Form 8-K SolarWinds Corp For: Apr 13

Exhibit 99.1

SolarWinds Announces First Quarter 2021 Preliminary Financial Results

AUSTIN, Texas - April 13, 2021 - SolarWinds Corporation (NYSE: SWI), a leading provider of powerful and affordable IT management software, today announced certain preliminary financial results for its first quarter ended March 31, 2021. The Company plans to report its full first quarter 2021 financial results on Thursday, April 29, 2021.

Recent Financial Results (Preliminary and Unaudited)

Set forth below are preliminary estimates of selected unaudited financial information for the three months ended March 31, 2021 and actual selected unaudited financial results for the three months ended March 31, 2020. The following information reflects the company's preliminary estimates based on currently available information and is subject to change.

After an initial review of its first quarter 2021 financial performance, SolarWinds expects to report:

On a GAAP basis:

•Total revenue in the range of $255.8 million to $256.8 million, representing approximately 4% year-over-year growth, and consisting of:

◦Core IT Management revenue in the range of $173.1 million to $173.9 million, representing a consistent year-over-year performance.

◦N-able revenue in the range of $82.7 million to $82.9 million, representing 13% year-over-year growth.

•Net loss for the first quarter in the range of $16.6 million to $16.9 million.

On a non-GAAP basis:

•Total non-GAAP revenue in the range of $255.9 million to $256.9 million, representing approximately 3% year-over-year growth, and consisting of:

◦Core IT Management non-GAAP revenue in the range of $173.2 million to $174.0 million, representing a decline of 1% year-over-year.

◦N-able revenue in the range of $82.7 million to $82.9 million, representing 13% year-over-year growth.

•Adjusted EBITDA in the range of $103.0 million to $106.0 million, representing an adjusted EBITDA margin of approximately 40% to 41%.

“We are pleased with our preliminary first quarter financial results, which exceeded the high end of our previously provided outlook with respect to both non-GAAP total revenue and adjusted EBITDA,” said Sudhakar Ramakrishna, president and Chief Executive Officer, SolarWinds. “I am extremely proud of the poise and collaboration that our team has exhibited to deliver value to our customers, contributing to our better than anticipated first quarter results. I continue to be encouraged by the resiliency of our business, and the positive customer and partner feedback to our ‘Secure by Design’ initiatives. Our entire team remains focused on our mission to deliver powerful, affordable, and secure solutions.”

Ramakrishna continued, “In addition, we remain committed to completing the previously announced potential spin-off of our N-able (formerly SolarWinds MSP) business in the second quarter of 2021. I want to thank our customers and partners for their ongoing support and thank our employees for their commitment.”

The Company's unaudited interim consolidated financial statements for the three months ended March 31, 2021 are not yet available. SolarWinds has provided ranges, rather than specific amounts, for the preliminary estimates of the financial information described above primarily because its financial closing procedures for the three months ended March 31, 2021 are not yet complete and, as a result, the final results upon completion of the closing procedures may vary from the preliminary estimates. See “Forward-Looking Statements” for additional information regarding factors that could result in differences between the preliminary estimated ranges of certain of the Company's financial results and operating data presented above and the actual financial results and other information SolarWinds will report for the three months ended March 31, 2021.

The financial results included in this press release are preliminary and pending final review by the Company and its external auditors. Financial results will not be final until SolarWinds files its Quarterly Report on Form 10-Q for the period. Information about SolarWinds' use of non-GAAP financial measures is provided below under “Non-GAAP Financial Measures.”

The following table reconciles expected GAAP total revenue to expected non-GAAP total revenue for the three months ended March 31, 2021, and reconciles actual GAAP total revenue to non-GAAP total revenue for the three months ended March 31, 2020:

| Three Months Ended March 31, | |||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

| Low | High | Actual | |||||||||||||||

| (in thousands) | |||||||||||||||||

| Total GAAP revenue | $ | 255,830 | $ | 256,810 | $ | 246,950 | |||||||||||

| Impact of purchase accounting | 70 | 90 | 1,513 | ||||||||||||||

| Total non-GAAP revenue | $ | 255,900 | $ | 256,900 | $ | 248,463 | |||||||||||

| Total GAAP revenue - Core IT Management | $ | 173,130 | $ | 173,910 | $ | 173,737 | |||||||||||

| Impact of purchase accounting | 70 | 90 | 1,513 | ||||||||||||||

| Non-GAAP total revenue - Core IT Management | $ | 173,200 | $ | 174,000 | $ | 175,250 | |||||||||||

| Total GAAP revenue - N-able | $ | 82,700 | $ | 82,900 | $ | 73,213 | |||||||||||

| Impact of purchase accounting | — | — | — | ||||||||||||||

| Non-GAAP total revenue - N-able | $ | 82,700 | $ | 82,900 | $ | 73,213 | |||||||||||

The following table reconciles expected net loss to expected adjusted EBITDA for the three months ended March 31, 2021, and reconciles actual net income to adjusted EBITDA for the three months ended March 31, 2020:

| Three Months Ended March 31, | |||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

| Low | High | Actual | |||||||||||||||

| (in thousands) | |||||||||||||||||

| Net income (loss) | $ | (16,620) | $ | (16,870) | $ | 415 | |||||||||||

| Amortization and depreciation | 69,600 | 69,700 | 67,768 | ||||||||||||||

| Income tax (benefit) expense | (12,130) | (11,130) | 2,415 | ||||||||||||||

| Interest expense, net | 16,000 | 16,300 | 24,095 | ||||||||||||||

| Impact of purchase accounting on total revenue | 70 | 90 | 1,513 | ||||||||||||||

| Unrealized foreign currency (gains) losses | (900) | (1,200) | 983 | ||||||||||||||

| Acquisition and other costs | 800 | 1,000 | 1,943 | ||||||||||||||

| Spin-off exploration costs | 9,700 | 10,200 | — | ||||||||||||||

| Debt related costs | 80 | 110 | 93 | ||||||||||||||

| Stock-based compensation expense and related employer-paid payroll taxes | 18,000 | 18,300 | 11,483 | ||||||||||||||

| Restructuring costs | 400 | 500 | 222 | ||||||||||||||

| Cyber Incident costs | 18,000 | 19,000 | — | ||||||||||||||

| Adjusted EBITDA | $ | 103,000 | $ | 106,000 | $ | 110,930 | |||||||||||

| Adjusted EBITDA margin | 40.3 | % | 41.3 | % | 44.6 | % | |||||||||||

In addition, in connection with the potential spin-off of the N-able business, SolarWinds is providing its financial outlook, as of April 13, 2021, for the N-able business for the second quarter of 2021 and full year 2021. This financial outlook for the N-able business is based on the assumption that the potential separation of the N-able business is completed in the second quarter of 2021. SolarWinds will provide an update to its financial outlook for the second quarter of 2021 on its earnings release call, currently scheduled for April 29, 2021.

The financial information below represents forward-looking non-GAAP financial information, including an estimate of adjusted EBITDA. Adjusted EBITDA excludes, among other items mentioned below, stock-based compensation expense and related employer-paid payroll taxes, amortization, costs related to the exploration of a potential spin-off of SolarWinds’ MSP business and other costs related to non-recurring items. The Company has not reconciled the estimates of these non-GAAP financial measures to their most directly comparable GAAP measure as a result of uncertainty regarding, and the potential variability of, these excluded items in future periods. Accordingly, reconciliation is not available without unreasonable effort, although it is important to note that these excluded items could be material to the Company's results computed in accordance with GAAP in

future periods. The reported results provide reconciliations of non-GAAP financial measures to their nearest GAAP equivalents.

N-able Financial Outlook for Second Quarter of 2021

SolarWinds’ management currently expects the N-able business to achieve the following results for the second quarter of 2021:

•Total GAAP revenue in the range of $83.5 to $84.0 million, representing growth over the second quarter of 2020 total revenue of the N-able business of approximately 14%.

N-able Financial Outlook for Full Year 2021

SolarWinds’ management currently expects the N-able business to achieve the following results for the full year 2021:

•Total GAAP revenue in the range of $340 to $344 million, representing growth over 2020 total revenue of the N-able business of 12% to 14%.

•Adjusted EBITDA in the range of $105 to $110 million, representing approximately 31% to 32% of total revenue of the N-able business.

SolarWinds to Host First Quarter Conference Call on April 29, 2021

SolarWinds will host a conference call to discuss its financial results for the first quarter of 2021 and its business at 7:30 a.m. CT (8:30 a.m. ET/5:30 a.m. PT) on Thursday, April 29, 2021. A live webcast of the call will be available on the SolarWinds Investor Relations website at http://investors.solarwinds.com. A live dial-in will be available domestically at (833) 968-2238 and internationally at +1 (825) 312-2061. To access the live call, please dial in 5-10 minutes before the scheduled start time and enter the conference passcode 1676649 to gain access to the conference call. A replay of the webcast will be available on a temporary basis shortly after the event on the SolarWinds Investor Relations website.

The company will issue its earnings release, highlighting its first quarter of 2021 results at approximately 7:00 a.m. CT (8:00 a.m. ET/5:00 a.m. PT) on Thursday, April 29, 2021.

Forward-Looking Statements

This press release contains “forward-looking” statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding SolarWinds' preliminary financial results for the first quarter of fiscal 2021, including the results of its Core IT Management and N-able businesses, and SolarWinds' financial outlook for the N-able business for the second quarter of 2021 and full year 2021. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “aim,” “anticipate,” “believe,” “can,” “could,” “seek,” “should,” “feel,” “expect,” “will,” “would,” “plan,” “intend,” “estimate,” “continue,” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the following: (a) risks related to the potential spin-off of our N-able business into a newly created and separately traded public company, including that the process of potentially completing the spin-off could disrupt or adversely affect the consolidated or separate businesses, results of operations and financial condition, that the spin-off may not achieve some or all of any anticipated benefits with respect to either business, and that the spin-off may not be completed in accordance with our expected plans or anticipated timelines, or at all; (b) the discovery of new or different information regarding the cyberattack disclosed in December 2020 (the "Cyber Incident") or of additional vulnerabilities within, or attacks on, our products, services and systems; (c) the possibility that our mitigation and remediation efforts with respect to the Cyber Incident may not be successful; (d) the possibility that customer, personnel or other data was exfiltrated as a result of the Cyber Incident; (e) numerous financial, legal, reputational and other risks to us related to the Cyber Incident, including risks that the incident may result in the loss, compromise or corruption of data, loss of business as a result of termination or non-renewal of agreements or reduced purchases or upgrades of our products, severe reputational damage adversely affecting customer, partner and vendor relationships and investor confidence, increased attrition of personnel and distraction of key and other personnel, U.S. or foreign regulatory investigations and enforcement actions, litigation, indemnity obligations, damages for contractual breach, penalties for violation of applicable laws or regulations, significant costs for remediation and the incurrence of other liabilities; (f) risks that our insurance coverage, including coverage relating to certain security and privacy damages and claim expenses, may not be available or sufficient to compensate for all liabilities we incur related to these matters; (g) the possibility that our steps to secure our internal environment, improve our product development

environment and ensure the security and integrity of the software that we deliver to our customers may not be successful or sufficient to protect against threat actors or Cyber Incident; (h) the possibility that the global COVID-19 pandemic may adversely affect our business, results of operations and financial condition; (i) any of the following factors either generally or as a result of the impacts of the Cyber Incident or the global COVID-19 pandemic on the global economy or on our business operations and financial condition or on the business operations and financial conditions of our customers, their end-customers and our prospective customers: (1) reductions in information technology spending or delays in purchasing decisions by our customers, their end-customers and our prospective customers, (2) the inability to sell products to new customers or to sell additional products or upgrades to our existing customers, (3) any decline in our renewal or net retention rates, (4) the inability to generate significant volumes of high quality sales leads from our digital marketing initiatives and convert such leads into new business at acceptable conversion rates, (5) the timing and adoption of new products, product upgrades or pricing model changes by SolarWinds or its competitors, (6) potential foreign exchange gains and losses related to expenses and sales denominated in currencies other than the functional currency of an associated entity, and (7) risks associated with our international operations; (j) the possibility that our operating income could fluctuate and may decline as percentage of revenue as we make further expenditures to support our business or expand our operations; (k) our inability to successfully identify, complete, and integrate acquisitions and manage our growth effectively; (l) our status as a controlled company; and (m) such other risks and uncertainties described more fully in documents filed with or furnished to the Securities and Exchange Commission, including the risk factors discussed in our Annual Report on Form 10-K for the period ended December 31, 2020 filed on March 1, 2021 and the Form 10-Q for the quarter ended March 31, 2021 that SolarWinds anticipates filing on or before May 10, 2021. All information provided in this release is as of the date hereof and SolarWinds undertakes no duty to update this information except as required by law.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with GAAP, we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets and determining compensation. Accordingly, these non-GAAP financial measures may provide insight to investors into the motivation and decision-making of management in operating the business.

SolarWinds also believes that these non-GAAP financial measures are used by investors and security analysts to (a) compare and evaluate its performance from period to period and (b) compare its performance to those of its competitors. These non-GAAP measures exclude certain items that can vary substantially from company to company depending upon their financing and accounting methods, the book value of their assets, their capital structures and the method by which their assets were acquired.

There are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. Certain items that are excluded from these non-GAAP financial measures can have a material impact on operating and net income (loss).

As a result, these non-GAAP financial measures have limitations and should not be considered in isolation from, or as a substitute for, the most comparable GAAP measures. SolarWinds' management and board of directors compensate for these limitations by using these non-GAAP financial measures as supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measure. Set forth in the tables above are the corresponding GAAP financial measures for each non-GAAP financial measure presented. Investors are encouraged to review the reconciliations of these non-GAAP financial measures to their most comparable GAAP financial measures that are set forth in the tables above.

Non-GAAP Revenue. We define non-GAAP total revenue as total revenue, respectively, excluding the impact of purchase accounting from acquisitions. We monitor these measures to assess our performance because we believe our revenue growth rates would be overstated without these adjustments. We believe presenting non-GAAP total revenue aids in the comparability between periods and in assessing our overall operating performance.

Adjusted EBITDA and Adjusted EBITDA Margin. We regularly monitor adjusted EBITDA and adjusted EBITDA margin, as it is a measure we use to assess our operating performance. We define adjusted EBITDA as net income or loss, excluding the impact of purchase accounting on total revenue, amortization of acquired intangible assets and developed technology,

depreciation expense, stock-based compensation expense and related employer-paid payroll taxes, restructuring costs, acquisition and other costs, spin-off exploration costs, Cyber Incident costs, interest expense, net, debt related costs including fees related to our credit agreements, debt extinguishment and refinancing costs, unrealized foreign currency (gains) losses, and income tax expense (benefit). We define adjusted EBITDA margin as adjusted EBITDA divided by non-GAAP revenue. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; adjusted EBITDA excludes the impact of the write-down of deferred revenue due to purchase accounting in connection with acquisitions, and therefore includes revenue that will never be recognized under GAAP; adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Management believes this measure is useful for the following reasons:

•Amortization of Acquired Intangible Assets. We provide non-GAAP information that excludes expenses related to purchased intangible assets associated with our acquisitions. We believe that eliminating this expense from our non-GAAP measures is useful to investors, because the amortization of acquired intangible assets can be inconsistent in amount and frequency and is significantly impacted by the timing and magnitude of our acquisition transactions, which also vary in frequency from period to period. Accordingly, we analyze the performance of our operations in each period without regard to such expenses.

•Stock-Based Compensation Expense and Related Employer-paid Payroll Taxes. We provide non-GAAP information that excludes expenses related to stock-based compensation and related employer-paid payroll taxes. We believe that the exclusion of stock-based compensation expense provides for a better comparison of our operating results to prior periods and to our peer companies as the calculations of stock-based compensation vary from period to period and company to company due to different valuation methodologies, subjective assumptions and the variety of award types. Employer-paid payroll taxes on stock-based compensation is dependent on our stock price and the timing of the taxable events related to the equity awards, over which our management has little control, and does not correlate to the core operation of our business. Because of these unique characteristics of stock-based compensation and related employer-paid payroll taxes, management excludes these expenses when analyzing the organization’s business performance.

•Acquisition and Other Costs. We exclude certain expense items resulting from acquisitions, such as legal, accounting and advisory fees, changes in fair value of contingent consideration, costs related to integrating the acquired businesses, deferred compensation, severance and retention expense. In addition, we exclude certain other costs including expense related to our offerings. We consider these adjustments, to some extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, acquisitions result in operating expenses that would not otherwise have been incurred by us in the normal course of our organic business operations. We believe that providing these non-GAAP measures that exclude acquisition and other costs, allows users of our financial statements to better review and understand the historical and current results of our continuing operations, and also facilitates comparisons to our historical results and results of less acquisitive peer companies, both with and without such adjustments.

•Spin-off Exploration Costs. We exclude certain expense items resulting from the exploration of a potential spin-off transaction of our MSP business into a newly created and separately traded public company. These costs include legal, accounting and advisory fees, implementation and integration costs, duplicative costs for subscriptions and information technology systems, employee and contractor costs and other incremental separation costs related to the potential spin-off of the MSP business. The potential MSP spin-off transaction results in operating expenses that would not otherwise have been incurred by us in the normal course of our organic business operations. We believe that providing non-GAAP measures that exclude these costs facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance.

•Restructuring Costs. We provide non-GAAP information that excludes restructuring costs such as severance and the estimated costs of exiting and terminating facility lease commitments, as they relate to our corporate restructuring and exit activities and costs related to the separation of employment with executives of the Company. These costs are inconsistent in amount and are significantly impacted by the timing and nature of these events. Therefore, although we may incur these types of expenses in the future, we believe that eliminating these costs for purposes of calculating the

non-GAAP financial measures facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance.

•Cyber Incident Costs. We exclude certain expenses resulting from the Cyber Incident. Expenses include costs to investigate and remediate the Cyber Incident, and legal and other professional services related thereto, and consulting services being provided to customers at no charge. Cyber Incident costs are provided net of insurance reimbursements, although the timing of recognizing insurance reimbursements may differ from the timing of recognizing the associated expenses. We expect to incur significant legal and other professional services expenses associated with the Cyber Incident in future periods. The Cyber Incident results in operating expenses that would not have otherwise been incurred by us in the normal course of our organic business operations. We believe that providing non-GAAP measures that exclude these costs facilitates a more meaningful evaluation of our operating performance and comparisons to our past operating performance. We continue to invest significantly in cybersecurity and expect to make additional investments. These estimated investments are in addition to the Cyber Incident costs and not included in the net Cyber Incident costs reported.

#SWIfinancials

About SolarWinds

SolarWinds (NYSE:SWI) is a leading provider of powerful and affordable IT infrastructure management software. Our products give organizations worldwide, regardless of type, size or IT infrastructure complexity, the power to monitor and manage the performance of their IT environments, whether on-premises, in the cloud, or in hybrid models. We continuously engage with all types of technology professionals—IT operations professionals, DevOps professionals, and managed service providers (MSPs)—to understand the challenges they face maintaining high-performing and highly available IT infrastructures. The insights we gain from engaging with them, in places like our THWACK online community, allow us to build products that solve well-understood IT management challenges in ways that technology professionals want them solved. This focus on the user and commitment to excellence in end-to-end hybrid IT performance management has established SolarWinds as a worldwide leader in network management software and MSP solutions. Learn more today at www.solarwinds.com.

The SolarWinds, SolarWinds & Design, Orion, and THWACK trademarks are the exclusive property of SolarWinds Worldwide, LLC or its affiliates, are registered with the U.S. Patent and Trademark Office, and may be registered or pending registration in other countries. All other SolarWinds trademarks, service marks, and logos may be common law marks or are registered or pending registration. All other trademarks mentioned herein are used for identification purposes only and are trademarks of (and may be registered trademarks of) their respective companies.

© 2021 SolarWinds Worldwide, LLC. All rights reserved.

CONTACTS:

| Investors: | Media: | ||||||||||

| Howard Ma Phone: 512.498.6707 ir@solarwinds.com | Tiffany Nels Phone: 512.682.9535 pr@solarwinds.com | ||||||||||

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. April 14, 2021 Analyst Day Presentation

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Disclaimers General This presentation and the accompanying oral presentation do not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. The information contained in this presentation (the “Presentation”) has been prepared to assist financial analysts in making their own evaluation of N-able, Inc. in connection with publishing independent research reports and for no other purpose. This Presentation is subject to updating, completion, revision, verification and further amendment. None of N-able or its respective affiliates has authorized anyone to provide interested parties with additional or different information. The information contained herein does not purport to be all-inclusive or contain all of the information that may be required to make a full analysis of N-able. Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the federal securities law. These forward-looking statements are based on management's beliefs and assumptions and on information currently available to management and involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “aim,” “anticipate,” “believe,” “can,” “could,” “seek,” “should,” “feel,” “expect,” “will,” “would,” “plan,” “project,” “intend,” “estimate,” “continue,” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the following: (a) the risk that the spin-off may not be completed in a timely manner or at all; (b) our ability to defend against and mitigate cyberattacks, such as the cyberattack on SolarWinds Orion Software Platform and internal systems (the “Cyber Incident”), to our IT systems and those of our MSP partners and their SME customers; (c) potential tax liabilities that may arise as a result of the spin-off; (d) our ability to operate as an independent publicly traded company, including compliance with applicable laws and regulations; (d) financial, legal, reputational and other risks to us related to the Cyber Incident, including risks that the incident may result in the loss, compromise or corruption of data, loss of business as a result of termination or non-renewal of agreements or reduced purchases or upgrades of our products, severe reputational damage adversely affecting customer, partner and vendor relationships and investor confidence, increased attrition of personnel and distraction of key and other personnel; (e) the possibility that the global COVID-19 pandemic and the Cyber Incident may adversely affect our business, results of operations and financial condition; (f) any of the following factors either generally or as a result of the impacts of the global COVID-19 pandemic on the global economy or on our business operations and financial condition or on the business operations and financial conditions of our MSP partners and their SME customers: (1) reductions in information technology spending or delays in purchasing decisions by our MSP partners and their SME customers, (2) the inability to sell products to new MSP partners or to sell additional products or upgrades to our existing MSP partners, (3) any decline in our renewal or net revenue retention rates, (4) the inability to generate significant volumes of high quality sales leads from our digital marketing initiatives and convert such leads into new business at acceptable conversion rates, (5) the timing and adoption of new products, product upgrades or pricing model changes by us our competitors, (6) potential foreign exchange gains and losses related to expenses and sales denominated in currencies other than the functional currency of an associated entity, and (7) risks associated with our international operations; (g) the possibility that our operating income could fluctuate and may decline as percentage of revenue as we make further expenditures to support our business or expand our operations; (h) our inability to successfully identify, complete, and integrate acquisitions and manage our growth effectively; (i) our status as a controlled company; (j) Our status as an emerging growth company; and (k) such other risks and uncertainties described more fully in documents filed with or furnished to the Securities and Exchange Commission by us or by SolarWinds Corporation, including the risk factors discussed in our registration statement on Form 10, as filed with the Securities and Exchange Commission on April 6, 2021 and the SolarWinds Annual Report on Form 10-K for the period ended December 31, 2020 filed on March 1, 2021. All information provided in this presentation is as of the date hereof and we undertake no duty to update this information except as required by law. 2

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Disclaimers continued Non-GAAP Financial Measures In addition to financial information prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period. We believe that these non-GAAP financial measures provide supplemental information that is meaningful when assessing our operating performance because they exclude the impact of certain amounts that our management and board of directors do not consider part of core operating results when assessing our operational performance, allocating resources, preparing annual budgets and determining compensation. The excluded items include the impact of purchase accounting, amortization of acquired intangible assets, stock-based compensation, acquisition and sponsor related costs, restructuring charges, unrealized foreign currency gains (losses) and certain debt-related costs. Please see the appendix at the end of this presentation for a description of these adjustments and a reconciliation of each non-GAAP financial measure to its nearest GAAP equivalent. The non-GAAP measures have limitations, and you should not consider them in isolation or as a substitute for our GAAP financial information. Presentation of Financials The spin-off of N-able by SolarWinds Corporation is anticipated to be completed in the second quarter of 2021. The Company’s financial statements for the periods prior to the spin-off are presented on a “carve-out” basis. The historical financial information in this presentation we have included does not reflect what our financial condition, results of operations or cash flows would have been had we been a stand-alone entity during the historical periods presented, or what our financial condition, results of operations or cash flows will be in the future as an independent entity. Accordingly, these historical results should not be relied upon as an indicator of our future performance. In addition, our financial projections do not include any costs or liabilities associated with the Cyber Incident. Confidentiality This presentation and the accompanying oral presentation are strictly confidential and is for you to familiarize yourself with the company. All confidential information is subject to the terms of the non-disclosure agreement entered into between the parties and we request that you keep such information we provide at this meeting confidential and that you do not disclose any of the information to any other parties without our prior express written permission. 3

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Introduction and agenda 4 N-able attendees A g e n d a 1 │ Company Overview 2 │ Platform & Technology Overview 3 │ Go-to-Market & Partner Success 4 │ Financial Overview John Pagliuca President & Chief Executive Officer Tim O’Brien Executive Vice President, Chief Financial Officer Mav Turner Group Vice President, Product Management

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Spin-off transaction summary Overview • In August 2020, SolarWinds announced its board of directors authorized management to explore a potential spin-off of its MSP business into a newly created and separately traded public company (N-able) • N-able is a leading global provider of cloud-based software solutions for managed service providers (MSPs), enabling them to support digital transformation and growth within small and medium-sized enterprises (SMEs) Listing • NYSE: NABL Distribution • When-issued trading period: Up to 10 days prior to distribution date • Record date: 9-10 days prior to distribution date • Distribution date: Targeting May or June (pending SEC review and other factors) • SolarWinds will file an 8-K with additional information Capital Structure • In connection with the spin-off, we expect to put a new credit facility in place, consisting of a $350M Term Loan B and a $60M Revolving Credit Facility • Pro forma for the transaction, N-able expects total gross and net leverage of ~2.9x and ~2.5x, respectively1 5 1 Based on FY 2020 Adjusted EBITDA of $121M

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Spin-off optimizes focus on N-able’s business and value creation 6 Enhanced management and employee focus on strategic initiatives Creation of standalone, growth-oriented targeting “Rule of 50” company Targeted investments and capital allocation to maximize for growth Unique brand identity that resonates with MSP partners

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Company Overview John Pagliuca (President & CEO)

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Empowering MSPs through purpose-built technology to enable and accelerate digital transformation for small to medium-sized enterprises 8

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. N-able at a glance Note: Metrics represent 2020A financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details. 9 25K+ MSP partners 109% Dollar-based net retention rate $303M Revenue 15% YoY Revenue growth Rule of 50 Target 100% Recurring revenue model >1,400 >$50K ARR MSPs 500K+ SME customers 87% Non-GAAP Gross margin

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Our history of innovation and growth 10 2013 • SolarWinds acquires N-able 2015 • Remote Access & Support capabilities added via BeAnywhere acquisition • Patch Management integrated into platform via SWI technology migration • Professional Services Automation & Ticketing added via Capzure acquisition 2016 • SolarWinds acquires LOGICNow, combining with N-able to create SWI MSP • Backup & Recovery added into the platform • Automation Manager added to RMM solutions • Web Protection security services launched 2017 • Email Security and Archiving solution added via SpamExperts acquisition • SWI MSP launches EmpowerMSP Partner Conferences • NetPath integrated into platform via SWI technology migration 2018 • MSP Institute founded • Mobile app available on iOS and Android 2019 • Password Management and Documentation service added via Passportal acquisition • Endpoint Detection and Response launched via strategic partnership with SentinelOne • Cloud to Cloud backup launched with Office 365 offering 2020 • Head Nerds formed • Ecosystem Framework for integrations implemented • Technology Alliance Program (TAP) expanded beyond 20 partnerships • Cisco and Microsoft strategic integration efforts announced

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. We believe COVID has validated our value to MSPs and SMEs 11 Mission critical value Transitory headwinds, long-term opportunity • Accelerated digital transformation by SMEs throughout the pandemic, with increased demand for secure, modern remote work environments • We believe MSPs became more important to SMEs during the pandemic, delivering critical services powered by our platform • We believe IT management and security of distributed workforces sustain long-term demand for our solutions in a post-COVID world • Q2’20 saw increased churn and downgrades from existing partners and slower pace of partner additions • Improvement over the remainder of 2020, including expansion within existing partners and growth in new additions

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Update on cyber incident 12 • On 12/14/20, SolarWinds filed a Form 8-K announcing it had been the victim of a cyberattack on its Orion Software Platform and internal systems • Malicious code known as Sunburst was injected into builds of SolarWinds’ Orion Software Platform released between March and June 2020 • If present and activated, Sunburst could allow an attacker to compromise the server on which the Orion Software Platform was installed • Investigations are on-going, but to date: • We have not identified Sunburst in any N-able solutions • The threat actor had access to, and we believe may have exfiltrated source code and other confidential information across, SolarWinds’ environment, of which we were a part • We believe the cyber incident has had an adverse impact on our reputation, new subscription sales and retention rates, but the extent of such impact was not significant to our financial results during 2020, and we expect such impacts to diminish over time in the absence of new discoveries or events

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Summary of cyber indemnification 13 Under the separation agreement, SolarWinds will indemnify us for all liabilities based upon, arising out of, or relating to the cyber incident, including for: • Actions brought by third parties within four years after the separation related to the cyber incident with respect to either our or SolarWinds’ products or services or any breach or exfiltration of information; • Actions brought by SolarWinds stockholders related to the cyber incident; • Any investigation that we conduct following our discovery within four years after the separation of a cyber event relating to, arising out of or resulting from the cyber incident; and • Actions brought by third parties with respect to statements in our public disclosure documents regarding the cyber incident to the extent based on information provided to us by SolarWinds for use in such documents. In future periods, we may incur additional costs related to the cyber incident but do not have a reasonable estimate of potential costs and have not included amounts in our financial projections. Under the separation agreement, we will be responsible for: • Our costs related to compliance, mitigation, increased or changed IT, cybersecurity, research and development and additional personnel and related costs with respect to improving, enhancing or hardening the cyber security or defenses of our environment; • Other than to the extent otherwise covered by SolarWinds’ indemnity, our disclosure documents or any other public statements made by us or our directors or officers after the separation related to the cyber incident; and • Any consequential, special, or exemplary liabilities from any loss of customers, vendors, partners, employees or other commercial relationships or any increase in insurance premiums, whether or not relating to, arising out of resulting from the cyber incident. Note: The foregoing summary of the separation agreement to be entered into in connection with the spin-off is qualified in its entirety by reference to the full text of such agreement, a form of which is filed with N-able’s Form 10 registration statement, available on the SEC website at www.sec.gov under the name “N-able, Inc.”.

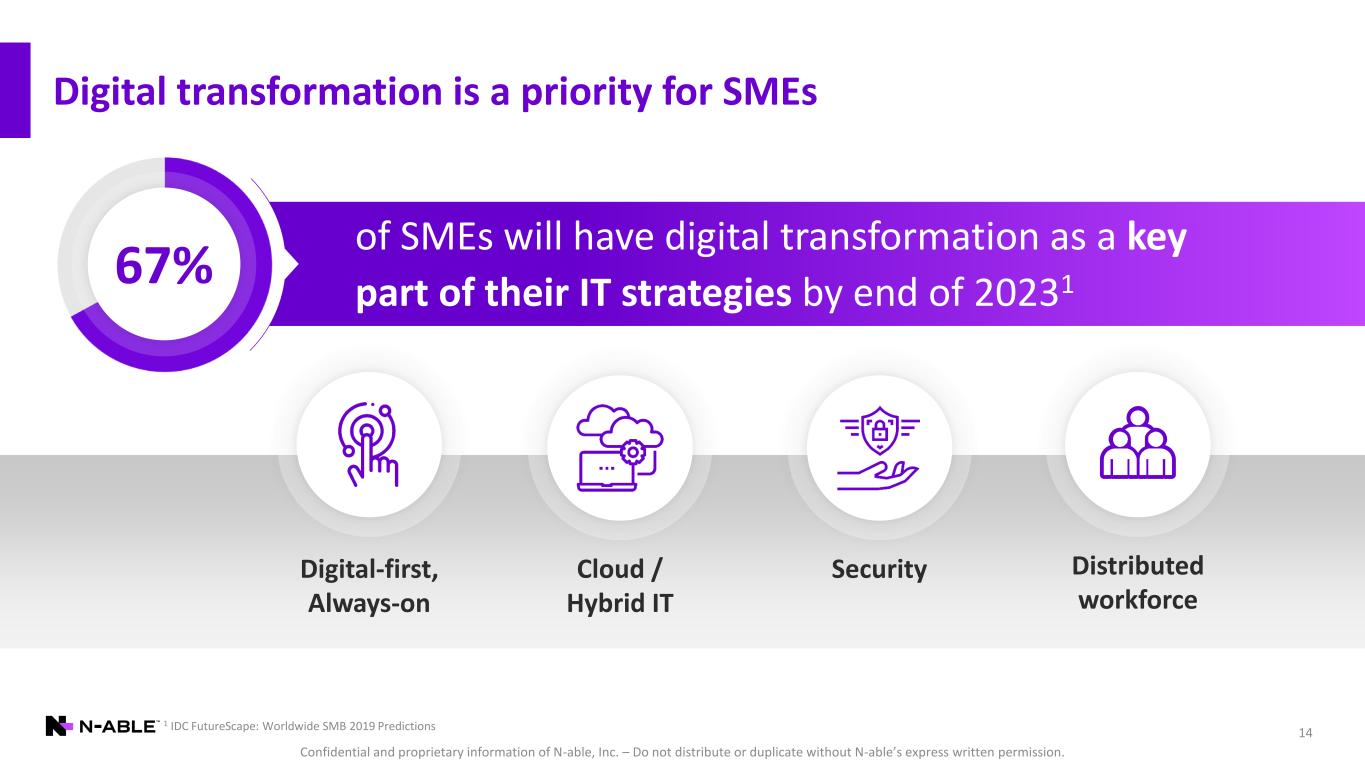

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 14 Digital transformation is a priority for SMEs 1 IDC FutureScape: Worldwide SMB 2019 Predictions of SMEs will have digital transformation as a key part of their IT strategies by end of 20231 67% Cloud / Hybrid IT Security Distributed workforce Digital-first, Always-on

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 15 SMEs face increased IT management and security complexities IT management and security not a core competency Growing cyber threats Increasing IT costs and compliance burdens Proliferation of connected endpoints Need for always- on, always- available IT environments

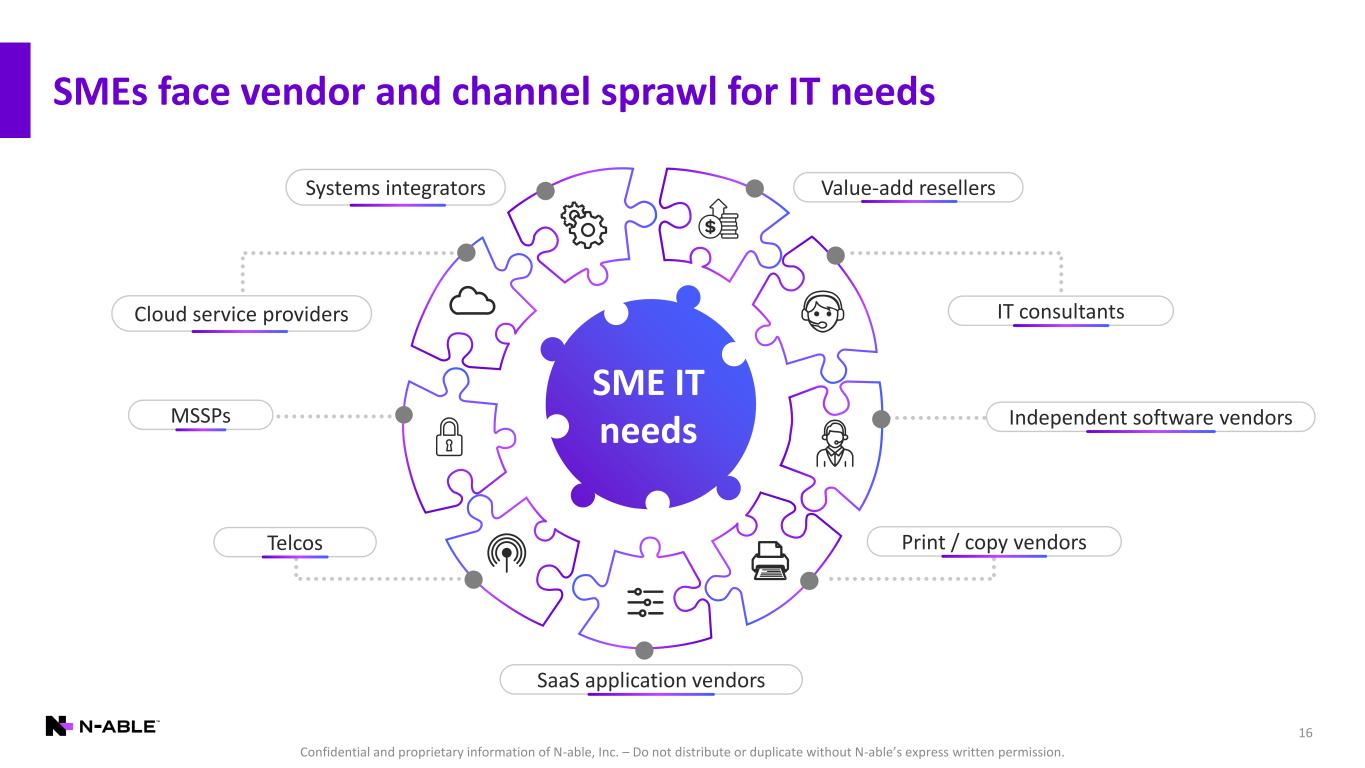

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. SMEs face vendor and channel sprawl for IT needs 16 SME IT needs Value-add resellersSystems integrators IT consultants Independent software vendors SaaS application vendors Print / copy vendors MSSPs Cloud service providers Telcos

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSPs SMEs are increasingly relying on MSPs for proactive and recurring IT services 17 Rise of the managed IT services model… Enable SMEs’ digital transformation / cloud journey Trusted security provider Single source for SMEs’ IT needs Address growing IT complexity and risk

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 18 …across a variety of mission-critical services and industries MSPs around the world offering broad range of services IT service / help desk Application management …servicing SMEs across wide variety of industry verticals Network performance monitoring Managed anti-virus Advanced endpoint protection Web content filtering Backup & recovery Business continuity Retail Transportation Banks Insurance Real estate Health care Arts and entertainment Hotels and accommodations Food service Email security Security event management Disaster recover-as-a- service Device & systems monitoring !

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 1 Gartner “Small and Midsize Business IT Spending, Worldwide, 2018-2024,” 18 February, 2021 Note: Global SME IT Managed Services Spend and N-able TAM estimates based on Frost & Sullivan “Total Addressable Market for SMB IT Managed Service Providers,” February 2021 19 Large and attractive market opportunity 20252020 MSPs prefer purpose-built solutions that both address disparate SME customers’ needs and improve their own operational efficiency $253B Global SME IT Managed Services Spend $133B Global SME IT Managed Services Spend $44B N-able TAM $23B N-able TAM SME IT spending reached ~$1.2T in 20201 SMEs increasingly reliant on MSPs for all IT needs MSPs have many IT vendors to choose from

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Leading global provider of purpose-built software for MSPs 20 Business management Sell through Sell to Data protection: Backup & recovery Disaster recovery Continuity Remote management & monitoring: Endpoints Servers Network devices Professional Services Automation Ticketing Billings Security solutions: Endpoint protection Web protection E-mail security Vulnerability assessment Password management Document management Business insights and analytics Monitor everything Deep security Patch management

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 21 Why purpose-built matters Visibility, alerts, and control from one centralized dashboard Require centralized views and alerts across all customer environments Enterprise-class layered securitySecure customers’ and own business World-class partner success resources MSP business opportunity is compelling but challenging Different devices, networks and SaaS apps for different customers Automate and streamline processes Complete coverage of devices and services Out-of-the-box automation tools and business management solutions Device and SaaS apps sprawl Monitor and protect mission- critical IT Growing cyberthreats IT must support the business, not distract it Too many IT vendors / channels SME challenges MSP challenges N-able platform solution

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 22 Why we win: Breadth and depth of platform Monitor Everything Layered Security Partner Success

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Experienced management team with culture of innovation 23Note: Reflects post-separation expected corporate titles. Mike Cullen Group Vice President, Partner Success Mav Turner Group Vice President, Product Management Jim Mulkey Group Vice President, Engineering Sara Foley Vice President, Product Management Joel Kemmerer Group Vice President, Chief Information Officer Kevin Bury Senior Vice President, Chief Customer Officer Tim O’Brien Executive Vice President, Chief Financial Officer Mike Adler Executive Vice President, Chief Technology Officer Frank Colletti Executive Vice President, Worldwide Sales Peter Anastos Executive Vice President, General Counsel John Pagliuca President, Chief Executive Officer Kathleen Pai Executive Vice President, Chief People Officer

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Platform & Technology Overview Mav Turner (GVP, Product Management)

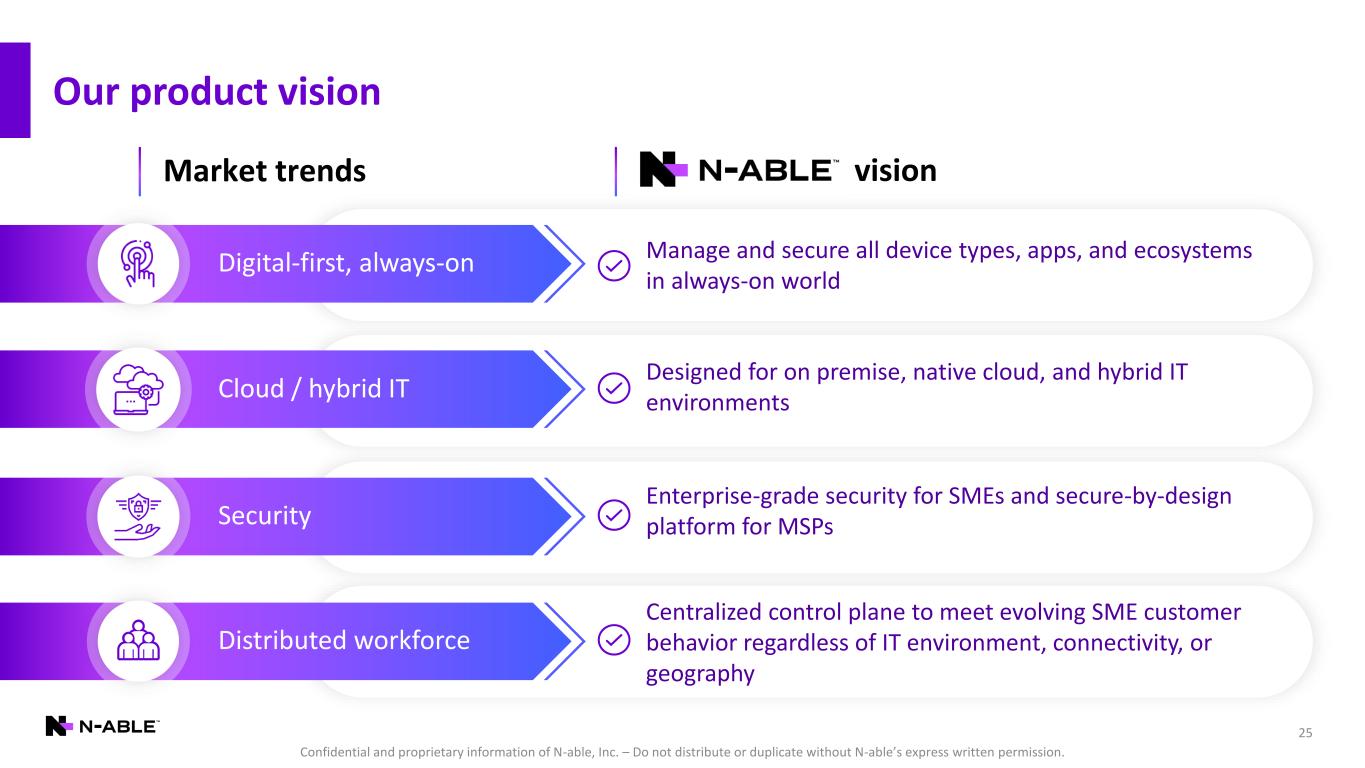

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Our product vision 25 Market trends Digital-first, always-on Cloud / hybrid IT Security Distributed workforce Manage and secure all device types, apps, and ecosystems in always-on world Designed for on premise, native cloud, and hybrid IT environments Enterprise-grade security for SMEs and secure-by-design platform for MSPs Centralized control plane to meet evolving SME customer behavior regardless of IT environment, connectivity, or geography vision

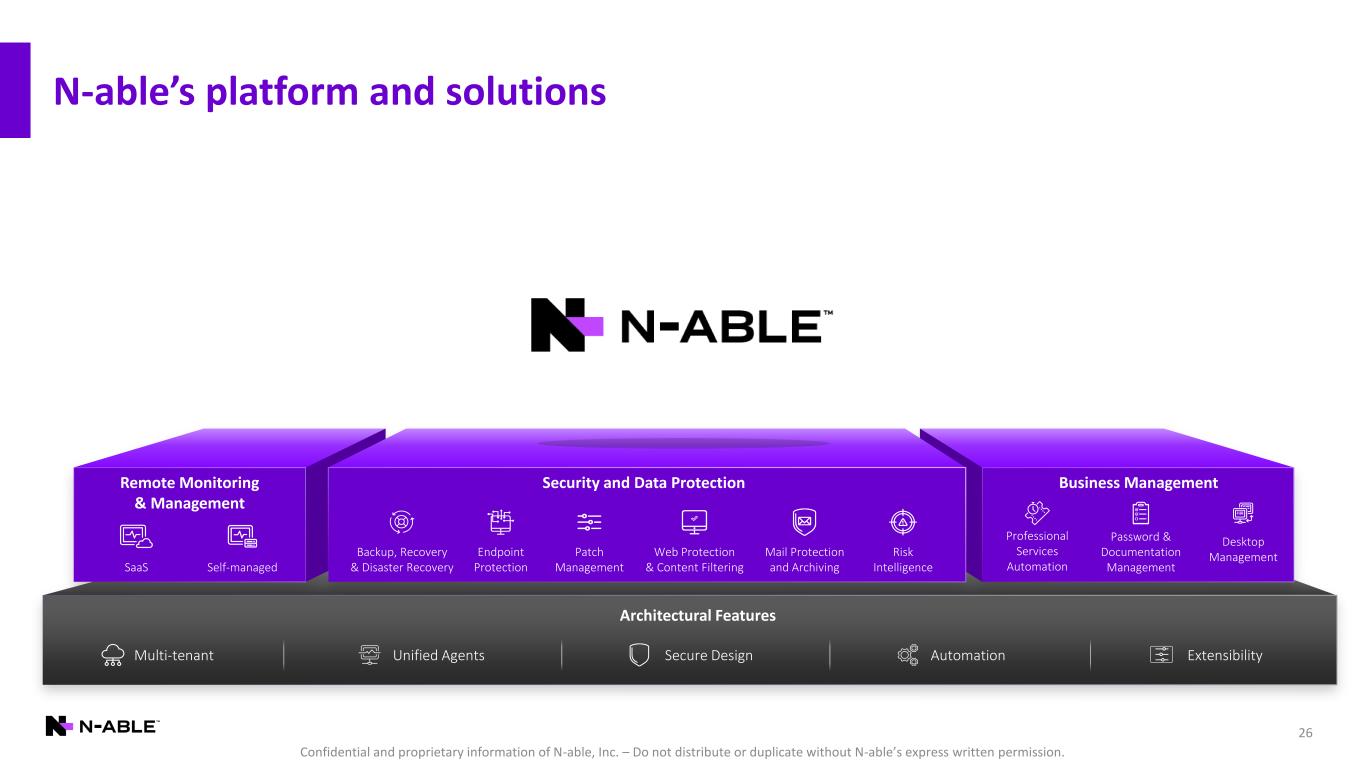

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 26 N-able’s platform and solutions Architectural Features SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Professional Services Automation Password & Documentation Management Desktop Management Business Management Unified Agents ExtensibilityMulti-tenant Secure Design Automation

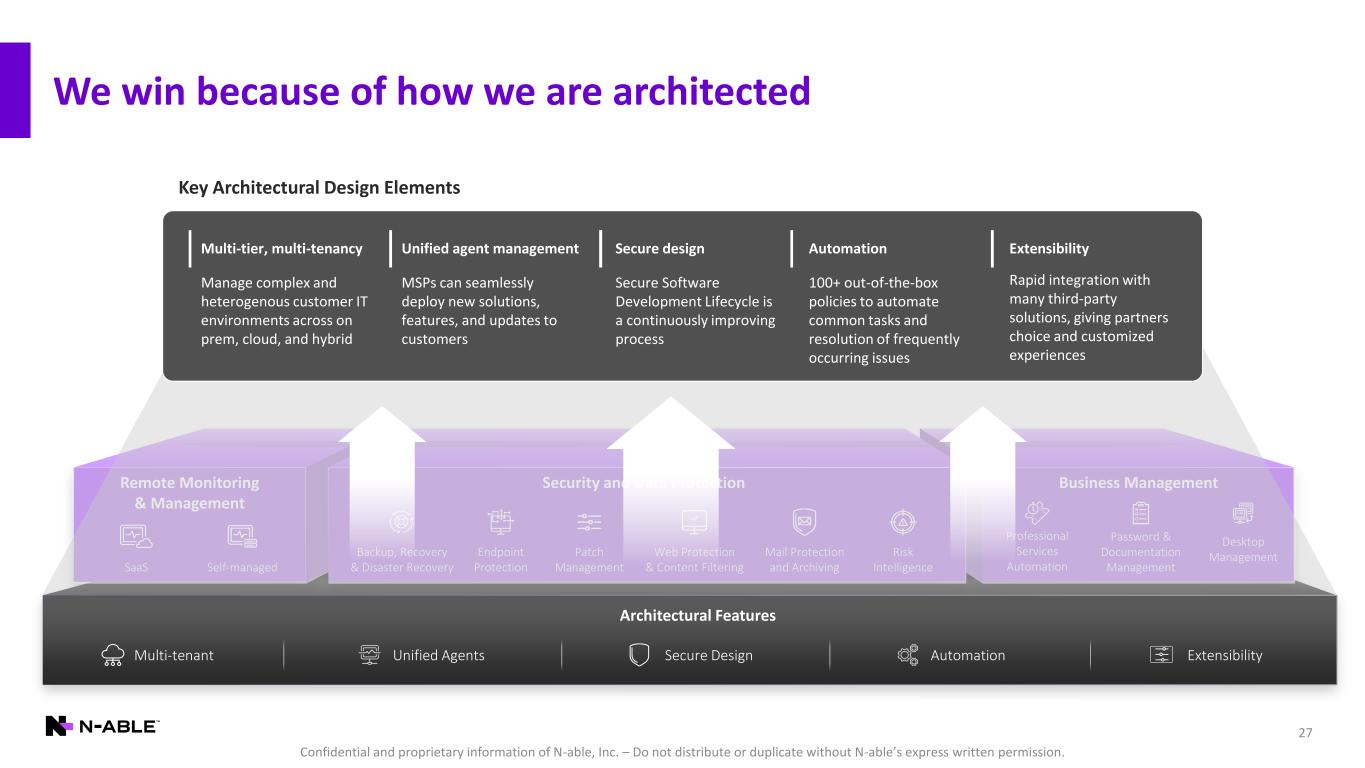

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 27 We win because of how we are architected Architectural Features Unified Agents ExtensibilityMulti-tenant Secure Design Automation SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Password & Documentation Management Desktop Management Business Management Professional Services Automation Key Architectural Design Elements Multi-tier, multi-tenancy Unified agent management ExtensibilitySecure design Automation Manage complex and heterogenous customer IT environments across on prem, cloud, and hybrid MSPs can seamlessly deploy new solutions, features, and updates to customers Rapid integration with many third-party solutions, giving partners choice and customized experiences Secure Software Development Lifecycle is a continuously improving process 100+ out-of-the-box policies to automate common tasks and resolution of frequently occurring issues

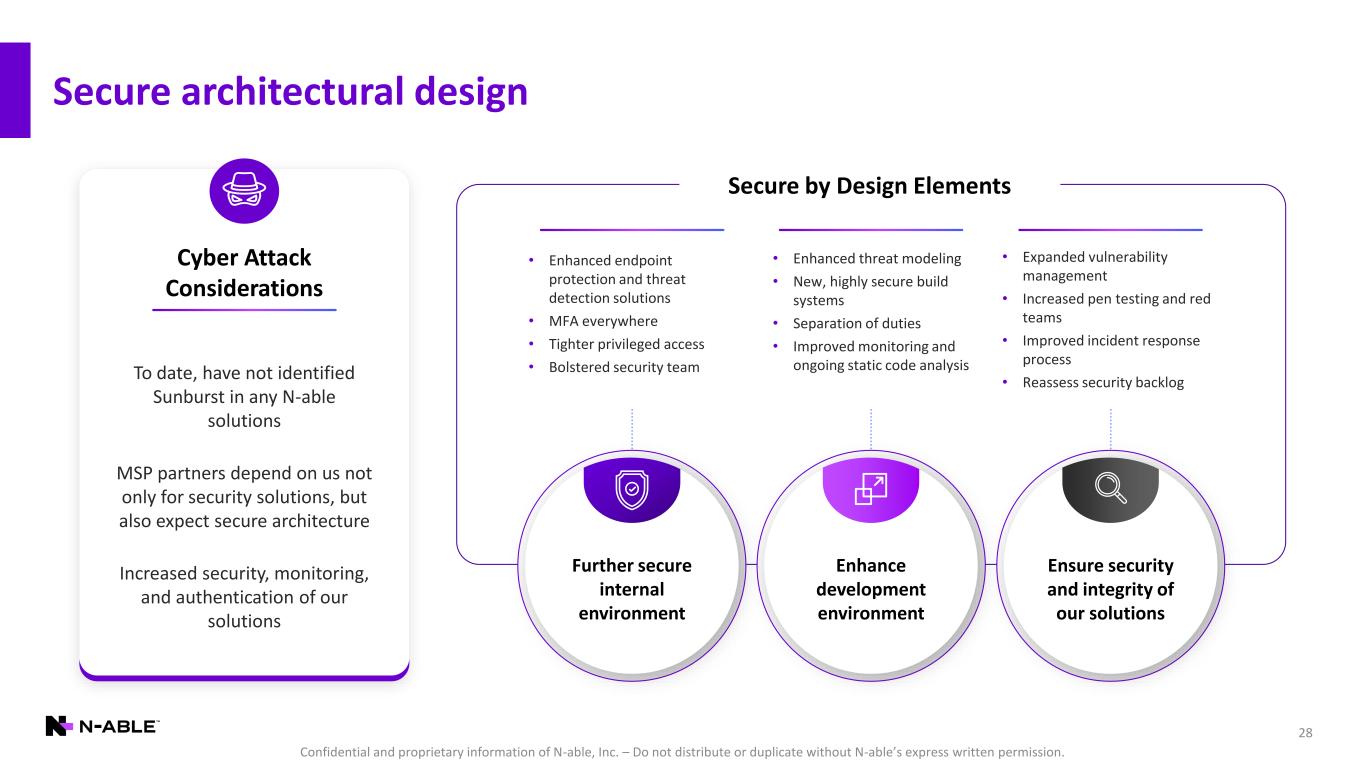

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 28 • Enhanced endpoint protection and threat detection solutions • MFA everywhere • Tighter privileged access • Bolstered security team • Enhanced threat modeling • New, highly secure build systems • Separation of duties • Improved monitoring and ongoing static code analysis • Expanded vulnerability management • Increased pen testing and red teams • Improved incident response process • Reassess security backlog Further secure internal environment Enhance development environment Ensure security and integrity of our solutions Secure by Design Elements To date, have not identified Sunburst in any N-able solutions MSP partners depend on us not only for security solutions, but also expect secure architecture Increased security, monitoring, and authentication of our solutions Cyber Attack Considerations Secure architectural design

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 29 Monitor Everything from Anywhere Visibility and control over disparate devices and IT environments Solution capabilities What problems does it solve for the MSP? Architectural Features SaaS Self-managed Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Remote Monitoring & Management Security and Data Protection Password & Documentation Management Desktop Management Business Management Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Enables MSPs of all sizes to manage complex SME IT environments Single pane of glass to manage thousands of users and devices Robust out-of-the-box automation policies and performance checks Rapidly identify and resolve issues Manage complex hybrid IT environments Maximize uptime and productivity for customers Reduce cost and complexity through automation

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 30 Layered Security Comprehensive defense via integrated solutions Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Layered protection spanning network and systems infrastructure, applications, and end user devices via: Protect SME customers from multiple attack vectors Preventative protection + recoverability = complete defense Platform integration and unified agent approach enable seamless deployment ✓ Data protection ✓ Patch management ✓ Endpoint security ✓ Web protection ✓ E-mail security and archiving ✓ Vulnerability assessment solutions

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 31 Data Protection Powerful and easy to use, cloud-first backup Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Fully cloud-based backup, recovery, and disaster recovery for servers, workstations, files, data, and cloud-based applications Geographically distributed architecture, primarily on AWS File-based backup vs traditional image-based approach enables high speed recovery and low operating costs Efficiently manage exponential data proliferation Solutions do not require hardware Extensive storage location options Reduces technician time spent managing backups

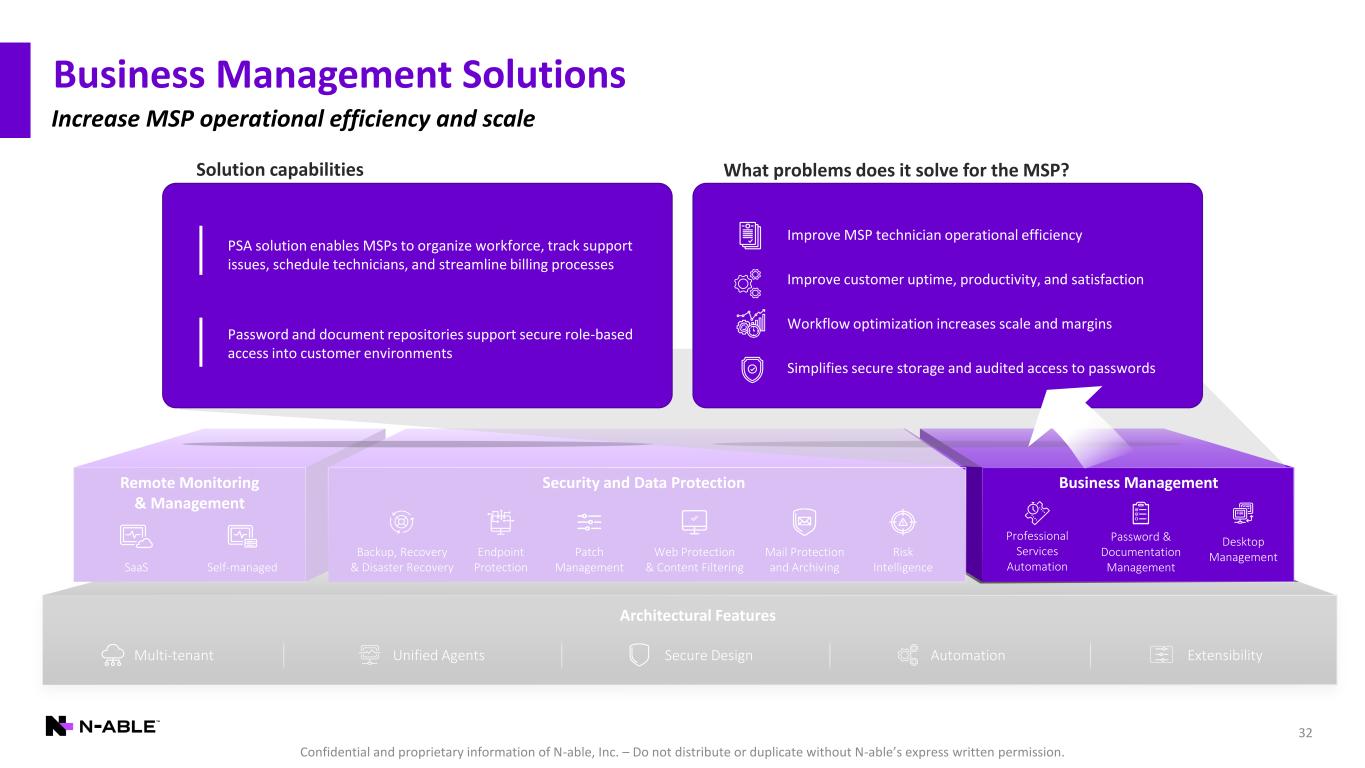

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 32 Business Management Solutions Architectural Features SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Increase MSP operational efficiency and scale Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Solution capabilities What problems does it solve for the MSP? Improve MSP technician operational efficiency Improve customer uptime, productivity, and satisfaction Workflow optimization increases scale and margins Simplifies secure storage and audited access to passwords PSA solution enables MSPs to organize workforce, track support issues, schedule technicians, and streamline billing processes Password and document repositories support secure role-based access into customer environments

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Architectural Features 33 Ecosystem Framework enables freedom of choice SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation Technology Alliance Program (TAP) Integrated Solution Partnerships • 3rd party solution options expand platform reach • Collaborative marketing increases awareness for N-able and TAP partners • N-able gains visibility into rising trends and solution providers • Creates immersive platform experience for partners • Joint roadmap planning fosters “better together” offering • N-able leads MSP partner relationship from GTM through billing and support

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Architectural Features 34 Horizontal expansion via enterprise tech partnerships SaaS Self-managed Remote Monitoring & Management Password & Documentation Management Desktop Management Business Management Backup, Recovery & Disaster Recovery Endpoint Protection Patch Management Web Protection & Content Filtering Mail Protection and Archiving Risk Intelligence Security and Data Protection Professional Services Automation Unified Agents ExtensibilityMulti-tenant Secure Design Automation • Pairs N-able’s multi-tier, multi-tenant RMM with Intune MDM for consolidated management and reporting • Building out our Azure server monitoring capabilities and M365 Cloud Backup • Robust MDM capabilities for Apple devices, including multi-tenancy, remote control, and integrated backup and EDR • Once we manage Macs, we can layer on additional services • Cisco integration expands our monitoring breadth and gives partners direct path to discover and monitor Cisco Meraki devices

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. What’s next 35 Tech Trends Impacting SMEs N-able Platform Capabilities and Priorities ▪ Growing attack surfaces ▪ Dissipating network boundaries ▪ Data proliferation Layered Security ▪ Layered security approach ▪ Network management and security ▪ Scalable and efficient data management ▪ Permanent distributed workforces ▪ Increasing cloud / hybrid ID complexity ▪ AI augmentation Platform and Productivity ▪ Leading cloud-based platform ▪ Cloud-native RMM and security ▪ Next-gen technician efficiency ▪ SaaS proliferation ▪ IoT devices ▪ Co-managed IT Monitor Everything ▪ Identity management and controls ▪ Monitor breadth and depth ▪ Enterprise-class scalability

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Go-to-Market & Partner Success John Pagliuca (President & CEO)

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 37 Our GTM and multi-dimensional land and expand strategy High-velocity, low-touch inside sales motion with frictionless free trial approach to acquire MSPs… …driving efficient growth as MSP partners drive sales… …by adding new SME customers… …that add new devices, services, and drive usage N-able Sales Reps Localized distributor model internationally 25K+ MSP Partners 500K+ SME Customers Devices/Networks Services UsageF ri ct io n le ss t ri a l a p p ro a ch 1 2 3 4 ! P o w e re d b y N -a b le P la tfo rm

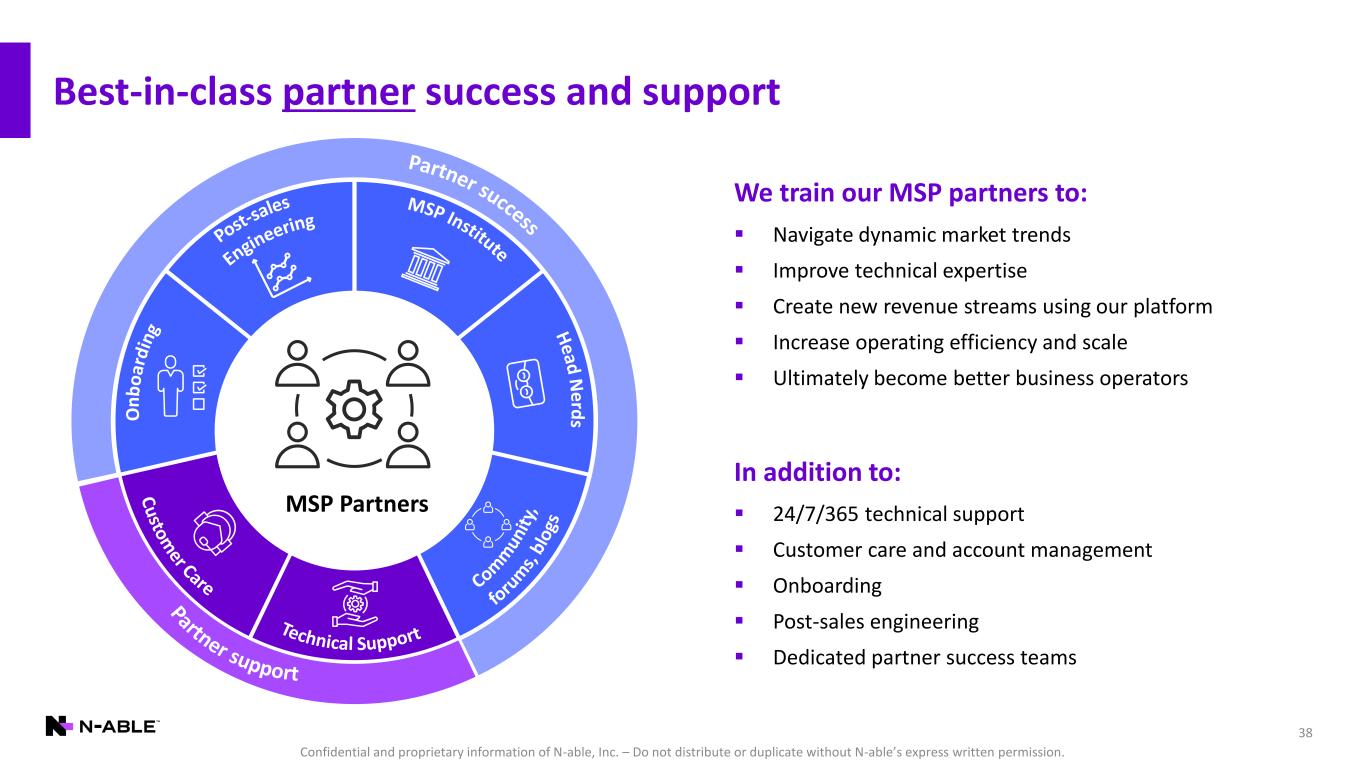

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 38 Best-in-class partner success and support MSP Partners We train our MSP partners to: ▪ Navigate dynamic market trends ▪ Improve technical expertise ▪ Create new revenue streams using our platform ▪ Increase operating efficiency and scale ▪ Ultimately become better business operators In addition to: ▪ 24/7/365 technical support ▪ Customer care and account management ▪ Onboarding ▪ Post-sales engineering ▪ Dedicated partner success teams

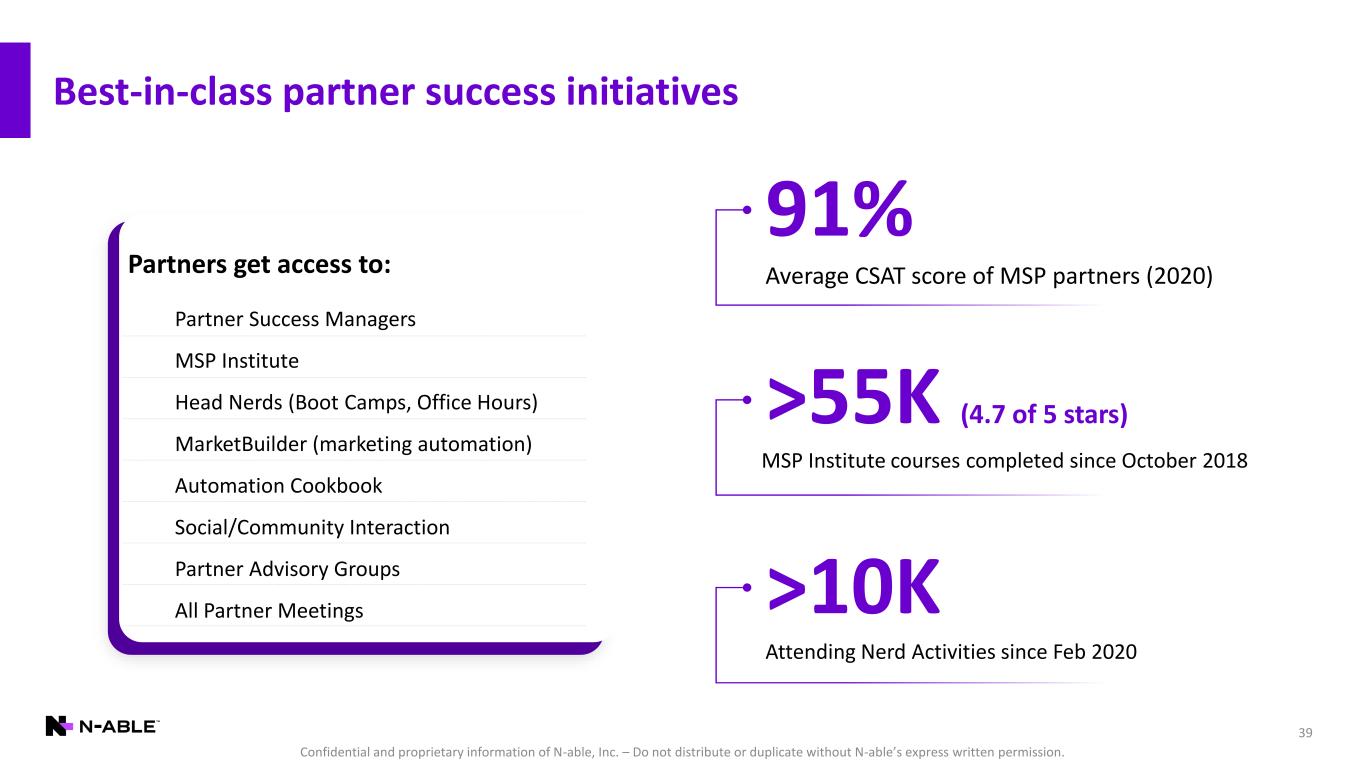

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Best-in-class partner success initiatives 39 Partner Success Managers MSP Institute Head Nerds (Boot Camps, Office Hours) All Partner Meetings MarketBuilder (marketing automation) Partner Advisory Groups Zero to Many (OnDemand) One to Many (Boot Camps & Office Hours) 91% Average CSAT score of MSP partners (2020) >55K (4.7 of 5 stars) MSP Institute courses completed since October 2018 >10K Attending Nerd Activities since Feb 2020 Automation Cookbook Social/Community Interaction Partners get access to:

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 40 The value of our differentiated go-to-market model Financial impactGo-to-market approach Targeted inside-sales strategy Cost efficient pipeline generation and conversion Localized channel strategy High international revenue mix Acquiring MSPs that will grow alongside us Natural revenue expansion MSPs serve as extension of our sales footprint Product-led growth with high operating leverage Best-in-class partner success initiatives Strong dollar-based net retention rates

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSP industry trends 41 More security Co-managed IT Platform consolidation International maturity Mergers & acquisitions

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 42 Case study A: MSP acquirer standardizing on N-able E xi t A R R $0 $50 $100 $150 $200 $250 $300 $350 $400 2016 2017 2018 2019 2020 Data Protection Security Business Management $337K ARR in 2020 18.9K Devices Managed Long-term N-able partner with locations throughout Central US and Midwest; has acquired many smaller MSPs over time and standardized nearly all customers on N-able platform. $64K ARR in 2016 12.6K Devices Managed RMM $000s Growth on N-able platform: • Grew ARR from $64K in 2016 to $337K in 2020 (51% CAGR) • Nearly doubled total ARR from $172K 2019 to $337K in 2020 • Data protection ARR grew from $6K in 2018 to $42K in 2020 • EDR ARR ramped form $4K in 2019 to $155K in 2020 Value we deliver: • Ability to scale and standardize as they acquire new MSPs • Advanced technical training and customizations • Account managers help set and execute on strategic roadmap MSP industry trends in play: • M&A, platform consolidation, more security, co-managed IT EDR & Business Management Adoption Data Protection Adoption

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 43 Case study B: PE-backed MSP; large rip and replace E xi t A R R $0 $100 $200 $300 $400 $500 $600 $700 2016 2017 2018 2019 2020 Data Protection Security Business Management $558K ARR in 2020 32.5K Devices Managed Large PE-backed nationwide MSP, with some larger mid-enterprise customers. In 2020, acquired company that was using another MSP platform; replaced with N-able and more than doubled ARR on N-able. $174K ARR in 2016 17.5K Devices Managed RMM $000s Growth on N-able platform: • Grew ARR from $174K in 2016 to $558K in 2020 (34% CAGR) • More than doubled total ARR from $257K 2019 to $558K in 2020 • Added data protection in 2017 for ARR of $20K and has since grown sevenfold to $140K in 2020 Value we deliver: • Depth of solution stack, especially in monitoring and patch management for larger enterprise customers (co-managed IT) • Specialized account management for product roadmap input, support on market trends and new revenue streams • One-to-one engagements to help integrate new acquisitions MSP industry trends in play: • M&A, platform consolidation, co-managed IT Data Protection Adoption

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 44 Case study C: European-based, multinational MSP $48K ARR in 2016 $0 $20 $40 $60 $80 $100 $120 $140 $160 2016 2017 2018 2019 2020 Data Protection Security Business ManagementRMM $143K ARR in 2020 E xi t A R R $000s Amsterdam-based MSP with global customer base. Have embraced majority of N-able solutions and built service delivery around N-able. Growth on N-able platform: • Grew ARR from $48K in 2016 to $143K in 2020 (31% CAGR) • RMM ARR grew from $34K in 2016 to $93K in 2020 • Data protection ARR grew from <$1K in 2016 to $17K in 2020 • Security ARR grew from ~$10K in 2016 to >$30K in 2020 Value we deliver: • Single pane of glass to easily aggregate customer data across multiple customers on real-time basis • Sells to end customers “fully managed” all-inclusive contracts that are powered by N-able solution stack MSP industry trends in play: • Platform consolidation, more security, international

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 45 Case study D: Massive ramp in multi-solution adoption RMM $0 $50 $100 $150 $200 $250 $300 2016 2017 2018 2019 2020 Data Protection Security Business Management Security Adoption $40K ARR in 2016 1.8K Devices Managed $260K ARR in 2020 12.0K Devices Managed Data Protection and Business Management Adoption E xi t A R R $000s Started small via RMM rip and replace. Adopted security solutions in 2019 and then tripled ARR in 2020 across all key solution categories. Growth on N-able platform: • Grew ARR from $40K in 2016 to $260K in 2020 (60% CAGR) • RMM ARR grew from $40K in 2016 to $164K in 2020 • Security ARR grew from ~$16K in 2016 to >$53K in 2020 • Adopted data protection in 2020 for ARR of $35K and business management for ARR of $8K Value we deliver: • Single point of glass and single point of vendor contact • Enable “fully managed” approach for customers via proper monitoring, reporting and security • Partner success team helps identify areas for greater efficiency MSP industry trends in play: • Platform consolidation and security

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Financial Overview Tim O’Brien (CFO)

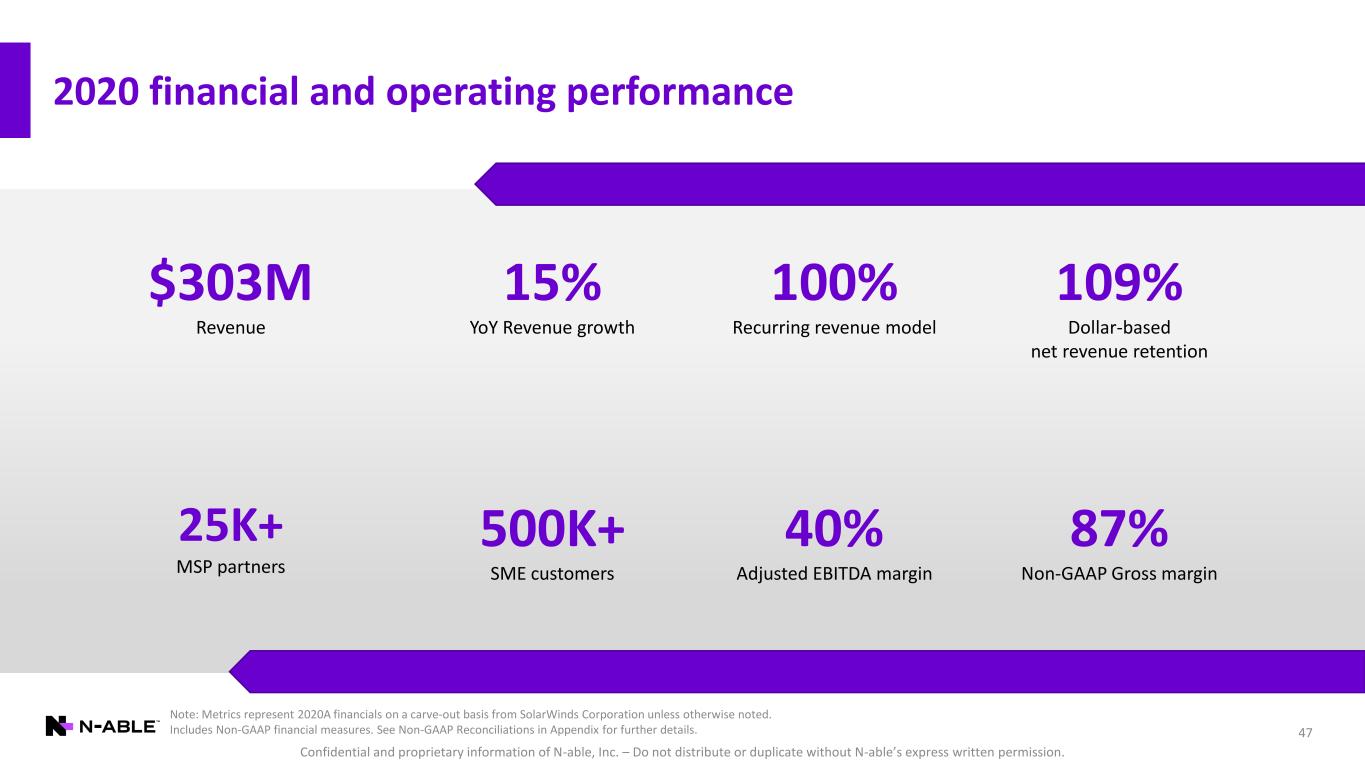

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 47 2020 financial and operating performance 25K+ MSP partners $303M Revenue 109% Dollar-based net revenue retention 500K+ SME customers 40% Adjusted EBITDA margin 15% YoY Revenue growth 100% Recurring revenue model 87% Non-GAAP Gross margin Note: Metrics represent 2020A financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details.

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. MSPs prefer purpose-built platforms and solutions that address disparate SME customers’ needs and improve their own operational efficiency MSP industry supply chain 48 SME IT spending in 2020 - $1.2T1 SMEs increasingly reliant on MSPs for IT management and security MSPs have various vendors to choose from MSPs want to improve scale & margin 1 Gartner “Small and Midsize Business IT Spending, Worldwide, 2018-2024,” 18 February, 2021 Note: Global SME IT Managed Services Spend and N-able TAM estimates based on Frost & Sullivan “Total Addressable Market for SMB IT Managed Service Providers” (February 2021)

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 49 Our growth algorithm New MSP Revenue Current Year Revenue Gross Revenue Retained Net Retention Partner-Enabled Expansion = Prior Year Revenue New Services New SMEs / Devices

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. ▪ Add new MSP technicians onto our platform ▪ Add new SME customers ▪ Manage more SME devices / endpoints ▪ Deliver additional services powered by our platform ▪ Manage more SME devices / endpoints Partner-enabled expansion — unique aspect to our model 50 MSP Partner 25K+ MSP Partners 500K+ SME Customers Services Services Services Elements of partner-enabled expansion Services Services Services ! Benefits of our differentiated GTM approach ▪ Sales reach extension into SME market ▪ Sales expansion through natural adoption ▪ Capital efficient scaling ▪ Loyalty and retention ▪ Strong international presence ✓ ✓ ✓ ✓ ✓ SME Customer SME Customer

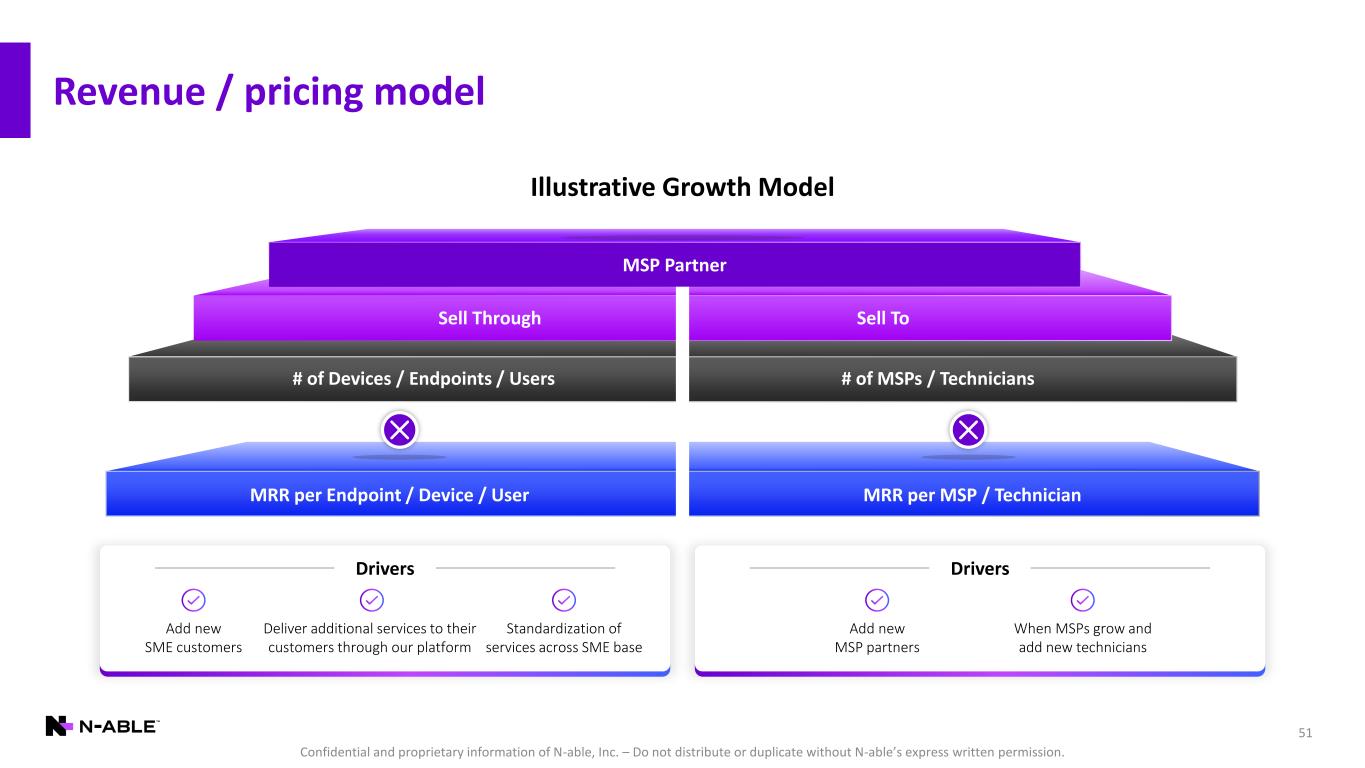

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. When MSPs grow and add new technicians Add new MSP partners Drivers Deliver additional services to their customers through our platform Add new SME customers Standardization of services across SME base Drivers Revenue / pricing model 51 MRR per Endpoint / Device / User MRR per MSP / Technician Illustrative Growth Model MSP Partner Sell Through Sell To # of Devices / Endpoints / Users # of MSPs / Technicians

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Strong track record for consistent revenue growth and at scale Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Quarterly revenue presented may not precisely sum to annual revenue due to rounding. 52 Annual revenue ($M) $228 $264 $303 2018 2019 2020 15% 15%Y/Y growth: $61 $66 $67 $70 $73 $73 $76 $80 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Quarterly revenue ($M) 12% 17% 16% 17% 20% 12% 14% 15%Y/Y growth: 12% 18% 16% 18% 20% 13% 15% 16% Y/Y subscription growth: COVID impact

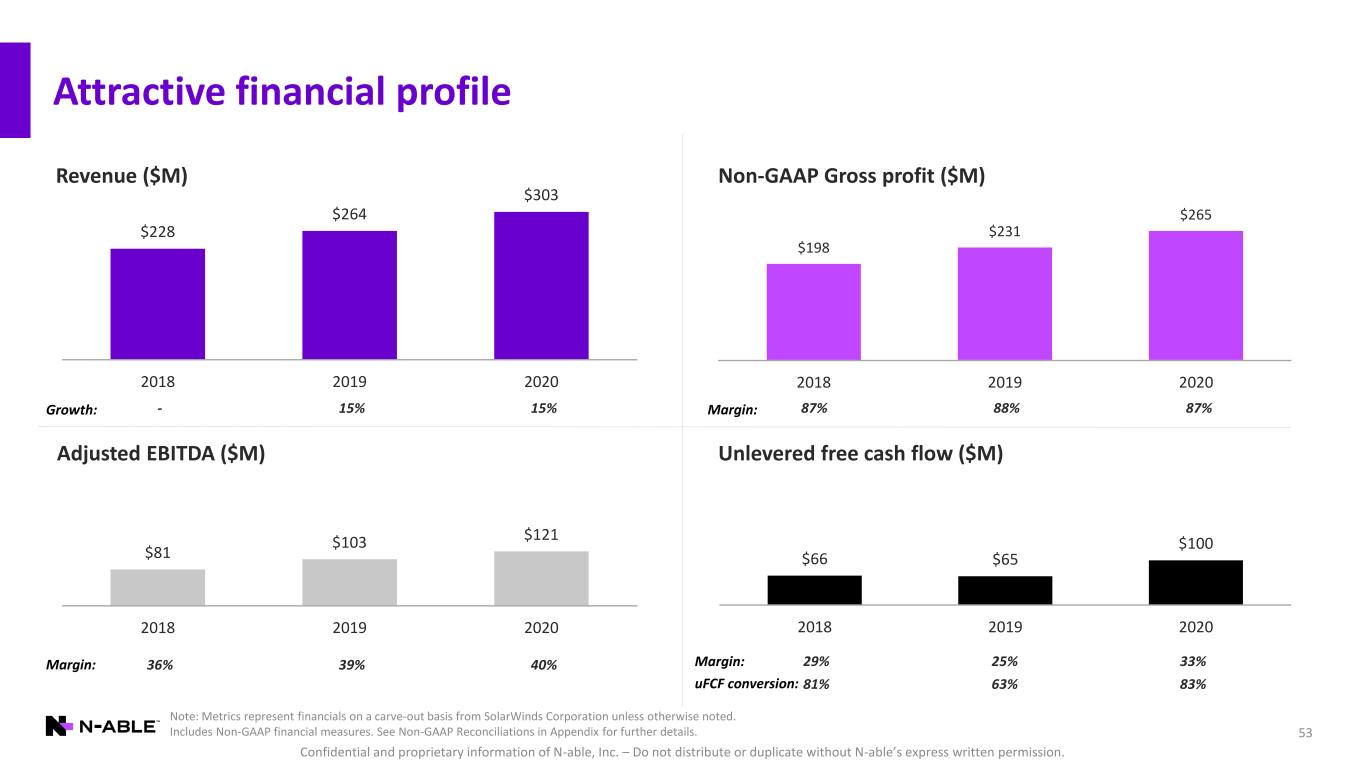

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. $228 $264 $303 2018 2019 2020 Attractive financial profile 53 $198 $231 $265 2018 2019 2020 $81 $103 $121 2018 2019 2020 $66 $65 $100 2018 2019 2020 - 15% 15%Growth: 87% 88% 87%Margin: 36% 39% 40%Margin: Adjusted EBITDA ($M) Unlevered free cash flow ($M) Revenue ($M) Non-GAAP Gross profit ($M) Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted. Includes Non-GAAP financial measures. See Non-GAAP Reconciliations in Appendix for further details. 29% 25% 33%Margin: 81% 63% 83%uFCF conversion:

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 108% 108% 109% 2018 2019 2020 54 Highly visible and predictable revenue model 84% 86% 86% 2018 2019 2020 Average revenue per partner ($000s) Dollar-based net revenue retention Partners spending ARR of $50K+ Gross revenue retention $8.9 $10.2 $11.6 2018 2019 2020 833 1,117 1,473 2018 2019 2020 Note: Metrics represent financials on a carve-out basis from SolarWinds Corporation unless otherwise noted.

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Partner cohort revenue analysis 55 $0 $20 $40 $60 $80 2015 2016 2017 2018 2019 2020 2014 and Prior 2015 2016 2017 2018 2019 2020 ($M, quarterly) 2018 cohort: 1.4x ARR in two years

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Preliminary guidance 56 Q1’21E Q2’21E FY’21E Revenue $82.7 – $82.9M $83.5 – $84.0M $340 – $344M Y/Y growth ~13% ~14% 12% – 14% Adjusted EBITDA - - $105 – $110M Adjusted EBIDTA margin - - 31% – 32% Note: Q1’21 financial results included in this presentation are preliminary and pending final review by SolarWinds and its external auditors. Q2’21 and FY’21 outlook was provided by SolarWinds on and as of April 13, 2021 with respect to the N-able business and is based on the assumption that the potential separation of the N-able business is completed in the second quarter of 2021.

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. 57 2021 and medium-term targets % of total revenue, except for revenue growth Rule of 50 2019 2020 2021E Medium- Term Target Revenue growth 15% 15% 12 - 14% 15 - 17% Gross margin 88% 87% 87 - 88% 87 - 88% S&M 25% 25% 28 - 29% 27 - 28% R&D 13% 13% 15 - 16% 14 - 15% G&A 13% 12% 12 - 13% 10 - 11% Adjusted EBITDA margin 39% 40% 31 - 32% 33 - 35% Note: Note: All financial metrics except for revenue growth are presented on a non-GAAP basis. See Non-GAAP Reconciliations in Appendix for further details. 2019 and 2020 metrics represent financials on a carve-out basis from SolarWinds Corporation. FY’21 outlook was provided by SolarWinds on and as of April 13, 2021 with respect to the N-able business and is based on the assumption that the potential separation of the N-able business is completed in the second quarter of 2021.

Confidential and proprietary information of N-able, Inc. – Do not distribute or duplicate without N-able’s express written permission. Capital structure 58 Sources as of 12/31/2020 Amount ($M) N-able’s Existing Cash & Cash Equivalents $100 New 5-yr $60 million Revolving Credit Facility - New 7-yr Term Loan B 350 Total $450 Pro Forma Capitalization as of 12/31/2020 Amount ($M) X Adjusted EBITDA Cash & Cash Equivalents $50 New 5-yr $60 million Revolving Credit Facility - New 7-yr Term Loan B 350 Total Debt $350 ~2.9x Total Net Debt $300 ~2.5x Adjusted EBITDA as of 12/31/2020 $121 Uses as of 12/31/2020 Amount ($M) Cash to N-able’s Balance Sheet1 $50 Repay Intercompany Debt 373 Transfer to Parent2 22 Estimated Transaction Fees & Expenses 5 Total $450 Note: If we proceed with a private placement, upon its closing, and prior to consummation of the separation and distribution, we would pay a dividend to SolarWinds in an amount equal to the net proceeds of the private placement. We would not retain any of the net proceeds from the private placement. 1 Reflects expected minimum cash and cash equivalents balance of $50.0 million pursuant to the terms of the separation and distribution agreement. 2 Cash in excess of the $50.0 million subsequent to the expected repayment of outstanding indebtedness upon the distribution date will be transferred to SolarWinds.