Form DEF 14A CEL SCI CORP For: Sep 20

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act

of 1934

Filed by a Party

other than the Registrant ☐

Check the

appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (As Permitted by Rule

14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under Rule 14a-12

|

CEL-SCI

CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

Payment of Filing

Fee (Check the appropriate box):

☒ No

fee required

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1) Title

of each class of securities to which transaction

applies:

(2) Aggregate

number of securities to which transaction applies:

(3) Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed

maximum aggregate value of transaction:

(5) Total

fee paid:

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date

of its filing.

(1) Amount

Previously Paid:

(2) Form,

Schedule or Registration Statement No.:

(3) Filing

Party:

(4) Date

Filed:

CEL-SCI CORPORATION

8229 Boone Blvd., Suite 802

Vienna, Virginia 22l82

(703) 506-9460

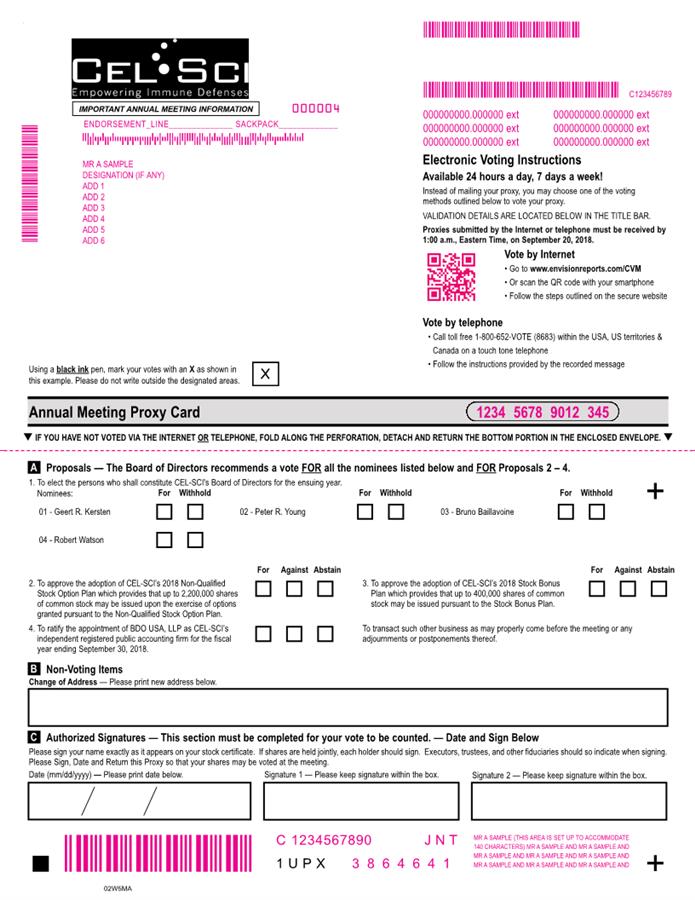

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 20, 2018

To the

Shareholders:

Notice

is hereby given that the annual meeting of the shareholders of

CEL-SCI Corporation (“CEL-SCI”) will be held at 4820-C

Seton Drive, Baltimore, MD 21215, on September 20, 2018 at 10:30

a.m. local time, for the following purposes:

(1)

to elect the

directors who shall constitute CEL-SCI’s Board of Directors

for the ensuing year;

(2)

to approve the

adoption of CEL-SCI’s 2018 Non-Qualified Stock Option Plan

which provides that up to 2,200,000 shares of common stock may be

issued upon the exercise of options granted pursuant to the

Plan;

(3)

to approve the

adoption of CEL-SCI’s 2018 Stock Bonus Plan which provides

that up to 400,000 shares of common stock may be issued to persons

granted stock bonuses pursuant to the Plan;

(4)

to ratify the

appointment of BDO USA, LLP as CEL-SCI’s independent

registered public accounting firm for the fiscal year ending

September 30, 2018; and

to

transact such other business as may properly come before the

meeting or any adjournments or postponements thereof.

July

27, 2018 is the record date for the determination of shareholders

entitled to notice of and to vote at the meeting. Shareholders are

entitled to one vote for each share held. As of July 27, 2018,

there were 23,479,079 outstanding shares of CEL-SCI’s common

stock.

CEL-SCI

CORPORATION

July 27,

2018

Geert R. Kersten,

Chief Executive Officer

The Board of Directors solicits the enclosed proxy. Your vote is

important no matter how large or small your holdings. To assure

your representation at the meeting, please vote

promptly.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to be held on September 20, 2018. This

Proxy Statement is available at: www.irdirect.net/CVM/sec_filings/

|

If you

need additional copies of this Proxy Statement or the enclosed

proxy card, or if you have other

questions

about the proposals or how to vote your shares, you may contact our

proxy solicitor:

|

|

ADVANTAGE PROXY

|

|

(877)

870-8565 (toll free) or (206) 870-8565 (collect)

Or by email at: [email protected]

|

PLEASE INDICATE YOUR VOTING INSTRUCTIONS ON THE ATTACHED PROXY

CARD,

AND SIGN, DATE AND RETURN THE PROXY CARD, OR VOTE VIA THE INTERNET

OR BY TELEPHONE

TO SAVE THE COST OF FURTHER SOLICITATION, PLEASE VOTE

PROMPTLY

CEL-SCI CORPORATION

8229 Boone Blvd., Suite 802

Vienna, Virginia 22l82

(703) 506-9460

PROXY STATEMENT

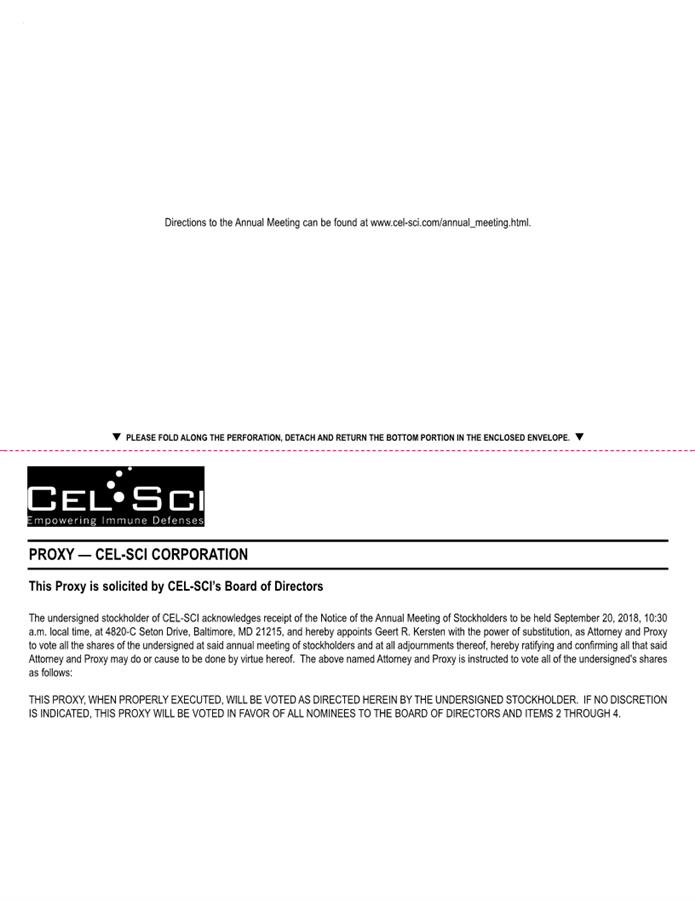

The

accompanying proxy is solicited by CEL-SCI’s directors for

voting at the annual meeting of shareholders to be held on

September 20, 2018, and at any and all adjournments of such

meeting. If the proxy is executed and returned, it will be voted at

the meeting in accordance with any instructions, and if no

specification is made, the proxy will be voted for the proposals

set forth in the accompanying notice of the annual meeting of

shareholders. Shareholders who execute proxies may revoke them at

any time before they are voted, either by writing to CEL-SCI at the

address shown above or in person at the time of the meeting.

Additionally, any later dated proxy will revoke a previous proxy

from the same shareholder. This proxy statement was posted on the

CEL-SCI’s website on or about August 8, 2018.

There

is one class of capital stock outstanding. Provided a quorum

consisting of one-third of the shares entitled to vote is present

at the meeting, the affirmative vote of a majority of the shares of

common stock voting in person or represented by proxy is required

to elect directors. Cumulative voting in the election of directors

is not permitted. The other proposals to come before the meeting

will be adopted if votes cast in favor of the proposal exceed the

votes cast against the proposal.

Shares

of CEL-SCI’s common stock represented by properly executed

proxies that reflect abstentions or "broker non-votes" will be

counted as present for purposes of determining the presence of a

quorum at the annual meeting. “Broker non-votes”

represent shares held by brokerage firms in "street-name" with

respect to which the broker has not received instructions from the

customer or otherwise does not have discretionary voting authority.

Abstentions and broker non-votes will not be counted as having

voted against the proposals to be considered at the

meeting.

PRINCIPAL SHAREHOLDERS

The

following table lists, as of July 27,

2018, information with respect to the persons owning

beneficially 5% or more of CEL-SCI’s outstanding common stock

and the number and percentage of outstanding shares owned by each

director and officer of CEL-SCI and by the officers and directors

as a group. Unless otherwise indicated, each owner has sole voting

and investment powers over his or her shares of common

stock.

|

Name and

Address

|

Number of Shares

(1)

|

Percent of

Class

|

|

|

|

|

|

Geert R.

Kersten

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

1,513,453(2)

|

6.2%

|

|

|

|

|

|

Patricia B.

Prichep

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

237,483

|

1.0%

|

|

|

|

|

|

Eyal Talor,

Ph.D.

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

173,130

|

*

|

2

|

Name and

Address

|

Number of Shares

(1)

|

Percent of

Class

|

|

|

|

|

|

Daniel H.

Zimmerman, Ph.D.

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

48,827

|

*

|

|

|

|

|

|

John

Cipriano

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

83,200

|

*

|

|

|

|

|

|

Peter R. Young,

Ph.D.

208 Hewitt Drive,

Suite 103-143

Waco, TX

76712

|

45,292

|

*

|

|

|

|

|

|

Bruno

Baillavoine

8229 Boone Blvd.,

Suite 802

Vienna, VA

22182

|

9,167

|

*

|

|

|

|

|

|

Robert

Watson

245 N. Highland

Ave. NE, Suite 230-296

Atlanta, GA

30307

|

0

|

*

|

|

|

|

|

|

All Officers and

Directors

as a Group (8

persons)

|

2,110,552

|

8.6%

|

* Less

than 1% of outstanding shares.

(1)

Includes shares

issuable prior to September 30, 2018 upon the exercise of options

or warrants held by the following persons:

|

(2)

|

Name

|

Options or

Warrants Exercisable

Prior

to

September

30,

2018

|

|

|

Geert R. Kersten,

Esq.

|

740,232(3)

|

|

|

Patricia B.

Prichep

|

78,027

|

|

|

Eyal Talor,

Ph.D.

|

57,563

|

|

|

Daniel Zimmerman,

Ph.D.

|

28,134

|

|

|

John

Cipriano

|

35,200

|

|

|

Peter R. Young,

Ph.D.

|

29,201

|

|

|

Bruno

Baillavoine

|

9,167

|

|

|

Robert

Watson

|

0

|

(3)

Amount includes

shares held in trust for the benefit of Mr. Kersten's children and

securities held in a separate trust, for which Mr. Kersten is a

beneficiary.

(4)

Amount includes

shares issuable upon the exercise of warrants held by Mr. Kersten

directly and in the trust.

3

OFFICERS AND DIRECTORS

Information

concerning CEL-SCI’s officers and directors

follows:

|

Name

|

|

Age

|

|

Position

|

|

Committees

|

|

Geert

R. Kersten, Esq.

|

|

59

|

|

Director,

Chief Executive Officer and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

Patricia

B. Prichep

|

|

67

|

|

Senior

Vice President of Operations and Corporate Secretary

|

|

|

|

|

|

|

|

|

|

|

|

Eyal

Talor, Ph.D.

|

|

62

|

|

Chief

Scientific Officer

|

|

|

|

|

|

|

|

|

|

|

|

Daniel

H. Zimmerman, Ph.D.

|

|

77

|

|

Senior

Vice President of Research, Cellular Immunology

|

|

|

|

|

|

|

|

|

|

|

|

John

Cipriano

|

|

76

|

|

Senior

Vice President of Regulatory Affairs

|

|

|

|

|

|

|

|

|

|

|

|

Peter

R. Young, Ph.D. (1)

|

|

73

|

|

Director,

Independent

|

|

Audit,

Compensation, and Nominating

|

|

|

|

|

|

|

|

|

|

Bruno

Baillavoine

|

|

64

|

|

Director,

Independent

|

|

Audit,

Compensation, and Nominating

|

|

|

|

|

|

|

|

|

|

Robert

Watson

|

|

61

|

|

Director,

Independent

|

|

|

(1)

Dr. Young is the

chairman of the Audit, Compensation and Nominating

committees.

The

directors of CEL-SCI serve in such capacity until the next annual

meeting of CEL-SCI's shareholders and until their successors have

been duly elected and qualified. The officers of CEL-SCI serve at

the discretion of CEL-SCI's directors. CEL-SCI’s officers

devote substantially all of their time to CEL-SCI’s

business.

Geert

Kersten has served in his current leadership role at CEL-SCI since

1995. Mr. Kersten has been with CEL-SCI since 1987, the early days

of CEL-SCI’s inception. He has been involved in the

pioneering field of cancer immunotherapy for almost three decades

and has successfully steered CEL-SCI through many challenging

cycles in the biotechnology industry. Prior to CEL-SCI, Mr. Kersten

worked at the law firm of Finley & Kumble and worked at Source

Capital, an investment banking firm located in McLean, VA. He is a

native of Germany, graduated from Millfield School in England, and

completed his studies in the US. Mr. Kersten received his

Undergraduate Degree in Accounting and an M.B.A. from George

Washington University, and a law degree (J.D.) from American

University in Washington, DC. Mr. Kersten’s experience

overseeing the financing and research and development of CEL-SCI

for over 25 years qualifies him to continue to serve on

CEL-SCI’s board of directors. Mr. Kersten is also the

inventor of a patent on the potential use of Multikine® (Leukocyte

Interleukin, Injection) in managing cholesterol.

4

Patricia B. Prichep

joined CEL-SCI in 1992 and has been CEL-SCI's Senior Vice President

of Operations since March 1994. Between December 1992 and March

1994, Ms. Prichep was CEL-SCI's Director of Operations. Ms. Prichep

became CEL-SCI's Corporate Secretary in May 2000. She is

responsible for all day-to-day operations of CEL-SCI, including

human resources and is the liaison with CEL-SCI’s independent

registered public accounting firm for financial reporting. From

June 1990 to December 1992, Ms. Prichep was the Manager of Quality

and Productivity for the NASD’s Management, Systems and

Support Department, where she was responsible for the internal

auditing and work flow analysis of operations. Between 1982 and

1990, Ms. Prichep was Vice President and Operations Manager for

Source Capital, Ltd. She handled all operations and compliance for

Source Capital and was licensed as a securities broker. Ms. Prichep

received her B.A. from the University of Bridgeport in

Connecticut.

Eyal

Talor, Ph.D. joined CEL-SCI in October 1993. In October 2009, Dr.

Talor was promoted to Chief Scientific Officer. Between this

promotion and March of 1994 he was the Senior Vice President of

Research and Manufacturing. He is a clinical immunologist with over

19 years of hands-on management of clinical research and drug

development for immunotherapy application (pre-clinical to Phase

III), in the biopharmaceutical industry. His expertise includes;

biopharmaceutical R&D and Biologics product development, GMP

(Good Manufacturing Practices) manufacture, Quality Control

testing, and the design and building of GMP manufacturing and

testing facilities. He served as Director of Clinical Laboratories

(certified by the State of Maryland) and has experience in the

design of clinical trials (Phase I – III) and GCP (Good

Clinical Practices) requirements. He also has broad experience in

the different aspects of biological assay development, analytical

methods validation, raw material specifications, and QC (Quality

Control) tests development under FDA/GMP, USP, and ICH guidelines.

He has extensive experience in the preparation of documentation for

IND and other regulatory submissions. His scientific area of

expertise encompasses immune response assessment. He is the author

of over 25 publications and has published a number of reviews on

immune regulations in relation to clinical immunology. Before

coming to CEL-SCI, he was Director of R&D and Clinical

Development at CBL, Inc., Principal Scientist - Project Director,

and Clinical Laboratory Director at SRA Technologies, Inc. Prior to

that he was a full time faculty member at The Johns Hopkins

University, Medical Intuitions; School of Public Health. He has

invented technologies which are covered by two US patents; one on

Multikine’s composition of matter and method of use in

cancer, and one on a platform Peptide technology

(‘Adapt’) for the treatment of autoimmune diseases,

asthma, allergy, and transplantation rejection. He also is

responsible for numerous product and process inventions as well as

a number of pending US and PCT (Patent Cooperation Treaty) patent

applications. He received his Ph.D. in Microbiology and Immunology

from the University of Ottawa, Ottawa, Ontario, Canada, and had

post-doctoral training in clinical and cellular immunology at The

Johns Hopkins University, Baltimore, Maryland, USA. He holds an

Adjunct Associate teaching position at the Johns Hopkins University

Medical Institutions.

Daniel

H. Zimmerman, Ph.D. was CEL-SCI's Senior Vice President of Cellular

Immunology between 1996 and December 2008 and again since November

2009. He joined CEL-SCI in January 1996 as the Vice President of

Research, Cellular Immunology. Dr. Zimmerman founded CELL-MED, Inc.

and was its president from 1987-1995. From 1973-1987, Dr. Zimmerman

served in various positions at Electronucleonics, Inc. His

positions included: Scientist, Senior Scientist, Technical Director

and Program Manager. Dr. Zimmerman held various teaching positions

at Montgomery College between 1987 and 1995. Dr. Zimmerman has

invented technologies which are covered by over a dozen US patents

as well as many foreign equivalent patents. He is the author of

over 40 scientific publications in the area of immunology and

infectious diseases. He has been awarded numerous grants from the

National Institutes of Health (NIH) and the Department of Defense.

From 1969-1973, Dr. Zimmerman was a Senior Staff Fellow at the NIH.

For the following 25 years, he continued on at NIH as a guest

worker. Dr. Zimmerman received a Ph.D. in Biochemistry in 1969, and

a Masters in Zoology in 1966 from the University of Florida as well

as a B.S. in Biology from Emory and Henry College in

1963.

5

John

Cipriano was CEL-SCI’s Senior Vice President of Regulatory

Affairs between March 2004 and December 2008 and again since

October 2009. Mr. Cipriano brings to CEL-SCI over 30 years of

experience with both biotech and pharmaceutical companies. In

addition, he held positions at the United States Food and Drug

Administration (FDA) as Deputy Director, Division of Biologics

Investigational New Drugs, Office of Biologics Research and Review

and was the Deputy Director, IND Branch, Division of Biologics

Evaluation, Office of Biologics. Mr. Cipriano completed his B.S. in

Pharmacy from the Massachusetts College of Pharmacy in Boston,

Massachusetts and his M.S. in Pharmaceutical Chemistry from Purdue

University in West Lafayette, Indiana.

Peter

R. Young, Ph.D. has been a Director of CEL-SCI since August 2002.

Dr. Young has been a senior executive within the pharmaceutical

industry in the United States and Canada for most of his career,

originally in organizations that are now part of Sanofi S.A. Over

the last 20 years he has primarily held positions of Chief

Executive Officer or Chief Financial Officer and has extensive

experience with acquisitions and equity financing. Since November

2001, Dr. Young has been the President of Agnus Dei, LLC, which has

acted as a partner in an organization managing immune system

clinics which treat patients with diseases such as cancer, multiple

sclerosis and hepatitis. Between 1997 and 2006, Dr. Young was also

the President and Chief Executive Officer of SRL Technology, Inc.,

a company involved in the development of pharmaceutical drug

delivery systems. Between 1998 and 2001, Dr. Young was the Chief

Financial Officer of Adams Laboratories, Inc, the developer of

Mucinex®. Dr. Young received his Ph.D. in Organic Chemistry

from the University of Bristol, England after obtaining his

Bachelor's degree in Honors Chemistry, Mathematics and Economics.

Subsequently, he qualified as a Fellow of the Chartered Institute

of Management Accountants. CEL-SCI believes Dr. Young’s

extensive knowledge of the life sciences industry, coupled with his

business acumen and financial expertise, gives him the

qualifications and skills to serve as a director, the chair of the

audit committee, the chair of the nominating committee and a member

of CEL-SCI’s compensation committee.

Bruno

Baillavoine has been a Director of CEL-SCI since June 2015. Since

2010, Mr. Baillavoine has been a partner of Globomass Holdings

Limited, a London, England based developer of renewable energy

projects from concept through final operations. Since 2012 Mr.

Baillavoine has been the Executive Chairman of Globomass Holdings.

Globomass Holdings has subsidiaries in Ireland, Bulgaria, Croatia,

Serbia, and has recently acquired a 20% stake in a US based

renewable energy company. Between 1978 and 1982 he was the

marketing manager of Ravenhead Ltd., a manufacturer of glass

tableware, and part of United Distillers Group (later acquired by

Grand Metropolitan). During this time Mr. Baillavoine became the UK

Business Manager where he restored market share and profit for

United Distillers. From 1982 to 1986 Mr. Baillavoine was Group

Corporate Planning and Group Marketing Director for Prontaprint

where he expanded the number of shops to 500 locations in four

years. Mr. Baillavoine joined Grand Metropolitan Plc between

1986-1988 (now Diageo Plc), an FTSE 100 beverage, food, hotel and

leisure company, as director in the Special Operations division. In

this capacity, he developed plans for Grand Met’s

trouble-shooting division for over 20,000 Grand Met retail outlets.

From 1988-1991 he was the Managing Director of Nutri Systems (UK)

Ltd., a subsidiary of the US based provider of professionally

supervised weight loss programs. Between 1991 and 1995, Mr.

Baillavoine was Director of BET Group plc, a multinational business

support services group, and in 1992, was promoted to the Managing

Director for the manufacturing businesses. The £2.3 billion

turnaround of BET during his tenure is one of the most successful

turnarounds of a top 100 FTSE company. Since 1995, Mr. Baillavoine

has held a number of CEO positions across a wide range of

industries and geographical locations. Mr. Baillavoine has European

and American educations (US high school and University of Wisconsin

Eau Claire 1972-1976). CEL-SCI believes Mr.

Ballavoine is qualified to act as a director due to his extensive

business experience and success in the turnaround and growth of

global businesses.

Robert

Watson has been a director of CEL-SCI since December 2017. Mr.

Watson joined Intermedix, Inc. in July 2017 as President of its

Preparedness Technology Division. Immediately prior to joining

Intermedix, he was the President and Chief Growth Officer of

NantHealth, Inc. (Nasdaq: NH) from January 2015 to May 2017. Prior

to NantHealth, he was President and CEO of Streamline Health, Inc.

(Nasdaq: STRM) from January 2011 to January 2015. Mr. Watson has

over 35 years of experience in the healthcare information

technology industry as a CEO, board member and advisor to multiple

healthcare information technology companies. He has participated in

over 75 acquisitions, raised nearly $750,000,000 in capital,

completed three public offerings and successfully sold four

companies. Mr. Watson holds a MBA from the Wharton School of

Business at the University of Pennsylvania and a BA degree from

Syracuse University. Mr. Watson’s business experience and

educational background makes him qualified to serve as a director

of CEL-SCI.

6

CEL-SCI’s

nominating committee, consisting of Mr. Baillavoine and Dr. Young,

has nominated Geert R. Kersten, Peter R. Young, Bruno Baillavoine

and Robert Watson to stand for election as directors at the annual

meeting. Unless the proxy contains contrary instructions, it is

intended that the proxies will be voted for the election of the

nominees to the board of directors. In case any nominee shall be

unable or shall fail to act as a director by virtue of an

unexpected occurrence, the proxies may be voted for such other

person or persons as shall be determined by the persons acting

under the proxies in their discretion. All nominees to the board of

directors have consented to stand for election. CEL-SCI’s

Nominating Committee Charter can be reviewed at CEL-SCI’s

website: cel-sci.com/about

cel-sci/corporate overview.

CEL-SCI

does not have any policy regarding the consideration of director

candidates recommended by shareholders since a shareholder has

never recommended a nominee to the Board of Directors and under

Colorado law, any shareholder can nominate a person for election as

a director at the annual shareholders’ meeting. However,

CEL-SCI’s nominating committee will consider candidates

recommended by shareholders. To submit a candidate for the Board of

Directors the shareholder should send the name, address and

telephone number of the candidate, together with any relevant

background or biographical information, to Dr. Peter Young at the

address shown on the cover page of this proxy statement.

CEL-SCI’s nominating committee has not established any

specific qualifications or skills a nominee must meet to serve as a

director. Although CEL-SCI does not have any process for

identifying and evaluating director nominees, CEL-SCI does not

believe there would be any differences in the manner in which

CEL-SCI evaluates nominees submitted by shareholders as opposed to

nominees submitted by any other person.

CEL-SCI’s

Board of Directors does not have a “leadership

structure”, as such, since each director is entitled to

introduce resolutions to be considered by the Board and each

director is entitled to one vote on any resolution considered by

the Board. CEL-SCI’s Chief Executive Officer is not the

Chairman of CEL-SCI’s Board of Directors.

CEL-SCI’s

Board of Directors has the ultimate responsibility to evaluate and

respond to risks facing CEL-SCI. CEL-SCI’s Board of Directors

fulfills its obligations in this regard by meeting on a regular

basis and communicating, when necessary, with CEL-SCI’s

officers.

Peter

R. Young, Bruno Baillavoine and Robert Watson are independent as

that term is defined in section 803 of the listing standards of the

NYSE American.

CEL-SCI’s

Board of Directors met 20 times during the fiscal year ended

September 30, 2017. All of the Directors attended these meetings,

either in person or by telephone conference call. In addition, the

Board of Directors had a number of informal telephonic meetings

during the course of the year.

CEL-SCI

has adopted a Code of Ethics which is applicable to CEL-SCI’S

principal executive, financial, and accounting officers and persons

performing similar functions. The Code of Ethics is available on

CEL-SCI’s website, located at cel-sci.com/company_code_of_ethics.

If a

violation of this code of ethics act is discovered or suspected,

the Senior Officer must (anonymously, if desired) send a detailed

note, with relevant documents, to CEL-SCI’s Audit Committee,

c/o Dr. Peter Young, 208 Hewitt Drive, Suite 103-143, Waco, TX

76712.

CEL-SCI

does not have a policy with regard to Board member’s

attendance at annual meetings. All Board members, with the

exception of Peter Young and Robert Watson, attended the last

annual shareholder’s meeting held on June 12, 2017. Mr.

Watson did not join the Board until December 18, 2017.

Holders

of CEL-SCI’s common stock can send written communications to

CEL-SCI’s entire Board of Directors, or to one or more Board

members, by addressing the communication to “the Board of

Directors” or to one or more directors, specifying the

director or directors by name, and sending the communication to

CEL-SCI’s offices in Vienna, Virginia. Communications

addressed to the Board of Directors as whole will be delivered to

each Board member. Communications addressed to a specific director

(or directors) will be delivered to the director (or directors)

specified.

7

Security holder

communications sent to specified Board members or not sent to the

Board of Directors as a whole are not relayed to other Board

members.

Executive Compensation

Compensation Discussion and Analysis

This

Compensation Discussion and Analysis (CD&A) outlines

CEL-SCI’s compensation philosophy, objectives and process for

its executive officers. This CD&A

includes information on how compensation decisions are made, the

overall objectives of CEL-SCI’s compensation program, a

description of the various components of compensation that are

provided, and additional information pertinent to understanding

CEL-SCI’s executive officer compensation

program.

The

Compensation Committee determines the compensation of

CEL-SCI’s Chief Executive Officer and delegates to the Chief

Executive Officer the responsibility to determine the base salaries

of all other officers under the constraints of an overall

limitation on the total amount of compensation to be paid to

them.

Compensation Philosophy

CEL-SCI’s

compensation philosophy extends to all employees, including

executive officers, and is designed to align employee and

shareholder interests. The philosophy’s objective is to pay

fairly based upon the employee’s position, experience and

individual performance. Employees may be rewarded through

additional compensation when CEL-SCI meets or exceeds targeted

business objectives or if they voluntarily defer compensation

during times when the Company is financially in need of help.

Generally, under CEL-SCI’s compensation philosophy, as an

employee’s level of responsibility increases, a greater

portion of his or her total potential compensation becomes

contingent upon annual performance.

A

substantial portion of an executive's compensation incorporates

performance criteria that support and reward achievement of

CEL-SCI’s long term business goals.

The

fundamental principles of CEL-SCI’s compensation philosophy

are described below:

●

Market-driven. Compensation programs

are structured to be competitive both in their design and in the

total compensation that they offer.

●

Performance-based. Certain officers

have some portion of their incentive compensation linked to

CEL-SCI’s performance. The application of performance

measures as well as the form of the reward may vary depending on

the employee’s position and responsibilities.

Based

on a review of its compensation programs, CEL-SCI does not believe

that such programs encourage any of its employees to take risks

that would be likely to have a material adverse effect on

CEL-SCI. CEL-SCI reached this conclusion based on the

following:

●

The salaries paid

to employees are consistent with the employees’ duties and

responsibilities.

●

Employees who have

high impact relative to the expectations of their job duties and

functions are rewarded.

●

CEL-SCI retains

employees who have skills critical to its long term

success.

8

Review of Executive Officer Compensation

CEL-SCI’s

current policy is that the various elements of the compensation

package are not interrelated in that gains or losses from past

equity incentives are not factored into the determination of other

compensation. For instance, if options that are granted

in a previous year have an exercise price which is below the market

price of CEL-SCI’s common stock, the Committee does not take

that circumstance into consideration in determining the amount of

the options or restricted stock to be granted the next

year. Similarly, if the options or restricted shares

granted in a previous year become extremely valuable, the Committee

does not take that into consideration in determining the options or

restricted stock to be awarded for the next

year.

CEL-SCI

does not have a policy with regard to the adjustment or recovery of

awards or payments if relevant performance measures upon which they

are based are restated or otherwise adjusted in a manner that would

reduce the size of an award or payment.

Components of Compensation - Executive Officers

CEL-SCI’s

executive officers are compensated through the following three

components:

●

Base

Salary

●

Long-Term

Incentives (“LTIs”) (stock options and/or grants of

common stock)

●

Benefits

These

components provide a balanced mix of base compensation and

compensation that are contingent upon each executive

officer’s individual performance. A goal of the compensation

program is to provide executive officers with a reasonable level of

security through base salary and benefits. CEL-SCI wants to ensure

that the compensation programs are appropriately designed to

encourage executive officer retention and motivation to create

shareholder value. The Compensation

Committee believes that CEL-SCI’s stockholders are best

served when CEL-SCI can attract and retain talented executives by

providing compensation packages that are competitive but

fair.

In past

years, base salaries, benefits and incentive compensation

opportunities were generally targeted near the median of general

survey market data derived from indices covering similar

biotech/pharmaceutical companies. The companies included

Advaxis, Inc., Amicus Therapeutics, Inc., Celsion Corp., CytRx

Corporation, GERON Corp, Idera Pharmaceuticals, Inc., Northwest

Biotherapeutics, Inc., Oragenics, Inc., TG Therapeutics, Inc.,

Venaxis, Inc., Arrowhead Research Corp, CorMedix Inc., Fibrocell

Science, Inc., Hemispherx Biopharma, Inc., Mateon Therapeutics,

Inc., Catalyst Bioscience, Inc., Sorrento Therapeutics, Inc., Tenax

Therapeutics, Inc., Trovagene, Inc. and ZIOPHARM Oncology,

Inc.

Base Salaries

Base

salaries generally have been targeted to be competitive when

compared to the salary levels of persons holding similar positions

in other pharmaceutical companies and other publicly traded

companies of comparable size. Each executive officer’s

respective responsibilities, experience, expertise and individual

performance are considered.

A

further consideration in establishing compensation for the senior

employees is their long term history with CEL-SCI. Taken into

consideration are factors that have helped CEL-SCI survive in times

when it was financially weak, such as: willingness to accept salary

cuts, willingness not to be paid at all for extended time periods,

and in general an attitude that helped CEL-SCI survive during

financially difficult times.

9

Long-Term Incentives

Stock

grants and option grants help to align the interests of

CEL-SCI’s employees with those of its

shareholders. Options and stock grants are made under

CEL-SCI’s Stock Option, Incentive Stock Bonus, Stock Bonus

and Stock Compensation Plans. Options are granted with

exercise prices equal to the closing price of CEL-SCI’s

common stock on the day immediately preceding the date of grant,

with pro rata vesting at the end of each of the following three

years.

CEL-SCI

believes that grants of equity-based compensation:

●

Enhance the link

between the creation of shareholder value and long-term executive

incentive compensation;

●

Provide focus,

motivation and retention incentive; and

●

Provide competitive

levels of total compensation.

Benefits

In

addition to cash and equity compensation programs, executive

officers participate in the health and welfare benefit programs

available to other employees. In a few limited circumstances,

CEL-SCI provides other benefits to certain executive officers, such

as car allowances.

All

executive officers are eligible to participate in CEL-SCI’s

401(k) plan on the same basis as its other employees. CEL-SCI

matches 100% of each employee’s contribution up to 6% of his

or her salary.

10

Compensation Table

The

following table sets forth in summary form the compensation

received by (i) the Chief Executive and Financial Officer of

CEL-SCI and (ii) by each other executive officer of CEL-SCI who

received in excess of $100,000 during the three fiscal years ended

September 30, 2017.

|

Name

and

Principal

Position

|

|

Fiscal

Year

|

Salary

(1)

|

Bonus

(2)

|

Restricted Stock

Awards (3)

|

Option Awards

(4)

|

All Other

Compen-sation

(5)

|

Total

|

|

|

|

$

|

$

|

$

|

$

|

$

|

$

|

|

|

Geert R.

Kersten,

|

|

2017

|

437,461

|

--

|

15,900

|

326,961

|

55,631

|

835,953

|

|

Chief Executive

|

|

2016

|

558,432

|

--

|

15,900

|

--

|

54,981

|

629,314

|

|

Officer and

Treasurer

|

|

2015

|

514,083

|

--

|

16,050

|

--

|

54,981

|

585,114

|

|

|

|

|

|

|

|

|

|

|

|

Patricia B.

Prichep,

|

|

2017

|

171,028

|

--

|

13,704

|

217,974

|

9,031

|

411,737

|

|

Senior Vice

President

|

|

2016

|

245,804

|

--

|

14,725

|

--

|

9,031

|

269,559

|

|

of Operations

and

|

|

2015

|

235,702

|

--

|

14,128

|

--

|

6,906

|

256,736

|

|

Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eyal Talor,

Ph.D.,

|

|

2017

|

270,163

|

--

|

9,600

|

217,974

|

6,031

|

503,768

|

|

Chief Scientific

Officer

|

|

2016

|

303,597

|

--

|

9,600

|

--

|

6,031

|

319,227

|

|

xcxcxc

|

|

2015

|

290,983

|

--

|

9,600

|

--

|

6,031

|

306,613

|

|

|

|

|

|

|

|

|

|

|

|

Daniel Zimmerman,

Ph.D.,

|

|

2017

|

166,320

|

--

|

13,333

|

35,989

|

6,031

|

221,673

|

|

Senior Vice President

of

|

|

2016

|

228,413

|

--

|

13,708

|

37,081

|

6,031

|

285,233

|

|

Research,

Cellular

|

|

2015

|

219,026

|

--

|

13,148

|

52,003

|

6,031

|

290,209

|

|

Immunology

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Cipriano,

|

|

2017

|

185,592

|

--

|

--

|

163,480

|

31

|

349,103

|

|

Senior Vice President

of

|

|

2016

|

211,405

|

--

|

--

|

--

|

31

|

211,437

|

|

Regulatory

Affairs

|

|

2015

|

202,718

|

--

|

--

|

--

|

31

|

202,749

|

|

|

|

|

|

|

|

|

|

|

(1)

The dollar value of

base salary (cash and non-cash) earned. The officers of the Company

received stock in lieu of salary increases in FY 2016 and 2015. On

September 30, 2017, the Company had not paid and owed salaries to

the following employees:

|

Name

|

Salary

|

|

Geert

Kersten

|

$125,559

|

|

Patricia

Prichep

|

$71,648

|

|

Eyal

Talor, Ph.D.

|

$33,392

|

|

Daniel

Zimmerman, Ph.D.

|

$62,088

|

|

John

Cipriano

|

$31,828

|

11

(2)

The dollar value of

bonus (cash and non-cash) earned.

(3)

The fair value of

the shares of restricted stock issued during the periods covered by

the table is shown as compensation for services to the persons

listed in the table. For all persons listed in the table, the

shares were issued as CEL-SCI's contribution on behalf of the named

officer who participates in CEL-SCI's 401(k) retirement plan. The

value of all stock awarded during the periods covered by the table

is calculated according to ASC 718-10-30-3 which represented the

grant date fair value.

(4)

The fair value of

all stock options granted during the periods covered by the table

are calculated on the grant date in accordance with ASC 718-10-30-3

which represented the grant date fair value.

(5)

All other

compensation received that CEL-SCI could not properly report in any

other column of the table including the dollar value of any

insurance premiums paid by, or on behalf of, CEL-SCI with respect

to term life insurance for the benefit of the named executive

officer and car allowances paid by CEL-SCI. Includes board of

director fees for Mr. Kersten.

Employee Pension, Profit Sharing or Other Retirement

Plans

CEL-SCI

has a defined contribution retirement plan, qualifying under

Section 401(k) of the Internal Revenue Code and covering

substantially all CEL-SCI’s employees. CEL-SCI’s

contribution to the plan is made in shares of CEL-SCI's common

stock. Each participant's contribution is matched by CEL-SCI with

shares of common stock which have a value equal to 100% of the

participant's contribution, not to exceed the lesser of $1,000 or

6% of the participant's total compensation. CEL-SCI's contribution

of common stock is valued each quarter based upon the closing price

of its common stock. The fiscal 2017 expenses for this plan were

approximately $163,000. Other than the 401(k) Plan, CEL-SCI does

not have a defined benefit, pension plan, profit sharing or other

retirement plan.

Compensation of Directors During Year Ended September 30,

2017

|

Name

|

Fees

|

Stock Awards

(1)

|

Option

Awards

(2)

|

Total

|

|

Geert

Kersten

|

$40,000

|

-

|

326,961

|

$366,961

|

|

Alexander Esterhazy

(3)

|

$33,750

|

-

|

15,581

|

$49,331

|

|

Peter R.

Young

|

$50,000

|

-

|

51,477

|

$101,477

|

|

Bruno

Baillavoine

|

$45,000

|

-

|

51,477

|

$96,477

|

(1)

The fair value of

stock issued for services.

(2)

The fair value of

options granted computed in accordance with ASC 718-10-30-3 on the

date of grant which represents their grant date fair

value.

(3)

Mr. Esterhazy

passed away on August 30, 2017.

Directors’

fees paid to Geert Kersten are included in the Executive

Compensation table.

12

Employment Contracts

Geert Kersten

On

August 31, 2016, CEL-SCI entered into a three-year employment

agreement with Geert Kersten, CEL-SCI’s Chief Executive

Officer. The employment agreement with Mr. Kersten, which is

essentially the same as Mr. Kersten’s prior employment

agreement, as amended on August 30, 2013, provides that, during the

term of the agreement, CEL-SCI will pay Mr. Kersten an annual

salary of $559,052, plus any increases in proportion to salary

increases granted to other senior executive officers of CEL-SCI, as

well any increases approved by the Board of Directors during the

period of the employment agreement.

During

the employment term, Mr. Kersten will be entitled to receive any

other benefits which are provided to CEL-SCI's executive officers

or other full time employees in accordance with CEL-SCI's policies

and practices and subject to Mr. Kersten’s satisfaction of

any applicable condition of eligibility.

If Mr.

Kersten resigns within ninety (90) days of the occurrence of any of

the following events: (i) a reduction in Mr. Kersten’s salary

(ii) a relocation (or demand for relocation) of Mr. Kersten’s

place of employment to a location more than ten (10) miles from his

current place of employment, (iii) a significant and material

reduction in Mr. Kersten’s authority, job duties or level of

responsibility or the imposition of significant and material

limitations on the Mr. Kersten’s autonomy in his position, or

(iv) a Change in Control, then the employment agreement will be

terminated and Mr. Kersten will be entitled to receive a lump-sum

payment from CEL-SCI equal to 24 months of salary ($1,118,104) and

the unvested portion of any stock options would vest immediately.

For purposes of the employment agreement a change in the control of

CEL-SCI means: (1) the merger of CEL-SCI with another entity if

after such merger the shareholders of CEL-SCI do not own at least

50% of voting capital stock of the surviving corporation; (2) the

sale of substantially all of the assets of CEL-SCI; (3) the

acquisition by any person of more than 50% of CEL-SCI's common

stock; or (4) a change in a majority of CEL-SCI's directors which

has not been approved by the incumbent directors.

The

employment agreement will also terminate upon the death of Mr.

Kersten, Mr. Kersten’s physical or mental disability, willful

misconduct, an act of fraud against CEL-SCI, or a breach of the

employment agreement by Mr. Kersten.

If the

employment agreement is terminated for any of the these reasons,

Mr. Kersten, or his legal representatives, as the case may be, will

be paid the salary provided by the employment agreement through the

date of termination, any options or bonus shares of CEL-SCI then

held by Mr. Kersten will become fully vested and the expiration

date of any options which would expire during the four year period

following his termination of employment will be extended to the

date which is four years after his termination of

employment.

Patricia B. Prichep / Eyal Talor, Ph.D.

On

August 31, 2016, CEL-SCI entered into a three-year employment

agreement with Patricia B. Prichep, CEL-SCI’s Senior Vice

President of Operations. The employment agreement with Ms. Prichep,

which is essentially the same as Ms. Prichep’s prior

employment agreement entered into on August 30, 2013 provides that,

during the term of the agreement, CEL-SCI will pay Ms. Prichep an

annual salary of $245,804 plus any increases approved by the Board

of Directors during the period of the employment

agreement.

On

August 31, 2016, CEL-SCI entered into a three-year employment

agreement with Eyal Talor, Ph.D., CEL-SCI’s Chief Scientific

Officer. The employment agreement with Dr. Talor, which is

essentially the same as Dr. Talor’s prior employment

agreement entered into on August 30, 2013, provides that, during

the term of the agreement, CEL-SCI will pay Dr. Talor an annual

salary of $303,453 plus any increases approved by the Board of

Directors during the period of the employment

agreement.

13

If Ms.

Prichep or Dr. Talor resigns within ninety (90) days of the

occurrence of any of the following events: (i) a relocation (or

demand for relocation) of employee’s place of employment to a

location more than ten (10) miles from the employee’s current

place of employment, (ii) a significant and material reduction in

the employee’s authority, job duties or level of

responsibility or (iii) the imposition of significant and material

limitations on the employee’s autonomy in her or his

position, the employment agreement will be terminated and the

employee will be paid the salary provided by the employment

agreement through the date of termination and the unvested portion

of any stock options held by the employee will vest

immediately.

In the

event there is a change in the control of CEL-SCI, the employment

agreements with Ms. Prichep and Dr. Talor allow Ms. Prichep and/or

Dr. Talor (as the case may be) to resign from her or his position

at CEL-SCI and receive a lump-sum payment from CEL-SCI equal to 18

months of salary ($368,706 and $455,180 respectively). In addition,

the unvested portion of any stock options held by the employee will

vest immediately. For purposes of the employment agreements, a

change in the control of CEL-SCI means: (1) the merger of CEL-SCI

with another entity if after such merger the shareholders of

CEL-SCI do not own at least 50% of voting capital stock of the

surviving corporation; (2) the sale of substantially all of the

assets of CEL-SCI; (3) the acquisition by any person of more than

50% of CEL-SCI's common stock; or (4) a change in a majority of

CEL-SCI's directors which has not been approved by the incumbent

directors.

The

employment agreements with Ms. Prichep and Dr. Talor will also

terminate upon the death of the employee, the employee’s

physical or mental disability, willful misconduct, an act of fraud

against CEL-SCI, or a breach of the employment agreement by the

employee. If the employment agreement is terminated for any of

these reasons the employee, or her or his legal representatives, as

the case may be, will be paid the salary provided by the employment

agreement through the date of termination.

Compensation Committee Interlocks and Insider

Participation

CEL-SCI

has a compensation committee comprised of Mr. Bruno Baillavoine and

Dr. Peter Young, both of whom are independent

directors.

During

the year ended September 30, 2017, no director of CEL-SCI was also

an executive officer of another entity, which had an executive

officer of CEL-SCI serving as a director of such entity or as a

member of the compensation committee of such entity.

Loan from Officer and Director

Between

December 2008 and June 2009, CEL-SCI’s President, and a

director, Maximilian de Clara, loaned CEL-SCI

$1,104,057. Between July 2009 and July 2015, the loan

from Mr. de Clara bore interest at 15% per year. At Mr. de

Clara’s option, the loan was convertible into shares of

CEL-SCI’s common stock, determined by dividing the amount to

be converted by $100.00. In accordance with the loan

agreement, CEL-SCI issued Mr. de Clara warrants to purchase 6,593

shares of CEL-SCI’s common stock at a price of $100.00 per

share. These warrants expired on December 24,

2014. In consideration for an extension of the due date,

Mr. de Clara received warrants to purchase 7,397 shares of

CEL-SCI’s common stock at a price of $125.00 per

share. These warrants expired on January 6,

2015. In consideration of Mr. de Clara’s agreement

to subordinate his note to the convertible preferred shares and

convertible debt as part of a prior year settlement agreement,

CEL-SCI extended the maturity date of the note to July 6, 2015.

In August 2014, the loan was transferred to the de

Clara Trust, of which CEL-SCI’s Chief Executive Officer,

Geert Kersten, is the trustee and a beneficiary. Mr. de

Clara continued to receive the interest payments.

On June

29, 2015, CEL-SCI extended the maturity date of the note to July 6,

2017, lowered the interest rate to 9% per year and changed the

conversion price to $14.75, the closing stock price on the previous

trading day. The new terms were effective July 7,

2015. Concurrently, CEL-SCI extended the expiration

date of the Series N warrants to August 18,

2017.

14

On

October 11, 2015, at the request of Lake Whillans Vehicle I, LLC,

the note was extended for one year to July 6, 2018.

On

January 12, 2016, CEL-SCI owed the de Clara Trust $1,105,989, which

amount included accrued and unpaid interest. On January 13, 2016,

the de Clara Trust demanded payment on the note payable. At the

same time CEL-SCI sold 120,000 shares of its common stock and

120,000 Series X warrants to the de Clara Trust for approximately

$1,100,000. Each warrant allows the de Clara Trust to purchase one

share of CEL-SCI’s common stock at a price of $9.25 per share

at any time on or before January 13, 2021.

Stock Option, Bonus and Compensation Plans

CEL-SCI

has Incentive Stock Option Plans, Non-Qualified Stock Option, Stock

Bonus, Stock Compensation Plans and an Incentive Stock Bonus Plan.

All Stock Option, Bonus and Compensation Plans have been approved

by the stockholders. A summary description of these Plans follows.

In some cases these Plans are collectively referred to as the

"Plans".

Incentive Stock Option Plans.

The Incentive Stock Option Plans authorize the issuance of shares

of CEL-SCI's common stock to persons who exercise options granted

pursuant to the Plans. Only CEL-SCI’s employees may be

granted options pursuant to the Incentive Stock Option

Plans.

Options

may not be exercised until one year following the date of grant.

Options granted to an employee then owning more than 10% of the

common stock of CEL-SCI may not be exercisable by its terms after

five years from the date of grant. Any other option granted

pursuant to the Plans may not be exercisable by its terms after ten

years from the date of grant.

The

purchase price per share of common stock purchasable under an

option is determined by CEL-SCI’s Compensation Committee but

cannot be less than the fair market value of the common stock on

the date of the grant of the option (or 110% of the fair market

value in the case of a person owning more than 10% of CEL-SCI's

outstanding shares).

Non-Qualified Stock Option

Plans. The Non-Qualified Stock Option Plans authorize the

issuance of shares of CEL-SCI's common stock to persons that

exercise options granted pursuant to the Plans. CEL-SCI's

employees, directors, officers, consultants and advisors are

eligible to be granted options pursuant to the Plans, provided

however that bona fide services must be rendered by such

consultants or advisors and such services must not be in connection

with a capital-raising transaction or promoting CEL-SCI’s

common stock. The option exercise price is determined by

CEL-SCI’s Compensation Committee.

Stock Bonus Plans. Under the

Stock Bonus Plans, shares of CEL-SCI’s common stock may be

issued to CEL-SCI's employees, directors, officers, consultants and

advisors, provided however that bona fide services must be rendered

by consultants or advisors and such services must not be in

connection with a capital-raising transaction or

promoting CEL-SCI’s common stock.

Stock Compensation Plans. Under

the Stock Compensation Plan, shares of CEL-SCI’s common stock

may be issued to CEL-SCI’s employees, directors, officers,

consultants and advisors in payment of salaries, fees and other

compensation owed to these persons. However, bona fide services

must be rendered by consultants or advisors and such services must

not be in connection with a capital-raising transaction or

promoting CEL-SCI’s common stock.

Incentive Stock Bonus Plan.

Under the 2014 Incentive Stock Bonus Plan, shares of

CEL-SCI’s common stock may be issued to executive officers

and other employees who contribute significantly to the success of

CEL-SCI, so as to allow such persons to participate in

CEL-SCI’s future prosperity and growth and to align their

interests with those of CEL-SCI’s shareholders. The purpose

of the Plan is to provide long term incentive for outstanding

service to CEL-SCI and its shareholders and to assist in recruiting

and retaining people of outstanding ability and initiative in

executive and management positions.

15

Other Information Regarding the

Plans. The Plans are administered by CEL-SCI's Compensation

Committee (“the Committee”), each member of which is a

director of CEL-SCI. The members of the Committee were selected by

CEL-SCI's Board of Directors and serve for a one-year tenure and

until their successors are elected. A member of the Committee may

be removed at any time by action of the Board of Directors. Any

vacancies which may occur on the Committee will be filled by the

Board of Directors. The Committee is vested with the authority to

interpret the provisions of the Plans and supervise the

administration of the Plans. In addition, the Committee is

empowered to select those persons to whom shares or options are to

be granted, to determine the number of shares subject to each grant

of a stock bonus or an option and to determine when, and upon what

conditions, shares or options granted under the Plans will vest or

otherwise be subject to forfeiture and cancellation.

In the

discretion of the Committee, any option granted pursuant to the

Plans may include installment exercise terms such that the option

becomes fully exercisable in a series of cumulating portions. The

Committee may also accelerate the date upon which any option (or

any part of any options) is first exercisable. Any shares issued

pursuant to the Stock Bonus Plans or Stock Compensation Plan and

any options granted pursuant to the Incentive Stock Option Plans or

the Non-Qualified Stock Option Plans will be forfeited if the

"vesting" schedule established by the Committee administering the

Plans at the time of the grant is not met. Vesting means the period

during which the employee must remain an employee of CEL-SCI or the

period of time a non-employee must provide services to CEL-SCI. At

the time an employee ceases working for CEL-SCI (or at the time a

non-employee ceases to perform services for CEL-SCI), any shares or

options not fully vested will be forfeited and cancelled. At the

discretion of the Committee payment for the shares of common stock

underlying options may be paid through the delivery of shares of

CEL-SCI's common stock having an aggregate fair market value equal

to the option price, provided such shares have been owned by the

option holder for at least one year prior to such exercise. A

combination of cash and shares of common stock may also be

permitted at the discretion of the Committee.

Options

are generally non-transferable except upon death of the option

holder. Shares issued pursuant to the Stock Bonus Plans will

generally not be transferable until the person receiving the shares

satisfies the vesting requirements imposed by the Committee when

the shares were issued.

The

Board of Directors of CEL-SCI may at any time, and from time to

time, amend, terminate, or suspend one or more of the Plans in any

manner it deems appropriate, provided that such amendment,

termination or suspension will not adversely affect rights or

obligations with respect to shares or options previously

granted.

Stock Options

The

following tables show information concerning the options granted

during the fiscal year ended September 30, 2017, to the persons

named below:

|

Options

Granted

|

||||

|

Name

|

Grant

Date

|

Options

Granted

|

Price

Per

Share

|

Expiration

Date

|

|

|

|

|

|

|

|

Geert

Kersten

|

7/28/2017

|

180,000

|

$

2.18

|

7/27/2027

|

|

|

|

|

|

|

|

Patricia

Prichep

|

7/28/2017

|

120,000

|

$

2.18

|

7/27/2027

|

|

|

|

|

|

|

|

Eyal

Talor

|

7/28/2017

|

120,000

|

$

2.18

|

7/27/2027

|

|

|

|

|

|

|

|

Daniel

Zimmerman

|

6/29/2017

|

6,000

|

$

1.87

|

6/28/2027

|

|

Daniel

Zimmerman

|

9/18/2017

|

20,000

|

$

1.59

|

9/17/2027

|

|

|

|

|

|

|

|

John

Cipriano

|

7/28/2017

|

90,000

|

$

2.18

|

7/27/2027

|

|

|

|

|

|

|

|

Bruno

Baillavoine

|

6/12/2017

|

7,500

|

$

2.50

|

6/11/2027

|

|

Bruno

Baillavoine

|

7/28/2017

|

20,000

|

$

2.18

|

7/27/2027

|

|

|

|

|

|

|

|

Peter

Young

|

6/12/2017

|

7,500

|

$

2.50

|

6/11/2027

|

|

Peter

Young

|

7/28/2017

|

20,000

|

$

2.18

|

7/27/2027

|

16

The

following tables show information concerning the options cancelled

and exercised during the fiscal year ended September 30, 2017 to

CEL-SCI’s officers and directors:

Options Cancelled

|

Name

|

Total Options

|

Weighted Average Exercise Price

|

Weighted Average Remaining Contractual

Term (Years)

|

|

|

|

|

|

None

Options Exercised

|

|

Date of

|

Shares Acquired

|

Value

|

|

Name

|

Exercise

|

On Exercise

|

Realized

|

|

|

|

|

|

None

The

following lists the outstanding options held by the persons named

below as of September 30, 2017:

|

|

Shares underlying unexercised

|

|

||

|

|

Option which are:

|

Exercise

|

Expiration

|

|

|

Name

|

Exercisable

|

Unexercisable

|

Price

|

Date

|

|

|

|

|

|

|

|

Geert

R. Kersten

|

800

|

|

155.00

|

03/04/18

|

|

|

7,354(1)

|

|

62.50

|

04/23/19

|

|

|

5,334(2)

|

|

95.00

|

07/06/19

|

|

|

1,200

|

|

95.00

|

07/20/19

|

|

|

1,200

|

|

120.00

|

07/20/20

|

|

|

1,200

|

|

172.50

|

04/14/21

|

|

|

1,800

|

|

97.50

|

05/17/22

|

|

|

7,560

|

|

70.00

|

12/17/17

|

|

|

11,080

|

|

70.00

|

12/17/22

|

|

|

1,800

|

|

52.50

|

06/30/23

|

|

|

3,600

|

|

27.25

|

02/25/24

|

|

|

42,928

|

|

|

|

|

|

|

|

|

|

|

|

|

10,666(2)

|

95.00

|

07/06/19

|

|

|

|

8,920

|

70.00

|

12/17/22

|

|

|

|

180,000

|

2.18

|

07/27/27

|

|

|

|

199,586

|

|

|

17

|

|

Shares underlying unexercised

|

|

||

|

|

Option which are:

|

Exercise

|

Expiration

|

|

|

Name

|

Exercisable

|

Unexercisable

|

Price

|

Date

|

|

|

|

|

|

|

|

Patricia

B. Prichep

|

400

|

|

155.00

|

03/04/18

|

|

|

2,868(1)

|

|

62.50

|

04/23/19

|

|

|

4,000(2)

|

|

95.00

|

07/06/19

|

|

|

600

|

|

95.00

|

07/20/19

|

|

|

600

|

|

120.00

|

07/20/20

|

|

|

600

|

|

172.50

|

04/14/21

|

|

|

1,200

|

|

97.50

|

05/17/22

|

|

|

2,320

|

|

70.00

|

12/17/17

|

|

|

4,624

|

|

70.00

|

12/17/22

|

|

|

1,200

|

|

52.50

|

06/30/23

|

|

|

2,400

|

|

27.25

|

02/25/24

|

|

|

20,812

|

|

|

|

|

|

|

8,000(2)

|

95.00

|

07/06/19

|

|

|

|

1,376

|

70.00

|

12/17/22

|

|

|

|

120,000

|

2.18

|

07/27/27

|

|

|

|

129,376

|

|

|

|

|

|

|

|

|

|

Eyal

Talor, Ph.D.

|

400

|

|

155.00

|

03/04/18

|

|

|

963(1)

|

|

62.50

|

04/23/19

|

|

|

4,000(2)

|

|

95.00

|

07/06/19

|

|

|

600

|

|

95.00

|

07/20/19

|

|

|

600

|

|

120.00

|

07/20/20

|

|

|

600

|

|

172.50

|

04/14/21

|

|

|

1,200

|

|

97.50

|

05/17/22

|

|

|

1,497

|

|

70.00

|

12/17/17

|

|

|

4,624

|

|

70.00

|

12/17/22

|

|

|

1,200

|

|

52.50

|

06/30/23

|

|

|

2,400

|

|

27.25

|

02/25/24

|

|

|

18,084

|

|

|

|

|

|

|

8,000(2)

|

95.00

|

07/06/19

|

|

|

|

1,376

|

70.00

|

12/17/22

|

|

|

|

120,000

|

2.18

|

07/27/27

|

|

|

|

129,376

|

|

|

|

|

|

|

|

|

|

Daniel

Zimmerman, Ph.D.

|

300

|

|

155.00

|

03/04/18

|

|

|

600

|

|

120.00

|

07/20/20

|

|

|

600

|

|

172.50

|

04/14/21

|

|

|

900

|

|

97.50

|

05/17/22

|

|

|

1,568

|

|

70.00

|

12/17/17

|

|

|

900

|

|

52.50

|

06/30/23

|

|

|

1,800

|

|

27.25

|

02/25/24

|

|

|

8,000

|

|

27.50

|

08/05/24

|

|

|

2,667

|

|

15.50

|

06/25/25

|

|

|

1,334

|

|

11.75

|

07/21/26

|

|

|

18,669

|

|

|

|

|

|

|

1,333

|

15.50

|

06/25/25

|

|

|

|

2,666

|

11.75

|

07/21/26

|

|

|

|

6,000

|

1.87

|

06/28/27

|

|

|

|

20,000

|

1.59

|

09/17/27

|

|

|

|

29,999

|

|

|

18

|

|

Shares underlying unexercised

|

|

||

|

|

Option which are:

|

Exercise

|

Expiration

|

|

|

Name

|

Exercisable

|

Unexercisable

|

Price

|

Date

|

|

|

|

|

|

|

|

John

Cipriano

|

300

|

|

155.00

|

03/04/18

|

|

|

600

|

|

120.00

|

07/20/20

|

|

|

600

|

|

172.50

|

04/14/21

|

|

|

400

|

|

62.50

|

09/30/19

|

|

|

900

|

|

97.50

|

05/17/22

|

|

|

900

|

|

57.50

|

06/30/23

|

|

|

1,800

|

|

27.25

|

02/25/24

|

|

|

5,500

|

|

|

|

|

|

|

90,000

|

2.18

|

07/27/27

|

|

|

|

90,000

|

|

|

(1)

Options awarded to

employees who did not collect a salary, or reduced or deferred

their salary, between September 15, 2008 and June 30, 2009. For

example, Mr. Kersten and Ms. Prichep did not collect any salary

between September 30, 2008 and June 30, 2009.

(2)

Long-term

performance options: The Board of Directors has identified the

successful Phase III clinical trial for Multikine to be the most

important corporate event to create shareholder value. Therefore,

one third of the options can be exercised when the first 400

patients are enrolled in CEL-SCI's Phase III head and neck cancer

clinical trial. One third of the options can be exercised when all

of the patients have been enrolled in the Phase III clinical trial.

One third of the options can be exercised when the Phase III trial

is completed. The grant-date fair value of these options awarded to

the senior management of the Company amounts to $3.3 million in

total.

Summary. The following shows

certain information as of July 27, 2018 concerning the stock

options and stock bonuses granted by CEL-SCI. Each option

represents the right to purchase one share of CEL-SCI's common

stock.

|

Name of

Plan

|

Total Shares

Reserved Under Plans

|

Shares Reserved

for Outstanding Options

|

Shares

Issued

|

Remaining

Options/Shares Under Plans

|

|

|

|

|

|

|

|

Incentive Stock

Option Plans

|

138,400

|

123,558

|

N/A

|

385

|

|

Non-Qualified Stock

Option Plans

|

3,387,200

|

2,946,606

|

N/A

|

399,533

|

|

Stock Bonus

Plans

|

783,760

|

N/A

|

288,337

|

495,390

|

|

Stock Compensation

Plan

|

134,000

|

N/A

|

118,590

|

15,410

|

|

Incentive Stock

Bonus Plan

|

640,000

|

N/A

|

624,000

|

16,000

|

Of the

shares issued pursuant to CEL-SCI's Stock Bonus Plans, 209,015

shares were issued as part of CEL-SCI's contribution to its 401(k)

plan.

The

following table shows the weighted average exercise price of the