roper deploys most of its available cash to acquire new businesses to fuel compounding cash flow growth and value creation for shareholders, as we did in 2020 with our deployment of $6.0 billion to acquire exceptional vertical software businesses, including the acquisition of Vertafore, Inc. for approximately $5.35 billion. |

The Board’s Role in Roper’s Success

The Board contributes significantly to Roper’s strong performance. As directors, each of us commits to the rigor and extensive time commitment and workload required to serve on Roper’s Board, including participation in at least 15 days of Board meetings each year. We continually monitor the existing portfolio of Roper businesses, review capital deployment opportunities, and carefully examine the different ways Roper can create additional value for shareholders. Between Board meetings, we continue our discussions with management and each other, enabling the Company to draw from our broad experiences and expertise.

Our direct involvement in and deep understanding of the Company allows us to address a multitude of issues, including acquisition selection, capital deployment, and succession planning, while sustaining Roper’s successful culture and business model. The soundness of our strategy is further evidenced by our ability to deliver meaningful earnings and cash flow growth in 2020 despite the challenges of COVID-19 and the secular decline in the energy markets.

Table of Contents

Our Governance Practices and Other Best Practices

Roper remains committed to strong corporate governance as demonstrated by the following practices:

| • | Declassified Board. Our directors are elected annually. |

| • | Majority Voting for Directors. Our By-laws require the resignation of incumbent directors who fail to obtain a majority of votes cast in uncontested elections. |

| • | Proxy Access. Our By-laws permit a shareholder, or a group of up to 20 shareholders, that has owned at least 3% of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials up to the greater of two directors or 20% of the number of our directors then in office. |

| • | Independent Chair of the Board. Wilbur Prezzano currently serves as our Independent Chair. Amy Brinkley is scheduled to become the Independent Chair on June 1. |

| • | Executive Compensation Alignment with Shareholders. Because our shareholder value creation is derived from the Roper executive team’s capital deployment strategy and ability to operate a broad portfolio of businesses, our executives must possess a unique set of skills. We continue to refine our executive compensation practices to maintain close alignment with shareholder interests. |

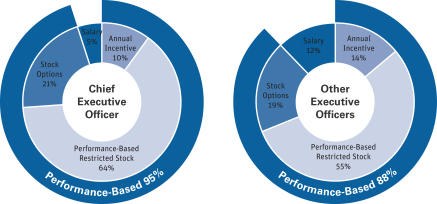

| • | Pay for Performance. Similar to prior years, in 2020, 95% of our CEO’s compensation was subject to performance risk and tied to long-term results and our stock price, and for our other executive officers, on average, 88% of their compensation was performance-based. |

| • | Significant Reduction in Non-Employee Director Pay for 2020. In 2020, the average total compensation paid to our non-employee directors (other than the Independent Chair) was reduced by 40% compared to 2019. With respect to our Independent Chair, his total compensation was reduced by 38% compared to 2019. |

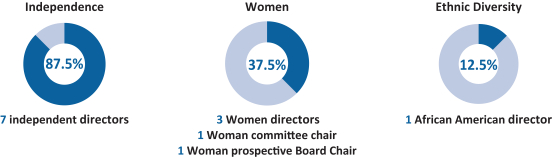

| • | Diverse Board Membership. 37.5% of directors nominated for election are women and 12.5% are ethnically diverse. |

| • | Clear oversight of ESG and Human Capital Management. The Nominating and Governance Committee has oversight responsibility for matters related to ESG and Human Capital Management. |

| • | Clear Proxy Statement Disclosure. We strive to present the information in our Proxy Statement in a clear and easy-to-read manner. |

| • | Shareholder Outreach Program. Roper’s senior management team regularly engages shareholders for feedback. |

2021 Incentive Plan

Our agenda this year includes a proposal to approve the Roper Technologies, Inc. 2021 Incentive Plan. This new plan would replace our existing incentive plan. Equity compensation is one way we link pay with performance, and it is an important part of our overall compensation program. We urge you to vote FOR the approval of the 2021 Incentive Plan, so that we can continue to use equity as a key component in our compensation programs.

Table of Contents

Open Communications With Our Shareholders

We value your continued support and input. Please continue to share your comments with us on any topic. Communications may be addressed to the directors in care of the Corporate Secretary, Roper Technologies, Inc., 6901 Professional Parkway, Suite 200, Sarasota, Florida 34240.

Sincerely,

The Board of Directors

|

|

| ||

| Shellye L. Archambeau | Amy Woods Brinkley | John F. Fort III | ||

|

|

|

| ||

| L. Neil Hunn | Robert D. Johnson | Wilbur J. Prezzano | ||

|

|

|

| ||

| Laura G. Thatcher | Richard F. Wallman | Christopher Wright | ||

Table of Contents

NOTICE OF THE 2021 ANNUAL MEETING OF SHAREHOLDERS

2021 ANNUAL MEETING INFORMATION

For additional information about our Annual Meeting, see Annual Meeting and Voting Information on page 58.

| Meeting Date: June 14, 2021 |

|

|

|

Meeting Place: 6901 Professional Parkway, Suite 200 Sarasota, Florida 34240 |

|

|

|

Meeting Time: 9:30 a.m. (Eastern) |

|

Record Date: April 19, 2021 | ||||||

ANNUAL MEETING BUSINESS

Roper’s annual meeting of shareholders will be held June 14, 2021 to:

| ● | elect as directors the eight nominees named in the accompanying proxy statement; |

| ● | approve, on an advisory basis, the compensation of our named executive officers; |

| ● | ratify the appointment of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for 2021; |

| ● | approve the Roper Technologies, Inc. 2021 Incentive Plan; and |

| ● | transact any other business that may be properly brought before the annual meeting. |

PROXY MATERIALS

On or about April 29, 2021, we began distributing to each shareholder entitled to vote at the annual meeting either: (i) a Meeting Notice; or (ii) this proxy statement, a proxy card and our 2020 Annual Report to Shareholders and Form 10-K. The Meeting Notice contains instructions to electronically access our proxy statement and our 2020 Annual Report to Shareholders and Form 10-K, how to vote via the internet or by mail and how to receive a paper copy of our proxy materials by mail, if desired.

|

VOTING AT THE ANNUAL MEETING

Your vote is important. Shareholders who are owners of record of Roper common shares at the close of business on April 19, 2021, the record date, or their legal proxy holders, are entitled to vote at the annual meeting. Whether or not you expect to attend the annual meeting, we urge you to vote as soon as possible by one of these methods:

| ||||

|

|

| ||

|

Via the Internet: www.proxypush.com/ROP |

Call Toll-Free: 1-866-829-5176

|

Mail Signed Proxy Card: Follow the instructions on your proxy card or voting instruction form | ||

|

If you are a beneficial owner of shares held through a broker, bank or other holder of record, you must follow the voting instructions you receive from the holder of record to vote your shares. Shareholders may also vote at the annual meeting. For more information on how to vote your shares, please refer to Annual Meeting and Voting Information on page 58. | ||||

John K. Stipancich

Executive Vice President, General Counsel and Corporate Secretary

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on June 14, 2021

| ||||

This Notice of the Annual Meeting of Shareholders, our Proxy Statement and our Annual Report to

Shareholders and Form 10-K are available free of charge at www.proxydocs.com/ROP.

Table of Contents

Table of Contents

This summary highlights information about Roper Technologies, Inc. (the “Company”, “we”, “us” or “our”) and the upcoming 2021 Annual Meeting of Shareholders (the “2021 Annual Meeting”). It does not contain all of the information you should consider. We recommend reading the complete proxy statement (the “Proxy Statement”) and our 2020 Annual Report to Shareholders (the “2020 Annual Report”), which includes our Annual Report on Form 10-K, before voting. The Proxy Statement and the enclosed proxy card are being mailed or otherwise made available to shareholders on or about April 29, 2021.

2021 ANNUAL MEETING OF SHAREHOLDERS

| Date and Time: Monday, June 14, 2021 9:30 a.m. local time |

Record Date: April 19, 2021 |

Place: Roper Technologies, Inc. 6901 Professional Parkway Suite 200 Sarasota, Florida 34240 |

VOTING MATTERS AND BOARD RECOMMENDATIONS

| Proposals | Board Recommendation |

Vote Required | ||||

| 1: |

Election of eight directors for a one-year term | FOR EACH NOMINEE | Majority of votes cast | |||

| 2: |

Advisory vote to approve the compensation of our named executive officers | FOR | Majority of shares present in person or represented by proxy | |||

| 3: |

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021 | FOR | Majority of shares present in person or represented by proxy | |||

| 4: |

Approval of the Roper Technologies, Inc. 2021 Incentive Plan | FOR | Majority of shares present in person or represented by proxy | |||

|

|

Roper Technologies, Inc. 2021 Proxy Statement | i |

Table of Contents

PROXY STATEMENT SUMMARY (CONTINUED)

2021 DIRECTOR NOMINEES

Shareholders are electing all eight director nominees who will serve for a one-year term expiring at the 2022 Annual Meeting of Shareholders (the “2022 Annual Meeting”).

| COMMITTEES | |||||||||||||||||||||||||||||||||||

| Name and Primary Occupation | Age |

Director Since |

Independent | AC |

CC |

NGC |

EC | ||||||||||||||||||||||||||||

| Shellye L. Archambeau Former Chief Executive Officer, MetricStream, Inc. |

58 | 2018 | 🌑 | 🌑 | |||||||||||||||||||||||||||||||

| Amy Woods Brinkley Retired Chief Risk Officer, Bank of America Corp. |

65 | 2015 | 🌑 | 🌑 | |||||||||||||||||||||||||||||||

| John F. Fort III Retired Chief Executive Officer, Tyco International Ltd. |

79 | 1995 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||||||||||

| L. Neil Hunn President and Chief Executive Officer, Roper Technologies, Inc. |

49 | 2018 | |||||||||||||||||||||||||||||||||

| Robert D. Johnson Chairman, Spirit AeroSystems Holdings, Inc. |

73 | 2005 | 🌑 | 🌑 | |||||||||||||||||||||||||||||||

| Laura G. Thatcher Retired Head of Executive Compensation Practice, Alston & Bird LLP |

65 | 2015 | 🌑 | Chair | 🌑 | ||||||||||||||||||||||||||||||

| Richard F. Wallman Retired Chief Financial Officer and Senior Vice President, Honeywell International Inc. |

70 | 2007 | 🌑 | Chair | 🌑 | ||||||||||||||||||||||||||||||

| Christopher Wright Executive Chairman, Kestrel Partners and Director, Merifin Capital |

63 | 1991 | 🌑 | Chair | 🌑 | ||||||||||||||||||||||||||||||

AC = Audit Committee CC = Compensation Committee NGC = Nominating and Governance Committee EC = Executive Committee

CORPORATE GOVERNANCE

We strive to maintain effective corporate governance practices and policies, including:

Proxy Access: In March 2016, we amended our By-laws to implement proxy access for eligible shareholders. Our proxy access provision permits a shareholder, or a group of up to 20 shareholders, that has owned at least 3% of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials up to the greater of two directors or 20% of the number of our directors then in office, provided that the shareholders and the nominees satisfy the requirements set forth in the By-laws.

Shareholder Outreach: We regularly engage our shareholders for feedback to learn their views on the Company’s strategy and performance as well as any governance matters of concern.

One-Year Terms for Directors: All of our directors serve one-year terms.

Independent Directors: All of our directors except our CEO are independent, as is each member of the Audit, Compensation, Executive, and Nominating and Governance Committees.

Independent Chair of the Board: Our Chair of the Board is independent.

| ii |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

PROXY STATEMENT SUMMARY (CONTINUED)

Majority Voting Standards for Uncontested Director Elections: We require any incumbent director who fails to obtain a majority vote in uncontested elections to tender his or her resignation.

Shareholder Engagement: We highly value feedback from our shareholders. In addition to our traditional Investor Relations engagement efforts, since the beginning of 2020, we have had discussions with numerous shareholders on ESG topics including climate change and diversity and inclusion. These discussions have been extremely helpful in identifying issues of importance to our investors as we develop our ESG program. We also shared feedback received during these discussions with our Nominating and Governance Committee, informing their decision-making.

Anti-Hedging and Anti-Pledging Policy: We have both anti-hedging and anti-pledging policies.

Board Refreshment/Term Limits: Currently, the mandatory retirement age for our Directors is 80. Beginning in 2020, Directors joining our Board will be required to retire upon the earlier of (i) the attainment of age 80, and (ii) the 15-year anniversary of the first annual meeting following the date the director joined the Board.

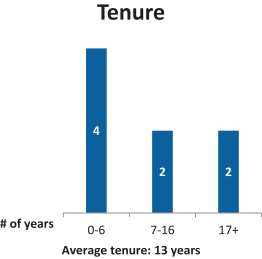

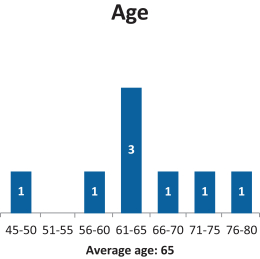

BOARD SNAPSHOT *

Tenure Age2 Average tenure: 7 years Average age: 62 Independence Women Ethnic Diversity Born Outside of the U.S. 7 independent directors 3 women directors 1 woman committee chairs 1 Woman prospective Board Chair 1 African American director 87.5% 37.5% 12.5%

| * | Does not include Mr. Prezzano, who is retiring at the Annual Meeting |

|

|

Roper Technologies, Inc. 2021 Proxy Statement | iii |

Table of Contents

PROXY STATEMENT SUMMARY (CONTINUED)

BUSINESS HIGHLIGHTS

We achieved another year of strong results in 2020 despite the challenges of COVID-19:

| • | Annual shareholder return of 22.4%, exceeding the return of 18.4% for the S&P 500 |

| • | GAAP revenue increased 3% to $5.53 billion |

| • | GAAP gross margin increased 20 basis points to 64.1% |

| • | Adjusted EBITDA increased 3% to $1.98 billion(1) |

| • | Adjusted operating cash flow increased 14% to $1.72 billion and adjusted free cash flow increased 16% to $1.67 billion(1) |

| • | We deployed $6 billion toward high quality software acquisitions |

| • | Our annual dividend increased by 10%, increasing for the 28th consecutive year |

| (1) | This financial information is presented on an adjusted (non-GAAP) basis. A reconciliation from non-GAAP financial measures to the most comparable GAAP measure and other related information is available in “Appendix A—Reconciliations.” |

COMPENSATION HIGHLIGHTS

The creation of shareholder value is the foundation and driver of our executive compensation program. Aspects of our program that closely align the compensation of our executive officers with the long-term interests of our shareholders include the following:

Pay for Performance: Almost all of our executive officer compensation is tied to pre-set, objective performance criteria and long-term shareholder value creation. In 2020, 95% of CEO’s direct compensation was subject to performance risk and tied to long-term results and our stock price. For our other executive officers, on average, 88% of their direct compensation was performance-based.

COVID 19: Despite the adverse impact that the COVID-19 pandemic had on our financial performance and operating results, the Compensation Committee elected not to adjust targets or exercise discretion with result to awards made under the 2020 bonus plan or any outstanding long-term incentive programs to our executive officers. We also reduced the base salary of our CEO by 25%, and those of our other executive officers by 20%, for the period of May through September.

Performance-Based Equity: All restricted stock awards to our executive officers are subject to satisfaction of performance criteria (no awards are solely time-based).

Double Trigger Vesting: “Double trigger” vesting of equity awards if a change in control occurs; no excise tax gross-ups for change-in-control payments.

Dollar Value Equity: As a result of the superior performance of Roper’s stock price, and in light of market practice, we transitioned from a practice of granting a fixed number of equity awards to a dollar value-based approach for non-employee directors in 2019 and all executive officers in 2020.

Significant Reduction in Non-Employee Director Pay for 2020: In 2020, the average total compensation paid to our non-employee directors (other than the Independent Chair) was reduced by 40% compared to 2019. With respect to our Independent Chair, his total compensation was reduced by 38% as compared to 2019.

Stock Ownership Guidelines: Substantial share ownership and retention guidelines for our executive officers and non-employee directors.

| iv |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

PROXY STATEMENT SUMMARY (CONTINUED)

Clawback Policy: We have a clawback policy to recoup erroneously paid cash and equity compensation.

Dividends Only on Shares Earned: Dividends on executive officers’ restricted shares are paid only if the shares are earned.

Annual Bonus Caps: We have caps on annual bonuses to avoid an excessive short-term focus and potentially adverse risk-taking.

No Repricing: Repricing of stock options absent shareholder approval is prohibited.

Limited Benefits: No defined pension benefit plan, few perquisites, and limited severance agreements.

2020 ESG HIGHLIGHTS

We are committed to conducting business in an ethically and socially responsible manner. In 2020, we took the following steps to enhance our ESG program:

ESG Oversight: In 2020, the charter of the Nominating and Governance Committee was amended to assign the Committee the responsibility to oversee the Company’s ESG initiatives as well as its key human capital management programs.

Corporate Responsibility Statement: In the fall of 2020, we made available on our website a Corporate Responsibility Statement, which highlights the efforts of many of our businesses in the areas of emissions reduction, water management, public health (including assisting with the fight against COVID-19), food sustainability and safety and security.

OneTen Coalition Founding Member: In December 2020, Roper became a founding member of the OneTen Coalition. OneTen is an organization that plans to combine the power of over 30 committed large, public American companies to upskill, hire and promote one million Black Americans over the next 10 years into family-sustaining jobs with opportunities for advancement.

COVID-19 Vaccination Distribution: In November 2020, the U.S. Centers for Disease Control and Prevention selected MHA Long Term Care Services, Inc, an affiliate of Managed Health Care Associates, Inc. (“MHA”), as the COVID-19 vaccinations network administrator on behalf of the MHA independent long-term care pharmacy network. MHA, a Roper company, has over 1,600 pharmacy locations nationwide across their portfolio of members and is providing long-term care pharmacies network administration services to support the delivery and administration of vaccinations for both the residents and staff of the long-term care facilities they serve. MHA is providing these services without cost.

|

|

Roper Technologies, Inc. 2021 Proxy Statement | v |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Our Certificate of Incorporation provides that the Board of Directors of the Company (the “Board of Directors” or the “Board”) will consist of a number of members to be fixed, from time to time, by the Board of Directors, but not less than the minimum number required under Delaware law. The Board of Directors is currently comprised of nine directors who are elected on an annual basis.

With the exception of Wilbur J. Prezzano, who will retire at the Annual Meeting, our Board unanimously recommended each incumbent director for reelection at the 2021 Annual Meeting. If reelected, the director nominees will serve until the 2022 Annual Meeting and until their successors have been duly elected and qualified. Certain information about our director nominees is set forth under “Board of Directors.” This information includes the business experience, qualifications, attributes and skills that each individual brings to our Board. Mr. Prezzano, who has served as a director since 1997, is retiring effective at the Annual Meeting consistent with the retirement provisions of our Corporate Governance Guidelines. As a result, our Board size will be reduced from nine to eight members effective at the Annual Meeting.

Although not anticipated, if prior to the meeting a director nominee is unable to serve, the proxy will be voted for a substitute nominee selected by the Board of Directors or the Board may choose to reduce its size.

The Board of Directors recommends a vote “FOR” the election to the Board of Directors of each of the following director nominees:

| Name | Age | Director Since |

Independent | Primary Occupation | ||||

| Shellye L. Archambeau |

58 | 2018 | Yes | Former Chief Executive Officer, MetricStream, Inc. | ||||

| Amy Woods Brinkley |

65 | 2015 | Yes | Retired Chief Risk Officer, Bank of America Corp. | ||||

| John F. Fort III |

79 | 1995 | Yes | Retired Chief Executive Officer, Tyco International Ltd. | ||||

| L. Neil Hunn |

49 | 2018 | No | President and Chief Executive Officer, Roper Technologies, Inc. | ||||

| Robert D. Johnson |

73 | 2005 | Yes | Chairman, Spirit AeroSystems Holdings, Inc. | ||||

| Laura G. Thatcher |

65 | 2015 | Yes | Retired Head of Executive Compensation Practice, Alston & Bird LLP | ||||

| Richard F. Wallman |

70 | 2007 | Yes | Retired Chief Financial Officer and Senior Vice President, Honeywell International Inc. | ||||

| Christopher Wright |

63 | 1991 | Yes | Executive Chairman, Kestrel Partners and | ||||

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 1 |

Table of Contents

Nominee Information

for terms expiring at the 2022 Annual Meeting

|

|

Shellye L. Archambeau

Former Chief Executive Officer, MetricStream, Inc.

|

Director Since 2018 Independent Age 58

| ||

| Committee:

● Nominating and Governance

Current Public Directorships:

● Okta, Inc. ● Nordstrom Inc. ● Verizon Communications, Inc.

Key Qualifications & Expertise:

● Executive leadership and management experience ● Software, technology and e-commerce ● Cybersecurity experience ● Developing and marketing emerging technology software applications and solutions ● Innovation, digital media and communications ● Building and scaling consumer and B2B businesses in the technology industry ● Entrepreneurial perspective ● Public company board experience | ||||

|

Ms. Archambeau

is the former Chief Executive Officer of MetricStream, Inc., a Silicon-Valley based global provider of governance, risk, compliance and quality management solutions to organizations across diverse | ||||

| industries. She served in this role from the time she joined MetricStream in 2002 until 2018. Prior to joining MetricStream, Ms. Archambeau served as Chief Marketing Officer and Executive Vice President of Sales for Loudcloud, Inc., a provider of Internet infrastructure services; Chief Marketing Officer of NorthPoint Communications, a provider of local data network services; and President of Blockbuster, Inc.’s e-commerce division, where she launched the entertainment retailer’s first online presence. Before she joined Blockbuster, Ms. Archambeau held domestic and international executive positions during a 15-year career at IBM Corporation. Ms. Archambeau has served as director of Okta, Inc., a provider of identity management solutions, since 2018, Nordstrom, Inc., since 2015, and Verizon Communications, Inc., since 2013.

| ||||

| 2 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

BOARD OF DIRECTORS (CONTINUED)

|

|

Amy Woods Brinkley

Founder, AWB Consulting, LLC

|

Director Since 2015 Independent Age 65

| ||

| Committee:

● Audit

Current Public Directorships:

● Carter’s, Inc. ● TD Bank Group

Key Qualifications & Expertise:

● Executive leadership and management experience ● Risk management, controls, corporate governance ● Financial reporting rules and regulations and audit procedures ● Broad-based knowledge of banking and financial services ● Marketing and e-commerce ● Corporate governance ● Public company board experience

● Talent and team development | ||||

|

Ms. Brinkley is the founder, owner and manager of AWB Consulting, LLC, an executive advising and risk management consulting firm. Ms. Brinkley served as Chief Risk Officer for Bank of America from 2002 until | ||||

| her retirement in 2009, after more than 30 years with the company. Prior to 2002, she served as President of the company’s Consumer Products division and was responsible for the credit card, mortgage, consumer finance, telephone, and e-commerce businesses. During her employment at Bank of America Corporation, Ms. Brinkley also held the positions of Executive Vice President and Chief Marketing Officer overseeing the company’s Olympic sponsorship and its national rebranding and name change. Ms. Brinkley has served as director of Carter’s Inc., since 2010, and TD Bank Group, since 2010. Ms. Brinkley also serves as a director of TD Bank Group’s subsidiaries: TD Group US Holdings, LLC, TD Bank US Holding Company, TD Bank, NA, and TD Bank, USA. In addition, she served as a Commissioner for Atrium Health, a non-profit hospital network from 2001 to 2019 and as a Trustee for the Princeton Theological Seminary from 2002 to 2019.

| ||||

|

|

John F. Fort III

Retired Chief Executive Officer, Tyco International Ltd.

|

Director Since 1995 Independent Age 79

| ||

| Committees:

● Nominating and Governance ● Audit

Key Qualifications & Expertise:

● Executive leadership and management experience ● Finance and accounting expertise ● Mergers and acquisitions ● Diversified industrial company leadership ● Global business, industry and operations experience ● Business strategy expertise ● Risk management ● In-depth knowledge of Company and its history provides valuable perspective | ||||

| Mr. Fort served as Chairman and Chief Executive Officer of Tyco International Ltd., a provider of diversified industrial products and services, from

1982 until his retirement from the company in 1993. | ||||

| He served as Interim CEO of Tyco from June to September 2002 and as an advisor to Tyco’s Board of Directors from March 2003 to March 2004. Mr. Fort has been self-employed since 1993.

| ||||

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 3 |

Table of Contents

BOARD OF DIRECTORS (CONTINUED)

|

|

L. Neil Hunn

President and Chief Executive Officer, Roper Technologies, Inc.

|

Director Since 2018 Age 49

| ||

|

Key Qualifications & Expertise:

● Executive leadership and management experience ● Deep understanding of organization ● Software and technology expertise ● Strategic focus and planning ● Global industry and operational experience ● Mergers and acquisitions, capital markets ● Healthcare experience ● Provides key leadership and guidance for the Company’s growth ● Management development and understanding of business challenges and opportunities

| ||||

|

Prior to being

named President and Chief Executive Officer in August 2018, Mr. Hunn served as Executive Vice President and Chief Operating Officer from 2017 to 2018. Mr. Hunn also served as Group Vice President | ||||

| of Roper’s medical segment from 2011 to 2018 and helped drive significant growth in the Company’s medical technology and application software businesses. In addition to his operating responsibilities at Roper, Mr. Hunn led the execution of the majority of the company’s capital deployment since joining Roper. Prior to joining Roper, Mr. Hunn served 10 years as Executive Vice President and Chief Financial Officer at MedAssets, an Atlanta-based SaaS company, and as President of its revenue cycle technology businesses. He successfully led MedAssets’ initial public offering and the execution of several M&A transactions. Mr. Hunn also held roles at CMGI, an incubator of Internet businesses, and Parthenon Group, a strategy consulting firm.

| ||||

|

|

Robert D. Johnson

Chairman, Spirit AeroSystems Holdings, Inc.

|

Director Since 2005 Independent Age 73

| ||

| Committee:

● Compensation

Current Public Directorships:

● Spirit AeroSystems Holdings, Inc. ● Spirit Airlines, Inc.

Key Qualifications & Expertise:

● Executive leadership and management experience ● Manufacturing, supply chain, engineering and production

● Mergers and acquisitions ● Global business, industry, and operations experience ● Extensive business acumen ● Public company board experience, including governance and executive compensation expertise

● Talent and team development | ||||

|

Mr. Johnson was

Chief Executive Officer of Dubai Aerospace Enterprise Ltd., a global aerospace engineering and services company, from August 2006 to December 2008. Mr. Johnson also served as | ||||

| Chairman of Honeywell Aerospace, a leading global supplier of aircraft engines, equipment, systems and services, from January 2005 to January 2006, and as its President and Chief Executive Officer from 1999 to 2005. Mr. Johnson similarly served as President and Chief Executive Officer for Honeywell Aerospace’s predecessor, AlliedSignal, an aerospace, automotive and engineering company. He also held management positions with AAR Corporation, a provider of aviation and expeditionary services to the global commercial, government and defense aviation industries, and GE Aviation, an aircraft engine supplier. Mr. Johnson has served as Chairman of the Board for Spirit AeroSystems Holdings, Inc., a global leader in aerostructures design and manufacturing, since 2006 and as a director of Spirit Airlines, Inc., since 2010.

| ||||

| 4 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

BOARD OF DIRECTORS (CONTINUED)

|

|

Laura G. Thatcher

Retired Head of Executive Compensation Practice, Alston & Bird LLP

|

Director Since 2015 Independent Age 65

| ||

|

Committees:

● Compensation (Chair) ● Executive

Key Qualifications & Expertise:

● Executive compensation expertise ● Organizational development ● Senior leadership and management experience ● Corporate governance ● Mergers and acquisitions

● Talent and team development | ||||

|

Ms. Thatcher

retired in December 2013 after 33 years of legal practice at Alston & Bird LLP, where she developed and led the firm’s executive compensation practice for 18 years and served as special executive | ||||

| compensation counsel to many U.S. and international publicly traded companies. Ms. Thatcher co-authored the Compensation Committee Handbook, 3rd edition (John Wiley & Sons, 2008), which serves as a guidebook for executive compensation strategies and practices, addressing a full range of functional issues facing compensation committees of public companies, including organizing, planning, compliance and sound corporate governance.

Ms. Thatcher served on the Board of Directors of Batson-Cook Company, a regional commercial construction and development company, from 1994 to 2007. She also served on the Board of Directors of The Atlanta Legal Aid Society, Inc., from 2008 to 2014, and was a Past Chair of the Advisory Board of the Certified Equity Professional Institute (CEPI) of Santa Clara University and was on the Board of Review for a special project sponsored by CEPI that provided universally accepted industry guidance regarding areas of risk and appropriate controls in equity compensation.

| ||||

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 5 |

Table of Contents

BOARD OF DIRECTORS (CONTINUED)

|

|

Richard F. Wallman

Retired Chief Financial Officer and Senior Vice President, Honeywell International Inc.

|

Director Since 2007 Independent Age 70

| ||

| Committees:

● Nominating and Governance (Chair) ● Executive

Current Public Directorships:

● SmileDirectClub, Inc. ● Extended Stay America, Inc. (Mr. Wallman will be stepping down from his directorship upon Blackstone/Starwood’s acquisition) ● Charles River Laboratories International, Inc.

Key Qualifications & Expertise:

● Executive leadership and management experience ● Finance and accounting expertise ● Multi-industry perspective ● Global business, industry, manufacturing and operations experience

● Mergers and acquisitions ● Risk management and controls ● Management development and understanding of global challenges and opportunities ● Public company board experience

| ||||

|

Mr. Wallman served

as the Chief Financial Officer and Senior Vice President of Honeywell International Inc., a diversified industrial technology and manufacturing company, and its predecessor AlliedSignal, Inc., from | ||||

| 1995 until his retirement in 2003. Mr. Wallman has also served in senior financial positions with IBM Corporation and Chrysler Corporation.

Mr. Wallman has served as a director of SmileDirectClub, Inc., since 2019, Extended Stay America, Inc., since 2013, and Charles River Laboratories International, Inc., a provider of laboratory services for the pharmaceutical, medical device and biotechnology industries, since 2011. In the last five years, Mr. Wallman served as a director of Wright Medical Group N.V., a global medical device company, Boart Longyear Ltd., a global mineral exploration company, Convergys Corporation, a provider of customer management and information management products, and ESH Hospitality, Inc., a lodging real estate investment trust.

| ||||

| 6 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

BOARD OF DIRECTORS (CONTINUED)

|

|

Christopher Wright

Executive Chairman, Kestrel Partners and

|

Director Since 1991 Independent Age 63

| ||

| Committees:

● Audit (Chair) ● Executive

Current Public Directorships:

● G.P. Investments Limited (Luxembourg) ● Spice Private Equity A.G. (Zurich)

Key Qualifications & Expertise:

● Executive and management experience ● Global public and private company board experience ● Finance and accounting expertise ● Mergers and acquisitions ● In-depth knowledge of Company ● Broad experience in technology, software and healthcare sectors ● Understanding of global challenges, risk and opportunities

| ||||

|

Mr. Wright is a

director of Merfin Capital Group, a European investment firm. He is also the Chairman of EMAlternatives LLC, a Washington, DC based private equity asset management firm, Chairman | ||||

| of Yimei Capital, a Shanghai based investment firm, and Executive Chairman of Kestrel Partners, a UK based investment management company. Until mid-2003 he served as Chief Executive Officer for Dresdner Kleinwort Capital and was a Group Board Member of Dresdner Kleinwort overseeing the bank’s alternative assets globally. He has acted as Chairman of various investment funds prior to and following the latter’s integration with Allianz S.E., and as Global Head of Private Equity at Standard Bank Limited from 2006 to 2007. Mr. Wright has served as director of G.P. Investments Limited (Luxembourg), since 2017, and of Spice Private Equity A.G. (Zurich), since 2016. He previously served as Chairman of Maxcess International Inc. until 2017, a privately-owned industrial technology company, and was a director of Yatra Ltd. (Euronext) from 2010 to 2018. Mr. Wright is a member of the Endowment Investment Committee of Corpus Christi College, Oxford; and a director of the Sutton Trust, an educational charity.

| ||||

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 7 |

Table of Contents

Table of Contents

CORPORATE GOVERNANCE (CONTINUED)

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 9 |

Table of Contents

Table of Contents

CORPORATE RESPONSIBILITY (CONTINUED)

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 11 |

Table of Contents

CORPORATE RESPONSIBILITY (CONTINUED)

| 12 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

Table of Contents

BOARD COMMITTEES AND MEETINGS (CONTINUED)

Board Committees

The current committee memberships are set forth below.

| Director | Audit | Compensation | Nominating and Governance |

Executive | ||||||||

| Shellye L. Archambeau |

|

🌑 |

|

|||||||||

| Amy Woods Brinkley |

🌑 |

|||||||||||

| John F. Fort III |

🌑 |

|

🌑 |

|

||||||||

| Robert D. Johnson |

|

🌑 |

|

|||||||||

| Wilbur J. Prezzano |

|

🌑 |

|

|

🌑 |

|

Chair | |||||

| Laura G. Thatcher |

|

Chair |

|

🌑 | ||||||||

| Richard F. Wallman |

|

Chair |

|

🌑 | ||||||||

| Christopher Wright |

Chair |

🌑 | ||||||||||

| 14 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

BOARD COMMITTEES AND MEETINGS (CONTINUED)

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 15 |

Table of Contents

BOARD COMMITTEES AND MEETINGS (CONTINUED)

| 16 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

Compensation for our non-employee directors is governed by our Director Compensation Plan, which is a sub-plan of our 2016 Incentive Plan. The Director Compensation Plan recognizes the Board’s instrumental contribution to Roper’s long-term success and creation of superior shareholder value. Over the past 15 years, our shareholders have earned a cumulative 1091.6% return – about three and a half times that of the S&P 500’s 311.0% return. Compensation paid to our Directors reflects the significant time commitment and effort associated with serving on our Board, including participation in a minimum of 15 days of Board meetings each year, in addition to numerous Committee meetings throughout the year. Our rapid growth, business transformation into software, and various market developments has made it increasingly challenging to find and assimilate the caliber of independent director capable of adding value to our high-growth, asset-light, diversified enterprise. Despite these challenges, in the past six years, we have added three new independent directors to the Board bringing needed key skills, strengths and capabilities to the Board while significantly increasing its level of gender diversity. Going forward, the Board will continue to insist on the high standards of qualifications that are in place.

Consistent with Roper’s long-standing “pay-for-performance” philosophy, the Director Compensation Plan ties director compensation directly to the Company’s stock performance, closely aligning the financial interests of our directors with those of our shareholders. Directors receive limited cash retainers and no perquisites (such as deferred compensation benefits), and instead receive a higher percentage of their compensation in shares of Company stock.

In April 2020, the Director Compensation Plan was amended to more closely align with market practice. The director plan was modified as follows: (i) reduction of the value of annual equity compensation from $665,000 to $385,000 (a reduction of 42%); and (ii) reduction of the supplemental annual cash retainer for the Independent Chair from $175,000 to $125,000 (a reduction of 29%). There were no changes to the annual cash retainer of $60,000 or the $5,000 committee chair retainers. The amendment to the Director Compensation Plan was approved by shareholders at the 2020 Annual Meeting of Shareholders. The amended Director Compensation Plan is summarized in the table below.

| 2020 Annual Equity Award |

||||

| Economic value of $385,000 (based on the closing price of the Company’s stock on date of grant)

• Award vests 50% on the six-month anniversary of the grant date and 50% on the day prior to the next Annual Meeting of Shareholders |

$ | 385,000 | ||

| 2020 Annual Cash Retainer |

||||

| Cash Retainer |

$ | 60,000 | ||

| 2020 Supplemental Annual Cash Retainers |

||||

| Independent Chair |

$ | 125,000 | ||

| Chair of Audit Committee |

$ | 5,000 | ||

| Chair of Compensation Committee |

$ | 5,000 | ||

| Chair of Nominating and Governance Committee |

$ | 5,000 | ||

We also reimburse our directors for reasonable travel expenses incurred in connection with attendance at Board, Committee and shareholder meetings and other Company business. In addition, the cash retainer and the number of restricted stock units granted are prorated for any new director appointed during the year based on the number of full months such director serves as a non-employee director during the year.

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 17 |

Table of Contents

DIRECTOR COMPENSATION (CONTINUED)

Mr. Hunn is an employee of our Company and did not receive any compensation for his service as a director. His compensation is set forth in the “Executive Compensation” section below.

2020 Director Compensation

| Name |

Fees Earned or |

Stock |

Total ($) | ||||||||||||

| Shellye L. Archambeau |

60,000 | 385,000 | 445,000 | ||||||||||||

| Amy Woods Brinkley |

60,000 | 385,000 | 445,000 | ||||||||||||

| John F. Fort III |

60,000 | 385,000 | 445,000 | ||||||||||||

| Robert D. Johnson |

60,000 | 385,000 | 445,000 | ||||||||||||

| Robert E. Knowling, Jr.(3) |

60,833 | 385,000 | 445,833 | ||||||||||||

| Wilbur J. Prezzano |

185,000 | 385,000 | 570,000 | ||||||||||||

| Laura G. Thatcher |

64,167 | 385,000 | 449,167 | ||||||||||||

| Richard F. Wallman |

65,000 | 385,000 | 450,000 | ||||||||||||

| Christopher Wright |

65,000 | 385,000 | 450,000 | ||||||||||||

| (1) | The dollar values shown represent the grant date fair values for RSUs granted to these directors during 2020, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC Topic 718”). |

| (2) | As of December 31, 2020, each non-employee director had 940 unvested RSUs outstanding, representing 50% of the 2020 award, which vest on the day prior to the Annual Meeting. |

| (3) | Mr. Knowling retired from the Board of Directors in January 2021. |

Our share ownership and retention guidelines for non-employee directors require each director to own shares of our common stock with a value of at least 10 times the annual cash base retainer, or $600,000 in value, within five years of becoming a director. Until the ownership requirements are met, non-employee directors are required to retain 60% of any shares they receive (on a net after tax basis) under our Director Compensation Plan. All of our directors are in compliance with these guidelines.

| 18 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

Beneficial ownership is determined in accordance with SEC rules. Under the rules, the number of shares beneficially owned by a person and the percentage of ownership held by that person includes shares of common stock that could be acquired upon exercise of an option within sixty days, although such shares are not deemed exercised and outstanding for computing the percentage of ownership held by any other person. Unless otherwise indicated in the footnotes below, the persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

The following table shows the beneficial ownership of Roper common stock as of March 31, 2021 by (i) each of our director nominees, (ii) each named executive officer in the “2020 Summary Compensation Table,” (iii) all of our current directors and executive officers as a group, and (iv) all persons who we know are the beneficial owners of five percent or more of Roper common stock. Except as noted below, the address of each person in the table is c/o Roper Technologies, Inc., 6901 Professional Parkway, Suite 200, Sarasota, Florida 34240.

| Name of Beneficial Owner

|

Beneficial Ownership |

Percent | ||||||||

| T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 |

12,785,311 | (3) | 12.1 | % | ||||||

| The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 |

8,646,830 | (4) | 8.3 | % | ||||||

| BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 |

7,323,918 | (5) | 7.0 | % | ||||||

| Shellye L. Archambeau |

5,608 | * | * | |||||||

| Amy Woods Brinkley |

12,418 | * | * | |||||||

| Jason Conley |

80,825 | * | * | |||||||

| Robert C. Crisci |

111,888 | * | * | |||||||

| John F. Fort III |

14,468 | (6) | * | * | ||||||

| L. Neil Hunn |

401,988 | * | * | |||||||

| Robert D. Johnson |

6,558 | * | * | |||||||

| Wilbur J. Prezzano |

17,358 | * | * | |||||||

| Laura G. Thatcher |

16,358 | * | * | |||||||

| Richard F. Wallman |

56,529 | (7) | * | * | ||||||

| Christopher Wright |

52,261 | (8) | * | * | ||||||

| John K. Stipancich |

65,987 | * | * | |||||||

| All current directors and executive officers as a group (12 individuals) |

842,246 | * | *% | |||||||

| ** | Less than 1%. |

| (1) | Includes the following shares that could be acquired on or before May 30, 2021 upon exercise of stock options issued under Company plans as follows: Mr. Conley (51,150), Mr. Hunn (195,000), Mr. Crisci (69,500), Mr. Stipancich (31,500), and all current directors and executive officers as a group (347,150). Holders do not have voting or investment power over unexercised option shares. |

| (2) | Includes the following shares of unvested restricted stock held by named executives officers over which they have sole voting power but no investment power: Mr. Conley (16,674), Mr. Hunn (111,472), Mr. Crisci (27,937), and Mr. Stipancich (16,640). The total for all current directors and executive officers as a group is (172,723). |

| (3) | Based on information reported on Schedule 13G/A filed with the SEC on February 16, 2021, as of December 31, 2020, T. Rowe Price Associates, Inc. beneficially owned 12,785,311 shares of Roper common stock with sole voting power over 4,572,318 shares and sole dispositive power over all of the shares. |

| (4) | Based on information reported on Schedule 13G filed with the SEC on February 10, 2021, as of December 31, 2020, The Vanguard Group (“Vanguard”) beneficially owned 8,646,830 shares of Roper common stock with shared voting power over 168,807 shares, sole dispositive power over 8,195,465 shares, and shared dispositive power over 451,365 shares. |

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 19 |

Table of Contents

BENEFICIAL OWNERSHIP (CONTINUED)

| (5) | Based on information reported on Schedule 13G/A filed with the SEC on February 1, 2021, as of December 31, 2020, BlackRock, Inc. (and certain of its subsidiaries) beneficially owned 7,323,918 shares of Roper common stock with sole voting power over 6,125,001 shares and sole dispositive power over 7,323,918 shares. |

| (6) | Includes 300 shares held by Mr. Fort’s spouse. |

| (7) | Includes 500 shares held in an IRA account by Mr. Wallman’s spouse. |

| (8) | Includes 14,500 shares held by an LLC of which Mr. Wright is a managing member, and in which he retains a continuing beneficial ownership of 10%. The shares held by the LLC are held in a margin account. In addition, 35,208 shares directly held by Mr. Wright are held in a margin account. |

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers, and greater than 10% shareholders to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors, and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, all Section 16(a) filing requirements applicable to its officers, directors, and greater than 10% shareholders were complied with in fiscal year 2020, except for the inadvertent late reports relating to two sales by Robert Johnson pursuant to an Exchange Act Rule 10b5-1 plan.

| 20 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) provides information about our compensation objectives and policies for our CEO and other executive officers included in the Summary Compensation Table and referred to in this CD&A as “named executive officers.” Our named executive officers for 2020 are:

| • | L. Neil Hunn, President and Chief Executive Officer; |

| • | Robert C. Crisci, Executive Vice President and Chief Financial Officer; |

| • | John K. Stipancich, Executive Vice President, General Counsel and Corporate Secretary; and |

| • | Jason Conley, Vice President and Chief Accounting Officer. |

With the goal of generating long-term value for our shareholders, we maintain an executive compensation program designed to:

| • | attract and retain executives with the leadership skills, attributes and experience necessary to succeed in an enterprise with Roper’s unique strategic focus, capital deployment strategy and broad portfolio diversity; |

| • | motivate executives to demonstrate exceptional personal performance and perform consistently at or above the levels that we expect, over the long-term and through a range of economic cycles; |

| • | link compensation to the achievement of goals and objectives that we believe best correlate with the creation of long-term shareholder value; and |

| • | compensate executives in a manner consistent with private equity opportunities in light of their dual obligations for (i) supervising the operating performance of our diverse set of approximately 45 companies, and (ii) effectively deploying capital to acquire high-quality companies consistent with our strategic focus. |

To achieve these objectives our compensation program combines annual and long-term components, cash and equity, and fixed and variable elements, with a bias toward long-term equity awards tied closely to driving growth and shareholder returns. Our executive compensation program rewards our executive officers when they help increase long-term shareholder value, achieve annual business goals, effectively deploy capital and successfully execute other strategic objectives.

2020 Financial Performance

In 2020, we demonstrated the resilience of our operating model. Faced with the challenges and uncertainties posed by the COVID-19 pandemic, we adapted and responded with another year of strong results.

| • | Annual shareholder return of 22.4%, exceeding the return of 18.4% for the S&P 500 |

| • | GAAP revenue increased 3% to $5.53 billion |

| • | Adjusted EBITDA increased by 3% to 1.98 billion (1) |

| • | Adjusted operating cash flow increased 14% to $1.72 billion and adjusted free cash flow increased 16% to $1.67 billion(1) |

| • | We deployed $6 billion toward the acquisition of niche software businesses, led by the acquisition of Vertafore in September, continuing our long-term transformation by enhancing the quality and resilience of our portfolio |

| • | Our annual dividend increased by 10%, increasing for the 28th consecutive year |

| (1) | This financial information is presented on an adjusted (non-GAAP) basis. A reconciliation from non-GAAP financial measures to the most comparable GAAP measure and other related information is available in “Appendix A—Reconciliations”. |

Compensation Updates

Roper’s Compensation Committee regularly reviews our executive compensation program with a view toward continuous improvement and consideration of investor feedback. In 2020, as a result of the sustained performance of Roper’s stock price, and in light of market practice, we transitioned from a practice of granting a fixed number of equity awards to a dollar value-based approach for all named executive officers.

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 21 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

With respect to the challenges and uncertainties posed by COVID-19:

| • | We reduced the CEO’s salary by 25% and the other named executive officers’ salaries by 20% from May through September; |

| • | In order to promote alignment with the impact of COVID-19 on our shareholders, we determined to not exercise discretion with respect to the 2020 bonus opportunity or adjust any outstanding long-term incentive program for the named executive officers; and |

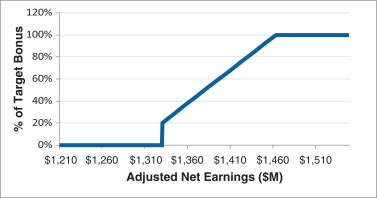

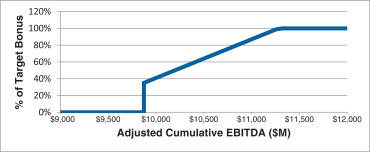

| • | In light of the challenges posed by COVID-19 and the deterioration in the energy markets in both 2020 and 2021, solely for 2021 the Compensation Committee adopted an incremental cash opportunity to earn up to 50% of each named executive officer’s target bonus should Roper overdrive growth beyond the maximum payout threshold of 10% adjusted net earnings growth under the 2021 annual cash incentive plan, with the full incremental bonus being paid for adjusted net earnings growth of 15% or more. |

The creation of shareholder value is the foundation and driver of our executive compensation program. The compensation of our named executive officers is closely aligned with the long-term interests of our shareholders.

Superior Returns for Roper Shareholders¹

Roper is proud of its long track record of superior returns for its shareholders. Roper has significantly outperformed the S&P 500 over the past 1, 3, 5, 10 and 15 years.

| Period |

Compound Annual Shareholder Return |

Total Shareholder Return (TSR) |

||||||||||||||

| Roper | S&P 500 | Roper | S&P 500 | |||||||||||||

| 1-Year |

22.4% | 18.4% | 22.4% | 18.4% | ||||||||||||

| 3-Years |

19.2% | 14.2% | 69.3% | 48.9% | ||||||||||||

| 5-Years |

18.6% | 15.2% | 134.2% | 103.0% | ||||||||||||

| 10-Years |

19.6% | 13.9% | 498.2% | 267.0% | ||||||||||||

| 15-Years |

18.0% | 9.9% | 1091.6% | 311.0% | ||||||||||||

| 22 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

As outlined in the graph below, $100 invested in Roper at the end of 2001 would have yielded an investor $1,962 as of December 31, 2020, compared to only $479 for the same investment in the S&P 500.

| ¹ | All periods ending December 31 of the referenced year. |

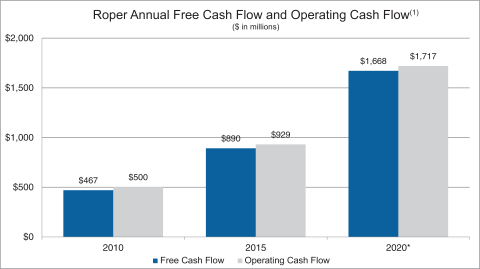

Focus on Cash Generation

We believe that cash generation is the best measure of our performance, and far superior to other traditional financial metrics. Through a combination of strategic and operational excellence and disciplined capital deployment, Roper has historically delivered meaningful year-over-year increases in free cash flow. After servicing debt obligations and returning capital to our shareholders through dividends, excess cash flow is deployed to acquire high-quality businesses with significant cash generation potential. We then provide these companies with oversight, guidance, and incentive systems to help drive profitable growth in our unique operating structure. This strategy has proven to be successful over the long-term, generating a compound annual shareholder return of 18% over the past 15 years.

Though some peers and other observers choose Economic Value Added (“EVA”) as a measure of performance, we believe that such a metric inappropriately penalizes companies, such as Roper, that emphasize capital deployment as a significant driver of shareholder value. For example, because EVA assigns a weighted average cost of capital to an acquisition, each acquisition that Roper makes is likely to be detrimental to its EVA for several years. However, Roper’s long-term success in driving superior returns for its shareholders while following its disciplined acquisition program demonstrates the challenges of EVA when applied to Roper’s strategic capital deployment business model. We believe that if Roper had directed excess cash flow for EVA-accretive uses, such as share repurchases, rather than compounding cash flow through cash generating acquisitions, the Company’s long-term shareholder returns would have been considerably lower. As such, the Company will continue to adhere to its proven strategy of combining operational excellence with prudent capital deployment in order to deliver superior returns to its shareholders.

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 23 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Resilient 2020 Performance for Roper

Against the unprecedented backdrop of COVID-19, Roper experienced another excellent year highlighted by strong operational execution and disciplined capital deployment. Despite the challenges of COVID-19, Roper delivered increases in revenue and EBITDA, as well as record cash flow. Our strategic focus on asset-light, diversified technology businesses and our ability to generate and compound cash flow delivered another year of outperformance.

| (1) | This financial information is presented on an adjusted (non-GAAP) basis. A reconciliation from non-GAAP financial measures to the most comparable GAAP measure and other related information is available in “Appendix A—Reconciliations”. |

Simple Strategy Drives Powerful Value Creation

Roper has a simple and successful business model that is unique among vertical software and multi-industry diversified companies. We operate high-margin, high cash-generating, asset-light businesses across a wide range of diverse end-markets. Our high-performing businesses generate excess free cash flow that our executive team deploys to acquire additional high-performing businesses. This creates a “compounding effect” for cash flow that drives long-term value creation. Our adjusted free cash flow increased from $467 million in 2010 to $1.668 billion in 2020, a compound annual growth rate of 14%, driven by our combination of outstanding business performance and value-creating capital deployment.

Note: Free Cash Flow = Cash from Operations less Capital Expenditures less Capitalized Software Expenditures.

*Amounts provided for fiscal year 2020 are adjusted for cash taxes of $192 million related to the sale of Gatan.

| (1) | This financial information is presented on an adjusted (non-GAAP) basis. A reconciliation from non-GAAP financial measures to the most comparable GAAP measure and other related information is available in “Appendix A—Reconciliations”. |

| 24 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

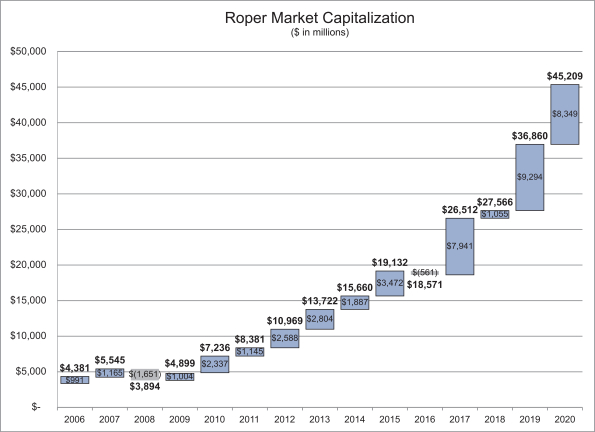

Market Capitalization Growth

Roper’s market capitalization has increased more than $40 billion since January 2010.*

| * | Chart reflects ending period as December 31, 2020. |

Key Metric: Cash Return on Investment

In addition to cash flow, Cash Return on Investment (“CRI”) is the key metric Roper uses to measure the performance and value of its operating businesses and potential acquisitions. CRI measures the quality of a business’s cash flow. Our business leaders, executive leaders, and Board of Directors focus on cash flow growth and disciplined investments targeted to enhance CRI.

| • | CRI is highly correlated to shareholder value creation and we believe our strategy of improving CRI has been a key driver of our long-term performance. |

| • | Our CRI discipline, as applied throughout the organization, allows Roper to focus our investment on areas that will increase shareholder value, drive cash flow growth, and minimize physical and working capital assets. |

| • | Through a combination of internal improvements and disciplined capital deployment, Roper has increased CRI dramatically over the past 20 years, a key driver of our strong shareholder returns over the period. |

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 25 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Acquisition-Focused Capital Deployment

We deploy the majority of our free cash flow toward acquisitions to generate long-term growth and create long-term shareholder value. Unlike most other large corporations, we do not have a separate corporate development or merger-and-acquisition team. Instead, our CEO and other top executives are responsible for the disciplined deployment of capital through acquisitions. As such, our executives must be well versed at improving operations and optimizing capital deployment, as both are significant contributors to value creation for our shareholders.

OVERVIEW OF OUR COMPENSATION PROGRAM

Consideration of Say-on-Pay Vote

At the 2020 Annual Meeting of Shareholders, 85.4% of the votes cast were in favor of the advisory vote to approve our named executive officer compensation. While the level of support is lower than the prior years’ support of 97% in 2019, 95% in 2018 and 95% in 2017, the Compensation Committee believes the Say-on-Pay vote continues to reflect the solid support of our shareholders for our long-standing pay-for-performance philosophy and approach of integrating executive compensation with our value creation model, as well as for recent changes to our executive compensation program.

Taking into consideration input from shareholders, the Say-on-Pay vote, external developments, and internal considerations, Roper has undertaken many changes over the past several years to our executive compensation program to ensure it remains closely aligned with the long-term interests of our shareholders:

| • | 100% of restricted shares are performance-based, with all vesting contingent upon meeting multi-year EBITDA and relative operating cash flow margin performance requirements. |

| • | Only stock options, which are inherently performance-based, vest by continued time-based service alone. |

| • | Annual vesting of equity awards (one-third per year over three years) was eliminated. |

| • | CEO equity awards may vest only at the end of a three-year period. |

| • | Equity awards for other named executive officers may vest 50% after the second year and 50% after the third year, with no opportunity at the end of three years to make up for any shortfall in the vesting of the first 50% tranche. |

| • | Dividends on restricted shares are not paid until the shares are earned, and are forfeited if shares are not earned. |

| • | Starting in 2017, the operating cash flow less capital expenditures and capitalized software (measured as a percentage of revenue) was changed from an internal goal to relative performance against an external benchmark with 50th percentile performance required for any portion of the restricted shares to vest and 75th percentile performance required for full vesting. |

| • | Transitioned from the practice of granting a fixed number of equity awards to a dollar value-based approach for both non-employee directors and named executive officers as a result of the superior performance of the Company’s stock price and to align with market practice. |

| • | 95% of our CEO’s compensation is subject to performance risk and tied to financial results and stock price. |

| • | Based on the results of the advisory vote at the 2017 Annual Meeting of Shareholders to approve the frequency of the Say-on-Pay vote, the Say-on-Pay vote will continue to be held every year. |

| 26 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Checklist of Compensation Practices

Consistent with shareholder interests and market best practices, positive features of our executive compensation program include the following:

|

| |

| What We Do | What We Don’t Do | |

| ✓ Substantially all compensation for named executive officers is tied to performance.

✓ Performance-based vesting requirements apply to 100% of restricted stock awards (no time vesting alone).

✓ CEO special long-term cash bonus based on five-year results to reinforce a long-term planning horizon and sustainable growth.

✓ Cash bonuses are capped and performance-based restricted stock awards limited to 100% of target (risk mitigation features).

✓ Robust share ownership and retention guidelines.

✓ “Clawback” policy to recoup erroneously paid cash and equity compensation.

✓ Risk assessment review as part of risk mitigation process.

✓ Independent compensation consultant retained by the Compensation Committee.

✓ Limited perquisites and other benefits.

|

Ò No payment of dividends on performance-based restricted stock awards until earned.

Ò No defined-benefit pension plan or SERPs for named executive officers (only 401(k) plan on the same terms as other eligible employees and voluntary deferral of cash compensation).

Ò No “single trigger” equity vesting upon change-in-control.

Ò Severance pay is very limited, as is the use of employment agreements.

Ò No hedging or pledging of Company stock is permitted (with the exception of the number of shares pledged as of the date of the adoption of the policy in January 2015 for one independent director).

Ò No excise tax gross-ups on change-in-control payments.

Ò No re-pricing of underwater stock options or cash buy-outs without shareholder approval.

Ò No granting of stock options with an exercise price less than fair market value at grant. |

Objectives of our Compensation Program

Our compensation program for our named executive officers reflects our business needs, market requirements, and challenges in creating long-term shareholder value and is designed to:

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 27 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Our executive compensation program consists of several elements, each with an objective that fits into our overall program to provide an integrated and competitive total pay package.

| 28 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Other Pay Elements

As Roper has largely avoided perquisites, supplemental pensions, and other compensation not tied to performance, the other items summarized below represent only a small portion of our named executive officers’ total compensation.

|

|

Roper Technologies, Inc. 2021 Proxy Statement | 29 |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

Mix of Total Compensation

Compensation for our named executive officers encourages a long-term focus and closely aligns with shareholder interests. For 2020, the total direct compensation at target that was at risk and tied to stock price and performance objectives was 95% for the CEO, and 88% on average for our other named executive officers.

2020 Total Direct Compensation Mix

Compensation Committee Oversight

The Compensation Committee oversees our executive compensation program to appropriately compensate our named executive officers, motivate our named executive officers to achieve our business objectives, and align our named executive officers’ interests with those of our shareholders. The Compensation Committee reviews each element of compensation for each named executive officer and determines any adjustments to compensation structure and levels in light of various considerations, including:

| • | The scope of the named executive officer’s responsibilities, performance and experience as well as competitive compensation levels. |

| • | Our financial results against prior periods. |

| • | The structure of our compensation program relative to sound risk management, as discussed with management. |

| • | The results of the advisory shareholder vote on the compensation of our named executive officers and input from shareholders. |

| • | Competitive pressures from private equity and capital deployment companies, as well as market practices and external developments generally. |

| • | The utilization of a compensation consultant who provides extensive external benchmarking of named executive officer compensation of industry peer group companies for comparison purposes. |

| 30 |

|

Roper Technologies, Inc. 2021 Proxy Statement |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS (CONTINUED)

The Compensation Committee has maintained a simple program that drives long-term performance and superior value creation for shareholders enabling Roper to attract, retain, and motivate an outstanding leadership team.

Compensation Consultant

In September 2019, the Compensation Committee, as part of an effort to bring a fresh perspective to its’ compensation practices, retained the services of Compensia, a national compensation consulting firm, (the “Consultant”) to closely monitor developments and trends in executive compensation and to provide recommendations for appropriate adjustments to the Company’s compensation program, policies, and practices in line with the Company’s business and talent strategies and investor expectations.

| • | The Consultant is independent, reports directly to the Chair of the Compensation Committee and has never performed other work for the Company. The Compensation Committee determined that its engagement of the Consultant did not raise any conflicts of interest. |

| • | The Consultant attends all meetings of the Compensation Committee where evaluations of the effectiveness of our overall executive compensation program is conducted or where compensation for named executive officers is analyzed or approved. |

| • | The Chair of the Compensation Committee meets with the Consultant in advance of committee meetings and confers with the Consultant between meetings. |

| • | The Consultant assists in gathering and analyzing market data on compensation levels and provides expert knowledge of marketplace trends and best practices relating to competitive pay levels as well as developments in regulatory and technical matters. |

Role of Our Named Executive Officers

While the Compensation Committee is ultimately responsible for making all compensation decisions affecting our named executive officers, our CEO participates in the process because of his close day-to-day association with the other named executive officers and his knowledge of the Company’s diverse business operations.

| • | Our CEO discusses with the Compensation Committee the performance of the Company and of each named executive officer, including himself. The CEO also discusses with the committee the performance of key executives reporting to his direct reports. |

| • | The CEO makes recommendations on the components of compensation for the named executive officers, other than himself, but does not participate in the portion of the committee meeting regarding the review of his own performance or the determination of the actual amounts of his compensation. |