Form 8-K CubeSmart, L.P. For: May 18 Filed by: CubeSmart

Exhibit 99.1

| New York City Portfolio Presentation May 2022 |

| Safe Harbor Statement The forward-looking statements contained in this presentation are subject to various risks and known and unknown uncertainties. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, there can be no assurance that the Company’s expectations will be achieved. Factors which could cause the Company’s actual results, performance, or achievements to differ significantly from the results, performance, or achievements expressed or implied by such statements are set forth under the captions “Item 1A. Risk Factors” and “Forward-Looking Statements” in our annual report on Form 10-K and in our quarterly reports on Form 10-Q and described from time to time in the Company’s filings with the SEC. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events. Use of Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures. The definitions of these terms, the reasons for their use, and reconciliations to the most directly comparable GAAP measures are included in our Earnings Release as well as the Non-GAAP Financial Measures section under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (or similar captionsin our annual report on Form 10-K and quarterly reports on Form 10-Q, and described from time to time in the Company’s filings with the SEC. 2 New York City Portfolio Presentation |

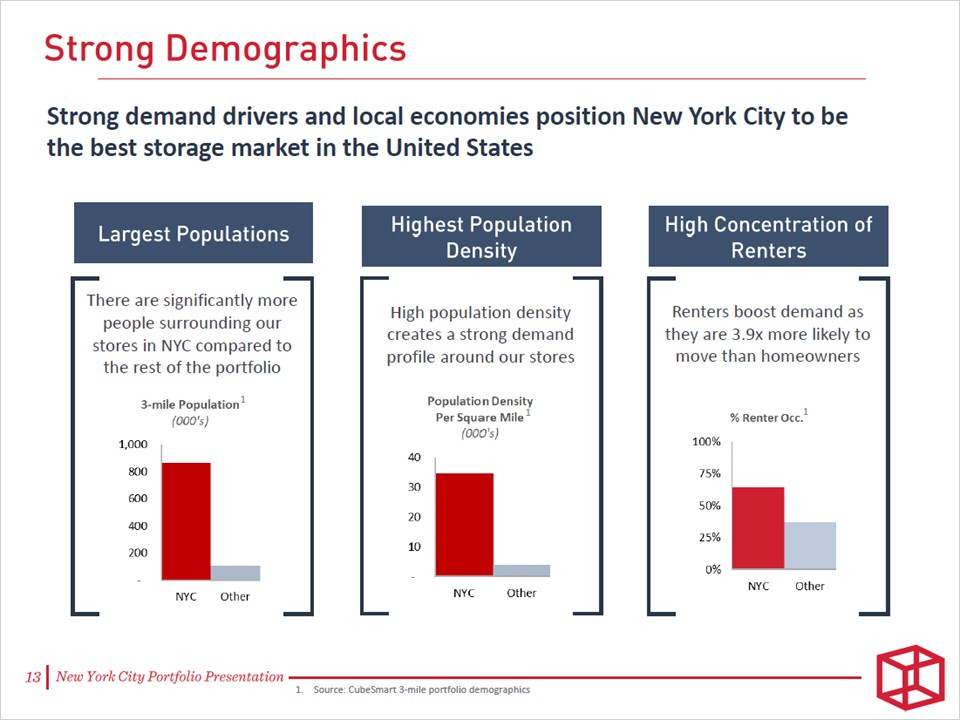

| CubeSmart’s New York City Strategy CUBE remains uniquely positioned to outperform in the country’s strongest self-storage market Market Leader • The scale of our portfolio in both New York City and the surrounding suburbs creates competitive advantages Vibrant Demographics • New York City is the strongest self storage market in the world, as the unique market demographics support outsized cash flows Advantageous Supply-Demand Characteristics • New York City continues to have the lowest square feet of storage per capita, even accounting for recent development deliveries • New ICAP legislation should limit future supply Positive Recent Trends • New York City has performed well over the last year, as occupancies are at all-time highs and rates continue to grow 3 New York City Portfolio Presentation |

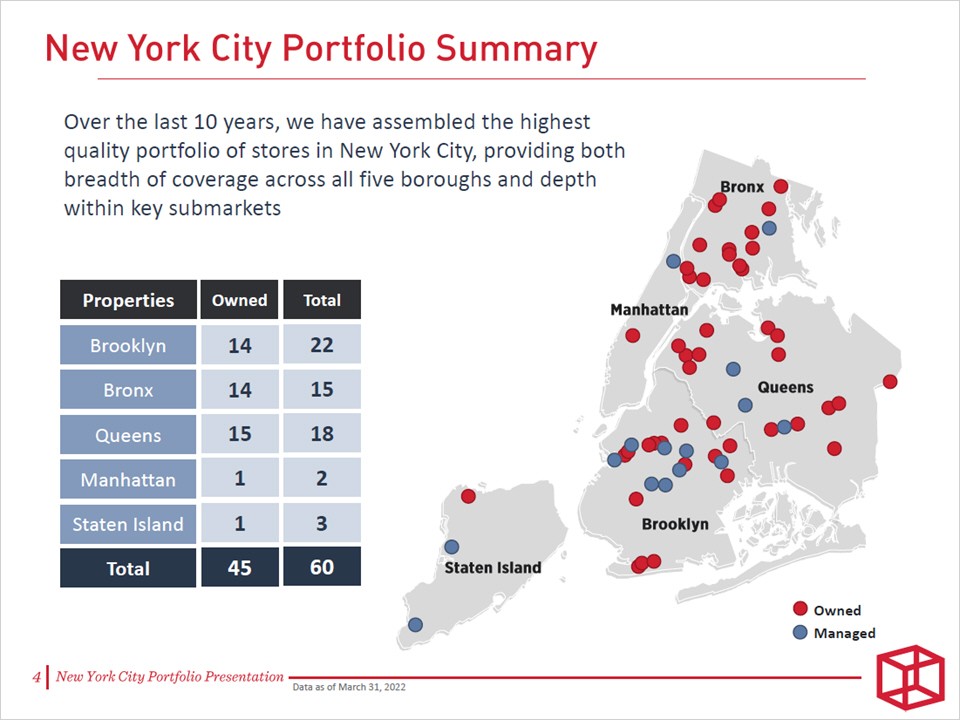

| New York City Portfolio Summary Brooklyn Bronx Queens Manhattan Staten Island 14 14 15 1 1 Total 45 Over the last 10 years, we have assembled the highest quality portfolio of stores in New York City, providing both breadth of coverage across all five boroughs and depth within key submarkets Owned 22 15 18 2 3 60 Properties Total Data as of March 31, 2022 Owned Managed 4 New York City Portfolio Presentation |

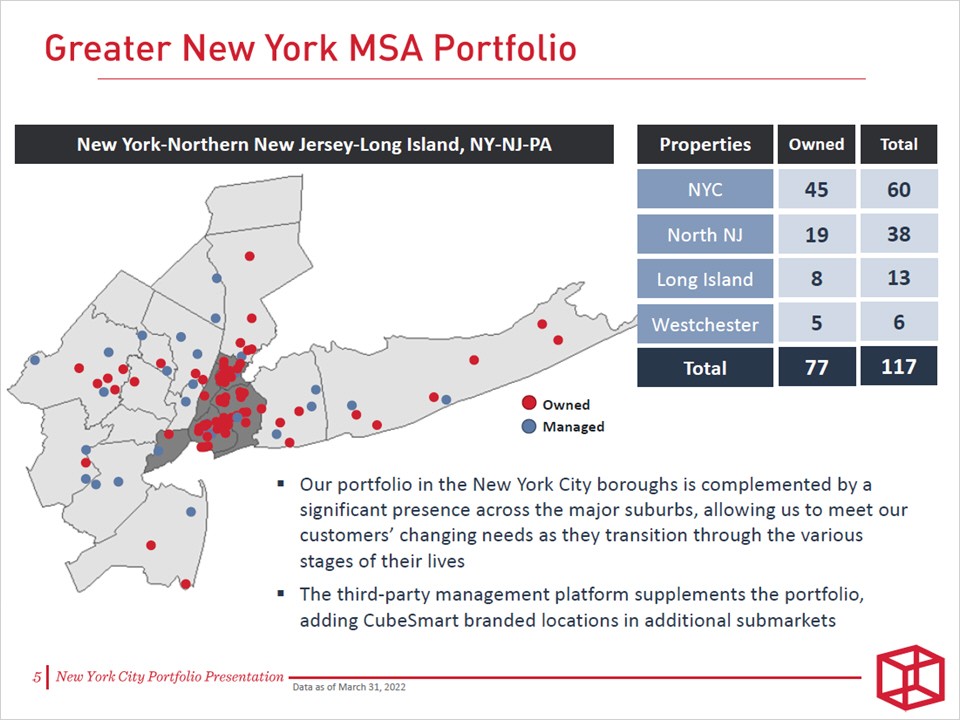

| Greater New York MSA Portfolio NYC North NJ Long Island Westchester 45 19 8 5 Total 77 Owned 60 38 13 6 117 Properties Total ▪ Our portfolio in the New York City boroughs is complemented by a significant presence across the major suburbs, allowing us to meet our customers’ changing needs as they transition through the various stages of their lives ▪ The third-party management platform supplements the portfolio, adding CubeSmart branded locations in additional submarkets New York-Northern New Jersey-Long Island, NY-NJ-PA Owned Managed Data as of March 31, 2022 5 New York City Portfolio Presentation |

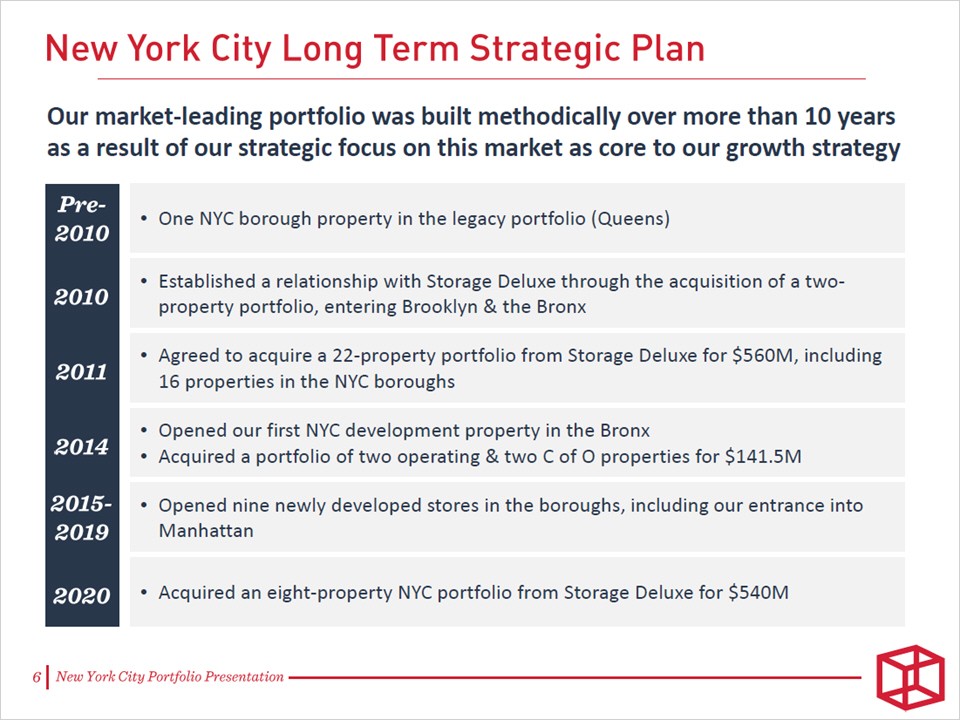

| New York City Long Term Strategic Plan Our market-leading portfolio was built methodically over more than 10 years as a result of our strategic focus on this market as core to our growth strategy Pre-2010 • One NYC borough property in the legacy portfolio (Queens) 2010 • Established a relationship with Storage Deluxe through the acquisition of a twoproperty portfolio, entering Brooklyn & the Bronx 2011 • Agreed to acquire a 22-property portfolio from Storage Deluxe for $560M, including 16 properties in the NYC boroughs 2014 • Opened our first NYC development property in the Bronx • Acquired a portfolio of two operating & two C of O properties for $141.5M 2015-2019 • Opened nine newly developed stores in the boroughs, including our entrance into Manhattan 2020 • Acquired an eight-property NYC portfolio from Storage Deluxe for $540M 6 New York City Portfolio Presentation |

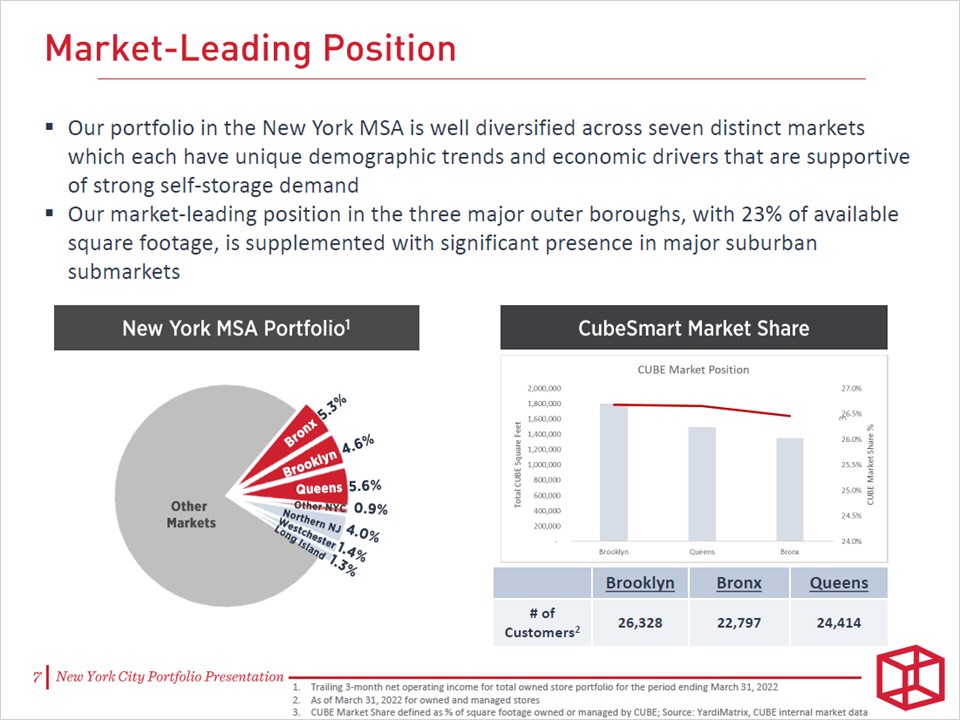

| Market-Leading Position ▪ Our portfolio in the New York MSA is well diversified across seven distinct markets which each have unique demographic trends and economic drivers that are supportive of strong self-storage demand ▪ Our market-leading position in the three major outer boroughs, with 23% of available square footage, is supplemented with significant presence in major suburban submarkets Brooklyn Bronx Queens # of Customers2 26,328 22,797 24,414 1. Trailing 3-month net operating income for total owned store portfolio for the period ending March 31, 2022 2. As of March 31, 2022 for owned and managed stores 3. CUBE Market Share defined as % of square footage owned or managed by CUBE; Source: YardiMatrix, CUBE internal market data 7 New York City Portfolio Presentation |

| High Quality Assets Our NYC stores make up the largest portfolio of purpose built Class A properties in the market - Our portfolio has exposure to attractive submarkets in New York, with purpose built climate controlled stores that have an average age of just 12 years - These distinctive assets create vibrant billboards for our brand 1. 2022 Same Store Portfolio 8 New York City Portfolio Presentation |

| High Quality Real Estate CubeSmart at 2880 Exterior Street, Bronx, NY Our purpose-built portfolio is built in exceptional locations Property stands out with great visibility for distinctive branding Easily accessible from highway exit Right off the Major Deegan with 148,000 cars daily Significant multifamily presence with 37k residents per square mile 9 New York City Portfolio Presentation |

| High Quality Real Estate Our purpose-built portfolio is located on exceptional real estate CubeSmart at E 135th Street, Bronx, NY Adjacent to our property, two Class A multifamily towers now sit on the site of what was a former bus depot 10 New York City Portfolio Presentation |

| Brand Recognition Our leading position affords us competitive advantages from the ubiquity of our brand within the market - Our distinct properties function as billboards and our significant presence allows for efficiency with out of home marketing, all driving meaningful brand recognition - Our NYC properties receive 11% more of their reservations through brand related search terms compared to the rest of our portfolio 11 New York City Portfolio Presentation |

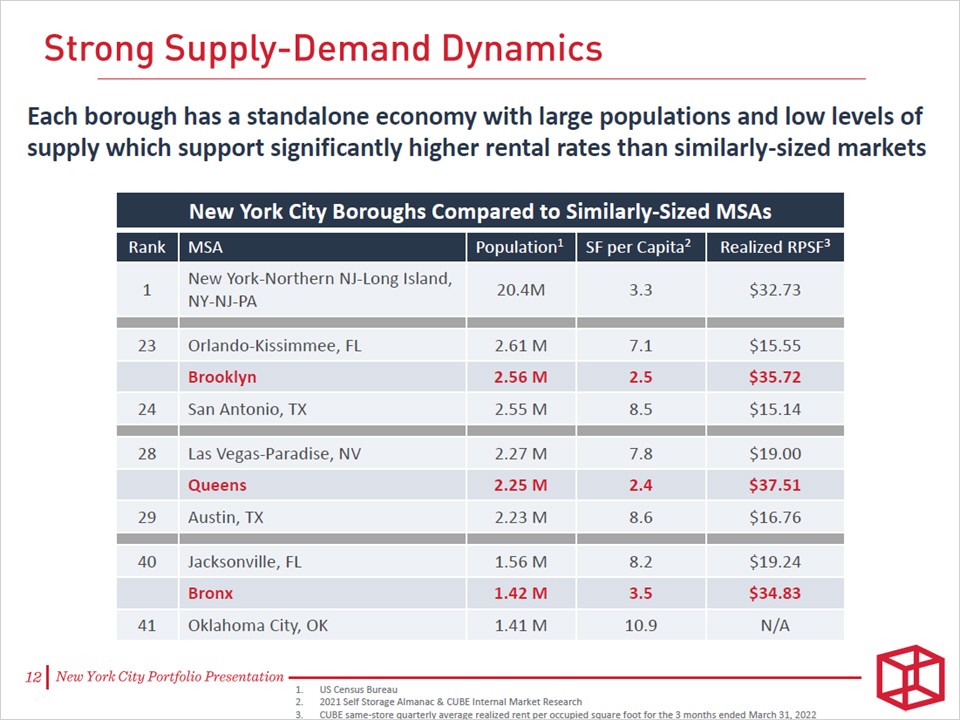

| Strong Supply-Demand Dynamics Each borough has a standalone economy with large populations and low levels of supply which support significantly higher rental rates than similarly sized markets New York City Boroughs Compared to Similarly Sized MSAs Rank MSA Population 1 SF per Capita 2 Realized RPSF 3 1 New York Northern NJ Long Island, NY NJ PA 20.4M 3.3 $32.73 23 Orlando Kissimmee, FL 2.61 M 7.1 $15.55 Brooklyn 2.56 M 2.5 $35.72 24 San Antonio, TX 2.55 M 8.5 $15.14 28 Las Vegas Paradise, NV 2.27 M 7.8 $19.00 Queens 2.25 M 2.4 $37.51 29 Austin, TX 2.23 M 8.6 $16.76 40 Jacksonville, FL 1.56 M 8.2 $19.24 Bronx 1.42 M 3.5 $34.83 41 Oklahoma City, OK 1.41 M 10.9 N/A 1. US Census Bureau 2. 2021 Self Storage Almanac & CUBE Internal Market Research 3. CUBE same store quarterly average realized rent per occupied square foot for the 3 months ended March 31, 2022 12 New York City Portfolio Presentation |

| New York City Portfolio Presentation May 2022 |

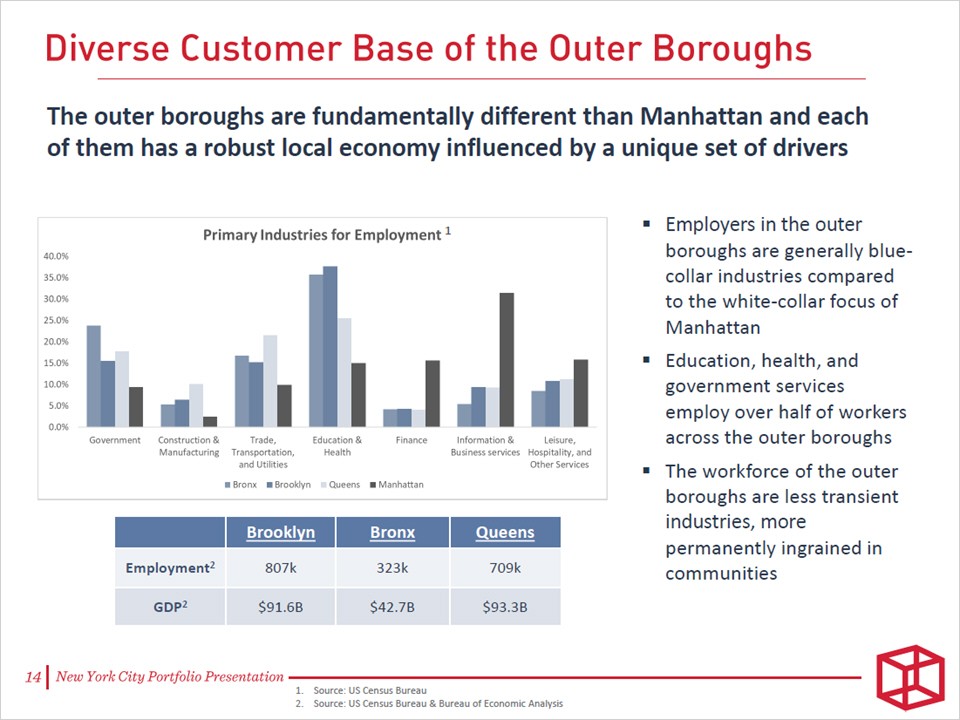

| Diverse Customer Base of the Outer Boroughs The outer boroughs are fundamentally different than Manhattan and each of them has a robust local economy influenced by a unique set of drivers - Employers in the outer boroughs are generally blue collar industries compared to the white collar focus of Manhattan - Education, health, and government services employ over half of workers across the outer boroughs - The workforce of the outer boroughs are less transient industries, more permanently ingrained in communities Brooklyn Bronx Queens Employment 2 807k 323k 709k GDP 2 $91.6B $42.7B $93.3B 1. Source: US Census Bureau 2. Source: US Census Bureau & Bureau of Economic Analysis 14 New York City Portfolio Presentation |

| Unique Storage Customers New York City renters have distinctive demand drivers that manifest themselves in unique interactions with the product - NYC customers rent for much longer, with median lengths of stay approximately three months greater than the rest of the portfolio - The unit mix for stores in NYC is drastically different, with average unit sizes of 34 square feet, 66% smaller than the same store portfolio - Customer behaviors for NYC renters are different, as payments are made in cash significantly more frequently than around the rest of the country 15 New York City Portfolio Presentation |

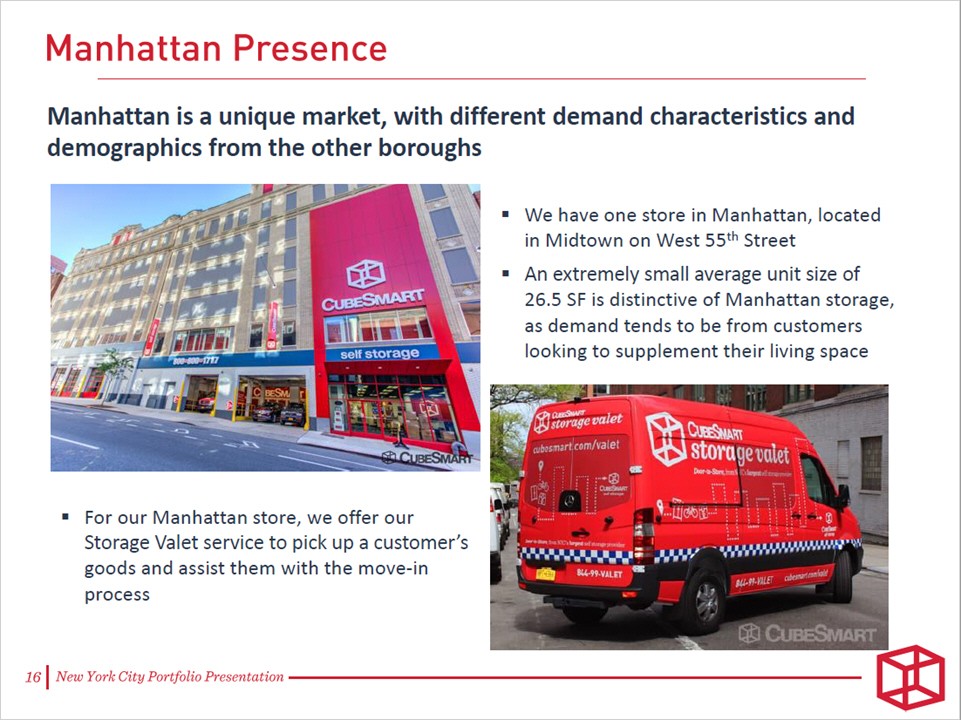

| Manhattan Presence Manhattan is a unique market, with different demand characteristics and demographics from the other boroughs - We have one store in Manhattan, located in Midtown on West 55 th Street - An extremely small average unit size of 26.5 SF is distinctive of Manhattan storage, as demand tends to be from customers looking to supplement their living space - For our Manhattan store, we offer our Storage Valet service to pick up a customer’s goods and assist them with the move in process 16 New York City Portfolio Presentation |

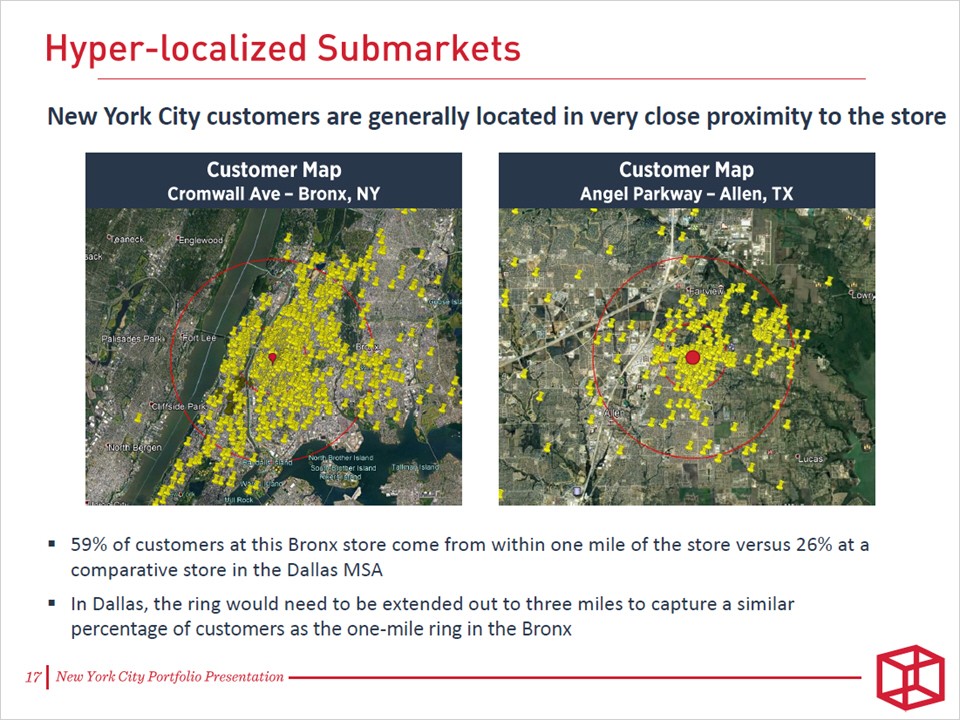

| Hyper-localized Submarkets New York City customers are generally located in very close proximity to the store Customer Map Cromwall Ave – Bronx, NY Customer Map Angel Parkway – Allen, TX ▪ 59% of customers at this Bronx store come from within one mile of the store versus 26% at a comparative store in the Dallas MSA ▪ In Dallas, the ring would need to be extended out to three miles to capture a similar percentage of customers as the one-mile ring in the Bronx 17 New York City Portfolio Presentation |

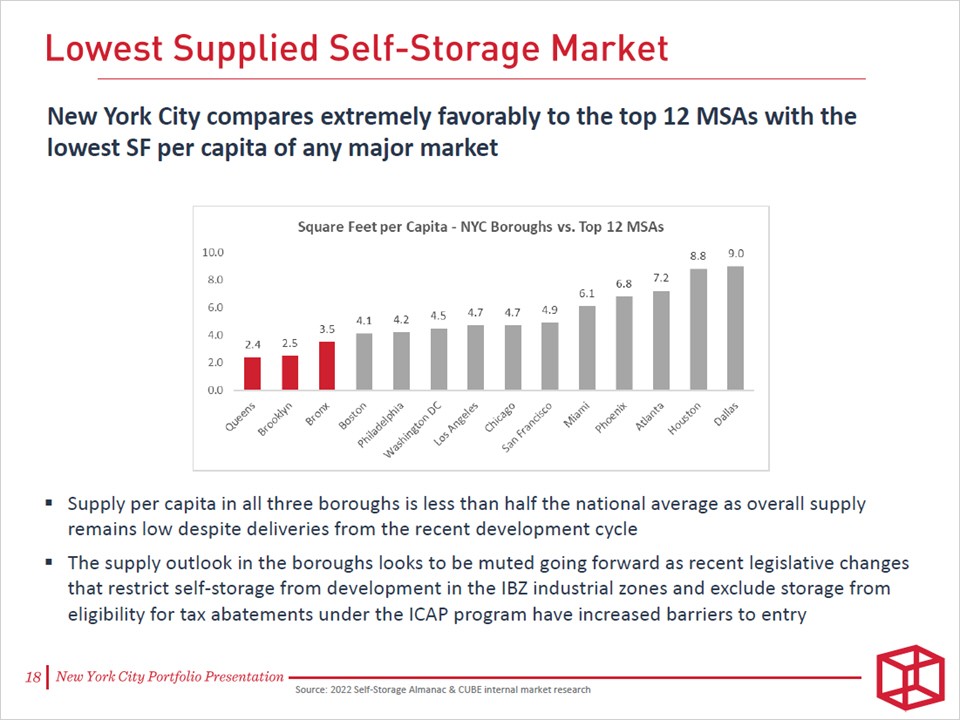

| Lowest Supplied Self-Storage Market New York City compares extremely favorably to the top 12 MSAs with the lowest SF per capita of any major market - Supply per capita in all three boroughs is less than half the national average as overall supply remains low despite deliveries from the recent development cycle - The supply outlook in the boroughs looks to be muted going forward as recent legislative changes that restrict self storage from development in the IBZ industrial zones and exclude storage from eligibility for tax abatements under the ICAP program have increased barriers to entry Source: 2022 Self-Storage Almanac & CUBE internal market research 18 New York City Portfolio Presentation |

| CubeSmart Development Since 2014 we have continued our investment in the NYC boroughs by developing brand new Class-A properties, creating long-term value $516 Million Invested in the NYC Boroughs Brooklyn Bronx Queens Manhattan $159m $141m $135m $81m $294m of value creation for our shareholders1 1. Value creation based on proforma forecast NOI at stabilization and management’s view of current market cap rates 19 New York City Portfolio Presentation |

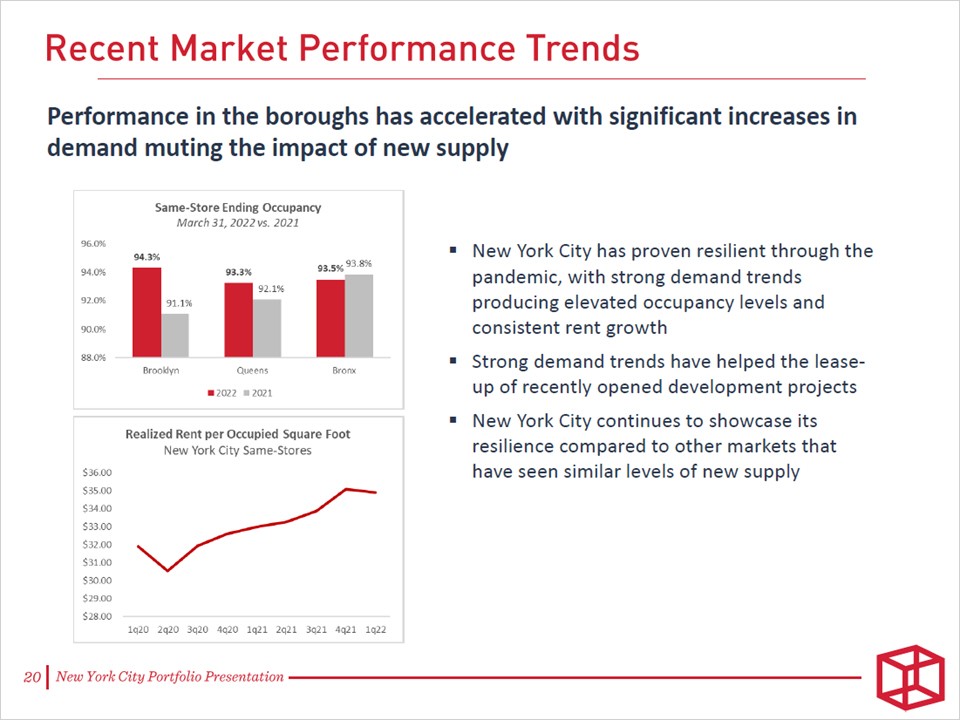

| Recent Market Performance Trends Performance in the boroughs has accelerated with significant increases in demand muting the impact of new supply - New York City has proven resilient through the pandemic, with strong demand trends producing elevated occupancy levels and consistent rent growth - Strong demand trends have helped the lease up of recently opened development projects - New York City continues to showcase its resilience compared to other markets that have seen similar levels of new supply 20 New York City Portfolio Presentation |

| Long-Term New York City Strategy New York City will remain a key component of our long-term strategy Market Leader • The competitive advantages afforded to us by our market-leading portfolio position us to maximize cash flows from our NYC portfolio Vibrant Demographics • The unique demographics of New York City will continue to drive strong demand for storage Advantageous Supply-Demand Characteristics • Healthy demand trends coupled with a limited supply pipeline will create a strong fundamental backdrop Positive Recent Trends • Strong performance through current market conditions reinforce the strength of the New York City storage market through all cycles 21 New York City Portfolio Presentation |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valstybės investicinis kapitalas UAB audited Annual information for the year 2023

- Robbins LLP Reminds IRobot Corporation Shareholders of the Pending May 7, 2024 Lead Plaintiff Deadline

- CIDARA Therapeutics ALERT: Bragar Eagel & Squire, P.C. is Investigating Cidara Therapeutics, Inc. on Behalf of Cidara Therapeutics Stockholders and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share