Form 8-K CHAMPIONS ONCOLOGY, INC. For: Jan 07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 7, 2019

CHAMPIONS ONCOLOGY, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-11504 | |

(State or Other Jurisdiction | (Commission File Number) | |

of Incorporation) | ||

1 University Plaza, Suite 307, Hackensack, New Jersey 07601

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (201) 808-8400

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. | Regulation FD Disclosure. | |

Attached as Exhibit 99.1 to this Current Report on Form 8-K is the investor presentation of Champions Oncology, Inc., which may be used in presentations to investors from time to time in the future. The information in this report shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

Item 9.01. | Financial Statements and Exhibits. | |

(d) exhibits

The following exhibit is filed herewith:

Exhibit No.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

CHAMPIONS ONCOLOGY, INC. | |||

(Registrant) | |||

Date: January 7, 2019 | By: | /s/ Ronnie Morris | |

Ronnie Morris | |||

Chief Executive Officer | |||

Investor Presentation January 2019 Confidential 1

Notice of Forward Looking Statements This presentation contains certain “forward-looking statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation, and availability of resources. These forward-looking statements include, without limitation, statements regarding projections, predictions, expectations, estimates, or forecasts as to our business, financial and operational results, and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Forward-looking statements speak only as of the date the statements are made. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to, those described the “Risk Factors” section of our Annual Report on Form 10-K, as updated in our subsequent reports filed with the SEC, including reports on Form 10-Q. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward- looking statements. 2 Nasdaq: CSBR

Addressing Pharma’s Needs The challenge with Oncology drugs is the high cost of clinical trials and low success rates • High Failure Rate • 93% of drugs fail in clinical trials • Skyrocketing R&D Costs • $1.2 billion average capital outlay per approved drug • Patient responses remain low even for approved drugs • 10% response in third line of therapy • High Cost of Oncology Drugs • Average monthly patient/insurance cost is $11,000 for new oncology drugs PHARMA NEEDS BETTER TOOLS OR DIFFERENT STRATEGY 3 Nasdaq: CSBR

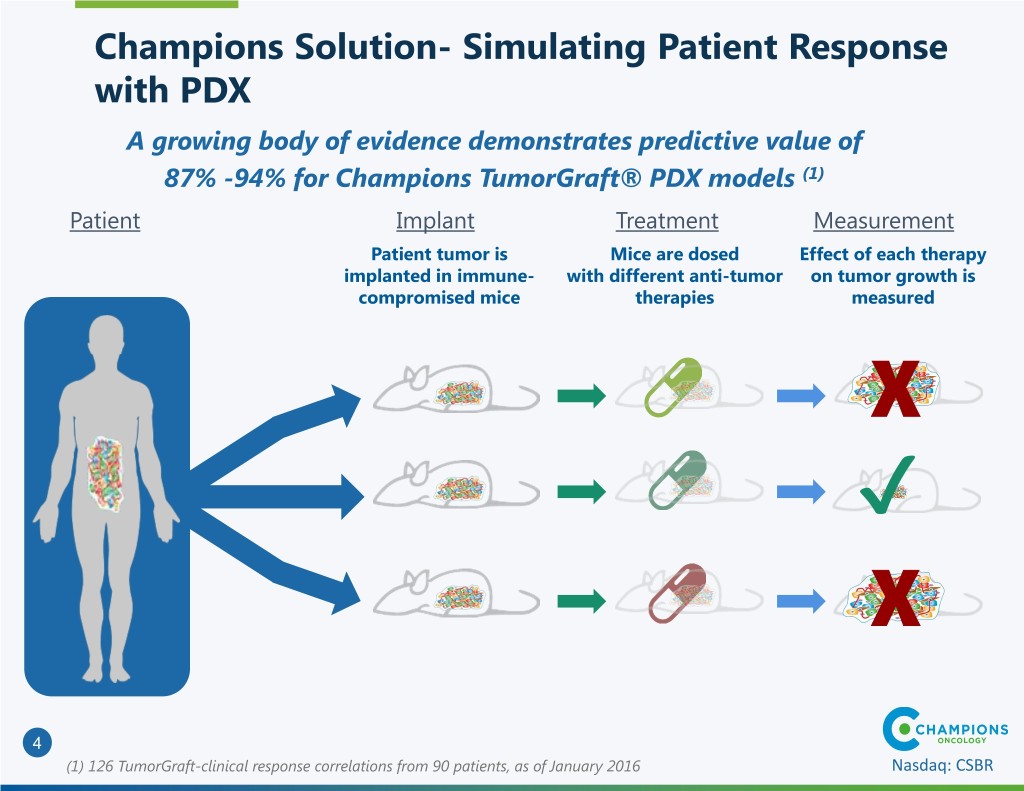

Champions Solution- Simulating Patient Response with PDX A growing body of evidence demonstrates predictive value of 87% -94% for Champions TumorGraft® PDX models (1) Patient Implant Treatment Measurement Patient tumor is Mice are dosed Effect of each therapy implanted in immune- with different anti-tumor on tumor growth is compromised mice therapies measured χ ✔ χ 4 (1) 126 TumorGraft-clinical response correlations from 90 patients, as of January 2016 Nasdaq: CSBR

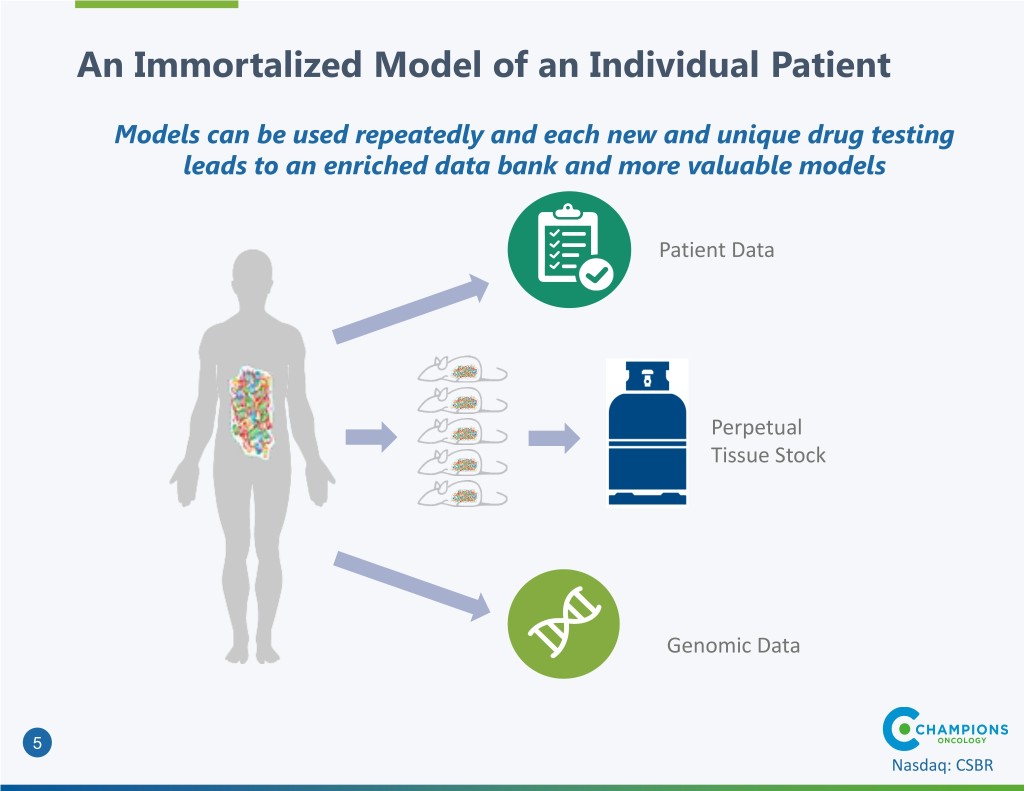

An Immortalized Model of an Individual Patient Models can be used repeatedly and each new and unique drug testing leads to an enriched data bank and more valuable models Patient Data Perpetual Tissue Stock Genomic Data 5 Nasdaq: CSBR

Champions Results We don’t use better mice. We use cheaper people. ✓ Over 1,000 Studies Completed • Ranging in size from $25,000 to more than $2M ✓ 250+ Customers • Including 18 of the top 20 pharma companies and 200 other pharma and biotech companies ✓ 30% Revenue Growth • 3 year cumulative annual growth in core business ✓ No customer accounts for greater than 15% of the revenue ✓ Significant Repeat Business 6 Nasdaq: CSBR

Champions History • Ronnie Morris (CEO) and Joel Ackerman (Chairman) took over running the company and first invested in 2011 • Over the past 7 years, CSBR has been building infrastructure necessary to capitalize on growing demand ‒ Management Team ‒ TumorBank ‒ Lab Capabilities ‒ Extensive and deep Pharma relationships ‒ Expanding our footprint in end to end solutions for pharma • With continued top line growth and more streamlined cost structure, CSBR is poised to realize sustained operating profitability during its 2019 fiscal year which commenced May 1, 2018 CSBR expects continued revenue growth, significant EPS growth and does not require additional capital 7 Nasdaq: CSBR

Current Strengths ➢Portfolio of offerings: Strong market desire to utilize Champions for oncology Comprehensive suite of offerings with a growing market demand 8

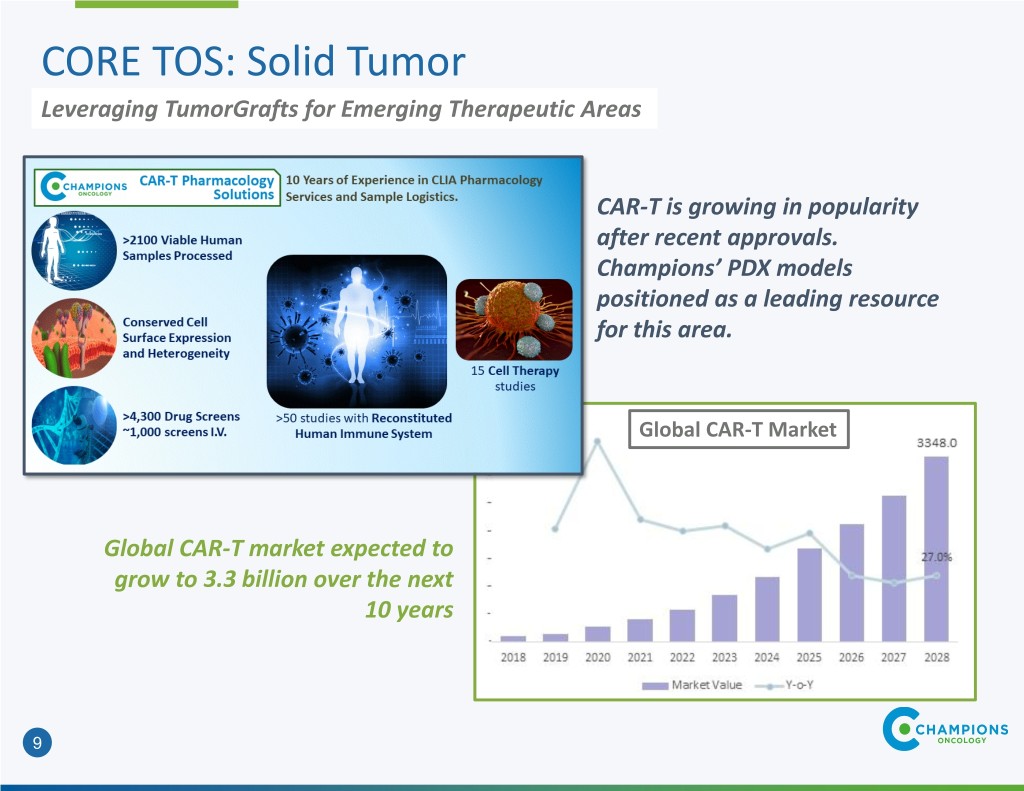

CORE TOS: Solid Tumor Leveraging TumorGrafts for Emerging Therapeutic Areas CAR-T is growing in popularity after recent approvals. Champions’ PDX models positioned as a leading resource for this area. Global CAR-T Market Global CAR-T market expected to grow to 3.3 billion over the next 10 years 9

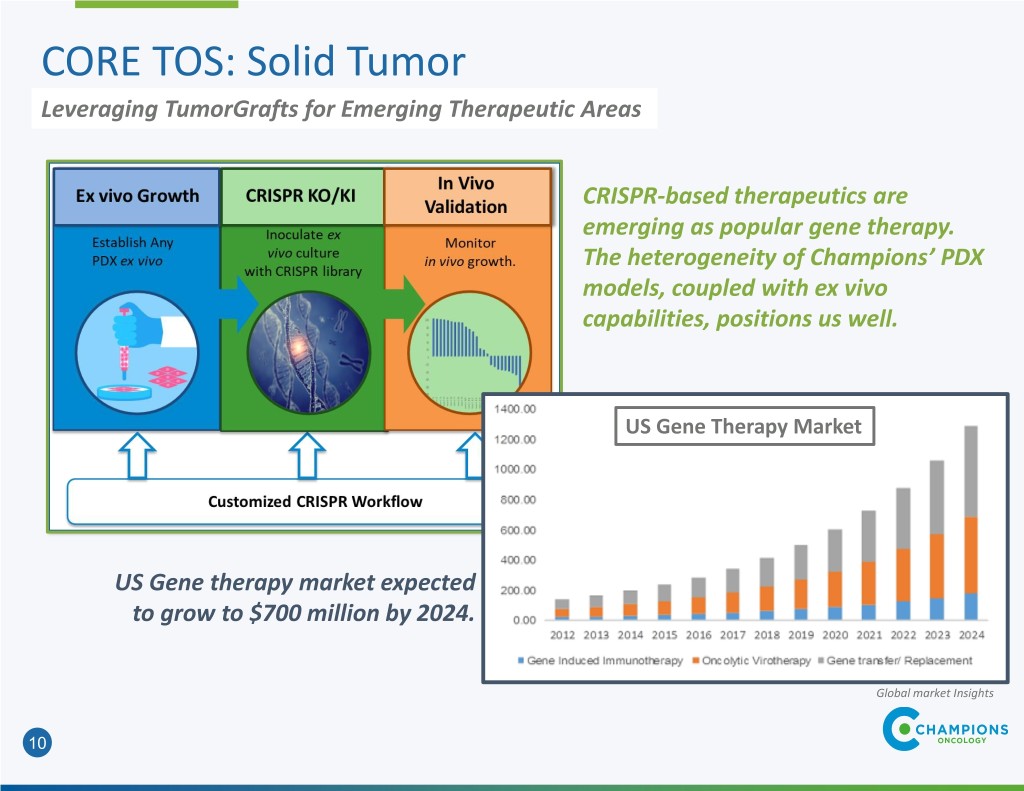

CORE TOS: Solid Tumor Leveraging TumorGrafts for Emerging Therapeutic Areas CRISPR-based therapeutics are emerging as popular gene therapy. The heterogeneity of Champions’ PDX models, coupled with ex vivo capabilities, positions us well. US Gene Therapy Market US Gene therapy market expected to grow to $700 million by 2024. Global market Insights 10

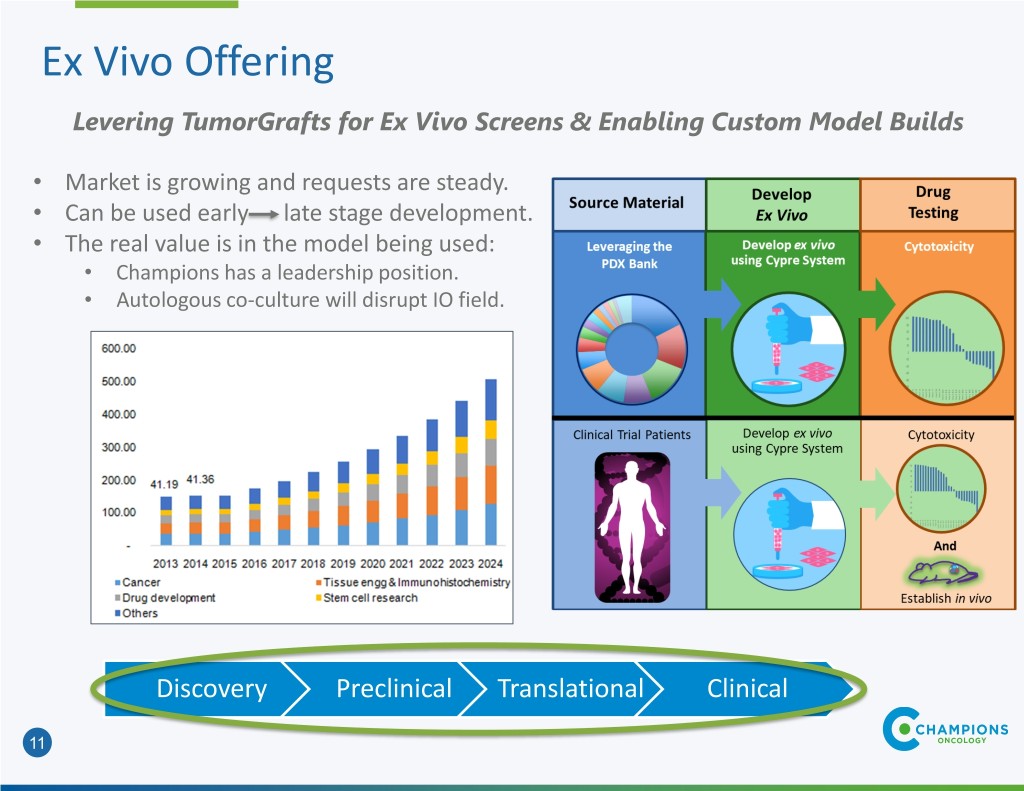

Ex Vivo Offering Levering TumorGrafts for Ex Vivo Screens & Enabling Custom Model Builds • Market is growing and requests are steady. • Can be used early late stage development. • The real value is in the model being used: • Champions has a leadership position. • Autologous co-culture will disrupt IO field. Discovery Preclinical Translational Clinical 11

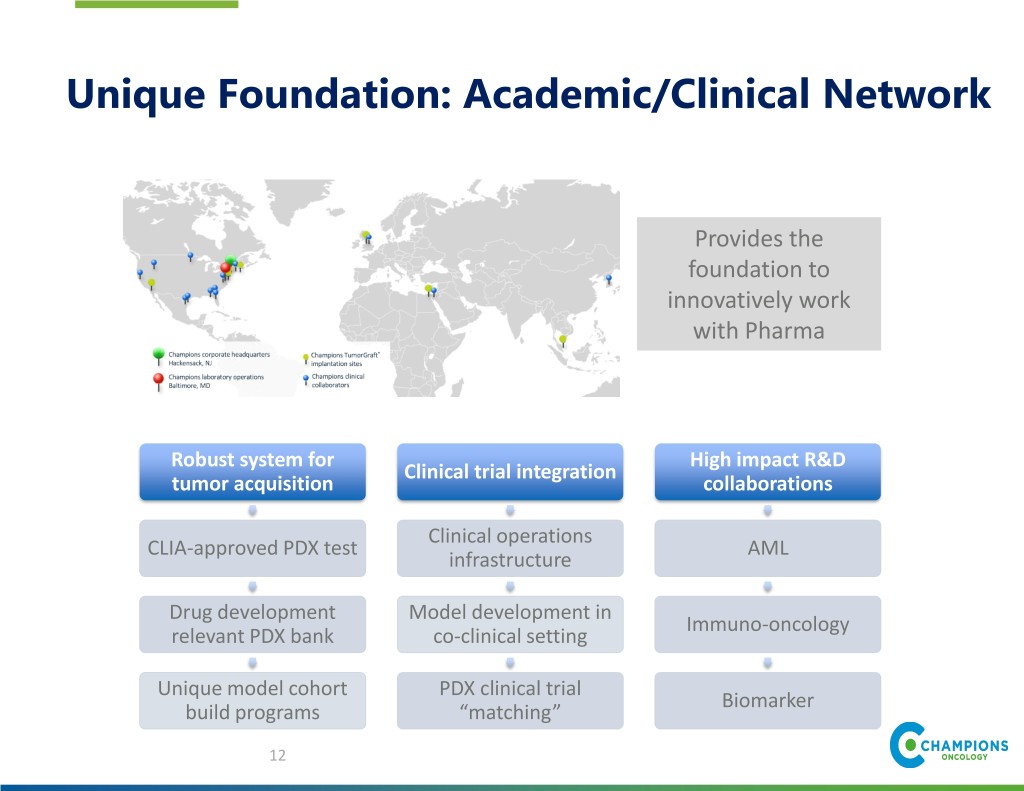

Unique Foundation: Academic/Clinical Network Provides the foundation to innovatively work with Pharma Robust system for High impact R&D Clinical trial integration tumor acquisition collaborations Clinical operations CLIA-approved PDX test AML infrastructure Drug development Model development in Immuno-oncology relevant PDX bank co-clinical setting Unique model cohort PDX clinical trial Biomarker build programs “matching” 12

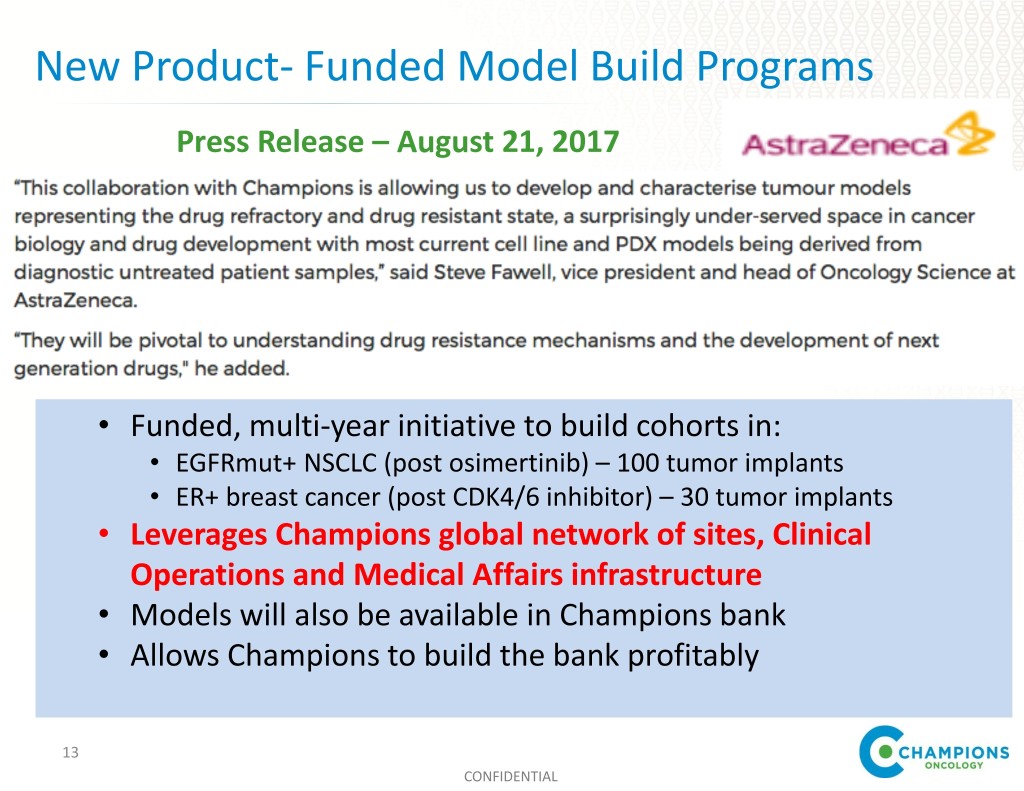

New Product- Funded Model Build Programs Press Release – August 21, 2017 • Funded, multi-year initiative to build cohorts in: • EGFRmut+ NSCLC (post osimertinib) – 100 tumor implants • ER+ breast cancer (post CDK4/6 inhibitor) – 30 tumor implants • Leverages Champions global network of sites, Clinical Operations and Medical Affairs infrastructure • Models will also be available in Champions bank • Allows Champions to build the bank profitably 13 CONFIDENTIAL

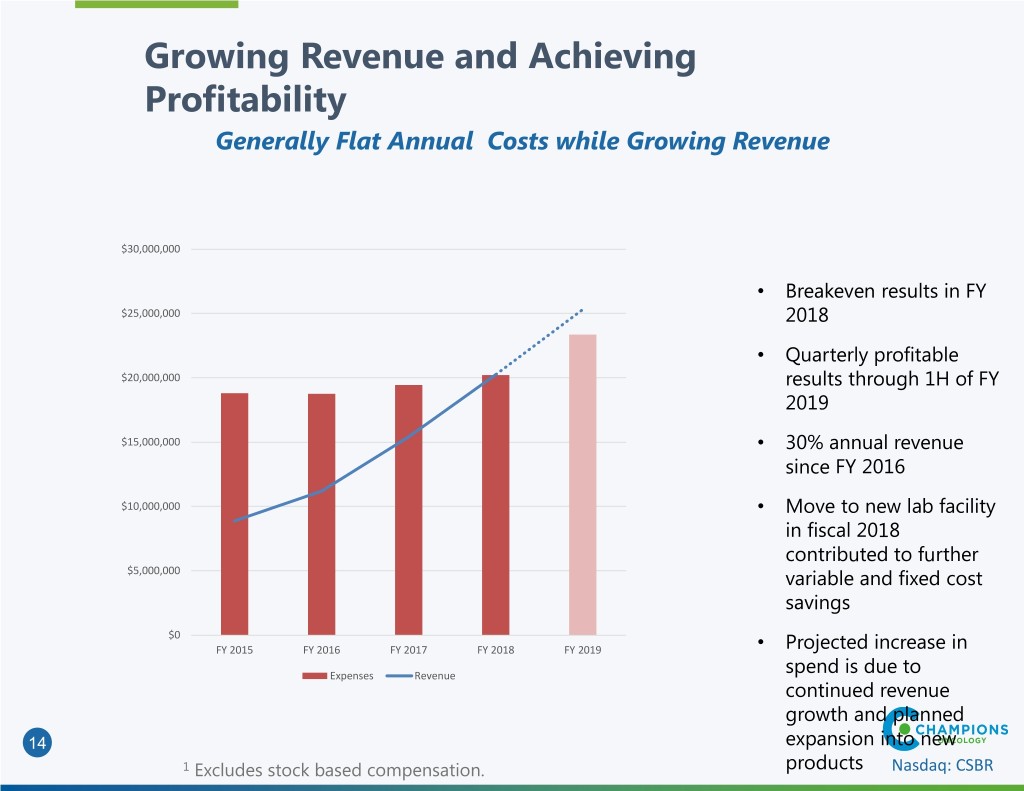

Growing Revenue and Achieving Profitability Generally Flat Annual Costs while Growing Revenue $30,000,000 • Breakeven results in FY $25,000,000 2018 • Quarterly profitable $20,000,000 results through 1H of FY 2019 $15,000,000 • 30% annual revenue since FY 2016 $10,000,000 • Move to new lab facility in fiscal 2018 contributed to further $5,000,000 variable and fixed cost savings $0 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 • Projected increase in Expenses Revenue spend is due to continued revenue growth and planned 14 expansion into new 1 Excludes stock based compensation. products Nasdaq: CSBR

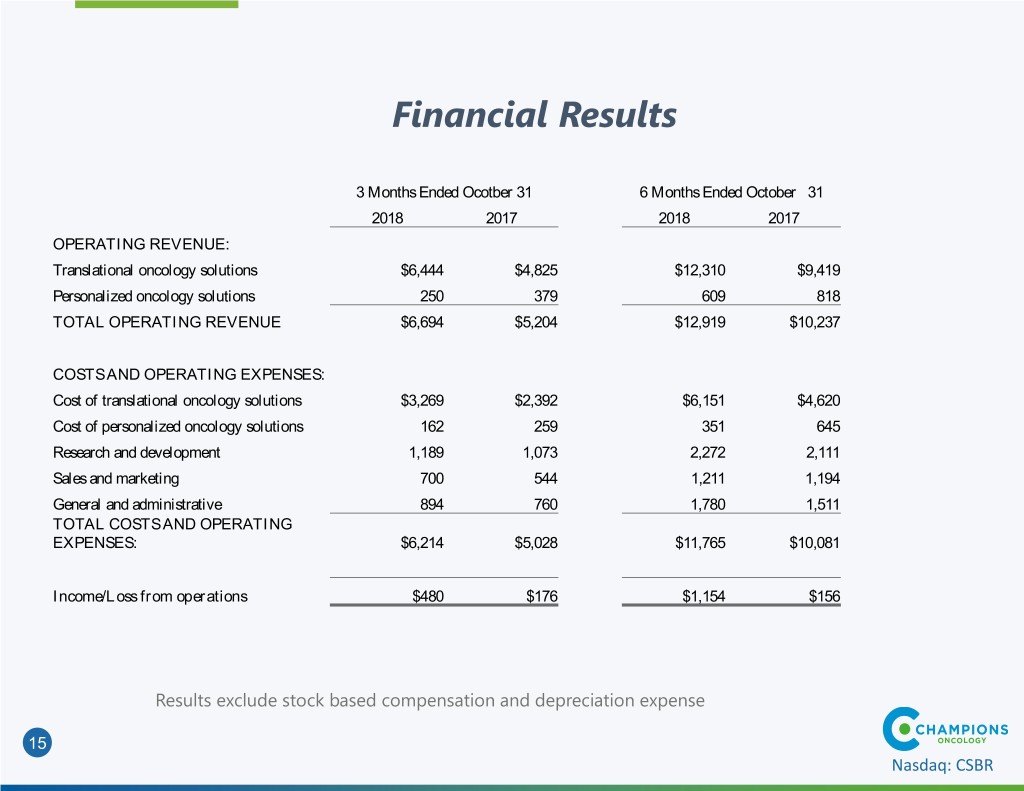

Financial Results 3 Months Ended Ocotber 31 6 Months Ended October 31 2018 2017 2018 2017 OPERATING REVENUE: Translational oncology solutions $6,444 $4,825 $12,310 $9,419 Personalized oncology solutions 250 379 609 818 TOTAL OPERATING REVENUE $6,694 $5,204 $12,919 $10,237 COSTS AND OPERATING EXPENSES: Cost of translational oncology solutions $3,269 $2,392 $6,151 $4,620 Cost of personalized oncology solutions 162 259 351 645 Research and development 1,189 1,073 2,272 2,111 Sales and marketing 700 544 1,211 1,194 General and administrative 894 760 1,780 1,511 TOTAL COSTS AND OPERATING EXPENSES: $6,214 $5,028 $11,765 $10,081 Income/Loss from operations $480 $176 $1,154 $156 Results exclude stock based compensation and depreciation expense 15 Nasdaq: CSBR

Financial Results/Observations • GAAP reporting may distort underlying health of the business • Timing mismatch of revenue and expense recognition • Revenue is recognized only after model completion, generally 6 months after the study is signed • Expenses are recognized as incurred during the study period • Result: Growth in bookings may lead to an increase in expenses not offset by revenue until the study completes • YTD non-cash stock comp expense of $ 171,000 16 Nasdaq: CSBR

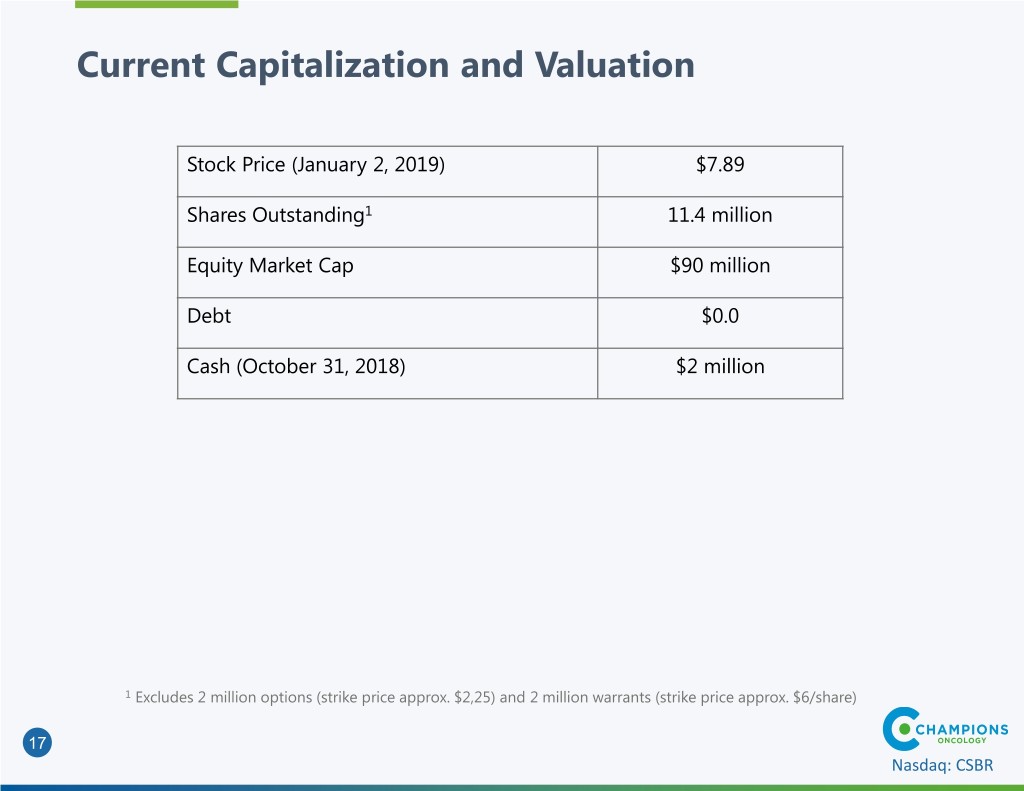

Current Capitalization and Valuation Stock Price (January 2, 2019) $7.89 Shares Outstanding1 11.4 million Equity Market Cap $90 million Debt $0.0 Cash (October 31, 2018) $2 million 1 Excludes 2 million options (strike price approx. $2,25) and 2 million warrants (strike price approx. $6/share) 17 Nasdaq: CSBR

Investment Highlights • Opportunities to increase revenues and profitability ‒ Accelerating core business revenue growth ‒ New product offerings to increase revenues ‒ Quarterly profitable results in 1H of FY 2019 ‒ Company expects to remain profitable ‒ Monetize data bank • Insiders own 50+%; highly incentivized to create value • No debt on the balance sheet with no intention to raise for working capital 18 Nasdaq: CSBR

A Deep and Experienced Senior Management Team David Sidransky MD – Founder and Lead Scientific Director • Professor of Oncology, Johns Hopkins Ronnie Morris MD – President and Chief Executive Officer • Experience - Founder and CMO of MDVIP Joel Ackerman – Chairman Board of Directors • Experience - Partner at Warburg Pincus Phil Breitfeld, MD – Chief Innovation/Strategy • Experience – 30+ years in Oncology in both academia and indusry • Most recently, Global Vice President ay Quintiles David Miller – CFO • Experience - Private Equity 19

Contacts Company Contacts Ronnie Morris, MD, President and CEO Champions Oncology, Inc. Tel 201.808.8401 | championsoncology.com David Miller, CFO Champions Oncology, Inc. Tel 551.206.8104| championsoncology.com Investor Relations Brett Maas, Managing Partner Hayden IR Tel 646.536.7331 | www.haydenir.com 20 Nasdaq: CSBR

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Transaction in Own Shares

- Bigbank's Unaudited Financial Results for Q1 2024

- JBSAY ALERT: ROSEN, SKILLED INVESTOR COUNSEL, Encourages JBS S.A. Investors to Inquire About Securities Class Action Investigation – JBSAY

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share