Form 8-K Veritas Farms, Inc. For: May 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 11, 2021

| Veritas Farms, Inc. |

| (Exact name of registrant as specified in charter) |

| Nevada | 333-210190 | 90-1254190 | ||

| (State or other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 1512 E. Broward Blvd., Suite 300, Fort Lauderdale, FL | 33301 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (561) 288-6603

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Company under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report on Form 8-K, and unless otherwise indicated, the terms “the Company,” “Veritas Farms,” “we,” “us” and “our” refer to Veritas Farms, Inc. and its subsidiary.

Item 1.01 Entry into a Material Definitive Agreement.

Securities Purchase Agreement

General

On May 11, 2021 (the “Effective Date”), the Company entered into a Securities Purchase Agreement (the “SPA”) with The Cornelis F. Wit Revocable Living Trust, of which Cornelis F. Wit is trustee (the “Purchaser”), an existing shareholder, pursuant to which the Company contemporaneously sold to the Purchaser an aggregate of (a) 2,000,000 shares of its Series A Convertible Preferred Stock having the rights, preferences, powers, restrictions and limitations set forth below (the “Series A Preferred Shares”); and (b) 1,000,000 shares of its Series B Convertible Preferred Stock having the rights, preferences, powers, restrictions and limitations set forth below (the “Series B Preferred Shares,” and together with the Series A Preferred Shares, collectively, the “Preferred Shares”) in exchange for (i) the payment of $2,000,000 (including $302,500 principal plus accrued but unpaid interest in bridge financing provided by the Purchaser to the Company during April 2021); and (ii) the surrender of 2,000,000 units (the “Units”), each Unit consisting of two shares of common stock and one warrant to purchase an additional share of common stock in accordance with the terms of the subscription agreements for the purchase of the Units entered into by the Purchaser and the Company in September and October 2020. As a result of the transaction and the voting rights accorded the Preferred Shares as set forth below, the Purchaser now holds approximately 88% of the voting power of the Company and accordingly, a “Change in Control” has occurred.

Series A Preferred Shares

A total of 4,000,000 shares of the Company’s authorized but undesignated and unissued shares of preferred stock have been designated as the Series A Preferred Shares, with the following rights, preferences, powers, restrictions and limitations:

Stated Value. The Series A Preferred Shares have a stated value of $1.00 per share (“Stated Value”).

Ranking. In respect of rights to the payment of dividends and the distribution of assets in the event of any liquidation, dissolution or winding-up of the Company, the Series A Preferred Shares rank (a) junior to the Company’s Series B Shares; and (b) senior to (i) the Company’s common stock, par value $0.001 per share (the “Common Stock”) and any other class or series of stock (including other series of Preferred Stock) of the Company (collectively, “Junior Stock”).

Dividends. From and after the date of the issuance of Series A Preferred Shares, dividends at the rate per annum of 8%, compounded annually, accrue daily on the Stated Value (the “Accruing Dividends”). Accruing Dividends shall accrue from day to day, whether or not declared, and shall be cumulative; provided, however, such Accruing Dividends shall be payable only when, as, and if declared by the Board of Directors and the Company shall be under no obligation to pay such Accruing Dividends except as set forth herein. The Company shall not declare, pay or set aside any dividends on shares of any other class or series of capital stock of the Company (other than dividends on (a) shares of Series B Preferred Shares; and (b) Common Stock payable in shares of Common Stock) unless (in addition to the obtaining of any consents required elsewhere in the Articles of Incorporation) the holders of the Series A Preferred Shares then outstanding shall first receive, or simultaneously receive, a dividend on each outstanding share of Series A Preferred Share in an amount at least equal to the sum of (a) the amount of the aggregate Accruing Dividends then accrued on such Series A Preferred Shares and not previously paid; and (b) (i) in the case of a dividend on Common Stock or any class or series that is convertible into Common Stock, that dividend per Series A Preferred Share as would equal the product of (A) the dividend payable on each share of such class or series determined, if applicable, as if all shares of such class or series had been converted into Common Stock; and (B) the number of shares of Common Stock issuable upon conversion of a Series A Preferred Share, in each case calculated on the record date for determination of holders entitled to receive such dividend; or (ii) in the case of a dividend on any class or series that is not convertible into Common Stock, at a rate per Series A Preferred Share determined by (A) dividing the amount of the dividend payable on each share of such class or series of capital stock by the original issuance price of such class or series of capital stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such class or series); and (B) multiplying such fraction by an amount equal to the Stated Value of the Series A Preferred Shares; provided, that if the Company declares, pays or sets aside, on the same date, a dividend on shares of more than one class or series of capital stock of the Company, the dividend payable to the holders of Series A Preferred Shares shall be calculated based upon the dividend on the class or series of capital stock that would result in the highest Series A Preferred Share.

1

Liquidation Preference. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company or any Deemed Liquidation Event, (as defined) (collectively, a “Liquidation Event”), the holders of Series A Preferred Shares shall be entitled to receive, after payment to all holders of Series B Preferred Shares of a liquidation preference equal to the aggregate amount of one hundred fifty percent (150%) of the Stated Valued of the Series B Preferred Shares and the amount of the accrued but unpaid dividends on the Series B Preferred Shares, but prior and in preference to any distribution of any of the assets of the Company to the holders of Junior Stock by reason of their ownership thereof, an aggregate amount per share equal to the Stated Value of the Series A Preferred Shares and the accrued but unpaid dividends thereon. After the payment to all holders of Series B Preferred Shares of a liquidation preference equal to the aggregate amount of one hundred fifty percent (150%) of the Stated Valued of the Series B Preferred Shares and the amount of the accrued but unpaid dividends on the Series B Preferred Shares and to all holders of the Series A Preferred Shares the full liquidation preference hereunder, the remaining assets of the Company available for distribution to its shareholders shall be distributed among the holders of the shares of Series B Preferred Shares and Junior Stock, pro rata, on an “as converted basis,” determined immediately prior to such Liquidation Event, and the Series A Preferred Shares shall not be entitled to participate in such distribution of the remaining assets of the Company.

Conversion. Each Series A Preferred Share is convertible into Common Stock at the option of the holder thereof at a conversion rate of $0.05 per share of Common Stock. The conversion rate is subject to adjustment in the event of stock splits, stock dividends, other recapitalizations and similar events, as well as in the event of issuance by the Company of shares of Common Stock or securities exercisable for, convertible into or exchangeable for Common Stock at an effective price per share less than the conversion rate then in effect (other than certain customary exceptions).

Voting. The Series A Preferred Shares shall vote on an “as converted” basis together with holders of Series B Preferred Shares and holders of Common Stock as a single class on all matters brought to a vote of shareholders. Certain matters, including actions which would have a material adverse effect on the rights of holders of Series A Preferred Shares of approval of holders of a majority of the then issued and outstanding Series A Preferred Shares voting as a separate class.

Series B Preferred Shares

A total of 1,000,000 shares of the Company’s authorized but undesignated and unissued shares of preferred stock have been designated as the Series B Preferred Shares, with the following rights, preferences, powers, restrictions and limitations:

Stated Value. The Series B Preferred Shares have a stated value of $1.00 per share (“Stated Value”).

Ranking. In respect of rights to the payment of dividends and the distribution of assets in the event of any liquidation, dissolution or winding-up of the Company, the Series B Preferred Shares rank senior to the (a) Series A Preferred Shares; (b) the Company’s Common Stock and any other class or series of Junior Stock.

2

Dividends. From and after the date of the issuance of Series B Preferred Shares, dividends at the rate per annum of 8%, compounded annually, accrue daily on the Stated Value (the “Accruing Dividends”). Accruing Dividends shall accrue from day to day, whether or not declared, and shall be cumulative; provided, however, such Accruing Dividends shall be payable only when, as, and if declared by the Board of Directors and the Company shall be under no obligation to pay such Accruing Dividends except as set forth herein. The Company shall not declare, pay or set aside any dividends on shares of any other class or series of capital stock of the Company (other than dividends on (a) shares of Series B Preferred Shares; and (b) Common Stock payable in shares of Common Stock) unless (in addition to the obtaining of any consents required elsewhere in the Articles of Incorporation) the holders of the Series B Preferred Shares then outstanding shall first receive, or simultaneously receive, a dividend on each outstanding share of Series B Preferred Share in an amount at least equal to the sum of (a) the amount of the aggregate Accruing Dividends then accrued on such Series B Preferred Shares and not previously paid; and (b) (i) in the case of a dividend on Common Stock or any class or series that is convertible into Common Stock, that dividend per Series B Preferred Share as would equal the product of (A) the dividend payable on each share of such class or series determined, if applicable, as if all shares of such class or series had been converted into Common Stock; and (B) the number of shares of Common Stock issuable upon conversion of a Series B Preferred Share, in each case calculated on the record date for determination of holders entitled to receive such dividend; or (ii) in the case of a dividend on any class or series that is not convertible into Common Stock, at a rate per Series B Preferred Share determined by (A) dividing the amount of the dividend payable on each share of such class or series of capital stock by the original issuance price of such class or series of capital stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such class or series); and (B) multiplying such fraction by an amount equal to the Stated Value of the Series B Preferred Shares; provided, that if the Company declares, pays or sets aside, on the same date, a dividend on shares of more than one class or series of capital stock of the Company, the dividend payable to the holders of Series B Preferred Shares shall be calculated based upon the dividend on the class or series of capital stock that would result in the highest Series B Preferred Share.

Liquidation Preference. In the event of a Liquidation Event, the holders of Series B Preferred Shares shall be entitled to receive, prior and in preference to any distribution of any of the assets of the Company to the holders of Junior Stock (including Series A Preferred Shares), a liquidation preference equal to the aggregate amount of one hundred fifty percent (150%) of the Stated Valued of the Series B Preferred Shares and the amount of the accrued but unpaid dividends on the Series B Preferred Shares. After the payment to all holders of Series B Preferred Shares of such liquidation preference and to all holders of the Series A Preferred Shares their full liquidation preference, the remaining assets of the Company available for distribution to its shareholders shall be distributed among the holders of the shares of Series B Preferred Shares and Junior Stock other than Series A Preferred Shares, pro rata, on an “as converted basis,” as applicable.

Conversion. Each Series A Preferred Share is convertible into Common Stock at the option of the holder thereof at a conversion rate of $0.20 per share of Common Stock. The conversion rate is subject to adjustment in the event of stock splits, stock dividends, other recapitalizations and similar events, as well as in the event of issuance by the Company of shares of Common Stock or securities exercisable for, convertible into or exchangeable for Common Stock at an effective price per share less than the conversion rate then in effect (other than certain customary exceptions).

Voting. The Series A Preferred Shares shall vote together with holders of Series B Preferred Shares and holders of Common Stock as a single class on all matters brought to a vote of shareholders. Each Series B Preferred Share shall entitle the holder thereof to such number of votes as equal the number of shares of Common Stock then issuable upon conversion of the Series B Share multiplied by 50. Certain matters, including actions which would have a material adverse effect on the rights of holders of Series B Preferred Shares of approval of holders of a majority of the then issued and outstanding Series B Preferred Shares voting as a separate class.

The Preferred Shares were issued to the Purchaser pursuant to the exemptions from registration under the Securities Act of 1933, as amended (the “Securities Act”) afforded by Section 4(a)(2) thereof and Regulation D thereunder.

Other Rights Accorded the Purchaser

Pursuant to the SPA, the Purchaser and the Company agreed to fix the number of members of the board of directors of the Company at five (5), three of whom shall be designated by the Purchaser and two of whom shall be “independent” and acceptable to the Purchaser. In addition, the Purchaser has been accorded certain registration rights under the Securities Act with respect to the shares of Common Stock issuable upon conversion of the Preferred Shares and ongoing financial and other information rights with respect to the Company.

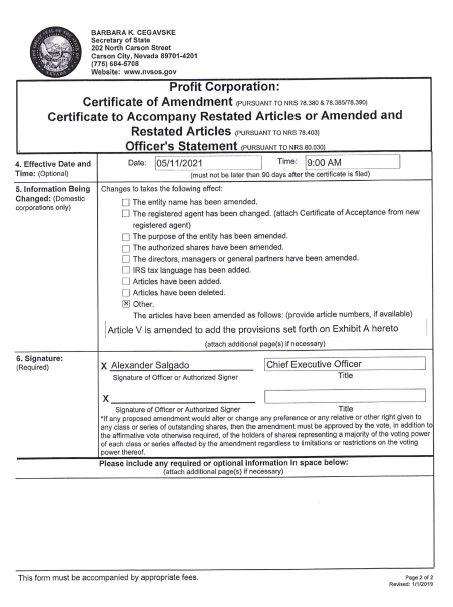

The above descriptions of the SPA and the terms of the rights, preferences, powers, restrictions and limitations of the Preferred Shares are only summaries and are qualified in their entirety by reference to the complete text of the SPA and the Amendment to the Company’s Articles of Incorporation filed as Exhibits 10.1 and 10.2 to this Current Report.

3

Changes in Management

General

In accordance with the terms of the SPA, on the Effective Date Dr. Bao T. Doan and Marc J. Horowitz stepped down from the board of directors. In addition, Alexander M. Salgado stepped down as Chief Executive Officer and a director of the Company, and from any and all other positions he held with the Company and its subsidiary, and entered into a Separation Agreement (the “Salgado Separation Agreement”) and a Consulting Agreement to assist with transition (the “Salgado Consulting Agreement”) with the Company and Michael Pelletier entered into a Separation Agreement (the “Pelletier Separation Agreement”) and a Consulting Agreement (the “Pelletier Consulting Agreement”) with the Company pursuant to which he stepped down as an employee of the Company and from any and all other positions he held with the Company and its subsidiary, except pursuant to the Pelletier Consulting Agreement he will continue to serve as Chief Financial Officer for an interim period in order to transition to his successor.

Appointment of New Directors and Executive Officers

On the Effective Date, Stephen E. Johnson, Kuno D. van der Post and Craig J. Fabel were elected and appointed as the Purchaser’s designees on the board of directors. In addition, Mr. Johnson was appointed as Chief Executive Officer and President of the Company, and Ramon Pino, was appointed as Executive Vice President of Finance, Treasurer and Secretary of the Company.

The following is a brief description of the background and business experience of Mr. Johnson, Dr. van der Post, Mr. Fabel and Mr. Pino.

Stephen E. Johnson, age 56. Prior to joining the Company, since November 2019, Mr. Johnson is a member of New World Angels, a Florida-based angel investment group that provides seed funding and venture capital to qualified early-stage and start-up companies, and since April 2021 is a director with Frontier BPM, a global software application service provider delivering powerful, cost-effective life sciences applications and data management services. From October 2019 to September 2020, Mr. Johnson was Chief Revenue Officer of Anju Software, Inc., a private healthcare company offering software and services to the pharmaceutical and Contract Research Organizations. From June 2017 to October, 2019, Mr. Johnson served as Chief Executive Officer, and from June 2010 to October 2019, as President, and from April 2008 to June 2017 as Chief Operating Officer, and from September 2006 to April 2008 as Executive Vice President, National Sales, of OmniComm Systems, Inc., a company delivering software and services to the pharmaceutical/healthcare industry (OTCQX:OMCM); OmniComm was acquired by Anju Software, Inc., a private company, in October 2019 and contemporaneously therewith filed a Certification and Notice of Termination of Registration with the SEC). Mr. Johnson assisted with the transition of OmniComm to Anju under a one year agreement after the acquisition in 2019. From 2000 to August 2006, Mr. Johnson served as East Coast and Central U.S. Sales Manager for Oracle Corporation, a supplier of software for enterprise information management, within its Clinical Applications Division. Mr. Johnson received his B.S. in Microbiology from the University of Massachusetts.

Kuno D. van der Post, age 53. Prior to joining the Company, from September 2020 to present, Dr van der Post serves as the Chief Commercial Officer for ActiGraph LLC, a medical grade device company servicing the global life science research market. From October 2019 to June 2020, Dr. van der Post was Chief Commercial Officer of Anju Software, Inc., a private healthcare company offering software and services to the pharmaceutical and Contract Research Organizations. From June 2017 to October, 2019, Dr. van der Post served as the Chief Commercial Officer, and from June 2013 until June 2017, as Senior Vice President of Business Development, of OmniComm Systems, Inc., a company delivering software and services to the pharmaceutical/healthcare industry (OTCQX:OMCM); OmniComm was acquired by Anju Software, Inc., a private company, in October 2019 and contemporaneously therewith filed a Certification and Notice of Termination of Registration with the SEC). Dr. van de Post transitioned from OmniComm to Anju after the acquisition in 2019. Dr. van der Post has been working in both the preclinical and clinical development arena for over 14 years. Prior to joining OmniComm Systems, from October 2009 to September 2012, Dr. van der Post worked for the Health Sciences Global Business Unit of Oracle Corporation, supplier of software for enterprise information management, as Sales Director, Latin America and prior to that as European Channel Sales Director, and from March 2007 to September 2009 Dr. van der Post worked for Medidata Solutions, Inc. as Area Sales Director. Dr. van der Post obtained his PhD degree from the University of Liverpool (UK) and his Master of Science degree from University of Salford (UK). We believe that Dr. van der Post’s business experience will make him a valuable member of our board of directors.

4

Craig J. Fabel, age 50. Prior to joining the Company, from April 2012 to present, Craig Fabel is Chief Executive Officer of Silverback Companies LLC, providing advisory services and investments with early-stage emerging companies and is the holding company for an Amazon marketing agency called Etail Partners. Etail Partners is the exclusive marketing and sales agency of global brands on Amazon. From May 2019 to present, Mr. Fabel serves as the Chief Executive Officer of Oingo Products LLC, sales and marketing of consumer branded disposable gloves and hand sanitizer products. From January 2018 to April 2019, Mr. Fabel served as President and a Director of the Board of Green Roads World, a leading CBD manufacturer and sales company. From January 2009 to December 2012, Mr. Fabel served as National Sales Manager of Invacare Supply Company, a healthcare distribution and sales company to the homecare market. From January 2008 to December 2009, Mr. Fabel served as Director of Business Development for AOM Healthcare Solutions (subsidiary of Owens & Minor, Nasdaq:OMI), a company delivering products and services for the diabetic patient market. February 2004 to January 2008, Mr. Fabel served as Founder and Chief Executive Officer of PulseMD Corporation, a software and services company providing advanced electronic medical record software and data integration. From July 2001 to January 2004, Mr. Fabel served as Managing Partner of Alternergy Partners, a company providing advisory services for private investors and Venture Capital of early-stage companies. From September 1999 to June 2001, Mr. Fabel was with FoundryOne Corporation, an accelerator/incubator for the commercialization of intellectual property developed by leading technology research companies. From 1992 to 1999, Mr. Fabel held sales and management roles for PSS World Medical, a national medical distributor. Mr. Fabel received his B.S. in Marketing from Florida State University. We believe that Mr. Fabel’s diverse business experience will make him a valuable member of our board of directors.

Ramon Pino, age 32. Prior to joining the Company, from October 2019 to January 2021, Mr. Pino was Vice President and Controller of Anju Software, Inc., a private healthcare company offering software and services to the pharmaceutical and Contract Research Organizations. From January 2018 to October 2019, Mr. Pino served as Controller, and from January 2015 to December 2017, as Accounting Manager, of OmniComm Systems, Inc., a company delivering software and services to the pharmaceutical/healthcare industry (OTCQX:OMCM; OmniComm was acquired by Anju Software, Inc., a private company, in October 2019 and contemporaneously therewith filed a Certification and Notice of Termination of Registration with the SEC). Mr. Pino transitioned from OmniComm to Anju after the acquisition in 2019. Mr. Pino holds a Bachelor of Science degree in Accounting from the University of Central Florida and a Master of Accounting degree from Florida International University.

There will be no grant or award to Mr. Johnson, in connection with his appointment as a director of the Company.

The Company will compensate Dr. van der Post and Mr. Fabel, and all other non-employee directors, for their service on the board of directors with an annual grant of stock options under the 2017 Incentive Stock Plan to purchase 100,000 shares of Common Stock of the Company, at a per share exercise price equal to the closing price of the Common Stock on the grant date, with 25% of the shares subject to the options vesting every ninety (90) days following the grant date subject to the director’s continuous service to the Company, with a term of ten (10) years.

Each of Mr. Johnson, Dr. van der Post, Mr. Fabel and Mr. Pino (a) has no family relationship with any director or other executive officer of the Company or any person nominated or chosen by the Company to become a director or executive officer; and (b) is not a party to any related person transaction with the Company.

Thomas E. Vickers, a director of the Company since October 2020, and Kellie Newton, a director of the Company since April 2019, continue to serve as members of the board of directors. In addition, as of the Effective Date, Thomas E. Vickers, will be elected Chairman of the Board of Directors. Mr. Vickers will receive $3,000 monthly for his service as Chairman of the Board.

5

Director Independence

The Company’s Board of Directors has determined that each of our four non-employee directors, Thomas E. Vickers, Kuno D. van der Post, Kellie Newton and Craig Fabel, is “independent” within the meaning of the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and the listing standards of the Nasdaq Stock Market and the NYSE American. Moreover, our board of directors has determined that Mr. Vickers qualifies as an “audit committee financial expert” as the term is defined by the applicable rules and regulations of the SEC and the listing standards of the Nasdaq Stock Market and the NYSE American, based on his education and extensive financial and accounting experience as a principal financial officer, principal accounting officer and controller for 10 years.

Appointment of Committee Members

As of the Effective Date, the following directors will serve as members of the following board committees:

Audit Committee:

Mr. Vickers, Chairman

Ms. Newton

Mr. Fabel

Compensation Committee:

Mr. Vickers, Chairman

Ms. Newton

Mr. Van der Post

Nominating and Corporate Governance Committee:

Ms. Newton, Chairman

Mr. Vickers

Mr. Fabel

Mr. Van der Post

Employment Agreements

The Company and Mr. Johnson intend to enter into an employment agreement for Mr. Johnson’s service as Chief Executive Officer and President which will provide for an annual base salary of $225,000, subject to periodic review for increases, and an award of stock options to purchase 450,000 shares of the Company’s Common Stock under our 2017 Stock Incentive Plan, with a per share exercise price equal to the closing price of the Common Stock on the grant date, which options will vest ratably over three (3) years subject to Mr. Johnson’s continuous service to the Company, with a term of ten years. Mr. Johnson will be eligible to participate in the standard employee benefit plans generally available to executive employees of the Company, including health insurance, life and disability insurance, 2017 Stock Incentive Plan, 401(k) plan, and paid time off and paid holidays. The Company will also reimburse Mr. Johnson for his documented business expenses incurred in connection with his employment pursuant to the Company’s standard reimbursement expense policy and practices.

Subject to the Board of Director’s determination, Mr. Johnson will also be eligible to receive an incentive performance bonus based upon the Company’s performance with respect to applicable performance targets as determined by the Board of Directors.

The Company and Mr. Pino intend to enter into an employment agreement for Mr. Pino’s service as Executive Vice President – Finance, Treasurer and Secretary which will provide for an annual base salary of $190,000, subject to periodic review for increases, and an award of stock options to purchase 385,000 shares of the Company’s Common Stock under our 2017 Stock Incentive Plan, with a per share exercise price equal to the closing price of the Common Stock on the grant date, which options will vest ratably over three (3) years subject to Mr. Pino’s continuous service to the Company, with a term of ten years. Mr. Pino will be eligible to participate in the standard employee benefit plans generally available to executive employees of the Company, including health insurance, life and disability insurance, 2017 Stock Incentive Plan, 401(k) plan, and paid time off and paid holidays. The Company will also reimburse Mr. Pino for his documented business expenses incurred in connection with his employment pursuant to the Company’s standard reimbursement expense policy and practices.

Subject to the Board of Director’s determination, Mr. Pino will also be eligible to receive an incentive performance bonus based upon the Company’s performance with respect to applicable performance targets as determined by the Board of Directors.

6

Salgado Separation and Consulting Agreements

Pursuant to the Salgado Separation Agreement and Salgado Consulting Agreement entered into by Mr. Salgado with the Company effective as of the Effective Date, the Company agreed to pay Mr. Salgado a severance equal to two years’ of his base salary and the continuation of vested stock options to purchase 1,250,000 shares held by Mr. Salgado for a period of three-years in consideration for Mr. Salgado’s resignation from all officers and Board positions held with the Company and its subsidiary. The Separation Agreement additionally contains, among other things, customary releases, confidentiality, and non-disparagement provisions. In addition, on the Effective Date the Company entered into a Consulting Agreement with Mr. Salgado for a term of three months pursuant to which Mr. Salgado will provide consulting services in order to transition to his successor in exchange for a monthly consulting fee of $16,666.66. The foregoing descriptions of the Salgado Separation Agreement and the Salgado Consulting Agreement are only summaries and are qualified in their entirety by reference to the complete texts of the Separation Agreement and the Consulting Agreement, which are filed as Exhibits 10.3 and 10.4 to this Current Report on Form 8-K.

Pelletier Separation and Consulting Agreements.

Pursuant to the Pelletier Separation Agreement entered into by Mr. Pelletier with the Company effective May 14, 2021, and the Pelletier Consulting Agreement entered into by Mr. Pelletier with the Company as of the Effective Date, the Company agreed to pay Mr. Pelletier a severance equal to six months of his base salary and the continuation of vested stock options to purchase 16,667 shares held by Mr. Pelletier for a period of three months from the expiration or termination of his severance period. The Separation Agreement additionally contains, among other things, customary releases, confidentiality, and non-disparagement provisions. In addition, on the Effective Date the Company entered into a Consulting Agreement with Mr. Pelletier for a term of three months pursuant to which Mr. Pelletier will continue to serve as the Company’s Chief Financial Officer in order to transition to his successor in exchange for a monthly consulting fee of $12,000. The foregoing descriptions of the Pelletier Separation Agreement and the Pelletier Consulting Agreement are only summaries and are qualified in their entirety by reference to the complete texts of the Separation Agreement and the Consulting Agreement, which are filed as Exhibit 10.5 and 10.6 to this Current Report on Form 8-K.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.01 Changes in Control of Registrant.

The disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The disclosure set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On May 11, 2021, the Company issued a press release announcing it having entered into the Securities Purchase Agreement and the related change in the Company’s Chief Executive Officer. A copy of the press release dated is attached hereto as Exhibit 99.1.

7

In accordance with General Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 7.01, and including Exhibit 99.1 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in this Current Report on Form 10-K or in any subsequent filing under the Exchange Act or any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits |

| * | Furnished but not filed. |

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 12, 2021 | VERITAS FARMS, INC. | |

| By: | /s/ Michael Pelletier | |

| Michael Pelletier, Chief Financial Officer | ||

9

Exhibit 10.1

Execution Version

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT (this “Agreement”), dated as of May 11, 2021 (the “Effective Date”), is made by and between VERITAS FARMS, INC., a Nevada corporation (the “Company”) and The Cornelis F. Wit Revocable Living Trust (the “Purchaser”). The Company and the Purchaser are sometimes referred to herein individually, as a “Party” and collectively, as the “Parties.”

RECITALS

WHEREAS, the Company wishes to sell to the Purchaser an aggregate of (a) 2,000,000 shares of its Series A Convertible Preferred Stock having the rights, preferences, powers, restrictions and limitations set forth in the Certificate of Designation attached as Exhibit A hereto (the “Series A Preferred Shares”); and (b) 1,000,000 shares of its Series B Convertible Preferred Stock having the rights, preferences, powers, restrictions and limitations set forth in the Certificate of Designation attached as Exhibit B hereto (the “Series B Preferred Shares,” and together with the Series A Preferred Shares, collectively, the “Preferred Shares”) and the Purchaser wishes to Purchase the Preferred Shares from the Company, all on and subject to the terms and conditions set forth herein; and

WHEREAS, the Company and the Purchaser are executing and delivering this Agreement in reliance upon the exemption from securities registration pursuant to Section 4(a)2 of and Regulation D promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”).

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt and adequacy are hereby acknowledged, the Parties agree as follows:

ARTICLE I

CONSIDERATION

1.1 Sale and Purchase of Preferred Shares. On and subject to the terms and conditions set forth in this Agreement, at Closing (as hereinafter defined), the Company and shall sell the Preferred Shares to the Purchaser and the Purchaser shall purchase and acquire the Preferred Shares from the Company at a purchase price of $1.00 per Preferred Share (the “Purchase Price”).

1.2 Payment of the Purchase Price. The Purchase Price for the Shares shall be payable by the Purchaser to the Company in full at Closing (a) by conversion of the principal amount and accrued but unpaid interest on that certain Secured Convertible Promissory Note dated April 8, 2021 in the original principal amount of $124,000 (the “Note”) made by the Company in favor of the Purchaser; (b) by delivery and exchange of 2,000,000 Units (the “Units”), each consisting of (i) two shares of the Company’s common stock, par value $0.001 (the “Common Stock”); and (i) one common stock purchase warrant (the “Warrants”), by the Purchaser’s exercise of the exchange rights granted to the Purchaser under those certain Subscription Agreements between the Company and the Purchaser dated September 14, 2020 and October 13, 2020 (the “2020 Subscription Agreements”) pursuant to which the Units were issued for an aggregate purchase price of $1,000,000; and (c) the balance by wire transfer in immediately available funds to such bank account as may be designated by the Company.

1.3 Closing. The closing of the purchase and sale of the Preferred Shares provided for in this Agreement (the “Closing”) shall be consummated by electronic or other exchange of documents contemporaneously with the execution of this Agreement on the Effective Date.

1.4 Board Composition at Closing. At Closing, the Company’s board of directors shall consist of five (5) directors, (a) three of whom , Stephen E. Johnson, Kuno D. van der Post and Craig Fabel, are designees of Purchaser and (b) two of whom Thomas E. Vickers and Kellie Newton are current members of the Company’s board of directors. All other current members of the board of directors shall have resigned at Closing.

1.5 Closing Deliveries by the Company. At Closing, the Company shall deliver (or cause to be delivered) to the Purchaser:

(a) Certificates in the name of the Purchaser for the Preferred Shares purchased hereunder;

(b) evidence in form and substance reasonably satisfactory to the Purchaser that the composition of the Company’s board of directors be comprised at Closing as provided in Section 1.4;

(c) evidence, in form and substance reasonably satisfactory to the Purchaser, that the working capital deficiency of the Company is no greater than $2,000,000;

(d) a Separation Agreement between the Company and Alexander Salgado, in the form attached hereto as Exhibit C, duly executed by the parties thereto;

(e) a Consulting Agreement between the Company and Alexander Salgado, in the form attached hereto as Exhibit D, duly executed by the parties thereto;

(f) a Separation Agreement between the Company and Michael Pelletier, in the form attached hereto as Exhibit E, duly executed by the parties thereto;

(g) a Consulting Agreement between the Company and Michael Pelletier, in the form attached hereto as Exhibit F, duly executed by the parties thereto;

(h) an amendment to the Employment Agreement between the Company and Dave Smith, in the form attached hereto as Exhibit G, duly executed by the parties thereto;

2

(i) a copy of the minutes of meeting or written consent duly executed by each director of the Company, providing the valid adoption of resolutions of the Company’s board of directors approving this Agreement and each other transaction agreement provided for in this Agreement to which the Company is a party, and the consummation of the transactions contemplated hereby and thereby;

(j) a copy of the Current Report on Form 8-K, in form and substance satisfactory to the Purchaser, disclosing the transactions contemplated in this Agreement, as provided in Section 3.3;

(k) waivers, in form and substance satisfactory to the Purchaser, duly executed by each I-Bankers Direct, LLC. and WestPark Capital, Inc., of fees and commission with respect to the transactions contemplated by this Agreement.

(l) copies of all material consents, authorizations, filings, licenses, approvals, and notice required or otherwise reasonably requested by the Purchaser in connection with the execution, delivery and performance by the Company or the validity and enforceability of, this Agreement; and

(m) such other documents as may be necessary to effect the consummation of the transactions contemplated by this Agreement.

1.6 Closing Deliveries by the Purchaser. At Closing, the Purchaser shall deliver (or cause to be delivered) to the Company:

(a) The Note, for cancellation;

(b) The certificates representing the 4,000,000 shares of common stock 2,000,000 Warrants comprising the Units, accompanied by a stock power or powers duly executed in blank, a warrant assignment or assignments or other instruments of transfer in form and substance reasonably satisfactory to the Company;

(c) The balance of the Purchase Price, as provided in Section 1.2(b);

(d) copies of all consents, authorizations, filings, licenses, approvals, and further assurances, if any, required or otherwise reasonably requested by the Company in connection with the execution, delivery and performance by the Purchaser or the validity and enforceability of this Agreement; and

(e) such other documents as may be necessary to effect the consummation of the transactions contemplated by this Agreement.

3

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF THE PARTIES

2.1 Representations and Warranties of the Company. Except as set forth in the SEC Reports (as hereinafter defined), which shall be deemed a part hereof, the Company hereby makes the following representations and warranties to the Purchaser:

(a) SEC Reports. The Company has timely (including within any additional time periods provided by Rule 12b-25 under the Exchange Act) filed all reports, schedules, forms, statements and other documents required to be filed by it with the SEC since January 1, 2018, pursuant to the Securities Act and the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) including all exhibits thereto and financial statements, notes and schedules included or incorporated by reference therein and all amendments thereto (collectively, the “SEC Reports”). As of their respective filing dates, the SEC Reports complied in all material respects with the requirements of the Securities Act and the Exchange Act and the rules and regulations of the SEC promulgated thereunder, and none of the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. All material agreements to which the Company and its Subsidiary (as hereinafter defined) are a party or to which any of their respective property or assets are subject that are required to be filed as Exhibits to the SEC Reports are included as a part of, or specifically identified in, the SEC Reports.

(b) Organization, Good Standing and Qualification.

(i) The Company is a corporation, duly incorporated, validly existing and in good standing under the laws of the State of Nevada, with the requisite corporate power and authority to own and use its properties and assets and to carry on its business as currently conducted. The Company is duly qualified to transact business and is in good standing in each jurisdiction in which the failure to so qualify could be reasonably expected to result in a material adverse effect on the business, assets (including intangible assets), liabilities, financial condition, property, prospects or results of operations of the Company and the Subsidiary (as hereinafter defined), taken as a whole (a “Material Adverse Effect”).

(ii) The Company has one subsidiary, 271 Lake Davis Holdings, LLC (the “Subsidiary”). The Company directly owns all the membership interests of the Subsidiary free and clear of any lien, charge, security interest, encumbrance, right of first refusal or other restriction The Subsidiary is duly formed, validly existing and in good standing under the laws of the State of Delaware, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. The Subsidiary is duly qualified to transact business and is in good standing in each jurisdiction in which the failure to so qualify could be reasonably expected to result in a Material Adverse Effect. The Subsidiary is not in violation of any of the provisions of its certificate of organization, operating agreement or other organizational or charter documents (each as amended through the date hereof). Other than the foregoing, the Company (a) does not own or hold (of record, beneficially or otherwise) nor has the Company ever owned or held, directly or indirectly, any equity interests, debt securities or any other security or interest in any other Person (as hereinafter defined) or the right to acquire any such security or interest: (b) is not, nor has it ever been, a partner or member of any partnership, limited liability company or joint venture; and (c) does not have any obligation to make any investment in any Person.

4

(c) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and the other transaction agreements to which it is a party (collectively, the “Transaction Agreements”), and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery by the Company of this Agreement and the other Transaction Agreements to which it is a party and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company or its stockholders in connection therewith. This Agreement and the other Transaction Agreements to which the Company is a party have been duly executed by the Company and, when delivered in accordance with the terms hereof and thereof, will constitute the valid and binding obligations of the Company enforceable against the Company in accordance with their respective terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of general application affecting enforcement of creditors’ rights; and (ii) as limited by general principles of equity that restrict the availability of equitable remedies. The Company is not in violation of any of the provisions of its Amended and Restated Articles of Incorporation or bylaws (each as amended through the date hereof).

(d) Capitalization; Subsidiary.

(i) As of the date of this Agreement, the authorized capital stock of the Company consists of (i) 200,000,000 shares of Common Stock, par value $0.001; and (ii) 5,000,000 shares of preferred stock, par value $0.001 per share. No shares of capital stock of the Company are entitled to preemptive or similar rights, nor is any holder of capital stock of the Company entitled to statutory preemptive or similar rights arising out of any agreement or understanding with the Company.

(ii) All issued and outstanding shares of the Company’s Common Stock (A) have been duly authorized and validly issued and are fully paid and nonassessable; and (B) were issued in compliance with all applicable state and federal laws concerning the issuance of securities. There are no shares of preferred stock issued and outstanding.

(iii) There are no outstanding options, warrants, rights (including conversion and rights of first refusal and similar rights) to subscribe to, calls, or commitments of any character whatsoever relating to securities, rights or obligations convertible into or exchangeable for, or giving any individual, corporation, partnership, trust, limited liability company, association or other entity (any of the foregoing, a “Person”) any right to subscribe for or acquire any shares of capital stock of the Subsidiary, or contracts, commitments, understandings, or arrangements by which the Subsidiary is or may become bound to issue additional shares of capital stock of the Subsidiary, or securities or rights convertible or exchangeable into shares of capital stock of the Subsidiary.

5

(iv) Except as set forth in the SEC Reports or as set forth on Schedule 2.1(d)(iv) attached hereto, there are no outstanding options, warrants, rights (including conversion and rights of first refusal and similar rights) to subscribe to, calls, or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exchangeable for, or giving any Person any right to subscribe for or acquire any shares of capital stock of the Company, or contracts, commitments, understandings, or arrangements by which the Company is or may become bound to issue additional shares of capital stock of the Company, or securities or rights convertible or exchangeable into shares of capital stock of the Company. The issue and sale of the Preferred Shares will not obligate the Company to issue Common Stock or other securities to any Person (other than the Purchaser) and will not result in a right of any holder of Company securities to adjust the exercise, conversion, exchange or reset price under such securities.

(e) Issuance of the Preferred Shares and Conversion Shares. The Preferred Shares are duly authorized, and when issued and paid for in accordance with the terms hereof, and the shares of Common Stock issuable upon conversion of the Preferred Shares (the “Conversion Shares”) will be duly and validly issued, fully paid and nonassessable, and free and clear of all liens, encumbrances and rights of first refusal of any kind (collectively, “Liens”). Based in part upon the representations of the Purchaser set forth in Section 2.2 of this Agreement, (i) the Preferred Shares will be issued in compliance with all applicable federal and state securities laws; and (ii) no registration under the Securities Act is required for the offer and sale of the Preferred Shares by the Company to the Purchaser under this Agreement. The Company has reserved from its duly authorized capital stock the maximum number of Common Stock issuable upon conversion of the Preferred Shares.

(f) No Conflicts. The execution, delivery and performance by the Company of this Agreement and the other Transaction Agreements to which it is a party, and the consummation by the Company of the transactions contemplated hereby do not and will not (i) conflict with or violate any provision of the Company’s Amended and Restated Articles of Incorporation or bylaws (each as amended through the date hereof); (ii) conflict with, or constitute a default (or an event which with notice or lapse of time, or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time, or both) of, any agreement, credit facility, indenture or instrument (evidencing a Company or Subsidiary debt or otherwise) to which the Company or the Subsidiary is a party or by which any property or asset of the Company or any Subsidiary is bound or affected; (iii) result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company or the Subsidiary is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company or any Subsidiary is bound or affected, or (iv) conflict with, or result in or constitute any violation of, or result in the termination, suspension or revocation of, any Authorization (as hereinafter defined applicable to the Company or the Subsidiary, or to any of their respective properties or assets, or to any of the Preferred Shares, or result in any other impairment of the rights of the holder of any such Authorization, except in the case of each of clauses (ii), (iii) and (iv), as could not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. The business of the Company and the Subsidiary is conducted in compliance in all material respects with all laws, ordinances or regulations of any governmental authority. As used herein, “Authorization” means any registration (including any registration under the Securities Act) or filing with, or any notification to, or any approval, permission, consent, ratification, waiver, authorization, order, finding of suitability, permit, license, franchise, exemption, certification or similar instrument or document of or from, any U.S. court, arbitral tribunal, arbitrator, administrative or regulatory agency or commission or other governmental or regulatory authority, agency or governing body, domestic or foreign, including without limitation any trading market (each, a “Governmental Entity”), or any other person, or under any statute, law, ordinance, rule, regulation or agency requirement of any Governmental Entity,

6

(g) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, Authorization or order of, give any notice to, or make any filing or registration with, any court or other U.S. or foreign federal, state, local or other governmental authority or other person in connection with the execution, delivery and performance by the Company of this Agreement, other than filings which may be required under federal and state securities laws, including Form D and any blue sky filings.

(h) Litigation; Proceedings. Except as set forth in the SEC Reports or Schedule 2.1(h) attached hereto, there is no action, suit, inquires, notice of violation, proceeding or investigation pending or, to the knowledge of the Company, threatened against or affecting the Company or any of its properties (including for these purposes the Subsidiary) before or by any court, arbitrator, governmental or administrative agency, or regulatory authority (U.S. federal, state, county, local or foreign), which if adversely determined, could reasonably be expect to have a Material Adverse Effect nor is the Company aware of any reasonable basis therefor. Neither the Company nor the Subsidiary nor, to the Company’s knowledge, any of its officers, directors or any of its employees is a party or is named as subject to the provisions of any order, writ, injunction, judgment or decree of any court or government agency or instrumentality (in the case of officers, directors or employees, such as would affect the Company). There is no action, suit, proceeding or investigation by the Company or the Subsidiary pending or which the Company or the Subsidiary intends to initiate, which if adversely determined, could reasonably be expected to have a Material Adverse Effect. The foregoing includes, without limitation, actions, suits, proceedings or investigations pending or threatened in writing (or any basis therefor known to the Company) involving the prior employment of any of the Company’s employees, their services provided in connection with the Company’s business, any information or techniques allegedly proprietary to any of their former employers or their obligations under any agreements with prior employers.

(i) No Default or Violation. Neither the Company nor any Subsidiary (i) is in material default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a material default), nor has the Company or any Subsidiary received written notice of a claim that it is in material default under or is in material violation of any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound, (ii) is not in violation in any material respect of any order of any court, arbitrator or governmental body, or (iii) is not in violation in any material respect of any statute, rule or regulation of any governmental authority, which in each instance could not, individually or in the aggregate, be reasonably expected to have a Material Adverse Effect.

(j) Brokers Fees. No fees or commissions will be payable by the Company to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other Person, including but not limited to I-Bankers Direct, LLC. and WestPark Capital, Inc., with respect to the transactions contemplated by this Agreement.

7

(k) Intellectual Property.

(i) Each of the Company and the Subsidiary owns or possesses sufficient legal rights to its respective Intellectual Property (as defined below) necessary for its business as now conducted and as presently proposed to be conducted. To the knowledge of the Company, all such Intellectual Property rights are enforceable and there is no existing infringement by another Person of any of the Intellectual Property rights of the Company or the Subsidiary. To the Company’s knowledge, no product or service marketed or sold (or proposed to be marketed or sold) by the Company or the Subsidiary violates or will violate any license or infringes or will infringe any intellectual property rights of any other party. Other than with respect to commercially available software products under standard end-user object code license agreements, there are no outstanding options, licenses, agreements, claims, encumbrances or shared ownership interests of any kind relating to the Intellectual Property, nor is the Company or the Subsidiary bound by or a party to any options, licenses or agreements of any kind with respect to the patents, trademarks, service marks, trade names, copyrights, trade secrets, licenses, information, proprietary rights and processes of any other Person. Neither the Company nor any Subsidiary has received any communications alleging that the Company or the Subsidiary, as the case may be, has violated, or by conducting its business, would violate any of the patents, trademarks, service marks, trade names, copyrights, trade secrets, mask works or other proprietary rights or processes of any other Person. For purposes of this Agreement, “Intellectual Property” means all patents, patent applications, trademarks, trademark applications, service marks, service mark applications, trade names, copyrights, trade secrets, domain names, mask works, technology, information and proprietary rights and processes, similar or other intellectual property rights, subject matter of any of the foregoing, tangible embodiments of any of the foregoing, licenses in, to and under any of the foregoing (and all goodwill associated therewith), and any and all such cases that are necessary, owned or used by the Company or the Subsidiary in the conduct of its respective businesses as now conducted and as presently proposed to be conducted.

(ii) All material licenses or other agreements under which the Company or the Subsidiary is granted Intellectual Property (excluding licenses to use software utilized in the Company’s or such Subsidiary’s internal operations and which is generally commercially available) are in full force and effect and, to the Company’s knowledge, there is no material default by any party thereto. The Company has no reason to believe that the licensors under such licenses and other agreements do not have and did not have all requisite power and authority to grant the rights to the Intellectual Property purported to be granted thereby.

8

(iii) All licenses or other agreements under which the Company or the Subsidiary has granted rights to Intellectual Property to others (including all end-user agreements) are in full force and effect, there has been no material default by the Company or the Subsidiary thereunder and, to the Company’s knowledge, there is no material default of any provision thereof relating to Intellectual Property by any other party thereto.

(iv) Each of the Company and the Subsidiary has taken all steps required in accordance with commercially reasonable business practice to establish and preserve their ownership in their owned Intellectual Property and to keep confidential all material technical information developed by or belonging to the Company or such Company which has not been patented or copyrighted.

(l) Regulatory Permits. Each of the Company and the Subsidiary possesses all material certificates, authorizations and permits issued by the appropriate U.S. federal, state or foreign regulatory authorities materially necessary to conduct its business (“Permits”) and neither the Company nor any Subsidiary has received any notice of proceedings relating to the revocation or modification of any Permit.

(m) FDA Compliance. The Company and its Subsidiary, and the manufacture, marketing and sales of their products, comply with any and all applicable requirements of the applicable FDA (Food and Drug Administration) laws to which the Company or the Subsidiary is subject. Notwithstanding the foregoing, the Parties acknowledge the products of the Company’s and its Subsidiary’s Goods contain, or are derived from, hemp in accordance with the Parties’ understanding of Section 7606 of the Agricultural Act of 2014 (Pub. L. 113-79) and applicable provisions of the Agriculture Improvement Act of 2018 (collectively, the “Farm Bill”), though there remains uncertainties as to whether any other federal, state or local law may or may not conflict with, or be superseded by, the Farm Bill. Each party further acknowledges and agrees that such currently existing uncertainties under federal, state and local laws, including the Food, Drug and Cosmetic Act, concerning hemp are subject to change at any time in the sole discretion of the applicable authority, and each Party hereby: (i) agrees that the representations, warranties, guaranties and covenants contained in this Agreement shall not be deemed to be breached by virtue of such products containing hemp in accordance with the Farm Bill; and (ii) to the extent allowable by law, waives any defenses to the enforcement of the Agreement based on an “illegality of purpose” theory or related defenses.

(n) Insurance. Except as set forth on Schedule 2.1(n) hereto, the Company and the Subsidiary are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which the Company and the Subsidiary are engaged in their locality. Neither the Company nor the Subsidiary has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business without a significant increase in cost.

9

(o) Title. The Company and its Subsidiary have good and marketable title (a) in fee simple with respect to the real property described as owned by them in the SEC Reports; and (b) to all personal property owned by each of them that is material to its respective business, in each case free and clear of all Liens, except for Liens that do not materially affect the value of such real or personal property and do not interfere with the use made and proposed to be made of such real or personal property by the Company or the Subsidiary. Any real property and facilities held under lease by the Company and the Subsidiary is held by them under valid, subsisting and enforceable leases of which the Company and the Subsidiary are in material compliance with such exceptions as are not material and do not interfere with the use made and proposed to be made of such property and buildings by the Company or the Subsidiary, as the case may be.

(p) Financial Statements. As of their respective filing dates, as applicable, the financial statements of the Company included in the SEC Reports (the “Financial Statements”) complied as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto. The Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles consistently applied (“GAAP”), during the periods involved (except (i) as may be otherwise indicated in such financial statements or the notes thereto; or (ii) in the case of unaudited interim statements, to the extent they may exclude footnotes or may be condensed or summary statements) and fairly present in all material respects the financial position of the Company and its consolidated Subsidiary as of and for the dates thereof and the results of its operations and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments).

(q) Material Changes. Since the date of the latest audited Financial Statements included within the SEC Reports and except as set forth or contemplated herein or in the Schedules hereto, (i) there has been no event, occurrence or development that has had or that could reasonably be expected to result in a Material Adverse Effect; (ii) the Company has not incurred any liabilities (contingent or otherwise) other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice; and (B) liabilities that would not be required to be reflected in the Company’s financial statements pursuant to GAAP or that would not be required to be disclosed in filings made with the SEC; (iii) the Company has not altered its method of accounting; (iv) the Company has not declared or made any dividend or distribution of cash or other property to its stockholders or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock; and (v) the Company has not issued any equity securities. The Company does not have pending before the SEC any request for confidential treatment of information.

10

(r) Off-Balance Sheet Arrangements. There is no transaction, arrangement or other relationship between the Company and an unconsolidated or other off-balance sheet entity that is required to be disclosed by the Company in its SEC Reports filings and is not so disclosed or that otherwise would be reasonably expected to result in a Material Adverse Effect. There are no such transactions, arrangements or other relationships with the Company that may create contingencies or liabilities that are not otherwise disclosed by the Company in its SEC Reports filings.

(s) Transactions With Affiliates and Employees. Except as set forth in the SEC Reports or as contemplated in this Agreement or the other Transaction Agreements, none of the officers or directors of the Company and its Subsidiary and, to the knowledge of the Company, none of the employees of the Company or its Subsidiary is presently a party to any transaction with the Company or its Subsidiary (other than for services as employees, officers and directors) which would be required to be disclosed by the Company pursuant to Item 404 under Regulation S-K under the Exchange Act, including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of the Company, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner, in each case other than for (i) payment of salary for services rendered; (ii) reimbursement for expenses incurred on behalf of the Company or its Subsidiary; and (iii) other employee benefits, including stock option agreements, whether or not issued, under any stock option plan of the Company.

(t) Internal Accounting Controls. The Company and the Subsidiary maintains a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability; (iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. The Company has established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the Company and designed such disclosure controls and procedures to ensure that material information relating to the Company, including its Subsidiary, is made known to the certifying officers by others within those entities. To the Company’s knowledge, except as set forth in its most recently filed Annual Report on Form 10-K (the “2020 Form 10-K”), there are no material weaknesses in the Company’s internal control over financial reporting. Since the filing of the Company’s 2020 Form 10-K, there have been no significant changes in the Company’s internal control over financial reporting (as such term is defined in Item 308(c) of Regulations S-K under the Exchange Act) or, to the Company’s knowledge, in other factors that could significantly affect the Company’s internal control over financial reporting.

(u) Registration Rights. Except as set forth in the SEC Reports, no Person has any right to cause the Company to effect the registration under the Securities Act of any securities of the Company.

(v) Investment Company. The Company is not, and after giving effect to the sale of the Preferred Shares and the application of the net proceeds therefrom, will not be, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

(w) Foreign Corrupt Practices. Neither the Company nor its Subsidiary nor any of the Company’s directors, officers, employees or agents have, directly or indirectly, made, offered, promised or authorized any payment or gift of any money or anything of value to or for the benefit of any “foreign official” (as such term is defined in the U.S. Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”)), foreign political party or official thereof or candidate for foreign political office for the purpose of (i) influencing any official act or decision of such official, party or candidate; (ii) inducing such official, party or candidate to use his, her or its influence to affect any act or decision of a foreign governmental authority; or (iii) securing any improper advantage, in the case of (i), (ii) and (iii) above in order to assist the Company or any of its affiliates in obtaining or retaining business for or with, or directing business to, any person. Neither the Company nor any of its directors, officers, employees or agents have made or authorized any bribe, rebate, payoff, influence payment, kickback or other unlawful payment of funds or received or retained any funds in violation of any law, rule or regulation. The Company further represents that it has maintained and has caused its Subsidiary and affiliates to maintain, systems of internal controls (including, but not limited to, accounting systems, purchasing systems and billing systems) to ensure compliance with the FCPA or any other applicable anti-bribery or anti-corruption law. Neither the Company, or, to the Company’s knowledge, any of its officers, directors or employees have violated in any material respect any provision of the FCPR nor are the subject of any allegation, voluntary disclosure, investigation, prosecution or other enforcement action related to the FCPA or any other anti-corruption law.

11

(x) OFAC. Neither the Company nor its Subsidiary nor, to the knowledge of the Company, any director, officer, agent, employee, affiliate or Person acting on behalf of the Company or its Subsidiary is currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”); and the Company will not directly or indirectly use the proceeds of the sale of the Preferred Shares, or lend, contribute or otherwise make available such proceeds to the Subsidiary, joint venture partner or other Person or entity, towards any sales or operations in Cuba, Iran, Syria, Sudan, Myanmar or any other country sanctioned by OFAC or for the purpose of financing the activities of any Person currently subject to any U.S. sanctions administered by OFAC.

(y) Environmental Matters. Neither the Company nor its Subsidiary has any liabilities under any Environmental Law, nor, to the Company’s knowledge, do any factors exist that are reasonably likely to give rise to any such liability, materially affecting any of the properties owned or leased by the Company or the Subsidiary. Neither the Company nor the Subsidiary has violated in any material respect any Environmental Law applicable to it now or previously in effect. As used herein, “Environmental Law” means any federal, state, provincial, local or foreign law, statute, code or ordinance, principle of common law, rule or regulation, as well as any permit, order, decree, judgment or injunction issued, promulgated, approved or entered thereunder, relating to pollution or the protection, cleanup or restoration of the environment or natural resources, or to the public health or safety, or otherwise governing the generation, use, handling, collection, treatment, storage, transportation, recovery, recycling, discharge or disposal of hazardous materials.

(z) Labor Relations; Employee Matters. No material labor dispute exists or, to the knowledge of the Company, is imminent with respect to any of the employees of the Company or its Subsidiary which could reasonably be expected to result in a Material Adverse Effect. To the Company’s knowledge, no employee intends to terminate employment with the Company or is otherwise likely to become unavailable to continue as an Employee, nor does the Company have a present intention to terminate the employment of any of the foregoing. Each current and former employee, consultant and officer of the Company has executed an agreement with the Company regarding confidentiality and proprietary information substantially in the form or forms delivered to the counsel for the Purchaser (the “Confidential Information Agreements”). No current or former employee has excluded works or inventions from his or her assignment of inventions pursuant to such Confidential Information Agreement. Each current and former officer of the Company and the Subsidiary has executed a non-competition and non-solicitation agreement substantially in the form or forms delivered to counsel for the Purchaser. To the Company’s knowledge, no employee is in violation of any agreement covered by this Section 2.1(z). The employment of each employee of the Company is terminable at the will of the Company except for Dave Smith or Alexander Salgado. Except as contemplated by the Transaction Agreements or as required by law, upon termination of the employment of any such employees or upon a change of control of the Company, no severance or other payments will become due. The Company has no policy, practice, plan or program of paying severance pay or any form of severance compensation in connection with the termination of employment services.

12

(aa) Taxes. Each of the Company and the Subsidiary has prepared in good faith and duly and timely filed all tax returns required to be filed by it and such returns are complete and accurate in all material respects, except for tax returns that would not reasonably be expected to have a Material Adverse Effect; and each of the Company and the Subsidiary has paid all taxes required to have been paid by it, except for taxes which it reasonably disputes in good faith or the failure of which to pay has not had or would not reasonably be expected to have a Material Adverse Effect. Neither the Company nor the Subsidiary has knowledge of a tax deficiency which has been or might be asserted or threatened against it which could reasonably be expected to result in a Material Adverse Effect.

2.2 Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants to the Company as follows:

(a) Organization and Good Standing. The Purchaser is duly incorporated, formed or organized, validly existing and in good standing under the laws of the State of its incorporation, formation or organization, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted.