Form 8-K SIMMONS FIRST NATIONAL For: Oct 19

EXHIBIT 99.1

| For Immediate Release: | October 19, 2020 |

SIMMONS REPORTS THIRD QUARTER 2020 EARNINGS

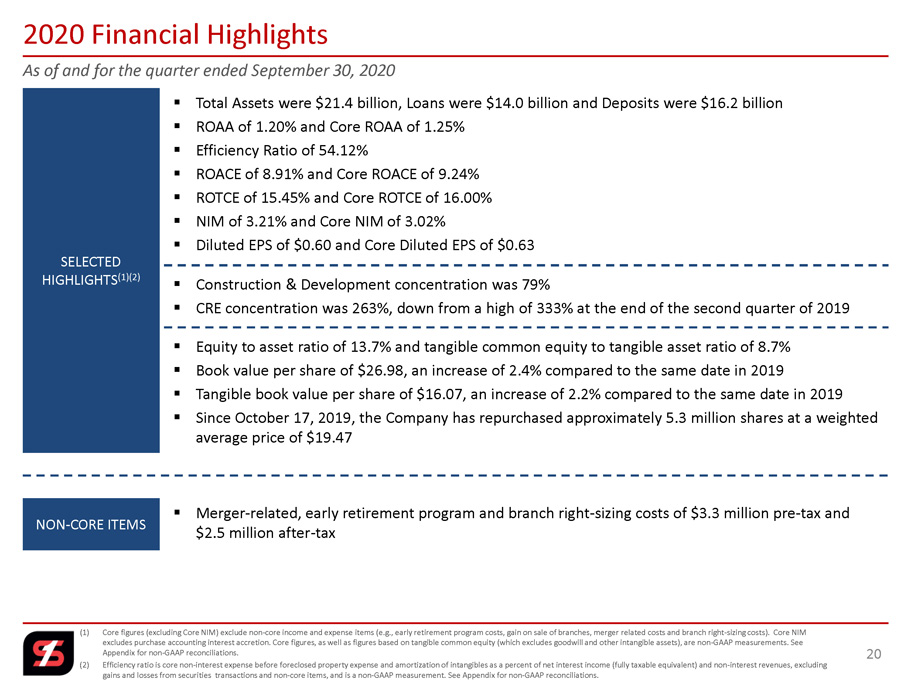

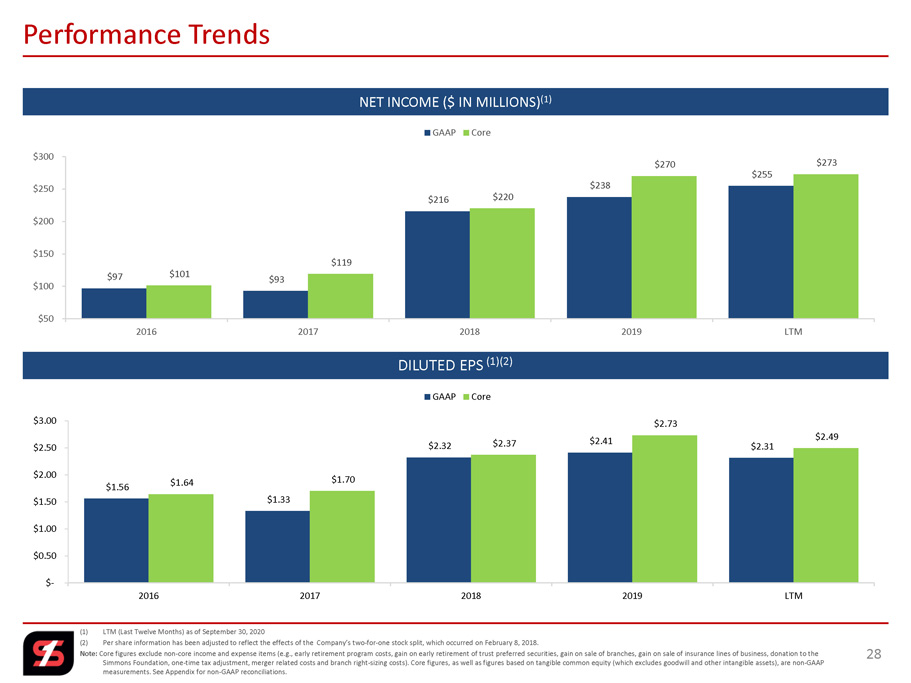

Pine Bluff, AR – Simmons First National Corporation (NASDAQ: SFNC) (the “Company” or “Simmons”) today announced net income of $65.9 million for the quarter ended September 30, 2020, compared to $81.8 million for the same period in 2019, a decrease of $15.9 million, or 19.5%. Diluted earnings per share were $0.60, a decrease of $0.24, or 28.6%, compared to the same period in the prior year. Included in the third quarter of 2019 results was a one-time after-tax gain on the sale of Visa Inc. class B common stock of $31.7 million.

Included in third quarter 2020 results were $2.5 million in net after-tax merger-related, early retirement program and net branch right-sizing costs. Excluding the impact of these items, core earnings were $68.3 million for the quarter ended September 30, 2020, compared to $84.0 million for the quarter ended September 30, 2019, a decrease of $15.6 million, or 18.6%. Core diluted earnings per share were $0.63, a decrease of $0.24, or 27.6%, from the same period in 2019.

Year-to-date net income for the first nine months of 2020 was $201.9 million, or $1.83 diluted earnings per share, compared to $185.1 million, or $1.94 diluted earnings per share, for the same period in 2019. Excluding $426,000 in net after-tax merger-related, early retirement program and net branch right-sizing costs and the gains on the sales of branches in south Texas and Colorado, year-to-date core earnings for 2020 were $202.3 million, an increase of $3.8 million compared to the same period last year. Core diluted earnings per share for the first nine months of 2020 were $1.83, a decrease of $0.25, or 12.0%, from the same period in 2019.

“We are very proud of our results under these trying conditions. We have experienced very meaningful shifts in consumer habits which we believe will impact our delivery of products and services as well as the retail delivery of everyday amenities. Our investment in digital channels will continue to position our company for these changes and our associates are ready for the new normal,” said George A. Makris, Jr., chairman and CEO of Simmons First National Corporation.

| Selected Highlights: | 3rd Qtr 2020 | 2nd Qtr 2020 | 3rd Qtr 2019 |

| Net income | $65.9 million | $58.8 million | $81.8 million |

| Diluted earnings per share | $0.60 | $0.54 | $0.84 |

| Return on avg assets | 1.20% | 1.08% | 1.83% |

| Return on avg common equity | 8.91% | 8.21% | 13.70% |

| Return on tangible common equity (1) | 15.45% | 14.55% | 24.89% |

| Core earnings (2) | $68.3 million | $60.1 million | $84.0 million |

| Core diluted earnings per share (2) | $0.63 | $0.55 | $0.87 |

| Core return on avg assets (2) | 1.25% | 1.11% | 1.88% |

| Core return on avg common equity (2) | 9.24% | 8.40% | 14.06% |

| Core return on tangible common equity (1)(2) | 16.00% | 14.87% | 25.52% |

| Efficiency ratio (3) | 54.12% | 51.46% | 43.77% |

| Pre-tax, pre-provision (PTPP) earnings (2) | $87.5 million | $97.7 million |

$122.6 million |

| (1) | Return on tangible common equity excludes goodwill and other intangible assets and is a non-GAAP measurement. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

| (2) | Core figures exclude non-core items and are non-GAAP measurements. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

| (3) | Efficiency ratio is core non-interest expense before foreclosed property expense and amortization of intangibles, as a percent of net interest income (fully taxable equivalent) and non-interest revenues, excluding gains and losses from securities transactions and non-core items, and is a non-GAAP measurement. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

P.O. BOX 7009 501 MAIN STREET PINE BLUFF, ARKANSAS 71611-7009 (870) 541-1000 www.simmonsbank.com

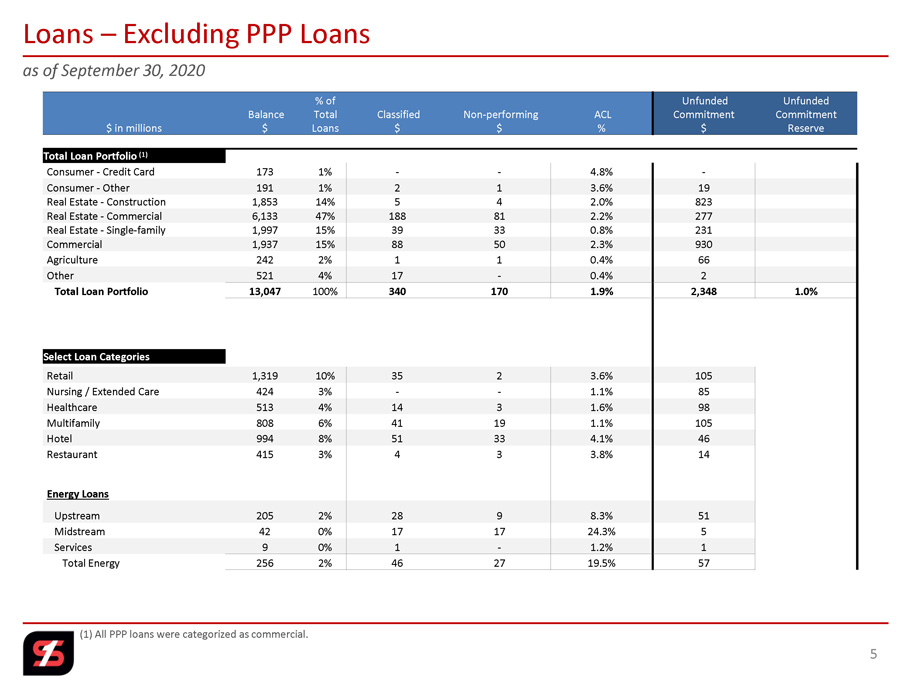

Loans

| ($ in billions) | 3rd Qtr 2020 | 2nd Qtr 2020 | 3rd Qtr 2019 |

| Total loans | $14.02 | $14.61 | $13.00 |

Total loans were $14.0 billion at September 30, 2020, an increase of $1.0 billion, or 7.8%, compared to September 30, 2019, primarily due to The Landrum Company (“Landrum”) merger completed during the fourth quarter of 2019. On a linked-quarter basis (September 30, 2020 compared to June 30, 2020), total loans decreased $589.5 million, or 4.0%. The decrease was across most loan categories with the largest decrease in the real estate loan portfolios. Makris stated, “Loan demand is very weak in almost every aspect of our commercial economy.”

Through September 30, 2020, the Company originated approximately 8,200 loans under the Paycheck Protection Program (“PPP”) of the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, with an average balance of $118,000 per loan. Approximately 93% of the PPP loans had a balance less than $350,000 as of September 30, 2020.

|

PPP Loans Balance as of September 30, 2020 |

# of Loans |

Balance ($ in millions) |

||

| Less than $50,000 | 5,216 | 63% | $94.4 | 10% |

| $50,000 to $350,000 | 2,441 | 30% | $304.8 | 31% |

| More than $350,000 to less than $2 million | 481 | 6% | $358.0 | 37% |

| $2 million to $10 million | 61 | 1% | $213.3 | 22% |

| Total | 8,199 | 100% | $970.5 | 100% |

Deposits

| ($ in billions) | 3rd Qtr 2020 | 2nd Qtr 2020 | 3rd Qtr 2019 |

| Total deposits | $16.2 | $16.6 | $13.5 |

| Non-interest bearing deposits | $4.4 | $4.6 | $3.1 |

| Interest bearing deposits | $9.0 | $9.0 | $7.3 |

| Time deposits | $2.8 | $3.0 | $3.1 |

Total deposits were $16.2 billion at September 30, 2020, an increase of $2.8 billion, or 20.6%, since September 30, 2019, primarily due to the Landrum merger. On a linked-quarter basis, total deposits decreased $369.5 million, or 2.2%, primarily due to decreases in non-interest bearing and large public fund time deposits.

Net Interest Income

| 3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 | |

| Loan yield (1) | 4.54% | 4.84% | 5.19% | 5.43% | 5.47% |

| Core loan yield (1) (2) | 4.29% | 4.52% | 4.86% | 5.00% | 5.19% |

| Security yield (1) | 2.60% | 2.50% | 2.63% | 2.73% | 2.87% |

| Cost of interest bearing deposits | 0.54% | 0.59% | 1.03% | 1.22% | 1.40% |

| Cost of deposits (3) | 0.39% | 0.44% | 0.80% | 0.94% | 1.09% |

| Cost of borrowed funds | 1.85% | 1.84% | 2.06% | 2.30% | 2.52% |

| Net interest margin (1) | 3.21% | 3.42% | 3.68% | 3.78% | 3.82% |

| Core net interest margin (1) (2) | 3.02% | 3.18% | 3.42% | 3.44% | 3.59% |

| (1) | Fully tax equivalent using an effective tax rate of 26.135%. |

| (2) | Core loan yield and core net interest margin exclude accretion and are non-GAAP measurements. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

| (3) | Includes non-interest bearing deposits. |

The Company’s net interest income for the third quarter of 2020 was $153.6 million, an increase of $4.3 million, or 2.9%, from the same period of 2019. The increase in net interest income was primarily due to the decline in the cost of interest-bearing deposits of 86 basis points, which was partially offset by a reduction in the loan yield of 93 basis points. Included in interest income was the yield accretion recognized on loans acquired of $8.9 million and $9.3 million for the third quarters of 2020 and 2019, respectively.

The loan yield was 4.54% for the quarter ended September 30, 2020, while the core loan yield, which excludes the accretion, was 4.29% for the same period. The decrease in the loan yield during the third quarter of 2020 was primarily driven by the lower yielding PPP loans originated during the second and third quarters of 2020. The PPP loan yield was approximately 2.37% during the third quarter of 2020 (including accretion of net fees), which decreased the loan yield by approximately 16 basis points.

Net interest margin (FTE) was 3.21% for the quarter ended September 30, 2020, while the core net interest margin, which excludes the accretion, was 3.02% for the same period. The decrease in the net interest margin during the third quarter of 2020 was primarily driven by additional liquidity created in response to the COVID-19 pandemic and the lower yielding PPP loans originated during the second and third quarters of 2020, which decreased the net interest margin by approximately 30 basis points.

Non-Interest Income

Non-interest income for the third quarter of 2020 was $71.9 million, a decrease of $12.8 million compared to the same period in the previous year, primarily due to the gain on sale of Visa Inc. class B common stock recognized during the prior year period. During the third quarter of 2020, the Company benefited from additional gains on the sale of securities and incremental mortgage lending income driven by the current low mortgage interest rate environment.

|

Selected Non-Interest Income Items ($ in millions) |

3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 |

| Service charges on deposit accounts | $10.4 | $8.6 | $13.3 | $13.3 | $10.8 |

| Mortgage lending income | $14.0 | $12.5 | $5.0 | $4.0 | $4.5 |

| SBA lending income | $0.3 | $0.2 | $0.3 | $0.3 | $1.0 |

| Debit and credit card fees | $8.9 | $8.0 | $7.9 | $8.9 | $7.1 |

| Gain on sale of securities | $22.3 | $0.4 | $32.1 | $0.4 | $7.4 |

| Gain on sale of Visa Inc. class B stock | - | - | - | - | $42.9 |

| Other income | $5.4 | $9.8 | $12.8 | $7.1 | $1.8 |

| Core other income (1)(2) | $5.0 | $7.6 | $6.9 | $7.1 | $44.7 |

| (1) | Core figures exclude non-core items and are non-GAAP measurements. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

| (2) | Core other income includes the gain on sale of Visa Inc. class B common stock. |

Non-Interest Expense

Non-interest expense for the third quarter of 2020 was $118.9 million, an increase of $12.1 million compared to the third quarter of 2019. Included in this quarter were $3.3 million of pre-tax non-core items for merger-related, early retirement program and branch right-sizing costs. Excluding these expenses, core non-interest expense was $115.3 million for the third quarter of 2020, an increase of $11.3 million compared to the same period in 2019, primarily the result of the Landrum merger and additional software and technology costs related to the Company’s Next Generation Banking (“NGB”) initiative.

The efficiency ratio for the third quarter of 2020 was 54.12%.

|

Selected Non-Interest Expense Items ($ in millions) |

3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 |

| Salaries and employee benefits | $61.1 | $57.6 | $67.9 | $63.2 | $52.1 |

| Merger related costs | $0.9 | $1.8 | $1.1 | $24.8 | $2.6 |

| Other operating expenses | $38.2 | $39.7 | $41.8 | $38.0 | $37.9 |

| Core salaries and employee benefits (1) | $58.7 | $57.2 | $67.9 | $63.2 | $51.9 |

| Core merger related costs (1) | - | - | - | - | - |

| Core other operating expenses (1) | $38.2 | $38.0 | $41.6 | $38.0 | $37.8 |

| (1) | Core figures exclude non-core items and are non-GAAP measurements. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

Early in 2020, the Company offered qualifying associates an early retirement option resulting in $2.3 million of non-core expense during the third quarter. The Company expects ongoing net annualized savings of approximately $2.9 million.

Management continuously evaluates the Company’s branch network as part of its analysis of the profitability of the Company’s operations and the efficiency with which it delivers banking services to its markets. As a result of this ongoing evaluation, the Company closed 11 branch locations during the second quarter of 2020, with estimated net annual cost savings of approximately $2.4 million related to these locations. The Company closed an additional 23 branch locations on October 9, 2020, with an expected net annual cost savings of approximately $6.7 million.

Asset Quality

| 3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 | |

| Allowance for credit losses on loans to total loans | 1.77% | 1.59% | 1.69% | 0.47% | 0.51% |

| Allowance for credit losses on loans to non-performing loans | 147% | 175% | 154% | 74% | 78% |

| Non-performing loans to total loans | 1.20% | 0.91% | 1.10% | 0.64% | 0.65% |

| Net charge-off ratio (annualized) | 0.16% | 1.04% | 0.07% | 0.09% | 0.59% |

| Net charge-off ratio YTD (annualized) | 0.43% | 0.56% | 0.07% | 0.24% | 0.30% |

At September 30, 2020, the allowance for credit losses on loans was $248.3 million. Provision for credit losses on loans for the third quarter of 2020 was $22.3 million. Included in total loans was $970.5 million of government guaranteed PPP loans. Excluding the PPP loans, the allowance for credit losses on loans to total loans was 1.90%.

Foreclosed Assets and Other Real Estate Owned

At September 30, 2020, foreclosed assets and other real estate owned were $12.6 million, a decrease of $7.0 million, or 35.7%, compared to the same period in 2019. The composition of these assets is divided into three types:

|

($ in millions)

|

3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 |

| Closed bank branches and branch sites | $0.6 | $2.7 | $8.8 | $5.7 | $5.9 |

| Foreclosed assets – acquired | $9.3 | $9.2 | $9.2 | $10.3 | $10.1 |

| Foreclosed assets – legacy | $2.7 | $2.2 | $2.8 | $3.1 | $3.6 |

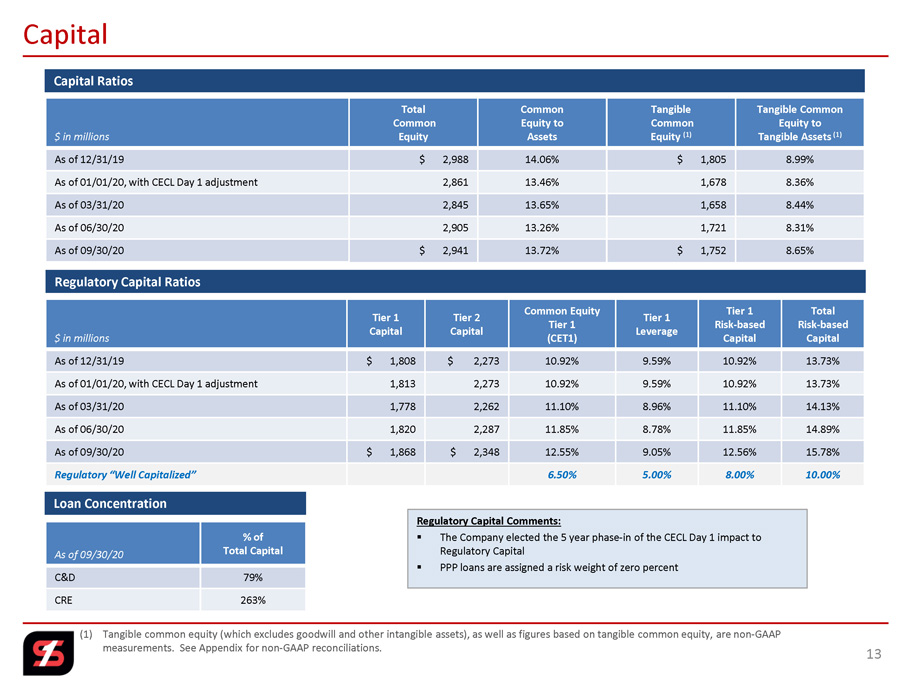

Capital

| 3rd Qtr 2020 |

2nd Qtr 2020 |

1st Qtr 2020 |

4th Qtr 2019 |

3rd Qtr 2019 | |

| Stockholders’ equity to total assets | 13.7% | 13.3% | 13.7% | 14.1% | 14.3% |

| Tangible common equity to tangible assets (1) | 8.7% | 8.3% | 8.4% | 9.0% | 9.1% |

| Regulatory common equity tier 1 ratio | 12.6% | 11.9% | 11.1% | 10.9% | 10.3% |

| Regulatory tier 1 leverage ratio | 9.1% | 8.8% | 9.0% | 9.6% | 9.1% |

| Regulatory tier 1 risk-based capital ratio | 12.6% | 11.9% | 11.1% | 10.9% | 10.3% |

| Regulatory total risk-based capital ratio | 15.8% | 14.9% | 14.1% | 13.7% | 13.2% |

| (1) | Tangible common equity to tangible assets is a non-GAAP measurement. Please see “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below. |

At September 30, 2020, common stockholders' equity was $2.9 billion. Book value per share was $26.98 and tangible book value per share was $16.07 at September 30, 2020. The ratio of stockholders’ equity to total assets was 13.7% at September 30, 2020, while the ratio of tangible common equity to tangible assets was 8.7%. As of September 30, 2020, PPP loans totaled $970.5 million, which are 100% federally guaranteed and have a zero percent risk-weight for regulatory capital ratios. Excluding PPP loans from total assets, equity to total assets was 14.4%, tangible common equity to tangible assets was 9.1% and the regulatory tier 1 leverage ratio was 9.5%.

Simmons First National Corporation

Simmons First National Corporation is a financial holding company headquartered in Pine Bluff, Arkansas, with total consolidated assets of approximately $21.4 billion as of September 30, 2020, conducting financial operations in Arkansas, Illinois, Kansas, Missouri, Oklahoma, Tennessee and Texas. The Company, through its subsidiaries, offers comprehensive financial solutions delivered with a client-centric approach. The Company’s common stock is listed on the NASDAQ Global Select Market under the symbol “SFNC.”

Conference Call

Management will conduct a live conference call to review this information beginning at 9:00 a.m. CDT today, Monday, October 19, 2020. Interested persons can listen to this call by dialing toll-free 1-866-298-7926 (United States and Canada only) and asking for the Simmons First National Corporation conference call, conference ID 6533868. In addition, the call will be available live or in recorded version on the Company’s website at www.simmonsbank.com for at least 60 days.

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance. These measures adjust GAAP performance measures to, among other things, include the tax benefit associated with revenue items that are tax-exempt, as well as exclude from income available to common shareholders certain expenses related to significant non-core activities, including merger-related expenses, gain on sale of branches, early retirement program expenses and net branch right-sizing expenses. In addition, the Company also presents certain figures based on tangible common stockholders’ equity and tangible book value, which exclude goodwill and other intangible assets. The Company further presents certain figures that are exclusive of PPP loans. The Company’s management believes that these non-GAAP financial measures are useful to investors because they present the results of the Company’s ongoing operations without the effect of mergers or other items not central to the Company’s ongoing business, as well as normalizing for tax effects. Management, therefore, believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the tables of this release.

Forward-Looking Statements

Some of the statements in this news release may not be based on historical facts and should be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, without limitation, statements made in Mr. Makris’s quotes, may be identified by reference to future periods or by the use of forward-looking terminology, such as “believe,” “budget,” “expect,” “foresee,” “anticipate,” “intend,” “indicate,” “target,” “estimate,” “plan,” “project,” “continue,” “contemplate,” “positions,” “prospects,” “predict,” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could,” “might” or “may,” or by variations of such words or by similar expressions. These forward-looking statements include, without limitation, statements relating to Simmons’ future growth, revenue, assets, asset quality, profitability, net interest margin, non-interest revenue, share repurchase program, acquisition strategy, NGB and other digital banking initiatives, the Company’s ability to recruit and retain key employees, the benefits associated with the Company’s early retirement program and completed and future branch closures, the adequacy of the allowance for credit losses, and the ability of the Company to manage the impact of the COVID-19 pandemic. Any forward-looking statement speaks only as of the date of this news release, and Simmons undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date of this news release. By nature, forward-looking statements are based on various assumptions and involve inherent risk and uncertainties. Various factors, including, but not limited to, changes in economic conditions, credit quality, interest rates, loan demand, deposit flows, real estate values, the assumptions used in making the forward-looking statements, the securities markets generally or the price of Simmons common stock specifically, and information technology affecting the financial industry; the effect of steps the Company takes in response to COVID-19, the severity and duration of the pandemic, including whether there is a widespread resurgence in COVID-19 infections combined with the seasonal flu, the pace of recovery when the pandemic subsides and the heightened impact it has on many of the risks described herein; the effects of the COVID-19 pandemic on, among other things, the Company’s operations, liquidity, and credit quality; general economic and market conditions; unemployment; claims, damages, and fines related to litigation or government actions, including litigation or actions arising from the Company’s participation in and administration of programs related to the COVID-19 pandemic (including, among other things, the PPP loan program authorized by the CARES Act); changes in accounting principles relating to loan loss recognition (current expected credit losses, or CECL); the Company’s ability to manage and successfully integrate its mergers and acquisitions; cyber threats, attacks or events; reliance on third parties for key services; and other factors, many of which are beyond the control of the Company, could cause actual results to differ materially from those contemplated by the forward-looking statements. Additional information on factors that might affect the Company’s financial results is included in its Form 10-K for the year ended December 31, 2019, and its Form 10-Q for the quarter ended June 30, 2020, which have been filed with, and are available from, the U.S. Securities and Exchange Commission.

####

FOR MORE INFORMATION CONTACT:

Stephen C. Massanelli

EVP, Chief Administrative Officer and Investor Relations Officer

Simmons First National Corporation

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated End of Period Balance Sheets | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Cash and non-interest bearing balances due from banks | $ | 382,691 | $ | 234,998 | $ | 244,123 | $ | 277,208 | $ | 161,440 | ||||||||||

| Interest bearing balances due from banks and federal funds sold | 2,139,440 | 2,310,162 | 1,493,076 | 719,415 | 368,530 | |||||||||||||||

| Cash and cash equivalents | 2,522,131 | 2,545,160 | 1,737,199 | 996,623 | 529,970 | |||||||||||||||

| Interest bearing balances due from banks - time | 4,061 | 4,561 | 4,309 | 4,554 | 5,041 | |||||||||||||||

| Investment securities - held-to-maturity | 47,102 | 51,720 | 53,968 | 40,927 | 42,237 | |||||||||||||||

| Investment securities - available-for-sale | 2,607,288 | 2,496,896 | 2,466,640 | 3,288,343 | 2,210,931 | |||||||||||||||

| Mortgage loans held for sale | 192,729 | 120,034 | 49,984 | 58,102 | 50,099 | |||||||||||||||

| Other assets held for sale | 389 | 399 | 115,315 | 260,332 | 383 | |||||||||||||||

| Loans: | ||||||||||||||||||||

| Loans | 14,017,442 | 14,606,900 | 14,374,277 | 14,425,704 | 13,003,549 | |||||||||||||||

| Allowance for credit losses on loans | (248,251 | ) | (231,643 | ) | (243,195 | ) | (68,244 | ) | (66,590 | ) | ||||||||||

| Net loans | 13,769,191 | 14,375,257 | 14,131,082 | 14,357,460 | 12,936,959 | |||||||||||||||

| Premises and equipment | 470,491 | 478,896 | 484,990 | 492,384 | 378,678 | |||||||||||||||

| Premises held for sale | 4,486 | 4,576 | - | - | - | |||||||||||||||

| Foreclosed assets and other real estate owned | 12,590 | 14,111 | 20,805 | 19,121 | 19,576 | |||||||||||||||

| Interest receivable | 77,352 | 79,772 | 57,039 | 62,707 | 53,966 | |||||||||||||||

| Bank owned life insurance | 257,718 | 256,643 | 255,197 | 254,152 | 234,655 | |||||||||||||||

| Goodwill | 1,075,305 | 1,064,765 | 1,064,978 | 1,055,520 | 926,648 | |||||||||||||||

| Other intangible assets | 114,460 | 117,823 | 121,673 | 127,340 | 101,149 | |||||||||||||||

| Other assets | 282,102 | 293,071 | 278,173 | 241,578 | 268,219 | |||||||||||||||

| Total assets | $ | 21,437,395 | $ | 21,903,684 | $ | 20,841,352 | $ | 21,259,143 | $ | 17,758,511 | ||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Non-interest bearing transaction accounts | $ | 4,451,385 | $ | 4,608,098 | $ | 3,572,244 | $ | 3,741,093 | $ | 3,044,330 | ||||||||||

| Interest bearing transaction accounts and savings deposits | 8,993,255 | 8,978,045 | 8,840,678 | 9,090,878 | 7,337,571 | |||||||||||||||

| Time deposits | 2,802,007 | 3,029,975 | 3,146,811 | 3,276,969 | 3,086,108 | |||||||||||||||

| Total deposits | 16,246,647 | 16,616,118 | 15,559,733 | 16,108,940 | 13,468,009 | |||||||||||||||

| Federal funds purchased and securities sold | ||||||||||||||||||||

| under agreements to repurchase | 313,694 | 387,025 | 377,859 | 150,145 | 116,536 | |||||||||||||||

| Other borrowings | 1,342,769 | 1,393,689 | 1,396,829 | 1,297,599 | 1,098,395 | |||||||||||||||

| Subordinated notes and debentures | 382,739 | 382,604 | 388,396 | 388,260 | 354,223 | |||||||||||||||

| Other liabilities held for sale | - | - | 58,405 | 159,853 | - | |||||||||||||||

| Accrued interest and other liabilities | 209,305 | 219,545 | 214,730 | 165,422 | 174,277 | |||||||||||||||

| Total liabilities | 18,495,154 | 18,998,981 | 17,995,952 | 18,270,219 | 15,211,440 | |||||||||||||||

| Stockholders' equity: | ||||||||||||||||||||

| Preferred stock | 767 | 767 | 767 | 767 | - | |||||||||||||||

| Common stock | 1,090 | 1,090 | 1,090 | 1,136 | 966 | |||||||||||||||

| Surplus | 2,032,372 | 2,029,383 | 2,026,420 | 2,117,282 | 1,708,058 | |||||||||||||||

| Undivided profits | 866,503 | 819,153 | 778,893 | 848,848 | 814,338 | |||||||||||||||

| Accumulated other comprehensive income (loss): | ||||||||||||||||||||

| Unrealized accretion (depreciation) on AFS securities | 41,509 | 54,310 | 38,230 | 20,891 | 23,709 | |||||||||||||||

| Total stockholders' equity | 2,942,241 | 2,904,703 | 2,845,400 | 2,988,924 | 2,547,071 | |||||||||||||||

| Total liabilities and stockholders' equity | $ | 21,437,395 | $ | 21,903,684 | $ | 20,841,352 | $ | 21,259,143 | $ | 17,758,511 | ||||||||||

| Page 1 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated Statements of Income - Quarter-to-Date | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||

| INTEREST INCOME | ||||||||||||||||||||

| Loans | $ | 163,180 | $ | 176,910 | $ | 187,566 | $ | 193,402 | $ | 179,971 | ||||||||||

| Interest bearing balances due from banks and federal funds sold | 623 | 603 | 2,441 | 2,625 | 1,586 | |||||||||||||||

| Investment securities | 14,910 | 13,473 | 18,943 | 16,962 | 14,467 | |||||||||||||||

| Mortgage loans held for sale | 1,012 | 668 | 281 | 402 | 382 | |||||||||||||||

| TOTAL INTEREST INCOME | 179,725 | 191,654 | 209,231 | 213,391 | 196,406 | |||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||

| Time deposits | 9,437 | 10,803 | 13,323 | 16,198 | 15,573 | |||||||||||||||

| Other deposits | 6,769 | 7,203 | 17,954 | 20,331 | 21,363 | |||||||||||||||

| Federal funds purchased and securities | ||||||||||||||||||||

| sold under agreements to repurchase | 335 | 337 | 759 | 368 | 249 | |||||||||||||||

| Other borrowings | 4,943 | 4,963 | 4,877 | 4,615 | 5,381 | |||||||||||||||

| Subordinated notes and debentures | 4,631 | 4,667 | 4,835 | 4,813 | 4,576 | |||||||||||||||

| TOTAL INTEREST EXPENSE | 26,115 | 27,973 | 41,748 | 46,325 | 47,142 | |||||||||||||||

| NET INTEREST INCOME | 153,610 | 163,681 | 167,483 | 167,066 | 149,264 | |||||||||||||||

| Provision for credit losses | 22,981 | 21,915 | 23,134 | 4,903 | 21,973 | |||||||||||||||

| NET INTEREST INCOME AFTER PROVISION | ||||||||||||||||||||

| FOR CREDIT LOSSES | 130,629 | 141,766 | 144,349 | 162,163 | 127,291 | |||||||||||||||

| NON-INTEREST INCOME | ||||||||||||||||||||

| Trust income | 6,744 | 7,253 | 7,151 | 7,430 | 6,108 | |||||||||||||||

| Service charges on deposit accounts | 10,385 | 8,570 | 13,328 | 13,332 | 10,825 | |||||||||||||||

| Other service charges and fees | 1,764 | 1,489 | 1,588 | 1,915 | 1,308 | |||||||||||||||

| Mortgage lending income | 13,971 | 12,459 | 5,046 | 4,029 | 4,509 | |||||||||||||||

| SBA lending income | 304 | 245 | 296 | 321 | 956 | |||||||||||||||

| Investment banking income | 557 | 571 | 877 | 822 | 513 | |||||||||||||||

| Debit and credit card fees | 8,850 | 7,996 | 7,914 | 8,920 | 7,059 | |||||||||||||||

| Bank owned life insurance income | 1,591 | 1,445 | 1,298 | 1,411 | 1,302 | |||||||||||||||

| Gain on sale of securities, net | 22,305 | 390 | 32,095 | 377 | 7,374 | |||||||||||||||

| Other income | 5,380 | 9,809 | 12,801 | 7,073 | 44,721 | |||||||||||||||

| TOTAL NON-INTEREST INCOME | 71,851 | 50,227 | 82,394 | 45,630 | 84,675 | |||||||||||||||

| NON-INTEREST EXPENSE | ||||||||||||||||||||

| Salaries and employee benefits | 61,144 | 57,644 | 67,924 | 63,235 | 52,065 | |||||||||||||||

| Occupancy expense, net | 9,647 | 9,217 | 9,510 | 9,272 | 8,342 | |||||||||||||||

| Furniture and equipment expense | 6,231 | 6,144 | 5,723 | 5,758 | 4,898 | |||||||||||||||

| Other real estate and foreclosure expense | 602 | 274 | 325 | 1,089 | 1,125 | |||||||||||||||

| Deposit insurance | 2,244 | 2,838 | 2,475 | (134 | ) | - | ||||||||||||||

| Merger-related costs | 902 | 1,830 | 1,068 | 24,831 | 2,556 | |||||||||||||||

| Other operating expenses | 38,179 | 39,651 | 41,788 | 38,044 | 37,879 | |||||||||||||||

| TOTAL NON-INTEREST EXPENSE | 118,949 | 117,598 | 128,813 | 142,095 | 106,865 | |||||||||||||||

| NET INCOME BEFORE INCOME TAXES | 83,531 | 74,395 | 97,930 | 65,698 | 105,101 | |||||||||||||||

| Provision for income taxes | 17,633 | 15,593 | 20,694 | 12,976 | 23,275 | |||||||||||||||

| NET INCOME | 65,898 | 58,802 | 77,236 | 52,722 | 81,826 | |||||||||||||||

| Preferred stock dividends | 13 | 13 | 13 | 13 | - | |||||||||||||||

| NET INCOME AVAILABLE TO COMMON STOCKHOLDERS | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| BASIC EARNINGS PER SHARE | $ | 0.60 | $ | 0.54 | $ | 0.68 | $ | 0.49 | $ | 0.85 | ||||||||||

| DILUTED EARNINGS PER SHARE | $ | 0.60 | $ | 0.54 | $ | 0.68 | $ | 0.49 | $ | 0.84 | ||||||||||

| Page 2 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated Risk-Based Capital | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Tier 1 capital | ||||||||||||||||||||

| Stockholders' equity | $ | 2,942,241 | $ | 2,904,703 | $ | 2,845,400 | $ | 2,988,924 | $ | 2,547,071 | ||||||||||

| CECL transition provision (1) | 134,798 | 130,480 | 134,558 | - | - | |||||||||||||||

| Disallowed intangible assets, net of deferred tax | (1,167,357 | ) | (1,160,385 | ) | (1,164,038 | ) | (1,160,079 | ) | (1,013,309 | ) | ||||||||||

| Unrealized (gain) loss on AFS securities | (41,509 | ) | (54,310 | ) | (38,230 | ) | (20,891 | ) | (23,709 | ) | ||||||||||

| Total Tier 1 capital | 1,868,173 | 1,820,488 | 1,777,690 | 1,807,954 | 1,510,053 | |||||||||||||||

| Tier 2 capital | ||||||||||||||||||||

| Trust preferred securities and subordinated debt | 382,739 | 382,604 | 388,396 | 388,260 | 354,223 | |||||||||||||||

| Qualifying allowance for loan losses and | ||||||||||||||||||||

| reserve for unfunded commitments | 96,734 | 83,780 | 96,015 | 76,644 | 74,455 | |||||||||||||||

| Total Tier 2 capital | 479,473 | 466,384 | 484,411 | 464,904 | 428,678 | |||||||||||||||

| Total risk-based capital | $ | 2,347,646 | $ | 2,286,872 | $ | 2,262,101 | $ | 2,272,858 | $ | 1,938,731 | ||||||||||

| Risk weighted assets | $ | 14,878,932 | $ | 15,362,175 | $ | 16,012,233 | $ | 16,554,081 | $ | 14,725,571 | ||||||||||

| Adjusted average assets for leverage ratio | $ | 20,652,454 | $ | 20,742,824 | $ | 19,832,219 | $ | 18,852,798 | $ | 16,681,527 | ||||||||||

| Ratios at end of quarter | ||||||||||||||||||||

| Equity to assets | 13.72 | % | 13.26 | % | 13.65 | % | 14.06 | % | 14.34 | % | ||||||||||

| Tangible common equity to tangible assets (2) | 8.65 | % | 8.31 | % | 8.44 | % | 8.99 | % | 9.08 | % | ||||||||||

| Common equity Tier 1 ratio (CET1) | 12.55 | % | 11.85 | % | 11.10 | % | 10.92 | % | 10.25 | % | ||||||||||

| Tier 1 leverage ratio | 9.05 | % | 8.78 | % | 8.96 | % | 9.59 | % | 9.05 | % | ||||||||||

| Tier 1 risk-based capital ratio | 12.56 | % | 11.85 | % | 11.10 | % | 10.92 | % | 10.25 | % | ||||||||||

| Total risk-based capital ratio | 15.78 | % | 14.89 | % | 14.13 | % | 13.73 | % | 13.17 | % | ||||||||||

(1) The Company has elected to use the CECL transition provision allowed for in the year of adopting ASC 326.

(2) Calculations of tangible common equity to tangible assets and the reconciliations to GAAP are included in the schedules accompanying this release.

| Page 3 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated Investment Securities | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Investment Securities - End of Period | ||||||||||||||||||||

| Held-to-Maturity | ||||||||||||||||||||

| Mortgage-backed securities | $ | 24,297 | $ | 25,980 | $ | 27,121 | $ | 10,796 | $ | 11,549 | ||||||||||

| State and political subdivisions | 21,930 | 24,777 | 25,985 | 27,082 | 28,692 | |||||||||||||||

| Other securities | 875 | 963 | 862 | 3,049 | 1,996 | |||||||||||||||

| Total held-to-maturity (net of credit losses) | 47,102 | 51,720 | 53,968 | 40,927 | 42,237 | |||||||||||||||

| Available-for-Sale | ||||||||||||||||||||

| U.S. Treasury | $ | - | $ | - | $ | 424,989 | $ | 449,729 | $ | - | ||||||||||

| U.S. Government agencies | 471,973 | 210,921 | 161,289 | 194,249 | 178,139 | |||||||||||||||

| Mortgage-backed securities | 903,687 | 1,154,086 | 1,179,837 | 1,742,945 | 1,337,794 | |||||||||||||||

| State and political subdivisions | 1,133,006 | 1,054,068 | 678,243 | 880,524 | 681,202 | |||||||||||||||

| Other securities | 98,622 | 77,821 | 22,282 | 20,896 | 13,796 | |||||||||||||||

| Total available-for-sale (net of credit losses) | 2,607,288 | 2,496,896 | 2,466,640 | 3,288,343 | 2,210,931 | |||||||||||||||

| Total investment securities (net of credit losses) | $ | 2,654,390 | $ | 2,548,616 | $ | 2,520,608 | $ | 3,329,270 | $ | 2,253,168 | ||||||||||

| Fair value - HTM investment securities | $ | 49,064 | $ | 53,751 | $ | 55,714 | $ | 41,855 | $ | 43,302 | ||||||||||

| Investment Securities - QTD Average | ||||||||||||||||||||

| Taxable securities | $ | 1,534,742 | $ | 1,642,083 | $ | 2,324,188 | $ | 1,940,755 | $ | 1,561,308 | ||||||||||

| Tax exempt securities | 1,155,099 | 866,944 | 900,223 | 825,000 | 681,505 | |||||||||||||||

| Total investment securities - QTD average | $ | 2,689,841 | $ | 2,509,027 | $ | 3,224,411 | $ | 2,765,755 | $ | 2,242,813 | ||||||||||

| Page 4 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated Loans | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Loan Portfolio - End of Period | ||||||||||||||||||||

| Consumer | ||||||||||||||||||||

| Credit cards | $ | 172,880 | $ | 184,348 | $ | 188,596 | $ | 204,802 | $ | 195,083 | ||||||||||

| Other consumer | 190,736 | 214,024 | 267,870 | 249,195 | 215,283 | |||||||||||||||

| Total consumer | 363,616 | 398,372 | 456,466 | 453,997 | 410,366 | |||||||||||||||

| Real Estate | ||||||||||||||||||||

| Construction | 1,853,360 | 2,010,256 | 2,024,118 | 2,248,673 | 2,081,595 | |||||||||||||||

| Single-family residential | 1,997,070 | 2,207,087 | 2,343,543 | 2,414,753 | 1,951,842 | |||||||||||||||

| Other commercial real estate | 6,132,823 | 6,316,444 | 6,466,104 | 6,358,514 | 5,758,511 | |||||||||||||||

| Total real estate | 9,983,253 | 10,533,787 | 10,833,765 | 11,021,940 | 9,791,948 | |||||||||||||||

| Commercial | ||||||||||||||||||||

| Commercial | 2,907,798 | 3,038,216 | 2,314,472 | 2,451,119 | 2,215,539 | |||||||||||||||

| Agricultural | 241,687 | 217,715 | 191,535 | 191,525 | 214,610 | |||||||||||||||

| Total commercial | 3,149,485 | 3,255,931 | 2,506,007 | 2,642,644 | 2,430,149 | |||||||||||||||

| Other | 521,088 | 418,810 | 578,039 | 307,123 | 371,086 | |||||||||||||||

| Total Loans | $ | 14,017,442 | $ | 14,606,900 | $ | 14,374,277 | $ | 14,425,704 | $ | 13,003,549 | ||||||||||

| Page 5 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated Allowance and Asset Quality | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Allowance for Credit Losses on Loans | ||||||||||||||||||||

| Beginning balance, prior to adoption of ASC 326 | $ | 68,244 | $ | 66,590 | $ | 64,179 | ||||||||||||||

| Impact of adopting ASC 326 (1) | $ | 151,377 | ||||||||||||||||||

| Beginning balance, after adoption of ASC 326 | $ | 231,641 | $ | 243,195 | $ | 219,621 | ||||||||||||||

| Loans charged off | ||||||||||||||||||||

| Credit cards | 832 | 1,053 | 1,441 | 1,287 | 1,117 | |||||||||||||||

| Other consumer | 1,091 | 592 | 1,379 | 1,425 | 1,065 | |||||||||||||||

| Real estate | 1,153 | 1,824 | 396 | 892 | 1,367 | |||||||||||||||

| Commercial | 4,327 | 35,687 | 523 | 459 | 17,778 | |||||||||||||||

| Total loans charged off | 7,403 | 39,156 | 3,739 | 4,063 | 21,327 | |||||||||||||||

| Recoveries of loans previously charged off | ||||||||||||||||||||

| Credit cards | 276 | 272 | 225 | 287 | 223 | |||||||||||||||

| Other consumer | 366 | 301 | 443 | 304 | 1,422 | |||||||||||||||

| Real estate | 120 | 253 | 101 | 146 | 55 | |||||||||||||||

| Commercial | 936 | 98 | 347 | 77 | 65 | |||||||||||||||

| Total recoveries | 1,698 | 924 | 1,116 | 814 | 1,765 | |||||||||||||||

| Net loans charged off | 5,705 | 38,232 | 2,623 | 3,249 | 19,562 | |||||||||||||||

| Provision for credit losses on loans | 22,315 | 26,678 | 26,197 | 4,903 | 21,973 | |||||||||||||||

| Balance, end of quarter | $ | 248,251 | $ | 231,641 | $ | 243,195 | $ | 68,244 | $ | 66,590 | ||||||||||

| Non-performing assets | ||||||||||||||||||||

| Non-performing loans | ||||||||||||||||||||

| Nonaccrual loans | $ | 168,349 | $ | 131,888 | $ | 156,746 | $ | 91,723 | $ | 84,660 | ||||||||||

| Loans past due 90 days or more | 156 | 537 | 1,305 | 855 | 177 | |||||||||||||||

| Total non-performing loans | 168,505 | 132,425 | 158,051 | 92,578 | 84,837 | |||||||||||||||

| Other non-performing assets | ||||||||||||||||||||

| Foreclosed assets and other real estate owned | 12,590 | 14,111 | 20,805 | 19,121 | 19,576 | |||||||||||||||

| Other non-performing assets | 1,983 | 2,008 | 2,169 | 1,964 | 540 | |||||||||||||||

| Total other non-performing assets | 14,573 | 16,119 | 22,974 | 21,085 | 20,116 | |||||||||||||||

| Total non-performing assets | $ | 183,078 | $ | 148,544 | $ | 181,025 | $ | 113,663 | $ | 104,953 | ||||||||||

| Performing TDRs (troubled debt restructurings) | $ | 2,791 | $ | 3,960 | $ | 4,110 | $ | 4,411 | $ | 6,519 | ||||||||||

| Ratios | ||||||||||||||||||||

| Allowance for credit losses on loans to total loans | 1.77 | % | 1.59 | % | 1.69 | % | 0.47 | % | 0.51 | % | ||||||||||

| Allowance for credit losses to non-performing loans | 147 | % | 175 | % | 154 | % | 74 | % | 78 | % | ||||||||||

| Non-performing loans to total loans | 1.20 | % | 0.91 | % | 1.10 | % | 0.64 | % | 0.65 | % | ||||||||||

| Non-performing assets (including performing TDRs) | ||||||||||||||||||||

| to total assets | 0.87 | % | 0.70 | % | 0.89 | % | 0.56 | % | 0.63 | % | ||||||||||

| Non-performing assets to total assets | 0.85 | % | 0.68 | % | 0.87 | % | 0.53 | % | 0.59 | % | ||||||||||

| Annualized net charge offs to total loans | 0.16 | % | 1.04 | % | 0.07 | % | 0.09 | % | 0.59 | % | ||||||||||

| Annualized net credit card charge offs to | ||||||||||||||||||||

| total credit card loans | 1.26 | % | 1.67 | % | 2.29 | % | 1.99 | % | 1.82 | % | ||||||||||

(1) The Company adopted ASC 326.effective January 1, 2020.

| Page 6 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||||||||||||||||||

| Consolidated - Average Balance Sheet and Net Interest Income Analysis | ||||||||||||||||||||||||||||||||||||

| For the Quarters Ended | ||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||

| Three Months Ended Sep 2020 | Three Months Ended Jun 2020 | Three Months Ended Sep 2019 | ||||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||||||

| Earning assets: | ||||||||||||||||||||||||||||||||||||

| Interest bearing balances due from banks | ||||||||||||||||||||||||||||||||||||

| and federal funds sold | $ | 2,265,233 | $ | 623 | 0.11 | % | $ | 2,190,878 | $ | 603 | 0.11 | % | $ | 344,761 | $ | 1,586 | 1.83 | % | ||||||||||||||||||

| Investment securities - taxable | 1,534,742 | 7,193 | 1.86 | % | 1,642,083 | 7,131 | 1.75 | % | 1,561,308 | 9,514 | 2.42 | % | ||||||||||||||||||||||||

| Investment securities - non-taxable (FTE) | 1,155,099 | 10,382 | 3.58 | % | 866,944 | 8,434 | 3.91 | % | 681,505 | 6,687 | 3.89 | % | ||||||||||||||||||||||||

| Mortgage loans held for sale | 145,226 | 1,012 | 2.77 | % | 86,264 | 668 | 3.11 | % | 39,551 | 382 | 3.83 | % | ||||||||||||||||||||||||

| Loans (FTE) | 14,315,014 | 163,379 | 4.54 | % | 14,731,306 | 177,168 | 4.84 | % | 13,053,540 | 180,080 | 5.47 | % | ||||||||||||||||||||||||

| Total interest earning assets (FTE) | 19,415,314 | 182,589 | 3.74 | % | 19,517,475 | 194,004 | 4.00 | % | 15,680,665 | 198,249 | 5.02 | % | ||||||||||||||||||||||||

| Non-earning assets | 2,350,007 | 2,304,798 | 2,039,933 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 21,765,321 | $ | 21,822,273 | $ | 17,720,598 | ||||||||||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: | ||||||||||||||||||||||||||||||||||||

| Interest bearing transaction and | ||||||||||||||||||||||||||||||||||||

| savings accounts | $ | 8,977,886 | $ | 6,769 | 0.30 | % | $ | 9,138,563 | $ | 7,203 | 0.32 | % | $ | 7,322,395 | $ | 21,363 | 1.16 | % | ||||||||||||||||||

| Time deposits | 2,998,091 | 9,437 | 1.25 | % | 3,057,153 | 10,803 | 1.42 | % | 3,122,422 | 15,573 | 1.98 | % | ||||||||||||||||||||||||

| Total interest bearing deposits | 11,975,977 | 16,206 | 0.54 | % | 12,195,716 | 18,006 | 0.59 | % | 10,444,817 | 36,936 | 1.40 | % | ||||||||||||||||||||||||

| Federal funds purchased and securities | ||||||||||||||||||||||||||||||||||||

| sold under agreement to repurchase | 386,631 | 335 | 0.34 | % | 392,633 | 337 | 0.35 | % | 123,883 | 249 | 0.80 | % | ||||||||||||||||||||||||

| Other borrowings | 1,357,278 | 4,943 | 1.45 | % | 1,395,109 | 4,963 | 1.43 | % | 1,127,886 | 5,381 | 1.89 | % | ||||||||||||||||||||||||

| Subordinated notes and debentures | 382,672 | 4,631 | 4.81 | % | 387,422 | 4,667 | 4.84 | % | 354,178 | 4,576 | 5.13 | % | ||||||||||||||||||||||||

| Total interest bearing liabilities | 14,102,558 | 26,115 | 0.74 | % | 14,370,880 | 27,973 | 0.78 | % | 12,050,764 | 47,142 | 1.55 | % | ||||||||||||||||||||||||

| Non-interest bearing liabilities: | ||||||||||||||||||||||||||||||||||||

| Non-interest bearing deposits | 4,529,782 | 4,354,781 | 3,012,544 | |||||||||||||||||||||||||||||||||

| Other liabilities | 190,169 | 216,508 | 288,517 | |||||||||||||||||||||||||||||||||

| Total liabilities | 18,822,509 | 18,942,169 | 15,351,825 | |||||||||||||||||||||||||||||||||

| Stockholders' equity | 2,942,812 | 2,880,104 | 2,368,773 | |||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 21,765,321 | $ | 21,822,273 | $ | 17,720,598 | ||||||||||||||||||||||||||||||

| Net interest income (FTE) | $ | 156,474 | $ | 166,031 | $ | 151,107 | ||||||||||||||||||||||||||||||

| Net interest spread (FTE) | 3.00 | % | 3.22 | % | 3.47 | % | ||||||||||||||||||||||||||||||

| Net interest margin (FTE) - quarter-to-date | 3.21 | % | 3.42 | % | 3.82 | % | ||||||||||||||||||||||||||||||

| Net interest margin (FTE) - year-to-date | 3.43 | % | 3.55 | % | 3.88 | % | ||||||||||||||||||||||||||||||

| Core net interest margin (FTE) - quarter-to-date (1) | 3.02 | % | 3.18 | % | 3.59 | % | ||||||||||||||||||||||||||||||

| Core loan yield (FTE) - quarter-to-date (1) | 4.29 | % | 4.52 | % | 5.19 | % | ||||||||||||||||||||||||||||||

| Core net interest margin (FTE) - year-to-date (1) | 3.20 | % | 3.30 | % | 3.64 | % | ||||||||||||||||||||||||||||||

| Core loan yield (FTE) - year-to-date (1) | 4.56 | % | 4.69 | % | 5.24 | % | ||||||||||||||||||||||||||||||

(1) Calculations of core net interest margin and core loan yield and the reconciliations to GAAP are included in the schedules accompanying this release.

| Page 7 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated - Selected Financial Data | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands, except share data) | ||||||||||||||||||||

| QUARTER-TO-DATE | ||||||||||||||||||||

| Financial Highlights - GAAP | ||||||||||||||||||||

| Net Income | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| Diluted earnings per share | 0.60 | 0.54 | 0.68 | 0.49 | 0.84 | |||||||||||||||

| Return on average assets | 1.20 | % | 1.08 | % | 1.48 | % | 1.04 | % | 1.83 | % | ||||||||||

| Return on average common equity | 8.91 | % | 8.21 | % | 10.83 | % | 8.01 | % | 13.70 | % | ||||||||||

| Return on tangible common equity | 15.45 | % | 14.55 | % | 19.00 | % | 14.62 | % | 24.89 | % | ||||||||||

| Net interest margin (FTE) | 3.21 | % | 3.42 | % | 3.68 | % | 3.78 | % | 3.82 | % | ||||||||||

| FTE adjustment | 2,864 | 2,350 | 2,305 | 2,172 | 1,843 | |||||||||||||||

| Amortization of intangibles | 3,362 | 3,369 | 3,413 | 3,270 | 2,947 | |||||||||||||||

| Amortization of intangibles, net of taxes | 2,483 | 2,489 | 2,521 | 2,416 | 2,176 | |||||||||||||||

| Average diluted shares outstanding | 109,207,294 | 109,130,866 | 113,137,223 | 108,472,559 | 96,968,775 | |||||||||||||||

| Shares repurchased under plan | - | - | 4,922,336 | 390,000 | - | |||||||||||||||

| Average price of shares repurchased | - | - | 18.96 | 25.95 | - | |||||||||||||||

| Cash dividends declared per common share | 0.17 | 0.17 | 0.17 | 0.16 | 0.16 | |||||||||||||||

| Financial Highlights - Core (non-GAAP) | ||||||||||||||||||||

| Core earnings (excludes non-core items) (1) | $ | 68,338 | $ | 60,147 | $ | 73,838 | $ | 71,074 | $ | 83,963 | ||||||||||

| Core diluted earnings per share (1) | 0.63 | 0.55 | 0.65 | 0.66 | 0.87 | |||||||||||||||

| Core net interest margin (FTE) (2) | 3.02 | % | 3.18 | % | 3.42 | % | 3.44 | % | 3.59 | % | ||||||||||

| Accretable yield on acquired loans | 8,948 | 11,723 | 11,837 | 15,100 | 9,322 | |||||||||||||||

| Efficiency ratio (1) | 54.12 | % | 51.46 | % | 57.79 | % | 52.63 | % | 43.77 | % | ||||||||||

| Core return on average assets (1) | 1.25 | % | 1.11 | % | 1.42 | % | 1.41 | % | 1.88 | % | ||||||||||

| Core return on average common equity (1) | 9.24 | % | 8.40 | % | 10.35 | % | 10.80 | % | 14.06 | % | ||||||||||

| Core return on tangible common equity (1) | 16.00 | % | 14.87 | % | 18.19 | % | 19.49 | % | 25.52 | % | ||||||||||

| YEAR-TO-DATE | ||||||||||||||||||||

| Financial Highlights - GAAP | ||||||||||||||||||||

| Net Income | $ | 201,897 | $ | 136,012 | $ | 77,223 | $ | 237,828 | $ | 185,119 | ||||||||||

| Diluted earnings per share | 1.83 | 1.22 | 0.68 | 2.41 | 1.94 | |||||||||||||||

| Return on average assets | 1.25 | % | 1.28 | % | 1.48 | % | 1.33 | % | 1.44 | % | ||||||||||

| Return on average common equity | 9.27 | % | 9.45 | % | 10.83 | % | 9.93 | % | 10.65 | % | ||||||||||

| Return on tangible common equity | 16.19 | % | 16.57 | % | 19.00 | % | 17.99 | % | 19.27 | % | ||||||||||

| Net interest margin (FTE) | 3.43 | % | 3.55 | % | 3.68 | % | 3.85 | % | 3.88 | % | ||||||||||

| FTE adjustment | 7,519 | 4,655 | 2,305 | 7,322 | 5,150 | |||||||||||||||

| Amortization of intangibles | 10,144 | 6,782 | 3,413 | 11,805 | 8,535 | |||||||||||||||

| Amortization of intangibles, net of taxes | 7,493 | 5,010 | 2,521 | 8,720 | 6,304 | |||||||||||||||

| Average diluted shares outstanding | 110,480,508 | 111,083,999 | 113,137,223 | 98,796,628 | 95,450,732 | |||||||||||||||

| Cash dividends declared per common share | 0.51 | 0.34 | 0.17 | 0.64 | 0.48 | |||||||||||||||

| Financial Highlights - Core (non-GAAP) | ||||||||||||||||||||

| Core earnings (excludes non-core items) (1) | $ | 202,323 | $ | 133,985 | $ | 73,838 | $ | 269,566 | $ | 198,492 | ||||||||||

| Core diluted earnings per share (1) | 1.83 | 1.21 | 0.65 | 2.73 | 2.08 | |||||||||||||||

| Core net interest margin (FTE) (2) | 3.20 | % | 3.30 | % | 3.42 | % | 3.59 | % | 3.64 | % | ||||||||||

| Accretable yield on acquired loans | 32,508 | 23,560 | 11,837 | 41,244 | 26,144 | |||||||||||||||

| Efficiency ratio (1) | 54.46 | % | 54.62 | % | 57.79 | % | 50.33 | % | 49.49 | % | ||||||||||

| Core return on average assets (1) | 1.26 | % | 1.26 | % | 1.42 | % | 1.51 | % | 1.55 | % | ||||||||||

| Core return on average common equity (1) | 9.29 | % | 9.31 | % | 10.35 | % | 11.25 | % | 11.42 | % | ||||||||||

| Core return on tangible common equity (1) | 16.22 | % | 16.33 | % | 18.19 | % | 20.31 | % | 20.62 | % | ||||||||||

| END OF PERIOD | ||||||||||||||||||||

| Book value per share | $ | 26.98 | $ | 26.64 | $ | 26.11 | $ | 26.30 | $ | 26.36 | ||||||||||

| Tangible book value per share | 16.07 | 15.79 | 15.22 | 15.89 | 15.73 | |||||||||||||||

| Shares outstanding | 109,023,781 | 108,994,389 | 108,966,331 | 113,628,601 | 96,613,855 | |||||||||||||||

| Full-time equivalent employees | 2,904 | 2,939 | 3,079 | 3,270 | 2,701 | |||||||||||||||

| Total number of financial centers | 226 | 226 | 240 | 251 | 212 | |||||||||||||||

(1) Core earnings exclude non-core items, which is a non-GAAP measurement. Reconciliations to GAAP are included in the schedules accompanying this release.

(2) Excludes accretable yield adjustment on loans, which is a non-GAAP measurement. Reconciliations to GAAP are included in the schedules accompanying this release.

| Page 8 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Consolidated - Reconciliation of Core Earnings (non-GAAP) | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||

| QUARTER-TO-DATE | ||||||||||||||||||||

| Net Income | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| Non-core items | ||||||||||||||||||||

| Gain on sale of branches | - | (2,204 | ) | (5,889 | ) | - | - | |||||||||||||

| Merger-related costs | 902 | 1,830 | 1,068 | 24,831 | 2,556 | |||||||||||||||

| Early retirement program | 2,346 | 493 | - | - | 177 | |||||||||||||||

| Branch right-sizing (net) | 72 | 1,721 | 238 | 37 | 160 | |||||||||||||||

| Tax effect (1) | (867 | ) | (482 | ) | 1,198 | (6,503 | ) | (756 | ) | |||||||||||

| Net non-core items | 2,453 | 1,358 | (3,385 | ) | 18,365 | 2,137 | ||||||||||||||

| Core earnings (non-GAAP) | $ | 68,338 | $ | 60,147 | $ | 73,838 | $ | 71,074 | $ | 83,963 | ||||||||||

| Diluted earnings per share | $ | 0.60 | $ | 0.54 | $ | 0.68 | $ | 0.49 | $ | 0.84 | ||||||||||

| Non-core items | ||||||||||||||||||||

| Gain on sale of branches | - | (0.02 | ) | (0.05 | ) | - | - | |||||||||||||

| Merger-related costs | 0.01 | 0.02 | 0.01 | 0.23 | 0.04 | |||||||||||||||

| Early retirement program | 0.02 | - | - | - | - | |||||||||||||||

| Branch right-sizing (net) | - | 0.02 | - | - | - | |||||||||||||||

| Tax effect (1) | - | (0.01 | ) | 0.01 | (0.06 | ) | (0.01 | ) | ||||||||||||

| Net non-core items | 0.03 | 0.01 | (0.03 | ) | 0.17 | 0.03 | ||||||||||||||

| Core diluted earnings per share (non-GAAP) | $ | 0.63 | $ | 0.55 | $ | 0.65 | $ | 0.66 | $ | 0.87 | ||||||||||

| YEAR-TO-DATE | ||||||||||||||||||||

| Net Income | $ | 201,897 | $ | 136,012 | $ | 77,223 | $ | 237,828 | $ | 185,119 | ||||||||||

| Non-core items | ||||||||||||||||||||

| Gain on sale of branches | (8,093 | ) | (8,093 | ) | (5,889 | ) | - | - | ||||||||||||

| Merger-related costs | 3,800 | 2,898 | 1,068 | 36,379 | 11,548 | |||||||||||||||

| Early retirement program | 2,839 | 493 | - | 3,464 | 3,464 | |||||||||||||||

| Branch right-sizing (net) | 2,031 | 1,959 | 238 | 3,129 | 3,092 | |||||||||||||||

| Tax effect (1) | (151 | ) | 716 | 1,198 | (11,234 | ) | (4,731 | ) | ||||||||||||

| Net non-core items | 426 | (2,027 | ) | (3,385 | ) | 31,738 | 13,373 | |||||||||||||

| Core earnings (non-GAAP) | $ | 202,323 | $ | 133,985 | $ | 73,838 | $ | 269,566 | $ | 198,492 | ||||||||||

| Diluted earnings per share | $ | 1.83 | $ | 1.22 | $ | 0.68 | $ | 2.41 | $ | 1.94 | ||||||||||

| Non-core items | ||||||||||||||||||||

| Gain on sale of branches | (0.07 | ) | (0.07 | ) | (0.05 | ) | - | - | ||||||||||||

| Merger-related costs | 0.03 | 0.03 | 0.01 | 0.37 | 0.12 | |||||||||||||||

| Early retirement program | 0.02 | - | - | 0.03 | 0.04 | |||||||||||||||

| Branch right-sizing (net) | 0.02 | 0.02 | - | 0.03 | 0.03 | |||||||||||||||

| Tax effect (1) | - | 0.01 | 0.01 | (0.11 | ) | (0.05 | ) | |||||||||||||

| Net non-core items | - | (0.01 | ) | (0.03 | ) | 0.32 | 0.14 | |||||||||||||

| Core diluted earnings per share (non-GAAP) | $ | 1.83 | $ | 1.21 | $ | 0.65 | $ | 2.73 | $ | 2.08 | ||||||||||

| (1) Effective tax rate of 26.135%. | ||||||||||||||||||||

| Reconciliation of Selected Non-Core Non-Interest Income and Expense Items (non-GAAP) | ||||||||||||||||||||

| QUARTER-TO-DATE | ||||||||||||||||||||

| Other income | $ | 5,380 | $ | 9,809 | $ | 12,801 | $ | 7,073 | $ | 44,721 | ||||||||||

| Non-core items (1) | (370 | ) | (2,204 | ) | (5,889 | ) | - | - | ||||||||||||

| Core other income (non-GAAP) | $ | 5,010 | $ | 7,605 | $ | 6,912 | $ | 7,073 | $ | 44,721 | ||||||||||

| Non-interest expense | $ | 118,949 | $ | 117,598 | $ | 128,813 | $ | 142,095 | $ | 106,865 | ||||||||||

| Non-core items (1) | (3,690 | ) | (4,044 | ) | (1,306 | ) | (24,868 | ) | (2,893 | ) | ||||||||||

| Core non-interest expense (non-GAAP) | $ | 115,259 | $ | 113,554 | $ | 127,507 | $ | 117,227 | $ | 103,972 | ||||||||||

| Salaries and employee benefits | $ | 61,144 | $ | 57,644 | $ | 67,924 | $ | 63,235 | $ | 52,065 | ||||||||||

| Non-core items (1) | (2,448 | ) | (493 | ) | - | - | (176 | ) | ||||||||||||

| Core salaries and employee benefits (non-GAAP) | $ | 58,696 | $ | 57,151 | $ | 67,924 | $ | 63,235 | $ | 51,889 | ||||||||||

| Merger related costs | $ | 902 | $ | 1,830 | $ | 1,068 | $ | 24,831 | $ | 2,556 | ||||||||||

| Non-core items (1) | (902 | ) | (1,830 | ) | (1,068 | ) | (24,831 | ) | (2,556 | ) | ||||||||||

| Core merger related costs (non-GAAP) | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Other operating expenses | $ | 38,179 | $ | 39,651 | $ | 41,788 | $ | 38,044 | $ | 37,881 | ||||||||||

| Non-core items (1) | (11 | ) | (1,662 | ) | (212 | ) | (4 | ) | (90 | ) | ||||||||||

| Core other operating expenses (non-GAAP) | $ | 38,168 | $ | 37,989 | $ | 41,576 | $ | 38,040 | $ | 37,791 | ||||||||||

(1) Non-core items include gain on sale of branches, merger related costs, early retirement program expenses and branch right sizing costs.

| Page 9 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Reconciliation Of Non-GAAP Financial Measures - End of Period | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||

| Calculation of Tangible Common Equity and the Ratio of Tangible Common Equity to Tangible Assets | ||||||||||||||||||||

| Total common stockholders' equity | $ | 2,941,474 | $ | 2,903,936 | $ | 2,844,633 | $ | 2,988,157 | $ | 2,547,071 | ||||||||||

| Intangible assets: | ||||||||||||||||||||

| Goodwill | (1,075,305 | ) | (1,064,765 | ) | (1,064,978 | ) | (1,055,520 | ) | (926,648 | ) | ||||||||||

| Other intangible assets | (114,460 | ) | (117,823 | ) | (121,673 | ) | (127,340 | ) | (101,149 | ) | ||||||||||

| Total intangibles | (1,189,765 | ) | (1,182,588 | ) | (1,186,651 | ) | (1,182,860 | ) | (1,027,797 | ) | ||||||||||

| Tangible common stockholders' equity | $ | 1,751,709 | $ | 1,721,348 | $ | 1,657,982 | $ | 1,805,297 | $ | 1,519,274 | ||||||||||

| Total assets | $ | 21,437,395 | $ | 21,903,684 | $ | 20,841,352 | $ | 21,259,143 | $ | 17,758,511 | ||||||||||

| Intangible assets: | ||||||||||||||||||||

| Goodwill | (1,075,305 | ) | (1,064,765 | ) | (1,064,978 | ) | (1,055,520 | ) | (926,648 | ) | ||||||||||

| Other intangible assets | (114,460 | ) | (117,823 | ) | (121,673 | ) | (127,340 | ) | (101,149 | ) | ||||||||||

| Total intangibles | (1,189,765 | ) | (1,182,588 | ) | (1,186,651 | ) | (1,182,860 | ) | (1,027,797 | ) | ||||||||||

| Tangible assets | $ | 20,247,630 | $ | 20,721,096 | $ | 19,654,701 | $ | 20,076,283 | $ | 16,730,714 | ||||||||||

| Paycheck protection program ("PPP") loans | (970,488 | ) | (963,712 | ) | ||||||||||||||||

| Total assets less PPP loans | $ | 20,466,907 | $ | 20,939,972 | ||||||||||||||||

| Tangible assets less PPP loans | $ | 19,277,142 | $ | 19,757,384 | ||||||||||||||||

| Ratio of equity to assets | 13.72 | % | 13.26 | % | 13.65 | % | 14.06 | % | 14.34 | % | ||||||||||

| Ratio of equity to assets less PPP loans | 14.38 | % | 13.87 | % | ||||||||||||||||

| Ratio of tangible common equity to tangible assets | 8.65 | % | 8.31 | % | 8.44 | % | 8.99 | % | 9.08 | % | ||||||||||

| Ratio of tangible common equity to tangible assets less PPP loans | 9.09 | % | 8.71 | % | ||||||||||||||||

| Calculation of Tangible Book Value per Share | ||||||||||||||||||||

| Total common stockholders' equity | $ | 2,941,474 | $ | 2,903,936 | $ | 2,844,633 | $ | 2,988,157 | $ | 2,547,071 | ||||||||||

| Intangible assets: | ||||||||||||||||||||

| Goodwill | (1,075,305 | ) | (1,064,765 | ) | (1,064,978 | ) | (1,055,520 | ) | (926,648 | ) | ||||||||||

| Other intangible assets | (114,460 | ) | (117,823 | ) | (121,673 | ) | (127,340 | ) | (101,149 | ) | ||||||||||

| Total intangibles | (1,189,765 | ) | (1,182,588 | ) | (1,186,651 | ) | (1,182,860 | ) | (1,027,797 | ) | ||||||||||

| Tangible common stockholders' equity | $ | 1,751,709 | $ | 1,721,348 | $ | 1,657,982 | $ | 1,805,297 | $ | 1,519,274 | ||||||||||

| Shares of common stock outstanding | 109,023,781 | 108,994,389 | 108,966,331 | 113,628,601 | 96,613,855 | |||||||||||||||

| Book value per common share | $ | 26.98 | $ | 26.64 | $ | 26.11 | $ | 26.30 | $ | 26.36 | ||||||||||

| Tangible book value per common share | $ | 16.07 | $ | 15.79 | $ | 15.22 | $ | 15.89 | $ | 15.73 | ||||||||||

| Calculation of Regulatory Tier 1 Leverage Ratio Less Average PPP Loans | ||||||||||||||||||||

| Total Tier 1 capital | $ | 1,868,173 | $ | 1,820,488 | ||||||||||||||||

| Adjusted average assets for leverage ratio | $ | 20,652,454 | $ | 20,742,824 | ||||||||||||||||

| Average PPP loans | (967,152 | ) | (645,172 | ) | ||||||||||||||||

| Adjusted average assets less average PPP loans | $ | 19,685,302 | $ | 20,097,652 | ||||||||||||||||

| Tier 1 leverage ratio | 9.05 | % | 8.78 | % | ||||||||||||||||

| Tier 1 leverage ratio less average PPP loans | 9.49 | % | 9.06 | % | ||||||||||||||||

| Page 10 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Reconciliation Of Non-GAAP Financial Measures - Quarter-to-Date | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Calculation of Core Return on Average Assets | ||||||||||||||||||||

| Net income | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| Net non-core items, net of taxes, adjustment | 2,453 | 1,358 | (3,385 | ) | 18,365 | 2,137 | ||||||||||||||

| Core earnings | $ | 68,338 | $ | 60,147 | $ | 73,838 | $ | 71,074 | $ | 83,963 | ||||||||||

| Average total assets | $ | 21,765,321 | $ | 21,822,273 | $ | 20,920,223 | $ | 20,041,890 | $ | 17,720,598 | ||||||||||

| Return on average assets | 1.20 | % | 1.08 | % | 1.48 | % | 1.04 | % | 1.83 | % | ||||||||||

| Core return on average assets | 1.25 | % | 1.11 | % | 1.42 | % | 1.41 | % | 1.88 | % | ||||||||||

| Calculation of Return on Tangible Common Equity | ||||||||||||||||||||

| Net income | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| Amortization of intangibles, net of taxes | 2,483 | 2,489 | 2,521 | 2,416 | 2,176 | |||||||||||||||

| Total income available to common stockholders | $ | 68,368 | $ | 61,278 | $ | 79,744 | $ | 55,125 | $ | 84,002 | ||||||||||

| Net non-core items, net of taxes | 2,453 | 1,358 | (3,385 | ) | 18,365 | 2,137 | ||||||||||||||

| Core earnings | 68,338 | 60,147 | 73,838 | 71,074 | 83,963 | |||||||||||||||

| Amortization of intangibles, net of taxes | 2,483 | 2,489 | 2,521 | 2,416 | 2,176 | |||||||||||||||

| Total core income available to common stockholders | $ | 70,821 | $ | 62,636 | $ | 76,359 | $ | 73,490 | $ | 86,139 | ||||||||||

| Average common stockholders' equity | $ | 2,942,045 | $ | 2,879,337 | $ | 2,869,177 | $ | 2,611,143 | $ | 2,368,773 | ||||||||||

| Average intangible assets: | ||||||||||||||||||||

| Goodwill | (1,064,893 | ) | (1,064,955 | ) | (1,055,498 | ) | (997,004 | ) | (926,687 | ) | ||||||||||

| Other intangibles | (116,385 | ) | (120,111 | ) | (125,746 | ) | (118,311 | ) | (103,028 | ) | ||||||||||

| Total average intangibles | (1,181,278 | ) | (1,185,066 | ) | (1,181,244 | ) | (1,115,315 | ) | (1,029,715 | ) | ||||||||||

| Average tangible common stockholders' equity | $ | 1,760,767 | $ | 1,694,271 | $ | 1,687,933 | $ | 1,495,828 | $ | 1,339,058 | ||||||||||

| Return on average common equity | 8.91 | % | 8.21 | % | 10.83 | % | 8.01 | % | 13.70 | % | ||||||||||

| Return on tangible common equity | 15.45 | % | 14.55 | % | 19.00 | % | 14.62 | % | 24.89 | % | ||||||||||

| Core return on average common equity | 9.24 | % | 8.40 | % | 10.35 | % | 10.80 | % | 14.06 | % | ||||||||||

| Core return on tangible common equity | 16.00 | % | 14.87 | % | 18.19 | % | 19.49 | % | 25.52 | % | ||||||||||

| Calculation of Efficiency Ratio (1) | ||||||||||||||||||||

| Non-interest expense | $ | 118,949 | $ | 117,598 | $ | 128,813 | $ | 142,095 | $ | 106,865 | ||||||||||

| Non-core non-interest expense adjustment | (3,690 | ) | (4,044 | ) | (1,306 | ) | (24,868 | ) | (2,893 | ) | ||||||||||

| Other real estate and foreclosure expense adjustment | (600 | ) | (242 | ) | (319 | ) | (1,063 | ) | (1,057 | ) | ||||||||||

| Amortization of intangibles adjustment | (3,362 | ) | (3,369 | ) | (3,413 | ) | (3,270 | ) | (2,947 | ) | ||||||||||

| Efficiency ratio numerator | $ | 111,297 | $ | 109,943 | $ | 123,775 | $ | 112,894 | $ | 99,968 | ||||||||||

| Net-interest income | $ | 153,610 | $ | 163,681 | $ | 167,483 | $ | 167,066 | $ | 149,264 | ||||||||||

| Non-interest income | 71,851 | 50,227 | 82,394 | 45,630 | 84,675 | |||||||||||||||

| Non-core non-interest income adjustment | (370 | ) | (2,204 | ) | (5,889 | ) | - | - | ||||||||||||

| Fully tax-equivalent adjustment (effective tax rate of 26.135%) | 2,864 | 2,350 | 2,305 | 2,172 | 1,843 | |||||||||||||||

| Gain on sale of securities | (22,305 | ) | (390 | ) | (32,095 | ) | (377 | ) | (7,374 | ) | ||||||||||

| Efficiency ratio denominator | $ | 205,650 | $ | 213,664 | $ | 214,198 | $ | 214,491 | $ | 228,408 | ||||||||||

| Efficiency ratio (1) | 54.12 | % | 51.46 | % | 57.79 | % | 52.63 | % | 43.77 | % | ||||||||||

(1) Efficiency ratio is core non-interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non-interest revenues, excluding gains and losses from securities transactions and non-core items.

| Page 11 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Reconciliation Of Non-GAAP Financial Measures - Quarter-to-Date (continued) | ||||||||||||||||||||

| For the Quarters Ended | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| (Unaudited) | 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Calculation of Core Net Interest Margin | ||||||||||||||||||||

| Net interest income | $ | 153,610 | $ | 163,681 | $ | 167,483 | $ | 167,066 | $ | 149,264 | ||||||||||

| Fully tax-equivalent adjustment (effective tax rate of 26.135%) | 2,864 | 2,350 | 2,305 | 2,172 | 1,843 | |||||||||||||||

| Fully tax-equivalent net interest income | 156,474 | 166,031 | 169,788 | 169,238 | 151,107 | |||||||||||||||

| Total accretable yield | (8,948 | ) | (11,723 | ) | (11,837 | ) | (15,100 | ) | (9,322 | ) | ||||||||||

| Core net interest income | $ | 147,526 | $ | 154,308 | $ | 157,951 | $ | 154,138 | $ | 141,785 | ||||||||||

| PPP loan and excess liquidity interest income | (6,131 | ) | $ | (5,623 | ) | |||||||||||||||

| Net interest income adjusted for PPP loans and liquidity | $ | 150,343 | $ | 160,408 | ||||||||||||||||

| Average earning assets | $ | 19,415,314 | $ | 19,517,475 | $ | 18,581,491 | $ | 17,753,004 | $ | 15,680,665 | ||||||||||

| Average PPP loan balance and excess liquidity | (2,359,928 | ) | (2,071,411 | ) | ||||||||||||||||

| Average earning assets adjusted for PPL loans and liquidity | $ | 17,055,386 | $ | 17,446,064 | ||||||||||||||||

| Net interest margin | 3.21 | % | 3.42 | % | 3.68 | % | 3.78 | % | 3.82 | % | ||||||||||

| Core net interest margin | 3.02 | % | 3.18 | % | 3.42 | % | 3.44 | % | 3.59 | % | ||||||||||

| Net interest margin adjusted for PPP loans and liquidity | 3.51 | % | 3.70 | % | ||||||||||||||||

| Calculation of Core Loan Yield | ||||||||||||||||||||

| Loan interest income (FTE) | $ | 163,379 | $ | 177,168 | $ | 187,566 | $ | 193,402 | $ | 179,971 | ||||||||||

| Total accretable yield | (8,948 | ) | (11,723 | ) | (11,837 | ) | (15,100 | ) | (9,322 | ) | ||||||||||

| Core loan interest income | $ | 154,431 | $ | 165,445 | $ | 175,729 | $ | 178,302 | $ | 170,649 | ||||||||||

| PPP loan interest income | (5,782 | ) | (3,733 | ) | ||||||||||||||||

| Core loan interest income without PPP loans | $ | 148,649 | $ | 161,712 | ||||||||||||||||

| Average loan balance | $ | 14,315,014 | $ | 14,731,306 | $ | 14,548,853 | $ | 14,144,703 | $ | 13,053,540 | ||||||||||

| Average PPP loan balance | (967,152 | ) | $ | (645,172 | ) | |||||||||||||||

| Average loan balance without PPP loans | $ | 13,347,862 | $ | 14,086,134 | ||||||||||||||||

| Core loan yield | 4.29 | % | 4.52 | % | 4.86 | % | 5.00 | % | 5.19 | % | ||||||||||

| Core loan yield without PPP loans | 4.43 | % | 4.62 | % | ||||||||||||||||

| Calculation of Pre-Tax, Pre-Provision (PTPP) Earnings | ||||||||||||||||||||

| Net income available to common stockholders | $ | 65,885 | $ | 58,789 | $ | 77,223 | $ | 52,709 | $ | 81,826 | ||||||||||

| Provision for income taxes | 17,633 | 15,593 | 20,694 | 12,976 | 23,275 | |||||||||||||||

| Provision for credit losses (including provision for unfunded commitments) | 22,981 | 21,915 | 23,134 | 4,903 | 21,973 | |||||||||||||||

| (Gain) loss on sale of securities | (22,305 | ) | (390 | ) | (32,095 | ) | (377 | ) | (7,374 | ) | ||||||||||

| Net pre-tax non-core items | 3,320 | 1,840 | (4,583 | ) | 24,868 | 2,893 | ||||||||||||||

| Pre-tax, pre-provision (PTPP) earnings | $ | 87,514 | $ | 97,747 | $ | 84,373 | $ | 95,079 | $ | 122,593 | ||||||||||

| Page 12 |

| Simmons First National Corporation | SFNC | |||||||||||||||||||

| Reconciliation Of Non-GAAP Financial Measures - Year-to-Date | ||||||||||||||||||||

| For the Quarters Ended | ||||||||||||||||||||

| (Unaudited) | Sep 30 | Jun 30 | Mar 31 | Dec 31 | Sep 30 | |||||||||||||||

| 2020 | 2020 | 2020 | 2019 | 2019 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Calculation of Core Return on Average Assets | ||||||||||||||||||||

| Net income | $ | 201,897 | $ | 136,012 | $ | 77,223 | $ | 237,828 | $ | 185,119 | ||||||||||

| Net non-core items, net of taxes, adjustment | 426 | (2,027 | ) | (3,385 | ) | 31,738 | 13,373 | |||||||||||||

| Core earnings | $ | 202,323 | $ | 133,985 | $ | 73,838 | $ | 269,566 | $ | 198,492 | ||||||||||

| Average total assets | $ | 21,503,564 | $ | 21,371,248 | $ | 20,920,223 | $ | 17,871,748 | $ | 17,140,419 | ||||||||||

| Return on average assets | 1.25 | % | 1.28 | % | 1.48 | % | 1.33 | % | 1.44 | % | ||||||||||

| Core return on average assets | 1.26 | % | 1.26 | % | 1.42 | % | 1.51 | % | 1.55 | % | ||||||||||

| Calculation of Return on Tangible Common Equity | ||||||||||||||||||||

| Net income | $ | 201,897 | $ | 136,012 | $ | 77,223 | $ | 237,828 | $ | 185,119 | ||||||||||

| Amortization of intangibles, net of taxes | 7,493 | 5,010 | 2,521 | 8,720 | 6,304 | |||||||||||||||

| Total income available to common stockholders | $ | 209,390 | $ | 141,022 | $ | 79,744 | $ | 246,548 | $ | 191,423 | ||||||||||

| Net non-core items, net of taxes | 426 | (2,027 | ) | (3,385 | ) | 31,738 | 13,373 | |||||||||||||

| Core earnings | 202,323 | 133,985 | 73,838 | 269,566 | 198,492 | |||||||||||||||

| Amortization of intangibles, net of taxes | 7,493 | 5,010 | 2,521 | 8,720 | 6,304 | |||||||||||||||

| Total core income available to common stockholders | $ | 209,816 | $ | 138,995 | $ | 76,359 | $ | 278,286 | $ | 204,796 | ||||||||||

| Average common stockholders' equity | $ | 2,910,366 | $ | 2,894,351 | $ | 2,869,177 | $ | 2,396,024 | $ | 2,323,530 | ||||||||||

| Average intangible assets: | ||||||||||||||||||||

| Goodwill | (1,061,793 | ) | (1,060,226 | ) | (1,055,498 | ) | (921,635 | ) | (896,236 | ) | ||||||||||

| Other intangibles | (120,731 | ) | (122,928 | ) | (125,746 | ) | (104,000 | ) | (99,178 | ) | ||||||||||

| Total average intangibles | (1,182,524 | ) | (1,183,154 | ) | (1,181,244 | ) | (1,025,635 | ) | (995,414 | ) | ||||||||||

| Average tangible common stockholders' equity | $ | 1,727,842 | $ | 1,711,197 | $ | 1,687,933 | $ | 1,370,389 | $ | 1,328,116 | ||||||||||

| Return on average common equity | 9.27 | % | 9.45 | % | 10.83 | % | 9.93 | % | 10.65 | % | ||||||||||

| Return on tangible common equity | 16.19 | % | 16.57 | % | 19.00 | % | 17.99 | % | 19.27 | % | ||||||||||

| Core return on average common equity | 9.29 | % | 9.31 | % | 10.35 | % | 11.25 | % | 11.42 | % | ||||||||||

| Core return on tangible common equity | 16.22 | % | 16.33 | % | 18.19 | % | 20.31 | % | 20.62 | % | ||||||||||

| Calculation of Efficiency Ratio (1) | ||||||||||||||||||||

| Non-interest expense | $ | 365,360 | $ | 246,411 | $ | 128,813 | $ | 461,112 | $ | 319,017 | ||||||||||

| Non-core non-interest expense adjustment | (9,040 | ) | (5,350 | ) | (1,306 | ) | (42,972 | ) | (18,104 | ) | ||||||||||

| Other real estate and foreclosure expense adjustment | (1,161 | ) | (561 | ) | (319 | ) | (3,282 | ) | (2,219 | ) | ||||||||||

| Amortization of intangibles adjustment | (10,144 | ) | (6,782 | ) | (3,413 | ) | (11,805 | ) | (8,535 | ) | ||||||||||

| Efficiency ratio numerator | $ | 345,015 | $ | 233,718 | $ | 123,775 | $ | 403,053 | $ | 290,159 | ||||||||||

| Net-interest income | $ | 484,774 | $ | 331,164 | $ | 167,483 | $ | 601,753 | $ | 434,687 | ||||||||||

| Non-interest income | 204,472 | 132,621 | 82,394 | 205,031 | 159,401 | |||||||||||||||

| Non-core non-interest income adjustment | (8,463 | ) | (8,093 | ) | (5,889 | ) | - | - | ||||||||||||

| Fully tax-equivalent adjustment (effective tax rate of 26.135%) | 7,519 | 4,655 | 2,305 | 7,322 | 5,150 | |||||||||||||||

| Gain on sale of securities | (54,790 | ) | (32,485 | ) | (32,095 | ) | (13,314 | ) | (12,937 | ) | ||||||||||

| Efficiency ratio denominator | $ | 633,512 | $ | 427,862 | $ | 214,198 | $ | 800,792 | $ | 586,301 | ||||||||||

| Efficiency ratio (1) | 54.46 | % | 54.62 | % | 57.79 | % | 50.33 | % | 49.49 | % | ||||||||||

| Calculation of Core Net Interest Margin | ||||||||||||||||||||

| Net interest income | $ | 484,774 | $ | 331,164 | $ | 167,483 | $ | 601,753 | $ | 434,687 | ||||||||||

| Fully tax-equivalent adjustment (effective tax rate of 26.135%) | 7,519 | 4,655 | 2,305 | 7,322 | 5,150 | |||||||||||||||

| Fully tax-equivalent net interest income | 492,293 | 335,819 | 169,788 | 609,075 | 439,837 | |||||||||||||||

| Total accretable yield | (32,508 | ) | (23,560 | ) | (11,837 | ) | (41,244 | ) | (26,144 | ) | ||||||||||

| Core net interest income | $ | 459,785 | $ | 312,259 | $ | 157,951 | $ | 567,831 | $ | 413,693 | ||||||||||

| Average earning assets | $ | 19,172,318 | $ | 19,049,487 | $ | 18,581,491 | $ | 15,824,571 | $ | 15,174,671 | ||||||||||

| Net interest margin | 3.43 | % | 3.55 | % | 3.68 | % | 3.85 | % | 3.88 | % | ||||||||||

| Core net interest margin | 3.20 | % | 3.30 | % | 3.42 | % | 3.59 | % | 3.64 | % | ||||||||||

| Calculation of Core Loan Yield | ||||||||||||||||||||

| Loan interest income (FTE) | $ | 528,294 | $ | 364,915 | $ | 187,566 | $ | 710,935 | $ | 517,533 | ||||||||||

| Total accretable yield | (32,508 | ) | (23,560 | ) | (11,837 | ) | (41,244 | ) | (26,144 | ) | ||||||||||

| Core loan interest income | $ | 495,786 | $ | 341,355 | $ | 175,729 | $ | 669,691 | $ | 491,389 | ||||||||||

| Average loan balance | $ | 14,530,938 | $ | 14,640,082 | $ | 14,548,853 | $ | 12,938,013 | $ | 12,531,355 | ||||||||||

| Core loan yield | 4.56 | % | 4.69 | % | 4.86 | % | 5.18 | % | 5.24 | % | ||||||||||

(1) Efficiency ratio is core non-interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non-interest revenues, excluding gains and losses from securities transactions and non-core items.

Page 13

Exhibit 99.2

NASDAQ: SFNC 3 rd Quarter 2020 Investor Presentation