Form 8-K Ally Financial Inc. For: Mar 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 15, 2018

(Date of report; date of

earliest event reported)

Commission file number: 1-3754

ALLY FINANCIAL INC.

(Exact name of registrant as specified in its charter)

Delaware | 38-0572512 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

Ally Detroit Center

500 Woodward Ave.

Floor 10, Detroit, Michigan

48226

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Ally Financial Inc. will host a Financial Outlook conference call on Thursday, March 15, at 9:00 a.m. ET. The presentation is attached hereto and incorporated by reference as Exhibit 99.1. Presentation materials will be available at http://www.ally.com/about/investor/ under the Events and Presentations section of the Investor Relations website.

Item 9.01 Financial Statements and Exhibits.

(d) | Exhibits | |

Exhibit No. | Description | |

99.1 | ||

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Ally Financial Inc. Registrant | ||||||

Dated: | March 15, 2018 | /s/ David J. DeBrunner | ||||

David J. DeBrunner | ||||||

Vice President, Chief Accounting Officer and Controller | ||||||

3

1

Ally Financial Inc.

Financial Outlook Update

March 15, 2018

2

Forward-Looking Statements and Additional Information

This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained

in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and

based on company and third-party data available at the time of the presentation or related communication.

This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements

about targets and expectations for various financial and operating metrics. Forward-looking statements often use words such as ―believe,‖

―expect,‖ ―anticipate,‖ ―intend,‖ ―pursue,‖ ―seek,‖ ―continue,‖ ―estimate,‖ ―project,‖ ―outlook,‖ ―forecast,‖ ―potential,‖ ―target,‖ ―objective,‖ ―trend,‖

―plan,‖ ―goal,‖ ―initiative,‖ ―priorities,‖ or other words of comparable meaning or future-tense or conditional verbs such as ―may,‖ ―will,‖ ―should,‖

―would,‖ or ―could.‖ Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All

forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which

are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future

objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking

statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking

statements are described in our Annual Report on Form 10-K for the year ended December 31, 2017, our subsequent Quarterly Reports on Form

10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange

Commission (collectively, our ―SEC filings‖). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was

made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the

date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including

disclosures of a forward-looking nature) that we may make in any subsequent SEC filings.

This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are

reported according to generally accepted accounting principles (―GAAP‖). These non-GAAP financial measures may be useful to investors but

should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable

GAAP financial measures are reconciled in the presentation.

Our use of the term ―loans‖ describes all of the products associated with our direct and indirect lending activities. The specific products include

loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term ―lend‖ or ―originate‖ refers to our direct

origination of loans or our purchase or acquisition of loans.

3 CONFIDENTIAL

Overview and Summary Outlook

Business Overview

Financial Drivers

Capital and Balance Sheet Update

Conclusion

1

2

3

4

Agenda

5

4

(end of period balances)

Unsecured

Debt

11%

Secured

Debt

12%

Deposits

62%

Other

Borrowings

15%

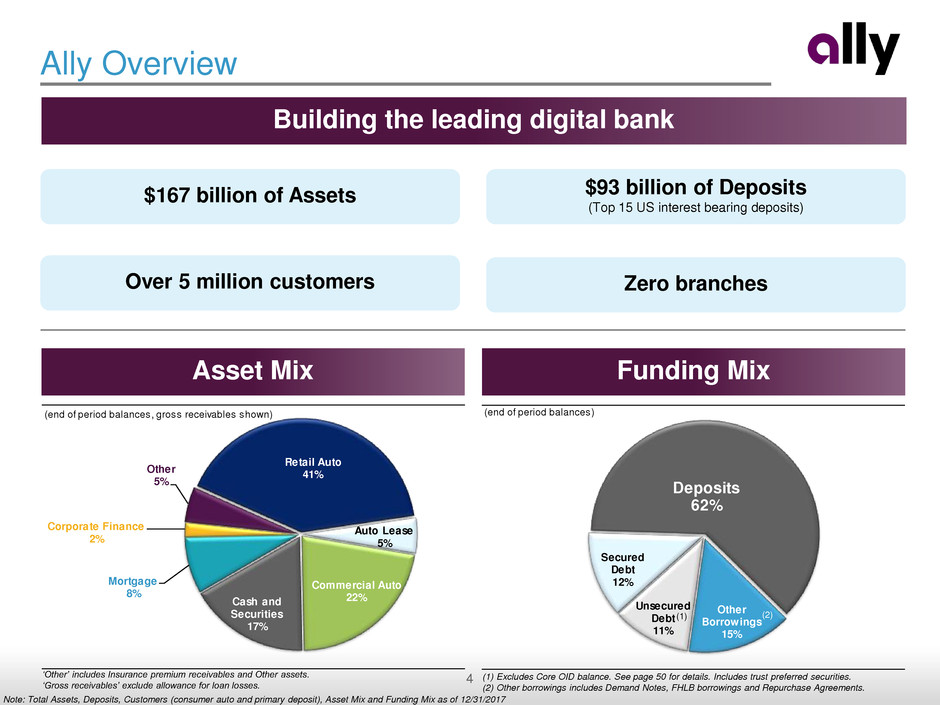

Ally Overview

Note: Total Assets, Deposits, Customers (consumer auto and primary deposit), Asset Mix and Funding Mix as of 12/31/2017

Building the leading digital bank

Asset Mix

$167 billion of Assets

Zero branches Over 5 million customers

$93 billion of Deposits

(Top 15 US interest bearing deposits)

Funding Mix

(1) Excludes Core OID balance. See page 50 for details. Includes trust preferred securities.

(2) Other borrowings includes Demand Notes, FHLB borrowings and Repurchase Agreements.

„Other‟ includes Insurance premium receivables and Other assets.

„Gross receivables‟ exclude allowance for loan losses.

(1) (2)

(end of period balances, gross receivables shown)

Retail Auto

41%

Auto Lease

5%

Commercial Auto

22%Cash and

Securities

17%

Mortgage

8%

Corporate Finance

2%

Other

5%

5

Optimizing risk-adjusted returns in auto finance while maintaining leading position

as full spectrum lender

Balancing deposit growth and beta while continuing strategic objective to be more

core funded

Maintain strong expense efficiency while supporting long-term strategic

positioning, digital capabilities and product expansion

Financial path remains intact – incremental benefit from lower corporate tax rate

Key Financial Themes and Priorities

Stronger position to generate and deploy capital as earnings grow

6

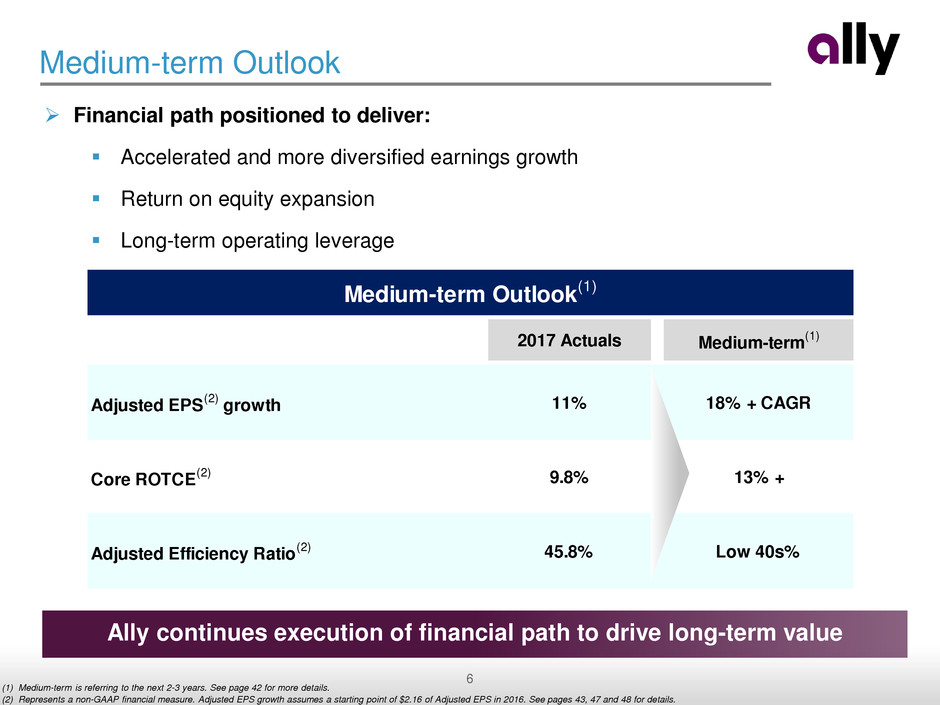

Medium-term Outlook(1)

2017 Actuals Medium-term

(1)

Adjusted EPS

(2)

growth 11% 18% + CAGR

Core ROTCE

(2) 9.8% 13% +

Adjusted Efficiency Ratio

(2) 45.8% Low 40s%

Medium-term Outlook

Ally continues execution of financial path to drive long-term value

Financial path positioned to deliver:

Accelerated and more diversified earnings growth

Return on equity expansion

Long-term operating leverage

(1) Medium-term is referring to the next 2-3 years. See page 42 for more details.

(2) Represents a non-GAAP financial measure. Adjusted EPS growth assumes a starting point of $2.16 of Adjusted EPS in 2016. See pages 43, 47 and 48 for details.

7

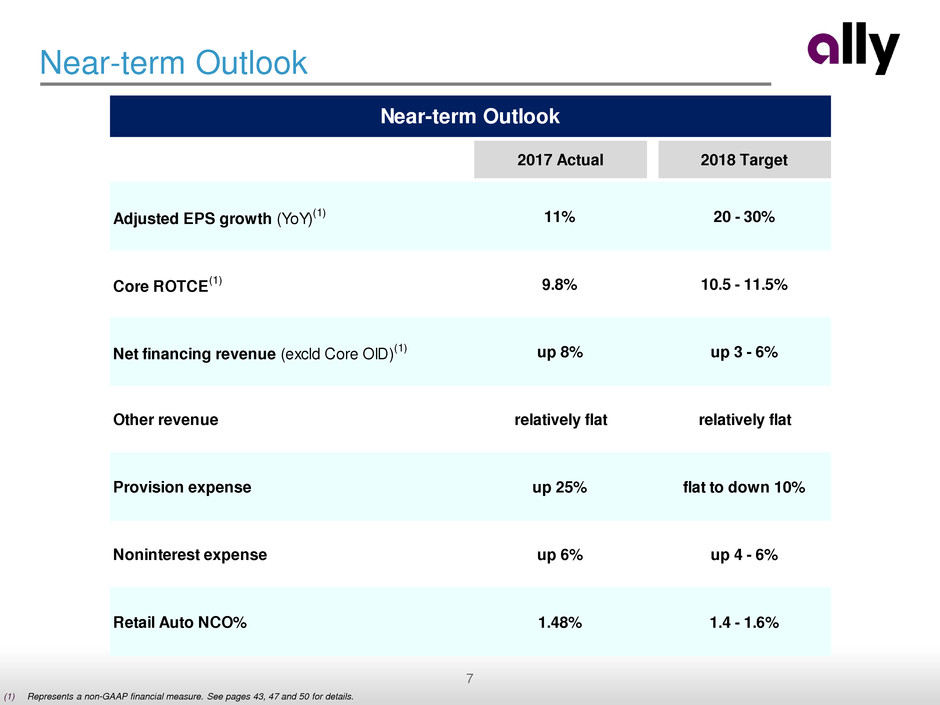

Near-term Outlook Medium-term Outlook(1)

2017 Actual 2018 Target

Adjusted EPS growth (YoY)

(1) 11% 20 - 30%

Core ROTCE

(1) 9.8% 10.5 - 11.5%

Net financing revenue (excld Core OID)

(1) up 8% up 3 - 6%

Other revenue relatively flat relatively flat

Provision expense up 25% flat to down 10%

Noninterest expense up 6% up 4 - 6%

Retail Auto NCO% 1.48% 1.4 - 1.6%

Near-term Outlook

(1) Represents a non-GAAP financial measure. See pages 43, 47 and 50 for details.

8 CONFIDENTIAL

Overview and Summary Outlook

Business Overview

Financial Drivers

Capital and Balance Sheet Update

Conclusion

1

2

3

4

Agenda

5

9

Brief History

Transitioned to more resilient business model

2010 - 2014 2015 - 2017

Product

Mix

Credit

Mix

(FICO)

New Retail Standard

Lease

Used

New Retail Subvented

Super Prime (740+)

Prime/Near (659–620)

Nonprime (619-0)

Prime (739–660)

CSG / Other(1)

(% of consumer auto originations)

(% of retail auto originations)

1919 2006 2010 2015

2006 – 2009

Stabilization

• Protected dealers during crisis

• Launched Ally Bank and

deposits

• Became Bank Holding Company

and received TARP funds

2010 – 2014

Restructuring

• Shifted to dealer-centric model

• Enhanced bank digital

functionality

• Addressed legacy issues

2015 – forward

Growth

• Optimize risk-adjusted returns

• Reached $90B+ of deposits

• Launch product diversification

initiatives

(1) Commercial Services Group (CSG) are business customers. Average annualized credit losses of 40-45 bps on CSG loans for 2016 and 2017.

19%

22%

35%

24%

New Retail Subvented Lease New Retail Standard Used

2%

11%

45%

41%

New R tail Subvent d Lease New Retail Standard Used

36%

35%

17%

9%

4%

Super Prime (CB 740+) Prime (CB 739-660) Prime/Near (CB 659-620)

23%

35%

25%

12%

6%

Auto

10

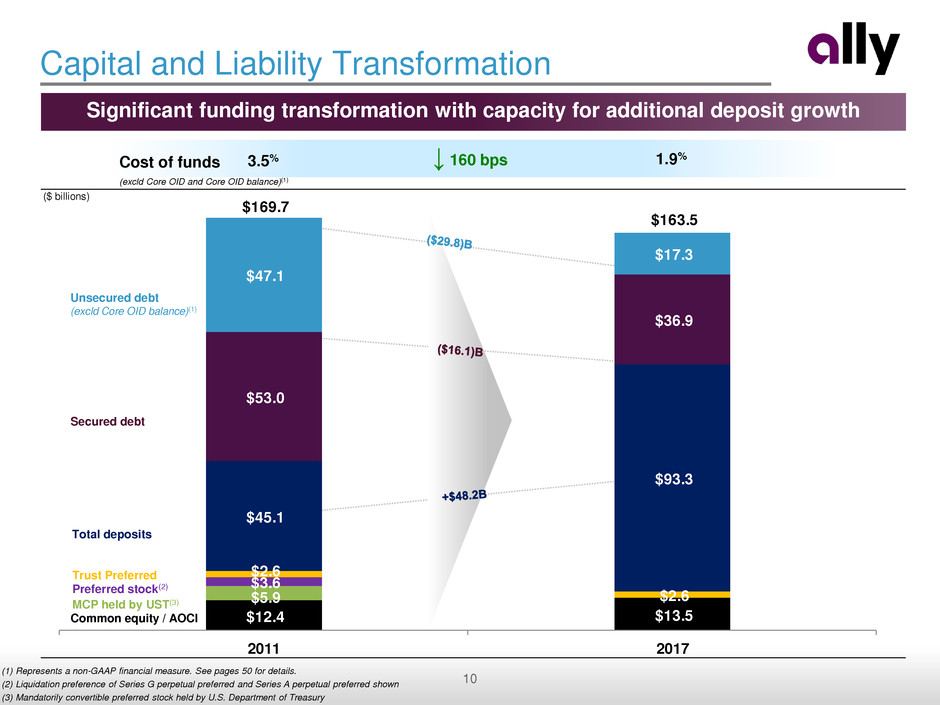

($ billions)

$12.4 $13.5

$5.9

$3.6

$2.6

$2.6

$45.1

$93.3

$53.0

$36.9

$47.1

$17.3

$169.7

$163.5

2011 2017

Capital and Liability Transformation

Secured debt

Cost of funds

(excld Core OID and Core OID balance)(1)

3.5% 1.9% ↓ 160 bps

Unsecured debt

(excld Core OID balance)(1)

Trust Preferred

Preferred stock(2)

MCP held by UST(3)

Common equity / AOCI

(1) Represents a non-GAAP financial measure. See pages 50 for details.

(2) Liquidation preference of Series G perpetual preferred and Series A perpetual preferred shown

(3) Mandatorily convertible preferred stock held by U.S. Department of Treasury

Total deposits

Significant funding transformation with capacity for additional deposit growth

11

Ally Today

(1) The Ally CashBack Credit Card is issued by TD Bank N.A.

A L L Y A U T O

I N S U R A N C E

Co-brand product(1)

C A S H B A C K C A R D

A L L Y H O M E

D E P O S I T S

C O R P O R A T E

F I N A N C E

A L L Y I N V E S T

Building the leading digital bank

12

Proven Auto Finance Go-To-Market Strategy

Note: based on period-end 12/31/2017

Unique competitive advantages and capabilities

• Superior service model; multi-generational dealer relationships

Relationship

Based

Broadest

Product Suite

Full Spectrum

• Commercial lending, Insurance and SmartAuction are differentiators

• Super-prime to sub-prime, new/used, loan/lease

Significant

National Scale

• $114 billion of total Auto Finance assets

• ~18,500 active dealer relationships in all 50 states

Proven

Adaptability

• Evolved from captive to diversified market-driven competitor

Forward

Thinking

• Continue to position for future evolution with enhanced offerings and

aligning with emerging industry players

13

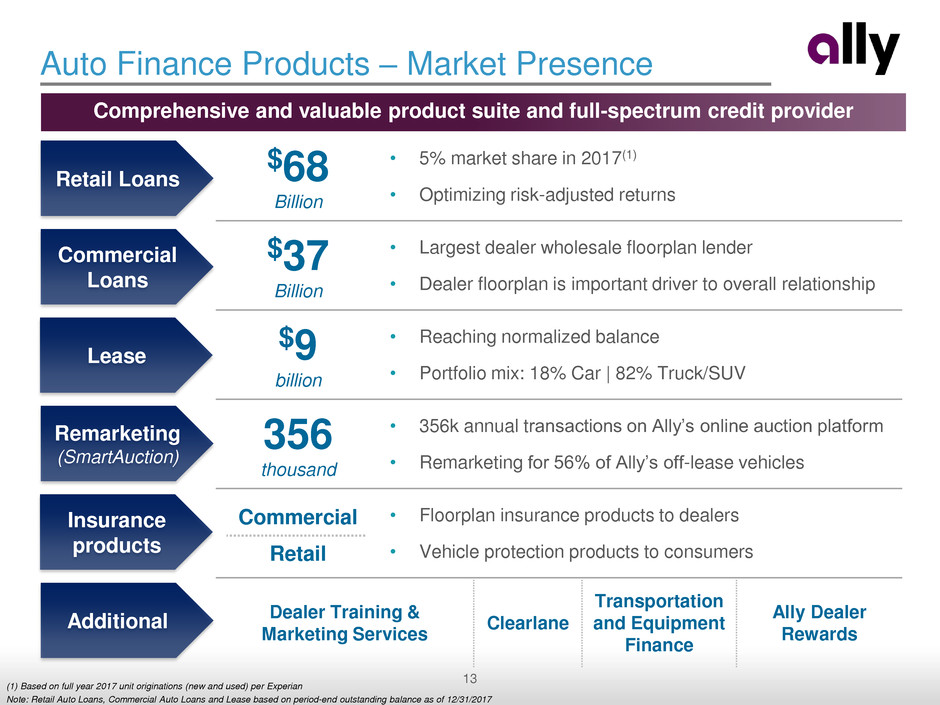

Auto Finance Products – Market Presence

Comprehensive and valuable product suite and full-spectrum credit provider

Theme:

Retail Loans

Commercial

Loans

Lease

Remarketing

(SmartAuction)

Insurance

products

$68

Billion

• 5% market share in 2017(1)

• Optimizing risk-adjusted returns

$37

Billion

• Largest dealer wholesale floorplan lender

• Dealer floorplan is important driver to overall relationship

$9

billion

• Reaching normalized balance

• Portfolio mix: 18% Car | 82% Truck/SUV

356

thousand

• 356k annual transactions on Ally’s online auction platform

• Remarketing for 56% of Ally’s off-lease vehicles

Commercial

Retail

• Floorplan insurance products to dealers

• Vehicle protection products to consumers

Dealer Training &

Marketing Services

Clearlane

Transportation

and Equipment

Finance

Ally Dealer

Rewards

Additional

(1) Based on full year 2017 unit originations (new and used) per Experian

Note: Retail Auto Loans, Commercial Auto Loans and Lease based on period-end outstanding balance as of 12/31/2017

14

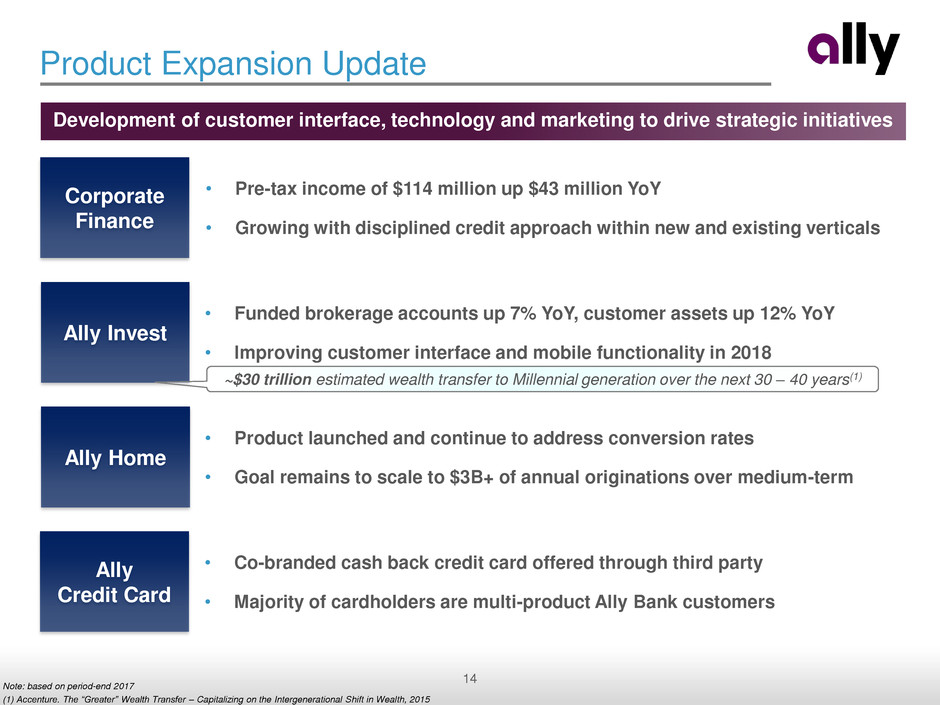

Product Expansion Update

Note: based on period-end 2017

(1) Accenture. The “Greater” Wealth Transfer – Capitalizing on the Intergenerational Shift in Wealth, 2015

Development of customer interface, technology and marketing to drive strategic initiatives

• Pre-tax income of $114 million up $43 million YoY

• Growing with disciplined credit approach within new and existing verticals

Corporate

Finance

Ally Invest

Ally Home

• Funded brokerage accounts up 7% YoY, customer assets up 12% YoY

• Improving customer interface and mobile functionality in 2018

• Product launched and continue to address conversion rates

• Goal remains to scale to $3B+ of annual originations over medium-term

Ally

Credit Card

• Co-branded cash back credit card offered through third party

• Majority of cardholders are multi-product Ally Bank customers

~$30 trillion estimated wealth transfer to Millennial generation over the next 30 – 40 years(1)

15

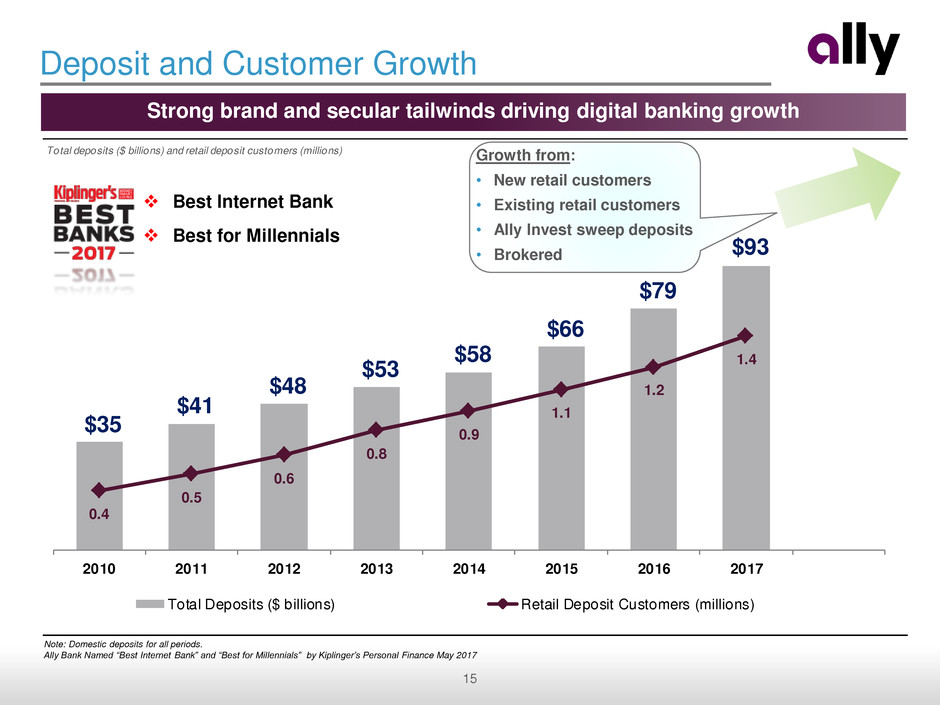

Total deposits ($ billions) and retail deposit customers (millions)

$35

$41

$48

$53

$58

$66

$79

$93

0.4

0.5

0.6

0.8

0.9

1.1

1.2

1.4

2010 2011 2012 2013 2014 2015 2016 2017

Total Deposits ($ billions) Retail Deposit Customers (millions)

Growth from:

• New retail customers

• Existing retail customers

• Ally Invest sweep deposits

• Brokered

Deposit and Customer Growth

Strong brand and secular tailwinds driving digital banking growth

Note: Domestic deposits for all periods.

Ally Bank Named “Best Internet Bank” and “Best for Millennials” by Kiplinger‟s Personal Finance May 2017

Best Internet Bank

Best for Millennials

16

($ billions)

$21.8

$27.7

$35.0

$43.2

$47.9

$55.4

$66.6

$77.9

7.9%

9.1%

10.8%

12.6% 13.0%

13.8%

14.8%

16.0%

2010 2011 2012 2013 2014 2015 2016 2017

Ally Market Share of Direct Banks

($ billions)

$277

$400

$449

$488

5.8%

6.2% 6.4%

6.7%

7.0% 7.3%

7.8%

8.2%

2010 2011 2012 2013 2014 2015 2016 2017

Market Share

($ trillions)

$4.8 $4.9

$5.0 $5.1

$5.2

$5.5

$5.7 $5.9

2010 2011 2012 2013 2014 2015 2016 2017

($ trillions)

$7.9

$8.8

$9.4 $ .8

$10.4

$10.9

$11.6

$12.1

2010 2011 2012 20 3 2014 2015 2016 2017

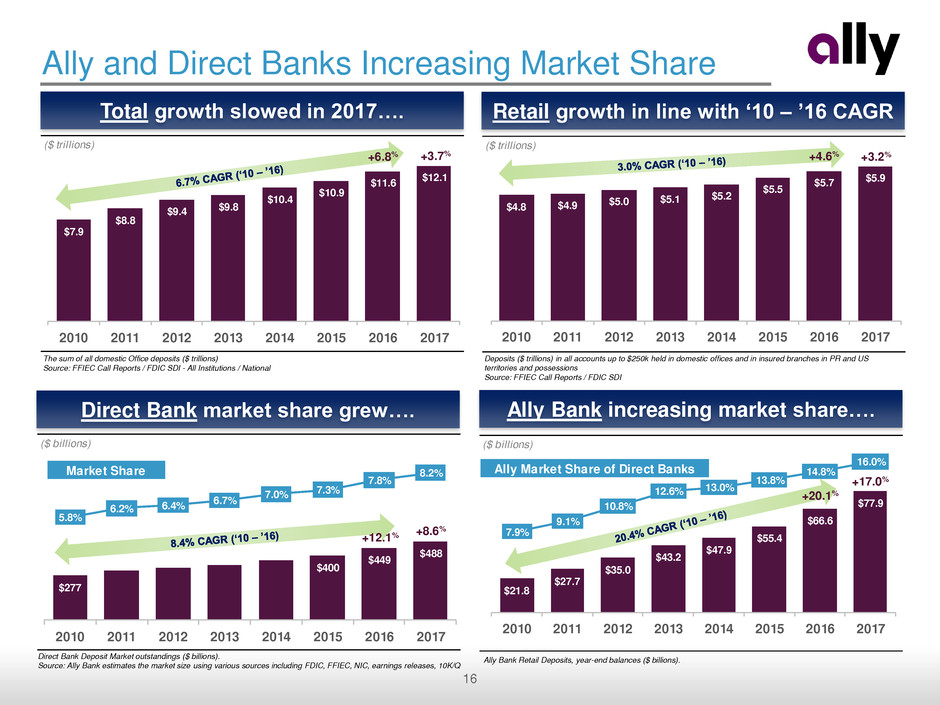

Ally and Direct Banks Increasing Market Share

Total growth slowed in 2017…. Retail growth in line with ‘10 – ’16 CAGR

Direct Bank market share grew…. Ally Bank increasing market share….

+3.7%

The sum of all domestic Office deposits ($ trillions)

Source: FFIEC Call Reports / FDIC SDI - All Institutions / National

Deposits ($ trillions) in all accounts up to $250k held in domestic offices and in insured branches in PR and US

territories and possessions

Source: FFIEC Call Reports / FDIC SDI

+8.6%

Direct Bank Deposit Market outstandings ($ billions).

Source: Ally Bank estimates the market size using various sources including FDIC, FFIEC, NIC, earnings releases, 10K/Q

+17.0%

Ally Bank Retail Deposits, year-end balances ($ billions).

+3.2% +6.8% +4.6%

+20.1%

+12.1%

17

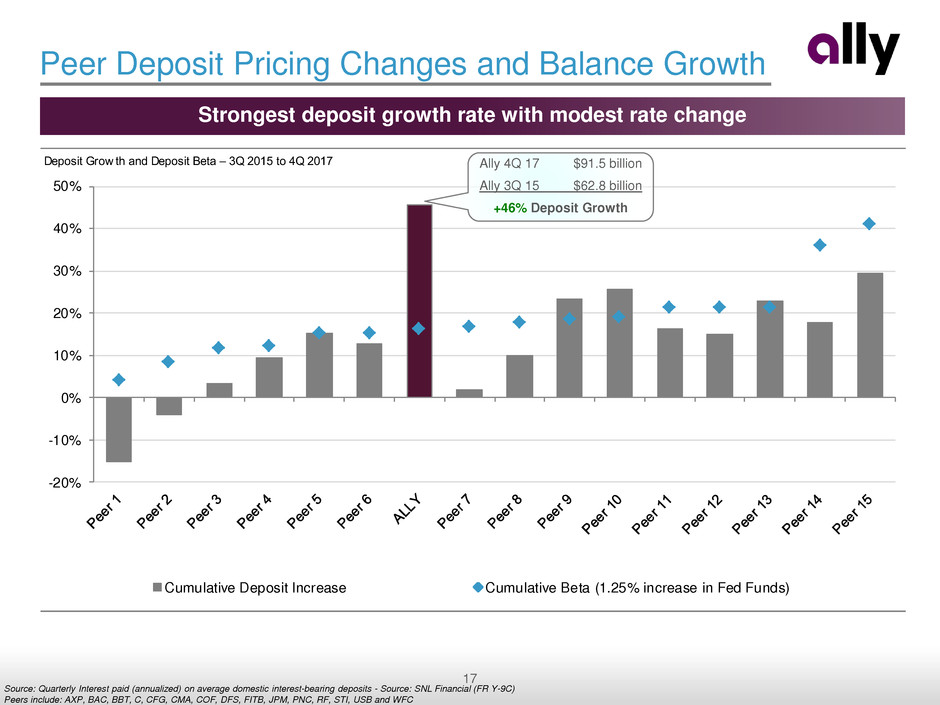

Deposit Grow th and Deposit Beta – 3Q 2015 to 4Q 2017

-20%

-10%

0%

10%

20%

30%

40%

50%

Cumulative Deposit Increase Cumulative Beta (1.25% increase in Fed Funds)

Peer Deposit Pricing Changes and Balance Growth

Strongest deposit growth rate with modest rate change

Source: Quarterly Interest paid (annualized) on average domestic interest-bearing deposits - Source: SNL Financial (FR Y-9C)

Peers include: AXP, BAC, BBT, C, CFG, CMA, COF, DFS, FITB, JPM, PNC, RF, STI, USB and WFC

Ally 4Q 17 $91.5 billion

Ally 3Q 15 $62.8 billion

+46% Deposit Growth

18 CONFIDENTIAL

Overview and Summary Outlook

Business Overview

Financial Drivers

Capital and Balance Sheet Update

Conclusion

1

2

3

4

Agenda

5

19

($ billions)

$48.0 $50.6 $51.8

$53.5 $55.4

$59.0 $61.2

$63.9 $66.6

$70.0 $71.1

$74.9 $77.9

$10.2

$10.2 $10.2

$10.5 $11.0

$11.3

$11.6

$11.9

$12.4

$14.5 $15.1

$15.2

$15.3

$58.2

$60.9 $61.9

$64.0 $66.5

$70.3

$72.8

$75.7

$79.0

$84.5 $86.2

$90.1

$93.3

4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

Retail Deposits Brokered / Other

$22.7

$23.7 $23.7

$24.3

$24.6

25.4

25.9

$26.3 $26.2

$26.6

$27.4

$28.2 $28.1

4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

$0.40

$0.52

$0.46

$0.51 $0.52 $0.52

$0.54

$0.56

$0.54

$0.48

$0.58

$0.65

$0.70

4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

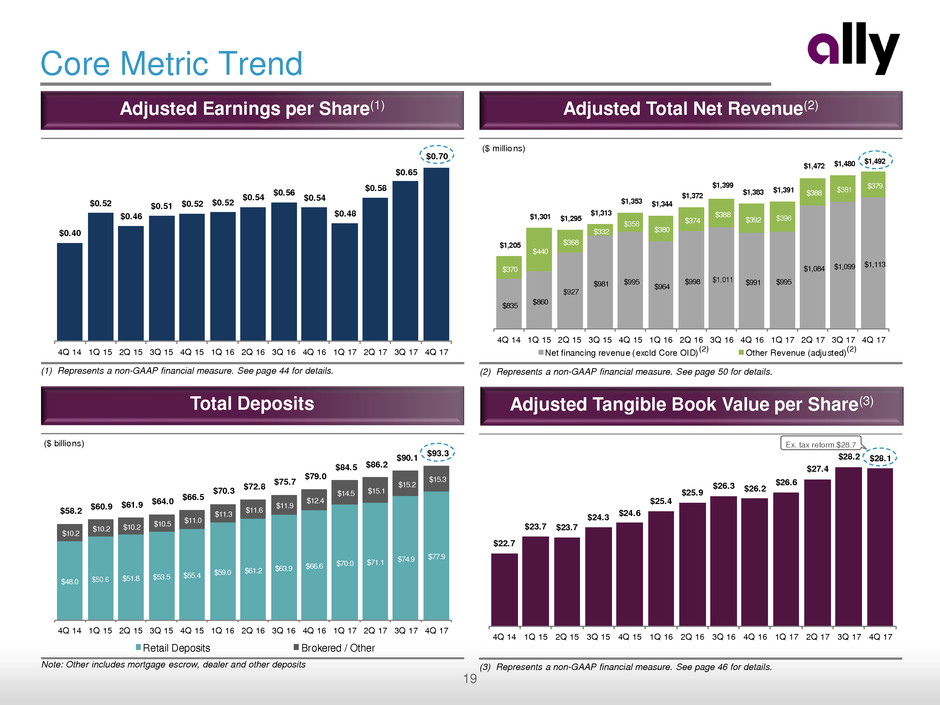

Core Metric Trend

Adjusted Earnings per Share(1) Adjusted Total Net Revenue(2)

Total Deposits Adjusted Tangible Book Value per Share(3)

(3) Represents a non-GAAP financial measure. See page 46 for details.

(1) Represents a non-GAAP financial measure. See page 44 for details. (2) Represents a non-GAAP financial measure. See page 50 for details.

Note: Other includes mortgage escrow, dealer and other deposits

Ex. tax reform $28.7

($ millions)

$835

$860

$927

$981 $995 $964

$998 $1,011 $99 $995

$1,084 $1,099

$1,113

$370

$440

$368

$332

$358

$380

$374

$388

$392 $396

$388 $381

$379

$1,205

$1,301 $1,295

$1,313

$1,353 $1,344

$1,372

$1,399

$1,383 $1,391

$1,472 $1,480

$1,492

4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

Net financing revenue (excld Core OID) Other Revenue (adjusted)

(2) (2)

20

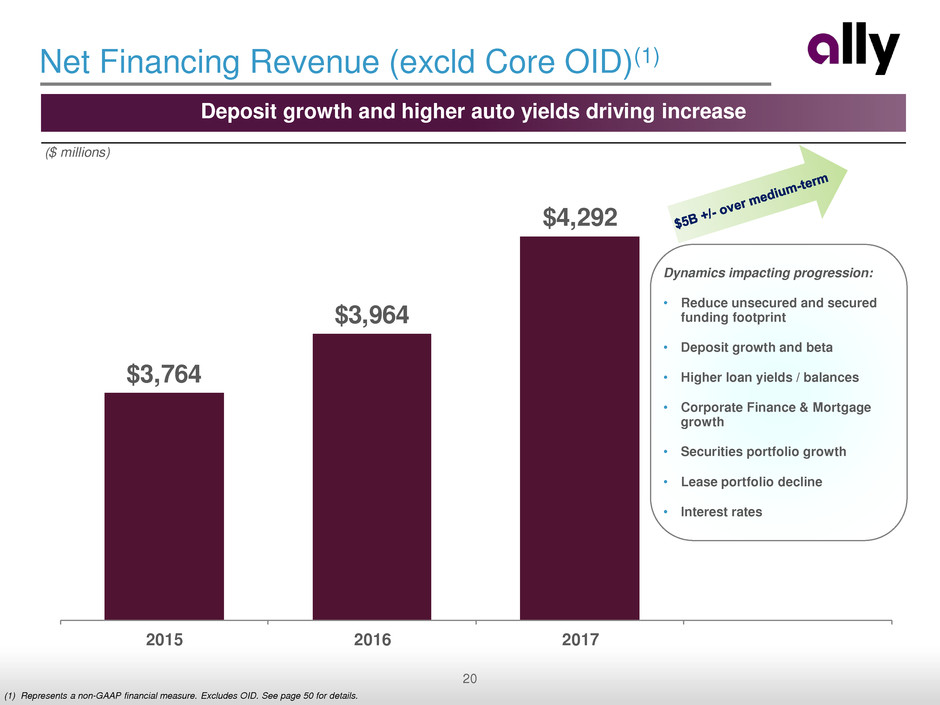

($ millions)

$3,764

$3,964

$4,292

2015 2016 2017

Net Financing Revenue (excld Core OID)(1)

Deposit growth and higher auto yields driving increase

(1) Represents a non-GAAP financial measure. Excludes OID. See page 50 for details.

Dynamics impacting progression:

• Reduce unsecured and secured

funding footprint

• Deposit growth and beta

• Higher loan yields / balances

• Corporate Finance & Mortgage

growth

• Securities portfolio growth

• Lease portfolio decline

• Interest rates

21

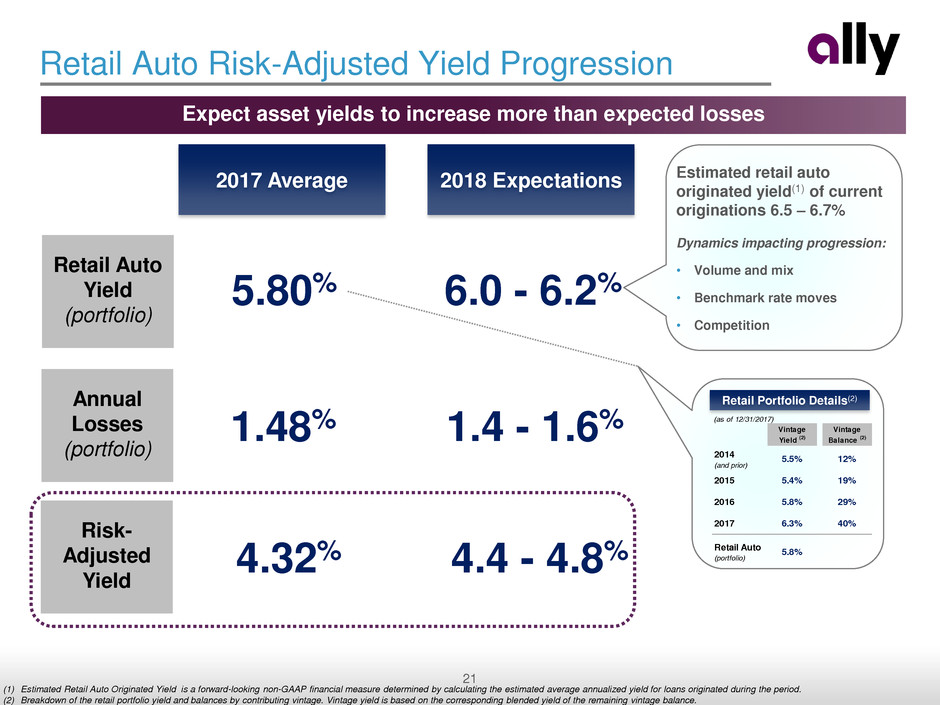

Retail Auto Risk-Adjusted Yield Progression

Expect asset yields to increase more than expected losses

2017 Average 2018 Expectations

Retail Auto

Yield

(portfolio)

Annual

Losses

(portfolio)

Risk-

Adjusted

Yield

5.80% 6.0 - 6.2%

1.48% 1.4 - 1.6%

4.32% 4.4 - 4.8%

Estimated retail auto

originated yield(1) of current

originations 6.5 – 6.7%

Dynamics impacting progression:

• Volume and mix

• Benchmark rate moves

• Competition

(1) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period.

(2) Breakdown of the retail portfolio yield and balances by contributing vintage. Vintage yield is based on the corresponding blended yield of the remaining vintage balance.

Retail Portfolio Details(2)

(as of 12/31/2017)

Vintage

Yield (2)

Vintage

Balance (2)

2014

(and prior)

5.5% 12%

2015 5.4% 19%

2016 5.8% 29%

2017 6.3% 40%

Retail Auto

(portfolio)

5.8%

22

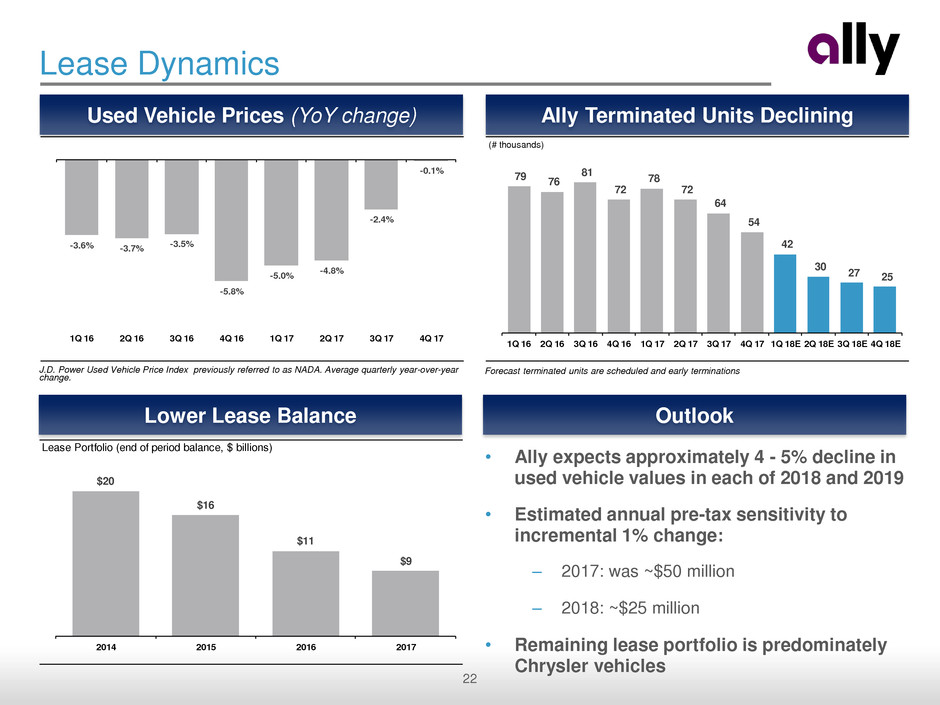

Outlook Lower Lease Balance

Ally Terminated Units Declining Used Vehicle Prices (YoY change)

Lease Dynamics

• Ally expects approximately 4 - 5% decline in

used vehicle values in each of 2018 and 2019

• Estimated annual pre-tax sensitivity to

incremental 1% change:

‒ 2017: was ~$50 million

‒ 2018: ~$25 million

• Remaining lease portfolio is predominately

Chrysler vehicles

J.D. Power Used Vehicle Price Index previously referred to as NADA. Average quarterly year-over-year

change.

-3.6% -3.7% -3.5%

-5.8%

-5.0%

-4.8%

-2.4%

-0.1%

1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

Forecast terminated units are scheduled and early terminations

Lease Portfolio (end of period balance, $ billions)

$20

$16

$11

$9

2014 2015 2016 2017

(# thousands)

79

76

81

72

78

72

64

54

42

30

27 25

1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18E 2Q 18E 3Q 18E 4Q 18E

23

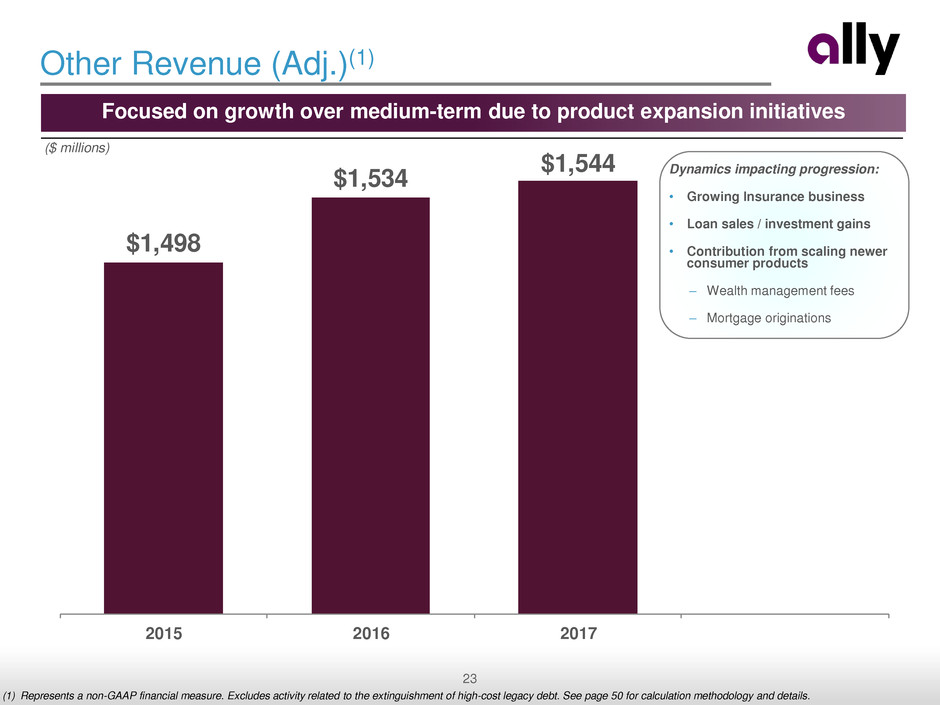

($ millions)

$1,498

$1,534

$1,544

2015 2016 2017

Other Revenue (Adj.)(1)

Focused on growth over medium-term due to product expansion initiatives

(1) Represents a non-GAAP financial measure. Excludes activity related to the extinguishment of high-cost legacy debt. See page 50 for calculation methodology and details.

Dynamics impacting progression:

• Growing Insurance business

• Loan sales / investment gains

• Contribution from scaling newer

consumer products

‒ Wealth management fees

‒ Mortgage originations

24

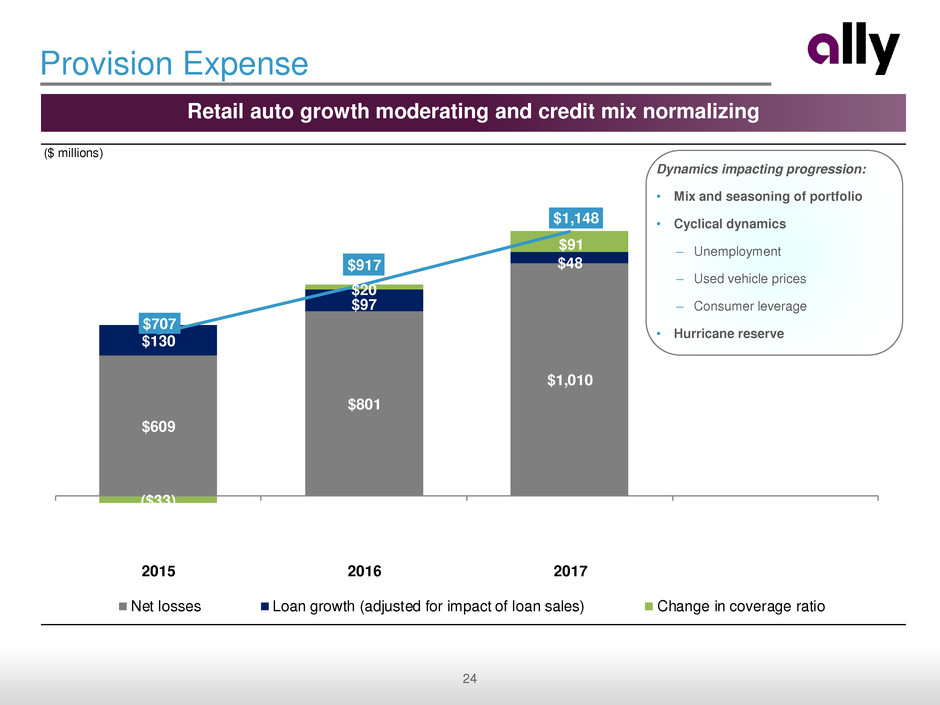

($ millions)

$609

$801

$1,010

$130

$97

$48

($33)

$20

$91

$707

$917

$1,148

2015 2016 2017

Net losses Loan growth (adjusted for impact of loan sales) Change in coverage ratio

Provision Expense

Retail auto growth moderating and credit mix normalizing

Dynamics impacting progression:

• Mix and seasoning of portfolio

• Cyclical dynamics

‒ Unemployment

‒ Used vehicle prices

‒ Consumer leverage

• Hurricane reserve

25

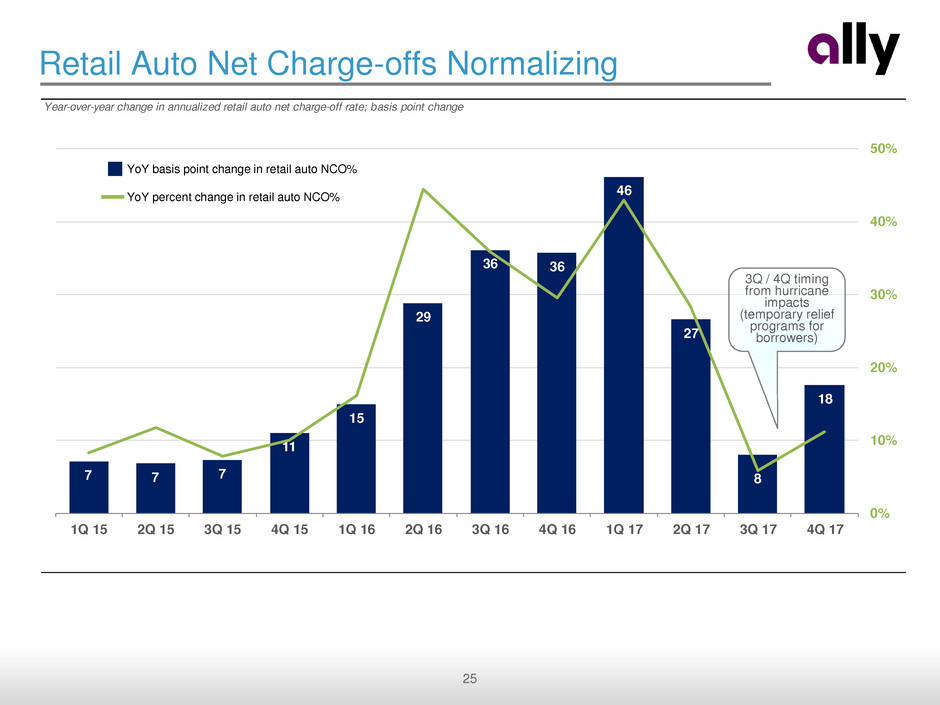

Year-over-year change in annualized retail auto net charge-off rate; basis point change

7 7 7

11

15

29

36 36

46

27

8

18

0%

10%

20%

30%

40%

50%

1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

Retail Auto Net Charge-offs Normalizing

YoY basis point change in retail auto NCO%

YoY percent change in retail auto NCO%

3Q / 4Q timing

from hurricane

impacts

(temporary relief

programs for

borrowers)

26

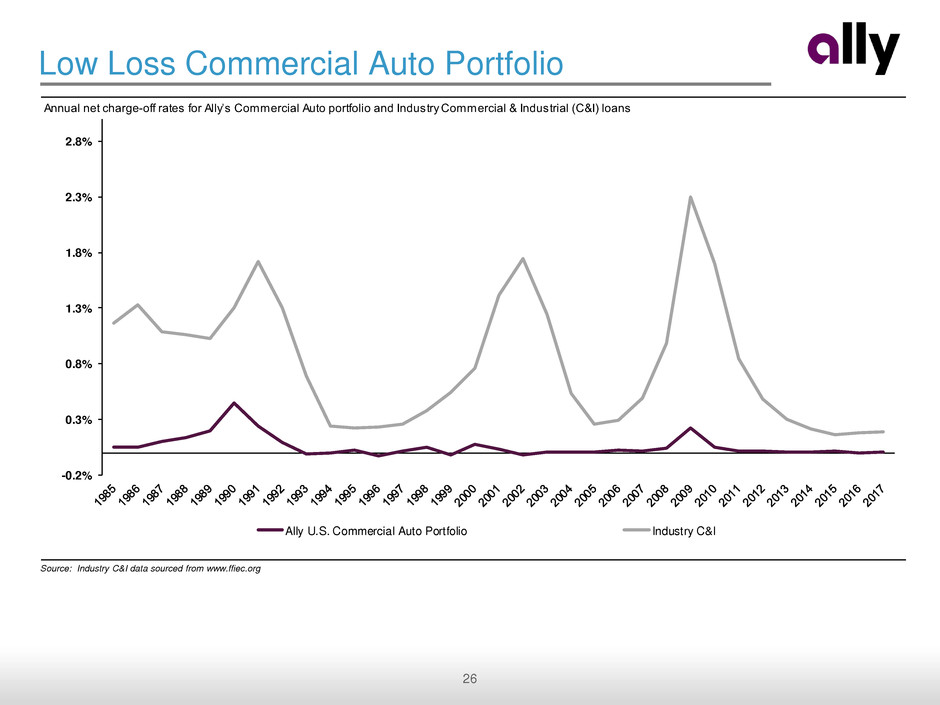

Low Loss Commercial Auto Portfolio

Source: Industry C&I data sourced from www.ffiec.org

Annual net charge-off rates for Ally’s Commercial Auto portfolio and Industry Commercial & Industrial (C&I) loans

-0.2%

0.3%

0.8%

1.3%

1.8%

2.3%

2.8%

Ally U.S. Commercial Auto Portfolio Industry C&I

27

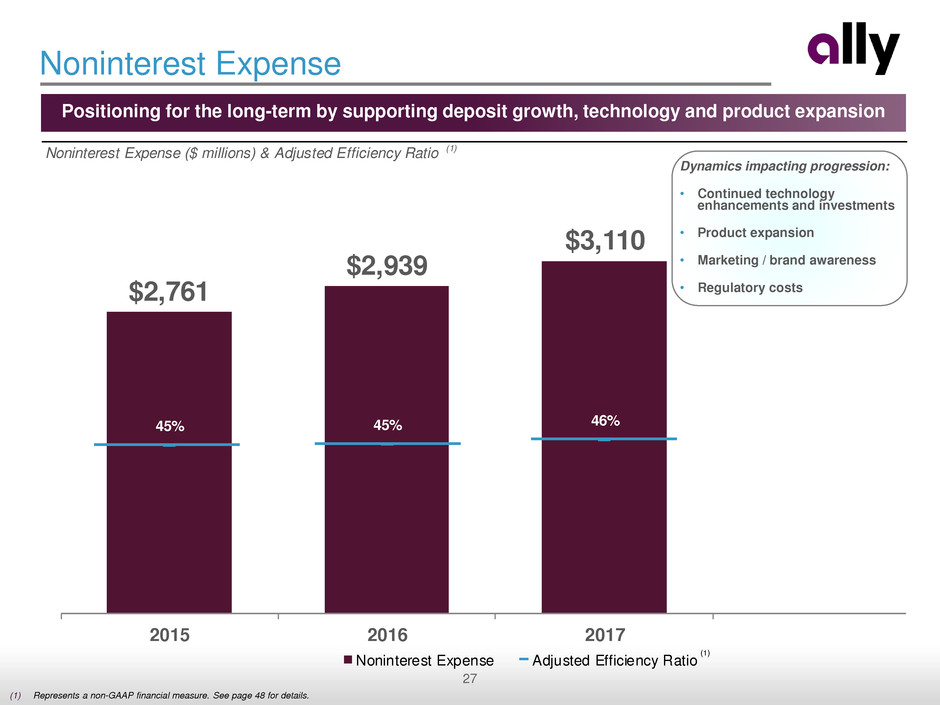

Noninterest Expense ($ millions) & Adjusted Efficiency Ratio (1)

$2,761

$2,939

$3,110

45% 45% 46%

2015 2016 2017

Noninterest Expense Adjusted Efficiency Ratio

Noninterest Expense

Dynamics impacting progression:

• Continued technology

enhancements and investments

• Product expansion

• Marketing / brand awareness

• Regulatory costs

Positioning for the long-term by supporting deposit growth, technology and product expansion

(1)

(1) Represents a non-GAAP financial measure. See page 48 for details.

28 CONFIDENTIAL

Overview and Summary Outlook

Business Overview

Financial Drivers

Capital and Balance Sheet Update

Conclusion

1

2

3

4

Agenda

5

29

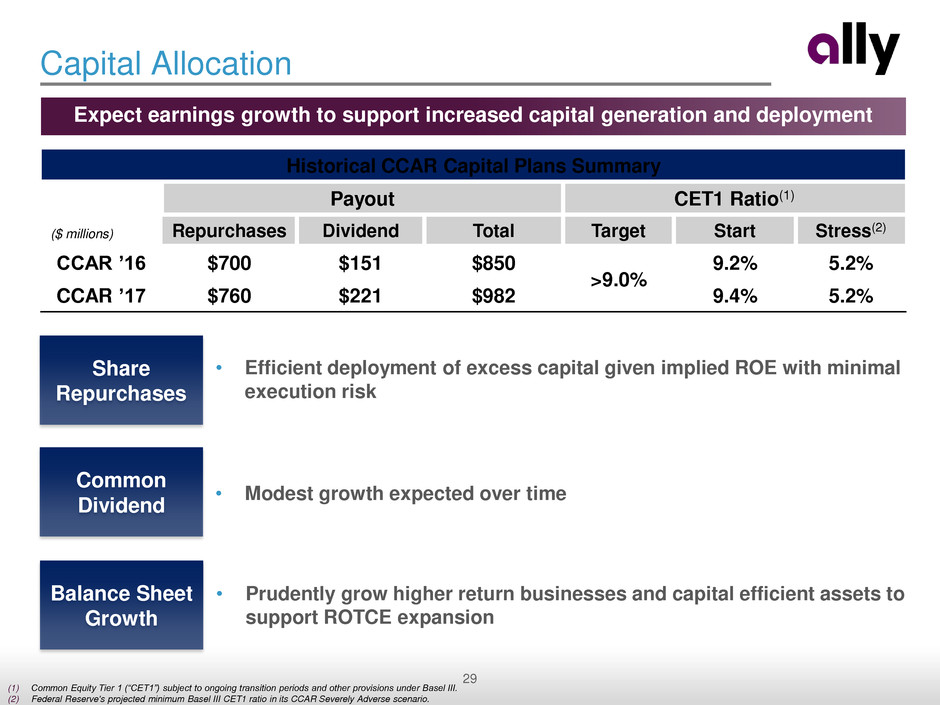

Common

Dividend

• Modest growth expected over time

Balance Sheet

Growth

• Prudently grow higher return businesses and capital efficient assets to

support ROTCE expansion

Capital Allocation

Share

Repurchases

• Efficient deployment of excess capital given implied ROE with minimal

execution risk

Expect earnings growth to support increased capital generation and deployment

Historical CCAR Capital Plans Summary

Payout CET1 Ratio(1)

($ millions) Repurchases Dividend Total Target Start Stress(2)

CCAR ’16 $700 $151 $850

>9.0%

9.2% 5.2%

CCAR ’17 $760 $221 $982 9.4% 5.2%

(1) Common Equity Tier 1 (“CET1”) subject to ongoing transition periods and other provisions under Basel III.

(2) Federal Reserve's projected minimum Basel III CET1 ratio in its CCAR Severely Adverse scenario.

30

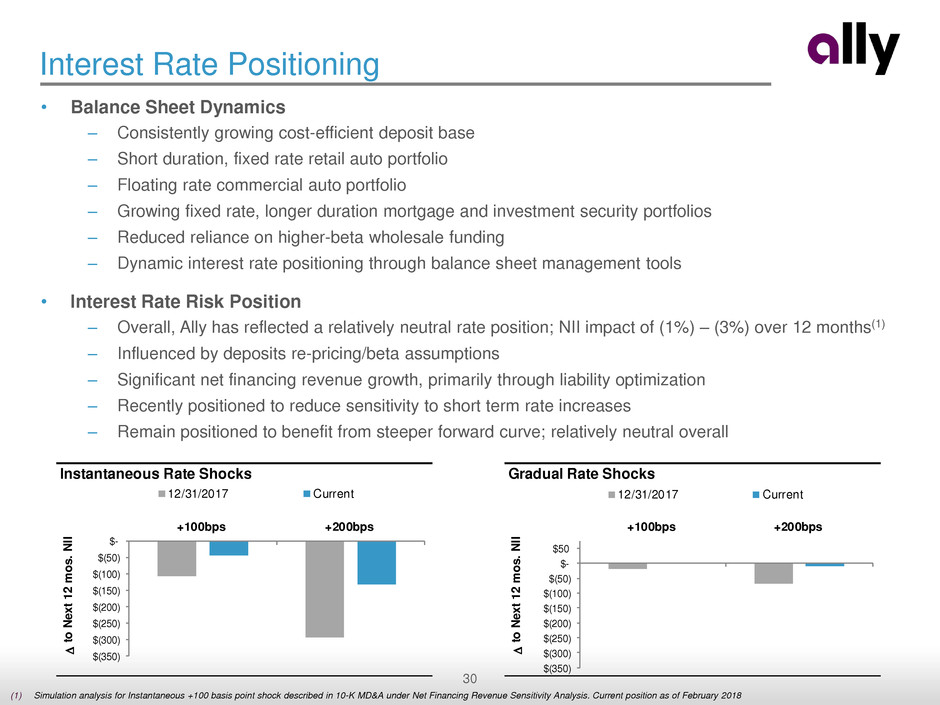

Interest Rate Positioning

• Balance Sheet Dynamics

‒ Consistently growing cost-efficient deposit base

‒ Short duration, fixed rate retail auto portfolio

‒ Floating rate commercial auto portfolio

‒ Growing fixed rate, longer duration mortgage and investment security portfolios

‒ Reduced reliance on higher-beta wholesale funding

‒ Dynamic interest rate positioning through balance sheet management tools

• Interest Rate Risk Position

‒ Overall, Ally has reflected a relatively neutral rate position; NII impact of (1%) – (3%) over 12 months(1)

‒ Influenced by deposits re-pricing/beta assumptions

‒ Significant net financing revenue growth, primarily through liability optimization

‒ Recently positioned to reduce sensitivity to short term rate increases

‒ Remain positioned to benefit from steeper forward curve; relatively neutral overall

(1) Simulation analysis for Instantaneous +100 basis point shock described in 10-K MD&A under Net Financing Revenue Sensitivity Analysis. Current position as of February 2018

Inst ntane us Rate Shocks

D

to

N

ex

t 1

2 m

os

. N

II

$(350)

$(300)

$(250)

$(200)

$(150)

$(100)

$(50)

$-

+100bps +200bps

12/31/2017 Current

Gradual Rate Shocks

D

to

N

ex

t 1

2 m

os

. N

II

$(350)

$(300)

$(250)

$(200)

$(150)

$(100)

$(50)

$-

$50

+100bps +200bps

12/31/2017 Current

31

Ally - Deposit Pricing Path v. Fed Funds Target

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0%

All

y D

ep

os

it P

ric

ing

Fed Funds Target

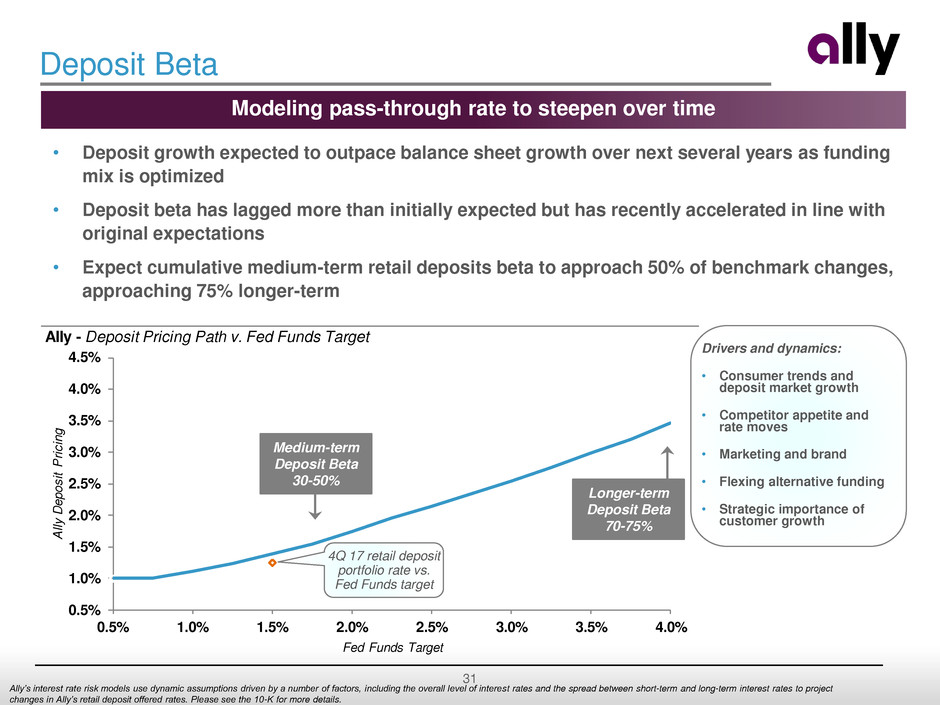

Deposit Beta

Modeling pass-through rate to steepen over time

• Deposit growth expected to outpace balance sheet growth over next several years as funding

mix is optimized

• Deposit beta has lagged more than initially expected but has recently accelerated in line with

original expectations

• Expect cumulative medium-term retail deposits beta to approach 50% of benchmark changes,

approaching 75% longer-term

Longer-term

Deposit Beta

70-75%

Medium-term

Deposit Beta

30-50%

Ally‟s interest rate risk models use dynamic assumptions driven by a number of factors, including the overall level of interest rates and the spread between short-term and long-term interest rates to project

changes in Ally‟s retail deposit offered rates. Please see the 10-K for more details.

Drivers and dynamics:

• Consumer trends and

deposit market growth

• Competitor appetite and

rate moves

• Marketing and brand

• Flexing alternative funding

• Strategic importance of

customer growth

4Q 17 retail deposit

portfolio rate vs.

Fed Funds target

32

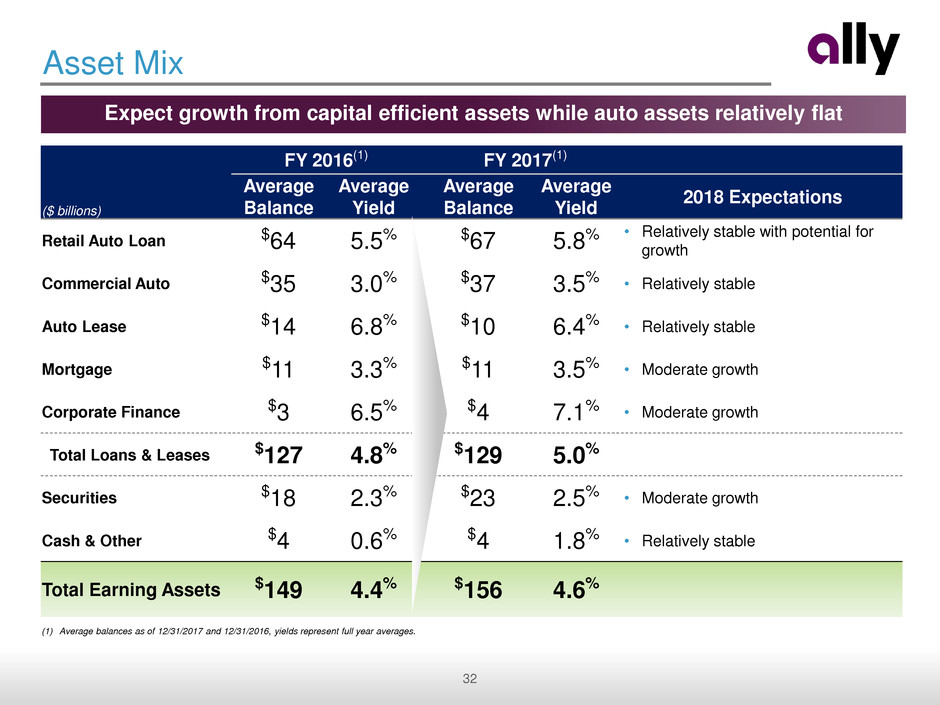

Asset Mix

($ billions)

FY 2016(1) FY 2017(1)

Average

Balance

Average

Yield

Average

Balance

Average

Yield

2018 Expectations

Retail Auto Loan $64 5.5% $67 5.8%

• Relatively stable with potential for

growth

Commercial Auto $35 3.0% $37 3.5% • Relatively stable

Auto Lease $14 6.8% $10 6.4% • Relatively stable

Mortgage $11 3.3% $11 3.5% • Moderate growth

Corporate Finance $3 6.5% $4 7.1% • Moderate growth

Total Loans & Leases $127 4.8% $129 5.0%

Securities $18 2.3% $23 2.5% • Moderate growth

Cash & Other $4 0.6% $4 1.8% • Relatively stable

Total Earning Assets $149 4.4% $156 4.6%

Expect growth from capital efficient assets while auto assets relatively flat

(1) Average balances as of 12/31/2017 and 12/31/2016, yields represent full year averages.

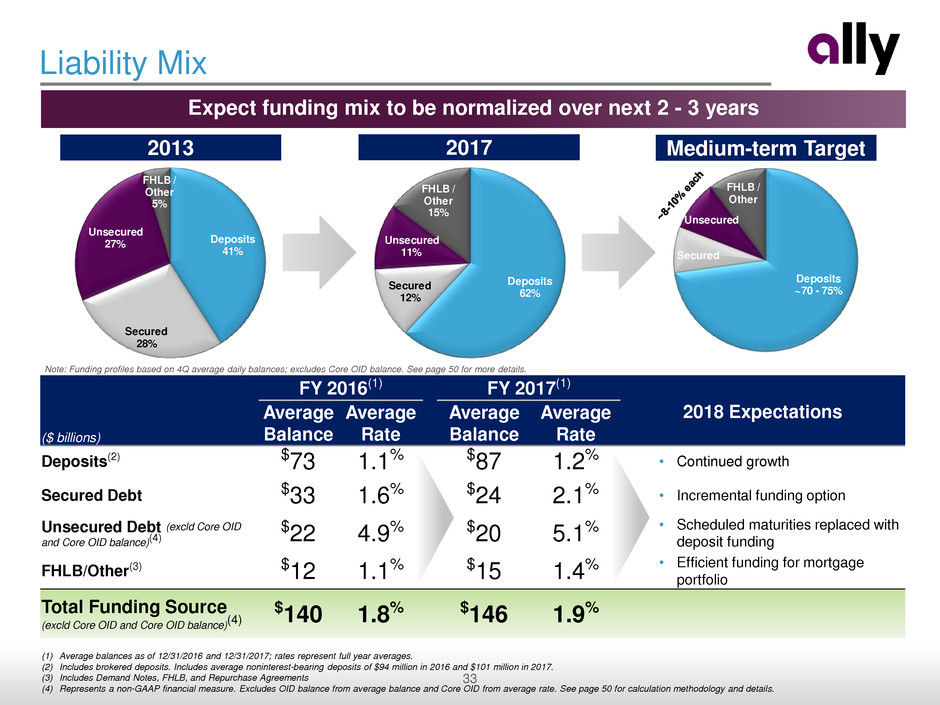

33

Deposits

41%

Secured

28%

Unsecured

27%

FHLB /

Other

5%

Deposits

62%

Secured

12%

Unsecured

11%

FHLB /

Other

15%

Secured

Unsecured

FHLB /

Other

Deposits

~70 - 75%

Liability Mix

($ billions)

FY 2016(1) FY 2017(1)

2018 Expectations Average

Balance

Average

Rate

Average

Balance

Average

Rate

Deposits(2) $73 1.1% $87 1.2% • Continued growth

Secured Debt $33 1.6% $24 2.1% • Incremental funding option

Unsecured Debt (excld Core OID

and Core OID balance)(4)

$22 4.9% $20 5.1%

• Scheduled maturities replaced with

deposit funding

FHLB/Other(3) $12 1.1% $15 1.4%

• Efficient funding for mortgage

portfolio

Total Funding Source

(excld Core OID and Core OID balance)(4)

$140 1.8% $146 1.9%

Expect funding mix to be normalized over next 2 - 3 years

2013 2017 Medium-term Target

Note: Funding profiles based on 4Q average daily balances; excludes Core OID balance. See page 50 for more details.

(1) Average balances as of 12/31/2016 and 12/31/2017; rates represent full year averages.

(2) Includes brokered deposits. Includes average noninterest-bearing deposits of $94 million in 2016 and $101 million in 2017.

(3) Includes Demand Notes, FHLB, and Repurchase Agreements

(4) Represents a non-GAAP financial measure. Excludes OID balance from average balance and Core OID from average rate. See page 50 for calculation methodology and details.

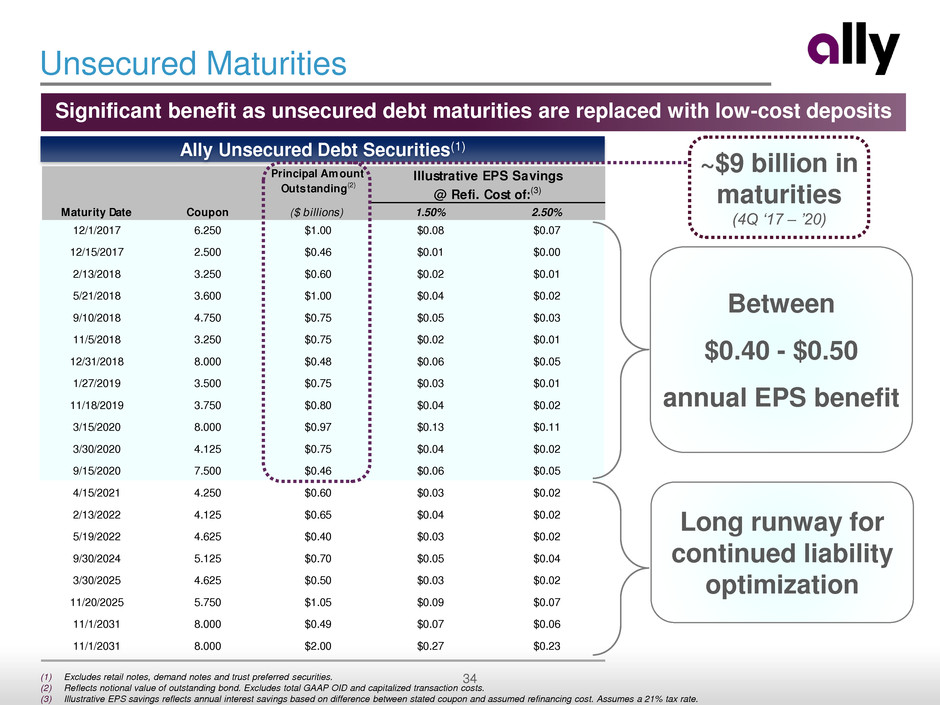

34

Principal Amount

Outstanding(2)

Maturity Date Coupon ($ billions) 1.50% 2.50%

12/1/2017 6.250 $1.00 $0.08 $0.07

12/15/2017 2.500 $0.46 $0.01 $0.00

2/13/2018 3.250 $0.60 $0.02 $0.01

5/21/2018 3.600 $1.00 $0.04 $0.02

9/10/2018 4.750 $0.75 $0.05 $0.03

11/5/2018 3.250 $0.75 $0.02 $0.01

12/31/2018 8.000 $0.48 $0.06 $0.05

1/27/2019 3.500 $0.75 $0.03 $0.01

11/18/2019 3.750 $0.80 $0.04 $0.02

3/15/2020 8.000 $0.97 $0.13 $0.11

3/30/2020 4.125 $0.75 $0.04 $0.02

9/15/2020 7.500 $0.46 $0.06 $0.05

4/15/2021 4.250 $0.60 $0.03 $0.02

2/13/2022 4.125 $0.65 $0.04 $0.02

5/19/2022 4.625 $0.40 $0.03 $0.02

9/30/2024 5.125 $0.70 $0.05 $0.04

3/30/2025 4.625 $0.50 $0.03 $0.02

11/20/2025 5.750 $1.05 $0.09 $0.07

11/1/2031 8.000 $0.49 $0.07 $0.06

11/1/2031 8.000 $2.00 $0.27 $0.23

Illustrative EPS Savings

@ Refi. Cost of:(3)

Ally Unsecured Debt Securities(1)

Unsecured Maturities

Significant benefit as unsecured debt maturities are replaced with low-cost deposits

Between

$0.40 - $0.50

annual EPS benefit

Long runway for

continued liability

optimization

~$9 billion in

maturities

(4Q „17 – ‟20)

(1) Excludes retail notes, demand notes and trust preferred securities.

(2) Reflects notional value of outstanding bond. Excludes total GAAP OID and capitalized transaction costs.

(3) Illustrative EPS savings reflects annual interest savings based on difference between stated coupon and assumed refinancing cost. Assumes a 21% tax rate.

35

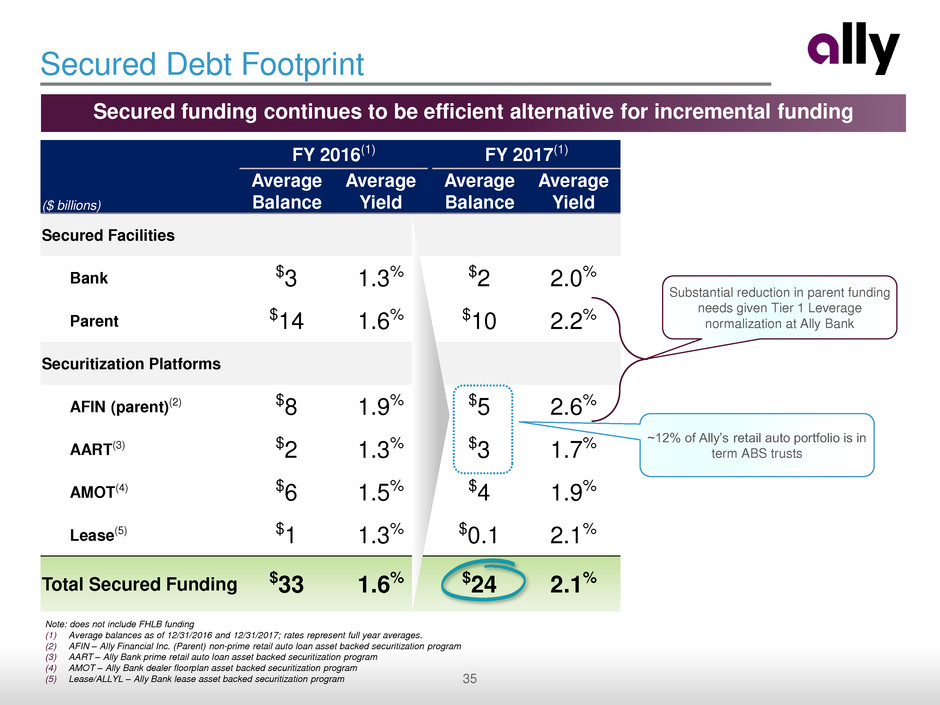

($ billions)

FY 2016(1) FY 2017(1)

Average

Balance

Average

Yield

Average

Balance

Average

Yield

Secured Facilities

Bank $3 1.3% $2 2.0%

Parent $14 1.6% $10 2.2%

Securitization Platforms

AFIN (parent)(2) $8 1.9% $5 2.6%

AART(3) $2 1.3% $3 1.7%

AMOT(4) $6 1.5% $4 1.9%

Lease(5) $1 1.3% $0.1 2.1%

Total Secured Funding $33 1.6% $24 2.1%

Secured Debt Footprint

Secured funding continues to be efficient alternative for incremental funding

Note: does not include FHLB funding

(1) Average balances as of 12/31/2016 and 12/31/2017; rates represent full year averages.

(2) AFIN – Ally Financial Inc. (Parent) non-prime retail auto loan asset backed securitization program

(3) AART – Ally Bank prime retail auto loan asset backed securitization program

(4) AMOT – Ally Bank dealer floorplan asset backed securitization program

(5) Lease/ALLYL – Ally Bank lease asset backed securitization program

Substantial reduction in parent funding

needs given Tier 1 Leverage

normalization at Ally Bank

~12% of Ally’s retail auto portfolio is in

term ABS trusts

36 CONFIDENTIAL

Overview and Summary Outlook

Business Overview

Financial Drivers

Capital and Balance Sheet Update

Near-term Outlook and Conclusion

1

2

3

4

Agenda

5

37

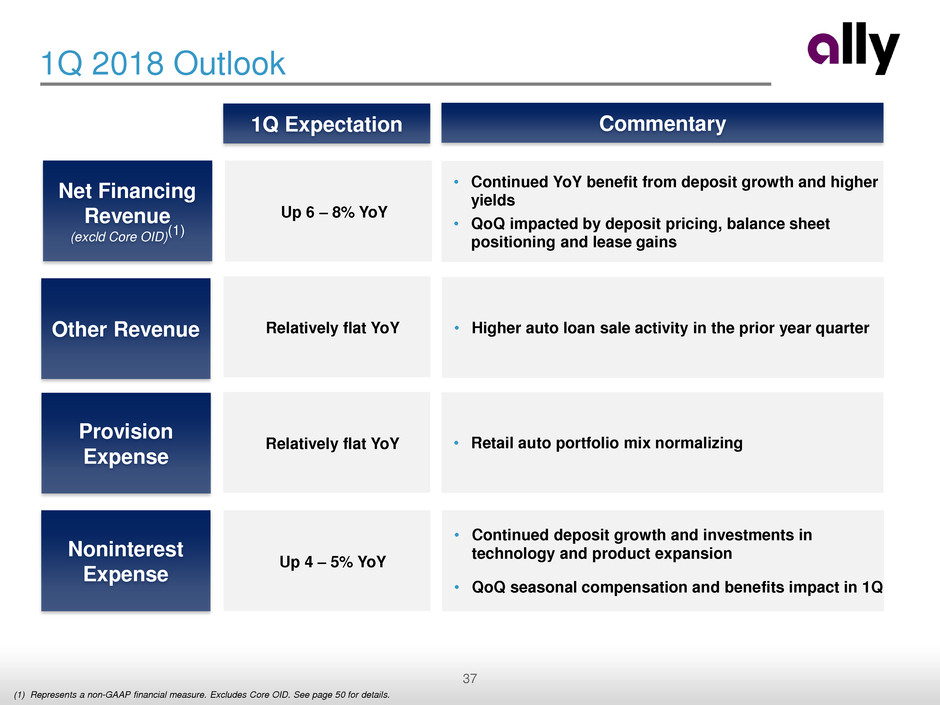

1Q 2018 Outlook

Net Financing

Revenue

(excld Core OID)(1)

Provision

Expense

Noninterest

Expense

Up 6 – 8% YoY

Relatively flat YoY

Relatively flat YoY

Up 4 – 5% YoY

1Q Expectation Commentary

• Continued YoY benefit from deposit growth and higher

yields

• QoQ impacted by deposit pricing, balance sheet

positioning and lease gains

Other Revenue • Higher auto loan sale activity in the prior year quarter

• Retail auto portfolio mix normalizing

• Continued deposit growth and investments in

technology and product expansion

• QoQ seasonal compensation and benefits impact in 1Q

(1) Represents a non-GAAP financial measure. Excludes Core OID. See page 50 for details.

38

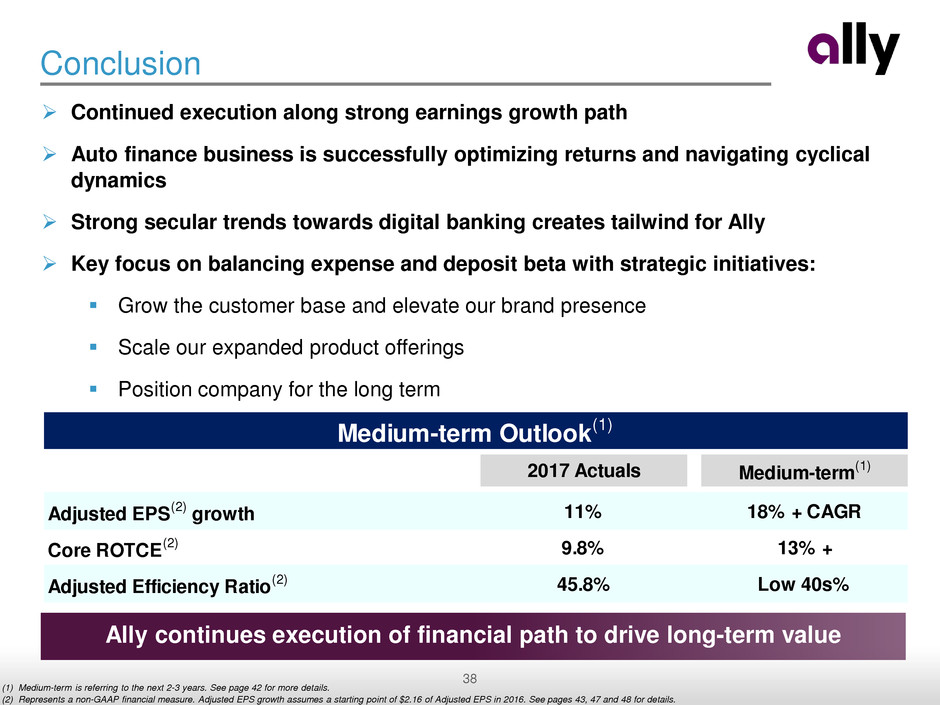

Medium-term Outlook(1)

2017 Actuals Medium-term

(1)

Adjusted EPS

(2)

growth 11% 18% + CAGR

Core ROTCE

(2) 9.8% 13% +

Adjusted Efficiency Ratio

(2) 45.8% Low 40s%

Conclusion

Continued execution along strong earnings growth path

Auto finance business is successfully optimizing returns and navigating cyclical

dynamics

Strong secular trends towards digital banking creates tailwind for Ally

Key focus on balancing expense and deposit beta with strategic initiatives:

Grow the customer base and elevate our brand presence

Scale our expanded product offerings

Position company for the long term

Ally continues execution of financial path to drive long-term value

(1) Medium-term is referring to the next 2-3 years. See page 42 for more details.

(2) Represents a non-GAAP financial measure. Adjusted EPS growth assumes a starting point of $2.16 of Adjusted EPS in 2016. See pages 43, 47 and 48 for details.

39 CONFIDENTIAL

Supplemental

40

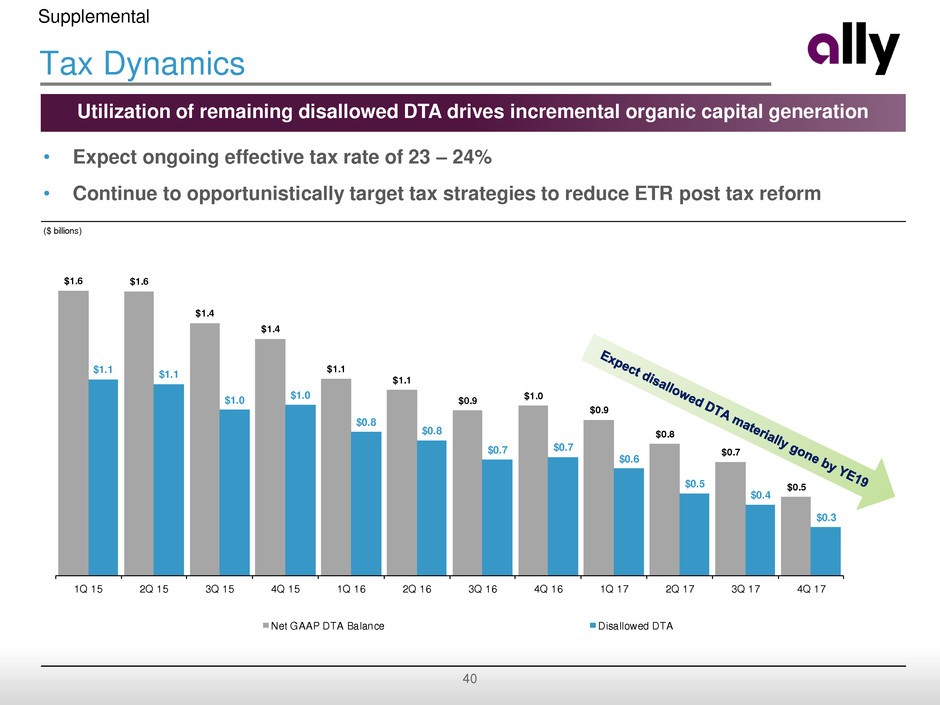

($ billions)

$1.6 $1.6

$1.4

$1.4

$1.1

$1.1

$0.9

$1.0

$0.9

$0.8

$0.7

$0.5

$1.1 $1.1

$1.0 $1.0

$0.8

$0.8

$0.7 $0.7

$0.6

$0.5

$0.4

$0.3

1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17

Net GAAP DTA Balance Disallowed DTA

Tax Dynamics

Utilization of remaining disallowed DTA drives incremental organic capital generation

• Expect ongoing effective tax rate of 23 – 24%

• Continue to opportunistically target tax strategies to reduce ETR post tax reform

Supplemental

41

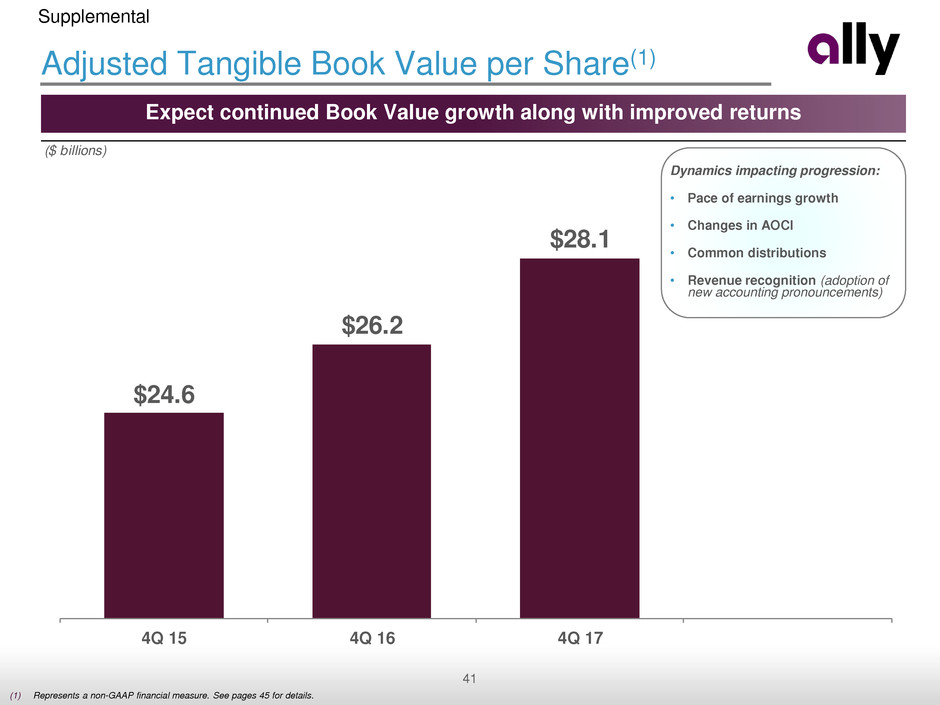

Adjusted Tangible Book Value per Share(1)

($ billions)

$24.6

$26.2

$28.1

4Q 15 4Q 16 4Q 17

Dynamics impacting progression:

• Pace of earnings growth

• Changes in AOCI

• Common distributions

• Revenue recognition (adoption of

new accounting pronouncements)

Expect continued Book Value growth along with improved returns

(1) Represents a non-GAAP financial measure. See pages 45 for details.

Supplemental

42

Notes on non-GAAP and other financial measures

Supplemental

1) Accelerated issuance expense (Accelerated OID) is the recognition of issuance expenses related to calls of redeemable debt.

2) Core net income attributable to common shareholders is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE

and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate

earnings. Core net income attributable to common shareholders adjusts GAAP net income attributable to common shareholders for discontinued operations net of tax, tax-

effected Core OID expense, tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and

preferred stock capital actions. See page 43 for calculation methodology and details.

3) Core original issue discount (Core OID) amortization expense is a non-GAAP financial measure for OID, primarily related to bond exchange OID which excludes international

operations and future issuances. See page 50 for calculation methodology and details.

4) Core outstanding original issue discount balance (Core OID balance) is a non-GAAP financial measure for outstanding OID, primarily related to bond exchange OID which

excludes international operations and future issuances. See page 50 for calculation methodology and details.

5) Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations by excluding (1) Core OID and (2) repositioning items primarily

related to the extinguishment of high-cost legacy debt and strategic activities. Management believes core pre-tax income can help the reader better understand the operating

performance of the core businesses and their ability to generate earnings. See page 49 for calculation methodology and details.

6) Estimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated

during the period.

7) Interest rate risk modeling – We prepare our forward-looking baseline forecasts of net financing revenue taking into consideration anticipated future business growth,

asset/liability positioning, and interest rates based on the implied forward curve. We have experienced significant growth in deposit balances over the past several years, resulting

in increased exposure to deposit portfolio repricing assumptions on liquid and time deposit balances. During the first quarter of 2017 we implemented a dynamic pass-through

modeling assumption on our retail liquid deposit portfolio, whereby deposit pass-through levels increase as the absolute level of short-term market interest rates rise. Our baseline

forecast assumes a medium-term cumulative deposit beta on retail liquid products of 30% to 50%, steadily increasing to approximately 75% over the longer term. For deposits

with contractual maturities, we assume betas will exceed retail liquid product levels on new and maturing volumes. We continually monitor industry and competitive repricing

activity along with other market factors when contemplating deposit pricing actions. Please see the 2017 10-K for more details.

8) Medium-term is referring to the next 2-3 years. Excludes potential impact of Current Expected Credit Losses (“CECL”). The medium-term for the Adjusted EPS compound annual

growth rate (“CAGR”) assumes a starting point of $2.16 in 2016.

9) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair value and

loans held-for-sale.

10) Tangible Common Equity is a non-GAAP financial measure that is defined as common stockholders‟ equity less goodwill and identifiable intangible assets, net of deferred tax

liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Ally believes that tangible common equity is important because

we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to compare certain aspects of our capital

adequacy on the same basis to other companies in the industry. For purposes of calculating Core return on tangible common equity (Core ROTCE), tangible common equity is

further adjusted for tax-effected Core OID balance and net deferred tax asset. See page 47 for more details.

11) U.S. consumer auto originations

New Retail – standard and subvented rate new vehicle loans

Lease – new vehicle lease originations

Used – used vehicle loans

Growth – total originations from non-GM/Chrysler dealers and direct-to-consumer loans

The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements,

but which are supplemental to and not a substitute for U.S. GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Pre-Tax

Income, Core Net Income Attributable to Common Shareholders, Core Return on Tangible Common Equity (Core ROTCE), Estimated Retail

Auto Originated Yield, Adjusted Efficiency Ratio, Adjusted Total Net Revenue, Adjusted Other Revenue, Core original issue discount (Core

OID) amortization expense and Core outstanding original issue discount balance (Core OID balance), Net Financing Revenue, excluding

Core OID and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are

useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial

Measures and Other Key Terms, and Reconciliation to GAAP later in this document

43

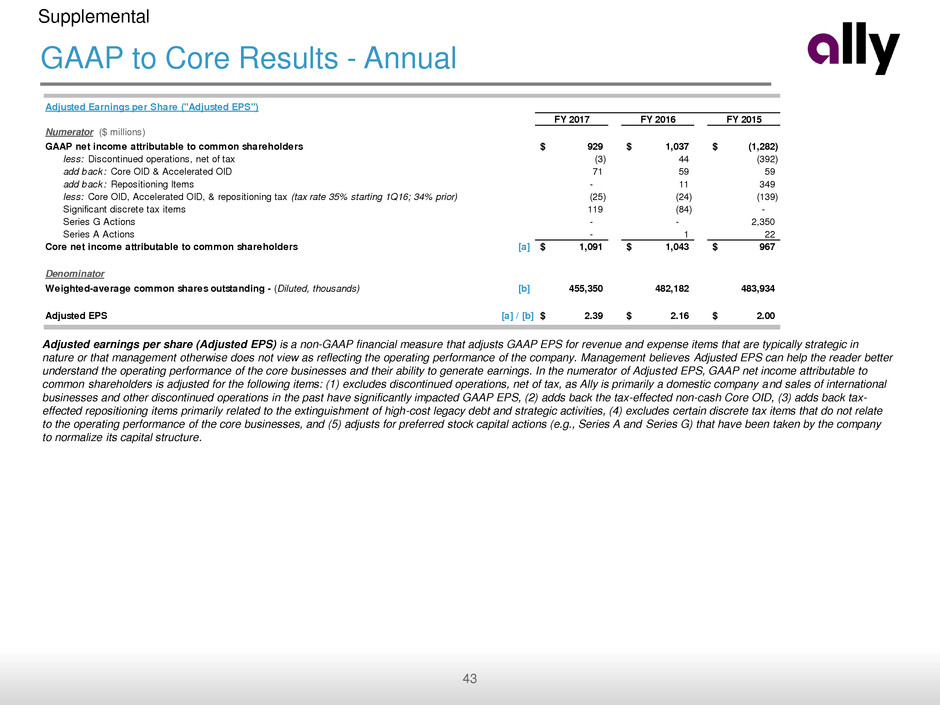

GAAP to Core Results - Annual

Supplemental

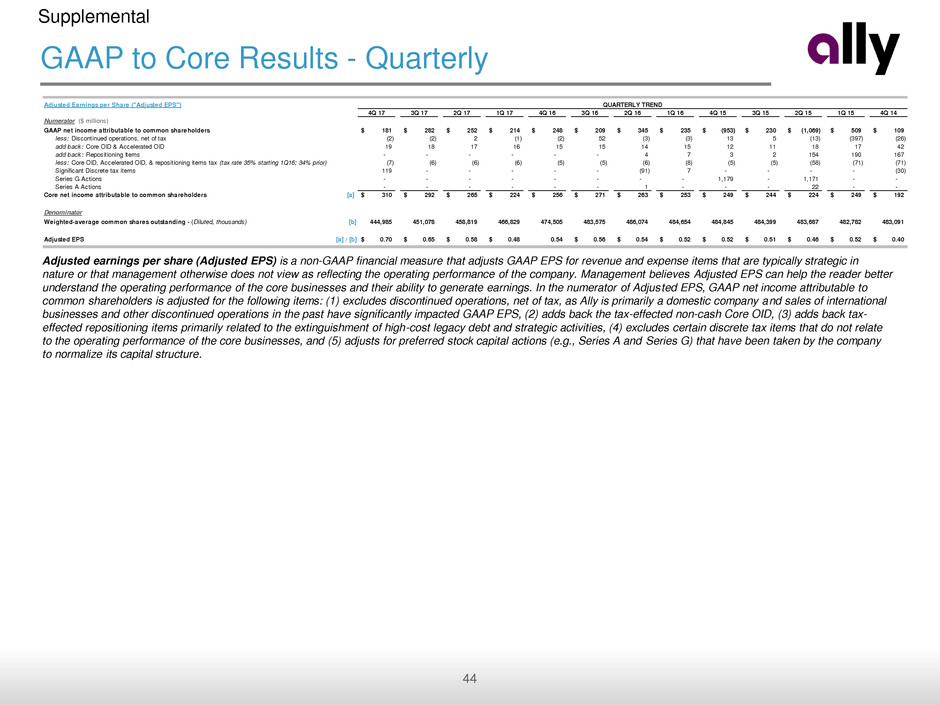

Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in

nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better

understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income attributable to

common shareholders is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international

businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash Core OID, (3) adds back tax-

effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes certain discrete tax items that do not relate

to the operating performance of the core businesses, and (5) adjusts for preferred stock capital actions (e.g., Series A and Series G) that have been taken by the company

to normalize its capital structure.

Adjusted Earnings per Share ("Adjusted EPS")

FY 2017 FY 2016 FY 2015

Numerator ($ millions)

GAAP net income attributable to common shareholders 929$ 1,037$ (1,282)$

less: Discontinued operations, net of tax (3) 44 (392)

add back: Core OID & Accelerated OID 71 59 59

add back: Repositioning Items - 11 349

less: Core OID, Accelerated OID, & repositioning tax (tax rate 35% starting 1Q16; 34% prior) (25) (24) (139)

Significant discrete tax items 119 (84) -

Series G Actions - - 2,350

Series A Actions - 1 22

Core net income attributable to common shareholders [a] 1,091$ 1,043$ 967$

Denominator

Weighted-average common shares outstanding - (Diluted, thousands) [b] 455,350 482,182 483,934

Adjusted EPS [a] / [b] 2.39$ 2.16$ 2.00$

44

GAAP to Core Results - Quarterly

Supplemental

Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in

nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better

understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income attributable to

common shareholders is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international

businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash Core OID, (3) adds back tax-

effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes certain discrete tax items that do not relate

to the operating performance of the core businesses, and (5) adjusts for preferred stock capital actions (e.g., Series A and Series G) that have been taken by the company

to normalize its capital structure.

Adjusted Earnings per Share ("Adjusted EPS")

4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

Numerator ($ millions)

GAAP net income attributable to common shareholders 181$ 282$ 252$ 214$ 248$ 209$ 345$ 235$ (953)$ 230$ (1,069)$ 509$ 109$

less: Discontinued operations, net of tax (2) (2) 2 (1) (2) 52 (3) (3) 13 5 (13) (397) (26)

add back: Core OID & Accelerated OID 19 18 17 16 15 15 14 15 12 11 18 17 42

add back: Repositioning Items - - - - - - 4 7 3 2 154 190 167

less: Core OID, Accelerated OID, & repositioning items tax (tax rate 35% starting 1Q16; 34% prior) (7) (6) (6) (6) (5) (5) (6) (8) (5) (5) (58) (71) (71)

Significant Discrete tax items 119 - - - - - (91) 7 - - - - (30)

Series G Actions - - - - - - - - 1,179 - 1,171 - -

Series A Actions - - - - - - 1 - - - 22 - -

Cor net income attributable to common shareholders [a] 310$ 292$ 265$ 224$ 256$ 271$ 263$ 253$ 249$ 244$ 224$ 249$ 192$

Denominator

Weighted-average common shares outstanding - (Diluted, thousands) [b] 444,985 451,078 458,819 466,829 474,505 483,575 486,074 484,654 484,845 484,399 483,687 482,782 483,091

0

Adjusted EPS [a] / [b] 0.70$ 0.65$ 0.58$ 0.48$ 0.54 0.56$ 0.54$ 0.52$ 0.52$ 0.51$ 0.46$ 0.52$ 0.40$

QUARTERLY TREND

45

GAAP to Core Results - Annual

Supplemental

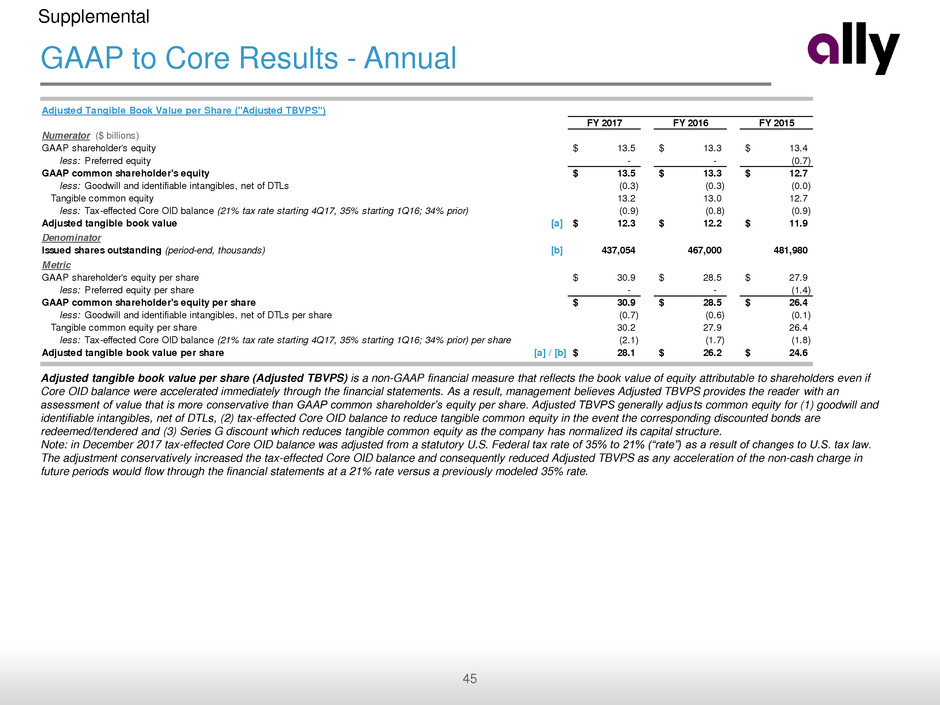

Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if

Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an

assessment of value that is more conservative than GAAP common shareholder‟s equity per share. Adjusted TBVPS generally adjus ts common equity for (1) goodwill and

identifiable intangibles, net of DTLs, (2) tax-effected Core OID balance to reduce tangible common equity in the event the corresponding discounted bonds are

redeemed/tendered and (3) Series G discount which reduces tangible common equity as the company has normalized its capital structure.

Note: in December 2017 tax-effected Core OID balance was adjusted from a statutory U.S. Federal tax rate of 35% to 21% (“rate”) as a result of changes to U.S. tax law.

The adjustment conservatively increased the tax-effected Core OID balance and consequently reduced Adjusted TBVPS as any acceleration of the non-cash charge in

future periods would flow through the financial statements at a 21% rate versus a previously modeled 35% rate.

Adjusted Tangible Book Value per Share ("Adjusted TBVPS")

FY 2017 FY 2016 FY 2015

Numerator ($ billions)

GAAP shareholder's equity 13.5$ 13.3$ 13.4$

less: Preferred equity - - (0.7)

GAAP common shareholder's equity 13.5$ 13.3$ 12.7$

less: Goodwill and identifiable intangibles, net of DTLs (0.3) (0.3) (0.0)

Tangible common equity 13.2 13.0 12.7

less: Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) (0.9) (0.8) (0.9)

Adjusted tangible book value [a] 12.3$ 12.2$ 11.9$

Denominator

Issued shares outstanding (period-end, thousands) [b] 437,054 467,000 481,980

Metric

GAAP shareholder's equity per share 30.9$ 28.5$ 27.9$

less: Preferred equity per share - - (1.4)

GAAP common shareholder's equity per share 30.9$ 28.5$ 26.4$

less: Goodwill and identifiable intangibles, net of DTLs per share (0.7) (0.6) (0.1)

Tangible common equity per share 30.2 27.9 26.4

less: Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) per share (2.1) (1.7) (1.8)

Adjusted tangible book value per share [a] / [b] 28.1$ 26.2$ 24.6$

46

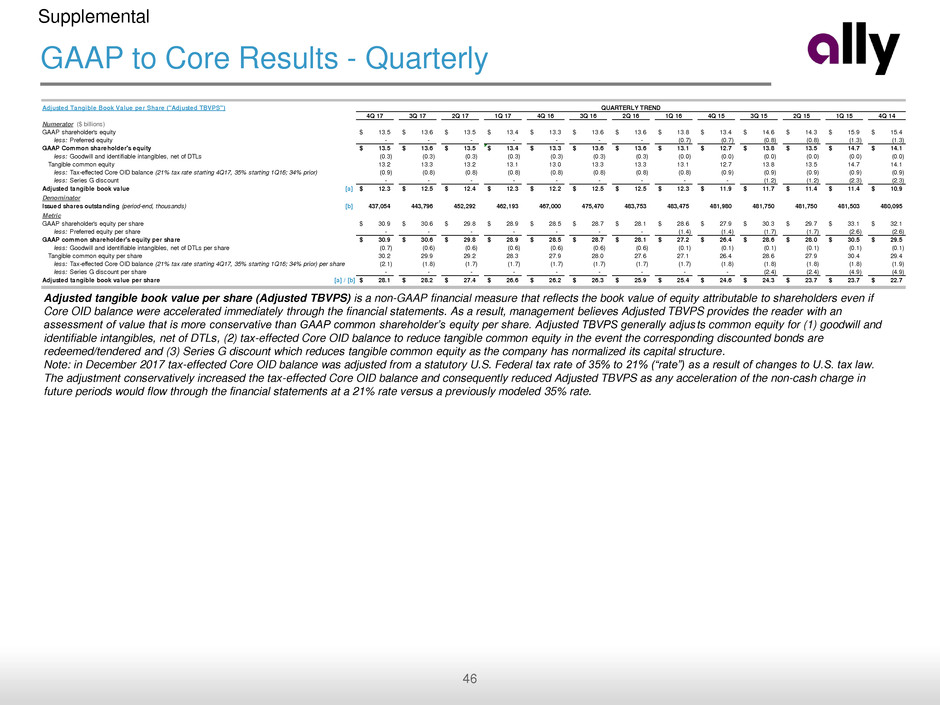

GAAP to Core Results - Quarterly

Supplemental

Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if

Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an

assessment of value that is more conservative than GAAP common shareholder‟s equity per share. Adjusted TBVPS generally adjus ts common equity for (1) goodwill and

identifiable intangibles, net of DTLs, (2) tax-effected Core OID balance to reduce tangible common equity in the event the corresponding discounted bonds are

redeemed/tendered and (3) Series G discount which reduces tangible common equity as the company has normalized its capital structure.

Note: in December 2017 tax-effected Core OID balance was adjusted from a statutory U.S. Federal tax rate of 35% to 21% (“rate”) as a result of changes to U.S. tax law.

The adjustment conservatively increased the tax-effected Core OID balance and consequently reduced Adjusted TBVPS as any acceleration of the non-cash charge in

future periods would flow through the financial statements at a 21% rate versus a previously modeled 35% rate.

Adjusted Tangible Book Value per Share ("Adjusted TBVPS")

4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

Numerator ($ billions)

GAAP shareholder's equity 13.5$ 13.6$ 13.5$ 13.4$ 13.3$ 13.6$ 13.6$ 13.8$ 13.4$ 14.6$ 14.3$ 15.9$ 15.4$

less: Preferred equity - - - - - - - (0.7) (0.7) (0.8) (0.8) (1.3) (1.3)

GAAP Common shareholder's equity 13.5$ 13.6$ 13.5$ 13.4$ 13.3$ 13.6$ 13.6$ 13.1$ 12.7$ 13.8$ 13.5$ 14.7$ 14.1$

less: Goodwill and identifiable intangibles, net of DTLs (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0)

Tangible common equity 13.2 13.3 13.2 13.1 13.0 13.3 13.3 13.1 12.7 13.8 13.5 14.7 14.1

less: Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) (0.9) (0.8) (0.8) (0.8) (0.8) (0.8) (0.8) (0.8) (0.9) (0.9) (0.9) (0.9) (0.9)

less: Series G discount - - - - - - - - - (1.2) (1.2) (2.3) (2.3)

Adjusted tangible book value [a] 12.3$ 12.5$ 12.4$ 12.3$ 12.2$ 12.5$ 12.5$ 12.3$ 11.9$ 11.7$ 11.4$ 11.4$ 10.9$

Denominator

Issued shares outstanding (period-end, thousands) [b] 437,054 443,796 452,292 462,193 467,000 475,470 483,753 483,475 481,980 481,750 481,750 481,503 480,095

Metric

GAAP shareholder's equity per share 30.9$ 30.6$ 29.8$ 28.9$ 28.5$ 28.7$ 28.1$ 28.6$ 27.9$ 30.3$ 29.7$ 33.1$ 32.1$

less: Preferred equity per share - - - - - - - (1.4) (1.4) (1.7) (1.7) (2.6) (2.6)

GAAP common shareholder's equity per share 30.9$ 30.6$ 29.8$ 28.9$ 28.5$ 28.7$ 28.1$ 27.2$ 26.4$ 28.6$ 28.0$ 30.5$ 29.5$

less: Goodwill and identifiable intangibles, net of DTLs per share (0.7) (0.6) (0.6) (0.6) (0.6) (0.6) (0.6) (0.1) (0.1) (0.1) (0.1) (0.1) (0.1)

Tangible common equity per share 30.2 29.9 29.2 28.3 27.9 28.0 27.6 27.1 26.4 28.6 27.9 30.4 29.4

less: Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) per share (2.1) (1.8) (1.7) (1.7) (1.7) (1.7) (1.7) (1.7) (1.8) (1.8) (1.8) (1.8) (1.9)

less: Series G discount per share - - - - - - - - - (2.4) (2.4) (4.9) (4.9)

Adjusted tangible book value per share [a] / [b] 28.1$ 28.2$ 27.4$ 26.6$ 26.2$ 26.3$ 25.9$ 25.4$ 24.6$ 24.3$ 23.7$ 23.7$ 22.7$

QUARTERLY TREND

47

GAAP to Core Results - Annual

Supplemental

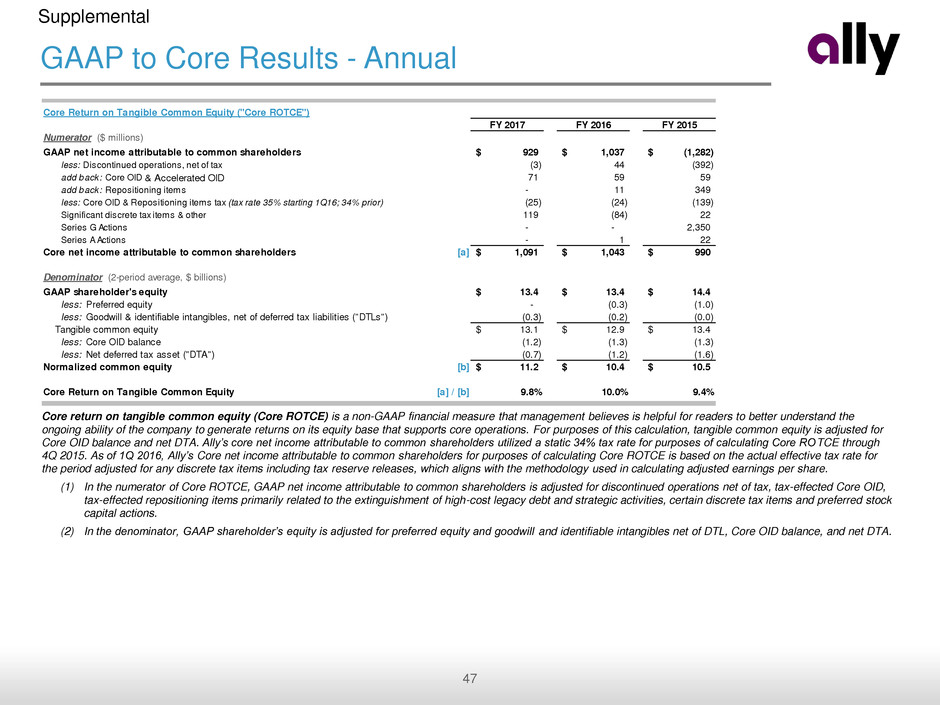

Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the

ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for

Core OID balance and net DTA. Ally‟s core net income attributable to common shareholders utilized a static 34% tax rate for purposes of calculating Core ROTCE through

4Q 2015. As of 1Q 2016, Ally‟s Core net income attributable to common shareholders for purposes of calculating Core ROTCE is based on the actual effective tax rate for

the period adjusted for any discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted earnings per share.

(1) In the numerator of Core ROTCE, GAAP net income attributable to common shareholders is adjusted for discontinued operations net of tax, tax-effected Core OID,

tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock

capital actions.

(2) In the denominator, GAAP shareholder‟s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, Core OID balance, and net DTA.

Core Return on Tangible Common Equity ("Core ROTCE")

FY 2017 FY 2016 FY 2015

Numerator ($ millions)

GAAP net income attributable to common shareholders 929$ 1,037$ (1,282)$

less: Discontinued operations, net of tax (3) 44 (392)

add back: Core OID 71 59 59

add back: Repositioning items - 11 349

less: Core OID & Repositioning items tax (tax rate 35% starting 1Q16; 34% prior) (25) (24) (139)

Significant discrete tax items & other 119 (84) 22

Series G Actions - - 2,350

Series A Actions - 1 22

Core net income attributable to common shareholders [a] 1,091$ 1,043$ 990$

Denominator (2-period average, $ billions)

GAAP shareholder's equity 13.4$ 13.4$ 14.4$

less: Preferred equity - (0.3) (1.0)

less: Goodwill & identifiable intangibles, net of deferred tax liabilities ("DTLs") (0.3) (0.2) (0.0)

Tangible common equity 13.1$ 12.9$ 13.4$

less: Core OID balance (1.2) (1.3) (1.3)

less: Net deferred tax asset ("DTA") (0.7) (1.2) (1.6)

Normalized common equity [b] 11.2$ 10.4$ 10.5$

Core Return on Tangible Common Equity [a] / [b] 9.8% 10.0% 9.4%

add back: Core OID & Accelerated OID 19 18 17 16 15

48

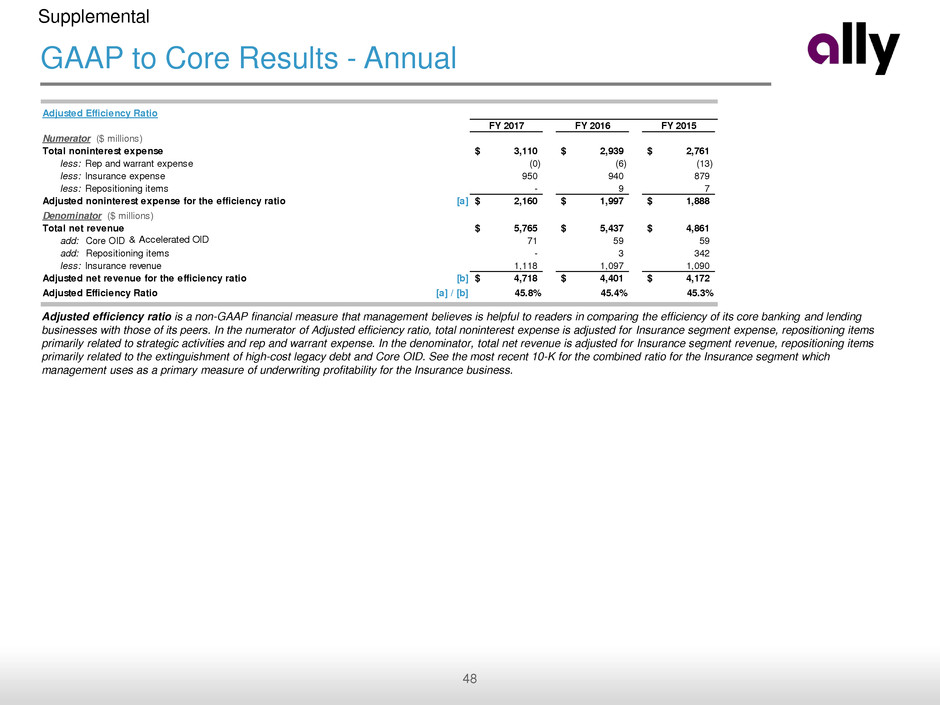

GAAP to Core Results - Annual

Supplemental

Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending

businesses with those of its peers. In the numerator of Adjusted efficiency ratio, total noninterest expense is adjusted for Insurance segment expense, repositioning items

primarily related to strategic activities and rep and warrant expense. In the denominator, total net revenue is adjusted for Insurance segment revenue, repositioning items

primarily related to the extinguishment of high-cost legacy debt and Core OID. See the most recent 10-K for the combined ratio for the Insurance segment which

management uses as a primary measure of underwriting profitability for the Insurance business.

Adjusted Efficiency Ratio

FY 2017 FY 2016 FY 2015 FY 2014

Numerator ($ millions)

Total noninterest expense 3,110$ 2,939$ 2,761$ 2,948$

less: Rep and warrant expense (0) (6) (13) (10)

less: Insurance expense 950 940 879 988

less: Repositioning items - 9 7 39

Adjusted noninterest expense for the efficiency ratio [a] 2,160$ 1,997$ 1,888$ 1,932$

Denominator ($ millions)

Total net revenue 5,765$ 5,437$ 4,861$ 4,651$

add: Core OID 71 59 59 186

add: Repositioning items - 3 342 148

less: Insurance revenue 1,118 1,097 1,090 1,185

Adjusted net revenue for the efficiency ratio [b] 4,718$ 4,401$ 4,172$ 3,800$

Adjusted Efficiency Ratio [a] / [b] 45.8% 45.4% 45.3% 50.8%

add back: Core OID & Accelerated OID 19 18 17 16 15

49

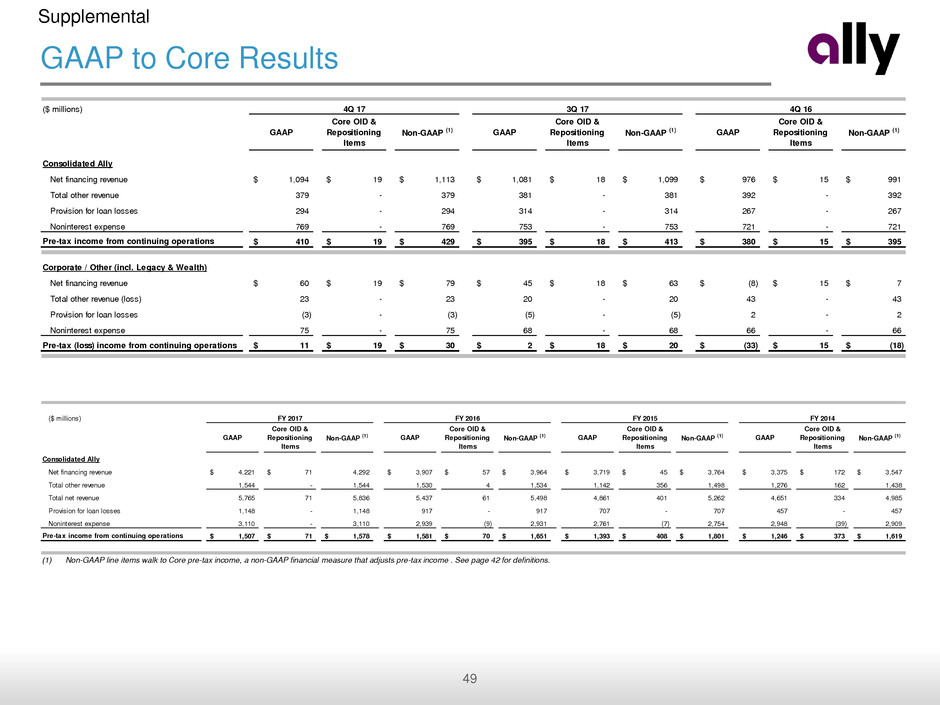

Supplemental

(1) Non-GAAP line items walk to Core pre-tax income, a non-GAAP financial measure that adjusts pre-tax income . See page 42 for definitions.

($ millions)

GAAP

Core OID &

Repositioning

Items

Non-GAAP (1) GAAP

Core OID &

Repositioning

Items

Non-GAAP (1) GAAP

Core OID &

Repositioning

Items

Non-GAAP (1) GAAP

Core OID &

Repositioning

Items

Non-GAAP (1)

Consolidated Ally

Net financing revenue 4,221$ 71$ 4,292 3,907$ 57$ 3,964$ 3,719$ 45$ 3,764$ 3,375$ 172$ 3,547$

Total other revenue 1,544 - 1,544 1,530 4 1,534 1,142 356 1,498 1,276 162 1,438

Total net revenue 5,765 71 5,836 5,437 61 5,498 4,861 401 5,262 4,651 334 4,985

Provision for loan losses 1,148 - 1,148 917 - 917 707 - 707 457 - 457

Noninterest expense 3,110 - 3,110 2,939 (9) 2,931 2,761 (7) 2,754 2,948 (39) 2,909

Pre-tax income from continuing operations 1,507$ 71$ 1,578$ 1,581$ 70$ 1,651$ 1,393$ 408$ 1,801$ 1,246$ 373$ 1,619$

FY 2017 FY 2016 FY 2015 FY 2014

($ millions)

GAAP

Core OID &

Repositioning

Items

Non-GAAP (1) GAAP

Core OID &

Repositioning

Items

Non-GAAP (1) GAAP

Core OID &

Repositioning

Items

Non-GAAP (1)

Consolidated Ally

Net financing revenue 1,094$ 19$ 1,113$ 1,081$ 18$ 1,099$ 976$ 15$ 991$

Total other revenue 379 - 379 381 - 381 392 - 392

Provision for loan losses 294 - 294 314 - 314 267 - 267

Noninterest expense 769 - 769 753 - 753 721 - 721

Pre-tax income from continuing operations 410$ 19$ 429$ 395$ 18$ 413$ 380$ 15$ 395$

Corporate / Other (incl. Legacy & Wealth)

Net financing revenue 60$ 19$ 79$ 45$ 18$ 63$ (8)$ 15$ 7$

Total other revenue (loss) 23 - 23 20 - 20 43 - 43

Provision for loan losses (3) - (3) (5) - (5) 2 - 2

Noninterest expense 75 - 75 68 - 68 66 - 66

Pre-tax (loss) income from continuing operations 11$ 19$ 30$ 2$ 18$ 20$ (33)$ 15$ (18)$

4Q 17 3Q 17 4Q 16

GAAP to Core Results

50

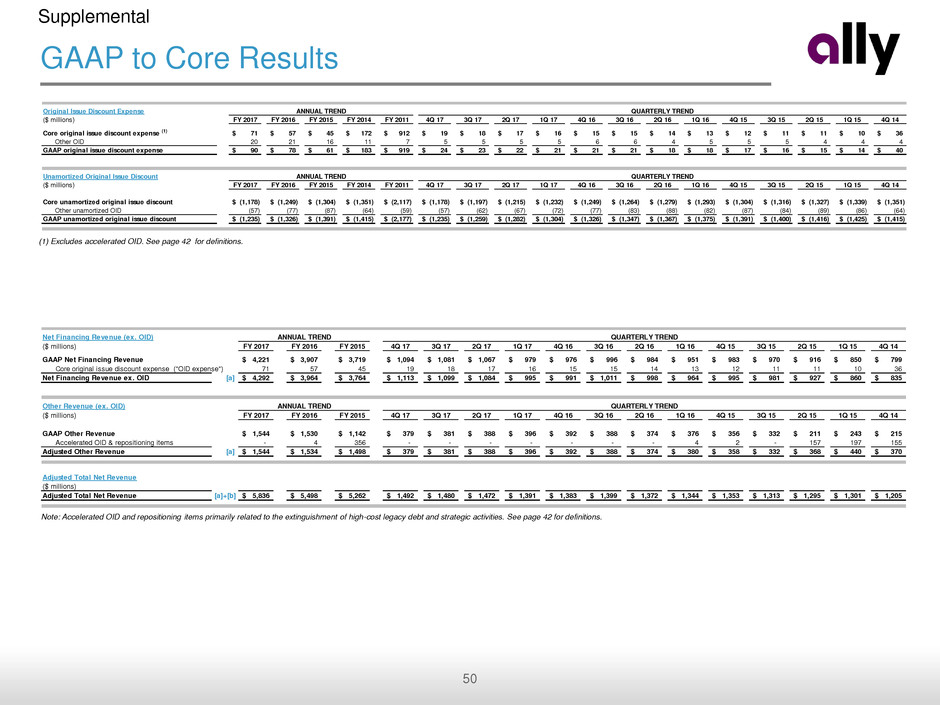

Supplemental

(1) Excludes accelerated OID. See page 42 for definitions.

Note: Accelerated OID and repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities. See page 42 for definitions.

GAAP to Core Results

Original Issue Discount Expense

($ millions) FY 2017 FY 2016 FY 2015 FY 2014 FY 2011 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

Core original issue discount expense (1) 71$ 57$ 45$ 172$ 912$ 19$ 18$ 17$ 16$ 15$ 15$ 14$ 13$ 12$ 11$ 11$ 10$ 36$

Other OID 20 21 16 11 7 5 5 5 5 6 6 4 5 5 5 4 4 4

GAAP original issue discount expense 90$ 78$ 61$ 183$ 919$ 24$ 23$ 22$ 21$ 21$ 21$ 18$ 18$ 17$ 16$ 15$ 14$ 40$

Unamortized Original Issue Discount

($ millions) FY 2017 FY 2016 FY 2015 FY 2014 FY 2011 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

Core unamortized original issue discount (1,178)$ (1,249)$ (1,304)$ (1,351)$ (2,117)$ (1,178)$ (1,197)$ (1,215)$ (1,232)$ (1,249)$ (1,264)$ (1,279)$ (1,293)$ (1,304)$ (1,316)$ (1,327)$ (1,339)$ (1,351)$

Other unamortized OID (57) (77) (87) (64) (59) (57) (62) (67) (72) (77) (83) (88) (82) (87) (84) (89) (86) (64)

GAAP unamortized original issue discount (1,235)$ (1,326)$ (1,391)$ (1,415)$ (2,177)$ (1,235)$ (1,259)$ (1,282)$ (1,304)$ (1,326)$ (1,347)$ (1,367)$ (1,375)$ (1,391)$ (1,400)$ (1,416)$ (1,425)$ (1,415)$

QUARTERLY TREND

QUARTERLY TREND

ANNUAL TREND

ANNUAL TREND

Net Financing Revenue (ex. OID)

FY 2017 FY 2016 FY 2015 Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

P Net Financing Reve u 4,221$ 3,907$ 3,719$ 1,094$ 1,081$ 1,067$ 979$ 976$ 996$ 984$ 951$ 983$ 970$ 916$ 850$ 799$

Core or ginal i sue discou nse ("OID expense") 71 57 45 19 18 17 16 15 15 14 13 12 11 11 10 36

Net Financing Revenue ex. OID [a] 4,292$ 3,964$ 3,764$ 1,113$ 1,099$ 1,084$ 995$ 991$ 1,011$ 998$ 964$ 995$ 981$ 927$ 860$ 835$

Oth r Revenue (ex. OID)

($ millions) FY 2017 FY 2016 FY 2015 Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14

GAAP Other Revenue 1,544$ 1,530$ 1,142$ 379$ 381$ 388$ 396$ 392$ 388$ 374$ 376$ 356$ 332$ 211$ 243$ 215$

Accelerated OID & repositioning items - 4 356 - - - - - - - 4 2 - 157 197 155

Adjusted Other Revenue [a] 1,544$ 1,534$ 1,498$ 379$ 381$ 388$ 396$ 392$ 388$ 374$ 380$ 358$ 332$ 368$ 440$ 370$

Adjusted Total Net Revenue

($ millions)

Adjusted Total Net Revenue [a]+[b] 5,836$ 5,498$ 5,262$ 1,492$ 1,480$ 1,472$ 1,391$ 1,383$ 1,399$ 1,372$ 1,344$ 1,353$ 1,313$ 1,295$ 1,301$ 1,205$

QUARTERLY TREND

QUARTERLY TREND

ANNUAL TREND

ANNUAL TREND

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ally Financial (ALLY) Tops Q1 EPS by 11c, Beats on Revenue

- Ascendion Receives Ally Financial Innovation Award at 2024 Supplier Symposium

- Top Wealth Group Holding Limited Announces Closing of Initial Public Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share