Form 8-K Ocuphire Pharma, Inc. For: Aug 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 12, 2022

(Exact name of registrant as specified in its charter)

|

|

||||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

(Address of principal executive offices and zip code)

(Registrant’s telephone number including area code)

(Registrant’s former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition.

|

On August 12, 2022, Ocuphire Pharma, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2022. A copy of this

press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”) and is incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02, and Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act of 1933, as

amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

| Item 7.01 |

Regulation FD Disclosure.

|

On August 12, 2022, the Company posted an updated corporate presentation to its website at https://ir.ocuphire.com/presentations, which the Company may

use from time to time in communications or conferences. A copy of the corporate presentation is attached as Exhibit 99.2 to this Report.

The information in this Report, including Exhibit 99.2 hereto, is furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of

Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference

in such a filing. The Company’s submission of this Report shall not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Exhibit 99.2 hereto contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based on current expectations and

are not guarantees of future performance. Further, the forward-looking statements are subject to the limitations listed in Exhibit 99.2 and in the other reports of the Company filed with the Securities and Exchange Commission, including that actual

events or results may differ materially from those in the forward-looking statements.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

Press Release, dated August 12, 2022

|

||

|

Corporate Presentation, dated August 12, 2022

|

||

|

104

|

Cover Page Interactive Data File (embedded with Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

OCUPHIRE PHARMA, INC.

|

||

|

Dated: August 12, 2022

|

||

|

By:

|

/s/ Mina Sooch

|

|

|

Mina Sooch

|

||

|

Chief Executive Officer

|

||

Exhibit 99.1

Ocuphire Pharma Announces Financial Results for the Second Quarter 2022 and Provides Corporate Update

Completed Final Clinical Trials and Pre-NDA FDA Meeting to Support Registration of Nyxol in

Reversal of Mydriasis (RM), On Track for Late 2022 NDA Submission and Potential 2023 Approval

Positive Results from Phase 3 LYNX-1 Trial of Nyxol in Night Vision Disturbances (NVD) Mark Sixth Positive Nyxol Clinical Data Readout Across

Multiple Indications

Data Expected in 2H 2022 from Phase 2b Trial of APX3330, a Potential First-in-Class Oral Treatment for Diabetic Retinopathy

Plans to Initiate VEGA Phase 3 FDA Registration Program for Nyxol Alone and in Combination with Low-Dose Pilocarpine (LDP) in Presbyopia in 2H

2022

FARMINGTON HILLS, Mich., August 12, 2022 - Ocuphire Pharma, Inc. (Nasdaq: OCUP), a clinical-stage ophthalmic biopharmaceutical company focused on developing and

commercializing therapies for the treatment of refractive and retinal eye disorders, today announced financial results for the second quarter ended June 30, 2022 and provided a corporate update.

“Ocuphire has continued to deliver in the second quarter of 2022 on execution as a highly-productive and capital efficient company, with continued success in late-stage

clinical trials, multiple positive data presentations featured at medical meetings, and additional IP protection granted for both Nyxol and APX3330,” said Mina Sooch, MBA, founder and CEO of Ocuphire Pharma. “With the completion of the final

clinical trials of Nyxol in reversal of mydriasis, we remain focused on a late 2022 NDA filing as we ramp up our pre-commercial activities and entertain discussions with commercial partners in preparation for the anticipated approval of Nyxol as

the first and only dilation reversal drop in 2023. We look forward to reporting top-line results in the second half of this year from the Phase 2b trial of APX3330 in diabetic retinopathy (DR). The opportunity in retina has multi-billion dollar

potential. We are well positioned to deliver on our upcoming late-stage clinical and regulatory milestones through the second half of 2022.”

Dr. Jay Pepose, Ocuphire’s Chief Medical Advisor

and Board Member added, “A disruptive catalyst later this year will be top-line results from the ongoing multi-center, randomized, double-masked, placebo-controlled Phase 2b ZETA-1 trial

evaluating APX3330 in diabetic retinopathy. APX3330 is a novel oral therapy with a dual mechanism of action in validated pathways, decreasing both abnormal angiogenesis and inflammation. It has shown a favorable safety profile for a systemic oral

drug in hundreds of patients in 11 prior clinical trials. More recently, masked safety data from 70% of the 103 enrolled patients who completed 24 weeks of treatment in ZETA-1 trial were

presented in July confirming the favorable safety and tolerability profile seen in prior trials. If approved, APX3330 has the potential to be a convenient oral treatment for diabetic patients with non-proliferative diabetic retinopathy and other

diabetes-related complications. This could represent a paradigm shift from observation and monitoring progression today to an early, non-injection treatment option.”

Key Anticipated Future Milestones

| • |

Reversal of Mydriasis (RM): Planned New Drug Application

(NDA) with the FDA for Nyxol in RM indication in late 2022, with potential launch as first dilation reversal drop in 2H 2023

|

| • |

Presbyopia: Plan to initiate VEGA-2 trial, the first of

two Phase 3 registration trials intended to support the use of Nyxol alone and Nyxol with 0.4% low dose pilocarpine (LDP) in presbyopia, in 2H of 2022; if successful, the Company expects to file a supplemental NDA for Nyxol as a

single-agent for presbyopia and a new NDA for the combination thereafter

|

| • |

Diabetic Retinopathy (DR) and Diabetic Macular Edema (DME):

Report top-line results from the APX3330 Phase 2b ZETA-1 trial in 2H 2022

|

Second Quarter and Recent Business Highlights

Clinical Development

| • |

In April, the Company announced positive results from the MIRA-4 Phase 3 pediatric study in subjects aged 3-12 years, the final clinical trial supporting a planned NDA submission with for Nyxol

in RM. The study met its primary safety endpoint, demonstrating a favorable safety and tolerability profile with no adverse events reported with similar efficacy seen in adults.

|

| • |

In May, the Company announced positive top-line results from the LYNX-1 Phase 3 trial evaluating Nyxol for Night Vision Disturbance (NVD). The study met the FDA-agreed upon primary endpoint with

statistically significantly more Nyxol-treated subjects having gained 15 or more letters of mesopic low contrast distance visual acuity compared to placebo. Key secondary efficacy endpoints were also met with statistical significance, and

Nyxol showed a favorable safety and tolerability profile with no serious adverse events reported. This is the first Phase 3 trial to study NVD and to show an improvement in distance and contrast vision at night with a pupil modulation

mechanism which has cross-over safety differentiation to presbyopia. The Phase 3 protocol for VEGA-2 was submitted to the FDA in July.

|

| • |

In June, the Company held a Type B Pre-NDA meeting with the FDA at which it received guidance on the content of CMC, clinical and non-clinical modules of the planned NDA for Nyxol in RM. The FDA

confirmed that OraVerse and Regitine were appropriate to use as reference listed drugs to support a 505(b)(2) NDA.

|

Presentations, Publications, and Conferences

| • |

From April through August 2022, Ocuphire was represented at conferences by Mina Sooch and several prominent key thought leaders, including David Boyer, MD, Peter Kaiser, MD, David Lally, MD, and

Michael Allingham, MD, PhD who presented updates on APX3330 in DR, as well as Jay Pepose, MD, PhD, Marguerite McDonald, MD, Inder Paul Singh, MD, Ralph Chu, MD, James Katz, MD and Douglas Devries, OD who presented data for Nyxol in

Presbyopia and RM. Since the beginning of the year, 9 podium papers, 5 posters, and over 10 panel or company talks were presented across a total of 20 medical, scientific, industry and investment conferences.

|

| • |

In June at the 45th Annual Macula Society Meeting in Germany and in July at the American Society of Retina Specialists (ASRS) 2022 in New York, David Boyer, MD and David Lally MD,

presented updated masked safety data from the ongoing ZETA-1 Phase 2b trial evaluating APX3330. The latest data from mid-June represented 100% of 103 subjects having completed 12 weeks or more and 70% having completed 24 weeks. These

safety data are consistent with favorable safety profile from the prior 11 clinical trials with total exposure experience of over 9,000 subject-days with a 600 mg daily dose of APX3330.

|

| • |

In July, at the 40th Annual Meeting of ASRS, David Boyer, MD, presented for the first time to the retina medical community a late-breaking paper highlighting positive data from the MIRA-2 and

MIRA-3 Phase 3 registration trials for Nyxol eye drops to rapidly reverse mydriasis.

|

| • |

In July, the Company announced the publication of a preclinical study supporting the novel mechanism of action inhibiting NFkB and the inflammatory pathway for APX3330 and APX pipeline

candidates. The publication, titled “RelA is an Essential Target for Enhancing Cellular Responses to the DNA Repair/Ref-1 Redox Signaling Protein and Restoring Perturbated Cellular Redox Homeostasis in Mouse PDAC Cells” was published in Frontiers in Oncology and can be accessed here.

|

Corporate

| • |

In April, Ocuphire appointed Jay Pepose, MD, PhD, as Chief Medical Advisor in addition to his Board of Directors role.

|

| • |

Ocuphire was granted two new patents covering APX3330 and Nyxol:

|

| o |

APX3330 for Use in Diabetics: U.S. Patent No. 11,351,130 with claims to methods of treating inflammation and chronic pain in subjects suffering from diabetes using APX3330 was issued on June 7,

2022 with expiry in 2038.

|

| o |

Nyxol for Reversal of Mydriasis: U.S. Patent No. 11,400,077 with claims directed to methods for mydriasis treatment using phentolamine was issued on August 2, 2022 with expiry in 2039.

|

Second Quarter Ended June 30, 2022 Financial Highlights

As of June 30, 2022, Ocuphire had cash and cash equivalents of approximately $17.0 million. Based on current projections, management believes the current cash on hand

will be sufficient to fund operations through the third quarter of 2023. Net cash used in operating activities in the second quarter of 2022 was $3.8 million, with a cumulative total for the six months ended June 30, 2022 of $10.0 million.

General and administrative expenses for the three and six months ended June 30, 2022, were $1.8 million and $3.5 million, respectively, compared to $3.4 million and

$5.million, respectively, for the three and six months ended June 30, 2021.

Research and development expenses for the three and six months ended June 30, 2022, were $3.2 million and $7.9 million, respectively, compared to $3.8 million and $7.3

million, respectively, for the three and six months ended June 30, 2021. The decrease from the comparable second quarter in 2021 was primarily attributable to the completion of clinical trials and the timing manufacturing activities for Nyxol and

APX3330. The increase from the comparable six-month period in 2021 was primarily attributable to more ongoing clinical trials and manufacturing activities for Nyxol and APX3330 as well as

regulatory, preclinical and other development activities.

The total loss from operations for the three and six months ended June 30, 2022, was $4.9 million and $11.4 million, respectively, compared to $7.1 million and $12.3

million, respectively, for the three and six months ended June 30, 2021.

Net loss for the three and six months ended June 30, 2022, was $4.9 million and $11.5 million, respectively, compared to $7.1 million and $46.2 million, respectively,

for the three and six months ended June 30, 2021. Net loss per share for the three and six months ended June 30, 2022, was ($0.25) and ($0.60) per share, respectively, compared to ($0.52) and ($3.76) per share, respectively, for the comparable

periods in 2021.

For further details on Ocuphire’s financial results, refer to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 to be filed with the

Securities and Exchange Commission.

About Ocuphire Pharma

Ocuphire is a publicly-traded (NASDAQ: OCUP), clinical-stage ophthalmic biopharmaceutical company focused on developing and commercializing small-molecule therapies for

the treatment of refractive and retinal eye disorders. The Company’s lead product candidate, Nyxol® eye drops (0.75% phentolamine ophthalmic solution), is a once-daily, preservative-free eye drop formulation of phentolamine mesylate, a

non-selective alpha-1 and alpha-2 adrenergic antagonist designed to reduce pupil size, and is being developed for several indications, including reversal of pharmacologically-induced mydriasis (RM), presbyopia and dim light or night vision

disturbances (NVD), and has been studied in 12 completed clinical trials. Ocuphire has reported positive data from MIRA-2 and MIRA-3 registration trials and MIRA-4 pediatric safety trial for the treatment of RM. Ocuphire also reported positive

top-line data from the VEGA-1 Phase 2 trial of Nyxol for treatment of presbyopia, both Nyxol as a single agent and Nyxol with low dose pilocarpine (“LDP”) 0.4% as adjunctive therapy. The Company recently reported positive top-line results from

LYNX-1 Phase 3 trial of Nyxol for NVD. Ocuphire’s second product candidate, APX3330, is an oral tablet designed to inhibit angiogenesis and inflammation pathways relevant to retinal and choroidal vascular diseases, such as diabetic retinopathy (DR)

and diabetic macular edema (DME) and has been studied in 11 Phase 1 and 2 trials. The Company announced in March the completion of enrollment in the ZETA-1 Phase 2b clinical trial of APX3330 to treat DR/DME. Please visit www.clinicaltrials.gov to learn more about Ocuphire’s ongoing APX3330 Phase 2b trial in DR/DME ZETA-1 (NCT04692688) and completed Nyxol trials: Phase 3 registration

trial in NVD LYNX-1 (NCT04638660), Phase 3 registration trials in RM MIRA-2 (NCT04620213) and MIRA-3 (NCT05134974), MIRA-4 Phase 3 pediatric safety study (NCT05223478), and Phase 2 trial in presbyopia VEGA-1 (NCT04675151). As

part of its strategy, Ocuphire will continue to explore opportunities to acquire additional ophthalmic assets and seek strategic partners for late-stage development, regulatory preparation, and commercialization of drugs in key global markets. For

more information, visit www.ocuphire.com.

Forward Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, the success and timing of planned regulatory filings, including planned NDA filings, the results of the ZETA-1 Phase 2b trial, the results of the VEGA-2 Phase 3

trials, the market for Ocuphire’s indications, business strategy, pre-commercialization activities, and commercialization of Ocuphire’s product candidates. These forward-looking statements are based upon Ocuphire’s current expectations and

involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties,

including, without limitation: (i) the success and timing of regulatory submissions and pre-clinical and clinical trials, including enrollment and data readouts; (ii) regulatory requirements or developments; (iii) changes to clinical trial

designs and regulatory pathways; (iv) changes in capital resource requirements; (v) risks related to the inability of Ocuphire to obtain sufficient additional capital to continue to advance its product candidates and its preclinical programs;

(vi) legislative, regulatory, political and economic developments, (vii) changes in market opportunities, (viii) the effects of COVID-19 on clinical programs and business operations, (ix) the success and timing of commercialization of any of

Ocuphire’s product candidates and (x) the maintenance of Ocuphire’s intellectual property rights. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and

should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in documents that have been and may be filed by Ocuphire from time to time with the SEC. All forward-looking statements

contained in this press release speak only as of the date on which they were made. Ocuphire undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Contacts

Corporate

Corey Davis, Ph.D.

LifeSci Advisors

Ocuphire Pharma, Inc.

Condensed Balance Sheets

(in thousands, except share amounts and par value)

|

As of

|

||||||||

|

June 30,

2022

|

December 31,

2021

|

|||||||

|

(unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

17,025

|

$

|

24,534

|

||||

|

Prepaids and other current assets

|

740

|

1,314

|

||||||

|

Short-term investments

|

126

|

219

|

||||||

|

Total current assets

|

17,891

|

26,067

|

||||||

|

Property and equipment, net

|

8

|

10

|

||||||

|

Total assets

|

$

|

17,899

|

$

|

26,077

|

||||

|

Liabilities and stockholders’ equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

1,886

|

$

|

1,584

|

||||

|

Accrued expenses

|

1,418

|

1,733

|

||||||

|

Short-term loan

|

—

|

538

|

||||||

|

Total current liabilities

|

3,304

|

3,855

|

||||||

|

Warrant liabilities

|

—

|

—

|

||||||

|

Total liabilities

|

3,304

|

3,855

|

||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders’ equity:

|

||||||||

|

Preferred stock, par value $0.0001; 10,000,000 shares authorized as of June 30, 2022 and December 31, 2021; no shares issued and

outstanding at June 30, 2022 and December 31, 2021.

|

—

|

—

|

||||||

|

Common stock, par value $0.0001; 75,000,000 shares authorized as of June 30, 2022 and December 31, 2021; 20,099,602 and 18,845,828 shares

issued and outstanding at June 30, 2022 and December 31, 2021, respectively.

|

2

|

2

|

||||||

|

Additional paid-in-capital

|

115,483

|

111,588

|

||||||

|

Accumulated deficit

|

(100,890

|

)

|

(89,368

|

)

|

||||

|

Total stockholders’ equity

|

14,595

|

22,222

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

17,899

|

$

|

26,077

|

||||

Ocuphire Pharma, Inc.

Condensed Consolidated Statements of Comprehensive Loss

(in thousands, except share and per share amounts)

(Unaudited)

|

For the Three Months Ended

June 30, |

For the Six Months Ended

June 30, |

|||||||||||||||

|

2022

|

2021

|

2022

|

2021

|

|||||||||||||

|

Collaborations revenue

|

$

|

—

|

$

|

100

|

$

|

—

|

$

|

100

|

||||||||

|

Operating expenses:

|

||||||||||||||||

|

General and administrative

|

1,776

|

3,408

|

3,512

|

5,112

|

||||||||||||

|

Research and development

|

3,162

|

3,829

|

7,934

|

7,311

|

||||||||||||

|

Total operating expenses

|

4,938

|

7,237

|

11,446

|

12,423

|

||||||||||||

|

Loss from operations

|

(4,938

|

)

|

(7,137

|

)

|

(11,446

|

)

|

(12,323

|

)

|

||||||||

|

Interest expense

|

(4

|

)

|

—

|

(9

|

)

|

—

|

||||||||||

|

Fair value change of warrant liabilities

|

—

|

—

|

—

|

(33,829

|

)

|

|||||||||||

|

Other income (expense), net

|

15

|

1

|

(67

|

)

|

2

|

|||||||||||

|

Loss before income taxes

|

(4,927

|

)

|

(7,136

|

)

|

(11,522

|

)

|

(46,150

|

)

|

||||||||

|

Benefit (provision) for income taxes

|

—

|

—

|

—

|

—

|

||||||||||||

|

Net loss

|

(4,927

|

)

|

(7,136

|

)

|

(11,522

|

)

|

(46,150

|

)

|

||||||||

|

Other comprehensive loss, net of tax

|

—

|

—

|

—

|

—

|

||||||||||||

|

Comprehensive loss

|

$

|

(4,927

|

)

|

$

|

(7,136

|

)

|

$

|

(11,522

|

)

|

$

|

(46,150

|

)

|

||||

|

Net loss per share:

|

||||||||||||||||

|

Basic and diluted

|

$

|

(0.25

|

)

|

$

|

(0.52

|

)

|

$

|

(0.60

|

)

|

$

|

(3.76

|

)

|

||||

|

Number of shares used in per share calculations:

|

||||||||||||||||

|

Basic and diluted

|

19,502,563

|

13,608,596

|

19,197,213

|

12,273,541

|

||||||||||||

Exhibit 99.2

Ocuphire Corporate Presentation August 2022

Disclosures and Forward-Looking Statements This presentation contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning the success and timing of planned regulatory filings, including planned NDA filings,

pre-commercial activities, commercialization strategy and timelines, business strategy, product labels, cash runway, scalability, future clinical trials in reversal of mydriasis (RM), presbyopia (P), dim light/night vision disturbance (NVD)

and diabetic retinopathy (DR)/diabetic macular edema (DME), including the potential for Nyxol to be a “best in class” presbyopia drop, and the potential market opportunity in RM/NVD/P/DR/DME. These forward-looking statements are based upon

the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a

result of various risks and uncertainties, including, without limitation: (i) the success, costs, and timing of regulatory submissions and pre-clinical and clinical trials, including enrollment and data readouts; (ii) regulatory requirements

or developments; (iii) changes to clinical trial designs and regulatory pathways; (iv) changes in capital resource requirements; (v) risks related to the inability of Ocuphire to obtain sufficient additional capital to continue to advance its

product candidates and its preclinical programs; (vi) legislative, regulatory, political and economic developments, (vii) changes in market opportunities, (viii) the effects of COVID-19 on clinical programs and business operations, (ix) the

success and timing of commercialization of any of Ocuphire’s product candidates, including the scalability of Ocuphire’s product candidates and (x) the maintenance of Ocuphire’s intellectual property rights. The foregoing review of important

factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in

documents that have been and may be filed by the Company from time to time with the SEC. All forward-looking statements contained in this presentation speak only as of the date on which they were made. The Company undertakes no obligation to

update such statements to reflect events that occur or circumstances that exist after the date on which they were made. The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the

information contained in or incorporated by reference into this presentation. Nothing contained in or incorporated by reference into this presentation is, or shall be relied upon as, a promise or representation by the Company as to the past

or future. The Company assumes no responsibility for the accuracy or completeness of any such information. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market shares

and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The trademarks included herein are the property of the owners thereof and are

used for reference purposes only. Such use should not be construed as an endorsement of such products.

Two Lead Assets for Front and Back of the Eye Nyxol eye drops with > 650 patients treated across 12

trials (505(b)(2) pathway) APX3330 oral tablets with > 340 patients treated across 11 trials (NCE pathway) Four Large Markets with Unmet Needs in Reversal of Mydriasis (RM), Presbyopia, Night Vision Disturbance (NVD), and Diabetic

Retinopathy Differentiated and novel MOAs Limited to no competition Successful Execution of Trials with 6 Positive Phase 3 & Phase 2 Data Read-outs for Nyxol in RM, Presbyopia, and NVD Potential 2023 commercialization opportunities in

RM Near-term initiation planned for Presbyopia VEGA Phase 3 program with Nyxol alone and Nyxol with 0.4% Low Dose Pilocarpine as adjunctive therapy Track Record of Delivering on Timelines and Capital Efficiency $17 million cash reported

at 6-30-22 sufficient for operations through 3Q 2023 Low-cost, fast-enrolling, short-duration clinical trials Favorable precedent regulatory environment for ophthalmic drug approval Upcoming Catalysts in 2H22: APX3330 ZETA-1 P2b trial for

DR/DME 2H22 NDA Filing for Nyxol for RM LATE 2022 P= Presbyopia RM = Reversal of Mydriasis NVD = Night Vision Disturbances DR/DME = Diabetic Retinopathy/Diabetic Macular Edema 3 Ocuphire PharmaNasdaq: OCUP

Ophthalmology is Ripe for Partnering Prolific FDA Ophthalmology Division Deal Activity April

2021 Novartis / Alcon $355 M September 2021 REGENXBIO / Allergan $1.75 B October 2021 Théa / Curacle ~$2 B December 2021 Rayner / Omidria ~$1 B December 2021 Novartis / Gyroscope ~$1.5B January 2022 Théa /

Akorn Undisclosed May 2022 Alcon / Kala $385 M New Product Approvals Allergan – Vuity™ Oyster Point – Tyrvaya™ Bausch Health – Xipere™ Roche – Susvimo™ Novartis – Beovu™ Roche - Vabysmo™ Ocular Therapeutics – Dextenza™ Santen -

Verkazia™ Samsung Bioepis - Byooviz™ Samsung Bioepis - Byooviz™

Source: Eisai and Apexian Data; GlobalData Market Research Report, 2020; Company Estimates for US

Market Size; *Ocuphire internal estimates 11 Completed Phase 1 and Phase 2 Trials >340Subjects Dosed Patents to2034+ APX3330 Oral REF-1 Inhibitor New Chemical Entity Phase 2b Data 2H22 11 Completed Phase 1,Phase 2, and Phase 3

Trials >650Subjects Dosed Exposure in Humans 28 Days Patent Coverage2034+ Exposure in Humans 365 Days Retina Refractive Two Late-Stage Clinical Assets Addressing Unmet Needs in Multiple Large Markets Ocuphire Overview Nyxol®

Novel α1/ α2 Blocker 505(b)(2) NDA-Filing Ready Presbyopia Reversal of Mydriasis Night Vision Disturbances Diabetic Retinopathy Diabetic Macular Edema Development Milestone Prevalence (US) Prevalence (US) Development

Milestone Phase 2 Enrolled (103 subjects) ~128 M ~100 M ~1 M ~8 M 1st Phase 3 Positive Data Phase 2 Positive Data 2 Phase 3 Positive Data ~36 M

Indication Product Candidate Pre-clinical Phase 1 Phase 2 Phase

3 Regulatory Approval Anticipated Milestones Reversal of Mydriasis (RM) Nyxol® Eye Drop Positive MIRA-3 Phase 3 data in Q1 2022 (n=368) Positive MIRA-4 Pediatric data in 2Q 2022 (n=23) File Nyxol NDA for RM in late 2022 Presbyopia

(P) Nyxol® Eye Drop Positive VEGA-1 Nyxol alone data in Q1 2022 (and in combination with LDP in mid-2021) VEGA Phase 3 program planned to initiate in 2H 2022 for single agent and combination with LDP Presbyopia (P) Nyxol® + 0.4% Low

Dose Pilocarpine (LDP) Eye Drops Dim Light or Night Vision Disturbances (NVD) Nyxol® Eye Drop Positive LYNX-1 Phase 3 data in 2Q 2022 (n=145) Diabetic Retinopathy (DR)/ Macular Edema (DME) APX3330 Oral Pill ZETA-1 Phase 2b data

expected in 2H 2022 (n=103) DME or Wet Age-Related Macular Degeneration (wAMD) APX2009 (Intravitreal or Local Delivery) Seeking partner funding for IND enabling studies and further development Looking Ahead: Ocuphire Pipeline &

Clinical Milestones Note: 0.75% Nyxol (Phentolamine Ophthalmic Solution) is the same as 1% Nyxol (Phentolamine Mesylate Ophthalmic Solution) Multiple Phase 3 & Phase 2 Clinical Data Readouts Anticipated this Year Phase 2b

Fully Enrolled

7 Reversal of Mydriasis P NVD Presbyopia Night Vision Disturbance Nyxol® Eye Drops Three

Indications Nyxol as a Single Drop for Presbyopia Nyxol with LDP Adjunctive Therapy 1 0.4% 2 RM

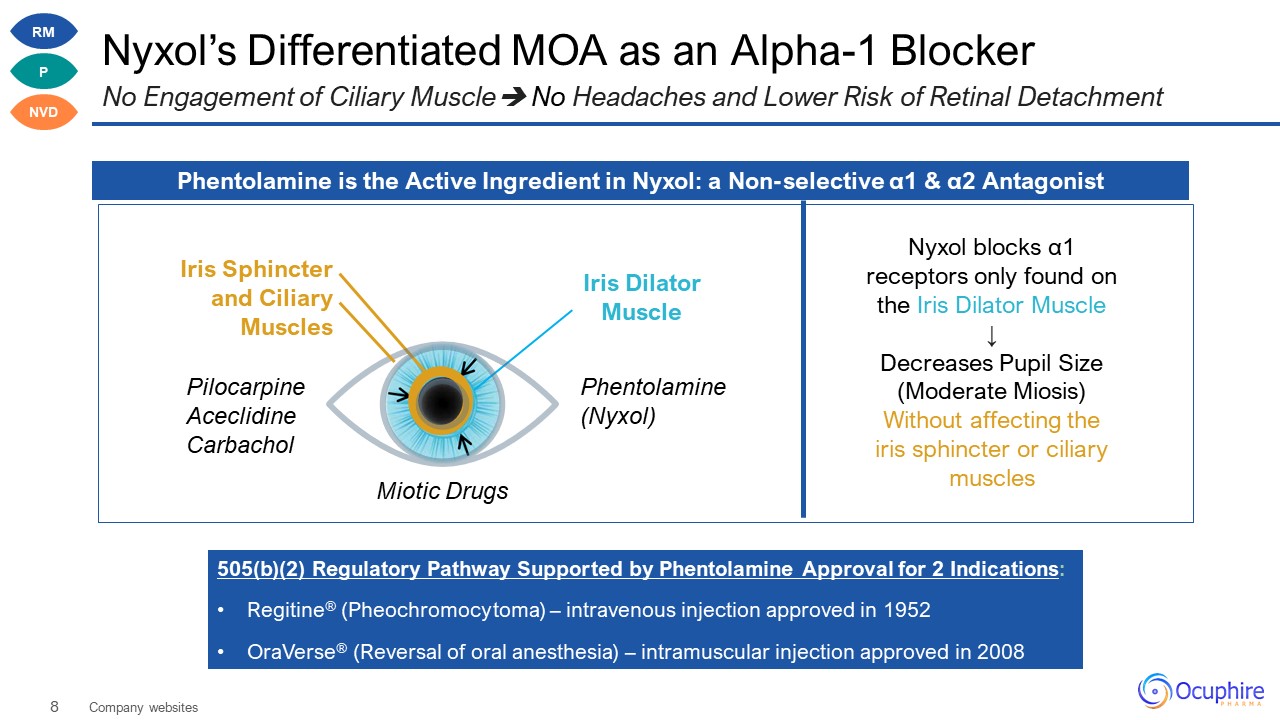

Nyxol’s Differentiated MOA as an Alpha-1 Blocker No Engagement of Ciliary Muscle No Headaches and

Lower Risk of Retinal Detachment Phentolamine is the Active Ingredient in Nyxol: a Non-selective α1 & α2 Antagonist 505(b)(2) Regulatory Pathway Supported by Phentolamine Approval for 2 Indications: Regitine® (Pheochromocytoma) –

intravenous injection approved in 1952 OraVerse® (Reversal of oral anesthesia) – intramuscular injection approved in 2008 Nyxol blocks α1 receptors only found on the Iris Dilator Muscle ↓ Decreases Pupil Size (Moderate Miosis) Without

affecting the iris sphincter or ciliary muscles Iris Dilator Muscle Iris Sphincter and Ciliary Muscles Company websites Pilocarpine Aceclidine Carbachol Phentolamine (Nyxol) Miotic Drugs RM P NVD

Nyxol: 0.75% Phentolamine Ophthalmic Solution Preservative Free, EDTA Free, and Stable Efficacy Data

Favorable Safety Profile Durable Nyxol Improves Vision by Decreasing Pupil (~1-1.5mm) ↑ Near Vision ↑ Distance Vision ↑ Contrast Sensitivity (night) No Systemic Effects No Changes in Blood Pressure No Changes in Heart

Rate Well-Tolerated Topical Effects Mild, Transient, Reversible Eye Redness IOP Unchanged or Decreased Minimal to No Headaches Effects Last ≥ 24 Hours Chronic daily dosing of Nyxol at bedtime reduces pupil size for up to 24 to 36

hours Nyxol Product Candidate Profile Nyxol Clinical Trials Novel, Differentiated Alpha 1/2 Blocker Eye Drop for Refractive Indications RM P NVD

10 RM Nyxol®forReversal of Mydriasis (RM) Mydriasis or dilated eyes causes: heightened sensitivity

to light inability to focus reading, working, and driving difficulty halos and glare headaches I have to visit my retina MD for my monthly injections, where I am dilated. Being dilated every month is a huge burden on my

day.

Summary of MIRA FDA Registration Trial Designs Source: In order from left to rightMIRA-2 Registration

Trial NCT# 04620213 MIRA-3 Registration Trial NCT# 05134974 MIRA-2 1st Phase 3 MIRA-3 2nd Phase 3 US Sites 12 16 Subjects Enrolled 185 368 Eligibility Healthy ≥ 12 years old Healthy ≥ 12 years

old Randomization 1:1 2:1 Mydriatic Agents 2.5% Phenylephrine, 0.5% Tropicamide and Paremyd 2.5% Phenylephrine, 0.5% Tropicamide and Paremyd Positive Data Readout 1Q 2021 1Q 2022 Primary Endpoint % of subjects (study eye) returning

to baseline (within 0.2 mm) pupil diameter (PD) at 90 min Secondary Endpoints % of subjects returning to baseline PD at 0min to 24h (overall, by mydriatic agent, by iris color) Mean time to return to baseline PD Mean change in pupil

diameter at all timepoints Distance-corrected near vision Accommodation (Tropicamide/Paremyd) Safety and tolerability RM Randomized, Double-Masked, Placebo-Controlled, Parallel, Multi-Center, One-Day Trials Total Exposure To

Nyxol >330 >550 Total Subjects Enrolled

Primary Endpoint Achieved in Two FDA Registration Phase 3 Trials Source: (Left panel) MIRA-3 Table

14.2.1.1 (mITT); (Right panel) MIRA-2 Table 14.2.1.1 (mITT). Data include all three mydriatics (Phenylephrine, Tropicamide, Paremyd). Rapid, Consistent and Sustained Reversal of Pupil Dilation with Nyxol MIRA-3 Phase 3 Trial MIRA-2 Phase 3

Trial RM 0

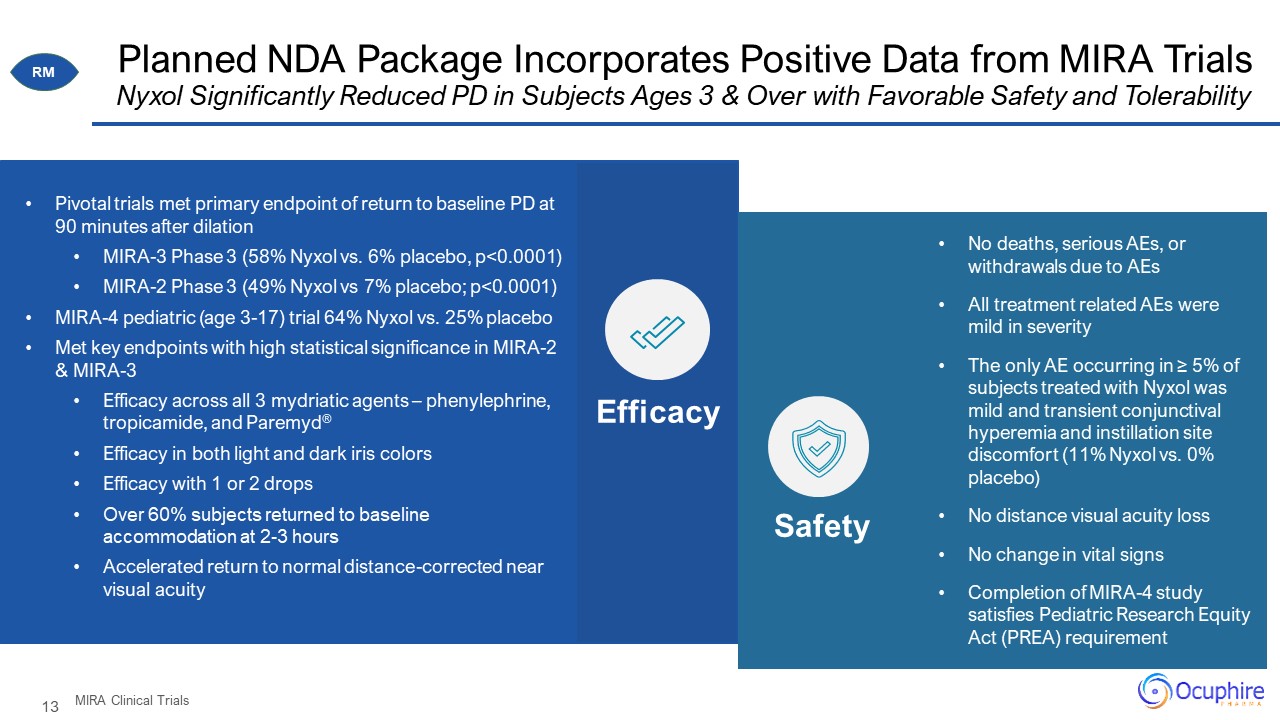

Planned NDA Package Incorporates Positive Data from MIRA Trials Nyxol Significantly Reduced PD in

Subjects Ages 3 & Over with Favorable Safety and Tolerability MIRA Clinical Trials RM No deaths, serious AEs, or withdrawals due to AEs All treatment related AEs were mild in severity The only AE occurring in ≥ 5% of subjects treated

with Nyxol was mild and transient conjunctival hyperemia and instillation site discomfort (11% Nyxol vs. 0% placebo) No distance visual acuity loss No change in vital signs Completion of MIRA-4 study satisfies Pediatric Research Equity

Act (PREA) requirement Efficacy Safety Pivotal trials met primary endpoint of return to baseline PD at 90 minutes after dilation MIRA-3 Phase 3 (58% Nyxol vs. 6% placebo, p<0.0001) MIRA-2 Phase 3 (49% Nyxol vs 7% placebo;

p<0.0001) MIRA-4 pediatric (age 3-17) trial 64% Nyxol vs. 25% placebo Met key endpoints with high statistical significance in MIRA-2 & MIRA-3 Efficacy across all 3 mydriatic agents – phenylephrine, tropicamide, and

Paremyd® Efficacy in both light and dark iris colors Efficacy with 1 or 2 drops Over 60% subjects returned to baseline accommodation at 2-3 hours Accelerated return to normal distance-corrected near visual acuity

NDA Submission Targeted For Late 2022 Multiple Positive Clinical Trials To Support Broad Label Target

Label Indication The treatment of pharmacologically induced mydriasis produced by adrenergic (e.g., phenylephrine) or parasympatholytic (e.g., tropicamide) agents, or a combination thereof. RM MIRA-2Phase 3 MIRA-1 Phase 2b MIRA-3 Phase

3 RM NDA Filing Late 2022 n=32 crossover Primary Endpoint Met ✓ Secondary Endpoints Met ✓ n=185 Primary Endpoint Met ✓ Secondary Endpoints Met ✓ n=368 Primary Endpoint Met ✓ Secondary Endpoints Met

✓ MIRA-4 Pediatric n=23 Primary Endpoint Met ✓ Secondary Endpoints Met ✓ Production of 3 registration batches ✓ Manufacturing

Commercial Strategy With Cash Pay Model Source: GlobalData Market Research Survey Simple,

Value-Driven, Capital-Efficient and Accelerates Adoption RM Low Adoption Hurdles: No reimbursement or payors/PBMs No training, dilations are routine No specialty/retail pharmacies No competition 58% physicians would start prescribing

Nyxol within 1st year* Sell Directly Office Strategic and/or Distribution Partners 20,000 Ophthalmologists 46,000 Optometrists 3,000 Retinal Specialists Preservative-Free Single Unit Vial (5-pack) Physician Sells to Patient

~$500M+ US RM Market Opportunity Reversal of Mydriasis (RM) Market Opportunity With No Commercially

Available Treatment, Nyxol Could Achieve Significant Revenues 80 to 100 Average number of patients seen by an ECP per week 40 to 50 Average number patients dilated per week 20 to 25 Number of patients who choose reversal drop vials per

week 1000 to 1,250 Total vials per year per ECP 10,000 to 16,000 Target number of ECPs 10 M to 20 M Total vials per year Source: GlobalData Market Research SurveyCalculation: 100M Annual Eye Dilations X 65% X 80% X $10 per patient =

$500+M Opportunity. Values Rounded, Not Exact. ECP- Eyecare Practitioner RM Patient Willingness to Pay $10-$20+ 80% of Patients Likely to Request Drop 65% Report Moderate to Severe Impact to Daily Function MIRA Trials Represent 95% of

Dilation Drops Used in Practice 100M Annual Eye Dilations $100M to $200M Potential Nyxol Revenue Opportunity

P Nyxol® forPRESBYOPIA 17 Nyxol Alone Nyxol with LDP Adjunctive Therapy 88% of patients expressed

an interest in presbyopia-correcting drops across all ages and income groups Source: Burke Healthcare Research April 2020, n = 1000 presbyopes ages 40-80 years old. FDA approval of AbbVie Eye Drop a New Moment in Presbyopia

10/29/21

Nyxol® and Nyxol + Low Dose Pilocarpine Presbyopia Eye Drops Source: Nyxol® data from 12 completed

trials; Pilocarpine product label and literature Differentiated MOA with Two Potential Product Labels for Functional Near Vision Improvement 0.4% 0.75% Nyxol 0.4% LDP Iris Dilator Muscle Inhibition Iris Sphincter and Ciliary

Muscles Activation Evening drop Phentolamine (alpha1/2 antagonist) Novel MOA (iris dilator) 24+ hour PD durability Moderate pupil reduction Well-tolerated with no systemic effects Stable, preservative-free, single-use

vial Pilocarpine (cholinergic agonist) Known MOA on sphincter (and ciliary) muscle Potent miotic at approved doses (1%, 2%, 4%) Low concentration avoids known safety issues: Headache, brow ache, and redness Accommodative spasm causing

loss of distance vision especially at night Risk of retinal detachment Daytime drop Optimal Pupil Target is 2-3 mm P Two Drops Tunable Option Nyxol with LDP as Adjunctive Therapy for Presbyopia Single Durable Drop Nyxol as a Single

Agent for Presbyopia

Presbyopia VEGA-1 Phase 2 Trial Clinical trial NCT#04675151. DCNVA = distance-corrected near visual

acuity . BCDVA = best corrected distance visual acuity Completed Randomized, Double-Masked, Placebo-Controlled, Multi-Center One-Week Trial Primary: % of subjects with ≥ 3 lines of improvement in distance-corrected near visual acuity

comparing Nyxol + LDP vs placebo alone at 1 hour Secondary: Primary endpoint for Nyxol alone vs placebo % of subjects with ≥ 2 and ≥ 3 lines gained at time points from 30 min to 6 hours % of subjects achieving 20/40 or better vision No

loss of distance vision Pupil diameter at time points Safety and tolerability (redness) Endpoints Visit 1 VEGA-1 Randomization 4 arms 0.75% Nyxol Placebo 17 US sites 150 presbyopic patients Visit 2 (Day

5) Screening Treatment Arms Nyxol + LDP LDP Drop Nyxol Baseline Nyxol Alone No Treatment Nyxol Baseline LDP Alone LDP Drop Placebo Baseline Placebo Alone No Treatment Placebo Baseline Evening Dosing (4 doses) Males or

females ≥ 40 and ≤ 64 years of age DCNVA of 20/50 Snellen equivalent or worse in photopic conditions in each eye & binocularly BCDVA of 20/20 Snellen equivalent or better in each eye under photopic conditions No limitation on axial

length or diopters for myopia patients Eligibility Criteria P Phase 2 Enrollment Completed Feb to May 2021 – 150 Subjects Reported Topline Results in June 2021 and Jan 2022

VEGA-1: Planned P3 Efficacy Endpoint Met by Nyxol and Nyxol+LDP VEGA-1 TLR Table 14.2.2.2.1; Table

14.2.2.2; Table 14.2.1.7; Table 14.2.1.2 Nyxol Single Drop and LDP Combination Provide Statistically Significant 3-line Near Vision Gain Nyxol as a Single Drop for Presbyopia Nyxol with LDP Adjunctive Therapy 1 0.4% 2 Nyxol+LDP is

statistically superior to Nyxol alone and LDP alone p<0.0001 p=0.03 p=0.008 P DCNVA Letters Gained 79% of subjects achieved ≥10 letter improvement in DCNVA at 1 Hour (p=0.005 vs placebo) and a similar trend at other time points 53%

of subjects achieved ≥ 10 letter improvement in DCNVA at 12 hours (p=0.005 vs placebo) and a similar trend at other time points

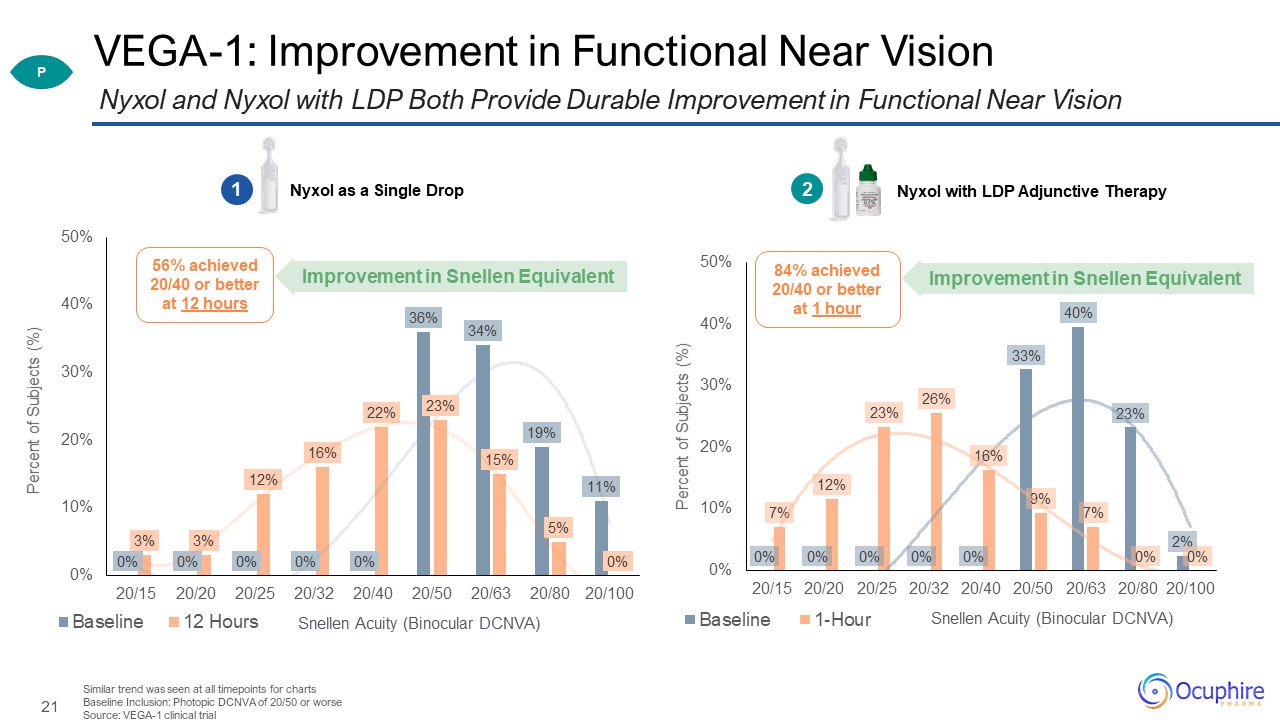

VEGA-1: Improvement in Functional Near Vision Similar trend was seen at all timepoints for

charts Baseline Inclusion: Photopic DCNVA of 20/50 or worse Source: VEGA-1 clinical trial Nyxol and Nyxol with LDP Both Provide Durable Improvement in Functional Near Vision Nyxol as a Single Drop 1 Nyxol with LDP Adjunctive

Therapy 56% achieved 20/40 or better at 12 hours 84% achieved 20/40 or better at 1 hour Improvement in Snellen Equivalent P 0.4% 2 Improvement in Snellen Equivalent Snellen Acuity (Binocular DCNVA)

No serious AEs, most AEs were mild No headaches, no brow aches, and no blurry vision AEs were

reported No loss in distance vision under photopic and mesopic lighting ~5% mild, transient redness No change in IOP Safety Nyxol and Nyxol+LDP Pooled Safety Findings Met planned P3 endpoint at 12 hours (29%; p=0.02) Efficacy Met

primary endpoint at 1 hour (60%; p=0.004) Durable near vision gain at 12 and 18 hours Durability Durable near vision gain through at least 6 hours 56% (12 hours post-dose) Functional Vision (20/40 or better) 84% (1-hour

post-dose) Sustained PD reduction at least 18 hours Reduction in PD Sustained PD reduction at least 6 hours Ages 40-64 No myopia exclusions Light and dark irides Breadth of Patients Showed Efficacy Ages 40-64 20/50 or worse

DCNVA Light and dark irides Summary Of Positive VEGA-1 Phase 2 Results PP Population, VEGA-1 Trial *Trend toward statistical significance even in smaller Nyxol arm from time 0 to time 6 hours (n=30); larger sample size for all arms

planned in Phase 3 program Nyxol and Nyxol + LDP has Demonstrated Efficacy Response & Well Tolerated Safety Profile P Single Durable Drop Nyxol as a Single Drop Two Drops Tunable Option Nyxol with LDP Adjunctive Therapy 0.4%

Well-Controlled, Multi-Center Phase 2 Trial Evaluating Nyxol & Nyxol+LDP Efficacy 2 1

Phase 3 Phase 2 Phase 1 Orasis CSF-1 (Low dose pilo) Ocuphire Nyxol + 0.4%

pilo Visus Brimochol® (carbachol + brim) Other Cholinergic Agonists* Cholinergic Agonist* (pilocarpine) Lenz Aceclidine; Aceclidine + brim Eyenovia MicroLine (2% pilo) Novartis EV-06 / Dioptin Alpha Antagonist &

pilocarpine* Ocuphire Nyxol (0.75% phentolamine) Alpha Antagonist Presbyopia Eye Drops Competitive Landscape * act on sphincter and ciliary muscles in dose-dependent manner Corporate Websites, Grzybowski, A, Markeviciute A, Zemaitiene

R. A Review of Pharmacological Presbyopia Treatment. 2020 Pupil modulation (miotic) MOA Combination drugs Soften lens MOA (not a miotic) Nyxol is potentially differentiated: New MOA class (iris dilator muscle) Favorable safety and

tolerability (e.g.: no headaches, no risk of retinal detachment) 24-hour durability and rapid onset Broad range of patients Nyxol+LDP is the only option offering tunability for more efficacy Nyxol Creates a New, Differentiated MOA Class;

Nyxol+LDP Offers Tunability Option P NDA Allergan VUITYTM; 1.25% pilo Lens Softening

Potential ‘Best in Class’ Presbyopia Drop(s) Product Attributes* 1) Efficacy (> 3-Line Gain w/o

loss of 1 line in DCNVA - Primary Endpoint Responders)* 2) Safety: Loss of Distance in Mesopic 3) Tolerability: Headaches and Conjunctival Hyperemia 4) Durability (% responders at the longest timepoint) Placebo Adjusted Values for Vuity ™

were 15-23% in Gemini 1 & 2; Placebo Adjusted Nyxol was 16% and Nyxol+LDP was 33% (all stat significant) Source: Nyxol Data: ASCRS (July 2021) Abstract# 76645 (Phase 2) and VEGA-1; Abstract 74336 (Phase 3). VUITY™ Data FDA Label and AAO

2021 Presentation. Nyxol and Nyxol+LDP Combination Data Differentiate on Efficacy, Safety, and Durability Nyxol’s Potential Differentiated Solution Nyxol Nyxol+LDP 29% (vs placebo 12%) (12 hours) 61% (vs placebo 14%) (30 min) No

Loss No Loss No Headaches <5% mild redness No Headaches ~5% mild redness 37% at 18 hours 37% at 6 hours VUITYTM 26-31% (vs. placebo 8-11%) (3 hours) No Loss >5% Headaches >5% redness 18% at 6 hours Caveats of

cross-trial comparisons for VUITYTM and Nyxol/LDP. Differences include age, severity of near vision loss, lighting conditions, doses, timing, and # of patients Ocuphire P

Presbyopia is a Burgeoning Market Opportunity Source: 1. Global Prevalence of Presbyopia, 2018,

Fortune Business Insights Reading Glasses Forecast 2016-2027, Cataract & Refractive Surgery Today, 2021, NEI 2010 data.2. Vitale S. et. Al. JAMA Ophthalmology, 2008, Vision problems, US, Arch. Ophthal, 2014, Vision Monday. 3. NEI/NIH

https://www.nei.nih.gov/sites/default/files/health-pdfs/Presbyopia.pdf Values in Figure Rounded VuityTM Approval Sets the Stage for Market Development of a New Category by Large Pharma $500 M+ Revenue Opportunity Private Cash

Pay Vuity™ List Price $79 ~$8B+ Estimated US Presbyopia Market Opportunity Pseudophakes Cataract surgery for artificial lens Hyperopes Poor Near Vision due to shorter eyeball Myopes Poor distance Vision/ elongated

eyeball Emmetropes No refractive error/post-Lasik 9M 14M 30M 66M Number of Patients Addressable Market (25%) US Market Opportunity 9M 2M 4M 8M 17M 2M 33M Patients ~128M Presbyopes in the US Low < -6.0D High >

-6.0D ~$8 B+Market Revenues P

I’m no longer comfortable driving at night, especially with my son in the car. I have a hard time

playing beach volleyball in the evenings due to the bright lights at the courts. Post-LASIK, Age 42 26 NVD Nyxol® for Dim Light or Night Vision Disturbances

NVD LYNX-1 Phase 3 Registration Design Note: Inclusion Criteria includes subjects with baseline

mesopic LCVA of 20/63 or worse Randomized, Double-Masked, Placebo-Controlled Two-Week Trial LYNX-1 Primary: % of subjects with ≥ 3 lines of improvement in mesopic low contrast best-corrected distance visual acuity (Day 8) Secondary (Days

8 & 15): Pupil diameter Visual acuity measures (distance and near) Safety and tolerability (redness) Endpoints Eligibility Screening* Randomization 1:1 daily evening dose (14 days) daily evening dose (14 days) 0.75% Nyxol

Placebo 19 US sites 140 - 160 patients with NVD Phase 3 Initiated in Dec 2020; 145 Patients Enrolled Top Line Results Reported May 19, 2022 Day 0 Day 8 Assessments Primary Endpoint Day 15 Assessments NVD

LYNX-1: Nyxol Met Primary and Secondary Endpoints in NVD Source: LYNX-1 clinical trial; PP population;

mLCVA: mesopic low contrast visual acuity; pLCVA: photopic low contrast visual acuity Significantly Higher % of Nyxol Treated Subjects Gained ≥15 Letter and ≥10 Letter From Baseline NVD Peripheral imperfections scatter light when pupils

enlarge in dim light, causing halos/starbursts,/glare that impair vision The imperfections may be caused by LASIK surgery, IOL implants, certain types of cataracts (cortical), and natural reasons (especially dry eye and age) Symptoms

cannot be properly corrected by any type of lens (reading glasses, contact lenses) or surgical procedures The Problem The Solution 47% (vs 24% placebo) of subjects achieved ≥ 10 letter improvement in mLCVA at Day 15 (p<0.05)* No

Treatment Options for NVD n=73 n=70 n=73 n=68 30% (vs 7% placebo) of subjects achieved ≥ 10 letter improvement in pLCVA at Day 15 (p<0.05)*

Summary of Positive LYNX-1 Phase 3 Results For Nyxol Eye Drops Source: mITT Population,

LYNX-1Trial Data Support a Favorable Benefit/Risk Profile For Subjects with NVD No deaths or serious AEs AEs occurring in >5% of Nyxol treated subjects included: instillation site irritation (9% vs 0% placebo), installation site pain

(13% vs 0% placebo), dysgeusia (11% vs 0% placebo) and conjunctival hyperemia (9% vs 3% placebo) 84% of the AEs considered related to Nyxol were mild No statistical difference in conjunctival hyperemia between treatment arms with evening

dosing at Day 8 and Day 15 Efficacy Safety Met primary endpoint at Day 8 with 13% of subjects gaining 15 or more ETDRS letters of mesopic low contrast distance visual acuity vs. 3% on placebo (p<0.05) Nyxol’s 3 line efficacy increased

after 14 days of evening dosing, with 21% responders compared to 3% on placebo (p<0.01) Nyxol statistically significantly reduced pupil diameter by a mean of ~1 mm on Day 8 and Day 15 Significant improvements in low contrast distance

vision under photopic conditions were also observed Nyxol demonstrated benefit in mesopic high contrast near vision NVD

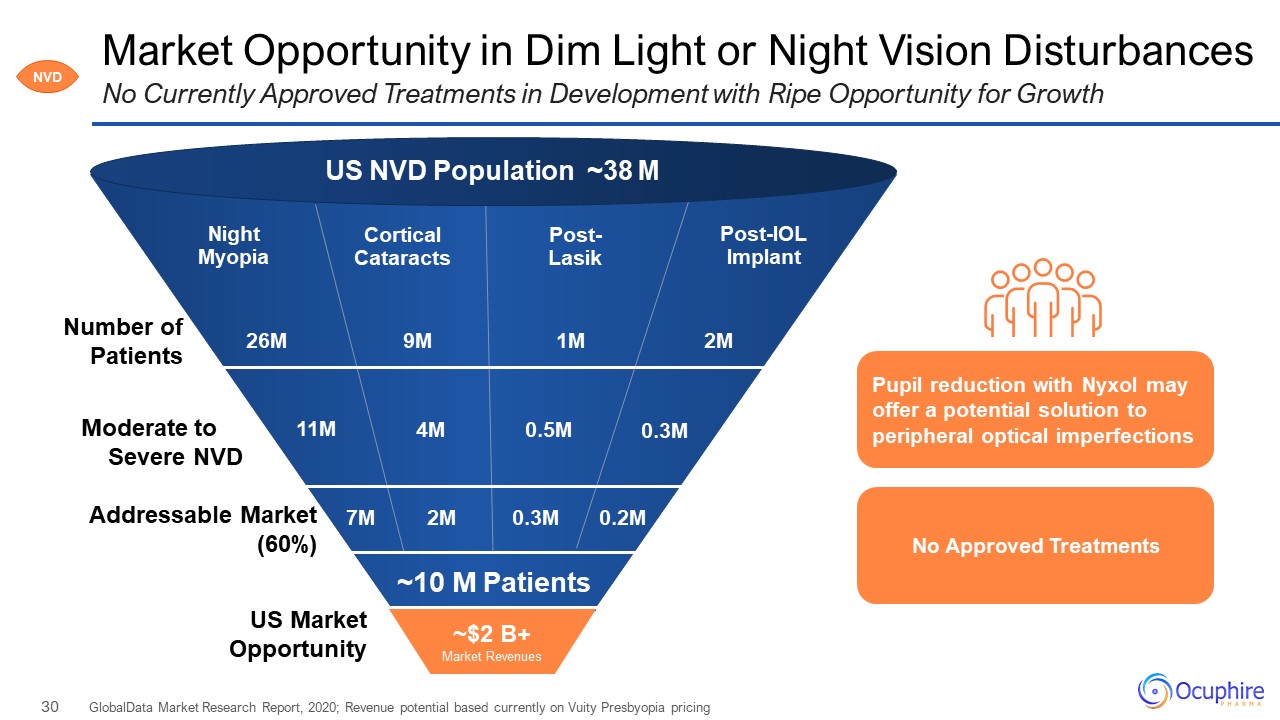

Market Opportunity in Dim Light or Night Vision Disturbances GlobalData Market Research Report, 2020;

Revenue potential based currently on Vuity Presbyopia pricing No Currently Approved Treatments in Development with Ripe Opportunity for Growth NVD Post-IOL Implant Post-Lasik Cortical Cataracts Night Myopia 2M 1M 26M Number of

Patients Moderate to Severe NVD Addressable Market (60%) US Market Opportunity 0.3M 0.5M 11M ~10 M Patients US NVD Population ~38 M 9M 4M No Approved Treatments Pupil reduction with Nyxol may offer a potential solution to

peripheral optical imperfections ~$2 B+Market Revenues 7M 2M 0.3M 0.2M

31 Apx3330 ORAL tAblet Diabetic Retinopathy and Diabetic Macular Edema DR DME I could

lose my hearing, I could lose talking, but … it's frightening to lose my eyesight. Patient Diagnosed with DR

Diabetic Retinopathy At a Glance Larger Disease to Manage with Growing Diabetes The number of people

with DR expected to increase more than 14M by 2050 There are 8M adults in the U.S. with DR1 DR is the leading cause of blindness among working-age adults If untreated, DR can rob people of their vision prematurely2,3 56% of patients

reported anxiety related to anti-VEGF treatment DR/DME affects about 1 in 4 people with type 1 and type 2 diabetes Majority of mild to moderate patients with DR are not treated with anti-VEGF due to injection fear and

burden DR DME Source:1. American Diabetes Association; International Diabetes Federation; Healthline; 2. Das UN. DME, retinopathy and age-related macular degeneration as inflammatory conditions. Arch Med Sci. 2016;12(5):1142-1157.

doi:10.5114/aoms.2016.61918 3. Patient survey adapted from Lions International Foundation and International Diabetes Foundation-Europe; Meltzer 2000 $13B (2020) Global Intravitreal Injection Revenues

APX3330 History and Ref-1 Inhibition Mechanism Logsdon et al (2018), Li et al (2014). Ref-1 Involved

in Multiple Key Pathways that Contribute to Diabetic Retinopathy and DME Mechanism of Action – Ref-1 Inhibition Hypoxia Ref-1 HIF-1α VEGF (Signaling Cascade) Inflammation Ref-1 NF-κB Other Growth Factors (Signaling

Cascade) TNF-α Chemokines Neovascularization Lucentis® EYLEA® Anti-VEGF Steroids APX3330 Ref-1 (reduction-oxidation effector factor-1) is a novel target discovered by Dr. Mark R. Kelley at Indiana University School of

Medicine APX3330 is a small molecule oral drug candidate and a first-in-class inhibitor of Ref-1 APX3330 previously developed by Eisai for multiple hepatic inflammatory indications and later by Apexian for advanced solid tumors in 11 Phase

1 and 2 trials Similar oncology origin as approved anti-VEGFs MOA uniquely decreases both abnormal angiogenesis and inflammation by blocking pathways downstream of Ref-1 Extensively studied in over 20 in-vitro and animal studies with

favorable efficacy and safety DR DME

Preclinical Data: Oral APX3330 Blocks Neovascularization Source: Silva et al. ARVO 2021 Annual

Meeting; Li 2014;Pasha 2018;Jiang 2011 (Vldlr -/- : Very Low-Density Lipoprotein receptor knock-out mice) Eisai PK clinical data APX_CLN_0002 Apexian preclinical data Eisai preclinical data Lesion Volume Decrease with Oral APX3330 in

Murine Laser CNV Model Similar to EYLEA® Data Lesion Size and Corresponding Fluorescent Stains in L-CNV Models Treated with APX3330 at 25 mg/kg oral gavage -55% L-CNV Mouse Retina Model Vehicle 25 mg/kg 50 mg/kg APX3330 Gavage

OCT Lesion Volume APX3330 Efficacy was also seen after intraperitoneal and intravitreal injection APX33301 DR DME 2 µg/ml in mouse plasma at 2hrs; 25 mg/kg oral single dose ~20 µg/ml (120 mg/day) in human plasma ~40 µg/ml (240

mg/day) in human plasma Plasma concentration of APX33302 In addition, APX3330 detected in rat and mouse retina after oral dosing3,4 z Linear PK Profile of APX3330 EYLEA L-CNV Mouse OCT Lesion Volume Data ~45% MEAN±SEM 120 mg 240 mg

DR/DME ZETA-1 Phase 2b Design NPDR = non-proliferative diabetic retinopathy (which includes non

centrally involved diabetic macular edema) PDR = proliferative diabetic retinopathy (which includes non centrally involved diabetic macular edema) ZETA-1 Clinical Trial is Sponsored by Ocuphire Pharma

https://clinicaltrials.gov/ct2/show/NCT04692688?term=ZETA-1&draw=2&rank=1 Ongoing, Randomized, Double-Masked, Placebo-Controlled 24-Week Trial (Similar To Eylea P3 DR Trial) Primary: % of subjects with a ≥ 2 step improvement on the

DRSS (Diabetic Retinopathy Severity Scale) score at week 24 Secondary: Central subfield thickness (CST) BCDVA (ETDRS) DRSS change at week 12 Rescue subjects Safety and tolerability Exploratory: Labs / PK Endpoints Phase 2b Enrolled

103 DR Patients from April 2021 to March 2022 Top Line Expected in 2H 2022 ZETA-1 Eligibility Screening Randomization APX3330 600mg/day (BID) Placebo BID 25 US sites 90-100 participants with moderately severe-to-severe NPDR or mild

PDR Noncentral DME is permitted 1:1 Week 0 Week 12 Week 24 Week 4 Primary Endpoint DR DME

Why DRSS is an Important Endpoint? Eylea® Panorama study FDA Accepted Endpoint for EYLEA® in PANORAMA

Pivotal DR Trial - 2 Step Improvement on the DRSS Score at Week 24 ETDRS Severity Level Steps Very Mild Mild Mod. Sev. VerySev. Mild Mod. High Risk Non-proliferative disease Proliferative disease PANORAMA: Reduction of DRSS

Significantly reduces the incidence of Vision Threatening DR Diabetic Retinopathy Severity Scale (DRSS) Risk of vision-threatening events increases with worsening step progression DR DME

Masked Safety Findings from Ongoing ZETA-1 Trial 1. DME possibly study medication related (APX3330 or

placebo) 2. Cellulitis (2 events in same subject), dyskinesia, transient ischemic event, COVID-19 and acute respiratory failure (same subject), progression of multivessel coronary artery disease, cholelithiasis, osteomyelitis, vertigo 3.

Excludes 9 number of early withdrawals (4 due to AE, 3 due to lost to follow up, 2 due to withdrew consent. Note: ZETA-1 Interim Data as of database 6/15/22 with complete monitoring before final database lock; assumes 50% subjects on

APX3330 Favorable Safety Profile (as of 6/15/2022) Observed with 600 mg Oral Daily Doses in Diabetic Subjects 0 Major Organ Toxicities (Liver, heart, kidney, brain, lung or vital sign abnormalities e.g., blood pressure or heart

rate) Oral APX3330 safety profile consistent with that seen in prior trials >7000Subject-Days of at 600mg/day APX3330 Exposure 10 SAE in 8/103 Subjects 0 Treatment Related 10 Unrelated2 70%Subjects completed thru Week

24 103 Subjects Enrolled 100%Subjects completed thru Week 12 3 4 subjects withdrew due to an AE DME, dyspnea, osteomyelitis, syncope 145 TEAEs In 60/103 Subjects (58%) 121 Unrelated 24 Treatment-Related 7 Moderate 0

Severe Diarrhea, DME1, pruritis, urticaria, blurry vision, decrease in hemoglobin levels, decrease in hematocrit levels 74 Mild 37 Moderate 10 Severe 17 Mild DR DME

Novel MOA for treating retina ↓ Inflammation ↓ Abnormal Angiogenesis Convenient Oral Dosing for

Patient Compliance Allow Daily vs. Episodic Exposure Oral pill may reduce the burden of frequent anti-VEGF injections >9000 Subject-exposure days* at ≥600 mg/day dose Few Systemic Adverse Effects < 5% Mild Gastrointestinal

(diarrhea) < 5% Mild Skin Rash (reversible) No Organ Toxicity (Liver, Cardiovascular {BP, HR}, Kidney, Neurologic, Pulmonary) No Ocular Effects No observed ocular AEs APX3330 Product Candidate Profile for Multiple Retinal

Indications *11 completed Phase 1 and Phase 2 clinical trials by Eisai and Apexian; along with ongoing ZETA-1 trial by Ocuphire (*includes ~103 subject) Oral, First-In-Class Ref-1 Inhibitor with Favorable Human Safety Data APX3330:

Well-tolerated Oral Dose up to 600mg/day Twice Daily Dosing DR DME Expected Efficacy Data Favorable Safety Profile

Diabetic Retinopathy PDR (DRSS >60) Moderate to Severe NPDR (DRSS 43-53) Mild NPDR 34 Million

Diabetics in US 10 M 6M 1M 1M ~$8 M+DR Patients DME 1M Wet AMD 2M Dry AMD 10M+ RVO 2M GA 1M DR DME Broad Opportunities to Treat Retinal Diseases with APX Platform APX3330 May Treat Patients Across Retinal Diseases as

Single Agent or Adjunctive Therapy Anti-VEGF treatments APX3330 APX2009 / APX2014 / APX3330 (Local Delivery) US Market Opportunity Addressable Market Potential First Oral Rx for Retina Diseases APX3330 Inflammatory component is

common across these retina indications and potentially addressable by the MOA of Ref-1 Source:1. American Diabetes Association; International Diabetes Federation; Healthline; *Ocuphire internal analysis and assumptions; 2. Das UN. DME,

retinopathy and age-related macular degeneration as inflammatory conditions. Arch Med Sci. 2016;12(5):1142-1157. doi:10.5114/aoms.2016.61918 3. Patient survey adapted from Lions International Foundation and International Diabetes

Foundation-Europe; Meltzer 2000 4. Estimates are provided by the National Eye Institute, FactSheet, Global Data, and Research and Markets. Estimated values are rounded. 5. Estimated prevalence in the U.S. ~$10B+ Market Revenues

40 Milestones Team/Boards Financial Data

Track Record of Achieving Milestones Exciting News Cadence Ongoing Partnering Discussions with

Leading Ophthalmic Companies (including Europe and Asia) 2021 – 1H 2022 2H 2022 – 2023 Submit Nyxol NDA for RM Report Phase 2b Data for DR/DME (ZETA-1) Initiate VEGA-2 & VEGA-3 Phase 3 Presbyopia Trials Initiate LYRA-1 Long-term

Safety Trial Potential NDA Approval for RM Establish Commercial Partnership Report VEGA-2 Presbyopia Data Multiple Positive Data Readouts in 2021-1H 2022 with Multiple Catalyst Ahead

Ocuphire Management Team Decades of Biotech and Drug Development Experience Mina Sooch,

MBA President & CEO and Founder Drey ColemanVP, Clinical Operations Amy Rabourn, CPA VP, Finance Charlie Hoffmann, MBA VP Corporate Development and Operations Mitch Brigell, PhD Head, Clinical Development and

Strategy Daniela Oniciu, PhD Global Head, R&D, Chemistry and Product Development Ronil Patel, MS Senior Director BD and Market Strategy Chris Ernst Global Head, QA and Manufacturing Barbara Withers, PhDVP, Clinical and

Regulatory Strategy Bindu Manne Head, Market Development and Commercialization Laura Gambino Director, Project Management

Ocuphire Board of Directors Sean Ainsworth, MBA Lead Independent Director, Board Director James

Manuso, PhD/MBA Board Director Jay Pepose, MD, PhD Board Director Richard Rodgers, MBA Board Director Susan Benton, MBA Board Director Cam Gallagher, MBA Chair, Board Director Mina Sooch, MBA Vice-Chair, Board Director

President & CEO Seasoned Directors with Decades of Drug Development, M&A/Financings, and Ophthalmology

Ocuphire's World-Class Medical Advisory Board Fortunate for the Insights of Leading KOLs & Drug

Candidate Co-Founders (Ant. Seg | Retina) James Katz, MD University of Illinois Jay Pepose, MD, PhD UCLA School of Medicine Thomas Samuelson, MD University of Minnesota Paul Karpecki, OD Indiana University Eliot Lazar,

MD Georgetown University Marguerite McDonald, MD Columbia University David Boyer, MD Chicago Medical School Mark Kelley, PhD Indiana University Co-Founder Apexian/APX3330 elCON Medical Michael Allingham, MD, PhD University of

North Carolina Peter Kaiser, MD Harvard Medical School Jeffrey Heier, MD Boston University Y. Ralph Chu, MD Northwestern University Douglas Devries, OD University of Nevada David Brown, MD Baylor University Mitch Jackson,

MD University of Chicago David Lally, MD Vanderbilt University Refractive Specialist Refractive Specialist Refractive Specialist Glaucoma Specialist Refractive Specialist Retinal Specialist Retinal Specialist Retinal

Specialist Retinal Specialist Retinal Specialist Refractive Specialist Refractive Specialist Retinal Specialist Optometry Optometry

OCUP – Market Snapshot Source: FactSet Active Trading Volume and Sufficient Cash Runway Through 3Q

2023 NASDAQ: OCUP Price/share $2.79 As of 8-11-22 Market Cap $57 M As of 8-11-22 Shares Outstanding 20.6 million As of 10Q (6-30-22) Cash $17 M As of 10Q (6-30-22) Cash Runway Sufficient through 3Q 2023 As of 10Q

(6-30-22) Average Daily Volume ~120 K 60-day trailing average Research Analyst Coverage on OCUP John Newman Canaccord Genuity Kristen Kluska Cantor Fitzgerald James Molloy Alliance Global Partners Sean Kim Jones Trading Matthew

Caufield H. C. Wainwright

www.ocuphire.com [email protected] Ocuphire Pharma Click here to view Ocuphire Pharma’s Investor

R&D Day Recording

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ocuphire Pharma Announces APX3330 Presentation at ARVO 2024 Annual Meeting

- YPF SA reports

- Victory Sells Tahlo Lake Property in British Columbia

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share