Form DEF 14A CIM REAL ESTATE FINANCE For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | x | ||||

| Filed by a Party other than the Registrant | o | ||||

Check the appropriate box:

| o | Preliminary Proxy Statement | ||||

| o | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to §240.14a-12 | ||||

CIM REAL ESTATE FINANCE TRUST, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

CIM REAL ESTATE FINANCE TRUST, INC.

2398 East Camelback Road, 4th Floor

Phoenix, Arizona 85016

April 29, 2022

Dear Stockholder:

You are cordially invited to attend our 2022 Annual Meeting of Stockholders to be held on Tuesday, July 12, 2022, at 10:30 A.M. (Pacific time). The meeting will be held as a virtual meeting conducted exclusively via live webcast at https://www.proxydocs.com/CMFT. For procedures for attending the virtual annual meeting, please refer to the section entitled “Proxy Statement Questions and Answers” beginning on page 1 of the accompanying proxy statement.

The matters expected to be acted upon at the meeting are described in the accompanying Notice of 2022 Annual Meeting of Stockholders and proxy statement, and include (i) the election of ten directors; (ii) the approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan; and (iii) the ratification of the appointment of our independent registered public accounting firm.

There will be an opportunity during the meeting for your questions regarding the affairs of CIM Real Estate Finance Trust, Inc. to be addressed and for a discussion of the business to be considered at the meeting.

It is important that you use this opportunity to take part in the affairs of your company by voting on the business to come before this meeting. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING VIA LIVE WEBCAST, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR AUTHORIZE YOUR PROXY BY USING THE TELEPHONE BY DIALING 1-844-280-5348 OR THE INTERNET AT HTTPS://WWW.PROXYDOCS.COM/CMFT, SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. FOR SPECIAL INSTRUCTIONS ON HOW TO VOTE YOUR SHARES, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD. Authorizing a proxy to vote your shares does not deprive you of your right to attend the meeting via live webcast and to vote your shares by attending the live webcast of the meeting.

We look forward to seeing you at the meeting.

Sincerely,

Richard S. Ressler

Chairman of the Board, President and Chief Executive Officer

CIM REAL ESTATE FINANCE TRUST, INC.

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 12, 2022

To CIM Real Estate Finance Trust, Inc. Stockholders:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders of CIM Real Estate Finance Trust, Inc., a Maryland corporation (the “Company,” “we,” “our,” or “us”), will be held on Tuesday, July 12, 2022, at 10:30 A.M. (Pacific time). The meeting will be held as a virtual meeting conducted exclusively via live webcast at https://www.proxydocs.com/CMFT. For procedures for attending the virtual annual meeting, please refer to the section entitled “Proxy Statement Questions and Answers” beginning on page 1 of the accompanying proxy statement. The purpose of the meeting is to consider and vote upon:

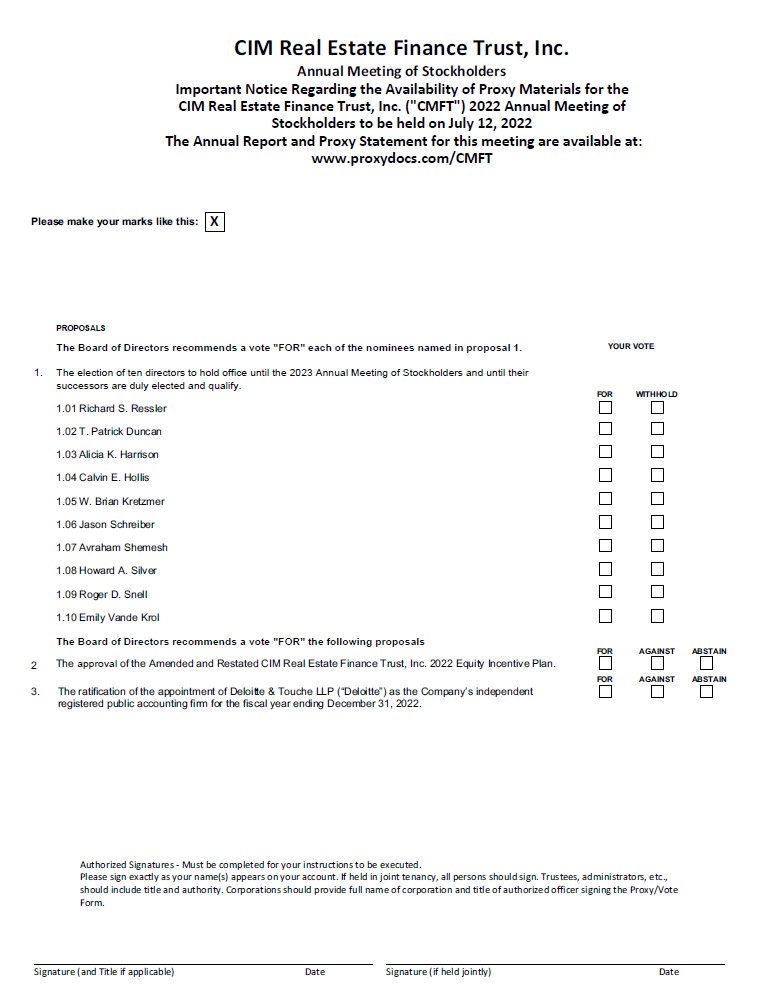

1.The election of ten directors to hold office until the 2023 Annual Meeting of Stockholders and until their successors are duly elected and qualify;

2.The approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan;

3.The ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and

4.The transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof.

The proposals and other related matters are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on April 28, 2022 are entitled to receive this notice and to vote at the meeting. We reserve the right, in our sole discretion, to postpone or adjourn the 2022 Annual Meeting of Stockholders to provide more time to solicit proxies for the meeting, if necessary.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULY 12, 2022.

THE PROXY STATEMENT AND ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT https://www.proxydocs.com/CMFT.

All stockholders are cordially invited to attend the annual meeting via live webcast. Whether or not you expect to attend, we urge you to read the proxy statement and either (a) complete, sign and date the enclosed proxy card and return it promptly in the envelope provided or (b) authorize your proxy by telephone by dialing 1-844-280-5348 or over the Internet at https://www.proxydocs.com/CMFT. For specific instructions on how to vote your shares, please refer to the instructions on the proxy card. Your prompt response will help avoid potential delays and may save the Company significant additional expense associated with soliciting stockholder votes.

By Order of the Board of Directors

Laura Eichelsderfer

Secretary

Phoenix, Arizona

April 29, 2022

PLEASE VOTE — YOUR VOTE IS IMPORTANT

CIM REAL ESTATE FINANCE TRUST, INC.

2398 East Camelback Road, 4th Floor

Phoenix, Arizona 85016

PROXY STATEMENT

QUESTIONS AND ANSWERS

We are providing you with this proxy statement, which contains information about the items to be voted upon at our 2022 Annual Meeting of Stockholders. To make this information easier to understand, we have presented some of the information below in a question and answer format.

Q: Why did you send me this proxy statement?

A: Our board of directors is soliciting your proxy to vote your shares of the Company’s common stock at the 2022 Annual Meeting of Stockholders. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and is designed to assist you in voting. This proxy statement, proxy card and our 2021 annual report to stockholders are being mailed to you on or about May 2, 2022.

Q: What is a proxy and how will the proxies vote my shares?

A: A proxy is a person who votes the shares of stock of another person. The term “proxy” also refers to the proxy card. When you return the enclosed proxy card, or authorize your proxy by telephone or over the Internet, you are giving your permission to either our chief financial officer and treasurer or our secretary to vote your shares of common stock at the annual meeting as you instruct. If you sign and return the proxy card, or authorize your proxy by telephone or over the Internet, and give no instructions, the proxies will vote in accordance with the recommendation of the board of directors. The board of directors unanimously recommends that you vote:

•“FOR” all of the director nominees,

•“FOR” the approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan, and

•“FOR” the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

With respect to any other proposals to be properly presented at the meeting for voting, your shares will be voted in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in the discretion of one or both of the proxies. The proxies will not vote your shares of common stock if you do not return the enclosed proxy card or authorize your proxy by telephone or over the Internet. This is why it is important for you to return the proxy card to us or authorize your proxy by telephone or over the Internet as soon as possible, whether or not you plan on attending the meeting via live webcast.

If you authorize your proxy by telephone or over the Internet, please do not return your proxy card.

Q: How can I attend the meeting?

A: The annual meeting will be a completely virtual meeting conducted exclusively via live webcast and not at a physical location. The virtual annual meeting will be held on Tuesday, July 12, 2022, at 10:30 A.M. (Pacific time). To attend the virtual annual meeting you must register no later than Monday, July 11, 2022 at 5:00 P.M. Eastern time. To register, log into https://www.proxydocs.com/CMFT and enter the control number located on the proxy card you receive with the proxy statement or that was included with your voting instruction form provided by your bank, broker or other nominee if you hold your shares of the Company’s common stock in street name through an account with an intermediary. Once you have registered you will receive a confirmation email containing further instructions related to the virtual annual meeting, including a hyperlink that will allow you to join the live webcast. If you do not register for the meeting by Monday, July 11, 2022 at 5:00 P.M. Eastern time, you will not be able to attend the meeting. Instructions on how to attend and participate online at the annual meeting, including how to ask questions and vote, are posted at https://www.proxydocs.com/CMFT.

1

Q: How many shares of common stock can vote?

A: As of the close of business on the record date of April 28, 2022, there were 437,822,340 shares of our common stock issued and outstanding. Every stockholder of record as of the close of business on April 28, 2022 is entitled to one vote for each share of common stock held at that date and time. Fractional shares will have corresponding fractional votes.

Q: What is a “quorum”?

A: A “quorum” consists of the presence in person or by proxy of stockholders holding at least a majority of the outstanding shares entitled to vote. There must be a quorum present in order for business to be transacted at the annual meeting. If you submit a properly executed proxy card, even if you abstain from voting or do not give instructions for voting, then you will at least be considered part of the quorum.

Q: What may I vote on?

A: You may vote on (i) the election of nominees to serve on our board of directors; (ii) the approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan, (iii) the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and (iv) any other proposal properly presented for a vote at the annual meeting.

Q: How does the board of directors recommend I vote on the proposals?

A: The board of directors recommends a vote “FOR” all of the nominees for election as director who are named as such in this proxy statement, “FOR” the approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan, and “FOR” the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

Q: Who is entitled to vote?

A: Anyone who owned our common stock at the close of business on April 28, 2022, the record date, is entitled to vote at the annual meeting.

Q: How do I vote?

A: You may vote your shares of common stock either by attending the live webcast of the annual meeting or by proxy. You may authorize a proxy to vote your shares in any of the following ways:

•Authorizing a Proxy by Mail – You may authorize a proxy by completing the accompanying proxy card and mailing it in the accompanying self-addressed, postage-paid return envelope. Completed proxy cards must be received by Monday, July 11, 2022.

•Authorizing a Proxy by Telephone – You may authorize a proxy by telephone by dialing 1-844-280-5348 until 11:59 p.m. Eastern time on Monday, July 11, 2022.

•Authorizing a Proxy by Internet – You may authorize a proxy electronically using the Internet at https://www.proxydocs.com/CMFT until 11:59 p.m. Eastern time on Monday, July 11, 2022.

If you attend the virtual annual meeting, you also may vote during the live webcast, and any previous proxies that you authorized will be superseded by the vote that you cast at the annual meeting. You may attend the live webcast of the annual meeting without revoking any previously authorized proxy.

Q: What vote is required to approve each proposal?

A: The affirmative vote of a plurality of all the votes cast at the annual meeting at which a quorum is present is required for the election of each director nominee. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

The affirmative vote of a majority of all the votes cast at the annual meeting at which a quorum is present is required for the approval of the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

The affirmative vote of a majority of all the votes cast at the annual meeting at which a quorum is present is required for the ratification of the appointment of Deloitte as the Company’s independent registered public

2

accounting firm for the fiscal year ending December 31, 2022. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Q: Will my vote make a difference?

A: Yes. Your vote is very important to ensure that the proposals can be acted upon. Unlike most public companies, no large brokerage houses or affiliated groups of stockholders own substantial blocks of our shares. As a result, a large number of our stockholders must be present via live webcast or by proxy at the annual meeting to constitute a quorum. YOUR VOTE IS VERY IMPORTANT EVEN IF YOU OWN ONLY A SMALL NUMBER OF SHARES. Your immediate response will help avoid potential delays and may save us significant additional expense associated with soliciting stockholder votes. We encourage you to participate in the governance of the Company and welcome your attendance at the annual meeting.

Q: What if I return my proxy card and then change my mind?

A: If you are a stockholder of record as of April 28, 2022, you have the right to revoke your proxy at any time before the vote by:

1.notifying our Secretary, or any other corporate officer of the Company, in writing at our offices located at 2398 East Camelback Road, 4th Floor, Phoenix, Arizona 85016;

2.attending and voting at the live webcast of the annual meeting; or

3.returning another proxy after your first proxy, which is received before the annual meeting date. Only the most recent vote will be counted and all others will be discarded regardless of the method of voting.

If you hold shares of our common stock in “street name,” you will need to contact the institution that holds your shares and follow its instructions for revoking a proxy.

Q: Who pays the cost of this proxy solicitation?

A: The Company will pay all the costs of soliciting these proxies. We have retained Mediant Communications to assist us in the distribution of proxy materials and solicitation of votes. We anticipate paying Mediant Communications approximately $256,197 for such services, which includes estimated postage and other out-of-pocket expenses, plus other fees and expenses for other services related to this proxy solicitation such as the printing and review of proxy materials and our annual report, dissemination of broker search cards and solicitation of brokers and banks, and delivery of executed proxies. In addition to the distribution of these proxy materials, the solicitation of proxies may be made in person, by telephone or by electronic communication by our directors and officers who will not receive any additional compensation for such solicitation activities. The Company will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders.

Q: Whom should I call if I have any questions?

A: If you have any questions about how to submit your proxy, or if you need additional copies of this proxy statement or the enclosed proxy card or voting instructions, you should contact:

Mediant Communications

P.O. Box 8035, Cary, North Carolina 27512-9916

CIM Real Estate Finance Trust, Inc.

Call toll free: (844) 280-5348

3

PROPOSAL 1

ELECTION OF DIRECTORS

At the annual meeting, you and the other stockholders will vote on the election of ten members of our board of directors. Those persons elected will serve as directors until the 2023 Annual Meeting of Stockholders and until their successors are duly elected and qualify. The board of directors has nominated the following people for election as directors:

•Richard S. Ressler

•T. Patrick Duncan

•Alicia K. Harrison

•Calvin E. Hollis

•W. Brian Kretzmer

•Jason Schreiber

•Avraham Shemesh

•Howard A. Silver

•Roger D. Snell

•Emily Vande Krol

Each of the nominees for director is a current member of our board of directors. The principal occupation and certain other information about the nominees are set forth below. We are not aware of any family relationship among any of the nominees to become directors or executive officers of the Company. Each of the nominees for election as director has stated that there is no arrangement or understanding of any kind between him or her and any other person relating to his or her election as a director, except that such nominees have agreed to serve as our directors if elected.

If you return a properly executed proxy card, or if you authorize your proxy by telephone or over the Internet, unless you direct the proxies to withhold your votes, the individuals named as the proxies will vote your shares “FOR” the election of the nominees listed above. If any nominee becomes unable or unwilling to stand for election, the board may reduce its size, designate a substitute nominee, or fill the vacancy through a majority vote of the remaining directors. If a substitute is designated, proxies voting for the original nominee will be cast for the substituted nominee.

4

INFORMATION ABOUT DIRECTORS AND OFFICERS

Board of Directors

In accordance with applicable law and our charter and bylaws, the business and affairs of the Company are managed under the direction of our board of directors. Our board of directors currently consists of ten directors, six of whom are independent directors. Our board of directors has formed four standing committees: the audit committee; the compensation committee; the nominating and corporate governance committee; and the investment risk management committee.

Director Nominees

Our board of directors, upon the recommendations of our nominating and corporate governance committee, has nominated each of the following individuals for election as a director to serve until our 2023 Annual Meeting of Stockholders and until his or her successor is duly elected and qualifies. Each named nominee currently is a director of the Company, and Messrs. Duncan, Hollis, Kretzmer, Snell and Silver, and Ms. Harrison, are independent directors.

Name | Age * | Position(s) | ||||||||||||

Richard S. Ressler | 63 | Chairman of the Board, Chief Executive Officer and President | ||||||||||||

T. Patrick Duncan | 73 | Independent Director | ||||||||||||

Alicia K. Harrison | 62 | Independent Director | ||||||||||||

| Calvin E. Hollis | 70 | Independent Director | ||||||||||||

W. Brian Kretzmer | 69 | Independent Director | ||||||||||||

| Jason Schreiber | 42 | Director | ||||||||||||

Avraham Shemesh | 60 | Director | ||||||||||||

Howard A. Silver | 67 | Independent Director | ||||||||||||

| Roger D. Snell | 66 | Independent Director | ||||||||||||

| Emily Vande Krol | 37 | Director | ||||||||||||

* As of April 29, 2022.

Richard S. Ressler has served as our chief executive officer, president and a director since February 2018, and as the chairman of our board of directors since August 2018. He has served as the chairman of the investment risk management committee since April 2022 and served as a member of the nominating and corporate governance committee from August 2018 to March 2022. Mr. Ressler is the founder and President of Orchard Capital Corp. (“Orchard Capital”), a firm that provides consulting and advisory services to companies in which Orchard Capital or its affiliates invest. Through his affiliation with Orchard Capital, Mr. Ressler serves in various senior capacities with, among others, CIM Group, L.P. (together with its controlled affiliates, “CIM”), a community-focused real estate and infrastructure owner, operator, lender and developer, and the indirect parent of our external manager, CIM Real Estate Finance Management, LLC (“CMFT Management” or our “manager”), and our property manager, Orchard First Source Asset Management (together with its controlled affiliates, “OFSAM”), which provides personnel staffing to OFS Capital Management, LLC, a registered investment adviser focusing primarily on investments in middle market and broadly syndicated U.S. loans, debt and equity positions in collateralized loan obligations and other structured credit investments, and OFS CLO Management, LLC, a registered investment adviser focusing primarily on investments in broadly syndicated U.S. loans. OFS Capital Management, LLC serves as a sub-advisor to our investment advisor, CIM Capital IC Management, LLC (“CIM Capital IC Management”), for securities and certain other investments, and OCV Management, LLC (“OCV”), an investor, owner and operator of technology companies. Mr. Ressler also serves as a board member for various public and private companies in which Orchard Capital or its affiliates invest, including, through an agreement with Orchard Capital, as non-executive chairman of the board of Ziff Davis, Inc. (NASDAQ: ZD), formerly known as j2Global, Inc. Through his affiliation with CIM, Mr. Ressler has served as chairman of the board of Creative Media & Community Trust Corporation (fka CIM Commercial Credit Corporation) (NASDAQ: CMCT) (“CMCT”), a publicly traded real estate investment trust (“REIT”) that invests primarily in creative office and residential properties, since March 2014. He served as chief executive officer, president and director of CIM Income NAV, Inc. (“CINAV”) from February 2018, and as chairman of the board from August 2018, until CINAV’s merger with the Company in December 2021. Mr. Ressler served as chief executive officer, president and director of Cole Office & Industrial REIT (CCIT III), Inc.

5

(“CCIT III”) from February 2018, and as chairman of the board from August 2018, until CCIT III’s merger with our company in December 2020. Mr. Ressler also served as director of Cole Office & Industrial REIT (CCIT II), Inc. (“CCIT II”) from January 2019 until CCIT II’s merger with Griffin Realty Trust, Inc. (“GRT”) in March 2021. He served as a director of Cole Credit Property Trust V, Inc. (“CCPT V”) from January 2019 to October 2019. Mr. Ressler co-founded CIM in 1994 and serves as the executive chairman of CIM, and as an officer of various affiliates of CIM, including our manager. Mr. Ressler co-founded the predecessor of OFSAM in 2001 and chairs its executive committee. Mr. Ressler co-founded OCV in 2016 and chairs its executive committee. Prior to founding Orchard Capital, from 1988 until 1994, Mr. Ressler served as Vice Chairman of Brooke Group Limited, the predecessor of Vector Group, Ltd. (NYSE: VGR) and served in various executive capacities at VGR and its subsidiaries. Prior to VGR, Mr. Ressler was with Drexel Burnham Lambert, Inc., where he focused on merger and acquisition transactions and the financing needs of middle-market companies. Mr. Ressler began his career in 1983 with Cravath, Swaine and Moore LLP, working on public offerings, private placements, and merger and acquisition transactions. Mr. Ressler holds a B.A. from Brown University, and J.D. and M.B.A. degrees from Columbia University. Mr. Ressler was selected to serve as a director because of his extensive real estate, business management and finance experience and expertise, in addition to his leadership roles at several public companies, all of which bring valuable insight to the board of directors.

T. Patrick Duncan has served as an independent director since September 2015, as a member of our nominating and corporate governance committee since August 2018, and as chairman of that committee since April 2022. He has served as the chairman of the compensation committee and as a member of the investment risk management committee since March 2022. He previously served as the non-executive chairman of the board of directors from November 2015 until August 2018, as the chairman of the valuation, compensation and affiliate transactions committee from August 2018 until March 2022, and as a member of the audit committee from September 2015 until March 2022. Mr. Duncan also served as a member of the board of directors of CINAV from August 2013 until September 2015. For 27 years, Mr. Duncan served in various roles at USAA Real Estate Company, a private real estate investment company, most recently as its chief executive officer from January 2005 until he retired in May 2013. Mr. Duncan also served as vice chairman of the board of directors of USAA Real Estate Company and as a director of United Lender Services, a USAA company, from his retirement in May 2013 until December 2015. Prior to serving as chief executive officer, Mr. Duncan held the position of senior vice president, real estate operations with USAA Real Estate, with responsibilities that included the direction of all acquisitions, sales, co-investments, build-to-suits, land development capital markets, management and leasing of real estate. Before joining USAA Real Estate in 1986, Mr. Duncan was with Trammell Crow Company in Dallas, Texas with responsibilities as a financial partner of the firm and prior to that, Mr. Duncan was a manager with Deloitte & Touche LLP. Mr. Duncan previously served on the boards of Meridian Industrial Trust, a former New York Stock Exchange-listed REIT, from 1994 to 1998, American Industrial Properties REIT, a former New York Stock Exchange-listed REIT, from 1996 to 2001, and Square Mile Capital Management, LLC, a diversified real estate investment firm, from 2012 to 2014. Mr. Duncan previously served on the board of the Texas Research and Technology Foundation and the Association of Foreign Investors in Real Estate (AFIRE). Mr. Duncan received a degree from the University of Arizona and is a Certified Public Accountant, Certified Commercial Investment Member, and holds a Texas Real Estate Broker’s License. Mr. Duncan was selected to serve as a director because of his extensive experience as a real estate industry executive with executive investment, capital markets and financial expertise, all of which are expected to bring valuable insight to the board of directors.

Alicia K. Harrison has served as an independent director of our company since June 2016, and as a member of our audit committee since April 2022. Ms. Harrison served as a member of our valuation, compensation and affiliate transactions committee and as chairperson of our nominating and corporate governance committee from August 2018 until March 2022. Ms. Harrison has served on the board of directors and the audit and capital committees of Ryan Companies US, Inc., a national commercial real estate development, design and management company, since May 2012, and as a member of the board of directors and the nominating and governance committee of Independent Bank Group, Inc., a bank holding company (NASDAQ: IBTX), since May 2019. She joined the audit committee of Independent Bank Group, Inc. in May 2020. Previously, Ms. Harrison worked for Wells Fargo & Company and its predecessor banks from 1986 until 2012, when she retired as executive vice president in Commercial Banking. Her responsibilities at Wells Fargo included positions as area manager and group head for Southwest Regional Commercial Banking Office, manager of the Real Estate Department and integration team member for the Government and Institutional Banking Group, integrating the employees and clients of Wachovia Corporation following its acquisition by Wells Fargo in 2008. Prior to joining Wells Fargo, Ms. Harrison began her banking career in Houston with a predecessor bank of JPMorgan Chase & Co. (MBank) as a banker in the Energy Division after completing the Commercial Training program. Ms. Harrison is a Life Member of the Arizona State University Sun Angel Foundation, and previously served as a trustee of the Sun Angel Foundation and on the boards of directors of the Fresh Start Women’s Foundation, the Greater Phoenix Economic Council, the Phoenix Art

6

Museum, the Arizona Chapter of the American Red Cross, the Arizona Business Leadership Association and the Arizona Science Center. Ms. Harrison received a B.S. degree in Finance from Arizona State University and has completed postgraduate courses with the London School of Economics, City of London University Banking and the University of Southern California’s London Graduate School Program. Ms. Harrison was selected to serve as a director because of her financial services, investment management and real estate experience, all of which are expected to bring valuable insight to the board of directors.

Calvin E. Hollis has served as an independent director of our company since December 2020, and as a member of our compensation committee since April 2022. He served as an independent director of CCIT II from March 2018, as well as a member of CCIT II’s valuation, compensation and affiliate transactions committee and CCIT II’s nominating and corporate governance committee from August 2018 until its merger with GRT in March 2021. Mr. Hollis served as an independent director of CCPT V from March 2018 until its merger with our company in December 2020, and as a member of CCPT V’s valuation, compensation and affiliate transactions committee from August 2018 until its merger with our company in December 2020. Mr. Hollis retired from his position as Senior Executive Officer, Real Estate, Countywide Planning and Development for the Los Angeles County Metropolitan Transportation Authority effective year-end 2017. He served in that position from May 2011 until December 2017. His responsibilities included executive oversight of all real estate operations including acquisitions and dispositions, non-operating property asset management, and the commercial long term ground lease program. From February 2009 to May 2011, Mr. Hollis served as the Acting Chief Executive Officer and then Chief Operating Officer for the Community Redevelopment Agency (“CRA”) of the City of Los Angeles. Prior to joining the CRA, Mr. Hollis served as a Managing Principal with Keyser Marston Associates, Inc. from March 1983 to February 2009, where he provided real estate advisory services to over 150 public, institutional, and private clients in major public-private real estate transactions. Mr. Hollis is a former member of Lambda Alpha and the Urban Land Institute Public Private Partnership Council. Mr. Hollis received a B.A. in Economics from California State University Los Angeles. Mr. Hollis was selected to serve as a director because of his experience with real estate projects and transactions of all types, including his experience with public-private partnerships, all of which are expected to bring valuable insight to the board of directors.

W. Brian Kretzmer has served as an independent director of our company since February 2018, as a member of our audit committee since August 2018, and as a member of our nominating and corporate governance committee since March 2022. He served as a member of the valuation, compensation and affiliate transactions committee from August 2018 until March 2022. Mr. Kretzmer has served as a director of Ziff Davis, Inc. (NASDAQ: ZD) since July 2007, and is a member of the Ziff Davis audit committee. Mr. Kretzmer currently operates his own consultancy practice and is an investor in several private firms where he serves in multiple capacities. From 1999 to 2006, Mr. Kretzmer was Chief Executive Officer of MAI Systems Corporation (which operated principally through its subsidiary, Hotel Information Systems), a provider of enterprise management solutions for lodging organizations. He also served as Chief Financial Officer of MAI Systems Corporation from 1993 to 1996 and 1999 to 2000. Mr. Kretzmer is a thirty-year veteran in technology industries. He served as an independent director of CINAV from February 2018, and as a member of its audit committee and valuation, compensation and affiliate transactions committee from August 2018, until CINAV’s merger with our company in December 2021. He also served as an independent director of CCIT III from February 2018 until its merger with our company in December 2020. Mr. Kretzmer holds a B.A. from Montclair State University and an M.B.A. from Fairleigh Dickinson University. Mr. Kretzmer was selected to serve as a director because of his extensive operational and financial perspective and accounting expertise, in addition to his leadership roles at MAI Systems Corporation, all of which are expected to bring valuable insight to the board of directors.

Jason Schreiber has served as a director of our company since April 2022. Mr. Schreiber has served as a Principal of CIM in its Investments department since May 2016, and as a member of its Investment Committee since 2016. From April 2014 to April 2016, Mr. Schreiber served as a 1st Vice President, Investments, at CIM. He also served at CIM from May 2010 to March 2014 as a Vice President, Investments, and from July 2007 to April 2010 as an Associate, Investments. Prior to joining CIM, Mr. Schreiber served from July 2001 to July 2005 as an Analyst at Goldman, Sachs & Co. Mr. Schreiber received a Master of Business Administration degree from Harvard Business School, and a Bachelor of Arts degree in Economics and the History of Art from Brown University. Mr. Schreiber was selected to serve as a director because of his extensive experience in real estate investments and transactions, which are expected to bring valuable insight to the board of directors.

Avraham Shemesh has served as a director of our company since March 2019. Mr. Shemesh is a Co-Founder and Principal of CIM, with more than 25 years of active real estate, infrastructure and lending experience. Since co-founding CIM in 1994, Mr. Shemesh has been instrumental in building the firm’s real estate, infrastructure and debt platforms. He serves on CIM’s Investment and Real Assets Management Committees, providing guidance on the diverse opportunities available across CIM’s various platforms, and acts as an officer for various CIM entities,

7

including our manager and our property manager. Mr. Shemesh is responsible for CIM’s long-time relationships with strategic institutions and oversees teams essential to acquisitions, portfolio management and internal and external communication. Since March 2014, Mr. Shemesh has served as a director of CMCT. Additionally, he served as a director of CIM Income NAV from January 2019 until CINAV’s merger with our company in December 2021. Mr. Shemesh served as chief executive officer, president and director of CCIT II from February 2018, and as chairman of the board from August 2018, until CCIT II’s merger with GRT in March 2021. He served as chief executive officer and director of CCPT V from March 2018, and as chairman of the board from August 2018 until CCPT V’s merger with our company in December 2020. He also served as a director of CCIT III from January 2019, until CCIT III’s merger with our company in December 2020. Prior to CIM, Mr. Shemesh was involved in a number of successful entrepreneurial real estate activities, including co-founding Dekel Development, which developed a wide variety of commercial and multifamily properties in Los Angeles. Mr. Shemesh was selected to serve as a director because of his significant experience with the real estate acquisition process and strategic planning as a result of his experience with CIM, including as Co-Founder thereof, as well as his leadership roles at CIM and CMCT, all of which are expected to bring valuable insight to the board of directors.

Howard A. Silver has served as an independent director and a member of our audit committee since October 2019, and has served as the chairman of our audit committee since January 2022. He served as a member of the valuation, compensation and affiliate transactions committee from October 2019 until March 2022. Since February 2021, he has served as an independent director and chairman of the audit committee of Alpine Acquisition Corporation (NASDAQ: REVEU), a special purpose acquisition company. He also served as an independent director and chairman of the audit committee of CCIT III from July 2016, as well as a member of CCIT III’s valuation, compensation and affiliate transactions committee from August 2018, until its merger with our company in December 2020. From 1994 until 2007, Mr. Silver held various positions with Equity Inns, Inc., a publicly listed hospitality REIT on the New York Stock Exchange, including chief executive officer, president, chief financial officer, chief operating officer and secretary. Until the sale of Equity Inns to Whitehall Global Real Estate Funds in October 2007, Equity Inns was the largest hotel REIT focused on the upscale extended stay, all suite and midscale limited service segments of the hotel industry. From 1992 until 1994, Mr. Silver served as chief financial officer of Alabaster Originals, L.P., a fashion jewelry wholesaler. Prior to joining Equity Inns, Mr. Silver was employed by Ernst & Young LLP from 1987 to 1992 and by PricewaterhouseCoopers LLP from 1978 to 1985, both global accounting firms. From 2012 until the sale of the company in 2018, Mr. Silver served as a member of the board of directors and as lead independent director of Education Realty Trust, Inc. (NYSE: EDR), a publicly listed collegiate housing REIT. Mr. Silver has also served as a member of the board of directors and chairman of the audit committee of Jernigan Capital, Inc. (NYSE: JCAP), a publicly listed mortgage REIT focused on lending to self-storage facilities, since April 2015. From January 2014 until the sale of the company in January 2016, he served as a member of the board of directors and as chairman of the audit committee of Landmark Apartment Trust, Inc., a publicly registered, non-listed multifamily REIT, and, from its inception in 2004 through the sale of the company in November 2013, he served as a member of the board of directors and chairman of the audit committee of CapLease, Inc. (NYSE: LSE), a publicly listed net lease REIT. From 2004 until the sale of the company in May 2012, Mr. Silver also served as a member of the board of directors of Great Wolf Resorts, Inc. (NASDAQ: WOLF), a publicly listed family entertainment resort company. Mr. Silver graduated cum laude from the University of Memphis with a B.S. in Accountancy and has been a Certified Public Accountant since 1980. Mr. Silver was selected to serve as a director because of his extensive experience in the real estate industry and accounting, which is expected to bring valuable insight to the board of directors.

Roger D. Snell has served as an independent director of our company since December 2021, and as a member of our compensation committee and our investment risk management committee since April 2022. He previously served as an independent director and chairman of the audit committee of CINAV from September 2011, and as a member of the valuation, compensation and affiliate transactions committee of the CINAV board of directors from August 2018, until CINAV’s merger with the Company in December 2021. Since January 2021, Mr. Snell serves as a member of the board of directors and investment committee of Veritas Investments, Inc., a real estate management firm specializing in mixed-use multifamily and retail properties in the San Francisco Bay area. From September 2021 until April 2022, Mr. Snell served as chief executive officer and a member of the board of directors of Conifer Realty, LLC, a nationally ranked, full-service real estate company specializing in the development, construction, management, and ownership of high-quality, affordable housing communities. Mr. Snell served as chief investment officer of Veritas Investments, Inc. from October 2011 until January 2021. From February 2003 until December 2011, Mr. Snell was the managing director of SIP Investment Partners, a commercial real estate investment firm. From February 1997 to June 2002, Mr. Snell was president and chief executive officer of Peregrine Real Estate Investment Trust, a publicly traded commercial real estate and hotel property REIT that was reorganized into a private company named WinShip Properties. Prior to joining Peregrine, Mr. Snell was managing director of Snell & Co., LLC, an investment advisory firm, in 1996, and president and chief executive officer of Perini Investment

8

Properties, a publicly traded REIT focusing on commercial real estate and hotel properties (later renamed Pacific Gateway Properties), from January 1993 to January 1996. Prior to joining Perini, Mr. Snell held various leadership positions in other commercial real estate investment and development companies. Mr. Snell received an M.B.A. from Harvard Business School and a B.S. degree from the University of California, Berkeley. Mr. Snell was selected to serve as a director because of his experience as a real estate industry executive with executive investment, capital markets and portfolio management expertise, all of which are expected to bring valuable insight to the board of directors.

Emily Vande Krol has served as a director of our company since April 2022. Ms. Vande Krol has served as a Principal of CIM since March 2022, has been CIM’s Head of Partner Solutions Group since February 2019, and President of CCO Capital, CIM’s registered broker-dealer since December 2019. She joined CIM in 2018 as Senior Vice President of Partner & Co-Investor Relations through the acquisition of Cole Capital and facilitated the integration of the global and private wealth distribution platforms. During her 7-year tenure at Cole Capital, she served in various capacities within the sales and operations of the organization and most recently, from March 2015 to February 2018, as Senior Vice President, Head of Internal Sales. Ms. Vande Krol received her Bachelor of Science degree in Accounting from Arizona State University. She holds FINRA Series 7, 66 and 24 licenses. Ms. Vande Krol was selected to serve as a director because of her extensive managerial and operational experience with externally managed REITs, which is expected to bring valuable insight to the board of directors.

Vote Required; Recommendation

The affirmative vote of a plurality of all the votes cast at a meeting of stockholders duly called at which a quorum is present is necessary for the election of a director. A properly executed proxy card, or instruction by telephone or over the Internet, indicating “FOR” a nominee will be considered a vote in favor of such nominee for election as director. A properly executed proxy card, or instruction by telephone or over the Internet, indicating “WITHHOLD” will be considered a vote against such nominee for election as director.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES FOR ELECTION AS DIRECTORS

9

CORPORATE GOVERNANCE

Director Attendance at Board Meetings and Annual Stockholder Meeting

The board of directors held six meetings during the fiscal year ended December 31, 2021. Each of our directors at the time attended over ninety percent of all regularly scheduled quarterly meetings of our board of directors and the committees on which he or she served, and over eighty percent of all other meetings of the board and committees on which he or she served, during the fiscal year ended December 31, 2021. Although we do not have a formal policy regarding attendance by members of our board of directors at our Annual Meeting of Stockholders, we encourage all of our directors to attend.

Director Independence

Under the listing standards of either the New York Stock Exchange (the “NYSE”) or the NASDAQ Global Market (“NASDAQ”), upon a listing of our common stock, at least a majority of the Company’s directors would be required to qualify as “independent” as affirmatively determined by the board. Although our shares are not listed for trading on the NYSE or NASDAQ, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, our senior management and our independent registered public accounting firm, the board has determined that Messrs. Duncan, Hollis, Kretzmer, Silver and Snell, and Ms. Harrison, who comprise a majority of our board, meet the current independence and qualifications requirements of the NYSE and NASDAQ.

Board Leadership Structure

Richard S. Ressler serves as both the chairman of our board of directors and our chief executive officer. He is also the chair of the investment risk management committee. Mr. Duncan, our former chairman, is the chair of the nominating and corporate governance committee and the compensation committee, and Mr. Silver is the chair of the audit committee. The nominating and corporate governance committee, the compensation committee and the audit committee are comprised entirely of independent directors, and consider matters for which the oversight of our independent directors is key, including board membership and committee leadership, matters relating to the valuation of the Company’s common stock, and review and approval of transactions with affiliates.

Our board of directors has the authority to select the leadership structure it considers appropriate, considering many factors including the specific needs of our business and what is in the best interests of our stockholders. The independent directors have determined that the most effective board of directors leadership structure for the Company at the present time is for the chief executive officer to also serve as chairman of the board of directors. The independent directors believe that, because the chief executive officer is ultimately responsible for the day-to-day operation of the Company and for executing the Company’s strategy, and because the performance of the Company is an integral part of board deliberations, the chief executive officer is the director best qualified to act as chairman of the board of directors.

The board of directors retains the authority to modify this structure to best address the Company’s unique circumstances, and to advance the best interests of all stockholders, as and when appropriate. The board of directors believes that the current board leadership structure is the most appropriate at this time, given the specific characteristics and circumstances of the Company. With the assistance of the nominating and corporate governance committee, the board of directors will continue to monitor the corporate governance practices of the Company, including the leadership structure of its board of directors.

In addition, although we do not have a lead independent director, in light of the function and make-up of the nominating and corporate governance committee, the compensation committee and the audit committee, and for the reasons further set forth below, the board of directors believes that its current corporate governance practices achieve independent oversight and management accountability. Our governance practices provide for strong independent leadership, independent discussion among directors and for independent evaluation of and communication with our executive officers, as well as the officers and key personnel of our manager. Some of the relevant processes and other corporate governance practices include:

•A majority of our directors are independent directors. Each director is an equal participant in decisions made by the full board of directors. In addition, related party transactions with CIM or any of its affiliates, including our manager, must be approved by the audit committee, which is comprised entirely independent directors.

•Each of our directors is elected annually by our stockholders.

10

•The board of directors can decline to renew the management agreement with our external manager upon the affirmative vote of two-thirds (2/3) of the independent directors that (1) there has been unsatisfactory performance by the manager that is materially detrimental to the Company or (2) the management fees payable to the manager are not fair.

Board Committees

The board of directors has established an audit committee, a compensation committee, a nominating and corporate governance committee, and an investment risk management committee and previously established a special committee and a valuation, compensation and affiliate transactions committee. In March of 2022, in order to further prepare the Company for a potential listing of its common stock on a national securities exchange, the board of directors took action to align its committee structure to the listing requirements of the NYSE and NASDAQ, including the creation of a stand-alone compensation committee and a change in the membership of the nominating and corporate governance committee to consist entirely of independent directors. The valuation, compensation and affiliate transactions committee was concurrently dissolved. At this time, we believe that the charters for our audit committee, compensation committee and nominating and corporate governance committee meet the listing requirements of each of the NYSE and NASDAQ. The audit committee, compensation committee, and nominating and corporate governance committee are each comprised solely of independent directors, and a majority of the members of the investment risk management committee are independent directors.

In addition, a special committee of the board was formed in April 2021 consisting entirely of independent directors in connection with the exploration of the potential merger transaction between the Company and CINAV. For further detail regarding the special committee and the valuation, compensation and affiliate transactions committee, see “- Recently Dissolved Committees” below.

Audit Committee

The audit committee is comprised of Ms. Harrison and Messrs. Kretzmer and Silver, all of whom are independent directors. Mr. Silver serves as the chairman of the audit committee. The audit committee reports regularly to the full board. The audit committee meets on a regular basis at least four times annually, usually in conjunction with regular meetings of the board, and met four times during 2021. The audit committee (i) has direct responsibility for selecting an independent registered public accounting firm registered with the Public Company Accounting Oversight Board (“PCAOB”) to serve as our independent auditors and to audit our annual financial statements, (ii) reviews with the independent registered public accounting firm the plans and results of the audit engagement, (iii) approves the audit and non-audit services provided by the independent registered public accounting firm, (iv) reviews the independence of the independent registered public accounting firm, (v) considers the range of audit and non-audit fees, and (vi) reviews the adequacy of our internal accounting controls with the independent registered public accounting firm.

Our board of directors has adopted a charter for the audit committee that sets forth its specific functions and responsibilities. The audit committee charter can be located on our sponsor’s website at www.cimgroup.com/investment-strategies/individual/managed-reit-corporate-governance.

Although our shares are not listed for trading on any national securities exchange, all members of the audit committee meet the current independence and qualifications requirements of the NYSE and NASDAQ, as well as the applicable rules and regulations of the SEC. While each member of the audit committee has significant financial and/or accounting experience, the board of directors has determined that Messrs. Kretzmer and Silver satisfy the SEC’s requirements for an “audit committee financial expert” and has designated Messrs. Kretzmer and Silver as our audit committee financial experts.

Compensation Committee

The compensation committee is comprised of Messrs. Duncan, Hollis and Snell, all of whom are independent directors. Mr. Duncan serves as the chairman of the compensation committee. The compensation committee was newly formed in March 2022, though its predecessor, the valuation, compensation and affiliate transactions committee met six times during 2021.

The primary focus of our compensation committee is to assist the board of directors in fulfilling its responsibilities with respect to officer and director compensation. The compensation committee assists the board of directors in this regard by: (i) to the extent the Company is responsible for paying the compensation and/or any other employee benefits of the chief executive officer, reviewing and approving our corporate goals with respect to compensation of the chief executive officer and determining the chief executive officer’s compensation; (ii) to the

11

extent the Company is responsible for paying the compensation and/or any other employee benefits of the executive officers of the Company other than the chief executive officer, reviewing and approving compensation levels and benefit plans for such executive officers; (iii) recommending to the board of directors compensation for all non-employee directors, including board of directors and committee retainers, meeting fees and equity-based compensation; (iv) reviewing and approving all company benefit plans, incentive compensation plans, and equity-based plans; and (v) approving and issuing awards under such plans in accordance and consistent with any written guidelines and restrictions established by the board of directors.

Our board of directors has adopted a charter for the compensation committee that sets forth its specific functions and responsibilities. The charter of the compensation committee is available on our sponsor’s website at www.cimgroup.com/investment-strategies/individual/managed-reit-corporate-governance.

Although our shares are not listed for trading on any national securities exchange, all members of the compensation committee meet the current independence and qualifications requirements of the NYSE and NASDAQ, as well as the applicable rules and regulations of the SEC.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee consists of two directors, Messrs. Duncan and Kretzmer, with Mr. Duncan serving as the chairperson of the committee. Following the amendment and restatement of the charter of the nominating and corporate governance committee in March 2022, and the concurrent restructuring of the membership of the nominating and corporate governance committee, all of the members of the nominating and corporate governance committee are independent directors. The committee met one time during 2021.

Our board of directors has adopted a charter for the nominating and corporate governance committee that sets forth its specific functions and responsibilities. The charter of the nominating and corporate governance committee is available on our sponsor’s website at www.cimgroup.com/investment-strategies/individual/managed-reit-corporate-governance.

The primary purpose of the nominating and corporate governance committee is to assist the board of directors in fulfilling its responsibilities with respect to director nominations, corporate governance and board of directors and committee evaluations. The nominating and corporate governance committee assists the board of directors in this regard by: (1) from time to time, reviewing, assessing and making recommendations to the board of directors regarding the size, structure and composition of the board of directors and its committees; (2) establishing criteria for the selection of directors to serve on the board; (3) evaluating the qualifications of candidates for the board, in light of the criteria approved by the board, including candidates proposed by the Company’s management, directors or stockholders, and evaluating the independence of such possible candidates; (4) recommending prospective candidates to the board for nomination by the board at each annual meeting of the stockholders or any special meeting of the stockholders at which directors are to be elected, and for any vacancies or newly created directorships on the board of directors; (5) making recommendations to the board of directors regarding members to serve on committees of the board of directors, taking into account the experience and expertise of each individual director; (6) overseeing an annual evaluation of the board of directors; and (7) developing and recommending to the board of directors a set of corporate governance policies and principles, and periodically re-evaluating such policies and principles for the purpose of suggesting amendments to them if appropriate .

Although our shares are not listed for trading on any national securities exchange, all members of the nominating and corporate governance committee meet the current independence and qualifications requirements of the NYSE and NASDAQ, as well as the applicable rules and regulations of the SEC.

The nominating and corporate governance committee and the board of directors annually review the appropriate experience, skills and characteristics required of board members in the context of the then-current membership of the board, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in a variety of areas. This assessment includes, in the context of the perceived needs of the board at that time, issues of knowledge, experience, judgment and skills such as an understanding of the real estate industry or brokerage industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflicts of interest with the Company and the ability of the candidate to attend board meetings regularly and to devote an appropriate amount of effort in preparation for those meetings.

Historically, our board of directors has solicited candidate recommendations from its own members and management of the Company. The Company has not employed and does not currently employ or pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential director nominees, although we are

12

not prohibited from doing so if we determine such action to be in the best interests of the Company. Our nominating and corporate governance committee and board of directors also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In order to be considered by our board of directors, recommendations made by stockholders must be submitted within the time frame required to request a proposal to be included in the proxy materials. See “Stockholder Proposals” below for more information on procedures to be followed by our stockholders in submitting such recommendations. In evaluating the persons recommended as potential directors, our nominating and corporate governance committee and board of directors will consider each candidate without regard to the source of the recommendation and take into account those factors that our board of directors determines are relevant. Stockholders may directly nominate potential directors (without the recommendation of our board of directors) by satisfying the procedural requirements for such nomination as provided in Article II, Section 11 of our bylaws.

In considering possible candidates for election as a director, the nominating and corporate governance committee and the board of directors are guided by the principles that each director should (i) be an individual of high character and integrity; (ii) be accomplished in his or her respective field, with superior credentials and recognition; (iii) have relevant expertise and experience upon which to base advice and guidance to management in the conduct of our real estate investment and management activities; (iv) have sufficient time available to devote to our affairs; and (v) represent the long-term interests of our stockholders as a whole. Our nominating and corporate governance committee and board of directors may also consider an assessment of its diversity, including factors such as, but not limited to, age, geography, gender and ethnicity. While we do not have a formal diversity policy, we believe that the backgrounds and qualifications of our directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow our board of directors to fulfill its responsibilities.

Our nominating and corporate governance committee recommended to the board of directors, and the board of directors nominated each of the nominees for election as a director at the 2022 Annual Meeting of Stockholders.

Investment Risk Management Committee

The investment risk management committee was newly formed in March 2022. The investment risk management committee is comprised of Messrs. Ressler, Duncan and Snell, of whom Messrs. Duncan and Snell are independent directors. Mr. Ressler serves as the chairman of the committee. The investment risk management committee reviews and approves any proposed investments for which our investment guidelines (as in effect at such time) contemplate such review and approval by the board of directors or a duly authorized committee thereof.

Recently Dissolved Committees

Special Committee

A special committee of the board of directors was formed in April 2021 in connection with the exploration of the potential merger transaction between the Company and CINAV. The special committee consisted of Ms. Harrison and Messrs. Duncan, Kretzmer, Silver and Lawrence S. Jones, all of whom are or were independent directors. Mr. Duncan served as the chairman of the special committee. In connection with the formation of the special committee, the board of directors authorized and delegated to the special committee the full power to take any and all actions that it deemed necessary, advisable or appropriate (and to enter into any contracts, agreements, arrangements or understandings as it deemed necessary, advisable or appropriate, in the name and on behalf of the Company) in connection with, or in response to, the exploration of the merger transaction. The Company entered into a merger agreement with CINAV on September 21, 2021, and the merger was consummated in December 2021. The special committee was dissolved upon the consummation of the merger with CINAV.

Valuation, Compensation and Affiliate Transactions Committee

As discussed above, the valuation, compensation and affiliate transactions committee was dissolved in March 2022 as part of the Company’s alignment of its committee structure with the listing requirements of the NYSE and NASDAQ. The valuation, compensation and affiliate transactions committee met six times during 2021.

Prior to its dissolution, the primary purposes of the valuation, compensation and affiliate transactions committee were to: (1) assist the board in satisfying its obligations to determine and provide the fair value of assets of the Company and the determination of the net asset value (“NAV”) per share of the common stock of the Company to comply with all applicable SEC, state and Financial Industry Regulatory Authority (“FINRA”) requirements; (2) oversee the Company’s board compensation programs, including plans and programs relating to cash compensation, incentive compensation, equity-based awards and other benefits and perquisites pertaining to the

13

board and to administer any such plans or programs as required by the terms thereof; (3) periodically review the performance of the Company’s manager and determine whether compensation paid to it was reasonable in relation to the nature and quality of services performed and the investment performance of the Company, and that the provisions of the management agreement were being carried out by the manager; (4) consider for approval any other agreements and transactions between the Company and/or its subsidiaries on the one hand and any of (i) the manager, (ii) CIM and/or its subsidiaries, (iii) a director or officer of the Company, or (iv) an affiliate of the foregoing, on the other hand; and (5) carry out any other duties delegated to it by the board of directors.

Communication with Directors

We have established procedures for stockholders or other interested parties to communicate directly with our board of directors. Such parties can contact the board by mail at: Chairman of the Board of Directors of CIM Real Estate Finance Trust, Inc., c/o Corporate Secretary, 2398 East Camelback Road, 4th Floor, Phoenix, Arizona 85016.

The chairman of the board of directors will receive all communications made by these means, and will distribute such communications to such member or members of our board of directors as he deems appropriate, depending on the facts and circumstances outlined in the communication received.

The Board’s Role in Risk Oversight

The board of directors oversees our stockholders’ interest in the long-term health and the overall success of the Company and its financial strength.

The board of directors is actively involved in overseeing risk management for the Company. It does so, in part, through its oversight of our property acquisitions and assumptions of debt, as well as its oversight of our Company’s executive officers and our manager. In particular, the board of directors is responsible for evaluating the performance of the manager, and may decline to renew the management agreement with our external manager upon the affirmative vote of two-thirds (2/3) of the independent directors that (1) there has been unsatisfactory performance by the manager that is materially detrimental to the Company or (2) the management fees payable to the manager are not fair.

In addition, the audit committee is responsible for assisting the board of directors in overseeing the Company’s management of risks related to financial reporting. The audit committee has general responsibility for overseeing the accounting and financial processes of the Company, including oversight of the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and the adequacy of the Company’s internal control over financial reporting. In addition, we have adopted policies and procedures with respect to complaints related to accounting, internal accounting controls or auditing matters, which enable anonymous and confidential submission of complaints that the audit committee shall discuss with management. Further, in connection with the annual audit of the Company’s financial statements, the audit committee conducts a detailed review with the Company’s independent auditors of the accounting policies used by the Company and its financial statement presentation.

Code of Business Conduct and Ethics

Our board of directors has adopted a Code of Business Conduct and Ethics for Principal Executive Officer and Senior Financial Officers that is applicable to our principal executive officer, principal financial officer and principal accounting officer and a Code of Business Conduct and Ethics that is applicable for Independent Directors. These Codes of Business Conduct and Ethics contain general guidelines for conducting our business and are designed to help our officers, directors, employees and independent consultants resolve ethical issues in an increasingly complex business environment. The Codes of Business Conduct and Ethics are located on our sponsor’s website at www.cimgroup.com/investment-strategies/individual/managed-reit-corporate-governance.

If, in the future, we amend, modify or waive a provision in the Codes of Business Conduct and Ethics, we may, rather than file a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

No Hedging or Pledging of Stock

Directors are prohibited from hedging and pledging the Company’s securities or the securities of any other non-traded real estate investment trust sponsored and managed by CCO Group, LLC (“CCO Group”).

14

Compensation of Directors

Summary

Directors who are also officers or employees of CIM or its affiliates (Messrs. Ressler. Schreiber and Shemesh and Ms. Vande Krol) do not receive any special or additional remuneration for service on the board of directors or any of its committees. During the year ended December 31, 2021, and for the first quarter of 2022 ended March 31, 2022, each independent director received compensation for service on the board of directors and any of its committees in accordance with the compensation program set forth below:

•an annual board membership retainer of $90,000; and

•an additional annual retainer for each standing committee on which a director serves equal to $25,000 for the committee chair and $15,000 for other members of the committee.

Generally, each director’s aggregate annual board compensation was paid 75% in cash (in four quarterly installments) and 25% in the form of an annual grant of restricted shares of common stock based on the then-current NAV per share at the time of issuance pursuant to the CIM Real Estate Finance Trust, Inc. 2018 Equity Incentive Plan (the “Equity Plan”), as further described below. Restricted stock grants pursuant to the Equity Plan will generally vest one year from the date of the grant. In addition, all directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the board of directors.

Independent directors who served on a special committee received a one-time payment of $36,000 per special committee, and the chairman of the committee received $54,000 per special committee.

Effective as of April 1, 2022, the board of directors approved a revised compensation program for independent directors providing for an annual cash board membership retainer of $80,000, payable quarterly in arrears. Independent directors serving in the following roles are entitled to receive these additional cash retainers:

•Audit Committee Chair: $20,000;

•Audit Committee Members (other than the Audit Committee Chair): $10,000;

•Compensation Committee Chair and Nominating and Corporate Governance Committee Chair: $15,000; and

•Compensation Committee, Nominating and Corporate Governance Committee and Investment Risk Management Committee Members (other than the Compensation Committee Chair and the Nominating and Corporate Governance Committee Chair)1: 5,000

In addition, each independent director is entitled to an equity award of $80,000, payable in the form of restricted shares of common stock to be issued on October 1 of each year (the “Award Date”) and that vest on the one-year anniversary of the Award Date, subject to the director’s continued service on the board. The award is calculated based on the then-current NAV per share on the Award Date and will be issued pursuant to the Amended and Restated CIM Real Estate Finance Trust, Inc. 2022 Equity Incentive Plan (the “2022 Amended and Restated Equity Plan”). Independent directors will continue to receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the board of directors.

1 Mr. Ressler, the chairman of our board of directors and our chief executive officer, serves as the chairman of the investment risk management committee and receives no additional compensation for such service.

15

Director Compensation Table

The following table sets forth certain information with respect to our director compensation during the fiscal year ended December 31, 2021:

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total Compensation ($) | |||||||||||||||||||||||||||

T. Patrick Duncan | $ | 108,750 | $ | 36,250 | $ | — | $ | — | $ | 145,000 | ||||||||||||||||||||||

Alicia K. Harrison | $ | 97,500 | $ | 32,500 | $ | — | $ | — | $ | 130,000 | ||||||||||||||||||||||

Lawrence S. Jones | $ | 170,625 | $ | 32,500 | $ | — | $ | — | $ | 203,125 | ||||||||||||||||||||||

W. Brian Kretzmer | $ | 90,000 | $ | 30,000 | $ | — | $ | — | $ | 120,000 | ||||||||||||||||||||||

Howard A. Silver | $ | 90,000 | $ | 30,000 | $ | — | $ | — | $ | 120,000 | ||||||||||||||||||||||

| Marcus E. Bromley | $ | 118,125 | $ | 29,887 | $ | — | $ | — | $ | 148,012 | ||||||||||||||||||||||

| Stephen O. Evans | $ | 118,125 | $ | 29,887 | $ | — | $ | — | $ | 148,012 | ||||||||||||||||||||||

| Robert A. Gary, IV | $ | 118,125 | $ | 29,887 | $ | — | $ | — | $ | 148,012 | ||||||||||||||||||||||

| Calvin E. Hollis | $ | 67,500 | $ | 29,887 | $ | — | $ | — | $ | 97,387 | ||||||||||||||||||||||

Richard S. Ressler | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

Avraham Shemesh | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

Roger D. Snell | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

Elaine Y. Wong | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

___________________

(1)Marcus E. Bromley, Stephen O. Evans, Robert A. Gary, IV, Lawrence S. Jones and Elaine Y. Wong served as directors for a portion of the fiscal year ended December 31, 2021, but did not stand for re-election at our 2021 Annual Meeting of Stockholders. Mr. Snell joined the board of directors in December 2021 and did not receive any compensation for his service during 2021. Ms. Wong, an affiliate of the Company, our manager or their affiliates, did not receive additional compensation for her service on the board of directors.

(2)Represents the grant date fair value of the restricted shares of common stock issued pursuant to the Equity Plan, for purposes of Accounting Standards Codification Topic 718, Compensation—Stock Compensation. Each of the independent directors elected prior to the date of grant received a grant of restricted shares of common stock in October 2021, which shares vest approximately one year from the date of grant. The grant date fair value of the restricted shares is based on the estimated NAV per share of the common stock on the grant date, which was $7.20.

Long Term Incentive Plan Awards to Independent Directors Under the Prior Equity Plan

In August 2018, in connection with the approval and implementation of a revised compensation structure for our independent directors, the board of directors approved the Equity Plan, under which 400,000 shares of the Company’s common stock were reserved for issuance and share awards of approximately 306,000 were available for future grant at December 31, 2021.

In October 2021, the Company granted awards of approximately 3,900 restricted shares to each of the independent members of the board of directors (approximately 35,000 restricted shares in aggregate) under the Equity Plan, representing 25% of each independent director’s annual aggregate board compensation for the twelve month period beginning October 2021 (the “2021 Restricted Stock Awards”). Except as noted below, the 2021 Restricted Stock Awards will vest on October 1, 2022, approximately one year from the date of grant.

On November 8, 2021, the valuation, compensation and affiliate transactions committee approved the acceleration of the vesting of all restricted shares for all non-returning independent directors to December 28, 2021, the date on which the Annual Meeting of Stockholders was held. In addition, the board of directors approved the payment of cash compensation to each of the non-returning independent directors, payable in one lump sum following the annual meeting, equal to the cash compensation each non-returning independent director would have received if they had continued to serve as a member of the board of directors through September 30, 2022.