Form 8-K ABERCROMBIE & FITCH CO For: Jun 14

J u n e 1 4 , 2 0 2 2 A L W A Y S F O R W A R D P L A N 1

Forward-Looking Statements OTHER INFORMATION This presentation includes certain adjusted non-GAAP financial measures and a reconciliation of GAAP to non-GAAP financial measures is included in the Appendix to this presentation. As used in this presentation, "GAAP" refers to accounting principles generally accepted in the United States of America. The company’s two brand-based operating segments are Hollister, which includes the company’s Hollister, Gilly Hicks and Social Tourist brands, and Abercrombie, which includes the company’s Abercrombie & Fitch and abercrombie kids brands. Throughout this presentation, references to financial metrics, plans, goals and targets for "Hollister" include the company's Hollister and Social Tourist brands and financial goals but exclude Gilly Hicks. Financial metrics, plans, goals and targets for "Abercrombie Brands" includes the company's Abercrombie & Fitch and abercrombie kids brands. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, including, without limitation, statements regarding our Always Forward Plan and longer-term goals and targets, relate to our current assumptions, estimates, judgments, expectations, plans, and projections about our business. Words or phrases such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “could,” “may,” “outlook,” “forecast,” “aspire,” “target,” and similar expressions may identify forward-looking statements. Factors that could cause the company's financial targets and estimates to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management, include, but are not limited to, the risks described or referenced in Part 1, Item 1A. “Risk Factors” of the company's Annual Report on Form 10-K for the fiscal year ended January 29, 2022 and otherwise in reports and filings that we have made with the Securities and Exchange Commission (SEC), as well as the following: risks and uncertainty related to the ongoing COVID-19 pandemic, including the potential emergence of additional variants, and any other adverse public health developments; risks related to changes in global economic and financial conditions, and the resulting impact on consumer confidence and consumer spending, as well as other changes in consumer discretionary spending habits; risks related to recent inflationary pressures with respect to labor and raw materials and global supply chain constraints that have, and could continue to, affect freight, transit and other costs; risks related to geopolitical conflict, including the on-going hostilities in Ukraine, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience; risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory; risks related to our ability to successfully invest in customer, digital, and omnichannel initiatives; risks related to our ability to execute on our global store network optimization initiative; risks related to our international growth strategy; risks related to cyber security threats and privacy or data security breaches or the potential loss or disruption of our information systems; failure to protect our reputation; risks associated with climate change and other corporate responsibility issues; and risks related to our ability to attract or retain talent. Additional information will be made available in other reports and filings that we make from time to time with the SEC. These forward-looking statements are subject to risks and uncertainties and the inclusion of such information should not be regarded as a representation by the Company, or any other person, that the objectives of the Company will be achieved. The forward-looking statements in this presentation are based on information presently available to our management and relate only to events as of the date on which the statements are made. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements, including any financial targets or estimates, whether as a result of new information, future events, or otherwise. Investors and others should note that we may announce material business and financial information to our investors using our websites (including corporate.abercrombie.com), filings with the SEC, webcasts, press releases, and conference calls. We use these mediums to communicate with our customers and the public about our company, our products, and other issues. It is possible that the information that we make available may be deemed to be material information. We therefore encourage investors and others interested in our company to review the information that we make available on our websites. 2

ALWAYS FORWARD Fran Horowitz, Chief Executive Officer BRAND GROWTH PLANS Kristin Scott, President, Global Brands Carey Krug, Abercrombie Marketing Robert Zajac, Hollister Marketing BREAK DIGITAL REVOLUTION Samir Desai, Chief Digital & Technology Officer FINANCIAL DISCIPLINE Scott Lipesky, Chief Financial Officer MORNING IN REVIEW Fran Horowitz, Chief Executive Officer Q&A AGENDA I N V E S T O R D A Y J U N E 1 4 , 2 0 2 2 3

S H E / H E R Always Forward Fran Horowitz A L W A Y S F O R W A R D P L A N 4

$4.1B - $4.3B A L WAY S F O R WA R D P L A N REVENUES 8%+ OPERATING MARGIN LONGER-TERM GOAL OF $5B IN REVENUES AND A 10%+ OPERATING MARGIN 2025 TARGETS: 5

Evolved Brand Purpose 2 0 1 7 - 2 0 2 1 A C C O M P L I S H M E N T S Grew Digital Reduced Occupancy Returned Cash to Shareholders 6

DIGITAL REVOLUTION ENTERPRISE-WIDEEXECUTE FOCUSED FINANCIAL DISCIPLINE OPERATE WITH BRAND GROWTH PLANS AUTHENTIC PURPOSE EMBODY OUR 7

We are here for you on the journey to being and becoming who you are O U R C O R P O R AT E P U R P O S E 8

OVER 100K ASSOCIATE VOLUNTEER HOURS PURPOSE-LED PARTNERSHIPS Fiscal year-end 2016-2021 9

TOP TALENT DIVERSITY INCLUSION 10

O N E O F F O R T U N E ’ S BEST PLACES TO WORK IN RETAIL 2 0 2 1 C O R P O R AT E E Q U A L I T Y I N D E X BEST PLACES TO WORK FOR LGBTQ EQUALITY 1 6 Y E A R S I N A R O W 11

Our portfolio is there for our customers’ journeys through different life stages 12

DIGITAL REVOLUTION FINANCIAL DISCIPLINE BRAND GROWTH PLANS AUTHENTIC PURPOSE EMBODY OUR ENTERPRISE-WIDEEXECUTE FOCUSED OPERATE WITH 13

A L W A Y S F O R W A R D P L A N Execute focused brand growth plans 14

We believe every day should feel as exceptional as the start of a long weekend B R A N D P U R P O S E 15

T H E R E I N V E N T I O N O F A FA S H I O N I C O N ABERCROMBIE IS BACK 16

SALES CAGR +6% TO +8% WOMEN’S SALES GROWTH | STORE EXPANSION | BRAND LOVERS 2 0 2 2 – 2 0 2 5 TA R G E T A B E R C R O M B I E B R A N D S 17

We believe in liberating the spirit of an endless summer inside everyone B R A N D P U R P O S E 18

Fiscal year-end 2017-2021 +4% SALES CAGR S I N C E 2 0 1 7 U N I T E D S TAT E S 19

DATA-DRIVEN STORE GROWTH | EMEA STABILIZATION | EXPAND GEN Z BASE SALES CAGR FLAT TO +2% 2 0 2 2 – 2 0 2 5 TA R G E T 20

B R A N D P U R P O S E We believe in making the world a happier place through movement by inspiring and enabling just 10 minutes of activity a day. Play Happy! 21

DOUBLE DIGIT SALES GROWTH Fiscal year-end 2016-2021 S I N C E B R A N D R E L A U N C H : 22

SALES CAGR +15% BRAND AWARENESS | ASSORTMENT ARCHITECTURE | MEN’S EXPANSION 2 0 2 2 – 2 0 2 5 TA R G E T 23

We see the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better everything B R A N D P U R P O S E 24

B R A N D P U R P O S E We are creating a world where you always have the support of your community behind you to fuel new adventures and relationships. Now’s the time when risks are power moves and regrets are just good stories. 25

DIGITAL REVOLUTION FINANCIAL DISCIPLINE BRAND GROWTH PLANS AUTHENTIC PURPOSE EMBODY OUR ENTERPRISE-WIDEEXECUTE FOCUSED OPERATE WITH 26

I N C R E A S E D DIGITAL TO 47% P E N E T R AT I O N R E M O V E D ~25% OF SQ FT - 1 . 6 M G R O S S S Q U A R E F E E T 2 0 1 7 - 2 0 2 1 T R A N S F O R M A T I O N Fiscal year-end 2017-2021 27

ENTERPRISE-WIDE DIGITAL REVOLUTION THEM EVERYWHERE WOW THEM BETTER KNOW 28

DIGITAL REVOLUTION FINANCIAL DISCIPLINE BRAND GROWTH PLANS AUTHENTIC PURPOSE EMBODY OUR ENTERPRISE-WIDEEXECUTE FOCUSED OPERATE WITH 29

THE ONLY CONSTANT IS CHANGE A G I L I T Y & F L E X I B I L I T Y I S K E Y R E TA I L T R U T H 30

BALANCE SHEET STRENGTH T I G H T I N V E N T O R Y M A N A G E M E N T D I S C I P L I N E D C A P I TA L A L L O C AT I O N 31

INVENTORY DISCIPLINE 32

Brand Growth Plans Digital Revolution Financial Discipline Authentic Purpose $4.1B - $4.3B REVENUES 8%+ OPERATING MARGIN 2025 TARGETS: 33

SAMIR DESAI CHIEF DIGITAL & TECHNOLOGY OFFICER CAREY KRUG ABERCROMBIE BRANDS MARKETING ROBERT ZAJAC HOLLISTER BRANDS MARKETING FRAN HOROWITZ CHIEF EXECUTIVE OFFICER KRISTIN SCOTT PRESIDENT, GLOBAL BRANDS SCOTT LIPESKY CHIEF FINANCIAL OFFICER TODAY’S PRESENTERS 34

THE BEST TEAM IN RETAIL STORES | DISTRIBUTION | CORPORATE 35

36

S H E / H E R Brand Growth Plans Kristin Scott A L W A Y S F O R W A R D P L A N 37

5 BRANDS CUSTOMER OBSESSED 3 GENERATIONS 700+ STORES3 REGIONS 38

THEM EVERYWHERE WOW THEM BETTER KNOW 39

40

A L W A Y S F O R W A R D P L A N Execute focused brand growth plans 41

We believe every day should feel as exceptional as the start of a long weekend B R A N D P U R P O S E 42

W E H AV E G R O W N T H E WOMEN’S BUSINESS BY 40% S I N C E 2 0 1 9 43

A D D E D 12+ MILLION NEW CUSTOMERS S I N C E 2 0 1 8 44

45

ABERCROMBIE & FITCH BRAND VIDEO 46

23-40 Years Old 72M Millennials in the U.S. $76B Market1 O UR G ROWT H O P P O RT UN I T Y 1. US Only Market Size; Source: The NPD Group/Consumer Tracking Service, Wearer ages 23-40, 2021 47

DOUBLE-DIGIT WOMEN’S SALES GROWTH STORE EXPANSION GROW BRAND LOVERS 48

DOUBLE-DIGIT WOMEN’S SALES GROWTH Build on current momentum through key categories and franchises G R O W T H S T R A T E G Y 49

D O U B L E - D I G I T W O M E N ’ S S A L E S G R O W T H 50

D O U B L E - D I G I T W O M E N ’ S S A L E S G R O W T H 51

D O U B L E - D I G I T W O M E N ’ S S A L E S G R O W T H 52

YPB VIDEO 53

30-40 NET NEW STORES MARKET-LEVEL SALES & LOCATION DATA STORE EXPANSION G R O W T H S T R A T E G Y A customer-centric experience hub for browsing, buying, or omni activity 54

GROW BRAND LOVERS G R O W T H S T R A T E G Y Authentically engage our customers through digital marketing and social selling 55

S H E / H E R Abercrombie Marketing Carey Krug A L W A Y S F O R W A R D P L A N 56

A B E R C R O M B I E B R A N D T E A M COREY ROBINSON ABERCROMBIE MERCHANDISING & DESIGN HE / HIM JOANNA EWING ABERCROMBIE BRANDS CREATIVE DIRECTOR SHE / HER CAREY KRUG ABERCROMBIE BRANDS MARKETING SHE / HER 57

Our brand purpose was the inflection point for the phenomenal growth we are witnessing today… B R A N D - B U I L D I N G 58

B R A N D - B U I L D I N G …and the beginning of the next great chapter in the Abercrombie story 59

O U R C O M M U N I T YO U R C O U N I T Y Influencers AffiliatesCustomers Editorial Community Brand Partners 60

TIKTOK’S FAVORITE FASHION K N O W N A S B R A N D 61

62

2 0 1 9 2 0 2 0 2 0 2 1 MOST LOVED P RODU CT A W A R D 63

I N F L U EN C ER MA R KET ER O F T H E Y E A R 2 0 2 1 64

T R E N D I N G “A BER C ROMBI E I S BAC K” 9 6 % P O S I T I V E I N 2 0 2 1 65

W I N N I N G O N S O C I A L When leading companies want to innovate, they partner with Abercrombie to participate in their alpha / beta testing 66

#abercrombie hashtags used to-date 343 Million 67

T H E T R E V O R P R O J E C T X A B E R C R O M B I E A community where Everyone Belongs 68

M O V I N G AT T H E PA C E O F T H E C O N S U M E R We have created rich and enduring relationships with our Abercrombie Community 69

Our community agrees: Abercrombie is back 70

ABERCROMBIE IS BACK VIDEO 71

A B E R C R O M B I E B R A N D S +6% to +8% SALES CAGR 2022 - 2025 2 0 2 5 TA R G E T: A L WAY S F O R WA R D P L A N 72

S H E / H E R Brand Growth Plans: Hollister Kristin Scott A L W A Y S F O R W A R D P L A N 73

We believe in liberating the spirit of an endless summer inside everyone B R A N D P U R P O S E 74

HOLLISTER BRAND VIDEO 75

76

W E K N O W G E N Z . 77

U . S . S A L E S GROWN AT 4% CAGR S I N C E 2 0 1 7 Fiscal year-end 2017-2021 78

AT T R A C T E D 20+ MILLION NEW CUSTOMERS S I N C E 2 0 1 8 Fiscal year-end 2018-2021 79

G R E W RETENTION RATE S I N C E 2 0 1 8 Fiscal year-end 2018-2021. US and EMEA only. 80

1. US Only Market Size; Source: The NPD Group/Consumer Tracking Service, Wearer ages 13-22, 2021 H O L L I S T E R 67M GEN ZS IN THE UNITED STATES $ 4 4 B A D D R E S S A B L E M A R K E T 1 81

DATA-DRIVEN STORE GROWTH EMEA STABILIZATION EXPAND GEN Z BASE 82

DATA-DRIVEN STORE GROWTH Hollister Revenue Derived from Stores in 2021 65% Net New Stores 2022 –2025 Plan 30-40 83

EMEA STABILIZATION SALES GROWTH EMEA full-year sales decline from 2019 to 2021 ~$60M Q1 2022 compared to Q1 2021 84

EXPAND GEN Z BASE Market Share Opportunity 1% Market Share Value1 19-22 YO ~$190M 1. US Only Market Size; Source: The NPD Group/Consumer Tracking Service, Wearer ages 19-22, US Dollar sales, 2021 85

H E / H I M Hollister Marketing Robert Zajac A L W A Y S F O R W A R D P L A N 86

Global Teen All Gen Z E X PA N D I N G G E N Z B A S E 87

W E K N O W G E N Z . 88

BRANDLOVE POPULARITY REFLECTING DIVERSITY COOL UNDERSTANDS GEN Z 89

CLUB CALI 3 5 M I L L I O N M E M B E R S $ 6 . 6 B I N R E V E N U E CUSTOMERS A T T R A C T E D 2 0 + M I L L I O N N E W C U S T O M E R S I N C R E A S E D R E T E N T I O N Fiscal year-end 2016-2021Fiscal year-end 2018-2021. US and EMEA only. 90

Since 2017 U N I T E D S TAT E S G R O W T H +4% SALES CAGR S I N C E 2 0 1 7 Fiscal year-end 2017-2021 91

HOLLISTER SIZZLE REEL 92

LOYALTY DRIVEN HUMAN POWERED SOCIALLY FUELED W E A R E W E A R E W E A R E 93

94 T H E H O L L I S T E R C O L L E C T I V E Human Powered

GOOD VIBRAS T H E H O L L I S T E R C O L L E C T I V E Co-creating content and product to celebrate Latinx diversity 95

T H E H O L L I S T E R C O L L E C T I V E GAMING Capturing new audiences, growing the brand and the business 96

T H E H O L L I S T E R C O M M U N I T Y Socially Fueled 97

S O C I A L I N N O VAT I O N COMMERCE +70% Social Sales +80% Instagram Storefront Visitors May 2021- May 2022 98

S O C I A L I N N O VAT I O N SNAPCHAT Leading with technology to drive Brand Love and omnichannel commerce 99

H O L L I S T E R H O U S E R E WA R D S MEMBERSHIP Iterative membership program with evolving benefits and services, tailored to Gen Z 100

H O L L I S T E R FLAT to +2% SALES CAGR 2022 – 2025 2 0 2 5 TA R G E T: A L WAY S F O R WA R D P L A N 101

S H E / H E R Kristin Scott A L W A Y S F O R W A R D P L A N Brand Growth Plans: Gilly Hicks 102

103

104

105

GILLY HICKS BRAND VIDEO 106

G I L LY H I C K S RESONATING WITH 13 TO 40 YEAR OLDS $ 4 7 B A D D R E S S A B L E A C T I V E W E A R M A R K E T 1 1. US Only Market Size; Source: The NPD Group/Consumer Tracking Service, Wearers ages 13-22, 2021 107

GROW BRAND AWARENESS ASSORTMENT ARCHITECTURE BUILD MEN’S BUSINESS 108

GROW BRAND AWARENESS I N C R E A S E MARKETING EFFORTS O P E N 30-40 STORES B y 2 0 2 5 ( P l a n n e d S t a n d a l o n e Fo r m a t s ) 109

ASSORTMENT ARCHITECTURE G R O W ACTIVE CATEGORY TO 50% O f To t a l S a l e s B y 2 0 2 5 110

ASSORTMENT ARCHITECTURE D I S T O R T LOUNGE CATEGORY TO 30% O f To t a l S a l e s B y 2 0 2 5 111

BUILD MEN’S BUSINESS I N C R E A S E MEN’S BUSINESS TO 20% O f To t a l S a l e s B y 2 0 2 5 112

G I L LY H I C K S +15% SALES CAGR 2022 - 2025 2 0 2 5 TA R G E T: A L WAY S F O R WA R D P L A N 113

We see the world through kids’ eyes, where play is life and every day is an opportunity to be anything and better everything B R A N D P U R P O S E 114

B R A N D P U R P O S E We are creating a world where you always have the support of your community behind you to fuel new adventures and relationships. Now’s the time when risks are power moves and regrets are just good stories 115

116

117

H E / H I M Digital Revolution Samir Desai A L W A Y S F O R W A R D P L A N 118

A B E R C R O M B I E & F I T C H H O L L I S T E R A N D G R O W I N G 60% OF REVENUE FROM DIGITAL 300M+ VISITS A YEAR ON DIGITAL 20%+ DTC BUSINESS IN MOBILE APP 2 0 2 1 R E S U L T S 119

THEM EVERYWHERE WOW THEM BETTER KNOW 120

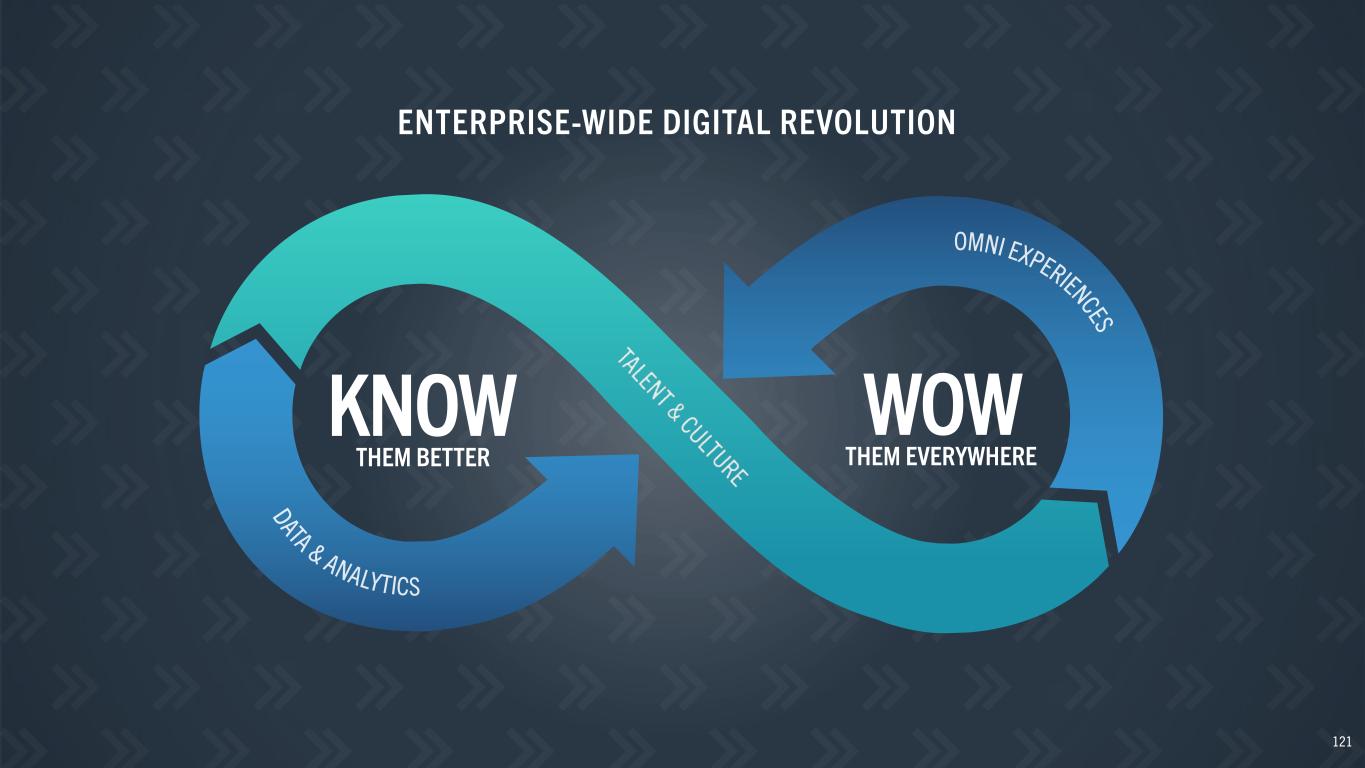

ENTERPRISE-WIDE DIGITAL REVOLUTION THEM EVERYWHERE WOW THEM BETTER KNOW 121

Using AI and machine learning, we now have a 360-degree view of each customer KNOW THEM BETTER 122

Trend | Inventory | Customer Experience | Real Estate Knowing the customer improves how we work KNOW THEM BETTER 123

We use data and digital product testing to predict fashion trends and build seasonal strategies KNOW THEM BETTER 124

Our planning teams are moving to automated algorithms and AI to drive decisions KNOW THEM BETTER 125

We can anticipate customer needs and serve highly personalized experiences KNOW THEM BETTER 126

Data science identifies locations and store formats that will perform best KNOW THEM BETTER 127

STORE LOCATION U S I N G D ATA T O I N F O R M C H I C A G O , I L L I N O I S OPENINGS <‘21 ’22 128

DATA DRIVEN WITH AGILITY CUSTOMER OBSESSED RESULTS ORIENTED LEARN FAST TALENT & CULTURE We operate more like a tech company than a traditional retailer 129

TALENT & CULTURE We have built a team of top talent from leading brands and businesses 130

TALENT & CULTURE We are building a digital academy and citizen developers to maximize talent 131

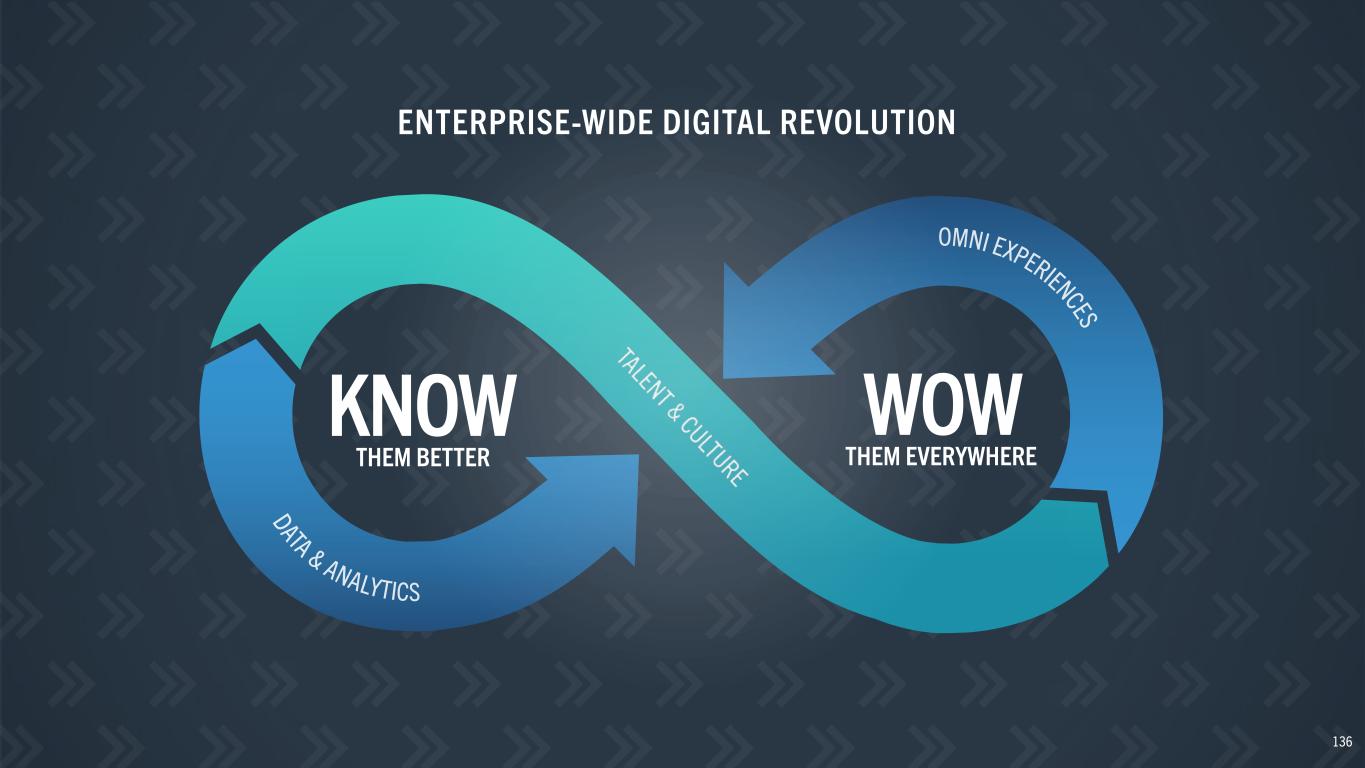

ENTERPRISE-WIDE DIGITAL REVOLUTION THEM EVERYWHERE WOW THEM BETTER KNOW 132

We are modernizing our foundational systems WOW THEM EVERYWHERE ERP Platform | Database | Supply Chains | Integration Associate Experience | Store Experience 133

The future of retail is retail everywhere WOW THEM EVERYWHERE Discovery | Browse | Purchase | Fulfillment | Loyalty 134

I N S T O R E A T H O M E WOW THEM EVERYWHERE 135

ENTERPRISE-WIDE DIGITAL REVOLUTION THEM EVERYWHERE WOW THEM BETTER KNOW 136

H E / H I M Financial Discipline Scott Lipesky A L W A Y S F O R W A R D P L A N 137

138 A LWAY S FO R WA R D P L A N CREATING SHAREHOLDER VALUE 2 0 2 5 TA R G E T S +3% TO 5% SALES CAGR OFF 2022 8%+ OPERATING MARGINS INVESTMENT DISCIPLINED & AGILE PLAN FREE CASH FLOW $600M MINIMUM GENERATION 2022-2025 138

$642M 2018 - 2021 2 0 1 7 – 2 0 2 1 R E S U L T S RETURNED CASH TO SHAREHOLDERS GREW SALES LOW-SINGLE DIGIT CAGR 9.6% EXPANDED GROSS MARGIN ADJUSTED 2021 LEVERAGED EXPENSES TRIPLED 2017 ADJUSTED OPERATING MARGIN 2 0 1 8 I N V E S T O R D A Y G O A L S 139

$4.1B - $4.3B REVENUES 8%+ OPERATING MARGIN LONGER-TERM GOAL OF $5B IN REVENUES AND A 10%+ OPERATING MARGIN A L WAY S F O R WA R D P L A N 2025 TARGETS: 140

A L W A Y S F O R W A R D P L A N FINANCIAL PRINCIPLES EXPECTED LOW- TO MID- SINGLE DIGIT SALES GROWTH CAGR FROM 2022 - 2025 INVESTMENTS IN DIGITAL, TECH, AND STORE GROWTH UTILIZE A PORTION OF EXCESS FREE CASH FOR SHARE REPURCHASES REFLECTS ASSUMPTIONS ON INFLATION AND CONSUMER HEALTH 141

A L W A Y S F O R W A R D P L A N SALES GROWTH BY BRAND 2 0 2 2 T O 2 0 2 5 T A R G E T C A G R +6% TO +8% FLAT TO +2% +15% 142

+2% TO +4% +4% TO +6% +LOW-DOUBLE DIGIT % E M E A A P A C A L W A Y S F O R W A R D P L A N SALES GROWTH BY REGION 2 0 2 2 T O 2 0 2 5 T A R G E T C A G R U N I T E D S TA T E S 143

SALES GROWTH BY CHANNEL A L W A Y S F O R W A R D P L A N 2 0 2 2 T O 2 0 2 5 T A R G E T C A G R +MID-SINGLE +LOW-SINGLE D I G I TA L S T O R E S D I G I T % D I G I T % ~50% DIGITAL PENETRATION RETURN TO NET STORE OPENERS 144

2 0 1 7 T O 2 0 2 1 DIGITAL SALES GROWTH $150M INVESTED IN DIGITAL & TECH $750M GROWTH IN DIGITAL SALES INVEST IN PEOPLE, SYSTEMS, AND TOOLS MOVE AT THE SPEED OF OUR CUSTOMER A L W A Y S F O R W A R D P L A N 2 0 2 2 T O 2 0 2 5 145

2 0 1 7 - 2 0 2 1 POSITIONING FOR GROWTH S TO R E F L E E T 146

STORE FLEET OPTIMIZATION 868 6.7M A L W A Y S F O R W A R D P L A N 729 5.1M $660M $430M ~15% ~20% STORE COUNT GROSS SQ. FT. OCCUPANCY FOUR-WALL OP MARGIN %* 2 0 1 7 2 0 2 1 * N O N - G A A P . S E E A P P E N D I X . 147

STORE FLEET OPPORTUNITY 729 5.1M A L W A Y S F O R W A R D P L A N 825 2 0 2 5 $430M +3% to +5% ~20% >20% STORE COUNT GROSS SQ. FT. OCCUPANCY F U N D A M E N T A L S OMNI-ENABLED; MORE OFF-MALL LOCATIONS NEW STORES BETWEEN 2,500 - 6,000 SQ. FT. ~2-YEAR PAYBACK FOR NEW A&F AND HCo STORES * N O N - G A A P . S E E A P P E N D I X . FOUR-WALL OP MARGIN %* +3% to +5% 2 0 2 1 148

149 59.7% 60.2% 59.4% 60.5% 62.3% 2017 2018 2019 2020 2021 GROSS MARGIN A L W A Y S F O R W A R D P L A N 149

$100M NET FREIGHT & RAW MATERIALS HEADWIND VS 2021 2 0 2 5 Y E A R E N D 62.3% 2 0 2 1 60% - 63% MODEST AUR BENEFIT A&F BRAND MIX BENEFIT GROSS MARGIN A L W A Y S F O R W A R D P L A N 150

I N V E N T O R Y M A N A G E M E N TQ 1 2 0 2 2 E N D I N G U N I T S O N H A N D ~93% CURRENT CURRENT UNIT INVENTORY COMPOSITION DISCIPLINE FY 2022 RECEIPT UNITS FLAT VS 2021 CONTINUOUS RIGHT-SIZING OF UNIT BUYS 7% CLEARANCE CARRYOVER (1%) vs. Q1 LY 19% +5% vs. Q1 LY FUTURE SET 16% (4%) vs. Q1 LY LONG-LIFE 58% Flat vs. Q1 LY SEASONAL 151

I N V E N T O R Y M A N A G E M E N TQ 1 2 0 2 2 E N D I N G U N I T S O N H A N D ~93% CURRENT CURRENT UNIT INVENTORY COMPOSITION DISCIPLINE EXPECT FY 2022 RECEIPT UNITS FLAT VS. 2021 CONTINUOUS RIGHT-SIZING OF UNIT BUYS 7% CLEARANCE CARRYOVER (1%) vs. Q1 LY 19% +5% vs. Q1 LY FUTURE SET 16% (4%) vs. Q1 LY LONG-LIFE 58% Flat vs. Q1 LY SEASONAL 152

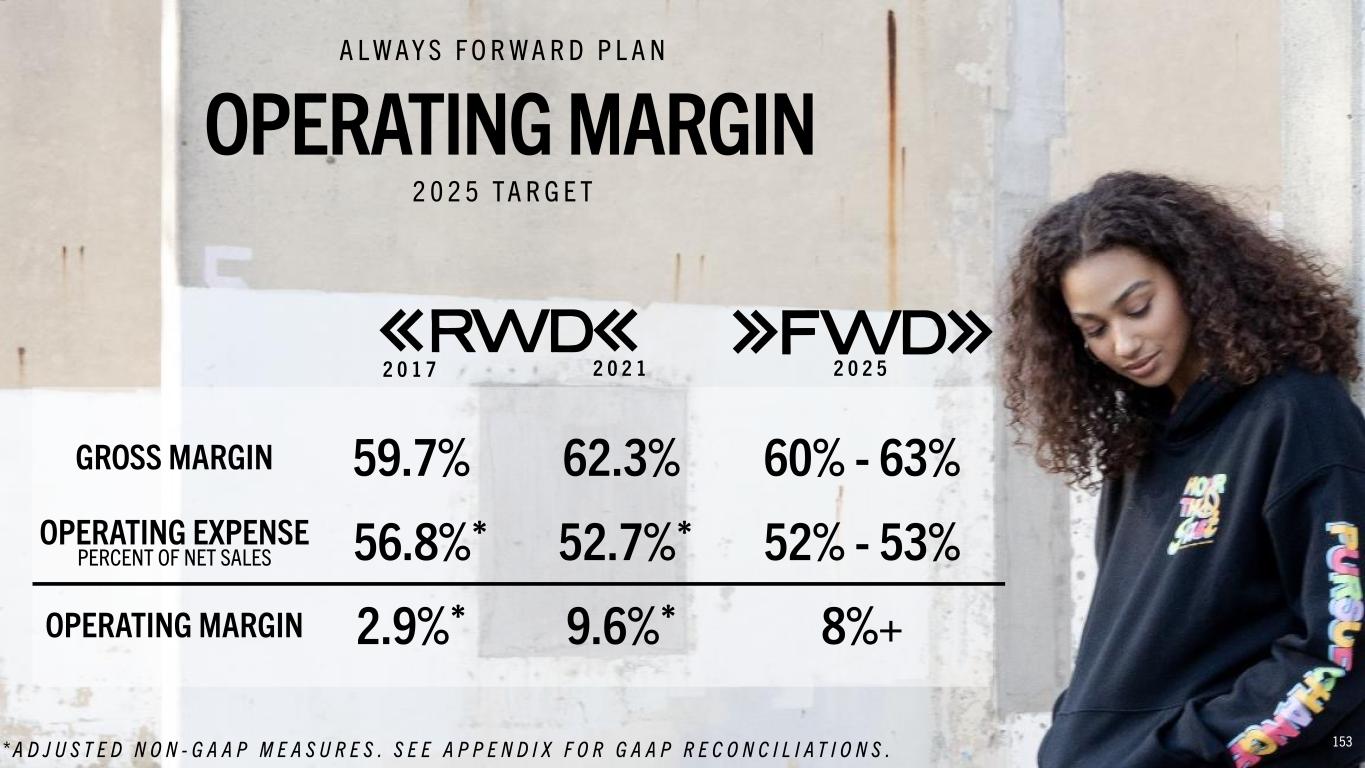

153 OPERATING MARGIN A L W A Y S F O R W A R D P L A N 2 0 2 5 T A R G E T 2 0 1 7 59.7% 62.3% 2 0 2 1 56.8%* 52.7%* 2.9%* 9.6%* GROSS MARGIN OPERATING EXPENSE OPERATING MARGIN 60% - 63% 2 0 2 5 52% - 53% 8%+ * A D J U S T E D N O N - G A A P M E A S U R E S . S E E A P P E N D I X F O R G A A P R E C O N C I L I A T I O N S . PERCENT OF NET SALES 153

CAPITAL ALLOCATION STRATEGY A L W A Y S F O R W A R D P L A N $700M Minimum Liquidity Target EXCESS $700M Minimum Liquidity Target 2021 2025 LONGER-TERM Increasing Capital Investments into the Business Maintaining Serial Share Repurchaser Mentality Dividend and / or Debt Repayment 154 154

CAPITAL INVESTMENT PLAN A L W A Y S F O R W A R D P L A N 155 DIGITAL & TECHNOLOGY STORES OTHER SUPPLY CHAIN 2 0 2 2 T O 2 0 2 5 TA R G E T $150M - $175M ANNUALLY 155

SHAREHOLDER RETURNS A L W A Y S F O R W A R D P L A N 2 0 1 8 – 2 0 2 1 $7 82 M $6 42 M F R E E C A S H F L O W * R E T U R N T O S H A R E H O L D E R S 2 0 2 2 - 2 0 2 5 $6 00 M + F R E E C A S H F L O W * SHARE REPURCHASES: $524M OUTSTANDING SHARE REDUCTION: >20% DIVIDENDS: $118M EXPECT TO COMMIT A PORTION OF FREE CASH FLOW TO STEADY SHAREHOLDER RETURNS 156* N O N - G A A P M E A S U R E S . S E E A P P E N D I X .

157 A LWAY S FO R WA R D P L A N CREATING SHAREHOLDER VALUE 2 0 2 5 TA R G E T S +3% TO 5% SALES CAGR OFF 2022 8%+ OPERATING MARGINS INVESTMENT DISCIPLINED & AGILE PLAN FREE CASH FLOW $600M MINIMUM GENERATION 2022-2025 157

We are here for you on the journey to being and becoming who you are O U R C O R P O R AT E P U R P O S E 158

159

Q&A 160

161 APPENDIX A L WAY S F O R WA R D P L A N

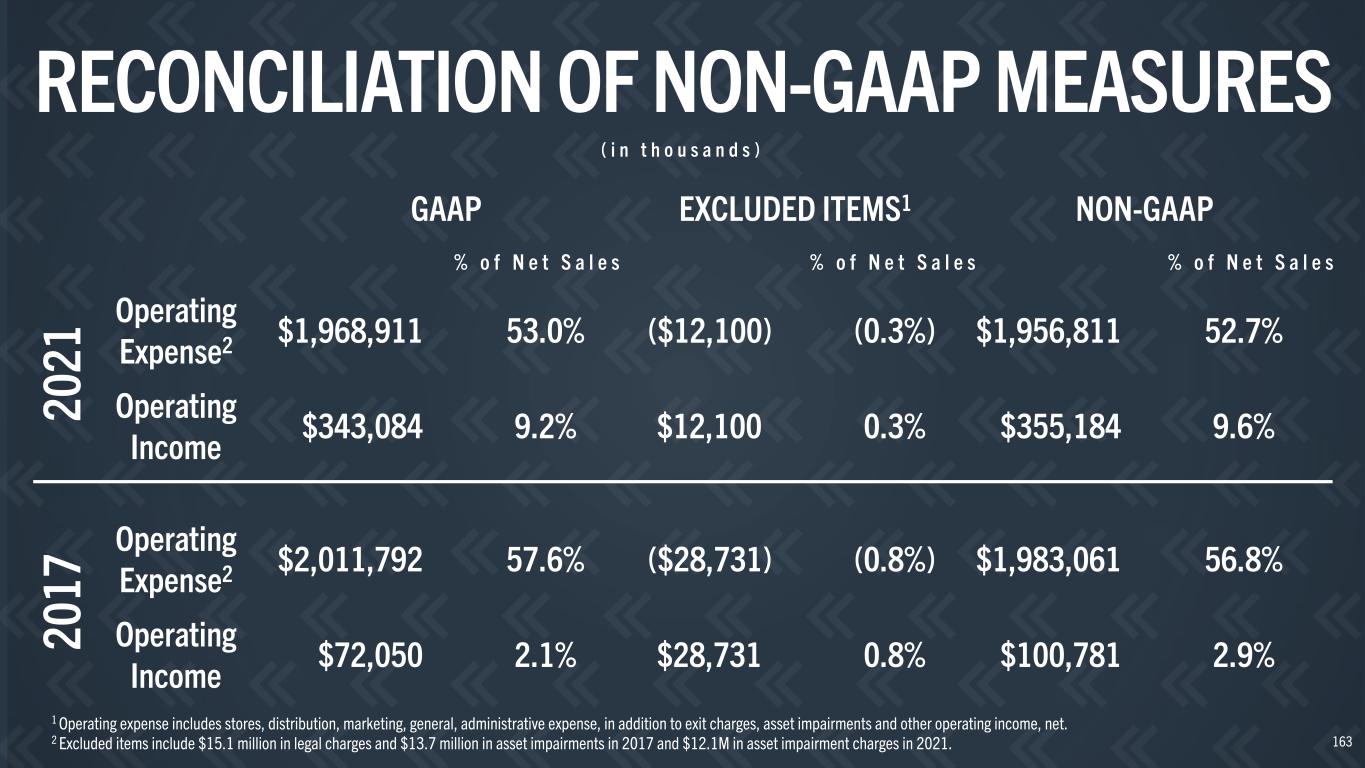

USE OF NON-GAAP MEASURES The non-GAAP metrics discussed in this presentation include adjusted operating expense, adjusted operating income, and free cash flow. The company believes that each of the non-GAAP financial measures presented herein are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items, which the company believes do not reflect its future operating outlook, such as certain asset impairment charges related to the company’s flagship stores and charges related to certain legal matters , and are used by management to evaluate the comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplementally to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies. Free cash flow is calculated as cash flows generated from operations less cash flows used for capital expenditures. The company uses free cash flow as a measure to assess the company’s liquidity and determine cash remaining for general corporate and strategic purposes as well as the amount of cash available to return to stockholders pursuant to the company's capital allocation strategy. Accordingly, the company believes free cash flow is useful to investors. The most directly comparable GAAP financial measure is net cash provided by operating activities. This presentation also refers to certain non-GAAP store-level metrics, including 4-wall operating margins. Store-level 4-wall operating margins exclude certain components of the company’s results of operations, including but not limited to, amounts related to marketing, depreciation and amortization of home-office and IT assets, distribution center expense, direct-to-consumer expense, and other corporate overhead expenses that are considered normal operating costs as well as all asset impairment and flagship store exit charges. This measure also excludes certain product costs related to direct-to-consumer, wholesale, licensing and franchise operations as well as variances from estimated freight and import costs, and provisions for inventory shrink and lower of cost or net realizable value. In addition, this metric excludes revenue other than store sales and does not include gift card breakage. As such, store-level 4-wall operating margin is not indicative of the overall results of the company and does not accrue directly to the benefit of shareholders because of these exclusions. The company provides store-level 4-wall operating margins on occasion because it believes that it provides a meaningful supplement to the company’s operating results. 162

RECONCILIATION OF NON-GAAP MEASURES 1 Operating expense includes stores, distribution, marketing, general, administrative expense, in addition to exit charges, asset impairments and other operating income, net. 2 Excluded items include $15.1 million in legal charges and $13.7 million in asset impairments in 2017 and $12.1M in asset impairment charges in 2021. Operating Expense2 Operating Income $355,184 9.6% ($12,100) (0.3%) EXCLUDED ITEMS1 $12,100 0.3% $1,956,811 52.7% % o f N e t S a l e s NON-GAAP $1,968,911 53.0% % o f N e t S a l e s GAAP $343,084 9.2% % o f N e t S a l e s 20 21 Operating Expense2 Operating Income $100,781 2.9% ($28,731) (0.8%) $28,731 0.8% $1,983,061 56.8%$2,011,792 57.6% $72,050 2.1%20 17 163 ( i n t h o u s a n d s )

RECONCILIATION OF NON-GAAP MEASURES Net cash provided by operating activities Less: Purchases of property and equipment Free Cash Flow $277,782 2 0 2 1 $96,979 $180,803 164 $404,918 2 0 2 0 $101,910 $303,008 $300,685 2 0 1 9 $202,784 $97,901 $352,933 2 0 1 8 $152,393 $200,540 $1,336,318 C u m u l a t i v e 2 0 1 8 - 2 0 2 1 $554,066 $782,252 ( i n t h o u s a n d s ) $300,000+ Ta r g e t A v e r a g e A n n u a l 2 0 2 2 - 2 0 2 5 $150,000 to $175,000 $150,000+

REFINITIV STREETEVENTS EDITED TRANSCRIPT ANF.N - Abercrombie & Fitch Co Investor Day EVENT DATE/TIME: JUNE 14, 2022 / 1:00PM GMT REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies.

C O R P O R A T E P A R T I C I P A N T S Carey Krug Abercrombie & Ftich Co. - Head of Marketing Abercrombie & Fitch Fran Horowitz Abercrombie & Fitch Co. - CEO & Director Kristin Scott Abercrombie & Fitch Co. - President of Global Brands Pamela Nagler Quintiliano Abercrombie & Fitch Co. - VP of IR Robert Zajac Abercrombie & Fitch Co. - Head of Marketing Hollister Samir Desai Abercrombie & Fitch Co. - Executive VP and Chief Digital & Technology Officer Scott D. Lipesky Abercrombie & Fitch Co. - Executive VP & CFO C O N F E R E N C E C A L L P A R T I C I P A N T S Corey Tarlowe Jefferies LLC, Research Division - Equity Analyst Dana Lauren Telsey Telsey Advisory Group LLC - CEO & Chief Research Officer Kimberly Conroy Greenberger Morgan Stanley, Research Division - MD Marni Shapiro The Retail Tracker - Co-Founder Matthew Robert Boss JPMorgan Chase & Co, Research Division - MD and Senior Analyst Mauricio Serna Vega UBS Investment Bank, Research Division - Analyst Paul Lawrence Lejuez Citigroup Inc., Research Division - MD and Senior Analyst Susan Kay Anderson B. Riley Securities, Inc., Research Division - VP & Analyst Janet Kloppenburg JJK Research Associates - President James Corcoran P R E S E N T A T I O N Pamela Nagler Quintiliano - Abercrombie & Fitch Co. - VP of IR All right. So good morning, everyone. On behalf of the Abercrombie team, welcome to our 2022 Investor Day. We're thrilled to be here live with you all in New York City. And for those who are unable to make it in person, today's conference is being webcast and recorded. Earlier this morning, we issued the press release, which is available on our company website at corporate.abercrombie.com in the Investors section. Also available on our company website in the Investors section is today's presentation. Please keep in mind that any forward-looking statements made by the company today are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information available to the company currently and are subject to risks and uncertainties that could cause actual results to differ materially from the 2025 and long-term targets, goals, expectations and assumptions we mention today. A detailed discussion of these risk factors and uncertainties is contained in the company's annual report on Form 10-K and our other reports and filings we may make with the Securities and Exchange Commission. In addition, we will be referencing certain non-GAAP financial measures during this presentation. Additional details and a reconciliation of GAAP to adjusted non-GAAP financial measures are included in the appendix to the presentation. 2 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

And with that, just want to take a moment for a few housekeeping items. This morning, we're very excited to talk about our Always Forward Plan. Because the vast majority of the second quarter is still ahead of us, you all know how important back-to-school is, we're not going to be commenting on intra-quarter trends today. From an operating segment and reporting perspective, when we discuss Abercrombie brands, it does include Abercrombie adults and kids. Hollister, as a reminder, includes Hollister, Gilly Hicks and Social Tourist. We will be discussing Gilly Hicks separately today as well, which I know you're all excited about and then providing annual revenues on Gilly at the end of the year. So Social Tourist, talking about it today, but it's currently immaterial in sales. For the purpose of brand conversations this morning, when we mentioned Hollister, it's going to be focused on the Hollister brand. Now walking you quickly through the cadence of the day. On the back of your name tags, you see a QR code, that provides today schedule. It also has the Wi-Fi passcode for the event. And we're going to be kicking off this morning with our CEO, Fran Horowitz. From there, you're going to hear our other senior leaders in the organization to tell you all about what they do. The presentations are scheduled to last until noon. There's going to be a few breaks throughout the morning to refresh, recharge, check out our store build-outs, we're really excited about those. They have recently updated elements for Abercrombie, Hollister, Gilly, Social Tourist, kids, all our brands are there. And you also have the opportunity to meet the leaders who make it all happen. So make sure to talk to our merchants because you don't get that opportunity very often. Following the presentations, we have a Q&A session. We do ask that you hold all of your questions for our presenters until then. And then after that, we have some lunch for you all as well with our senior leaders. And I know you love seeing Fran and Scott. And we haven't had a chance to be in person that often. So we've seen a lot of you virtually. But this is also a really great chance to interact with our other senior leaders and meet additional members of our team. So with that, let's get started. It's my absolute pleasure to introduce our very first presenter of the day, Chief Executive Officer, Fran Horowitz. Fran Horowitz - Abercrombie & Fitch Co. - CEO & Director Thanks, Pam, and good morning, everyone. What a time to come together. It has been a little over 4 years since our last Investor Day. And during that time, the world and our company have changed significantly. Today, we are fundamentally different than we were just a few short years ago, having transformed who we are and how we operate. While some of these changes were planned, some of them were clearly unexpected, reflecting the many unprecedented challenges and associated opportunities that have certainly come our way. Standing before you today, I want to be clear. Our eyes, wide open. We understand that the world, the economy, the customer, retail has changed tremendously. We're at a crossroads again in retail. And the global economies are moving in very different directions. And over the past few years, we have consistently proven our ability to navigate through unprecedented challenges while maintaining a focus on making progress on our long-term goals. And I'm excited today to share our Always Forward Plan. We have targeted $4.1 billion to $4.3 billion in revenues with a operating margin at or above 8% by the end of fiscal 2025. Longer term, our aspiration is to be a global omnichannel retailer with $5 billion in revenues and operating margin at or above 10%. But for the purpose of this morning's discussions, we will focus on how we are going to achieve our 2025 target through our powerful family of brands. Our Always Forward Plan reflects the current dynamic environment with an expectation to be clear for the known and the unknown consumer pressures that will emerge. And this provides us, which is very important to realize, multiple avenues to achieve our goals, giving us the confidence that we can meet our 2025 term -- 2025 and longer-term goals while continuing to deliver very strong shareholder returns. So before we go forward, let's just -- let's go back quickly and let's look at all the accomplishments since our last Investor Day from 2017 through 2021 and what we have been able to accomplish. 3 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

We've evolved the purpose and positioning at each of our brands, executing a turnaround at Abercrombie adults that many, many thought was impossible. And we grew our U.S. Hollister business at a 4% CAGR when the teen market has been declining, slightly declining since 2018. We've increased our digital penetration to 47% from roughly 1/3 pre-pandemic. Digital sales are $1.7 billion. We reduced our occupancy costs by $200 million, removing roughly 1.6 million underproductive square feet. And we generated $780 million of free cash flow, roughly returning $640 million to shareholders through share repurchases and dividends while maintaining our strong balance sheet. And today, we have purpose-led brands and a solid underlying foundation and a clear vision of who we are and who we want to be. And we can adjust to the environment faster than ever before. And that is why when our customer invests in apparel, they will continue to choose us. As we look forward, our Always Forward Plan is anchored in 3 key strategic principles. We are going to have executed -- we're going to execute focused brand growth plans, an enterprise-wide digital revolution and we will continue to operate with financial discipline. And over the next few years -- over the next few hours, you'll hear from our team on the specifics of these principles. And needless to say, they will inform on how we invest, how we grow and how we engage. We'll also discuss our key assumptions around the global consumer and inflation and how we will be agile with our investments and growth with the underlying assumption that we will continue to adapt to our customer and the broader environment. So our strategic principles are rooted in our corporate purpose, we are here for you on the journey to being and becoming who you are. Because we believe that when people are free to be who they are, truly are, they can reach their full potential. And each generation brings an opportunity to not -- to change the world for good. We've worked hard on that purpose, and I love what that stands for. Each brand must exemplify our corporate purpose and in turn, in their unique brand purposes. While fashion trends come and go, the best retailers intimately know their customer. That informed view is woven into the DNA of the company and its brands. It is a focus that keeps customers coming back season after season and generation after generation. Our corporate purpose is especially meaningful given our customers range from age 5 through the millennial. So we are truly with them through their formative years as they physically and mentally grow with us. They are change agents of the world, and we learn so much from them and we strive to support the causes that they collectively care about. And these center around inclusivity, mental health and wellness, being your authentic self and making the world a better place, all of which ladder back to our purpose. Our customers and our beliefs are partnerships, such as the Serious Fun Network, The Trevor Project, GLSEN, The Academy Group, The Steve Fund. Our relationships with our partners are not transactional. I'm very clear with the team when we make these relationships, that they need to be engagements and they need to have volunteers in support with them. And that's what we have created with all these long-term partnerships. We also use these partnerships to help inform our lens for our influence and affiliate partnerships. Our beliefs must align and track to our purpose. And our purpose has not only been our customers, it's about our associates. We take great pride in our associate engagement opportunities, including our highly competitive leadership development program, where recent undergraduates participate in a multidimensional rotational experience. In addition, we have created associate resource groups for our BIPOC, LGBTQIA+, women's and family team members that we can better support each of them. And we actively solicit feedback from our store employees who lead our customer interaction day in and day out. And collectively, this information is invaluable. Our culture and associate focus are key components of our foundation and what positions us for ongoing success. Last year, an incredibly proud moment, we were named one of Fortune's Best Places to Work in Retail. It was also our 16th year being an HRC Best Places to Work for LGBTQ Equality, super excited and very proud of that. Today, we have a purpose-led company and powerful family of differentiated brands, which is something I couldn't say when I joined this company in 2014. We cater to kids to millennials, and we tailor our product voice and experience to appropriately connect with them at the different stages of their lives. We authentically speak to and listen to them and we've gained their trust and respect, and we do not take that for granted. And the 4 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

benefit of having that diversity of brands that we are not dependent on just one customer, economy or fashion cycle for us to be able to achieve our long-term goals. Purpose interacts how we attract with our customers and communities and engage with our teams and partners. It also applies to how we approach our brands as each is on its unique journey. So let's take a few minutes and dive into each one of our principles, and we're going to start with execute focused brand growth plans. Our Always Forward Plan 2025 targets a [3-5%] (corrected by company after the call) sales CAGR of 2022 levels with Abercrombie adults, Hollister and Gilly Hicks serving as our main opportunities for growth. So let's start with Abercrombie adults, which we currently view as our largest growth story. At Abercrombie adults, we believe every day should feel as exceptional as the start of a long weekend. We introduced our updated brand positioning and purpose in early 2019. And we bring that to life every day through our commitments to outfitting the young millennial for their busy and active lives, both on social media and in real life. Our updated positioning and purpose is truly resonating with our target customer. We have received accolades. Abercrombie is back, and we could not agree more. What the Abercrombie team has accomplished is truly phenomenal and rarely seen in retail. There's also been commentary on our past practices. And you know what, we own our past. But I want to clearly state in front of you all that we are fundamentally different company today with a focus on inclusivity and belonging. And since the day I joined, we have worked to change the present and positively impact the future and that is a nonnegotiable. Since the turnaround first began to gain traction, Abercrombie adults has outpaced the broader U.S. apparel market with women's growing around 60% since 2019. We currently have significant momentum at Abercrombie adults. And this is very important because our sales and margin perspective as Abercrombie adults carries the highest growth and operating margin of our brands, reflecting its above-company average digital penetration and AUR. It also caters to the highest income demographic of all of our brands with almost 30% of its customers coming from households making over $150,000 per year. Our Always Forward Plan assumes that we grow total Abercrombie sales, which includes kids to a 6% to 8% sales CAGR 2022 through 2025. We expect Abercrombie adults to grow at a rate above the total brand sales CAGR, adding $300 million to $450 million of revenues by 2025. So where is this growth going to come from? First, building on momentum in the key women's categories and franchise collections that have been driving results, including jeans, best dressed guest and our newest YPB, Your Personal Best. Second, opening smaller, more omni-enabled locations globally. These will continue to look different than the past as we lean into data and analytics, to dictate an ideal size, location and product offering for each market, like our recently opened store Southport location in Chicago, which is already one of our most productive locations. And we will also continue our industry-leading efforts in digital marketing and social selling, which our teams have won multiple awards over the past few years. Okay. So let's turn to Hollister. Hollister targets Gen Z consumer with the purpose, liberating the spirit of an endless summer inside everyone by offering an optimistic California-inspired assortment. So over the past few years, Hollister has been the tale of 2 worlds, the U.S. and international. And from 2017 to 2021, our U.S. business has grown at a 4% CAGR even as we have reduced our store count to a base of 351. Growth was achieved despite a deceleration in the teen apparel market since 2018. As such, we're confident that Hollister U.S. is well positioned to sustain these levels of growth. Unfortunately, the strength of Hollister has been offset by international, which has contracted over 20% in the face of COVID-related lockdowns and restrictions, reflecting outsized exposure in EMEA and APAC relative to our other brands. As we look at 2025, we are focused -- we're forecasting total sales CAGR in the flat to plus 2% range for just the Hollister brand, adding up to $100 million from 2022 levels. We believe it's appropriate to apply a conservative growth rate until we can gain more visibility on the impact of inflationary pressures. The Hollister brand's penetration among high-income households is significantly smaller than A&F on a percent to total basis with almost 5 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

45% of this customer at a household income of under $75,000 per year. As we anniversary an environment that includes stimulus, we expect this cohort to be more economically sensitive but have planned accordingly and remain confident in our ability to convert traffic based on our trend-right apparel mix. So for Hollister, where will we focus? We're going to focus, first, net store openings as we fill white space in U.S. and Western European markets. Similar to Abercrombie, we'll leverage data and analytics to support our store size, location and product mix. We captured a portion of lost sales in EMEA as the region works through macroeconomic challenges, and we're going to continue to broaden our Gen Z customer base. The older Gen Z customer, aged 19 to 22, loves our brand. But it's told us we do not offer a product that caters specifically to them. We expect to capitalize on this opportunity by offering more elevated styles that we know will resonate with this older Gen Z consumer. Gilly Hicks, our third area of opportunity. At Gilly Hicks, we strive to help our customers play happy with men's and women's active, lounge and intimates that have a broad appeal from Gen Z through millennials. 2021 was a very important year for Gilly. We embarked on a successful brand relaunch, opened a first of its kind stand-alone store and introduced a small assortment of men's product. It has been steadily building momentum since we brought back the brand from dormancy in 2016, and that accelerated last year with the brand relaunch. So Gilly. We expect to grow Gilly at roughly a 15% CAGR through fiscal year-end 2025 to about $170 million of revenues from approximately $110 million this year. While off a lower dollar base than Abercrombie adults, on a percentage basis, Gilly Hicks represents a significant growth opportunity. We will pursue growth by building brand awareness through marketing and store openings. And currently, product lives in all Hollister stores globally. We also have 2 freestanding locations and with a third set to open this week and 30 side-by-side locations. So we are excited about the opportunity to expand Gilly beyond the walls of Hollister and have plans for additional stores this year. We, as you hear us say frequently, we are a test-and-learn culture. We will learn from this first wave of stores and use the learnings to inform the store growth through 2025. In addition, we will emphasize our active assortment, which has been the top-performing category since it was introduced in 2020 and we also will continue to broaden our men's assortment. I'll quickly touch on kids and Social Tourist to close out our brand conversation. Abercrombie kids offers 5 to 16 and abides by play is life motto, always emphasizing kindness. We view kids as a stable business and are not assuming incremental growth in our 2025 target. And Social Tourist, which was introduced just last year, caters to the older Gen Z and younger millennial by providing an edgier, more fashion forward vibe that fits into their social-first lifestyle. At Social Tourist, we will continue to add digital and social learnings and thoughtfully apply those to all brands while leaning further into our relationships with leading social providers, including TikTok, Instagram and Snapchat. We view growth from kids and Social Tourist to be upside to our plan. Now let's turn to our second strategic principle, accelerate an enterprise-wide digital revolution. The customer expectation for a seamless experience continues to rise quickly. And to win in retail today and in the future, we must connect with them on all channels. With our brand plans focused and prioritized, our digital revolution is truly the how we will evolve our company and omni experience to meet them wherever, whenever, however they choose to shop with us. This experience is not the same for every customer or even every brand, which Kristin and Samir will discuss in more detail shortly. So we are actually approaching our digital revolution from a position of strength. In 2021, our digital sales penetration rose to 47% from roughly 1/3 pre-pandemic. And digital carries a higher 4-wall operating margin than our stores. And importantly, as digital demand significantly accelerated, we were able to keep pace due to the consistent investments we have made over the years. So digital goes hand-in-hand with the physical store experience and balancing digital fulfillment and occupancy is critical to maintaining and expanding profitability. As our digital sales have grown, we have been optimizing our store fleet. We removed 25% of our square footage or about 1.6 million underproductive square -- gross square feet, which reduced our occupancy costs by over $200 million. As we closed those underperforming locations, we improved our existing store experiences. We expanded digital capabilities by our store associates and our omnichannel capabilities to include curbside and 6 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

same-day delivery. And we fully integrated devices for mobile payment in stores and ramped personalization efforts tailoring our digital sites to match our customer expectations. So to date, our digital preparation has been a mix of what we call table stakes and innovation. And in the future, we plan to accelerate our investments in innovation, digital agility and modernizing our core platforms. We are approaching our digital revolution in 2 ways, Know Them Better and Wow Them Everywhere. So first, well, we pride ourselves on staying close to our customers through our Always Forward plan, we will turn that strength into a key competitive advantage by knowing our customers even better. We will build on our unrelenting customer obsession through expanding and accelerating our investment in best-in-class customer analytics to determine what drives them and how they want to engage and what they want from us. Next, Wow Them Everywhere. While in the past, we have talked about how the line between stores and digital has blurred, today, there's no line. Customer engagement and commerce is not limited to 2 channels, it happens on social, it happens to partnerships and it will happen through the metaverse. As customer expectations continue to rise, we are proactively building our teams and our systems to continue to meet and exceed our customers' expectations and provide a break through digital retail experience. And third, operate with financial discipline. This has been an area of focus since the day I walked on to campus in 2014. I'll underscore this by one of my favorite expressions, which is, the only constant in retail is change. And over the last few years, that could not be more true. The moves that we have made over the past 4 years have fundamentally improved our operating model and shifted us to a more agile cost structure with less fixed occupancy and more variable fulfillment and marketing. We've also transformed our end-to-end product life cycle to enable agility and flexibility around the products we deliver and the levels of inventory we buy. Our updated operating model and strong balance sheet will fuel the investments in our Always Forward Plan. Over the past 4 years, we've generated $1.3 billion of operating cash flow. We've invested $500 million back into the business, resulting in $780 million of excess cash flow -- free cash flow, excuse me. Going forward, we expect to continue to deliver the cash flow needed to organically fund our investments while continuing to return cash to shareholders. We are committed to maintaining our expense discipline. We'll continue to seek expense efficiencies while protecting and funding our Always Forward ambition. While we're on the topic of balance sheet, I'd like to take a moment to discuss inventory. So today is about the future, but we thought it was very important just to take a moment and talk about inventory. It has received significant press lately. And I think the most important thing is that the headline is just not -- it's not the whole story. We have learned critical lessons around inventory management over the past 4 years. And I want to be clear that we are confident in our inventory, our strategy and our inventory is current and balanced. In the first quarter, our inventories were up 45%, which again, I'm going to repeat myself, that may have been the headline, but it is not the full story. Our units on hand were up just 10% following a historic low last year and remained down to 2019 and to 2020. When looking at the composition of inventories, at the end of the first quarter, 93% of inventory units were current, 93%. Those units were either new product that hasn't been set, long-life product like jeans or fragrances or seasonal product. And to underscore that, current product, not winter clearance carryover that we did not sell through, and that is why we remain confident with our current inventory position. Scott will walk you through a little bit more detail about our inventory during his session. But let me assure you, we will continuously track consumer behavior and leverage all the tools in our toolkit to make sure that we manage our inventory tightly. We'll also leverage those tools in our toolkit to achieve our Always Forward Plan. We are confident in our ability to achieve $4.1 billion to $4.3 billion of revenues and an operating margin of at least 8%. We are in a dramatically different place than we were just 4 years ago. And those changes have made -- have positioned us to deliver steady growth. 7 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

Today, we have a family of differentiated global brands each catering to a unique edit point. Our company and our brands are purpose-led. And listening to and learning from our company, from our customers is deeply, deeply ingrained in our thinking and culture in a way that it has never been before. We are committed to constantly adapting to meet and exceed their ever-changing needs. Our operating model has evolved. And we are excited to meet our customers where they shop with new store locations and ever-improving omnichannel experience. And looking ahead, we have focused areas for growth, a clear strategy and the team in place to successfully execute to our Always Forward Plan. We are resilient. And after what we have conquered over the last few years, we believe nothing is insurmountable, especially with the amazing global teams that we have in place. So let's talk to some of the leaders of the teams we're going to make -- who made it all happen and are here with us today. I'm excited to introduce Kristin Scott, President of Global Brands; Robert Zajac and Carey Krug, our heads of marketing for Abercrombie and Hollister; Samir Desai, our Chief Digital and Technology Officer; and Scott Lipesky, our CFO. In addition, throughout the day, you'll have the opportunity to meet with the key leaders to have also been agents of change. We are thrilled to have them here. But it's also important to recognize that we couldn't fit everybody, obviously, in this room today. So from our stores and our DC associates, to those in our regional home offices, there was just with simply too much talent, too many talented individuals to fit in this room today. I am incredibly proud of how we have empowered and given each and every one of them a voice, where they can be heard and impact the organization regardless of title. This is what sets us apart from others and helps us retain some of the best talent in retail. And speaking of some of the best talent in retail, it is my pleasure to welcome to the stage, Kristin Scott, President of Global Brands. Kristin Scott - Abercrombie & Fitch Co. - President of Global Brands Thanks, Fran, and good morning, everyone. I'm really excited to be here with all of you today to share more detail on our brand positioning and our brand growth strategies that will get us to $4.1 billion to $4.3 billion in sales short term and $5 billion in sales long term. As Fran mentioned, we're going to focus mostly today on our top 3 priorities, which are Abercrombie adult, Hollister and Gilly Hicks. But before we do that, I'm going to share a little bit about my personal journey and what actually led me to Abercrombie. So I've been in retail for over 30 years now, and I've been fortunate enough to work with a number of amazing brands and leaders. So I started my career at Target and I spent 16 years there. When I started at Target, there were only 300 stores. So this was a very long time ago. And when I started at Target, they didn't even have a design team. So it was very different back then. I was very fortunate to be part of the transformation from Target to Target. And when I reflect back on my career, that was such an amazing learning at such a young point in my career, and I reflect back on that frequently. We also didn't have design teams, as I said. So I had to learn product development from the ground up, working with my vendors, which is very old school, and I don't think it happens anywhere anymore, but fortunate that I was able to do that. When I left Target, I went to Gap and I ran Gap Outlet. And at the time, they were going through a transformation as well. So they were in the process of transforming from a Gap brand remake outlet model to a product development model. So naturally, my product development skills that I learned at Target were very applicable to Gap at that point. After Gap, I went on to Victoria's Secret, and I spent about 9 years at Victoria's Secret, and I did a number of different roles there. I spent most of my time though on what they call the emerging businesses. So those were businesses that somebody thought should be billion-dollar ideas. And me and my team actually got to figure that out. So as you can imagine, some of these ideas come and they have no history, nothing to reflect on. So my team and I got to spend a lot of time with customers, trying to figure out how to drive growth in these billion-dollar ideas. I consider that time in my career as really my Master's course in brand building and using customer insights to drive growth. And it was really an amazing part of my career that I reflect on all the time as well. 8 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

In early 2016, I got a call from a recruiter, and it was about the job at Abercrombie as the Hollister Brand President. And at the time, one of my good friends and mentors was on the Abercrombie Board and she had been talking a lot about how impressed she was with what was happening at Abercrombie. The culture was amazing, the brand showed so much potential and the team was so talented. And so naturally, I was curious when I got this call. So I returned the call. And after about 2 hours on the phone with this recruiter, he said to me in the call, he said, okay, I don't know if there's such a thing as business soulmates, but if there is, that's you and Fran. And so I was like, wow, I've got to meet this Fran. I'm really interested in her now. So I met Fran on a Saturday, we shopped and had lunch, and I knew exactly what he meant at that point. And so I knew that she and I would be a great team and that I would learn a lot from her and that we would work very well together. So thankfully, she thought that too and invited me to campus to meet with some of the senior leaders to interview. And when I stepped foot on campus, I knew that's where I was meant to be. There's something so special about the Abercrombie culture. And I've been at a lot of retail, as you heard, and there is nothing like it out there. So I knew I wanted this job. I also had a son at home, a teenage son at home. So I had a built-in focus group of Hollister's target customer every weekend. And I could clearly see the opportunity that we had to transform Hollister into the leading global Gen Z retailer that it is today. So thankfully Fran hired me, and I started my job as the Hollister Brand President and back-to-school 2016. And at Hollister, back to school is like Black Friday. I started in August. And by the second week, we got a bus together, and we filled it up with Hollister associates and went to visit stores. We went from Columbus to Cincinnati and hit all of our stores just to listen to our customer. And that kicked off what I would call our mission to become customer obsessed. Fran and Scott have put the wheels in motion with the playbook for Hollister defining the purpose, and then we were able to take it to the next level and truly become customer obsessed. So for the next couple of years, we saw tremendous growth. And in fact, Hollister saw its turnaround in 2017, which is very exciting. Then in late 2018, Fran decided we'd benefit from reorganizing how the brands were structured. And so she wanted to have one leader over all brands so that we could share best practices, we could share talent more easily, we could learn from each other more easily and really build this customer-obsessed culture across the brands equally. And that's when she put me in my role, which is the President of Global Brands. So I believe, without a doubt, that I have the best job in retail right now. I get to come to work every day and work with absolutely amazing people, some of whom you're going to meet today. And I'm truly surrounded by inspiration. And whether that's at the Home Office or in our stores where we have tens of thousands of associates working for us who truly love these brands and help our customers fall in love with these brands at the same time. So we're lucky enough to have some of these leaders here, as Fran mentioned. I'm going to quickly introduce them. And they're just going to waive their hands. They're in the back of the room. But the leaders we have with us from the brands today are Corey Robinson, there's Corey. Corey heads up Omni Merchandising and Design for Abercrombie adults. You may have seen him in the pop-up shops; We have Betsy Hall, who heads up Omni-Merchandising for Hollister and Social Tourist; Kelly Hall, who is not related to Betsy, but she heads up our kids business; Kim Dolder, who heads up our Gilly Hicks business; Lisa Lowman, who is our Head of Design for Hollister and Social Tourist; and then over here, we have Carey Krug and Robert Zajac, who lead marketing for Abercrombie brands in the Hollister, Gilly Hicks and Social Tourist brands. And I'm excited for you to spend time with them. So I encourage you on your breaks, at lunch as you go through the pop-up shops, get to know them because they and their teams are truly the magic behind our brands, and they are the ones who are going to bring this Always Forward Plan to life. All right. Okay. So for the last 4 years, our teams have focused on strengthening the brands by being completely customer obsessed. And we're lucky, as you heard Fran say, we're lucky that we have a broad customer range. So we've got a 5-year old through a millennial who shops with us across our brands. 9 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

And based on that, we have amazing data and insights and just customer qualitative insights as well that we're able to share across our brands that help us anticipate shifts in customer mindset or even incoming trends. We've become experts at immersing ourselves in the lives of our customer. So what that means is that we literally show up where they are. So if you're working in Hollister, you're going to show up at the first day of school, and you're going to see what the kids are wearing to school. You're going to show up at a Friday night football game and interact with the kids and watch how they're interacting with each other. If you're an Abercrombie adult, you're going to go on a 4-day weekend with your target customer. You're going to go to happy hour, you're going to go to brunch, you're going to spend time with them. And it's truly about getting to know them on their turf. We also collect over 6 million points of customer feedback on an annual basis through focus groups, insight labs and surveys. So in the face of the COVID-related pressures that we saw and the disruption that we saw to our associates, to our customers and to our supply chain, our teams stayed maniacally focused on the customer. And what this did is it allowed us to really anticipate shifts in mindset. So we were able to tell when they were feeling differently about going out or staying in, and we were able to change our product stories and our messaging to match what they were feeling. This allowed us to tailor all of our messaging to be at the right price and meet them where they wanted to interact with our brands as well. So on that last point, we know that each and every customer journey is different. We recently completed a major data-driven project with a third party that helped us understand these journeys and expectations at a very detailed level. And as a result, we're now able to segment our customers within each of our brands based on their attitudes and behaviors. So this has unlocked tremendous opportunities for us to build meaningful strategies to impact how each segment of our customers experiences our brands both digitally and physically at different points in their personal journey. So simply said, this allows us to Know Them Better and Wow Them Everywhere. So looking at our family of brands today, I couldn't be more excited about the potential and our unique positioning. Our confidence in the future is very high and our customer obsession will fuel our ability to hit the 2025 target and beyond. So as Fran mentioned, our 2025 plan targets a 3% to 5% sales CAGR off of 2022 with Abercrombie adults, Hollister and Gilly Hicks being our main opportunities for growth. We are fortunate, though, to have the agility and the flexibility to shift our focus across our entire family of brands as we react to the marketplace and get new learnings and enough opportunities from our best-in-class test-and-learn culture. So let's start with Abercrombie adults, where we currently have the largest growth opportunity. Okay, so as you heard, Abercrombie is focused on the young millennial, and we have a 25-year-old edit point. We know that this target customer absolutely lives for the 4-day weekend, which is at the root of our brand purpose. We believe that every day should feel as exceptional as the start of a long weekend. The response to this positioning, which we introduced in 2019, has been overwhelmingly positive. The Abercrombie turnaround first started in late 2019, and it's continued to build momentum ever since. This turn has been fueled by a global young millennial customer who over-indexes in digital relative to the rest of our brands. However, there's still a misperception that Abercrombie is just another U.S. mall-based teen retailer, which could not be further from the truth. We have transformed into an agile, digitally led, customer-centric, purpose-led brand uniquely positioned for today's on-the-go millennial customer. So what gives us confidence in our 2025 plan? As you heard Fran say, our women's business has grown about 40% since the repositioning and around 60% in our largest market, the U.S. This significantly outpaced the total apparel industry, which according to NPD, has grown approximately 10% in the U.S. since 2018. And from 2018, we've also added over 12 million customers. At Abercrombie today, we lead with purpose, partnering with key organizations like The Trevor Project and The Steve Fund to truly make a difference in the lives of our customers. The Trevor Project is the world's largest suicide prevention and crisis intervention organization for LGBTQ young people. And The Steve Fund is the nation's leading organization focused on supporting the mental health and emotional well-being of young people of color. 10 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day

Here's a short brand video that brings to life the powerful changes that we've made as we've fine-tuned our brand positioning and immersed ourselves in the lives of our target customers. (presentation) Kristin Scott - Abercrombie & Fitch Co. - President of Global Brands So our strategy to age up Abercrombie adults to target a 25-year-old has unlocked significant growth opportunity as we are now squarely in the consideration set of the largest addressable adult cohort, the millennial, which encompasses about 72 million people and $76 billion in an addressable market. Our young millennial customer has their own income and they're allocating a large portion of their discretionary dollars to socializing and travel and need to be outfitted for all their adventures, which, of course, they will be documenting on social media. So for Abercrombie, we'll focus on 3 key areas. The first is building our momentum in the women's business, growing sales by double digits annually. Second is taking a data-driven approach to store expansion. And third is growing our brand lovers through our industry-leading efforts in digital marketing and social selling. All right. Let's start with the women's business, where we plan to grow our sales double digits annually. So over the past several years, through time spent with our target customers, we've identified untapped opportunities and built key women's categories and franchises to address them. We've also been refining our existing categories along the way. Our women's business has been a clear winner among our brands and across the broader apparel marketplace. Even with our most recent growth, we know that we still have a lot of market share to gain. So according to NPD, every 50 basis points in women's share would add approximately $240 million to our top line. We plan to build on our successful categories and franchises, including denim, best dressed guest, and YPB, our most recent introduction, which just launched in March and is already far exceeding our expectations. So let's drill down a bit further on each of these which all carry a higher merchandise margin than the brand average, and they also have attracted new customers to the brand. Okay, so denim, many of us are wearing it in the room today. We have quickly become her new favorite brand. And since 2017, we've been able to grow our AUR by about 50%, and we have grown sales by roughly 2.5x. Within denim, our Curve Love fit, which we first introduced in 2019 is now representing 50% of our denim sales. And we know denim is a core part of the young millennial's outfit, and we believe that we can more than double our market share in denim as our brand awareness grows. In addition to denim, she is loving our dresses. And since 2017, dress sales have risen almost 80% and there's still tremendous opportunity. Last year, we introduced the best dressed guest collection, which came directly from insights from our customer and long weekend spent with them. We learned that she wanted affordable, quality, stylish stresses for all of the celebrations that she was going to. And given the differentiated nature of the best dressed guest collection, we believe that sales are incremental to our existing dress assortment. 2021 marked our biggest year in the history of the brand for dresses and we are set to blow that away this year. So we know there's a lot of opportunity here. And last but absolutely not least, is YPB or Your Personal Best. So this is our recently launched performance active line that blends technical and fashion in a perfectly Abercrombie way. The reception has been phenomenal, and we see tremendous upside in this category. Active is another example of product that our customers actually asked for to support their lifestyle. After countless hours of wear testing and feedback from fitness enthusiasts, we launched YPB in March. Our customer is absolutely loving the product and the compelling value. And the initial launch beat our expectations, and we see a long runway of growth in active, which has been the fastest-growing segment of the apparel market. For those of you who haven't seen the line yet, here is a quick clip. (presentation) 11 REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2022 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JUNE 14, 2022 / 1:00PM, ANF.N - Abercrombie & Fitch Co Investor Day