Form 8-K Industrial Logistics For: Apr 26

Exhibit 99.1

FOR IMMEDIATE RELEASE

Industrial Logistics Properties Trust Announces First Quarter 2021 Results

First Quarter Net Income Attributable to Common Shareholders of $0.30 Per Share

First Quarter Normalized FFO Attributable to Common Shareholders of $0.47 Per Share

Newton, MA (April 26, 2021): Industrial Logistics Properties Trust (Nasdaq: ILPT) today announced financial results for the quarter ended March 31, 2021.

John Murray, President and Chief Executive Officer of ILPT, made the following statement:

“This quarter’s results reflect growth in Normalized FFO and strong leasing activity. We entered new and renewal leases for approximately 620,000 square feet, reflecting progress on our efforts to renew leases expiring next year in Hawaii. This leasing activity resulted in weighted average rental rates that were 16% higher than prior rental rates for the same space with a weighted average lease term of nearly 12 years. Occupancy increased to 98.6%, reflecting demand for ILPT's high quality industrial and logistics properties.

We have a pipeline of attractive investment opportunities, capacity to fund portfolio growth with more than $550 million of liquidity and moderate leverage. In March, ILPT agreed to purchase a newly built 358,000 square foot Class A industrial building located near the Rickenbacker intermodal terminal and airport in Columbus, Ohio. The property is 100% leased to a high quality credit tenant for approximately seven more years and includes excess land that can support future expansion of over 100,000 square feet.

Earlier this month we announced our regular quarterly distribution to shareholders. Our dividend remains well covered.”

Quarterly Results:

•Net income attributable to common shareholders of $19.3 million, or $0.30 per diluted share.

•Normalized funds from operations, or Normalized FFO, attributable to common shareholders of $30.7 million, or $0.47 per diluted share.

(dollars in thousands, except per share data) | Three Months Ended | ||||||||||

| Financial | March 31, 2021 | March 31, 2020 | Change | ||||||||

| Net income attributable to common shareholders per share | $0.30 | $0.20 | 50.0% | ||||||||

| Normalized FFO attributable to common shareholders per share | $0.47 | $0.46 | 2.2% | ||||||||

| Net operating income (NOI) | $41,994 | $50,286 | (16.5)% | ||||||||

| Same property cash basis NOI | $37,664 | $38,007 | (0.9)% | ||||||||

A Maryland Real Estate Investment Trust with transferable shares of beneficial interest listed on the Nasdaq.

No shareholder, Trustee or officer is personally liable for any act or obligation of the Trust.

Reconciliations of net income attributable to common shareholders determined in accordance with U.S. generally accepted accounting principles, or GAAP, to funds from operations, or FFO, attributable to common shareholders and Normalized FFO attributable to common shareholders for the quarters ended March 31, 2021 and 2020 appear later in this press release. Reconciliations of net income determined in accordance with GAAP to net operating income, or NOI, and Cash Basis NOI, and a reconciliation of NOI to same property NOI and calculation of same property Cash Basis NOI for the quarters ended March 31, 2021 and 2020, also appear later in this press release.

Three Months Ended | |||||||||||

Occupancy | March 31, 2021 | December 31, 2020 | March 31, 2020 | ||||||||

Occupancy | 98.6% | 98.5% | 98.9% | ||||||||

Same property occupancy | 98.5% | 98.4% | 98.5% | ||||||||

| Three Months Ended | |||||

| Leasing Activity | March 31, 2021 | ||||

| Leasing activity for new and renewal leases and rent resets (square feet) | 620,000 | ||||

| Weighted average lease term for new and renewal leases (by square feet) | 11.7 years | ||||

| Weighted average rental rate change versus prior rental rate for same space (by square feet) | 16.0% | ||||

| Commitments for leasing capital and concessions for new and renewal leases (per square foot per year) | $0.45 | ||||

Acquisition Activity:

•In March 2021, ILPT entered into an agreement to acquire a newly built net leased property located near the Rickenbacker intermodal terminal and airport in Columbus, Ohio containing approximately 358,000 rentable square feet for a purchase price of $31.5 million, excluding acquisition related costs. This property is 100% leased to a single tenant with a remaining lease term of approximately seven years. This acquisition is expected to close during the second quarter of 2021.

Liquidity:

•As of March 31, 2021, ILPT had approximately $26.1 million of cash and cash equivalents, and $533 million available to borrow under its revolving credit facility.

Conference Call:

On Tuesday, April 27, 2021 at 10:00 a.m. Eastern Time, John Murray, Chief Executive Officer, Richard Siedel, Chief Financial Officer, and Yael Duffy, Chief Operating Officer, will host a conference call to discuss ILPT’s first quarter 2021 financial results.

The conference call telephone number is (877) 418-4826. Participants calling from outside the United States and Canada should dial (412) 902-6758. No pass code is necessary to access the call from either number. Participants should dial in about 15 minutes prior to the scheduled start of the call. A replay of the conference call will be available through 11:59 p.m. on Tuesday, May 4, 2021. To access the replay, dial (412) 317-0088. The replay pass code is 10153753.

2

A live audio webcast of the conference call will also be available in a listen-only mode on ILPT’s website, at www.ilptreit.com. Participants wanting to access the webcast should visit ILPT’s website about five minutes before the call. The archived webcast will be available for replay on ILPT’s website following the call for about one week. The transcription, recording and retransmission in any way of ILPT’s first quarter conference call are strictly prohibited without the prior written consent of ILPT.

Supplemental Data:

A copy of ILPT’s First Quarter 2021 Supplemental Operating and Financial Data is available for download at ILPT’s website, which is located at www.ilptreit.com. ILPT’s website is not incorporated as part of this press release.

ILPT is a real estate investment trust, or REIT, that owns and leases industrial and logistics properties throughout the United States. ILPT is managed by the majority owned operating subsidiary of The RMR Group Inc. (Nasdaq: RMR), an alternative asset management company that is headquartered in Newton, MA.

Non-GAAP Financial Measures:

ILPT presents certain “non-GAAP financial measures” within the meaning of applicable rules of the Securities and Exchange Commission, or SEC, including FFO attributable to common shareholders, Normalized FFO attributable to common shareholders, NOI and Cash Basis NOI. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income or net income attributable to common shareholders as indicators of ILPT’s operating performance or as measures of ILPT’s liquidity. These measures should be considered in conjunction with net income and net income attributable to common shareholders as presented in ILPT’s condensed consolidated statements of income. ILPT considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income and net income attributable to common shareholders. ILPT believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of ILPT’s operating performance between periods and with other REITs and, in the case of NOI and Cash Basis NOI, reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of ILPT’s properties.

Please see the pages attached hereto for a more detailed statement of ILPT’s operating results and financial condition and for an explanation of ILPT’s calculation of NOI, Cash Basis NOI, same property NOI, same property Cash Basis NOI, FFO attributable to common shareholders and Normalized FFO attributable to common shareholders and a reconciliation of those amounts to amounts determined in accordance with GAAP.

3

Industrial Logistics Properties Trust

Condensed Consolidated Statements of Income

(amounts in thousands, except per share data)

(unaudited)

| Three Months Ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||

| Rental income | $ | 54,217 | $ | 64,278 | ||||||||||||||||

| Expenses: | ||||||||||||||||||||

| Real estate taxes | 7,247 | 8,811 | ||||||||||||||||||

| Other operating expenses | 4,976 | 5,181 | ||||||||||||||||||

| Depreciation and amortization | 12,678 | 18,290 | ||||||||||||||||||

| General and administrative | 3,756 | 4,831 | ||||||||||||||||||

| Total expenses | 28,657 | 37,113 | ||||||||||||||||||

| Interest income | — | 111 | ||||||||||||||||||

Interest expense (including net amortization of debt issuance costs, premiums and discounts of $505 and $586, respectively) | (8,741) | (14,519) | ||||||||||||||||||

| Income before income tax expense and equity in earnings of investees | 16,819 | 12,757 | ||||||||||||||||||

| Income tax expense | (63) | (63) | ||||||||||||||||||

| Equity in earnings of investees | 2,581 | — | ||||||||||||||||||

| Net income | 19,337 | 12,694 | ||||||||||||||||||

| Net loss attributable to noncontrolling interest | — | 152 | ||||||||||||||||||

| Net income attributable to common shareholders | $ | 19,337 | $ | 12,846 | ||||||||||||||||

| Weighted average common shares outstanding - basic | 65,139 | 65,075 | ||||||||||||||||||

| Weighted average common shares outstanding - diluted | 65,177 | 65,082 | ||||||||||||||||||

| Per common share data (basic and diluted): | ||||||||||||||||||||

Net income attributable to common shareholders | $ | 0.30 | $ | 0.20 | ||||||||||||||||

4

Industrial Logistics Properties Trust

Funds from Operations Attributable to Common Shareholders and Normalized Funds from Operations Attributable to Common Shareholders (1)

(amounts in thousands, except per share data)

(unaudited)

| Three Months Ended March 31, | |||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

| Net income attributable to common shareholders | $ | 19,337 | $ | 12,846 | |||||||||||||

| Depreciation and amortization | 12,678 | 18,290 | |||||||||||||||

| Equity in earnings of unconsolidated joint venture | (2,581) | — | |||||||||||||||

| Share of FFO from unconsolidated joint venture | 1,236 | — | |||||||||||||||

| FFO adjustments attributable to noncontrolling interest | — | (977) | |||||||||||||||

| FFO attributable to common shareholders and Normalized FFO attributable to common shareholders | 30,670 | 30,159 | |||||||||||||||

| Weighted average common shares outstanding - basic | 65,139 | 65,075 | |||||||||||||||

| Weighted average common shares outstanding - diluted | 65,177 | 65,082 | |||||||||||||||

| Per common share data (basic and diluted): | |||||||||||||||||

| FFO attributable to common shareholders and Normalized FFO attributable to common shareholders | $ | 0.47 | $ | 0.46 | |||||||||||||

| Distributions declared | $ | 0.33 | $ | 0.33 | |||||||||||||

(1) ILPT calculates FFO attributable to common shareholders and Normalized FFO attributable to common shareholders as shown above. FFO attributable to common shareholders is calculated on the basis defined by The National Association of Real Estate Investment Trusts, which is net income attributable to common shareholders, calculated in accordance with GAAP, excluding any gain or loss on sale of real estate and equity in earnings of an unconsolidated joint venture, plus real estate depreciation and amortization of consolidated properties and its proportionate share of FFO of unconsolidated joint venture properties and minus FFO adjustments attributable to noncontrolling interest, as well as certain other adjustments currently not applicable to ILPT. In calculating Normalized FFO attributable to common shareholders, ILPT adjusts for the items shown above including similar adjustments for ILPT’s unconsolidated joint venture, if any. FFO attributable to common shareholders and Normalized FFO attributable to common shareholders are among the factors considered by ILPT’s Board of Trustees when determining the amount of distributions to ILPT’s shareholders. Other factors include, but are not limited to, requirements to maintain ILPT’s qualification for taxation as a REIT, limitations in the agreements governing ILPT’s debt, the availability to ILPT of debt and equity capital, ILPT’s distribution rate as a percentage of the trading price of its common shares, or dividend yield, and ILPT’s dividend yield compared to the dividend yields of other industrial REITs, ILPT’s expectation of its future capital requirements and operating performance and ILPT’s expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders differently than ILPT does.

5

Industrial Logistics Properties Trust

Calculation and Reconciliation of Property Net Operating Income and Cash Basis Net Operating Income (1)

(dollars in thousands)

(unaudited)

| Three Months Ended March 31, | |||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

| Calculation of NOI and Cash Basis NOI: | |||||||||||||||||

| Rental income | $ | 54,217 | $ | 64,278 | |||||||||||||

| Real estate taxes | (7,247) | (8,811) | |||||||||||||||

| Other operating expenses | (4,976) | (5,181) | |||||||||||||||

| NOI | 41,994 | 50,286 | |||||||||||||||

Non-cash straight line rent adjustments included in rental income | (2,044) | (1,967) | |||||||||||||||

| Lease value amortization included in rental income | (180) | (200) | |||||||||||||||

| Lease termination fees included in rental income | (507) | — | |||||||||||||||

| Cash Basis NOI | $ | 39,263 | $ | 48,119 | |||||||||||||

| Reconciliation of Net Income to NOI and Cash Basis NOI: | |||||||||||||||||

| Net income | $ | 19,337 | $ | 12,694 | |||||||||||||

| Equity in earnings of investees | (2,581) | — | |||||||||||||||

| Income tax expense | 63 | 63 | |||||||||||||||

| Income before income tax expense and equity in earnings of investees | 16,819 | 12,757 | |||||||||||||||

| Interest expense | 8,741 | 14,519 | |||||||||||||||

| Interest income | — | (111) | |||||||||||||||

| General and administrative | 3,756 | 4,831 | |||||||||||||||

| Depreciation and amortization | 12,678 | 18,290 | |||||||||||||||

| NOI | 41,994 | 50,286 | |||||||||||||||

Non-cash straight line rent adjustments included in rental income | (2,044) | (1,967) | |||||||||||||||

| Lease value amortization included in rental income | (180) | (200) | |||||||||||||||

| Lease termination fees included in rental income | (507) | — | |||||||||||||||

| Cash Basis NOI | $ | 39,263 | $ | 48,119 | |||||||||||||

(1) The calculations of NOI and Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to ILPT’s property level results of operations. ILPT calculates NOI and Cash Basis NOI as shown above. ILPT defines NOI as income from its rental of real estate less its property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that ILPT records as depreciation and amortization expense. ILPT defines Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization and lease termination fees, if any. ILPT uses NOI and Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate NOI and Cash Basis NOI differently than ILPT does.

6

Industrial Logistics Properties Trust

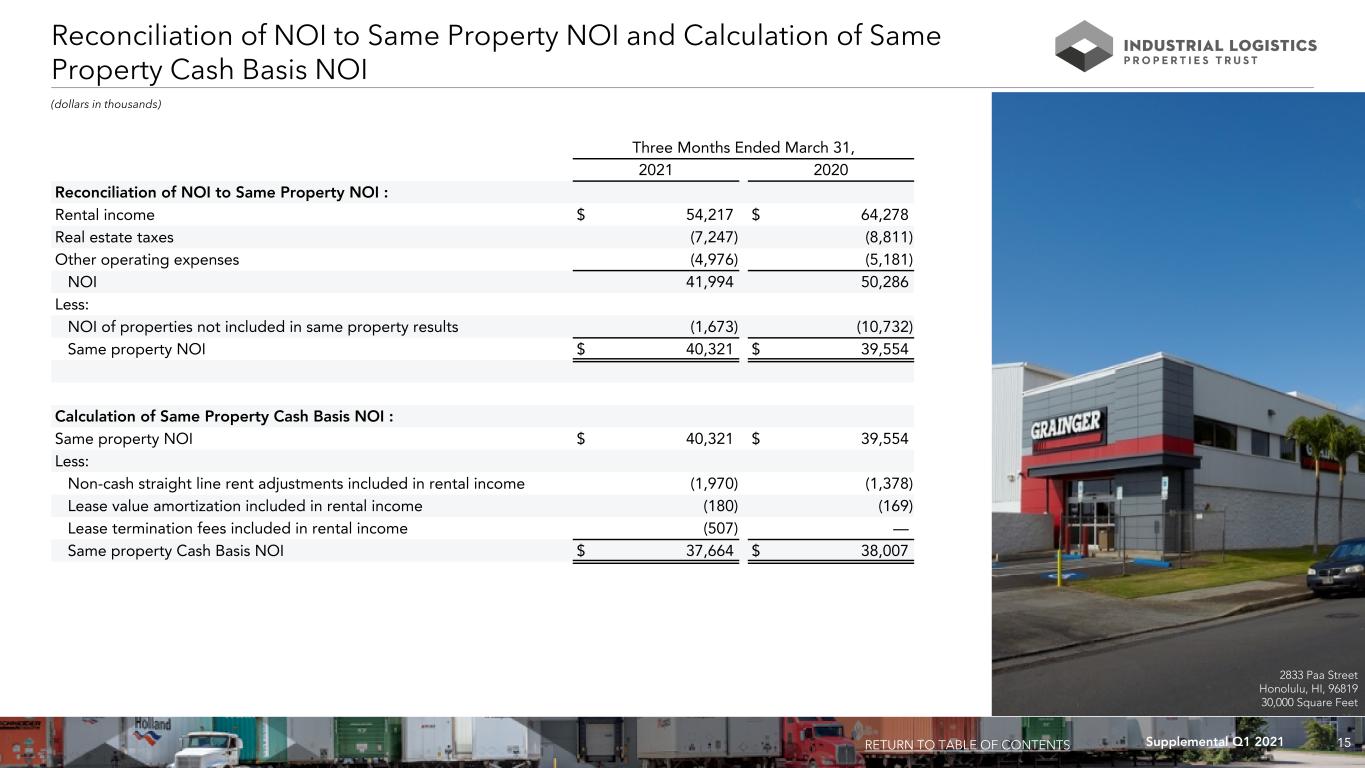

Reconciliation of Net Operating Income to Same Property Net Operating Income and Calculation of Same

1

Property Cash Basis Net Operating Income (1)

(dollars in thousands)

(unaudited)

| Three Months Ended March 31, | |||||||||||||||||

| 2021 | 2020 | ||||||||||||||||

Reconciliation of NOI to Same Property NOI (2): | |||||||||||||||||

| Rental income | $ | 54,217 | $ | 64,278 | |||||||||||||

| Real estate taxes | (7,247) | (8,811) | |||||||||||||||

| Other operating expenses | (4,976) | (5,181) | |||||||||||||||

| NOI | 41,994 | 50,286 | |||||||||||||||

| Less: | |||||||||||||||||

| NOI of properties not included in same property results | (1,673) | (10,732) | |||||||||||||||

| Same property NOI | $ | 40,321 | $ | 39,554 | |||||||||||||

Calculation of Same Property Cash Basis NOI (2): | |||||||||||||||||

| Same property NOI | $ | 40,321 | $ | 39,554 | |||||||||||||

| Less: | |||||||||||||||||

Non-cash straight line rent adjustments included in rental income | (1,970) | (1,378) | |||||||||||||||

| Lease value amortization included in rental income | (180) | (169) | |||||||||||||||

| Lease termination fees included in rental income | (507) | — | |||||||||||||||

| Same property Cash Basis NOI | $ | 37,664 | $ | 38,007 | |||||||||||||

(1)See footnote (1) on page 6 of this press release for the definitions of NOI and Cash Basis NOI and page 3 for a description of why ILPT believes they are appropriate supplemental measures and a description of how ILPT uses these measures.

(2)For the three months ended March 31, 2021 and 2020, same property NOI and same property Cash Basis NOI are based on properties that ILPT owned as of March 31, 2021 and that it owned continuously since January 1, 2020 and exclude 12 properties owned by an unconsolidated joint venture in which ILPT owns a 22% interest.

7

Industrial Logistics Properties Trust

Condensed Consolidated Balance Sheets

(dollars in thousands, except per share data)

(unaudited)

| March 31, | December 31, | |||||||||||||

| 2021 | 2020 | |||||||||||||

| ASSETS | ||||||||||||||

| Real estate properties: | ||||||||||||||

| Land | $ | 709,099 | $ | 709,099 | ||||||||||

| Buildings and improvements | 1,100,183 | 1,099,971 | ||||||||||||

| Total real estate properties, gross | 1,809,282 | 1,809,070 | ||||||||||||

| Accumulated depreciation | (149,003) | (141,406) | ||||||||||||

| Total real estate properties, net | 1,660,279 | 1,667,664 | ||||||||||||

| Investment in unconsolidated joint venture | 62,511 | 60,590 | ||||||||||||

| Acquired real estate leases, net | 78,394 | 83,644 | ||||||||||||

| Cash and cash equivalents | 26,147 | 22,834 | ||||||||||||

| Rents receivable, including straight line rents of $64,797 and $62,753, respectively | 70,411 | 69,511 | ||||||||||||

| Deferred leasing costs, net | 5,208 | 4,595 | ||||||||||||

| Debt issuance costs, net | 1,108 | 1,477 | ||||||||||||

| Due from related persons | 1,409 | 2,665 | ||||||||||||

| Other assets, net | 3,552 | 2,765 | ||||||||||||

| Total assets | $ | 1,909,019 | $ | 1,915,745 | ||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||||

| Revolving credit facility | $ | 217,000 | $ | 221,000 | ||||||||||

| Mortgage notes payable, net | 645,715 | 645,579 | ||||||||||||

| Assumed real estate lease obligations, net | 14,053 | 14,630 | ||||||||||||

| Accounts payable and other liabilities | 14,720 | 14,716 | ||||||||||||

| Rents collected in advance | 7,522 | 7,811 | ||||||||||||

| Security deposits | 6,569 | 6,540 | ||||||||||||

| Due to related persons | 2,224 | 2,279 | ||||||||||||

| Total liabilities | 907,803 | 912,555 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

| Shareholders' Equity: | ||||||||||||||

Common shares of beneficial interest, $.01 par value: 100,000,000 shares authorized; 65,301,088 shares issued and outstanding for both periods presented | 653 | 653 | ||||||||||||

| Additional paid in capital | 1,011,058 | 1,010,819 | ||||||||||||

| Cumulative net income | 243,563 | 224,226 | ||||||||||||

| Cumulative common distributions | (254,058) | (232,508) | ||||||||||||

| Total shareholders' equity | 1,001,216 | 1,003,190 | ||||||||||||

| Total liabilities and shareholders' equity | $ | 1,909,019 | $ | 1,915,745 | ||||||||||

8

Warning Concerning Forward-Looking Statements

This press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever ILPT uses words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, ILPT is making forward-looking statements. These forward-looking statements are based upon ILPT’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by ILPT’s forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond ILPT’s control. For example:

•Mr. Murray’s statement that this quarter’s results reflect growth in Normalized FFO and strong leasing activity and occupancy may imply that ILPT will achieve similar or better results in the future. However, ILPT’s business is subject to various risks, and leasing activity and occupancy depend on various factors, including the timing for when existing leases expire, leasing demand for ILPT’s properties, ILPT’s ability to successfully compete for tenants and other economic and market conditions, including pandemics. As a result, ILPT may not achieve similar or better results in the future, and these results may worsen,

•Mr. Murray refers to progress ILPT made toward its goal of entering new or renewal leases for its Hawaii property leases that are expiring next year. However, ILPT may not continue to realize progress on this goal and it may not achieve it. Further, any new or renewed leases it may enter may not be on terms as favorable to ILPT as those of the expiring leases,

•Mr. Murray states that ILPT agreed to purchase a newly built 358,000 square foot property in Columbus, Ohio and that the property includes excess land that can support future expansion of 100,000 square feet. This acquisition is subject to conditions. These conditions may not be met and this acquisition may not occur or may be delayed or the terms may change. Further, ILPT may not seek to expand this property if it completes this acquisition and any expansion it may pursue may cost more and take longer than it expects and ILPT may not realize the returns it may expect from any such expansion, and

•Mr. Murray states that ILPT has a pipeline of attractive investment opportunities, capacity to fund growth with more than $550 million of liquidity and moderate leverage, and that ILPT’s dividend remains well covered. However, ILPT may not be successful in entering into agreements to acquire or to complete any acquisitions for those investment opportunities. Further, ILPT may increase its leverage in the future and, if its operating results deteriorate, or if ILPT applies its available cash for other uses that do not generate expected or favorable returns, the coverage of its dividend may decline. ILPT’s distribution rates are set and reset from time to time by ILPT’s Board of Trustees. ILPT’s Board of Trustees considers many factors when setting distribution rates, including ILPT’s FFO attributable to common shareholders, its Normalized FFO attributable to common shareholders, requirements to maintain its qualification for taxation as a REIT, limitations in the agreements governing its debt, the availability to it of debt and equity capital, its dividend yield and its dividend yield compared to the dividend yields of other industrial REITs, its expectation of its future capital

9

requirements and operating performance, its expected needs for and availability of cash to pay its obligations and other factors deemed relevant by ILPT’s Board of Trustees in its discretion. Accordingly, future distributions to ILPT’s shareholders may be increased or decreased and ILPT cannot be sure as to the rate at which future distributions will be paid.

The information contained in ILPT’s filings with the SEC, including under “Risk Factors” in ILPT’s periodic reports, or incorporated therein, identifies important factors that could cause ILPT’s actual results to differ materially from those stated in or implied by ILPT’s forward-looking statements. ILPT’s filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue reliance upon forward-looking statements.

Except as required by law, ILPT does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

| Contact: | |||||

| Kevin Barry, Manager, Investor Relations | |||||

| (617) 658-0776 | |||||

(END)

10

1 Supplemental Operating and Financial Data ALL AMOUNTS IN THIS REPORT ARE UNAUDITED. FIRST QUARTER 2021 Exhibit 99.2 510 John Dodd Road Spartanburg, SC, 29303 1,015,740 Square Feet

2Supplemental Q1 2021 CORPORATE INFORMATION Company Profile................................................................................................................................................................................................ 3 Investor Information........................................................................................................................................................................................... 4 Equity Research Coverage................................................................................................................................................................................. 5 FINANCIALS Key Financial Data............................................................................................................................................................................................. 6 Condensed Consolidated Balance Sheets......................................................................................................................................................... 7 Condensed Consolidated Statements of Income.............................................................................................................................................. 8 Debt Summary and Maturity Schedule.............................................................................................................................................................. 9 Leverage Ratios and Coverage Ratios............................................................................................................................................................... 10 Capital Expenditures Summary......................................................................................................................................................................... 11 Property Acquisitions and Dispositions Information Since 1/1/21.................................................................................................................... 12 Unconsolidated Joint Venture........................................................................................................................................................................... 13 Calculation and Reconciliation of NOI and Cash Basis NOI.............................................................................................................................. 14 Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI................................................................... 15 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre.............................................................................................................................. 16 Calculation of FFO Attributable to Common Shareholders and Normalized FFO Attributable to Common Shareholders............................ 17 PORTFOLIO INFORMATION Portfolio Summary by Property Type................................................................................................................................................................ 18 Same Property Results of Operations by Property Type.................................................................................................................................. 19-20 Occupancy and Leasing Summary..................................................................................................................................................................... 21 Occupancy and Leasing Analysis by Property Type.......................................................................................................................................... 22 Tenant Credit Characteristics............................................................................................................................................................................ 23 Tenants Representing 1% or More of Total Annualized Rental Revenues........................................................................................................ 24 Five Year Lease Expiration and Reset Schedule by Property Type................................................................................................................... 25 Portfolio Lease Expiration Schedule.................................................................................................................................................................. 26 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS......................................................................................................................... 27-28 WARNING CONCERNING FORWARD-LOOKING STATEMENTS............................................................................................................................. 29 Table of Contents Please refer to the Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document.

3Supplemental Q1 2021 Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634 (t) (617) 219-1460 Stock Exchange Listing: Nasdaq Trading Symbol: Common Shares: ILPT The Company: Industrial Logistics Properties Trust, or ILPT, we, our or us, is a real estate investment trust, or REIT, that owns and leases industrial and logistics properties throughout the United States. As of March 31, 2021, our portfolio was comprised of 289 wholly owned properties containing approximately 34.9 million rentable square feet located in 31 states, including 226 buildings, leasable land parcels and easements containing approximately 16.8 million rentable square feet that are primarily industrial lands located on the island of Oahu, HI, and 63 properties containing approximately 18.1 million rentable square feet located in 30 other states. As of March 31, 2021, we also owned a 22% equity interest in an unconsolidated joint venture, which owns 12 properties located in nine states containing approximately 9.2 million rentable square feet. ILPT is a component of 140 market indices and it comprises more than 1% of the following indices as of March 31, 2021: Invesco S&P SmallCap High Dividend Low Volatility ETF INAV Index (XSHDIV), Invesco KBW Premium Yield Equity REIT ETF INAV Index (KBWYIV), Invesco S&P SmallCap Low Volatility ETF INAV Index (XSLVIV), Invesco S&P SmallCap Financials ETF INAV Index (PSCFIV) and the Bloomberg Reit Industrial/Warehouse Index (BBREINDW). Management: ILPT is managed by The RMR Group LLC, or RMR LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of March 31, 2021, RMR had $31.8 billion of real estate assets under management and the combined RMR managed companies had approximately $10 billion of annual revenues, nearly 2,100 properties and approximately 43,000 employees. We believe that being managed by RMR is a competitive advantage for ILPT because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at a lower cost than we would have to pay for similar quality services if we were self managed. Key Data (as of and for the three months ended March 31, 2021): (dollars and sq. ft. in thousands) Total properties 289 Total sq. ft. 34,870 Percent leased 98.6% Q1 2021 Rental income $ 54,217 Q1 2021 Net income attributable to common shareholders $ 19,337 Q1 2021 Normalized FFO attributable to common shareholders $ 30,670 Company Profile RETURN TO TABLE OF CONTENTS

4Supplemental Q1 2021 Investor Information Board of Trustees Bruce M. Gans Lisa Harris Jones Joseph L. Morea Lead Independent Trustee Independent Trustee Independent Trustee John G. Murray Kevin C. Phelan Adam D. Portnoy Managing Trustee Independent Trustee Chair of the Board & Managing Trustee Executive Officers John G. Murray Richard W. Siedel, Jr. Yael Duffy President and Chief Executive Officer Chief Financial Officer and Treasurer Chief Operating Officer and Vice President Contact Information Investor Relations Inquiries Industrial Logistics Properties Trust Financial, investor and media inquiries should be directed to Two Newton Place Kevin Barry, Manager, Investor Relations, 255 Washington Street, Suite 300 at (617) 658-0776 or [email protected]. Newton, MA 02458-1634 (t) (617) 219-1460 (email) [email protected] (website) www.ilptreit.com RETURN TO TABLE OF CONTENTS

5Supplemental Q1 2021 ILPT is followed by the analysts listed here. Please note that any opinions, estimates or forecasts regarding ILPT’s performance made by these analysts do not represent opinions, forecasts or predictions of ILPT or its management. ILPT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Equity Research Coverage B. Riley Securities, Inc. JMP Securities Bryan Maher Aaron Hecht [email protected] [email protected] (646) 885-5423 (415) 835-3963 BofA Securities RBC Capital Markets James Feldman Michael Carroll [email protected] [email protected] (646) 855-5808 (440) 715-2649 BTIG Thomas Catherwood [email protected] (212) 738-6140 RETURN TO TABLE OF CONTENTS

6Supplemental Q1 2021 (dollars in thousands, except per share data) As of and For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Selected Balance Sheet Data: Total gross assets $ 2,058,022 $ 2,057,151 $ 2,659,564 $ 2,659,579 $ 2,654,807 Total assets $ 1,909,019 $ 1,915,745 $ 2,498,994 $ 2,505,600 $ 2,512,320 Total liabilities $ 907,803 $ 912,555 $ 1,421,571 $ 1,418,989 $ 1,417,498 Total equity $ 1,001,216 $ 1,003,190 $ 1,077,423 $ 1,086,611 $ 1,094,822 Selected Income Statement Data: Rental income $ 54,217 $ 60,081 $ 65,106 $ 65,110 $ 64,278 Net income $ 19,337 $ 40,140 $ 13,814 $ 14,557 $ 12,694 Net income attributable to common shareholders $ 19,337 $ 40,315 $ 14,089 $ 14,821 $ 12,846 NOI $ 41,994 $ 46,659 $ 50,559 $ 51,137 $ 50,286 Adjusted EBITDAre $ 40,502 $ 43,554 $ 46,051 $ 46,947 $ 45,892 FFO attributable to common shareholders $ 30,670 $ 30,177 $ 29,939 $ 30,689 $ 30,159 Normalized FFO attributable to common shareholders $ 30,670 $ 30,199 $ 30,117 $ 30,569 $ 30,159 Per Common Share Data (basic and diluted): Net income attributable to common shareholders $ 0.30 $ 0.62 $ 0.22 $ 0.23 $ 0.20 FFO attributable to common shareholders and Normalized FFO attributable to common shareholders $ 0.47 $ 0.46 $ 0.46 $ 0.47 $ 0.46 Dividends: Annualized dividends paid per share $ 1.32 $ 1.32 $ 1.32 $ 1.32 $ 1.32 Annualized dividend yield (at end of period) 5.7% 5.7% 6.0% 6.4% 7.5% Normalized FFO attributable to common shareholders payout ratio 70.2% 71.7% 71.7% 70.2% 71.7% Key Financial Data RETURN TO TABLE OF CONTENTS 200 Orange Point Drive, Lewis Center, OH, 43035 125,060 Square Feet

7Supplemental Q1 2021 Condensed Consolidated Balance Sheets March 31, December 31, 2021 2020 ASSETS Real estate properties: Land $ 709,099 $ 709,099 Buildings and improvements 1,100,183 1,099,971 Total real estate properties, gross 1,809,282 1,809,070 Accumulated depreciation (149,003) (141,406) Total real estate properties, net 1,660,279 1,667,664 Investment in unconsolidated joint venture 62,511 60,590 Acquired real estate leases, net 78,394 83,644 Cash and cash equivalents 26,147 22,834 Rents receivable, including straight line rents of $64,797 and $62,753, respectively 70,411 69,511 Deferred leasing costs, net 5,208 4,595 Debt issuance costs, net 1,108 1,477 Due from related persons 1,409 2,665 Other assets, net 3,552 2,765 Total assets $ 1,909,019 $ 1,915,745 LIABILITIES AND SHAREHOLDERS' EQUITY Revolving credit facility $ 217,000 $ 221,000 Mortgage notes payable, net 645,715 645,579 Assumed real estate lease obligations, net 14,053 14,630 Accounts payable and other liabilities 14,720 14,716 Rents collected in advance 7,522 7,811 Security deposits 6,569 6,540 Due to related persons 2,224 2,279 Total liabilities 907,803 912,555 Commitments and contingencies Shareholders' Equity: Common shares of beneficial interest, $.01 par value: 100,000,000 shares authorized; 65,301,088 shares issued and outstanding for both periods presented 653 653 Additional paid in capital 1,011,058 1,010,819 Cumulative net income 243,563 224,226 Cumulative common distributions (254,058) (232,508) Total shareholders' equity 1,001,216 1,003,190 Total liabilities and shareholders' equity $ 1,909,019 $ 1,915,745 (dollars in thousands, except per share data) RETURN TO TABLE OF CONTENTS 4000 Principio Parkway North East, MD, 21901 1,194,744 Square Feet

8Supplemental Q1 2021 Condensed Consolidated Statements of Income Three Months Ended March 31, 2021 2020 Rental income $ 54,217 $ 64,278 Expenses: Real estate taxes 7,247 8,811 Other operating expenses 4,976 5,181 Depreciation and amortization 12,678 18,290 General and administrative 3,756 4,831 Total expenses 28,657 37,113 Interest income — 111 Interest expense (including net amortization of debt issuance costs, premiums and discounts of $505 and $586, respectively) (8,741) (14,519) Income before income tax expense and equity in earnings of investees 16,819 12,757 Income tax expense (63) (63) Equity in earnings of investees 2,581 — Net income 19,337 12,694 Net loss attributable to noncontrolling interest — 152 Net income attributable to common shareholders $ 19,337 $ 12,846 Weighted average common shares outstanding - basic 65,139 65,075 Weighted average common shares outstanding - diluted 65,177 65,082 Per common share data (basic and diluted): Net income attributable to common shareholders $ 0.30 $ 0.20 Additional Data: General and administrative expenses / total assets (at end of period) 0.2% 0.2% Non-cash straight line rent adjustments included in rental income $ 2,044 $ 1,967 Lease value amortization included in rental income $ 180 $ 200 Lease termination fees included in rental income $ 507 $ — (amounts in thousands, except percentage data and per share data) RETURN TO TABLE OF CONTENTS 1095 South 4800 West Salt Lake City, UT, 84104 150,300 Square Feet 1230 West 171st Street Harvey, IL, 60426 40,410 Square Feet 7121 South Fifth Avenue Pocatello , ID, 83204 33,394 Square Feet

9Supplemental Q1 2021 (1) Principal balance excludes unamortized debt issuance costs related to these debts. Total debt outstanding as of March 31, 2021, including unamortized debt issuance costs totaling $4,285, was $862,715. (2) We have a revolving credit facility which has a maturity date of December 29, 2021. This revolving credit facility requires interest to be paid at a rate of LIBOR plus a premium and imposes a commitment fee. The interest rate premium is subject to adjustment based on changes to our leverage ratio. The commitment fee is based on the unused portion of our revolving credit facility and was 25 basis points per annum as of March 31, 2021. We have the option to extend the maturity date of our revolving credit facility for two, six month periods, subject to payment of extension fees and satisfaction of other conditions. Principal balance represents the amount outstanding under our revolving credit facility at March 31, 2021. Interest rate is as of March 31, 2021 and excludes the commitment fee. The maximum borrowing availability under our revolving credit facility may be increased up to $1,500,000 in certain circumstances. Interest Principal Maturity Due at Years to Rate Balance (1) Date Maturity Maturity Unsecured Floating Rate Debt: $750,000 revolving credit facility (2) 1.410% $ 217,000 12/29/2021 $ 217,000 0.7 Secured Fixed Rate Debt: 186 properties in Hawaii 4.310% 650,000 2/7/2029 650,000 7.9 Total / weighted average debt 3.584% $ 867,000 $ 867,000 6.1 Debt Summary and Maturity Schedule RETURN TO TABLE OF CONTENTS (dollars in thousands) As of March 31, 2021 $ (T h o u sa n d s) $217,000 $650,000 Revolving Credit Facility Secured Fixed Rate 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 $0 $250,000 $500,000 $750,000 (2)

10Supplemental Q1 2021 As of and For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Leverage Ratios: Net debt / total gross assets 40.9% 41.2% 50.3% 50.5% 50.9% Net debt / gross book value of real estate assets 42.8% 43.2% 51.5% 51.5% 51.8% Net debt / total market capitalization 35.4% 35.5% 47.7% 49.5% 53.7% Secured debt / total assets 34.0% 33.9% 42.3% 42.2% 44.0% Variable rate debt / net debt 25.8% 26.1% 23.9% 23.8% 19.6% Coverage Ratios: Net debt / annualized Adjusted EBITDAre 5.2x 4.9x 7.3x 7.2x 7.4x Adjusted EBITDAre / interest expense 4.6x 4.0x 3.6x 3.6x 3.2x Leverage Ratios and Coverage Ratios RETURN TO TABLE OF CONTENTS

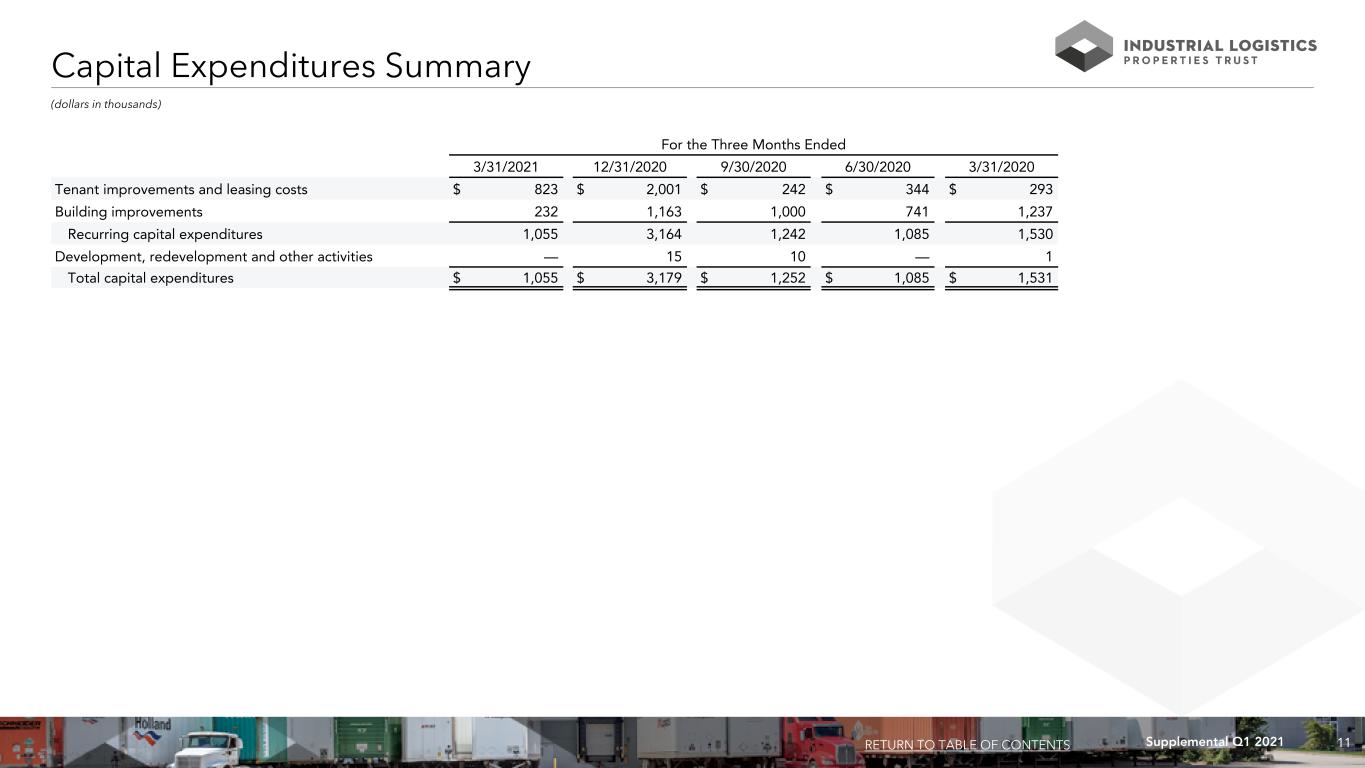

11Supplemental Q1 2021 (dollars in thousands) For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Tenant improvements and leasing costs $ 823 $ 2,001 $ 242 $ 344 $ 293 Building improvements 232 1,163 1,000 741 1,237 Recurring capital expenditures 1,055 3,164 1,242 1,085 1,530 Development, redevelopment and other activities — 15 10 — 1 Total capital expenditures $ 1,055 $ 3,179 $ 1,252 $ 1,085 $ 1,531 Capital Expenditures Summary RETURN TO TABLE OF CONTENTS

12Supplemental Q1 2021 Property Acquisitions and Dispositions Information Since 1/1/2021 (dollars and sq. ft. in thousands, except per sq. ft. data) Acquisitions: Dispositions: RETURN TO TABLE OF CONTENTS We have not acquired any properties since January 1, 2021. We have not disposed any properties since January 1, 2021.

13Supplemental Q1 2021 Unconsolidated Joint Venture (dollars and sq. ft. in thousands) Investment in Unconsolidated Joint Venture: ILPT Weighted Average ILPT Carrying Value at Number of Number of Square Occupancy at Lease Term at Joint Venture Ownership March 31, 2021 Properties States Feet March 31, 2021 March 31, 2021 (1) The Industrial Fund REIT LLC 22% $ 62,511 12 9 9,227 100% 8.0 (1) Lease term is weighted based on annualized rental income. Annualized rental income is calculated using the annualized contractual base rents from the joint venture's tenants pursuant to the lease agreements as of March 31, 2021, plus straight line rent adjustments and estimated recurring expense reimbursements to be paid to the joint venture by their tenants, and excluding lease value amortization. (2) The mortgage loans require interest-only payments until the respective maturity dates. (3) Includes the interest rate stated in, or determined pursuant to, the contract terms. (4) Reflects the entire balance of the debt secured by the respective properties. (5) Reflects our proportionate share of the principal debt balances based on our ownership percentage of the joint venture as of March 31, 2021; none of the debt is recourse to us. Unconsolidated Debt: Coupon Interest Maturity Principal Balance ILPT ILPT Share of Principal Balance (5) Secured Debt(2) Rate (3) Date at March 31, 2021 (4) Ownership at March 31, 2021 1 Property 3.600% 10/1/2023 $ 56,980 22% $ 12,536 11 Properties 3.330% 11/7/2029 350,000 22% 77,000 Total / Weighted Average 3.368% $ 406,980 $ 89,536 Number of Leases Expiring 1 2 1 1 2 1 1 1 1 1 1 % of Total Annualized Rental Revenues Expiring 5.7% 12.1% 2.5% 11.8% 10.7% 3.1% 18.2% 18.4% 3.9% 5.9% 7.7% A nn ua liz ed R ev en ue E xp iri ng 2021 2024 2025 2026 2027 2028 2029 2030 2031 2034 2038 $0 $5,000 $10,000 $15,000 $20,000 Unconsolidated Joint Venture Lease Expiration Schedule As of March 31, 2021 RETURN TO TABLE OF CONTENTS

14Supplemental Q1 2021 Calculation and Reconciliation of NOI and Cash Basis NOI (dollars in thousands) For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Calculation of NOI and Cash Basis NOI: Rental income $ 54,217 $ 60,081 $ 65,106 $ 65,110 $ 64,278 Real estate taxes (7,247) (8,406) (9,036) (8,932) (8,811) Other operating expenses (4,976) (5,016) (5,511) (5,041) (5,181) NOI 41,994 46,659 50,559 51,137 50,286 Non-cash straight line rent adjustments included in rental income (2,044) (2,858) (2,120) (2,096) (1,967) Lease value amortization included in rental income (180) (185) (202) (204) (200) Lease termination fees included in rental income (507) — — — — Cash Basis NOI $ 39,263 $ 43,616 $ 48,237 $ 48,837 $ 48,119 Reconciliation of Net Income to NOI and Cash Basis NOI: Net income $ 19,337 $ 40,140 $ 13,814 $ 14,557 $ 12,694 Equity in earnings of investees (2,581) (529) — — — Income tax expense 63 75 13 126 63 Income before income tax expense and equity in earnings of investees 16,819 39,686 13,827 14,683 12,757 Gain on early extinguishment of debt — — — (120) — Interest expense 8,741 11,009 12,886 13,205 14,519 Interest income — — — (2) (111) Gain on sale of real estate — (23,996) — — — General and administrative 3,756 4,723 5,180 4,846 4,831 Acquisition and certain other transaction related costs — 22 178 — — Depreciation and amortization 12,678 15,215 18,488 18,525 18,290 NOI 41,994 46,659 50,559 51,137 50,286 Non-cash straight line rent adjustments included in rental income (2,044) (2,858) (2,120) (2,096) (1,967) Lease value amortization included in rental income (180) (185) (202) (204) (200) Lease termination fees included in rental income (507) — — — — Cash Basis NOI $ 39,263 $ 43,616 $ 48,237 $ 48,837 $ 48,119 RETURN TO TABLE OF CONTENTS 309 Dulty's Lane Burlington, NJ, 08016 633,836 Square Feet

15Supplemental Q1 2021 Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI (dollars in thousands) Three Months Ended March 31, 2021 2020 Reconciliation of NOI to Same Property NOI : Rental income $ 54,217 $ 64,278 Real estate taxes (7,247) (8,811) Other operating expenses (4,976) (5,181) NOI 41,994 50,286 Less: NOI of properties not included in same property results (1,673) (10,732) Same property NOI $ 40,321 $ 39,554 Calculation of Same Property Cash Basis NOI : Same property NOI $ 40,321 $ 39,554 Less: Non-cash straight line rent adjustments included in rental income (1,970) (1,378) Lease value amortization included in rental income (180) (169) Lease termination fees included in rental income (507) — Same property Cash Basis NOI $ 37,664 $ 38,007 RETURN TO TABLE OF CONTENTS 2833 Paa Street Honolulu, HI, 96819 30,000 Square Feet

16Supplemental Q1 2021 Calculation of EBITDA, EBITDAre, and Adjusted EBITDAre (dollars in thousands) For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Net income $ 19,337 $ 40,140 $ 13,814 $ 14,557 $ 12,694 Plus: interest expense 8,741 11,009 12,886 13,205 14,519 Plus: income tax expense 63 75 13 126 63 Plus: depreciation and amortization 12,678 15,215 18,488 18,525 18,290 EBITDA 40,819 66,439 45,201 46,413 45,566 Gain on sale of real estate — (23,996) — — — Equity in earnings of unconsolidated joint venture (2,581) (529) — — — Share of EBITDAre from unconsolidated joint venture 2,025 939 — — — EBITDAre 40,263 42,853 45,201 46,413 45,566 Plus: acquisition and certain other transaction related costs — 22 178 — — Plus: general and administrative expense paid in common shares (1) 239 679 672 654 326 Less: gain on early extinguishment of debt — — — (120) — Adjusted EBITDAre $ 40,502 $ 43,554 $ 46,051 $ 46,947 $ 45,892 (1) Amounts represent equity based compensation to our trustees, our officers and certain other employees of RMR LLC. RETURN TO TABLE OF CONTENTS

17Supplemental Q1 2021 Calculation of FFO Attributable to Common Shareholders and Normalized FFO Attributable to Common Shareholders (dollars and shares in thousands, except per share data) For the Three Months Ended 3/31/2021 12/31/2020 9/30/2020 6/30/2020 3/31/2020 Net income attributable to common shareholders $ 19,337 $ 40,315 $ 14,089 $ 14,821 $ 12,846 Depreciation and amortization 12,678 15,215 18,488 18,525 18,290 Equity in earnings of unconsolidated joint venture (2,581) (529) — — — Share of FFO from unconsolidated joint venture 1,236 556 — — — Gain on sale of real estate — (23,996) — — — FFO adjustments attributable to noncontrolling interest — (1,384) (2,638) (2,657) (977) FFO attributable to common shareholders 30,670 30,177 29,939 30,689 30,159 Acquisition and certain other transaction related costs — 22 178 — — Gain on early extinguishment of debt — — — (120) — Normalized FFO attributable to common shareholders $ 30,670 $ 30,199 $ 30,117 $ 30,569 $ 30,159 Weighted average common shares outstanding - basic 65,139 65,139 65,112 65,089 65,075 Weighted average common shares outstanding - diluted 65,177 65,152 65,129 65,091 65,082 Per Common Share Data (basic and diluted): Net income attributable to common shareholders $ 0.30 $ 0.62 $ 0.22 $ 0.23 $ 0.20 FFO attributable to common shareholders and Normalized FFO attributable to common shareholders $ 0.47 $ 0.46 $ 0.46 $ 0.47 $ 0.46 RETURN TO TABLE OF CONTENTS

18Supplemental Q1 2021 Portfolio Summary By Property Type (dollars and sq. ft. in thousands) (1) Includes buildings, leasable land parcels and easements which are primarily industrial lands located in Hawaii. As of and For the Three Months Ended March 31, 2021 Mainland Hawaii Key Statistic Properties Properties (1) Total Properties 63 226 289 Percent of total 21.8% 78.2% 100.0% Total square feet 18,114 16,756 34,870 Percent of total 51.9% 48.1% 100.0% Leased square feet 18,114 16,252 34,366 Percent leased 100.0% 97.0% 98.6% Rental income $ 26,982 $ 27,235 $ 54,217 Percent of total 49.8% 50.2% 100.0% NOI $ 22,002 $ 19,992 $ 41,994 Percent of total 52.4% 47.6% 100.0% Cash Basis NOI $ 21,276 $ 17,987 $ 39,263 Percent of total 54.2% 45.8% 100.0% RETURN TO TABLE OF CONTENTS

19Supplemental Q1 2021 (dollars and sq. ft. in thousands) As of and For the Three Months Ended 3/31/2021 3/31/2020 Properties: Mainland Properties 61 61 Hawaii Properties 226 226 Total 287 287 Square Feet (1): Mainland Properties 16,648 16,648 Hawaii Properties 16,756 16,756 Total 33,404 33,404 Percent Leased (2): Mainland Properties 100.0% 99.6% Hawaii Properties 97.0% 97.5% Total 98.5% 98.5% Rental income: Mainland Properties $ 24,946 $ 23,962 Hawaii Properties 27,235 26,396 Total $ 52,181 $ 50,358 (1) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. (2) Includes (i) space being fitted out for occupancy pursuant to existing leases, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. Same Property Results of Operations By Property Type RETURN TO TABLE OF CONTENTS

20Supplemental Q1 2021 As of and For the Three Months Ended 3/31/2021 3/31/2020 NOI: Mainland Properties $ 20,329 $ 20,037 Hawaii Properties 19,992 19,517 Total $ 40,321 $ 39,554 Cash Basis NOI: Mainland Properties $ 19,677 $ 19,624 Hawaii Properties 17,987 18,383 Total $ 37,664 $ 38,007 NOI % Change: Mainland Properties 1.5 % Hawaii Properties 2.4 % Total 1.9 % Cash Basis NOI % Change: Mainland Properties 0.3 % Hawaii Properties -2.2 % Total -0.9 % Same Property Results of Operations by Property Type (Cont.) (dollars in thousands) RETURN TO TABLE OF CONTENTS 1360 Pali Highway Honolulu, HI, 96813 126,733 Square Feet

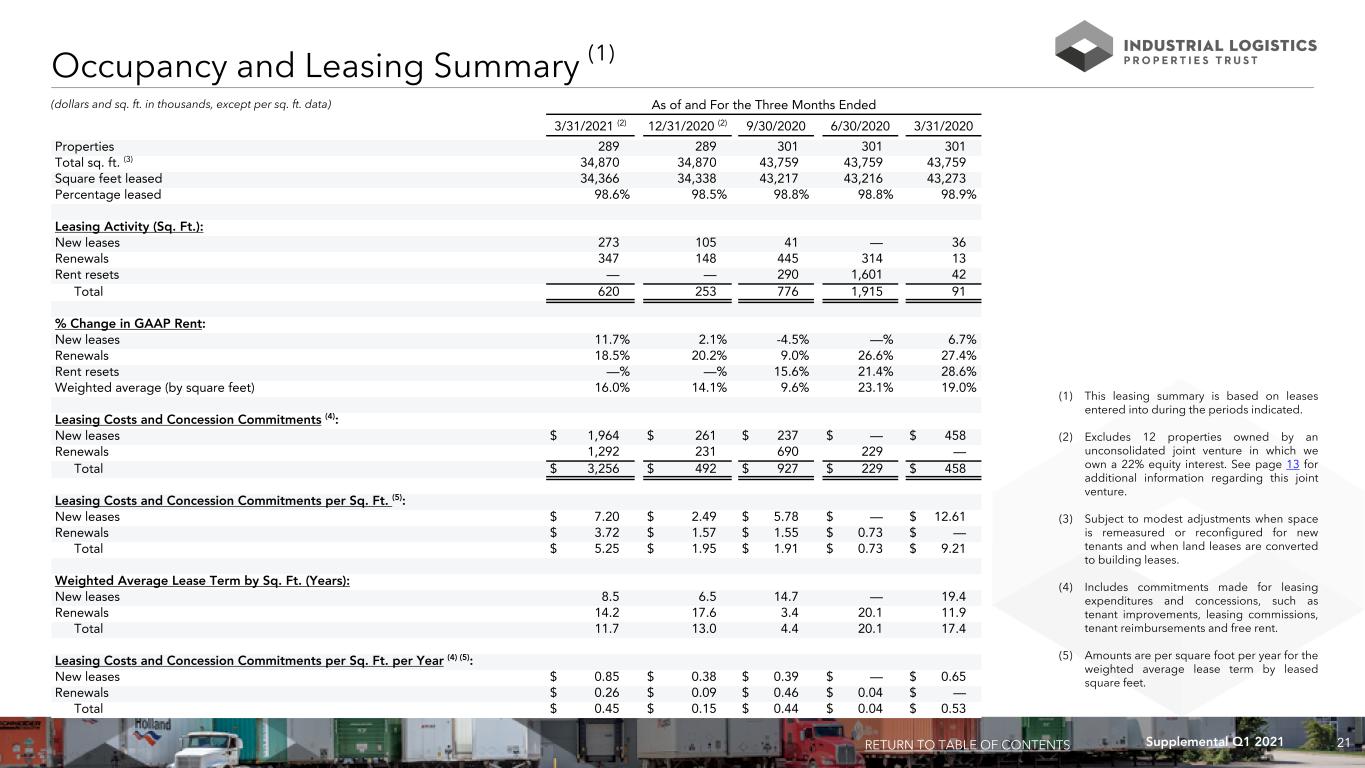

21Supplemental Q1 2021 (dollars and sq. ft. in thousands, except per sq. ft. data) As of and For the Three Months Ended 3/31/2021 (2) 12/31/2020 (2) 9/30/2020 6/30/2020 3/31/2020 Properties 289 289 301 301 301 Total sq. ft. (3) 34,870 34,870 43,759 43,759 43,759 Square feet leased 34,366 34,338 43,217 43,216 43,273 Percentage leased 98.6% 98.5% 98.8% 98.8% 98.9% Leasing Activity (Sq. Ft.): New leases 273 105 41 — 36 Renewals 347 148 445 314 13 Rent resets — — 290 1,601 42 Total 620 253 776 1,915 91 % Change in GAAP Rent: New leases 11.7% 2.1% -4.5% —% 6.7% Renewals 18.5% 20.2% 9.0% 26.6% 27.4% Rent resets —% —% 15.6% 21.4% 28.6% Weighted average (by square feet) 16.0% 14.1% 9.6% 23.1% 19.0% Leasing Costs and Concession Commitments (4): New leases $ 1,964 $ 261 $ 237 $ — $ 458 Renewals 1,292 231 690 229 — Total $ 3,256 $ 492 $ 927 $ 229 $ 458 Leasing Costs and Concession Commitments per Sq. Ft. (5): New leases $ 7.20 $ 2.49 $ 5.78 $ — $ 12.61 Renewals $ 3.72 $ 1.57 $ 1.55 $ 0.73 $ — Total $ 5.25 $ 1.95 $ 1.91 $ 0.73 $ 9.21 Weighted Average Lease Term by Sq. Ft. (Years): New leases 8.5 6.5 14.7 — 19.4 Renewals 14.2 17.6 3.4 20.1 11.9 Total 11.7 13.0 4.4 20.1 17.4 Leasing Costs and Concession Commitments per Sq. Ft. per Year (4) (5): New leases $ 0.85 $ 0.38 $ 0.39 $ — $ 0.65 Renewals $ 0.26 $ 0.09 $ 0.46 $ 0.04 $ — Total $ 0.45 $ 0.15 $ 0.44 $ 0.04 $ 0.53 (1) This leasing summary is based on leases entered into during the periods indicated. (2) Excludes 12 properties owned by an unconsolidated joint venture in which we own a 22% equity interest. See page 13 for additional information regarding this joint venture. (3) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. (4) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. (5) Amounts are per square foot per year for the weighted average lease term by leased square feet. Occupancy and Leasing Summary (1) RETURN TO TABLE OF CONTENTS

22Supplemental Q1 2021 Occupancy and Leasing Analysis by Property Type (sq. ft. in thousands) Sq. Ft. Leased New and As of 12/31/2020 Expired Renewal As of 3/31/2021 Property Type 12/31/2020 % Leased (2) Leases Leases 3/31/2021 % Leased Mainland Properties 18,055 99.7% (118) 177 18,114 100.0 % Hawaii Properties 16,283 97.2% (474) 443 16,252 97.0 % Total 34,338 98.5% (592) 620 34,366 98.6 % (1) Subject to modest adjustments when space is remeasured or reconfigured for new tenants and when land leases are converted to building leases. (2) Excludes effects of space remeasurements during the period, if any. Percent leased includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease by tenants, if any. RETURN TO TABLE OF CONTENTS Total Sq. Ft. (1) Sq. Ft. Leases Executed During As of the Three Months Ended 3/31/2021 Property Type 3/31/2021 New Renewals Total Mainland Properties 18,114 177 — 177 Hawaii Properties 16,756 96 347 443 Total 34,870 273 347 620

23Supplemental Q1 2021 As of March 31, 2021 Mainland Properties % of Annualized Rental Revenues Investment grade rated: 33.4% Subsidiaries of investment grade rated parent entities: 18.5% Other unrated or non-investment grade: 48.1% Investment grade rated: 23.4% Subsidiaries of investment grade rated parent entities: 10.3% Other leased Hawaii lands: 38.6% Other unrated or non-investment grade: 27.7% Consolidated Properties % of Annualized Rental Revenues % of Annualized Rental Revenues Mainland Tenant Credit Characteristics Properties Consolidated Investment grade rated 33.4% 23.4% Subsidiaries of investment grade rated parent entities 18.5% 10.3% Other leased Hawaii lands —% 38.6% Subtotal investment grade rated, subsidiaries of investment grade rated parent entities and other leased Hawaii lands 51.9% 72.3% Other unrated or non-investment grade 48.1% 27.7% 100.0% 100.0% Tenant Credit Characteristics RETURN TO TABLE OF CONTENTS

24Supplemental Q1 2021 % of Total No. of Leased % of Total Annualized Rental Tenant States Properties Sq. Ft. (1) Leased Sq. Ft. (1) Revenues 1 Amazon.com Services, Inc. AZ, SC, TN, VA 4 3,869 11.3% 10.0% 2 Federal Express Corporation / FedEx Ground Package System, Inc. AR, CO, HI, IA, ID, IL, MN, MO, NC, ND, NV, OH, OK, UT 17 952 2.8% 4.5% 3 Restoration Hardware, Inc. MD 1 1,195 3.5% 2.9% 4 American Tire Distributors, Inc. CO, LA, NE, NY, OH 5 722 2.1% 2.5% 5 Servco Pacific Inc. HI 6 590 1.7% 2.4% 6 UPS Supply Chain Solutions Inc. NH 1 614 1.8% 2.3% 7 Par Hawaii Refining, LLC HI 3 3,148 9.2% 2.3% 8 EF Transit, Inc. IN 1 535 1.6% 1.9% 9 BJ's Wholesale Club, Inc. NJ 1 634 1.8% 1.7% 10 Shurtech Brands, LLC OH 1 645 1.9% 1.6% 11 Coca-Cola Bottling of Hawaii, LLC HI 4 351 1.0% 1.6% 12 Safeway Inc. HI 2 146 0.4% 1.6% 13 ELC Distribution Center LLC KS 1 645 1.9% 1.5% 14 Manheim Remarketing, Inc. HI 1 338 1.0% 1.5% 15 Exel Inc. SC 1 945 2.8% 1.4% 16 Avnet, Inc. OH 1 581 1.7% 1.4% 17 Warehouse Rentals Inc. HI 5 278 0.8% 1.3% 18 YNAP Corporation NJ 1 167 0.5% 1.2% 19 ODW Logistics, Inc. OH 3 760 2.2% 1.1% 20 Honolulu Warehouse Co., Ltd. HI 1 298 0.9% 1.1% 21 Refresco Beverages US Inc. MO, SC 2 421 1.2% 1.1% 22 Hellmann Worldwide Logistics Inc. FL 1 240 0.7% 1.1% 23 AES Hawaii, Inc. HI 2 1,242 3.6% 1.0% 24 General Mills Operations, LLC MI 1 158 0.5% 1.0% 66 19,474 56.9% 50.0% Tenants Representing 1% or More of Total Annualized Rental Revenues RETURN TO TABLE OF CONTENTS As of March 31, 2021 (sq. ft. in thousands)

25Supplemental Q1 2021 2026 and Total 2021 2022 2023 2024 2025 Thereafter Mainland Properties Expirations: Total sq. ft. 18,114 Leased sq. ft. 18,114 222 716 2,230 3,928 2,158 8,860 Percent 1.2% 4.0% 12.3% 21.7% 11.9% 48.9% Annualized rental revenues $ 103,929 $ 1,230 $ 4,909 $ 14,416 $ 22,542 $ 11,831 $ 49,001 Percent 1.2% 4.7% 13.9% 21.7% 11.4% 47.1% Hawaii Properties Expirations: Total sq. ft. 16,756 Leased sq. ft. 16,252 100 1,967 345 2,781 206 10,853 Percent 0.6% 12.1% 2.1% 17.1% 1.3% 66.8% Annualized rental revenues $ 107,154 $ 935 $ 14,590 $ 2,455 $ 6,096 $ 1,325 $ 81,753 Percent 0.9% 13.6% 2.3% 5.7% 1.2% 76.3% Total Expirations: Total sq. ft. 34,870 Leased sq. ft. 34,366 322 2,683 2,575 6,709 2,364 19,713 Percent 0.9% 7.8% 7.5% 19.5% 6.9% 57.4% Annualized rental revenues $ 211,083 $ 2,165 $ 19,499 $ 16,871 $ 28,638 $ 13,156 $ 130,754 Percent 1.0% 9.2% 8.0% 13.6% 6.2% 62.0% Next Scheduled Rent Resets at Hawaii Properties: Reset sq. ft. 4,512 87 467 411 294 454 2,799 Percent (1) 0.5% 2.9% 2.5% 1.8% 2.8% 17.2% Annualized rental revenues $ 29,332 $ 701 $ 3,860 $ 2,535 $ 2,103 $ 3,115 $ 17,018 Percent (1) 0.7% 3.6% 2.4% 2.0% 2.9% 15.9% (1) Percent based on Hawaii Properties leased square feet and Hawaii Properties annualized rental revenues for Hawaii Properties. Five Year Lease Expiration and Reset Schedule by Property Type RETURN TO TABLE OF CONTENTS (dollars and sq. ft. in thousands) As of March 31, 2021

26Supplemental Q1 2021 Cumulative % of Total Cumulative % % of Total % of Total Leased Leased of Total Leased Annualized Annualized Annualized Number of Square Feet Square Feet Square Feet Rental Revenues Rental Revenues Rental Revenues Period / Year Tenants Expiring (1) Expiring (1) Expiring (1) Expiring Expiring Expiring 4/1/2021-12/31/2021 14 322 0.9% 0.9% $ 2,165 1.0% 1.0% 2022 60 2,683 7.8% 8.7% 19,499 9.2% 10.2% 2023 31 2,575 7.5% 16.2% 16,871 8.0% 18.2% 2024 31 6,709 19.5% 35.7% 28,638 13.6% 31.8% 2025 15 2,364 6.9% 42.6% 13,156 6.2% 38.0% 2026 7 1,028 3.0% 45.6% 7,121 3.4% 41.4% 2027 11 4,578 13.3% 58.9% 24,696 11.7% 53.1% 2028 20 2,459 7.2% 66.1% 17,881 8.5% 61.6% 2029 8 1,697 4.9% 71.0% 5,393 2.6% 64.2% 2030 9 1,232 3.6% 74.6% 9,516 4.5% 68.7% Thereafter 82 8,719 25.4% 100.0% 66,147 31.3% 100.0% Total 288 34,366 100.0% $ 211,083 100.0% Weighted average remaining lease term (in years) 8.3 9.4 Portfolio Lease Expiration Schedule RETURN TO TABLE OF CONTENTS (dollars and sq. ft. in thousands) As of March 31, 2021

27Supplemental Q1 2021 FFO and Normalized FFO Attributable to Common Shareholders: We calculate funds from operations, or FFO, attributable to common shareholders and Normalized FFO attributable to common shareholders as shown on page 17. FFO attributable to common shareholders is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income attributable to common shareholders, calculated in accordance with GAAP, excluding any gain or loss on sale of real estate and equity in earnings of an unconsolidated joint venture, plus real estate depreciation and amortization of consolidated properties and its proportionate share of FFO of unconsolidated joint venture properties and minus FFO adjustments attributable to noncontrolling interest, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO attributable to common shareholders, we adjust for the items shown on page 17 including similar adjustments for our unconsolidated joint venture, if any. FFO attributable to common shareholders and Normalized FFO attributable to common shareholders are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in the agreements governing our debt, the availability to us of debt and equity capital, our distribution rate as a percentage of the trading price of our common shares, or dividend yield, and our dividend yield compared to the dividend yields of other industrial REITs, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders differently than we do. Non-GAAP Financial Measures: We present certain “non-GAAP financial measures” within the meaning of applicable SEC rules, including FFO attributable to common shareholders, Normalized FFO attributable to common shareholders, EBITDA, EBITDAre, Adjusted EBITDAre, NOI and Cash Basis NOI. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income or net income attributable to common shareholders as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income and net income attributable to common shareholders as presented in our condensed consolidated statements of income. We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income and net income attributable to common shareholders. We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of our operating performance between periods and with other REITs and, in the case of NOI and Cash Basis NOI, reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of our properties. NOI and Cash Basis NOI: The calculations of net operating income, or NOI, and Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to our property level results of operations. We calculate NOI and Cash Basis NOI as shown on pages 14 and 15. We define NOI as income from our rental of real estate less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that we record as depreciation and amortization expense. We define Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization and lease termination fees, if any. We use NOI and Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate NOI and Cash Basis NOI differently than we do. Non-GAAP Financial Measures and Certain Definitions EBITDA, EBITDAre and Adjusted EBITDAre: We calculate earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 16. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, including our proportionate share of EBITDAre from unconsolidated joint venture properties, and excluding gains and losses on the sale of real estate, equity in earnings of an unconsolidated joint venture, loss on impairment of real estate assets, if any, as well as certain other adjustments currently not applicable to us. In calculating Adjusted EBITDAre, we adjust for the items shown on page 16 . Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. RETURN TO TABLE OF CONTENTS

28Supplemental Q1 2021 Non-GAAP Financial Measures and Certain Definitions (Cont.) Annualized dividend yield - Annualized dividend yield is the annualized dividend paid during the applicable period divided by the closing price of our common shares at the end of the relevant period. Annualized rental revenues - Annualized rental revenues is the annualized contractual rents, as of March 31, 2021, including straight line rent adjustments and excluding lease value amortization, adjusted for tenant concessions including free rent and amounts reimbursed to tenants, plus estimated recurring expense reimbursements from tenants. Building improvements - Building improvements generally include (i) expenditures to replace obsolete building components and (ii) expenditures that extend the useful life of existing assets. Development, redevelopment and other activities - Development, redevelopment and other activities generally include capital expenditures projects that (i) reposition a property or (ii) result in new sources of revenue. Gross book value of real estate assets - Gross book value of real estate assets is real estate assets at cost, plus certain acquisition related costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any. Leased square feet - Leased square feet is pursuant to existing leases as of March 31, 2021, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied, or is being offered for sublease by tenants, if any. Leasing costs - Leasing costs include leasing related costs, such as brokerage commissions and tenant inducements. Net debt - Net debt is total debt less cash. Percent change in GAAP rent - Percent change in GAAP rent is the percent change from prior rents charged for same space. Rents include estimated recurring expense reimbursements and exclude lease value amortization. References in this report to "same space" represent same land area and building area (with leasing rates for vacant space based upon the most recent rental rate for the same space). Same property - For the three months ended March 31, 2021 and 2020, same property NOI and Cash Basis NOI are based on properties that we owned as of March 31, 2021 and that we owned continuously since January 1, 2020, excluding 12 properties owned by an unconsolidated joint venture in which we own a 22% equity interest. Tenant improvements - Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space. Total gross assets - Total gross assets is total assets plus accumulated depreciation. Total market capitalization - Total market capitalization is total debt plus the market value of our common shares at the end of the applicable period. RETURN TO TABLE OF CONTENTS

29Supplemental Q1 2021 This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements RETURN TO TABLE OF CONTENTS

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- DiCello Levitt LLP Announces Investor Class Action Lawsuit Filed Against Perion Network Ltd. (Nasdaq: Peri) and Lead Plaintiff Deadline

- Guanajuato Silver Announces Brokered LIFE Offering of Units

- ROSEN, NATIONAL TRIAL LAWYERS, Encourages Northern Genesis Acquisition Corp. n/k/a The Lion Electric Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – NGA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share