Form 8-K AQUINOX PHARMACEUTICALS, For: Aug 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2019

Aquinox Pharmaceuticals, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 001-36327 | 98-0542593 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

450 - 887 Great Northern Way,

Vancouver, B.C.

Canada, V5T 4T5

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (604) 629-9223

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.000001 | AQXP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement.

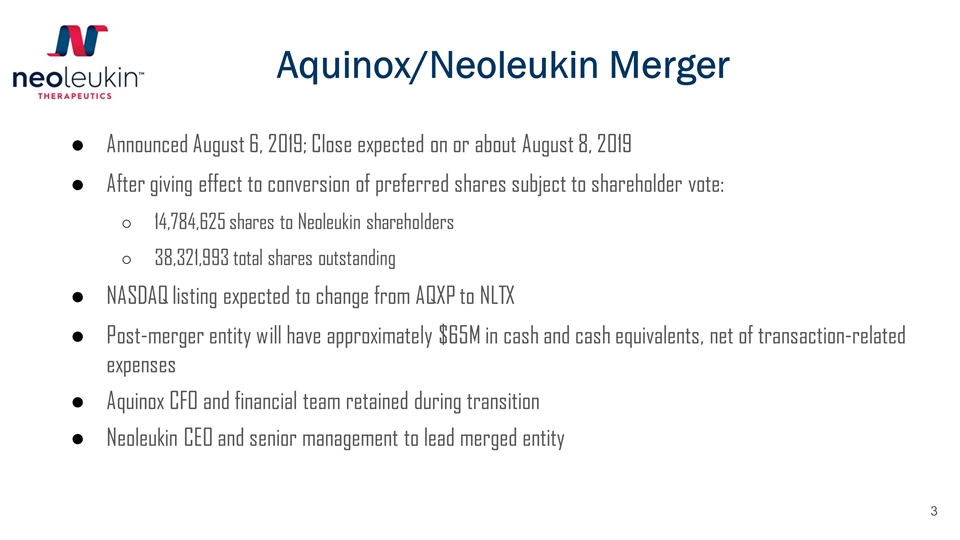

On August 5, 2019, Aquinox Pharmaceuticals, Inc. (“Aquinox”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Neoleukin Therapeutics, Inc., a Delaware corporation (“Neoleukin”), and Apollo Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Aquinox (“Merger Sub”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, Merger Sub will be merged with and into Neoleukin (the “Merger”), with Neoleukin surviving the Merger as a wholly-owned subsidiary of Aquinox. The Merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), Aquinox will issue to the former holders of Neoleukin capital stock (i) shares of Aquinox common stock representing approximately 19.5% of Aquinox’s issued and outstanding shares of common stock (calculated prior to the issuance of those new shares of common stock) and (ii) shares of a newly created Aquinox non-voting convertible preferred stock that, following approval of Aquinox’s stockholders, will be convertible (the “Preferred Stock Conversion”) into a number of additional shares of Aquinox common stock such that following such conversion, the former holders of Neoleukin capital stock will, together with the shares of common stock issued at the Effective Time, hold in aggregate approximately 38.58% of the fully diluted outstanding shares of Aquinox (taking into account currently outstanding Aquinox stock options and a portion of the currently granted Aquinox options that may be in the money at closing, but excluding equity incentive awards covering shares of Aquinox common stock that are expected to be granted to continuing employees, including members of management, of Neoleukin). Any outstanding shares of Neoleukin common stock that are unvested or subject to repurchase or forfeiture restrictions will become fully vested and any repurchase or forfeiture restrictions thereon will lapse immediately prior to the Effective Time.

A certificate of designation creating the new convertible preferred stock was adopted by the board of directors of Aquinox (the “Aquinox Board”) at the time the Merger Agreement was signed and will be filed and be effective as of the time of closing (the “Certificate of Designation”).

Following the closing, Dr. Jonathan G. Drachman will serve as Chief Executive Officer of the combined company and Kamran Alam will serve as interim Chief Financial Officer of the combined company. Additionally, following the closing, the Aquinox Board will consist of seven directors, including three designees of Neoleukin, three designees of Aquinox and an independent director mutually selected by Neoleukin and Aquinox, and is expected to be comprised of Dr. Drachman, Ms. Sarah B. Noonberg, Dr. Lewis T. “Rusty” Williams, Mr. Todd Simpson, Mr. Sean Nolan and Ms. M. Cantey Boyd with the independent director seat deemed vacant until it is filled after the closing.

The Merger Agreement contains customary representations, warranties and covenants made by Aquinox and Neoleukin, including covenants relating to obtaining the requisite approvals of the stockholders of Aquinox and Neoleukin, indemnification of directors and officers, Aquinox’s and Neoleukin’s conduct of their respective businesses between the date of signing of the Merger Agreement and the closing.

In connection with the Merger, Aquinox will prepare and file with the U.S. Securities and Exchange Commission (“SEC”) a proxy statement, and will seek the approval of Aquinox’s stockholders with respect to certain actions, including the following (collectively, the “Aquinox Stockholder Matters”):

| • | the approval of the Preferred Stock Conversion; and |

| • | the amendment of Aquinox’s restated certificate of incorporation to increase the number of authorized shares of common stock to an amount as determined by the Aquinox Board following the closing. |

The closing is subject to satisfaction or waiver of certain conditions including, among other things, (i) the required approvals by the Neoleukin stockholders, (ii) the accuracy of the representations and warranties, (iii) compliance by the parties with their respective covenants, (iv) no law or order preventing the Merger and related transactions, (v) Nasdaq approval for listing of the shares of common stock to be issued at closing, and (vi) the filing of the Certificate of Designation.

Support Agreements

In connection with the execution of the Merger Agreement, the executive officers and directors of Aquinox, and certain other stockholders of Aquinox entered into support agreements with Neoleukin and Aquinox relating to the Merger covering approximately 47% of the outstanding capital stock of Aquinox, as of date of the Merger Agreement (the “Aquinox Support Agreements”). The Aquinox Support Agreements provide, among other things, that the stockholders who are parties to the Aquinox Support Agreements will vote all of the shares held by them in favor of Aquinox Stockholder Matters. The Aquinox Support Agreements also place certain restrictions on the transfer of the shares of Aquinox held by the respective signatories thereto.

2

Lock-Up Agreements

Concurrently with the execution of the Merger Agreement, certain officers, directors and stockholders of Aquinox and Neoleukin, respectively, entered into lock-up agreements (the “Lock-Up Agreements”) pursuant to which they accepted certain restrictions on transfers of any shares of Aquinox’s common stock for up to 130 days following the Effective Time.

The foregoing descriptions of the Merger Agreement, the Aquinox Support Agreements, and the Lock-Up Agreements, are not complete and are qualified in their entirety by reference to those agreements or the forms thereof, as applicable, which are attached hereto as Exhibit 2.1, 2.2, and 2.3, respectively, to this report and incorporated herein by reference.

The Merger Agreement (and the foregoing description of the Merger Agreement and the transactions contemplated thereby) has been included to provide investors and stockholders with information regarding the terms of the Merger Agreement and the transactions contemplated thereby. It is not intended to provide any other factual information about Aquinox or Neoleukin. The representations, warranties and covenants contained in the Merger Agreement were made only as of specified dates for the purposes of the Merger Agreement, were solely for the benefit of the parties to the Merger Agreement and may be subject to qualifications and limitations agreed upon by such parties. In particular, in reviewing the representations, warranties and covenants contained in the Merger Agreement and discussed in the foregoing description, it is important to bear in mind that such representations, warranties and covenants were negotiated with the principal purpose of allocating risk between the parties, rather than establishing matters as facts. Such representations, warranties and covenants may also be subject to a contractual standard of materiality different from those generally applicable to stockholders and reports and documents filed with the SEC. Investors and stockholders are not third-party beneficiaries under the Merger Agreement. Accordingly, investors and stockholders should not rely on such representations, warranties and covenants as characterizations of the actual state of facts or circumstances described therein. Information concerning the subject matter of such representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Resignation of Directors; Resignation of Executive Officer

In connection with the Merger, the Aquinox Board accepted the resignations of Gary Bridger, Ph.D., Daniel Levitt, M.D., Ph.D., Richard S. Levy, M.D., David J. Main, Kevin Neu, M.D., and Robert E. Pelzer from the Aquinox Board, including the resignations of Mr. Main as Chairman of the Aquinox Board and as President and Chief Executive Officer of Aquinox, Mr. Pelzer from the Audit Committee of the Aquinox Board (the “Audit Committee”), Dr. Levitt and Dr. Levy from the Compensation Committee of the Aquinox Board (“Compensation Committee”), and Dr. Bridger and Dr. Neu from the Nominating and Corporate Governance Committee of the Aquinox Board (“Governance Committee”), each to be effective as of the closing date.

Separation Agreement with David J. Main

In connection with the Merger, Aquinox also entered into a separation agreement with Mr. Main. The separation agreement provides that Mr. Main’s employment will end effective as of the closing date. Pursuant to the separation agreement and consistent with the terms of Mr. Main’s employment agreement as amended through May 8, 2019, Mr. Main will be entitled to: (i) a lump sum payment equal to 18 months of his current base salary; (ii) a lump sum payment equal to 18 months bonus pay, that will be calculated and based on Mr. Main’s bonus payment average from the previous three years; (iii) the premiums necessary to continue Mr. Main’s health and dental benefits until the earliest of (A) 18 months from the separation date or (B) the date on which Mr. Main obtains other benefit coverage; (iv) a lump sum payment of $2,000 CDN on the separation date to cover the differential cost in coverage amounts between the group health benefits program and the individual health benefits plan; and (v) a transaction bonus of $401,250 upon the closing of the Merger. Aquinox will also cover the cost of Mr. Main’s U.S. and Canadian tax filing support services for the 2019 tax year. In addition, all unvested options held by Mr. Main will immediately vest and will remain exercisable for a period of 90 days following the separation date, at which time any vested but unexercised options will expire and be forfeit, with the exception of the options granted to Mr. Main in August of 2018 which provides for three years to exercise from the separation date.

The foregoing description of the terms of Mr. Main’s separation agreement is qualified in its entirety by reference to the full text of the separation agreement, a copy of which is filed as Exhibit 10.1 attached hereto, and the terms of which are incorporated by reference herein.

(c) Appointment of Executive Officer

In connection with the Merger, Dr. Drachman entered into an employment agreement pursuant to which he will be appointed Chief Executive Officer of Aquinox, effective as of the closing of the Merger.

3

Jonathan G. Drachman, M.D., age 57, has served as a director and the Chief Executive Officer of Neoleukin since November 2018. From November 2004 to May 2018, Dr. Drachman held several positions at Seattle Genetics, Inc., culminating in the position of Chief Medical Officer and Executive Vice President of Research and Development. From 1998 to 2004, he was a faculty member in the Division of Hematology at the University of Washington, and a Senior Investigator in the Division of Research and Education at Puget Sound Blood Center. He currently serves on the board of directors of Harpoon Therapeutics, Inc. and Calithera Biosciences, Inc. Dr. Drachman received his M.D. at Harvard Medical School and his A.B. in Biochemistry from Harvard College. He completed his residency in internal medicine and a fellowship in medical oncology at the University of Washington.

Dr. Drachman has no family relationships with any member of the Aquinox Board or any executive officer of Aquinox, and has not been involved in any related person transactions within the meaning of Item 404(a) of Regulation S-K promulgated by the SEC required to be disclosed herein.

Compensatory Arrangement with Jonathan G. Drachman

Pursuant to his employment agreement, Dr. Drachman will receive an annual base salary of $350,000 and will be eligible to receive an annual bonus with a target level of 50% of his base salary. As an inducement to enter into the employment agreement, subject to the approval of the Aquinox Board, Dr. Drachman will also be granted an option to purchase 1,650,000 shares of Aquinox’s common stock with an exercise price to be equal to the fair market value of Aquinox’s common stock on the date of grant, as determined by the Aquinox Board. The option will vest and become exercisable with respect to (i) 1/4th of the total underlying shares on the first anniversary of the grant date and (ii) with respect to 1/48th of the total underlying shares on a monthly basis thereafter such that the option will be fully vested and exercisable on the fourth anniversary of the grant date, subject to Dr. Drachman’s continuous service through each applicable vesting date.

In the event Dr. Drachman experiences a termination of his employment without “cause” or he resigns for “good reason” (each as defined in Dr. Drachman’s employment agreement), provided that he executes and makes effective a release of claims against Aquinox and its affiliates, Dr. Drachman will become entitled to (i) continued base salary for nine months, payable in accordance with Aquinox’s standard payroll practices; (ii) a pro-rated portion of his annual bonus, payable in a single lump-sum; (iii) premium payments for continued healthcare coverage for up to nine months; and (iv) accelerated vesting of the portion of his then-outstanding equity awards that would have vested and become exercisable, as applicable, if he had remained in service for an additional 12 months following his date of termination. In the event Dr. Drachman experiences a termination without “cause” or he resigns for “good reason” during the 12-month period following a change in control of Aquinox, then in lieu of the foregoing, Dr. Drachman would become entitled to (a) continued base salary for 12 months, payable in accordance with Aquinox’s standard payroll practices; (b) 100% of his annual target bonus, payable in a single lump-sum; (c) premium payments for continued healthcare coverage for up to 12 months; and (d) accelerated vesting his then-outstanding equity awards.

As previously disclosed in Aquinox’s proxy statement for the 2018 Annual Meeting of Stockholders, employee directors are not compensated for services on the Aquinox Board in addition to their regular employee compensation.

Aquinox expects to enter into Aquinox’s standard form of indemnification agreement for directors and executive officers with Dr. Drachman, which requires us to indemnify our directors and executive officers for certain expenses, including attorneys’ fees, judgments, penalties, fines and settlement amounts incurred by a director or executive officer in any action or proceeding arising out of their services as one of our directors or executive officers or as a director or executive officer of any other company or enterprise to which the person provides services at our request.

The foregoing description of Dr. Drachman’s employment agreement is qualified in its entirety by reference to the full text of his employment agreement, a copy of which is filed as Exhibit 10.2 attached hereto, and the terms of which are incorporated by reference herein.

(d) Election of Directors; Appointment of Committee Members

In connection with the Merger and effective as of the time of closing of the Merger, the Aquinox Board elected Ms. M. Cantey Boyd, Dr. Drachman, Dr. Sarah B. Noonberg, and Dr. Lewis T. “Rusty” Williams, to the Aquinox Board. Dr. Williams was designated as a Class I member of the Aquinox Board, to serve until the 2021 annual meeting of the stockholders of Aquinox; each of Dr. Drachman and Dr. Noonberg was designated as a Class II member of the Aquinox Board, to serve until the 2022 annual meeting of the stockholders of Aquinox; and Ms. Boyd designated as a Class III member of the Aquinox Board, to serve until the 2020 annual meeting of the stockholders of Aquinox. Ms. Boyd, Dr. Drachman, Dr. Noonberg, and Dr. Williams will serve until his or her respective terms expire and until his or her successor is duly elected and qualified or until his or her death. Mr. Sean Nolan will remain as a Class I member of the Aquinox Board and Mr. Todd Simpson will remain as a Class III member of the Aquinox Board.

4

In addition, to fill in the vacancies created by the departures of Dr. Bridger, Dr. Levitt, Dr. Levy, Mr. Main, Dr. Neu, and Mr. Pelzer, the Aquinox Board appointed (i) Dr. Drachman to serve as the interim Chairman of the Aquinox Board; (ii) Dr. Williams to serve as a member of the Audit Committee, with Mr. Nolan remaining as a member of the Audit Committee and Mr. Simpson remaining as Chair of the Audit Committee; (iii) Dr. Noonberg and Mr. Simpson to serve as members of the Compensation Committee, and Mr. Nolan to serve as the Chair of the Compensation Committee; and (iv) Ms. Boyd and Dr. Noonberg to serve as members of the Governance Committee, and Dr. Williams to serve as the Chair of the Governance Committee. Mr. Nolan and Mr. Simpson will both step down from the Governance Committee.

Aquinox expects to enter into Aquinox’s standard form of indemnification agreement for directors and executive officers with Ms. Boyd, Dr. Noonberg, and Dr. Williams, which requires us to indemnify our directors and executive officers for certain expenses, including attorneys’ fees, judgments, penalties, fines and settlement amounts incurred by a director or executive officer in any action or proceeding arising out of their services as one of our directors or executive officers or as a director or executive officer of any other company or enterprise to which the person provides services at our request.

M. Cantey Boyd

M. Cantey Boyd, age 39, has served as a Managing Director of Baker Bros. Advisors LP, a registered investment adviser focused on long-term investments in life-sciences companies, since March 2005. Prior to joining Baker Bros., Ms. Boyd served as an Analyst in the healthcare investment banking group of Deutsche Bank Securities from June 2002 to September 2004. Ms. Boyd received her A.B. in Business Economics from Brown University.

As a Managing Director of Baker Bros. Advisors LP, Ms. Boyd may be deemed to hold shared and voting dispositive power held by entities affiliated with Baker Bros. Advisors LP (the “Baker Entities”). After the Merger, the Baker Entities will be the beneficial owner of approximately 23% of Aquinox’s common stock. Pursuant to the Registration Rights Agreement, dated September 19, 2016 by and between Aquinox and the other parties thereto, which will remain in effect after the Merger, Aquinox has granted certain registration rights to the Baker Entities and Aquinox will, among other things, prepare and file with the SEC a registration statement to register for resale all shares now held or hereafter acquired by the Baker Entities, for up to ten years, and would include our obligation to facilitate certain underwritten public offerings of our common stock by the Baker Entities in the future.

Sarah B. Noonberg, M.D., Ph.D.

Sarah B. Noonberg, M.D., Ph.D., age 51, served as the Chief Medical Officer of Nohla Therapeutics Inc., a developer of universal, off-the-shelf cell therapies for patients with hematologic malignancies and other critical diseases, from May 2018 to May 2019. Prior to joining Nohla Therapeutics, she served as the Chief Medical Officer of Prothena Corporation plc, a biotechnology company, from May 2017 to March 2018. Prior to joining Prothena, Dr. Noonberg served as Group Vice President and Head of Global Clinical Development at BioMarin Pharmaceuticals Inc., a biotechnology company, from August 2015 to March 2017. From May 2007 to August 2015, she held several positions at Medivation, Inc., a biopharmaceutical company, culminating in the position of Senior Vice President of Early Development. She currently serves on the board of directors of Protagonist Therapeutics, Inc. Dr. Noonberg received her M.D. at the University of California, San Francisco, her Ph.D. in Bioengineering at the University of California, Berkeley, and her B.S. in Engineering at Dartmouth College. She is a board-certified internist and completed her residency at Johns Hopkins Hospital.

There are no related person transactions within the meaning of Item 404(a) of Regulation S-K promulgated by the SEC between Dr. Noonberg and Aquinox required to be disclosed herein.

Lewis T. “Rusty” Williams, M.D., Ph.D.

Lewis T. “Rusty” Williams, M.D., Ph.D., age 70, has served as the Chairman and Chief Executive Officer of Walking Fish Therapeutics, Inc., a biotechnology start-up company, since February 2019. Dr. Williams has also served as a venture partner of Quan Capital, LLP, a healthcare-focused venture capital firm, since October 2018. From January 2002 to December 2017, Dr. Williams founded and held several positions at Five Prime Therapeutics, Inc., culminating in the position of President and Chief Executive Officer from April 2011 to December 2017. From September 1992 to December 2001, Dr. Williams held several positions at Chiron Corporation, culminating in the position as Chief Scientific Officer and as a member of the board of directors. Prior to joining Chiron, Dr. Williams was a professor of medicine at the University of California, San Francisco from August 1984 to June 1993, where he served as the director of the Cardiovascular Research Institution and Daiichi Research Center. Prior to UCSF, Dr. Williams co-founded and serve on the board of directors of COR Therapeutics, Inc., a biotechnology company focused on cardiovascular disease, from June 1989 to September 1994, and served on the faculties of Harvard Medical School and Massachusetts General Hospital from July 1982 to July 1984. He is a member of the National Academy of Sciences and a fellow of the American Academy of Arts and Sciences. He currently serves on the board of directors of Five Prime Therapeutics. Dr. Williams received his B.S. in Chemistry from Rice University, and his M.D. and Ph.D. in Pharmacology / Biochemistry from Duke University.

5

There are no related person transactions within the meaning of Item 404(a) of Regulation S-K promulgated by the SEC between Dr. Williams and Aquinox required to be disclosed herein.

(e) Transition Agreement with Kamram Alam

In connection with the Merger, Aquinox also entered into a fixed-term transition agreement with Mr. Alam, who will serve as our Interim Chief Financial Officer following the closing of the Merger until May 31, 2020 (the “Transition Period”), unless terminated in compliance with the transition agreement.

Pursuant to his transition agreement, Mr. Alam will receive an annual base salary of $380,000 and will be eligible to receive a rentention bonus of $332,500. The retention bonus will be payable upon the earlier of Mr. Alam’s termination without cause and May 31, 2010. Mr. Alam will not be eligible for any additional equity awards during the Transition Period, but any equity awards granted prior to the transition retention agreement will continue to vest during the Transition Period. During the Transition Period, Mr. Alam will be eligible to participate in an individual extended health benefits plan paid for by Aquinox until August 8, 2020. In addition, Aquinox will pay Mr. Alam a lump sum payment of $2,000 CDN on August 8, 2019 to cover the differential cost in coverage amounts between the group health benefits program and the individual health benefits plan.

Consistent with the terms of his employment agreement, as amended, in connection with his separation and effective upon closing, Mr. Alam will be entitled to: (i) a lump sum payment equal to 12 months of his current base salary; (ii) a lump sum payment equal to 12 months bonus pay, that will be calculated and based on Mr. Alam’s bonus payment average from the previous three years; (iii) the premiums necessary to continue Alam’s health and dental benefits until the earliest of (A) 12 months from the separation date or (B) the date on which Mr. Alam obtains other benefit coverage; and (iv) a transaction bonus of $319,375 upon the closing of the Merger. In addition, all unvested options held by Mr. Alam will immediately vest and will remain exercisable for a period of 90 days following the separation date, at which time any vested but unexercised options will expire and be forfeit, with the exception of the options granted to Mr. Alam in August of 2018 which provides for three years to exercise from the separation date.

The foregoing description is qualified in its entirety by reference to the full text ofMr. Alam’s employment agreement, as amended, a copy of which was filed as Exhibit 10.2 with the Company’s Form 10-Q on August 1, 2019, and Mr. Alam’s transition agreement, a copy of which is filed as Exhibit 10.3 attached hereto, and each of which are incorporated by reference herein.

Item 7.01

On March 7, 2019, Aquinox and Neoleukin issued a joint press release announcing the execution of the Merger Agreement. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

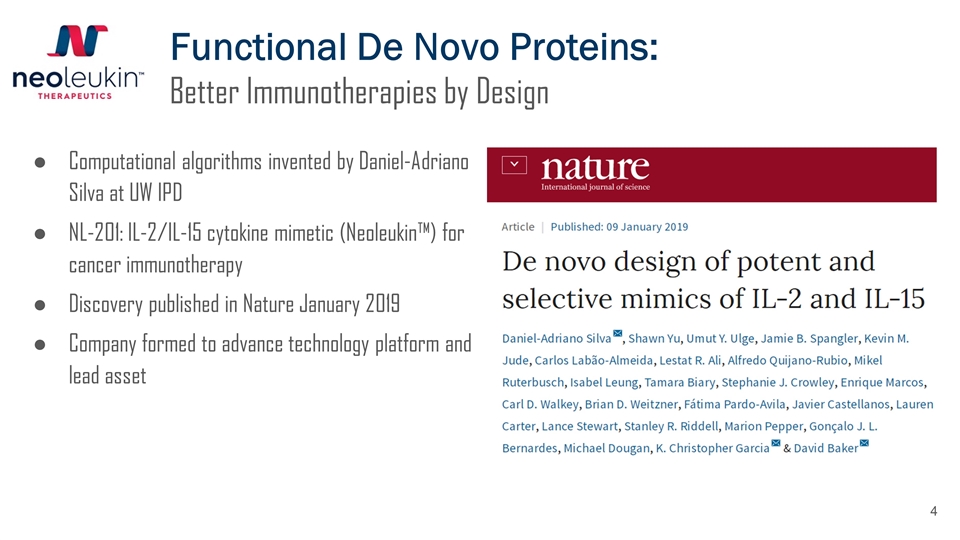

Aquinox and Neoleukin prepared investor presentation materials with information about the combined company, which it intends to use as part of investor presentations. A copy of the investor presentation materials to be used by management for presentations is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

This information contained in Item 7.01 of this Current Report on Form 8-K, including the attached Exhibit 99.1 and Exhibit 99.2, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference to such filing.

Forward Looking Statements

This report, including the exhibits attached hereto, contain forward-looking statements based upon Aquinox’s and Neoleukin’s current expectations. Forward-looking statements involve risks and uncertainties, and include, but are not limited to, statements about the structure, timing and completion of the proposed Merger; the combined company’s listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the expected executive officers and directors of the combined company; the combined company’s expected cash position at the closing of the proposed Merger; the future operations of the combined company; the nature, strategy and focus of the combined company; the development and commercial potential and potential benefits of any product candidates of the combined company; the executive and board structure of the combined company; the location of the combined company’s corporate headquarters; anticipated preclinical and clinical drug development activities and related timelines, including the expected timing for data and other clinical and preclinical results; Neoleukin having sufficient resources to advance its pipeline; and other statements that are not historical fact. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: (i) the risk that the conditions to the closing of the proposed Merger are not satisfied, including the failure to timely

6

obtain stockholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Aquinox and Neoleukin to consummate the proposed Merger; (iii) risks related to Aquinox’s ability to manage its operating expenses and its expenses associated with the proposed Merger pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange ratio, Aquinox stockholders and Neoleukin stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Aquinox’s common stock relative to the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the uncertainties associated with the clinical development and regulatory approval of product candidates; (x) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance these product candidates and its preclinical programs; (xi) uncertainties in obtaining successful clinical results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the failure to realize any value from product candidates and preclinical programs being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully bringing product candidates to market; and (xiii) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the SEC, including the factors described in the section entitled “Risk Factors” in Aquinox’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2019 filed with the SEC, and in other filings that Aquinox makes and will make with the SEC. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Aquinox expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| * | Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Aquinox Pharmaceuticals, Inc. | ||

| By: | /s/ Kamran Alam | |

| Name: | Kamran Alam | |

| Title: | Chief Financial Officer | |

Date: August 6, 2019

8

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

among:

AQUINOX PHARMACEUTICALS, INC.,

a Delaware corporation;

APOLLO SUB, INC.,

a Delaware corporation;

and

NEOLEUKIN THERAPEUTICS, INC.,

a Delaware corporation

Dated as of August 5, 2019

TABLE OF CONTENTS

| Page | ||||||

| SECTION 1. DESCRIPTION OF TRANSACTION |

2 | |||||

| 1.1 |

The Merger | 2 | ||||

| 1.2 |

Effects of the Merger | 2 | ||||

| 1.3 |

Closing; Effective Time | 2 | ||||

| 1.4 |

Certificate of Incorporation and Bylaws; Directors and Officers | 3 | ||||

| 1.5 |

Merger Consideration; Effect of Merger on Company Common Stock | 3 | ||||

| 1.6 |

Convertible Note Conversion | 3 | ||||

| 1.7 |

Conversion of Shares | 4 | ||||

| 1.8 |

Closing of the Company’s Transfer Books | 5 | ||||

| 1.9 |

Exchange of Shares | 5 | ||||

| 1.10 |

Appraisal Rights | 6 | ||||

| 1.11 |

UW Equity Right | 7 | ||||

| 1.12 |

Further Action | 7 | ||||

| 1.13 |

Withholding | 7 | ||||

| SECTION 2. REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

7 | |||||

| 2.1 |

Due Organization; Subsidiaries | 7 | ||||

| 2.2 |

Organizational Documents | 8 | ||||

| 2.3 |

Authority; Binding Nature of Agreement | 8 | ||||

| 2.4 |

Vote Required | 9 | ||||

| 2.5 |

Non-Contravention; Consents | 9 | ||||

| 2.6 |

Capitalization | 10 | ||||

| 2.7 |

Financial Statements | 11 | ||||

| 2.8 |

Absence of Changes | 12 | ||||

| 2.9 |

Absence of Undisclosed Liabilities | 13 | ||||

| 2.10 |

Title to Assets | 14 | ||||

| 2.11 |

Real Property; Leasehold | 14 | ||||

| 2.12 |

Intellectual Property | 14 | ||||

| 2.13 |

Agreements, Contracts and Commitments | 16 | ||||

| 2.14 |

Compliance; Permits; Restrictions | 17 | ||||

| 2.15 |

Legal Proceedings; Orders | 19 | ||||

| 2.16 |

Tax Matters | 20 | ||||

| 2.17 |

Employee and Labor Matters; Benefit Plans | 22 | ||||

| 2.18 |

Environmental Matters | 25 | ||||

| 2.19 |

Insurance | 26 | ||||

| 2.20 |

No Financial Advisors | 26 | ||||

| 2.21 |

Transactions with Affiliates | 26 | ||||

| 2.22 |

Anti-Bribery | 26 | ||||

| 2.23 |

Disclaimer of Other Representations or Warranties | 26 | ||||

| SECTION 3. REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

27 | |||||

| 3.1 |

Due Organization; Subsidiaries | 27 | ||||

| 3.2 |

Organizational Documents | 28 | ||||

| 3.3 |

Authority; Binding Nature of Agreement | 28 | ||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 3.4 |

Vote Required | 28 | ||||

| 3.5 |

Non-Contravention; Consents | 29 | ||||

| 3.6 |

Capitalization | 30 | ||||

| 3.7 |

SEC Filings; Financial Statements | 31 | ||||

| 3.8 |

Absence of Changes | 33 | ||||

| 3.9 |

Absence of Undisclosed Liabilities | 34 | ||||

| 3.10 |

Title to Assets | 34 | ||||

| 3.11 |

Real Property; Leasehold | 34 | ||||

| 3.12 |

Intellectual Property | 35 | ||||

| 3.13 |

Agreements, Contracts and Commitments | 36 | ||||

| 3.14 |

Compliance; Permits | 38 | ||||

| 3.15 |

Legal Proceedings; Orders | 39 | ||||

| 3.16 |

Tax Matters | 40 | ||||

| 3.17 |

Employee and Labor Matters; Benefit Plans | 42 | ||||

| 3.18 |

Environmental Matters | 45 | ||||

| 3.19 |

Transactions with Affiliates | 45 | ||||

| 3.20 |

Insurance | 46 | ||||

| 3.21 |

No Financial Advisors | 46 | ||||

| 3.22 |

Anti-Bribery | 46 | ||||

| 3.23 |

Valid Issuance | 46 | ||||

| 3.24 |

Opinion of Financial Advisor | 46 | ||||

| 3.25 |

Disclaimer of Other Representations or Warranties | 46 | ||||

| SECTION 4. |

COVENANTS RELATING TO CONDUCT OF BUSINESS PENDING THE MERGER | 47 | ||||

| 4.1 |

Operation of Parent’s Business. | 47 | ||||

| 4.2 |

Operation of the Company’s Business | 48 | ||||

| SECTION 5. |

ADDITIONAL AGREEMENTS OF THE PARTIES | 50 | ||||

| 5.1 |

Company Information Statement; Stockholder Written Consent; Section 280G Approval | 50 | ||||

| 5.2 |

Parent Stockholders’ Meeting | 52 | ||||

| 5.3 |

Reservation of Parent Common Stock; Issuance of Shares of Parent Common Stock | 52 | ||||

| 5.4 |

Employee Benefits | 53 | ||||

| 5.5 |

Indemnification of Officers and Directors | 53 | ||||

| 5.6 |

Additional Agreements | 55 | ||||

| 5.7 |

Access and Investigation | 55 | ||||

| 5.8 |

Notification of Certain Matters | 55 | ||||

| 5.9 |

Disclosure | 56 | ||||

| 5.10 |

Listing | 56 | ||||

| 5.11 |

Tax Matters | 57 | ||||

| 5.12 |

Legends | 57 | ||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 5.13 |

Directors and Officers | 57 | ||||

| 5.14 |

Section 16 Matters | 58 | ||||

| 5.15 |

Cooperation | 58 | ||||

| 5.16 |

Closing Certificates | 58 | ||||

| 5.17 |

Takeover Statutes | 59 | ||||

| 5.18 |

Stockholder Litigation | 59 | ||||

| 5.19 |

Parent Options | 59 | ||||

| 5.20 |

Private Placement | 59 | ||||

| SECTION 6. |

CONDITIONS PRECEDENT TO OBLIGATIONS OF EACH PARTY | 60 | ||||

| 6.1 |

No Restraints | 60 | ||||

| 6.2 |

Stockholder Approval | 60 | ||||

| 6.3 |

Listing | 60 | ||||

| 6.4 |

Certificate of Designation | 60 | ||||

| SECTION 7. |

ADDITIONAL CONDITIONS PRECEDENT TO OBLIGATIONS OF PARENT AND MERGER SUB | 60 | ||||

| 7.1 |

Accuracy of Representations | 60 | ||||

| 7.2 |

Performance of Covenants | 61 | ||||

| 7.3 |

Documents | 61 | ||||

| 7.4 |

FIRPTA Certificate | 61 | ||||

| 7.5 |

No Company Material Adverse Effect | 61 | ||||

| 7.6 |

Company Lock-Up Agreements | 61 | ||||

| SECTION 8. |

ADDITIONAL CONDITIONS PRECEDENT TO OBLIGATION OF THE COMPANY | 61 | ||||

| 8.1 |

Accuracy of Representations | 61 | ||||

| 8.2 |

Performance of Covenants | 62 | ||||

| 8.3 |

Documents | 62 | ||||

| 8.4 |

No Parent Material Adverse Effect | 62 | ||||

| 8.5 |

Parent Lock-Up Agreements | 62 | ||||

| 8.6 |

Company Employee Agreements | 62 | ||||

| 8.7 |

Retention Agreements | 62 | ||||

| SECTION 9. |

TERMINATION | 62 | ||||

| 9.1 |

Termination | 62 | ||||

| 9.2 |

Effect of Termination | 63 | ||||

| 9.3 |

Expenses | 64 | ||||

| SECTION 10. |

MISCELLANEOUS PROVISIONS | 64 | ||||

| 10.1 |

Non-Survival of Representations and Warranties | 64 | ||||

| 10.2 |

Amendment | 64 | ||||

iii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 10.3 |

Waiver | 64 | ||||

| 10.4 |

Entire Agreement; Counterparts; Exchanges by Electronic Transmission | 64 | ||||

| 10.5 |

Applicable Law; Jurisdiction | 65 | ||||

| 10.6 |

Attorneys’ Fees | 65 | ||||

| 10.7 |

Assignability | 65 | ||||

| 10.8 |

Notices | 65 | ||||

| 10.9 |

Cooperation | 66 | ||||

| 10.10 |

Severability | 66 | ||||

| 10.11 |

Other Remedies; Specific Performance | 66 | ||||

| 10.12 |

No Third Party Beneficiaries | 67 | ||||

| 10.13 |

Construction | 67 | ||||

iv

Exhibits:

| Exhibit A | Definitions | |

| Exhibit B-1 | Form of Parent Stockholder Support Agreement | |

| Exhibit B-2 | Form of Lock-Up Agreement | |

| Exhibit C | Form of Company Stockholder Written Consent | |

| Exhibit D | Form of Certificate of Designation | |

| Exhibit E-1 | Company Tax Representation Letter | |

| Exhibit E-2 | Parent Tax Representation Letter | |

| Exhibit F-1 | Company Tax Opinion | |

| Exhibit F-2 | Parent Tax Opinion | |

| Exhibit G | Post-Closing Directors and Officers |

v

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”) is made and entered into as of August 5, 2019, by and among AQUINOX PHARMACEUTICALS, INC., a Delaware corporation (“Parent”), APOLLO SUB, INC., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”), and NEOLEUKIN THERAPEUTICS, INC., a Delaware corporation (the “Company”). Certain capitalized terms used in this Agreement are defined in Exhibit A.

RECITALS

A. Parent and the Company intend to effect a merger of Merger Sub with and into the Company (the “Merger”) in accordance with this Agreement and the DGCL. Upon consummation of the Merger, Merger Sub will cease to exist and the Company will become a wholly owned subsidiary of Parent.

B. The Parties intend that the Merger qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and by executing this Agreement, the Parties intend to adopt a plan of reorganization within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3.

C. The Parent Board has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of Parent and its stockholders, (ii) approved and declared advisable this Agreement and the Contemplated Transactions, including the issuance of the Parent Common Stock Payment Shares and the Parent Preferred Stock Payment Shares to the stockholders of the Company pursuant to the terms of this Agreement, and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Parent vote to approve the Parent Stockholder Matters at the Parent Stockholders Meeting to be convened following the Closing.

D. The Merger Sub Board has (i) determined that the Contemplated Transactions are fair to, advisable, and in the best interests of Merger Sub and its sole stockholder, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholder of Merger Sub votes to adopt this Agreement and thereby approve the Contemplated Transactions.

E. The Company Board has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote to approve the Company Stockholder Matters.

F. Concurrently with the execution and delivery of this Agreement and as a condition and inducement to the Company’s willingness to enter into this Agreement, certain stockholders of Parent listed on Section A of the Parent Disclosure Schedule (solely in their capacity as stockholders of Parent) are executing support agreements in favor of the Company in substantially the form attached hereto as Exhibit B-1 (the “Parent Stockholder Support Agreement”), pursuant to which such Persons (the “Parent Signatories”) have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of Parent Common Stock in favor of the Parent Stockholder Matters.

G. Concurrently with the execution and delivery of this Agreement and as a condition and inducement to each of Parent and the Company’s willingness to enter into this Agreement, the stockholders of Parent listed on Section A of the Parent Disclosure Schedule (solely in their capacity as stockholders of Parent) and the stockholders of the Company listed on Section A of the Company Disclosure Schedule, (the “Company Signatories”) (solely in their capacity as stockholders of the Company) are executing lock-up agreements in substantially the form attached as Exhibit B-2 (each, a “Lock-Up Agreement”).

H. It is expected that promptly after execution of this Agreement, the Company Signatories will execute and deliver an action by written consent in the form attached hereto as Exhibit C adopting the Company Stockholder Matters (each, a “Company Stockholder Written Consent”).

I. Concurrently with the execution and delivery of this Agreement and as a condition and inducement of the Company’s willingness to enter into this Agreement, certain employees of the Company identified in Section B of the Company Disclosure Schedule (each, a “Company Named Employee”) have each executed employee agreements with Parent (the “Company Employee Agreements”), each to become effective upon the Closing (as defined herein).

J. Concurrently with the execution and delivery of this Agreement and as a condition and inducement of the Company’s willingness to enter into this Agreement, certain employees of Parent identified on Section C of the Company Disclosure Schedule (each, a “Parent Named Employee”) have each executed transition retention agreements with the Canadian subsidiary of Parent (the “Retention Agreements”), each to become effective upon the Closing (as defined herein).

AGREEMENT

The Parties, intending to be legally bound, agree as follows:

Section 1. DESCRIPTION OF TRANSACTION

1.1 The Merger. Upon the terms and subject to the conditions set forth in this Agreement, at the Effective Time, Merger Sub shall be merged with and into the Company, and the separate existence of Merger Sub shall cease. The Company will continue as the surviving corporation in the Merger (the “Surviving Corporation”).

1.2 Effects of the Merger. The Merger shall have the effects set forth in this Agreement, the Certificate of Merger and in the applicable provisions of the DGCL. As a result of the Merger, the Company will become a wholly owned subsidiary of Parent.

1.3 Closing; Effective Time. Subject to the satisfaction or waiver of the conditions set forth in Sections 6, 7 and 8, the consummation of the Merger (the “Closing”) shall take place electronically as promptly as practicable (but in no event later than the second Business Day following the satisfaction or waiver of the last to be satisfied or waived of the conditions set forth in Sections 6, 7 and 8, other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of each of such conditions), or at such other time, date and place as Parent and the Company may mutually agree in writing. The date on which the Closing actually takes place is referred to as the “Closing Date.” At the Closing, the Parties shall cause the Merger to be consummated by executing and filing with the Secretary of State of the State of Delaware a certificate of merger with respect to the Merger, satisfying the applicable requirements of the DGCL and in a form reasonably acceptable to Parent and the Company (the “Certificate of Merger”). The Merger shall become effective at the time of the filing of such Certificate of Merger with the Secretary of State of the State of Delaware or at such later time as may be specified in such Certificate of Merger with the consent of Parent and the Company (the time as of which the Merger becomes effective being referred to as the “Effective Time”).

2

1.4 Certificate of Incorporation and Bylaws; Directors and Officers. At the Effective Time:

(a) the certificate of incorporation of the Surviving Corporation shall be amended and restated in its entirety to read identically to the certificate of incorporation of Merger Sub as in effect immediately prior to the Effective Time, until thereafter amended as provided by the DGCL and such certificate of incorporation; provided, however, that at the Effective Time (as part of the Certificate of Merger), the certificate of incorporation shall be amended to (i) change the name of the Surviving Corporation to “Neoleukin Corporation” and (ii) make such other changes as are mutually agreed to by Parent and the Company;

(b) the certificate of incorporation of Parent shall be identical to the certificate of incorporation of Parent immediately prior to the Effective Time, until thereafter amended as provided by the DGCL and such certificate of incorporation, provided, however, that following the Effective Time but as soon thereafter as practicable the corporate name of Parent shall be changed to “Neoleukin Therapeutics, Inc.”;

(c) the bylaws of the Surviving Corporation shall be amended and restated in their entirety to read identically to the bylaws of Merger Sub as in effect immediately prior to the Effective Time, until thereafter amended as provided by the DGCL and such bylaws;

(d) the directors and officers of Parent, each to hold office in accordance with the certificate of incorporation and bylaws of Parent, shall be as set forth in Section 5.13; and

(e) the directors and officers of the Surviving Corporation, each to hold office in accordance with the certificate of incorporation and bylaws of the Surviving Corporation, shall be the persons in such roles as set forth in Section 5.13, or such other persons as shall be mutually agreed upon by Parent and the Company.

1.5 Merger Consideration; Effect of Merger on Company Common Stock. The aggregate merger consideration (the “Merger Consideration”) to be paid by Parent for all of the outstanding shares of Company Common Stock at the Closing shall be (i) 4,589,787 shares of Parent Common Stock (“Parent Common Stock Payment Shares”), which shares shall represent a number of shares equal to no more than 19.5% of the outstanding shares of Parent Common Stock as of immediately before the Effective Time, and (ii) 101,948 shares of Parent Convertible Preferred Stock (“Parent Preferred Stock Payment Shares”). Each Parent Preferred Stock Payment Share shall be convertible into 100 shares of Parent Common Stock, subject to and contingent upon the affirmative vote of a majority of the Parent Common Stock present or represented and entitled to vote at a meeting of stockholders of Parent to approve, for purposes of the Nasdaq Stock Market Rules, the issuance of shares of Parent Common Stock to the stockholders of the Company upon conversion of the Parent Preferred Stock Payment Shares in accordance with the terms of the Certificate of Designation in substantially the form attached hereto as Exhibit D (the “Preferred Stock Conversion Proposal”).

1.6 Convertible Note Conversion. Immediately prior to the Effective Time, without any action on the part of Parent, Merger Sub, the Company or the holders of Company Convertible Notes, each Company Convertible Note outstanding immediately prior shall have immediately been cancelled and converted automatically into the right of the holder of such Company Convertible Note to receive, upon and subject to the terms set forth in the Company Convertible Note, Company Common Stock. Upon conversion of the Company Convertible Notes, such Company Common Stock will be treated in accordance with Section 1.7.

3

1.7 Conversion of Shares.

(a) At the Effective Time, by virtue of the Merger and without any further action on the part of Parent, Merger Sub, the Company or any stockholder of the Company or Parent:

(i) any shares of Company Common Stock held as treasury stock or held or owned by the Company or any wholly owned Subsidiary of the Company immediately prior to the Effective Time shall be canceled and retired and shall cease to exist, and no consideration shall be delivered in exchange therefor; and

(ii) subject to Section 1.7(c), each share of Company Common Stock outstanding immediately prior to the Effective Time (excluding shares to be canceled pursuant to Section 1.7(a)(i) and excluding Dissenting Shares) shall be automatically converted solely into the right to receive (A) a number of Parent Common Stock Payment Shares equal to the Common Stock Exchange Ratio and (B) a number of Parent Preferred Stock Payment Shares equal to the Preferred Stock Exchange Ratio.

(b) If any shares of Company Common Stock outstanding immediately prior to the Effective Time are unvested or are subject to a repurchase option or a risk of forfeiture under any applicable restricted stock purchase agreement or other similar agreement with the Company, the vesting of such shares of Company Common Stock shall be accelerated immediately prior to the Effective Time, and such shares of Company Common Stock shall no longer be subject to any further vesting, right of repurchase, risk of forfeiture or other such conditions.

(c) No fractional shares of Parent Common Stock and Parent Convertible Preferred Stock shall be issued in connection with the Merger, and no certificates or scrip for any such fractional shares shall be issued. Any holder of Company Common Stock who would otherwise be entitled to receive a fraction of a share of Parent Common Stock (after aggregating all fractional shares of Parent Common Stock issuable to such holder) or a fraction of a share of Parent Convertible Preferred Stock (after aggregating all fractional shares of Parent Convertible Preferred Stock issuable to such holder) shall, in lieu of such fraction of a share and upon surrender by such holder of a letter of transmittal in accordance with Section 1.9 and any accompanying documents as required therein, be paid in cash the dollar amount (rounded to the nearest whole cent), without interest, determined by multiplying such fraction by (i) the Parent Closing Price in respect of shares of Parent Common Stock or (ii)(A) the Parent Closing Price multiplied by (B) 100, in respect of shares of Parent Convertible Preferred Stock.

(d) Each share of common stock, $0.0001 par value per share, of Merger Sub issued and outstanding immediately prior to the Effective Time shall be converted into and exchanged for one validly issued, fully paid and nonassessable share of common stock, $0.0001 par value per share, of the Surviving Corporation. Each stock certificate of Merger Sub evidencing ownership of any such shares shall, as of the Effective Time, evidence ownership of such shares of common stock of the Surviving Corporation.

(e) If, between the date of this Agreement and the Effective Time, the outstanding shares of Company Common Stock or Parent Common Stock or Parent Convertible Preferred Stock shall have been changed into, or exchanged for, a different number of shares or a different class, by reason of any stock dividend, subdivision, reclassification, recapitalization, split, combination or exchange of shares or other like change, the Common Stock Exchange Ratio or the Preferred Stock Exchange Ratio, as the case may be, shall, to the extent necessary, be equitably adjusted to reflect such change to the extent necessary to provide the holders of Company Common Stock and Parent Common Stock and Parent Convertible Preferred Stock, with the same economic effect as contemplated by this Agreement prior to such stock dividend, subdivision, reclassification, recapitalization, split, combination or exchange of shares or other like change; provided, however, that nothing herein will be construed to permit the Company or Parent to take any action with respect to Company Common Stock or Parent Common Stock or Parent Convertible Preferred Stock, respectively, that is prohibited or not expressly permitted by the terms of this Agreement.

4

1.8 Closing of the Company’s Transfer Books. At the Effective Time: (a) all holders of certificates representing shares of Company Common Stock that were outstanding immediately prior to the Effective Time shall cease to have any rights as stockholders of the Company; and (b) the stock transfer books of the Company shall be closed with respect to all shares of Company Common Stock outstanding immediately prior to the Effective Time. No further transfer of any such shares of Company Common Stock shall be made on such stock transfer books after the Effective Time. If, after the Effective Time, a valid certificate previously representing any shares of Company Common Stock outstanding immediately prior to the Effective Time (a “Company Stock Certificate”) is presented to the Exchange Agent or to the Surviving Corporation, such Company Stock Certificate shall be canceled and shall be exchanged as provided in Sections 1.7 and 1.9.

1.9 Exchange of Shares.

(a) On or prior to the Closing Date, Parent appoint American Stock Transfer & Trust Company, LLC to act as exchange agent in the Merger (the “Exchange Agent”). At the Effective Time, Parent shall deposit with the Exchange Agent: (i) certificates or evidence of book-entry shares representing the Parent Common Stock and Parent Convertible Preferred Stock issuable pursuant to Section 1.7(a) and (ii) cash sufficient to make payments in lieu of fractional shares in accordance with Section 1.7(c). The Parent Common Stock, Parent Convertible Preferred Stock and cash amounts so deposited with the Exchange Agent, together with any dividends or distributions received by the Exchange Agent with respect to such shares, are referred to collectively as the “Exchange Fund.”

(b) Promptly after the Effective Time, the Parties shall cause the Exchange Agent to mail to the Persons who were record holders of shares of Company Common Stock that were converted into the right to receive the Merger Consideration: (i) a letter of transmittal in customary form and containing such provisions as Parent may reasonably specify (including a provision confirming that delivery of Company Stock Certificates shall be effected, and risk of loss and title to Company Stock Certificates shall pass, only upon proper delivery of such Company Stock Certificates to the Exchange Agent, all to the extent applicable); and (ii) instructions for effecting the surrender of Company Stock Certificates in exchange for shares of Parent Common Stock. Upon surrender of a Company Stock Certificate to the Exchange Agent for exchange, together with a duly executed letter of transmittal and such other documents as may be reasonably required by the Exchange Agent or Parent: (A) the holder of such Company Stock Certificate shall be entitled to receive in exchange therefor a certificate or certificates or book-entry shares representing the Merger Consideration (in a number of whole shares of Parent Common Stock and Parent Convertible Preferred Stock) that such holder has the right to receive pursuant to the provisions of Section 1.7(a) (and cash in lieu of any fractional share of Parent Common Stock or Parent Convertible Preferred Stock pursuant to the provisions of Section 1.7(c)); and (B) the Company Stock Certificate so surrendered shall be canceled. Until surrendered as contemplated by this Section 1.9(b), each Company Stock Certificate shall be deemed, from and after the Effective Time, to represent only the right to receive a certificate or certificates or book-entry shares of Parent Common Stock and Parent Convertible Preferred Stock representing the Merger Consideration (and cash in lieu of any fractional share of Parent Common Stock or Parent Convertible Preferred Stock). If any Company Stock Certificate shall have been lost, stolen or destroyed, Parent may, in its discretion and as a condition precedent to the delivery of any shares of Parent Common Stock, require the owner of such lost, stolen or destroyed Company Stock Certificate to provide an applicable affidavit with respect to such Company Stock Certificate that includes an obligation of such owners to indemnify Parent against any claim suffered by Parent related to the lost, stolen or destroyed Company Stock Certificate as Parent may reasonably request. In the event of a transfer

5

of ownership of a Company Stock Certificate that is not registered in the transfer records of the Company, payment of the Merger Consideration in respect of such Company Stock Certificate may be made to a Person other than the Person in whose name such Company Stock Certificate so surrendered is registered if such Company Stock Certificate shall be properly endorsed or otherwise be in proper form for transfer and the Person requesting such payment shall pay any transfer or other Taxes required by reason of the transfer or establish to the reasonable satisfaction of Parent that such Taxes have been paid or are not applicable. The Merger Consideration and any dividends or other distributions as are payable pursuant to Section 1.9(c) shall be deemed to have been in full satisfaction of all rights pertaining to Company Common Stock formerly represented by such Company Stock Certificates.

(c) No dividends or other distributions declared or made with respect to Parent Common Stock or Parent Convertible Preferred Stock with a record date on or after the Effective Time shall be paid to the holder of any unsurrendered Company Stock Certificate with respect to the shares of Parent Common Stock and/or Parent Convertible Preferred Stock that such holder has the right to receive in the Merger until such holder surrenders such Company Stock Certificate or provides an affidavit of loss or destruction in lieu thereof in accordance with this Section 1.9 (at which time (or, if later, on the applicable payment date) such holder shall be entitled, subject to the effect of applicable abandoned property, escheat or similar Laws, to receive all such dividends and distributions, without interest).

(d) Any portion of the Exchange Fund that remains undistributed to holders of Company Stock Certificates as of the date that is one year after the Closing Date shall be delivered to Parent upon demand, and any holders of Company Stock Certificates who have not theretofore surrendered their Company Stock Certificates in accordance with this Section 1.9 shall thereafter look only to Parent for satisfaction of their claims for Parent Common Stock and Parent Convertible Preferred Stock, cash in lieu of fractional shares of Parent Common Stock and Parent Convertible Preferred Stock and any dividends or distributions with respect to shares of Parent Common Stock and Parent Convertible Preferred Stock.

(e) No party to this Agreement shall be liable to any holder of any Company Stock Certificate or to any other Person with respect to any shares of Parent Common Stock or Parent Convertible Preferred Stock (or dividends or distributions with respect thereto) or for any cash amounts delivered to any public official pursuant to any applicable abandoned property Law, escheat Law or similar Law.

1.10 Appraisal Rights.

(a) Notwithstanding any provision of this Agreement to the contrary, shares of Company Common Stock that are outstanding immediately prior to the Effective Time and which are held by stockholders who have exercised and perfected appraisal rights for such shares of Company Common Stock in accordance with the DGCL (collectively, the “Dissenting Shares”) shall not be converted into or represent the right to receive the Merger Consideration described in Section 1.5 attributable to such Dissenting Shares. Such stockholders shall be entitled to receive payment of the appraised value of such shares of Company Common Stock held by them in accordance with the DGCL unless and until such stockholders fail to perfect or effectively withdraw or otherwise lose their appraisal rights under the DGCL. All Dissenting Shares held by stockholders who shall have failed to perfect or shall have effectively withdrawn or lost their right to appraisal of such shares of Company Common Stock under the DGCL (whether occurring before, at or after the Effective Time) shall thereupon be deemed to be converted into and to have become exchangeable for, as of the Effective Time, the right to receive the Merger Consideration, without interest, attributable to such Dissenting Shares upon their surrender in the manner provided in Sections 1.7 and 1.9.

6

(b) The Company shall give Parent prompt written notice of any demands by dissenting stockholders received by the Company, withdrawals of such demands and any other instruments served on the Company and any material correspondence received by the Company in connection with such demands, and the Company shall have the right to direct all negotiations and proceedings with respect to such demands; provided that the Parent shall have the right to participate in such negotiations and proceedings. Neither the Parent nor the Company shall, except with the other party’s prior written consent, voluntarily make any payment with respect to, or settle or offer to settle, any such demands, or approve any withdrawal of any such demands or agree to do any of the foregoing.

1.11 UW Equity Right. At and after the Effective Time, if UW is or becomes entitled to receive Company Common Stock under the UW Equity Right, the UW Equity Right shall be converted into a right to receive Parent Common Stock and Parent Convertible Preferred Stock, and Parent shall assume the UW Equity Right in accordance with the terms (as in effect as of the date of this Agreement) of the UW Equity Right. All rights with respect to Company Common Stock under the UW Equity Right assumed by Parent shall thereupon be converted into rights with respect to Parent Common Stock and Parent Convertible Preferred Stock. Accordingly, from and after the Effective Time: (i) the UW Equity Right assumed by Parent may be exercised solely for shares of Parent Common Stock and Parent Convertible Preferred Stock; (ii) the number of shares of Parent Common Stock and Parent Convertible Preferred Stock subject to the UW Equity Right assumed by Parent shall be determined by multiplying (A) the number of shares of Company Common Stock that were subject to such UW Equity Right, by (B) the Common Stock Exchange Ratio and Preferred Stock Exchange Ratio, respectively, and rounding the resulting number down to the nearest whole number of shares of Parent Common Stock and Parent Convertible Preferred Stock.

1.12 Further Action. If, at any time after the Effective Time, any further action is determined by the Surviving Corporation to be necessary or desirable to carry out the purposes of this Agreement or to vest the Surviving Corporation with full right, title and possession of and to all rights and property of the Company, then the officers and directors of the Surviving Corporation shall be fully authorized, and shall use their and its reasonable best efforts (in the name of the Company, in the name of Merger Sub, in the name of the Surviving Corporation and otherwise) to take such action.

1.13 Withholding. The Parties and the Exchange Agent shall be entitled to deduct and withhold from the consideration otherwise payable pursuant to this Agreement to any holder of Company Common Stock or any other Person such amounts as such Party or the Exchange Agent is required to deduct and withhold under the Code or any other Law with respect to the making of such payment. To the extent that amounts are so withheld and paid over to the appropriate Governmental Body, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of whom such deduction and withholding was made.

Section 2. REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Subject to Section 10.13(h), except as set forth in the disclosure schedule delivered by the Company to Parent (the “Company Disclosure Schedule”), the Company represents and warrants to Parent and Merger Sub as follows:

2.1 Due Organization; Subsidiaries.

(a) The Company is a corporation or other legal entity duly incorporated or otherwise organized, validly existing and in good standing under the Laws of Delaware and has all necessary corporate power and authority: (i) to conduct its business in the manner in which its business is currently being conducted; (ii) to own or lease and use its property and assets in the manner in which its

7

property and assets are currently owned or leased and used; and (iii) to perform its obligations under all Contracts by which it is bound, in each case, except where the failure to have such power or authority would not reasonably be expected to prevent or materially delay the ability of the Company to consummate the Contemplated Transactions.

(b) The Company is duly licensed and qualified to do business, and is in good standing (to the extent applicable in such jurisdiction), under the Laws of all jurisdictions where the nature of its business requires such licensing or qualification other than in jurisdictions where the failure to be so qualified individually or in the aggregate would not be reasonably expected to have a Company Material Adverse Effect.

(c) The Company has no Subsidiaries, except for the Entities identified in Section 2.1(c) of the Company Disclosure Schedule; and neither the Company nor any of the Entities identified in Section 2.1(c) of the Company Disclosure Schedule owns any capital stock of, or any equity, ownership or profit sharing interest of any nature in, or controls directly or indirectly, any other Entity other than the Entities identified in Section 2.1(c) of the Company Disclosure Schedule. Each of the Company’s Subsidiaries is a corporation or other legal entity duly organized, validly existing and, if applicable, in good standing under the Laws of the jurisdiction of its organization and has all necessary corporate or other power and authority to conduct its business in the manner in which its business is currently being conducted and to own or lease and use its property and assets in the manner in which its property and assets are currently owned or leased and used, except where the failure to have such power or authority would not be reasonably expected to have a Company Material Adverse Effect.

(d) Neither the Company nor any of its Subsidiaries is or has otherwise been, directly or indirectly, a party to, member of or participant in any partnership, joint venture or similar business entity. Neither the Company nor any of its Subsidiaries has agreed or is obligated to make, or is bound by any Contract under which it may become obligated to make, any future investment in or capital contribution to any other Entity. Neither the Company nor any of its Subsidiaries has, at any time, been a general partner of, or has otherwise been liable for any of the debts or other obligations of, any general partnership, limited partnership or other Entity.

2.2 Organizational Documents. The Company has made available to Parent accurate and complete copies of the Organizational Documents of the Company and each of its Subsidiaries in effect as of the date of this Agreement. Neither the Company nor any of its Subsidiaries is in breach or violation of its respective Organizational Documents.

2.3 Authority; Binding Nature of Agreement.

(a) The Company and each of its Subsidiaries have all necessary corporate power and authority to enter into and to perform its obligations under this Agreement and, subject to receipt of the Required Company Stockholder Vote, to consummate the Contemplated Transactions. The Company Board (at meetings duly called and held) has (i) determined that the Contemplated Transactions are fair to, advisable and in the best interests of the Company and its stockholders, (ii) approved and declared advisable this Agreement and the Contemplated Transactions and (iii) determined to recommend, upon the terms and subject to the conditions set forth in this Agreement, that the stockholders of the Company vote in favor of the Company Stockholder Matters.

(b) This Agreement has been duly executed and delivered by the Company and assuming the due authorization, execution and delivery by Parent and Merger Sub, constitutes the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to the Enforceability Exceptions.

8

2.4 Vote Required. The affirmative vote (or written consent) of the holders of a majority of the shares of Company Common Stock each outstanding on the record date for the Company Stockholder Written Consent and entitled to vote thereon, voting as a single class (collectively, the “Required Company Stockholder Vote”), is the only vote (or written consent) of the holders of any class or series of Company Common Stock necessary to adopt and approve this Agreement and approve the Contemplated Transactions.

2.5 Non-Contravention; Consents. Subject to obtaining the Required Company Stockholder Vote, the filing of the Certificate of Merger required by the DGCL, and the filing of the Certificate of Designation, neither (x) the execution, delivery or performance of this Agreement by the Company, nor (y) the consummation of the Contemplated Transactions, will directly or indirectly (with or without notice or lapse of time):

(a) contravene, conflict with or result in a violation of any of the provisions of the Company’s Organizational Documents;

(b) contravene, conflict with or result in a violation of, or give any Governmental Body or other Person the right to challenge the Contemplated Transactions or to exercise any remedy or obtain any relief under, any Law or any order, writ, injunction, judgment or decree to which the Company or its Subsidiaries, or any of the assets owned or used by the Company or its Subsidiaries, is subject, except as would not reasonably be expected to be material to the Company or its business;

(c) contravene, conflict with or result in a violation of any of the terms or requirements of, or give any Governmental Body the right to revoke, withdraw, suspend, cancel, terminate or modify, any Governmental Authorization that is held by the Company or its Subsidiaries, except as would not reasonably be expected to be material to the Company or its business;

(d) contravene, conflict with or result in a violation or breach of, or result in a default under, any provision of any Company Material Contract, or give any Person the right to: (i) declare a default or exercise any remedy under any Company Material Contract; (ii) any material payment, rebate, chargeback, penalty or change in delivery schedule under any Company Material Contract; (iii) accelerate the maturity or performance of any Company Material Contract; or (iv) cancel, terminate or modify any term of any Company Material Contract, except in the case of any non-material breach, default, penalty or modification; or

(e) result in the imposition or creation of any Encumbrance upon or with respect to any asset owned or used by the Company or its Subsidiaries (except for Permitted Encumbrances).

Except for (i) any Consent set forth on Section 2.5 of the Company Disclosure Schedule under any Company Contract, (ii) the Required Company Stockholder Vote, (iii) the filing of the Certificate of Merger with the Secretary of State of the State of Delaware pursuant to the DGCL, (iv) the filing of the Certificate of Designation with the Secretary of State of the State of Delaware and (v) such consents, waivers, approvals, orders, authorizations, registrations, declarations and filings as may be required under applicable federal and state securities Laws, neither the Company nor any of its Subsidiaries is or will be required to make any filing with or give any notice to, or to obtain any Consent from, any Person in connection with (A) the execution, delivery or performance of this Agreement, or (B) the consummation of the Contemplated Transactions. The Company Board has taken and will take all actions necessary to ensure that the restrictions applicable to business combinations contained in Section 203 of the DGCL are, and will be, inapplicable to the execution, delivery and performance of this Agreement, the Lock-Up Agreements and to the consummation of the Contemplated Transactions. No other state takeover statute or similar Law applies or purports to apply to the Merger, this Agreement, the Lock-Up Agreements or any of the Contemplated Transactions.

9

2.6 Capitalization.

(a) The authorized capital stock of the Company as of the date of this Agreement consists of (i) 20,000,000 shares of Company Common Stock, of which 10,031,579 shares have been issued and are outstanding as of the date of this Agreement (including Company RSA Awards). 2,300,522 shares of Company Common Stock are issuable upon conversion of the Company Convertible Notes and will be outstanding at the Effective Time. The Company does not hold any shares of its capital stock in its treasury. Section 2.6(a) of the Company Disclosure Schedule lists, as of the date of this Agreement, each record holder of issued and outstanding Company Common Stock and the number and type of shares of Company Common Stock held by such holder. Accurate and complete copies of the Company Convertible Notes, as amended, have been provided to Parent.