Form 8-K Cardiovascular Systems For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2018

Cardiovascular Systems, Inc.

(Exact name of Registrant as Specified in its Charter)

Delaware | 000-52082 | 41-1698056 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

1225 Old Highway 8 Northwest

St. Paul, Minnesota 55112-6416

(Address of Principal Executive Offices and Zip Code)

(651) 259-1600

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01. Other Events.

Agreement with Aerolase Corp.

On July 31, 2018, Cardiovascular Systems, Inc. (the “Company”) issued a press release announcing the signing of an agreement with Aerolase Corp. for the co-development of a new laser atherectomy device. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

Investor Presentation

On July 31, 2018, the Company plans to make a slide presentation in New York, New York, at its previously announced analyst and investor day. A copy of the slides to be presented by Company representatives is attached hereto as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) | Exhibits |

Exhibit Number | Description | |

99.1 | ||

99.2 | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: July 31, 2018

CARDIOVASCULAR SYSTEMS, INC. | ||

By: | /s/ Jeffrey S. Points | |

Jeffrey S. Points Chief Financial Officer | ||

CARDIOVASCULAR SYSTEMS, INC. AND AEROLASE CORP. SIGN COLLABORATIVE AGREEMENT FOR LASER ATHERECTOMY TECHNOLOGY

St. Paul, Minn. – July 31, 2018 – Cardiovascular Systems, Inc. (CSI®) (NASDAQ: CSII), a medical device company developing and commercializing innovative interventional treatment systems for patients with peripheral and coronary artery disease, today announced that it has signed an agreement with Aerolase Corp. (Aerolase®) for the co-development of a new laser atherectomy device for physicians to use in more effectively treating multiple forms of arterial disease.

Scott Ward, CSI’s Chairman, President and Chief Executive Officer, said, “We believe there is an opportunity to leverage Aerolase’s innovative proprietary laser technology, which is FDA-cleared for dermatology and medical aesthetic uses and supported by leading physicians in those fields. The collaboration project aims to create a significant improvement in the quality of care for patients suffering from peripheral arterial disease and in-stent restenosis.”

Said Pavel Efremkin, PhD, Aerolase’s Chairman and Chief Executive Officer, “We are excited to pursue the development of an atherectomy laser device with an industry-leading company like CSI. Our dermatology and aesthetic medicine customers appreciate the portability, reliability, ease-of-use and minimal set up time that our lasers offer in addition to high clinical efficacies. We look forward to demonstrating that our solid-state, patented, air-cooled laser technology can transfer to atherectomy and provide similar benefits to interventional cardiologists.”

Under the terms of the agreement, CSI made an undisclosed equity investment in Aerolase and will make additional equity investments as development milestones are met.

Concluded Ward, “The successful development and commercialization of this laser atherectomy technology will expand the number of patients CSI serves. We are committed to transforming CSI into an innovative and global leader in the treatment of peripheral and coronary artery disease.”

About Aerolase Corp.

Aerolase Corp., based in Tarrytown, NY, invented, manufactures, markets and sells its LightPod® dermatology lasers, with systems sold in 42 countries. The company has won many industry awards and accolades recognizing the innovative quality of its lasers, which are based on important clinical advances and patented design. For more information, visit the company’s website at www.aerolase.com

About Cardiovascular Systems, Inc.

Cardiovascular Systems, Inc., based in St. Paul, Minn., is a medical device company focused on developing and commercializing innovative solutions for treating vascular and coronary disease. The company’s Orbital Atherectomy Systems treat calcified and fibrotic plaque in arterial vessels throughout the leg and heart in a few minutes of treatment time, and address many of the limitations associated with existing surgical, catheter and pharmacological treatment alternatives. The U.S. FDA granted the first 510(k) clearance for the use of the Orbital Atherectomy System in peripheral arteries in August 2007. In October 2013, the company received FDA approval for the Coronary Orbital Atherectomy System. To date, over 373,000 of CSI’s devices have been sold to leading institutions across the United States. For more information, visit the company’s website at www.csi360.com

Safe Harbor

Certain statements in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For example, statements in this press release regarding (i) the development of a new laser atherectomy device; (ii) the opportunity to

Certain statements in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For example, statements in this press release regarding (i) the development of a new laser atherectomy device; (ii) the opportunity to

leverage Aerolase’s technology; (iii) the benefits of a new laser atherectomy device; (iv) future equity investments; and (v) the future impact of adding laser atherectomy to CSI’s portfolio, are forward-looking statements. These statements involve risks and uncertainties that could cause results to differ materially from those projected, including, but not limited to, the ability of CSI and Aerolase to collaborate on the development of a new laser atherectomy device; the ability of the parties to meet development milestones; satisfaction of the conditions to CSI’s additional equity investments; technical challenges; regulatory developments; clinical trial requirements and results; FDA clearances and approvals; the experience of physicians regarding the effectiveness and reliability of products sold by CSI; the reluctance of physicians, hospitals and other organizations to accept new products; the impact of competitive products and pricing; general economic conditions; and other factors detailed from time to time in CSI’s SEC reports, including its most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. CSI encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this release. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, CSI's actual results may differ materially from the expected results discussed in the forward-looking statements contained in this release. The forward-looking statements made in this release are made only as of the date of this release, and CSI undertakes no obligation to update them to reflect subsequent events or circumstances.

Contacts:

Cardiovascular Systems, Inc. Jack Nielsen (651) 202-4919 | Padilla Matt Sullivan (612) 455-1709 |

# # #

Analyst Day Meeting Scott R. Ward Chairman, President & CEO July 31, 2018

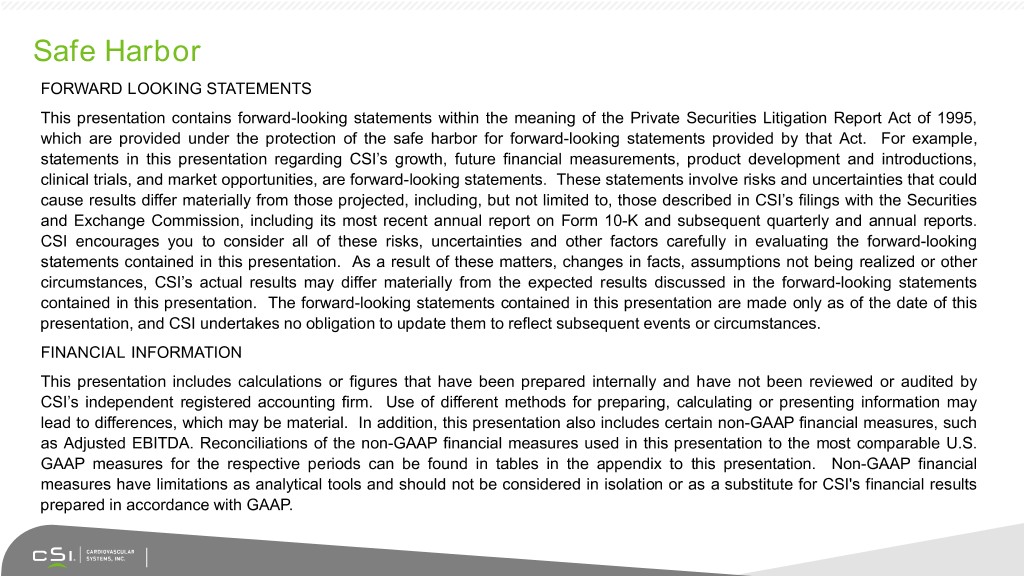

Safe Harbor FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Report Act of 1995, which are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For example, statements in this presentation regarding CSI’s growth, future financial measurements, product development and introductions, clinical trials, and market opportunities, are forward-looking statements. These statements involve risks and uncertainties that could cause results differ materially from those projected, including, but not limited to, those described in CSI’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent quarterly and annual reports. CSI encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this presentation. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, CSI’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this presentation. The forward-looking statements contained in this presentation are made only as of the date of this presentation, and CSI undertakes no obligation to update them to reflect subsequent events or circumstances. FINANCIAL INFORMATION This presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by CSI’s independent registered accounting firm. Use of different methods for preparing, calculating or presenting information may lead to differences, which may be material. In addition, this presentation also includes certain non-GAAP financial measures, such as Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this presentation to the most comparable U.S. GAAP measures for the respective periods can be found in tables in the appendix to this presentation. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP.

Agenda Overview: Scott Ward Clinician’s Perspective: Dr. Martin Leon Driving Sustainable Long-Term Growth: Rhonda Robb Clinician’s Perspective: Dr. David Kandzari Growth Summary & Financial Performance: Jeff Points Closing Comments: Scott Ward Physician Q&A: Dr. Martin Leon and Dr. David Kandzari CSI Q&A: Scott Ward, Rhonda Robb, Jeff Points

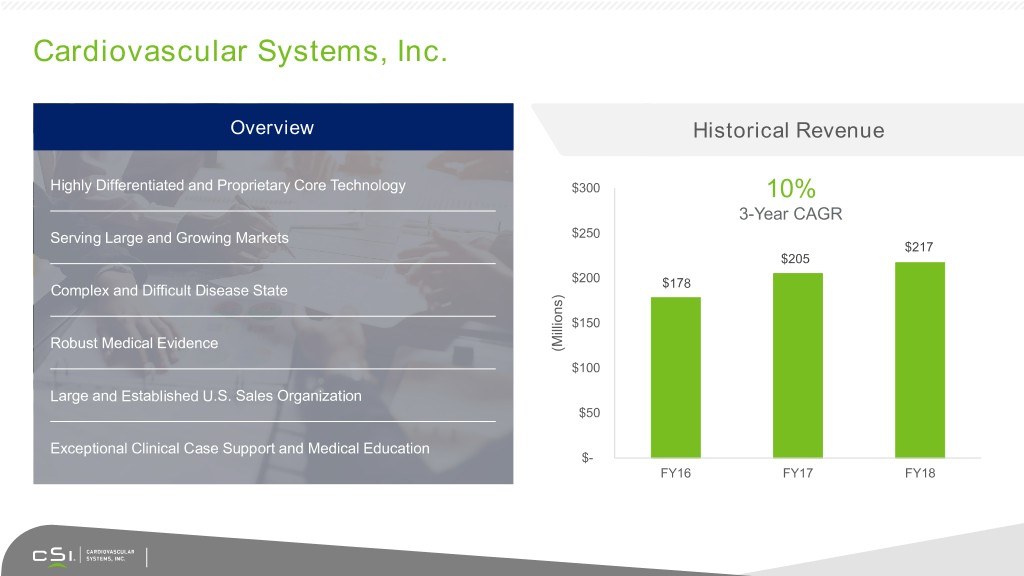

Cardiovascular Systems, Inc. Overview Historical Revenue Highly Differentiated and Proprietary Core Technology $300 10% 3-Year CAGR Serving Large and Growing Markets $250 $217 $205 $200 $178 Complex and Difficult Disease State $150 Robust Medical Evidence (Millions) $100 Large and Established U.S. Sales Organization $50 Exceptional Clinical Case Support and Medical Education $- FY16 FY17 FY18

Commitment to Our Mission Saving Limbs, Saving Lives Every Day Focused on Complex Peripheral and Coronary Artery Disease 2 Million+ 160,000 370,000 525,000 Deaths Annually From High Risk or Complex Patients with Critical Annual Amputations Coronary Artery High Risk Procedures Limb Ischemia (CLI)1 in the U.S.2 Disease in the U.S.3 Annually in the U.S.4 1. Yost ML, CLI U.S. Supplement, Beaufort, SC. 2016 as presented at NCVH 2017 2. Allie DE, Hebert CJ, Ingraldi A, Patlola RR, Walker CM. 24-Carat Gold, 14-Carat Gold, or Platinum Standards in the Treatment of Critical Limb Ischemia: Bypass Surgery or Endovascular Intervention? J Endovsc Ther. 2009;16(Suppl I):I134–I146. 3. CSI Company Estimates 4. American Heart Association - Heart Disease and Stroke Statistics- 2018 Update

Experienced and Talented Team Average Experience in Medical Technology: 18 Years Scott R. Ward, MS, MBA Jeffrey S. Points, MBA, Rhonda J. Robb, MBA Chairman, CPA Chief Operating Officer President and CEO Chief Financial Officer Alexander Rosenstein, Ryan D. Egeland, MD David S. Whitescarver, JD PhD JD General Counsel & Vice President, VP, Corporate Dev’t & Corporate Secretary Medical Affairs Intellectual Property John M. Hastings, MBA Sandra M. Sedo, MBA, JD Laura J. Gillund, MAIR VP, Manufacturing Chief Compliance Officer Chief Talent Officer & Operations Organizational Values: Confidence, Passion, Innovation, Accountability and Pace

CSI Today # 1 67 K >700 80 Market leadership 227 Patients treated of Mission Driven Engineers in calcified peripheral & Patents annually Employees and Scientists coronary atherectomy FY18 8% 68% Other Peripheral OAS $217M In Revenue 1% 23% International Coronary OAS

Strong Financial Platform for Growth Profitable Business Model: FY18 Net Income $1.7M Revenues Gross Margin Adjusted EBITDA Cash Balance 10% +80% +$56M +$56M CAGR $16.5M $217M $12.9M $205M 82% $116.3M $107.9M $178M 81% FY16 FY17 FY18 $60.6M 80% $(39.2)M FY16 FY17 FY18 FY16 FY17 FY18 FY16 FY17 FY18

Driving Sustainable Growth: Broaden Our Value Streams • Financial Goal: Five Year CAGR of 15 - 18% and Revenue of $435M - $500M in FY23 Financial Strength and the Talent to Execute Grow and Protect the Core Business Growth, Profitability, Cash and Liquidity Sustain Market Leadership Experienced and Talented Team +10% Growth in Core Business Global Expansion Accelerates Growth Innovation Drives Incremental Growth of Core Business Launch 20 New Products OrbusNeich and Medikit $70M - $100M in FY23 $25M- $50M in FY23

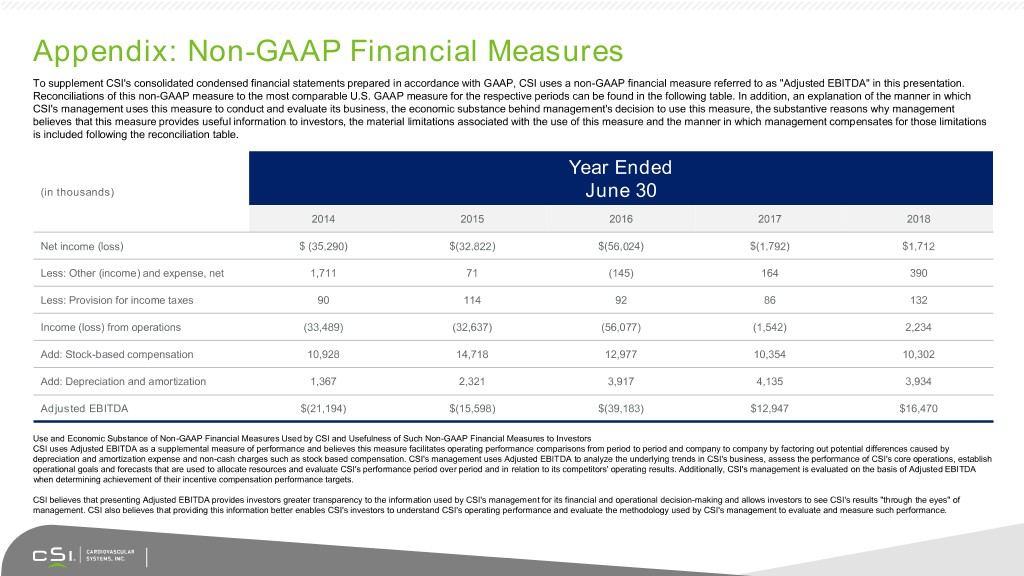

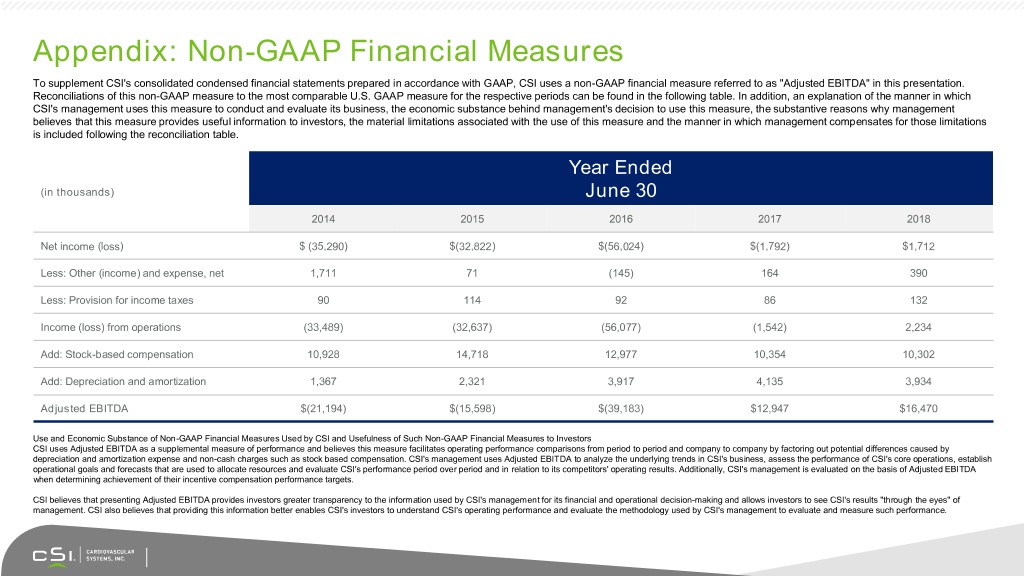

Appendix: Non-GAAP Financial Measures To supplement CSI's consolidated condensed financial statements prepared in accordance with GAAP, CSI uses a non-GAAP financial measure referred to as "Adjusted EBITDA" in this presentation. Reconciliations of this non-GAAP measure to the most comparable U.S. GAAP measure for the respective periods can be found in the following table. In addition, an explanation of the manner in which CSI's management uses this measure to conduct and evaluate its business, the economic substance behind management's decision to use this measure, the substantive reasons why management believes that this measure provides useful information to investors, the material limitations associated with the use of this measure and the manner in which management compensates for those limitations is included following the reconciliation table. Year Ended (in thousands) June 30 2014 2015 2016 2017 2018 Net income (loss) $ (35,290) $(32,822) $(56,024) $(1,792) $1,712 Less: Other (income) and expense, net 1,711 71 (145) 164 390 Less: Provision for income taxes 90 114 92 86 132 Income (loss) from operations (33,489) (32,637) (56,077) (1,542) 2,234 Add: Stock-based compensation 10,928 14,718 12,977 10,354 10,302 Add: Depreciation and amortization 1,367 2,321 3,917 4,135 3,934 Adjusted EBITDA $(21,194) $(15,598) $(39,183) $12,947 $16,470 Use and Economic Substance of Non-GAAP Financial Measures Used by CSI and Usefulness of Such Non-GAAP Financial Measures to Investors CSI uses Adjusted EBITDA as a supplemental measure of performance and believes this measure facilitates operating performance comparisons from period to period and company to company by factoring out potential differences caused by depreciation and amortization expense and non-cash charges such as stock based compensation. CSI's management uses Adjusted EBITDA to analyze the underlying trends in CSI's business, assess the performance of CSI's core operations, establish operational goals and forecasts that are used to allocate resources and evaluate CSI's performance period over period and in relation to its competitors' operating results. Additionally, CSI's management is evaluated on the basis of Adjusted EBITDA when determining achievement of their incentive compensation performance targets. CSI believes that presenting Adjusted EBITDA provides investors greater transparency to the information used by CSI's management for its financial and operational decision-making and allows investors to see CSI's results "through the eyes" of management. CSI also believes that providing this information better enables CSI's investors to understand CSI's operating performance and evaluate the methodology used by CSI's management to evaluate and measure such performance.

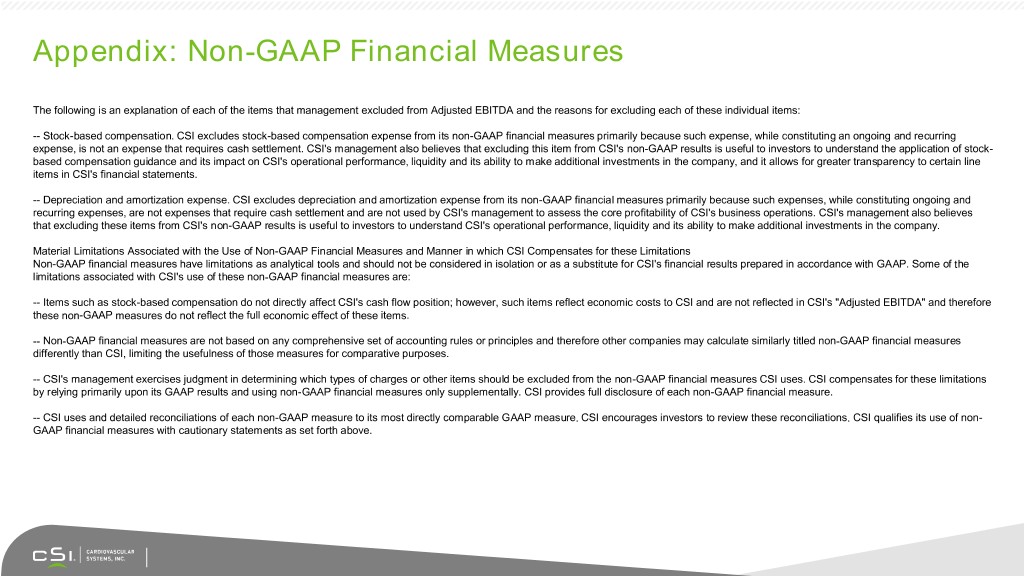

Appendix: Non-GAAP Financial Measures The following is an explanation of each of the items that management excluded from Adjusted EBITDA and the reasons for excluding each of these individual items: -- Stock-based compensation. CSI excludes stock-based compensation expense from its non-GAAP financial measures primarily because such expense, while constituting an ongoing and recurring expense, is not an expense that requires cash settlement. CSI's management also believes that excluding this item from CSI's non-GAAP results is useful to investors to understand the application of stock- based compensation guidance and its impact on CSI's operational performance, liquidity and its ability to make additional investments in the company, and it allows for greater transparency to certain line items in CSI's financial statements. -- Depreciation and amortization expense. CSI excludes depreciation and amortization expense from its non-GAAP financial measures primarily because such expenses, while constituting ongoing and recurring expenses, are not expenses that require cash settlement and are not used by CSI's management to assess the core profitability of CSI's business operations. CSI's management also believes that excluding these items from CSI's non-GAAP results is useful to investors to understand CSI's operational performance, liquidity and its ability to make additional investments in the company. Material Limitations Associated with the Use of Non-GAAP Financial Measures and Manner in which CSI Compensates for these Limitations Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP. Some of the limitations associated with CSI's use of these non-GAAP financial measures are: -- Items such as stock-based compensation do not directly affect CSI's cash flow position; however, such items reflect economic costs to CSI and are not reflected in CSI's "Adjusted EBITDA" and therefore these non-GAAP measures do not reflect the full economic effect of these items. -- Non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and therefore other companies may calculate similarly titled non-GAAP financial measures differently than CSI, limiting the usefulness of those measures for comparative purposes. -- CSI's management exercises judgment in determining which types of charges or other items should be excluded from the non-GAAP financial measures CSI uses. CSI compensates for these limitations by relying primarily upon its GAAP results and using non-GAAP financial measures only supplementally. CSI provides full disclosure of each non-GAAP financial measure. -- CSI uses and detailed reconciliations of each non-GAAP measure to its most directly comparable GAAP measure. CSI encourages investors to review these reconciliations. CSI qualifies its use of non- GAAP financial measures with cautionary statements as set forth above.

Driving Sustainable, Long-Term Growth Rhonda Robb Chief Operating Officer July 31, 2018

Safe Harbor FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Report Act of 1995, which are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For example, statements in this presentation regarding CSI’s growth, future financial measurements, product development and introductions, clinical trials, and market opportunities, are forward-looking statements. These statements involve risks and uncertainties that could cause results differ materially from those projected, including, but not limited to, those described in CSI’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent quarterly and annual reports. CSI encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this presentation. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, CSI’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this presentation. The forward-looking statements contained in this presentation are made only as of the date of this presentation, and CSI undertakes no obligation to update them to reflect subsequent events or circumstances. FINANCIAL INFORMATION This presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by CSI’s independent registered accounting firm. Use of different methods for preparing, calculating or presenting information may lead to differences, which may be material. In addition, this presentation also includes certain non-GAAP financial measures, such as Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this presentation to the most comparable U.S. GAAP measures for the respective periods can be found in tables in the appendix to this presentation. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP.

Key Growth Drivers Core Business New Geographies Innovation Achieve $435M - $500M in Revenue in FY23 (15% - 18% CAGR)

CSI Will Remain Focused Complex Coronary and Peripheral Disease Large, and growing markets with significant unmet medical needs Aging Patient Populations CSI market leadership with OAS in peripheral and coronary segments Opportunities for Innovation Focused on Complex Peripheral and Coronary Artery Disease

Key Growth Drivers Innovation in product line extensions Site of service strategies Evidence Core Business Expertise Excellence in quality and manufacturing Sustain 10+ % Growth in our Core Business

Innovation Ease of Use with OAS Enhancements GlideAssist is an innovative solution that: • Facilitates device tracking • Provides easier device repositioning • Exceptional performance especially in challenging anatomies ViperWire Flex Tip and Next Generation Pump launching in FY19 Video with representation of GlideAssist

Innovation Radial is a Core Competitive Advantage A new differentiated route of access for CSI, complementary to tibial/pedal Diamondback low 5Fr profile, with extended working length enables unique radial approach Expansion in portfolio of radial support devices: wires, sheaths, catheters, PTA balloons Value Drivers • Few vascular complications, lower bleeding • Efficiency in workflows, increase patient volumes, shorter length of stay; especially attractive for OBL’s Before After

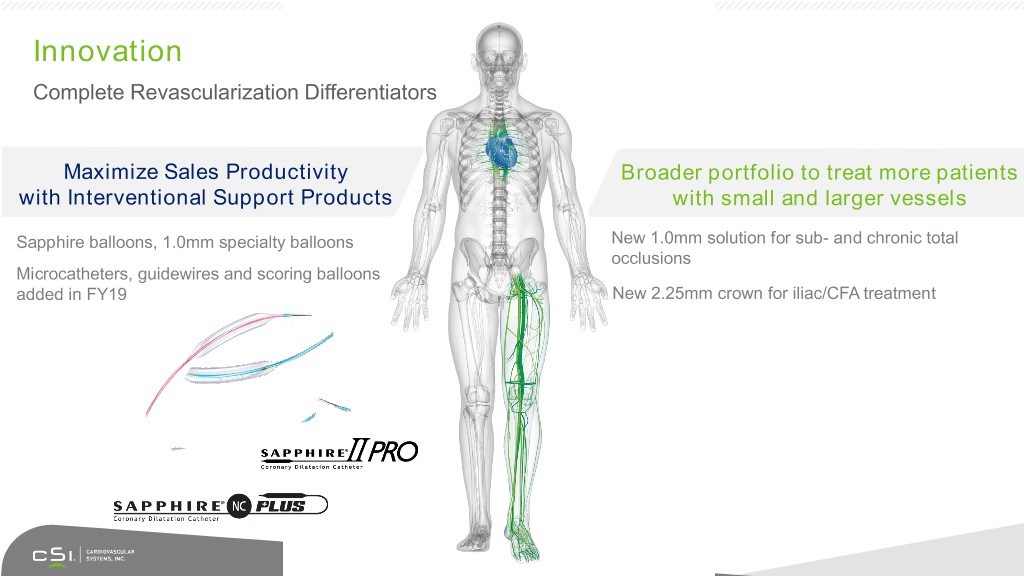

Innovation Complete Revascularization Differentiators Maximize Sales Productivity Broader portfolio to treat more patients with Interventional Support Products with small and larger vessels Sapphire balloons, 1.0mm specialty balloons New 1.0mm solution for sub- and chronic total occlusions Microcatheters, guidewires and scoring balloons added in FY19 New 2.25mm crown for iliac/CFA treatment

Innovation Complete Revascularization Differentiators Peripheral Exchangeable Platform Up to 50% of peripheral patients have multi-level disease Innovation facilitates utilization of multiple crowns during a single case Patient and economic benefits Business model innovation may enable new product configurations to meet unique needs of sites of service and throughout different geographic regions US Launch in late FY2019

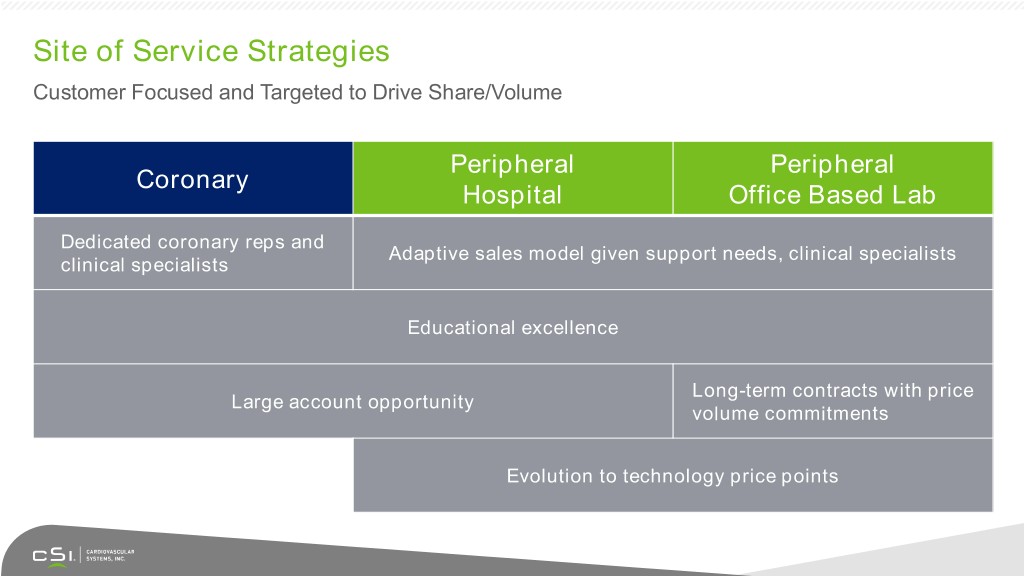

Site of Service Strategies Customer Focused and Targeted to Drive Share/Volume Peripheral Peripheral Coronary Hospital Office Based Lab Dedicated coronary reps and Adaptive sales model given support needs, clinical specialists clinical specialists Educational excellence Long-term contracts with price Large account opportunity volume commitments Evolution to technology price points

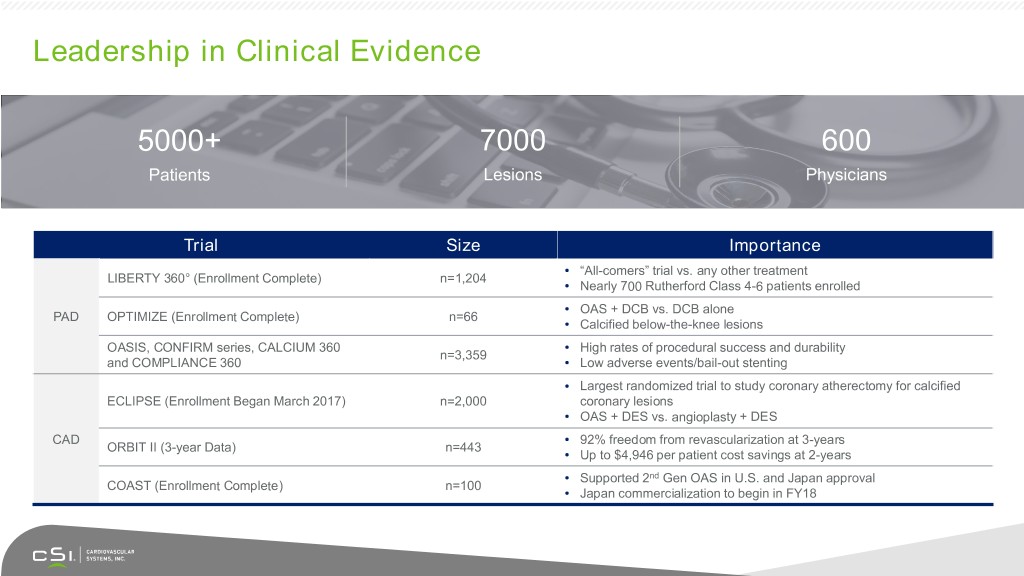

Leadership in Clinical Evidence 5000+ 7000 600 Patients Lesions Physicians Trial Size Importance • “All-comers” trial vs. any other treatment LIBERTY 360° (Enrollment Complete) n=1,204 • Nearly 700 Rutherford Class 4-6 patients enrolled • OAS + DCB vs. DCB alone PAD OPTIMIZE (Enrollment Complete) n=66 • Calcified below-the-knee lesions OASIS, CONFIRM series, CALCIUM 360 • High rates of procedural success and durability n=3,359 and COMPLIANCE 360 • Low adverse events/bail-out stenting • Largest randomized trial to study coronary atherectomy for calcified ECLIPSE (Enrollment Began March 2017) n=2,000 coronary lesions • OAS + DES vs. angioplasty + DES CAD • 92% freedom from revascularization at 3-years ORBIT II (3-year Data) n=443 • Up to $4,946 per patient cost savings at 2-years • Supported 2nd Gen OAS in U.S. and Japan approval COAST (Enrollment Complete) n=100 • Japan commercialization to begin in FY18

Leadership in Medical Evidence ECLIPSE Will Drive OAS as Standard of Care for Vessel Preparation Trial designed to establish a new standard of care of vessel preparation for patients with complex coronary disease Enrolling 2000 patients, 100 sites 400+ enrollments to date Enrollment completion expected in 18-24 months

Medical Evidence Peripheral Evidence Driving Guidelines 2016 AHA/ACC Guidelines on the 2 Year Clinical Data Presented; Management of Patients with PAD1 AMP August 8, 2018 Economic Data Presented FY19 Initiating 500 patient BTK An evaluation for revascularization study in 2019 options should be performed by an interdisciplinary care team before amputation in the patient with CLI (Class I)

Excellence in Quality and Manufacturing Scalable and Continuous COGS Reductions Manufacturing Volume driven overhead leverage Initiatives Labor productivity Scalable and continuous reductions LEAN continuous improvement protect margins from likely ASP declines Material cost reductions Sourcing and over the next 5+ years Supply Chain Vertical Integration

Key Growth Drivers Japan Launch Expanding Steady Cadence New Geographies Progressing Well Global Distribution of New Product Network Introductions New Geographies to Provide $25M-$50M in Revenue in FY23

Japan Launch Progressing Well Japan launch is progressing on plan Calcific burden in Japan significant Physicians accept need/value of vessel preparation Medikit is the exclusive distribution partner in Japan Coronary Classic and ViperWire Flex launch early 2019 Initiate enrollment of Peripheral OAS study in 2019

Expand Global Distribution Network

Expand Global Distribution Network Global interventional solutions provider Leadership team and distribution strength Footprint in more than 60 countries and Immediate CSI access to key markets across six continents Strong customer relationships; reputation Focus and ability to leverage infrastructure

A Steady Cadence of New Geographies FY19 FY23 $25M-$50M in FY23 FY19 FY23 Japan $25M - $50M Europe Middle East Southeast Asia $15M - $17.5M Canada $1.8M China FY18 FY21 FY23 Coronary Peripheral

Key Growth Drivers Innovation drives long term growth potential 20 new product launches by FY23 Portfolio expansion into complex Innovation coronary and peripheral patients $70M-$100M in Revenue From New Products in FY23

Building a Cardiovascular Company Steady Cadence of 20 Product Launches Through FY23 Innovation Will Drive $70M-$100M in Revenue in Fiscal 2023 Platforms Peripheral Products Coronary Products Support Products ViperWire Flex Laser Mixed Plaque Atherectomy Atherectomy OAS Gen III Scoring Balloons cPCI* Hemodynamic Glide Assist CTO/STO Support Exchangeable Radial Piloting Peripheral Support Products OAS Gen IV Radial In-Stent OAS Restenosis Microcatheters Small Vessel OAS PCI A/V Balloons Large OAS Fistula Vessel OAS Gen II Guidewires Next Gen Pump FY18 FY19 FY20 FY21 FY22 FY23 * cPCI = Complex PCI

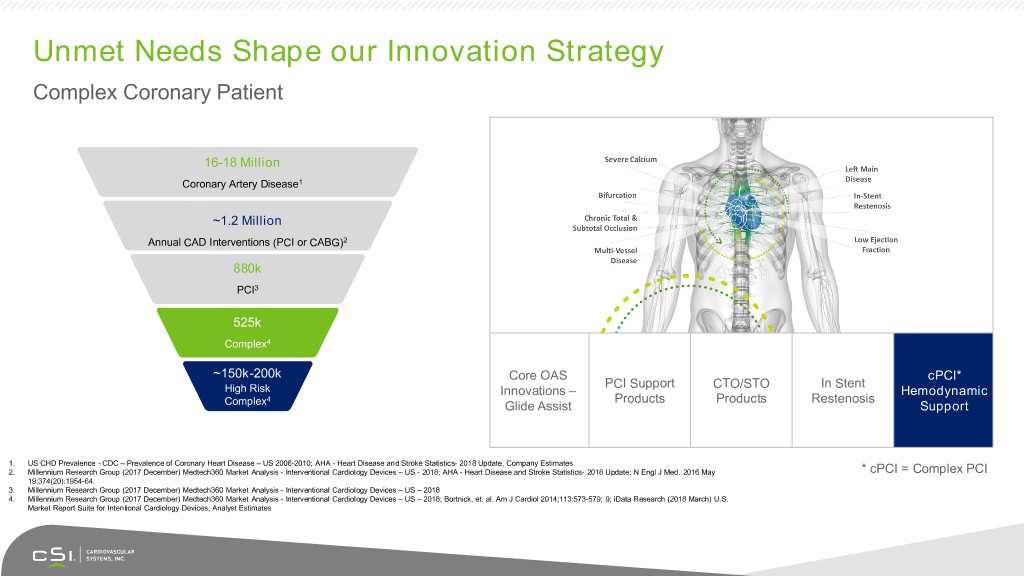

Unmet Needs Shape our Innovation Strategy Complex Coronary Patient 16-18 Million Coronary Artery Disease1 ~1.2 Million Annual CAD Interventions (PCI or CABG)2 880k PCI3 525k Complex4 ~150k-200k Core OAS cPCI* PCI Support CTO/STO In Stent High Risk Innovations – Hemodynamic 4 Products Products Restenosis Complex Glide Assist Support 1. US CHD Prevalence - CDC – Prevalence of Coronary Heart Disease – US 2006-2010; AHA - Heart Disease and Stroke Statistics- 2018 Update, Company Estimates 2. Millennium Research Group (2017 December) Medtech360 Market Analysis - Interventional Cardiology Devices – US - 2018; AHA - Heart Disease and Stroke Statistics- 2018 Update; N Engl J Med. 2016 May * cPCI = Complex PCI 19;374(20):1954-64. 3. Millennium Research Group (2017 December) Medtech360 Market Analysis - Interventional Cardiology Devices – US – 2018 4. Millennium Research Group (2017 December) Medtech360 Market Analysis - Interventional Cardiology Devices – US – 2018; Bortnick, et. al. Am J Cardiol 2014;113:573-579; 9; iData Research (2018 March) U.S. Market Report Suite for Intentional Cardiology Devices, Analyst Estimates

CSI cPCI Hemodynamic Support Video with representation of proposed product

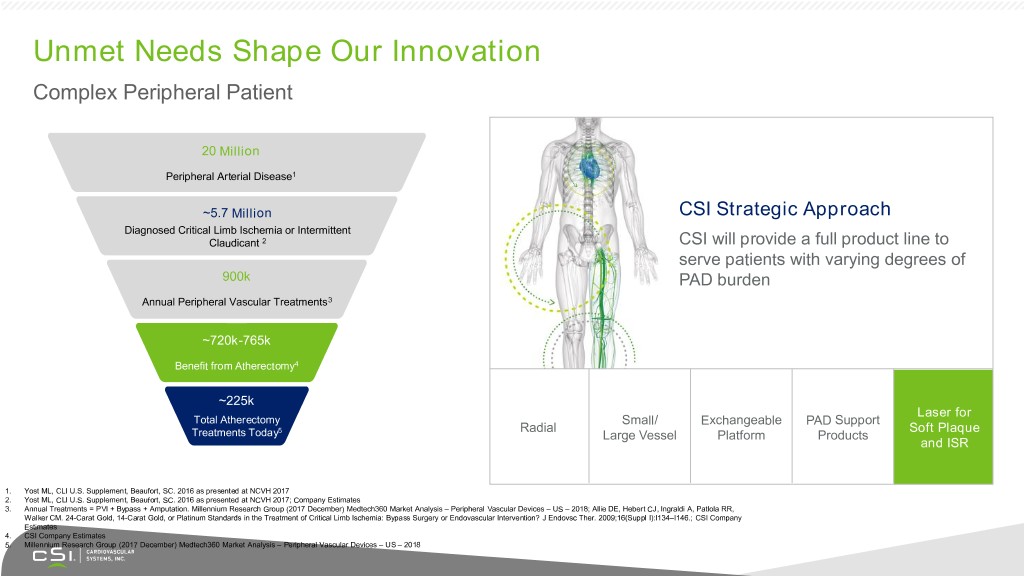

Unmet Needs Shape Our Innovation Complex Peripheral Patient 20 Million Peripheral Arterial Disease1 ~5.7 Million CSI Strategic Approach Diagnosed Critical Limb Ischemia or Intermittent Claudicant 2 CSI will provide a full product line to serve patients with varying degrees of 900k PAD burden Annual Peripheral Vascular Treatments3 ~720k-765k Benefit from Atherectomy4 ~225k Laser for Total Atherectomy Small/ Exchangeable PAD Support 5 Radial Soft Plaque Treatments Today Large Vessel Platform Products and ISR 1. Yost ML, CLI U.S. Supplement, Beaufort, SC. 2016 as presented at NCVH 2017 2. Yost ML, CLI U.S. Supplement, Beaufort, SC. 2016 as presented at NCVH 2017; Company Estimates 3. Annual Treatments = PVI + Bypass + Amputation. Millennium Research Group (2017 December) Medtech360 Market Analysis – Peripheral Vascular Devices – US – 2018; Allie DE, Hebert CJ, Ingraldi A, Patlola RR, Walker CM. 24-Carat Gold, 14-Carat Gold, or Platinum Standards in the Treatment of Critical Limb Ischemia: Bypass Surgery or Endovascular Intervention? J Endovsc Ther. 2009;16(Suppl I):I134–I146.; CSI Company Estimates 4. CSI Company Estimates 5. Millennium Research Group (2017 December) Medtech360 Market Analysis – Peripheral Vascular Devices – US – 2018

Future Innovation Vessel Preparation for Mixed Plaque CSI and Aerolase Corp. Development Agreement Laser Atherectomy Catheter Treats Soft Plaque and ISR

Future Innovation Vessel Preparation for Soft Plaque/ISR Large and attractive market, complimentary to OAS; expands the patient population that CSI will serve in a segment lacking innovation Target patients: De novo soft plaque and ISR in the peripheral patients; expand to Coronary Leverage existing channel; strong customer relationship CSI Approach: Portability, Reliability, Ease of Use and Minimal Set Up Time, Economical Solution for Hospitals and OBL’s Development well underway with Robust IP Portfolio; FIH mid 2021

Driving Sustainable Long-Term Growth Key Value Drivers Key Milestones Future Revenue 2019-2020 5 - Year CAGR 15% – 18% $435M - $500M • ViperWire, Next Gen Pump• PCI Support Portfolio • Radial Support Portfolio • Japan, Europe, Middle East, Asia • Peripheral Exchangeable $300M - $350M 2021-2022 $240M - $250M • ECLIPSE results • Laser FIH • OAS Gen II/III • High Risk Complex PCI • OAS small/large vessel Support FIH • Deeper Global Penetration 2023 • Laser and High Risk Complex PCI Support Commercial • Gen IV OAS Platforms FY19 FY21 FY23

Driving Sustainable Growth: Broaden Our Value Streams Financial Goal: Five Year CAGR of 15% - 18% & Revenue of $435M - $500M in FY23 Financial Strength and the Talent to Execute Grow and Protect the Core Business Growth, Profitability, Cash and Liquidity Sustain Market Leadership Experienced and Talented Team +10% Growth in Core Business Innovation Drives Incremental Growth Global Expansion Accelerates Growth of Core Business Launch 20 New Products OrbusNeich and Medikit $70M - $100M in FY23 $25M - $50M in FY23

Appendix: Non-GAAP Financial Measures To supplement CSI's consolidated condensed financial statements prepared in accordance with GAAP, CSI uses a non-GAAP financial measure referred to as "Adjusted EBITDA" in this presentation. Reconciliations of this non-GAAP measure to the most comparable U.S. GAAP measure for the respective periods can be found in the following table. In addition, an explanation of the manner in which CSI's management uses this measure to conduct and evaluate its business, the economic substance behind management's decision to use this measure, the substantive reasons why management believes that this measure provides useful information to investors, the material limitations associated with the use of this measure and the manner in which management compensates for those limitations is included following the reconciliation table. Year Ended (in thousands) June 30 2014 2015 2016 2017 2018 Net income (loss) $ (35,290) $(32,822) $(56,024) $(1,792) $1,712 Less: Other (income) and expense, net 1,711 71 (145) 164 390 Less: Provision for income taxes 90 114 92 86 132 Income (loss) from operations (33,489) (32,637) (56,077) (1,542) 2,234 Add: Stock-based compensation 10,928 14,718 12,977 10,354 10,302 Add: Depreciation and amortization 1,367 2,321 3,917 4,135 3,934 Adjusted EBITDA $(21,194) $(15,598) $(39,183) $12,947 $16,470 Use and Economic Substance of Non-GAAP Financial Measures Used by CSI and Usefulness of Such Non-GAAP Financial Measures to Investors CSI uses Adjusted EBITDA as a supplemental measure of performance and believes this measure facilitates operating performance comparisons from period to period and company to company by factoring out potential differences caused by depreciation and amortization expense and non-cash charges such as stock based compensation. CSI's management uses Adjusted EBITDA to analyze the underlying trends in CSI's business, assess the performance of CSI's core operations, establish operational goals and forecasts that are used to allocate resources and evaluate CSI's performance period over period and in relation to its competitors' operating results. Additionally, CSI's management is evaluated on the basis of Adjusted EBITDA when determining achievement of their incentive compensation performance targets. CSI believes that presenting Adjusted EBITDA provides investors greater transparency to the information used by CSI's management for its financial and operational decision-making and allows investors to see CSI's results "through the eyes" of management. CSI also believes that providing this information better enables CSI's investors to understand CSI's operating performance and evaluate the methodology used by CSI's management to evaluate and measure such performance.

Appendix: Non-GAAP Financial Measures The following is an explanation of each of the items that management excluded from Adjusted EBITDA and the reasons for excluding each of these individual items: -- Stock-based compensation. CSI excludes stock-based compensation expense from its non-GAAP financial measures primarily because such expense, while constituting an ongoing and recurring expense, is not an expense that requires cash settlement. CSI's management also believes that excluding this item from CSI's non-GAAP results is useful to investors to understand the application of stock- based compensation guidance and its impact on CSI's operational performance, liquidity and its ability to make additional investments in the company, and it allows for greater transparency to certain line items in CSI's financial statements. -- Depreciation and amortization expense. CSI excludes depreciation and amortization expense from its non-GAAP financial measures primarily because such expenses, while constituting ongoing and recurring expenses, are not expenses that require cash settlement and are not used by CSI's management to assess the core profitability of CSI's business operations. CSI's management also believes that excluding these items from CSI's non-GAAP results is useful to investors to understand CSI's operational performance, liquidity and its ability to make additional investments in the company. Material Limitations Associated with the Use of Non-GAAP Financial Measures and Manner in which CSI Compensates for these Limitations Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP. Some of the limitations associated with CSI's use of these non-GAAP financial measures are: -- Items such as stock-based compensation do not directly affect CSI's cash flow position; however, such items reflect economic costs to CSI and are not reflected in CSI's "Adjusted EBITDA" and therefore these non-GAAP measures do not reflect the full economic effect of these items. -- Non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and therefore other companies may calculate similarly titled non-GAAP financial measures differently than CSI, limiting the usefulness of those measures for comparative purposes. -- CSI's management exercises judgment in determining which types of charges or other items should be excluded from the non-GAAP financial measures CSI uses. CSI compensates for these limitations by relying primarily upon its GAAP results and using non-GAAP financial measures only supplementally. CSI provides full disclosure of each non-GAAP financial measure. -- CSI uses and detailed reconciliations of each non-GAAP measure to its most directly comparable GAAP measure. CSI encourages investors to review these reconciliations. CSI qualifies its use of non- GAAP financial measures with cautionary statements as set forth above.

Growth Summary and Financial Performance Jeff Points Chief Financial Officer July 31, 2018

Safe Harbor FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Report Act of 1995, which are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For example, statements in this presentation regarding CSI’s growth, future financial measurements, product development and introductions, clinical trials, and market opportunities, are forward-looking statements. These statements involve risks and uncertainties that could cause results differ materially from those projected, including, but not limited to, those described in CSI’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent quarterly and annual reports. CSI encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this presentation. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, CSI’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this presentation. The forward-looking statements contained in this presentation are made only as of the date of this presentation, and CSI undertakes no obligation to update them to reflect subsequent events or circumstances. FINANCIAL INFORMATION This presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by CSI’s independent registered accounting firm. Use of different methods for preparing, calculating or presenting information may lead to differences, which may be material. In addition, this presentation also includes certain non-GAAP financial measures, such as Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this presentation to the most comparable U.S. GAAP measures for the respective periods can be found in tables in the appendix to this presentation. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP.

Strong and Stable Business Model Cash and Liquidity $116M in cash and cash equivalents Recurring cash flow $40M line of credit at June 30, 2018 generated from operations unused and available Revenue Adjusted EBITDA Gross Margin (Millions) (Millions) CAGR = 12% $217 $16 82% $205 $13 81% $182 $178 80% $137 FY14 FY15 FY16 FY17 FY18 78% 77% $(16) $(21) FY14 FY15 FY16 FY17 FY18 $(39) FY14 FY15 FY16 FY17 FY18

Platform for Growth Growth through geographic expansion and innovation Organic growth investments are internally funded ~$250M R&D investments increase to 14%-17% FY19-FY23 R&D Investments of revenues in FY21 (12% in FY18) Leveraging SG&A spend down as a % of revenue Opportunistic portfolio management

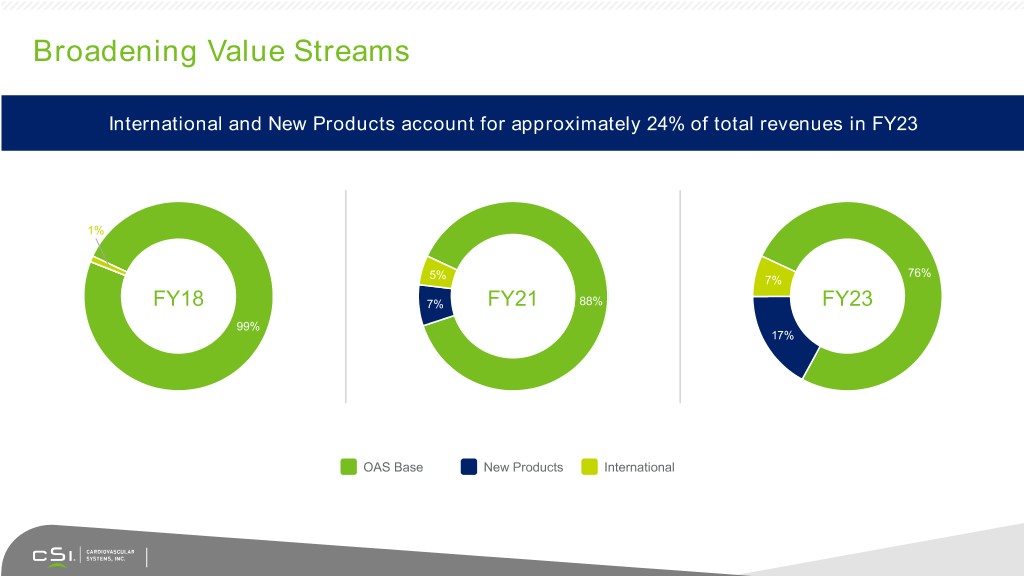

Broadening Value Streams International and New Products account for approximately 24% of total revenues in FY23 1% 76% 5% 7% FY18 7% FY21 88% FY23 99% 17% OAS Base New Products International

FY21 Financial Goals CSI Cost Down Material Cost Reduction Programs Volume Driven OH Leverage LEAN Productivity Initiatives Revenues Gross Margins R&D Investments Adjusted EBITDA Net Income • $300M–$350M • 78%–80% • Approximately $50M • 8%–10% • 3%–5% • CAGR = 11%-17% • Ongoing cost (14%-17% of revenues) of revenue of revenue reduction initiatives • CAGR = 25%

Poised for Significant Long-Term Revenue Growth Historical Revenue Future Revenue $435M–$500M $300M–$350M $240M–$250M $217M $205M $182M $178M $137M FY14 FY15 FY16 FY17 FY18 FY19 FY21 FY23 12% 15%–18% CAGR 5-Year CAGR

Appendix: Non-GAAP Financial Measures To supplement CSI's consolidated condensed financial statements prepared in accordance with GAAP, CSI uses a non-GAAP financial measure referred to as "Adjusted EBITDA" in this presentation. Reconciliations of this non-GAAP measure to the most comparable U.S. GAAP measure for the respective periods can be found in the following table. In addition, an explanation of the manner in which CSI's management uses this measure to conduct and evaluate its business, the economic substance behind management's decision to use this measure, the substantive reasons why management believes that this measure provides useful information to investors, the material limitations associated with the use of this measure and the manner in which management compensates for those limitations is included following the reconciliation table. Year Ended (in thousands) June 30 2014 2015 2016 2017 2018 Net income (loss) $ (35,290) $(32,822) $(56,024) $(1,792) $1,712 Less: Other (income) and expense, net 1,711 71 (145) 164 390 Less: Provision for income taxes 90 114 92 86 132 Income (loss) from operations (33,489) (32,637) (56,077) (1,542) 2,234 Add: Stock-based compensation 10,928 14,718 12,977 10,354 10,302 Add: Depreciation and amortization 1,367 2,321 3,917 4,135 3,934 Adjusted EBITDA $(21,194) $(15,598) $(39,183) $12,947 $16,470 Use and Economic Substance of Non-GAAP Financial Measures Used by CSI and Usefulness of Such Non-GAAP Financial Measures to Investors CSI uses Adjusted EBITDA as a supplemental measure of performance and believes this measure facilitates operating performance comparisons from period to period and company to company by factoring out potential differences caused by depreciation and amortization expense and non-cash charges such as stock based compensation. CSI's management uses Adjusted EBITDA to analyze the underlying trends in CSI's business, assess the performance of CSI's core operations, establish operational goals and forecasts that are used to allocate resources and evaluate CSI's performance period over period and in relation to its competitors' operating results. Additionally, CSI's management is evaluated on the basis of Adjusted EBITDA when determining achievement of their incentive compensation performance targets. CSI believes that presenting Adjusted EBITDA provides investors greater transparency to the information used by CSI's management for its financial and operational decision-making and allows investors to see CSI's results "through the eyes" of management. CSI also believes that providing this information better enables CSI's investors to understand CSI's operating performance and evaluate the methodology used by CSI's management to evaluate and measure such performance.

Appendix: Non-GAAP Financial Measures The following is an explanation of each of the items that management excluded from Adjusted EBITDA and the reasons for excluding each of these individual items: -- Stock-based compensation. CSI excludes stock-based compensation expense from its non-GAAP financial measures primarily because such expense, while constituting an ongoing and recurring expense, is not an expense that requires cash settlement. CSI's management also believes that excluding this item from CSI's non-GAAP results is useful to investors to understand the application of stock- based compensation guidance and its impact on CSI's operational performance, liquidity and its ability to make additional investments in the company, and it allows for greater transparency to certain line items in CSI's financial statements. -- Depreciation and amortization expense. CSI excludes depreciation and amortization expense from its non-GAAP financial measures primarily because such expenses, while constituting ongoing and recurring expenses, are not expenses that require cash settlement and are not used by CSI's management to assess the core profitability of CSI's business operations. CSI's management also believes that excluding these items from CSI's non-GAAP results is useful to investors to understand CSI's operational performance, liquidity and its ability to make additional investments in the company. Material Limitations Associated with the Use of Non-GAAP Financial Measures and Manner in which CSI Compensates for these Limitations Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP. Some of the limitations associated with CSI's use of these non-GAAP financial measures are: -- Items such as stock-based compensation do not directly affect CSI's cash flow position; however, such items reflect economic costs to CSI and are not reflected in CSI's "Adjusted EBITDA" and therefore these non-GAAP measures do not reflect the full economic effect of these items. -- Non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and therefore other companies may calculate similarly titled non-GAAP financial measures differently than CSI, limiting the usefulness of those measures for comparative purposes. -- CSI's management exercises judgment in determining which types of charges or other items should be excluded from the non-GAAP financial measures CSI uses. CSI compensates for these limitations by relying primarily upon its GAAP results and using non-GAAP financial measures only supplementally. CSI provides full disclosure of each non-GAAP financial measure. -- CSI uses and detailed reconciliations of each non-GAAP measure to its most directly comparable GAAP measure. CSI encourages investors to review these reconciliations. CSI qualifies its use of non- GAAP financial measures with cautionary statements as set forth above.

Analyst Day Meeting Scott R. Ward Chairman, President & CEO July 31, 2018

Safe Harbor FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Report Act of 1995, which are provided under the protection of the safe harbor for forward-looking statements provided by that Act. For examples, statements in this presentation regarding CSI’s growth, future financial measurements, product introductions, clinical trials, and market opportunities, are forward-looking statements. These statements involve risks and uncertainties that could cause results differ materially from those projected, including, but not limited to, those described in CSI’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent quarterly and annual reports. CSI encourages you to consider all of these risks, uncertainties and other factors carefully in evaluating the forward-looking statements contained in this presentation. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, CSI’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this presentation. The forward-looking statements contained in this presentation are made only as of the date of this presentation, and CSI undertakes no obligation to update them to reflect subsequent events or circumstances. FINANCIAL INFORMATION This presentation includes calculations or figures that have been prepared internally and have not been reviewed or audited by CSI’s independent registered accounting firm. Use of different methods for preparing, calculating or presenting information may lead to differences, which may be material. In addition, this presentation also includes certain non-GAAP financial measures, such as Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this presentation to the most comparable U.S. GAAP measures for the respective periods can be found in tables in the appendix to this presentation. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for CSI's financial results prepared in accordance with GAAP.

Cardiovascular Systems, Inc. Creating Shareholder Value Leveraging a A Compelling Creating Competitive Financially Strong with the Strong Core Business Growth Strategy Advantage Team and Talent to Win Improving outcomes for Driving market leading Highest quality Sustaining double digit growth complex coronary and performance in orbital products, services with strong gross margins peripheral artery disease atherectomy and relationships Positive cash flow, strong cash position & no long term debt Proprietary Expanding into new Innovation and robust core technology geographic markets medical evidence Positioned to invest in organic growth Serving large and Launching an Medical education A Mission driven organization growing markets innovative portfolio and superior with the leadership and of new products clinical support talent to succeed

David E. Kandzari, MD Director of Interventional Cardiology and Chief Scientific Officer Piedmont Heart Institute Dr. David E. Kandzari is the Director, Interventional Cardiology of the Piedmont Heart Institute and Chief Scientific Officer for the Piedmont Healthcare in Atlanta, Georgia. Dr. Kandzari specializes in cardiovascular disease, peripheral arterial disease and interventional cardiology. A graduate of Duke University School of Medicine, he completed his internship and residency at The John Hopkins University School of Medicine in Baltimore, Maryland. Following his residency, he completed his general and interventional cardiology fellowship at Duke University where he joined the faculty as the John B. Simpson Assistant Professor of Interventional Cardiology and Genomic Sciences. Dr. Kandzari is the former Director of Interventional Cardiology Research at the Scripps Clinic in La Jolla, California. Before joining the Scripps faculty, he also served as Chief Medical Officer for the Cordis Corporation, a Johnson & Johnson Company. He has also served as a Medical Officer for the Center for Devices and Radiological Health for the United States Food and Drug. Board certified by the American Board of Internal Medicine and its subspecialty Board of Cardiovascular Disease and Board of Interventional Cardiology, Dr. Kandzari has held national and international leadership roles in clinical trials in cardiovascular disease and has participated in national and international program committees in cardiology. He has authored and coauthored more than 300 studies, book chapters and scientific reviews, and has delivered more than 600 lectures, both nationally and internationally, on a variety of issues related to both interventional and general cardiology. Dr. Kandzari has been consecutively voted as one of Atlanta's Top Doctors by Atlanta Magazine from 2011 to 2018, and is peer-nominated in the top 1% of cardiologists by U.S News and World Report.

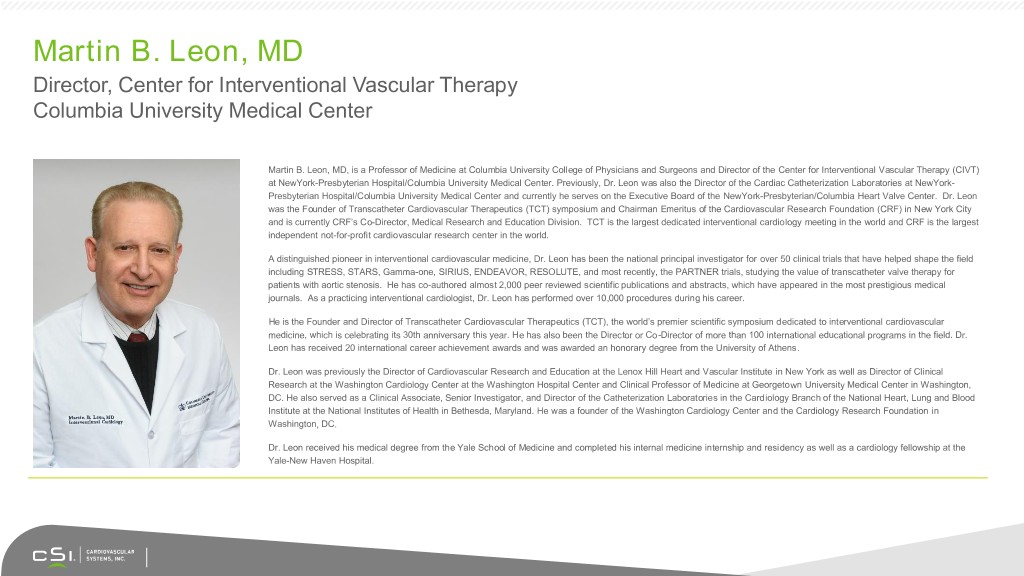

Martin B. Leon, MD Director, Center for Interventional Vascular Therapy Columbia University Medical Center Martin B. Leon, MD, is a Professor of Medicine at Columbia University College of Physicians and Surgeons and Director of the Center for Interventional Vascular Therapy (CIVT) at NewYork-Presbyterian Hospital/Columbia University Medical Center. Previously, Dr. Leon was also the Director of the Cardiac Catheterization Laboratories at NewYork- Presbyterian Hospital/Columbia University Medical Center and currently he serves on the Executive Board of the NewYork-Presbyterian/Columbia Heart Valve Center. Dr. Leon was the Founder of Transcatheter Cardiovascular Therapeutics (TCT) symposium and Chairman Emeritus of the Cardiovascular Research Foundation (CRF) in New York City and is currently CRF’s Co-Director, Medical Research and Education Division. TCT is the largest dedicated interventional cardiology meeting in the world and CRF is the largest independent not-for-profit cardiovascular research center in the world. A distinguished pioneer in interventional cardiovascular medicine, Dr. Leon has been the national principal investigator for over 50 clinical trials that have helped shape the field including STRESS, STARS, Gamma-one, SIRIUS, ENDEAVOR, RESOLUTE, and most recently, the PARTNER trials, studying the value of transcatheter valve therapy for patients with aortic stenosis. He has co-authored almost 2,000 peer reviewed scientific publications and abstracts, which have appeared in the most prestigious medical journals. As a practicing interventional cardiologist, Dr. Leon has performed over 10,000 procedures during his career. He is the Founder and Director of Transcatheter Cardiovascular Therapeutics (TCT), the world’s premier scientific symposium dedicated to interventional cardiovascular medicine, which is celebrating its 30th anniversary this year. He has also been the Director or Co-Director of more than 100 international educational programs in the field. Dr. Leon has received 20 international career achievement awards and was awarded an honorary degree from the University of Athens. Dr. Leon was previously the Director of Cardiovascular Research and Education at the Lenox Hill Heart and Vascular Institute in New York as well as Director of Clinical Research at the Washington Cardiology Center at the Washington Hospital Center and Clinical Professor of Medicine at Georgetown University Medical Center in Washington, DC. He also served as a Clinical Associate, Senior Investigator, and Director of the Catheterization Laboratories in the Cardiology Branch of the National Heart, Lung and Blood Institute at the National Institutes of Health in Bethesda, Maryland. He was a founder of the Washington Cardiology Center and the Cardiology Research Foundation in Washington, DC. Dr. Leon received his medical degree from the Yale School of Medicine and completed his internal medicine internship and residency as well as a cardiology fellowship at the Yale-New Haven Hospital.

Jeffrey S. Points Chief Financial Officer Cardiovascular Systems, Inc. Mr. Points joined CSI in September 2007 as Corporate Controller, became Senior Director and Controller in July 2013, Corporate Controller and Treasurer in January 2015, Vice President, Corporate Controller and Treasurer in May 2017 and was promoted to Chief Financial Officer in February 2018. From July 2005 to September 2007, Mr. Points was Assistant Controller at Empi, a manufacturer and provider of non-invasive medical products for pain management and physical rehabilitation. From January 1998 to July 2005, Mr. Points held various leadership positions at CliftonLarsonAllen, a national public accounting firm. Mr. Points also serves as a member of the Board of Directors for The Phoenix Residence, Inc.

Rhonda J. Robb Chief Operating Officer Cardiovascular Systems, Inc. Ms. Robb joined CSI as Chief Operating Officer in January 2018. Ms. Robb brings more than 30 years of medical device leadership to the company. Prior to CSI, she held several positions at Medtronic, most recently as Vice President and General Manager of the Heart Valve Therapies Business, including the transcatheter aortic valve business. In previous roles, Ms. Robb held leadership positions in Medtronic’s Coronary, Peripheral, and Cardiac Rhythm and Heart Failure businesses.

Scott R. Ward Chairman, President & Chief Executive Officer Cardiovascular Systems, Inc. Mr. Ward has been a member of the CSI Board of Directors since 2013 and has served as Chairman since November 2014. Mr. Ward served as our Interim President and Chief Executive Officer commencing in November 2015. In August 2016, Mr. Ward was appointed President and Chief Executive Officer. Since 2013, Mr. Ward has been one of the Managing Directors at SightLine Partners. Following his appointment as our President and Chief Executive Officer, Mr. Ward continues to be a Managing Director of Sightline Opportunity Management Fund II, LLC, and may provide limited advisory and consulting services to Sightline Partners in this capacity. From 1981 to 2010, Mr. Ward was employed by Medtronic, Inc., and held a number of senior leadership positions. Mr. Ward was Senior Vice President and President of Medtronic’s CardioVascular business from May 2007 to November 2010. Prior to that he was Senior Vice President and President of Medtronic’s Vascular business from May 2004 to May 2007, Senior Vice President and President of Medtronic’s Neurological and Diabetes business, from February 2002 to May 2004, and was President of Medtronic’s Neurological business from January 2000 to January 2002. He was Vice President and General Manager of Medtronic’s Drug Delivery business from 1995 to 2000. Prior to that, Mr. Ward led Medtronic’s Neurological Ventures in the successful development of new therapies. Mr. Ward serves on the boards of several private companies. Until April 4, 2016, Mr. Ward was the Chairman of the Board of Creganna Medical. Mr. Ward served as a member of the Board of Surmodics, Inc., from September 2010 to March 2015.

CSI®, Diamondback®, Diamondback 360®, GlideAssist®, ViperWire® and ViperWire Advance® are trademarks of Cardiovascular Systems, Inc. © 2018 Cardiovascular Systems, Inc. Sapphire® and OrbusNeich® are trademarks of OrbusNeich Medical, Inc.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ROSEN, TOP RANKED INVESTOR COUNSEL, Encourages Shoals Technologies Group, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – SHLS

- RUM Reports Annual Financial Results with Increased Net Comprehensive Income for the Year Ended December 31, 2023

- Belite Bio Announces $25 Million Registered Direct Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share