Form 8-K Synchrony Financial For: Jul 20

Exhibit 99.1

For Immediate Release Synchrony Financial (NYSE: SYF) July 20, 2021 |  | |||||||

SECOND QUARTER 2021 RESULTS AND KEY METRICS

$78.4B Loan Receivables | 5.3% Return on Assets | 17.8% CET1 Ratio | $521M Capital Returned | CEO COMMENTARY | ||||||||||||||||||||||||||||

Brian Doubles, Synchrony’s President and Chief Executive Officer, said, “We continue to deliver strong financial results, reflecting the power of our technology-enabled model, the durability of our partner-centric value propositions, and the diversity in our portfolio. “The hallmarks of our business — including exceptional digital capabilities, advanced data analytics, and our wide breadth of products and services — are key differentiators that enable us to deliver attractive financing solutions and seamless customer experiences, while also addressing our partners' evolving needs. “Synchrony is very well positioned to continue to win and renew key partnerships and solidify ourselves as a leading provider of one of the industry’s most complete, digitally-enabled consumer payments and financing product suites.” | ||||||||||||||||||||||||||||||||

| Synchrony Reported Second Quarter Net Earnings of $1.2 Billion or $2.12 Per Diluted Share | |||||||||||||||||||||||||||||||

| Purchase Volume Growth Accelerated as Consumer Confidence Improved | |||||||||||||||||||||||||||||||

| Continued Strength in Credit Performance, Contributing to a 112% Decrease in Provision for Credit Losses | |||||||||||||||||||||||||||||||

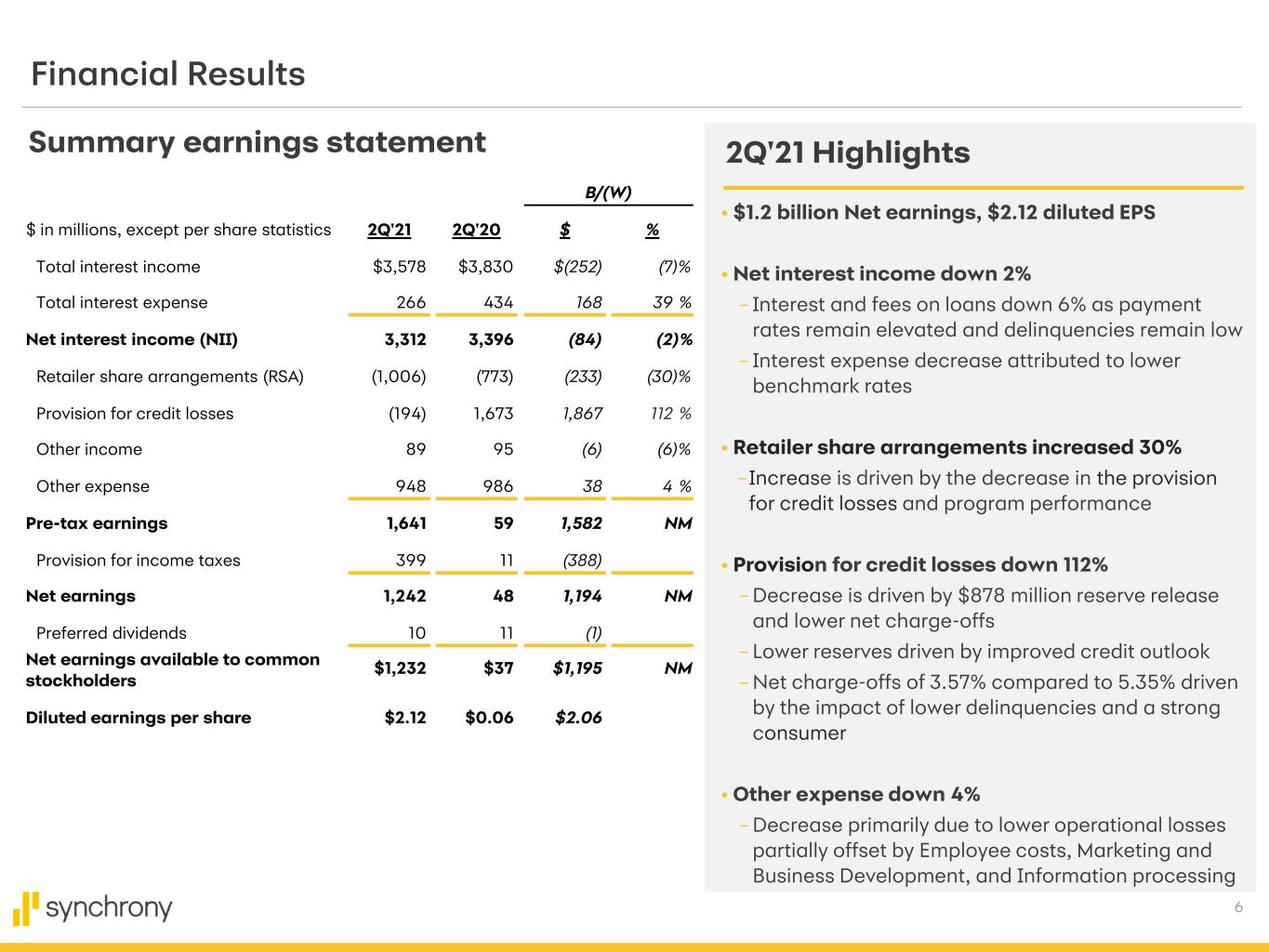

STAMFORD, Conn. – Synchrony Financial (NYSE: SYF) today announced second quarter 2021 net earnings of $1.2 billion, or $2.12 per diluted share, compared to $48 million, or $0.06 per diluted share in the second quarter 2020. | ||||||||||||||||||||||||||||||||

| KEY OPERATING & FINANCIAL METRICS* | ||||||||||||||||||||||||||||||||

| RECORD NET EARNINGS DRIVEN BY A STRONG CONSUMER, AS REFLECTED IN PURCHASE VOLUME GROWTH AND CREDIT QUALITY | ||||||||||||||||||||||||||||||||

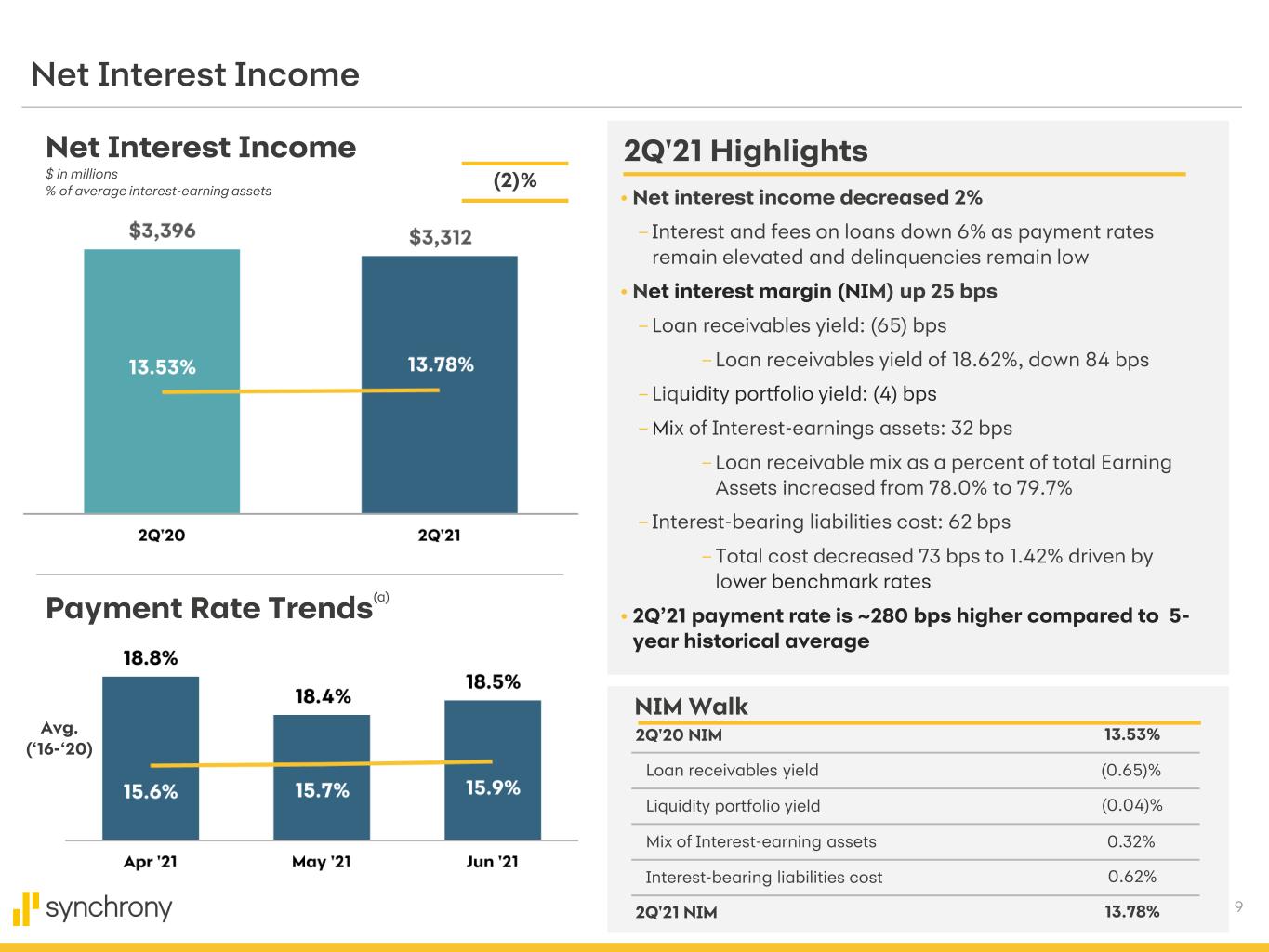

•Purchase volume increased 35% to $42.1 billion •Loan receivables increased $0.1 billion to $78.4 billion •Average active accounts increased 2% to 65.8 million •New accounts increased 58% to 6.3 million •Net interest margin increased 25 basis points to 13.78% •Efficiency ratio increased 330 basis points to 39.6% •Net earnings of $1.2 billion, or $2.12 per diluted share, compared to $48 million, or $0.06 per diluted share •Return on assets increased 5 percentage points to 5.3% •Return on equity increased 35 percentage points to 36.5% | ||||||||||||||||||||||||||||||||

| CFO COMMENTARY | BUSINESS AND FINANCIAL RESULTS FOR THE SECOND QUARTER OF 2021* | |||||||||||||||||||||||||

Brian Wenzel, Synchrony’s Executive Vice President and Chief Financial Officer, said, “Purchase volume increased significantly during the second quarter 2021, reflecting the impacts of stimulus, the lifting of remaining government restrictions and increased consumer confidence. “Customer payment rates continue to remain elevated, however, due to the impact of government stimulus and industry-wide forbearance measures. While this hindered loan receivables growth and yield, it supported continued strength in credit performance and led to lower provision for credit losses. “We remain focused on optimizing the key drivers of our business to drive sustainable growth, achieve strong returns, and generate and return considerable capital to our shareholders over the long-term.” | ||||||||||||||||||||||||||

| BUSINESS HIGHLIGHTS | ||||||||||||||||||||||||||

| CONTINUED TO WIN AND RENEW KEY PARTNERSHIPS | ||||||||||||||||||||||||||

•Announced a multi-year renewal with TJX Companies, Inc., further extending our 10+ year partnership, and renewed 10 additional programs, including Shop HQ, Mitchell Gold Co., Daniels, and Sutherlands •Added 4 new programs, including JCB and Ochsner Health | ||||||||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||||||

| EARNINGS GROWTH DRIVEN BY STRONG CONSUMER AS CREDIT IMPROVEMENT OFFSETS LOWER YIELD | ||||||||||||||||||||||||||

•Interest and fees on loans decreased 6% to $3.6 billion •Net interest income decreased $84 million, or 2%, to $3.3 billion, mainly due to lower finance charges and late fees. •Retailer share arrangements increased $233 million, or 30%, to $1.0 billion, reflecting the decrease in the provision for credit losses, including lower net charge-offs and program performance. •Provision for credit losses decreased $1.9 billion, or 112%, to $(194) million, driven by an $878 million reserve reduction and lower net charge-offs. •Other income decreased $6 million, or 6%, to $89 million, largely driven by higher program loyalty costs from higher purchase volume. •Other expense decreased $38 million, or 4%, to $948 million, mainly driven by lower operational losses, partially offset by higher employee, marketing and business development, and information processing costs. •Net earnings increased to $1.2 billion compared to $48 million. | ||||||||||||||||||||||||||

| CREDIT QUALITY | ||||||||||||||||||||||||||

| CREDIT PERFORMANCE CONTINUED TO BE DRIVEN BY A STRONG CONSUMER | ||||||||||||||||||||||||||

•Loans 30+ days past due as a percentage of total period-end loan receivables were 2.11% compared to 3.13% last year. •Net charge-offs as a percentage of total average loan receivables were 3.57% compared to 5.35% last year. •The allowance for credit losses as a percentage of total period-end loan receivables was 11.51%. | ||||||||||||||||||||||||||

| SALES PLATFORM HIGHLIGHTS | |||||||||||||||||||||||

| DIVERSITY ACROSS OUR PLATFORMS CONTINUES TO PROVIDE RESILIENCE | |||||||||||||||||||||||

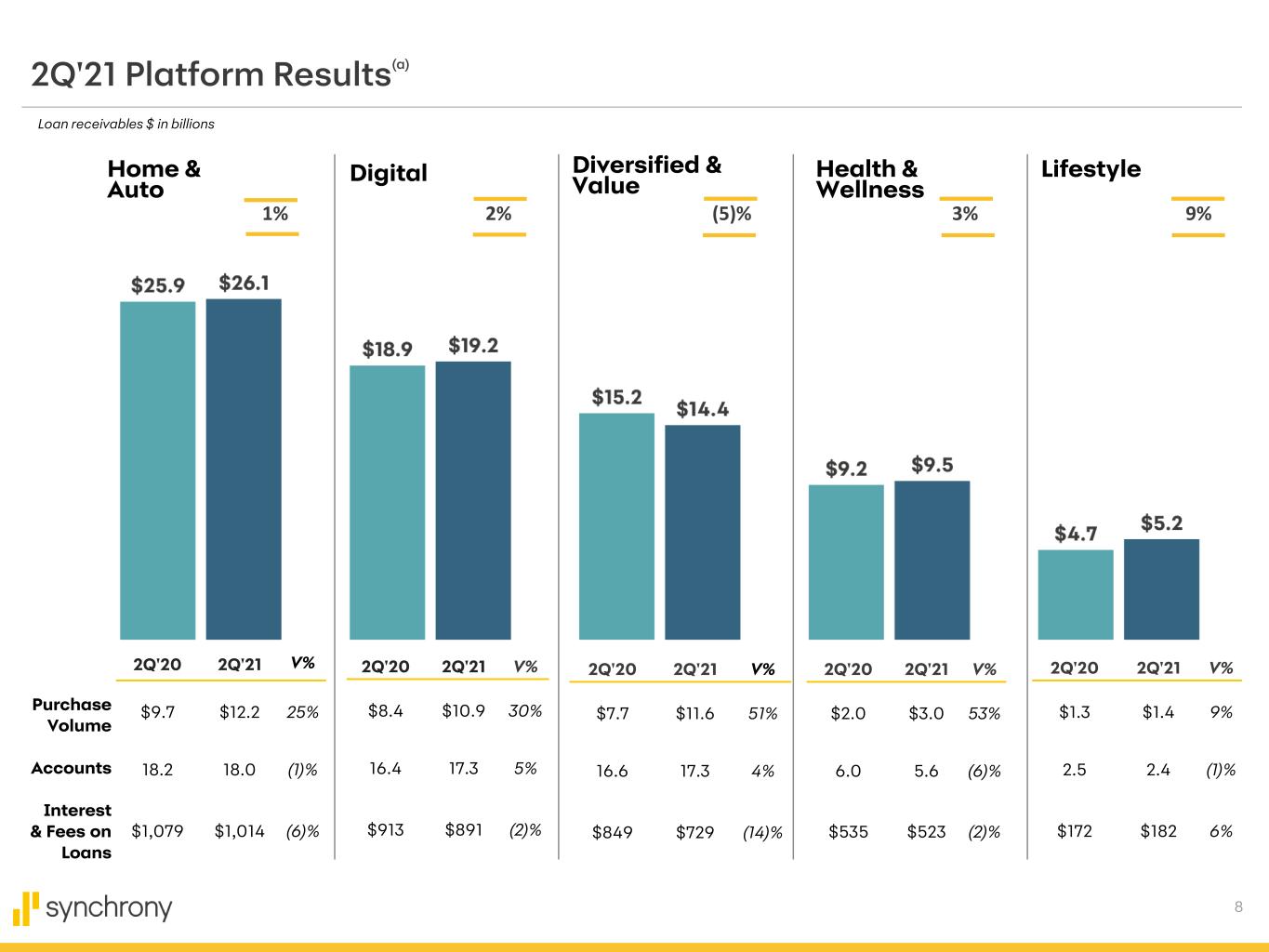

•Home & Auto period-end loan receivables increased 1% as purchase volume increased 25%, reflecting continued strength in our home partners and merchants. Interest and fees on loans decreased 6%, driven primarily by lower finance charge yield as payment rates remain elevated, and average active accounts decreased 1%. •Digital period-end loan receivables increased 2% and purchase volume increased 30%, reflecting strength in digital-based partners who have continued to be positively impacted by the effects of government restrictions on in-person retail experiences. Interest and fees on loans decreased 2%, driven primarily by lower finance charge yield as payment rates remain elevated, while average active accounts increased 5%. •Diversified & Value period-end loan receivables decreased 5% reflecting the impact of store closures in 2020, as well as prior year government restrictions and elevated payment rates. Purchase volume increased 51%, reflecting the lifting of government restrictions on in-person retail experiences. Interest and fees on loans decreased 14%, driven primarily by lower loan receivables, and average active accounts increased 4%. •Health & Wellness period-end loan receivables increased 3% and purchase volume increased 53% reflecting higher consumer confidence to undertake elective procedures, as well as the lifting of government restrictions on in-person experiences. Interest and fees on loans decreased 2%, driven primarily by lower finance charge yield as payment rates remain elevated, and average active accounts decreased 6%. •Lifestyle period-end loan receivables and purchase volume both increased 9%, reflecting continued strength in power sports. Interest and fees on loans increased 6%, driven primarily by loan receivables growth, and average active accounts decreased 1%. | |||||||||||||||||||||||

| BALANCE SHEET, LIQUIDITY & CAPITAL | |||||||||||||||||||||||

| FUNDING, CAPITAL & LIQUIDITY REMAIN ROBUST | |||||||||||||||||||||||

•Period-end loan receivables increased to $78.4 billion compared to $78.3 billion; purchase volume increased 35% and average active accounts increased 2%. •Deposits decreased $4.3 billion, or 7%, to $59.8 billion and comprised 81% of funding. •Total liquidity (liquid assets and undrawn credit facilities) of $21.2 billion, or 23.0% of total assets. •Total capital returned of $521 million, reflecting $393 million of share repurchases and $128 million of common stock dividends. •The Company has elected to defer the regulatory capital effects of CECL for two years; the estimated Common Equity Tier 1 ratio was 17.8% compared to 15.3%, and the estimated Tier 1 Capital ratio was 18.7% compared to 16.3%, reflecting our strong capital generation capabilities. | |||||||||||||||||||||||

*All comparisons are for the second quarter of 2021 compared to the second quarter of 2020, unless otherwise noted. | |||||||||||||||||||||||

| CORRESPONDING FINANCIAL TABLES AND INFORMATION | |||||||||||||||||||||||

No representation is made that the information in this news release is complete. Investors are encouraged to review the foregoing summary and discussion of Synchrony Financial's earnings and financial condition in conjunction with the detailed financial tables and information that follow and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed February 11, 2021, and the Company’s forthcoming Quarterly Report on Form 10-Q for the quarter ended June 30, 2021. The detailed financial tables and other information are also available on the Investor Relations page of the Company’s website at www.investors.synchronyfinancial.com. This information is also furnished in a Current Report on Form 8-K filed with the SEC today. | |||||||||||||||||||||||

CONFERENCE CALL AND WEBCAST | ||||||||||||||

On Tuesday, July 20, 2021, at 8:00 a.m. Eastern Time, Brian Doubles, President and Chief Executive Officer, and Brian Wenzel Sr., Executive Vice President and Chief Financial Officer, will host a conference call to review the financial results and outlook for certain business drivers. The conference call can be accessed via an audio webcast through the Investor Relations page on the Synchrony Financial corporate website, www.investors.synchronyfinancial.com, under Events and Presentations. A replay will also be available on the website. | ||||||||||||||

ABOUT SYNCHRONY FINANCIAL

Synchrony (NYSE: SYF) is a premier consumer financial services company. We deliver a wide range of specialized financing programs, as well as innovative consumer banking products, across key industries including digital, retail, home, auto, travel, health and pet. Synchrony enables our partners to grow sales and loyalty with consumers. We are one of the largest issuers of private label credit cards in the United States; we also offer co-branded products, installment loans and consumer financing products for small- and medium-sized businesses, as well as healthcare providers.

Synchrony is changing what’s possible through our digital capabilities, deep industry expertise, actionable data insights, frictionless customer experience and customized financing solutions.

For more information, visit www.synchrony.com and Twitter: @Synchrony.

| Investor Relations | Media Relations | ||||

| Kathryn Miller | Sue Bishop | ||||

| (203) 585-6291 | (203) 585-2802 | ||||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as "expects," "intends," "anticipates," "plans," "believes," "seeks," "targets," "outlook," "estimates," "will," "should," "may" or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated, including the future impacts of the novel coronavirus disease (“COVID-19”) outbreak and measures taken in response thereto for which future developments are highly uncertain and difficult to predict; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislative and regulatory developments and the impact of the Consumer Financial Protection Bureau’s regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Synchrony Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this news release and in our public filings, including under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed on February 11, 2021. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law.

NON-GAAP MEASURES

The information provided herein includes measures we refer to as "tangible common equity", and certain “CECL fully phased-in" capital measures, which are not prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). For a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures, please see the detailed financial tables and information that follow. For a statement regarding the usefulness of these measures to investors, please see the Company's Current Report on Form 8-K filed with the SEC today.

Exhibit 99.2

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL SUMMARY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, in millions, except per share statistics) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | 2Q'21 vs. 2Q'20 | Jun 30, 2021 | Jun 30, 2020 | YTD'21 vs. YTD'20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 3,312 | $ | 3,439 | $ | 3,659 | $ | 3,457 | $ | 3,396 | $ | (84) | (2.5) | % | $ | 6,751 | $ | 7,286 | $ | (535) | (7.3) | % | |||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (1,006) | (989) | (1,047) | (899) | (773) | (233) | 30.1 | % | (1,995) | (1,699) | (296) | 17.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (194) | 334 | 750 | 1,210 | 1,673 | (1,867) | (111.6) | % | 140 | 3,350 | (3,210) | (95.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, after retailer share arrangements and provision for credit losses | 2,500 | 2,116 | 1,862 | 1,348 | 950 | 1,550 | 163.2 | % | 4,616 | 2,237 | 2,379 | 106.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 89 | 131 | 82 | 131 | 95 | (6) | (6.3) | % | 220 | 192 | 28 | 14.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other expense | 948 | 932 | 1,000 | 1,067 | 986 | (38) | (3.9) | % | 1,880 | 1,988 | (108) | (5.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,641 | 1,315 | 944 | 412 | 59 | 1,582 | NM | 2,956 | 441 | 2,515 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 399 | 290 | 206 | 99 | 11 | 388 | NM | 689 | 107 | 582 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 1,242 | $ | 1,025 | $ | 738 | $ | 313 | $ | 48 | $ | 1,194 | NM | $ | 2,267 | $ | 334 | $ | 1,933 | NM | |||||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 1,232 | $ | 1,014 | $ | 728 | $ | 303 | $ | 37 | $ | 1,195 | NM | $ | 2,246 | $ | 312 | $ | 1,934 | NM | |||||||||||||||||||||||||||||||||||||||

| COMMON SHARE STATISTICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic EPS | $ | 2.13 | $ | 1.74 | $ | 1.25 | $ | 0.52 | $ | 0.06 | $ | 2.07 | NM | $ | 3.87 | $ | 0.52 | $ | 3.35 | NM | |||||||||||||||||||||||||||||||||||||||

| Diluted EPS | $ | 2.12 | $ | 1.73 | $ | 1.24 | $ | 0.52 | $ | 0.06 | $ | 2.06 | NM | $ | 3.84 | $ | 0.52 | $ | 3.32 | NM | |||||||||||||||||||||||||||||||||||||||

| Dividend declared per share | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | — | — | % | $ | 0.44 | $ | 0.44 | $ | — | — | % | |||||||||||||||||||||||||||||||||||||

| Common stock price | $ | 48.52 | $ | 40.66 | $ | 34.71 | $ | 26.17 | $ | 22.16 | $ | 26.36 | 119.0 | % | $ | 48.52 | $ | 22.16 | $ | 26.36 | 119.0 | % | |||||||||||||||||||||||||||||||||||||

| Book value per share | $ | 23.48 | $ | 21.86 | $ | 20.49 | $ | 19.47 | $ | 19.13 | $ | 4.35 | 22.7 | % | $ | 23.48 | $ | 19.13 | $ | 4.35 | 22.7 | % | |||||||||||||||||||||||||||||||||||||

Tangible common equity per share(1) | $ | 19.64 | $ | 17.95 | $ | 16.72 | $ | 15.75 | $ | 15.28 | $ | 4.36 | 28.5 | % | $ | 19.64 | $ | 15.28 | $ | 4.36 | 28.5 | % | |||||||||||||||||||||||||||||||||||||

| Beginning common shares outstanding | 581.1 | 584.0 | 583.8 | 583.7 | 583.2 | (2.1) | (0.4) | % | 584.0 | 615.9 | (31.9) | (5.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common shares | — | — | — | — | — | — | — | % | — | — | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | 1.0 | 2.2 | 0.2 | 0.1 | 0.5 | 0.5 | 100.0 | % | 3.2 | 1.4 | 1.8 | 128.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares repurchased | (8.7) | (5.1) | — | — | — | (8.7) | NM | (13.8) | (33.6) | 19.8 | (58.9) | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Ending common shares outstanding | 573.4 | 581.1 | 584.0 | 583.8 | 583.7 | (10.3) | (1.8) | % | 573.4 | 583.7 | (10.3) | (1.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding | 577.2 | 583.3 | 583.9 | 583.8 | 583.7 | (6.5) | (1.1) | % | 580.2 | 594.3 | (14.1) | (2.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding (fully diluted) | 581.7 | 587.5 | 586.6 | 584.8 | 584.4 | (2.7) | (0.5) | % | 584.6 | 595.9 | (11.3) | (1.9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| (1) Tangible Common Equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | 2Q'21 vs. 2Q'20 | Jun 30, 2021 | Jun 30, 2020 | YTD'21 vs. YTD'20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| PERFORMANCE METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on assets(1) | 5.3 | % | 4.3 | % | 3.1 | % | 1.3 | % | 0.2 | % | 5.1 | % | 4.8 | % | 0.7 | % | 4.1 | % | |||||||||||||||||||||||||||||||||||||||||

Return on equity(2) | 36.5 | % | 31.8 | % | 23.6 | % | 10.3 | % | 1.6 | % | 34.9 | % | 34.2 | % | 5.4 | % | 28.8 | % | |||||||||||||||||||||||||||||||||||||||||

Return on tangible common equity(3) | 46.3 | % | 40.8 | % | 30.4 | % | 13.1 | % | 1.6 | % | 44.7 | % | 43.6 | % | 6.7 | % | 36.9 | % | |||||||||||||||||||||||||||||||||||||||||

Net interest margin(4) | 13.78 | % | 13.98 | % | 14.64 | % | 13.80 | % | 13.53 | % | 0.25 | % | 13.88 | % | 14.35 | % | (0.47) | % | |||||||||||||||||||||||||||||||||||||||||

Efficiency ratio(5) | 39.6 | % | 36.1 | % | 37.1 | % | 39.7 | % | 36.3 | % | 3.3 | % | 37.8 | % | 34.4 | % | 3.4 | % | |||||||||||||||||||||||||||||||||||||||||

| Other expense as a % of average loan receivables, including held for sale | 4.95 | % | 4.82 | % | 5.01 | % | 5.44 | % | 5.04 | % | (0.09) | % | 4.89 | % | 4.90 | % | (0.01) | % | |||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 24.3 | % | 22.1 | % | 21.8 | % | 24.0 | % | 18.6 | % | 5.7 | % | 23.3 | % | 24.3 | % | (1.0) | % | |||||||||||||||||||||||||||||||||||||||||

| CREDIT QUALITY METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs as a % of average loan receivables, including held for sale | 3.57 | % | 3.62 | % | 3.16 | % | 4.42 | % | 5.35 | % | (1.78) | % | 3.59 | % | 5.35 | % | (1.76) | % | |||||||||||||||||||||||||||||||||||||||||

30+ days past due as a % of period-end loan receivables(6) | 2.11 | % | 2.83 | % | 3.07 | % | 2.67 | % | 3.13 | % | (1.02) | % | 2.11 | % | 3.13 | % | (1.02) | % | |||||||||||||||||||||||||||||||||||||||||

90+ days past due as a % of period-end loan receivables(6) | 1.00 | % | 1.52 | % | 1.40 | % | 1.24 | % | 1.77 | % | (0.77) | % | 1.00 | % | 1.77 | % | (0.77) | % | |||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | $ | 684 | $ | 699 | $ | 631 | $ | 866 | $ | 1,046 | $ | (362) | (34.6) | % | $ | 1,383 | $ | 2,171 | $ | (788) | (36.3) | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 30 days(6) | $ | 1,653 | $ | 2,175 | $ | 2,514 | $ | 2,100 | $ | 2,453 | $ | (800) | (32.6) | % | $ | 1,653 | $ | 2,453 | $ | (800) | (32.6) | % | |||||||||||||||||||||||||||||||||||||

Loan receivables delinquent over 90 days(6) | $ | 784 | $ | 1,170 | $ | 1,143 | $ | 973 | $ | 1,384 | $ | (600) | (43.4) | % | $ | 784 | $ | 1,384 | $ | (600) | (43.4) | % | |||||||||||||||||||||||||||||||||||||

| Allowance for credit losses (period-end) | $ | 9,023 | $ | 9,901 | $ | 10,265 | $ | 10,146 | $ | 9,802 | $ | (779) | (7.9) | % | $ | 9,023 | $ | 9,802 | $ | (779) | (7.9) | % | |||||||||||||||||||||||||||||||||||||

Allowance coverage ratio(7) | 11.51 | % | 12.88 | % | 12.54 | % | 12.92 | % | 12.52 | % | (1.01) | % | 11.51 | % | 12.52 | % | (1.01) | % | |||||||||||||||||||||||||||||||||||||||||

| BUSINESS METRICS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(8)(9) | $ | 42,121 | $ | 34,749 | $ | 39,874 | $ | 36,013 | $ | 31,155 | $ | 10,966 | 35.2 | % | $ | 76,870 | $ | 63,197 | $ | 13,673 | 21.6 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 78,374 | $ | 76,858 | $ | 81,867 | $ | 78,521 | $ | 78,313 | $ | 61 | 0.1 | % | $ | 78,374 | $ | 78,313 | $ | 61 | 0.1 | % | |||||||||||||||||||||||||||||||||||||

| Credit cards | $ | 74,429 | $ | 73,244 | $ | 78,455 | $ | 75,204 | $ | 75,353 | $ | (924) | (1.2) | % | $ | 74,429 | $ | 75,353 | $ | (924) | (1.2) | % | |||||||||||||||||||||||||||||||||||||

| Consumer installment loans | $ | 2,507 | $ | 2,319 | $ | 2,125 | $ | 1,987 | $ | 1,779 | $ | 728 | 40.9 | % | $ | 2,507 | $ | 1,779 | $ | 728 | 40.9 | % | |||||||||||||||||||||||||||||||||||||

| Commercial credit products | $ | 1,379 | $ | 1,248 | $ | 1,250 | $ | 1,270 | $ | 1,140 | $ | 239 | 21.0 | % | $ | 1,379 | $ | 1,140 | $ | 239 | 21.0 | % | |||||||||||||||||||||||||||||||||||||

| Other | $ | 59 | $ | 47 | $ | 37 | $ | 60 | $ | 41 | $ | 18 | 43.9 | % | $ | 59 | $ | 41 | $ | 18 | 43.9 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 76,821 | $ | 78,358 | $ | 79,452 | $ | 78,005 | $ | 78,697 | $ | (1,876) | (2.4) | % | $ | 77,585 | $ | 81,563 | $ | (3,978) | (4.9) | % | |||||||||||||||||||||||||||||||||||||

Period-end active accounts (in thousands)(9)(10) | 66,892 | 65,219 | 68,540 | 64,800 | 63,430 | 3,462 | 5.5 | % | 66,892 | 63,430 | 3,462 | 5.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(9)(10) | 65,810 | 66,280 | 66,261 | 64,270 | 64,836 | 974 | 1.5 | % | 66,163 | 68,401 | (2,238) | (3.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| LIQUIDITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquid assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 11,117 | $ | 16,620 | $ | 11,524 | $ | 13,552 | $ | 16,344 | $ | (5,227) | (32.0) | % | $ | 11,117 | $ | 16,344 | $ | (5,227) | (32.0) | % | |||||||||||||||||||||||||||||||||||||

| Total liquid assets | $ | 16,297 | $ | 22,636 | $ | 18,321 | $ | 21,402 | $ | 22,352 | $ | (6,055) | (27.1) | % | $ | 16,297 | $ | 22,352 | $ | (6,055) | (27.1) | % | |||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Undrawn credit facilities | $ | 4,900 | $ | 5,400 | $ | 5,400 | $ | 5,400 | $ | 5,650 | $ | (750) | (13.3) | % | $ | 4,900 | $ | 5,650 | $ | (750) | (13.3) | % | |||||||||||||||||||||||||||||||||||||

| Total liquid assets and undrawn credit facilities | $ | 21,197 | $ | 28,036 | $ | 23,721 | $ | 26,802 | $ | 28,002 | $ | (6,805) | (24.3) | % | $ | 21,197 | $ | 28,002 | $ | (6,805) | (24.3) | % | |||||||||||||||||||||||||||||||||||||

| Liquid assets % of total assets | 17.71 | % | 23.62 | % | 19.09 | % | 22.37 | % | 23.15 | % | (5.44) | % | 17.71 | % | 23.15 | % | (5.44) | % | |||||||||||||||||||||||||||||||||||||||||

| Liquid assets including undrawn credit facilities % of total assets | 23.04 | % | 29.25 | % | 24.72 | % | 28.02 | % | 29.00 | % | (5.96) | % | 23.04 | % | 29.00 | % | (5.96) | % | |||||||||||||||||||||||||||||||||||||||||

| (1) Return on assets represents net earnings as a percentage of average total assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Return on equity represents net earnings as a percentage of average total equity. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Return on tangible common equity represents net earnings available to common stockholders as a percentage of average tangible common equity. Tangible common equity ("TCE") is a non-GAAP measure. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Efficiency ratio represents (i) other expense, divided by (ii) net interest income, plus other income, less retailer share arrangements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) Based on customer statement-end balances extrapolated to the respective period-end date. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (7) Allowance coverage ratio represents allowance for credit losses divided by total period-end loan receivables. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (8) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (9) Includes activity and accounts associated with loan receivables held for sale. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (10) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF EARNINGS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | 2Q'21 vs. 2Q'20 | Jun 30, 2021 | Jun 30, 2020 | YTD'21 vs. YTD'20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 3,567 | $ | 3,732 | $ | 3,981 | $ | 3,821 | $ | 3,808 | $ | (241) | (6.3) | % | $ | 7,299 | $ | 8,148 | $ | (849) | (10.4) | % | |||||||||||||||||||||||||||||||||||||

| Interest on cash and debt securities | 11 | 10 | 12 | 16 | 22 | (11) | (50.0) | % | 21 | 89 | (68) | (76.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 3,578 | 3,742 | 3,993 | 3,837 | 3,830 | (252) | (6.6) | % | 7,320 | 8,237 | (917) | (11.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 146 | 170 | 200 | 245 | 293 | (147) | (50.2) | % | 316 | 649 | (333) | (51.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on borrowings of consolidated securitization entities | 44 | 51 | 52 | 53 | 59 | (15) | (25.4) | % | 95 | 132 | (37) | (28.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest on senior unsecured notes | 76 | 82 | 82 | 82 | 82 | (6) | (7.3) | % | 158 | 170 | (12) | (7.1) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | 266 | 303 | 334 | 380 | 434 | (168) | (38.7) | % | 569 | 951 | (382) | (40.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 3,312 | 3,439 | 3,659 | 3,457 | 3,396 | (84) | (2.5) | % | 6,751 | 7,286 | (535) | (7.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Retailer share arrangements | (1,006) | (989) | (1,047) | (899) | (773) | (233) | 30.1 | % | (1,995) | (1,699) | (296) | 17.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (194) | 334 | 750 | 1,210 | 1,673 | (1,867) | (111.6) | % | 140 | 3,350 | (3,210) | (95.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, after retailer share arrangements and provision for credit losses | 2,500 | 2,116 | 1,862 | 1,348 | 950 | 1,550 | 163.2 | % | 4,616 | 2,237 | 2,379 | 106.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interchange revenue | 223 | 171 | 185 | 172 | 134 | 89 | 66.4 | % | 394 | 295 | 99 | 33.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Debt cancellation fees | 66 | 69 | 72 | 68 | 69 | (3) | (4.3) | % | 135 | 138 | (3) | (2.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Loyalty programs | (247) | (179) | (202) | (155) | (134) | (113) | 84.3 | % | (426) | (292) | (134) | 45.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 47 | 70 | 27 | 46 | 26 | 21 | 80.8 | % | 117 | 51 | 66 | 129.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other income | 89 | 131 | 82 | 131 | 95 | (6) | (6.3) | % | 220 | 192 | 28 | 14.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other expense: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employee costs | 359 | 364 | 347 | 382 | 327 | 32 | 9.8 | % | 723 | 651 | 72 | 11.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Professional fees | 189 | 190 | 186 | 187 | 189 | — | — | % | 379 | 386 | (7) | (1.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Marketing and business development | 114 | 95 | 139 | 107 | 91 | 23 | 25.3 | % | 209 | 202 | 7 | 3.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Information processing | 137 | 131 | 128 | 125 | 116 | 21 | 18.1 | % | 268 | 239 | 29 | 12.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 149 | 152 | 200 | 266 | 263 | (114) | (43.3) | % | 301 | 510 | (209) | (41.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other expense | 948 | 932 | 1,000 | 1,067 | 986 | (38) | (3.9) | % | 1,880 | 1,988 | (108) | (5.4) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Earnings before provision for income taxes | 1,641 | 1,315 | 944 | 412 | 59 | 1,582 | NM | 2,956 | 441 | 2,515 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 399 | 290 | 206 | 99 | 11 | 388 | NM | 689 | 107 | 582 | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | $ | 1,242 | $ | 1,025 | $ | 738 | $ | 313 | $ | 48 | $ | 1,194 | NM | $ | 2,267 | $ | 334 | $ | 1,933 | NM | |||||||||||||||||||||||||||||||||||||||

| Net earnings available to common stockholders | $ | 1,232 | $ | 1,014 | $ | 728 | $ | 303 | $ | 37 | $ | 1,195 | NM | $ | 2,246 | $ | 312 | $ | 1,934 | NM | |||||||||||||||||||||||||||||||||||||||

3

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| STATEMENTS OF FINANCIAL POSITION | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Jun 30, 2021 vs. Jun 30, 2020 | |||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Cash and equivalents | $ | 11,117 | $ | 16,620 | $ | 11,524 | $ | 13,552 | $ | 16,344 | $ | (5,227) | (32.0) | % | ||||||||||||||||||||||||

| Debt securities | 5,728 | 6,550 | 7,469 | 8,432 | 6,623 | (895) | (13.5) | % | ||||||||||||||||||||||||||||||

| Loan receivables: | ||||||||||||||||||||||||||||||||||||||

| Unsecuritized loans held for investment | 55,994 | 53,823 | 56,472 | 52,613 | 52,629 | 3,365 | 6.4 | % | ||||||||||||||||||||||||||||||

| Restricted loans of consolidated securitization entities | 22,380 | 23,035 | 25,395 | 25,908 | 25,684 | (3,304) | (12.9) | % | ||||||||||||||||||||||||||||||

| Total loan receivables | 78,374 | 76,858 | 81,867 | 78,521 | 78,313 | 61 | 0.1 | % | ||||||||||||||||||||||||||||||

| Less: Allowance for credit losses | (9,023) | (9,901) | (10,265) | (10,146) | (9,802) | 779 | (7.9) | % | ||||||||||||||||||||||||||||||

| Loan receivables, net | 69,351 | 66,957 | 71,602 | 68,375 | 68,511 | 840 | 1.2 | % | ||||||||||||||||||||||||||||||

| Loan receivables held for sale | — | 23 | 5 | 4 | 4 | (4) | (100.0) | % | ||||||||||||||||||||||||||||||

| Goodwill | 1,105 | 1,104 | 1,078 | 1,078 | 1,078 | 27 | 2.5 | % | ||||||||||||||||||||||||||||||

| Intangible assets, net | 1,098 | 1,169 | 1,125 | 1,091 | 1,166 | (68) | (5.8) | % | ||||||||||||||||||||||||||||||

| Other assets | 3,618 | 3,431 | 3,145 | 3,126 | 2,818 | 800 | 28.4 | % | ||||||||||||||||||||||||||||||

| Total assets | $ | 92,017 | $ | 95,854 | $ | 95,948 | $ | 95,658 | $ | 96,544 | $ | (4,527) | (4.7) | % | ||||||||||||||||||||||||

| Liabilities and Equity | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 59,500 | $ | 62,419 | $ | 62,469 | $ | 63,195 | $ | 63,857 | $ | (4,357) | (6.8) | % | ||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 341 | 342 | 313 | 298 | 291 | 50 | 17.2 | % | ||||||||||||||||||||||||||||||

| Total deposits | 59,841 | 62,761 | 62,782 | 63,493 | 64,148 | (4,307) | (6.7) | % | ||||||||||||||||||||||||||||||

| Borrowings: | ||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 6,987 | 7,193 | 7,810 | 7,809 | 8,109 | (1,122) | (13.8) | % | ||||||||||||||||||||||||||||||

| Senior unsecured notes | 6,470 | 7,967 | 7,965 | 7,962 | 7,960 | (1,490) | (18.7) | % | ||||||||||||||||||||||||||||||

| Total borrowings | 13,457 | 15,160 | 15,775 | 15,771 | 16,069 | (2,612) | (16.3) | % | ||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 4,522 | 4,494 | 4,690 | 4,295 | 4,428 | 94 | 2.1 | % | ||||||||||||||||||||||||||||||

| Total liabilities | 77,820 | 82,415 | 83,247 | 83,559 | 84,645 | (6,825) | (8.1) | % | ||||||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||

| Preferred stock | 734 | 734 | 734 | 734 | 734 | — | — | % | ||||||||||||||||||||||||||||||

| Common stock | 1 | 1 | 1 | 1 | 1 | — | — | % | ||||||||||||||||||||||||||||||

| Additional paid-in capital | 9,620 | 9,592 | 9,570 | 9,552 | 9,532 | 88 | 0.9 | % | ||||||||||||||||||||||||||||||

| Retained earnings | 12,560 | 11,470 | 10,621 | 10,024 | 9,852 | 2,708 | 27.5 | % | ||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (56) | (56) | (51) | (31) | (37) | (19) | 51.4 | % | ||||||||||||||||||||||||||||||

| Treasury stock | (8,662) | (8,302) | (8,174) | (8,181) | (8,183) | (479) | 5.9 | % | ||||||||||||||||||||||||||||||

| Total equity | 14,197 | 13,439 | 12,701 | 12,099 | 11,899 | 2,298 | 19.3 | % | ||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 92,017 | $ | 95,854 | $ | 95,948 | $ | 95,658 | $ | 96,544 | $ | (4,527) | (4.7) | % | ||||||||||||||||||||||||

4

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | Interest | Average | Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | Balance | Expense | Rate | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 13,584 | $ | 4 | 0.12 | % | $ | 14,610 | $ | 4 | 0.11 | % | $ | 11,244 | $ | 4 | 0.14 | % | $ | 13,664 | $ | 4 | 0.12 | % | $ | 15,413 | $ | 3 | 0.08 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities available for sale | 5,988 | 7 | 0.47 | % | 6,772 | 6 | 0.36 | % | 8,706 | 8 | 0.37 | % | 7,984 | 12 | 0.60 | % | 6,804 | 19 | 1.12 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit cards | 72,989 | 3,484 | 19.15 | % | 74,865 | 3,657 | 19.81 | % | 76,039 | 3,908 | 20.45 | % | 74,798 | 3,752 | 19.96 | % | 75,942 | 3,740 | 19.81 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer installment loans | 2,417 | 59 | 9.79 | % | 2,219 | 53 | 9.69 | % | 2,057 | 50 | 9.67 | % | 1,892 | 46 | 9.67 | % | 1,546 | 37 | 9.63 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial credit products | 1,363 | 23 | 6.77 | % | 1,231 | 21 | 6.92 | % | 1,293 | 23 | 7.08 | % | 1,238 | 22 | 7.07 | % | 1,150 | 30 | 10.49 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 52 | 1 | NM | 43 | 1 | NM | 63 | — | — | % | 77 | 1 | NM | 59 | 1 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 76,821 | 3,567 | 18.62 | % | 78,358 | 3,732 | 19.32 | % | 79,452 | 3,981 | 19.93 | % | 78,005 | 3,821 | 19.49 | % | 78,697 | 3,808 | 19.46 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 96,393 | 3,578 | 14.89 | % | 99,740 | 3,742 | 15.22 | % | 99,402 | 3,993 | 15.98 | % | 99,653 | 3,837 | 15.32 | % | 100,914 | 3,830 | 15.26 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 1,559 | 1,635 | 1,525 | 1,489 | 1,486 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (9,801) | (10,225) | (10,190) | (9,823) | (9,221) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 5,238 | 5,305 | 5,228 | 5,021 | 4,779 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (3,004) | (3,285) | (3,437) | (3,313) | (2,956) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 93,389 | $ | 96,455 | $ | 95,965 | $ | 96,340 | $ | 97,958 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 60,761 | $ | 146 | 0.96 | % | $ | 62,724 | $ | 170 | 1.10 | % | $ | 62,800 | $ | 200 | 1.27 | % | $ | 63,569 | $ | 245 | 1.53 | % | $ | 64,298 | $ | 293 | 1.83 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,149 | 44 | 2.47 | % | 7,694 | 51 | 2.69 | % | 7,809 | 52 | 2.65 | % | 8,057 | 53 | 2.62 | % | 8,863 | 59 | 2.68 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior unsecured notes | 7,276 | 76 | 4.19 | % | 7,965 | 82 | 4.18 | % | 7,963 | 82 | 4.10 | % | 7,960 | 82 | 4.10 | % | 7,958 | 82 | 4.14 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 75,186 | 266 | 1.42 | % | 78,383 | 303 | 1.57 | % | 78,572 | 334 | 1.69 | % | 79,586 | 380 | 1.90 | % | 81,119 | 434 | 2.15 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 349 | 346 | 308 | 307 | 309 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 4,199 | 4,655 | 4,663 | 4,308 | 4,349 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 4,548 | 5,001 | 4,971 | 4,615 | 4,658 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 79,734 | 83,384 | 83,543 | 84,201 | 85,777 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total equity | 13,655 | 13,071 | 12,422 | 12,139 | 12,181 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 93,389 | $ | 96,455 | $ | 95,965 | $ | 96,340 | $ | 97,958 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 3,312 | $ | 3,439 | $ | 3,659 | $ | 3,457 | $ | 3,396 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest rate spread(1) | 13.47 | % | 13.65 | % | 14.29 | % | 13.42 | % | 13.11 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(2) | 13.78 | % | 13.98 | % | 14.64 | % | 13.80 | % | 13.53 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||

| AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST MARGIN | |||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||

| Six Months Ended Jun 30, 2021 | Six Months Ended Jun 30, 2020 | ||||||||||||||||||||||||||||||||||

| Interest | Average | Interest | Average | ||||||||||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | ||||||||||||||||||||||||||||||

| Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Interest-earning cash and equivalents | $ | 14,094 | $ | 8 | 0.11 | % | $ | 14,158 | $ | 45 | 0.64 | % | |||||||||||||||||||||||

| Securities available for sale | 6,378 | 13 | 0.41 | % | 6,379 | 44 | 1.39 | % | |||||||||||||||||||||||||||

| Loan receivables, including held for sale: | |||||||||||||||||||||||||||||||||||

| Credit cards | 73,921 | 7,141 | 19.48 | % | 78,830 | 8,012 | 20.44 | % | |||||||||||||||||||||||||||

| Consumer installment loans | 2,319 | 112 | 9.74 | % | 1,489 | 72 | 9.72 | % | |||||||||||||||||||||||||||

| Commercial credit products | 1,297 | 44 | 6.84 | % | 1,196 | 63 | 10.59 | % | |||||||||||||||||||||||||||

| Other | 48 | 2 | 8.40 | % | 48 | 1 | 4.19 | % | |||||||||||||||||||||||||||

| Total loan receivables, including held for sale | 77,585 | 7,299 | 18.97 | % | 81,563 | 8,148 | 20.09 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 98,057 | 7,320 | 15.05 | % | 102,100 | 8,237 | 16.22 | % | |||||||||||||||||||||||||||

| Non-interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Cash and due from banks | 1,597 | 1,468 | |||||||||||||||||||||||||||||||||

| Allowance for loan losses | (10,012) | (8,965) | |||||||||||||||||||||||||||||||||

| Other assets | 5,272 | 4,737 | |||||||||||||||||||||||||||||||||

| Total non-interest-earning assets | (3,143) | (2,760) | |||||||||||||||||||||||||||||||||

| Total assets | $ | 94,914 | $ | 99,340 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing deposit accounts | $ | 61,737 | $ | 316 | 1.03 | % | $ | 64,332 | $ | 649 | 2.03 | % | |||||||||||||||||||||||

| Borrowings of consolidated securitization entities | 7,420 | 95 | 2.58 | % | 9,425 | 132 | 2.82 | % | |||||||||||||||||||||||||||

| Senior unsecured notes | 7,619 | 158 | 4.18 | % | 8,382 | 170 | 4.08 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 76,776 | 569 | 1.49 | % | 82,139 | 951 | 2.33 | % | |||||||||||||||||||||||||||

| Non-interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

| Non-interest-bearing deposit accounts | 348 | 304 | |||||||||||||||||||||||||||||||||

| Other liabilities | 4,425 | 4,511 | |||||||||||||||||||||||||||||||||

| Total non-interest-bearing liabilities | 4,773 | 4,815 | |||||||||||||||||||||||||||||||||

| Total liabilities | 81,549 | 86,954 | |||||||||||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||||||||

| Total equity | 13,365 | 12,386 | |||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 94,914 | $ | 99,340 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 6,751 | $ | 7,286 | |||||||||||||||||||||||||||||||

Interest rate spread(1) | 13.56 | % | 13.89 | % | |||||||||||||||||||||||||||||||

Net interest margin(2) | 13.88 | % | 14.35 | % | |||||||||||||||||||||||||||||||

| (1) Interest rate spread represents the difference between the yield on total interest-earning assets and the rate on total interest-bearing liabilities. | |||||||||||||||||||||||||||||||||||

| (2) Net interest margin represents net interest income divided by average interest-earning assets. | |||||||||||||||||||||||||||||||||||

6

| SYNCHRONY FINANCIAL | ||||||||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | ||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Jun 30, 2021 vs. Jun 30, 2020 | |||||||||||||||||||||||||||||||||

| BALANCE SHEET STATISTICS | ||||||||||||||||||||||||||||||||||||||

| Total common equity | $ | 13,463 | $ | 12,705 | $ | 11,967 | $ | 11,365 | $ | 11,165 | $ | 2,298 | 20.6 | % | ||||||||||||||||||||||||

| Total common equity as a % of total assets | 14.63 | % | 13.25 | % | 12.47 | % | 11.88 | % | 11.56 | % | 3.07 | % | ||||||||||||||||||||||||||

| Tangible assets | $ | 89,814 | $ | 93,581 | $ | 93,745 | $ | 93,489 | $ | 94,300 | $ | (4,486) | (4.8) | % | ||||||||||||||||||||||||

Tangible common equity(1) | $ | 11,260 | $ | 10,432 | $ | 9,764 | $ | 9,196 | $ | 8,921 | $ | 2,339 | 26.2 | % | ||||||||||||||||||||||||

Tangible common equity as a % of tangible assets(1) | 12.54 | % | 11.15 | % | 10.42 | % | 9.84 | % | 9.46 | % | 3.08 | % | ||||||||||||||||||||||||||

Tangible common equity per share(1) | $ | 19.64 | $ | 17.95 | $ | 16.72 | $ | 15.75 | $ | 15.28 | $ | 4.36 | 28.5 | % | ||||||||||||||||||||||||

REGULATORY CAPITAL RATIOS(2)(3) | ||||||||||||||||||||||||||||||||||||||

| Basel III - CECL Transition | ||||||||||||||||||||||||||||||||||||||

Total risk-based capital ratio(4) | 20.1 | % | 19.7 | % | 18.1 | % | 18.1 | % | 17.6 | % | ||||||||||||||||||||||||||||

Tier 1 risk-based capital ratio(5) | 18.7 | % | 18.3 | % | 16.8 | % | 16.7 | % | 16.3 | % | ||||||||||||||||||||||||||||

Tier 1 leverage ratio(6) | 15.6 | % | 14.5 | % | 14.0 | % | 13.3 | % | 12.7 | % | ||||||||||||||||||||||||||||

| Common equity Tier 1 capital ratio | 17.8 | % | 17.4 | % | 15.9 | % | 15.8 | % | 15.3 | % | ||||||||||||||||||||||||||||

| (1) Tangible common equity ("TCE") is a non-GAAP measure. We believe TCE is a more meaningful measure of the net asset value of the Company to investors. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of Non-GAAP Measures and Calculations of Regulatory Measures. | ||||||||||||||||||||||||||||||||||||||

| (2) Regulatory capital ratios at June 30, 2021 are preliminary and therefore subject to change. | ||||||||||||||||||||||||||||||||||||||

| (3) Capital ratios starting March 31, 2020 reflect election to delay for two years an estimate of CECL’s effect on regulatory capital in accordance with the interim final rule issued by U.S. banking agencies in March 2020. | ||||||||||||||||||||||||||||||||||||||

| (4) Total risk-based capital ratio is the ratio of total risk-based capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (5) Tier 1 risk-based capital ratio is the ratio of Tier 1 capital divided by risk-weighted assets. | ||||||||||||||||||||||||||||||||||||||

| (6) Tier 1 leverage ratio is the ratio of Tier 1 capital divided by total average assets, after certain adjustments. Tier 1 leverage ratios are based upon the use of daily averages for all periods presented. | ||||||||||||||||||||||||||||||||||||||

7

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PLATFORM RESULTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited, $ in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | 2Q'21 vs. 2Q'20 | Jun 30, 2021 | Jun 30, 2020 | YTD'21 vs. YTD'20 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| HOME & AUTO | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 12,209 | $ | 9,915 | $ | 10,327 | $ | 10,653 | $ | 9,729 | $ | 2,480 | 25.5 | % | $ | 22,124 | $ | 18,833 | $ | 3,291 | 17.5 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 26,111 | $ | 25,456 | $ | 26,494 | $ | 26,202 | $ | 25,875 | $ | 236 | 0.9 | % | $ | 26,111 | $ | 25,875 | $ | 236 | 0.9 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 25,624 | $ | 25,785 | $ | 26,214 | $ | 25,908 | $ | 25,792 | $ | (168) | (0.7) | % | $ | 25,704 | $ | 26,396 | $ | (692) | (2.6) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) | 17,958 | 17,808 | 18,119 | 18,127 | 18,213 | (255) | (1.4) | % | 17,906 | 18,465 | (559) | (3.0) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 1,014 | $ | 1,059 | $ | 1,147 | $ | 1,114 | $ | 1,079 | $ | (65) | (6.0) | % | $ | 2,073 | $ | 2,250 | $ | (177) | (7.9) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 15 | $ | 15 | $ | 12 | $ | 14 | $ | 20 | $ | (5) | (25.0) | % | $ | 30 | $ | 32 | $ | (2) | (6.3) | % | |||||||||||||||||||||||||||||||||||||

| DIGITAL | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 10,930 | $ | 9,340 | $ | 11,005 | $ | 9,038 | $ | 8,439 | $ | 2,491 | 29.5 | % | $ | 20,270 | $ | 15,833 | $ | 4,437 | 28.0 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 19,233 | $ | 18,907 | $ | 20,427 | $ | 18,922 | $ | 18,945 | $ | 288 | 1.5 | % | $ | 19,233 | $ | 18,945 | $ | 288 | 1.5 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 18,783 | $ | 19,437 | $ | 19,392 | $ | 18,807 | $ | 19,062 | $ | (279) | (1.5) | % | $ | 19,108 | $ | 19,408 | $ | (300) | (1.5) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) | 17,258 | 17,318 | 16,898 | 16,440 | 16,414 | 844 | 5.1 | % | 17,298 | 16,462 | 836 | 5.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 891 | $ | 903 | $ | 976 | $ | 915 | $ | 913 | $ | (22) | (2.4) | % | $ | 1,794 | $ | 1,910 | $ | (116) | (6.1) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | (28) | $ | (12) | $ | (26) | $ | (16) | $ | (8) | $ | (20) | 250.0 | % | $ | (40) | $ | (12) | $ | (28) | 233.3 | % | |||||||||||||||||||||||||||||||||||||

| DIVERSIFIED & VALUE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 11,618 | $ | 9,220 | $ | 11,267 | $ | 9,634 | $ | 7,683 | $ | 3,935 | 51.2 | % | $ | 20,838 | $ | 17,084 | $ | 3,754 | 22.0 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 14,357 | $ | 14,217 | $ | 15,761 | $ | 14,825 | $ | 15,177 | $ | (820) | (5.4) | % | $ | 14,357 | $ | 15,177 | $ | (820) | (5.4) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 14,101 | $ | 14,574 | $ | 15,024 | $ | 14,919 | $ | 15,425 | $ | (1,324) | (8.6) | % | $ | 14,336 | $ | 16,485 | $ | (2,149) | (13.0) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) | 17,301 | 17,457 | 17,324 | 16,307 | 16,626 | 675 | 4.1 | % | 17,446 | 18,806 | (1,360) | (7.2) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 729 | $ | 789 | $ | 822 | $ | 809 | $ | 849 | $ | (120) | (14.1) | % | $ | 1,518 | $ | 1,897 | $ | (379) | (20.0) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | (2) | $ | 5 | $ | 20 | $ | 38 | $ | 17 | $ | (19) | (111.8) | % | $ | 3 | $ | 32 | $ | (29) | (90.6) | % | |||||||||||||||||||||||||||||||||||||

| HEALTH & WELLNESS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 2,988 | $ | 2,648 | $ | 2,676 | $ | 2,738 | $ | 1,952 | $ | 1,036 | 53.1 | % | $ | 5,636 | $ | 4,611 | $ | 1,025 | 22.2 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 9,515 | $ | 9,317 | $ | 9,580 | $ | 9,368 | $ | 9,222 | $ | 293 | 3.2 | % | $ | 9,515 | $ | 9,222 | $ | 293 | 3.2 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 9,334 | $ | 9,442 | $ | 9,476 | $ | 9,245 | $ | 9,387 | $ | (53) | (0.6) | % | $ | 9,387 | $ | 9,823 | $ | (436) | (4.4) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) | 5,585 | 5,706 | 5,724 | 5,708 | 5,966 | (381) | (6.4) | % | 5,642 | 6,153 | (511) | (8.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 523 | $ | 558 | $ | 589 | $ | 552 | $ | 535 | $ | (12) | (2.2) | % | $ | 1,081 | $ | 1,132 | $ | (51) | (4.5) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 36 | $ | 40 | $ | 27 | $ | 32 | $ | 23 | $ | 13 | 56.5 | % | $ | 76 | $ | 48 | $ | 28 | 58.3 | % | |||||||||||||||||||||||||||||||||||||

| LIFESTYLE | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1) | $ | 1,405 | $ | 1,154 | $ | 1,383 | $ | 1,267 | $ | 1,286 | $ | 119 | 9.3 | % | $ | 2,559 | $ | 2,283 | $ | 276 | 12.1 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 5,158 | $ | 4,988 | $ | 5,098 | $ | 4,842 | $ | 4,718 | $ | 440 | 9.3 | % | $ | 5,158 | $ | 4,718 | $ | 440 | 9.3 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 5,050 | $ | 5,003 | $ | 4,920 | $ | 4,771 | $ | 4,551 | $ | 499 | 11.0 | % | $ | 5,027 | $ | 4,607 | $ | 420 | 9.1 | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(3) | 2,442 | 2,573 | 2,536 | 2,404 | 2,462 | (20) | (0.8) | % | 2,510 | 2,634 | (124) | (4.7) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 182 | $ | 181 | $ | 187 | $ | 180 | $ | 172 | $ | 10 | 5.8 | % | $ | 363 | $ | 367 | $ | (4) | (1.1) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 6 | $ | 5 | $ | 6 | $ | 5 | $ | 4 | $ | 2 | 50.0 | % | $ | 11 | $ | 9 | $ | 2 | 22.2 | % | |||||||||||||||||||||||||||||||||||||

CORP, OTHER(4) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1)(2) | $ | 2,971 | $ | 2,472 | $ | 3,216 | $ | 2,683 | $ | 2,066 | $ | 905 | 43.8 | % | $ | 5,443 | $ | 4,553 | $ | 890 | 19.5 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 4,000 | $ | 3,973 | $ | 4,507 | $ | 4,362 | $ | 4,376 | $ | (376) | (8.6) | % | $ | 4,000 | $ | 4,376 | $ | (376) | (8.6) | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 3,929 | $ | 4,117 | $ | 4,426 | $ | 4,355 | $ | 4,480 | $ | (551) | (12.3) | % | $ | 4,023 | $ | 4,844 | $ | (821) | (16.9) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2)(3) | 5,266 | 5,418 | 5,660 | 5,284 | 5,155 | 111 | 2.2 | % | 5,361 | 5,881 | (520) | (8.8) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 228 | $ | 242 | $ | 260 | $ | 251 | $ | 260 | $ | (32) | (12.3) | % | $ | 470 | $ | 592 | $ | (122) | (20.6) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 62 | $ | 78 | $ | 43 | $ | 58 | $ | 39 | $ | 23 | 59.0 | % | $ | 140 | $ | 83 | $ | 57 | 68.7 | % | |||||||||||||||||||||||||||||||||||||

| TOTAL SYF | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Purchase volume(1)(2) | $ | 42,121 | $ | 34,749 | $ | 39,874 | $ | 36,013 | $ | 31,155 | $ | 10,966 | 35.2 | % | $ | 76,870 | $ | 63,197 | $ | 13,673 | 21.6 | % | |||||||||||||||||||||||||||||||||||||

| Period-end loan receivables | $ | 78,374 | $ | 76,858 | $ | 81,867 | $ | 78,521 | $ | 78,313 | $ | 61 | 0.1 | % | $ | 78,374 | $ | 78,313 | $ | 61 | 0.1 | % | |||||||||||||||||||||||||||||||||||||

| Average loan receivables, including held for sale | $ | 76,821 | $ | 78,358 | $ | 79,452 | $ | 78,005 | $ | 78,697 | $ | (1,876) | (2.4) | % | $ | 77,585 | $ | 81,563 | $ | (3,978) | (4.9) | % | |||||||||||||||||||||||||||||||||||||

Average active accounts (in thousands)(2)(3) | 65,810 | 66,280 | 66,261 | 64,270 | 64,836 | 974 | 1.5 | % | 66,163 | 68,401 | (2,238) | (3.3) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 3,567 | $ | 3,732 | $ | 3,981 | $ | 3,821 | $ | 3,808 | $ | (241) | (6.3) | % | $ | 7,299 | $ | 8,148 | $ | (849) | (10.4) | % | |||||||||||||||||||||||||||||||||||||

| Other income | $ | 89 | $ | 131 | $ | 82 | $ | 131 | $ | 95 | $ | (6) | (6.3) | % | $ | 220 | $ | 192 | $ | 28 | 14.6 | % | |||||||||||||||||||||||||||||||||||||

| (1) Purchase volume, or net credit sales, represents the aggregate amount of charges incurred on credit cards or other credit product accounts less returns during the period. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Includes activity and balances associated with loan receivables held for sale. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Active accounts represent credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Includes activity and balances associated with our program agreement with GAP Inc. which is scheduled to expire in April 2022. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8

| SYNCHRONY FINANCIAL | |||||||||||||||||||||||||||||

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF REGULATORY MEASURES(1) | |||||||||||||||||||||||||||||

| (unaudited, $ in millions, except per share statistics) | |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| Jun 30, 2021 | Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | |||||||||||||||||||||||||

COMMON EQUITY AND REGULATORY CAPITAL MEASURES(2) | |||||||||||||||||||||||||||||

| GAAP Total equity | $ | 14,197 | $ | 13,439 | $ | 12,701 | $ | 12,099 | $ | 11,899 | |||||||||||||||||||

| Less: Preferred stock | (734) | (734) | (734) | (734) | (734) | ||||||||||||||||||||||||

| Less: Goodwill | (1,105) | (1,104) | (1,078) | (1,078) | (1,078) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (1,098) | (1,169) | (1,125) | (1,091) | (1,166) | ||||||||||||||||||||||||

| Tangible common equity | $ | 11,260 | $ | 10,432 | $ | 9,764 | $ | 9,196 | $ | 8,921 | |||||||||||||||||||

| Add: CECL transition amount | 2,376 | 2,595 | 2,686 | 2,656 | 2,570 | ||||||||||||||||||||||||

| Adjustments for certain deferred tax liabilities and certain items in accumulated comprehensive income (loss) | 301 | 354 | 341 | 305 | 302 | ||||||||||||||||||||||||

| Common equity Tier 1 | $ | 13,937 | $ | 13,381 | $ | 12,791 | $ | 12,157 | $ | 11,793 | |||||||||||||||||||

| Preferred stock | 734 | 734 | 734 | 734 | 734 | ||||||||||||||||||||||||

| Tier 1 capital | $ | 14,671 | $ | 14,115 | $ | 13,525 | $ | 12,891 | $ | 12,527 | |||||||||||||||||||

| Add: Allowance for credit losses includible in risk-based capital | 1,039 | 1,031 | 1,079 | 1,034 | 1,031 | ||||||||||||||||||||||||

| Total Risk-based capital | $ | 15,710 | $ | 15,146 | $ | 14,604 | $ | 13,925 | $ | 13,558 | |||||||||||||||||||

ASSET MEASURES(2) | |||||||||||||||||||||||||||||

| Total average assets | $ | 93,389 | $ | 96,455 | $ | 95,965 | $ | 96,340 | $ | 97,958 | |||||||||||||||||||

| Adjustments for: | |||||||||||||||||||||||||||||

| Add: CECL transition amount | 2,376 | 2,595 | 2,686 | 2,656 | 2,570 | ||||||||||||||||||||||||

| Disallowed goodwill and other disallowed intangible assets (net of related deferred tax liabilities) and other | (1,965) | (1,987) | (1,924) | (1,906) | (1,980) | ||||||||||||||||||||||||

| Total assets for leverage purposes | $ | 93,800 | $ | 97,063 | $ | 96,727 | $ | 97,090 | $ | 98,548 | |||||||||||||||||||

| Risk-weighted assets | $ | 78,281 | $ | 76,965 | $ | 80,561 | $ | 76,990 | $ | 77,048 | |||||||||||||||||||

| CECL FULLY PHASED-IN CAPITAL MEASURES | |||||||||||||||||||||||||||||

| Tier 1 capital | $ | 14,671 | $ | 14,115 | $ | 13,525 | $ | 12,891 | $ | 12,527 | |||||||||||||||||||

| Less: CECL transition adjustment | (2,376) | (2,595) | (2,686) | (2,656) | (2,570) | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) | $ | 12,295 | $ | 11,520 | $ | 10,839 | $ | 10,235 | $ | 9,957 | |||||||||||||||||||

| Add: Allowance for credit losses | 9,023 | 9,901 | 10,265 | 10,146 | 9,802 | ||||||||||||||||||||||||

| Tier 1 capital (CECL fully phased-in) + Reserves for credit losses | $ | 21,318 | $ | 21,421 | $ | 21,104 | $ | 20,381 | $ | 19,759 | |||||||||||||||||||

| Risk-weighted assets | $ | 78,281 | $ | 76,965 | $ | 80,561 | $ | 76,990 | $ | 77,048 | |||||||||||||||||||

| Less: CECL transition adjustment | (2,166) | (2,386) | (2,477) | (2,447) | (2,361) | ||||||||||||||||||||||||

| Risk-weighted assets (CECL fully phased-in) | $ | 76,115 | $ | 74,579 | $ | 78,084 | $ | 74,543 | $ | 74,687 | |||||||||||||||||||

| TANGIBLE COMMON EQUITY PER SHARE | |||||||||||||||||||||||||||||

| GAAP book value per share | $ | 23.48 | $ | 21.86 | $ | 20.49 | $ | 19.47 | $ | 19.13 | |||||||||||||||||||

| Less: Goodwill | (1.93) | (1.90) | (1.85) | (1.85) | (1.85) | ||||||||||||||||||||||||

| Less: Intangible assets, net | (1.91) | (2.01) | (1.92) | (1.87) | (2.00) | ||||||||||||||||||||||||

| Tangible common equity per share | $ | 19.64 | $ | 17.95 | $ | 16.72 | $ | 15.75 | $ | 15.28 | |||||||||||||||||||

| (1) Regulatory measures at June 30, 2021 are presented on an estimated basis. | |||||||||||||||||||||||||||||

| (2) Capital ratios starting March 31, 2020 reflect election to delay for two years an estimate of CECL’s effect on regulatory capital in accordance with the interim final rule issued by U.S. banking agencies in March 2020. | |||||||||||||||||||||||||||||

9

2Q'21 FINANCIAL RESULTS July 20, 2021 Exhibit 99.3

2 Cautionary Statement Regarding Forward-Looking Statements The following slides are part of a presentation by Synchrony Financial in connection with reporting quarterly financial results. No representation is made that the information in these slides is complete. For additional information, see the earnings release and financial supplement included as exhibits to our Current Report on Form 8-K filed today and available on our website (www.synchronyfinancial.com) and the SEC's website (www.sec.gov). All references to net earnings and net income are intended to have the same meaning. All comparisons are for the second quarter of 2021 compared to the second quarter of 2020, unless otherwise noted. This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as "expects," "intends," "anticipates," "plans," "believes," "seeks," "targets," "outlook," "estimates," "will," "should," "may" or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward- looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated, including the future impacts of the novel coronavirus disease (“COVID-19”) outbreak and measures taken in response thereto for which future developments are highly uncertain and difficult to predict; retaining existing partners and attracting new partners, concentration of our revenue in a small number of partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or sub-service our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and other legislative and regulatory developments and the impact of the Consumer Financial Protection Bureau’s (the “CFPB”) regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed on February 11, 2021. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Disclaimers

3 $2.12 DILUTED EPS compared to $0.06 13.78% NET INTEREST MARGIN compared to 13.53% 17.8% CET1 liquid assets of $16.3 billion, 17.7% of total assets SUMMARY FINANCIAL METRICS CAPITAL 2Q'21 Financial Highlights $78.4 billion LOAN RECEIVABLES compared to $78.3 billion $59.8 billion DEPOSITS 81% of current funding 3.57% NET CHARGE-OFFS compared to 5.35% 65.8 million AVERAGE ACTIVE ACCOUNTS compared to 64.8 million $521 million CAPITAL RETURNED YTD returned $849 million, $593 million share repurchases 39.6% EFFICIENCY RATIO compared to 36.3%

4 ~65% 2Q'21 Business Highlights PARTNER EXPANSION CONSUMER PERFORMANCE DIGITAL 58% 33% (4)% New Accounts(a) Purchase Volume per Account (b) Average Balance per Account (c) ~45% ONLINE SALES* *Excluding Health & Wellness DIGITAL APPLICATIONS ~35% MOBILE CHANNEL APPLICATIONS DIGITAL PAYMENTS* *2Q'21 % of Total Payments ~55%