Form 8-K ADOMANI, INC. For: Sep 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2017

adomani, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38078 | 46-0774222 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

620 Newport Center Drive, Suite 1100

Newport Beach, CA 92660

(Address of principal executive offices) (Zip Code)

(949) 200-4613

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 7.01 Regulation FD Disclosure.

ADOMANI, Inc. (the “Company”) hereby furnishes as Exhibit 99.1 a copy of the slide presentation used by James Reynolds, Chief Executive Officer of the Company, and Michael K. Menerey, Chief Financial Officer of the Company, at the 2017 Disruptive Growth Company Showcase NYC on September 27, 2017.

As provided in General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description | |

| 99.1 | Slide Presentation of ADOMANI, Inc., September 27, 2017 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ADOMANI, Inc. | ||

| Dated: September 27, 2017 | By: | /s/ Michael K. Menerey |

| Michael K. Menerey | ||

| Chief Financial Officer | ||

EXHIBIT INDEX

| Exhibit Number | Description | |

| 99.1 | Slide Presentation of ADOMANI, Inc., September 27, 2017 |

Exhibit 99.1

DISCLAIMER 2 This presentation has been prepared by ADOMANI, Inc. (the “Company”) for discussion purposes only and should not be considered as an offer or invitation to subscribe for or purchase any securities in the Company or as an inducement to make an offer or invitation with respect to those securities. No agreement to subscribe for securities in the Company will be entered into on the basis of this presentation or any information, opinions, or conclusions expressed in the course of this presentation. This presentation is not a prospectus or other offering document under U.S. law or under any other law. This presentation contains general summary information and does not take into account the investment objectives, financial situation, and particular needs of any individual investor. This presentation contains, in addition to historical information, certain forward - looking statements that are based on our current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward - looking statements. Forward - looking statements can be identified by the fact that they do not relate strictly to historical facts and generally contain words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates," and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward - looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of our management, forward - looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. We are under no duty to update any of these forward - looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward - looking statements as representing our views as of any date subsequent to the date of this presentation. For historical information relating to the Company, you should consider the information contained in our filings with the U.S. Securities and Exchange Commission, including our Quarterly Report on Form 10 - Q for the fiscal quarter ended June 30, 2017, particularly in the sections entitled "Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors," as well as our subsequent filings with the Securities and Exchange Commission. Other unknown or unpredictable factors also could have material adverse effects on our future results, performance or achievements. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. By attending or receiving this presentation you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of our capital stock in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

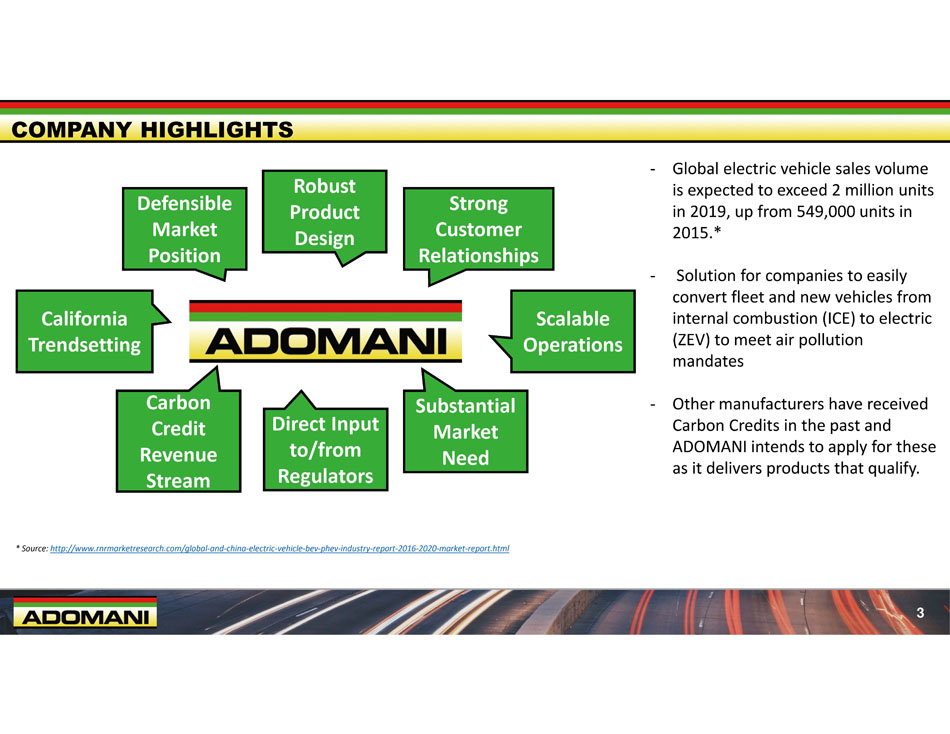

D e f e n si b l e Market Position Robust P r o du ct Design Strong Customer R elatio n s h i p s Scalable O p e r atio ns Direct Input to/from Regulators California T r e nd s e t ti ng S u b s t a n ti a l Market Need Carbon Credit R e v e nue Stream 3 COMPANY HIGHLIGHTS - Global electric vehicle sales volume is expected to exceed 2 million units in 2019, up from 549,000 units in 2015.* - Solution for companies to easily convert fleet and new vehicles from internal combustion (ICE) to electric (ZEV) to meet air pollution mandates - Other manufacturers have received Carbon Credits in the past and ADOMANI intends to apply for these as it delivers products that qualify. * Source: http://www.rnrmarketresearch.com/global - and - china - electric - vehicle - bev - phev - industry - report - 2016 - 2020 - market - report.htm l

COMPANY OVERVIEW A solution provider for the transition of internal combustion engine vehicles (ICE) to zero emission vehicles (ZEV) ADOMANI designs and integrates OEM - based electric - motor assembly kits for conversion installations into existing combustion powered fleets or new vehicles, and works with outside OEM partners to build/distribute new, purpose - built ZEVs. ADOMANI Conversion Drivetrains • Patented electric motor assembly drivetrains that use OEM combustion engine ancillary equipment (transmission, AC compressor, alternator, etc.) for cost savings and ease of maintenance, and make use of the current manufacturing and service infrastructure, creating a lower cost - to - entry structure for manufacturers’ conversion from ICEs to ZEVs ADOMANI Distributor & Co - Development Projects • Distribution and development of purpose - built co - developed ZEVs, including new school buses and commercial fleet vehicles 4

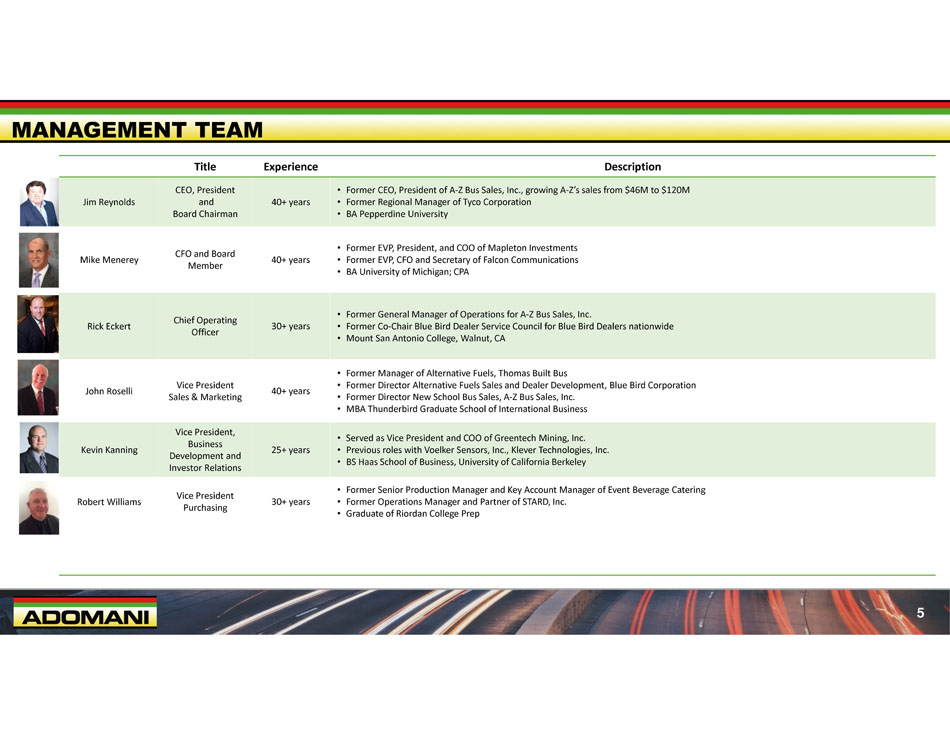

MANAGEMENT TEAM Ti t l e Experience Description Jim Reynolds CEO, President and Board Chairman 40+ years • Former CEO, President of A - Z Bus Sales, Inc., growing A - Z’s sales from $46M to $120M • Former Regional Manager of Tyco Corporation • BA Pepperdine University Mike Menerey CFO and Board Member 40+ years • Former EVP, President, and COO of Mapleton Investments • Former EVP, CFO and Secretary of Falcon Communications • BA University of Michigan; CPA Rick Eckert Chief Operating Officer 30+ years • Former General Manager of Operations for A - Z Bus Sales, Inc. • Former Co - Chair Blue Bird Dealer Service Council for Blue Bird Dealers nationwide • Mount San Antonio College, Walnut, CA John Roselli Vice President Sales & Marketing 40+ years • Former Manager of Alternative Fuels, Thomas Built Bus • Former Director Alternative Fuels Sales and Dealer Development, Blue Bird Corporation • Former Director New School Bus Sales, A - Z Bus Sales, Inc. • MBA Thunderbird Graduate School of International Business Kevin Kanning Vice President, Business Development and Investor Relations 25+ years • Served as Vice President and COO of Greentech Mining, Inc. • Previous roles with Voelker Sensors, Inc., Klever Technologies, Inc. • BS Haas School of Business, University of California Berkeley Robert Williams Vice President Purchasing 30+ years • Former Senior Production Manager and Key Account Manager of Event Beverage Catering • Former Operations Manager and Partner of STARD, Inc. • Graduate of Riordan College Prep 5

INDEPENDENT BOARD MEMBERS Title Experience Description Janet Boydell Board Member 10+ years Gary W. Nettles Board Member 25+ years • Currently Vice President for The Code Group, Inc., a staffing agency • Former CEO, A Hire Connection, Inc., professional services firm providing strategic management consulting and retained executive search services for C - Level functions, 2006 to 2015 • Previously Assistant Controller in the field of investment banking • BBA Cal Poly Pomona • Currently COO, CFO and Director of Allen Tel Products, Inc., supplier and manufacturer of data and telecommunication components • CPA and President of Guchereau & Nettles, accounting firm, 1987 to 2003 • Former Board Member, Cost - U - Less, Inc. • BS United States International University, San Diego, CA, Magna Cum Laude Jack Perkowski Board Member 20+ years • Former CEO & Chairman of ASIMCO Technologies - China’s first independent international automotive components manufacturer headquartered in Beijing. With sales over US$500M, ASIMCO is one of the largest producers of automotive components in China, with 9 manufacturing operations and ~800 service stations across China. • Founder and Managing Partner of JFP Holdings, Ltd. • MBA Harvard Business School 6

Best fleet vehicle candidates for ZEV conversion are those with: High initial acquisition cost Daily routes < 100 miles Vehicles of similar engine family and transmission type, allowing for economies of scale in the manufacturing of the conversion systems Re - Power Fleet Focus Models Re - Power Fleet Focus Models School Buses Stop and go driving with high fuel consumption Port Vehicles Transit Vehicles Light Duty Box Trucks TARGET CUSTOMERS Shuttle Vehicles 7

Marketing Partners Policy Partners Manufacturing/Distribution Partners Strategic Manufacturing Relationships – ADOMANI has relationships with our manufacturing & distribution partners, who perform all manufacturing and service for ADOMANI, providing scalability, growth opportunities, and a low cost structure. Policy Partners – CalStart is a member organization that works with business, fleets, and government to develop and implement clean, efficient transportation solutions. Marketing Partners – Supports economies, breakthrough products, behavior change campaigns to help elected leaders, the media and companies understand and effect change. PARTNERS 8

Conversions: • ADOMANI projects to fulfill ZEV conversion orders with these other companies. New Vehicles: • ADOMANI estimates it will fill orders for new vehicle ZEV powertrains from multiple organizations. Co - Development: • ADOMANI is in the process of co - development of school buses and transit buses with two different businesses . MANUFACTURING & DISTRIBUTION PARTNERING OPPORTUNITIES 9

2 ) ADOMANI sends drivetrain kits and vehicles to qualified kit installer 3) Installer installs ADOMANI kit, returns vehicles to ADOMANI 4) ADOMANI performs final QA and returns newly re - purposed vehicles to customer 1 ) Customer places order to ADOMANI, delivers vehicles to be re - purposed ADOMANI Conversion Drivetrains ZEV Powertrain Kit + Vehicle R e - pu r po se d ZEV Vehicle ADOMANI “Co - Development” Drivetrains 2) Manufacturer places order for ADOMANI ZEV drivetrain kits 3) ADOMANI delivers EV drivetrain kits 4) Manufacturer installs kits into new ZEVs 5) Manufacturer delivers new ZEVs to c u s t o me r 1) Customer places order for new ZEV with manufacturer ZEV Powertrain Kit ORDER FULFILLMENT PROCESS 10

ADOMANI CHINA Our wholly - owned subsidiary, Adomani (Nantong) Automotive Technology Co. Ltd, currently has a proposal to develop an 18,000 square foot facility in Nantong, China to fulfill conversion kit orders within China. Shanghai Nantong North City High - Tech Park • Allows for low cost kit assembly from local OEM suppliers • A strategic shipping port city located near Shanghai • Access to a skilled workforce 11

China accounts for approximately 45% of new electric vehicles (NEVs) sold worldwide 1 • China NEV market: Global and China’s sales volume combined anticipated to exceed 2 million units a year in 2019 and 2020, respectively, making China the world’s leading electric vehicle market 2 • Bus Market: The output escalated 313% year on year to 112,400 in 2015 2 • Special Purpose Vehicle Market: The output soared 10.7 times year on year to 47,800 in 2015; in the first two months of 2016, the output jumped by 115.55% 2 • 95% of China's Electric Vehicle Startups Potentially Face Wipeout 3 • Opportunity: Adjusted subsidies and permit limitations have the potential to create more opportunity for conversion ZEV kit solutions for cost savings 1 Source for 2016 : https : //raymondjames . bluematrix . com/sellside/EmailDocViewer?encrypt= 72 b 31572 - 8 d 9 f - 4 d 80 - 8375 - 290 e 2 dce 86 dc&mime=pdf&co=RaymondJames&id=ECM - ENERGYGROUP@RJLAN . RJF . com&source=mail 2 Source for 2011 - 2015 : http : //www . rnrmarketresearch . com/global - and - china - electric - vehicle - bev - phev - industry - report - 2016 - 2020 - market - report . html 3 Source : https : // www . bloomberg . com/news/articles/ 2016 - 08 - 28 /most - of - china - s - electric - car - startups - face - wipeout - by - new - rules 4 Source : https : // www . evwind . es/ 2012 / 01 / 16 / 5579 - electric - cars - sold - in - china - in - 2011 / 15911 5 Source : http : //www . cars 21 . com/news/view/ 5227 6 Source : http : //www . chinadaily . com . cn/business/motoring/ 2014 - 01 / 11 /content_ 17229981 . htm 7 Source : http : //www . caam . org . cn/AutomotivesStatistics/ 20150114 / 0905144510 . htm l 8 Source : http : //www . caam . org . cn/AutomotivesStatistics/ 20160120 / 1305184260 . htm l 9 Source : http : //www . ev - volumes . com/news/china - plug - in - sales - 2016 - q 4 - and - full - year/ ADOMANI – CHINA NEV MARKET 507,000 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 * Sales of new electric vehicles (NEVs) in China by year (2011 - 2016) (4)(5)(6)(7)(8)(9) 126,750 33 1 , 0 9 2 380,250 All - electric Vehicles Plug - In hybrids 83,610 247,482 74 , 7 6 3 12,791 17,642 29 , 71 5 8,159 2,580 1,416 3,038 5,579 11,375 14,604 45 , 04 8 2011 2012 * 2016 All - electric and plug - in figures are approximate 12

US accounts for approximately 20% of new electric vehicles (NEVs) sold worldwide 1 • US NEV market: Increase of 37% in sales in 2016 over 2015. More than half of sales occurred in CA driven by state’s zero - emission vehicle (ZEV) mandate 2 • Hybrid and Electric Bus Market: Potential year - over - year growth 20.5% through 2025 3 • Hybrid and Electric Truck Market : Potential year - over - year growth 30.9% through 2025 3 • Opportunity: Federal, state, and local incentives for electric, commercialized hybrid, and zero - emission trucks and buses along with legislation targeted toward the reduction of emissions. 1 Source: https://raymondjames.bluematrix.com/sellside/EmailDocViewer?encrypt=72b31572 - 8d9f - 4d80 - 8375 - 290e2dce86dc&mime=pdf&co=RaymondJame s&id=ECM - [email protected]&source=mail 2 Source: https:// www.forbes.com/sites/rrapier/2017/02/05/u - s - electric - vehicle - sales - soared - in - 2016/#3d90eda0217f 3 Source: http://www.frost.com/sublib/display - report.do?id=MC65 - 01 - 00 - 00 - 00 4 Source 2011 - 2015: https:// www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/national_transportation_statistics/html/table_01_19.htm l ; 5 Source 2016: http://www.ev - volumes.com/news/usa - plug - in - vehicle - sales - for - 2016/ ADOMANI – US NEV MARKET Note: NEVs includes passenger cars and commercial vehicles, such as buses, sanitation trucks, and other heavy - duty vehicles 14 , 64 8 47 , 6 9 4 6 3 , 41 6 71 , 04 4 80 , 9 0 5 7,981 38 , 58 6 49 , 0 0 8 5 5 , 35 7 42 , 82 5 76 , 2 2 5 1 7, 7 3 1 53 , 23 4 9 6 , 70 2 11 8 , 7 7 3 1 1 3, 8 6 9 1 5 7 ,1 3 0 0 2 5 , 0 0 0 5 0 , 0 0 0 7 5 , 0 0 0 1 0 0 , 0 0 0 1 2 5 , 0 0 0 1 5 0 , 0 0 0 2 0 0 , 0 0 0 1 7 5 , 0 0 0 9,750 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 Sales of new electric vehicles (NEVs) in US by year (2011 - 2016) (4)(5) All - electric Vehicles Plug - In hybrids 13

Conversion of older fleets to ZEVs or choosing new electric vehicles significantly reduces the major air pollutants (NO x , SO x , PM 2.5 , PM 10 , VOCs, and CO) that are emitted from traditional internal combustion engines These air pollutants are linked to respiratory and cardiovascular diseases as well as premature deaths, especially in vulnerable populations like children and the elderly ZEVs directly enhance the health and well - being of drivers, passengers and, ultimately, all of those who live and work in the communities where vehicles operate Converting fleets to electric also helps providers stay compliant with current and future local, state and federal environmental and emission regulations Health and Environmental Benefits Health and Environmental Benefits “Fueling” with electricity is less costly and the prices are more stable than traditional liquid or gaseous fuels Overall maintenance costs and hazardous waste handling costs, such as those for oil changes and disposal, can be reduced or completely eliminated Many benefits from local air district, state and federal financial incentives in the form of rebates, tax credits or carbon credits make the purchase of ZEVs cost effective Clean fleet vehicles attract customers and increase fleet revenue (mobile billboards) Financial Benefits Financial Benefits ELECTRIC FLEET SOLUTION 14

(USD in Thousands) 2014 2015 2016 Total revenue $53 $0 $68 Cost of goods sold $1 $0 $50 Research and development expense $59 $549 $37 Technology consulting expense $143 $135 $117 General and administrative expense (A) $2 , 059 $4 , 633 $9 , 398 Other expense / (income) ( $23) $718 $1 , 151 Net loss ( $2 , 186) ( $6 , 035) ( $10 , 685) FINANCIAL PERFORMANCE 15 *(A) Includes stock - based compensation Historical Net Loss – Consolidated Fiscal Year ended December 31,

(USD in Thousands) 16 Cash and cash equivalents $118 $4 , 537 $938 Working capital (deficit) $101 $4 , 049 ( $3 , 368) Total assets $169 $4 , 700 $3 , 406 Accumulated deficit ( $4 , 354) ( $10 , 389) ( $21 , 074) Total stockholders' deficit ( $198) ( $846) ( $2 , 707) FINANCIAL PERFORMANCE Historical Balance Sheet – Consolidated Fiscal Year ended December 31, 2014 2015 2016

D e f e n si b l e Market Position Robust P r o du ct Design Strong Customer R elatio n s h i p s Scalable O p e r atio ns Direct Input to/from Regulators California T r e nd s e t ti ng Substantial Market Need Carbon Credit Revenue Stream 17 COMPANY HIGHLIGHTS

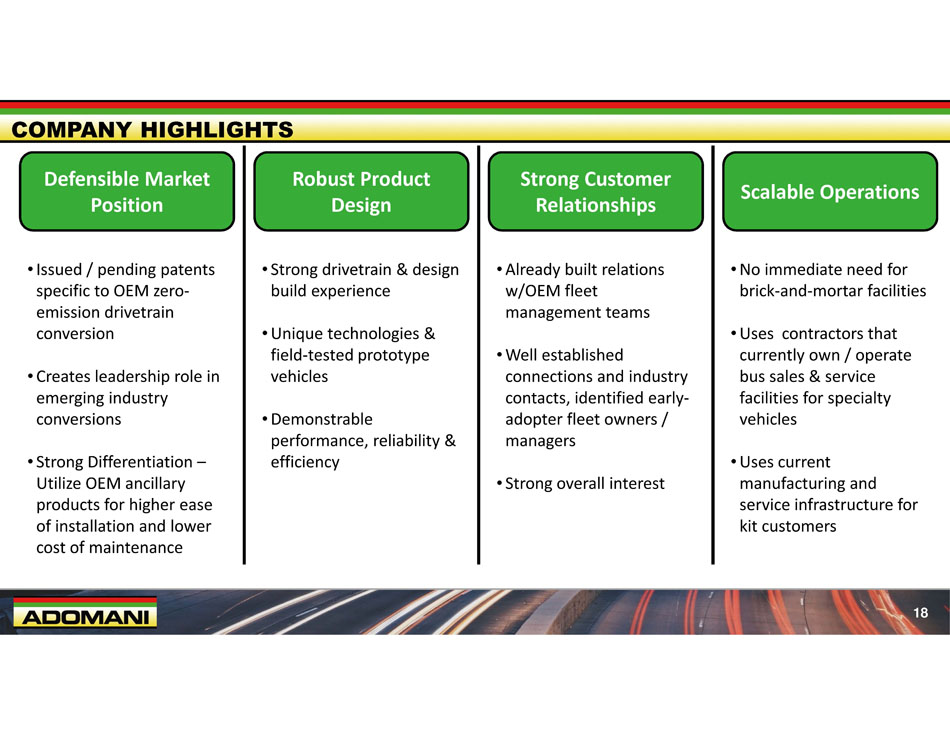

Defensible Market Position Scalable Operations Strong Customer Relationships Robust Product Design • Issued / pending patents specific to OEM zero - emission drivetrain conversion 18 • Creates leadership role in emerging industry conversions • Strong Differentiation – Utilize OEM ancillary products for higher ease of installation and lower cost of maintenance • Strong drivetrain & design build experience • Unique technologies & field - tested prototype vehicles • Demonstrable performance, reliability & efficiency • Already built relations w/OEM fleet management teams • Well established connections and industry contacts, identified early - adopter fleet owners / managers • Strong overall interest • No immediate need for brick - and - mortar facilities • Uses contractors that currently own / operate bus sales & service facilities for specialty vehicles • Uses current manufacturing and service infrastructure for kit customers COMPANY HIGHLIGHTS

California T r e nd s e t ti ng Substantial Market Need Direct Input to/from Regulators Carbon Credit Revenue Stream • CA at forefront of new vehicle sales & funding regarding ZEVs 19 • ADOMANI works within system to influence spending and RFP creation • “Carbon Credits” allow firms to buy credits to meet emission requirements • ADOMANI intends to apply for “Carbon Credits” as it delivers products that qualify • ADOMANI has & continues to build regional, state, & federal relations • ADOMANI well positioned to win grant funding through pilot vehicle demonstrations • Solution for companies to easily convert fleet and new vehicles from internal combustion (ICE) to electric (ZEV) to meet air pollution mandates • Global electric vehicle sales volume is expected to exceed 2 million units in 2019, up from 549,000 units in 2015. China currently accounts for roughly 60% of the global market * COMPANY HIGHLIGHTS * Source: http://www.rnrmarketresearch.com/global - and - china - electric - vehicle - bev - phev - industry - report - 2016 - 2020 - market - report.html

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Notice of AGM

- CTT Systems AB (publ.) - Interim Report First Quarter 2024

- Block listing Interim Review

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share