Form DEF 14A PIONEER NATURAL RESOURCE For: May 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

Pioneer Natural Resources Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

_________________________________________________________________________________

2) Aggregate number of securities to which transaction applies:

_________________________________________________________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_________________________________________________________________________________

4) Proposed maximum aggregate value of transaction:

_________________________________________________________________________________

5) Total fee paid:

_________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

_________________________________________________________________________________

2) Form, Schedule or Registration Statement No.:

_________________________________________________________________________________

3) Filing Party:

_________________________________________________________________________________

4) Date Filed:

________________________________________________________________________________

1

PIONEER NATURAL RESOURCES COMPANY

______________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 27, 2021

______________________________

To the Stockholders of Pioneer Natural Resources Company:

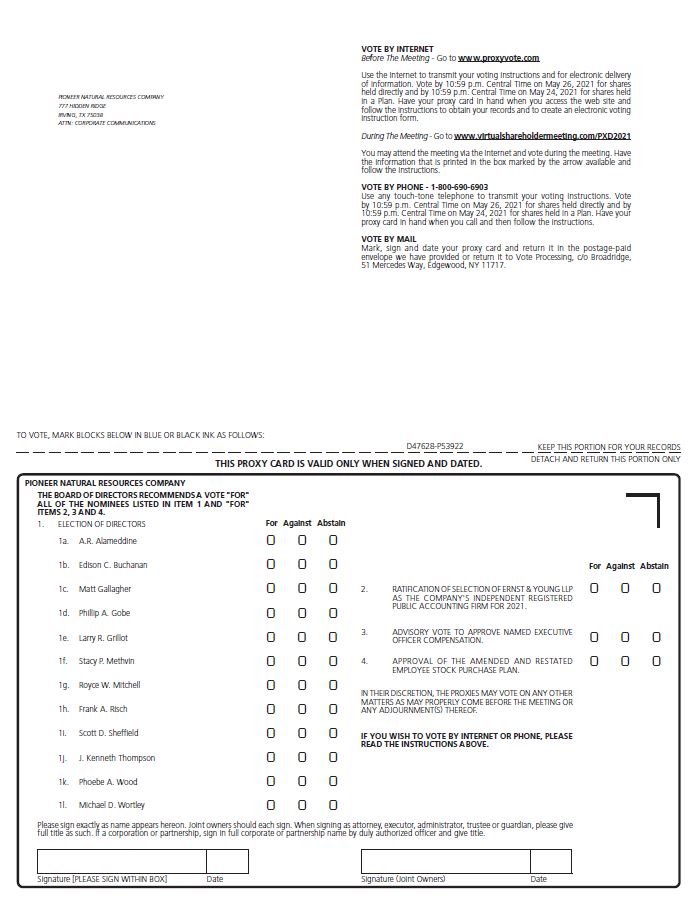

The Annual Meeting of Stockholders of Pioneer Natural Resources Company ("Pioneer" or the "Company") will be held on Thursday, May 27, 2021, at 9:00 a.m. Central Time (the "Annual Meeting"). In light of the public health impact of the coronavirus, or COVID-19, outbreak and taking into account federal, state and local guidance, Pioneer has determined that the Annual Meeting will be held in a virtual meeting format only, with log-in beginning at 8:45 a.m., Central Time. You may attend the Annual Meeting online, including to vote or submit questions, at the following website address www.virtualshareholdermeeting.com/PXD2021 by entering the company number and control number included on your Notice Regarding the Internet Availability of Proxy Materials (the "Notice of Availability"), on the proxy card you received, or in the instructions that accompanied your proxy materials. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/PXD2021. The Annual Meeting is being held for the following purposes:

1.To elect the Company's 12 director nominees named in this Proxy Statement, each for a term to expire at the 2022 Annual Meeting of Stockholders.

2.To ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2021.

3.To approve on an advisory basis the Company's named executive officer compensation.

4.To approve the Company's Amended and Restated Employee Stock Purchase Plan.

5.To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on April 1, 2021. If there are not sufficient votes represented for a quorum or to approve the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned or postponed in order to permit further solicitation of proxies.

The Annual Meeting will also be broadcast live on the Internet. To listen to the broadcast without participating in the meeting, log on to www.virtualshareholdermeeting.com/PXD2021.

Internet Availability of Proxy Materials. Beginning on or about April 15, 2021, the Company mailed the Notice of Availability to its stockholders containing instructions on how to access this Proxy Statement and vote online, and the Company made proxy materials available to the stockholders over the Internet. Instructions for requesting a paper copy of the proxy materials are contained in the Notice of Availability.

YOUR VOTE IS IMPORTANT

Please vote over the internet at www.proxyvote.com or by phone at 1-800-690-6903 promptly so that your shares may be voted in accordance with your wishes and so that we may have a quorum at the Annual Meeting. If you received a paper copy of the proxy materials (which includes the proxy card), you may also vote by completing, signing and returning the paper proxy card by mail.

By Order of the Board of Directors, | ||||||||

Irving, Texas April 15, 2021 | Thomas J. Murphy Corporate Secretary | |||||||

TABLE OF CONTENTS

| Proxy Statement Summary | |||||

| General Information | |||||

| Proposal One: Election of Directors | |||||

| Corporate Governance | |||||

| Corporate Governance Guidelines | |||||

| Board Leadership Structure | |||||

| CEO and Senior Management Succession Planning | |||||

| Director Independence | |||||

| Director Refreshment and Self-Evaluation Process | |||||

| Engagement with Stockholders | |||||

| Commitment to Sustainability | |||||

| Policies Restricting Transactions to Hedge the Market Value of the Company's Common Stock; Prohibited Equity Transactions | |||||

| Procedure for Directly Contacting the Board and Whistleblower Policy | |||||

| The Board, Its Committees and Its Compensation | |||||

| Meetings and Committees of the Board | |||||

| Board's Role in Oversight of Strategy and Risk Management | |||||

| Attendance at Annual Meetings | |||||

| Director Compensation | |||||

| Stock Ownership Guidelines for Non-Employee Directors | |||||

| Audit Committee Report | |||||

| Compensation and Leadership Development Committee Report | |||||

| Compensation Discussion and Analysis | |||||

| Executive Compensation Tables | |||||

| Summary Compensation Table | |||||

2020 Grants of Plan-Based Awards | |||||

Narrative Disclosure for the 2020 Grants of Plan-Based Awards Table | |||||

2020 Outstanding Equity Awards at Fiscal Year End | |||||

2020 Option Exercises and Stock Vested | |||||

| Pension Benefits | |||||

2020 Non-Qualified Deferred Compensation | |||||

| Potential Payments upon Termination or Change in Control | |||||

| Ratio of the CEO's Compensation to the Median Compensation of the Company's Other Employees | |||||

| Compensation Programs and Risk Considerations | |||||

| Security Ownership of Certain Beneficial Owners and Management | |||||

| Transactions with Related Persons | |||||

| Proposal Two: Ratification of Selection of Independent Registered Public Accounting Firm | |||||

| Proposal Three: Advisory Vote to Approve Named Executive Officer Compensation | |||||

| Proposal Four: Approval of the Company's Amended and Restated Employee Stock Purchase Plan | |||||

| Stockholder Proposals; Identification of Director Candidates | |||||

| General Information about the Annual Meeting | |||||

| Stockholder List | |||||

| Annual Report and Other Information | |||||

| Internet and Phone Voting | |||||

| Appendix A: Amended and Restated Employee Stock Purchase Plan | A-1 | ||||

PROXY STATEMENT SUMMARY

The following section is only a summary of key elements of this Proxy Statement, and is intended to assist you in reviewing this Proxy Statement in advance of the Annual Meeting. This summary does not contain all of the information you should consider, and you are encouraged to read this entire Proxy Statement before submitting your votes.

2021 Annual Meeting of Stockholders

| Date and time: | Thursday, May 27, 2021, at 9:00 a.m. Central Time | ||||

| Place: | Via live webcast at www.virtualshareholdermeeting.com/PXD2021. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualstockholdermeeting.com/PXD2021. | ||||

| Record date: | April 1, 2021 | ||||

| How to vote: | Prior to the meeting: If you are a stockholder of record, you may vote by Proxy using any of the following methods: By internet: at www.proxyvote.com By telephone: call toll-free 1-800-690-6903 Votes submitted by internet or phone must be received by 10:59 p.m., Central Time, on Wednesday, May 26, 2021. If you received a paper copy of the proxy materials, you may also vote by completing, signing and returning the paper proxy card by mail. During the meeting: Go to www.virtualshareholdermeeting.com/PXD2021. You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. | ||||

Voting Matters and Board Recommendations

| Proposal | Description | Board Vote Recommendation | Page Reference (for more detail) | ||||||||

| 1 | Election of the Company's 12 director nominees named in this Proxy Statement | FOR each of the director nominees | |||||||||

| 2 | Ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2021 | FOR | |||||||||

| 3 | Approval, on an advisory basis, of the Company's named executive officer compensation | FOR | |||||||||

| 4 | Approval of the Company's Amended and Restated Employee Stock Purchase Plan | FOR | |||||||||

Business Highlights

Pioneer's mission is to be America's leading independent energy company, focused on value, safety, the environment, technology and its people. While 2020 was a challenging year, the Company's immediate and decisive actions helped keep Pioneer's employees safe, protected the balance sheet, generated significant free cash flow and positioned Pioneer for the future. Highlights of the Company's 2020 performance included:

•Delivered strong cash flow - delivered strong cash flow from operating activities for the full year 2020 of $2.1 billion.

•Return of capital to stockholders - in 2020, Pioneer returned $521 million of capital to stockholders.

•Continued to maintain a strong balance sheet - ended 2020 with unrestricted cash on hand of $1.4 billion and net debt of $1.9 billion. The Company had $2.9 billion of liquidity as of December 31, 2020, comprised of its unrestricted cash and a $1.5 billion unsecured credit facility (undrawn as of December 31, 2020), which was amended in January 2021 to increase the amount available to be borrowed to $2.0 billion.

1

•ESG/Sustainability - Pioneer adopted targets, aligned with the Task Force on Climate-related Financial Disclosures ("TCFD"), to reduce greenhouse gases ("GHG") and methane emission intensities from the Company's operations, including a 25 percent reduction in GHG intensity and 40 percent reduction in methane intensity by 2030, inclusive of the recently acquired assets of Parsley Energy, Inc. ("Parsley"). In addition, the Company announced a goal to limit its flaring intensity to less than one percent of natural gas produced, with a plan to incorporate Parsley's assets into this target by 2022, and plans to end routine flaring, as defined by the World Bank, by 2030, with an aspiration to reach this goal by 2025.

Nominees for Director

| Committee Memberships(1) | Other Current Public Co. Boards (#)(2) | ||||||||||||||||||||||||||||

| Name | Age | Director Since | Primary Occupation | Independent(1) | AC | CLD | HSE | NCG | |||||||||||||||||||||

| A.R. Alameddine | 73 | 2021 | Former Lead Director, Parsley Energy, Inc. | ü | ü | ü | — | ||||||||||||||||||||||

| Edison C. Buchanan | 66 | 2002 | Former Managing Director, Credit Suisse First Boston | ü | ü | ü | — | ||||||||||||||||||||||

| Matt Gallagher | 38 | 2021 | President of Greenlake Energy Ventures, L.L.C. | ü | ü | — | |||||||||||||||||||||||

| Phillip A. Gobe | 68 | 2014 | Chairman and CEO, ProPetro Holding Corp. | ü C | 1 | ||||||||||||||||||||||||

| Larry R. Grillot | 74 | 2013 | Retired Dean, Mewbourne College of Earth and Energy, The University of Oklahoma | ü | ü | ü | — | ||||||||||||||||||||||

| Stacy P. Methvin | 64 | 2013 | Retired Vice President, Shell Oil Company | ü | ü C | ü | 1 | ||||||||||||||||||||||

| Royce W. Mitchell | 66 | 2014 | Executive Consultant | ü | üC ACFE | ü | |||||||||||||||||||||||

| Frank A. Risch | 78 | 2005 | Retired Vice President and Treasurer, Exxon Mobil Corporation | ü | üACFE | ü | — | ||||||||||||||||||||||

| Scott D. Sheffield | 68 | 1997 | Chief Executive Officer | 1 | |||||||||||||||||||||||||

| J. Kenneth Thompson | 69 | 2011 | President and CEO, Pacific Star Energy LLC | ü BC | ü | ü | 3 | ||||||||||||||||||||||

| Phoebe A. Wood | 68 | 2013 | Retired Vice Chairman and Chief Financial Officer, Brown-Forman Corporation | ü | ü | ü C | 3 | ||||||||||||||||||||||

| Michael D. Wortley | 73 | 2015 | Chief Legal Officer, Reata Pharmaceuticals, Inc. | ü | ü | ü | — | ||||||||||||||||||||||

____________________

(1) Definitions of abbreviations used in Nominees for Director table:

| AC | Audit Committee | C | Chairperson | |||||||||||

| CLD | Compensation and Leadership Development Committee | ACFE | Audit Committee Financial Expert | |||||||||||

| HSE | Health, Safety and Environment Committee | BC | Independent Board Chair | |||||||||||

| NCG | Nominating and Corporate Governance Committee | |||||||||||||

(2) Refers to a company with a class of securities registered pursuant to section 12 of the Securities Exchange Act of 1934.

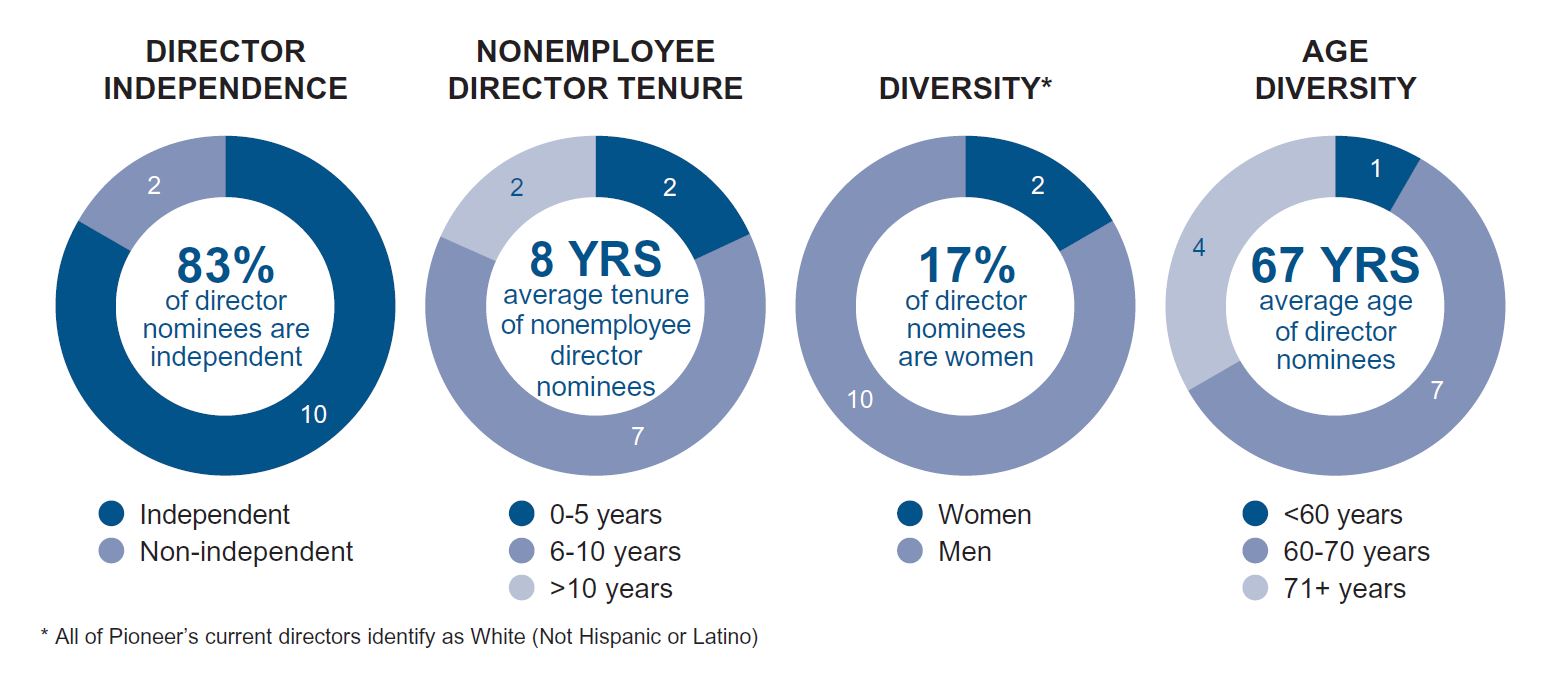

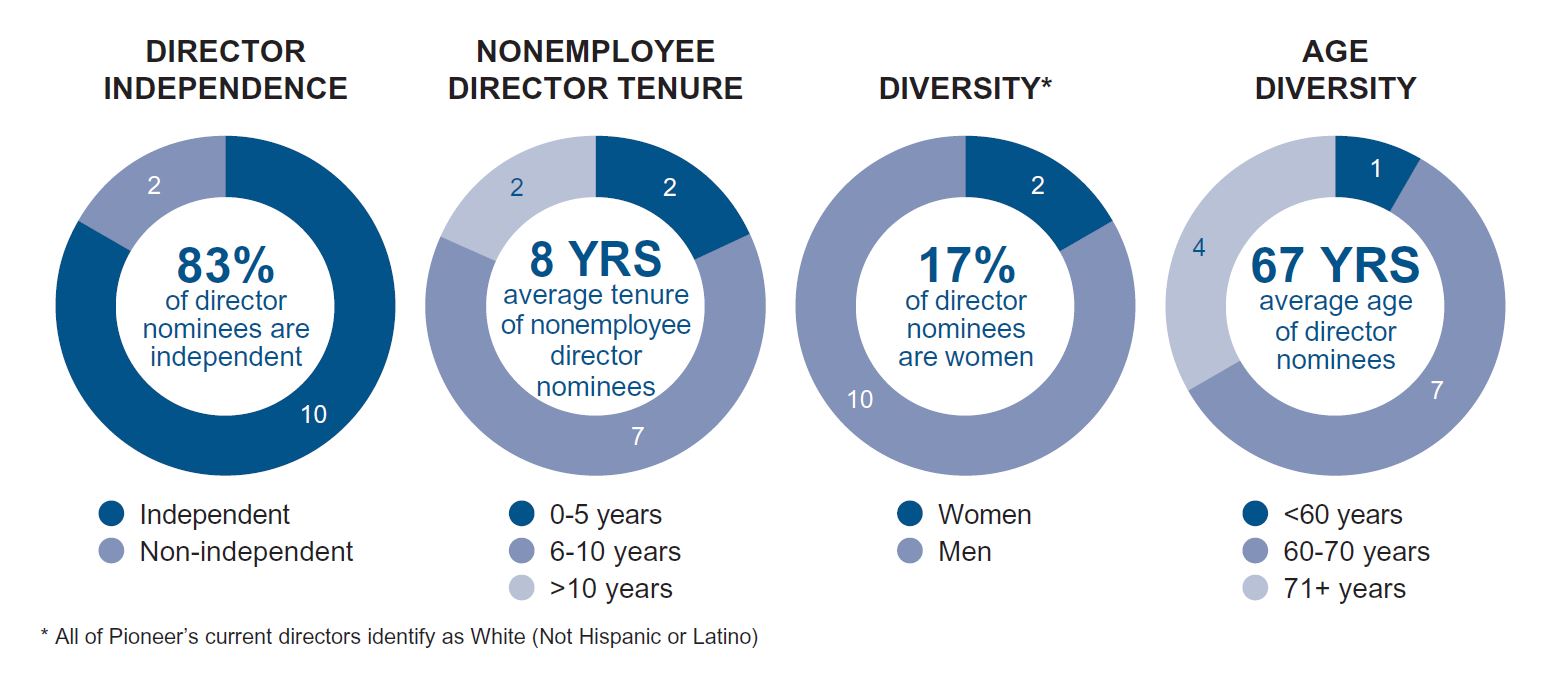

Composition Highlights of Director Nominees

•Independent Leadership: The Chairman of the Board, J. Kenneth Thompson, is an independent director.

2

•Independence: The Board seeks to ensure that at least two-thirds of its members will be independent under applicable laws and regulations. Ten out of the Board's 12 members are independent, as defined by the rules of the New York Stock Exchange (the "NYSE").

•Board refreshment: Over time, the Board refreshes its membership through a combination of adding or replacing directors to achieve the appropriate balance between maintaining longer-term directors with deep institutional knowledge of the Company and adding directors who bring a diversity of perspectives and experience. Since 2012, nine of the Board's current 12 directors have been named to the Board, all of whom are non-employee directors and two of whom are women.

•Diversity of skills and experience; Rooney Rule: In assessing the composition of the Pioneer Board, the Board and its Nominating and Corporate Governance Committee strive to achieve an overall balance of diversity of backgrounds and experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy. In the event that the Nominating and Corporate Governance Committee determines to recruit candidates from outside Pioneer as potential nominees to join the Pioneer board, the committee will use its best efforts to include, and will instruct any third-party search firm the committee engages to assist it in seeking candidates for the Board to include, qualified candidates with a diversity of gender and race/ethnicity in the initial pool from which the committee selects director candidates.

The Board believes that the above-named nominees for election at the Annual Meeting offer a diverse range of backgrounds, skills and experience in relevant areas that contribute to overall effective leadership and exercise of oversight responsibilities by the Board:

| ||

3

Governance Highlights

Pioneer's Board of Directors believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders. The following are some of the Company's more significant governance practices and policies:

| þ | The Board has an independent Chairman | ||||

| þ | Ten out of 12 directors are independent | ||||

| þ | Board refreshment: five out of 11 non-employee directors have tenures of seven or fewer years | ||||

| þ | Board diversity: two out of 11 non-employee directors are women; women chair two of the Board's four standing committees | ||||

| þ | Senior executive diversity: one-third of Pioneer's officers are women | ||||

| þ | Board oversight of: •the Company's long-term strategy •risk management - annual review of enterprise risks, with a focus on specific risks during interim quarters | ||||

| þ | Annual Board and committee self-evaluations | ||||

| þ | Active stockholder engagement process, with participation by independent Board members | ||||

| þ | Stockholder proxy access | ||||

| þ | All directors stand for election annually | ||||

| þ | Majority voting for directors in uncontested elections | ||||

| þ | Independent audit, compensation and governance committees | ||||

| þ | Robust stock ownership policy for directors | ||||

| þ | All directors attended more than 75 percent of the meetings of the Board and Committees on which they served during 2020 | ||||

| þ | Anti-hedging and pledging policies | ||||

| þ | Compensation clawback policy | ||||

| þ | No poison pill | ||||

Commitment to Sustainability

The Board and senior management of the Company understand that in order to continue to provide value to the Company's stockholders, Pioneer must remain focused on its social license to operate and committed to environmental, social and governance ("ESG") issues.

Pioneer's fourth annual Sustainability Report, available on the Company's website, highlights Pioneer's commitment to ESG issues, and highlights many of its efforts to ensure that its operations are performed safely and with respect for the environment, that its people are provided the resources they need to be collaborative and successful in their careers, and that the communities in which Pioneer operates share in the opportunities created by its investments.

•Environmental -

◦Emissions - Pioneer recently announced that it has adopted targets, aligned with the TCFD, to reduce GHG and methane emission intensities from the Company's operations, including a 25 percent reduction in GHG intensity and 40 percent reduction in methane intensity by 2030, inclusive of the recently acquired assets of Parsley. In addition, the Company recently announced a goal to limit its flaring intensity to less than one percent of natural gas produced, with a plan to incorporate Parsley's assets into this target by 2022.

◦Water - the Company is nearing completion of a unique water infrastructure project where Pioneer invested in upgrading the City of Midland's wastewater treatment plant and in return will receive non-potable water from the City of Midland, which will displace freshwater used in the Company's operations and represents a significant milestone in Pioneer's ongoing freshwater reduction strategy.

•Safety - in 2020, Pioneer implemented the next generation of the Company's In-Vehicle Monitoring System to improve driver safety, optimize maintenance, monitor vehicle health, automate mileage reporting and record fuel use. The National Safety Council and the Texas Department of

4

Transportation have, for the third year in a row, honored Pioneer with the Texas Employer Traffic Safety Award.

•Human capital - Pioneer is committed to providing its people a workplace where individuals bring their authentic selves and are supported in an environment that nurtures all aspects of their lives, leading them to perform at their best. Providing growth opportunities and career potential for women and people of diverse racial and ethnic backgrounds is a priority at Pioneer. The Company has included sexual orientation and gender identity in its anti-harassment and nondiscrimination labor practices and is a signatory to the Business Coalition for the Equality Act which, if passed, would extend these federal protections to other areas such as fair housing and credit.

•Board oversight - the Board is actively engaged in overseeing the Company's sustainability practices:

◦The Board regularly considers the potential impacts of climate change policy and growing alternative energy sources on global fossil fuel demand and Pioneer's long-term business prospects. As part of the Company's strategic planning process, management periodically prepares and reviews with the Board long-term scenarios under varying assumptions to stress test the Company's business outlook in the face of these risks.

◦The Health, Safety and Environment Committee reviews the Company's health, safety and environmental ("HSE") performance and the Company's management of current and emerging HSE and climate change-related issues, including trends in legislation and proposed regulations affecting the Company.

◦The Nominating and Corporate Governance Committee assists the Board in identifying, evaluating and monitoring social, governance, political, human rights and public policy trends, issues and concerns and other sustainability and corporate responsibility matters that could affect the Company's business and reputation, including climate change-related risks and opportunities.

◦The Compensation and Leadership Development Committee (the "Compensation Committee") oversees the Company's strategies, initiatives and programs with respect to Pioneer's culture, talent recruitment, development and retention, employee engagement and diversity and inclusion.

◦The Sustainability Reporting Committee oversees the Company's preparation of its annual sustainability report and other significant disclosures regarding ESG matters that are not otherwise overseen by the Health, Safety and Environment Committee.

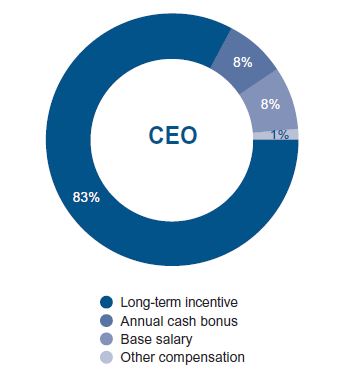

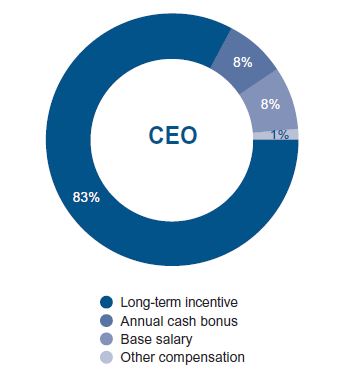

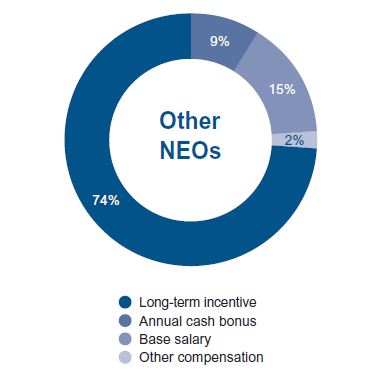

Executive Compensation Highlights

Structure - the three main components of the executive compensation program, each of which generally is targeted at the median level of the Company's peer group, are:

•Base salary - fixed cash compensation component.

•Annual cash bonus incentive award - variable cash payout based on Company and individual performance for the year.

•Long-term incentive plan awards - 100 percent of the Chief Executive Officer's ("CEO") target value of long-term incentive plan awards is allocated to performance-based performance unit awards; the allocation to performance unit awards for the other executive officers was increased from 50 percent to 60 percent beginning in 2020; the payout is dependent on relative total stockholder return against industry peers over a three-year period; the remaining target value of long-term incentive plan awards is allocated to time-based awards that vest over three years.

Proactive response to the industry downturn - management and the Compensation Committee acted quickly to align the Company's executive compensation program with the Company's response to the industry downturn caused by the COVID-19 pandemic and a significant reduction in oil prices:

•Reduced officer salaries: the Compensation Committee approved a 20 percent decrease in the 2020 annual base salary of Mr. Sheffield, a 15 percent decrease in the annual base salaries of the Named Executive Officers ("NEOs") and the Company's other executive officers, and a ten percent decrease in the annual base salaries of the Company's other officers (the annual base salary amounts were reinstated effective January 1, 2021).

5

•Reduced nonemployee director fees: the Board approved a 20 percent decrease in the directors' 2020 cash retainer fees, as well as a 20 percent reduction in the additional cash retainer fees payable to the Chairman of the Board and the Chairman of the Audit Committee (these retainer fees also were reinstated effective January 1, 2021).

•Adjusted corporate goals to align with the strategic response to the industry downturn, prioritizing free cash flow and return of capital to stockholders: the Compensation Committee, working with senior management, developed adjusted interim operational, financial, HSE and strategic and tactical goals to align management performance for the remainder of 2020 with the Company's change in strategy to respond to the unprecedented reduction in oil demand, prioritizing free cash flow generation and return of capital to investors and the maintenance of Pioneer's strong balance sheet and adequate liquidity; however, the Compensation Committee also reduced the total target amounts to reflect the mid-year adjustments and industry conditions and applied the payout to the NEOs' reduced salaries.

The following charts illustrate the various components of total 2020 annual compensation for the CEO and the other named executive officers as a group as reported in the Summary Compensation Table.

|  | ||||

6

The Company's executive compensation and compensation-related governance policies and practices incorporate many best practices, including the following:

| Key Compensation Practices | |||||

| þ | Pay for performance - over 85 percent of target 2020 total compensation for the CEO (annual bonus and long-term incentive compensation) was variable and dependent on performance | ||||

| þ | Emphasize long-term performance - long-term equity-based incentives represented over 80 percent of target 2020 total compensation for the CEO, of which, 100 percent of the CEO's equity awards were in the form of performance units with payout being dependent on relative total stockholder return against industry peers over a three-year period | ||||

| þ | Compensation clawback policy | ||||

| þ | Double-trigger cash severance benefits in the event of a change in control | ||||

| þ | Double-trigger acceleration of equity awards in the event of a change in control | ||||

| þ | Compensation Committee members are all independent and the committee utilizes an independent compensation consultant | ||||

| þ | Minimum stockholding requirements of six times base salary for the CEO and three times base salary for executive vice presidents | ||||

| þ | Health, safety and environmental goals incorporated into the annual cash bonus incentive program | ||||

| þ | Annual advisory vote on executive compensation | ||||

| þ | No tax gross ups | ||||

| þ | No employment agreements | ||||

| þ | No hedging or pledging of Company common stock | ||||

| þ | No repricing of stock options or buying out underwater stock options | ||||

Stockholder Outreach and Engagement

The Company regularly engages with stockholders, including with respect to corporate governance, sustainability and compensation matters. In many cases, calls with investors have involved at least one independent member of the Board. This process has led to a number of enhancements in the Company's governance, compensation and disclosure practices, including:

•The Company announced its long-term investment framework, prioritizing free cash flow generation and return of capital to stockholders, inclusive of a strong and growing base dividend, a variable dividend and oil production growth of approximately five percent, assuming the Company's leverage metrics remain low.

•Commencing with the 2020 long-term incentive program, 100 percent of the CEO's target value of long-term incentive plan awards is allocated to performance-based performance unit awards; consistent with the high priority placed on HSE and ESG, for the 2021 program, the Compensation Committee has increased the weighting for these metrics in the annual cash bonus incentive program from ten percent to 20 percent; and for the 2021 long-term incentive program, the Compensation Committee approved the addition of the S&P 500 index into the total stockholder return ("TSR") peer group for performance unit awards.

•The Board implemented proxy access.

•The Board enhanced its diversity through the appointment of three highly qualified women directors with significant and varied areas of experience (one of whom resigned in November 2020).

•The Board has enhanced its disclosure regarding the backgrounds, skills, qualifications and experience of each director nominee in response to recent corporate governance initiatives.

•The Company continued engagement with its investors and other stakeholders as to its sustainability disclosure, publishing its fourth annual Sustainability Report in 2020.

•The Board acted to declassify the Board, so that directors are elected annually.

•The Board adopted majority voting for directors.

7

PROXY STATEMENT

2021 Annual Meeting of Stockholders

_____________________________

GENERAL INFORMATION

This Proxy Statement provides information in connection with the solicitation of proxies by the Board of Directors (the "Board") of the Company for use at the Annual Meeting, which will be held online at www.virtualshareholdermeeting.com/PXD2021 on Thursday, May 27, 2021, at 9:00 a.m. Central Time. You may attend the Annual Meeting online using the control number included in your Notice of Availability and vote your shares of the Company's common stock if you were a stockholder of record at the close of business on April 1, 2021. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/PXD2021. To be admitted and participate in the Annual Meeting at www.virtualshareholdermeeting.com/PXD2021, you will need the 16-digit control number included on your Notice of Availability, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the Annual Meeting. However, even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper Proxy. The Board is requesting your Proxy so that the persons named on the Proxy will be authorized to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting. You may revoke the Proxy in writing at any time before it is exercised at the Annual Meeting. See "General Information about the Annual Meeting - Voting and Quorum - Revoking a Proxy."

About the Annual Meeting

In light of the public health impact of the coronavirus, or COVID-19, outbreak and taking into account federal, state and local guidance, Pioneer has determined that the Annual Meeting will be held in a virtual meeting format only. There will be no physical meeting location and the meeting will only be conducted via live webcast. You may submit questions for the meeting in advance at www.virtualshareholdermeeting.com/PXD2021. You may participate in the Annual Meeting, submit live questions and vote during the meeting at www.virtualshareholdermeeting.com/PXD2021 by entering the control number included on the Notice of Availability or the proxy card you received, or in the instructions that accompanied your proxy materials. Online check-in will begin at 8:45 a.m., Central Time. Please allow ample time for online check-in procedures. If you encounter any difficulties accessing the virtual meeting during check-in or during the course of the Annual Meeting, please call 844-986-0822 (U.S.) or 303-562-9302 (International).

This virtual stockholder meeting format uses technology designed to increase stockholder access and provide stockholders rights and opportunities to participate in the meeting similar to what they would have at an in-person meeting. In addition to online attendance, stockholders will be provided an opportunity to hear all portions of the official meeting, submit written questions and comments before and during the meeting, and vote online during the open poll portion of the meeting. The Company expects to resume in-person annual meetings beginning next year.

See "General Information about the Annual Meeting" for additional information relating to the Annual Meeting.

References in the Proxy Materials to the "Annual Meeting" also refer to any adjournments, postponements or changes in location of the Annual Meeting, to the extent applicable.

8

Electronic Availability of Proxy Statement and Annual Report

As permitted under the rules of the Securities and Exchange Commission (the "SEC"), the Company is making this Proxy Statement and its Annual Report available to its stockholders electronically via the internet. The Company is sending the Notice of Availability on or about April 15, 2021, to its stockholders of record as of the close of business on April 1, 2021. The Notice of Availability includes:

•instructions on how to access the Company's proxy materials electronically;

•the date, time and location of the Annual Meeting;

•a description of the matters intended to be acted upon at the Annual Meeting;

•a list of the materials being made available electronically;

•instructions on how a stockholder can request paper or e-mail copies of the Company's proxy materials;

•any control/identification numbers that a stockholder needs to access the Proxy and the online Annual Meeting; and

•information about attending online the Annual Meeting and voting online during the Annual Meeting.

Voting Matters and Board Recommendations

The following table sets forth the items currently on the agenda for the Annual Meeting, along with the Board's recommendations.

| Proposal | Description | Board Vote Recommendation | Page Reference (for more detail) | ||||||||

| 1 | Election of the Company's 12 director nominees named in this Proxy Statement | FOR each of the director nominees | |||||||||

| 2 | Ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2021 | FOR | |||||||||

| 3 | Approval, on an advisory basis, of the Company's named executive officer compensation | FOR | |||||||||

| 4 | Approval of the Company's Amended and Restated Employee Stock Purchase Plan | FOR | |||||||||

For additional information about the Annual Meeting, including what vote is required for each item, how a Proxy that is properly completed and submitted will be voted, and what is the quorum required for the meeting, please see "General Information about the Annual Meeting."

PROPOSAL ONE:

ELECTION OF DIRECTORS

Directors and Nominees

Upon recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the 12 individuals named below for election as directors at the Annual Meeting, each of whom is currently serving as a director of the Company. The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company's directors will be reduced or the persons acting under the Proxy will vote for the election of a substitute nominee that the Board recommends.

As discussed in more detail below, the Board considers each director's relevant experience, qualifications, skills and other factors in the course of the Board's annual self-evaluation. In addition, with regard to the overall composition of the Board, the Nominating and Corporate Governance Committee and the Board seek to achieve an overall balance of backgrounds and diversity of experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy. The biographies of each of the nominees set forth below contain certain information about his or her principal occupation and business experience and also highlight certain of the

9

nominee's particular attributes that the Board believes the nominee brings to the Board and that led the Nominating and Corporate Governance Committee and the Board to conclude that he or she should be nominated to serve as a director of the Company.

Required Vote

The Company's Amended and Restated Certificate of Incorporation, as amended (the "Certificate of Incorporation"), provides that all directors are to be elected annually. The Company's Sixth Amended and Restated Bylaws (the "Bylaws") provide for the election of directors by the majority vote of stockholders in uncontested elections. This means the number of votes cast "For" a nominee's election must exceed the number of votes cast "Against" such nominee's election in order for him or her to be elected to the Board. As a condition to being nominated, each nominee for director is required to submit an irrevocable letter of resignation that becomes effective if the nominee does not receive a majority of the votes cast in an uncontested election and the Board decides to accept the resignation. If a nominee who is currently serving as a director does not receive a majority of the votes cast for his or her election, the Board will act on the tendered resignation within 90 days after the date of the certification of the election results. If the resignation is not accepted, the Board will publicly disclose its decision and its primary rationale, and the director will continue to serve as a director until his or her successor is elected and qualified or until his or her earlier resignation or removal. If the Board accepts the resignation, the Board may fill the vacancy in accordance with the Company's Bylaws or may decrease the size of the Board.

10

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR"

THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW.

| A.R. Alameddine Director since: 2021 Age: 73 Independent: Yes | Mr. A.R. Alameddine joined the Board in connection with Pioneer's acquisition of Parsley. Prior to joining Pioneer's Board, Mr. Alameddine served on Parsley's board of directors from December 2013 until Parsley was acquired by the Company in January 2021, including service as Parsley's Lead Director from February 2016. Prior to his retirement in 2008, Mr. Alameddine held a number of positions in the oil and gas industry, including serving as Executive Vice President of | |||||||||

Worldwide Negotiation Execution and Implementation at Pioneer from 2005 until his retirement in 2008. Before joining Pioneer in 1997, Mr. Alameddine spent 26 years with Mobil Exploration & Producing Company, a subsidiary of Exxon Mobil Corporation, in various engineering and planning positions in the United States. In addition, he worked in Norway for three years on various North Sea projects. Selected Experiences, Qualifications, Attributes and Skills: Mr. Alameddine's extensive experience in the exploration and production ("E&P") industry, including in senior executive roles in operational and technical positions with a major international energy company, brings to the Board significant senior executive experience, and experience in and knowledge of the E&P industry and its operations. Education: Bachelor of Science degree in Petroleum Engineering, Louisiana State University Pioneer Committees: Compensation; Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): Parsley Energy, Inc. Current Non-Public Company Board or Other Service: None | |||||||||||

| Edison C. Buchanan Director since: 2002 Age: 66 Independent: Yes | Mr. Buchanan was a Managing Director of various groups in the Investment Banking Division of Dean Witter Reynolds in their New York and Dallas offices from 1981 to 1997. In 1997, Mr. Buchanan joined Morgan Stanley Dean Witter as a Managing Director in the Real Estate Investment Banking group. During 2000, Mr. Buchanan served as Managing Director and head of the domestic Real Estate Investment Banking Group of Credit Suisse First Boston. | |||||||||

Selected Experiences, Qualifications, Attributes and Skills: Mr. Buchanan's more than 20 years in investment banking and finance, including in senior executive roles, brings to the Board significant senior executive experience and extensive experience in corporate finance, mergers and acquisitions and commercial transactions, strategic planning and human resources. Education: Bachelor of Science degree in Civil Engineering, Tulane University Master of Business Administration in Finance and International Business, Columbia University Pioneer Committees: Compensation; Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Commonweal Conservancy (Chair) | |||||||||||

11

| Matt Gallagher Director since: 2021 Age: 38 Independent: Yes | Mr. Gallagher joined the Board in connection with Pioneer's acquisition of Parsley. He is currently serving as President of Greenlake Energy Ventures, L.L.C. and an Operating Partner at NGP Energy Capital Management, L.L.C. Prior to joining Pioneer's Board, Mr. Gallagher served as Parsley's President and Chief Executive Officer since January 2019. Mr. Gallagher previously served as Parsley's President and Chief Operating Officer from January 2017 until October 2018 | |||||||||

and as Parsley's President from October 2018 until January 2019, when pursuant to Parsley's succession plan, he was appointed President and Chief Executive Officer. Mr. Gallagher also served as a director of Parsley from January 2018 until Pioneer's acquisition of Parsley. Prior to being named Parsley's President, Mr. Gallagher served in a number of roles at Parsley since joining that company in 2010, including as Vice President—Chief Operating Officer from May 2014 through January 2017 and Vice President—Engineering and Geoscience from December 2013 to April 2014. Prior to joining Parsley, Mr. Gallagher worked in a number of positions at Pioneer from 2005 to 2010, including a variety of engineering roles with Pioneer. Selected Experiences, Qualifications, Attributes and Skills: Mr. Gallagher's extensive experience in various roles with energy companies, including more than six years in a Chief Operating or Chief Executive role, brings to the Board significant senior executive experience and experience in and knowledge of the E&P industry and its operations and related technology matters, as well as experience in HSE matters and human resources. Education: Bachelor of Science in Petroleum Engineering, the Colorado School of Mines Pioneer Committees: Health, Safety and Environment Current Public Company Directorships: Chesapeake Energy Corporation Prior Public Company Directorships (within last five years): Parsley Energy, Inc. Current Non-Public Company Board or Other Service: None | |||||||||||

12

| Phillip A. Gobe Director since: 2014 Age: 68 Independent: No | Mr. Gobe has served as the Chairman of the Board of Directors of ProPetro Holding Corp. ("ProPetro") since July 2019. He was appointed as ProPetro's chief executive officer in March 2020, and before that served as ProPetro’s Executive Chairman from October 2019 to March 2020. He had served as Chief Operating Officer of Energy Partners, Ltd. from December 2004, and President from May 2005 until his retirement in September 2007. Mr. Gobe also served as a director of | |||||||||

Energy Partners, Ltd. from November 2005 until May 2008. Prior to that, Mr. Gobe had served as Chief Operating Officer of Nuevo Energy Company from February 2001 until its acquisition by Plains Exploration & Production Company in May 2004, and prior to that time, he held numerous operations and human resources positions with Vastar Resources, Inc. and Atlantic Richfield Company ("ARCO") and its subsidiaries. Selected Experiences, Qualifications, Attributes and Skills: Mr. Gobe's extensive experience in various roles with energy companies, including a major international energy company, which included more than nine years in a Chief Operating role, brings to the Board significant senior executive experience and experience in and knowledge of the E&P industry and its operations and related technology matters, as well as experience in commercial transactions, HSE matters and human resources. Education: Bachelor of Arts, the University of Texas Master of Business Administration, the University of Louisiana in Lafayette Pioneer Committees: Health, Safety and Environment (Chair) Current Public Company Directorships: ProPetro Holding Corp. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Pantheon Resources plc | |||||||||||

13

| Larry R. Grillot Director since: 2013 Age: 74 Independent: Yes | Dr. Grillot served as the dean of the Mewbourne College of Earth and Energy at the University of Oklahoma from 2006 until his retirement from the university in June 2015. Prior to his role at the University of Oklahoma, from 1973 until his retirement in 2003, Dr. Grillot worked for Phillips Petroleum Company in a variety of technical and managerial positions in exploration and production, including Manager of E&P Technology and Services, Upstream Technology and Project Development, | |||||||||

Manager of International Exploration, President and Region Manager for Phillips Petroleum Canada Limited and Manager of E&P Planning. Dr. Grillot is a member of the American Association of Petroleum Geologists, the American Geophysical Union, the Society of Exploration Geophysicists and the Society of Petroleum Engineers. | |||||||||||

Selected Experiences, Qualifications, Attributes and Skills: Dr. Grillot's significant experience in technical and executive positions in the E&P industry, as well as his doctorate degree in Geological Sciences and former role as a college dean, brings to the Board a depth of knowledge and experience in geology and other technological areas important to the Company, as well as operational experience in the E&P industry, domestically and internationally. In addition, Dr. Grillot brings to the Board knowledge of operating in environmentally sensitive areas through his experience with Phillips Petroleum Company overseeing international exploration activities, including seismic data. | |||||||||||

Education: Bachelor of Science in Physics, Mississippi State University Master of Science in Geological Sciences, Brown University Ph.D. in Geological Sciences, Brown University Pioneer Committees: Audit; Health, Safety and Environment Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: None | |||||||||||

14

| Stacy P. Methvin Director since: 2013 Age: 64 Independent: Yes | Ms. Methvin was Vice President, Refining Margin Optimization of Shell Oil Company ("Shell") from 2011 until her retirement in 2012, and from 2009 until 2010, she was Vice President, Global Distribution of Shell. Ms. Methvin also held various other operational and management roles in the upstream, downstream and chemical businesses during her tenure at Shell and its subsidiaries that began in 1979, including President, Shell Louisiana E&P Company, President, Shell Deer | |||||||||

Park Refining Company, President, Shell Pipeline Company LP, President, Shell Chemical LP, and Vice President, Strategy and Portfolio for the downstream business. Selected Experiences, Qualifications, Attributes and Skills: With more than 15 years of senior executive service in operational and management roles in the upstream, downstream and chemical business segments of a major international energy company, Ms. Methvin brings to the Board significant senior executive experience, experience in and knowledge of the E&P industry and its operations, strategic planning and risk management, HSE matters, marketing transactions, international operations, regulatory compliance and human resources. Education: Bachelor of Arts in Geological and Geophysical Sciences, Princeton University Pioneer Committees: Compensation (Chair); Health, Safety and Environment Current Public Company Directorships: Magellan Midstream Partners, L.P. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Marquard & Bahls AG (Vice Chair); xF Technologies Inc.; Louisiana Governor's Advisory Commission on Coastal Protection, Restoration and Conservation; Memorial Hermann Healthcare System; The Houston Zoo (Chair) | |||||||||||

| Royce W. Mitchell Director since: 2014 Age: 66 Independent: Yes | Mr. Mitchell has been an executive consultant, focusing on advising management teams and board audit committees of E&P companies, since January 2005, except for the period from April 2008 through December 2008 when he served as Chief Financial Officer of Frac Tech Services, Ltd. Mr. Mitchell served as Executive Vice President, Chief Financial Officer and Chief Accounting Officer of Key Energy Services, Inc. from January 2002 to January 2005. | |||||||||

Before joining Key Energy Services, Inc., he was a partner with KPMG LLP from April 1986 through December 2001 specializing in the oil and gas industry. Selected Experiences, Qualifications, Attributes and Skills: With more than 25 years with a major accounting firm, including 15 years as a partner, and significant experience as a chief financial officer and consultant for energy companies, Mr. Mitchell brings to the Board extensive experience and knowledge in accounting, corporate finance, mergers and acquisitions, risk management and commercial transactions, including significant experience in the E&P industry. Mr. Mitchell has been determined by the Board to meet the SEC's definition of audit committee financial expert. Education: Bachelor of Business Administration, Texas Tech University Pioneer Committees: Audit (Chair); Health, Safety and Environment Current Public Company Directorships: None Prior Public Company Directorships (within last five years): ProPetro Holding Corp. Current Non-Public Company Board or Other Service: None | |||||||||||

15

| Frank A. Risch Director since: 2005 Age: 78 Independent: Yes | Mr. Risch retired in 2004 as Vice President and Treasurer (and Principal Financial Officer) of Exxon Mobil Corporation following a 38 year international career in finance, strategic planning and general management with Exxon and its operating affiliates in the U.S. and abroad. In 1990, he began a two year assignment in Dallas as Executive Assistant to the Chairman of the Board and CEO of Exxon Corporation. He became Assistant Controller of the corporation in | |||||||||

1992, Assistant Treasurer in 1994 and Vice President and Treasurer of the corporation on January 1, 1999. Selected Experiences, Qualifications, Attributes and Skills: Mr. Risch's extensive executive experience as a financial officer at a major international energy company brings to the Board extensive senior executive experience, and extensive knowledge and experience in accounting, finance, capital markets, strategic planning, risk management, mergers and acquisitions and commercial transactions. Mr. Risch has been determined by the Board to meet the SEC's definition of audit committee financial expert. Education: Bachelor of Science in Business Administration, Pennsylvania State University Master of Science in Industrial Administration, Carnegie Mellon University Pioneer Committees: Audit; Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: Carnegie Mellon University Tepper School of Business, Business Board of Advisors (Emeritus Member); Financial Executives International; The Dallas Theater Center (Life Trustee); The Dallas Holocaust and Human Rights Museum (Immediate Past Board Chair); HIAS International; Dallas CASA (Court Appointed Special Advocates) (Emeritus Director) | |||||||||||

16

| Scott D. Sheffield Director since: 1997 Age: 68 Independent: No | Mr. Sheffield was appointed the Company's Chief Executive Officer in February 2019 and also served as the Company's President from February 2019 through December 2020. He served as Chairman of the Board of the Company from 1999 through February 2019. Previously, he had served as Chief Executive Officer of the Company from 1997 through December 31, 2016, and then as the Executive Chairman until December 31, 2017, when he retired as an executive and officer of the Company. | |||||||||

Mr. Sheffield was the Chairman of the Board of Directors and Chief Executive Officer of Parker & Parsley Petroleum Company, a predecessor of the Company (together with its predecessor companies, "Parker & Parsley"), from January 1989 until Pioneer was formed in August 1997. Mr. Sheffield joined Parker & Parsley as a petroleum engineer in 1979, was promoted to Vice President - Engineering in September 1981, was elected President and a Director in April 1985, and became Parker & Parsley's Chairman of the Board and Chief Executive Officer on January 19, 1989. Before joining Parker & Parsley, Mr. Sheffield was employed as a production and reservoir engineer for Amoco Production Company. Mr. Sheffield's severance agreement provides that his failure to be re-elected constitutes "good reason" under his severance agreement whether or not his resignation is accepted by the Board, which would entitle him to terminate his employment and receive the benefits described in the section below entitled "Executive Compensation Tables - Potential Payments upon Termination or Change in Control." Selected Experiences, Qualifications, Attributes and Skills: Mr. Sheffield's more than 25 years' experience as CEO of the Company or its predecessor, and his extensive experience in petroleum engineering, brings to the Board extensive senior executive experience, experience in and knowledge of the E&P industry, its operations and related technology matters, corporate finance, capital markets and mergers and acquisitions, strategic planning, marketing and hedging transactions, international business matters, governmental and regulatory matters and human resources. In addition, his service on the Advisory Board of the Center for Global Energy Policy at Columbia University, which conducts research and convenes policy experts and industry leaders on a range of energy-relevant matters, brings to the Board knowledge of and insight into environmental policy and renewable energy matters. Education: Bachelor of Science in Petroleum Engineering, the University of Texas Pioneer Committees: None Current Public Company Directorships: The Williams Companies, Inc. Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: The Center for Global Energy Policy at Columbia University Advisory Board; CSL Capital Management, LLC | |||||||||||

17

| J. Kenneth Thompson Director since: 2011 Age: 69 Independent: Yes | Mr. Thompson has served as the Board's independent Chairman since February 2019, and prior to that time, had served as Lead Independent Director since May 2015. Mr. Thompson has served as the President and Chief Executive Officer of Pacific Star Energy LLC, a privately held firm that is a passive holder of oil lease royalties in Alaska, since September 2000. He served as Managing Director of Alaska Venture Capital Group LLC, a privately held oil and gas exploration company in | |||||||||

| which Pacific Star Energy LLC owns an interest, from December 2004 to December 2012. Mr. Thompson's experience includes serving as Executive Vice President of ARCO's Asia Pacific oil and gas operating companies in Alaska, California, Indonesia, China and Singapore from 1998 to 2000, and President and Chief Executive Officer of ARCO Alaska, Inc., the parent company's oil and gas producing subsidiary based in Anchorage, from June 1994 to January 1998. He also served in various technical and management roles at ARCO from 1974 to 1998, including as executive head of ARCO's oil and gas research and technology center from 1993 to 1994, which included research and technology application in various geoscience disciplines, engineering technologies and environmental sciences. When head of ARCO's Research & Technology Center, he also had oversight of the Information Technology department, the computing center and IT security. | |||||||||||

Selected Experiences, Qualifications, Attributes and Skills: Mr. Thompson's extensive experience as a CEO of an oil and gas exploration company and as a senior executive in operational and technical roles with a major international energy company brings to the Board significant senior executive experience, experience in and knowledge of the E&P industry and its operations, technology and research and development, strategic planning and risk management, HSE matters, international operations, and human resources. In addition, his experience as executive head of ARCO's oil and gas environmental research and technology initiatives and Chair of the environmental, health, safety and social responsibility committee of Coeur Mining, Inc. brings to the Board significant knowledge of and insight into environmental matters. In 2019, Mr. Thompson was selected as one of the 100 most influential corporate directors by the National Association of Corporate Directors. Education: Bachelor of Science degree in Petroleum Engineering, Missouri University of Science & Technology Pioneer Committees: Compensation; Nominating and Corporate Governance Current Public Company Directorships: Alaska Air Group, Inc.; Coeur Mining, Inc. (Chair of the environmental, health, safety and social responsibility committee); Tetra Tech, Inc. (Presiding Director and Chair of the compensation committee) Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: CDF Capital (Chair) | |||||||||||

18

| Phoebe A. Wood Director since: 2013 Age: 68 Independent: Yes | Ms. Wood has been a principal at CompaniesWood, a consulting firm specializing in advising and investing in early stage investments, since 2008. She was Executive Vice President and Chief Financial Officer of Brown-Forman Corporation, a diversified consumer products manufacturer, from 2001 to 2006, and Vice Chairman and Chief Financial Officer from 2006 to 2008, where she was responsible for the financial operations of the company, including corporate development, | |||||||||

controllership, treasury, investor relations, tax, information technology and internal audit. Prior to Brown-Forman Corporation, Ms. Wood was Vice President, Chief Financial Officer and a Director of Propel Corporation (a subsidiary of Motorola) from 2000 to 2001. Previously, Ms. Wood served in various capacities during her tenure at ARCO from 1976 to 2000, including as divisional CFO in Alaska and England. Selected Experiences, Qualifications, Attributes and Skills: Ms. Wood's extensive senior executive experience as a financial officer in diverse industries, including a major international energy company, and Chair of the audit committees of two other public companies, bring to the Board extensive senior executive experience, and deep knowledge and experience in accounting, finance, capital markets, strategic planning, risk management, corporate governance, mergers and acquisitions and commercial transactions. In 2018, Ms. Wood was selected as one of the 100 most influential corporate directors by the National Association of Corporate Directors. Education: A.B. degree, Smith College Master of Business Administration, the University of California Los Angeles Pioneer Committees: Compensation; Nominating and Corporate Governance (Chair) Current Public Company Directorships: Invesco Ltd. (Chair of the audit committee); Leggett & Platt, Incorporated (Chair of the audit committee); PPL Corporation (Chair of the governance and nominating committee) Prior Public Company Directorships (within last five years): Coca-Cola Enterprises Inc. Current Non-Public Company Board or Other Service: The Gheens Foundation Board of Trustees (Chair of the investment committee); American Printing House for the Blind Board of Trustees (Chair) | |||||||||||

19

| Michael D. Wortley Director since: 2015 Age: 73 Independent: Yes | Mr. Wortley has served as the Chief Legal Officer for Reata Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, since 2015. He has practiced corporate law for over 40 years, focusing primarily on corporate governance matters, acquisitions and divestitures, public and private financings and securities law matters, including over 25 years in management positions. Mr. Wortley was a partner in the Dallas, Texas, office of Vinson & Elkins L.L.P. from 1995 | |||||||||

to 2014 and served in various leadership capacities, including Chief Operating Partner of the firm and Managing Partner of the Dallas office. Prior to joining Vinson & Elkins L.L.P., he was an attorney with Johnson & Wortley, P.C. (which prior to 1993 was known as Johnson & Swanson or Johnson & Gibbs) from 1978 to 1995 and served in various leadership capacities, including President and Chairman of the Board. Selected Experiences, Qualifications, Attributes and Skills: Mr. Wortley's more than 40 years as a corporate attorney advising boards of directors and management teams on a wide variety of legal and strategic matters, both as a senior partner with large law firms and an executive with another public company, bring to the Board extensive experience and knowledge of legal and regulatory matters, corporate governance, finance, capital markets, mergers and acquisitions and commercial transactions, strategic planning, risk management, and HSE and international matters. Education: Bachelor of Arts, Southern Methodist University Juris Doctorate, Southern Methodist University Master's in Regional Planning, the University of North Carolina at Chapel Hill Pioneer Committees: Audit; Nominating and Corporate Governance Current Public Company Directorships: None Prior Public Company Directorships (within last five years): None Current Non-Public Company Board or Other Service: None | |||||||||||

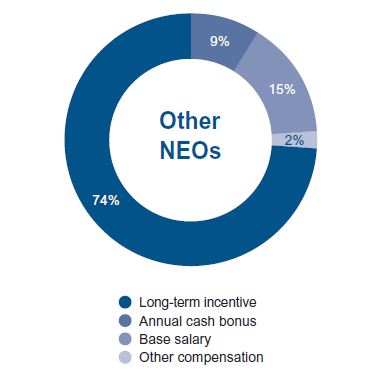

Board Composition; the Directors' Experiences, Qualifications, Attributes and Skills; Rooney Rule

The Board endeavors to achieve an overall balance of backgrounds and diversity of experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business and strategy, while also ensuring that the size of the Board is appropriate to function effectively and efficiently. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board's overall composition and the Company's current and future needs.

In considering whether an incumbent director should be nominated for reelection, the Board considers the results of its self-evaluation process. See "Corporate Governance - Director Refreshment and Self-Evaluation Process" below for more detail about this process. In identifying potential director candidates for addition to the Board, the Nominating and Corporate Governance Committee will rely on any source available for the identification and recommendation of candidates, including its directors, officers and stockholders. In the event that the Nominating and Corporate Governance Committee determines to recruit candidates from outside Pioneer as potential nominees to join the Pioneer board, the committee will use its best efforts to include, and will instruct any third-party search firm the committee engages to assist it in seeking candidates for the Pioneer Board to include, qualified candidates with a diversity of gender and race/ethnicity in the initial pool from which the committee selects director candidates.

As set out in the Company's Corporate Governance Guidelines, all directors are expected to possess the highest personal values and integrity; exhibit sound judgment, intelligence, personal character, and the ability to make independent analytical inquiries; be willing to devote adequate time to Board duties; strive for a collegial atmosphere showing mutual respect for all Directors and opinions; and be able to serve on the Board for a sustained period.

The table below summarizes certain key qualifications, skills and attributes that each director brings to the Board. The lack of a mark for a particular item does not mean the director does not possess that

20

qualification or skill. However, a mark indicates a specific area of focus or expertise that the director brings to the Board. More details on each director's qualifications, skills and attributes are included in the director biographies on the previous pages.

21

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duties to stockholders. The Company's Corporate Governance Guidelines cover the following principal subjects:

•Role and functions of the Board

•Qualifications and independence of directors

•Size of the Board and director selection process

•Committee functions and independence of committee members

•Meetings of non-employee directors

•Self-evaluation of the Board and its committees

•Ethics and conflicts of interest (a copy of the current "Code of Business Conduct and Ethics" is posted on the Company's website at www.pxd.com/culture/governance)

•Contacting the Board (including the Board's non-management or independent directors as a group), including reporting of concerns about the Company's accounting, internal controls or auditing matters

•Compensation of the Board and stock ownership requirements

•Succession planning and annual compensation review of senior management

•Directors' access to senior management and to independent advisors

•New director orientation

•Continuing director education

•Review and approval of related person transactions

The Company's Corporate Governance Guidelines are posted on the Company's website at www.pxd.com/culture/governance. The Corporate Governance Guidelines are reviewed periodically and as necessary by the Company's Nominating and Corporate Governance Committee, and any proposed additions to or amendments of the Corporate Governance Guidelines are presented to the Board for its approval.

Board Leadership Structure

The Company's governing documents allow the roles of Chairman of the Board and CEO to be filled by the same or different individuals. This approach allows the Board flexibility to determine whether the two roles should be separate or combined based upon the Company's needs from time to time.

In February 2019, the Board appointed J. Kenneth Thompson, an independent member of the Board, to serve as Chairman of the Board concurrently with the appointment of Scott D. Sheffield to serve as the Company's President and Chief Executive Officer. Prior to his appointment to Board Chair, Mr. Thompson had served as the Lead Director of the Board since May 2015, and has served as a member of the Board since 2011. The Board believes that Mr. Thompson's tenure as a director with the Company provides him deep knowledge of the Company, its history and its business, making him well suited to ensure that critical business issues are brought before the Board. In addition, the Board believes that Mr. Thompson's service as an independent director of a number of other boards provides him invaluable insight and exposure to many of the major issues Pioneer faces as a publicly-traded company.

As the Board's independent Chairman, Mr. Thompson's duties include approving the agenda and meeting schedules for each meeting of the Board, in consultation with the CEO and the Corporate Secretary and taking into account suggestions of other directors, and presiding at meetings of the Board. All directors are encouraged to suggest the inclusion of agenda items and meeting materials, and any director is free to raise at any Board meeting items that are not on the agenda for that meeting. In addition, the Board's non-employee directors regularly meet in executive session without the presence of any members of management, and, in accordance with the Company's Corporate Governance Guidelines, the Board will hold at least one executive session with independent directors each year. Mr. Thompson presides at

22

these executive sessions, following which he provides guidance and feedback to the Company's management team.

The Board regularly considers its leadership structure to ensure that the structure is appropriate in light of the needs of the Company's business, and the Board is open to different structures as circumstances may warrant. At the present time, the Board believes that the current arrangement of having Mr. Thompson, an independent director, serve as Chairman, best serves the interests of the Company and its stockholders.

CEO and Senior Management Succession Planning

The Board recognizes that management succession planning is a fundamental and ongoing part of its responsibilities. The full Board is responsible for overseeing CEO succession planning, and regularly reviews potential internal senior management candidates with the CEO and the Company's Vice President, Human Resources, including the qualifications, experience, and development plans for these individuals. In addition, the Compensation Committee regularly reviews potential successors to other senior officers within the organization with the CEO and the Company's Vice President, Human Resources, including their qualifications, experience, and development plans. Directors engage with potential CEO and senior management successors at Board and committee meetings and in less formal settings to allow directors to personally assess candidates. Effective January 1, 2021, Pioneer appointed Richard P. Dealy, then serving as the Company's Executive Vice President and Chief Financial Officer, as the Company's President and Chief Operating Officer, and named Mr. Sheffield, then President and Chief Executive Officer, as Chief Executive Officer.

Director Independence

Assessment Process. Each year, the Board, with the assistance of the Nominating and Corporate Governance Committee, assesses the independence of the Company's directors. In making this assessment, the committee and the Board use the independence standards of the NYSE corporate governance rules for determining whether directors are independent, and additionally consider the rules of the SEC and the NYSE in determining independence for Audit Committee and Compensation Committee members. A director cannot be considered independent unless the Board affirmatively determines that he or she does not have any relationship with management or the Company that may interfere with the exercise of his or her independent judgment, including any of the relationships that would disqualify the director from being independent under the rules of the NYSE and SEC. In addition, the Nominating and Corporate Governance Committee and the Board consider the tenure of each director and whether a long period of service could affect his or her objectivity and independence from management.

Independence of Pioneer's Directors. The Board has assessed the independence of each director under the independence standards of the NYSE and affirmatively determined that all of the Board's directors other than Messrs. Gobe and Sheffield (Messrs. Alameddine, Buchanan, Gallagher, Mitchell, Risch, Thompson and Wortley, Dr. Grillot and Mses. Methvin and Wood) are independent. In connection with its assessment of the directors' independence, the Board reviewed the facts and circumstances of certain of the directors' roles as independent directors of companies that have a business relationship as a vendor or service provider to the Company in the ordinary course of business.

In each such case, the Board concluded that the director is an independent director because he or she is not an employee or officer of the other party and his or her role at the other company is limited to that of an independent director, and the business between Pioneer and the other company would not impair the director's independence. This was applicable to Ms. Methvin's role as an independent director of the general partner of Magellan Midstream Partners, L.P., which owns interests in pipelines and storage facilities that provide services to the Company, and Mr. Thompson's role as an independent director of Tetra Tech, Inc., an engineering consulting firm that provides services to the Company. With regard to Mr. Gobe, although he is not an employee of the Company and was previously an independent director, under the independence standards of the NYSE, he could no longer be deemed to be independent on the Company's Board upon his appointment as ProPetro's Executive Chairman in October 2019 due to the level of revenues ProPetro derives from Pioneer under the services agreement that the Company and ProPetro negotiated prior to Mr. Gobe's service on the ProPetro board. During 2020, Andrew F. Cates and Mona K. Sutphen resigned from the Board. The Board had assessed their independence under the independence standards of the NYSE and determined that each was independent.

23

Audit Committee. In connection with its assessment of the independence of each non-employee director, the Board also determined that each member of the Audit Committee meets the additional independence standards of the NYSE and SEC applicable to members of the Audit Committee. Those standards require that the director not be an affiliate of the Company and that the director not receive from the Company, directly or indirectly, any consulting, advisory or other compensatory fees except for fees for services as a director.

Compensation Committee. In connection with its independence assessment, the Board also determined that each member of the Compensation Committee meets the additional independence standards of the NYSE and SEC applicable to members of the Compensation Committee. Those standards require that the Board consider all factors specifically relevant to determining whether a director has a relationship to the Company that is material to his or her ability to be independent from management of the Company in connection with the duties of a member of the Compensation Committee, including the source of his or her compensation and whether he or she is affiliated with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company.

Director Refreshment and Self-Evaluation Process

The Board does not currently believe that it is appropriate to impose either arbitrary term limits on directors' service or a mandatory retirement age. Directors who have served on the Board for an extended period of time provide valuable insight based on their experience with and understanding of the Company's mission, strategies and objectives and the challenges faced by the Company in the oil and gas industry, particularly given the industry's cyclical nature. In assessing the composition of the Board, the Board and its Nominating and Corporate Governance Committee strive to achieve an overall balance of backgrounds and diversity of experience at policy-making levels with a complementary mix of skills and professional experience in areas relevant to the Company's business, while also ensuring that the size of the Board is appropriate to function effectively and efficiently.

Self-Evaluation Process and Board Composition. Each year the Board undergoes a self-evaluation process. The most recent process was led by Mr. Thompson, the Board's independent Chairman, and Ms. Wood, the Chair of the Nominating and Corporate Governance Committee. As part of the annual board self-evaluation, Mr. Thompson and Ms. Wood confer with each director individually to discuss his or her views on a wide range of issues concerning the Board, including:

•whether the Board is effective in its role of overseeing and monitoring the Company's long-term strategy, with the right focus on strategic and significant issues;

•the effectiveness of the Board in identifying and discussing with management key material risks, and challenging management's assumptions;

•whether the Board has the right processes in place to evaluate the performance of the Company and the CEO, including against agreed goals;

•whether the Board has a culture that is effective in eliciting open, candid and honest discussion of all issues and constructive interaction among the Board members, as well as with management, and whether all directors are active participants;