Form DEF 14A Long Blockchain Corp. For: Apr 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Long Blockchain Corp.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

LONG

BLOCKCHAIN CORP.

12-1 Dubon Court

Farmingdale, New York 11735

NOTICE

OF

SPECIAL

MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2019

To the Stockholders of Long Blockchain Corp.:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders (the “Special Meeting”) of Long Blockchain Corp., a Delaware corporation (the “Company”), will be held at the offices of the Company’s general counsel, Graubard Miller, located at The Chrysler Building, 405 Lexington Avenue, 11th Floor, New York, New York 10174, on May 15, 2019 at 10:00 a.m., local time, for the following purposes:

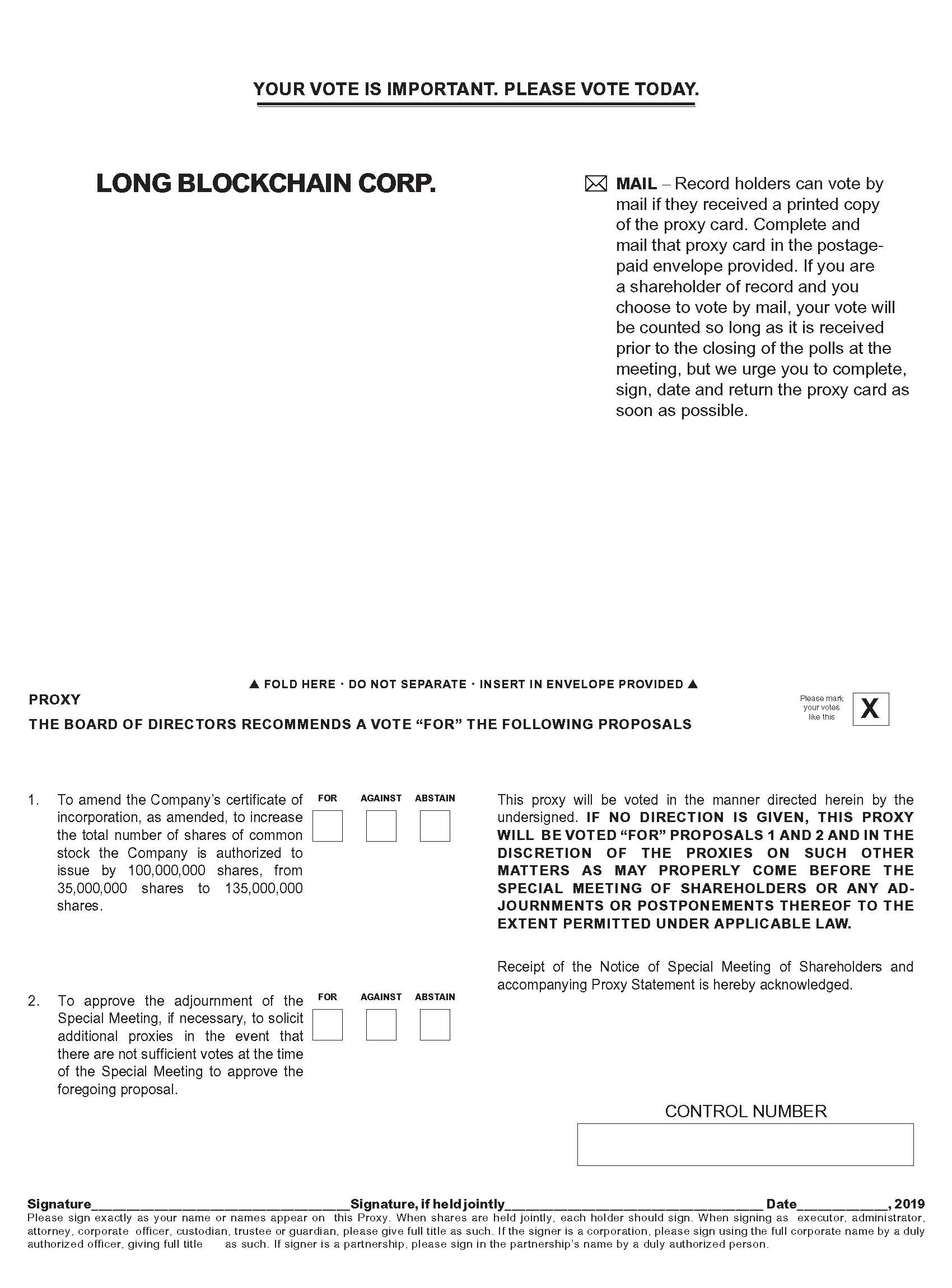

| 1. | to amend the Company’s certificate of incorporation, as amended (the “Certificate of Incorporation”), to increase the total number of shares of common stock the Company is authorized to issue by 100,000,000 shares, from 35,000,000 shares to 135,000,000 shares (the “Authorized Capital Increase Proposal”); and | |

| 2. | to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve the Authorized Capital Increase Proposal (the “Adjournment Proposal”). |

The Board has set the close of business on April 12, 2019 as the record date for the determination of stockholders who will be entitled to notice of and to vote at the Annual Meeting (the “record date”). The list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the Company’s headquarters at least ten days before the Annual Meeting.

Your vote is important no matter how many shares you own. Whether or not you expect to attend the meeting, please complete, sign and date the accompanying proxy and return it promptly in the enclosed postage paid reply envelope. Your prompt response is necessary to ensure that your shares are represented at the meeting. You can change your vote and revoke your proxy at any time before the meeting by following the procedures described in the accompanying proxy statement.

| By Order of the Board of Directors | |

| /s/ Andy Shape | |

| Andy Shape, Chief Executive Officer |

April 22, 2019

Farmingdale, New York

| Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 15, 2019: The Company’s Proxy Statement is available at http://www.cstproxy.com/longblockchain/sm2019. |

LONG

BLOCKCHAIN CORP.

12-1 Dubon Court

Farmingdale, New York 11735

PROXY STATEMENT

FOR

SPECIAL

MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 15, 2019

INTRODUCTION

The Company is providing this proxy statement in connection with the solicitation by the Board of proxies to be voted at the Special Meeting to be held on May 15, 2019, at 10:00 a.m., local time, and any adjournment or postponement thereof. The Special Meeting will be held at the offices of the Company’s general counsel, Graubard Miller, located at The Chrysler Building, 405 Lexington Avenue, 11th Floor, New York, New York 10174.

This proxy statement and the accompanying proxy card are being mailed beginning on or around April 22, 2019 in connection with the solicitation of proxies by the Board.

What proposals are being presented for a stockholder vote at the Annual Meeting?

There are two proposals being presented for stockholder vote at the Special Meeting:

| ● | the amendment of the Company’s Certificate of Incorporation to increase the total number of shares of common stock the Company is authorized to issue by 100,000,000 shares, from 35,000,000 shares to 135,000,000 shares, which we sometimes refer to as the “Authorized Capital Increase Proposal”; and | |

| ● | the adjournment of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve the Authorized Capital Increase Proposal, which we sometimes refer to as the “Adjournment Proposal.” |

What are the recommendations of the Board?

The Board recommends that you vote:

| ● | “FOR” the approval of the Authorized Capital Increase Proposal; and | |

| ● | “FOR” the approval of the Adjournment Proposal. |

Who is entitled to vote?

The holders of the Company’s common stock at the close of business on the record date, April 12, 2019, are entitled to vote at the Special Meeting. As of the record date, 31,249,641 shares of common stock were outstanding. Holders of the Company’s common stock have one vote for each share that they own on such date.

How do I submit my vote?

Record holders can vote by the following methods:

| ● | By mail. You may vote by proxy by completing the enclosed proxy card and returning it in the postage-paid return envelope. | |

| ● | In person. You may attend the Special Meeting and vote in person using the ballot provided to you at the meeting. |

Beneficial owners of shares held in street name may instruct their bank, broker or other nominee how to vote their shares. Beneficial owners should refer to the materials provided to them by their nominee for information on communicating these “voting instructions.” Beneficial owners may not vote their shares in person at the Special Meeting unless they obtain a legal proxy from the stockholder of record, present it to the inspector of election at the Special Meeting and produce valid identification. Beneficial owners should contact their bank, broker or other nominee for instructions regarding obtaining a legal proxy.

What is the difference between a “record holder” and a “beneficial owner” of the Company’s common stock?

If your shares are registered in your name with the Company’s transfer agent, Continental Stock Transfer and Trust Company, then you are considered the record holder for those shares. If you are the record holder of your shares, you have the right to vote your shares by proxy or to attend the meeting and vote in person.

If your shares are held through a bank, broker or other nominee, then you are considered to hold your shares in “street name.” While you are the “beneficial owner” of those shares, you are not considered the record holder. As the beneficial owner of shares of the Company’s common stock, you have the right to instruct your bank, broker or other nominee how to vote your shares. However, since you are not the record holder of your shares, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the stockholder of record.

What does it mean to vote “by proxy”?

When you vote by proxy, you grant another person the power to vote stock that you own. If you vote by proxy in accordance with this proxy statement, you will have designated the following individual as your proxy holder for the Special Meeting: Andy Shape, the Company’s Chief Executive Officer.

Any proxy given pursuant to this solicitation and received in time for the Special Meeting will be voted in accordance with your specific instructions. If you provide a proxy, but you do not provide specific instructions on how to vote on each proposal, the proxy holder will vote your shares “FOR” approval of the Authorized Capital Increase Proposal and “FOR” the Adjournment Proposal.

What happens if I do not provide voting instructions to my bank, broker or other nominee?

If you are a beneficial owner and do not provide your bank, broker or other nominee with voting instructions and do not obtain a legal proxy, under the rules of various national and regional securities exchanges, the bank, broker or other nominee may generally vote on routine matters but cannot vote on non-routine matters. If the bank, broker or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the bank, broker or other nominee will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

The Authorized Capital Increase Proposal and Adjournment Proposal are considered routine proposals, meaning that if you do not provide voting instructions, your bank, broker or other nominee will be permitted to vote on the proposals on your behalf. Therefore, broker non-votes generally will not occur with respect to these matters in connection with the Special Meeting. Despite the fact that your bank, broker or other nominee may vote your shares on your behalf, please complete, sign and date the accompanying proxy and return it promptly in the enclosed postage paid reply envelope, to ensure that your vote is counted.

How do I revoke my proxy or voting instructions?

A record holder may revoke his, her or its proxy by (i) submitting a written notice of revocation that is received by the Company’s Secretary at any time prior to the voting at the Special Meeting, (ii) submitting a subsequent proxy prior to the voting at the Special Meeting or (iii) attending the Special Meeting and voting in person. Attendance by a stockholder at the Special Meeting does not alone serve to revoke his or her proxy. Stockholders may send written notice of revocation to the Secretary, Long Blockchain Corp., 12-1 Dubon Court, Farmingdale, New York 11735.

| 2 |

Beneficial owners should refer to the materials provided to them by their bank, broker or other nominee for information on changing their voting instructions.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the common stock outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business. Abstentions are voted neither “FOR” nor “AGAINST” a matter, but are counted in the determination of a quorum. Similarly, shares may not be voted on a particular matter because a “broker non-vote” occurs, as described above, or because a stockholder otherwise withholds authority to vote the shares on such matter. The shares subject to a proxy which are not being voted on a particular matter because of a broker non-vote or because a stockholder has otherwise withheld authority will not be considered shares present and entitled to vote on the matter. These shares, however, may be considered present and entitled to vote on other matters and will count for purposes of determining the presence of a quorum, unless the proxy indicates that the shares are not being voted on any matter at the Special Meeting, in which case the shares will not be counted for purposes of determining the presence of a quorum.

How many votes are required to approve each proposal?

Authorized Capital Increase Proposal. Approval of the Authorized Capital Increase Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes and shares as to which a stockholder otherwise withholds authority to vote, which are not considered present and entitled to vote on this matter, also will have the same effect as a vote “AGAINST” this proposal

Adjournment Proposal. Approval of the Adjournment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock, represented in person or by proxy at the meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes and shares as to which a stockholder otherwise withholds authority to vote, which are not considered present and entitled to vote on this matter, will not have any effect on the vote with respect to this proposal.

Who is paying for this proxy statement and the solicitation of my proxy, and how are proxies solicited?

Proxies are being solicited by the Board for use at the Special Meeting. The Company’s officers and other employees, without additional remuneration, also may assist in the solicitation of proxies in the ordinary course of their employment. In addition to the use of the mail and the Internet, solicitations may be made personally or by email or telephone, as well as by public announcement. The Company will bear the cost of this proxy solicitation. The Company may also request brokers, dealers, banks and their nominees to solicit proxies from their clients where appropriate, and may reimburse them for reasonable expenses related thereto.

| 3 |

AUTHORIZED CAPITAL INCREASE PROPOSAL

On April 5, 2019, the Board unanimously adopted and declared the advisability of an amendment to the Company’s Certificate of Incorporation to increase the total number of shares of common stock the Company is authorized to issue by 100,000,000 shares, from 35,000,000 shares to 135,000,000 shares (the “Amendment”). The Board further directed that this Amendment be considered at a special meeting of stockholders. Accordingly, at the Special Meeting, stockholders will vote on a proposal to approve this Amendment. The form of the Amendment is attached as Annex A to this proxy statement.

If approved by the stockholders, the Amendment will become effective upon the filing of a certificate of amendment with the Secretary of State of the State of Delaware, which will occur as soon as reasonably practicable after the Special Meeting.

Description of the Amendment to the Certificate of Incorporation

If the Amendment is approved, the Board will be authorized to issue the additional shares of common stock, in its discretion, without further approval of the stockholders, and the Board does not intend to seek stockholder approval prior to any issuance of the shares of common stock, unless stockholder approval is required by applicable law, rule or regulation.

The additional shares of common stock for which authorization is sought would be identical to the shares of common stock the Company is presently authorized to issue. Holders of the common stock do not have preemptive rights to subscribe to additional securities which may be issued by the Company. The holders of the common stock are entitled to one vote for each share held of record on all matters to be voted on by stockholders. There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares of the common stock voted in an election of directors can elect all of the Company’s directors. The holders of the common stock are entitled to receive dividends when, as, and if declared by the Board out of funds legally available therefor. The Company has never paid dividends on its shares of common stock. In the event of the Company’s liquidation, dissolution or winding up, the holders of the common stock are entitled to share ratably in all assets remaining available for distribution after payment of liabilities and after provision has been made for each class of stock, if any, having preference over the common stock. There are no redemption or sinking fund provisions applicable to the common stock.

The Company’s Certificate of Incorporation also authorizes the Company to issue 1,000,000 shares of preferred stock, of which no shares were issued and outstanding as of the record date.

Reasons for the Amendment to the Certificate of Incorporation

As of April 8, 2018, 31,249,641 shares of the common stock were issued and outstanding, with 3,132,063 of such shares subject to cancellation pursuant to agreements with the holders thereof. In addition, as of such date, 46,750 shares of common stock were subject to outstanding options, 2,291,095 shares of common stock were subject to outstanding warrants, 3,793,009 shares were subject to outstanding convertible loans, as described below, and 2,393,831 shares of common stock were reserved for issuance as compensation to the Company’s current and former directors, officers and service providers (which shares may be issued pursuant to the Company’s equity compensation plans, to the extent available).

The Board believes approval of the amendment is in the best interests of the Company and its stockholders. The authorization of additional shares of common stock will enable the Company to meet its obligations under its outstanding options, warrants and convertible loans, as described below, while retaining flexibility to issue shares of common stock as equity compensation and respond to future business needs and opportunities. For example, the additional shares may be used as compensation to attract and retain qualified employees, for financing the Company’s business, for acquiring other businesses, or for forming strategic partnerships and alliances. The Company explores opportunities for strategic transactions that could result in the issuance of common stock, including equity capital raises, as they arise or as the Company’s needs require. Although the Company frequently reviews various transactions, the Company has no current agreement or commitment to issue additional shares of its common stock, except for issuances of common stock upon the exercise of its outstanding options and warrants, the conversion of its outstanding loans and in payment of compensation to its directors, officers and service providers, as described above.

| 4 |

The issuance of additional shares of common stock for which authorization is sought may have a dilutive effect on earnings per share and on the equity and voting power of existing security holders of the Company’s capital stock. It may also adversely affect the market price of the common stock. However, if the issuance of additional shares of common stock allows the Company to pursue its business plan and grow its business, the market price of the common stock may increase.

While not intended as an anti-takeover provision, the additional shares of common stock for which authorization is sought could also be used by management to oppose a hostile takeover attempt or to delay or prevent changes in control or management of the Company. For example, without further stockholder approval, the Board could strategically sell shares of common stock to purchasers who would oppose a takeover or favor the current Board. Although the Amendment has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at the Company), approval of the proposal could facilitate future efforts by management to deter or prevent changes in control of the Company, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and the Amendment is not being presented with the intent that it be utilized as a type of anti-takeover device or to secure management’s positions within the Company.

Convertible Loans and Warrants

On January 18, 2019, the Company and Court Cavendish Ltd., the lender (“Lender”) under the Company’s credit facility (the “Facility”), entered into a Second Amended and Restated Loan and Option Agreement (the “Restated Agreement”) for the Facility.

The Company previously had borrowed $3,000,000 under the Facility, of which $2,250,000 of principal (plus accrued interest) was outstanding as of immediately prior to entry into the Restated Agreement, and $750,000 of principal (plus accrued interest) had been converted into shares of the Company’s common stock at a price of $3.00 per share under the terms of the Facility as in effect at the time of such conversion. Upon entry into the Restated Agreement, $1,550,000 of principal plus all accrued interest was converted into 12,723,382 shares of the Company’s common stock, such that the average price for all shares issued under the Facility (including the prior conversion and certain fees previously paid in shares of the Company’s common stock) was $0.20 per share. In addition, the Company paid $40,000 to the Lender to cover the costs of the negotiation and execution of the Restated Agreement, which amount was added to the principal outstanding under the Facility, for an aggregate of $740,000 outstanding under the Facility immediately after entry into the Restated Agreement.

The Lender is not required to make any further extensions of credit under the Facility. Interest on the principal under the Facility continues to accrue monthly at the rate of 12.5% per annum and is payable quarterly in cash or common stock valued at $0.20 per share, at the Company’s election. The Facility will mature on December 21, 2019 (the “Maturity Date”). On the Maturity Date, all principal and any accrued but unpaid interest will be due and payable in cash or in shares of common stock valued at $0.20 per share, at the Lender’s election. The Lender also has the option, exercisable at any time prior to the Maturity Date, to have any principal and interest then outstanding converted into common stock at a price of $0.20 per share. The Company may prepay the amounts outstanding under the Facility (the “Loans”) at any time without premium or penalty. The Company granted to the Lender a security interest in all of its assets in order to secure its obligations under the Facility, pursuant to a security agreement with the Lender.

| 5 |

The Company also amended and restated the warrants previously issued to the Lender in connection with the Facility (the “Prior Warrants”), such that the Prior Warrants have a term of four years and will have an exercise price of $0.20 per share. Within 15 business days of obtaining the stockholder approval of the Authorized Capital Increase Proposal, the Company also will issue to certain of its key officers and consultants new four-year warrants to purchase 3,000,000 shares of the Company’s common stock at an exercise price of $0.25 per share (the “New Warrants,” and together with the Prior Warrants, the “Warrants”), including New Warrants to purchase 2,000,000 shares to Andy Shape, the Company’s Chief Executive Officer. The Lender requested that the Restated Agreement include provision for the New Warrants in order to ensure the interests of the recipients were aligned with those of the Lender.

Under the Restated Agreement, the Company is required to take all action necessary to increase the Company’s authorized shares of common stock to allow the Company to issue the maximum number of shares of its common stock into which the Loans and Warrants are then convertible or exercisable. Approval of the Authorized Capital Increase Proposal will satisfy this requirement.

The Facility has been the primary source of financing for the operations of the Company as it continues to pursue its business plan. The issuance of the Warrants and the grant of the option to convert the Loans into shares of common stock was offered to the Lender in order to induce the Lender to make the Loans and to extend their maturity date. The conversion of the Loans into common stock upon execution of the Restated Agreement, and the Company’s ability to pay the interest on the Loans in shares of common stock, also allow the Company to manage its liquidity. The Company is using the proceeds of the Loans, and will use the proceeds from any exercise of the Warrants, for working capital and other general corporate purposes.

Required Vote and Recommendation

Approval of the Authorized Capital Increase Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock entitled to vote thereon. Neither Delaware law, nor our Certificate Incorporation or bylaws, provides for appraisal or other similar rights for dissenting stockholders in connection with the Authorized Capital Increase Proposal. Accordingly, stockholders will have no right to dissent and obtain payment for their shares.

| THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE AUTHORIZED CAPITAL INCREASE PROPOSAL. |

| 6 |

ADJOURNMENT PROPOSAL

At the Special Meeting, if necessary, stockholders will vote on the Adjournment Proposal. If the Adjournment Proposal is adopted, the Board will have the discretion to adjourn the Special Meeting to a later date or dates to permit further solicitation of proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve the Authorized Capital Increase Proposal. It is possible for us to obtain sufficient votes to approve the Adjournment Proposal but not receive sufficient votes to approve the Authorized Capital Increase Proposal. In such a situation, the Company could adjourn the meeting for any number of days or hours as permitted under applicable law and attempt to solicit additional votes in favor of the Authorized Capital Increase Proposal.

In addition to an adjournment of the Special Meeting upon approval of the Adjournment Proposal, if a quorum is not present at the Special Meeting, the Company’s bylaws allow the Special Meeting to be adjourned for the purpose of obtaining a quorum. Any such adjournment may be made without notice, other than the announcement made at the Special Meeting, by the affirmative vote of a majority of the shares of common stock present in person or by proxy and entitled to vote at the Special Meeting. The Board also is empowered under Delaware law to postpone the meeting at any time prior to the meeting being called to order. In such event, the Company would issue a press release and take such other steps as it believes are necessary and practical in the circumstances to inform its stockholders of the postponement.

If the stockholders approve the Adjournment Proposal, and the Special Meeting is adjourned, the Company expects to use the additional time to solicit additional proxies in favor of the Authorized Capital Increase Proposal. Among other things, approval of the Adjournment Proposal could mean that, even if a majority of the Company’s common stock has been voted against the Authorized Capital Increase Proposal, the Company could adjourn the Special Meeting without a vote on the Authorized Capital Increase Proposal, and seek to convince the holders of those shares to change their votes.

The Adjournment Proposal will only be presented at the Special Meeting if there are not sufficient votes represented in person or by proxy for the Authorized Capital Increase Proposal. If the Adjournment Proposal is presented at the Special Meeting and is not approved, the Company may not be able to adjourn the Special Meeting to a later date. As a result, the Company may be prevented from increasing its authorized shares of common stock.

Required Vote and Recommendation

Approval of the Adjournment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock, represented in person or by proxy at the meeting and entitled to vote thereon.

| THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ADJOURNMENT PROPOSAL. |

| 7 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Security Ownership of Certain Beneficial Owners

The following table sets forth information regarding the beneficial ownership of the Company’s common stock as of April 12, 2019 by:

| ● | each person known by the Company to be the beneficial owner of more than 5% of the Company’s outstanding shares of common stock; | |

| ● | each of the Company’s officers and directors; and | |

| ● | all of the Company’s officers and directors as a group. |

The beneficial ownership of each person was calculated based on 31,249,641 shares of the Company’s common stock outstanding as of April 12, 2019. Of such outstanding shares, however, 3,132,063 are subject to cancellation pursuant to agreements with the holders thereof. Unless otherwise indicated, the Company believes that all persons named in the table below have sole voting and investment power with respect to all the shares of common stock beneficially owned by them.

| Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership | Percentage of Beneficial Ownership | ||||||

| Current Directors and Officers: | ||||||||

| Andy Shape(2) | 437,251 | 1.4 | % | |||||

| Thomas Cardella(3) | 63,262 | * | ||||||

| John Carson(3) | 22,043 | * | ||||||

| William Hayde(3) | 255,961 | * | ||||||

| Stephen Watkins | – | 0.0 | % | |||||

| All directors and executive officers (8 persons) | 778,517 | 2.5 | % | |||||

| Five Percent Holders: | ||||||||

| Court Cavendish Ltd(4) | 18,329,124 | 50.4 | % | |||||

| Andrew Stranberg(5) | 4,233,744 | 13.5 | % | |||||

| * | Less than one percent. |

| (1) | Unless otherwise indicated, the business address of each of the individuals is 12-1 Dubon Court, Farmingdale, New York 11735. |

| (2) | Includes 437,251 shares earned by Mr. Shape under his employment agreement dated July 26, 2018, but not yet issued. |

| (3) | Excludes 175,000, 175,000 and 233,330 shares payable to Messrs. Cardella, Carson and Hayde, respectively, upon certain conditions being met. |

| (4) | Includes (i) 3,793,009 shares issuable upon the conversion of the loans under the Facility and (ii) 1,300,000 shares issuable upon the exercise of the Prior Warrants. Dr. Patel is the controlling person of Court Cavendish Ltd. Accordingly, he may be deemed to have voting and dispositive power over the shares of common stock held by Court Cavendish Ltd. Dr. Patel disclaims ownership of the common stock held by Court Cavendish Ltd, except to the extent of his pecuniary interest therein. The business address of Court Cavendish Ltd and Dr. Patel is The Riverbridge House, Guildford Road, Leatherhead, Surrey, KT22 9AD, United Kingdom. |

| (5) | Includes 2,500,000 shares of common stock held by Stran & Company, Inc. (“Stran”). Excludes 450,000 shares of common stock issuable upon the exercise of warrants held by Stran, due to limitations preventing such warrants from being exercised to the extent Mr. Stranberg would own more than 9.9% of the Company’s common stock upon such exercise. Mr. Stranberg is the controlling person of Stran. Accordingly he may be deemed to have sole voting and dispositive power over the Shares held by Stran. The business address of each of Mr. Stranberg and Stran & Co. is 2 Heritage Drive, Quincy, Massachusetts 02171. |

The foregoing table does not reflect 1,949,736 shares held by TSLC Pte Ltd. While such shares presently remain outstanding, effective as of October 16, 2018, TSLC Pte Ltd agreed to cancel, and relinquished all rights in, such shares.

| 8 |

DISCRETIONARY VOTING OF PROXIES ON OTHER MATTERS

The Company does not intend to bring before the Special Meeting any matters other than those specified in the Notice of the Special Meeting, and the Company does not know of any business which persons other than the Board intend to present at the Special Meeting. Should any business requiring a vote of the stockholders, which is not specified in the notice, properly come before the Special Meeting, the proxy holders specified in this proxy statement and in the accompanying proxy card intend to vote the shares represented by them in accordance with their best judgment.

STOCKHOLDER PROPOSALS AND NOMINATIONS

The Company intends to hold its 2019 annual meeting of stockholders on October 1, 2019. A proposal that a stockholder intends to present at the 2019 annual meeting of stockholders and wishes to be considered for inclusion in the Company’s proxy materials must be received no later than July 3, 2019, which is a reasonable time prior to when the proxy materials will be mailed. All proposals must comply with Rule 14a-8 under the Exchange Act.

The Company’s bylaws contain provisions intended to promote the efficient functioning of stockholder meetings. Some of the provisions require advance notice to the Company of stockholder proposals or director nominations to be considered at an annual meeting. Under the Company’s bylaws, in order to properly bring stockholder proposals or director nominations before an annual meeting, even if the stockholder does not intend to include such proposal in the Company’s proxy materials, the stockholder must deliver written notice of such proposal or nomination to the Secretary not less than 60 days nor more than 90 days prior to the meeting; provided, however, that in the event that less than 70 days’ notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by a stockholder, to be timely, must be received no later than the close of business on the 10th day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made. Accordingly, for the 2019 annual meeting of stockholders, this notice must be received no earlier than July 3, 2019 and no later than August 2, 2019. A notice of a stockholder proposal or director nomination must include the information set forth in the Company’s bylaws. Stockholder proposals and director nominations should be addressed to Secretary, Long Blockchain Corp., 12-1 Dubon Court, Farmingdale, New York 11735.

Dated April 22, 2019

| 9 |

ANNEX A

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

OF

LONG BLOCKCHAIN CORP.

Pursuant to Section 242 of the

General Corporation Law of Delaware

The undersigned Chairman and Chief Executive Officer of Long Blockchain Corp. (the “Corporation”) does hereby certify:

FIRST: The name of the Corporation is Long Blockchain Corp.

SECOND: The certificate of incorporation of the Corporation is hereby amended by deleting the first paragraph of Article FOURTH in its entirety and by substituting the following new first paragraph of Article FOURTH in lieu thereof:

“FOURTH: The total number of shares of stock the Corporation is authorized to issue is 135,000,000 shares of common stock and 1,000,000 shares of preferred stock and the par value of each of such shares is $.0001 per share.”

THIRD: The foregoing amendment to the Corporation’s certificate of incorporation was duly adopted in accordance with the provisions of Sections 242 of the Delaware General Corporation Law.

IN WITNESS WHEREOF, the undersigned has signed this certificate of amendment on this ___ day of ________, 2019.

| Andy Shape, Chief Executive Officer |

| A-1 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- Dicello Levitt LLP Announces Investor Class Action Lawsuit Filed Against QuidelOrtho Corp. f/k/a Quidel Corp. (NASDAQ: QDEL) And Lead Plaintiff Deadline

- ROSEN, NATIONAL TRIAL LAWYERS, Encourages Northern Genesis Acquisition Corp. n/k/a The Lion Electric Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – NGA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share