Form 8-K CHIMERA INVESTMENT CORP For: Jun 08

Exhibit 4.1

WARRANT

THE OFFER AND SALE OF THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH THE FOLLOWING SENTENCE. BY ITS ACQUISITION HEREOF OR OF A BENEFICIAL INTEREST HEREIN, THE ACQUIRER (1) REPRESENTS THAT IT IS AN ACCREDITED INVESTOR WITHIN THE MEANING OF REGULATION D AS PROMULGATED UNDER THE SECURITIES ACT, AND (2) AGREES FOR THE BENEFIT OF CHIMERA INVESTMENT CORPORATION (THE “COMPANY”) THAT IT WILL NOT OFFER, SELL, PLEDGE OR OTHERWISE TRANSFER THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT OR ANY BENEFICIAL INTEREST HEREIN OR THEREIN EXCEPT: (A) TO THE COMPANY OR ANY SUBSIDIARY THEREOF, OR (B) PURSUANT TO A REGISTRATION STATEMENT THAT HAS BECOME EFFECTIVE UNDER THE SECURITIES ACT, OR (C) PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.

| Warrant Certificate No.: W-[•] | Original Issue Date: June 8, 2020 |

FOR VALUE RECEIVED, Chimera Investment Corporation, a Maryland corporation (the “Company”), hereby certifies that [•], a [•], or its registered assigns (the “Holder”) is entitled to purchase from the Company a number of duly authorized, validly issued, fully paid and non-assessable shares of Common Stock equal to the Warrant Share Number as set for the in the electronic, book-entry records of Computershare Inc. and Computershare Trust Company, N.A., collectively in their capacity as warrant agent for the warrants (the “Warrant Agent”) at a purchase price per share of $0.01 (the “Exercise Price”), all subject to the terms, conditions and adjustments set forth below in this Warrant and in the Warrant Agency Agreement, dated June 8, 2020 (the “Warrant Agreement”), by and between the Company and the Warrant Agent. Certain capitalized terms used herein are defined in Section 1.

1. Definitions. As used in this Warrant, the following terms have the respective meanings set forth below:

“Affiliate” means, as applied to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with, that Person. For the purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by” and “under common control with”), as applied to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of that Person, whether through the ability to exercise voting power, by contract or otherwise.

“Aggregate Exercise Price” means an amount equal to the product of (a) the number of Warrant Shares in respect of which this Warrant is then being exercised pursuant to Section 3 hereof, multiplied by (b) the Exercise Price.

“Allocated Public Offering” means a firm commitment underwritten offering of Subject Securities registered under the Securities Act.

“Applicable Law” means, with respect to a Person, collectively all laws, regulations, ordinances, decrees, judicial and administrative orders (and any license, franchise, permit or similar right granted under any of the foregoing) and any policies and other requirements of any applicable Governmental Authority that govern or otherwise apply to such Person’s activities in connection with this Warrant.

“Applicable Ownership Percentage” at any time, means the number of shares of Common Stock equal to the product of (a) a fraction, the numerator of which is the Warrant Share Number in effect at such time, and the denominator of which is the aggregate number of shares of Common Stock which are issuable upon exercise of all Credit Agreement Warrants (including without limitation this Warrant) at such time (without regard to any limitations on exercise herein or elsewhere and without regard to whether a sufficient number of shares of Common Stock are authorized and reserved to effect any such exercise and issuance) and (b) a number of shares of Common Stock equal to [•]% of all Common Stock outstanding at such time, on a fully-diluted basis.

“Board” means the board of directors of the Company.

“Benefit Plan Shares” has the meaning set forth in the definition of “fully diluted basis.”

“Business Day” means any day excluding Saturday, Sunday and any day which is a legal holiday under the laws of the State of New York or is a day on which banking institutions located in New York City are authorized or required by law or other governmental action to close.

“Cash Settlement Price” means the product of (x) the Fair Market Value of the Company’s Common Stock calculated as of the Exercise Date and (y) 0.9.

“Charter” means the Articles of Amendment and Restatement of the Company, as may be amended or supplemented from time to time.

“Credit Agreement” means the Credit Agreement, dated as of June 8, 2020, by and among Kali Funding LLC, as borrower, the Company, as guarantor and as seller, the lenders party thereto from time to time, and Ares Agent Services, L.P., as administrative agent and collateral agent, as in effect on the Original Issue Date.

“Credit Agreement Warrants” means all warrants issued pursuant to the Credit Agreement, including without limitation, this Warrant, any similar warrants issued contemporaneously with this Warrant pursuant to the Credit Agreement, and any warrants issued upon division or combination of, or in substitution for, any of such warrants.

2

“Common Stock” means the common stock, par value $0.01 per share, of the Company, and any capital stock into which such Common Stock shall have been converted, exchanged or reclassified following the date hereof.

“Company” has the meaning set forth in the preamble.

“Company Competitor” means, for the purposes of this Warrant, any Person that is a residential mortgage real estate investment trust, a competitor of the Company (i.e., bidding on or investing in similar assets as the Company), primarily engaged in similar business or activities as the Company, or any Affiliate thereof. Company Competitors shall include New Residential Investment Corp., OneMain Holdings, Inc., and any of their respective Affiliates. Notwithstanding the foregoing, Company Competitors shall not include any Competitor Affiliate identified on the list of Persons delivered by the Holder to the Company prior to the Original Issue Date.

“Competitor Affiliate” means, with respect to any Company Competitor or any Affiliate thereof, any fund, investment vehicle, regulated bank entity, unregulated lending entity or other Person that is managed, sponsored or advised by any person that is controlling, controlled by or under common control with the relevant Company Competitor or Affiliate thereof, but only to the extent that no personnel involved with the investment decisions of the relevant Company Competitor (i) makes (or has the right to make or participate with others in making) investment decisions on behalf of, or otherwise cause the direction of the investment policies of, such debt fund, investment vehicle, regulated bank entity or unregulated entity or (ii) has access to any information (other than information that is publicly available) relating to the Company or any subsidiary thereof.

“Convertible Securities” means any securities (directly or indirectly) convertible into or exchangeable for Common Stock, but excluding Options.

“Dividend Threshold Amount” means (i) $0.30 per share of Common Stock per fiscal quarter, or (ii), $0.50 per share of Common Stock per fiscal quarter if none of Company’s 7.00% Convertible Senior Notes due 2023 are outstanding at the close of business on the date immediately preceding the record date for such dividend, in each case as adjusted for any stock split, stock dividend, reverse stock split, reclassification or similar transaction and as further adjusted to account for any change in the frequency of payment by the Company of its regular cash dividend; provided that the dividend threshold amount shall be deemed to be zero if such dividend or distribution on the Company’s Common Stock is not a regularly scheduled dividend by the Company.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Excluded Issuances” shall have the meaning set forth in clause (iii) of Section 5(e).

3

“Ex-Dividend Date” means the first date on which shares of the Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive the issuance, dividend or distribution in question, from the Company or, if applicable, from the seller of Common Stock on such exchange or market (in the form of due bills or otherwise) as determined by such exchange or market; provided that if the Common Stock does not trade on an exchange or market, the “Ex-Dividend Date” shall mean the record date for such issuance, dividend or distribution.

“Exercise Date” means, (i) for an exercise of this Warrant pursuant to Section 3(a), the Business Day on which the conditions to such exercise as set forth in Section 3(a) shall have been satisfied, (ii) for an exercise of this Warrant pursuant to Section 3(b), the Expiration Date, and (iii) for an exercise of this Warrant pursuant to Section 3(d)(iii), the Exercise Commencement Date.

“Exercise Commencement Date” means the earliest of (i) June 10, 2023, (ii) the date on which the aggregate principal amount of all outstanding loans under the Credit Agreement have been repaid, prepaid, cancelled or otherwise discharged in full, (iii) the first date on which all outstanding loans under the Credit Agreement are owned or held by one or more lenders that are the Company or any of its Affiliates, and (iv) the first date on which any Event of Default (as defined in the Credit Agreement) has occurred and in connection with such Event of Default the aggregate principal amount of all outstanding loans under the Credit Agreement have been declared due and payable.

“Exercise Commencement Date Cash-Out” has the meaning set forth in Section 3(d)(iii).

“Exercise Period” means the period from, and including, the Exercise Commencement Date to, and including, the Expiration Time.

“Exercise Price” has the meaning set forth in the preamble.

“Expiration Date” means the date of the Expiration Time.

“Expiration Time” means 5:30 p.m., New York time, on the first anniversary of the Exercise Commencement Date.

“Fair Market Value” means, as of any particular date: (a) the last reported sales price per share of the Common Stock for each Business Day referred to below on the principal domestic securities exchange on which the Common Stock may at the time be listed; (b) if there have been no sales of the Common Stock on any such exchange on any such Business Day referred to below, the average of the highest bid and lowest asked prices for the Common Stock on such exchange at the end of such Business Day referred to below; (c) if on any such Business Day referred to below the Common Stock is not listed on a domestic securities exchange, the closing sales price of the Common Stock as quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association for such Business Day referred to below; or (d) if there have been no sales of the Common Stock on the OTC Bulletin Board, the Pink OTC Markets or similar

4

quotation system or association on any such Business Day referred to below, the average of the highest bid and lowest asked prices for the Common Stock quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association at the end of such Business Day referred to below; in each case, averaged over thirty (30) consecutive Business Days ending on the Business Day immediately prior to the day as of which “Fair Market Value” is being determined; provided, that if the Common Stock is listed on any domestic securities exchange, the term “Business Day” as used in this sentence means Business Days on which such exchange is open for trading. If at any time the Common Stock is not listed on any domestic securities exchange or quoted on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association, the “Fair Market Value” of the Common Stock shall be the fair market value per share as determined by the Board in good faith.

“fully-diluted basis” means, all (i) outstanding shares of Common Stock and (ii) shares of Common Stock that may be issuable upon conversion of the Company’s 7.00% Convertible Senior Notes due 2023 (which as of the Original Issue Date, such shares referred to in clause (i) and (ii) above shall initially be equal to [__] shares of Common Stock), it being understood that the calculation of “fully-diluted basis” for all purposes of this Warrant shall not include any issuance of shares of any equity securities (whether or not such equity securities are outstanding on the date hereof) pursuant to an employee stock option plan, management incentive plan, restricted stock plan, stock purchase plan, stock deferral plan, stock ownership plan or similar benefit plan, similar program or similar agreement in each case as is approved by the Board (collectively, “Benefit Plan Shares”, regardless of whether such Benefit Plan Shares are then vested, exercisable, convertible or exchangeable in accordance with their terms).

“Governmental Authority” means any federal, state, national, state, provincial or local government, or political subdivision thereof, or any multinational organization or any authority, agency or commission entitled to exercise any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power, or any court or tribunal (or any department, bureau or division thereof, or any governmental arbitrator or arbitral body).

“Holder” has the meaning set forth in the preamble; provided that for purposes of Section 6 “Holder” shall also include any Affiliate of the Holder that is designated to purchase the applicable Subject Securities pursuant to Section 6.

“Issuance Notice” means a written notice provided by the Company to the Holder with respect to a Triggering Event or an Allocated Public Offering, as applicable.

“Notice of Exercise” has the meaning set forth in Section 3(a).

“Options” means any warrants or other rights or options to subscribe for or purchase Common Stock or Convertible Securities.

“Ordinary Cash Dividends” means regularly scheduled cash dividends on shares of Common Stock that do not exceed the Dividend Threshold Amount.

5

“Original Issue Date” means June 8, 2020.

“OTC Bulletin Board” means the Financial Industry Regulatory Authority OTC Bulletin Board electronic inter-dealer quotation system.

“Ownership Limitations” means the limitations on beneficial or constructive ownership of shares of Common Stock contained in the Charter.

“Person” means and includes any natural person, corporation, limited partnership, general partnership, limited liability company, limited liability partnership, joint stock company, joint venture, association, company, trust, bank, trust company, land trust, business trust, statutory trust, series trust, other organization, whether or not a legal entity, Governmental Authority or other entity.

“Pink OTC Markets” means the OTC Markets Group Inc. electronic inter-dealer quotation system, including OTCQX, OTCQB and OTC Pink.

“Pre-Emptive Right” means, with respect to each Triggering Event, the right of the Holder to purchase from the Company, in accordance with the provisions of Section 6, up to the Holder’s Pro Rata Portion of the Subject Securities to be issued in such Triggering Event.

“Pre-Emptive Right Closing” means, for each Triggering Event with respect to which the Holder has exercised its Pre-Emptive Right to purchase a portion of the Subject Securities to be issued pursuant to such Triggering Event, the closing of the purchase of such Subject Securities pursuant to such exercise of the Holder’s Pre-Emptive Right.

“Pro Rata Portion” means, with respect to the Subject Securities to be issued pursuant to an Allocated Public Offering or a Triggering Event, as applicable, a number of such Subject Securities equal to the product of the total number of such Subject Securities multiplied by a fraction, (x) the numerator of which shall be the Warrant Share Number in effect immediately prior to such Allocated Public Offering or Triggering Event (without regard to any limitations on exercise herein or elsewhere and without regard to whether a sufficient number of shares of Common Stock are authorized and reserved to effect any such exercise and issuance), and (y) the denominator of which shall be the total number of shares of Common Stock outstanding on a fully-diluted basis on the date of the Issuance Notice pertaining to such Allocated Public Offering or Triggering Event.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Special Option” means an option or other security granted by the Company that is convertible or exercisable into or exchangeable for Common Stock for nominal or indeterminate consideration, and includes an over-allotment option or similar option granted to one or more underwriters in connection with a public offering of securities of the Company.

6

“Subject Securities” means, with respect to each Allocated Public Offering and each Triggering Event, the shares of Common Stock, Options and/or Convertible Securities to be issued pursuant thereto.

“Triggering Event” means the issue of Common Stock, Options and/or Convertible Securities by the Company, whether by way of public offering or private placement, including any issue of Common Stock on the exercise, conversion or exchange of any Special Option, but excluding any issue of Common Stock, Options and/or Convertible Securities pursuant to a Triggering Event Excluded Issuance or an Allocated Public Offering.

“Triggering Event Closing Date” means the date on which a Triggering Event occurs.

“Triggering Event Price” means, (i) in respect of an issue of Common Stock, Options and/or Convertible Securities by the Company for cash consideration pursuant to a Triggering Event, the purchase price per share of Common Stock, Options and/or Convertible Security to be paid for such Common Stock, Options and/or Convertible Securities by purchasers other than the Holder and (ii) in respect of an issue of Common Stock, Options and/or Convertible Securities for consideration other than cash consideration pursuant to a Triggering Event, the price per share of Common Stock, Options and/or Convertible Security, as determined by the Board acting in good faith, that would have been received by the Company had such Common Stock, Options and/or Convertible Securities been issued for cash consideration.

“Triggering Event Excluded Issuance” means (i) any Excluded Issuances, (ii) any issuance of Common Stock in a transaction registered under the Securities Act pursuant to an at-the-market Common Stock offering program of the Company, and (iii) any issuance of Subject Shares in connection with bona fide debt, equipment financing or non-equity financing transactions with lenders to the Company.

“Warrant” means this Warrant and all warrants represented and outstanding under this Warrant and in the records of the Warrant Agent issued upon division or combination of, or in substitution for, this Warrant.

“Warrant Share Number” means, at any time, the aggregate number of Warrant Shares as listed in the records of the Warrant Agent which are issuable upon exercise of this Warrant at such time (without regard to any limitations on exercise herein or elsewhere and without regard to whether a sufficient number of shares of Common Stock are authorized and reserved to effect any such exercise and issuance), as such number may be adjusted from time to time pursuant to the terms hereof. The Warrant Share Number shall initially be [•].

7

“Warrant Shares” means the shares of Common Stock or other capital stock of the Company which are issuable upon exercise of this Warrant in accordance with the records of the Warrant Agent and the terms of this Warrant.

| 2. | Exercise Period. Subject to the terms and conditions hereof and in the Warrant Agreement, this Warrant may be exercised, in whole or in part, at any time and from time to time during the Exercise Period, subject to the Company’s option pursuant to Section 3(d)(iii) to cause all or a portion of the Warrant to be exercised for cash on the Exercise Commencement Date. |

| 3. | Exercise of Warrant. |

| (a) | Cashless Exercise by Holder. Subject to the Company’s option pursuant to Section 3(d)(iii) to cause all or a portion of the Warrant to be exercised for cash on the Exercise Commencement Date, the Holder may exercise this Warrant for any or all unexercised Warrant Shares upon surrender of this Warrant to the Warrant Agent at the office of the Warrant Agent designated for such purposes (or the indemnification undertaking set forth in the Warrant Agreement with respect to this Warrant in the case of its loss, theft or destruction), together with a notice of exercise substantially in the form attached hereto as Exhibit A (each a “Notice of Exercise”), properly completed (including specifying the number of Warrant Shares to be purchased) and duly executed. As promptly as practicable following the receipt by the Warrant Agent of the Notice of Exercise and the Warrant, the Warrant Agent shall transmit an acknowledgment of confirmation of receipt of the Exercise Notice and Warrant to the Company. Subject to the terms and conditions hereof and in the Warrant Agreement, including the option of the Company to settle exercises of this Warrant for cash, on the Exercise Date, this Warrant shall be deemed cashlessly exercised for the number of Warrant Shares specified in the Notice of Exercise executed and delivered by the Holder. In connection therewith, the Company is hereby directed and authorized to withhold a number of Warrant Shares then issuable upon exercise of this Warrant with an aggregate Fair Market Value as of the Exercise Date equal to the Aggregate Exercise Price, and all the Warrant Shares so withheld by the Company shall be deemed irrevocably surrendered by the Holder to the Company in satisfaction of the payment by the Holder of the Aggregate Exercise Price. Within two (2) Business Days of the Exercise Date, the Company shall issue to the Holder the Warrant Shares that the Holder is entitled to receive pursuant to such exercise (net of the Warrant Shares so withheld by the Company); provided that the Company, at its option, shall have the right to settle any exercise in cash pursuant to clause (ii) of Section 3(d). |

| (b) | Automatic Cashless Exercise upon Expiration Date. Subject to the terms and conditions hereof and in the Warrant Agreement, including the option of the Company to settle exercises of this Warrant for cash, if on the Expiration Date any Warrant Shares remain unissued, then without any action by the Holder, the Warrant Agent or the Company whatsoever, on the Expiration Date, this Warrant shall be automatically, fully and cashlessly exercised for any remaining Warrant |

8

| Shares in accordance with this Section 3(b) ; provided that the Company, at its option, shall have the right to settle such exercise in cash pursuant to clause (ii) of Section 3(d). In connection therewith, the Company is hereby directed and authorized to withhold a number of Warrant Shares then issuable upon exercise of this Warrant with an aggregate Fair Market Value as of the Expiration Date equal to the Aggregate Exercise Price, and all the Warrant Shares so withheld by the Company shall be deemed irrevocably surrendered by the Holder to the Company in satisfaction of the payment by the Holder of the Aggregate Exercise Price. |

| (c) | In the event of the withholding of Warrant Shares pursuant to Section 3(a) or Section 3(b), as applicable, where the number of Warrant Shares to be withheld by the Company would not be a whole number, the number of Warrant Shares withheld by and surrendered to the Company as provided above shall be rounded up to the nearest whole number of Warrant Shares and the Company shall make a cash payment to the Holder (by delivery of a certified or official bank check or by wire transfer of immediately available funds) based on the incremental fraction of a Warrant Share being so withheld by or surrendered to the Company in an amount equal to the product of (x) such incremental fraction of a Warrant Share being so withheld or surrendered multiplied by (y) the Fair Market Value of one Warrant Share as of the Exercise Date. |

| (d) | Delivery of Stock Certificates and/or Book-Entry Shares or Cash; Exercise Commencement Date Cash-Out; Cancelled Warrants. |

| (i) | Subject to clause (ii) of this Section 3(d), upon receipt by the Warrant Agent of a Notice of Exercise and surrender of this Warrant, the Company shall, as promptly as practicable, and in any event within two (2) Business Days thereafter, at the option of the Holder, either (A) execute (or cause to be executed) and deliver (or cause to be delivered) to the Holder a certificate or certificates representing the Warrant Shares issuable upon such exercise, (B) cause to be issued to the Holder by entry on the books of the Company (or the Company’s transfer agent, if any) or (C) credit the account of the Holder’s prime broker with the Depository Trust Company through its Deposit/Withdrawal at Custodian system if the Company is then a participant in such system, the Warrant Shares issuable upon such exercise, in each case, together with cash in lieu of any fraction of a Warrant Share, as provided in Section 3(c). The Warrant Shares so delivered or issued, as the case may be, shall be in such denomination or denominations as the exercising Holder shall request in the Notice of Exercise and shall be registered in the name of the Holder or, subject to compliance with Section 8 below, such other Person’s name as shall be designated in the Notice of Exercise. This Warrant shall be deemed to have been exercised and the Warrant Shares shall be deemed to have been issued, and the Holder or any other Person so designated to be named therein shall be deemed to have become a holder of record of such Warrant Shares for all purposes, as of the Exercise Date. |

9

| (ii) | The Company shall have the right, at its option, to settle any exercise of this Warrant in whole or in part in cash in lieu of the issuance of Warrant Shares. If the Company elects to settle all or a portion of an exercise of this Warrant in cash, upon surrender of this Warrant to the Warrant Agent at the office of the Warrant Agent designated for such purposes (or the indemnification undertaking set forth in the Warrant Agreement with respect to this Warrant in the case of its loss, theft or destruction) in conformity with the foregoing provisions, the Company shall, as promptly as practicable and in any event within two (2) Business Days thereafter pay an amount in cash equal to the product of (x) the Warrant Shares to which the Holder is entitled pursuant to Section 3(a) or Section 3(b), as applicable, (net of the Warrant Shares withheld by the Company pursuant to such clause) for which the Company elects to settle in cash and (y) the Cash Settlement Price, such amounts to be paid, in the sole discretion of the Holder, by wire transfer of immediately available funds to a bank account designated by the Holder or by certified or official bank check or bank cashier’s check payable to the order of such Holder or by any combination of such wire transfer or check. If the Company elects to settle an exercise of the Warrant in part in cash, the Company shall deliver the remaining Warrant Shares in accordance with clause (i) of this Section 3(d). |

| (iii) | Notwithstanding the foregoing, the Company shall have the option to cause all or a portion of the Warrant to be exercised for cash on the Exercise Commencement Date (“Exercise Commencement Date Cash-Out”). Upon the determination of the Exercise Commencement Date, the Company shall provide the Warrant Agent notice as promptly as practicable after such determination is made. If the Company exercises the Exercise Commencement Date Cash-Out, it shall provide the Holder and the Warrant Agent at least ten (10) Business Days advance notice prior to the Exercise Commencement Date, and such notice shall include the portion of the Warrant to be exercised on the Exercise Commencement Date. The parties shall effect any Exercise Commencement Date Cash-Out pursuant to the processes and procedures set forth in Section 3(d)(ii), including without limitation with respect to the calculation and payment of the Cash Settlement Price. Any portion of the Warrant not exercised on the Exercise Commencement Date pursuant to this Section 3(d)(iii) shall continue to subject to the terms and conditions of this Warrant. |

| (iv) | Notwithstanding the foregoing, each of the Company and Holder acknowledge that, under certain circumstances, a specified number of Warrants issued to a Holder (or allocated to an Affiliate thereof) designated as a “Specified Increased-Cost Lender” (as defined in the Credit Agreement), shall be cancelled, and such Specified Increased-Cost Lender shall deliver such Warrants, or cause such Warrants to be delivered, to the Company for cancellation pursuant to the terms and conditions of the Credit Agreement. The Company shall be permitted to |

10

| instruct such Specified Increased-Cost Lender to deliver any such cancelled Warrants to the Warrant Agent (and shall provide the Warrant Agent commercially reasonable advance notice of any such cancellation, and other instructions and information as reasonably requested by the Warrant Agent). Each of the Company and Holder further agree that, to the extent that the Holder funds or otherwise makes a Loan (as defined in the Credit Agreement) to the Company in an amount less than such Holder’s Commitment (as defined in the Credit Agreement), a specified number of Warrants issued to such Holder shall be cancelled in an amount commensurate with such lesser funded amount (and any such cancelled Warrants shall be delivered to the Warrant Agent with appropriate instructions for cancellation from the Company). The Warrant Agent shall be fully protected in relying on such instructions from the Company and effecting the cancellation of the Warrants in the electronic, book-entry records of the Warrant Agent as instructed thereby, and shall have no duty or liability with respect to, and shall not be deemed to have knowledge of any such failure of the Holder to fund or otherwise make a Loan and/or the cancellation of any number of Warrants issued to the Holder unless and until it shall have received such instructions from the Company. |

| (v) | If the initial Commitment (as defined in the Credit Agreement) of the Holder (or, if the Holder does not have an initial Commitment, the initial Commitment of its applicable Lending Affiliate (as defined in the Credit Agreement) in respect of which this Warrant has been delivered) has not been funded in the amount requested by Kali Funding LLC, as borrower, pursuant to the Credit Agreement at or prior to 5:00 p.m., New York City time, on June 12, 2020 (the “Funding Deadline”), the Company shall have the right to deliver a written instruction to the Warrant Agent immediately after the Funding Deadline, accompanied by a certificate executed by two officers of the Company (one of whom shall be the chief executive officer or the chief financial officer of the Company) certifying that the Holder (or Lending Affiliate thereof) has failed to fund such initial Commitment at or prior to the Funding Deadline and instructing the Warrant Agent to cancel this Warrant issued to the Holder on the Original Issue Date. In such event, the Company shall deliver copies of such instruction and certificate to the Holder substantially concurrently with such delivery to the Warrant Agent. Upon receipt of such written instruction and certificate, the Warrant Agent shall promptly cancel this Warrant. The Warrant Agent shall be fully protected in relying on such instruction and certificate and effecting the cancellation of the Warrants in the electronic, book-entry records of the Warrant Agent as instructed thereby, and shall have no duty or liability with respect to, and shall not be deemed to have knowledge of any such failure of the Holder to fund such initial Commitment and/or the cancellation of this Warrant unless and until it shall have received such instruction and certificate from the Company. |

11

| (e) | Valid Issuance of Warrant and Warrant Shares; Payment of Taxes. The Company hereby represents, warrants, covenants and agrees as follows: |

| (i) | This Warrant is, and any Warrant issued in substitution for or replacement of this Warrant shall be, upon issuance, duly authorized and validly issued. This Warrant constitutes, and any Warrant issued in substitution for or replacement of this Warrant shall be, upon issuance, a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity. |

| (ii) | All Warrant Shares issuable upon exercise of this Warrant pursuant to the terms hereof shall be, upon issuance, and the Company shall take all such actions as may be necessary or appropriate in order that such Warrant Shares are, validly issued, fully paid and non-assessable, issued without violation of any preemptive or similar rights of any stockholder of the Company and free and clear of all taxes, liens and charges in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue). |

| (iii) | The Company shall use commercially reasonable efforts to ensure that all such Warrant Shares are issued without violation by the Company of any Applicable Law or governmental regulation or any requirements of any domestic securities exchange upon which shares of Common Stock or other securities constituting Warrant Shares may be listed at the time of such exercise (except for official notice of issuance which shall be immediately delivered by the Company upon each such issuance). The Company shall use best efforts to (A) procure, at its sole expense, the listing of the Warrant Shares issuable upon exercise of this Warrant, subject to issuance or notice of issuance, on all principal stock exchanges on which the Common Stock is then listed or traded and (B) maintain such listings of such Warrant Shares at all times after issuance. |

| (f) | Reservation of Shares. The Company shall at all times from the date hereof and for so long as any portion of this Warrant remains unexercised reserve and keep available out of its authorized but unissued Common Stock or treasury shares constituting Warrant Shares, solely for the purpose of issuance upon exercise of this Warrant, the maximum number of Warrant Shares issuable upon exercise of this Warrant, and the par value per Warrant Share shall at all times be less than or equal to the applicable Exercise Price. The Company shall not increase the par value of any Warrant Shares receivable upon exercise of this Warrant above the Exercise Price then in effect, and shall take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and non-assessable shares of Common Stock upon exercise of this Warrant. |

12

| (g) | Delivery of New Warrant. Unless the purchase rights represented by this Warrant shall have been fully exercised, the Warrant Agent shall, at the time of delivery of the Warrant Shares being issued in accordance with Section 3(d) or as promptly as practicable thereafter, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the unexpired and unexercised Warrant Shares called for by this Warrant. Such new Warrant shall in all other respects be identical to this Warrant. |

| 4. | Participation in Dividends. The Holder, as the holder of this Warrant, prior to exercise of this Warrant shall not be entitled to receive any dividends paid and distributions of any kind (including (x) cash or any other property or securities, or (y) any rights, options or warrants to subscribe for or purchase any of the foregoing) made to the holders of Common Stock. |

| 5. | Adjustments. In order to prevent dilution of the purchase rights granted under this Warrant, the Warrant Share Number issuable upon exercise of this Warrant shall be subject to adjustment (an “Adjustment”) from time to time as provided in this Section 5 (in each case, after taking into consideration any prior Adjustments pursuant to this Section 5). |

| (a) | Adjustment to Number of Warrant Shares Upon Share Dividend, Subdivision or Combination of Common Stock. If the Company shall, at any time or from time to time after the Original Issue Date, (i) pay a dividend or make any other distribution upon Common Stock or any other capital stock of the Company payable in shares of Common Stock, in Convertible Securities or in Options to all or substantially all the holders of the Common Stock, or (ii) subdivide (by any stock split, recapitalization or otherwise) its outstanding shares of Common Stock into a greater number of shares, in each case other than any such transaction covered by Section 5(b), Section 5(c), Section 5(d) or Section 5(e), the Warrant Share Number immediately prior to any such dividend, distribution or subdivision shall be proportionately increased so that the Holder shall be entitled to receive upon exercise of this Warrant the number of shares of Common Stock or other securities of the Company that the Holder would have owned or would have been entitled to receive upon or by reason of any event described above, had this Warrant been exercised immediately prior to the occurrence of such event. If the Company at any time combines (by combination, reverse stock split or otherwise) its outstanding shares of Common Stock into a smaller number of shares, the Warrant Share Number immediately prior to such combination shall be proportionately decreased so that the Holder shall be entitled to receive upon exercise of this Warrant the number of shares of Common Stock or other securities of the Company that the Holder would have owned or would have been entitled to receive upon or by reason of any event described above, had this Warrant been exercised immediately prior to the occurrence of such event. Any Adjustment under this Section 5(a) shall become effective on the Ex-Dividend Date for such dividend or at the close of business on the effective date for such subdivision or combination, as applicable. |

13

| (b) | Adjustment Upon Other Distributions. |

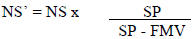

| (i) | In case the Company shall fix a record date for the making of a distribution to any or all holders of shares of its Common Stock of securities, evidences of indebtedness, assets, cash, rights, warrants or other property (excluding Ordinary Cash Dividends and other dividends or distributions referred to in Section 5(a) and Section 5(d)), in each such case; then the Warrant Share Number will be adjusted based on the following formula: |

| ||||

| where,

|

||||

| NS’ = | the Warrant Share Number in effect immediately after the close of business on such record date | |||

| NS = | the Warrant Share Number in effect immediately prior to the close of business on the record date fixed for such distribution | |||

| SP = | the Fair Market Value per share of Common Stock on the last Business Day immediately preceding the first date on which the Common Stock trades regular way without the right to receive such distribution | |||

| FMV = | the amount of the cash and the fair market value (as determined in good faith by the Board) of the securities, evidences of indebtedness, assets, rights, warrants or other property distributed with respect to each outstanding share of Common Stock on the record date for such distribution | |||

| (ii) | Such adjustment shall become effective immediately prior to 9:00 a.m., New York City time, on the Business Day following the date fixed for the determination of stockholders entitled to receive such distribution. Such adjustment shall be made successively whenever such a record date is fixed with respect to a subsequent event. |

| (iii) | In the case of adjustment for a cash dividend that is a regularly scheduled cash dividend, the “SP” in the numerator would be reduced by the per share amount of the portion of the cash dividend that would constitute an Ordinary Cash Dividend. |

| (iv) | In the event that such distribution is not so made, the Warrant Share Number issuable upon exercise of this Warrant then in effect shall be readjusted, effective as of the date when the Board determines not to distribute such shares, evidences of indebtedness, assets, rights, cash, warrants or other property, as the case may be, to the Warrant Share Number that would then be issuable upon exercise of this Warrant if such record date had not been fixed. |

14

| (c) | Adjustment Upon Reorganization, Reclassification, Consolidation or Merger. In the event of any (A) liquidation or dissolution of the Company in accordance with the terms and subject to the conditions set forth in the Charter, whether occurring directly or indirectly, in one or more related transactions, (B) capital reorganization of the Company, (C) reclassification of the stock of the Company (other than a change in par value or from par value to no par value or from no par value to par value or as a result of a stock dividend or subdivision, split-up or combination of shares), (D) consolidation or merger of the Company with or into another Person, (E) sale of all or substantially all of the Company’s assets to another Person or (F) other similar transaction, in each case which entitles all or substantially all of the holders of Common Stock to receive (either directly or upon subsequent liquidation) stock, securities, cash or other assets or consideration with respect to or in exchange for Common Stock, each Warrant shall, immediately prior to the time of such liquidation, dissolution, reorganization, reclassification, consolidation, merger, sale or similar transaction, be canceled (without any action of the Holder and regardless of any limitation or restriction on the exercisability of this Warrant that may otherwise be applicable) with the Holder entitled to receive the kind and number of shares of stock, securities, cash or other assets or consideration resulting from such transaction to which the Holder would have been entitled as a holder of the applicable number of Warrant Shares then issuable hereunder as a result of such exercise if the Holder had exercised this Warrant in full immediately prior to the time of such reorganization, reclassification, consolidation, merger, sale or similar transaction and acquired the applicable number of Warrant Shares then issuable hereunder as a result of such exercise (without taking into account any limitations or restrictions on the exercisability of this Warrant). The Company shall make provision for compliance with this Section 5(c) in the agreements, if any, relating to such transactions, if necessary to give effect to this Section 5(c). |

| (d) | Adjustment of Warrant Upon Spin-off. If, at any time from the date hereof and for so long as any portion of this Warrant remains unexercised, the Company shall spin-off another Person (the “Spin-Off Entity”), then the Company (A) shall cause the Spin-Off Entity to issue to the Holder a new warrant to purchase, at the Exercise Price, the number of shares of common stock or other proprietary interest in the Spin-Off Entity (and any other consideration) that the Holder would have owned had the Holder exercised this Warrant immediately prior to the consummation of such spin-off and (B) shall make (or cause the Spin-Off Entity to make) provision therefor in the agreement, if any, relating to such spin-off. Such new warrant shall provide for rights and obligations which shall be as nearly equivalent as may be practicable to the rights and obligations provided for in this Warrant. The provisions of this Section 5(d) (and any equivalent thereof in any such new warrant) shall apply to successive transactions. |

15

| (e) | Certain Issuances of Common Stock or Convertible Securities. |

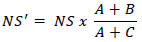

| (i) | If the Company shall issue shares of Common Stock, Options or Convertible Securities (other than in Excluded Issuances) without consideration or at a consideration per share (or having a conversion price per share) that is less than $8.00 then, in such event, the Warrant Share Number will be adjusted based on the following formula: |

| where, |

||||

| NS’ = | the adjusted Warrant Share Number in effect immediately after such issuance | |||

| NS = | the Warrant Share Number in effect immediately prior to such issuance | |||

| A = | the number of shares of Common Stock on a fully-diluted basis outstanding immediately prior to such issuance | |||

| B = | the number of additional shares of Common Stock issued (or into which Convertible Securities or Options may be exercised, converted or exchanged) | |||

| C = | the number of shares equal to the quotient of (i) the sum of the aggregate consideration received for the issuance of such Common Stock, Options or Convertible Securities and the aggregate minimum consideration receivable by the Company for issuance of Common Stock upon conversion or in exchange for, or upon exercise of, such Options or Convertible Securities divided by (ii) $8.00 | |||

| (ii) | For purposes of this Section 5(e), such aggregate consideration so received or receivable by the Company shall be deemed to be equal to the sum of the amount of cash plus the fair market value (as determined in good faith by the Board) of any consideration that consists, in whole or in part, of property other than cash. Any adjustment made pursuant to this Section 5(d) shall become effective immediately upon the date of such issuance. |

| (iii) | “Excluded Issuances” means (A) any issuance of shares of Common Stock, Options or any Convertible Securities issued in connection with a merger or other business combination or an acquisition of the securities or assets of another Person, business unit, division or business, other than in connection with the broadly marketed offering and sale of equity, Options or Convertible Securities for third-party financing of such transaction, (B) any issuance of shares of any equity securities (including upon |

16

| exercise of Options) to directors, officers, employees, consultants or other agents of the Company or any of its subsidiaries as approved by the Board or its designee(s) other than for bona fide capital raising purposes, (C) any issuance of shares of any equity securities pursuant to a dividend reinvestment plan, employee stock option plan, management incentive plan, restricted stock plan, employee stock purchase plan or stock, ownership plan or similar benefit plan, similar program or similar agreement as approved by the Board, (D) any issuance of shares of equity securities in connection with a bona fide third-party strategic partnership, joint venture arrangement, or commercial arrangement with a Person that is not an Affiliate of the Company or any of its subsidiaries (other than (x) any such strategic partnership, joint venture arrangement or commercial arrangement with a private equity firm or similar financial institution or (y) an issuance the primary purpose of which is a bona fide capital raise), (E) any issuance of shares of any equity securities pursuant to any Convertible Security or Options not described in clauses (B) or (C) of this sentence and outstanding as of the Original Issue Date (including any such issuance of shares of any equity securities pursuant to (1) this Warrant or any other warrants issued in connection with the Credit Agreement or (2) the Company’s 7.00% Convertible Senior Notes due 2023), (F) any issuance of shares pursuant to Section 5(a), Section 5(b), Sections 5(c) or Sections 5(d) above, (G) any issuance of Subject Securities for which the Holder exercises its right to purchase a portion of such Subject Securities pursuant to Section 6 or Section 7, and (H) any issuance of additional warrants to the Holders or other lenders in an additional tranche of financing as contemplated by the Agency Side Letter dated June 8, 2020, between the Company and certain Affiliates of the Holders. |

| (iv) | Upon the expiration or termination of any unexercised, unconverted or unexchanged Convertible Security which resulted in an adjustment to the Warrant Share Number pursuant to the terms of this Section 5(d), the Warrant Share Number then in effect shall be readjusted to such number of Warrant Shares that would be issuable upon exercise of this Warrant if such Convertible Security or Options had never been issued. |

| (f) | Calculations. All adjustments made to the Warrant Share Number issuable upon exercise of each Warrant pursuant to this Section 5 shall be calculated by the Company to the nearest one-hundredth of a Warrant Share (0.01). The number of shares of Common Stock outstanding at any given time shall not include shares owned or held by or for the account of the Company. The Company will not pay any dividend or make any distribution on any shares of Common Stock held in the treasury of the Company. |

17

| (g) | Certificate as to Adjustment. |

| (i) | As promptly as practicable following any adjustment of the Warrant Share Number pursuant to the provisions of this Section 5, but in any event not later than five (5) Business Days thereafter, the Company shall furnish to the Holder and the Warrant Agent a certificate of an officer of the Company setting forth in reasonable detail such Adjustment and the facts upon which it is based and certifying the calculation thereof. |

| (ii) | As promptly as practicable following the receipt by the Company of a written request by the Holder, but in any event not later than five (5) Business Days thereafter, the Company shall furnish to the Holder a certificate of an officer of the Company certifying the Warrant Share Number or the amount, if any, of other shares of stock, securities or assets then issuable upon exercise of the Warrant. |

| (h) | Notices. In the event: |

| (i) | that the Company shall take a record of the holders of its Common Stock (or other capital stock or securities at the time issuable upon exercise of the Warrant) for the purpose of entitling or enabling them to receive any dividend or other distribution (including any spin-off); or |

| (ii) | of any capital reorganization of the Company, any reclassification of the Common Stock of the Company, any consolidation or merger of the Company with or into another Person, or sale of all or substantially all of the Company’s assets to another Person; or |

| (iii) | of the voluntary or involuntary dissolution, liquidation or winding-up of the Company; or |

| (iv) | any other event that may cause an Adjustment; then, and in each such case, the Company shall send or cause to be sent to the Holder at least ten (10) Business Days or, if less, as soon as practicable, prior to the applicable Ex-Dividend Date, record date or the applicable expected effective date, as the case may be, for the event, a written notice specifying, as the case may be, (A) the Ex-Dividend Date, the record date for such dividend or distribution, and a description of such dividend or distribution, or (B) the effective date on which such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation, winding-up or other event is proposed to take place, and the date, if any is to be fixed, as of which the books of the Company shall close or a record shall be taken with respect to which the holders of record of Common Stock (or such other capital stock or securities at the time issuable upon exercise of the Warrant) shall be entitled to exchange their shares of Common Stock (or such other capital stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation, winding-up or other event, and the amount per share and character of such exchange applicable to the Warrant and the Warrant Shares. |

18

| (i) | In the event that more than one Adjustment is required to be made in connection with an event or series of events, the Adjustments pursuant to this Section 5 shall be applied in such order as to provide the holders of the Warrants with the benefits to which they would have been entitled had the Warrants been exercised immediately prior to the earliest record date for such events. |

| 6. | Pre-Emptive Right. |

| (a) | From the date hereof and for so long as any portion of this Warrant remains unexercised, subject to the terms and conditions set forth in this Section 6, the Company hereby grants to the Holder the right to purchase, directly or indirectly through any of its Affiliates, from time to time upon the occurrence of each Triggering Event up to a number of the Subject Securities to be issued pursuant to such Triggering Event equal to the lesser of (i) such number that when added to the Warrant Share Number then in effect (including any Warrant Shares that may be withheld by the Company upon such exercise) would equal the Applicable Ownership Percentage and (ii) such Holder’s Pro Rata Portion of the Subject Securities to be issued pursuant to such Triggering Event on the same terms and conditions as those applicable to all other Subject Securities to be issued in connection with the Triggering Event. In the event that a Triggering Event consists of an issue of one or more of Common Stock, Options and Convertible Securities, the Subject Securities shall be allocated to the Holder between Common Stock, Options and Convertible Securities on the same pro rata basis as are allocated to subscribers of the Triggering Event. |

| (b) | In respect of each exercise of the Pre-Emptive Right, the purchase price per Subject Security shall be equal to the greater of the Triggering Event Price and such price as may be prescribed by any securities regulator or stock exchange having jurisdiction over the issue of the Subject Securities to the Holder. |

| (c) | Except as otherwise specifically provided in this Section 6, the Company and the Holder shall each bear its own expenses incurred in connection with this Section 6 and in connection with all obligations required to be performed by each of them under this Section 6. |

| (d) | From the date hereof and for so long as any portion of this Warrant remains unexercised, the Company shall provide to the Holder an Issuance Notice as soon as practicable (i) following a determination by the Company to effect a Triggering Event, other than a Triggering Event that arises as a result of the exercise of a Special Option and (ii) following the exercise of a Special Option. Each Issuance Notice with respect to a Triggering Event shall include the number of Subject Securities that the Holder shall be entitled to purchase as a result of the applicable Triggering Event, a calculation demonstrating how such number was determined, the Triggering Event Price and the anticipated Triggering Event Closing Date and the terms and conditions of the Subject Securities, if other than Common Stock. The Company shall also give the Holder notice as promptly as practicable following the grant of a Special Option. |

19

| (e) | Subject to the provisions of this Warrant, the Pre-Emptive Right shall, in each instance, be exercisable by the Holder at any time during a period of five (5) days following receipt of an Issuance Notice in accordance with Section 3(d); provided that if the Holder wishes to exercise the Pre-Emptive Right, the Holder shall deliver an irrevocable notice (a “Pre-Emptive Right Exercise Notice”) in writing addressed to the Company confirming that it wishes to exercise the Pre-Emptive Right in respect of such Triggering Event, specifying the number of Subject Securities that it will purchase and whether such Subject Securities are to be issued to the Holder or any of its Affiliates. If the Company does not receive a Pre-Emptive Right Exercise Notice in respect of an Issuance Notice within the applicable period set forth above, the Holder shall be deemed to have not exercised the Pre-Emptive Right in respect of the Triggering Event to which such Issuance Notice relates and the Pre-Emptive Right shall be deemed to have expired in respect of such Triggering Event. |

| (f) | Subject to Applicable Law, the Pre-Emptive Right Closing of the issue of the Subject Securities shall occur on the Triggering Event Closing Date or such later date as the Company and the Holder may agree upon. |

| (g) | The Company and the Holder shall each use all commercially reasonable efforts to take, or cause to be taken, all actions, and to do, or cause to be done as promptly as practicable, all things necessary, proper or advisable under Applicable Law to consummate and make effective the transactions contemplated by this Section 6, including obtaining any governmental, regulatory, stock exchange or other consents, transfers, orders, qualifications, waivers, authorizations, exemptions and approvals, providing all notices and making all registrations, filings and applications necessary or desirable for the consummation of the transactions contemplated by this Section 6, including any filings with governmental or regulatory agencies and stock exchanges. The Company shall forthwith notify the Holder if as a condition of obtaining any applicable regulatory approvals, including securities regulatory and stock exchange approval, the purchase price must be an amount greater than the Triggering Event Price, and shall keep the Holder fully informed and allow the Holder to participate in any communications with such stock exchange regarding the exercise of the Holder’s rights under this Section 6. |

| (h) | The obligation of the Company to consummate an issue of Subject Securities, as the case may be, under this Section 6 is subject to the fulfilment, prior to or at the applicable closing date, of each of the following conditions, any of which may be waived by the Company in writing: |

20

| (i) | there shall not be in effect any injunction or restraining order issued by a court of competent jurisdiction which prohibits the consummation of the transactions contemplated by this Section 6 nor shall there be any investigation or proceeding pending before any court or governmental authority seeking to prohibit the consummation of the transactions contemplated by this Section 6; |

| (ii) | no Applicable Law shall have been enacted by any Governmental Authority which prohibits the consummation of the transactions contemplated by this Section 6 or makes such consummation illegal; |

| (iii) | the closing of the issue and sale of the securities constituting the Triggering Event shall have occurred prior to, or shall occur concurrently with, the Pre-Emptive Right Closing; |

| (iv) | the Holder shall execute substantially the same definitive agreements as other purchasers of securities pursuant to the applicable Triggering Event; and |

| (v) | any stock exchange upon which Common Stock is then listed and any other securities regulator having jurisdiction and whose approval is required, shall have approved the issue and sale of such securities. |

| (i) | The obligation of the Holder to consummate a purchase of Subject Securities under this Section 6 is subject to the fulfilment, prior to or at the applicable closing, of each of the following conditions, any of which may be waived by the Holder in writing: |

| (i) | there shall not be in effect any injunction or restraining order issued by a court of competent jurisdiction which prohibits the consummation of the transactions contemplated by this Section 6, nor shall there be any investigation or proceeding pending before any Governmental Authority seeking to prohibit the consummation of the transactions contemplated by this Section 6; |

| (ii) | no Applicable Law shall have been enacted by any Governmental Authority which prohibits the consummation of the transactions contemplated by this Section 6 or makes such consummation illegal; |

| (iii) | the closing of the issue and sale of the securities constituting the Triggering Event shall have occurred prior to, or shall occur concurrently with, the Pre-Emptive Right Closing; and |

| (iv) | any stock exchange upon which Common Stock is then listed and any other securities regulatory having jurisdiction and whose approval is required, shall have approved of the issue and sale of such securities. |

21

| (j) | At or prior to the closing of any issuance of securities to the Holder under this Section 6: |

| (i) | the Company shall deliver, or cause to be delivered, to the Holder the applicable securities registered in the name of or otherwise credited to the Holder; |

| (ii) | the Holder shall deliver or cause to be delivered to the Company payment of the applicable purchase price by certified or official bank check payable to the order of the Company or by wire transfer of immediately available funds to an account designated in writing by the Company; and |

| (iii) | the Company and the Holder, as applicable, shall deliver any documents required to evidence the requirements set forth in this Section 6. |

| (k) | Nothing herein contained or done pursuant hereto shall obligate the Holder to purchase or pay for, or shall obligate the Company to issue, the Subject Securities, except upon exercise by the Holder of the Pre-Emptive Right in accordance with the provisions of this Section 6 and compliance with all other conditions precedent to such issue and purchase contained in this Section 6. |

| (l) | The Holder shall not have any rights whatsoever as a holder of any of the Subject Securities (including any right to receive dividends or other distributions therefrom or thereon) until the Holder shall have acquired the Subject Securities. |

| 7. | Participation in Allocated Public Offering. |

| (a) | From the date hereof and for so long as any portion of this Warrant remains unexercised, at least two (2) Business Days prior to first publication of its intention to conduct an Allocated Public Offering, the Company acting in good faith (or the managing underwriter as the Company’s representative) shall provide the Holder with an Issuance Notice; provided, that with respect to an Allocated Public Offering that is an offering of Common Stock, if the Company reasonably determines in good faith that it is not possible to give two (2) Business Days’ notice, the Company (or the managing underwriter as the Company’s representative) shall use best efforts and act in good faith to provide the Holder with an Issuance Notice as promptly as reasonably practicable under the circumstances. If the Holder provides written notice of its intention to purchase securities in such offering at the public offering price prior to the pricing of such Allocated Public Offering, the Company shall instruct the managing underwriter of such offering, and shall use commercially reasonable efforts to cause such managing underwriter, to make available for purchase by such Holder, in such offering and at the public offering price, a number of Subject Securities to be sold in such offering equal to the lowest of (i) such Holder’s Pro Rata Portion of all Subject Securities being sold in such offering, (ii) the number of Subject Securities for which such Holder places a buy order with such managing underwriter and (iii) the number of Subject Securities that when added to the Warrant Share Number then in effect (including any Warrant Shares that may be withheld by the Company upon such exercise) would equal the Applicable Ownership Percentage. |

22

| (b) | Each Issuance Notice with respect to an Allocated Public Offering shall include the number of Subject Securities that the Holder shall be entitled to purchase as a result of such Allocated Public Offering, the Company’s good faith estimate of when the Company’s first expects to make publication of such offering, a calculation demonstrating how such number was determined, the anticipated pricing and closing date, and the terms and conditions of the Subject Securities, if other than Common Stock. Such Issuance Notice need not include a particular price, and instead may state that the Company intends to sell Subject Securities to the managing underwriter at a customary discount to the public offering price that will be determined upon pricing of such offering. |

| 8. | Transfer of Warrant. Subject to applicable federal and state securities laws and the transfer conditions referred to in the legend endorsed hereon and in Section 12, this Warrant may only be transferred by the Holder to an Affiliate of the Holder; provided that the Holder shall not be permitted to transfer this Warrant to any Company Competitor. For a transfer of this Warrant as an entirety by the Holder, upon surrender of this Warrant to the Warrant Agent at the office of the Warrant Agent designated for such purposes, the Warrant Agent shall issue a new Warrant of the same denomination to the assignee. For a transfer of this Warrant with respect to a portion of the Warrant Share Number, upon surrender of this Warrant to the Warrant Agent at the office of the Warrant Agent designated for such purposes, the Warrant Agent shall issue a new Warrant to the assignee, in such denomination as shall be requested by the Holder, and shall issue to the Holder a new Warrant covering the number of shares in respect of which this Warrant shall not have been transferred. |

| 9. | Limitation on Shares Deliverable Upon Exercise of Warrant. Notwithstanding anything to the contrary in this Warrant, the Holder will not be entitled to receive shares of Common Stock upon exercise of this Warrant to the extent (but only to the extent) that such receipt would result in a violation of the Ownership Limitations (unless the Company provides an exemption from the Ownership Limitations as permitted by the Charter). To the extent the that the Holder would not be entitled to receive shares pursuant to the prior sentence, the Company shall be required to settle the exercise in cash pursuant to clause (ii) of Section 3(d). Any purported delivery of shares of Common Stock upon exercise of this Warrant will be void and have no effect to the extent (but only to the extent) that such delivery would result in violation of the Ownership Limitations (unless the Company provides an exemption from the Ownership Limitations as permitted by the Charter). |

| 10. | Holder Not Deemed a Stockholder; Limitations on Liability. Except as expressly set forth herein, this Warrant does not entitle the Holder to any voting rights or other rights as a stockholder of the Company until the Holder has received Warrant Shares issuable upon exercise of this Warrant pursuant to the terms hereof, nor shall anything contained in this Warrant be construed to confer upon the Holder, as such, any of the rights of a |

23

stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

| 11. | Replacement on Loss; Division and Combination. |

| (a) | Replacement of Warrant on Loss. Upon receipt by the Warrant Agent of evidence reasonably satisfactory to the Company and the Warrant Agent of the loss, theft, destruction or mutilation of this Warrant and upon delivery of an indemnity reasonably satisfactory to the Company and the Warrant Agent and, in case of mutilation, upon surrender of such Warrant for cancellation to the Warrant Agent at the office of the Warrant Agent designated for such purposes, the Company at its own expense shall execute and deliver to the Warrant Agent for delivery to the Holder, in lieu of the Warrant so lost, stolen, mutilated or destroyed, a new Warrant of like tenor and exercisable for an equivalent number of Warrant Shares as the Warrant so lost, stolen, mutilated or destroyed. |

| (b) | Division and Combination of Warrant. Subject to compliance with the applicable provisions of this Warrant as to any transfer or other assignment which may be involved in such division or combination, including the provisions of Section 12, this Warrant may be divided or, following any such division of this Warrant, subsequently combined with other Warrants, upon the surrender of this Warrant or Warrants to the Warrant Agent at the office of the Warrant Agent designated for such purposes, together with a written notice specifying the names and denominations in which new Warrants are to be issued, signed by the respective Holders or their agents or attorneys. Subject to compliance with the applicable provisions of this Warrant as to any transfer or assignment which may be involved in such division or combination, the Company shall at its own expense execute and deliver to the Warrant Agent for delivery to the Holder or such other persons specified in the Holder’s notice, a new Warrant or Warrants in exchange for the Warrant or Warrants so surrendered in accordance with such notice. Such new Warrant or Warrants shall be of like tenor to the surrendered Warrant or Warrants and shall be exercisable in the aggregate for an equivalent number of Warrant Shares as the Warrant or Warrants so surrendered in accordance with such notice. |

24

| 12. | Compliance with the Securities Act. |

| (a) | Agreement to Comply with the Securities Act; Legend. The Holder, by acceptance of this Warrant, agrees to comply in all respects with the provisions of this Section 12 and the restrictive legend requirements set forth on the face of this Warrant and further agrees that such Holder shall not offer, sell or otherwise dispose of this Warrant or any Warrant Shares to be issued upon exercise hereof, except under circumstances that will not result in a violation of the Securities Act. This Warrant and all Warrant Shares issued upon exercise of this Warrant shall be stamped or imprinted with a legend in substantially the following form: |

“THE OFFER AND SALE OF THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH THE FOLLOWING SENTENCE. BY ITS ACQUISITION HEREOF OR OF A BENEFICIAL INTEREST HEREIN, THE ACQUIRER (1) REPRESENTS THAT IT IS AN ACCREDITED INVESTOR WITHIN THE MEANING OF REGULATION D AS PROMULGATED UNDER THE SECURITIES ACT, AND (2) AGREES FOR THE BENEFIT OF CHIMERA INVESTMENT CORPORATION (THE “COMPANY”) THAT IT WILL NOT OFFER, SELL, PLEDGE OR OTHERWISE TRANSFER THIS WARRANT AND THE SECURITIES, IF ANY, ISSUABLE UPON EXERCISE OF THIS WARRANT OR ANY BENEFICIAL INTEREST HEREIN OR THEREIN EXCEPT: (A) TO THE COMPANY OR ANY SUBSIDIARY THEREOF, OR (B) PURSUANT TO A REGISTRATION STATEMENT THAT HAS BECOME EFFECTIVE UNDER THE SECURITIES ACT, OR (C) PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.”

The requirement imposed by this Section 12 shall cease and terminate as to this Warrant or any particular Warrant Share when, in the written opinion of counsel reasonably acceptable to the Company, such legend is no longer required in order to assure compliance by the Company with the Securities Act. Wherever such requirement shall cease and terminate as to this Warrant or any Warrant Share, the Holder or the holder of such Warrant Share, as the case may be, shall be entitled to receive from the Company, without expense, a new warrant or a new stock certificate, as the case may be, not bearing the legend set forth in this Section 12.

| (b) | Representations of the Holder. In connection with the issuance of this Warrant, the Holder specifically represents, as of the date hereof, to the Company by acceptance of this Warrant as follows: |

| (i) | The Holder is an “accredited investor” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. The Holder is acquiring this Warrant and the Warrant Shares to be issued upon exercise hereof for investment for its own account and not with a view towards, or for resale in connection with, the public sale or distribution of this Warrant or the Warrant Shares, except pursuant to sales registered or exempted under the Securities Act. |

25

| (ii) | The Holder understands and acknowledges that this Warrant and the Warrant Shares to be issued upon exercise hereof are “restricted securities” under the federal securities laws inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that, under such laws and applicable regulations, such securities may be resold without registration under the Securities Act only in certain limited circumstances. In addition, the Holder represents that it is familiar with Rule 144 under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act. |

| (iii) | The Holder acknowledges that it can bear the economic and financial risk of its investment for an indefinite period, and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the investment in the Warrant and the Warrant Shares. The Holder has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the offering of the Warrant and the business, properties, prospects and financial condition of the Company. |

| 13. | Tax Treatment. |

| (a) | The Company shall, subject to Applicable Law, pay any and all documentary, stamp and similar issue or transfer tax due on (x) the issue of Warrants and (y) the issue of Warrant Shares pursuant to exercise of the Warrant; provided, however, that in the event certificates for Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by a properly completed and duly executed assignment agreement in form and substance reasonably satisfactory to the Company, and the Company may require as a condition thereto the payment of a sum sufficient to reimburse the Company for any stamp, documentary or other transfer taxes incidental thereto which are payable or are otherwise discharged by the Company. |

| (b) | The Company and its paying agent shall be entitled to deduct and withhold taxes on all payments and distributions (or deemed distributions) with respect to the Warrants (or upon the exercise thereof) to the extent required by Applicable Law. To the extent that any amounts are so deducted or withheld, such deducted or withheld amounts shall be treated for all purposes of this Warrant as having been paid to the Person in respect of which such deduction or withholding was made. In the event the Company previously remitted any amounts to a Governmental Authority on account of taxes required to be deducted or withheld in respect of any payment or distribution (or deemed distribution) with respect to a Warrant or upon the exercise thereof, the Company shall be entitled (i) to offset any such amounts against any amounts otherwise payable in respect of such Warrant, any Warrant Shares otherwise required to be issued upon the exercise of such Warrant or any amounts otherwise payable in respect of Warrant Shares received upon the exercise of such Warrant, or (ii) to require the Person in respect of whom such |

26

| deduction or withholding was made to reimburse the Company for such amounts. The Company shall take commercially reasonable steps to minimize or eliminate any withholding or deduction described in this Section 13(b), including by giving the Person in respect of whom such deduction or withholding may be made (i) notice of the proposed withholding and the amounts proposed to be withheld and (ii) an opportunity to provide additional information or to apply for an exemption from, or a reduced rate of, withholding |

| 14. | Warrant Register. The Warrant Agent shall keep and properly maintain at its principal executive offices books for the registration of the Warrant and any transfers thereof. The Warrant Agent and the Company may deem and treat the Person in whose name the Warrant is registered on such register as the Holder thereof for all purposes, and the Warrant Agent and the Company shall not be affected by any notice to the contrary, except any assignment, division, combination or other transfer of the Warrant effected in accordance with the provisions of this Warrant. |