Form DEF 14A Isoray, Inc. For: Dec 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

Isoray, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

October 27, 2020

Dear Stockholder:

You are cordially invited to attend the Fiscal 2021 Annual Meeting of Stockholders, and any adjournment, postponement or other delay thereof (the “Annual Meeting”), of Isoray, Inc., a Delaware corporation (“Isoray” or the “Company”), which will be held at the office of Gallagher & Kennedy, P.A., 2575 East Camelback Road, Phoenix, Arizona 85016 at 11:00 a.m. Mountain Time on Tuesday, December 8, 2020.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting, we will also report on the operations of the Company and its primary operating subsidiary, Isoray Medical, Inc. Directors and officers of the Company are expected to be present to respond to appropriate questions from stockholders. This Notice of Annual Meeting, Proxy Statement and accompanying proxy card are being distributed on or about October 27, 2020.

The Company’s principal executive office is 350 Hills Street, Suite 106, Richland, Washington 99354. Detailed information concerning our activities and operating performance during the fiscal year ended June 30, 2020 is contained in our Annual Report to Stockholders on Form 10-K.

As we have done in the past, this year, in accordance with U.S. Securities and Exchange Commission (“SEC”) rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this procedure makes the proxy distribution process more efficient, less costly and helps in conserving natural resources.

Whether or not you expect to attend in person, we urge you to vote your shares as soon as possible. As an alternative to voting in person at the meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting by any of these methods will ensure your representation at the meeting and will help ensure the presence of a quorum at the meeting.

Your vote is important. Whether or not you are able to attend in person, it is important that your shares be represented at the Annual Meeting. Accordingly, we ask that you please vote over the Internet or by telephone at your earliest convenience, or, if you receive a paper proxy card and voting instructions by mail, that you complete, sign and date the proxy card and return it in the enclosed envelope (to which no postage need be affixed if mailed in the United States) as soon as possible. If you do attend the Annual Meeting, you may change your vote by voting personally on each matter brought before the meeting.

We look forward to seeing you at the Annual Meeting.

If You Plan to Attend in Person:

Please note that space limitations make it necessary to limit attendance to stockholders. Admission to the meeting will be on a first-come, first-served basis. Stockholders holding stock in brokerage accounts (“street name” holders) will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date to enter the meeting. Cameras, recording devices and other electronic equipment will not be permitted in the meeting.

Sincerely,

Lori A. Woods

Chief Executive Officer

350 Hills Street, Suite 106

Richland, Washington 99354

www.isoray.com

ISORAY, INC.

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

|

TIME AND DATE |

11:00 a.m., Mountain Time, on Tuesday, December 8, 2020. |

|

|

|

|

|

|

PLACE |

Gallagher & Kennedy, P.A., 2575 East Camelback Road, Phoenix, Arizona 85016. |

|

|

|

|

|

|

ITEMS OF BUSINESS |

1. |

To elect four directors to hold office until the Fiscal 2022 Annual Meeting of Stockholders. |

|

|

|

|

|

|

2. |

To ratify the appointment of DeCoria, Maichel & Teague, P.S. as the independent registered public accounting firm of the Company for the fiscal year ending June 30, 2021. |

|

|

|

|

|

|

3. |

To hold an advisory vote on whether the Company should include an advisory vote of the stockholders on the compensation of the Company's named executive officers pursuant to Section 14A of the Securities Exchange Act every one, two, or three years. |

|

|

|

|

|

|

4. |

To take action on any other business that may properly be considered at the Annual Meeting or any adjournment thereof. |

|

|

|

|

|

BOARD OF DIRECTORS RECOMMENDATION |

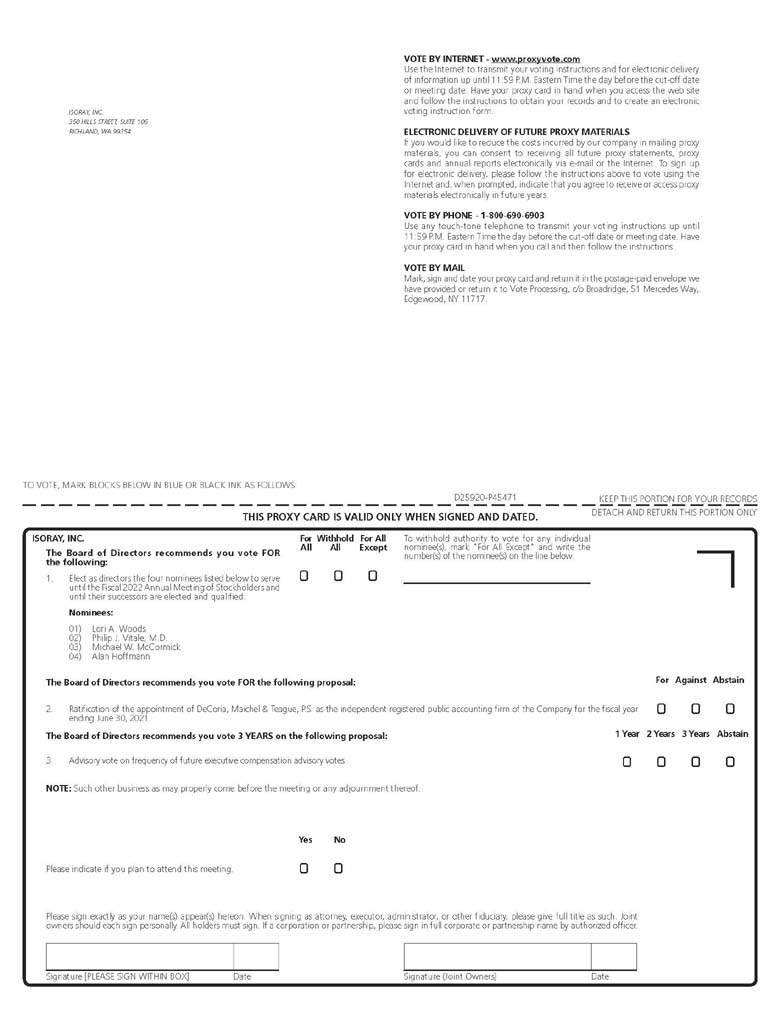

The Board of Directors recommends that you vote “FOR ALL” for the election of each nominee for the Board of Directors, “FOR” Proposal 2, and “3 YEARS” on Proposal 3. |

|

|

|

|

|

|

ADJOURNMENTS AND POSTPONEMENTS |

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. |

|

|

|

|

|

|

RECORD DATE |

You may vote at the Annual Meeting if you were a stockholder of record at the close of business on October 15, 2020. If your shares are held in an account at a brokerage firm, bank or similar organization, that organization is considered the record holder for purposes of voting at the Annual Meeting and will provide you with instructions on how you can direct that organization to vote your shares. |

|

|

|

|

|

|

INTERNET ACCESS TO PROXY MATERIALS |

Under rules adopted by the SEC, we are providing access to our Fiscal 2021 Annual Meeting materials, which include the accompanying Proxy Statement, over the Internet in lieu of mailing printed copies. We will begin mailing, on or about October 29, 2020, a “Notice of Internet Availability of Proxy Materials” (which is different than this Notice of Annual Meeting of Stockholders) to our stockholders. The Notice of Internet Availability of Proxy Materials will contain instructions on how to access and review the Annual Meeting materials and vote online. The Notice of Internet Availability of Proxy Materials also will contain instructions on how you can request a printed copy of the Annual Meeting materials, including a proxy card if you are a record holder or a voting instruction form if you are a beneficial owner. |

|

|

VOTING |

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying Proxy Statement and vote as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the Notice of Internet Availability of Proxy Materials and the section entitled “General Information About the Annual Meeting and Voting” beginning on page 1 of the accompanying Proxy Statement. |

|

|

|

|

|

|

ADMISSION |

Space limitations make it necessary to limit attendance at the Annual Meeting to stockholders. If your shares are held in an account at a brokerage firm, bank or similar organization and you wish to attend the Annual Meeting, you must obtain a letter from that brokerage firm, bank or similar organization confirming your beneficial ownership of the shares as of the record date and bring it to the Annual Meeting. Admission to the Annual Meeting will be on a first-come, first-served basis. Cameras and recording devices and other electronic equipment will not be permitted at the Annual Meeting. |

|

|

|

By Order of the Board of Directors,

Mark Austin Secretary |

This Notice of Annual Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about October 27, 2020.

ISORAY, INC.

350 Hills Street, Suite 106

Richland, Washington 99354

____________________

PROXY STATEMENT

Annual Meeting of Stockholders

December 8, 2020

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Isoray, Inc. of proxies to be voted at the Annual Meeting of Stockholders to be held at Gallagher & Kennedy, P.A., 2575 East Camelback Road, Phoenix, Arizona 85016 at 11:00 a.m. Mountain Time on Tuesday, December 8, 2020 (the “Annual Meeting”), and at any adjournment or postponement of the Annual Meeting. These proxy materials were first sent on or about October 27, 2020 to stockholders entitled to vote at the Annual Meeting. This proxy is solicited on behalf of the Board.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

You are receiving a proxy statement from us because you were the stockholder of record or beneficial owner of shares of our Common or Series B Preferred Stock at the close of business on the record date of October 15, 2020 (the “Record Date”) for the Annual Meeting. This Proxy Statement contains important information about the Annual Meeting and the items of business to be transacted at the Annual Meeting. You are strongly encouraged to read this Proxy Statement and Annual Report to Stockholders on Form 10-K, which include information that you may find useful in determining how to vote.

Who is entitled to attend and vote at the Annual Meeting?

Stockholders as of the Record Date are entitled to attend and to vote at the Annual Meeting. If your shares are held in an account at a brokerage firm, bank or similar organization, that organization is considered the record holder for purposes of voting at the Annual Meeting and will provide you with instructions on how to direct that organization to vote your shares.

How many shares are outstanding?

On the Record Date, 68,897,779 shares of our Common Stock were issued and outstanding and 59,065 shares of our Series B Preferred Stock were issued and outstanding. Each share of Common Stock and Series B Preferred Stock outstanding on the Record Date is entitled to one vote on each item brought before the stockholders at the Annual Meeting.

How many shares must be present or represented to conduct business at the Annual Meeting?

The presence, in person or by proxy, of a majority of the outstanding shares of our Common Stock and Series B Preferred Stock voting together as one class is necessary to constitute a quorum at the Annual Meeting. In counting the votes to determine whether a quorum exists at the Annual Meeting, we will use the proposal receiving the greatest number of all votes “for” or “against” and abstentions (including instructions to withhold authority to vote).

What shares can I vote at the Annual Meeting?

You may vote all of the shares you owned as of the Record Date, including shares held directly in your name as the stockholder of record and all shares held for you as the beneficial owner through a broker or other nominee, such as a bank.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares through a bank, broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those beneficially owned.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and we are sending our Notice of Internet Availability for Proxy Materials, which contains instructions on how to access and review the Annual Meeting materials and vote online. The Notice of Internet Availability for Proxy Materials also contains instructions on how you can request a printed copy of the Annual Meeting materials. As the stockholder of record, you have the right to vote in person or direct a proxyholder to vote your shares on your behalf at the Annual Meeting by signing and dating the enclosed proxy card and returning it to us in the enclosed postage-paid return envelope, or by following the procedures for voting over the Internet or by telephone.

Beneficial Owner. If your shares are held by a bank, broker or other nominee, you are considered the beneficial owner of those shares and they are considered to be held in “street name” for your account. That institution will send you separate instruction describing the procedure for voting your shares. Please follow the directions you are given carefully so that your vote is counted. As a beneficial owner, you may also vote in person at the Annual Meeting, but only after you obtain and present a “legal proxy” from your bank, broker or other nominee, giving you the right to vote your shares at the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or as a beneficial owner, you may direct how your shares are voted without attending the Annual Meeting by voting on the Internet, by phone or by proxy card. If you provide specific instructions with regard to items of business to be voted on at the Annual Meeting, your shares will be voted as you instruct on those items. When you sign and return the proxy card, you appoint Lori A. Woods and Philip Vitale, and each of them individually, as your representatives at the meeting. Lori A. Woods and Philip Vitale will vote your shares at the meeting as you have instructed them. This way your shares will be voted regardless of whether you attend the Annual Meeting. Even if you plan to attend the meeting, it is a good idea to complete, sign and return the enclosed proxy card in advance of the meeting just in case your plans change. Returning the proxy card will not affect your right to attend or vote at the Annual Meeting.

If you just sign your proxy card with no further instructions, or if you electronically transmit your proxy card but do not direct your vote on particular items, your shares will be voted in accordance with the Board’s recommendation on those items. If you hold your shares in “street name” as a beneficial owner and you do not instruct your bank, broker or other nominee how to vote your shares, your bank, broker or other nominee will only be able to vote your shares with respect to the routine matter of appointment of DeCoria, Maichel & Teague, P.S. as our independent registered public accounting firm for the fiscal year ending June 30, 2021. Please see “What is a broker non-vote?” below.

What proposals will be voted on at the Annual Meeting?

Three proposals are scheduled to be voted on at the Annual Meeting. The first is the election of four directors to hold office until the Fiscal 2022 Annual Meeting of Stockholders. The second is the ratification of the appointment by the Audit Committee of DeCoria, Maichel & Teague, P.S. as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2021. The third is an advisory vote on whether to hold an advisory vote of the stockholders on the compensation of the Company’s named executive officers pursuant to Section 14A of the Securities Exchange Act every one, two, or three years.

What happens if additional matters are presented at the Annual Meeting?

The only items of business that our Board intends to present at the Annual Meeting are set forth in this Proxy Statement. As of the date of this Proxy Statement, no stockholder has advised us of the intent to present any other matter, and we are not aware of any other matters to be presented at the Annual Meeting.

How can I attend the Annual Meeting?

Whether you hold shares in your name as the stockholder of record or beneficially own shares held in “street name,” you should be prepared to present photo identification for admittance to the Annual Meeting. Please also note that if you are a “street name” holder, you will need to provide proof of beneficial ownership as of the Record Date, such as your most recent brokerage account statement, a copy of the voting instruction card provided by your bank, broker or other nominee, or other similar evidence of ownership for admittance to the Annual Meeting. The Annual Meeting will begin promptly at 11 a.m. local time. Check-in will begin at 10:30 a.m. local time. However, if you are a “street name” holder, you may not vote at the Annual Meeting unless you have obtained a “legal proxy” from your broker, bank or other nominee. Even if you plan to attend the Annual Meeting, we recommend that you also vote by Internet, telephone or sign and date the proxy card or voting instruction card and return it promptly in order to ensure that your vote will be counted if you later decide not to, or are unable to, attend the Annual Meeting.

Can I change my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time prior to the vote at the Annual Meeting. If you are the stockholder of record, you may change your vote by (i) granting a new proxy bearing a later date, which automatically revokes your earlier proxy, (ii) providing a written notice of revocation to our Corporate Secretary at our principal executive offices prior to the Annual Meeting, or (iii) attending the Annual Meeting and voting in person. However, attendance at the Annual Meeting but not voting in person will not cause your previously granted proxy to be revoked unless you specifically so request. If you are a beneficial owner, you may change your vote by (i) submitting a new voting instruction card to your bank, broker or other nominee, or (ii) if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

What is a “broker non-vote”?

A broker holding your shares in “street name” must vote those shares according to any specific instructions it receives from you. In the absence of such instructions, your broker does not have discretion to vote your shares on any proposal that is considered to be “non-discretionary,” and may, but is not required to, vote your shares on any “discretionary” proposal. We believe that Proposal 2 is the only discretionary proposal. If your broker does not vote your shares at the Annual Meeting on a matter, it gives rise to what is called a “broker non-vote.”

How are “broker non-votes” counted?

Under the rules of the New York Stock Exchange (the “Exchange”) that govern most domestic stock brokerage firms, member firms that hold shares in “street name” for beneficial owners may, to the extent that such beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for stockholder action, vote in their discretion upon proposals which are considered “discretionary” proposals under the rules of the Exchange. These votes by brokerage firms are considered as votes cast in determining the outcome of any discretionary proposal. Member brokerage firms that have received no instructions from their clients as to “non-discretionary” proposals do not have discretion to vote on these proposals. If the brokerage firm returns a proxy card without voting on a non-discretionary proposal because it received no instructions, this is referred to as a “broker non-vote” on the proposal. “Broker non-votes” are considered in determining whether a quorum exists at the Annual Meeting.

In summary, if you do not vote your proxy, your brokerage firm or other nominee may either:

|

● |

vote your shares on discretionary matters (Proposal 2) and cast a “broker non-vote” on non-discretionary matters (Proposals 1 and 3); or |

|

|

|

|

|

|

● |

leave your shares unvoted altogether. |

We encourage you to provide instructions to your brokerage firm or other nominee by voting your proxy. This action ensures that your shares will be voted in accordance with your wishes at the Annual Meeting.

How many votes are required to approve the proposals?

You may vote either “FOR ALL”, “WITHHOLD ALL,” or “FOR ALL EXCEPT” certain nominees for Proposal 1. The vote with respect to the election of directors (Proposal 1) is governed by Delaware law and the Company’s bylaws and is a plurality of the votes cast by the holders of shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As a result, votes that are withheld from voting (whether by abstention, broker non-vote, or otherwise) will be counted in determining whether a quorum is present but will have no other effect on the election of directors. The four persons receiving the highest number of affirmative votes will be elected as directors of the Company.

You may vote either “FOR,” “AGAINST,” or “ABSTAIN” on Proposal 2. The vote required to ratify the re-appointment of our independent registered public accounting firm (Proposal 2) is governed by Delaware law and the Company’s bylaws and is the affirmative vote of a majority in voting power of shares of stock present in person or represented by proxy and entitled to vote thereon. As a result, abstentions will be considered in determining whether a quorum is present and the number of votes required obtaining the necessary majority vote, and therefore will have the same effect as voting against Proposal 2.

Because your vote on Proposal 2 is advisory, it will not be binding on the Board or the Company. However, the Board and the Audit Committee will consider the outcome of the advisory vote when making future decisions regarding the selection of our independent registered public accounting firm.

You may vote either “1 YEAR,” “2 YEARS,” “3 YEARS,” or “ABSTAIN” on Proposal 3. By voting on Proposal 3, stockholders may indicate whether they would prefer an advisory vote to approve our named executive officer compensation every one, two, or three years. A frequency of every one, two, or three years must receive a plurality of the votes represented and entitled to vote on this proposal at the meeting to be deemed by us as the frequency for the advisory vote that has been selected by stockholders. As a result, votes that are withheld from voting (whether by abstention, broker non-vote, or otherwise) will be counted in determining whether a quorum is present but will have no other effect on the frequency of the advisory vote on named executive officer compensation.

Because your vote on Proposal 3 is advisory, it will not be binding on the Board or the Company. However, the Board will consider the outcome of the advisory vote when making future decisions regarding executive compensation of our named executive officers.

If you withhold authority to vote for the election of directors, your shares will not be voted with respect to the director or directors identified. If you sign and submit your proxy card without voting instructions, your shares will be voted “FOR ALL” director nominees, “FOR” proposal 2, and “3 YEARS” on Proposal 3.

What happens if the Annual Meeting is adjourned?

If the Annual Meeting is adjourned until another time, no additional notice will be given regarding the time or location that the Annual Meeting will be continued, if this information is announced at the time of the adjournment, unless the adjournment is for more than 30 days, in which case a notice of the time and location will be given to each stockholder of record entitled to vote at the Annual Meeting. Any items of business that might have been properly transacted at the Annual Meeting may be transacted at any adjournment.

Who will serve as inspector of elections?

The Secretary of the Company, Mark Austin, will tabulate the votes cast at the meeting in combination with the votes cast prior to the meeting and act as the Inspector of Elections at the Annual Meeting.

Will I be receiving printed copies of the Fiscal 2021 Annual Meeting materials?

You will not receive printed copies unless you request them by following the instructions in the “Notice of Internet Availability of Proxy Materials” (the “Notice”) that you will receive in the mail. The Notice is different than the Notice of Annual Meeting of Stockholders that accompanies this Proxy Statement. We will begin mailing the Notice to stockholders on or about October 29, 2020.

Under rules adopted by the SEC, we are providing access to our Annual Meeting materials, which include this Proxy Statement and Annual Report to Stockholders on Form 10-K, over the Internet in lieu of mailing printed copies. The Notice will contain instructions on how to access and review the Annual Meeting materials and vote online. This electronic access process is designed to expedite stockholders’ receipt of materials, lower the cost of the Annual Meeting and help conserve natural resources. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

The Notice also will contain instructions on how you can request, at no cost, a printed copy of the Annual Meeting materials, including a proxy card if you are a record holder or a voting instruction form if you are a beneficial owner. By following the instructions in the Notice, you may request to receive, at no cost, a copy via e-mail of the Annual Meeting materials or future proxy solicitations. Your request to receive materials via e-mail will remain in effect until you terminate it.

Can I mark my votes on the Notice and send it back to the Company or my broker?

No. The Notice is not a ballot. You cannot use it to vote your shares. If you mark your vote on the Notice and send it back to the Company or your broker, your vote will not count.

How can I get electronic access to the Annual Meeting materials?

The Notice will provide you with instructions regarding how to view the Annual Meeting materials on the Internet.

This Proxy Statement and Annual Report to Stockholders on Form 10-K are also available without charge on the Company’s website at www.isoray.com and the SEC’s website at sec.gov. By referring to our website, we do not incorporate the website or any portion of the website by reference into this Proxy Statement.

The Notice will also contain instructions on how you can elect to receive future proxy materials electronically by e-mail. Choosing to receive future proxy materials by e-mail will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s Annual Meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and publish the final voting results in a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

What is the deadline for submitting proposals for consideration at the next Annual Meeting of stockholders or to nominate individuals to serve as directors?

As a stockholder, you may be entitled to present proposals for action at a future Annual Meeting of stockholders, including director nominations. Please refer to “Stockholder Proposals and Director Nominations” below.

How many shares of Common and Series B Preferred Stock are held or controlled by the officers and directors?

As of October 15, 2020, our directors and executive officers held or controlled approximately 888,873 shares of our Common Stock, constituting approximately 4.58% of the outstanding Common Stock. As of October 15, 2020, our directors and executive officers did not hold or control any shares of our Series B Preferred Stock. We believe that these holders will vote all of their shares of Common Stock in accordance with the Board’s recommendations on each of the proposals. On October 22, 2020, all of our Series B Stock converted into 59,065 shares of Common Stock as a result of the Company conducting a firm commitment offering of over $9 million.

How does the Board recommend that I vote?

The Board recommends that you vote “FOR ALL” for the election of each nominee for the Board, “FOR” Proposal 2, and “3 YEARS” on Proposal 3.

How do I vote my shares without attending the Annual Meeting?

Stockholders of record can vote as follows:

|

|

● |

Via the Internet: Stockholders may vote through the Internet by following the instructions included with your Notice Regarding the Availability of Proxy Materials. |

|

|

|

|

|

|

● |

By Telephone: Stockholders may vote by telephone by following the instructions included with your Notice Regarding the Availability of Proxy Materials. |

|

|

|

|

|

|

● |

By Mail: Those stockholders who receive a paper proxy card in the mail may sign, date and return their proxy cards in the pre-addressed, postage-paid envelope that is provided with the mailed proxy materials. If you have misplaced your return envelope or need to return a proxy card from outside the United States, you may mail your proxy card to the address listed on the proxy card. |

|

|

|

|

|

|

● |

At the Meeting: If you attend the Annual Meeting, you may vote in person by ballot, even if you have previously returned a proxy card or otherwise voted. |

If your shares are held in “street name” through a broker, bank or other nominee, that institution will send you separate instructions describing the procedure for voting your shares. Please follow the directions you are given carefully so your vote is counted. “Street name” stockholders who wish to vote in person at the Annual Meeting will need to obtain a proxy form from the institution that holds your shares and present it to the inspector of elections with your ballot.

How do I vote my shares in person at the Annual Meeting?

If you are a stockholder of record and prefer to vote your shares at the Annual Meeting, you should bring the enclosed proxy card or proof of identification to the Annual Meeting. You may vote shares held in “street name” at the Annual Meeting only if you obtain a signed legal proxy from the record holder (broker or other nominee) giving you the right to vote the shares.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone or proxy card so your vote will be counted even if you later decide not to attend the Annual Meeting.

May stockholders ask questions at the Annual Meeting?

Yes. Representatives of the Company will answer a limited number of stockholders’ questions of general interest at the end of the Annual Meeting. In order to give a greater number of stockholders an opportunity to ask questions, individuals or groups will be allowed to ask only one question and no repetitive or follow-up questions will be permitted.

What does it mean if I receive more than one proxy card?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, sign and return each proxy card.

May I change my vote?

Yes. If you vote by mail, Internet or telephone, you may later change your vote and revoke your proxy card by:

|

|

● |

Sending a written statement to that effect to the Secretary of the Company that is received before the commencement of the Annual Meeting on December 8, 2020; |

|

|

● |

Voting again via the Internet or telephone; |

|

|

|

|

|

|

● |

Submitting a properly signed proxy card with a later date; |

|

|

|

|

|

|

● |

Voting in person at the Annual Meeting; or |

|

|

|

|

|

|

● |

If you hold shares through a bank or brokerage firm, by contacting your financial institution and following its procedure to revoke your prior voting instructions. |

Are there any rights of appraisal or similar rights of dissenters with respect to any matter to be acted upon at the Annual Meeting?

No, rights of appraisal or similar rights of dissenters do not apply to any of the proposals to be acted upon at the Annual Meeting.

|

PROPOSAL 1 – ELECTION OF DIRECTORS |

Nominees

Our Board currently consists of four members. The Board oversees our business affairs and monitors the performance of management. In accordance with basic principles of corporate governance, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chairman, key executive officers and our principal external advisers (legal counsel, auditors, and other professionals), by reading reports and other materials that are sent to them and by participating in Board and committee meetings.

The Board, on the recommendation of the Nominations and Corporate Governance Committee, has nominated the following four existing members of the Board for re-election to the Board at the Fiscal 2021 Annual Meeting: Michael W. McCormick, Lori A. Woods, Philip J. Vitale, M.D., and Alan Hoffmann. If elected as a director at the Annual Meeting, each of the nominees would serve a one-year term expiring at the Fiscal 2022 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified. There are no family relationships among our directors, nominees for director, or our executive officers.

Each of the nominees has consented to serve as a director if elected. If any of the nominees should be unavailable to serve for any reason, the Board, upon the recommendation of the Nominations and Corporate Governance Committee, may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

Directors

Set forth below is certain information as of October 15, 2020 regarding our current directors that have been nominated for re-election, including biographical information.

Ms. Woods took office on June 4, 2018, Dr. Vitale took office in January 2014, Mr. McCormick took office in June 2015, and Mr. Hoffmann took office in January 2016.

|

Name |

Age |

Position Held |

Term |

|

Michael W. McCormick |

57 |

Chairman, Director |

Annual |

|

Lori A. Woods |

58 |

Chief Executive Officer, Director |

Annual |

|

Philip J. Vitale |

74 |

Director |

Annual |

|

Alan Hoffmann |

59 |

Director |

Annual |

Each member of the Board serves a one-year term and is subject to reelection at the Company’s Annual Meeting of Stockholders held each year.

Lori Woods – Ms. Woods has been a Director of the Company since June 4, 2018 and brings more than 30 years of experience in the healthcare industry and is particularly well-known and respected in the brachytherapy community. Ms. Woods returned to Isoray after previously serving as Vice President from 2006 to February 2008, at which time she was appointed Acting Chief Operating Officer before her appointment to Chief Operating Officer in February 2009, a position she held until January 2010. Beginning in February 2016, and continuing until her appointment as Interim CEO on June 4, 2018, Ms. Woods served as a senior consultant to Isoray. Ms. Woods was appointed CEO of the Company on December 12, 2018. From February 16, 2016 to June 3, 2018, Ms. Woods was a founder of Medvio, LLC, a medical device consulting company focused on the urology and oncology space. During her time at Medvio she worked with large public and international medical device companies, supporting the approval process and distribution of products in diverse international markets. Further, she worked with various partners to develop proprietary technologies for the colorectal and liver treatment markets. Previously, from January 2002 to July 2006, Ms. Woods served as Chief Executive Officer of Pro-Qura, Inc., a privately-owned cancer treatment management company focused on the quality delivery of brachytherapy treatments for prostate cancer. She has also served as the Director of Business Development for the Tumor Institute Radiation Oncology Group and the Seattle Prostate Institute (SPI) in Seattle, WA. SPI was an early innovator in prostate brachytherapy treatments and assisted in the training of more than 2,000 physicians in the use of prostate brachytherapy. Ms. Woods served as a board member of the Northwest division of the Juvenile Diabetes Research Foundation, focusing on their digital awareness programs, including their website and SEO strategy, and their public relations efforts. Ms. Woods earned a Bachelor of Science degree in Business Administration – Marketing and Communications from Loma Linda University, CA. Ms. Woods brings to the Board extensive experience and credibility in the brachytherapy industry and strong relationships with suppliers and distributors of brachytherapy products.

Philip Vitale, MD – Dr. Vitale has been a Director of the Company since 2014 and is a board certified urologist. He practiced Urology from 1978 to 2005 at Lovelace Health Systems in Albuquerque. He also served on the Board of Governors for 9 years and held various administrative positions including Chief Medical Officer and Senior Vice President at Lovelace. He was a staff urologist at Albuquerque VA Medical Center from 2005 until his retirement in November 2014. He served as Chief of the Urology section from 2008 to November 2013. Dr. Vitale was also an Assistant Professor at the University of New Mexico, Division of Urology. He is a member of the American Urological Association and the South Central Section of the American Urological Association. Prior to his retirement, Dr. Vitale’s clinical trials included: chemotherapy after prostatectomy (cap); a phase III randomized study for high risk prostate carcinoma; RTOG 0415 a phase III randomized study of hypofractionated 3d-crt/IMRT versus conventionally fractionated 3d-crt/IMRT in patients with favorable-risk prostate cancer; RTOG 0815 a phase III prospective randomized trial of dose-escalated radiotherapy with or without short-term androgen deprivation therapy for patients with intermediate-risk prostate cancer; and YP19A1 gene and pharmacogenetics of response to testosterone therapy. Dr. Vitale holds a B.A. in Biology from LaSalle College and obtained his M.D. from the New Jersey College of Medicine and Dentistry. He received his M.S. in Health Services Administration from the College of St. Francis. Dr. Vitale brings to the Board medical expertise in the industries the Company is targeting.

Michael McCormick – Mr. McCormick has been a Director of the Company since June 2015 and brings over 25 years of senior executive positions in global management, sales, and marketing to the Company. He was appointed Chairman of the Board effective as of June 4, 2018. He serves as a founder and partner of GO Intellectual Capital, which offers marketing services with a focus on the medical and aviation industries, as well as financial services. Previous to his service with GO, Mr. McCormick served as Executive Vice President of Global Sales and Marketing for Columbia Sportswear from 2006-2012, where his team successfully launched several new patented technologies, including Omni-Heat® Reflective and Omni-Freeze® Zero. During Mr. McCormick’s tenure, Columbia built an intellectual property portfolio with over 200 patents. Mr. McCormick started his career with Nike, working in several senior management roles and ultimately becoming the Director of National Sales, U.S., prior to his departure in 1999. He also served as Chief Marketing Officer of Golf Galaxy from 2003-2006 and Executive Vice President of Global Sales and Marketing of Callaway Golf from 2000-2003. Mr. McCormick brings over 26 years of marketing experience in a diverse group of industries to his service on the Company’s Board.

Alan Hoffmann – Mr. Hoffmann has been a Director of the Company since January 2016. He is the owner of Alan Hoffmann, CPA, PC, a certified public accounting firm he founded in 1996. The firm performs audits and reviews of private companies. In addition, Mr. Hoffmann currently serves as CFO for Cognitive Research Corporation, a privately-held, full-service contract research organization that specializes in central nervous system product development for pharmaceutical, nutraceutical, biotechnology and medical device companies. In 2011, he served as CFO for an international manufacturing company, Kinematics Manufacturing, Inc. His prior employment included Price Waterhouse from 1985-1989, and local firms in Arizona from 1989 to 1996, where he held multiple positions including Senior Tax Analyst, and Tax Manager. After receiving his undergraduate accounting degree with honors from the University of Wisconsin-Milwaukee in 1985, he became a Certified Public Accountant in 1989. He also served in the United States Marine Corps and was honorably discharged in 1985. He brings over 33 years of public accounting experience to the Company and the Board. Mr. Hoffmann brings to the Board his experience as a public accountant and understanding of oversight and review of financial statements prepared by the Chief Financial Officer.

Board Leadership Structure

The Board has the flexibility to decide when the positions of Chairman and CEO should be combined or separated and whether an executive or an independent director should be Chairman. This approach is designed to allow the Board to choose the leadership structure that will best serve the interests of our stockholders at any particular time. On June 4, 2018, the Board separated the positions of Chairman and CEO, and appointed Michael McCormick as Chairman of the Board. The Board’s key duties include oversight of strategy, risk management, and legal and regulatory compliance as well as CEO succession planning. In each of these areas, the Board determined that at this time having separate roles of Chairman and CEO is the optimal Board leadership structure for the Company.

Risk Oversight

Management is responsible for the day-to-day management of the risks we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. The Board as a whole exercises its oversight responsibilities with respect to strategic, operational and competitive risks, as well as risks related to crisis management and executive succession issues. The Board has delegated oversight of certain other types of risks to its committees. The Audit Committee oversees our policies and processes relating to our financial statements and financial reporting, risks relating to our capital, credit and liquidity status, and risks related to related person transactions. The Compensation Committee oversees risks related to our compensation programs and structure, including our ability to motivate and retain talented executives. The Nominations and Corporate Governance Committee oversees risks related to our governance structure and succession planning for Board membership.

In addition, our Compensation Committee has reviewed risks related to our compensation programs and structure, and has determined that the Company’s compensation policies and practices do not encourage excessive or unnecessary risk taking reasonably likely to result in a material adverse effect on the Company.

We believe that our Board leadership structure as discussed above promotes effective oversight of the Company’s risk management.

Board Committees and Meetings

During the fiscal year ended June 30, 2020, the Board held 5 regularly scheduled and special meetings and took action by written consent 5 times. The Board has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, a Compensation Committee, a Nominations and Corporate Governance Committee, and a Special Litigation Committee.

Audit Committee. The Audit Committee is responsible to the Board for the areas of audit and compliance and oversees the Company’s financial reporting process, including monitoring the integrity of the financial statements and the independence and performance of the auditors and supervises the Company’s compliance with legal and regulatory requirements. The Committee operates under a charter approved by the Board. The Committee’s Charter was revised and approved by the Board as of November 2, 2016 and was attached as Appendix A to the Proxy Statement for the Annual Meeting held in December 2016, and is available at https://isoray.com/investors/audit-committee/. The current members of the Audit Committee are Mr. Hoffmann (Chairman), Dr. Vitale, and Mr. McCormick. The Board has determined that Mr. Hoffmann is an “audit committee financial expert” as defined under SEC rules. The Board has affirmatively determined that none of the members of the Audit Committee have a material relationship with the Company that would interfere with the exercise of independent judgment and each of the members of the Audit Committee is “independent” as independence is defined in Section 121(A) of the listing standards of the NYSE American and Rule 10A-3 under the Securities Exchange Act of 1934, as amended.

Compensation Committee. The Compensation Committee is responsible for establishing and reviewing the compensation and employee benefit policies of the Company. The members of the Compensation Committee are Dr. Vitale (Chairman), Mr. McCormick, and Mr. Hoffmann, each of whom are “independent” directors within the meaning of SEC rules and NYSE American listing standards. The Committee operates under a charter approved by the Board. The Committee’s Charter as approved by the Board was attached as Appendix A to the Proxy Statement for the Annual Meeting held in March 2014, and is available at https://isoray.com/investors/compensation-committee-charter/. The Compensation Committee reviews and recommends to the Board for approval the compensation for the Company’s Chief Executive Officer and all of its other executive officers, including salaries, bonuses and grants of awards under, and administration of, the Company’s equity incentive plans. The Compensation Committee, among other things, reviews the candidates that the CEO recommends to the Board to whom awards will be made under the Company’s equity incentive plans, determines the number of options to be awarded, and the time, manner of exercise and other terms of the awards. The Chief Executive Officer provides input to the Compensation Committee with respect to the individual performance and compensation recommendations for all executive officers and employees (other than herself). Pursuant to its Charter, the Compensation Committee has the authority to engage independent compensation consultants and other professionals to assist in the design, formulation, analysis, and implementation of compensation programs for our executive officers. As part of our pay philosophy, our executive compensation program is designed to attract, motivate, and retain our executives in an increasingly competitive market. To this end, during fiscal 2020 we evaluated industry-specific and general market compensation practices and trends to ensure that our program features and NEO pay opportunities remain appropriately competitive. When determining salaries, target bonus opportunities and long-term incentive grants for NEOs, the Committee considers the performance of the Company and the individual, the nature of an individual's role within the Company, experience in the officer's current role, as well as input from its independent compensation consultant, among other variables. In fiscal 2020, to facilitate its review and determination of executive compensation, the Compensation Committee engaged Pearl Meyer to conduct a comprehensive competitive review of our executive compensation program. In connection with this review and in consultation with Pearl Meyer and senior management of the Company, Pearl Meyer identified a peer group comprised of 16 healthcare equipment, pharmaceutical and biotechnology companies roughly similar to the Company in revenue size or market capitalization, and focused on cancer treatments to the extent possible. In addition to peer group data, four published or private compensation surveys were also utilized in Pearl Meyer's 2020 report and comparisons to survey benchmark positions were made based on the Company's revenue or employee size. Pearl Meyer completed its review in May 2020 and presented its analysis of the Company's executive compensation program relative to peer and survey 25th, 50th and 75th percentile levels. Overall, the study suggested that total direct compensation was below the 25th percentile market levels.

Nominations Committee. The Nominations and Corporate Governance Committee consists of three directors who have each been determined to be “independent” as defined by applicable SEC rules and NYSE American listing standards. Mr. McCormick (Chairman), Dr. Vitale, and Mr. Hoffmann currently serve on the Nominations and Corporate Governance Committee. The Committee’s charter as approved by the Board was attached as Appendix A to the Proxy Statement for the Annual Meeting held in February 2015 and is available at https://isoray.com/investors/nominations-and-corporate-governance-committee/. The Committee identifies and solicits recommendations from management of qualified individuals as prospective Board members. The Committee also recommends the director nominees to the Board for election at the annual meeting of stockholders. The Committee oversees the annual review and evaluation of the performance of the Board and its committees, and develops and recommends corporate governance guidelines to the Board. In addition, the Committee examines, evaluates, and monitors the independence of directors for general Board positions as well as for specific committee duties, and evaluates specific qualifications for members serving as audit committee financial experts.

Special Litigation Committee. The Special Litigation Committee was established by the Board on September 17, 2017, and consists of Mr. Hoffmann (Chairman) and Mr. McCormick, each of whom are “independent” directors within the meaning of SEC rules and NYSE American listing standards.

The Board and its committees may retain outside advisors as they determine necessary to fulfill their responsibilities. All committees report their activities to the full Board. Each committee charter is posted on the Isoray website, www.isoray.com.

Each current Board member attended at least 75% of the aggregate meetings of the Board and of the Committees on which he served that were held during the period for which he was a Board or Committee member in the Company’s fiscal year ended June 30, 2020.

The following table summarizes the membership of the Board and each of its committees as of the date of this proxy statement, as well as the number of times each committee met or took action by written consent during the fiscal year ended June 30, 2020.

|

|

Board |

Audit |

Compensation |

Nominations |

Litigation |

|

Michael McCormick |

Chair |

Member |

Member |

Chair |

Member |

|

Lori A. Woods |

Member |

N/A |

N/A |

N/A |

N/A |

|

Philip Vitale, M.D. |

Member |

Member |

Chair |

Member |

N/A |

|

Alan Hoffmann |

Member |

Chair |

Member |

Member |

Chair |

|

Number of Meetings Held and Consents Taken in Fiscal 2020 |

10 |

4 |

2 |

1 |

0 |

Executive Sessions

Pursuant to the listing standards of the NYSE American, the independent directors are required to meet at least annually in executive sessions. During fiscal 2020, the Board held 2 executive sessions.

Report of the Audit Committee of the Board

The Audit Committee consists of three outside directors, each of whom has been determined to be financially literate and meets the independence standards for members of public company audit committees set forth in SEC rules adopted under the Sarbanes-Oxley Act of 2002 and applicable NYSE American listing standards. The Committee operates under a written charter adopted by the Board. Committee members are independent directors Alan Hoffmann (Chair), Philip J. Vitale, M.D., and Michael W. McCormick. Mr. Hoffmann has been determined to be qualified as an “audit committee financial expert” as defined in Item 407 of Regulation S-K.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and internal control over financial reporting in accordance with generally accepted auditing standards and issuing a report thereon. The Committee’s responsibility is to monitor and oversee these processes.

The Committee provides assistance to the Board in fulfilling its oversight responsibilities relating to corporate accounting and reporting practices of the Company toward assurance of the quality and integrity of its consolidated financial statements. The purpose of the Committee is to serve as an independent and objective party to monitor the Company’s financial reporting process and internal control system; oversee, review and appraise the audit activities of the Company’s independent auditors and internal auditing function; and maintain complete, objective and open communication between the Board, the independent accountants, financial management, and the internal audit function. The Audit Committee met 4 times during the 2020 fiscal year.

The Company’s independent auditor reports directly to the Committee. The Audit Committee is solely responsible to appoint or replace the Company’s independent auditor, and to assure the auditor’s independence and to provide oversight and supervision thereof. The Committee determines compensation of the independent auditor and has established a policy for approval of non-audit related engagements awarded to the independent auditor. Such engagements must not impair the independence of the auditor with respect to the Company, as prescribed by the Sarbanes-Oxley Act of 2002; thus payment amounts are limited and non-audit related engagements must be approved in advance by the Committee. The Committee determines the extent of funding that the Company must provide to the Committee to carry out its duties, and has determined that such amounts were sufficient in fiscal 2020.

With respect to the fiscal year ended June 30, 2020, in addition to its other work, the Committee:

|

|

● |

Reviewed and discussed with management the audited consolidated financial statements of the Company as of June 30, 2020 and the year then ended; |

|

|

|

|

|

|

● |

Discussed with DeCoria, Maichel & Teague, P.S. the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; and |

|

|

|

|

|

|

● |

Received from DeCoria, Maichel & Teague, P.S. the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding its communications with the Audit Committee concerning independence. In addition, discussed with the auditors the firm’s independence and determined that independence had been maintained. |

The Committee recommended, based on the review and discussion summarized above, that the Board include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended June 30, 2020 for filing with the SEC.

|

|

AUDIT COMMITTEE |

|

|

Alan Hoffmann, Chair |

|

|

Philip J. Vitale, M.D. |

|

|

Michael W. McCormick |

The foregoing report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

Nomination Process

The Nominations and Corporate Governance Committee is the nominating committee of the Board. The Committee is governed by the Company’s Certificate of Incorporation and Bylaws with respect to the nominations process. The Committee is responsible for recommending nominees for nomination by the Board for election to the Board. The Committee will consider nominations from stockholders, provided that such nominations are received by the Company’s Secretary in accordance with the Certificate of Incorporation, the Bylaws, and the date set in the prior year’s proxy statement.

The Committee will perform the following duties with respect to director nominations: (a) consider the criteria for identifying and recommending individuals who may be nominated for election to the Board; (b) provide a recommendation to the Board of the slate of nominees for election to the Board; (c) as the need arises, make recommendations to fill vacancies and actively seek individuals qualified to become Board members; and (d) consider stockholder nominations for the Board when properly submitted in accordance with the Company’s Certificate of Incorporation and Bylaws.

The Committee will consider candidates for the Board who are recommended by its members, other Board members, stockholders and management, as well as those identified by any third party search firm the Company may retain to assist in identifying and evaluating possible candidates. The Committee evaluates candidates recommended by stockholders in the same manner that it evaluates other candidates. The Committee’s evaluations will be based upon several criteria, including the candidate’s broad-based business and professional skills and experiences; commitment to representing the long-term interests of stockholders; an inquisitive and objective perspective; the willingness to take appropriate risks; leadership ability; personal and professional ethics; personal integrity and judgment; and practical wisdom and sound judgment. Candidates should have reputations, both personal and professional, consistent with the Company’s image and reputation.

At a minimum, the majority of directors on the Board should be “independent,” not only as that term may be legally defined, but also without the appearance of any conflict in serving as a director. In addition, directors must have time available to devote to Board activities and to enhance their knowledge of the medical isotope industry. Accordingly, the Committee seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities to the Company. The Company does not have a formal policy related to consideration of diversity in identifying director nominees.

The Committee will utilize the following process for identifying and evaluating nominees to the Board. In the case of incumbent directors whose terms of office are set to expire, the Committee will review such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation and quality of performance. In the case of new director candidates, the members of the Committee will be polled for suggestions as to potential candidates that may meet the criteria above, discuss candidates suggested by Company stockholders and may also engage, if the Committee deems appropriate, a professional search firm. The Committee will then meet to discuss and consider these candidates’ qualifications and then choose a candidate to recommend by majority vote. To date, the Board and the Committee have not engaged professional search firms to identify or evaluate potential nominees but may do so in the future, if necessary.

Vote Required for Election

You may vote either “FOR ALL”, “WITHHOLD ALL,” or “FOR ALL EXCEPT” certain nominees for Proposal 1. The vote with respect to the election of directors (Proposal 1) is governed by Delaware law and the Company’s bylaws and is a plurality of the votes cast by the holders of shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As a result, votes that are withheld from voting (whether by abstention, broker non-vote, or otherwise) will be counted in determining whether a quorum is present but will have no other effect on the election of directors. The four persons receiving the highest number of affirmative votes will be elected as directors of the Company.

The Board unanimously recommends that the stockholders vote “FOR ALL” on Proposal 1 to elect Lori A. Woods, Philip J. Vitale, M.D., Michael W. McCormick, and Alan Hoffmann as directors for a one year term expiring at the Fiscal 2022 Annual Meeting of Stockholders and until their successors have been duly elected and qualified.

|

PROPOSAL 2 – RATIFICATION OF RE-APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee has re-appointed the firm of DeCoria, Maichel & Teague, P.S. to serve as our independent registered public accounting firm for the fiscal year ending June 30, 2021, and has directed that such re-appointment be submitted to our stockholders for ratification at the Annual Meeting now that our fiscal 2020 year has ended. Our organizational documents do not require that our stockholders ratify the selection of our independent registered public accounting firm. If our stockholders do not ratify the selection, the Audit Committee will reconsider whether to retain DeCoria, Maichel & Teague, P.S., but still may retain it nonetheless. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in our best interests. Representatives from DeCoria, Maichel & Teague, P.S. are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so, and such representatives are expected to be available to respond to appropriate questions.

Audit and Non-Audit Fees

The Company paid or accrued the following fees in each of the prior two fiscal years to its principal accountant, DeCoria, Maichel & Teague, P.S. (in thousands):

|

For the Year Ended June 30, |

||||||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Audit fees |

|

$ |

74 |

|

|

$ |

47 |

|

|

Audit-related fees |

|

|

- |

|

|

|

- |

|

|

Tax fees |

|

$ |

12 |

|

|

$ |

9 |

|

|

All other fees |

|

|

13 |

|

|

$ |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

$ |

99 |

|

|

$ |

70 |

|

Audit fees include fees for the audit of our annual financial statements, reviews of our quarterly financial statements, and related consents for documents filed with the SEC. Tax fees include fees for the preparation of our federal and state income tax returns. All other fees are from consulting costs created by the review of documents related to equity offerings.

As part of its responsibility for oversight of the independent registered public accountants, the Audit Committee has established a pre-approval policy for engaging audit and permitted non-audit services provided by our independent registered public accountants, DeCoria, Maichel & Teague, P.S. In accordance with this policy, each type of audit, audit-related, tax and other permitted service to be provided by the independent auditors is specifically described and each such service, together with a fee level or budgeted amount for such service, is pre-approved by the Audit Committee. The Audit Committee has delegated authority to its Chairman to pre-approve additional non-audit services (provided such services are not prohibited by applicable law) up to a pre-established aggregate dollar limit. All services pre-approved by the Chairman of the Audit Committee must be presented at the next Audit Committee meeting for review and ratification. All of the services provided by DeCoria, Maichel & Teague, P.S. described above were approved by our Audit Committee.

The Company’s principal accountant, DeCoria, Maichel & Teague, P.S., did not engage any other persons or firms other than the principal accountant’s full-time, permanent employees.

Vote Required

You may vote either “FOR,” “AGAINST,” or “ABSTAIN” on Proposal 2. The vote required to ratify the re-appointment of our independent registered public accounting firm (Proposal 2) is governed by Delaware law and the Company’s bylaws and is the affirmative vote of a majority in voting power of shares of stock present in person or represented by proxy and entitled to vote thereon. As a result, abstentions will be considered in determining whether a quorum is present and the number of votes required obtaining the necessary majority vote, and therefore will have the same effect as voting against Proposal 2.

Because your vote on Proposal 2 is advisory, it will not be binding on the Board or the Company. However, the Board and the Audit Committee will consider the outcome of the advisory vote when making future decisions regarding the selection of our independent registered public accounting firm.

The Board unanimously recommends that the stockholders vote “FOR” Proposal 2 to ratify the re-appointment of DeCoria, Maichel & Teague, P.S. as the independent registered public accounting firm of the Company.

|

PROPOSAL 3 – ADVISORY (NON-BINDING) VOTE ON FREQUENCY OF EXECUTIVE COMPENSATION VOTE |

Section 14 of the Securities Exchange Act, pursuant to the Dodd-Frank Act, requires us to hold an advisory vote, not less frequently than once every six years, on the frequency of the advisory vote to approve the compensation of our named executive officers, which is commonly known as a “say-on-pay” vote. By voting on this Proposal 3, stockholders may indicate whether they would prefer that we hold a say-on-pay vote every one, two, or three years. We believe that our named executive compensation is straightforward, uncontroversial, and highly unlikely to provide incentives for excessive risk-taking. The Board believes that a less frequent vote would: (i) permit stockholders to focus on overall design issues rather than on the details of individual decisions, and (ii) align with the goals of our compensation arrangements which are designed to reward performance that promotes long-term stockholder value. Accordingly, we ask that you support a frequency of every three years for future stockholder advisory votes to approve the compensation of our named executive officers. We believe that a three-year cycle provides the Board and the Compensation Committee with sufficient time to thoughtfully evaluate and respond to stockholder input and effectively implement changes, as needed, to our named executive compensation program.

By voting on Proposal 3, stockholders may indicate whether they would prefer an advisory vote to approve our named executive officer compensation every one, two, or three years. The Board will consider the outcome of the vote requested by this Proposal 3 when making future decisions regarding the frequency of the “say-on-pay” vote. However, because this is an advisory vote and not binding on the Board or the Company, the Board may decide that it is in the best interest of our stockholders and the Company to hold an advisory vote on the compensation of our named executive officers more or less frequently than the frequency approved by our stockholders.

The Company is presenting the following proposal, which gives you as a stockholder the opportunity to inform the Company as to how often you wish the Company to include a “say-on-pay” proposal in our proxy statement. This resolution is required pursuant to Section 14A of the Securities Exchange Act (15 U.S.C. 78n-1). The current frequency of stockholder advisory votes on executive compensation is every three years and, under the current frequency, the next such vote will occur at the FY 2023 annual meeting of stockholders. While our Board of Directors intends to carefully consider the stockholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

“RESOLVED, that the stockholders wish the Company to include an advisory vote on the compensation of the Company's named executive officers pursuant to Section 14A of the Securities Exchange Act every:

|

● |

1 year; |

|

● |

2 years; or |

|

● |

3 years.” |

Vote Required

You may vote either “1 YEAR,” “2 YEARS,” “3 YEARS,” or “ABSTAIN” on Proposal 3. By voting on Proposal 3, stockholders may indicate whether they would prefer an advisory vote to approve our named executive officer compensation every one, two, or three years. A frequency of every one, two, or three years must receive a plurality of the votes represented and entitled to vote on this proposal at the meeting to be deemed by us as the frequency for the advisory vote that has been selected by stockholders. As a result, votes that are withheld from voting (whether by abstention, broker non-vote, or otherwise) will be counted in determining whether a quorum is present but will have no other effect on the frequency of the advisory vote on named executive officer compensation.

Because your vote on Proposal 3 is advisory, it will not be binding on the Board or the Company. However, the Board will consider the outcome of the advisory vote when making future decisions regarding executive compensation of our named executive officers.

The Board unanimously recommends that the stockholders vote “3 YEARS” on Proposal 3 to include an advisory vote of the stockholders on the compensation of the Company’s named executive officers pursuant to Section 14A of the Securities Exchange Act either every one, two, or three years.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth certain information regarding the beneficial ownership of the Company’s Common Stock and voting Preferred Stock as of October 22, 2020 for (i) each person known by the Company to be a beneficial owner of five percent or more of the outstanding Common or Series B Preferred Stock of the Company, (ii) each executive officer, director and nominee for director of the Company, and (iii) directors and executive officers of the Company as a group. As of October 15, 2020, the Company had 68,897,779 shares of Common Stock and 59,065 shares of Series B Preferred Stock outstanding. On October 22, 2020, all of our Series B Stock converted into 59,065 shares of Common Stock as a result of the Company conducting a firm commitment offering of over $9 million. Except as otherwise indicated below, the address for each listed beneficial owner is c/o Isoray, Inc., 350 Hills Street, Suite 106, Richland, Washington 99354.

Common Stock Share Ownership

|

Name of Beneficial Owner |

|

Common |

|

|

Common Stock |

Common Stock Warrants4 |

|

|

Percent of Class2, 3 |

|

||||||

|

Lori Woods |

|

|

590,576 |

|

|

|

212,500 |

24,038 |

|

|

|

0.95 |

% |

|||

|

Alan Hoffmann |

|

|

64,230 |

|

|

|

100,000 |

9,615 |

|

|

|

0.20 |

% |

|||

|

Michael McCormick |

|

|

41,230 |

|

|

|

100,000 |

9,615 |

|

|

|

0.17 |

% |

|||

|

Philip Vitale M.D. |

|

|

130,000 |

|

|

|

100,000 |

10,000 |

|

|

|

0.27 |

% |

|||

|

William Cavanagh III |

|

|

27,692 |

|

|

|

476,660 |

3,846 |

|

|

|

0.58 |

% |

|||

|

Michael Krachon |

|

|

133,844 |

|

|

|

450,000 |

14,422 |

|

|

|

0.68 |

% |

|||

|

Jonathan Hunt |

|

|

67,306 |

|

|

|

187,500 |

33,653 |

|

|

|

0.33 |

% |

|||

|

Jennifer Streeter |

|

|

5,440 |

|

|

|

287,500 |

- |

|

|

|

0.33 |

% |

|||

|

Mark Austin |

|

|

35,230 |

|

|

|

182,500 |

9,615 |

|

|

|

0.26 |

% |

|||

|

Directors and Executive Officers as a group |

|

|

1,095,548 |

|

|

|

2,096,660 |

114,804 |

|

|

|

3.77 |

% |

|||

|

|

1. |

Only includes those Common Stock options that could be exercised for Common Stock within 60 days after October 22, 2020. |

|

|

2. |

Percentage ownership is based on 87,226,074 shares of Common Stock outstanding on October 22, 2020. Shares of Common Stock subject to stock options or stock warrants which are currently exercisable or will become exercisable within 60 days after October 22, 2020 are deemed outstanding for computing the percentage ownership of the person or group holding such options but are not deemed outstanding for computing the percentage ownership of any other person or group. |

|

3. |

On October 22, 2020, all of our Series B Stock converted into 59,065 shares of Common Stock as a result of the Company conducting a firm commitment offering of over $9 million. |

|

| 4. | Purchased pursuant to public offering that closed on October 22, 2020. Each share of common stock purchased included one-half of a warrant. Each whole warrant is exercisable to purchase one share of common stock at an exercise price of $0.57 per share. Each warrant is immediately exercisable, and will expire October 22, 2025. |

No person or “group” (as such term is used in Section 13(d)(3) of the Exchange Act) is known to the Company to be the beneficial owner of more than 5 percent of the Company’s Common Stock.

Series B Preferred Stock Share Ownership

|

|

|

Series B |

|

|

|

|

|

|

|

|

|

Preferred |

|

|

|

|

|

|

|

|

|

Shares |

|

|

Percent of |

|

||

|

Name of Beneficial Owner |

|

Owned |

|

|