Form 8-K AMERICAN WOODMARK CORP For: Jun 04

Investor Presentation Version: June 2021 Exhibit 99.1

Legal Disclosure Forward-Looking Statements This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements as to expected future financial and operating results. These forward-looking statements may be identified by the use of words such as “anticipate,” “estimate,” “project,” “forecast,” “expect,” “believe,” “should,” “could,” “would,” “plan,” “may,” “intend,” “prospect,” “goal,” “will,” “predict,” or “potential” or other similar words or variations thereof. These statements are based on the current beliefs and expectations of the management of American Woodmark and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially from those expressed in this presentation. These risks and uncertainties are detailed in certain of American Woodmark’s filings with the Securities and Exchange Commission (“SEC”), including in its Annual Report on Form 10-K for the year ended April 30, 2020 under the heading “Risk Factors” and in its Quarterly Report on Form 10-Q for the period ended January 31, 2021 under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward-Looking Statements.” These reports, as well as the other documents filed by American Woodmark with the SEC, are available free of charge at the SEC’s website at www.sec.gov. The statements made in this presentation, including with respect to any projected financial and operating results, are based on information available to management as of the first day of the month set forth on the cover of this presentation and American Woodmark undertakes no obligation to update any such statements to reflect developments after such date. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA and Free Cash Flow. These measures are intended to serve as a supplement to, and not a substitute for, the most comparable GAAP measures. For reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures, please see Appendix A to this presentation.

Our Leadership Team Scott Culbreth President & Chief Executive Officer Paul Joachimczyk Vice President & Chief Financial Officer Rob Adams Sr. Vice President, Manufacturing and Technical Operations Teresa May Sr. Vice President & Chief Marketing Officer Strong leadership with decades of experience and expertise

2025 Vision Community Connections Customer Experience Interconnected Individuals Disruptive Innovation Systems Thinking We must stretch ourselves toward a higher level of excellence, engaging and better understanding every customer we serve. We will work to build a shared story and a strong connection with each and every community we touch. We will create an inclusive environment that fosters a sense of belonging, allowing each of us to realize how interconnected we are through our own stories. We must challenge how we see the world around us, creating innovative solutions that disrupt our entire interconnected system. We must look beyond the simple, learning to see the system at work and understanding the complex interconnectivity in everything we do.

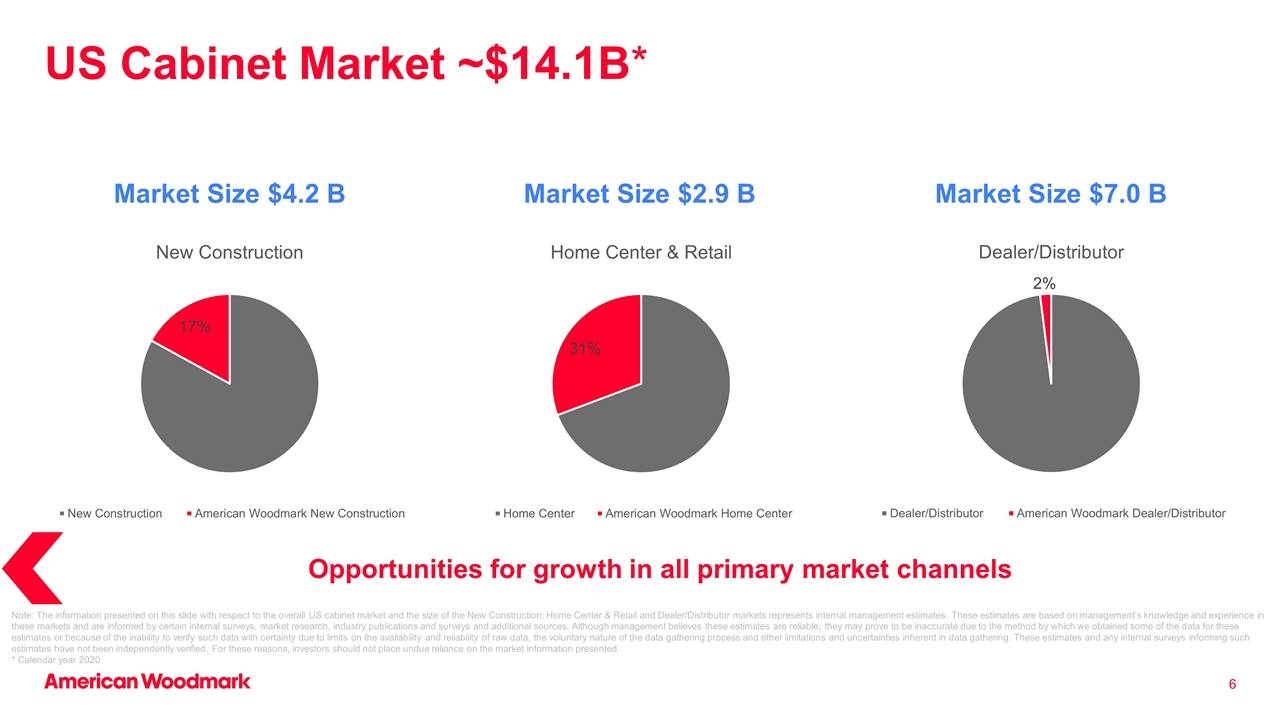

The Market New Construction Home Center and Retail Dealer/Distributor Target products for entry-level and mid-level housing Simplify the selection process Invest in digital service platform Provide an expanded omnichannel experience Target pro customers Leverage brick and mortar footprint Partner with trusted vendors Expand customer base Expand value offering

US Cabinet Market ~$14.1B* Market Size $4.2 B Market Size $2.9 B Market Size $7.0 B Opportunities for growth in all primary market channels Note: The information presented on this slide with respect to the overall US cabinet market and the size of the New Construction, Home Center & Retail and Dealer/Distributor markets represents internal management estimates. These estimates are based on management’s knowledge and experience in these markets and are informed by certain internal surveys, market research, industry publications and surveys and additional sources. Although management believes these estimates are reliable, they may prove to be inaccurate due to the method by which we obtained some of the data for these estimates or because of the inability to verify such data with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in data gathering. These estimates and any internal surveys informing such estimates have not been independently verified. For these reasons, investors should not place undue reliance on the market information presented. * Calendar year 2020

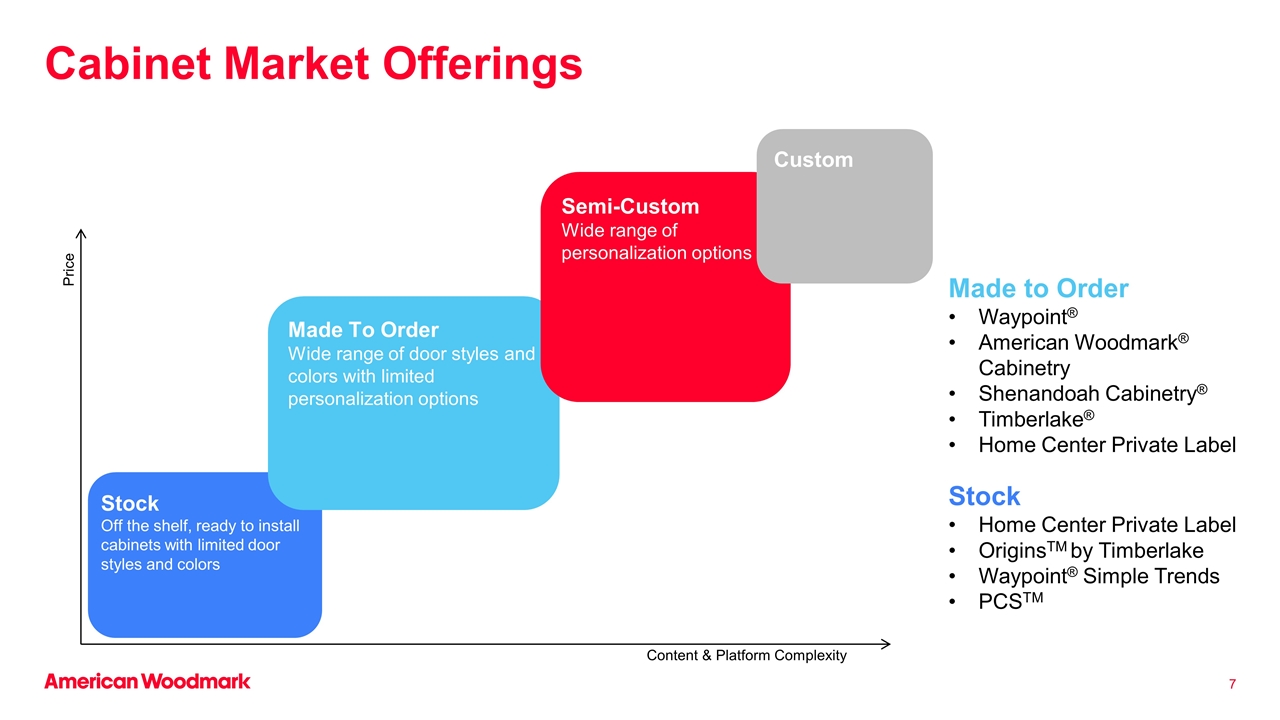

Made to Order Waypoint® American Woodmark® Cabinetry Shenandoah Cabinetry® Timberlake® Home Center Private Label Stock Home Center Private Label OriginsTM by Timberlake Waypoint® Simple Trends PCSTM Stock Off the shelf, ready to install cabinets with limited door styles and colors Price Content & Platform Complexity Made To Order Wide range of door styles and colors with limited personalization options Semi-Custom Wide range of personalization options Custom Cabinet Market Offerings

Expanding Product Offerings Establish the Model Expand supply sources to meet customer demand Expand Capability International manufacturing and distribution platform Evolve Offerings Styles, colors, expand markets Develop sustainable sourcing, operations and strategic projects to provide needed products which will grow our share and increase relevance

Building Digital Strengthen the Core E-commerce, content, configurators Build Internal Capability Manufacturing, distribution, digital, commercial Breakthrough Opportunity Styles, colors, expand markets Enhance our digital/online strategy to provide needed products/services which will allow us to capture share in this growing market

Leverage Frameless Capabilities Evolve Offerings Styles, colors, expand markets Manufacturing and Logistics Shift focus on cost and performance Commercial Capabilities Structure, systems and process Execute frameless strategy further establishing core competency and market share growth

Customer Experience Customer Expectations VOC Star Ratings Build Internal Capability Design and implement a customer-centric quality strategy focused on the total customer experience Heightened consumer expectations Strategies to create a competitive advantage Advanced analytics delivers insight that drives precise response Focus on expectation-driven ratings Enhance partners’ business with e-commerce and digital capabilities Relevant content drives consumer engagement Manufacturing and distribution transformation

Platform Vision ERP Enhance our internal systems Strategic Projects Automation to reduce labor dependencies Digital Marketing Deliver products/services and drive engagement These complexity reducing initiatives will increase EBITDA margins

ESG Environmental Corporate social responsibility is a priority, and we commit to executing our plan Social Governance Decrease landfill waste through Reduce, Reuse, and Recycle methodologies Transition to hybrid/electric fleet and equip shipping fleet with SmartWay Technology Utilize renewable energy Reduce recordable incident rate Develop and implement sustainability training for team members Strengthen Diversity & Inclusion initiatives Provide milestone updates to key stakeholders Board committee structure aligned to ESG priorities Ongoing focus on board diversity

Awards and Recognition New Construction Home Center & Retail Dealer/Distributor ESG We are honored to be recognized in all our primary market channels Lennar Little Red Hen KB Home Value & Partnership Leadership Meritage Homes Vendor of the Quarter Q1 2021 M/I Homes Supplier Appreciation for 2020 Multi-year winner of JD Power Award for Customer Satisfaction in Kitchen Cabinets Home Depot Innovation Lowe’s Vendor Advisory Council Hanley Wood’s Building Product Manufacturing Marketer of the Year 20% by 2020 – Women on the Board Forbes 2021 – America’s Best Large Employers

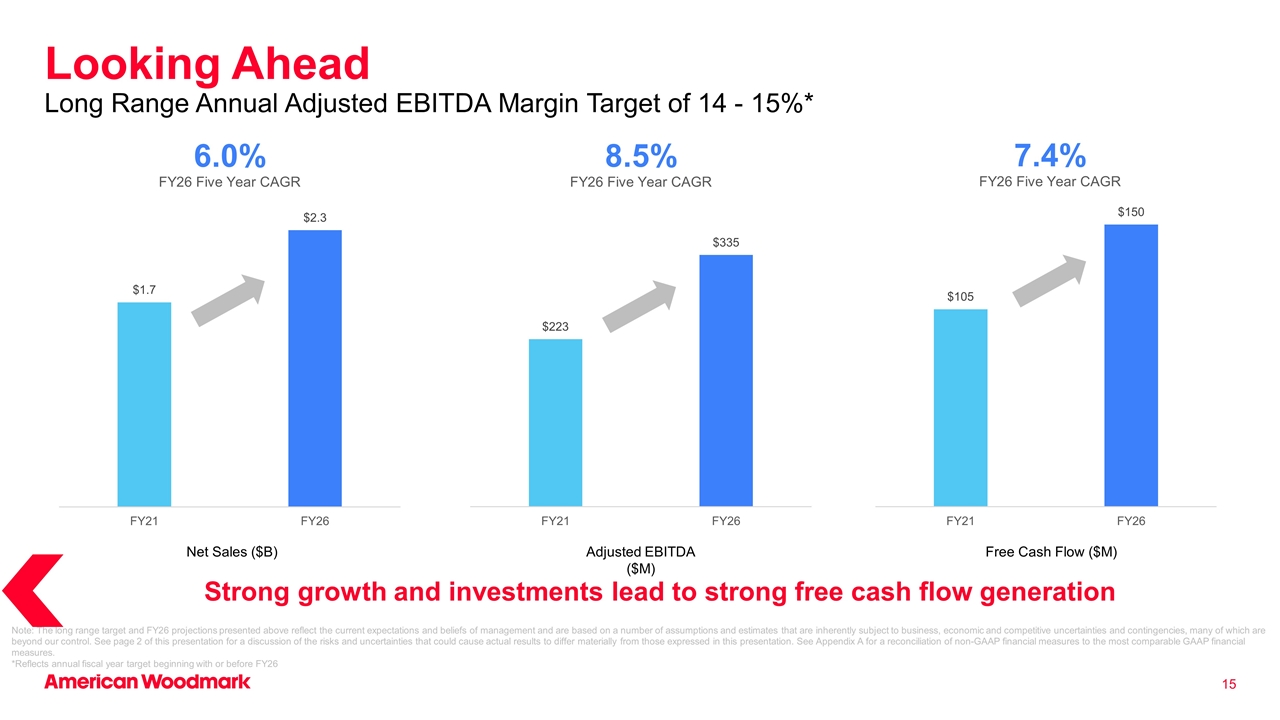

Note: The long range target and FY26 projections presented above reflect the current expectations and beliefs of management and are based on a number of assumptions and estimates that are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control. See page 2 of this presentation for a discussion of the risks and uncertainties that could cause actual results to differ materially from those expressed in this presentation. See Appendix A for a reconciliation of non-GAAP financial measures to the most comparable GAAP financial measures. *Reflects annual fiscal year target beginning with or before FY26 Looking Ahead Long Range Annual Adjusted EBITDA Margin Target of 14 - 15%* Strong growth and investments lead to strong free cash flow generation Net Sales ($B) Adjusted EBITDA ($M) Free Cash Flow ($M)

Investment Summary Focus on our Core Strong FCF Long-Term Focus * Any share repurchases are subject to authorization by American Woodmark’s Board of Directors as well as market conditions, the Company’s cash requirements for other purposes, compliance with applicable laws and regulations and contractual covenants and any other factors management may deem relevant at the time of such repurchases. American Woodmark is not obligated to make any share repurchases in the future. . Service platform is unmatched National turnkey offering in the builder market is a valued differentiator 35+ year relationship with home centers strengthened through improved service offerings Capital Management Free cash flow generated is reinvested for future growth Proven track record of returning capital to shareholders through share repurchases* Product offerings are well positioned with focus on relevant styles and colors. Stock offering addresses the entry price point consumer Strategic initiatives position us for future success Complexity reduction improves cost structure and margins

Contact: Kevin Dunnigan Treasury Director (540) 665-9100

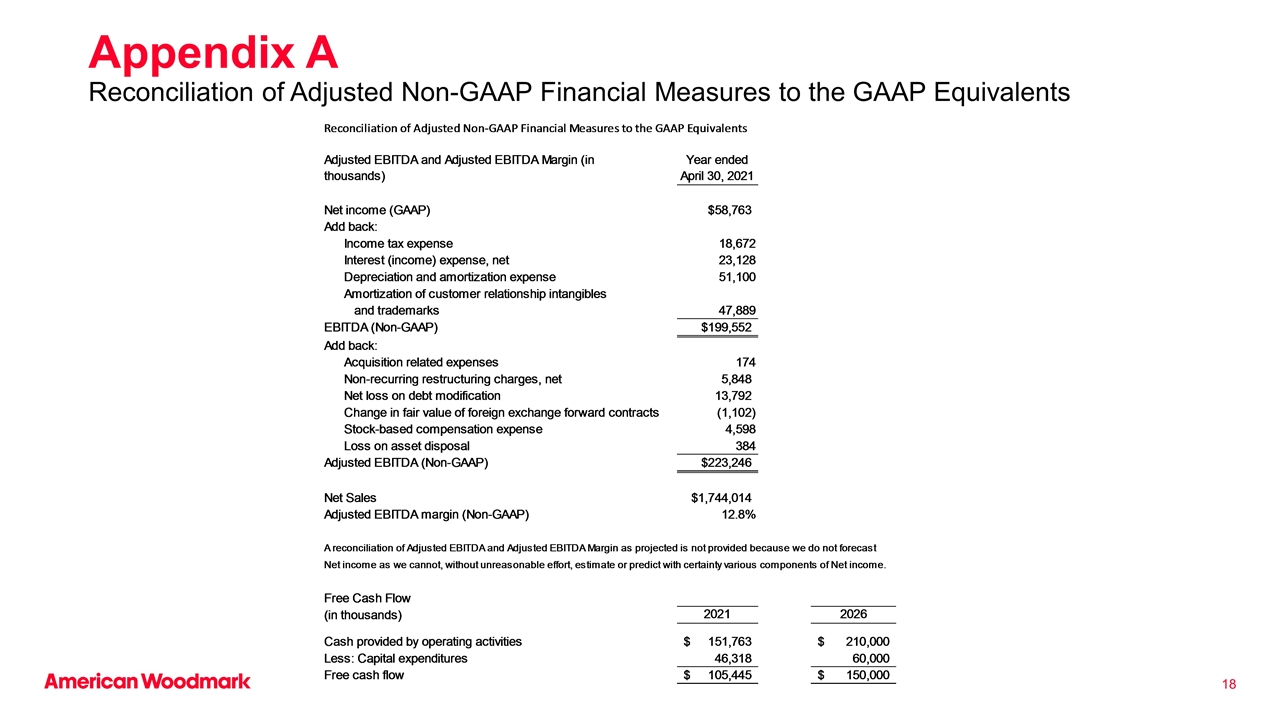

Appendix A Reconciliation of Adjusted Non-GAAP Financial Measures to the GAAP Equivalents

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Alphabet stock surges 11% to record high on Q1 earnings beat, first-ever dividend

- Gravity Announces Filing of Annual Report on Form 20-F for Fiscal Year 2023

- Nel ASA: Hy Stor Energy places gigawatt capacity reservation for Mississippi Clean Hydrogen Hub

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share