Form 8-K MRC GLOBAL INC. For: Jun 02

1Q 2021 Investor Presentation June 2, 2021 Rob Saltiel President & CEO Kelly Youngblood Executive Vice President & CFO Exhibit 99.1

Forward Looking Statements Non-GAAP Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such as “will,” “expect,” “look forward,” “guidance,” “targeted”, “goals”, and similar expressions are intended to identify forward-looking statements. Statements about the company’s business, including its strategy, its industry, the company’s future profitability, the company’s guidance on its sales, adjusted EBITDA, adjusted net income, adjusted diluted EPS, adjusted SG&A, gross profit, gross profit percentage, adjusted gross profit, adjusted gross profit percentage, net debt, tax rate, capital expenditures and cash from operations, free cash flow, free cash flow after dividends, growth in the company’s various markets and the company’s expectations, beliefs, plans, strategies, objectives, prospects and assumptions are not guarantees of future performance. These statements are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, most of which are difficult to predict and many of which are beyond our control, including the factors described in the company’s SEC filings that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements, including the company’s Current Report on Form 8-K dated April 27, 2021. For a discussion of key risk factors, please see the risk factors disclosed in the company’s SEC filings, which are available on the SEC’s website at www.sec.gov and on the company’s website, www.mrcglobal.com. Our filings and other important information are also available on the Investor Relations page of our website at www.mrcglobal.com. Undue reliance should not be placed on the company’s forward-looking statements. Although forward-looking statements reflect the company’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the company’s actual results, performance or achievements or future events to differ materially from anticipated future results, performance or achievements or future events expressed or implied by such forward-looking statements. The company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except to the extent required by law. In this presentation, the company is providing certain non-GAAP financial measures. These are not measures of financial performance calculated in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and should not be considered as alternatives. The following GAAP measures have the following non-GAAP measures presented and derived from the respective GAAP measures: net income (adjusted EBITDA) net income margin (adjusted EBITDA margin) gross profit (adjusted gross profit) gross profit percentage (adjusted gross profit percentage) net income (adjusted net income) diluted earnings per share (adjusted diluted EPS) selling, general and administrative expense (adjusted SG&A) net cash provided by operations (free cash flow and free cash flow after dividends) long-term debt, net (net debt) They should be viewed in addition to, and not as a substitute for, analysis of our results reported in accordance with GAAP. Management believes that these non-GAAP financial measures provide investors a view to measures similar to those used in evaluating our compliance with certain financial covenants under our credit facilities and provide meaningful comparisons between current and prior year period results. They are also used as a metric to determine certain components of performance-based compensation. They are not necessarily indicative of future results of operations that may be obtained by the company.

MRC Global A Compelling Investment Opportunity Market leader in PVF distribution with 100–year history Solid balance sheet and improving profitability Committed to ESG principles and sustainability 100 YEARS Diversified portfolio with multiple levers for growth Technical and value-added supply-chain solutions

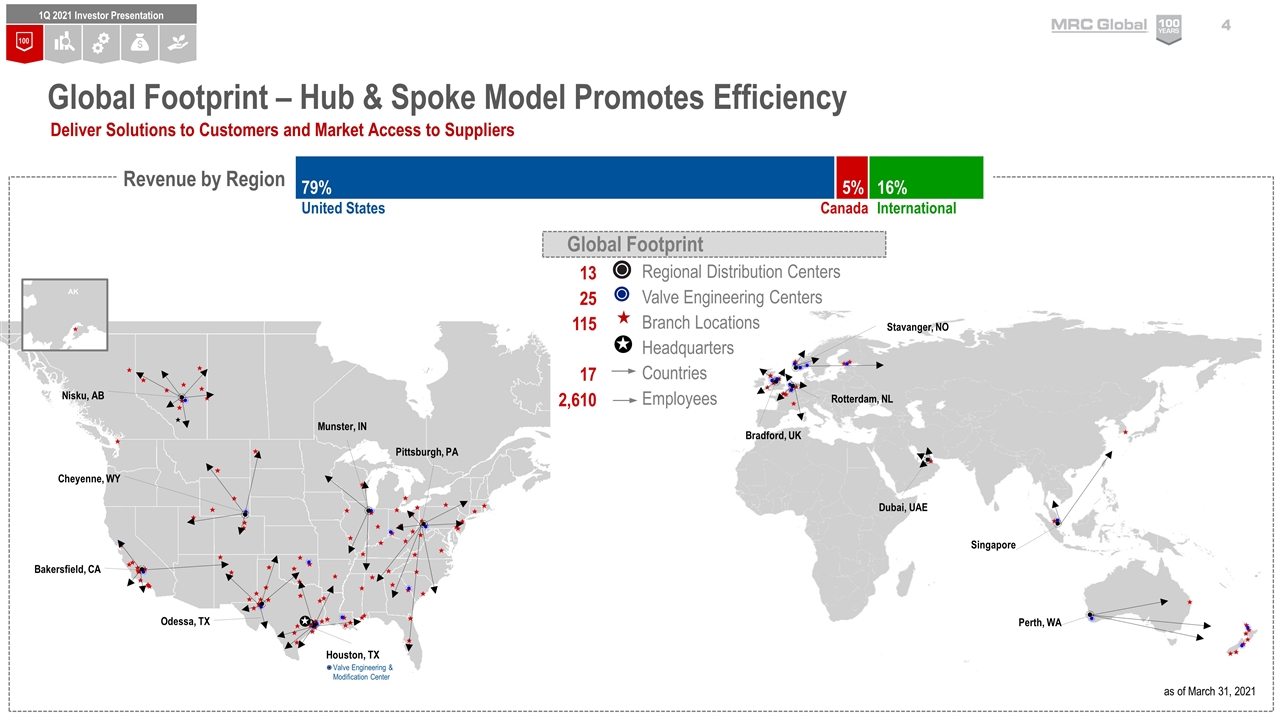

Dubai, UAE Perth, WA Singapore Stavanger, NO Bradford, UK Rotterdam, NL Global Footprint – Hub & Spoke Model Promotes Efficiency Nisku, AB Cheyenne, WY Bakersfield, CA Odessa, TX Houston, TX Munster, IN Pittsburgh, PA Deliver Solutions to Customers and Market Access to Suppliers as of March 31, 2021 Revenue by Region 79% United States 16% International 5% Canada Global Footprint Regional Distribution Centers Valve Engineering Centers Branch Locations Headquarters Countries Employees 13 25 115 17 2,610 100 1Q 2021 Investor Presentation Valve Engineering & Modification Center

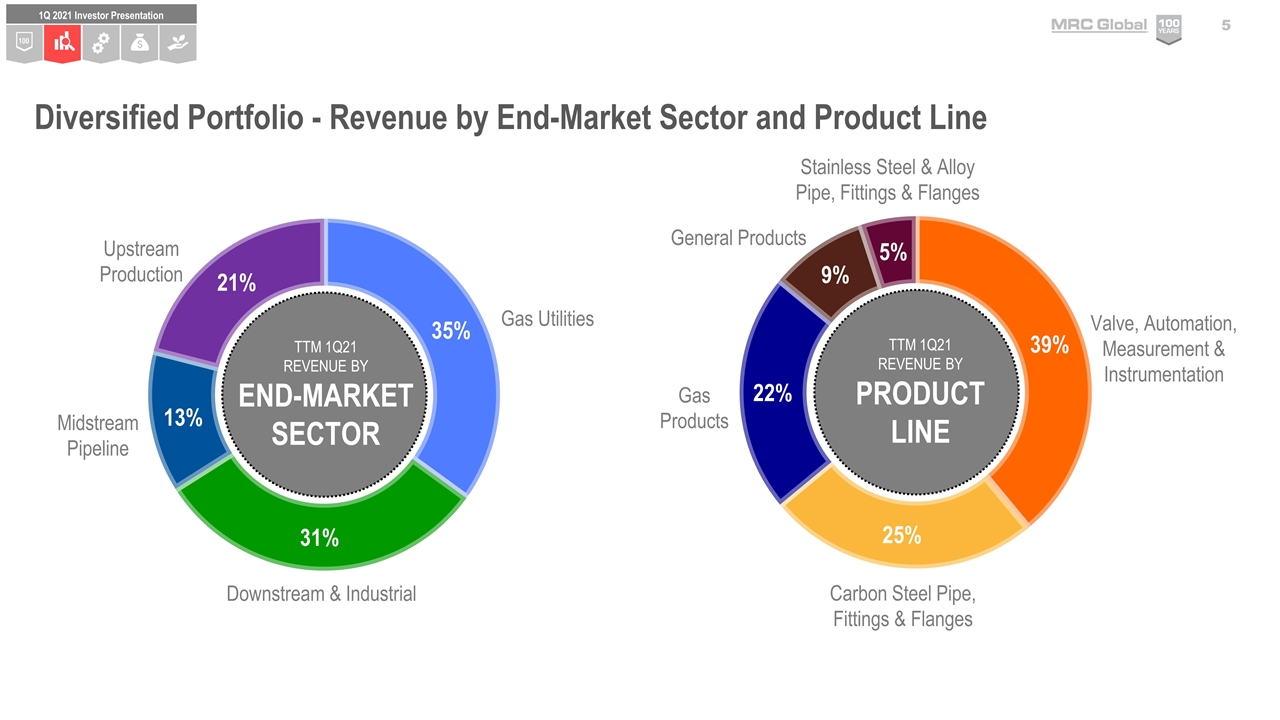

Diversified Portfolio - Revenue by End-Market Sector and Product Line Valve, Automation, Measurement & Instrumentation Carbon Steel Pipe, Fittings & Flanges Gas Products General Products Stainless Steel & Alloy Pipe, Fittings & Flanges Upstream Production Gas Utilities Downstream & Industrial Midstream Pipeline TTM 1Q21 REVENUE BY PRODUCT LINE TTM 1Q21 REVENUE BY END-MARKET SECTOR 100 1Q 2021 Investor Presentation

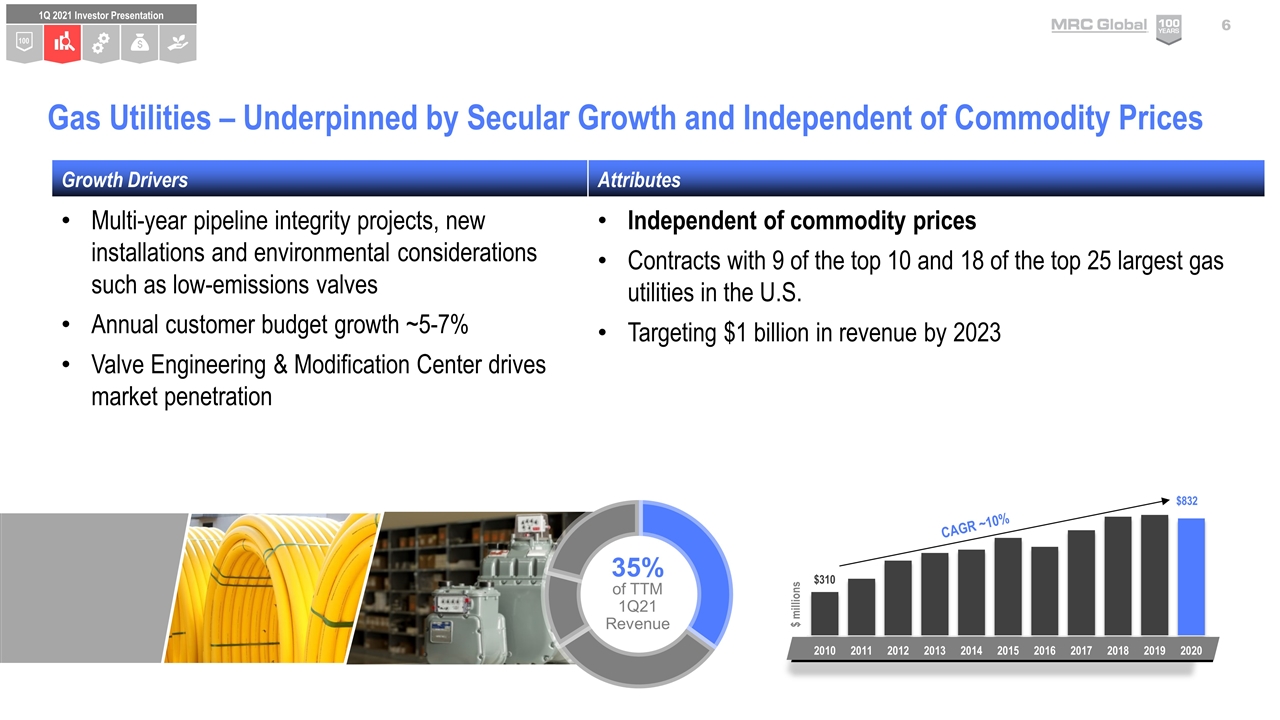

Growth Drivers Attributes Multi-year pipeline integrity projects, new installations and environmental considerations such as low-emissions valves Annual customer budget growth ~5-7% Valve Engineering & Modification Center drives market penetration Independent of commodity prices Contracts with 9 of the top 10 and 18 of the top 25 largest gas utilities in the U.S. Targeting $1 billion in revenue by 2023 Gas Utilities – Underpinned by Secular Growth and Independent of Commodity Prices $832 $ millions 35% of TTM 1Q21 Revenue 100 1Q 2021 Investor Presentation

Growth Drivers Attributes Increasing secular demand for plastics leading to petrochemical investments Valve-centric strategy and Downstream Center of Excellence targeting chemicals & petrochemicals industries Energy transition & decarbonization projects Less commodity price dependent Recurring MRO revenue plus greenfield and upgrade projects Contracts with the 10 largest refiners in the U.S. Heavily valve-centric Downstream & Industrial – Broad Customer Base with Multiple Growth Avenues 10% Chemicals 10% Refining 11% Industrial 31% of TTM 1Q21 Revenue $ millions 100 1Q 2021 Investor Presentation

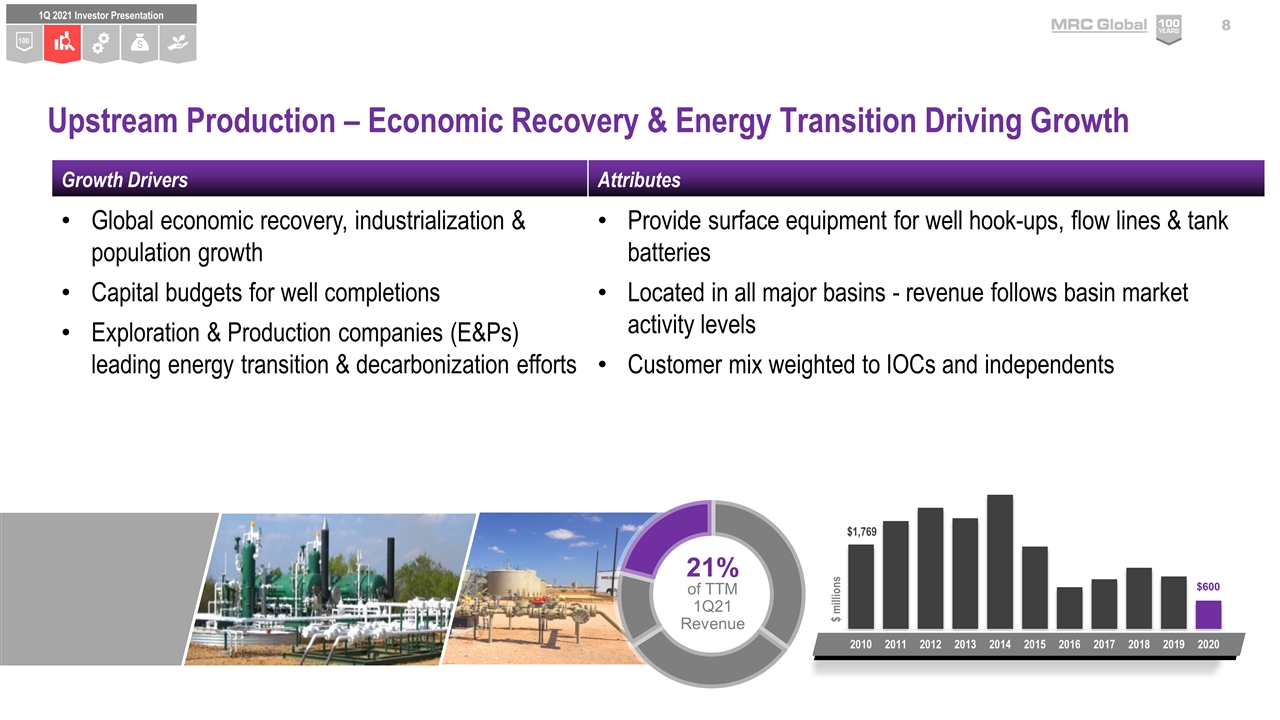

Growth Drivers Attributes Global economic recovery, industrialization & population growth Capital budgets for well completions Exploration & Production companies (E&Ps) leading energy transition & decarbonization efforts Provide surface equipment for well hook-ups, flow lines & tank batteries Located in all major basins - revenue follows basin market activity levels Customer mix weighted to IOCs and independents Upstream Production – Economic Recovery & Energy Transition Driving Growth 21% of TTM 1Q21 Revenue $ millions 100 1Q 2021 Investor Presentation

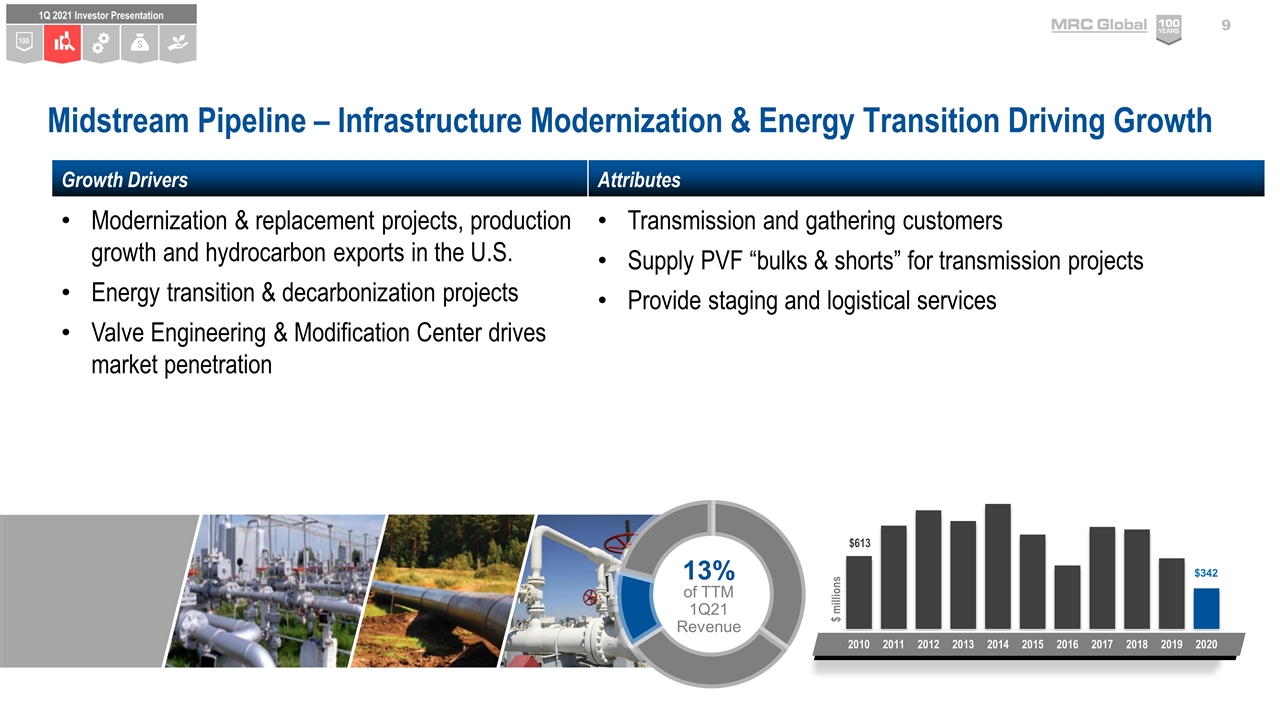

Growth Drivers Attributes Modernization & replacement projects, production growth and hydrocarbon exports in the U.S. Energy transition & decarbonization projects Valve Engineering & Modification Center drives market penetration Transmission and gathering customers Supply PVF “bulks & shorts” for transmission projects Provide staging and logistical services Midstream Pipeline – Infrastructure Modernization & Energy Transition Driving Growth 13% of TTM 1Q21 Revenue $ millions 100 1Q 2021 Investor Presentation

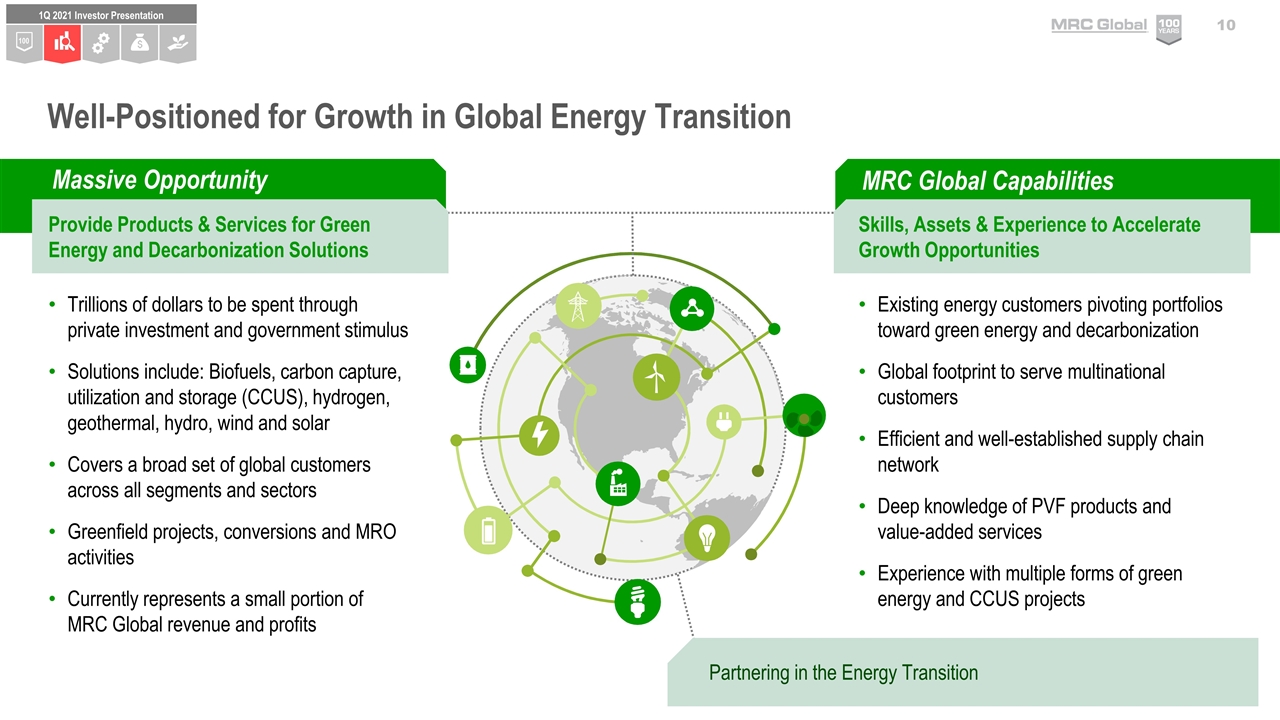

Massive Opportunity MRC Global Capabilities Well-Positioned for Growth in Global Energy Transition Provide Products & Services for Green Energy and Decarbonization Solutions Trillions of dollars to be spent through private investment and government stimulus Solutions include: Biofuels, carbon capture, utilization and storage (CCUS), hydrogen, geothermal, hydro, wind and solar Covers a broad set of global customers across all segments and sectors Greenfield projects, conversions and MRO activities Currently represents a small portion of MRC Global revenue and profits Skills, Assets & Experience to Accelerate Growth Opportunities Existing energy customers pivoting portfolios toward green energy and decarbonization Global footprint to serve multinational customers Efficient and well-established supply chain network Deep knowledge of PVF products and value-added services Experience with multiple forms of green energy and CCUS projects Partnering in the Energy Transition 100 1Q 2021 Investor Presentation

Technical and Value-Added Supply-Chain Solutions Providing customers technical, engineered products and supply-chain solutions: Valve Engineering Centers and Valve Engineering and Modification Center Actuation, modification, ValidTorqueTM Complete engineering documentation (CAD drawings) Testing services (e.g. hydrostatic testing, weld x-rays) Steam system surveys and audits On-site product assistance, training and demonstrations Quality Assurance Program – Approved Manufacturers List Qualification & Supplier Audits Integrated Supply Solutions 100 1Q 2021 Investor Presentation

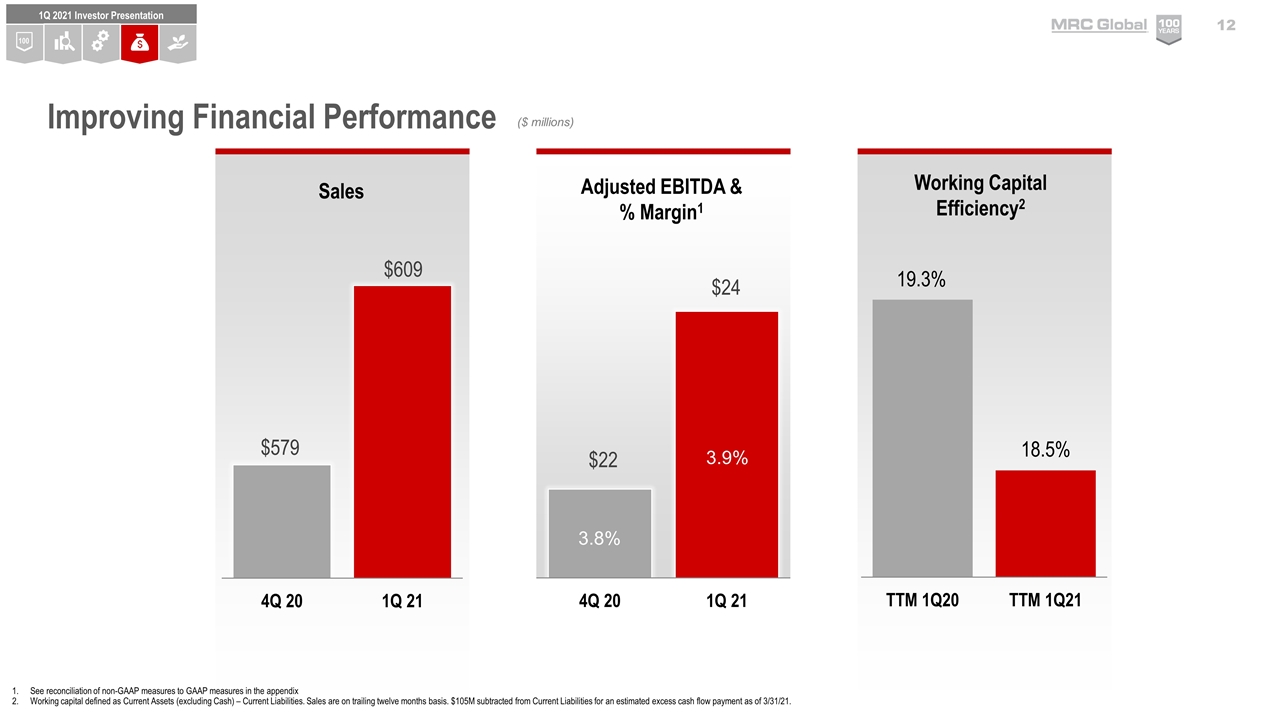

($ millions) Working Capital Efficiency2 Adjusted EBITDA & % Margin1 Improving Financial Performance See reconciliation of non-GAAP measures to GAAP measures in the appendix Working capital defined as Current Assets (excluding Cash) – Current Liabilities. Sales are on trailing twelve months basis. $105M subtracted from Current Liabilities for an estimated excess cash flow payment as of 3/31/21. Sales 100 1Q 2021 Investor Presentation

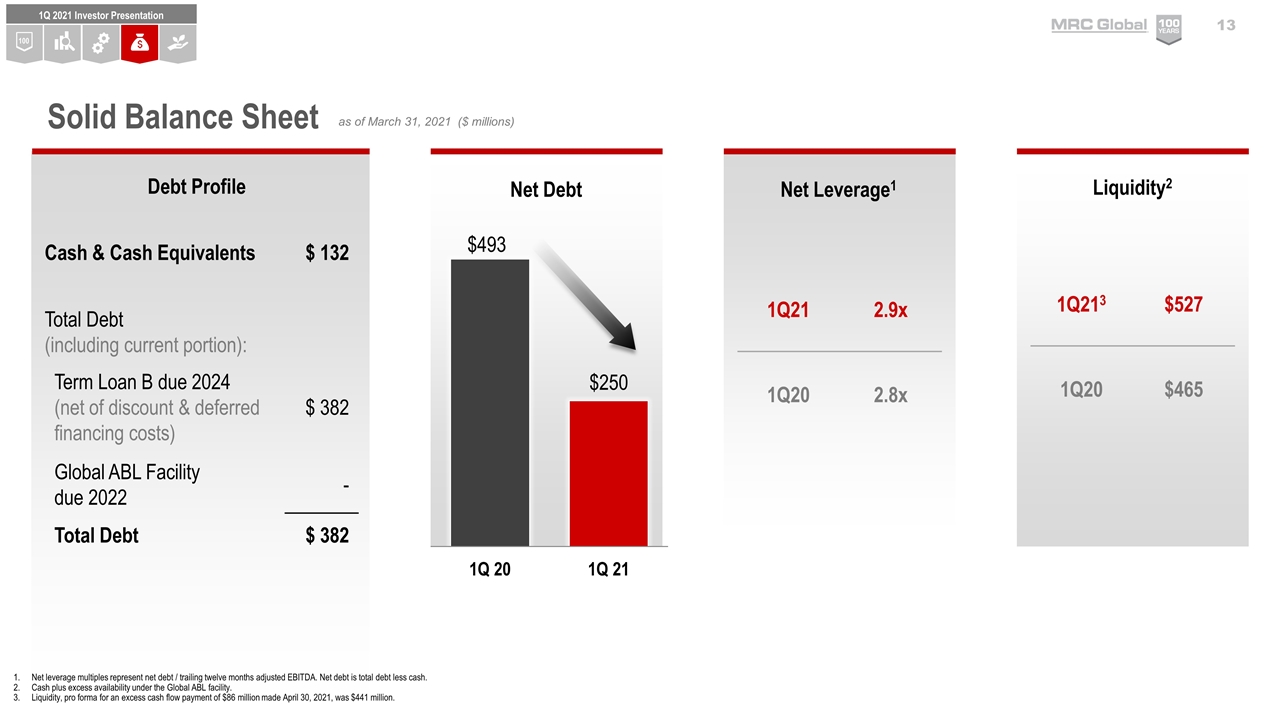

Net Leverage1 Liquidity2 as of March 31, 2021 ($ millions) Solid Balance Sheet Net leverage multiples represent net debt / trailing twelve months adjusted EBITDA. Net debt is total debt less cash. Cash plus excess availability under the Global ABL facility. Liquidity, pro forma for an excess cash flow payment of $86 million made April 30, 2021, was $441 million. 1Q21 2.9x 1Q20 2.8x 1Q213 $527 1Q20 $465 Net Debt Debt Profile Cash & Cash Equivalents $ 132 Total Debt (including current portion): Term Loan B due 2024 (net of discount & deferred financing costs) $ 382 Global ABL Facility due 2022 - Total Debt $ 382 100 1Q 2021 Investor Presentation

Committed to ESG Principles and Sustainability Diversity & Inclusion 33% of Board of Directors from Diversity Groups Women make up 45% of global corporate employees Social Responsibility Strong safety culture Top Quartile Safety Performance in 2020 National Association Wholesaler-Distributors Survey Supplier Quality Process (Processes, Policies & Audits) Environmental Pollution control for customers – Offer low-e valves reducing fugitive waste emissions Reduced our North American Scope 1 emissions ~44% from 2013 to 2020 Continually improving impact by reducing transportation moves Governance Adopted SASB reporting standards Executive compensation tied to safety metric ESG Management Committee reports to Governance Committee 100 1Q 2021 Investor Presentation

MRC Global A Compelling Investment Opportunity Market leader in PVF distribution with 100–year history Solid balance sheet and improving profitability Committed to ESG principles and sustainability 100 YEARS Diversified portfolio with multiple levers for growth Technical and value-added supply-chain solutions

APPENDIX

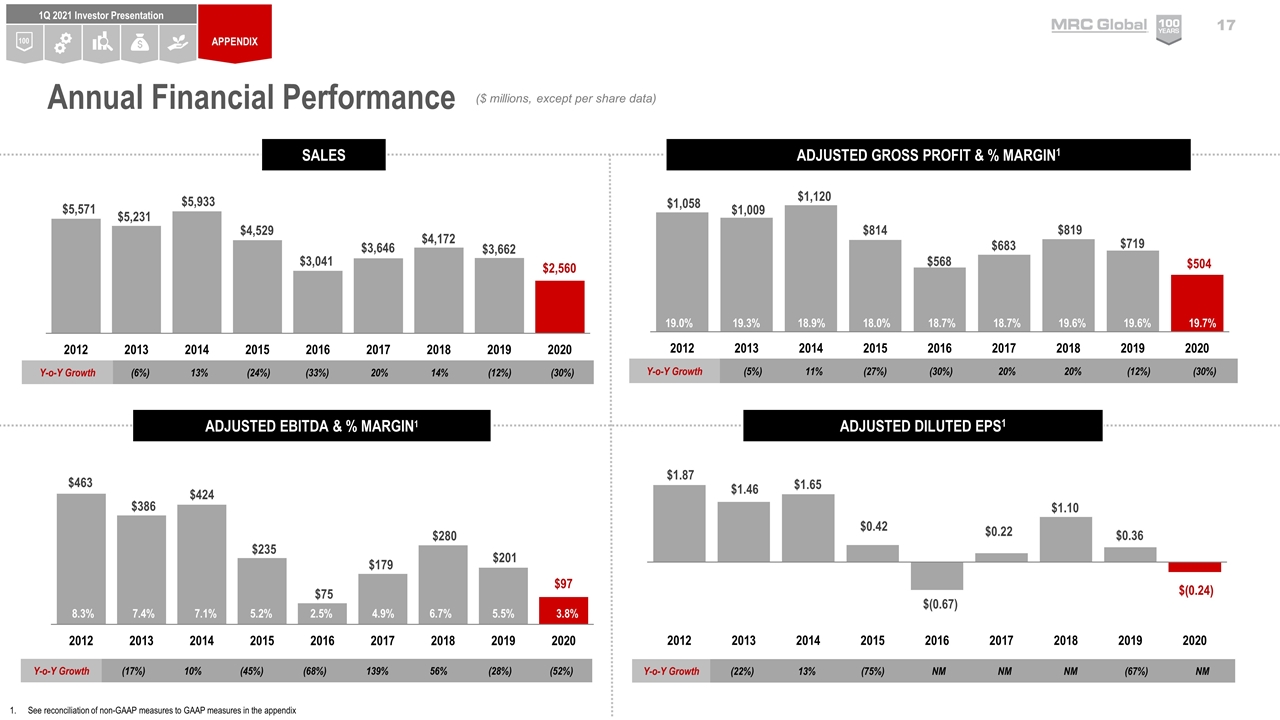

Annual Financial Performance ($ millions, except per share data) See reconciliation of non-GAAP measures to GAAP measures in the appendix APPENDIX Y-o-Y Growth (6%) 13% (24%) (33%) 20% 14% (12%) (30%) Y-o-Y Growth (17%) 10% (45%) (68%) 139% 56% (28%) (52%) 8.3% 7.4% 7.1% 5.2% 2.5% 4.9% 6.7% 5.5% 3.8% Y-o-Y Growth (5%) 11% (27%) (30%) 20% 20% (12%) (30%) 19.0% 19.3% 18.9% 18.0% 18.7% 18.7% 19.6% 19.6% 19.7% Y-o-Y Growth (22%) 13% (75%) NM NM NM (67%) NM 100 1Q 2021 Investor Presentation ADJUSTED EBITDA & % MARGIN1 ADJUSTED DILUTED EPS1 SALES ADJUSTED GROSS PROFIT & % MARGIN1

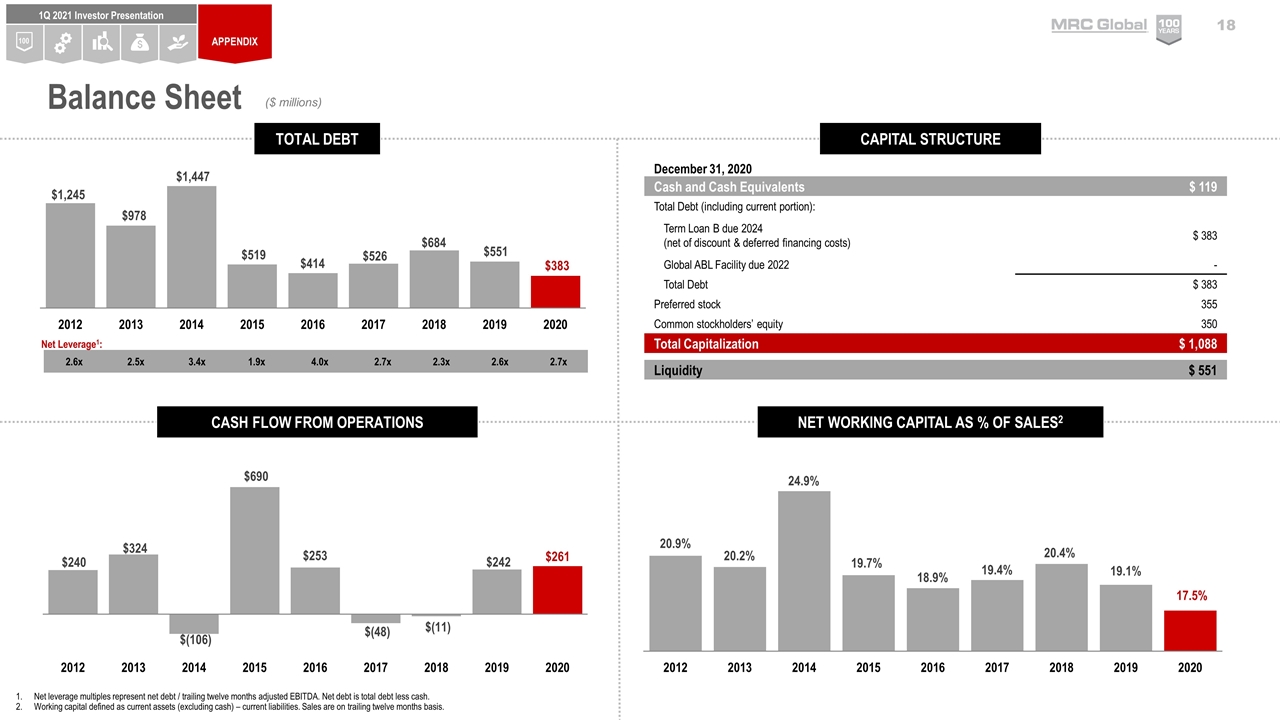

Balance Sheet ($ millions) Net leverage multiples represent net debt / trailing twelve months adjusted EBITDA. Net debt is total debt less cash. Working capital defined as current assets (excluding cash) – current liabilities. Sales are on trailing twelve months basis. 2.6x 2.5x 3.4x 1.9x 4.0x 2.7x 2.3x 2.6x 2.7x Net Leverage1: December 31, 2020 Cash and Cash Equivalents $ 119 Total Debt (including current portion): Term Loan B due 2024 (net of discount & deferred financing costs) $ 383 Global ABL Facility due 2022 - Total Debt $ 383 Preferred stock 355 Common stockholders’ equity 350 Total Capitalization $ 1,088 Liquidity $ 551 TOTAL DEBT CASH FLOW FROM OPERATIONS CAPITAL STRUCTURE NET WORKING CAPITAL AS % OF SALES2 APPENDIX 100 1Q 2021 Investor Presentation

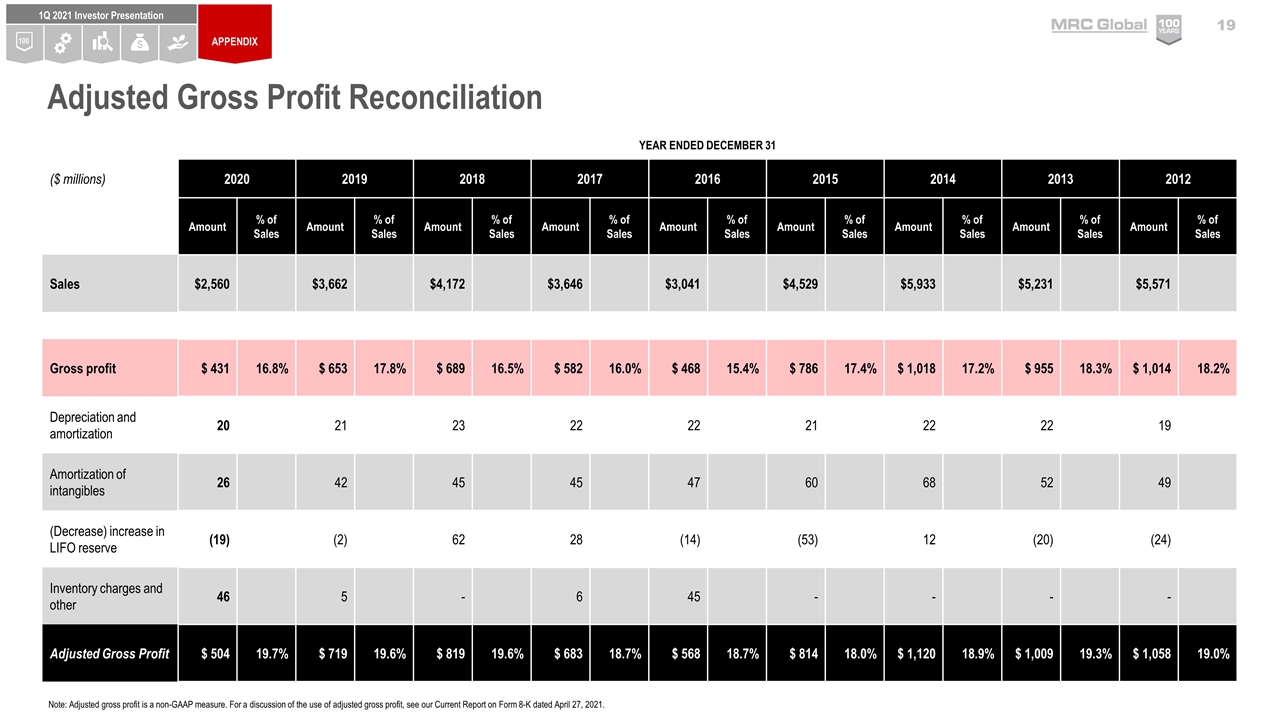

YEAR ENDED DECEMBER 31 ($ millions) 2020 2019 2018 2017 2016 2015 2014 2013 2012 Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Sales $2,560 $3,662 $4,172 $3,646 $3,041 $4,529 $5,933 $5,231 $5,571 Gross profit $ 431 16.8% $ 653 17.8% $ 689 16.5% $ 582 16.0% $ 468 15.4% $ 786 17.4% $ 1,018 17.2% $ 955 18.3% $ 1,014 18.2% Depreciation and amortization 20 21 23 22 22 21 22 22 19 Amortization of intangibles 26 42 45 45 47 60 68 52 49 (Decrease) increase in LIFO reserve (19) (2) 62 28 (14) (53) 12 (20) (24) Inventory charges and other 46 5 - 6 45 - - - - Adjusted Gross Profit $ 504 19.7% $ 719 19.6% $ 819 19.6% $ 683 18.7% $ 568 18.7% $ 814 18.0% $ 1,120 18.9% $ 1,009 19.3% $ 1,058 19.0% Note: Adjusted gross profit is a non-GAAP measure. For a discussion of the use of adjusted gross profit, see our Current Report on Form 8-K dated April 27, 2021. APPENDIX 100 1Q 2021 Investor Presentation Adjusted Gross Profit Reconciliation

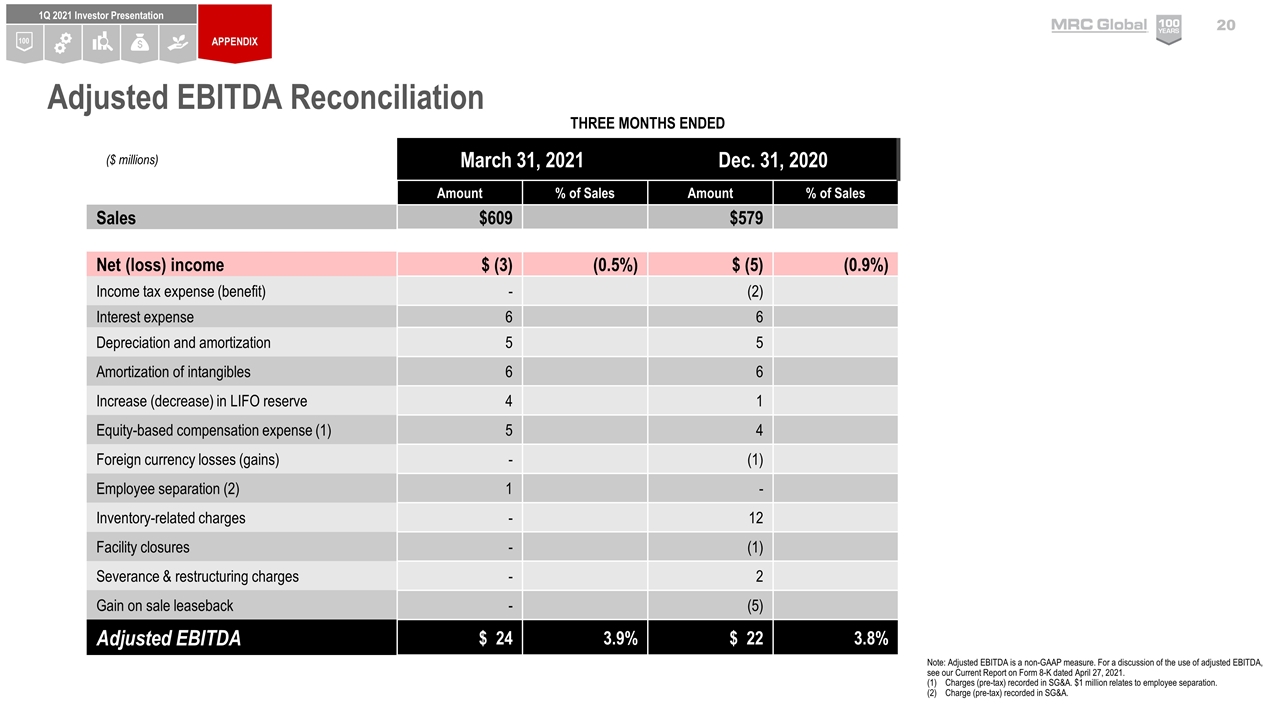

Note: Adjusted EBITDA is a non-GAAP measure. For a discussion of the use of adjusted EBITDA, see our Current Report on Form 8-K dated April 27, 2021. Charges (pre-tax) recorded in SG&A. $1 million relates to employee separation. Charge (pre-tax) recorded in SG&A. THREE MONTHS ENDED ($ millions) March 31, 2021 Dec. 31, 2020 Amount % of Sales Amount % of Sales Sales $609 $579 Net (loss) income $ (3) (0.5%) $ (5) (0.9%) Income tax expense (benefit) - (2) Interest expense 6 6 Depreciation and amortization 5 5 Amortization of intangibles 6 6 Increase (decrease) in LIFO reserve 4 1 Equity-based compensation expense (1) 5 4 Foreign currency losses (gains) - (1) Employee separation (2) 1 - Inventory-related charges - 12 Facility closures - (1) Severance & restructuring charges - 2 Gain on sale leaseback - (5) Adjusted EBITDA $ 24 3.9% $ 22 3.8% Adjusted EBITDA Reconciliation APPENDIX 100 1Q 2021 Investor Presentation

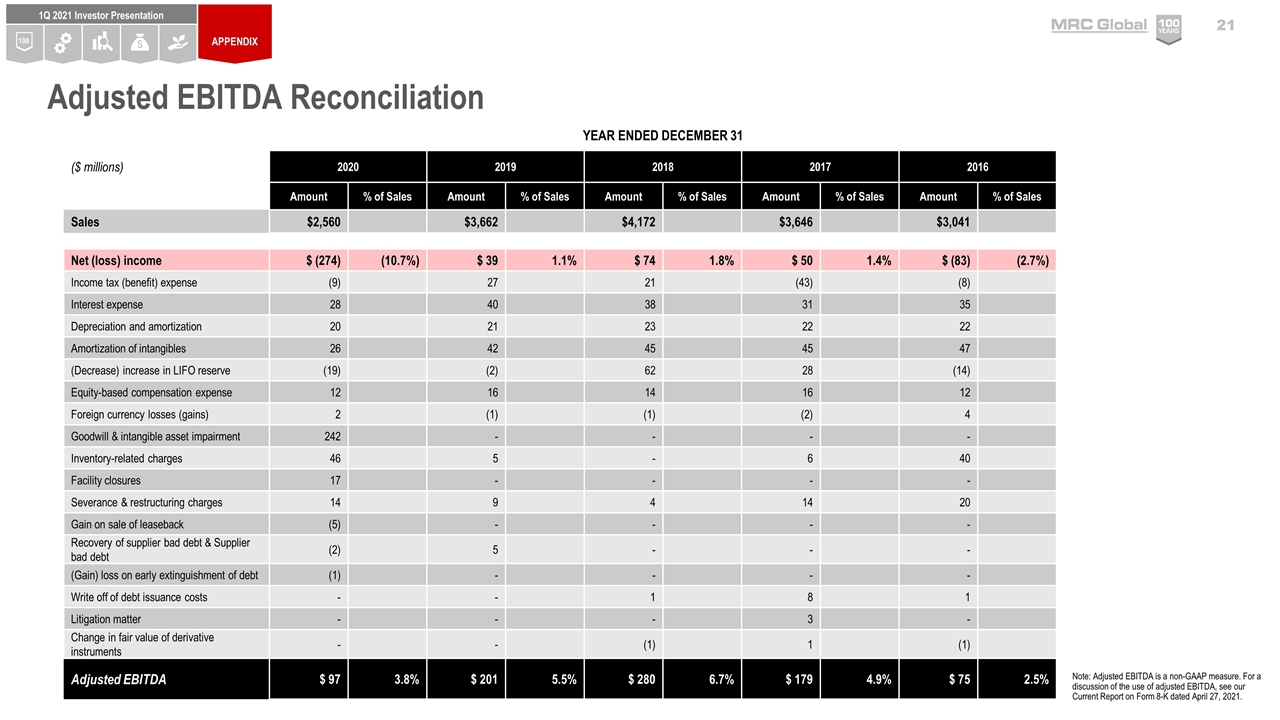

YEAR ENDED DECEMBER 31 ($ millions) 2020 2019 2018 2017 2016 Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Sales $2,560 $3,662 $4,172 $3,646 $3,041 Net (loss) income $ (274) (10.7%) $ 39 1.1% $ 74 1.8% $ 50 1.4% $ (83) (2.7%) Income tax (benefit) expense (9) 27 21 (43) (8) Interest expense 28 40 38 31 35 Depreciation and amortization 20 21 23 22 22 Amortization of intangibles 26 42 45 45 47 (Decrease) increase in LIFO reserve (19) (2) 62 28 (14) Equity-based compensation expense 12 16 14 16 12 Foreign currency losses (gains) 2 (1) (1) (2) 4 Goodwill & intangible asset impairment 242 - - - - Inventory-related charges 46 5 - 6 40 Facility closures 17 - - - - Severance & restructuring charges 14 9 4 14 20 Gain on sale of leaseback (5) - - - - Recovery of supplier bad debt & Supplier bad debt (2) 5 - - - (Gain) loss on early extinguishment of debt (1) - - - - Write off of debt issuance costs - - 1 8 1 Litigation matter - - - 3 - Change in fair value of derivative instruments - - (1) 1 (1) Adjusted EBITDA $ 97 3.8% $ 201 5.5% $ 280 6.7% $ 179 4.9% $ 75 2.5% Note: Adjusted EBITDA is a non-GAAP measure. For a discussion of the use of adjusted EBITDA, see our Current Report on Form 8-K dated April 27, 2021. Adjusted EBITDA Reconciliation APPENDIX 100 1Q 2021 Investor Presentation

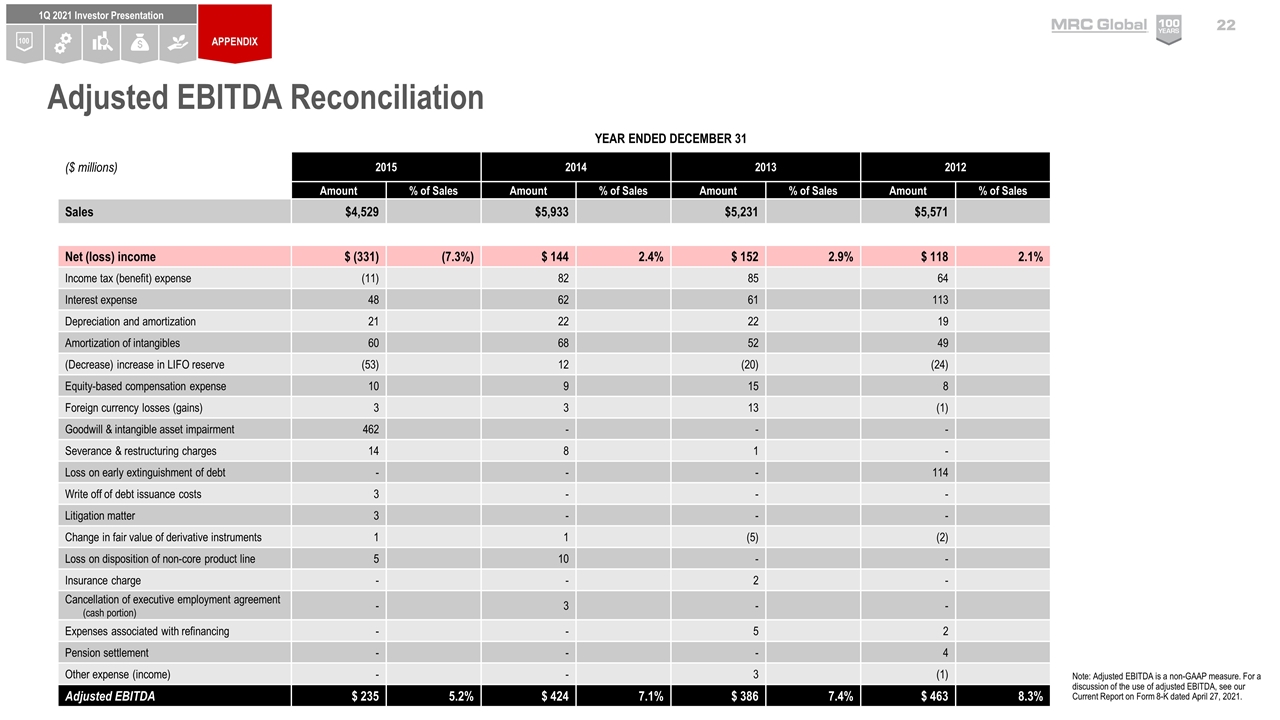

YEAR ENDED DECEMBER 31 ($ millions) 2015 2014 2013 2012 Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Sales $4,529 $5,933 $5,231 $5,571 Net (loss) income $ (331) (7.3%) $ 144 2.4% $ 152 2.9% $ 118 2.1% Income tax (benefit) expense (11) 82 85 64 Interest expense 48 62 61 113 Depreciation and amortization 21 22 22 19 Amortization of intangibles 60 68 52 49 (Decrease) increase in LIFO reserve (53) 12 (20) (24) Equity-based compensation expense 10 9 15 8 Foreign currency losses (gains) 3 3 13 (1) Goodwill & intangible asset impairment 462 - - - Severance & restructuring charges 14 8 1 - Loss on early extinguishment of debt - - - 114 Write off of debt issuance costs 3 - - - Litigation matter 3 - - - Change in fair value of derivative instruments 1 1 (5) (2) Loss on disposition of non-core product line 5 10 - - Insurance charge - - 2 - Cancellation of executive employment agreement (cash portion) - 3 - - Expenses associated with refinancing - - 5 2 Pension settlement - - - 4 Other expense (income) - - 3 (1) Adjusted EBITDA $ 235 5.2% $ 424 7.1% $ 386 7.4% $ 463 8.3% Note: Adjusted EBITDA is a non-GAAP measure. For a discussion of the use of adjusted EBITDA, see our Current Report on Form 8-K dated April 27, 2021. Adjusted EBITDA Reconciliation APPENDIX 100 1Q 2021 Investor Presentation

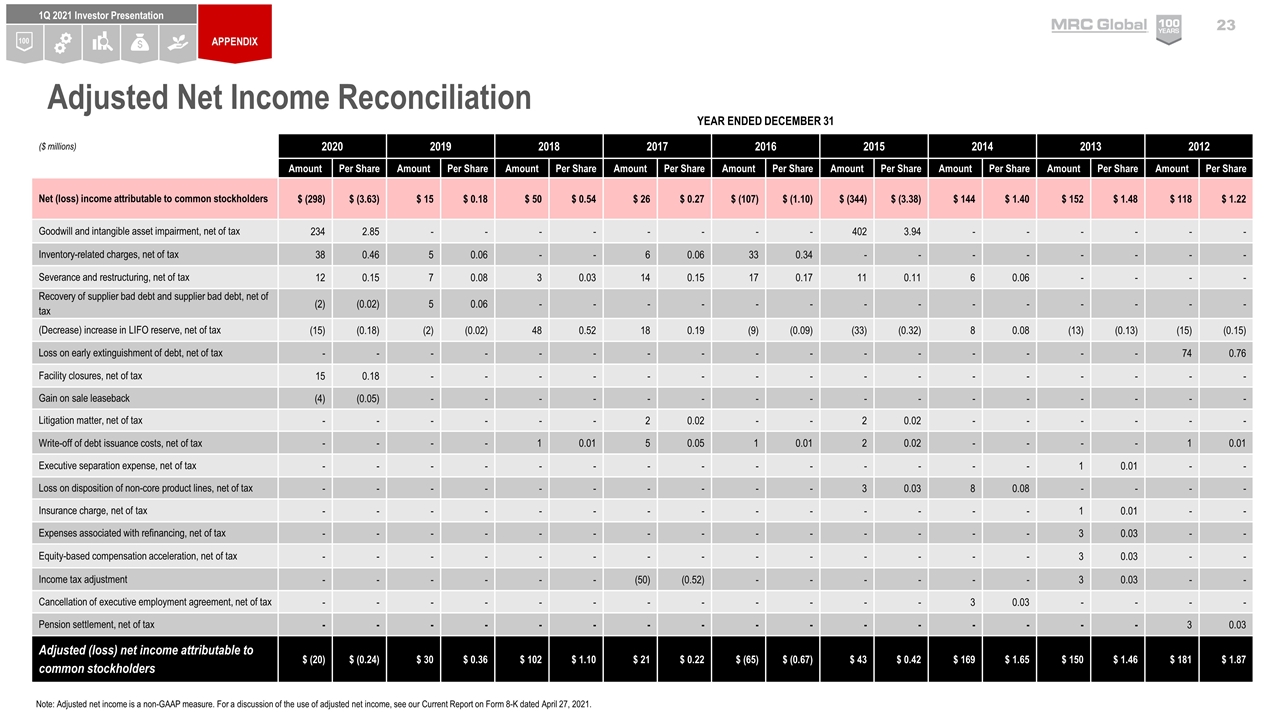

YEAR ENDED DECEMBER 31 ($ millions) 2020 2019 2018 2017 2016 2015 2014 2013 2012 Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Net (loss) income attributable to common stockholders $ (298) $ (3.63) $ 15 $ 0.18 $ 50 $ 0.54 $ 26 $ 0.27 $ (107) $ (1.10) $ (344) $ (3.38) $ 144 $ 1.40 $ 152 $ 1.48 $ 118 $ 1.22 Goodwill and intangible asset impairment, net of tax 234 2.85 - - - - - - - - 402 3.94 - - - - - - Inventory-related charges, net of tax 38 0.46 5 0.06 - - 6 0.06 33 0.34 - - - - - - - - Severance and restructuring, net of tax 12 0.15 7 0.08 3 0.03 14 0.15 17 0.17 11 0.11 6 0.06 - - - - Recovery of supplier bad debt and supplier bad debt, net of tax (2) (0.02) 5 0.06 - - - - - - - - - - - - - - (Decrease) increase in LIFO reserve, net of tax (15) (0.18) (2) (0.02) 48 0.52 18 0.19 (9) (0.09) (33) (0.32) 8 0.08 (13) (0.13) (15) (0.15) Loss on early extinguishment of debt, net of tax - - - - - - - - - - - - - - - - 74 0.76 Facility closures, net of tax 15 0.18 - - - - - - - - - - - - - - - - Gain on sale leaseback (4) (0.05) - - - - - - - - - - - - - - - - Litigation matter, net of tax - - - - - - 2 0.02 - - 2 0.02 - - - - - - Write-off of debt issuance costs, net of tax - - - - 1 0.01 5 0.05 1 0.01 2 0.02 - - - - 1 0.01 Executive separation expense, net of tax - - - - - - - - - - - - - - 1 0.01 - - Loss on disposition of non-core product lines, net of tax - - - - - - - - - - 3 0.03 8 0.08 - - - - Insurance charge, net of tax - - - - - - - - - - - - - - 1 0.01 - - Expenses associated with refinancing, net of tax - - - - - - - - - - - - - - 3 0.03 - - Equity-based compensation acceleration, net of tax - - - - - - - - - - - - - - 3 0.03 - - Income tax adjustment - - - - - - (50) (0.52) - - - - - - 3 0.03 - - Cancellation of executive employment agreement, net of tax - - - - - - - - - - - - 3 0.03 - - - - Pension settlement, net of tax - - - - - - - - - - - - - - - - 3 0.03 Adjusted (loss) net income attributable to common stockholders $ (20) $ (0.24) $ 30 $ 0.36 $ 102 $ 1.10 $ 21 $ 0.22 $ (65) $ (0.67) $ 43 $ 0.42 $ 169 $ 1.65 $ 150 $ 1.46 $ 181 $ 1.87 Note: Adjusted net income is a non-GAAP measure. For a discussion of the use of adjusted net income, see our Current Report on Form 8-K dated April 27, 2021. Adjusted Net Income Reconciliation APPENDIX 100 1Q 2021 Investor Presentation

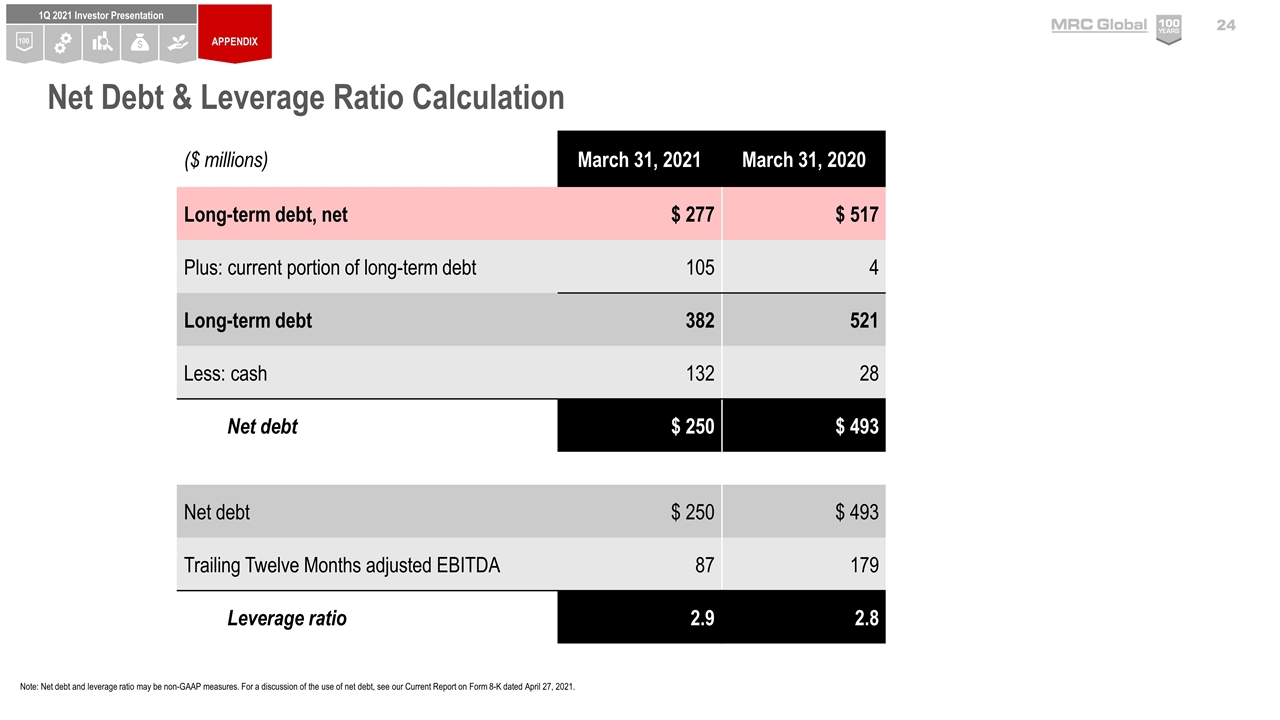

($ millions) March 31, 2021 March 31, 2020 Long-term debt, net $ 277 $ 517 Plus: current portion of long-term debt 105 4 Long-term debt 382 521 Less: cash 132 28 Net debt $ 250 $ 493 Net debt $ 250 $ 493 Trailing Twelve Months adjusted EBITDA 87 179 Leverage ratio 2.9 2.8 Note: Net debt and leverage ratio may be non-GAAP measures. For a discussion of the use of net debt, see our Current Report on Form 8-K dated April 27, 2021. Net Debt & Leverage Ratio Calculation 100 1Q 2021 Investor Presentation APPENDIX

Exhibit 99.2

MRC Global to Present at the

Stifel 2021 Virtual Cross Sector Insight Conference

HOUSTON, TX – June 2, 2021 – MRC Global Inc. (NYSE: MRC) announced that its management team will present at the Stifel 2021 Virtual Cross Sector Insight Conference to be held on June 8-10, 2021.

Rob Saltiel, President and Chief Executive Officer, is scheduled to present on Wednesday, June 9 at 10:40 a.m. Eastern Time (9:40 a.m. Central Time). A link to the live webcast and replay of the presentation will be located in the Investor Relations section of the MRC Global website at www.mrcglobal.com.

About MRC Global Inc.

MRC Global is the largest distributor of pipe, valves and fittings (PVF) and other infrastructure products and services to the energy industry, based on sales. Through approximately 230 service locations worldwide, approximately 2,600 employees and with 100 years of history, MRC Global provides innovative supply chain solutions and technical product expertise to customers globally across diversified end-markets including the upstream production, midstream pipeline, gas utility and downstream and industrial. MRC Global manages a complex network of over 200,000 SKUs and 10,000 suppliers simplifying the supply chain for its over 12,000 customers. With a focus on technical products, value-added services, a global network of valve and engineering centers and an unmatched quality assurance program, MRC Global is the trusted PVF expert. Find out more at www.mrcglobal.com.

Contact:

Monica Broughton

Investor Relations

MRC Global Inc.

832-308-2847

###

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Entergy Texas’ First Solar Resource Helps Customers Meet Sustainability Goals

- Novo Nordisk A/S – Total number of voting rights and share capital in Novo Nordisk A/S as of 26 April 2024

- Share repurchase programme

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share