Form DEF 14A DAVITA INC. For: Jun 10

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant X | ||

| Filed by a Party other than the Registrant ☐ | ||

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| X | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| DAVITA INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| X | No fee required. | |||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

|

☐ |

Fee paid previously with preliminary materials. | |||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Notice of 2021 Annual Meeting and Proxy Statement | ||||

April 23, 2021

Dear Fellow Stockholders:

On behalf of DaVita Inc. ("DaVita" or the "Company") and its Board of Directors (the "Board"), we are pleased to invite you to attend the DaVita Inc. 2021 Annual Meeting of Stockholders (the "Annual Meeting"), which will be held on Thursday, June 10, 2021, at 10:00 a.m. Mountain Time. The attached Notice of Annual Meeting and Proxy Statement will serve as your guide to the business to be conducted at the Annual Meeting and provide details on the virtual meeting.

For DaVita, this past year fixed a spotlight on our teammates’ commitment to care for patients with kidney disease. The ongoing COVID-19 pandemic created challenges that we could never have imagined at the beginning of 2020. These challenges – clinical, operational and financial – led to opportunities for us to harness the strength of our teams and our platforms to support our patients and our community in this time of global crisis. When I reflect on the year, I am inspired by the resilience, creativity and innovation showed by our organization to adapt to the unprecedented and rapidly changing landscape and by the depth of the empathy and commitment of our teams to each other and to the health and safety of our patients.

Over the past year, we took significant steps to enhance our infection control and safety practices and create new processes, such as the early cohorting of patients with suspected or confirmed cases of COVID-19, to ensure that we could continue to provide high-quality care for the more than 240,000 patients who depend on receiving life-sustaining dialysis treatment from us multiple times each week.

Earlier this year, the dialysis community came together with the CDC and federal government to launch a national program to allocate COVID-19 vaccines directly to dialysis providers for the vaccination of end-stage renal disease patients and their front-line caregivers, an important policy by the administration to protect some of the nation’s most vulnerable patients. We continue to work hard to implement this program to help ensure that all of our patients who want to be vaccinated can receive a vaccine as soon as possible. Across the U.S., COVID-19 vaccination rates for Blacks and Hispanics remain well below that of Whites and Asians. We have been able to deploy our care teams, including social workers and dietitians, to engage in one-on-one conversations to address common causes of vaccine hesitancy, with support from our Medical Directors. We believe these efforts, combined with offering patients direct access to the vaccine from a trusted care team and in a convenient site of care, have addressed the challenges with third-party sites, reduced hesitancy rates and improved health equity.

At DaVita we have a long history of investing in the development and well-being of our teammates. Through the pandemic, we increased this investment in caring for our own teammates, including providing tens of millions of dollars in relief payments to eligible teammates, adjusting pay and paid time off practices to better support our teammates and enhancing benefits, including backup child care and free counseling and mental health resources.

While caring for our patients and teammates, we have continued to focus on stewarding resources responsibly to deliver financial results for our stockholders.

Last year at this time, I shared with you how inspiring our 67,000 teammates around the world are, especially our caregiving teammates and physician partners. A year later, I feel even more strongly that our caregivers on the front line of this pandemic are heroes in every sense of the word. I thank them for their selfless service. Their courage, compassion and dedication honor the memory of those we have lost to the pandemic.

Very truly yours,

Javier J. Rodriguez

Director and Chief Executive Officer

April 23, 2021

Dear Fellow Stockholders:

I am proud to serve you as Chair of your Board of Directors and to share our accomplishments of the past year. I must start by acknowledging how proud your Board is of our teammates’ response to the unprecedented and extraordinary challenges presented by the global COVID-19 pandemic. Our caregivers have demonstrated the highest levels of resiliency, perseverance and innovation as they have continued to provide life-sustaining services to our patients.

At DaVita, we are committed to continuing to deliver on strong governance and responsible corporate citizenship, and being responsive to all stakeholders. In particular, I would like to highlight the following ways the Board and management have been working on your behalf.

Thoughtful Approach to Board Composition with a Demonstrated Commitment to Refreshment and Diversity.

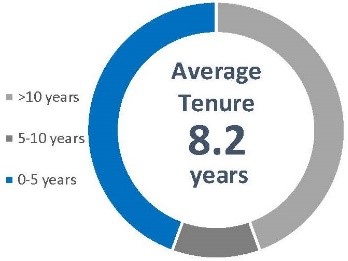

Your Board is committed to maintaining a balanced and effective Board with a broad mix of tenure, skills, experience and diversity of backgrounds and viewpoints. In 2020 we appointed two new independent directors to the Board, Shawn Guertin and Paula Price, who add to the richness of experience of your Board. Mr. Guertin is the former Executive Vice President, Chief Financial Officer and Chief Enterprise Risk Officer of Aetna, Inc., and Ms. Price is the former Executive Vice President and Chief Financial Officer of Macy’s, Inc. In addition, your Board has an average tenure of 8.2 years, and we are proud of the fact that it is comprised of 44% women and 33% people of color.

Ongoing Dialogue with Stockholders through Robust Engagement that Includes Independent Directors.

We believe that engaging with stockholders is fundamental to our commitment to good governance, and since our 2020 Annual Meeting of Stockholders, some combination of management and the Chair of our Compensation Committee met with stockholders representing approximately 64% of DaVita's outstanding shares. Over the past several years, feedback received from these discussions has helped inform changes to our executive compensation program and further improve our disclosures. Some of this year’s enhancements resulting from these discussions include changes to our compensation practices that require above median TSR performance for executives to receive target level PSU vesting and enhancing the linkage between DaVita’s ESG performance and executive pay. In addition, after consideration of feedback from stockholders, we have further enhanced our political and lobbying spending disclosures and have committed to additional semi-annual reporting regarding the company’s political and lobbying spend to begin in July of this year.

Commitment to Corporate Social Responsibility.

The Board’s Nominating and Governance Committee oversees DaVita’s policies and programs related to corporate, environmental and social responsibility. Being a responsible corporate citizen has long been an important principle at DaVita. Since 2008, we have published an annual social responsibility report we call Community Care, highlighting our organization’s and teammates’ contributions and support of the communities in which we live and operate. A shining example of supporting our communities was the decision by our Board and management to return approximately $250 million of CARES Act funding so that government support and funding could be used by those organizations in greater need than us.

In 2019 and 2020, our company surveyed key stakeholders to learn more about what ESG issues matter most to them and also reviewed the Sustainability Accounting Standards Board ("SASB") recommended metrics for health care service providers. Based, in part, on these data sources, our company has identified our top ESG priorities and five key focus areas, and we will be publishing a set of aspirational goals for 2025 across each of the pillars of our ESG program. Furthermore, we recognize that the latest climate science sends a warning that we must dramatically curb temperature rise to avoid the impacts of climate change, and as a company, we want to do our part. Accordingly, we have presented our environmental goals for 2025 and beyond to the Science Based Targets initiative for their review and confirmation that our goals are in alignment with climate science.

In spring 2021, for the first time we will publish our ESG report based on the recommendations from SASB and its material topics for health care service providers. We also published our first report on Diversity and Belonging, disclosing our company’s diversity metrics and a roadmap for delivering our vision of cultivating a diverse organization where everyone belongs.

We are tremendously proud of our ongoing efforts in sustainability and social responsibility. To learn more, I encourage you to read our 2020 Community Care social responsibility report at www.davita.com/communitycare.

In closing, I would like to say a special thank you to our stockholders. We recognize and greatly appreciate the trust and confidence you have placed in us. We will continue to represent your interests through our strong independent oversight of management.

On behalf of your Board of Directors,

Pamela M. Arway

Chair of the Board

Thursday, June 10, 2021

10:00 a.m. Mountain Time

Live Audio Webcast at www.virtualshareholdermeeting.com/DVA2021

The 2021 Annual Meeting of the Stockholders (the "Annual Meeting") of DaVita Inc., a Delaware corporation, will be a virtual-only meeting to be held as a live audio webcast over the Internet at www.virtualshareholdermeeting.com/DVA2021 on Thursday, June 10, 2021 at 10:00 a.m. Mountain Time, for the following purposes, which are further described in the accompanying Proxy Statement:

| – | To vote upon the election of the nine director nominees, identified in the accompanying Proxy Statement, to the Board of Directors, each to serve until the Company's 2022 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; |

| – | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021; |

| – | To approve, on an advisory basis, the compensation of our named executive officers; |

| – | To consider and vote upon a stockholder proposal regarding political contributions disclosure, if properly presented at the Annual Meeting; and |

| – | To transact such other business as may properly be brought before the Annual Meeting and any adjournment or postponement thereof by the presiding person of the Annual Meeting. |

We will mail, on or about April 23, 2021, a Notice of Internet Availability of Proxy Materials to stockholders of record and beneficial owners as of the close of business on April 13, 2021. On the date of mailing of the Notice of Internet Availability of Proxy Materials, the proxy materials will be available free of charge at www.proxyvote.com.

The Notice of Internet Availability of Proxy Materials will identify a toll-free telephone number, an e-mail address and a website where stockholders can request a paper or e-mail copy of the Proxy Statement, our 2020 Annual Report to Stockholders, and a form of proxy relating to the Annual Meeting; and information on how to access the form of proxy over the Internet and how to vote. If you virtually attend the Annual Meeting and previously voted via the telephone or Internet voting systems, or mailed your completed proxy card, you may vote during the Annual Meeting if you wish to change your vote in any way.

Please note that all votes cast via telephone or the Internet must be cast prior to 11:59 p.m. Eastern Time on Wednesday, June 9, 2021. Be aware that earlier voting deadlines apply for shares held through the DaVita Retirement Savings Plan. Additional information on voting deadlines and voting instructions are set out in the Proxy Statement under the heading "How to Vote."

We will make a list of stockholders entitled to vote at the Annual Meeting available electronically on the virtual meeting website during the Annual Meeting. In addition, during the ten days prior to the Annual Meeting, you may contact Investor Relations at 1-888-484-7505 to request the list of stockholders entitled to vote at the Annual Meeting.

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS |

| FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON |

| June 10, 2021: |

| The Notice of Annual Meeting of Stockholders, Proxy Statement and Annual |

| Report are available at www.proxyvote.com. |

By order of the Board of Directors,

Samantha A. Caldwell

Corporate Secretary

April 23, 2021

| Table of Contents |

| Proxy Statement Summary |

This Proxy Statement summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement before voting. Capitalized terms not otherwise defined in this section are defined later in this Proxy Statement.

| Meeting Agenda and Voting Matters |

Stockholders will be asked to vote on the following matters at the Annual Meeting:

| Items of Business | Board Recommendation | Where to Find More Information | ||

| Election of Nine Director Nominees Identified in this Proxy Statement | “FOR” all nominees | Pages 11-16 | ||

| Ratification of KPMG LLP as our Independent Registered Public | “FOR” | Page 38 | ||

| Accounting Firm for 2021 | ||||

| Advisory Vote to Approve Executive Compensation | “FOR” | Pages 39-40 | ||

| Stockholder Proposal Regarding Political Contributions Disclosure | “AGAINST” | Pages 41-44 |

| 2020 Financial Performance Summary |

We outperformed the high end of the guidance metrics set forth below that were provided to investors in our fourth quarter 2019 earnings release other than with respect to revenue, and we performed at the midpoint of our revenue guidance range.1, 2

We outperformed expectations provided at beginning of year on most metrics despite unknown COVID-19 headwinds when guidance was issued.

(1) The graphic contains non-GAAP financial measures. Please see Annex A for a presentation of the most directly comparable GAAP financial measure and a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

(2) In 2020, we also met expectations with respect to effective income tax rate on adjusted income from continuing operations attributable to DaVita Inc. and maintained our disciplined approach to capital efficient growth by coming in below the guided range for capital expenditures from continuing operations.

(3) "External Guidance" as presented in the graphic refers to selected 2020 guidance measures provided to investors on February 10, 2020 with our earnings results for the year ended December 31, 2019.

|

1 |

| COVID-19 Response |

DaVita has been on the front line of the COVID-19 pandemic, as a caregiving organization that needs to keep its doors open to provide life-sustaining care to its patients. During this time of great challenge, our top priorities continue to be the health, safety and well-being of our patients, teammates and physician partners. To that end, we have dedicated and continue to dedicate substantial resources in response to COVID-19:

COVID-19 Relief for Teammates

|

|

|

| |||

| Relief payments, primarily to frontline teammates | Free counseling & mental health resources | Access to Paid Time Off (PTO) advances and lifted PTO accrual caps for eligible teammates | Back-up child care |

COVID-19 Relief for Patients and Communities

|

|

|

| |||

| Continued to provide life-sustaining therapy to ~200,000 domestic dialysis patients in the face of the crisis | Enhanced our already-robust infection control processes | Secured appropriate PPE to maintain protocols that meet or exceed CDC guidelines | Provided outpatient dialysis to ~75% of our patients with suspected or confirmed COVID-19 to help reduce burdens on hospitals |

| Our Board and Governance |

The following sets forth a summary of information about our Board of Directors ("Board") and corporate governance program. See "— Board of Directors Information" for additional information about our Board and "—Corporate Governance" for additional information about our corporate governance program.

| Independent, Female Board Chair |

Three of Four Committee Chairs are Diverse | |||

| Pamela Arway | Phyllis Yale | Barbara Desoer | Paul Diaz | Shawn Guertin |

| Independent | Chair, Nominating & | Chair, Compensation | Chair, Compliance & | Chair, Audit |

| Board Chair | Governance Committee | Committee | Quality Committee | Committee |

|

|

|

|

|

| 2 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Board of Directors Snapshot | ||||||

| 33% | >95%* | 34 | 7 out of 9** | |||

| of director nominees added in last 3 years | overall attendance at Board and Committee meetings in 2020 | total meetings in 2020 | director nominees are independent | |||

*Director nominees

**Under NYSE Independence Standards

|

|

|

|

*Diversity and Tenure calculations are as of April 23, 2021.

| 2020 Stockholder Outreach |

|

Engaging with investors to solicit feedback on matters of interest to them is fundamental to our commitment to good governance. In 2020, we continued our robust year-round stockholder engagement efforts and met with investors representing approximately 64% of our outstanding shares. |

Outreach | Engagement | Committee Chair Participation |

|

|

|

Key Items Discussed with Stockholders in 2020 and 2021

|

Corporate Governance |

|

Executive Compensation |

|

Corporate Responsibility | ||

| Board Leadership and Succession Planning | Pay-for-Performance | Political Spending Disclosure | |||||

| Board Tenure and Refreshment | CEO Compensation | Workforce Development and Diversity | |||||

| Board Diversity | Long-Term Incentive Compensation | Sustainability | |||||

| 3 |

| Highlights of Our Executive Compensation Program |

Stockholder Feedback Helped Shape 2021 Executive Compensation Program

| Stockholder Feedback | DaVita Actions in Response |

|

Quantum and incentive value of the CEO Premium-Priced SSAR Award |

●Enhanced Proxy Statement disclosure to clarify that the award is meant to replace five years of grants

●Confirmed that the Board does not intend to make any additional equity grants to the CEO for five years

●Enhanced Proxy Statement disclosure to highlight that the base price is a 20% premium to the 2019 Dutch Auction tender offer clearing price and a 14% premium to the closing price on the day prior to approval of the award by the independent members of the Board

●Pages 53-56 |

|

Targets for incentive payouts |

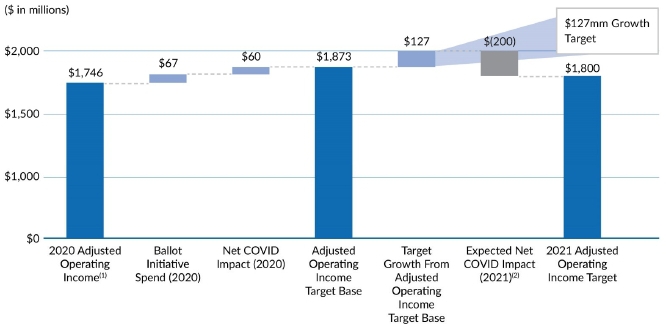

●For the 2021 STI Program, the adjusted operating income target for target level payout is $54 million higher than 2020 adjusted operating income, $127 million higher when adjusted for certain items for year-over-year comparability and $50 million higher than the midpoint of our full year 2021 adjusted operating income guidance(1)

●For the 2021 relative TSR dependent PSUs, performance at the 55th percentile (not 50th percentile) is required for target level vesting

●Pages 69-72 |

| (1) | “Adjusted operating income” is a non-GAAP financial measure that represents operating income excluding certain items which we do not believe are indicative of our ordinary results of operations, including, among other things, charges related to changes in ownership interests and legal accruals. Please see Annex A for a presentation of the most directly comparable GAAP financial measure and a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure. |

CEO 2020 Total Direct Compensation

Our CEO's 2020 Total Direct Compensation, which is defined as salary received during the year, annual cash performance bonus (or short-term incentive) earned for a year (and paid early the following year) and annualized grant date fair market value of long-term incentives (equity) awarded that year, is set forth below. The Annual Long-Term Incentive Award ("Annual LTI Award") shown reflects an annualized value calculated as 20% of the actual grant date fair value of the CEO Premium-Priced SSAR Award because that award is intended to replace five years of long-term incentive awards. For additional details on our CEO's compensation, see "— Compensation Discussion & Analysis — Executive Summary — CEO Premium-Priced SSAR Award."

| Base Salary | Annual Cash Award |

Annual LTI | Total Direct Compensation | |||||||

| $ | 1,246,154 | $ | 3,282,480 | $ | 13,699,392 | $ | 18,228,026 | |||

| 4 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Environmental, Social, Governance ("ESG") |

Having ESG as a priority is not new to DaVita. Our Trilogy of Care – Caring for Our Patients, Caring for Each Other, and Caring for Our World – has been at the heart of what we do for more than 15 years.

The Nominating and Governance Committee of DaVita’s Board oversees DaVita’s activities, policies and programs related to ESG. The management ESG Steering Committee provides guidance on strategy and disclosures for our ESG initiatives.

DaVita's ESG Areas of Focus

For more information on our 2025 ESG goals, organized around the following key topics, visit our Community Care website at www.davita.com/communitycare. Website references throughout this Proxy Statement are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this Proxy Statement.

| ESG Areas of Focus | ||||||||

| Patient Care |

Teammate Engagement |

Environmental Stewardship |

Healthy Communities |

Leading with Integrity and Accountability | ||||

|

●Quality of Care

●Patient Experience

●Patient Education

●Health Equity |

●Diversity & Belonging

●Teammate Development

●The DaVita Way |

●Carbon Emissions Reduction

●Water & Waste Reduction |

●Charitable Giving

●Volunteerism |

●Compliance, Ethics & Governance

●Data Privacy

●Supply Chain | ||||

|

|

|

| Patient Care | Diversity and Belonging | Commitment to 100% Renewable Energy |

| 96% of facilities scored 3, 4 or 5 stars in CMS’s Five Star Quality Rating System, more than any other dialysis provider. | As an organization that is 78% women and 54% teammates of color, we are working to ensure strong representation of women and people of color at all levels in our organization. | By 2022, DaVita’s agreements to purchase energy from wind and solar farm developments in Texas are expected to create as much clean energy annually as the amount of electricity we use to operate our U.S. centers. |

| 5 |

| Proxy Statement |

| General Information |

We are delivering this Proxy Statement in connection with the solicitation of proxies by the Board of Directors (the “Board”) of DaVita Inc. ("DaVita" or the "Company"), for use at our 2021 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held on Thursday, June 10, 2021 at 10:00 a.m. Mountain Time. The Annual Meeting will be a live audio webcast available at www.virtualshareholdermeeting.com/DVA2021, where you will be able to attend, vote your shares electronically and submit questions. We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate in our virtual meeting as they would at an in-person meeting.

The proxies solicited for the Annual Meeting will remain valid for use at any meetings held upon adjournment or postponement thereof by the presiding person of the Annual Meeting. The record date for the Annual Meeting is the close of business on April 13, 2021 (the "Record Date"). All holders of record of the Company's common stock ("Common Stock") on the Record Date are entitled to notice of the Annual Meeting and to vote at the Annual Meeting and any meetings held upon adjournment or postponement of that meeting by the presiding person of the Annual Meeting.

To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials ("e-proxy notice"), proxy card or voting instruction form. The audio webcast will begin promptly at 10:00 a.m. Mountain Time. Online check-in will begin at 9:45 a.m. Mountain Time, and you should allow ample time for the check-in procedures. If you encounter any technical difficulties with the virtual meeting platform on the meeting day, please call the technical support number that will be posted on the Annual Meeting log in page at www.virtualshareholdermeeting.com/DVA2021.

If you wish to submit a question during the Annual Meeting, log into the virtual meeting platform beginning at 9:45 a.m. Mountain Time on the meeting day, type your question into the “Ask a Question” field, and click “Submit.” We intend to answer questions submitted by stockholders during the Annual Meeting that comply with the Annual Meeting rules of conduct, which will be posted on the virtual meeting platform.

We are using the "e-proxy" rules adopted by the U.S. Securities and Exchange Commission (the “SEC”) to furnish proxy materials to our stockholders over the Internet. Under the e-proxy rules, the e-proxy notice will be mailed on or about April 23, 2021 to our stockholders of record and beneficial owners of our Common Stock as of the Record Date, in lieu of a printed copy of our proxy materials. We believe using this e-proxy notice model allows us to reduce costs and helps reduce our carbon footprint.

If you receive an e-proxy notice by mail, you will not receive a printed copy of the proxy materials unless you have previously made a permanent election to receive these materials in paper copy. The e-proxy notice provides instructions on how you may access and review our proxy materials, including this Proxy Statement, the accompanying Notice of 2021 Annual Meeting of Stockholders and the Company's 2020 Annual Report to Stockholders, as well as instructions on how you may submit your vote. If you received an e-proxy notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the e-proxy notice.

Whether or not you plan to virtually attend the Annual Meeting, we encourage you to vote prior to the Annual Meeting by telephone, Internet, or by requesting a proxy card to complete, sign, date and return by mail. Voting in advance will help ensure that your shares will be voted at the Annual Meeting.

| 6 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Proxy Statement |

Unless you instruct otherwise in your proxy, any proxy that is given and not revoked will be voted at the Annual Meeting:

| – | FOR the election of the nine director nominees identified in this Proxy Statement each to serve until the 2022 Annual Meeting of Stockholders (the "2022 Annual Meeting") or until their respective successors are duly elected and qualified; |

| – |

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021; |

| – |

FOR the approval, on an advisory basis, of the compensation of our named executive officers ("NEOs"); |

| – |

AGAINST the stockholder proposal regarding political contributions disclosure, if properly presented at the Annual Meeting; and |

| – | As determined by the proxy holders named in the proxy card in their discretion, with regard to all other matters as may properly be brought before the Annual Meeting and any adjournment or postponement thereof by the presiding person of the Annual Meeting. |

| Voting Information |

Our only voting securities are the outstanding shares of our Common Stock. As of the Record Date, we had approximately 106,612,581 shares of Common Stock outstanding. Each stockholder is entitled to one vote per share on each matter that we will consider at the Annual Meeting. Stockholders are not entitled to cumulate votes. Under the rules of the New York Stock Exchange (“NYSE”), your broker, bank or other nominee may not vote your uninstructed shares in the election of directors and certain other matters on a discretionary basis. Accordingly, brokers holding shares of record for their customers generally are not entitled to vote on these matters unless their customers give them specific voting instructions. If the broker does not receive specific instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. Thus, if you hold your shares in “street name,” meaning that your shares are registered in the name of your broker, bank or other nominee, and you do not instruct your broker, bank or other nominee how to vote, no votes will be cast on your behalf on any proposal other than the proposal for the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called “broker non-votes.” If the stockholders of record present at the Annual Meeting or represented by their proxies and entitled to vote at the Annual Meeting hold at least a majority of our shares of Common Stock outstanding as of the Record Date, a quorum will exist for the transaction of business at the Annual Meeting. Stockholders virtually attending the Annual Meeting or represented by proxy at the Annual Meeting who abstain from voting and broker non-votes are counted as present for quorum purposes. We will make a list of stockholders as of the Record Date available electronically during the Annual Meeting on the virtual meeting website, and during the ten days prior to the Annual Meeting you may contact Investor Relations at 1-888-484-7505 to request the list of stockholders as of the Record Date.

| How to Vote |

Stockholders

Shares of our Common Stock may be held directly in your own name or may be held beneficially through a broker, bank or other nominee in "street name." We have summarized below the distinctions between shares held of record and those owned beneficially.

Stockholder of Record — If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares and we are providing proxy materials directly to you. As the stockholder of record, you have the right to vote online during the Annual Meeting or to grant your voting proxy to the persons designated by us or a person you select.

Beneficial Owner — If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares held in "street name," and you have been provided proxy materials

| 7 |

from your broker, bank or other nominee who is considered the stockholder of record with respect to the shares. As the beneficial owner, you have the right to direct the broker, bank or nominee on how to vote your shares and are also invited to virtually attend the Annual Meeting. Your broker, bank or nominee is obligated to provide you with a voting instruction form for you to use. This voting instruction form will also include a 16-digit control number that will allow you to access the Annual Meeting audio webcast and vote your shares during the Annual Meeting. For additional information regarding attending and voting at the Annual Meeting, see the information under the heading “—General Information.”

Voting

Whether you hold our shares as a stockholder of record or as a beneficial owner, you may vote before the Annual Meeting. Most stockholders will have a choice of voting through the Internet or by telephone or, if you received a printed copy of the proxy materials, by completing a proxy card or voting instruction form and returning it in a postage-prepaid envelope. Please refer to the instructions below and in the e-proxy notice. If you are a Company employee, or "teammate," who holds shares of Common Stock through the DaVita Retirement Savings Plan (the "401(k) Plan"), certain earlier voting deadlines apply.

Teammate 401(k) Stockholders — If you participate in the 401(k) Plan and you are invested in our Common Stock fund in your account, you may give voting instructions to the 401(k) Plan trustee, Voya Institutional Trust (the "plan trustee"), as to the number of shares of Common Stock equivalent to the interest in our Common Stock fund credited to your account as of the most recent valuation date coincident with or preceding the Record Date. The plan trustee will vote your shares in accordance with your instructions received by June 7, 2021 at 11:59 p.m. Eastern Time. You may also revoke previously given voting instructions by June 7, 2021 at 11:59 p.m. Eastern Time, by filing with the plan trustee either written notice of revocation or a properly completed and signed voting instruction form bearing a later date. If you do not send instructions for a proposal, the plan trustee will vote the number of shares equal to the share equivalents credited to your account in the same proportion that it votes shares for which it did receive timely instructions.

Changing Your Vote — If you are a stockholder of record or beneficial owner, you may change your vote at any time prior to the applicable voting deadline with your 16-digit control number. If you virtually attend the Annual Meeting you will also be given the opportunity to vote or change your vote during the Annual Meeting through the virtual meeting platform at: www.virtualshareholdermeeting.com/DVA2021.

|

Through the Internet

|

Prior to the Annual Meeting, you may vote through the Internet by going to www.proxyvote.com and following the instructions. You will need to have the e-proxy notice, or if you received a printed copy of the proxy materials, your proxy card or voting instruction form, available when voting through the Internet. If you want to vote through the Internet, you must do so prior to 11:59 p.m., Eastern Time, on Wednesday, June 9, 2021. If you vote through the Internet, you do not need to return a proxy card. During the Annual Meeting, you may vote through the Internet by following the instructions at www.virtualshareholdermeeting.com/DVA2021. You will need to have your e-proxy notice, proxy card or voting instruction form available when you access the virtual Annual Meeting web page. | |

|

By Telephone

|

You may vote by touch tone telephone by calling 1-800-579-1639. You will need to have your e-proxy notice, or if you received a printed copy of the proxy materials, your proxy card or voting instruction form, available when voting by telephone. If you want to vote by telephone, you must do so prior to 11:59 p.m., Eastern Time, on Wednesday, June 9, 2021. If you vote by telephone, you do not need to return a proxy card. | |

|

By Mail

|

If you are a beneficial owner, you may vote by mail by signing and dating your voting instruction form provided by your broker, bank or nominee and mailing it in a postage-prepaid envelope. If you are a stockholder of record and you received a printed copy of our proxy materials, you may vote by signing and dating your proxy card and mailing it in a postage-prepaid envelope. If you are a stockholder of record and received the e-proxy notice, in order to obtain a proxy card, please follow the instructions on the e-proxy notice. If you want to vote by mail, the proxy card or voting instruction form must be received prior to 11:59 p.m. Eastern Time, on Wednesday, June 9, 2021. |

| 8 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Proxy Statement |

| Votes Required for Proposals |

The table below details the proposals to be voted on at the Annual Meeting, the Board's recommendation on how to vote on each proposal, the votes required to approve each proposal and the effect of abstentions and broker non-votes.

| Proposal | Voting Options |

Board Recommendation |

Vote Required to Adopt the Proposal |

Effect of Abstentions |

Effect of Broker Non- Votes* | |||||

| Proposal 1: Election of the nine director nominees identified in this Proxy Statement to serve until our 2022 Annual Meeting. | For, Against or Abstain for each nominee |

FOR each nominee | Majority of votes cast with respect to each nominee | No effect | No effect | |||||

| Proposal 2: Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021. | For, Against or Abstain |

FOR | Majority of shares represented virtually or by proxy and entitled to vote | Treated as votes Against |

Brokers have discretion to vote | |||||

| Proposal 3: Approval, on an advisory basis, of the compensation of our NEOs. | For, Against or Abstain |

FOR | Majority of shares represented virtually or by proxy and entitled to vote | Treated as votes Against |

No effect | |||||

| Proposal 4: Stockholder proposal regarding political contributions disclosure. | For, Against or Abstain |

AGAINST | Majority of shares represented virtually or by proxy and entitled to vote | Treated as votes Against | No effect |

| * |

See "Voting Information" for additional information on broker non-votes. |

| Proxy Solicitation Costs |

The Company pays the cost of preparing, assembling, printing and mailing to our stockholders the e-proxy notice, this Proxy Statement and the accompanying Notice of Annual Meeting, and the Annual Report to Stockholders, as well as the cost of our solicitation of proxies relating to the Annual Meeting. We may request banks and brokers to solicit their customers who beneficially own our Common Stock. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses relating to these solicitations. We have also retained MacKenzie Partners, Inc. (“MacKenzie”) to assist in the distribution and solicitation of proxies and to verify records related to the solicitation at a fee of $16,000, plus reimbursement for all reasonable out-of-pocket expenses incurred during the solicitation. MacKenzie and our officers, directors and teammates may supplement the original solicitation by mailing of proxies, by telephone, e-mail and personal solicitation. We have agreed to indemnify MacKenzie against liabilities and expenses arising in connection with the proxy solicitation unless caused by MacKenzie’s gross negligence, willful misconduct or bad faith.

| 9 |

| Delivery of Proxy Statement and Annual Report |

Beneficial owners, but not record holders, of Common Stock who share a single address may receive only one copy of the e-proxy notice and, as applicable, an Annual Report to Stockholders and Proxy Statement (collectively, the "Proxy Materials"), unless their broker has received contrary instructions from any beneficial owner at that address. This practice, known as “householding,” is designed to reduce printing and mailing costs for DaVita. If any beneficial owner at such an address wishes to discontinue householding and receive a separate copy of the Proxy Materials, they should notify their broker. Beneficial owners sharing an address to which a single copy of the Proxy Materials was delivered can also request prompt delivery of a separate copy of the Proxy Materials by contacting Investor Relations at the following address or phone number: DaVita Inc., Attn: Investor Relations, 2000 16th Street, Denver, Colorado 80202, 1-888-484-7505. Additionally, stockholders who share the same address and receive multiple copies of the Proxy Materials can request a single copy by contacting us at the address or phone number above.

| 10 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Proxy Statement |

| Proposal 1 Election of Directors |

At the Annual Meeting stockholders will elect nine directors each to serve until the 2022 Annual Meeting or until their respective successors are duly elected and qualified, subject to such director’s earlier death, resignation, disqualification or removal.

Voting Standard for Director Elections

The Amended and Restated Bylaws of the Company (the "Bylaws") require that each director be elected by the majority of votes cast by the holders of shares present virtually or represented by proxy and entitled to vote thereon in uncontested elections. In a contested election, where the number of nominees for director exceeds the number of directors to be elected, directors are elected by a plurality of shares represented virtually or by proxy at any such meeting and entitled to vote thereon. If a nominee for director who served as a director prior to the annual election is not elected by a majority of votes cast, the director must promptly tender his or her resignation from the Board, and the Nominating and Governance Committee will make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board, excluding the director in question, will act on the recommendation of the Nominating and Governance Committee and publicly disclose its decision and its rationale within 90 days (or, if so extended by the Board in certain circumstances, within 180 days) from the date the election results are certified. If a nominee for director who was not already serving as a director does not receive a majority of votes cast in an uncontested election at the Annual Meeting, the nominee is not elected to the Board. All 2021 nominees are currently serving on the Board.

Director Nominees

After a thorough evaluation and assessment, upon the Nominating and Governance Committee's recommendation, the Board has re-nominated Pamela M. Arway, Charles G. Berg, Barbara J. Desoer, Paul J. Diaz, John M. Nehra, Javier J. Rodriguez, and Phyllis R. Yale, and nominated Shawn M. Guertin and Paula A. Price, for election as directors. Please see the section titled “Corporate Governance — Selection of Directors” below for more information about the nomination process.

None of the director nominees has any family relationship with any other nominee or with any of our executive officers and no arrangement or understanding exists between any nominee and any other person or persons pursuant to which a nominee was or is to be selected as a director or nominee. Seven of the nine director nominees are independent under the NYSE listing standards (the "NYSE Independence Standards"). Please see the section titled “Corporate Governance — Director Independence” below for more information. Each director nominee has consented to being named as a nominee in this Proxy Statement and has agreed to serve as a director if elected.

Proxies

Unless a stockholder has made a contrary direction via its proxy, the persons named as proxies in the accompanying proxy have advised us that at the Annual Meeting they intend to vote the shares covered by the proxies for the election of each of the director nominees named above. If any director nominee is unable or unwilling to serve, the persons named as proxies may vote for the election of the substitute nominee that the Board may propose. The accompanying proxy contains a discretionary grant of authority with respect to this matter. The persons named as proxies may not vote for a greater number of persons than the number of director nominees named above.

| 11 |

| Board of Directors Information |

A biography of each director nominee, current as of April 23, 2021, setting forth his or her age, and describing his or her business experience during the past five years, including other prior relevant business experience, is presented below.

Former President of the Japan, Asia-Pacific, Australia Region, American Express International, Inc.

Director Since: 2009 Board Chair Since: 2020 Committee Service: Compensation Committee; Nominating and Governance Committee Other Public Company Boards:

—The Hershey Company (NYSE: HSY)

—Iron Mountain Inc. (NYSE: IRM)

|

Pamela M. Arway, 67, served as the President of the Japan, Asia-Pacific, Australia region for American Express International, Inc., a global payment services and travel company from 2005 to 2008. Ms. Arway joined the American Express Company in 1987, and subsequently served in various capacities, including as Chief Executive Officer ("CEO") of American Express Australia Limited from 2004 to 2005 and as Executive Vice President of Corporate Travel, North America from 2000 to 2004. Prior to her retirement in October 2008, she also served as advisor to the American Express Company’s Chairman and CEO. Since May 2010, Ms. Arway has been a member of the Board of Directors of The Hershey Company, a chocolate and confectionery company, and since March 2014, Ms. Arway has been a member of the Board of Directors of Iron Mountain Incorporated, an enterprise information management services company. Ms. Arway brings significant leadership experience as a global executive, with extensive management experience in the areas of marketing, international business, finance and government affairs. With her service as a director on the boards of other large public companies, Ms. Arway also brings significant experience in corporate governance and executive compensation related matters. |

Former Executive Chair, DaVita Medical Group

Director Since: 2007 Committee Service: Compliance and Quality Committee |

Charles G. Berg, 63, served as Executive Chair of DaVita Medical Group ("DMG"), DaVita's former integrated healthcare business, from November 2016 until December 2017. From 2008 to 2013, Mr. Berg served as Executive Chairman of WellCare Health Plans, Inc. (“WellCare”), a provider of managed care services for government-sponsored healthcare programs. Mr. Berg served as Non-Executive Chairman of the Board of Directors of WellCare from January 2011 until his retirement in May 2013. From January 2007 to April 2009, Mr. Berg was a Senior Advisor to Welsh, Carson, Anderson & Stowe, a private equity firm. From April 1998 to July 2004, Mr. Berg held various executive positions, including Executive Vice President - Medical Delivery, President and Chief Operating Officer ("COO") with Oxford Health Plans, Inc. (“Oxford”), a health benefit plan provider. He was the CEO when Oxford was acquired by UnitedHealth Group. He then became an executive of UnitedHealth Group and was primarily responsible for integrating the Oxford business. Mr. Berg also currently serves as a member of the Operating Council & Senior Advisory Board of Consonance Capital Partners, a private equity firm. Mr. Berg is an experienced business leader with significant experience in the healthcare industry and brings an understanding of the operational, financial and regulatory aspects of our industry and business.

|

| 12 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Proxy Statement |

Former Chief Executive Officer, Citibank, N.A.

Director Since: 2015 Committee Service: Compensation Committee, Chair; Compliance and Quality Committee Other Public Company Boards:

—Citigroup Inc. (NYSE: C)

|

Barbara J. Desoer, 68, served as the CEO and a member of the Board of Directors of Citibank, N.A., a wholly owned subsidiary of Citigroup, Inc., a diversified global financial services company, both positions she held from April 2014 through April 2019, and COO of Citibank, N.A. from October 2013 to April 2014. Prior to Citibank, N.A., Ms. Desoer spent 35 years at Bank of America, a diversified global financial services company, most recently as President, Bank of America Home Loans, where she led the integration of Countrywide, the largest mortgage originator and servicer in the United States. In previous Bank of America roles, Ms. Desoer served as a Global Technology & Operations executive, an international market-focused position leading teams in the United Kingdom, Asia and Latin America, and President, Consumer Products. Since April 2019, Ms. Desoer has served as Chair of Citibank, N.A. and as a member of the Board of Directors of Citigroup, Inc. She serves on the Board of Visitors at the University of California at Berkeley and on the Advisory Board of InStride. Ms. Desoer also has served on the board of directors of various non-profit and privately held corporations. Ms. Desoer is an experienced business leader with extensive management and international experience, and brings a deep understanding of regulated businesses. |

President and Chief Executive Officer, Myriad Genetics, Inc.

Director Since: 2007 Committee Service: Compliance and Quality Committee, Chair; Compensation Committee Other Public Company Boards:

—Myriad Genetics, Inc. (NASDAQ: MYGN)

|

Paul J. Diaz, 59, has served as the President, CEO and member of the Board of Directors for Myriad Genetics, Inc., a molecular diagnostic company since August 2020. From September 2017 to August 2020, Mr. Diaz was a Partner at Cressey & Company LP, a private equity firm focused exclusively on investing in and building health care businesses, and currently serves as a Partner Emeritus and a member of its Distinguished Executive Council. Since August 2014, Mr. Diaz has served as a Partner at Guidon Partners LP, a private investment partnership. He served as Executive Vice Chairman of Kindred Healthcare, Inc. (“Kindred”), a post-acute provider in the United States, which includes transitional care and rehabilitation hospitals, sub-acute units, and home healthcare and hospice agencies, from March 2015 to March 2016, CEO from January 2004 to March 2015, President from January 2002 to May 2012 and COO from January 2002 to December 2003. Prior to joining Kindred, Mr. Diaz was the Managing Member of Falcon Capital Partners, LLC, a private investment and consulting firm, and from 1996 to July 1998, Mr. Diaz served in various executive capacities, including as Executive Vice President and COO, with Mariner Health Group, Inc., a national provider of long-term care facilities, rehabilitation services and institutional pharmacies. Mr. Diaz serves on the Board of Trustees of Johns Hopkins Medicine. Mr. Diaz formerly served on the Board of Directors of PharMerica Corporation, Kindred, the Federation of American Hospitals and the Bloomberg School of Public Health at John Hopkins University. Mr. Diaz is an experienced business leader with significant experience in the healthcare industry and brings a deep understanding of the operational, financial and regulatory aspects of our industry and business. |

| 13 |

Former Executive Vice President, Chief Financial Officer and Chief Enterprise Risk Officer, Aetna, Inc.

Director Since: 2020 Committee Service: Audit Committee, Chair; Nominating and Governance Committee Other Public Company Boards:

—TriNet Group, Inc. (NYSE: TNET)

|

Shawn M. Guertin, 57, served in various roles during his tenure at Aetna, Inc. ("Aetna"), a diversified health care benefits company, including as Executive Vice President, Chief Financial Officer ("CFO") and Chief Enterprise Risk Officer from January 2014 to May 2019 and as Senior Vice President, CFO and Chief Enterprise Risk Officer from February 2013 to January 2014, where he oversaw a period of significant growth, leading to Aetna’s eventual merger with CVS Health Corporation. He also served as Head of Business Segment Finance at Aetna from April 2011 to February 2013. Prior to joining Aetna, from 1998 to 2011, Mr. Guertin served in various roles at Coventry Health Care, Inc. ("Coventry"), a diversified managed healthcare company, including as CFO and Treasurer. Prior to Coventry, Mr. Guertin held various leadership positions at The Travelers and UnitedHealthcare. Since January 2020, Mr. Guertin has served on the Board of Directors of TriNet Group, Inc., a leading provider of comprehensive human resources solutions. Mr. Guertin is an experienced business leader with significant experience in the healthcare industry and brings a deep understanding of the operational, financial and regulatory aspects of our industry and business. |

Former General Partner, New Enterprise Associates

Director Since: 2000 Committee Service: Audit Committee; Compensation Committee |

John M. Nehra, 72, was, from 1989 until his retirement in August 2014, affiliated with New Enterprise Associates (“NEA”), a venture capital firm, including, from 1993 until his retirement, as General Partner of several of its affiliated venture capital limited partnerships. After his retirement in August 2014, Mr. Nehra remained a retired Special Partner with NEA and continued serving on the board of directors of a number of NEA’s portfolio companies. Mr. Nehra also served as Managing General Partner of Catalyst Ventures, an affiliate of NEA, from 1989 to 2013. Mr. Nehra is an experienced business leader with approximately 45 years of experience in investment banking, research and capital markets and he brings a deep understanding of our business and industry through his nearly 21 years of service as a member of the Board as well as significant experience in the healthcare industry through his involvement with NEA’s healthcare-related portfolio companies.

|

| 14 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Proxy Statement |

Former Executive Vice President and CFO, Macy's Inc.

Director Since: 2020 Committee Service: Audit Committee; Compliance and Quality Committee Other Public Company Boards:

—Bristol-Myers Squibb Company (NYSE: BMY)

—Accenture plc (NYSE: ACN)

—Western Digital Corporation (NASDAQ: WDC)

|

Paula A. Price, 59, most recently served as an advisor to Macy's Inc., an omni-channel retailer of merchandise, from June 2020 to November 2020, and as Executive Vice President and CFO from July 2018 to May 2020. From 2014 to 2018, Ms. Price was a full-time senior lecturer at Harvard Business School in the Accounting and Management department. From 2009 to 2014, Ms. Price served as Executive Vice President and CFO of Ahold USA, a U.S. grocery retailer. From 2006 to 2008, Ms. Price was Senior Vice President, Controller and Chief Accounting Officer ("CAO") at CVS Caremark Corporation. Earlier in her career, Ms. Price was the CFO of the Institutional Trust Services division of JPMorgan Chase & Co. and also held senior management positions at Prudential Insurance Co. of America, Diageo plc, Kraft Foods Inc., and Sears Roebuck & Company. A certified public accountant, she began her career at Arthur Andersen & Co. Since September 2020, Ms. Price has served as a member of the Board of Directors of Bristol-Myers Squibb Company, a global biopharmaceutical company ("Bristol-Myers"), and since May 2014, has been a member of the Board of Directors of Accenture plc, a professional services company. Ms. Price also rejoined the Board of Directors of Western Digital Corporation, a developer, manufacturer and provider of data storage devices and solutions, in June 2020 after serving on its Board of Directors from 2014 to 2019. She also previously served as a director of Dollar General Corporation, a large U.S. discount retailer, from 2014 to 2018. Ms. Price brings significant leadership experience in the areas of accounting, finance, general management and strategy, as well as an understanding of the healthcare industry. With her service as a director on the boards of other large public companies, Ms. Price also brings significant experience in corporate governance and executive compensation related matters. |

Chief Executive Officer, DaVita Inc.

Director Since: 2019 Other Public Company Boards:

—Gilead Sciences, Inc. (NASDAQ: GILD)

|

Javier J. Rodriguez, 50, has served as our CEO since June 2019. From March 2014 until June 2019, he served as the CEO of DaVita Kidney Care. Since joining the Company in 1998, Mr. Rodriguez has served in a number of different capacities. From February 2012 to March 2014, he served as our President. From April 2006 through February 2012, he served as our Senior Vice President. Before that, from 2000 to 2006 he served as a Vice President of Operations and Payor Contracting. Mr. Rodriguez joined the Company in 1998 as a Director of Value Management. Prior to joining the Company, Mr. Rodriguez worked for Baxter Healthcare Corporation in Finance from 1995 to 1996. He also previously served as Director of Operations for CBS Marketing Inc. in Mexico City. Since June 2020, Mr. Rodriguez has been a member of the Board of Directors of Gilead Sciences, Inc., a research-based pharmaceutical company. Mr. Rodriguez provides extensive knowledge of our industry, business, regulatory environment and operations as well as significant executive leadership and management experience. |

| 15 |

Advisory Partner, Bain & Company, Inc.

Director Since: 2016 Committee Service: Nominating and Governance Committee, Chair; Compliance and Quality Committee Other Public Company Boards:

—Bristol-Myers Squibb Company (NYSE: BMY)

|

Phyllis R. Yale, 63, has been an Advisory Partner with Bain & Company, Inc. (“Bain”), a global management consulting firm, since July 2010. Ms. Yale was a Partner with Bain from 1987 to July 2010, and was a leader in building Bain’s healthcare practice. In her role at Bain, Ms. Yale works with healthcare payors, providers, and medical device companies, and frequently advises the world’s leading private equity firms on their investments in the healthcare sector. She has served as a member of the board of directors of several public and private companies in the healthcare sector, and since November 2019 has served as a member of the Board of Directors of Bristol-Myers. Ms. Yale previously served as Chair of the Board of Directors of Kindred and Chair of Blue Cross Blue Shield of Massachusetts, and has been on the board of directors of various other public, non-profit and privately held corporations. Ms. Yale has a deep knowledge base and experience in several aspects of the healthcare industry, including corporate strategies, marketing and cost and quality management, as well as mergers and acquisitions. |

The Board recommends a vote FOR the election of each of the named nominees as directors.

| 16 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Corporate Governance |

The general corporate governance framework for the Company is set by its Bylaws, Corporate Governance Guidelines, the charters for each of the Board’s Committees, the Code of Ethics and the Code of Conduct. Each of these governance documents is available under the Corporate Governance section of our website, located at www.davita.com/about/corporate-governance.

| Corporate Governance Highlights and 2021 Updates |

The Board believes that strong corporate governance is key to long-term stockholder interests. The Board monitors evolving governance standards and regularly seeks stockholder feedback on these topics. In early 2021, the Board approved certain updates to our corporate governance program. Some key features of the Company’s program, incorporating recent updates, include:

| ✓ | Annual election of all directors. | |

| ✓ |

Proxy access. Our Bylaws permit qualifying stockholders or groups of qualifying stockholders who have continuously owned at least 3% of the Company’s Common Stock for at least three consecutive years to use management’s proxy materials to nominate a number of director candidates not to exceed the greater of two or 20% of the number of directors then in office, subject to reduction in certain circumstances. | |

| ✓ |

Robust year-round stockholder engagement, including regular engagement with independent directors. We maintain a practice of routinely meeting with our stockholders in a number of forums to encourage an ongoing, meaningful dialogue on corporate governance, executive compensation and social responsibility matters, as well as other items of interest to our stockholders. Throughout 2020, management (and certain independent members of the Board, as applicable) met with stockholders representing approximately 64% of the Company's outstanding shares. | |

| ✓ | Stockholder right to call special meetings of stockholders at 10% ownership threshold. | |

| ✓ | No stockholder rights plan/poison pill. | |

| ✓ | Robust code of conduct. DaVita is committed to operating its business with honesty and integrity and maintaining the highest level of ethical conduct. | |

| ✓ | Independent non-executive chair. Pamela Arway has served as the Company’s Board Chair since June 1, 2020, putting DaVita among the 4% of S&P 500 companies with a female, non-employee director serving in such a role.1 | |

| ✓ | Independent advisors. Each Board Committee has the authority to retain independent advisors. | |

| ✓ | Majority vote standard in uncontested elections. | |

| ✓ |

Robust stock ownership guidelines for senior executives and directors that link the interests of management and the Board with those of stockholders. | |

| ✓ | Commitment to corporate social responsibility practices. | |

| ✓ | Significant risk oversight practices. | |

| ✓ | Robust Board oversight over the Company's political and lobbying expenditures. In 2021, the Board approved changes to the Company's Policy Relating to Political and Lobbying Expenditures to further enhance disclosure of the Board's oversight over the Company's political spending initiatives. In addition, the Company will publish a semi-annual report, beginning July 2021, which will include significant disclosure enhancements with respect to the Company's political and lobbying expenditures. | |

1 2020 Spencer Stuart Board Index

|

17 |

| Selection of Directors |

The Nominating and Governance Committee, in coordination with the Board, identifies, evaluates and recommends candidates to fill Board vacancies or to stand for election to the Board by the Company’s stockholders.

The Nominating and Governance Committee considers a number of factors and assesses the overall mix of qualifications, individual characteristics, experience level, and diverse perspectives and skills that are most beneficial to our Company. The Nominating and Governance Committee also seeks to ensure an appropriate mix of tenures of the directors, taking into account the benefits of having longer tenured directors in providing greater Board stability and ensuring continuity, as well as the benefits of having shorter tenured directors who can provide fresh perspectives and viewpoints.

In 2021, the Board approved changes to the Company’s Corporate Governance Guidelines, including:

| – | Commitment to maintaining the average tenure of independent directors to be no longer than 12 years; and |

| – | If at the time of a director search, the combined gender and ethnic/racial diversity of the Board is below 50%, then at least two of the final candidates considered by the Nominating and Governance Committee for nomination for election to the Board shall be members of an underrepresented group. |

Board Diversity

Our Board values diversity, taking into consideration not only racial, ethnic and gender diversity, but also the mix of qualifications of our directors including tenure, experience levels and types of experience, including both industry and subject matter expertise. We believe that a Board that collectively reflects a diversity of background and experience enhances the Board's effectiveness. Pamela Arway has served as the Company’s Board Chair since June 1, 2020, putting DaVita among the 4% of S&P 500 companies with a female, non-employee director serving in such a role.1

1 2020 Spencer Stuart Board Index

| Independent, Female Board Chair |

Three of Four Committee Chairs are Diverse | |||

| Pamela Arway | Phyllis Yale | Barbara Desoer | Paul Diaz | Shawn Guertin |

| Independent Board Chair |

Chair, Nominating & Governance Committee |

Chair, Compensation Committee |

Chair, Compliance & Quality Committee |

Chair, Audit Committee |

|

|

|

|

|

|

|

|

|

| 18 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Corporate Governance |

Stockholder Director Recommendations

The Nominating and Governance Committee will consider nominees for director recommended by stockholders upon submission in writing to our Corporate Secretary of the names and qualifications of such nominees at the following address: Corporate Secretary, DaVita Inc., 2000 16th Street, Denver, Colorado 80202. The Nominating and Governance Committee will evaluate candidates based on the same criteria regardless of whether the candidate was recommended by the Company or a stockholder.

Director Nominees

The Nominating and Governance Committee has recommended the nine candidates named in this Proxy Statement standing for election at the Annual Meeting. We believe that our Board reflects an effective mix of tenure, skills, experience and diversity. Ms. Price and Mr. Guertin, who were appointed as members of the Board in August and September 2020, respectively, were recommended to the Nominating and Governance Committee by a third-party executive search firm.

Our Board possesses a deep and broad set of skills and experiences that facilitate strong oversight and strategic direction. The following chart summarizes some of the competencies represented by the director nominees as of April 23, 2021. The details of each director nominee's competencies are included in each director's profile under the section titled "— Board of Directors Information."

| Experience and Skills | ||

| Risk Management |

| |

| Accounting/Financial |

| |

| Gov’t/Regulatory/Public Policy |

| |

| CEO Experience |

| |

| International |

| |

| Public Co. Board Experience |

| |

| Healthcare |

|

|

19 |

| Annual Board and Committee Evaluations |

The Board is committed to continuous improvement and annual self-evaluations are an important tool to that end. In 2020, we enhanced our Board and Committee evaluation process to include both written questionnaires and live interviews with directors on a rotating cycle, an overview of which is set forth below.

| Director Independence |

Under the listing standards of the NYSE, a majority of the members of the Board must satisfy the NYSE Independence Standards. No director qualifies as independent under the NYSE Independence Standards unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). In 2021, the Board approved enhancements to the Company's Corporate Governance Guidelines, one of which requires that at least two-thirds of the members of the Board satisfy the NYSE Independence Standards and certain additional independence standards discussed in detail below and included in the Company's Corporate Governance Guidelines (the "Additional Independence Standards").

The Board evaluates the independence of our directors annually and will review the independence of individual directors on an interim basis as needed to consider changes in employment, relationships and other factors. The Board evaluates the nature of any executive officer’s or director’s personal investment interest in director-affiliated entities (active or passive), the level of involvement by the director or executive officer as a partner in any such director-affiliated entities, any special arrangements or relationships between the parties that would lead to a personal benefit, any personal benefits derived as a result of business relationships with the Company, any other personal benefit derived by any director or executive officer as a result of the disclosed relationships or any other relevant factors.

Under the NYSE Independence Standards, a director is deemed not independent if the director is or has been employed by the Company within the last three years or if the director has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the listed company, other than director and committee fees. Under the Additional Independence Standards, a director is deemed not independent if (i) within the last four calendar years, (a) the director was an employee of the Company or one of its wholly-owned subsidiaries or (b) an immediate family member of the director was an executive officer of the Company, (ii) the director, during the current calendar year or any of the three immediately preceding calendar years has been paid by the Company more than $120,000 in compensation for services, other than for services rendered as a director, or (iii) the director is employed as an executive officer of another public company on whose board of directors any of the Company’s current executive officers serve.

| 20 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Corporate Governance |

The Board has determined that all of the director nominees, other than Messrs. Rodriguez and Berg, as well as each individual who served as a director at any time during 2020, other than Mr. Thiry, are independent under the NYSE Independence Standards.

Mr. Berg was employed by the Company from November 1, 2016 through December 15, 2017, and in 2019, received a one-time cash payment upon the closing of the sale of the Company's DMG business. Although Mr. Berg has not been employed by the Company within the last three years, he is not currently deemed independent under the NYSE Independence Standards or the Additional Independence Standards because of the one-time payment.

Mr. Rodriguez is not deemed independent under the NYSE Independence Standards or the Additional Independence Standards because he is employed as the Company's CEO.

For the duration of his service on the Board during 2020, Mr. Thiry was not deemed independent because of his concurrent employment as the Company's Executive Chairman.

Change in Status

Our Corporate Governance Guidelines require the Board to evaluate the appropriateness of the director’s continued service on the Board in the event that the director retires from his or her principal job, changes his or her principal job responsibility or experiences a significant event that could negatively affect his or her service to the Board. In such event, the Corporate Governance Guidelines provide that the impacted director shall promptly submit his or her resignation to the Board Chair. The members of the Board, excluding the impacted director, will determine whether such director’s continued service on the Board is in the best interests of our stockholders and will decide whether or not to accept the resignation of the director. In addition, the Corporate Governance Guidelines provide that prior to accepting an invitation to serve on the board of directors of another public company, a director must advise the Board Chair, so that the remaining members of the Board may evaluate any potential conflicts of interest.

|

21 |

| Leadership Structure and Meetings of Independent Directors |

Effective June 1, 2020, the Board appointed Pamela M. Arway, an independent director and member of the Board since May 2009, to serve as the Board Chair. The Board believes that Ms. Arway’s breadth of experience and depth of knowledge gained during her career and her tenure on our Board are highly beneficial to the Board Chair role.

As the Board Chair, Ms. Arway:

| – | Serves as the liaison between management and the independent directors |

| – | Approves meeting agendas for the Board |

| – | Approves meeting schedules, and presides at all meetings of the Board, including executive sessions of independent directors |

| – | Facilitates discussions outside of scheduled Board meetings among the independent directors on key issues, as appropriate |

| – | Has the authority to call meetings of the Board and the independent directors and, if requested by major stockholders, makes herself available for consultation and direct communication with them, as appropriate |

| – | Oversees the function of our Board committees, each of which has an independent Chair |

The Board believes that this leadership structure is appropriate for the Company at this time because it allows for independent oversight of management, increases management accountability, and encourages an objective evaluation of management’s performance relative to compensation. The independent directors evaluate the Board’s leadership structure, typically on an annual basis.

| 22 |

|

Notice of 2021 Annual Meeting and Proxy Statement |

| Corporate Governance |

| Succession Planning |

Management

The Board oversees management succession planning and the development of executive talent. The Board believes that management succession planning should be done in consultation with the CEO and that the full Board should have oversight of the succession planning process.

As part of this process, the CEO provides the Board with recommendations for potential successors for the position of CEO and other key senior management positions, and reviews development plans for potential succession candidates with the Board. The Board engages directly with potential succession candidates and regularly reviews short- and long-term as well as emergency succession plans for the CEO and other senior management positions.

Board

The Board also regularly considers its own composition, succession plans and refreshment efforts. Discussion of these topics is an important part of the annual Board evaluation process. When considering director succession planning, the Nominating and Governance Committee and the Board take into account, among other things, the current and expected needs of the Board and the Company in light of the overall composition of the Board towards achieving a balance of the skills, experience, diverse attributes and tenure that are viewed to be essential to the Board’s oversight role.

Our Corporate Governance Guidelines include a mandatory retirement age whereby a director who has reached the age of 75 shall not be re-nominated to our Board at the next Annual Meeting of Stockholders; however, the Nominating and Governance Committee may recommend, and the Board may approve, the nomination for reelection of a director at or after the age of 75, if, in light of all the circumstances, the Board determines it to be in the best interests of the Company and its stockholders. In 2021, the Board also approved an enhancement to the Company’s Corporate Governance Guidelines to support Board refreshment, which requires that the average tenure of independent directors, as determined in accordance with the NYSE Independence Standards, shall be no longer than 12 years.

| 23 |

| Environmental, Social and Governance Approach |

We strive to be a community first and a company second. Our environmental, social, and governance ("ESG") practices include how we care for our patients; how we support our teammates to grow and develop in a workplace where everyone belongs; and how we engage with our local communities and promote environmental stewardship through projects and initiatives in our community.

ESG Governance: The Nominating and Governance Committee oversees DaVita’s activities, policies and programs related to corporate environmental and social responsibility:

| – | Our newly created management ESG Steering Committee regularly reports to the Nominating and Governance Committee and gives the full Board an ESG update on no less than an annual basis |

| – | The management ESG Steering Committee provides guidance on strategy and disclosures for our ESG initiatives |

| – | The committee is comprised of leaders from across the business who represent various perspectives and stakeholders, and its objective is to align ESG strategy across the Company |