Form DEF 14A PRIME GLOBAL CAPITAL For: Sep 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box::

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material under §240.14a-12 | |||

|

PRIME GLOBAL CAPITAL GROUP INCORPORATED | ||||

| (Name of the Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

PRIME GLOBAL CAPITAL GROUP INCORPORATED

E-5-2, Megan Avenue 1, Block E

Jalan Tun Razak

50400 Kuala Lumpur, Malaysia

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Prime Global Capital Group Incorporated will be held at The Club Room, Level 18, Grand Hyatt Erawan Bangkok, 494, Rajdamri Road, Bangkok Metropolitan, Thailand, on September 18, 2019, at 8:30 a.m., Bangkok Thailand Time (UTC +8), for the following purposes, as more fully described in the accompanying proxy statement:

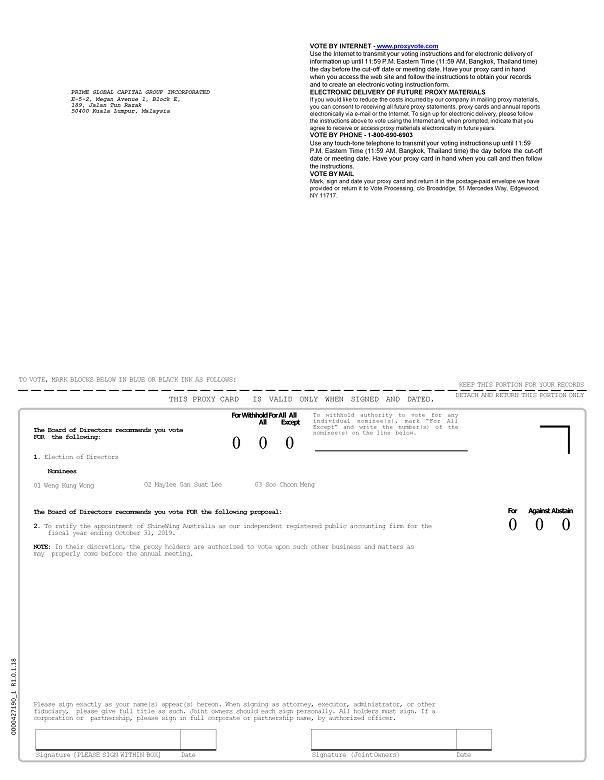

| 1. | To elect three directors to our Board of Directors to serve for the ensuing year; |

| 2. | To ratify the appointment of ShineWing Australia as our independent registered public accounting firm for the fiscal year ending October 31, 2019; and |

| 3. | To transact such other business as may properly come before the meeting. |

The record date for the determination of stockholders entitled to notice of and to vote at the annual meeting is July 22, 2019. Accordingly, only stockholders of record as of that date will be entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

Your vote is very important to us. Regardless of whether you expect to attend the meeting, please act promptly to vote your shares. You may vote your shares by telephone, over the Internet or by attending the annual meeting and voting your shares in person. You may also grant your proxy to vote by telephone, over the Internet or by returning a signed, dated and marked proxy card that you received. If you are present at the meeting and hold shares in your name, you may vote in person even if you have previously submitted your proxy by telephone, over the Internet or by mail. If your shares are held in street name with your broker or by a nominee and you wish to vote in person at the meeting, you will need to obtain a legal proxy from the institution that holds your shares and provide that legal proxy at the meeting.

| By Order of the Board of Directors | |

| Weng Kung Wong, | |

| Chief Executive Officer, Interim Chief Financial, and Secretary | |

| August 5, 2019 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 18, 2019

The Company’s Proxy Statement for the 2019 Annual Meeting of Stockholders and the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2019 are available at www.sec.gov.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

OF

PRIME GLOBAL CAPITAL GROUP INCORPORATED

Approximate date of mailing — August 5, 2019

Date, Time and Place of Annual Meeting

The annual meeting of stockholders of Prime Global Capital Group Incorporated, or “we”, “us” or the “Company,” is scheduled to be held as follows:

| Date: | Wednesday, September 18, 2019 | ||

| Time: | 8:30 a.m., Bangkok Thailand Time (UTC +8) | ||

| Place: |

The Club Room, Level 18 Grand Hyatt Erawan Bangkok 494, Rajdamri Road Bangkok Metropolitan, Thailand |

Proposals to be Considered at the Annual Meeting

At the annual meeting, you will be asked to consider and vote on the following proposals:

| · | To elect three directors to our Board of Directors to serve for the ensuing year; |

| · | To ratify the appointment of ShineWing Australia as our independent registered public accounting firm for the fiscal year ending October 31, 2019; and |

| · | To transact such other business as may properly come before the meeting. |

In the event that a quorum is not present at the annual meeting, you may also be asked to vote upon a proposal to adjourn or postpone the annual meeting to solicit additional proxies.

Record Date

Our Board of Directors has fixed the close of business on July 22, 2019, as the record date for the annual meeting and only holders of record of our common stock on the record date are entitled to vote at the annual meeting. On the record date, there were outstanding 512,682,393 shares of our common stock.

Voting Rights and Quorum

Each share of our common stock is entitled to one vote. The presence in person or representation by proxy of holders of a majority of the shares of our common stock issued and outstanding as of the close of business on July 22, 2019, will constitute a quorum at the annual meeting. If a share is represented for any purpose at the meeting, it is deemed to be present for the transaction of all business. Abstentions and broker non-votes are counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business. In the event that a quorum is not present at the annual meeting, it is expected that the annual meeting will be adjourned or postponed to solicit additional proxies.

| 1 |

Vote Required

Each item to be acted upon at the meeting requires the affirmative vote of the holders of a majority of the shares of our common stock represented at the meeting in person or by proxy and entitled to vote on the item, assuming that a quorum is present or represented at the meeting. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, and will have no effect. With respect to the other proposals, a properly executed proxy marked “ABSTAIN,” although counted for purposes of determining whether there is a quorum, will not be voted. Accordingly, an abstention will have the same effect as a vote cast against a proposal. Under Nevada law, a broker non-vote will have no effect on the outcome of the matters presented for a stockholder vote.

If you are the beneficial owner of shares held in “street name” by a broker, your broker, as the record holder of the shares, must vote those shares in accordance with your instructions. In accordance with the rules of the New York Stock Exchange (the “NYSE”), a brokerage firm may give a proxy to vote its customer’s stock without customer instructions if the brokerage firm (i) transmitted proxy materials to the beneficial owner of the stock, (ii) did not receive voting instructions by the date specified in the statement accompanying the proxy materials and (iii) has no knowledge of any contest with respect to the actions to be taken at the stockholders’ meeting and such actions are adequately disclosed to stockholders. In addition, under new NYSE rules, brokerage firms may not vote their customers’ stock without instructions from the customer if the vote concerns the election of directors, a matter relating to executive compensation, including the advisory proposal on compensation and the advisory proposal on how frequently stockholders should vote to approve the compensation of the named executive officers, which will be voted on at the meeting, or an authorization for a merger, consolidation or any matter that could substantially affect the rights or privileges of the stock.

Voting and Revocation of Proxies

After carefully reading and considering the information contained in this proxy statement, you may attend the annual meeting and vote your shares in person, by telephone or over the Internet. You may also grant your proxy to vote by returning a signed, dated and marked proxy card, by telephone or over the Internet.

Unless you specify to the contrary, all of your shares represented by valid proxies will be voted

| • | “FOR” all director nominees; and |

| • | “FOR” the appointment of ShineWing Australia as our independent registered public accounting firm. |

The persons you name as proxies may propose and vote for one or more adjournments or postponements of the annual meeting, including adjournments or postponements to permit further solicitations of proxies. Such proxy holders may also vote in its discretion on any other matters that properly come before the annual meeting.

Until exercised at the annual meeting, you can revoke your proxy and change your vote in any of the following ways:

| • | by delivering written notification to us at our principal executive offices at E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia, Attention: Corporate Secretary; |

| • | by changing your vote or revoking your proxy by telephone or over the Internet; |

| • | if you hold shares in your name, by attending the annual meeting and voting in person (your attendance at the meeting will not, by itself, revoke your proxy; you must vote in person at the meeting); |

| • | if you have instructed a broker or bank to vote your shares, by following the directions received from your broker or bank to change those instructions; or |

| • | if you hold shares in street name with your broker or by a nominee, by obtaining a legal proxy from the institution that holds your shares, attending the annual meeting and voting in person (your attendance at the meeting will not, by itself, revoke your proxy; you must vote in person at the meeting). |

| 2 |

If you decide to vote by completing, signing, dating and returning a proxy card, you should retain a copy of the voter control number found on the proxy card in the event that you decide later to change or revoke your proxy.

Solicitation of Proxies

The accompanying proxy is being solicited by our Board of Directors, and we will pay for the entire cost of the solicitation. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries for forwarding the solicitation material to the beneficial owners of our common stock held of record by those persons, and we may reimburse them for reasonable transaction and clerical expenses. In addition to the use of the mail, proxies may be solicited personally or by telephone, facsimile or other means of communication by our officers and regular employees. These people will receive no additional compensation for these services, but will be reimbursed for any expenses incurred by them in connection with these services. We have engaged Broadridge Financial Solutions, Inc. to assist in the solicitation of proxies. We will pay that firm approximately $13,285 for its services and reimburse its out-of-pocket expenses for such items as mailing, copying, phone calls, faxes and other related matters.

Delivery of One Proxy Statement to A Single Household

We will deliver only one proxy statement to multiple security holders sharing an address unless we have received contrary instructions from one or more of the security holders. Upon written or oral request, we will promptly deliver a separate copy of this proxy statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this proxy statement was delivered, or deliver a single copy of this proxy statement and any future proxy statements and annual reports to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address: Prime Global Capital Group Incorporated, E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia, Attn: Secretary. The Secretary may also be reached by telephone at +603 2162 0773; facsimile at +603 2161 0770.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of August 5, 2019, as to the beneficial ownership of our common stock, in each case, by (i) each person known to us to be the beneficial owner of more than 5% of our common stock; (ii) each executive officer; (iii) each individual named in the Summary Compensation Table; (iv) each of our directors and nominees; and (v) all of our current executive officers and directors as a group.

| Name of Beneficial Owner(1)(2) | Amount (number of shares) | Percentage of Outstanding Shares of Common Stock | ||||||

| Weng Kung Wong | 54,811,085 | 10.69% | ||||||

| Maylee Gan Suat Lee | 0 | 0% | ||||||

| Choon Meng Soo | 0 | 0% | ||||||

| All executive officers and directors as a group (three persons) | 54,811,085 | 10.69% | ||||||

* Less than 1%.

(1) The address of each person named in this table is c/o Prime Global Capital Group Incorporated, E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia.

(2) A person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of such securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, the sole voting and investment power with respect to the indicated shares of common stock. Percentages are based on 512,682,393 shares issued and outstanding at the close of business on August 5, 2019.

| 3 |

DIRECTORS, OFFICERS, NOMINEES AND CONTROL PERSONS

Set forth below are the present directors and executive officers and director nominees of the Company. There are no arrangements or understandings between any of the directors, director nominees, officers and other persons pursuant to which such person was selected as a director or an officer. Directors are elected to serve until the next annual meeting of stockholders and until their successors have been elected and have qualified. Officers are appointed to serve until the meeting of the Board of Directors following the next annual meeting of stockholders and until their successors have been elected and qualified.

| Name | Age | Position | ||||

| Weng Kung Wong | 46 | Chief Executive Officer, Interim Chief Financial Officer, Interim Secretary and Director | ||||

| Maylee Gan Suat Lee | 41 | Director | ||||

| Soo Choon Meng | 50 | Director | ||||

Weng Kung Wong, age 46, our Chief Executive Officer and Director since November 15, 2010, founded Mobile Wallet Sdn. Bhd., MWSB, one of the first Malaysian m-commerce companies, in 2004 and currently serves as its Executive Director and Chief Executive Officer. Prior to founding MWSB, Mr. Wong served as an Agency Unit Manager of MAA Insurance from April, 2001 to November, 2003. From January, 2000 to April, 2001, he was the Marketing Director of Spider Holding Sdn. Bhd., an herb products distribution company. Mr. Wong began his professional career in 1995 with Forever Living Products, a health products multilevel marketing company, where he spent four years in positions of accelerating responsibility in the areas of business development and marketing. Mr. Wong obtained a bachelor’s degree in Management Information Systems from the National Central University of Taiwan in 1995. As our Chief Executive Officer, Mr. Wong brings to our Board of Directors knowledge of our operations and history, business leadership, corporate strategy and entrepreneurial expertise.

Maylee Gan Suat Lee, age 41, joined our Board of Directors on April 1, 2016. She is currently the founder and senior partner of Messrs. Maylee Gan & Tai. Prior to founding her firm in 2008, Ms. Gan practiced at one of the top 5 legal firms in Malaysia, Lee Hishammuddin Allen & Gledhill from 2004 to 2008. Ms. Gan graduated with a Bachelor of Laws (Hons) degree from the University of London, England in 1999. She obtained her Certificate of Legal Practice in 2000 and has a Masters of Science in Information Technology (MSc IT) from the University of Staffordshire in 2004.

Ms. Gan was admitted and enrolled as an advocate and solicitor of the High Court of Malaya in 2005. She has vast experience in various complex corporate matters, and she was the lead associate in charge of the largest worldwide business disposal to-date which involves the worldwide sale of its Healthcare business division in 2006, and the largest Asset-Backed Securities transaction carried out by a listed corporation in Malaysia in the year 2008. Ms. Gan is also a Non-executive Director of G&L Trading Sdn. Bhd, as a successor of her late father. G&L Trading Sdn. Bhd supplies cleaning detergent to hotels and food & beverages related businesses. Through her vast experience in legal corporate matters with numerous large corporations, with which her legal firm is a panel of solicitor, Ms. Gan brings to the Board of Directors her legal insight, knowledge and experience in legal corporate matters.

Soo Choon Meng, 50, joined our Board of Directors on August 1, 2017. He is is currently the Managing Proprietor of C.M.SOO Associates, an accounting and audit firm. Mr. Soo has served as a director of Galasys GLT Sdn. Bhd. since 2004, and has been responsible for the day to day running of the business. Mr. Soo also serves on the Board of Directors of various other private Malaysian and international companies that are in the field of property holding and investment holding. Mr. Soo is a Chartered Accountant by training, having qualified by completing the professional examination of the Chartered Association of Certified Accountants (UK) in June 1996, and received his membership of the Malaysian Institute of Accountants (Chartered Accountant) in February 1999 and admitted as a Fellow Member of the Chartered Association of Certified Accountants (UK) in July 2003. Mr. Soo brings to the Board of Directors his expertise in financial and tax matters.

Family Relationships

There are no family relationships between any of our directors or executive officers.

| 4 |

Involvement in Certain Legal Proceedings

No executive officer or director is a party in a legal proceeding adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

No executive officer or director has been involved in the last ten years in any of the following:

| • | Any bankruptcy petition filed by or against any business or property of such person, or of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| • | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| • | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; | |

| • | Being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; | |

| • | Being the subject of or a party to any judicial or administrative order, judgment, decree or finding, not subsequently reversed, suspended or vacated relating to an alleged violation of any federal or state securities or commodities law or regulation, or any law or regulation respecting financial institutions or insurance companies, including but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail, fraud, wire fraud or fraud in connection with any business entity; or | |

| • | Being the subject of or a party to any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act, any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Certain Relationships And Related Transactions

Escrow Arrangement with Peijin Wu Hoppe

We are party to an escrow agreement dated July 7, 2014, with Peijin Wu Hoppe, our former director, pursuant to which we agreed to deposit One Hundred Thousand Dollars on an annual basis in an escrow account up to an aggregate of Five Hundred Thousand Dollars. The funds will be used to finance our indemnification obligations, if any, to Ms. Hoppe under our director retainer agreement with Ms. Hoppe. Unless earlier terminated in accordance with its terms, the escrow agreement expires upon the seventh anniversary of the termination of Ms. Hoppe’s director retainer agreement, or July 29, 2022. Our legal counsel, Chen-Drake Law Group, PC serves as the escrow agent at an annual fee of US$3,000.

As of the date of this report, we have deposited Two Hundred Thousand Dollars into the escrow account and expect to reach the full Five Hundred Thousand Dollar balance by May 2020. After the escrow balance reaches Five Hundred Thousand Dollars, we will be obligated to make additional deposits to ensure that the escrow balance is maintained at or above Five Hundred Thousand Dollars during the term of the escrow agreement.

The foregoing description of the escrow agreement is qualified in its entirety by reference to such agreement, which is filed as Exhibit 1 to this Proxy Statement and is incorporated herein by reference.

| 5 |

Transactions With Weng Kung Wong and Kok Wai Chai

As of October 31, 2018, and 2017, and the six months ended April 30, 2019, we obtained from Weng Kung Wong, our Chief Executive Officer and director, several unsecured, interest-free advances which, together with prior advances, have an aggregate principal amount of approximately US$2,270,089, US$2,427,767, and $2,272,466, respectively. We repaid approximately $1,428,050 during fiscal year ended October 31, 2018. The advances are not expected to be repayable within the next twelve months.

In April 2019, the Company, through VSSB obtained a loan in the aggregate amount of RM5,000,000 from Public Islamic Bank Berhad, a financial institution in Malaysia for working capital purpose, which bears interest at a rate of 1.00% per annum above base financing rate, variable rate quoted by the bank, with 120 monthly instalments of RM60,590 each (including interests) over a period of 10 years and will mature in 2029. The loan is secured by the first party charge over agricultural lands under Lot 3695, Lot 3696 and Lot 1552 situated at Pahang, Malaysia, and a third-party charge over the 15-story commercial office building registered under PGCG Assets. The loan is also secured by a specific debenture on the oil palm and durian plantation is to be obtained, and personally guaranteed by the director and chief executive officer of the Company, Mr. Weng Kung Wong and subsidiaries of the Company, UHT and PGCG Assets. The cost of funds was 7.97% per annum for the period ended April 30, 2019. The foregoing description of the loan with the Public Islamic Bank Berhad is qualified in its entirety by reference to such agreement, which is filed as Exhibit 2 to this Proxy Statement and is incorporated herein by reference.

We were parties to a loan from the Bank of China (Malaysia) Berhad consisting of a revolving line of credit, or the RC, in the amount of RM15,000,000 and a term loan, or the TL, in the amount of RM40,000,000, for an aggregate of RM55,000,000 in December 2014. This loan is personally guaranteed by Weng Kung Wong, our Chief Executive Officer and Director, and also guaranteed by UHT, our wholly owned subsidiary. The loan with Bank of China (Malaysia) Berhad has been redeemed through the loan granted by Public Islamic Bank Berhad in April 2019.

In August 2018, the Company, through PGCG Assets obtained a loan in the principal amount of RM50,000,000 from Public Islamic Bank Berhad, a financial institution in Malaysia to finance the acquisition of a fifteen story office building property, which bears interest at a rate of 1.50% per annum below the base financing rate, currently 6.97% per annum, with 180 monthly installments of RM407,750 each (including interests) over a period of 15 years or until full settlement and will mature in September 2033. The loan from Public Islamic Bank Berhad is secured by the first party charge over 15-story commercial office building in Kuala Lumpur, Malaysia, deed of assignment of rental proceeds over the rights and interest to the rental of the 15-story commercial office building and is personally guaranteed by the director and chief executive officer of the Company, Mr. Weng Kung Wong and a subsidiary of the Company, UHT. The loan is also secured by a debenture incorporating fixed and floating charge for RM50 million plus interest thereon over the assets of PGCG Assets. The cost of funds was 5.47% per annum for the period ended April 30, 2019. The foregoing description of the loan with the Public Islamic Bank Berhad is qualified in its entirety by reference to such agreement, which is filed as Exhibit 3 to this Proxy Statement and is incorporated herein by reference.

Weng Kung Wong and Kok Wai Chai also have jointly and severally guaranteed the repayment of the loans made by RHB Bank Berhad to PGCG Assets in the principal amount of RM9,840,000 in connection with the acquisition of its twelve story commercial building in Kuala Lumpur, Malaysia. The foregoing description of the loans with RHB Bank Berhad is qualified in its entirety by reference to such agreements, which are filed as Exhibits 4 through and including 6 to this Proxy Statement and are incorporated herein by reference

We have not adopted policies or procedures for approval of related person transactions but review them on a case-by-case basis. We believe that all related party transactions were on terms at least as favorable as we would have secured in arm’s-length transactions with third parties. Except as set forth above, we have not entered into any material transactions with any director, executive officer, and promoter, beneficial owner of five percent or more of our common stock, or family members of such persons.

| 6 |

CORPORATE GOVERNANCE

Director Independence

We have adopted standards for director independence that correspond to NYSE listing standards and SEC rules. An “independent director” means a person who is not an officer or employee of the Company or its subsidiaries, or any other individual having a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. To be considered independent, the Board must affirmatively determine that neither the director, nor any member of his or her immediate family, has had any direct or indirect material relationship with the Company within the previous three years. In addition, to be considered “independent” under SEC rules, each member of the Audit Committee may not accept, directly or indirectly, any consulting, advisory, or other compensatory fee from us, other than compensation for his or her services as a director.

The Board considered relationships, transactions and/or arrangements with each of the directors and concluded that none of the non-employee directors, or any of his or her immediate family members, has any relationship with us that would impair his or her independence. The Board has determined that each member of the Board, other than Mr. Wong, is an independent director under applicable NYSE listing standards and SEC rules. Mr. Wong does not meet the independence standards because he is an employee and executive officer of the Company.

Board Meetings

During fiscal year 2019, our Board held 1 meeting and acted by written consent 1 times during fiscal 2019 and 1 meeting and acted by written consent 1 times during the six months ended April 30, 2019. Our independent directors did not meet in executive sessions without the presence of any of our executive officers. Each director attended all meetings held during fiscal year 2018 and during the six months ended April 30, 2019. No director attended less than 75 percent of our Board or committee meetings of which they were members. The work of the Company’s directors is performed not only at meetings of the Board, but also by consideration of the Company’s significant business decisions through the review of documents and in numerous communications among Board members and others.

Director Attendance at Annual Meeting

We have not yet developed a policy regarding director attendance at annual meetings of the stockholders. A majority of our directors attended our 2018 Annual Stockholders Meeting.

Committees of Our Board

The members of each of our Compensation, Audit, and Nominations and Corporate Governance committees are comprised of our two independent directors Maylee Gan Suat Lee and Soo Choon Meng. Maylee Gan Suat Lee and Soo Choon Meng were appointed to serve as the Chairman or Chairperson, as applicable, of the Compensation Committee and the Nominations and Corporate Governance Committee, respectively. The Company current does not have an Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act but hopes to have one as its business develops. Copies of the charters for each of the Compensation, Audit and Nominations and Corporate Governance Committees are filed as Appendices A, B and C respectively, to this Proxy Statement.

Compensation Committee

Our Compensation Committee is responsible for developing and overseeing the implementation of our philosophy with respect to the compensation of executives and for monitoring the implementation and results of the compensation philosophy to ensure compensation remains competitive, creates proper incentives to enhance stockholder value and rewards superior performance. The Compensation Committee annually reviews and approves for each named executive officer, and particularly with regard to the Chief Executive Officer, all components of the executive’s compensation. The Compensation Committee may award discretionary bonuses to each of the named executives, and reviews and approves the process and factors (including individual and corporate performance measures and actual performance versus such measures) used by the Chief Executive Officer to recommend such awards. Additionally, the Compensation Committee reviews and approves the base salary, equity-incentive awards (if any) and any other special or supplemental benefits of the named executive officers. For additional information regarding the operation of the Compensation Committee, see our discussion under the section entitled “Compensation Discussion and Analysis” of this proxy statement. The Compensation Committee held 3 meetings during fiscal 2018 and 2 meetings during the six months ended April 30, 2019. The charter of the Compensation Committee is included as Appendix A to this Proxy Statement.

| 7 |

Audit Committee

The Audit Committee reviews with our management, the internal auditors and the independent registered public accounting firm, the adequacy and effectiveness of our system of internal control over financial reporting; reviews significant accounting matters; reviews quarterly unaudited financial information prior to public release; approves the audited financial statements prior to public distribution; approves our assertions related to internal controls prior to public distribution; reviews any significant changes in our accounting principles or financial reporting practices; reviews, approves and retains the services performed by our independent registered public accounting firm; has the authority and responsibility to evaluate our independent registered public accounting firm; discusses with the independent registered public accounting firm their independence and considers the compatibility of non-audit services with such independence; annually selects and retains our independent registered accounting firm to examine our financial statements; and conducts a legal compliance review. No member of the Audit Committee serves on the audit committees of more than three public companies. The Audit Committee held 3 meetings during fiscal 2018 and 2 meetings during the six months ended April 30, 2019. The charter of the Audit Committee is included as Appendix B to this Proxy Statement.

Nominations and Corporate Governance Committee

The Nominations and Governance Committee is involved in determining compensation for our Directors. The Nominations and Governance Committee reviews and administers our Directors’ compensation plans, including approval of grants of equity or equity-based awards, and makes recommendations to the Board with respect to compensation plans and equity-based plans for Directors. The Nominations and Governance Committee annually reviews Director compensation in relation to comparable companies and other relevant factors. Any change in Director compensation must be approved by our Board. The Nominations and Governance Committee held 3 meetings during fiscal 2018 and 2 meetings during the six months ended April 30, 2019. The charter of the Nominations and Governance Committee is included as Appendix C to this Proxy Statement.

Consideration of Director Nominees

The policy of the Nominations and Corporate Governance Committee is to consider properly submitted shareholder nominations for candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Directors” and “Stockholder Proposals.” In evaluating nominations, the Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on our Board and to address the membership criteria set forth below under “Board Diversity and Director Qualifications.”

Board Diversity and Director Qualifications

Although there is no specific board diversity policy in place presently, the Nominations and Corporate Governance Committee does consider such factors as it deems appropriate and consistent with our the charter of the Nominations and Corporate Governance Committee and other criteria which may be established by our Board. The Nominations and Corporate Governance Committee’s goal in selecting directors for nomination to our Board is generally to seek to create a well-balanced team that combines diverse experience, skill and intellect of seasoned directors in order to enable us to pursue our strategic objectives. The Nominations and Corporate Governance Committee has not reduced the qualifications for service on our Board to a checklist of specific standards or specific, minimum qualifications, skills or qualities. Rather, we seek, consistent with the vacancies existing on our Board at any particular time and the interplay of a particular candidate’s experience with the experience of other Directors, to select individuals whose business experience, knowledge, skills, diversity and integrity would be considered a desirable addition to our Board and any committees thereof. In addition, the Nominations and Corporate Governance Committee annually conducts an informal review of incumbent Directors in order to determine whether a Director should be nominated for re-election to our Board.

The Nominations and Corporate Governance Committee makes determinations as to Director selection based upon the facts and circumstances at the time of the receipt of the Director candidate recommendation. Applicable considerations include: whether the Nominations and Corporate Governance Committee is currently looking to fill a new position created by an expansion of the number of Directors, or a vacancy that may exist on our Board; whether the current composition of our Board is consistent with the criteria described in our charter; whether the candidate submitted possesses the qualifications that are generally the basis for selection of candidates to our Board; and whether the candidate would be considered independent under the rules of the NYSE and our standards with respect to Director independence.

| 8 |

Identifying and Evaluating Nominees for Directors

The Nominations and Corporate Governance Committee utilizes a variety of methods for identifying and evaluating nominees for Director. The Nominations and Corporate Governance Committee considers the appropriate size of our Board and whether any vacancies on our Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominations and Corporate Governance Committee will consider various potential candidates for Director. Candidates may come to the attention of the Nominations and Corporate Governance Committee through current Board members, professional search firms, shareholders or other persons. As described above, the Nominations and Corporate Governance Committee considers properly submitted nominations for candidates for our Board. Following verification of the recommending shareholder’s status, recommendations are considered by the Nominations and Corporate Governance Committee at its next regularly scheduled meeting.

Communications with Our Board

Stockholders and interested parties who wish to contact our Board, a committee thereof, the presiding non-management director of executive sessions or any individual director are invited to do so by writing to:

Board of Directors of Prime Global Capital Group Incorporated

c/o Corporate Secretary

E-5-2, Megan Avenue 1, Block E

Jalan Tun Razak

50400 Kuala Lumpur, Malaysia

All communications will be forwarded to our Board of Directors, the specified committee or the specified individual director, as appropriate.

Board Leadership Structure

We intend to designate Dato’ Weng Kung Wong to serve as executive member of the Board upon re-election to the Board. As the Chief Executive Officer, Interim Chief Financial Officer and Secretary of the Company, we believe that Mr. Wong will bring to the Board extensive experience and familiarity with our business in particular and its industries generally. We believe this background enhances the role of executive members of the Board in the development of long-term strategic plans and oversight of senior management in the implementation of those plans. We provide independent directors with opportunities to meet in executive sessions without management present at the time of each regular Board meeting and additionally as deemed appropriate or necessary. Because Mr. Wong is not independent under NYSE standards, the chair at these executive sessions will rotate among the chairman of the Compensation Committee, the Audit Committee and the Nominating and Governance Committee. We believe that this structure will allow multiple directors to exercise important leadership roles, and will also provide for focused engagement by the Board committees and their chairs in their respective areas of responsibility. We believe that this structure will help facilitate clear and open communications between the Board of Directors and senior management, while providing for active oversight by independent directors. For the above reasons, the Board of Directors believes the current and the prospective leadership structure is appropriate for the Company.

Board’s Role in Risk Oversight

Our management team is primarily responsible for the day-to-day assessment and management of the Company’s risk exposure. The Board of Directors provides oversight in connection with these efforts, with a particular focus on the most significant risks facing us. The Board of Directors believes that communication between the management team and the Board of Directors is essential for both effective risk management and for meaningful oversight. To this end, the Board of Directors meets with our Chief Executive Officer and the other members of our senior management team to discuss strategies, key challenges, and risks and opportunities for us. Management team members make themselves available to the Board of Directors to answer questions regarding the Company’s most significant issues, including risks affecting the Company.

| 9 |

In order to help facilitate its risk oversight responsibilities, the Board of Directors intends to utilize each of its committees to oversee specific areas of risk that are appropriately related to the committee’s areas of responsibility once such committees are established. The Audit Committee will assist the Board of Directors in discharging its oversight responsibilities in the areas of internal control over financial reporting, disclosure controls and procedures and legal and regulatory compliance. The Audit Committee will discuss with management, the internal audit group and the independent auditor guidelines and policies with respect to risk assessment and risk management. The Audit Committee will also discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposure. The Compensation Committee will assist the Board of Directors in discharging its oversight responsibilities regarding the risks related to the attraction and retention of personnel as well as the risks associated with the design of compensation programs and arrangements applicable to both executive officers and to all employees. The Nominating and Corporate Governance Committee will establish, monitor and evaluate the implementation of our corporate governance policies. While the Board committees will be responsible for initially monitoring certain risks, the entire Board of Directors will be kept informed of the significant risks facing the Company through management and committee reports about such risks and the steps being taken to mitigate these risks.

Risk Assessment of Compensation Policies and Practices

Our Board of Directors oversees management’s evaluation of whether our employee compensation policies and practices pose any risks that are reasonably likely to have a material adverse effect on the Company. In conducting this evaluation, management reviews our overall compensation structure, taking into account the overall mix of compensation and the overall business risk. Management undertakes such a review periodically and reports to the Board any finding that a risk related to our compensation structure may exist, as well as any factors which may mitigate the risk posed by the particular compensation policy or practice. We have determined that there are currently no risks arising from our compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

Employee, Director and Officer Hedging

We have not adopted any practice or policy regarding the ability of our employees (including officers) or directors, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities. As such, our employees, officer, directors or their designees are generally permitted to engage in these transactions.

Code of Conduct

On February 2, 2012, our Board of Directors adopted a Code of Business Conduct and Ethics applicable to all employees of the Company including the principal executive officer, the principal financial officer and the principal accounting officer. The Board also adopted a separate Code of Ethics for the Chief Executive Officer and Senior Financial Officers, which contains provisions specifically applicable to our Chief Executive Officer and senior financial officers including the Chief Financial Officer. A copy of the Code of Business Conduct and Ethics and Code of Ethics for the Chief Executive Officer and Senior Financial Officer are filed as Exhibit 7 to this Annual Report and are incorporated herein by reference. The Company will provide a copy of its Code of Business Conduct and Ethics and Code of Ethics for the Chief Executive Officer and Senior Financial Officers upon written request addressed to the Secretary of the Company.

| 10 |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Philosophy and Objectives

Our executive compensation philosophy is to create a long-term direct relationship between pay and our performance. Our executive compensation program is designed to provide a balanced total compensation package over the executive’s career with us. The compensation program objectives are to attract, motivate and retain the qualified executives that help ensure our future success, to provide incentives for increasing our profits by awarding executives when corporate goals are achieved and to align the interests of executives and long-term stockholders. The compensation package of our named executive officers consists of two main elements:

| 1. | base salary for our executives that is competitive relative to the market, and that reflects individual performance, retention and other relevant considerations; and |

| 2. | discretionary bonus awards payable in cash and tied to the satisfaction of corporate objectives. |

Process for Setting Executive Compensation

Our Compensation Committee is responsible for developing and overseeing the implementation of our philosophy with respect to the compensation of executives and for monitoring the implementation and results of the compensation philosophy to ensure compensation remains competitive, creates proper incentives to enhance stockholder value and rewards superior performance. The Compensation Committee annually reviews and approves for each named executive officer, and particularly with regard to the Chief Executive Officer, all components of the executive’s compensation. The Compensation Committee may award discretionary bonuses to each of the named executives, and reviews and approves the process and factors (including individual and corporate performance measures and actual performance versus such measures) used by the Chief Executive Officer to recommend such awards. Additionally, the Compensation Committee reviews and approves the base salary, equity-incentive awards (if any) and any other special or supplemental benefits of the named executive officers.

The Chief Executive Officer periodically provides the Compensation Committee with an evaluation of each named executive officer’s performance, based on the individual performance goals and objectives developed by the Chief Executive Officer at the beginning of the year, as well as other factors. The Compensation Committee provides an evaluation for the Chief Executive Officer. These evaluations serve as the bases for bonus recommendations and changes in the compensation arrangements of our named executives.

Our Compensation Peer Group

We currently engage in informal market analysis in evaluating our executive compensation arrangements. As the Company and its businesses mature, we may retain compensation consultants that will assist us in developing a formal benchmark and selecting a compensation peer group of companies similar to us in size or business for the purpose of comparing executive compensation levels.

Program Components

Our executive compensation program consists of the following elements:

| 11 |

Base Salary

Our base salary structure is designed to encourage internal growth, attract and retain new talent, and reward strong leadership that will sustain our growth and profitability. The base salary for each named executive officer reflects our past and current operating profits, the named executive officer’s individual contribution to our success throughout his career, internal pay equity and informal market data regarding comparable positions within similarly situated companies. In determining and setting base salary, the Compensation Committee considers all of these factors, though it does not assign specific weights to any factor. The Compensation Committee generally reviews the base salary for each named executive officer on an annual basis. For each of our named executive officers, we review base salary data internally obtained by the Company for comparable executive positions in similarly situated companies to ensure that the base salary rate for each executive is competitive relative to the market.

Discretionary Bonus

The objectives of our bonus awards are to encourage and reward our employees, including the named executive officers, who contribute to and participate in our success by their ability, industry, leadership, loyalty or exceptional service and to recruit additional executives who will contribute to that success.

Each of our named executive officers is eligible for consideration for a discretionary cash bonus. The Chief Executive Officer makes recommendations regarding bonus awards for the named executive officers and the Compensation Committee provides the bonus recommendation for the Chief Executive Officer. However, the Compensation Committee has sole and final authority and discretion in designating to whom awards are made, the size of the award, if any, and its terms and conditions. The bonus recommendation for each of the named executive officers depends on a number of factors, including (i) the performance of the Company for the year, (ii) the satisfaction of certain individual and corporate performance measures, and (iii) other factors which the Compensation Committee may deem relevant. The Company did not award any cash bonuses during fiscal year 2018 and for the six months ended April 30, 2019.

Stock Holdings

The Compensation Committee recognizes the importance of having a portion of the named executive officers’ compensation be paid in the form of equity, to help align the executives’ interests with the interests of the Company’s stockholders. At this point, however, the Compensation Committee has chosen to emphasize the cash-based portion of our compensation program over a stock program because it believes the discretionary nature of the cash-based compensation gives it the needed flexibility to factor in and reward the attainment of longer-term goals for the Company and the executives, as the Compensation Committee deems appropriate.

Accordingly, we encourage, but do not insist on, executive ownership of our common stock. Methods of supporting ownership include turning to executives to support the financing needs of the Company. We have historically allowed our named executives to participate in private placements of the Company’s securities on the same terms and conditions as other investors. During fiscal year 2012, our Chief Executive Officer invested approximately US $20,890,272 into the Company resulting in a beneficial ownership of 54,811,085 shares of common stock, or approximately 10.69% of our issued and outstanding common stock. Our executive officers did not purchase any of our securities during fiscal year 2019 and the six months ended April 30, 2019. We believe that this practice achieves the dual goals of meeting the Company’s financing needs and aligning our executives’ interests with the interests of our stockholders.

We have not timed nor do we plan to time our release of material non-public information for the purpose of affecting the value of executive compensation.

| 12 |

| Summary Compensation Table |

The following summary compensation table sets forth the aggregate compensation we paid or accrued during the fiscal years ended October 31, 2018, and 2017, and six months ended April 30, 2019 to (i) our Chief Executive Officer (principal executive officer), (ii) our Chief Financial Officer (principal financial officer), (iii) our three most highly compensated executive officers other than the principal executive officer and the principal financial officer who were serving as executive officers on October 31, 2018, whose total compensation was in excess of US$100,000, and (iii) up to two additional individuals who would have been within the two-other-most-highly compensated but were not serving as executive officers on October 31, 2018.

| Name and Principal Position |

Year | Salary (1) |

Bonus | Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

Nonqualified Deferred Compensation Earnings |

All Other Compensation |

Total (1) | |

| Weng Kung Wong | 6 months ended 4/30/2019 | 34,517 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 43,517 |

| Chief Executive Officer and President |

2018 | 83,939 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 83,939 |

| 2017 | 77,774 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 77,774 | |

| Liong Tat Teh | 2017 | 4,931 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 4,931 |

| Chief Financial Officer (2) | ||||||||||

___________________

| (1) | All cash compensation was paid in Malaysian Ringgit, our functional currency. The Malaysian Ringgit was converted into United States Dollars using the exchange rate prevailing at the dates of payment at an average annualized rate of 4.113, 4.0248 and 4.3438 for six months ended April 30, 2019, fiscal years ended October 31, 2018 and 2017, respectively. | |

| (2) | Liong Tat Teh resigned from his position as Chief Financial Officer and Secretary effective November 14, 2016. Concurrently therewith, Weng Kung Wong, our Chief Executive Officer, was appointed to fill the vacancy created by Mr. Teh’s resignation. |

Narrative disclosure to Summary Compensation Table

Mr. Wong is a party to an employment agreement with UHT, our subsidiary, dated July 19, 2011, or the Employment Agreement. Pursuant to the terms of the Employment Agreement, Mr. Wong will receive an annual base salary of MYR 337,836 or US83,939.

Mr. Wong may terminate his employment agreement by giving two months prior written notice or, in lieu of such notice, electing to immediately terminate and receive a sum equal to two month salary. UHT may terminate each Employment Agreement by giving 24 hours prior written notice in the event of any gross misconduct, criminal activities committed by the employee, or serious default or breach by the employee of any terms of his employment agreement or the rules and regulations of UHT.

| 13 |

Mr. Wong also executed a noncompetition and nondisclosure agreement containing non-solicitation obligations that survive the termination of the agreement for a period of two years, confidentiality obligations and other obligations relating to employee inventions by Mr. Wong.

The foregoing descriptions of the Employment Agreement is qualified in its entirety by reference to such agreement which is filed as Exhibit 8 to this Proxy Statement and is incorporated herein by reference.

Our executive officers are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with their services on our behalf.

Equity Awards

There are no options, warrants or convertible securities outstanding. At no time during the last fiscal year with respect to any of any of our executive officers was there:

| • | any outstanding option or other equity-based award repriced or otherwise materially modified (such as by extension of exercise periods, the change of vesting or forfeiture conditions, the change or elimination of applicable performance criteria, or the change of the bases upon which returns are determined; | |

| • | any waiver or modification of any specified performance target, goal or condition to payout with respect to any amount included in non-stock incentive plan compensation or payouts; | |

| • | any option or equity grant; | |

| • | any non-equity incentive plan award made to a named executive officer; | |

| • | any nonqualified deferred compensation plans including nonqualified defined contribution plans; or | |

| • | any payment for any item to be included under All Other Compensation in the Summary Compensation Table. |

Compensation of Directors

The following director compensation table sets forth the aggregate compensation we paid or accrued during the fiscal year ended October 31, 2018:

| Fees earned or paid in cash* | Stock awards | Option awards | Non-equity incentive plan compensation | Change in pension value and nonqualified deferred compensation | All other compensation | Total | ||||||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | earnings | ($) | ($) | |||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||||

| Maylee Gan Suat Lee | 8,944 | * | – | – | – | – | – | 8,944 | ||||||||||||||||||||

| Soo Choon Meng ** | 8,944 | * | – | – | – | – | – | 8,944 | ||||||||||||||||||||

| * | All fees were paid in Malaysian Ringgit, our functional currency. The Malaysian Ringgit was converted into United States Dollars using the exchange rate prevailing at the dates of payment at an average annualized rate of 4.0248 for fiscal year ended October 31, 2018. |

| ** | Soo Choon Meng was appointed to serve as a director effective August 1, 2017. |

| 14 |

Narrative disclosure to Director Compensation Table

During our fiscal year ended October 31, 2018, and the six months ended April 30, 2019, we did not provide compensation to any of our employee directors for serving as our director. We currently have no formal plan for compensating our employee directors for their services in their capacity as directors, although we may elect to issue stock options to such persons from time to time.

Non-Employee Director Fees

Our Compensation Committee and Board determines the form and amount of compensation for our non-employee directors based on informal surveys of similar companies and the amount necessary to attract and retain such directors. Directors who are residents of Malaysia receive a monthly retainer in the amount of RM3,000. All directors are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our Board of Directors. Our Compensation Committee may award special remuneration to any director undertaking any special services on our behalf other than services ordinarily required of a director.

Compensation Committee Interlocks and Insider Participation

Maylee Gan Suat Lee and Soo Choon Meng served on our Compensation Committee during fiscal year ended October 31, 2018, and the six months ended April 30, 2019.

During the fiscal year ended October 31, 2018,, none of our executive officers has served: (i) on the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our compensation committee; (ii) as a director of another entity, one of whose executive officers served on the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of the registrant; or (iii) on the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as our director.

Compensation Committee Report

Our Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis in this report with management. Based on its review and discussion with management, the Board of Directors recommended that the Compensation Discussion and Analysis be included in this proxy statement. The material in this report is not deemed filed with the SEC and is not incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made on, before, or after the date of this Proxy Statement and irrespective of any general incorporation language in such filing.

Submitted by members of the Compensation Committee:

Maylee Gan Suat Lee

Soo Choon Meng

| 15 |

CHANGES IN OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM; FEES

Appointment of ShineWing Australia

Effective July 17, 2017, the audit committee of the Board of Directors of Prime Global Capital Group Incorporated (the "Company") approved the dismissal of Centurion ZD CPA Limited, formerly known as DCAW (CPA) Limited (“Centurion CPA”), as our independent accountant. Centurion CPA audited our consolidated financial statements for the fiscal year ended October 31, 2016, and reviewed our consolidated financial statements for the related interim periods and the interim periods ended January 31, 2017 and April 30, 2017. Effective July 17, 2017, we retained the services of ShineWing Australia to audit our consolidated financial statements for our fiscal year ending October 31, 2017.

Centurion CPA’s reports on the financial statements of the Company for the fiscal year ended October 31, 2016, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles, except that its report for the fiscal year ended October 31, 2016, contained an emphasis of matter paragraph regarding the Company’s ability to continue as a going concern. During the Company’s fiscal year ended October 31, 2016 and through July 17, 2017, there were no disagreements with Centurion CPA on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which disagreements, if not resolved to Centurion CPA’s satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such periods. Furthermore, no “reportable events” occurred within the periods covered by Centurion CPA’s reports on the Company's consolidated financial statements, or subsequently up to the date of Centurion CPA’s dismissal. As used herein, the term “reportable event” means any of the items listed in paragraphs (a)(1)(v)(A)-(D) of Item 304 of Regulation S-K.

During the fiscal year ended October 31, 2016, and through July 17, 2017, neither the Company nor anyone acting on its behalf consulted ShineWing Australia regarding (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and ShineWing Australia did not provide either a written report or oral advice to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, (2) any matter that was either the subject of a disagreement with Centurion CPA on accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of Centurion CPA, would have caused Centurion CPA to make reference to the matter in their report, or a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K of the SEC’s rules and regulations.

Fees Billed by Our Independent Registered Public Accounting Firms

Our Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal accountant’s independence, and has approved such services in accordance with its pre-approval policies and procedures which are more fully described in Exhibit 9.

| 16 |

The following table sets forth fees billed by our auditors during the last two fiscal years for services rendered for the audit of our annual consolidated financial statements and the review of our quarterly financial statements, services by our auditors that are reasonably related to the performance of the audit or review of our consolidated financial statements and that are not reported as audit fees, services rendered in connection with tax compliance, tax advice and tax planning, and all other fees for services rendered.

| Years ended October 31, | ||||||||

| 2018 | 2017 | |||||||

| Audit fees (1) | $ | 76,000 | $ | 76,000 | ||||

| Audit related fees (2) | 16,000 | 12,000 | ||||||

| Tax fees | – | – | ||||||

| All other fees | – | – | ||||||

__________________

| (1) | Audit Fees represent fees for professional services billed and to be billed in connection with the audit of our consolidated annual financial statements, the audit of the effectiveness of internal control over financial reporting and review of the quarterly financial statements and internal controls over financial reporting, and audit services in connection with statutory or regulatory filings, consents or other SEC matters. |

| ShineWing Australia has billed us $76,000 and $76,000, in the aggregate, for the fiscal year ended October 31, 2018 and 2017, respectively, for audit services rendered. |

| (2) | Audit-Related Fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” In fiscal 2018 and 2017, this category consisted of fees billed by CH Fiduciary Ltd in connection with compiling the Company’s financial statements for fiscal 2018 and 2017. |

Audit Committee Report

The Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee has discussed with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Commission. It has received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant’s independence. Based upon the foregoing review and discussions, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the company’s Annual Report on Form 10K for the year ended October 31, 2018.

Submitted by members of the Audit Committee:

Maylee Gan Suat Lee

Soo Choon Meng

| 17 |

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Board of Directors has approved the persons named below as nominees for election to our Board of Directors. All presently serve as directors. Proxies will be voted for the election as directors for the ensuing year of the persons named below (or if for any reason unavailable, of such substitutes as our Board of Directors may designate). Our Board of Directors has no reason to believe that any of the nominees will be unavailable to serve.

Weng Kung Wong, age 46, our Chief Executive Officer and Director since November 15, 2010, founded Mobile Wallet Sdn. Bhd., MWSB, one of the first Malaysian m-commerce companies, in 2004 and currently serves as its Executive Director and Chief Executive Officer. Prior to founding MWSB, Mr. Wong served as an Agency Unit Manager of MAA Insurance from April, 2001 to November, 2003. From January, 2000 to April, 2001, he was the Marketing Director of Spider Holding Sdn. Bhd., an herb products distribution company. Mr. Wong began his professional career in 1995 with Forever Living Products, a health products multilevel marketing company, where he spent four years in positions of accelerating responsibility in the areas of business development and marketing. Mr. Wong obtained a bachelor’s degree in Management Information Systems from the National Central University of Taiwan in 1995. As our Chief Executive Officer, Mr. Wong brings to our Board of Directors knowledge of our operations and history, business leadership, corporate strategy and entrepreneurial expertise.

Maylee Gan Suat Lee, age 41, joined our Board of Directors on April 1, 2016. She is currently the founder and senior partner of Messrs. Maylee Gan & Tai. Prior to founding her firm in 2008, Ms. Gan practiced at one of the top 5 legal firms in Malaysia, Lee Hishammuddin Allen & Gledhill from 2004 to 2008. Ms. Gan graduated with a Bachelor of Laws (Hons) degree from the University of London, England in 1999. She obtained her Certificate of Legal Practice in 2000 and has a Masters of Science in Information Technology (MSc IT) from the University of Staffordshire in 2004. Ms. Gan was admitted and enrolled as an advocate and solicitor of the High Court of Malaya in 2005. She has vast experience in various complex corporate matters, and she was the lead associate in charge of the largest worldwide business disposal to-date which involves the worldwide sale of its Healthcare business division in 2006, and the largest Asset-Backed Securities transaction carried out by a listed corporation in Malaysia in the year 2008. Ms. Gan is also a Non-executive Director of G&L Trading Sdn. Bhd, as a successor of her late father. G&L Trading Sdn. Bhd supplies cleaning detergent to hotels and food & beverages related businesses. Through her vast experience in legal corporate matters with numerous large corporations, with which her legal firm is a panel of solicitor, Ms. Gan brings to the Board of Directors her legal insight, knowledge and experience in legal corporate matters.

Soo Choon Meng, 50, joined our Board of Directors on August 1, 2017. He is is currently the Managing Proprietor of C.M.SOO Associates, an accounting and audit firm. Mr. Soo has served as a director of Galasys GLT Sdn. Bhd. since 2004, and has been responsible for the day to day running of the business. Mr. Soo also serves on the Board of Directors of various other private Malaysian and international companies that are in the field of property holding and investment holding. Mr. Soo is a Chartered Accountant by training, having qualified by completing the professional examination of the Chartered Association of Certified Accountants (UK) in June 1996, and received his membership of the Malaysian Institute of Accountants (Chartered Accountant) in February 1999 and admitted as a Fellow Member of the Chartered Association of Certified Accountants (UK) in July 2003. We believe that Mr. Soo will bring to the Board of Directors his expertise in financial and tax matters.

Our Board of Directors unanimously recommends that you vote “FOR” all of the nominees listed above.

| 18 |

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors has appointed ShineWing Australia, an independent registered public accounting firm, to serve as our independent registered public accounting firm for the fiscal year ending October 31, 2019, subject to stockholder approval. A representative of ShineWing Australia is not expected to be present at the annual meeting.

ShineWing Australia’s principal function is to audit management’s assessment of the effectiveness of our internal control over financial reporting and our consolidated financial statements and, in connection with that audit, to review certain related filings with the Securities and Exchange Commission and to conduct limited reviews of the financial statements included in our quarterly reports.

Our Board of Directors unanimously recommends that you vote “FOR” the proposal to ratify the appointment of ShineWing Australia as our independent registered public accounting firm for the fiscal year ending October 31, 2019.

STOCKHOLDER PROPOSALS

Proposals by stockholders intended to be presented at the 2019 annual meeting of stockholders, to be considered for inclusion in our proxy statement for that annual meeting, must be personally delivered or mailed to our principal executive offices, as required by our Amended and Restated By-Laws, no later than 45 days prior to the mailing the proxy, to the attention of the Corporate Secretary as follows: our principal executive offices at E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia, Attention: Corporate Secretary.

With respect to any proposal by a stockholder not seeking to have its proposal included in the proxy statement but seeking to have its proposal considered at the 2019 Annual Stockholders Meeting, if that stockholder fails to notify us of its proposal in the manner set forth above, then the persons appointed as proxies may exercise their discretionary voting authority if the proposal is considered at the 2019 annual meeting, notwithstanding that stockholders have not been advised of the proposal in the proxy statement for the 2019 annual meeting. Any stockholder proposals must comply in all respects with Rule 14a-8 of Regulation 14A and other applicable rules and regulations of the SEC.

In order for a stockholder to bring other business before a stockholder meeting, timely notice must be received by us within the time limits described in the immediately preceding paragraph. The stockholder’s notice must contain:

| • | a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; |

| • | the name and record address of the shareholder proposing such business; |

| • | the class and number of shares of the corporation which are beneficially owned by the shareholder; |

| • | a description of any material interest of such shareholder in such business; |

| • | a representation that such shareholder intends to appear in person or by proxy at the meeting to bring such business before the meeting; and |

| • | any other information required by law. |

| 19 |

Our amended bylaws provide that a stockholder entitled to vote for the election of our directors may nominate persons for election to our Board of Directors by delivering written notice to our corporate secretary. With respect to an election to be held at an annual meeting of stockholders, such notice generally must be delivered not later than the close of business on the 45th day prior to the mailing of the proxy.

The stockholder’s notice must include:

(a) as to each person whom the stockholder proposes to nominate for election or re-election as a director,

| • | the name, age, business address and residence address of the person; |

| • | the principal occupation or employment of the person; |

| • | the class and number of shares of the corporation which are beneficially owned by the person; |

| • | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Rule 14a under the Securities Exchange Act of 1934; and |

(b) as to the stockholder giving the notice,

| • | the name and record address of the stockholder; and |

| • | the class and number of shares of the corporation which are beneficially owned by the stockholder. |

We may require any proposed nominee to furnish such other information as may reasonably be required by us to determine the eligibility of such proposed nominee to serve as a director of the corporation.

Because the 2019 annual meeting is to be held on September 18, 2019, our corporate secretary must have received written notice of a stockholder proposal to be acted upon at the 2019 annual meeting not later than the close of business on August 6, 2019, nor earlier than the close of business on July 22, 2019.

The requirements found in our amended and restated bylaws are separate from and in addition to the requirements of the Securities and Exchange Commission that a stockholder must meet to have a proposal included in our proxy statement. We will furnish any stockholder desiring a copy of our amended bylaws without charge by writing to our corporate secretary as described in “Voting and Revocation of Proxies.”

| 20 |

EXHIBITS

(1) Incorporated by reference to Exhibit 10.11 of our Annual Report on Form 10-K filed with the Securities and Commission on January 29, 2016.