Form DEF 14A Frankly Inc For: Nov 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material under §240.14a-12 | |

Frankly Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Notice of Meeting and

Management Information Circular

For the Annual General AND SPECIAL Meeting OF

Shareholders of Frankly Inc.

THIS mANAGEMENT INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION BY THE MANAGEMENT OF FRANKLY INC. OF PROXIES TO BE VOTED AT THE ANNUAL GENERAL AND SPECIAL MEETING OF ALL SHAREHOLDERS

To be held at the offices of:

Ellenoff Grossman & Schole LLP

1345 6th Ave.

New York, NY, 10105

at 11:00 a.m. (EST)

on December 20, 2018

| These materials are important and require your immediate attention. They require Shareholders to make important decisions. If you are in doubt as to how to deal with these materials or the matters they describe, please contact your financial, legal, tax or other professional advisors. |

November 16, 2018

Dear Fellow Shareholders,

On behalf of Frankly Inc., we invite you to attend our annual general and special meeting of shareholders to be held at the offices of Ellenoff Grossman & Schole LLP, 1345 6th Ave., New York, New York, 10105 at 11:00 a.m. (EST) on December 20, 2018. Your participation at this meeting is very important and we encourage you to review the information circular accompanying this letter, which includes important information for the holders of Frankly Inc. shares. We encourage you to vote on the matters set out in the circular by following the proxy instructions set out therein and returning your proxy or voting instruction form (as applicable) by the applicable deadline.

Our accomplishments this year have been enabled by our dedicated staff and your support of Frankly Inc. and we are sincerely grateful to each of you for having chosen to accompany us on this journey. We look forward to building on our past accomplishments with your continued support.

Yours truly,

| /s/ Louis Schwartz | |

| Louis Schwartz | |

| Chief Executive Officer |

| 2 |

FRANKLY INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held on December 20, 2018.

NOTICE IS HEREBY GIVEN that the Annual General And Special Meeting (the “Meeting”) of the holders of shares (“Shareholders”) of Frankly Inc. (the “Corporation”) will be held at the offices of Ellenoff Grossman & Schole LLP, 1345 6th Ave., New York, New York, 10105 at 11:00 a.m. (EST) on December 20, 2018. The Meeting is being held for the following purposes:

| (a) | to table before the Shareholders the consolidated financial statements of the Corporation for the year ended December 31, 2017, including the auditors’ report thereon (the “Financial Statements”); |

| (b) | to elect the directors of the Corporation (the “Directors”) who will serve until the end of the next annual meeting of Shareholders or until their successors are elected or appointed, as more fully described in the management information circular dated November 16, 2018 (the “Circular”) accompanying this notice of Meeting (the “Notice”); |

| (c) | to re-appoint Baker Tilly Virchow Krause LLP as the independent auditor of the Corporation for the fiscal year ending December 31, 2018; |

| (d) | for disinterested Shareholders to consider, and if thought fit, to pass, with or without variation, an ordinary resolution approving the amended and restated equity incentive plan of the Corporation (attached as Appendix “A” to the Circular); and |

| (e) | to transact such further and other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Additional information on the above matters can be found in the Circular under the heading “Business of the Meeting.”

The board of Directors has fixed the close of business on November 19, 2018 as the record date (the “Record Date”) for the determination of Shareholders entitled to notice of the Meeting or any adjournment or postponement thereof and to vote at the Meeting.

The Circular, this Notice, the forms of proxy and the voting instruction form are being mailed to Shareholders of record and beneficial shareholders as at the Record Date and are available under the Corporation’s profile on the System for Electronic Document Analysis and Retrieval, online at www.sedar.com. Shareholders are reminded to review the meeting materials before voting.

If you do not expect to attend the Meeting in person, please promptly complete and sign the enclosed applicable form of proxy and return it for receipt by no later than 48 hours prior to the Meeting. If you receive more than one proxy form because you own shares of the Corporation registered in different names or addresses, each proxy form should be completed and returned.

If you are a Non-Registered Shareholder (as defined in the Circular under the heading “Non-Registered Shareholders”), accompanying this Notice is a voting instruction form for your use. If you receive these materials through your broker or another intermediary, please complete and sign the materials in accordance with the instructions provided to you by such broker or other intermediary.

Dated as of this 16thday of November, 2018.

| BY ORDER OF THE BOARD OF DIRECTORS OF FRANKLY INC. | ||

| By: | /s/ Louis Schwartz | |

| Name: | Louis Schwartz | |

| Title: | Chief Executive Officer | |

| 3 |

TABLE OF CONTENTS

| 4 |

MANAGEMENT INFORMATION CIRCULAR

Introduction

This management information circular (this “Circular”) is being furnished to holders (the “Shareholders”) of common shares (“Common Shares”) in the capital of Frankly Inc. (the “Corporation” or “Frankly” or “we”) in connection with the solicitation of proxies by and on behalf of the management of the Corporation for the Annual General And Special Meeting (the “Meeting”) of the Shareholders to be held at the offices of Ellenoff Grossman & Schole LLP, 1345 6th Ave., New York, New York, 10105 at 11:00 a.m. (EST) on December 20, 2018.

This Circular, the accompanying notice of the Meeting (the “Notice”) and the form of proxy and the voting instructions form (collectively, the “Meeting Materials”) are being mailed to Shareholders of record of the Corporation as at the close of business on November 19, 2018 (the “Record Date”). The Corporation will bear all costs associated with the preparation and mailing of the Meeting Materials, as well as the cost of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Corporation may also directly solicit proxies (but not for additional compensation) personally, by telephone, by facsimile or by other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies and will be reimbursed for their reasonable expenses in doing so.

All information contained in this Circular is given as of November 16, 2018 unless otherwise specifically stated.

Currency

All dollar amounts set forth in this Circular are in United States (“U.S.”) dollars, except where otherwise indicated.

Forward-Looking Information

The Circular contains certain forward-looking information and forward-looking statements (collectively, “forward-looking information”) within the meaning of applicable securities laws relating, but not limited, statements with respect to the nature of the usage of the Corporation’s software-as-a-service platform, the Corporation’s strategy and capabilities, changing audience and advertising demand for local news and media, needs for new technology from local news and media industry, the vertical and regional expansion of the Corporation’s market and business opportunities, the expansion of the Corporation’s product offering, and the estimated number of smart device users, local news and media businesses and digital advertisers in the future. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict or are beyond the Corporation’s control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in these forward looking statements. Consequently, readers should not place undue reliance on such forward-looking statements. In addition, these forward-looking statements relate to the date on which they are made.

These forward-looking statements include, but are not limited to: the Corporation’s ability to implement the Corporation’s business strategy; the Corporation’s ability to successfully integrate any acquired businesses; the Corporation’s overall ability to effectively respond to technology changes affecting the industry and increasing competition from other technology providers; the Corporation’s ability to retain existing content management system (“CMS”) platform customers or add new ones; the Corporation’s ability to generate new customers for the Corporation’s mobile technology products; the availability of advertising inventory and the market demand and prices of such inventory; the Corporation’s ability to introduce changes to the Corporation’s existing products or develop and introduce new and unproven products and the Corporation’s customers’ or the market’s; the Corporation’s ability to manage the Corporation’s growth effectively; the recent consolidation and vertical integration within the local news broadcasting industry acceptance of such products; the business conditions of the Corporation’s customers particularly in the local news broadcasting and adjacent industries; the adoption of ASTC 3.0 and its implications on the Corporation’s customers; the Corporation’s ability to expand the Corporation’s customer base to global markets; the Corporation’s ability to protect its intellectual property; and the Corporation’s ability to access capital markets.

| 5 |

These and other factors are detailed from time to time in reports filed by the Corporation with securities regulators in Canada and with the Securities and Exchange Commission (the “SEC”) in the United States. Reference should be made to “Item 1A – Risk Factors” and “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Forward-Looking Information” in the Corporation’s annual and interim reports on Form 10-K and 10-Q.

Forward-looking information is based on current expectations, estimates and projections and it is possible that predictions, forecasts, projections, and other forms of forward-looking information will not be achieved by the Corporation. Except as required by law, the Corporation undertakes no obligation to update publicly or otherwise revise any forward-looking information, whether as a result of new information, future events or otherwise.

Voting in Person at the Meeting

A registered holder of Common Shares (“Registered Shareholder”), or a beneficial owner who has appointed themselves to represent them at the Meeting, will appear on a list of Shareholders prepared by TSX Trust Company, the registrar and transfer agent for purposes of the Meeting (the “Registrar”). To vote in person at the Meeting, each Registered Shareholder or appointee will be required to register by identifying themselves at the Meeting registration desk. Non-Registered Shareholders (as defined in this Circular under the heading “Non-Registered Shareholders”) must appoint themselves as a proxyholder to vote in person at the Meeting.

Solicitation of Proxies

The information contained in this Circular is furnished to Shareholders in connection with the solicitation of proxies to be used at the Meeting. The solicitation of proxies by this Circular is being made by or on behalf of the management of the Corporation and the total cost of the solicitation will be borne by the Corporation. The solicitation of proxies will be primarily by mail, but may also be in person or by telephone, fax or oral communication without special compensation by officers or employees of the Corporation. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals or beneficial owners and to obtain authorizations for the execution of proxies. The Corporation will reimburse these banks, brokerage houses and other custodians and nominees or fiduciaries for the reasonable costs incurred in obtaining authorization to execute forms of proxy from their principals or beneficial owners.

Voting of Proxies

The authorized share capital of the Corporation consists of an unlimited number Common Shares and an unlimited number of Class A restricted voting shares (“Restricted Shares”). Currently there are no Restricted Shares outstanding. Shareholders who are not disinterested Shareholders (as described below) may not vote on the resolution to amend the Restated Plan (as defined below). Each Common Share entitles the holder thereof to receive notice of, to attend and to cast one vote per share held at the Meeting. The Common Shares represented by any valid proxy in favour of the management designees named in the accompanying forms of proxy will be voted for or against or withheld from voting in accordance with the specific instructions made by the Shareholder on any ballot that may be called for at the Meeting for which they are eligible to vote and if a Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of any such specific instructions, such Common Shares will be voted by the designated persons named by management in the accompanying forms of proxy FOR the election of the Directors named in this Circular, and FOR the appointment of the auditor, Baker Tilly Virchow Krause LLP (“Baker Tilly” or the “Auditor”) and the authorization of the Directors to fix the Auditor’s remuneration, and FOR the approval of the Corporation’s amended and restated equity incentive plan (the “Restated Plan”).

| 6 |

In order to pass the Shareholder resolution to approve the Restated Plan (which is more fully described under “Approval of the Restated Plan”, below), the resolution must be approved by a majority of the aggregate votes cast by Shareholders at the Meeting who would not be eligible to receive an Award (as defined under “Approval of the Restated Plan”, below) under the Restated Plan and their respective associates (“Disinterested Shareholders”). Any proxies voted on behalf of Shareholders who are not Disinterested Shareholders will be disregarded for the purpose of determining whether the resolution to approve the Restated Plan is approved.

The accompanying forms of proxy confer discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to such other business or matters which may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. As of the date of this Circular, the Corporation is not aware of any such amendments or variations or any other matters to be addressed at the Meeting.

Appointment of Proxies

The persons named in the enclosed forms of proxy are directors and/or officers of the Corporation. Each Shareholder has the right to appoint a person or company, other than the persons designated by management in the forms of proxy, to represent the Shareholder at the Meeting. A Shareholder giving a proxy can strike out the names of the management designees printed in the accompanying forms of proxy and insert the name of another designated person or company in the space provided, or the Shareholder may complete another form of proxy. A proxy designee need not be a Shareholder of the Corporation.

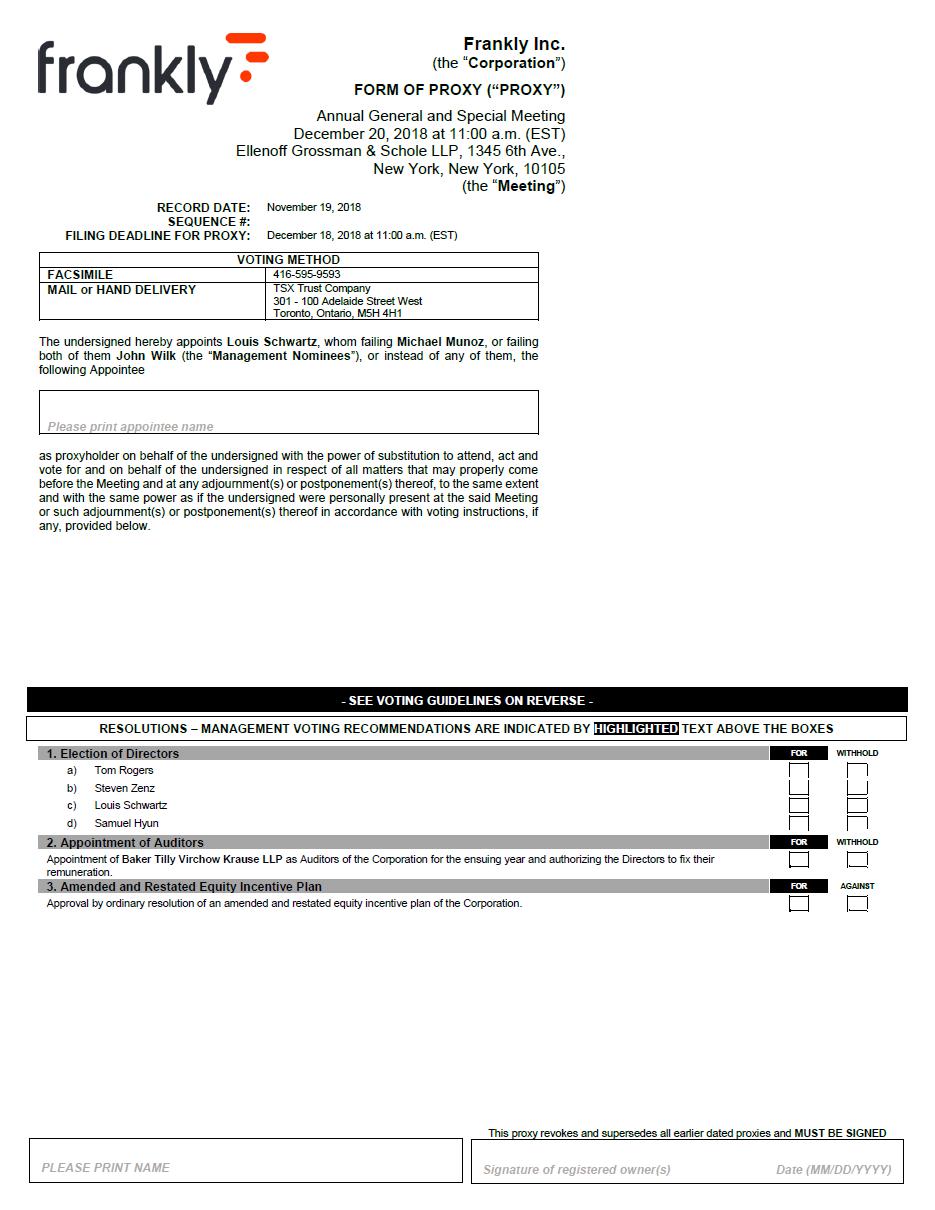

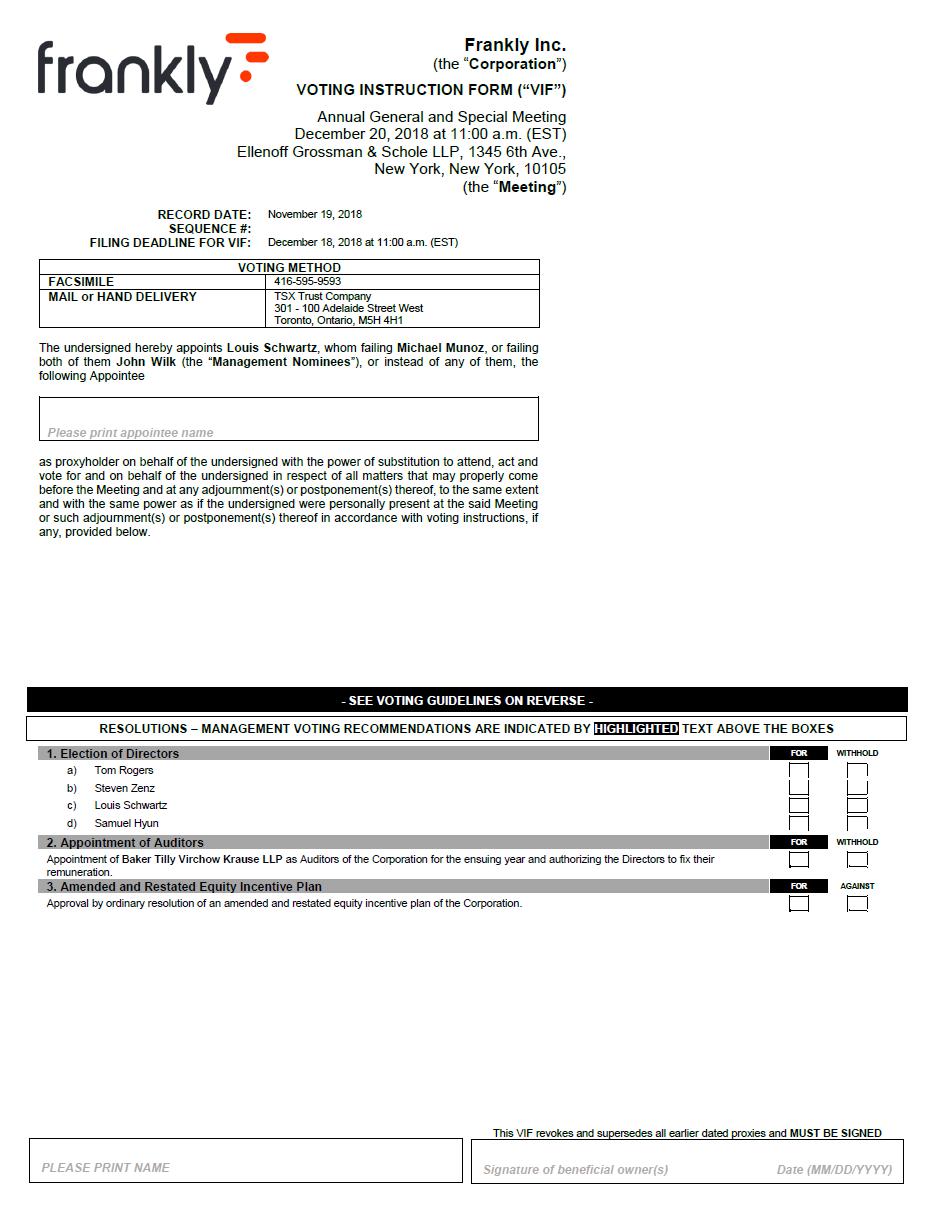

Those Shareholders who wish to be represented at the Meeting by proxy must complete and deliver the applicable proper form of proxy to the Registrar either in person, or by mail or courier, to 301-100 Adelaide Street West, Toronto, Ontario, M5H 4H1, by fax at (416) 595-9593 or via the internet at www.voteproxyonline.com.

The forms of proxy must be deposited with the Registrar by no later than 11:00 a.m. (EST) on December 18, 2018, or with the Chairman of the Meeting (the “Chairman”) before the commencement of the Meeting, or if the Meeting is adjourned or postponed, not less than 48 hours, excluding Saturdays, Sundays and statutory holidays, preceding the time of such adjourned or postponed Meeting or with the Chairman before the commencement of such adjourned or postponed Meeting.

If a Shareholder who has completed a form of proxy attends the Meeting in person, any votes cast by such Shareholder on a poll will be counted and the completed form of proxy will be disregarded.

Non-Registered Shareholders

The information set forth in this section is of importance to many Shareholders, as a substantial number of Shareholders do not hold Common Shares in their own name. Shareholders who hold their Common Shares through brokers, intermediaries, trustees or other persons, or who otherwise do not hold their Common Shares in their own name (“Non-Registered Shareholders”) should note that only proxies deposited by Shareholders who are Registered Shareholders (that is, Shareholders whose names appear on the records maintained by the registrar and transfer agent for the Common Shares as registered holders of Common Shares) will be recognized at the Meeting. If Common Shares are listed in an account statement provided to a Non-Registered Shareholder by a broker, those Common Shares will, in all likelihood, not be registered in the Shareholder’s name. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as the depository and therefore nominee for many Canadian brokerage firms). Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client can only be voted at the direction of the Non-Registered Shareholder. Without specific instructions, brokers (or their agents and nominees) are prohibited from voting shares for the broker’s clients. Subject to the following discussion in relation to NOBOs (as defined below), the Corporation does not know for whose benefit the Common Shares of the Corporation registered in the name of CDS & Co., a broker or another nominee, are held.

| 7 |

There are two categories of Non-Registered Shareholders for the purposes of applicable securities regulatory policy in relation to the mechanism of dissemination to Non-Registered Shareholders of proxy-related materials and other securityholder materials and the request for voting instructions from such Non-Registered Shareholders. Non- objecting beneficial owners (“NOBOs”) are Non-Registered Shareholders who have advised their intermediary (such as brokers or other nominees) that they do not object to their intermediary disclosing ownership information to the Corporation, consisting of their name, address, e-mail address, securities holdings and preferred language of communication. Securities legislation restricts the use of that information to matters strictly relating to the affairs of the Corporation. Objecting beneficial owners (“OBOs”) are Non-Registered Shareholders who have advised their intermediary that they object to their intermediary disclosing such ownership information to the Corporation.

National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54- 101”) permits the Corporation, in its discretion, to obtain a list of its NOBOs from intermediaries and use such NOBO list for the purpose of distributing the Meeting Materials directly to, and seeking voting instructions directly from, such NOBOs. As a result, the Corporation is entitled to deliver Meeting Materials to Non-Registered Shareholders in two manners: (a) directly to NOBOs and indirectly through intermediaries to OBOs; or (b) indirectly to all Non-Registered Shareholders through intermediaries. In accordance with the requirements of NI 54- 101, the Corporation is sending the Meeting Materials directly to NOBOs and indirectly through intermediaries to OBOs. The Corporation will pay the fees and expenses of intermediaries for their services in delivering Meeting Materials to OBOs in accordance with NI 54-101.

The Corporation has used a NOBO list to send the Meeting Materials directly to NOBOs whose names appear on that list. If the Registrar has sent these materials directly to a NOBO, such NOBO’s name, address and information about its holdings of Common Shares have been obtained from the intermediary holding such shares on the NOBO’s behalf in accordance with applicable securities regulatory requirements. As a result, any NOBO can expect to receive a voting instruction form from the Corporation’s Registrar. NOBOs should complete and return the voting instruction form to the Registrar in the envelope provided. In addition, internet voting is available. Instructions in respect of the procedure for internet voting can be found in the voting instruction form. The Registrar will tabulate the results of voting instruction forms received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Common Shares represented by such voting instruction forms.

Applicable securities regulatory policy requires intermediaries, on receipt of Meeting Materials that seek voting instructions from Non-Registered Shareholders indirectly, to seek voting instructions from Non-Registered Shareholders in advance of shareholders’ meetings on Form 54-101F7 - Request for Voting Instructions Made by Intermediary (“Form 54-101F7”). Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Non-Registered Shareholders in order to ensure that their Common Shares are voted at the Meeting or any adjournment(s) or postponement(s) thereof. Often, the voting instruction form supplied to a Non-Registered Shareholder by its broker is identical to the form of proxy provided to Registered Shareholders; however, its purpose is limited to instructing the Registered Shareholder how to vote on behalf of the Non-Registered Shareholder. Non-Registered Shareholders who wish to appear in person and vote at the Meeting should be appointed as their own representatives at the Meeting in accordance with the directions of their intermediaries and Form 54-101F7. Non-Registered Shareholders can also write the name of someone else whom they wish to attend at the Meeting and vote on their behalf. Unless prohibited by law, the person whose name is written in the space provided in Form 54-101F7 will have full authority to present matters to the Meeting and vote on all matters that are presented at the Meeting, even if those matters are not set out in Form 54-101F7 or this Circular. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically mails a voting instruction form in lieu of the form of proxy. Non-Registered Shareholders are requested to complete and return the voting instruction form to Broadridge by mail or facsimile. Broadridge will then provide aggregate voting instructions to the Registrar, who tabulates the results and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting or any adjournment(s) or postponement(s) thereof. By choosing to send the Meeting Materials to NOBOs directly, the Corporation (and not the intermediary holding Common Shares on your behalf) has assumed responsibility for (i) delivering these materials to you; and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

| 8 |

All references to Shareholders in this Circular and the accompanying instrument of proxy and Notice are to Registered Shareholders unless specifically stated otherwise.

Revocation

A Registered Shareholder who has given a proxy may revoke the proxy:

| (i) | by completing and signing a form of proxy bearing a later date and depositing it with the Registrar as described above; | |

| (ii) | by depositing an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing or by electronic signature: (i) at the registered office of the Corporation addressed to John Wilk, the Secretary of the Corporation, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used; or (ii) with the Chairman prior to the commencement of the Meeting on the day of the Meeting or any adjournment of the Meeting; or | |

| (iii) | in any other manner permitted by law. |

A Non-Registered Shareholder may revoke a voting instruction form or a waiver of the right to receive Meeting

Materials and to vote given to an intermediary at any time by written notice to the intermediary, except that an intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote that is not received by the intermediary at least seven days prior to the Meeting.

Record Date

The Record Date for determining Shareholders entitled to receive notice of and vote at the Meeting is November 19, 2018. Shareholders of record as at the close of business on such date will be entitled to attend and vote at the Meeting, or any adjournment(s) or postponement(s) thereof, in the manner and subject to the procedures described in this Circular.

Common Shares and Quorum

Only Shareholders of record at the Record Date are entitled to receive notice of and vote at the meeting. As at November 16, 2018, the Corporation had 2,660,155 Common Shares issued and outstanding. Each Common Share entitles the holder thereof to one vote at the Meeting. All Shareholders shall vote as one class, with the exception that Shareholders that are not Disinterested Shareholders shall not be entitled to vote with respect to the Restated Plan.

| 9 |

Pursuant to the articles of the Corporation, a quorum is present at the Meeting if two or more voting persons are present in person and authorized to cast in the aggregate not less than 33⅓% of the total number of all shares carrying the right to vote at the meeting.

Principal Shareholders

The following tables set forth information with respect to the only Shareholders, to the knowledge of the Directors or executive officers, and as of the date hereof, who beneficially own, control or direct, directly or indirectly, Common Shares carrying more than 10% of the Voting rights attached thereto:

| Name | Number of Common Shares | Percentage of Outstanding Common Shares | ||||||

| Raycom Media, Inc. | 547,325 | 20.6 | % | |||||

| SKP America, LLC | 545,289 | 20.5 | % | |||||

Frankly Inc. was incorporated pursuant to the provisions of the Business Corporations Act (Ontario) (the “OBCA”) on June 7, 2013, under the name “WB III Acquisition Corp.” (“WB III”). The Corporation completed its initial public offering on October 17, 2013, and was listed on the TSX Venture Exchange (the “TSX-V”) as a capital pool company. It completed its qualifying transaction on December 23, 2014 (the “Qualifying Transaction”). The Qualifying Transaction proceeded by way of a “reverse triangular merger” among the Corporation, WB III Subco Inc., a wholly-owned subsidiary of the Corporation, and TicToc Planet, Inc., a private Delaware corporation subsequently renamed Frankly Co. and currently a wholly owned subsidiary of the Corporation (“Frankly Co.”). The Qualifying Transaction resulted in a reverse takeover of the Corporation by the shareholders of Frankly Co.

In connection with the Qualifying Transaction, among other things, Frankly Co. amalgamated with the Corporation’s wholly-owned subsidiary, WB III Subco Inc. (the “Amalgamation”) and the securityholders of Frankly Co. received securities of the Corporation in exchange for their securities of Frankly Co.

As a result of the Qualifying Transaction and at the effective time of the closing of the Qualifying Transaction, former Frankly Co. shareholders held approximately 96.6% of the Common Shares and shareholders of the Corporation at the effective time of the closing of the Qualifying Transaction held approximately 3.4% of the Common Shares.

On December 22, 2014, and prior to the completion of the Qualifying Transaction, pursuant to Articles of Amendment the Corporation changed its name to “Frankly Inc.” and completed a consolidation of its share capital on a basis of one post—consolidation common share for every 20.333 common shares existing immediately before the consolidation.

The Corporation was continued under the laws of British Columbia on July 11, 2016.

On February 3, 2017, the Corporation effected a reverse stock split of its Common Shares pursuant to which every 17 Common Shares outstanding decreased to one Common Share (the “Consolidation”). Unless otherwise indicated, all references to numbers of Common Shares in this Circular are expressed on a post-Consolidation basis.

| 10 |

The authorized capital of the Corporation consists of an unlimited number of Common Shares and unlimited number of Restricted Shares. All Shareholders are entitled to receive notice of and to attend all meetings of the shareholders of the Corporation. Each Common Share entitles the Shareholder thereof to one vote per share at any meeting of the shareholders of the Corporation. Common Shares shall vote as one class at all meetings of shareholders of the Corporation, unless otherwise required by applicable law.

The Corporation’s Common Shares are listed for trading on the TSX-V under the symbol “TLK”. The address of the Corporation’s head office is 27-01 Queens Plaza North, Suite 502, Long Island City, New York, 11101.

The Meeting will be constituted as an annual general and special meeting of Shareholders.

As part of the annual and special business set out in the Notice, the Corporation will place before Shareholders the Financial Statements and the Shareholders will be asked to consider and vote on: (a) the election of the Directors who will serve until the end of the next annual meeting of Shareholders, or until their successors are elected or appointed; (b) the appointment of the Auditor of the Corporation for the ensuing year and the authorization of the directors to fix the Auditor’s remuneration; (c) the Restated Plan; and (d) such further and other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. Shareholders that are not Disinterested Shareholders shall not be entitled to vote on the Restated Plan.

Interests of Certain Persons or Companies in the Matters to be Acted Upon

Except as otherwise disclosed in this Circular, no Director or officer of the Corporation, nor any proposed nominee for election as a Director, nor any other insider of the Corporation, nor any associate or affiliate of any one of them, has or has had, at any time since the beginning of the financial year ended December 31, 2017, any material interest, direct or indirect, in any transaction or proposed transaction that has materially affected or would materially affect the Corporation.

As at the date of this Circular, the Directors and executive officers of the Corporation and their associates, as a group, beneficially owned, directly or indirectly, or exercised control or direction over, an aggregate of 373,192 Common Shares representing approximately 14.0% of the issued and outstanding Common Shares on a non-diluted basis.

Certain principal holders of Common Shares, Directors or officers of the Corporation, or associates or affiliates of any of the foregoing persons, may have a material interest in the resolution to approve the Restated Plan, as they may stand to benefit as eligible participants under the Restated Plan. Accordingly, as discussed above under “Voting of Proxies”, only Disinterested Shareholders shall be eligible to vote on the Shareholder resolution to approve the Restated Plan.

Certain Relationships and Related Transactions, and Director Independence

The following is a summary of transactions and series of similar transactions, since the beginning of the fiscal year ending December 31, 2017, to which the Corporation was a party or will be a party, in which:

| ● | the amount involved exceeded or will exceed the lesser of $120,000 or one percent of the average of the Corporation’s total assets at year-end for the last two completed fiscal years; and | |

| ● | a director, executive officer, holder of more than 5% of the Common Shares or any member of their immediate family had or will have a direct or indirect material interest. |

Pursuant to the Corporation’s Code of Ethical Conduct, all related party transactions must be approved by vote of a majority of the Corporation’s disinterested and independent directors.

| 11 |

Raycom Transactions and Agreements

Raycom Media, Inc. (“Raycom”) is a holder of more than 5% of the issued and outstanding Common Shares. Below are descriptions of agreements that the Corporation currently have in place with Raycom.

Website Software and Services Agreement and Local Sales Products Agreement

Frankly Media LLC (“Frankly Media”) entered into a Website Software and Services Agreement with Raycom (the “Raycom Service Agreement”), dated October 1, 2011 and amended on October 1, 2014 and August 25, 2015. Pursuant to the Service Agreement, Frankly Media provides website software, platform and advertising services to Raycom. The Service Agreement expires on December 31, 2022 unless terminated earlier upon written notice. Frankly Media also entered into a local sales products agreement, dated August 1, 2015 (the “LSP Agreement”) with Raycom, pursuant to which Frankly Media provides targeted display and video advertising services. The LSP Agreement will expire on August 1, 2017. During the fiscal year ended December 31, 2017, the Corporation recognized revenue of $5,270,346 under the Service Agreement and LSP Agreement.

On December 22, 2016, pursuant to an amendment (the “Advance Agreement”) Raycom pre-paid $3 million of future fees for services (the “Original Raycom Advance”) to be provided by the Corporation pursuant to the Raycom Services Agreement. Pursuant to the Advance Agreement, if the Corporation had completed an equity raise of at least $5 million before March 31, 2017, then the Corporation could have either (i) refunded the prepayment to Raycom within 30 days of the completion of the equity raise along with an additional $30,000 for fees in connection with the prepayment by Raycom, or (ii) applied the prepayment to services provided by the Corporation for the year ending December 31, 2017 in which case Raycom would have received a discount of $300,000 (the “Discount”) for the services to be provided by the Corporation. If the Corporation did not complete an equity raise of at least $5 million by March 31, 2017, then the prepayment would have been applied to the services to be provided for the year ending December 31, 2017 and the Discount will be applied to services to be provided by the Corporation for the year ending December 31, 2017.

On March 30, 2017, the Corporation entered into an amendment to the Advance Agreement (the “Second Raycom Advance”) pursuant to which Raycom pre-paid an additional $2 million of future fees for services to be provided by the Corporation pursuant to the Raycom Services Agreement. The amendment also extended the date for completing the equity raise and if the Corporation did not complete an equity raise of at least $5 million by May 31, 2017, then the prepayment would have been applied to the services to be provided for the period commencing June 1, 2017 and Raycom would have received the Discount for services to be provided by the Corporation for the year ending December 31, 2017.

On May 25, 2017, the Corporation entered into a further amendment to the Advance Agreement, pursuant to which if the Corporation did not complete an equity raise of at least $5 million by June 30, 2017, then the prepayment would have been applied to the services to be provided for the period commencing July 1, 2017 and Raycom would have received the Discount for services to be provided by the Corporation for the year ending December 31, 2017.

On October 6, 2017, the Corporation entered into a further amendment to the Advance Agreement, pursuant to which the prepayment will be applied to the services to be provided for the period commencing January 1, 2018. Additionally, Raycom will receive an additional $180,000 discount (the “Second Discount”) in the amount of their 2018 fees.

In connection with the Advance Agreement, the Corporation recognized interest expense of $319,651 for the year ended December 31, 2017.

| 12 |

On October 15, 2018, Raycom exercised its right to terminate its Service Agreement and LSP Agreement, with such termination to be effective as of December 31, 2018. The deferred revenue balance under the website agreement of $1,588,994 as of September 30, 2018 will continue to be reduced by monthly billings to Raycom under the Service Agreement and LSP Agreement through its December 31, 2018 termination date. The remaining balance owed by the Company to Raycom as of December 31, 2018 under the Advance Agreement, comprised of deferred revenue and accrued interest, will be forgiven in full on that date.

Unit Purchase Agreement and Worldnow Promissory Notes

On July 28, 2015, the Corporation signed an agreement (the “Unit Purchase Agreement”) to purchase the outstanding units of Gannaway Web Holdings, LLC, d/b/a Worldnow (now Frankly Media), pursuant to which the Corporation issued the Worldnow Promissory Notes (as defined below) to Gannaway Entertainment Inc. (“GEI”) and Raycom in the aggregate principal amounts of $11 million and $4 million, respectively, as partial consideration for their respective membership interests in Worldnow. The Worldnow Promissory Notes bore simple interest at a rate of 5% per year.

The August 2016 Refinancing

On August 31, 2016, the Corporation entered into a $14.5 million credit facility (the “Credit Facility”) under a credit agreement, as amended on December 20, 2016, March 30, 2017, May 25, 2017, October 25, 2017, December 27, 2017 and March 28, 2018 (the “Credit Agreement”) with Raycom. The proceeds of the Credit Facility were used to pay in full the $11 million promissory note (the “GEI Promissory Note”) issued to GEI and $3 million of the $4 million promissory note issued to Raycom (the “Original Raycom Note” and together with the GEI Promissory Note, the “Worldnow Promissory Notes”), each issued in connection with the acquisition of Gannaway Web Holdings, LLC, now Frankly Media. In addition, the Corporation issued to Raycom warrants to purchase 871,160 Common Shares (the “Raycom Warrants”) at a price per share of CDN$8.50 ($6.63 based on the exchange rate at August 18, 2016) and repaid in full the Corporation’s $2.0 million outstanding revolving credit facility with Bridge Bank (the “Bridge Bank Loan”). Subject to Raycom’s discretion, the Corporation also has an additional $1.5 million available for borrowing under the Credit Facility. The Corporation also entered into a share purchase agreement (the “Raycom SPA”) pursuant to which the Corporation converted $1 million of the Original Raycom Note into 150,200 Common Shares. The Corporation refers to these transactions as the “August 2016 Refinancing”.

On May 7, 2018, the Corporation amended and restated the Credit Agreement (the “Amended Credit Agreement”) to increase the amount of funding available under the Credit Agreement by $7.5 million. The Amended Credit Agreement supersedes the original Credit Agreement. The $1.0 million that was advanced by Raycom to the Corporation on March 13, 2018 is included in the $7.5 million funding increase, bringing the total amount provided to us under the Amended Credit Agreement to $22 million (the “Amended Credit Facility”). Of the $7.5 million, the Corporation’s customer Cordillera Communications (“Cordillera” and together with Raycom, the “Lenders”) is participating as a lender for up to $300,000. Under the Amended Credit Agreement, outstanding term loans in the amount of $14.5 million were characterized as Term B Loans under a non-revolving term loan facility in such amount (“Facility B”) and an outstanding term loan in the amount of $1.0 million was characterized as a Term A Loan under a non-revolving term loan facility in the amount of $7.5 million (“Facility A”).

On October 15, 2018, the Corporation amended the Amended Credit Agreement with Raycom to reduce the principal debt balance due under the Amended Credit Agreement as of October 2, 2018 from $21,800,000 (includes $300,000 due to Cordillera) plus accrued interest as of September 30, 2018 of $1,298,653 (together the “Loan Balance”) to $10,000,000 (the “New Loan Balance”) as of October 1, 2018.

| 13 |

Securities Purchase Agreement

Pursuant to the Raycom SPA, the Corporation issued to Raycom an aggregate of 150,200 Common Shares for a purchase price of CDN $1,276,700 (or $1 million based on the exchange rate at August 18, 2016) in repayment of $1 million of the Original Raycom Note. Raycom’s 397,125 Class A restricted shares were also converted into Common Shares on a one-for-one basis. Under the Raycom SPA, the Corporation agreed to enlarge the Board to seven directors, subject to Shareholder approval, within 90 days of August 31, 2016.

On December 20, 2016, the Corporation entered into an amendment to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to extend the time period for enlargement of the Board to seven members from 90 days following August 31, 2016, to the earlier of, and subject to Shareholder approval: (a) 45 days following the effective date of the Form S-1 registration statement for the Corporation’s U.S. Initial Public Offering, or (b) April 15, 2017.

On March 30, 2017, the Corporation entered into amendments to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to further extend the time period for enlargement of the Board to seven members to the earlier of, and subject to shareholder approval: (a) 45 days following the effective date of the Corporation’s Form S-1 registration statement for the Corporation’s U.S. Initial Public Offering, or (b) May 31, 2017.

On May 25, 2017, the Corporation entered into amendments to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to further extend the time period for the successful listing of Common Shares on NASDAQ Stock Market (“NASDAQ”) from May 31, 2017 to June 30, 2017 and the enlargement of the Board to seven members to the earlier of, and subject to shareholder approval: (a) 45 days following the effective date of the Form S-1 registration statement for the Corporation’s U.S. Initial Public Offering, or (b) July 31, 2017.

On October 25, 2017, the Corporation entered into amendments to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to further extend the time period for the successful listing of Common Shares from June 30, 2017 to December 31, 2017 and the enlargement of the Board to seven members to December 31, 2017, subject to shareholder approval.

On December 27, 2017, the Corporation entered into amendments to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to extend the date the Corporation become subject to various financial covenant ratios from December 31, 2017 to March 31, 2018 and the enlargement of the Board to seven members from December 31, 2017 to March 31, 2018, subject to Shareholder approval.

On March 28, 2018, the Corporation entered into amendments to the Raycom SPA and Credit Agreement, pursuant to which Raycom and the Corporation agreed to extend the date the Corporation become subject to various financial covenant ratios from March 31, 2018 to June 30, 2019, the enlargement of the Board to seven members from March 31, 2018 to June 30, 2018, subject to Shareholder approval and agreed that interest payments on the outstanding loan balance for the period commencing on January 1, 2018 and continuing thereafter will be suspended, and each such suspended interest payment will be added to the principal balance of the loan, and the 12% rate for overdue interest will not apply to such suspended interest.

On October 15, 2018, the Corporation entered into amendment to the Raycom SPA, pursuant to which Raycom Board designation rights were removed and the Corporation is no longer required to enlarge its Board to seven directors.

Credit Agreement

Pursuant to the Credit Agreement, the Corporation entered into the Credit Facility with Raycom in the principal amount of $14.5 million and issued to Raycom Warrants to purchase 871,160 Common Shares at a price per Common Share of CDN$8.50 ($6.63 based on the exchange rate at August 18, 2016). The Credit Facility terminates on August 31, 2021. The Raycom Warrants have a 5-year term but upon a repayment of principal under the Credit Agreement, a pro-rata portion thereof will expire on the date which is later of (a) August 31, 2017 or (b) 30 days from the date of each principal repayment. Upon each payment of principal, the number of Raycom Warrants that will expire will equal the product of the (i) then outstanding number of Raycom Warrants and (ii) the principal repayment divided by the then outstanding principal balance of the loan. The exercise price and the number of Common Shares underlying the Raycom Warrants will be subject to adjustment as set forth in the Credit Agreement.

| 14 |

Subject to approval of Raycom, at its sole discretion, the Corporation may require further loans up to an aggregate amount of $1.5 million. The Corporation will pay interest on each loan outstanding at any time at a rate per annum of 10%. Interest will accrue and be calculated, but not compounded, daily on the principal amount of each loan on the basis of the actual number of days each loan is outstanding and will be compounded and payable monthly in arrears on each interest payment date. To the maximum extent permitted by applicable law, the Corporation will pay interest on all overdue amounts, including any overdue interest payments, from the date each of those amounts is due until the date each of those amounts is paid in full. That interest will be calculated daily, compounded monthly and payable on demand of Raycom at a rate per annum of 12%. The Corporation have the option to repay all or a portion of loans outstanding under the Credit Facility without premium, penalty or bonus upon prior notice to Raycom and repayment of all interest, fees and other amounts accrued and unpaid under the Credit Facility.

The Corporation also agreed to make the following mandatory repayments:

| (a) | $2 million prior to August 31, 2019; | |

| (b) | commencing on November 30, 2019 and on the last day of the month of each three month period thereafter, an amount of $687,500 per three month period; | |

| (c) | proceeds (less actual costs paid and income taxes) on any asset sales or issuances of debt or equity; | |

| (d) | upon a successful listing of Common Shares on NASDAQ with a capital raise of between $8 million to $11 million, mandatory repayment in the amount of $2 million, which will be applied toward the repayment obligation required by (a) above if completed by June 30, 2017; | |

| (e) | upon a successful listing of Common Shares on NASDAQ with a capital raise of more than $12 million, a mandatory repayment in the amount of $3 million which will be applied toward the $2 million repayment obligation required by (a) above if completed by June 30, 2017 and any amounts raised in excess of $2 million will be applied pro rata to repayment obligations required by (b) above commencing November 30, 2019; and | |

| (f) | commencing on the fiscal year ending December 31, 2017, and each fiscal year ending thereafter, 100% of the current year excess cash flow amount in excess of $2 million must be paid to Raycom as a mandatory repayment amount no later than May 1 of the following year until a total leverage ratio of not more than 3:1 has been met for such fiscal year, at which point 50% of the current year excess cash amount in excess of $2 million will be paid to Raycom as mandatory repayment amounts. Such excess cash flow payments will be applied pro rata to reduce other mandatory payments due thereunder. |

The mandatory prepayment provision described in subsection (c) above is not applicable to the December Private Placement (as defined below), the SVB Line of Credit (as defined below) or a U.S. public offering of equity resulting in proceeds to the Corporation of less than $8 million.

In addition, the Corporation must maintain certain leverage ratios and interest coverage ratios beginning the fiscal quarter ending December 31, 2017. The leverage ratios range from 4:1 to 2.5:1 and 2:1 to 3.5:1 for the interest coverage ratio. On December 27, 2017, the Credit Agreement was amended to extend the period for commencement of the leverage ratio and interest coverage ratio covenants from the calendar quarter ending December 31, 2017 to the calendar quarter ending March 31, 2018. On March 28, 2018, the Credit Agreement was amended to extend the period for commencement of the leverage ratio and interest coverage ratio covenants from the calendar quarter ending March 31, 2018 to the calendar quarter ending June 30, 2019. The Corporation is also subject to certain covenants relating to, among others, indebtedness, fundamental corporate changes, dispositions, acquisitions and distributions.

| 15 |

Upon an event of default, Raycom may by written notice terminate the facility immediately and declare all obligations under the Credit Agreement and the related loan documents, whether matured or not, to be immediately due and payable. Raycom may also as and by way of collateral security, deposit and retain in an interest bearing account, amounts received by Raycom from us under the Credit Agreement and the related loan documents and realize upon the Security Interest Agreements, Guaranty Agreements and Pledge Agreement as described below. If the Corporation fails to perform any obligations under the Credit Agreement and the related loan documents, Raycom may upon 10 days’ notice, perform such covenant or agreement if capable. Any amount paid by Raycom under such covenant or agreement will be repaid by the Corporation on demand and will bear interest at 12% per annum.

On March 13, 2018, the Corporation received $1 million of the additional $1.5 million of credit available under the Credit Agreement, bringing the total outstanding balance under the Credit Agreement to $15.5 million. Interest expense recognized under the Credit Agreement for the year ended December 31, 2017 amounted to $2,039,804.

The Amended Credit Agreement terminates on December 31, 2020. The additional availability of $6.5 million under Facility A is available to be drawn until December 31, 2018, subject to monthly borrowing limits based on the achievement of minimum monthly operating profit thresholds. Facility B is postponed and subordinated to Facility A. The Amended Credit Agreement also provides that, if the Corporation (or Guarantors, as defined therein) receive any amount from such a customer for the early termination of any contractual arrangement with such customer, the availability under Facility A will be reduced by such amount and the Facility A lenders may reduce the monthly borrowing limits accordingly. As a result, the amount available under Facility A was reduced from $7.5 million to $7.3 million in the third quarter of 2018. The interest rate payable under the original Credit Agreement amount outstanding bears an interest rate of 10% and the increased credit amount of $7.5 million bears an interest rate of U.S. LIBOR (1 month) plus 8%. The U.S. LIBOR rate used for computation of interest will be updated on the first day of each interest period (month). Interest payments on the Credit Facility will be deferred and capitalized annually and added at the end of each calendar year, to the principal balance of the Credit Facility, and thereafter interest shall be calculated on such increased principal balance. To the maximum extent permitted by applicable law, the Corporation will pay interest on all overdue amounts, including any overdue interest payments, from the date each of those amounts is due until the date each of those amounts is paid in full. That interest will be calculated daily, compounded monthly and payable on demand of Raycom at a rate per annum of 12%. The Corporation have the option to repay all or a portion of loans outstanding under the Amended Credit Facility without premium, penalty or bonus upon prior notice to Raycom and repayment of all interest, fees and other amounts accrued and unpaid under the Credit Facility.

The Corporation also agreed to make the following mandatory repayments:

| (a) | if any of Frankly, Inc., Frankly Media or Frankly Co. completes a debt or equity financing in excess of $10 million, an amount of $2 million within five business days of completion of such financing, unless the debt or equity financing is equal to $10 million or less, then an amount equal to 20% of such financing within five business days of completion of such financing; | |

| (b) | commencing on December 31, 2019 and on the last day of the month of each three month period thereafter, an amount of $687,500 per three month period; | |

| (c) | proceeds (less actual costs paid and income taxes) on any asset sales; and | |

| (d) | commencing on the fiscal year ending December 31, 2017, and each fiscal year ending thereafter, 100% of the current year excess cash flow amount in excess of $2 million must be paid to the Lenders as a mandatory repayment amount no later than May 1 of the following year until a total leverage ratio of not more than 3:1 has been met for such fiscal year, at which point 50% of the current year excess cash amount in excess of $2 million will be paid to Raycom as mandatory repayment amounts. Such excess cash flow payments will be applied pro rata to reduce other mandatory payments due thereunder. |

| 16 |

In addition, the Corporation must maintain certain leverage ratios and interest coverage ratios beginning the fiscal quarter ending June 30, 2019. The leverage ratio is 5.5:1 and 2:1 for the interest coverage ratio. The Corporation is also subject to certain covenants relating to, among others, indebtedness, fundamental corporate changes, dispositions, acquisitions and distributions.

Upon an event of default, the Lenders may by written notice terminate the facility immediately and declare all obligations under the Amended Credit Agreement and the related loan documents, whether matured or not, to be immediately due and payable. The Lenders may also as and by way of collateral security, deposit and retain in an interest bearing account, amounts received by the Lenders from the Corporation under the Amended Credit Agreement and the related loan documents and realize upon the Security Interest Agreements, Guaranty Agreements and Pledge Agreement, as defined in the Amended Credit Agreement. If the Corporation fails to perform any obligations under the Amended Credit Agreement and the related loan documents, the Lenders may upon 10 days’ notice, perform such covenant or agreement if capable. Any amount paid by the Lenders under such covenant or agreement will be repaid by the Corporation on demand and will bear interest at 12% per annum.

On October 15, 2018, the Corporation amended the Amended Credit Agreement with Raycom to reduce the principal debt balance due under the Amended Credit Agreement as of October 2, 2018 from $21,800,000 (includes $300,000 due to Cordillera) plus accrued interest of $1,298,653 as of September 30, 2018 to $10,000,000 as of October 1, 2018. In addition, the Amended Credit Agreement was amended as follows:

| (a) | Commencing on October 1, 2018, interest under the Amended Credit Agreement will accrue on the New Loan Balance at the annual rate of 10%. | |

| (b) | The maturity date of the New Loan Balance was revised to September 30, 2021. The New Loan Balance along with all accrued interest will be due on the revised maturity date. All interest payments on the New Loan Balance will be deferred and made on the revised maturity date. | |

| (c) | Commencing on October 1, 2018, various provisions of the Amended Credit Agreement will no longer be operative, which primarily removed all scheduled mandatory principal repayments and financial covenants under the Amended Credit Agreement. In addition, the deleted provisions under the Amended Credit Agreement reduced the scope of events that qualify as events of default. | |

| (d) | The Corporation’s debt to Cordillera under the Amended Credit Agreement has been extinguished and Cordillera is no longer party to the Amended Credit Agreement as of October 1, 2018. |

Guaranty Agreements, Security Interest Agreements and Pledge Agreement

In connection with the Credit Agreement, the Corporation’s subsidiaries Frankly Co. and Frankly Media have entered into Guaranty Agreements whereby Frankly Co. and Frankly Media have guaranteed the Corporation’s obligations under the Credit Agreement. In addition, each of Frankly Inc., Frankly Co. and Frankly Media have entered into security interest agreements (the “Security Interest Agreements”) pursuant to which Raycom has first priority security interests in substantially all of the Corporation’s assets. Under the Security Interest Agreements, the Corporation does not have a right to sell or otherwise dispose of all or part of the collateral except in the ordinary course of business that are not material. Frankly Media has also entered into an Intellectual Property Pledge Agreement pursuant to which it has granted a security interest in all of its intellectual property to Raycom. The Corporation has also (i) deposited its intellectual property in escrow accounts for the benefit of Raycom, (ii) in furtherance of the security interest granted to Raycom in the Corporation’s equity interest in Frankly Media, entered into a pledge agreement and a control agreement pursuant to which the Corporation granted Raycom control of the equity interest of Frankly Media and (iii) entered into an insurance transfer and consent assigning the Corporation’s rights and payments under insurance policies covering the Corporation’s operations and business naming Raycom as mortgagee, first loss payee and additional named insured.

| 17 |

In addition, the Corporation has entered into a Pledge Agreement pursuant to which the Corporation granted Raycom a security interest on substantially all the assets and securities of the Corporation’s current and future subsidiaries.

Upon an event of default, the Corporation will be required to deposit all interests, income, dividends, distributions and other amounts payable in cash in respect of the pledged interests into a collateral account over which Raycom has the sole control and may apply such amounts in its sole discretion to the secured obligations under the Credit Agreement. Upon the cure or waiver of a default, Raycom will repay to the Corporation all cash interest, income, dividends, distributions and other amounts that remain in such collateral account. In addition, upon an event of default, Raycom has the right to (i) transfer in its name or the name of any of its agents or nominees the pledged interests, (ii) to exercise all voting, consensual and other rights and power and any and all rights of conversion, exchange, subscription and other rights, privileges or options pertaining to the pledged interests whether or not transferred into the name of Raycom, and (iii) to sell, resell, assign and deliver all or any of the pledged interests. The Corporation has also agreed to use best efforts to cause a registration under the Securities Act and applicable state securities laws of the pledged interests upon the written request from Raycom.

Raycom may transfer or assign, syndicate, grant a participation interest in or grant a security interest in, all or any part of its rights, remedies and obligations under the Credit Agreement and the related loan documents, without notice or the Corporation’s consent.

PRESENTATION OF FINANCIAL STATEMENTS

Management, on behalf of the board of directors of the Corporation (the “Board”), will submit the Financial Statements to the Shareholders at the Meeting, but no vote by the Shareholders with respect thereto is required or proposed to be taken in respect of the Financial Statements.

The Financial Statements placed before Shareholders are available under the Corporation’s profile on System for Electronic Document Analysis and Retrieval (“SEDAR”), online at www.sedar.com. Copies of the Financial Statements will also be made available at the Meeting.

Under the articles of incorporation of the Corporation, the Board is to consist of a minimum of three (3) and a maximum of eleven (11) directors (“Directors”). The Board has determined that the number of Directors to be elected at the Meeting is four (4).

In the absence of any instructions to the contrary, management of the Corporation proposes to nominate and the Common Shares represented by proxies received by management will be voted FOR the approval of the election of the four persons whose names are set forth below.

Management does not contemplate that any of the nominees will be unable to serve as a Director. If, as a result of circumstances not now contemplated, any nominee is unavailable to serve as a Director, the proxy will be voted for the election of such other person or persons as management may select. Each Director elected will hold office until the next annual meeting of Shareholders, or until his respective successor is elected or appointed in accordance with applicable law and the Corporation’s constating documents.

| 18 |

Director Nominees of Frankly Inc.

The table below sets forth information with respect to each of the four (4) nominees for election to the Board, including the number of Common Shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised by each such nominee, as at November 16, 2018:

| Name, City, Province, and Country of Residence(1) | Age | Period of Service as a Director(1) | Principal Occupation | Independent | Common Shares Held(2) | |||||||||

Tom Rogers (3)(4)(5)(6) New York, New York USA | 64 | October 2016 to present | Executive Chairman, WinView, Inc. | Yes | 70,612 (2.65%) | |||||||||

Steven Zenz (3)(4)(5)(6) Minneapolis, Minnesota USA | 64 | October 2016 to present | Consultant | Yes | 56,120 (2.11%) | |||||||||

Louis Schwartz Atlanta, GA USA | 50 | April 2018 to present | Chief Executive Officer, Frankly Inc. | No | 127,039 (4.78%) | |||||||||

Samuel Hyun (3)(4)(5) Seoul South Korea | 48 | April 2016 to present | Head of Global Planning Team, SK Planet, Co., Ltd. | No(7) | 37,583 (1.41%) | |||||||||

Notes:

| (1) | Each Director listed will hold his position as a Director of the Corporation until the next annual meeting of Shareholders or until his respective successor is elected or appointed in accordance with applicable laws and the Corporation’s constating documents. |

| (2) | Based upon information furnished to the Corporation by each individual Director. |

| (3) | Member of the Audit Committee of the Corporation. |

| (4) | Member of the Nominating and Corporate Governance Committee of the Corporation. |

| (5) | Member of the Compensation Committee of the Corporation. |

| (6) | Member of the Strategic Process Committee of the Corporation. |

| (7) | Mr. Hyun is independent under the requirements of National Instrument 52-110 - Audit Committees (“NI 52-110”). |

The following are brief biographies of each of the nominees for Director:

Tom Rogers

Tom Rogers is the Chairman of the Board and has served as a director on the Board since October 3, 2016. Mr. Rogers has served since June 2016 and is currently still serving as Executive Chairman of WinView, Inc., a company that operates at the intersection of TV sports, social media, gaming and mobility, and with 28 patents, is the leading player in the application of games in which viewers can engage while simultaneously watching live TV sports. Mr. Rogers also has served since June 2003 and is currently still serving as Chairman and Chief Executive Officer of TRget Media, LLC, a media investment and operations advisory firm. From May 1981 to December 1986, Mr. Rogers served as Senior Counsel to the U.S. House of Representatives Telecommunications, Consumer Protection and Finance Subcommittee, where he was responsible for drafting a number of communications laws, including the Cable Act of 1984, which established a federal framework to replace a patchwork of local regulatory burdens. Thereafter, Mr. Rogers served as President of NBC Cable from August 1988 to October 1999 and served as Executive Vice President of The National Broadcasting Company (“NBC”) as well as NBC’s Chief Strategist from September 1992 to October 1999. At NBC, Mr. Rogers oversaw the creation of CNBC, the NBC/Microsoft cable channel and Internet joint venture, MSNBC. In addition, he served as Co-Chairman of the Arts and Entertainment and History Channels, and was responsible for overseeing many other cable channels, including Court TV, Bravo, American Movie Classics, Independent Film Channel, the National Geographic Channel, and numerous regional sports channels. From November 1999 to April 2003, Mr. Rogers served as Chairman and CEO of Primedia (NYSE: PRM) which at the time was the leading targeted media company in the US, where he oversaw such diverse properties as New York Magazine, Motor Trend, Seventeen, and Cable World. Mr. Rogers drove the digital development and online presence of scores of the company’s print properties. From July 2005 and September 2016, when the company was sold, Mr. Rogers served as President and CEO and then as Chairman of TiVo, Inc. (“TiVo”). Under Mr. Roger’s leadership, TiVo emerged as the leader in providing cable operators worldwide with an advanced television user experience while also providing consumers the only retail cable set top box and the media industry with an array of unique audience research data solutions. Mr. Rogers has also served as Chairman of the Board of Teleglobe (NASDAQ: TLGB), a leading international telecommunications, voice-over-internet, and mobile telephony provider from 2004 to 2006. He was also Chairman of the Board and a board member of Supermedia (NASDAQ: SPMD), the print and digital yellow pages spin off of Verizon. Mr. Rogers also served on the board of Dex Media (NASDAQ: DXM), a print and digital marketing company and successor company to Supermedia. Mr. Rogers holds a Bachelor of Arts from Wesleyan University and a J.D. from Columbia Law School. He has also been inducted into the Broadcasting Hall of Fame, as well as the Cable Hall of Fame. We believe Mr. Rogers’ deep background and extensive experience in the media industry make him well qualified to serve as a member of the Board.

| 19 |

Steven Zenz

Steven Zenz has served as a director on the Board since October 3, 2016. Mr. Zenz has served as a consultant since January 2011, advising companies on matters including merger and acquisition transactions and Securities and Exchange Commission offerings and filings. From 1976 until 2010, he was with KPMG LLP (“KPMG”), where he was a partner for 22 years. At KPMG, he served in various leadership capacities, including partner in charge of the audit group and partner in charge of the firm’s SEC and technical accounting practices for KPMG’s Minneapolis office. He also served as the lead audit partner for publicly held companies. Mr. Zenz has been a member of the board of directors of Insignia Systems, Inc. (NASDAQ: ISIG), a provider of point of sale in-store signage and promotional advertising media for consumer packaged goods companies and retailers since October 2013, and serves as the audit committee chair and is a member of the compensation committee. He has served as a director and audit committee chair of Redbrick Health, a venture-backed private health technology company from June 2015 to April 30, 2018, when the company was sold. Mr. Zenz also serves on the board of trustees and audit committee of the William Blair Mutual Funds. He holds a Bachelor of Science degree in accounting and a Masters of Business Taxation from the University of Minnesota. We believe Mr. Zenz’s extensive experience in advising public companies, including on SEC offerings and filings, makes him well qualified to serve as a member of the Board.

Louis Schwartz

Louis Schwartz has served as a director and Chief Executive Officer of the Corporation since April 12, 2018. Previously, Mr. Schwartz served as the Corporation’s Chief Operating Officer since February 2016 and Chief Financial Officer since July 2016. Mr. Schwartz joined the Corporation in August 2015 in connection with the acquisition of Frankly Media and served as President of Frankly Media. Prior to that, Mr. Schwartz was the Chief Digital Officer of World Wrestling Entertainment, Inc., a professional wrestling entertainment company, where he oversaw all digital platforms and helped lead the development of the WWE Network, the first OTT 24/7 streaming network from October 2014. Mr. Schwartz also served as CEO of UUX from November 2012, an OTTP video technology company, where he successfully led the merger of Totalmovie, a leading Latin American retail OTT service, with OTT Networks, an OTT video technology company. From March 2010 to March 2012, Mr. Schwarz served as CEO of the Americas and General Counsel for Piksel, a video technology company, and in May 2000, he co-founded Multicast Media Technologies, one of the first Internet video platform companies, which was sold to Piksel in March 2010. Mr. Schwartz graduated from Pennsylvania State University with a Bachelor of Science degree in Real Estate Finance before receiving a Juris Doctorate from the Mississippi College School of Law. We believe Mr. Schwartz’s deep technology and media background and operational and transactional experience make him well qualified to serve as Chief Executive Officer.

| 20 |

Samuel Hyun

Choong Sik (Samuel) Hyun has served as a director on the Board since April 2016. Mr. Hyun joined SK Group, South Korea’s third-largest conglomerate in 1998 and held increasingly senior positions, culminating in his service as Manager of SK Networks from January 1998 to May 2012, as Project Leader of M&A office for SK Planet Co., Ltd., an Internet services and e-Commerce company (“SK Planet”) from June 2012 to December 2012, and currently as Head of Global Planning Team of SK Planet Co., Ltd. since January 2013. Mr. Hyun has been involved in several mergers, acquisitions and strategic partnerships with globally-renowned companies like Shopkick, a leading Silicon Valley-based mobile commerce and shopping service, Suning Commerce Group, one of the largest retailers in China, and Megabox, a top-tier multiplex cinema company in Korea. Mr. Hyun holds a Master of Education in Pedagogy and Bachelor of Science from Seoul National University, South Korea and a Master’s in Business Administration from China Europe International Business School. Mr. Hyun has over 20 years’ experience in strategic long/short term planning, mergers and acquisitions, strategic consulting and securities trading, which enables him to contribute important skills to the Board.

Interests of Informed Persons in Material Transactions

Other than as disclosed below, since the commencement of the Corporation’s most recently completed financial year, the Corporation did not have any transactions, or any proposed transactions, with any “informed person” (as defined in National Instrument 51-102 - Continuous Disclosure Obligations), or any proposed Director of the Corporation, or any associate or affiliate of any informed person or proposed Director, who had a material interest, direct or indirect, which has materially affected or would materially affect Corporation or any of its subsidiaries.

Raycom

A description of the relationship between Raycom and the Corporation can be found under the heading “Certain Relationships and Related Transactions, and Director Independence - Raycom Transactions and Agreements”.

Corporate Cease Trade Orders or Bankruptcies

To the knowledge of the Corporation, none of the persons proposed for election as Directors nor any personal holding company owned or controlled by any of them: (a) are, as at the date of this Circular, or have been, within the 10 years before the date of this Circular, a director, Chief Executive Officer or Chief Financial Officer of any company that: (i) was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (an “Order”) that was issued while the proposed director was acting in the capacity as director, Chief Executive Officer or Chief Financial Officer; or (ii) was subject to an Order that was issued after the proposed director ceased to be a director, Chief Executive Officer or Chief Financial Officer and which resulted from an event that occurred while that person was acting in the capacity as director, Chief Executive Officer or Chief Financial Officer; (b) are, as at the date of this Circular, or have been within 10 years before the date of this Circular, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (e) have, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

Penalties and Sanctions

To the knowledge of the Corporation, none of the persons proposed for election as Directors nor any personal holding company owned or controlled by any of them: (a) has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for the proposed director.

| 21 |

Conflicts of Interest

Conflicts of interest are subject to the applicable provisions of the Business Corporations Act (British Columbia), as amended (the “BCBCA”), and may result in a director abstaining from voting on a resolution in order to have the matter resolved by the other directors, or the matter may be presented to the Shareholders for ratification. When a conflict of interest arises, the directors of the Corporation must, in accordance with the applicable provisions of the BCBCA, act honestly and in good faith with a view to the best interests of the Corporation and must exercise the care, diligence and skill a reasonably prudent person would exercise in comparable circumstances.

Required Approval

In the election of the above named director-nominees, the four people receiving the highest number of affirmative votes cast by Shareholders of Common Shares at the Meeting will be elected. The persons named in the accompanying forms of proxy will, in the absence of specifications or instructions to withhold from voting on the forms of proxy, vote FOR each of the above named director-nominees, to hold office until the next annual meeting of Shareholders.