Form 8-K Pine Technology Acquisit For: Dec 07

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and among

The Tomorrow Companies Inc.,

Pine Technology Acquisition Corp.,

and

PINE TECHNOLOGY MERGER CORP.

Dated as of December 7, 2021

TABLE OF CONTENTS

| Page | ||

| ARTICLE I DEFINITIONS | 5 | |

| 1.1 | Definitions | 5 |

| 1.2 | Construction | 16 |

| ARTICLE II MERGER | 17 | |

| 2.1 | Merger | 17 |

| 2.2 | Merger Effective Time | 17 |

| 2.3 | Effect of the Merger | 17 |

| 2.4 | U.S. Tax Treatment | 18 |

| 2.5 | Certificate of Incorporation and Bylaws | 18 |

| 2.6 | Closing; Effective Time | 18 |

| 2.7 | Post-Closing Board of Directors and Officers | 18 |

| 2.8 | Taking of Necessary Action; Further Action | 18 |

| 2.9 | No Further Ownership Rights in Company Securities | 19 |

| 2.10 | Appraisal Rights | 19 |

| ARTICLE III CONSIDERATION | 19 | |

| 3.1 | Conversion of Company Securities | 19 |

| 3.2 | No Fractional Shares | 20 |

| 3.3 | Withholding | 20 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 21 | |

| 4.1 | Corporate Existence and Power | 21 |

| 4.2 | Authorization | 21 |

| 4.3 | Governmental Authorization | 21 |

| 4.4 | Non-Contravention | 22 |

| 4.5 | Capitalization | 22 |

| 4.6 | Corporate Records | 23 |

| 4.7 | Subsidiaries | 23 |

| 4.8 | Consents | 23 |

| 4.9 | Financial Statements | 24 |

| 4.10 | Books and Records | 24 |

| 4.11 | Internal Accounting Controls | 24 |

| 4.12 | Absence of Certain Changes | 24 |

| 4.13 | Properties; Title to the Company’s Assets | 25 |

| 4.14 | Litigation | 25 |

| 4.15 | Contracts | 25 |

1

TABLE OF CONTENTS

(cont’d)

| 4.16 | Licenses and Permits | 27 |

| 4.17 | Compliance with Laws | 27 |

| 4.18 | Intellectual Property | 27 |

| 4.19 | Data Privacy | 29 |

| 4.20 | Employees; Employment Matters | 29 |

| 4.21 | Withholding | 30 |

| 4.22 | Employee Benefits | 30 |

| 4.23 | Real Property | 32 |

| 4.24 | Tax Matters | 32 |

| 4.25 | Environmental Laws | 34 |

| 4.26 | Finders’ Fees | 34 |

| 4.27 | Directors and Officers | 34 |

| 4.28 | Anti-Money Laundering Laws | 34 |

| 4.29 | Insurance | 34 |

| 4.30 | Related Party Transactions | 34 |

| 4.31 | Customers and Suppliers | 35 |

| 4.32 | Government Contracts | 35 |

| 4.33 | Absence of Certain Business Practices | 35 |

| 4.34 | Specified Company Securityholders | 36 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB | 36 | |

| 5.1 | Corporate Existence and Power | 36 |

| 5.2 | Corporate Authorization | 36 |

| 5.3 | Governmental Authorization | 36 |

| 5.4 | Non-Contravention | 36 |

| 5.5 | Finders’ Fees | 37 |

| 5.6 | Issuance of Shares | 37 |

| 5.7 | Capitalization | 37 |

| 5.8 | Information Supplied | 38 |

| 5.9 | Trust Fund | 38 |

| 5.10 | Listing | 38 |

| 5.11 | Board Approval | 38 |

| 5.12 | Parent SEC Documents and Financial Statements | 39 |

| 5.13 | Business Activities | 40 |

| 5.14 | Absence of Certain Business Practices | 40 |

| 5.15 | Affiliate Transactions | 41 |

| 5.16 | Litigation | 41 |

| 5.17 | Expenses, Indebtedness and Other Liabilities | 41 |

| 5.18 | Tax Matters | 41 |

| 5.19 | Investment Company Act; JOBS Act | 43 |

| ARTICLE VI COVENANTS OF THE PARTIES PENDING CLOSING | 43 | |

| 6.1 | Conduct of the Business | 43 |

| 6.2 | Exclusivity | 44 |

| 6.3 | Access to Information | 45 |

| 6.4 | Notices of Certain Events | 45 |

| 6.5 | Cooperation with Form S-4/Proxy Statement; Other Filings | 46 |

| 6.6 | Trust Account | 48 |

| 6.7 | Obligations of Merger Sub | 48 |

| 6.8 | Private Placement | 48 |

| 6.9 | Termination of Affiliate Transactions | 48 |

| 6.10 | CFIUS Filing | 48 |

2

TABLE OF CONTENTS

(cont’d)

| ARTICLE VII COVENANTS OF THE COMPANY | 49 | |

| 7.1 | Reporting; Compliance with Laws | 49 |

| 7.2 | Commercially Reasonable Efforts to Obtain Consents | 49 |

| 7.3 | Company’s Stockholders Approval | 49 |

| ARTICLE VIII COVENANTS OF ALL PARTIES HERETO | 50 | |

| 8.1 | Commercially Reasonable Efforts; Further Assurances; Governmental Consents | 50 |

| 8.2 | Confidentiality | 50 |

| 8.3 | Directors’ and Officers’ Indemnification and Liability Insurance | 51 |

| 8.4 | Nasdaq Listing | 51 |

| 8.5 | Certain Tax Matters | 51 |

| 8.6 | Equity Incentive Plan | 52 |

| 8.7 | Closing Parent RSU Grant | 52 |

| 8.8 | Transaction Litigation | 52 |

| 8.9 | Amendment to Parent Bylaws. | 53 |

| ARTICLE IX CONDITIONS TO CLOSING | 53 | |

| 9.1 | Condition to the Obligations of the Parties | 53 |

| 9.2 | Conditions to Obligations of Parent and Merger Sub | 53 |

| 9.3 | Conditions to Obligations of the Company | 54 |

| ARTICLE X TERMINATION | 55 | |

| 10.1 | Termination Without Default | 55 |

| 10.2 | Termination Upon Default | 55 |

| 10.3 | Effect of Termination | 55 |

| ARTICLE XI MISCELLANEOUS | 56 | |

| 11.1 | Non-Survival of Representations, Warranties and Covenants | 56 |

| 11.2 | Notices | 56 |

| 11.3 | Amendments; No Waivers; Remedies | 57 |

| 11.4 | Arm’s Length Bargaining; No Presumption Against Drafter | 57 |

| 11.5 | Publicity | 57 |

| 11.6 | Expenses | 57 |

| 11.7 | No Assignment or Delegation | 57 |

| 11.8 | Governing Law | 57 |

| 11.9 | Counterparts; Facsimile Signatures | 57 |

| 11.10 | Entire Agreement | 57 |

| 11.11 | Severability | 57 |

| 11.12 | Further Assurances | 57 |

| 11.13 | Third Party Beneficiaries | 58 |

| 11.14 | Waiver | 58 |

| 11.15 | Jurisdiction; Waiver of Jury Trial | 58 |

| 11.16 | Enforcement | 58 |

| 11.17 | Non-Recourse | 58 |

| 11.18 | No Other Representations; No Reliance | 59 |

3

AGREEMENT AND PLAN OF MERGER

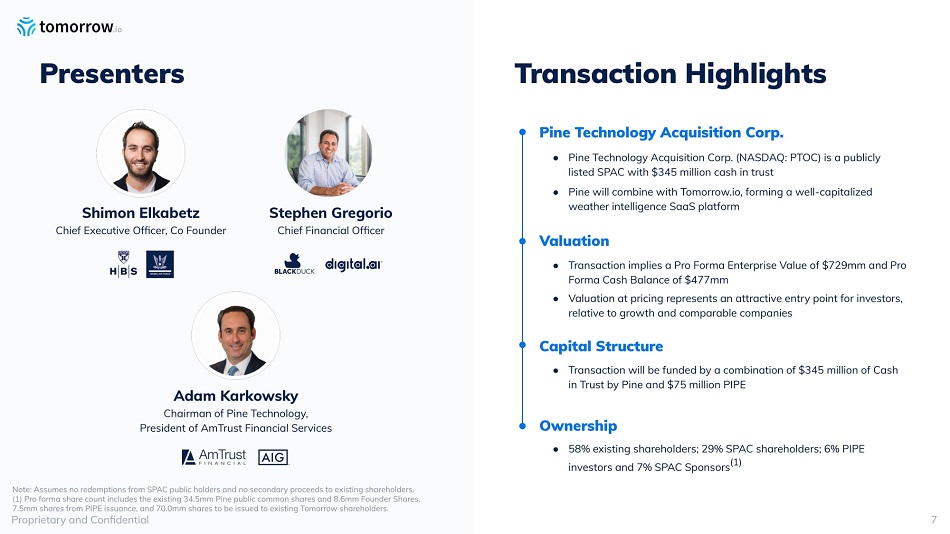

AGREEMENT AND PLAN OF MERGER, dated as of December 7, 2021 (this “Agreement”), is entered into by and among The Tomorrow Companies Inc., a Delaware corporation (the “Company”), Pine Technology Acquisition Corp., a Delaware corporation (“Parent”), and Pine Technology Merger Corp., a Delaware corporation (“Merger Sub”).

W I T N E S S E T H:

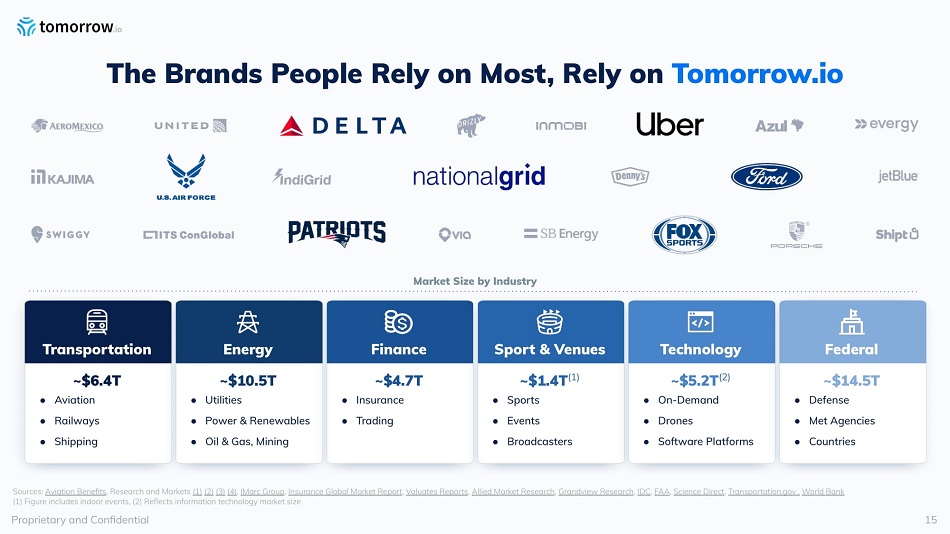

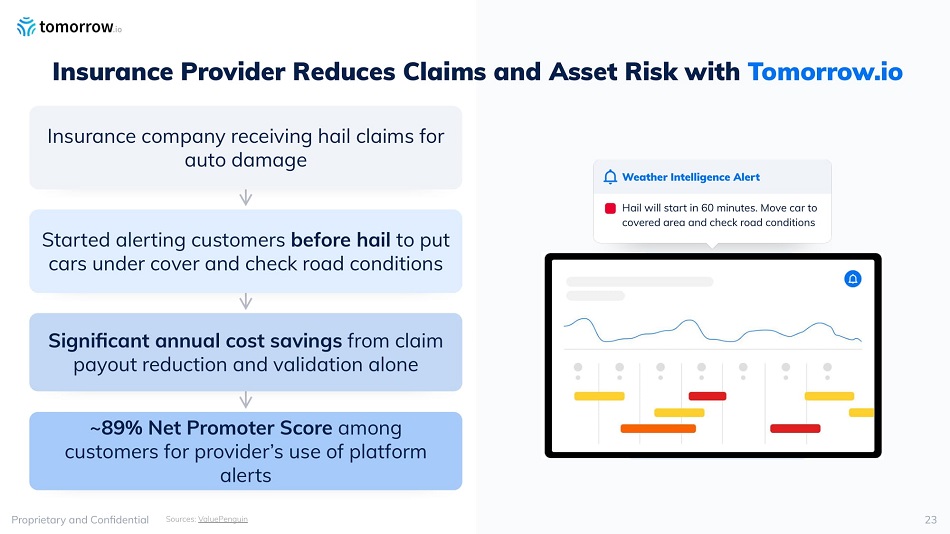

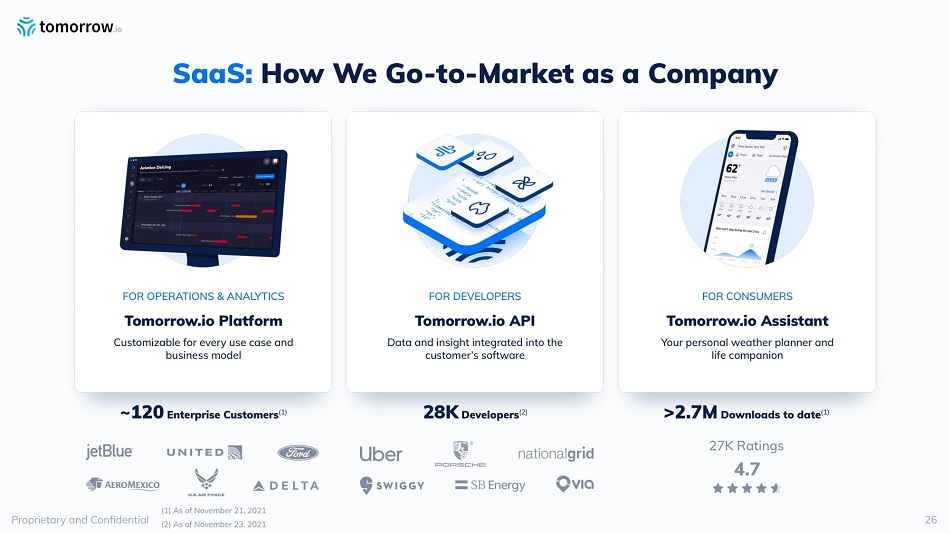

A. The Company is in the business of weather forecasting and related activities (the “Business”);

B. Parent is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, and Merger Sub is a wholly-owned subsidiary of Parent;

C. The Company Securityholders are listed on the Capitalization Schedule and Annex 4.5(a) to Schedule 4.5 and own 100% of the issued and outstanding Company Securities;

D. Merger Sub will merge with and into the Company (the “Merger”), after which the Company will be the surviving company (the “Surviving Corporation”), and a wholly-owned subsidiary of Parent and Parent shall change its name to “The Tomorrow Companies Inc.”;

E. Contemporaneously with the execution of, and as a condition and an inducement to Parent and the Company entering into this Agreement, Company Securityholders set forth on Schedule 1 (“Specified Company Securityholders”) are entering into and delivering support agreements, substantially in the form attached hereto as Exhibit A (each, a “Company Support Agreement”), pursuant to which each of the Specified Company Securityholders has agreed to vote in favor of this Agreement and the Merger;

F. Contemporaneously with the execution of, and as a condition and an inducement to Parent and the Company entering into this Agreement, the Sponsor and the Specified Company Securityholders are entering into and delivering lockup agreements, substantially in the form attached hereto as Exhibit D (each, a “Lockup Agreement”), pursuant to which Sponsor and each of the Specified Company Securityholders has agreed with Parent to certain restrictions on the transfer of its shares of Parent Class A Shares;

G. Contemporaneously with the execution of, and as a condition and an inducement to Parent and the Company entering into this Agreement, certain investors (the “PIPE Investors”) have entered into subscription agreements in substantially the form attached hereto as Exhibit B (collectively, the “Subscription Agreements”), pursuant to which, at the Closing, such Persons have agreed, subject to the terms and conditions set forth therein, to subscribe for and purchase shares of Parent Class A Shares at a purchase price of $10.00 per share, for an aggregate cash amount of $75,000,000 (the “PIPE Investment Amount” and such transactions, the “Private Placement”);

H. Contemporaneously with the execution of, and as a condition and an inducement to Parent and the Company entering into this Agreement, specified stockholders of Parent are entering into and delivering the Parent Support Agreement, substantially in the form attached hereto as Exhibit C (the “Parent Support Agreement”), pursuant to which each such Parent Stockholder has agreed (x) not to transfer or redeem any shares of Parent Common Stock held by such Parent Stockholder and (y) to vote in favor of this Agreement and the Merger at the Parent Stockholder Meeting; and

I. The Company’s Board of Directors has unanimously (i) approved and declared advisable this Agreement and the transactions contemplated by this Agreement and the Additional Agreements to which the Company is or will be party, including the Merger, on the terms and subject to the conditions set forth herein, (ii) determined that this Agreement and such transactions are fair to, and in the best interests of, the Company and the Company Stockholders and (iii) resolved to recommend that the Company Stockholders approve the Merger and such other transactions and adopt this Agreement and the Additional Agreements to which the Company is or will be a party (the “Company Board Recommendation”).

4

In consideration of the mutual covenants and promises set forth in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions.

“A&R Charter Proposal” has the meaning set forth in Section 6.5(e).

“Action” means any legal action, litigation, suit, claim, hearing or proceeding, including any audit, claim or assessment for Taxes or otherwise, by or before any Authority.

“Additional Agreements” means the Registration Rights Agreement, the Company Support Agreements, the Subscription Agreements, the Parent Support Agreements, and the Lockup Agreements.

“Additional Parent SEC Documents” has the meaning set forth in Section 5.12(a).

“Affiliate” means, with respect to any Person, any other Person directly or indirectly Controlling, Controlled by or under common Control with such Person. “Affiliate” shall also include, with respect to any individual natural Person, (a) such Person’s spouse, Parent, lineal descendant, sibling, aunt, uncle, niece, nephew, mother-in-law, father-in-law, sister-in-law, or brother-in-law or (b) a trust for the benefit of such Person and/or the individuals described in the foregoing clause (a) or of which such Person is a trustee.

“Affiliate Transaction” has the meaning set forth in Section 4.30.

“Aggregate Transaction Proceeds” means an amount equal to, without duplication, (a) the sum of (i) the aggregate cash proceeds available for release to Parent from the Trust Fund in connection with the transactions contemplated hereby (net of the Parent Redemption Amount); plus (ii) the aggregate cash proceeds committed to be funded to Parent on the Closing Date in respect of the Private Placement; plus (iii) Parent’s cash balance as of the Closing Date, minus (b) the Unpaid Expenses.

“Agreement” has the meaning set forth in the preamble.

“Alternative Proposal” has the meaning set forth in Section 6.2(b).

“Alternative Transaction” has the meaning set forth in Section 6.2(a).

“Annual Financial Statements” has the meaning set forth in Section 4.9(a).

“Authority” means any governmental, regulatory or administrative body, agency or authority, any court or judicial authority, any arbitrator, or any public, private or industry regulatory authority, whether international, national, foreign, Federal, state, or local.

“Balance Sheet Date” has the meaning set forth in Section 4.9(a).

“Books and Records” means all books and records, ledgers, employee records, customer lists, files, correspondence, and other records of every kind (whether written, electronic, or otherwise embodied) owned or controlled by a Person in which a Person’s assets, the business or its transactions are otherwise reflected, other than stock books and minute books.

5

“Business” has the meaning set forth in the recitals to this Agreement.

“Business Day” means any day other than a Saturday, Sunday or a legal holiday on which commercial banking institutions in New York, New York are authorized to close for business.

“Capitalization Schedule” means Schedule 3.1(h), as updated as contemplated herein.

“Certificate of Merger” has the meaning set forth in Section 2.2.

“CFIUS” means the Committee on Foreign Investment in the United States, or any member agency thereof acting in its capacity as a member agency.

“CFIUS Approval” means (i) the CFIUS Parties have received written notice from CFIUS that CFIUS has determined that the transaction contemplated by this Agreement is not a “covered transaction” and is not subject to review under the DPA, (ii) the CFIUS Parties have received a written notice issued by CFIUS that it has concluded an assessment, review or investigation of the CFIUS Declaration or CFIUS Notice provided pursuant to the DPA with respect to the transaction contemplated by this Agreement, determined that there are no unresolved national security concerns, and has therefore terminated all action under the DPA, (iii) if CFIUS has sent a report (the “CFIUS Report”) to the President of the United States (“POTUS”) requesting POTUS’s decision, then POTUS has (A) announced a decision not to take any action to suspend or prohibit the transaction contemplated by this Agreement or (B) not taken any action to suspend or prohibit the transaction contemplated by this Agreement after 15 days from the date of receipt of the CFIUS Report, or (iv) if the CFIUS Parties submitted a CFIUS Declaration, they have received a written notice from CFIUS that it has determined, pursuant to 31 C.F.R. § 800.407(a)(2), that it is not able to conclude action pursuant to the declaration but has not requested the submission of a CFIUS Notice.

“CFIUS Declaration” means a declaration filing with respect to the transaction contemplated by this Agreement submitted to CFIUS by the CFIUS Parties pursuant to 31 C.F.R. Part 800 Subpart D.

“CFIUS Notice” means a notice filing with respect to the transaction contemplated by this Agreement submitted to CFIUS pursuant to 31 C.F.R. Part 800 Subpart E.

“CFIUS Parties” means Parent, the Company, and any Person that is a party to a CFIUS Declaration or a CFIUS Notice.

“Claim” has the meaning set forth in Section 11.14.

“Closing” has the meaning set forth in Section 2.6.

“Closing Date” has the meaning set forth in Section 2.6.

“Closing Payment Shares” means an aggregate number of Parent Class A Shares equal to 70,000,000 Parent Class A Shares.

“COBRA” means collectively, the requirements of Sections 601 through 606 of ERISA and Section 4980B of the Code.

“Code” means the Internal Revenue Code of 1986, as amended.

6

“Company” has the meaning set forth in the Preamble.

“Company Capital Stock” means Company Common Stock, Company Series Seed Preferred Stock, Company Series A Preferred Stock, Company Series A-1 Preferred Stock, Company Series B Preferred Stock, Company Series B-1 Preferred Stock, Company Series C Preferred Stock, Company Series D Preferred Stock and Company Series X Preferred Stock (if any).

“Company Certificate” has the meaning set forth in Section 9.2(c).

“Company Certificate of Incorporation” means the Seventh Amended and Restated Certificate of Incorporation of the Company, as filed on March 15, 2021 with the Secretary of State of the State of Delaware pursuant to the DGCL, as amended.

“Company Common Stock” means common stock of the Company, par value $0.0001 per share.

“Company Consent” has the meaning set forth in Section 4.8.

“Company Expenses” means, as of any determination time, the aggregate of all fees, expenses, commissions or other amounts incurred by or on behalf of, or otherwise payable by, whether or not due, the Company and its Subsidiaries in connection with the negotiation, preparation or execution of this Agreement or any Additional Agreements, the performance of any covenants or agreements in this Agreement or any Additional Agreement or the consummation of the transactions contemplated hereby or thereby, including (i) fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, compensation consultants, analysts, legal, accounting, tax, public relations and investor relations advisors, transfer or exchange agents, as applicable, and other professional fees, (ii) costs and expenses related to (x) directors’ and officers’ liability insurance or (y) the preparation, filing and distribution of the SEC Statement and Additional Parent SEC Documents, or (iii) filing fees paid or payable by or on behalf of the Company or its Subsidiaries to any Authority in connection with the transactions contemplated hereby but, in all cases, excluding fees (other than legal fees of the Company’s counsel), costs, expenses, brokerage fees, commissions, finders’ fees and disbursements relating to the issuance and sale of shares of Company Series X Preferred Stock.

“Company Financial Statements” has the meaning set forth in Section 4.9(a).

“Company Fundamental Representations” means the representations and warranties made pursuant to Section 4.1 (Corporate Existence and Power), Section 4.2 (Authorization), Section 4.5(a) and (c) (Capitalization), Section 4.7 (Subsidiaries) and Section 4.26 (Finders’ Fees).

“Company Intellectual Property” means all Intellectual Property owned or purported to be owned by the Company or any Subsidiary of the Company, including without limitation Company Patents, Company Marks, and Company Copyrights.

“Company IT Systems” means all Software, databases, compilations, hardware, microprocessors, networks, firmware and other information technology and communications systems used in connection with the operations of the Business as presently conducted.

“Company Option” means each option to purchase Company Common Stock granted, and that remains outstanding, including options issued under the Equity Incentive Plan.

“Company Preferred Stock” has the meaning set forth in Section 4.5(a).

7

“Company Product” means all software products and services marketed, licensed, sold, distributed or otherwise made commercially available by or on behalf of the Company or any Subsidiary of the Company.

“Company Restricted Stock” means any outstanding shares of Company Capital Stock that are unvested or subject to a risk of forfeiture or repurchase option in favor of the Company.

“Company Securities” means the Company Common Stock, the Company Preferred Stock, the Company Options and the Company Warrants.

“Company Securityholder” means each Person who holds Company Securities immediately prior to the Effective Time.

“Company Series A Preferred Stock” means the series A preferred stock of the Company, par value $0.0001 per share.

“Company Series A-1 Preferred Stock” means the series A-1 preferred stock of the Company, par value $0.0001 per share.

“Company Series B Preferred Stock” means the series B preferred stock of the Company, par value $0.0001 per share.

“Company Series B-1 Preferred Stock” means the series B-1 preferred stock of the Company, par value $0.0001 per share.

“Company Series C Preferred Stock” means the series C preferred stock of the Company, par value $0.0001 per share.

“Company Series D Preferred Stock” means the series D preferred stock of the Company, par value $0.0001 per share.

“Company Series Seed Preferred Stock” means the series seed preferred stock of the Company, par value $0.0001 per share.

“Company Series X Preferred Stock” means any series of preferred stock of the Company, par value $0.0001 per share, authorized after the date hereof; provided, that if such series of preferred stock of the Company is sold at a fixed pre-money valuation other than $700,000,000, then any such transaction or series of transactions with respect to the sale by the Company of the Company Series X Preferred Stock after the date hereof and prior to the Closing shall be subject to the mutual agreement of the Company and Parent.

“Company Stockholder Approval” has the meaning set forth in Section 4.2(b).

“Company Stockholders” means, at any given time, the holders of Company Capital Stock.

“Company Stockholder Written Consent” has the meaning set forth in Section 7.3(a).

“Company Stockholder Written Consent Deadline” has the meaning set forth in Section 7.3(a).

“Company Support Agreement” has the meaning set forth in the recitals to this Agreement.

“Company Warrant” means the warrants to purchase Company Series D Preferred Stock outstanding immediately prior to the Effective Time.

8

“Consideration Shares” has the meaning set forth in Section 3.1(a).

“Contracts” means the Leases and all other contracts, agreements, leases (including equipment leases, car leases and capital leases), licenses, Permits, commitments, client contracts, statements of work (SOWs), sales and purchase orders and similar instruments, oral or written, to which the Company is a party or by which any of its respective assets is bound.

“Control” of a Person means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract, or otherwise. “Controlled”, “Controlling” and “under common Control with” have correlative meanings. Without limiting the foregoing, a Person (the “Controlled Person”) shall be deemed Controlled by any other Person (the “50% Owner”) (i) owning beneficially, as meant in Rule 13d-3 under the Exchange Act, securities entitling such Person to cast 50% or more of the votes for election of directors or equivalent governing authority of the Controlled Person or (ii) entitled to be allocated or receive 50% or more of the profits, losses, or distributions of the Controlled Person.

“Conversion Ratio” means a number of Parent Class A Shares equal to the quotient obtained by dividing (a) the Closing Payment Shares by (b) the Fully Diluted Company Shares.

“Converted Company Option” has the meaning set forth in Section 3.1(b).

“Data Protection Laws” means all Laws applicable to the Company and its Subsidiaries in connection with the Business and relating to the processing, privacy or security of Personal Information and all regulations or guidance issued thereunder.

“DGCL” has the meaning set forth in Section 2.1.

“DPA” means Section 721 of Title VII of the Defense Production Act of 1950, as amended and as may be amended from time to time, including the regulations promulgated thereunder, codified at 31 C.F.R. Part 800, et seq.

“Effective Date” has the meaning set forth in Section 6.5(c).

“Effective Time” has the meaning set forth in Section 2.2.

“Election of Directors Proposal” has the meaning set forth in Section 6.5(e).

“Enforceability Exceptions” has the meaning set forth in Section 4.2(a).

“Environmental Laws” means all Laws that prohibit, regulate or control any Hazardous Material or any Hazardous Material Activity, including the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, the Resource Recovery and Conservation Act of 1976, the Federal Water Pollution Control Act, the Clean Air Act, the Hazardous Materials Transportation Act and the Clean Water Act.

“Equity Incentive Plan” means the Company’s 2016 Stock Incentive Plan.

“Equity Interest” means, with respect to any Person, any capital stock of, or other ownership, membership, partnership, voting, joint venture, equity interest, preemptive right, stock appreciation, phantom stock, profit participation or similar rights in, such Person or any Indebtedness, securities, options, warrants, call, subscription or other rights or entitlements of, or granted by, such Person that are convertible into, or are exercisable or exchangeable for, or give any person any right or entitlement to acquire any such capital stock or other ownership, partnership, voting, joint venture, equity interest, preemptive right, stock appreciation, phantom stock, profit participation or similar rights, in all cases, whether vested or unvested, of such Person or any similar security or right that is derivative or provides any economic benefit based, directly or indirectly, on the value or price of any such capital stock or other ownership, partnership, voting, joint venture, equity interest, preemptive right, stock appreciation, phantom stock, profit participation or similar rights, in all cases, whether vested or unvested.

9

“Equity Plan Proposal” has the meaning set forth in Section 6.5(e).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means each entity, trade or business that is, or was at the relevant time, a member of a group described in Section 414(b), (c), (m) or (o) of the Code that includes or included the Company.

“ESPP Proposal” has the meaning set forth in Section 6.5(e).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Foreign Corrupt Practices Act” means the Foreign Corrupt Practices Act of 1977, as amended.

“Foreign Plan” means each Plan maintained outside the jurisdiction of the United States that provides benefits in respect of any current or former employee, officer, director, independent contractor or otherwise of the Company or any of its Subsidiaries that is primarily based outside the United States, including any such plan required to be maintained or contributed to by applicable Law, custom or rule of the relevant jurisdiction.

“Fully Diluted Company Shares” means the sum, without duplication, of (a) shares of Company Common Stock (including Company Restricted Stock) that are issued and outstanding immediately prior to the Effective Time; plus (b) shares of Company Preferred Stock (on an as converted to Company Common Stock basis) that are issued and outstanding immediately prior to the Effective Time; plus (c) the aggregate number of shares of Company Series D Preferred Stock (on an as converted to Company Common Stock basis) issuable upon exercise of the Company Warrants as of immediately prior to the Effective Time; plus (d) the aggregate number of shares of Company Common Stock issuable upon exercise of Company Options as of immediately prior to the Effective Time.

“Hazardous Material” means any material, emission, chemical, substance or waste that has been designated by any Authority to be radioactive, toxic, hazardous, a pollutant or a contaminant.

“Hazardous Material Activity” means the transportation, transfer, recycling, storage, use, treatment, manufacture, removal, remediation, release, exposure of others to, sale, labeling, or distribution of any Hazardous Material or any product or waste containing a Hazardous Material, or product manufactured with ozone depleting substances, including any required labeling, payment of waste fees or charges (including so-called e-waste fees) and compliance with any recycling, product take-back or product content requirements.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“IPO” means the initial public offering of Parent pursuant to a prospectus dated March 10, 2021.

“Indebtedness” means with respect to any Person, (a) all obligations of such Person for borrowed money, or with respect to deposits or advances of any kind (including amounts by reason of overdrafts and amounts owed by reason of letter of credit reimbursement agreements), including with respect thereto, all interests, fees and costs, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person under conditional sale or other title retention agreements relating to property purchased by such Person, (d) all obligations of such Person issued or assumed as the deferred purchase price of property or services (other than accounts payable to creditors for goods and services incurred in the ordinary course of business), (e) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any Lien or security interest on property owned or acquired by such Person, whether or not the obligations secured thereby have been assumed, (f) all obligations of such Person under leases required to be accounted for as capital leases under U.S. GAAP, (g) all guarantees by such Person, (h) all liability of such Person with respect to any hedging obligations, including interest rate or currency exchange swaps, collars, caps or similar hedging obligations, (i) any unfunded or underfunded liabilities pursuant to any pension or nonqualified deferred compensation plan or arrangement and (j) any agreement to incur any of the same.

10

“Intellectual Property” means any and all of the following, as they exist in any jurisdiction throughout the world and under any international treaties or conventions: (a) patents, patent applications of any kind and patent rights (collectively, “Patents”); (b) registered and unregistered trademarks, service marks, trade names, trade dress, corporate names, logos, packaging design, slogans and Internet domain names, rights to social media accounts, and other indicia of source, origin or quality, together with all goodwill associated with any of the foregoing, and registrations and applications for registration of any of the foregoing (collectively, “Marks”); (c) copyrights in both published and unpublished works (including without limitation all compilations, databases and computer programs, manuals and other documentation and all derivatives, translations, adaptations and combinations of the above), mask work rights and registrations and applications for registration of any of the foregoing (collectively, “Copyrights”); (d) rights under applicable trade secret Law; (e) rights under data; and (f) any and all other intellectual property rights and/or proprietary rights recognized by Law.

“Interim Balance Sheet” has the meaning set forth in Section 4.9(a).

“Knowledge of the Company” or “to the Company’s Knowledge” or similar terms (whether or not capitalized) means the actual knowledge of Shimon Elkabetz, Itai Zlotnik and Rei Goffer.

“Knowledge of Parent” or “to Parent’s Knowledge” or similar terms (whether or not capitalized) means the actual knowledge of Adam Karkowsky, Christopher Longo and Ciro M. DeFalco.

“Law” means any domestic or foreign, federal, state, municipality or local law, statute, ordinance, code, rule, or regulation.

“Leases” means the leases described on Schedule 1.1(c), together with all fixtures and improvements erected on the premises leased thereby.

“Lien” means, with respect to any property or asset, any mortgage, lien, pledge, charge, security interest or encumbrance of any kind in respect of such property or asset, and any conditional sale or voting agreement or proxy, including any agreement to give any of the foregoing.

“Lockup Agreements” has the meaning set forth in the recitals to this Agreement.

“Material Adverse Effect” or “Material Adverse Change” means any event, occurrence, fact, condition or change that, individually or in the aggregate, (i) has or would reasonably be expected to result in a material adverse change or a material adverse effect upon the assets, liabilities, financial condition, business, operations or properties of the Company and the Business, taken as a whole, or (ii) does or would reasonably be expected to prevent, materially delay or materially impede the ability of the Company to consummate the Merger; provided, however, that with respect to clause (i) only, “Material Adverse Effect” or “Material Adverse Change” shall not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (a) general economic or political conditions; (b) conditions generally affecting the industries in which the Company operates; (c) any changes in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security or any market index or any change in prevailing interest rates; (d) acts of war (whether or not declared), armed hostilities or terrorism, or the escalation or worsening thereof; (e) any action expressly required by this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Parent; (f) any changes in applicable Laws or accounting rules (including U.S. GAAP) or the enforcement, implementation or interpretation thereof; (g) the announcement, pendency or completion of the transactions contemplated by this Agreement; (h) any natural or man-made disaster or acts of God or the COVID-19 pandemic; or (i) any failure by the Company to meet any internal or published projections, forecasts or revenue or earnings predictions; except, in the case of subclauses (a), (b), (c), (d), (f) and (h), to the extent such change, event, circumstance or effect has a disproportionate adverse effect on such entity as compared to other Persons engaged in the same industry.

11

“Material Contracts” has the meaning set forth in Section 4.15(a).

“Merger” has the meaning set forth in the recitals to this Agreement.

“Merger Sub” has the meaning set forth in the Preamble.

“Merger Sub Common Stock” has the meaning set forth in Section 5.7(b).

“Money Laundering Laws” has the meaning set forth in Section 4.28.

“Nasdaq” means The Nasdaq Capital Market.

“Nasdaq Proposal” has the meaning set forth in Section 6.5(e).

“OFAC” means the Office of Foreign Assets Control of the U.S. Treasury Department.

“Offer Documents” has the meaning set forth in Section 6.5(a).

“Open Source Software” means any software (in source or object code form) that is subject to (a) a license or other agreement commonly referred to as an open source, free software, copyleft or community source code license (including but not limited to any code or library licensed under the GNU Affero General Public License, GNU General Public License, GNU Lesser General Public License, BSD License, Apache Software License, or any other public source code license arrangement) or (b) any other license or other agreement that requires, as a condition of the use, modification or distribution of software subject to such license or agreement, that such software or other software linked with, called by, combined or distributed with such software be (i) disclosed, distributed, made available, offered, licensed or delivered in source code form, (ii) licensed for the purpose of making derivative works, (iii) licensed under terms that allow reverse engineering, reverse assembly, or disassembly of any kind, or (iv) redistributable at no charge, including without limitation any license defined as an open source license by the Open Source Initiative as set forth on www.opensource.org.

“Material Customers” has the meaning set forth in Section 4.31(a).

“Material Suppliers” has the meaning set forth in Section 4.31(b).

“Order” means any decree, order, judgment, writ, award, injunction, rule or consent of or by an Authority.

“Other Filings” means any filings to be made by Parent required under the Exchange Act, Securities Act or any other United States federal, foreign or blue sky laws, other than the SEC Statement and the other Offer Documents.

“Outside Closing Date” has the meaning set forth in Section 10.1(a).

“Parent” has the meaning set forth in the Preamble.

“Parent Board Recommendation” has the meaning set forth in Section 5.11.

“Parent Certificate of Incorporation” means the Amended and Restated Certificate of Incorporation of Parent, as filed on May 17, 2021 with the Secretary of State of the State of Delaware pursuant to the DGCL.

“Parent Class A Shares” means the Class A common stock, $0.0001 par value, of Parent.

“Parent Class B Shares” means the Class B common stock, $0.0001 par value, of Parent.

“Parent Common Stock” means Parent Class A Shares and Parent Class B Shares.

“Parent Equity Incentive Plan” has the meaning set forth in Section 8.6.

12

“Parent Expenses” means, as of any determination time, the aggregate of all fees, expenses, commissions or other amounts incurred by or on behalf of, or otherwise payable by, whether or not due, Parent or Merger Sub in connection with the negotiation, preparation or execution of this Agreement or any Additional Agreements, the performance of any covenants or agreements in this Agreement or any Additional Agreement or the consummation of the transactions contemplated hereby or thereby, including (i) deferred underwriting commissions disclosed in any Parent SEC Documents, (ii) fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, legal, accounting, tax, public relations and investor relations advisors, the Trustee and transfer or exchange agent, as applicable, and other professional fees, (iii) costs and expenses related to (x) directors’ and officers’ liability insurance or (y) the preparation, filing and distribution of the SEC Statement and Additional Parent SEC Documents, (iv) amounts outstanding under any working capital loans between Parent and Sponsor or (v) filing fees paid or payable by or on behalf of Parent or Merger Sub to any Authority in connection with the transactions contemplated hereby.

“Parent Fundamental Representations” means the representations and warranties made pursuant to Section 5.1 (Corporate Existence and Power), Section 5.2 (Corporate Authorization), Section 5.5 (Finders’ Fees) and Section 5.7 (Capitalization).

“Parent Parties” has the meaning set forth in Article V.

“Parent Preferred Stock” has the meaning set forth in Section 5.7(a).

“Parent Proposals” has the meaning set forth in Section 6.5(e).

“Parent Redemption Amount” has the meaning set forth in Section 6.6.

“Parent RSU” means an award of restricted stock units under the Parent Equity Incentive Plan, with each restricted stock unit providing the holder thereof the opportunity to be issued one Parent Class A Share.

“Parent SEC Documents” has the meaning set forth in Section 5.12(a).

“Parent Stockholder Approval” has the meaning set forth in Section 5.2.

“Parent Stockholder Meeting” has the meaning set forth in Section 6.5(a).

“Parent Stockholders” means, at any given time, the holders of Parent Common Stock.

“Parent Support Agreement” has the meaning set forth in the recitals to this Agreement.

“Parent Units” means the outstanding units of Parent sold as part of Parent’s IPO.

“Permit” means each license, franchise, permit, order, approval, consent or other similar authorization required to be obtained and maintained by the Company under applicable Law to carry out or otherwise affecting, or relating in any way to, the Business.

“Permitted Liens” means (a) all defects, exceptions, restrictions, easements, rights of way and encumbrances disclosed in policies of title insurance which have been made available to Parent; (b) mechanics’, carriers’, workers’, repairers’ and similar statutory Liens arising or incurred in the ordinary course of business for amounts (i) that are not delinquent, (ii) that are not material to the business, operations and financial condition of the Company so encumbered, either individually or in the aggregate, and (iii) not resulting from a breach, default or violation by the Company or any of its Subsidiaries of any Contract or Law; (c) Liens for Taxes not yet due and payable or which are being contested in good faith by appropriate proceedings (and for which adequate accruals or reserves have been established on the Company Financial Statements in accordance with U.S. GAAP); (d) non-exclusive licenses of Intellectual Property; and (e) the Liens set forth on Schedule 1.1(a).

13

“Person” means an individual, corporation, partnership (including a general partnership, limited partnership or limited liability partnership), limited liability company, association, trust or other entity or organization, including a government, domestic or foreign, or political subdivision thereof, or an agency or instrumentality thereof.

“Personal Information” means any data or information that are regulated by Data Protection Laws.

“Plan” means each “employee benefit plan” within the meaning of Section 3(3) of ERISA and all other compensation and benefits plans, policies, programs, or arrangements, including multiemployer plans within the meaning of Section 3(37) of ERISA, and each other equity, stock purchase, stock option, restricted stock, severance, retention, employment (other than any employment offer letter in such form as previously provided to Parent that is terminable “at will” without any contractual obligation on the part of the Company to make any severance, termination, change of control, or similar payment), consulting, change of control, collective bargaining, bonus, incentive, deferred compensation, employee loan, fringe benefit and other benefit plan, agreement, program, policy, commitment or other arrangement, whether or not subject to ERISA (including any related funding mechanism now in effect or required in the future), whether formal or informal, oral or written, in each case, that is sponsored, maintained, contributed or required to be contributed to by the Company or any of its Subsidiaries, or under which the Company or any of its Subsidiaries has any current or future liability (whether with respect to any current or former officer, employee, director, independent contractor or otherwise).

“Private Placement” has the meaning set forth in the recitals to this Agreement.

“Prospectus” has the meaning set forth in Section 11.14.

“Proxy Statement” has the meaning set forth in Section 6.5(a).

“Real Property” means, collectively, all real properties and interests therein (including the right to use), together with all buildings, fixtures, trade fixtures, plant and other improvements located thereon or attached thereto; all rights arising out of use thereof (including air, water, oil and mineral rights); and all subleases, franchises, licenses, permits, easements and rights-of-way which are appurtenant thereto.

“Registration Rights Agreement” means the registration rights agreement, in substantially the form attached hereto as Exhibit E.

“Representatives” has the meaning set forth in Section 6.2(a).

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the Securities and Exchange Commission.

“SEC Statement” means the Form S-4, including the Proxy Statement, whether in preliminary or definitive form, and any amendments or supplements thereto.

“Securities Act” means the Securities Act of 1933, as amended.

“Series X Conversion Ratio” means a number of Parent Class A Shares equal to (a) the Series X Financing Amount, if any, divided by $10.00, divided by (b) the total number of shares of Company Series X Preferred Stock issued and outstanding immediately prior to the Effective Time.

“Series X Financing Amount” means the aggregate dollar value amount of all Company Series X Preferred Stock purchased after the date hereof; provided, that the maximum aggregate dollar value of the Series X Financing Amount shall not exceed $35,000,000.

“Software” means any and all computer programs, including operating system and applications software, implementations of algorithms, and program interfaces, whether in source code or object code form and all documentation, including user manuals relating to the foregoing.

14

“Specified Business Conduct Laws” means: (a) the Foreign Corrupt Practices Act and other applicable Law relating to bribery or corruption; (b) all applicable Law imposing economic or financial sanctions on any Person, including all applicable Law administered by OFAC or the Bureau of Industry and Security administered by the U.S. Department of Commerce, all sanctions laws or embargos imposed or administered by the U.S. Department of State, the United Nations Security Council, Her Majesty’s Treasury of the United Kingdom, the European Union and all anti-boycott or anti-embargo laws; (c) all applicable Law relating to the import, export, re-export, transfer of information, data, goods, software, and technology, including the Export Administration Regulations administered by the U.S. Department of Commerce and the International Traffic in Arms Regulations administered by the U.S. Department of State; and (d) the Money Laundering Control Act of 1986, as amended, the Currency and Foreign Transactions Reporting Act of 1970, as amended, The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, as amended, and other applicable Law relating to money laundering.

“Specified Company Securityholder” has the meaning set forth in the recitals to this Agreement.

“Sponsor” means Pine Technology Sponsor LLC, a Delaware limited liability company.

“Standard Contracts” has the meaning set forth in Section 4.15(a)(vi).

“Subscription Agreement” has the meaning set forth in the recitals to this Agreement.

“Subsidiary” means, with respect to any Person, any corporation, association, partnership, limited liability company, trust or other entity of which fifty percent (50%) or more of the total voting power, whether by way of Contract or otherwise, of shares of capital stock or other equity interests (including limited liability company or partnership interests) entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly (e.g., through another Subsidiary), by (a) such Person (b) such Person and one or more of its Subsidiaries, or (c) one or more Subsidiaries of such Person.

For the avoidance of doubt, a Subsidiary of a Person includes direct and indirect Subsidiaries (e.g., a Subsidiary of a Subsidiary).

“Surviving Corporation” has the meaning set forth in the recitals to this Agreement.

“Tangible Personal Property” means all tangible personal property and interests therein, including machinery, computers and accessories, furniture, office equipment, communications equipment, automobiles, laboratory equipment and other equipment owned or leased by the Company and other tangible property, including the items listed on Schedule 1.1(b).

“Tax(es)” means any U.S. federal, state or local or non-U.S. tax, charge, fee, levy, custom, duty, deficiency, or other assessment of any kind or nature imposed by any Taxing Authority (including any income (net or gross), gross receipts, profits, windfall profit, sales, use, goods and services, ad valorem, franchise, license, withholding, employment, social security, workers compensation, unemployment compensation, employment, capital stock, stamp, payroll, transfer, excise, import, real property, personal property, intangible property, excise, escheat, abandoned or unclaimed property, occupancy, recording, minimum or alternative minimum), together with any interest, penalty, additions to tax or additional amount imposed with respect thereto.

“Taxing Authority” means the Internal Revenue Service and any other Authority responsible for the collection, assessment or imposition of any Tax or the administration of any Law relating to any Tax.

“Tax Opinion” has the meaning set forth in Section 2.4(b).

15

“Tax Return” means any return, information return, declaration, election, claim for refund or credit, report or any similar statement, and any amendment thereto, including any attached schedule and supporting information, whether on a separate, consolidated, combined, unitary or other basis, that is filed or required to be filed with any Taxing Authority in connection with the determination, assessment, collection or payment of a Tax or the administration of any Law relating to any Tax.

“Trade Secrets” means any trade secrets and other confidential or proprietary information (including customer and supplier lists, customer and supplier records, pricing and cost information, reports, methodologies, technical information, proprietary business information, processes, plans, drawings, blue prints, know-how, inventions and invention disclosures (whether or not patented or patentable and whether or not reduced to practice), ideas, research in progress, algorithms, data, databases, data collections, designs, processes, formulae, drawings, schematics, blueprints, flow charts, models, strategies, prototypes, techniques, source code, source code documentation, testing procedures, testing results and business, financial, sales and marketing plans) and rights under applicable trade secret Law in the foregoing.

“Transactions” means the transactions contemplated by this Agreement to occur at or immediately prior to the Closing, including the Merger.

“Transaction Proposal” has the meaning set forth in Section 6.5(e).

“Transfer Taxes” has the meaning set forth in Section 8.5(c).

“Trust Account” has the meaning set forth in Section 5.9.

“Trust Agreement” has the meaning set forth in Section 5.9.

“Trust Fund” has the meaning set forth in Section 5.9.

“Trustee” has the meaning set forth in Section 5.9.

“Unaudited Financial Statements” has the meaning set forth in Section 4.9(a).

“Unpaid Expenses” means the Company Expenses and Parent Expenses that remain unpaid as of immediately prior to the Closing.

“Unvested Company Option” means each Company Option outstanding as of immediately prior to the Effective Time that is not vested as of immediately prior to the Effective Time or will not vest solely as a result of the consummation of the Merger.

“U.S. GAAP” means U.S. generally accepted accounting principles, consistently applied.

1.2 Construction.

(a) References to particular sections and subsections, schedules, annexes and exhibits not otherwise specified are cross-references to sections and subsections, schedules, annexes and exhibits of this Agreement unless otherwise indicated. Captions are not a part of this Agreement, but are included for convenience, only. The table of contents contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

(b) The words “herein,” “hereof,” “hereunder,” and words of similar import refer to this Agreement as a whole and not to any particular provision of this Agreement and reference to a particular section of this Agreement will include all subsections thereof, unless, in each case, the context otherwise requires; and, unless the context requires otherwise, “party” means a party signatory hereto.

(c) Any use of the singular or plural, or the masculine, feminine or neuter gender, includes the others, unless the context otherwise requires; the words “include,” “includes,” and “including” means “including without limitation”; the word “or” means “and/or”; the word “any” means “any one, more than one, or all”; the words “made available” mean that the subject documents or other materials were posted to the electronic data site maintained by the Company in connection with the transactions contemplated by this Agreement or otherwise provided to Parent or its Representatives in electronic form, in each case, at least forty-eight (48) hours prior to the date of this Agreement; and, unless otherwise specified, any financial or accounting term has the meaning of the term under United States generally accepted accounting principles as consistently applied heretofore by the Company.

16

(d) Unless otherwise specified, any reference to any agreement (including this Agreement), instrument, or other document includes all schedules, exhibits, or other attachments referred to therein, and any reference to a statute or other law means such law as amended, restated, supplemented or otherwise modified from time to time and includes any rule, regulation, ordinance or the like promulgated thereunder, in each case, as amended, restated, supplemented or otherwise modified from time to time. Unless otherwise specified, all references to currency amounts in this Agreement shall mean United States Dollars.

(e) Any reference to a numbered schedule means the same-numbered section of the disclosure schedule. Any reference in a schedule contained in the disclosure schedules delivered by a party hereunder shall be deemed to be an exception to (or, as applicable, a disclosure for purposes of) the applicable representations and warranties (or applicable covenants) that are contained in the section or subsection of this Agreement that corresponds to such schedule and any other representations and warranties of such party that are contained in this Agreement to which the relevance of such item thereto is reasonably apparent on its face. The mere inclusion of an item in a schedule as an exception to (or, as applicable, a disclosure for purposes of) a representation or warranty shall not be deemed an admission that such item represents a material exception or material fact, event or circumstance or that such item would have a Material Adverse Effect or establish any standard of materiality to define further the meaning of such terms for purposes of this Agreement.

(f) If any action is required to be taken or notice is required to be given within a specified number of days following a specific date or event, the day of such date or event is not counted in determining the last day for such action or notice. If any action is required to be taken or notice is required to be given on or before a particular day, the date that is the reference date in calculating such period shall be excluded when calculating the time before which or within which such action or notice is to be taken or given, and if such date which is not a Business Day, such action or notice shall be considered timely if it is taken or given on or before the next Business Day.

ARTICLE II

MERGER

2.1 Merger. Upon the terms and subject to the conditions set forth in this Agreement, and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), at the Effective Time, (a) Merger Sub shall be merged with and into the Company, (b) the separate corporate existence of Merger Sub shall thereupon cease, and the Company shall be the Surviving Corporation in the Merger, and (c) the Surviving Corporation shall become a wholly-owned Subsidiary of Parent. The Company Securityholders shall be entitled to the consideration described in, and in accordance with the provisions of, Article III.

2.2 Merger Effective Time. Subject to the provisions of this Agreement, at the Closing, the Company shall file a certificate of merger with the Secretary of State of the State of Delaware, executed in accordance with the relevant provisions of the DGCL (the “Certificate of Merger”). The Merger shall become effective upon the filing of the Certificate of Merger or at such later time as is agreed to by the parties and specified in the Certificate of Merger (the time at which the Merger becomes effective is herein referred to as the “Effective Time”).

2.3 Effect of the Merger. At the Effective Time, the effect of the Merger shall be as provided in this Agreement, the Certificate of Merger and the applicable provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, agreements, powers and franchises, debts, liabilities, duties and obligations of the Company and Merger Sub shall become the property, rights, privileges, agreements, powers and franchises, debts, liabilities, duties and obligations of the Surviving Corporation, which shall include the assumption by the Surviving Corporation of any and all agreements, covenants, duties and obligations of the Company and the Merger Sub set forth in this Agreement to be performed after the Closing. Merger Sub will be merged with and into the Company, and the separate corporate existence of Merger Sub will cease, and the Surviving Corporation will become wholly owned directly by Parent, all as provided under the DGCL and the provisions of this Agreement.

17

2.4 U.S. Tax Treatment.

(a) For U.S. federal income tax purposes, the Merger is intended to constitute a “reorganization” within the meaning of Section 368(a) of the Code (the “U.S. Tax Treatment”). The parties to this Agreement hereby (i) adopt this Agreement insofar as it relates to the Merger as a “plan of reorganization” within the meaning of Section 1.368-2(g) of the United States Treasury regulations, (ii) agree to file and retain such information as shall be required under Section 1.368-3 of the United States Treasury regulations, and (iii) agree to file all Tax and other informational returns on a basis consistent with the U.S. Tax Treatment. Notwithstanding the foregoing or anything else to the contrary contained in this Agreement, the parties acknowledge and agree that, other than the representations set forth in Sections 4.24(b) and 5.18(e), no party is making any representation or warranty as to the qualification of the Merger as a reorganization under Section 368(a) of the Code or as to the effect, if any, that any transaction consummated on, after or prior to the Effective Time has or may have on any such reorganization status. Each of the parties acknowledges and agrees that each such party (A) has had the opportunity to obtain independent legal and tax advice with respect to the transactions contemplated by this Agreement and (B) is responsible for paying its own Taxes, including any adverse Tax consequences that may result if the Merger is determined not to qualify as a reorganization under Section 368(a) of the Code.

(b) If, in connection with the preparation and filing of the Parent SEC Documents, the SEC Statement or any Other Filing (each individually, a “Securities Filing”) or the SEC’s review thereof, the SEC requests or requires that a tax opinion with respect to the U.S. federal income tax consequences of the Merger be prepared and submitted in such connection (a “Tax Opinion”), (i) the Company and Parent shall each use its reasonable best efforts to deliver to Goodwin Procter LLP (“Goodwin”), in connection with any Tax Opinion to be rendered by such counsel, customary Tax representation letters satisfactory to such counsel, dated and executed as of the date such relevant filing shall have been declared effective by the SEC and such other date(s) as determined to be reasonably necessary by such counsel in connection with the preparation and filing of such Securities Filing, and (ii) the Company shall use its reasonable best efforts to cause Goodwin to furnish a Tax Opinion, subject to customary assumptions and limitations, to the effect that the U.S. Tax Treatment should apply to the Merger and describing the U.S. federal income tax consequences to the Company Securityholders in connection with the Merger. For the avoidance of doubt, in no event shall any such Tax Opinion be a condition to Closing.

2.5 Certificate of Incorporation and Bylaws.

(a) At the Effective Time, the Company Certificate of Incorporation and bylaws, as in effect immediately prior to the Effective Time, shall cease to have effect and the certificate of incorporation and bylaws of Merger Sub, as in effect immediately prior to the Effective Time, shall be the certificate of incorporation and bylaws of the Surviving Corporation, except that references to the name of Merger Sub shall be replaced by references to the name of “Tomorrow.io Inc.”

(b) Immediately prior to the Effective Time, Parent shall adopt the Amended and Restated Bylaws of Parent in the form attached hereto as Exhibit F.

2.6 Closing; Effective Time. Unless this Agreement is earlier terminated in accordance with Article X, the closing of the Merger (the “Closing”) shall take place virtually at 10:00 a.m. local time, on the second (2nd) Business Day after the satisfaction or waiver (to the extent permitted by applicable law) of the conditions set forth in Article IX or at such other time, date and location as Parent and Company agree in writing. The parties may participate in the Closing via electronic means. The date on which the Closing actually occurs is hereinafter referred to as the “Closing Date”.

2.7 Post-Closing Board of Directors and Officers.

(a) Immediately after the Closing, Parent’s Board of Directors will consist of seven (7) directors: (i) one (1) of whom shall be designated by Sponsor and shall be Adam Karkowsky and (ii) six (6) of whom shall be designated by the Company prior to Closing. At least a majority of the Board of Directors shall qualify as independent directors under the Securities Act and the Nasdaq rules.

(b) The initial officers of Parent shall be as set forth on Schedule 2.7(b), who shall serve in such capacity in accordance with the terms of the Parent A&R Bylaws following the Effective Time.

(c) From and after the Effective Time, the directors and officers of the Surviving Corporation shall be those persons set forth on Schedule 2.7(c) (or such other Persons as designated by the Company prior to the Closing).

2.8 Taking of Necessary Action; Further Action. If, at any time after the Closing, any further action is necessary or desirable to carry out the purposes of this Agreement and to vest the Surviving Corporation with full right, title and interest in, to and under, or possession of, all assets, property, rights, privileges, powers and franchises of the Company and the Merger Sub, the officers and directors of the Surviving Corporation are fully authorized in the name and on behalf of the Company and the Merger Sub, to take all lawful action necessary or desirable to accomplish such purpose or acts, so long as such action is not inconsistent with this Agreement.

18

2.9 No Further Ownership Rights in Company Securities. At the Effective Time, the stock transfer books of the Company shall be closed and thereafter there shall be no further registration of transfers of shares of Company Capital Stock or other securities of the Company on the records of the Company. From and after the Effective Time, the holders of certificates evidencing ownership of shares of Company Capital Stock of the Company outstanding immediately prior to the Effective Time shall cease to have any rights with respect to such shares of Company Capital Stock, except as otherwise provided for herein or by Law.

2.10 Appraisal Rights. Notwithstanding anything to the contrary contained herein, any shares of Company Capital Stock that are issued and outstanding immediately prior to the Effective Time and in respect of which appraisal rights shall have been perfected, and not waived, withdrawn or lost, in accordance with the DGCL in connection with the Merger and that are owned by a holder who complies in all respects with Section 262 of the DGCL (such shares, “Dissenting Shares”) shall not be converted into the right to receive the applicable portion of the Consideration Shares, but shall instead be converted into the right to receive such consideration as may be determined to be due with respect to any such Dissenting Shares pursuant to the DGCL. At the Effective Time, (a) all Dissenting Shares shall be cancelled, extinguished and cease to exist and (b) the holders of Dissenting Shares shall be entitled only to such rights as may be granted to them under the DGCL. Each holder of Dissenting Shares who, pursuant to the DGCL, becomes entitled to payment thereunder for such shares shall receive payment therefor in accordance with the DGCL (but only after the value therefor shall have been agreed upon or finally determined pursuant to such provisions). If, after the Effective Time, any Dissenting Shares shall lose their status as Dissenting Shares, then any such shares shall immediately be deemed to have converted at the Effective Time into the right to receive the applicable portion of the Consideration Shares (upon the terms and conditions of this Agreement) in respect of such shares as if such shares never had been Dissenting Shares, and Parent shall issue and deliver (or cause to be issued and delivered) to the holder thereof, following the satisfaction of the applicable conditions set forth in this Agreement, the applicable portion of the Consideration Shares as if such shares never had been Dissenting Shares. The Company shall give Parent prompt written notice (and in any event within two (2) Business Days) of any demands received by the Company for appraisal of shares of Company Capital Stock, attempted withdrawals of such demands and any other instruments served pursuant to the DGCL and received by the Company relating to rights to be paid the fair value of Dissenting Shares, and Parent shall have the right to participate in and, following the Effective Time, direct all negotiations and proceedings with respect to such demands. Prior to the Effective Time, neither the Company nor Parent shall, except with the prior written consent of the other party (in its sole discretion), or as otherwise required under the DGCL, (i) make any payment or offer to make any payment with respect to, or settle or compromise or offer to settle or compromise, any claim or demand in respect of any Dissenting Shares, (ii) waive any failure to timely deliver a written demand for appraisal or otherwise comply with the provisions under Section 262 of the DGCL or (iii) agree or commit to do any of the foregoing.

ARTICLE III

CONSIDERATION

3.1 Conversion of Company Securities.

(a) Conversion of Company Capital Stock. Subject to Section 2.10, at the Effective Time, by virtue of the Merger and without any action on the part of Parent, Merger Sub, the Company or the Company Securityholders, (i) each share of Company Capital Stock issued and outstanding immediately prior to the Effective Time (other than the Dissenting Shares and shares of Company Series X Preferred Stock) shall be canceled and automatically converted into the right to receive a number of Parent Class A Shares equal to the Conversion Ratio and (ii) each share of Company Series X Preferred Stock issued and outstanding immediately prior to the Effective Time (other than Dissenting Shares) shall be canceled and automatically converted into the right to receive a number of Parent Class A Shares equal to the Series X Conversion Ratio (collectively, clauses (i) and (ii), the “Consideration Shares”). If any shares of Company Capital Stock issued and outstanding immediately prior to the Effective Time are shares of Company Restricted Stock, then the Parent Class A Shares issued in exchange for such Company Restricted Stock pursuant to the immediately preceding sentence shall to the same extent be unvested and subject to the same repurchase option or risk of forfeiture, and the certificates and/or book entries representing such Parent Class A Shares shall accordingly be marked with appropriate legends.

(b) Treatment of Company Options. Prior to the Effective Time, the Company and Parent and the Board of Directors of the Company (or any duly authorized committee thereof) shall, as applicable, take or cause to be taken all corporate actions necessary, including adopting appropriate resolutions to provide that, as of the Effective Time, each Company Option (whether or not vested) shall be assumed by Parent and shall continue in full force and effect, containing the same terms, conditions, vesting and other provisions as are currently applicable to such Company Options; provided that (A) each such Company Option shall be exercisable for such number of Parent Class A Shares that equals the Conversion Ratio multiplied by the number of shares of Company Common Stock subject to such Company Option as of immediately prior to the Effective Time, in each case, at such per share exercise price that shall equal the per share exercise price of such Company Option as of immediately prior to the Effective Time divided by the Conversion Ratio (as so converted, a “Converted Company Option”), further provided that (B) with respect to each such Company Option, any fractional shares that would be issuable upon exercise thereof will be rounded down to the nearest whole number of Parent Class A Shares and the per share exercise price will be rounded up to the nearest whole cent. Parent shall adopt the Parent Equity Incentive Plan, which will cover the Converted Company Options, pursuant to Section 8.6; provided, however, that the per share exercise price and the number of Parent Class A Shares purchasable pursuant to each Converted Company Option shall be determined in a manner consistent with the requirements of Section 409A of the Code; further provided that in the case of any Unvested Company Options to which Section 422 of the Code applies, the exercise price and the number of Parent Class A Shares purchasable pursuant to the applicable Converted Company Option shall be determined in accordance with the foregoing, subject to such adjustments as are necessary in order to satisfy the requirements of Section 424(a) of the Code.

19

(c) Treatment of the Company Warrants. At the Effective Time, the Company Warrants shall no longer be outstanding and each Person who previously held Company Warrants shall cease to have any rights with respect to such Company Warrants in accordance with its terms.

(d) Conversion of Shares of Merger Sub. Each share of Merger Sub that is issued and outstanding immediately prior to the Effective Time will, by virtue of the Merger and without further action on the part of the sole shareholder of Merger Sub, be converted into and become one share of the Surviving Corporation (and the shares of the Surviving Corporation into which the shares of Merger Sub are so converted shall be the only shares of the Surviving Corporation that are issued and outstanding immediately after the Effective Time). Each certificate evidencing ownership of shares of Merger Sub will, as of the Effective Time, be deemed to evidence ownership of such shares of the Surviving Corporation.

(e) Treatment of Shares of Company Capital Stock Owned by the Company. At the Effective Time, all shares of Company Capital Stock that are owned by the Company as treasury shares immediately prior to the Effective Time shall be canceled and extinguished without any conversion thereof.

(f) Surrender of Certificates. All Consideration Shares issued upon the surrender and cancellation of the Company Capital Stock, in accordance with the terms hereof, shall be deemed to have been issued in full satisfaction of all rights pertaining to such securities.

(g) Lost or Destroyed Certificates. In the event any certificates representing shares of Company Capital Stock shall have been lost, stolen or destroyed, Parent shall issue in exchange for such lost, stolen or destroyed certificates or securities, as the case may be, upon the making of an affidavit of that fact by the holder thereof (without the requirement to post a bond), such securities, as may be required pursuant to this Section 3.1.

(h) Capitalization Schedule. No later than three (3) Business Days prior to the Closing Date, the Company shall deliver to Parent a final and updated Capitalization Schedule, which sets forth the following information: (i) the name of each Company Securityholder; (ii) the number and type or class/series of each Company Security held by each Company Securityholder, including, if applicable to such Company Securityholder, the number of shares of Company Common Stock issuable upon conversion or exercise of such Company Security and the exercise price per share for such Company Security; (iii) the vesting arrangements with respect to each Company Security held by such Company Securityholder (including the vesting schedule, vesting commencement date, date fully vested and the extent to which such Company Security is or will be vested as of the Effective Time); (iv) the total number of Parent Class A Shares issuable pursuant to Section 3.1(a) in respect of each share of Company Capital Stock held by such Company Securityholder; and (v) the total number of Parent Class A Shares issuable pursuant to Section 3.1(b) upon conversion of each Company Option held by such Company Securityholder, and the respective exercise price per share applicable to such Company Option following the Effective Time. The parties agree that the Capitalization Schedule delivered by the Company to Parent prior to the Closing Date solely represents the Company’s good faith estimate of such information and calculations and is not binding on the parties in any respect.

3.2 No Fractional Shares. No fractional Parent Class A Shares, or certificates or scrip representing fractional Parent Class A Shares, will be issued upon the conversion of the Company Capital Stock pursuant to the Merger, and such fractional share interests will not entitle the owner thereof to vote or to any rights of a stockholder of Parent. Any fractional Parent Class A Shares will be rounded down to the nearest whole number of Parent Class A Shares.

3.3 Withholding. Parent and the Surviving Corporation shall be entitled to deduct and withhold from the consideration otherwise payable to any Person pursuant to this Agreement such amounts as may be required to be deducted or withheld with respect to the making of such payment under the Code, or under any provision of state, local or non-U.S. Tax Law. To the extent that amounts are so deducted and withheld and timely remitted to the appropriate Taxing Authorities, such amounts shall be treated for all purposes under this Agreement as having been paid to the Person in respect of which such deduction and withholding was made. Notwithstanding the foregoing, Parent, the Company and the Surviving Corporation shall use reasonable best efforts to reduce or eliminate any such withholding including requesting and providing recipients of consideration with a reasonable opportunity to provide documentation establishing exemptions from or reductions of such withholdings.

20

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as set forth in the disclosure schedules delivered by the Company to Parent prior to the execution of this Agreement, the Company hereby represents and warrants to Parent that each of the following representations and warranties are true, correct and complete as of the date of this Agreement.

4.1 Corporate Existence and Power. The Company and each of its Subsidiaries is a corporation or other legal entity duly organized and validly existing under the Laws of the jurisdiction of its organization and has all power and authority required to own, lease and operate its properties and assets and to carry on the Business as presently conducted. The Company and each of its Subsidiaries is duly licensed or qualified to do business in each jurisdiction in which its properties are owned or leased by it or the operation of its Business as currently conducted makes such licensing or qualification necessary, except where the failure to be so licensed or qualified would not have a Material Adverse Effect. The Company is not in violation of its organizational documents. Complete and correct copies of the Company’s and its Subsidiaries’ organizational documents, as amended and in full force and effect as of the date of this Agreement, have been made available to Parent.

4.2 Authorization.

(a) The execution, delivery and performance by the Company of this Agreement and the Additional Agreements to which the Company is or will be a party and the consummation by the Company of the transactions contemplated hereby and thereby are within the corporate powers of the Company and have been duly authorized by all necessary action on the part of the Company. This Agreement and the Additional Agreements to which the Company is or will be a party have been duly and validly executed and delivered by the Company. Assuming the due authorization, execution and delivery thereof by the other parties hereto, this Agreement constitutes, and, upon the execution and delivery thereof, each Additional Agreement to which the Company is or will be a party will, assuming the due authorization, execution and delivery thereof by the other parties thereto, constitute, a valid and legally binding agreement of the Company, enforceable against the Company in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity (the “Enforceability Exceptions”).