Form 6-K VEON Ltd. For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of November 2019

Commission File Number 1-34694

VEON Ltd.

(formerly VimpelCom Ltd.)

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): o.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): o.

Information contained in this report

On November 4, 2019, the Registrant issued a press release, presentation materials, and supplemental factbook, copies of which are furnished hereto as Exhibits 99.1, 99.2, and 99.3.

EXHIBIT INDEX

Exhibit No. | Description of Exhibit |

99.1 | |

99.2 | |

99.3 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

VEON LTD. | ||

(Registrant) | ||

Date: November 4, 2019 | ||

By: | /s/ Scott Dresser | |

Name: | Scott Dresser | |

Title: | Group General Counsel | |

4 N O V E M B E R 2 0 1 9 SOLID 3Q19 RESULTS SUPPORTED BY GOOD OPERATIONAL PERFORMANCE AND ONGOING FOCUS ON COST EFFICIENCIES FY 2019 GUIDANCE CONFIRMED 1

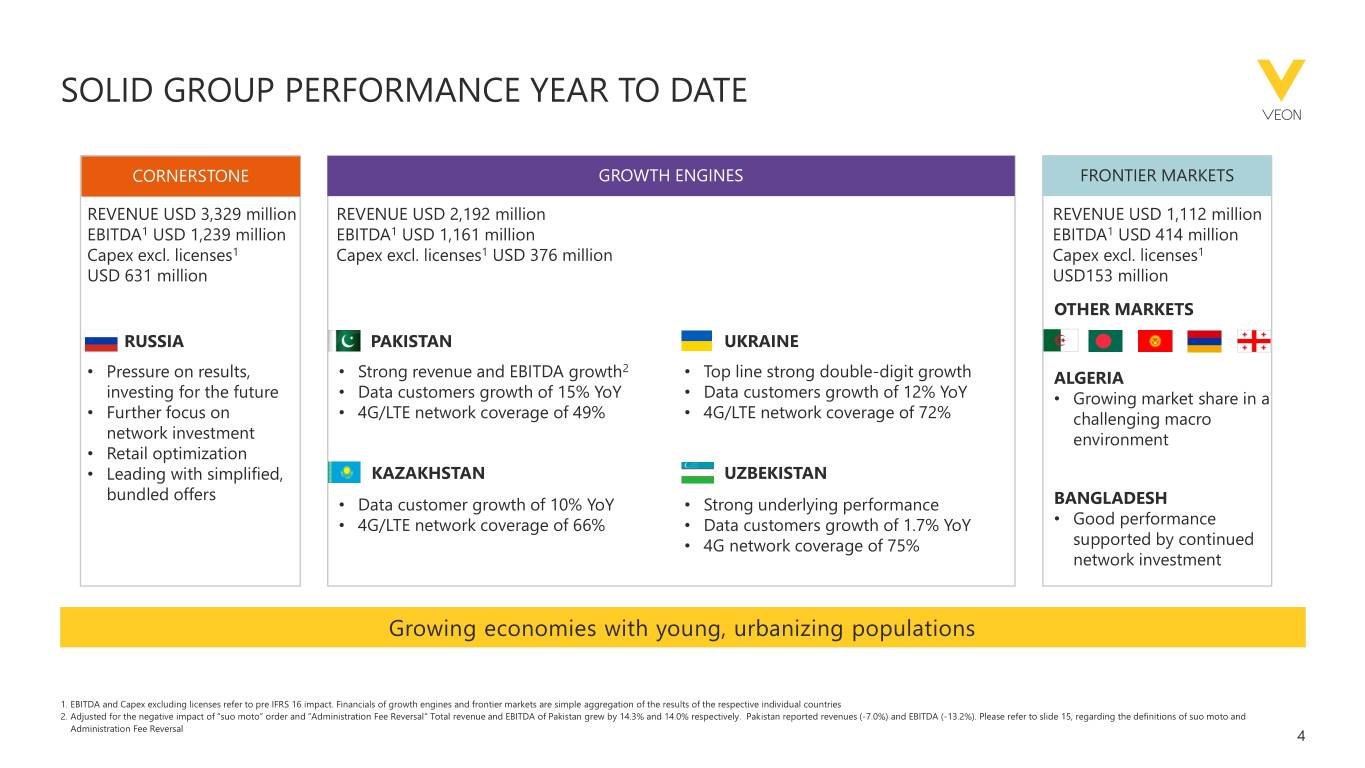

Amsterdam (4 November 2019) – VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a leading global provider of connectivity and digital services, today announces results for the quarter ended 30 September 2019. KEY POINTS • Revenue, EBITDA and equity free cash flow (excluding licenses) tracking in line with our full year 2019 guidance • Underperformance in Russia was offset by strong performances from our Growth Engines (Pakistan, Ukraine, Uzbekistan, Kazakhstan), while our Frontier Markets are delivering in line with our expectations • Strong data usage continued to lead service revenue growth, underpinned by continued network investment • Good progress against corporate cost reduction and Group cost intensity targets • Monitor certified our compliance program; the Deferred Prosecution Agreement expired URSULA BURNS, CHAIRMAN AND CHIEF EXECUTIVE OFFICER, COMMENTS: “VEON reported a solid nine months and third quarter, with continuing good operational execution across the Group. Our year to date revenues increased by 4.6% with year to date EBITDA up 8.8% on an organic basis. Our service revenue growth for the Group was largely driven by the strong growth in core access data on the back of the continued investment in our data networks in the period. This will remain a key focus for VEON over the medium-term while we explore new services to drive both new incremental revenues as well as support our core connectivity business. Our Russian operation continues to face challenges related to its network quality gap versus competitors, market pricing structure, favouring unlimited tariff plans and the effectiveness of its distribution, which together had an adverse impact on our customer base dynamics. We remain focused on the Russian market and although short-term results may continue to be pressured, continued network investments and further optimization of our distribution footprint through the balance of 2019 and into 2020 should ensure our business is strengthened and well positioned for the long term. Our Growth Engines (Ukraine, Pakistan, Uzbekistan and Kazakhstan) continue to deliver strong organic growth in both revenue and EBITDA for the first nine months of 2019, up 14% and 21% respectively, and the medium-term outlook remains encouraging. While local and Group reported numbers were impacted by regulatory changes in Pakistan, the operational performance of the Pakistan business remains robust. Cost improvements across the Group remain a focus area, and while we are on track to deliver on our guidance on cost savings at the headquarters level for 2019, we expect to make further progress across the broader Group in this area over the next couple of years. Consistent with our ambition to further simplify our Group structure, we successfully concluded the mandatory tender offer (MTO) for GTH, the delisting of GTH and have transferred Jazz (Pakistan), Banglalink (Bangladesh) and Med Cable (Algeria) to VEON Holdings. The intragroup transfers for Djezzy (Algeria) and Mobilink Bank (Pakistan) are continuing. The expiration of the Deferred Prosecution Agreement and the conclusion of the external monitorship are significant and positive milestones for VEON. We have established effective compliance and controls programs and demonstrated our continuing commitment to leading with integrity across our businesses, which both the US government and the monitor recognized. Reaching this point in our journey is a great achievement, and we are understandably pleased with the outcome. Strong ethics, compliance, and controls remain integral to how we operate and expect others to operate with us. We recently announced the appointment of Kaan Terzioglu and Sergi Herrero as joint Chief Operating Officers and I am excited about the skills and experience they will bring to bear on the business as they look to execute on our strategy over the next few years. I would again like to thank Kjell Johnsen for his positive impact to the Group over the past few years. Managing a complex business such as ours, with operations across 10 emerging markets, will never be without its challenges, but I am pleased with the continued progress we are making on operational execution. While Russia is operating below our expectations, we are working hard to address this and, notwithstanding this underperformance, I am pleased we remain on track to deliver on our Group FY 2019 guidance to the market.” 2

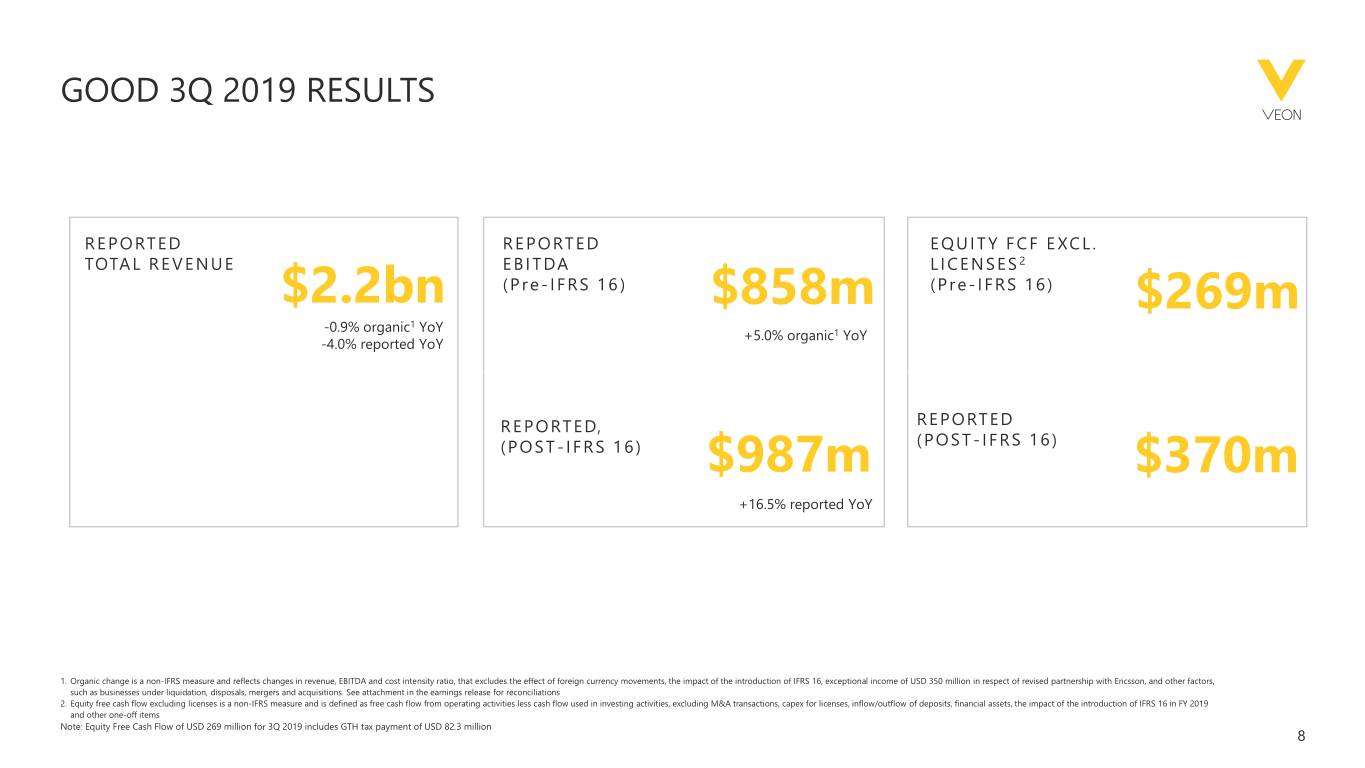

3Q19 RESULTS 1 • Reported revenue: USD 2,223 million -4.0% YoY • Reported EBITDA: EBITDA USD 987 million +16.5% YoY, adjusted for IFRS16 +1.3% • Group Subscribers: 212 million +0.5% YoY • Group capital expenditures excluding licenses: USD 377 million, adjusted for IFRS 16 USD 324 million • Revenue organic2 growth tracking in line: total revenue decreased by 0.9% organically2 year on year (YoY) with service revenue decreasing 0.4% organically2, reflecting the impact of regulatory changes3 in Pakistan. Excluding these, total revenue increased by 2.4% organically2 in 3Q19 • Data revenue organic2 growth remains robust: the momentum in mobile data revenue continued in the period growing organically2 by 18.4% YoY, with Ukraine (+36.9%), Pakistan (+25.2%) and Bangladesh (+26.4%) delivering strong performances on the back of ongoing 4G/LTE investments • Strong organic2 growth in EBITDA (pre-IFRS 16): EBITDA (pre-IFRS 16) increased organically2 by 5.0% YoY to USD 858 million, resulting in an EBITDA margin of 38.6%. Excluding the impact of the reversal of both the “suo moto”3 order and the Administration Fee Reversal3, EBITDA increased 11.0% organically YoY • Currency headwinds lessened: the impact of currency movements on reported revenues in the period was limited to USD 72 million compared to the USD 179 million headwind in the second quarter of 2019 • Cost intensity ratio4 pre-IFRS 16 continued to improve organically2: we recorded a 2.2 percentage point YoY organic2 improvement in our cost intensity ratio4, helped in particular by Russia and Ukraine • Corporate costs8 trending lower: corporate costs were USD 56 million in 3Q19, which resulted in a 25% YoY decline in the first nine months of 2019. This is in line with VEON’s ambition to reduce corporate costs by 25% YoY in FY 2019 • Strong equity free cash flow (excluding licenses)5: adjusting for IFRS 16, the company generated USD 269 million of equity free cash flow (excluding licenses)5 during the quarter, with YTD equity free cash flow (excluding licenses)5 of USD 902 million • Cash flow impacted by non-operating items: cash flow was impacted by a payment of USD 82.3 million related to the Global Telecom Holding S.A.E. (“GTH”) tax settlement (the “GTH Tax Settlement”), the partial payment as security of USD 225 million for the license renewal in Pakistan as well as the USD 296 million interim dividend payment KEY DEVELOPMENTS • Kaan Terzioglu and Sergi Herrero appointed as joint Chief Operating Officers • The Deferred Prosecution Agreement VEON entered into with the US Department of Justice expired on 31 October 2019, and the external compliance monitorship has concluded. VEON’s commitment to ethics, compliance, and controls is unwavering and is reflected in our structures, procedures and daily ways of working • VEON Holdings B.V. (“VEON Holdings”) successfully concluded the mandatory tender offer (“MTO”) in relation to GTH’s shares not owned by the VEON Group. Following the approval by GTH shareholders, VEON has completed the intra- group transfers of Jazz, Banglalink and Med Cable to VEON Holdings • VEON announced a new Strategy Framework at its Capital Markets Day in September, identifying new services and future assets as additional growth opportunities and introducing a flexible dividend policy to support associated investment needs • VEON launched a large-scale 5G network trial in Shymkent, Kazakhstan, as part of its vision to empower customer ambitions through market-leading technologies and services while demonstrating our commitment to remain at the forefront of technology • In October 2019, VEON Holdings issued USD 700 million in 4.00% senior unsecured notes due 2025 • VEON’s long-term credit rating was upgraded in September 2019 from BB+ (non-investment grade) to BBB- (investment grade) by ratings agency, Fitch, reflecting the increased credit worthiness of the VEON Group OUTLOOK FY 2019 guidance6 confirmed: Low single-digit organic2 growth for revenue, at least mid-single-digit organic2 growth for EBITDA and equity free cash flow (excluding licences) of approximately USD 1 billion. While we are tracking ahead of our guidance, we note there remains some seasonality around free cash flow generation. 3

1 Key results compare to prior year results unless stated otherwise 2 Organic change is a non-IFRS measure and reflects changes in revenue, EBITDA and cost intensity ratio, that excludes the effect of foreign currency movements, the impact of the introduction of IFRS 16, exceptional income of USD 350 million in respect of revised partnership with Ericsson and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. See Attachment C for reconciliations 3 In June 2018, the Supreme Court ordered (“suo moto”) an interim suspension of the deduction of taxes and service/maintenance charges on prepaid and postpaid connections on each recharge/top-up/load levied by mobile phone service providers. On 24 April 2019, the Supreme Court disposed of the proceedings and restored the impugned tax deductions, deciding that it would not interfere in the matter of the collection of public revenue (the “suo moto” order). On 3 July 2019, the Supreme Court issued its detailed reasons and, in addition to confirming its ruling on tax deductions, further clarified that mobile phone service providers cannot charge customers for service and maintenance charges, which were approximately 10% of customer recharges. As a result of this clarification by the Supreme Court, the Pakistan Telecommunication Authority (“PTA”) issued two letters to Jazz, dated 30 August 2019 and 19 September 2019, requesting Jazz to refund the service and maintenance charges (the “administration fees”) collected by Jazz between April 2019 and July 2019. Further to the PTA’s directions, on 29 September 2019, Jazz proceeded with crediting these administration fees to the balances of the affected customers; the amounts refunded could be used from 29 September 2019 for a period of 45 days. Jazz reversed these administration fees in 3Q19, and is not entitled to charge these administration fees going forward (the “Administration Fee Reversal”). 4 Cost intensity ratio is defined as service costs plus selling, general and administrative costs, less other revenue, divided by total service revenue. Based on FY 2018, in USD million (3,697+1,701-133)/8,526 5 Equity free cash flow (excluding licenses) is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding the impact of IFRS 16, M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. EFCF target for FY 2019 is based on currency rates of 20 February 2019, excludes USD 136 million payment of the GTH Tax Settlement, includes the one-time cash received in connection with a revised arrangement from Ericsson of USD 350 million. See attachment C for reconciliations 6 FY 2019 targets exclude the impact of the introduction of IFRS 16 7 In June 2018, the Supreme Court ordered (“suo moto”) an interim suspension of the deduction of taxes on prepaid and postpaid connections on each recharge/top- up/load levied by mobile phone service providers. On 24 April 2019, the Supreme Court disposed of the proceedings and restored the impugned tax deductions, deciding that it would not interfere in the matter of the collection of public revenue. On 3 July 2019, the Supreme Court issued its detailed reasons and, in addition to confirming its ruling on tax deductions, further clarified that mobile phone service providers cannot charge customers for service and maintenance charges 8 Corporate costs in a non-IFRS financial measure and represents costs incurred by the holding entities in the Netherlands, Luxembourg and Egypt, primarily comprised of salary costs and consulting costs. We also present in this release ’run-rate corporate costs” in order to represent what our corporate cost performance would be if results for a given period were annualized or extrapolated into future periods Note for 9M19 results: In Q2 2019, both revenue and EBITDA were positively impacted by special compensation of USD 38 million related to the termination of a network sharing agreement in Kazakhstan between our subsidiary KaR-Tel LLP and Kcell Joint Stock Company ("Kcell”) due to Kazakh telecom JSC’s acquisition of 75% of Kcell's shares. In addition, in Q2 2019, as a result of the USD 136 million GTH Tax Settlement (see below “GTH Tax Settlement’’), VEON has recorded an additional provision of USD 56 million with USD 27 million in the EBITDA and USD 29 million in the income tax. 4

KEY RESULTS: CONSOLIDATED FINANCIAL AND OPERATING HIGHLIGHTS 3Q19 Organic USD million 3Q19 3Q18 Reported YoY Reported YoY pre-IFRS 16 pre-IFRS 16 YoY 1 Total revenue, of which 2,223 2,223 2,317 (4.0%) (4.0%) (0.9%) mobile and fixed service revenue 2,076 2,076 2,151 (3.5%) (3.5%) (0.4%) mobile data revenue 626 626 548 14.2% 14.2% 18.4% EBITDA 987 858 848 16.5% 1.3% 5.0% EBITDA margin (EBITDA/total revenue) 44.4% 38.6% 36.6% 7.8p.p. 2.0p.p. 2.2p.p. Profit from continued operations 31 46 (718) 104.2% n.m. Profit from discontinued operations - - 1,279 n.m n.m. Profit for the period (before NCI) 31 46 561 n.m. n.m. Equity free cash flow excl. licenses 2 370 269 263 40.4% 2.1% Capital expenditures excl. licenses 377 324 311 21.0% 4.1% LTM capex excl. licenses/revenue 19.3% 17.0% 16.8% 2.6p.p. 0.3p.p. Net debt 8,252 6,275 5,736 43.9% 9.4% Net debt/LTM EBITDA 2.1 1.7 1.7 n.m. Total mobile customer (millions) 211.7 211.7 210.7 0.5% Total fixed-line broadband customers (millions) 4.0 4.0 3.7 8.1% 9M19 USD million 9M19 9M18 Reported YoY Reported YoY Organic pre-IFRS 16 pre-IFRS 16 YoY 1 Total revenue, of which 6,609 6,609 6,837 (3.3%) (3.3%) 4.6% mobile and fixed service revenue 6,161 6,161 6,443 (4.4%) (4.4%) 3.4% mobile data revenue 1,783 1,783 1,569 13.6% 13.6% 22.4% EBITDA 3,280 2,897 2,559 28.2% 13.2% 8.8% EBITDA margin (EBITDA/total revenue) 49.6% 43.8% 37.4% 12.2p.p. 6.4p.p. 1.5p.p. Profit from continued operations 635 697 (650) 197.8% n.m. Profit from discontinued operations - - 978 n.m. Profit for the period (Before NCI) 635 697 329 n.m n.m. Equity free cash flow excl. licenses 2 1,165 902 804 44.9% 12.2% Capital expenditures excl. licenses 1,364 1,163 1,068 27.7% 8.8% LTM capex excl. licenses/revenue 19.3% 17.0% 16.8% 2.6p.p. 0.3p.p. Net debt 8,252 6,275 5,736 43.9% 9.4% Net debt/LTM EBITDA 2.1 1.7 1.7 n.m. Total mobile customer (millions) 211.7 211.7 210.7 0.5% Total fixed-line broadband customers (millions) 4.0 4.0 3.7 8.1% 1 Organic change is a non-IFRS measure and reflects changes in revenue, EBITDA and cost intensity ratio, that excludes the effect of foreign currency movements, the impact of the introduction of IFRS 16, exceptional income of USD 350 million in respect of revised partnership with Ericsson and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. See Attachment C for reconciliations 2 Equity free cash flow excluding licenses is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding the impact of IFRS 16, M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. See attachment C for reconciliations 5

CONTENTS MAIN EVENTS ................................................................................................... 7 GROUP PERFORMANCE ....................................................................................... 9 COUNTRY PERFORMANCE ................................................................................... 1 2 CONFERENCE CALL INFORMATION ......................................................................... 1 9 ATTACHMENTS ................................................................................................ 2 2 PRESENTATION OF FINANCIAL RESULTS VEON’s results presented in this earnings release are based on IFRS unless otherwise stated and have not been audited. Certain amounts and percentages that appear in this earnings release have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in tables, may not be an exact arithmetic aggregation of the figures that precede or follow them. All non-IFRS measures disclosed in the document, i.e. EBITDA, EBITDA margin, EBIT, net debt, equity free cash flow (excluding licenses), organic growth, capital expenditures excluding licenses, are reconciled to the comparable IFRS measures in Attachment C. IMPACT OF IFRS 16 - LEASES ON FINANCIAL INFORMATION From 1 January 2019, VEON has adopted International Financial Reporting Standards (IFRS) 16 (Leases). VEON is presenting Q3 2019 results excluding the impact of IFRS 16 for comparability purposes with prior periods, as well as presenting reported results which will reflect the new baseline for future period over period comparisons. All forward looking targets exclude the impact of the introduction of IFRS 16 in FY 2019. All comparisons are on a year on year (YoY) basis unless otherwise stated. 6

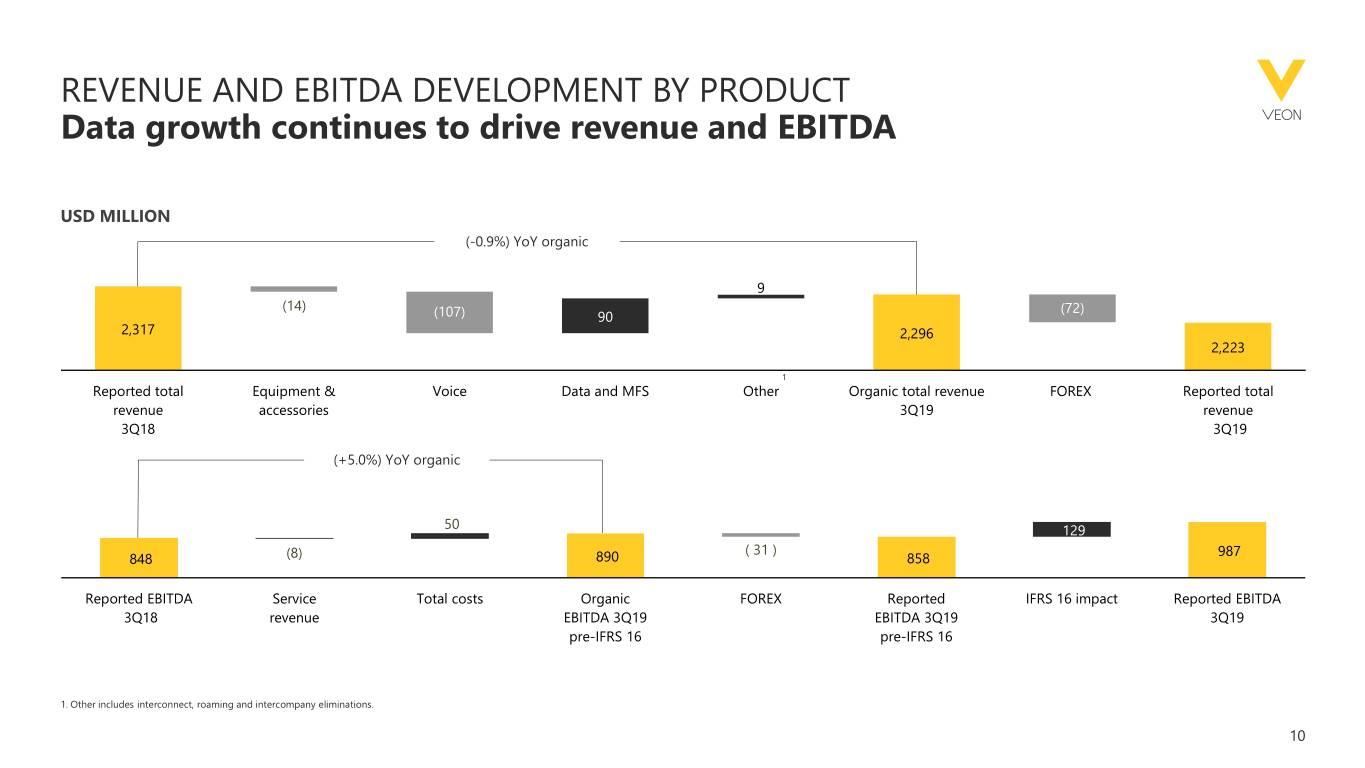

MAIN EVENTS REVENUE AND EBITDA Reported revenue (-4.0% YoY) and EBITDA (+16.5% YoY) were impacted by both currency movements and IFRS 16 implementation this year. On an organic1 basis revenue decreased by 0.9% YoY with EBITDA up 5.0% YoY. While we are tracking ahead of our guidance, we note there remains some seasonality to performance. While reported revenue was impacted by currency movements, the headwinds in Q3 2019 were limited to USD 72 million, compared to the currency headwinds of USD 179 million in the 2Q19. The performance of the Russian ruble and Pakistan rupee will be key currency variables over the remainder of this year. During Q3 2019, both reported revenue and EBITDA were negatively impacted by the reversal of the “suo moto”2 order, and the Administration Fee Reversal2 in Pakistan. Adjusted for these impacts, organic revenue would have increased by 2.4% YoY and organic EBITDA would have increased by 11.0% YoY. 1 Organic change is a non-IFRS measure and reflects changes in revenue, EBITDA and cost intensity ratio. Organic change excludes the effect of foreign currency movements, the impact of the introduction of IFRS 16, exceptional income of USD 350 million in respect of revised partnership with and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. See Attachment C for reconciliations. 2 In June 2018, the Supreme Court ordered (“suo moto”) an interim suspension of the deduction of taxes and service/maintenance charges on prepaid and postpaid connections on each recharge/top-up/load levied by mobile phone service providers. On 24 April 2019, the Supreme Court disposed of the proceedings and restored the impugned tax deductions, deciding that it would not interfere in the matter of the collection of public revenue (the “suo moto” order). On 3 July 2019, the Supreme Court issued its detailed reasons and, in addition to confirming its ruling on tax deductions, further clarified that mobile phone service providers cannot charge customers for service and maintenance charges, which were approximately 10% of customer recharges. As a result of this clarification by the Supreme Court, the Pakistan Telecommunication Authority (“PTA”) issued two letters to Jazz, dated 30 August 2019 and 19 September 2019, requesting Jazz to refund the service and maintenance charges (the “administration fees”) collected by Jazz between April 2019 and July 2019. Further to the PTA’s directions, on 29 September 2019, Jazz proceeded with crediting these administration fees to the balances of the affected customers; the amounts refunded could be used from 29 September 2019 for a period of 45 days. Jazz reversed these administration fees in Q3 2019, and is not entitled to charge these administration fees going forward (the “Administration Fee Reversal”). COST INTENSITY In Q3 2019, our cost intensity ratio1 improved by 2.2 percentage points YoY to 58.9% pre IFRS 16, mainly due to lower service costs in Russia and Ukraine. We are seeing continued progress on cost across a number of our smaller markets and expect the contribution from the other markets to become more meaningful over the coming year. In our 2018 results, VEON announced its commitment to reduce the Group’s cost intensity ratio1 by at least 1 percentage point organically per annum between 2019 and 2021, from 61.8% as reported in FY 2018. This ambition remains on track. At the Group level, we still expect the main contributor to cost intensity improvement for 2019 to be a further reduction in VEON’s corporate costs. 1 Cost intensity ratio is defined as service costs plus selling, general and administrative costs, less other revenue, divided by total service revenue. Based on FY 2018, in USD million (3,697+1,701-133)/8,526 GTH RESTRUCTURING On 9 September 2019, VEON announced that its offer to acquire substantially all of the operating assets of GTH has been approved by GTH's shareholders. Following that approval, VEON completed the intra-group transfers of Jazz, Banglalink and Med Cable. GTH's shares were subsequently delisted from the Egyptian Stock Exchange. The second settlement payment of USD 82.3 million relating to outstanding tax liabilities of GTH and its Egyptian subsidiaries was paid in Q3 2019 by GTH to the Egyptian Tax Authority. As a result, GTH has resolved all outstanding tax liabilities in Egypt for the tax years 2000 through 2018. 7

ISSUANCE OF USD 700 MILLION SENIOR NOTES On 9 October 2019, VEON Holdings issued USD 700 million 4.00% senior unsecured notes due 2025 (the “Notes”). VEON Holdings intends to use the net proceeds of the Notes primarily to refinance drawings on the revolving credit facility used to fund the mandatory tender offer for GTH MTO and for general corporate purposes. MONITOR CERTIFIES VEON’S COMPLIANCE PROGRAM On 31 October 2019, the Deferred Prosecution Agreement (“DPA”) that VEON entered into with the US Department of Justice on 18 February 2016 expired. This marks the conclusion of the compliance monitorship required by the DPA and VEON’s settlement with the US Securities and Exchange Commission and demonstrates that VEON successfully established robust and sustainable compliance and controls program. VEON’s commitment to ethics, compliance, and controls is unwavering and is reflected in our structures, procedures and daily ways of working. PAKISTAN LICENSE RENEWAL The ex-Warid license renewal was due in May 2019. Pursuant to directions from the Islamabad High Court, the Pakistan Telecommunication Authority (“PTA”) issued a license renewal decision on 22 July 2019 requiring payment of USD 39.5 million per MHz for 900 MHz spectrum and USD 29.5 million per MHz for 1800 MHz spectrum, equating to an aggregate price of approximately USD 450 million (excluding applicable taxes of approximately 10%). On 17 August 2019, Jazz appealed the PTA’s order to the Islamabad High Court and is now awaiting a date to be scheduled for the hearing. On 23 August 2019, the Islamabad High Court suspended the PTA’s order pending the outcome of the appeal and subject to Jazz making payment in the form of security (under protest) pending resolution of the appeal as per the options given in the PTA’s order. In September 2019, Jazz deposited 50% of the disputed license renewal fee (approximately USD 225 million) in order to maintain its appeal in the Islamabad High Court regarding the PTA's underlying decision on the license renewal. There were no specific terms and conditions attached to the deposit. The deposit is recorded within non-current financial assets in the statement of financial position. NEW STRATEGY FRAMEWORK AND DIVIDEND POLICY In September 2019, VEON announced a new Strategy Framework, supporting a new long-term vision to empower customer ambitions through guiding choices and connecting customers with resources that match their lifestyle and business needs. VEON also announced the formation of VEON Ventures, a new division tasked with identifying future assets with the potential to scale the Group’s existing products and services or offer adjacent revenue opportunities. In order to support appropriate capital allocation, VEON announced a new dividend policy in September 2019 which will be introduced from financial year 2020, which targets paying at least 50% of prior year Equity Free Cash Flow after licenses in dividends to shareholders. Dividend payments will remain subject to a review by VEON's Board of Directors of medium-term investment opportunities and the Group's capital structure. The Group’s internal target is to keep Net Debt/EBITDA at around 2.0x (2.4x post IFRS 16). 8

GROUP PERFORMANCE FINANCIALS BY COUNTRY Reported Reported 3Q19 Reported Organic1 9M19 Reported Organic1 USD million 3Q19 3Q18 pre-IFRS 16 9M19 9M18 pre-IFRS 16 Pre-IFRS16 YoY YoY Pre-IFRS16 YoY YoY YoY YoY Total revenue 2,223 2,223 2,317 (4.0%) (4.0%) (0.9%) 6,609 6,609 6,837 (3.3%) (3.3%) 4.6% Russia 1,157 1,157 1,172 (1.3%) (1.3%) (2.7%) 3,329 3,329 3,512 (5.2%) (5.2%) 0.4% Pakistan 286 286 395 (27.5%) (27.5%) (7.0%) 996 996 1,126 (11.5%) (11.5%) 11.3% Algeria 197 197 207 (4.7%) (4.7%) (3.3%) 577 577 609 (5.4%) (5.4%) (2.7%) Bangladesh 135 135 131 3.1% 3.1% 3.8% 406 406 391 3.8% 3.8% 4.6% Ukraine 231 231 180 28.1% 28.1% 18.3% 630 630 509 23.8% 23.8% 20.9% Uzbekistan 66 66 83 (20.5%) (20.5%) (8.8%) 197 197 238 (17.3%) (17.3%) (10.9%) HQ - - - - - - Other and eliminations 151 151 149 474 474 452 Service revenue 2,076 2,076 2,151 (3.5%) (3.5%) (0.4%) 6,161 6,161 6,443 (4.4%) (4.4%) 3.4% Russia 1,039 1,039 1,042 (0.2%) (0.2%) (1.6%) 3,013 3,013 3,228 (6.7%) (6.7%) (1.0%) Pakistan 265 265 369 (28.3%) (28.3%) (8.0%) 926 926 1,048 (11.6%) (11.6%) 11.2% Algeria 197 197 206 (4.6%) (4.6%) (3.1%) 575 575 606 (5.1%) (5.1%) (2.4%) Bangladesh 133 133 127 4.4% 4.4% 5.2% 397 397 377 5.3% 5.3% 6.1% Ukraine 230 230 179 28.1% 28.1% 18.3% 627 627 507 23.7% 23.7% 20.8% Uzbekistan 66 66 83 (20.6%) (20.6%) (8.9%) 196 196 238 (17.3%) (17.3%) (10.9%) HQ - - - - - - Other and eliminations 146 146 145 427 427 439 EBITDA 987 858 848 16.5% 1.3% 5.0% 3,280 2,897 2,559 28.2% 13.2% 8.8% Russia 525 439 418 25.5% 5.0% 3.5% 1,491 1,239 1,303 14.5% (4.9%) 0.9% Pakistan 140 130 192 (26.8%) (32.3%) (13.2%) 509 475 541 (5.9%) (12.3%) 10.3% Algeria 89 81 93 (3.9%) (12.7%) (11.3%) 262 237 271 (3.3%) (12.5%) (10.0%) Bangladesh 55 45 47 17.2% (4.7%) (4.0%) 170 140 139 22.4% 0.6% 1.4% Ukraine 149 143 104 44.2% 38.3% 27.7% 405 388 287 41.1% 35.2% 32.0% Uzbekistan 36 35 37 (3.0%) (6.0%) 8.1% 103 99 106 (2.7%) (6.3%) 1.3% HQ (56) (56) (92) 181 181 (224) Other and eliminations 49 41 49 159 138 136 EBITDA margin 44.4% 38.6% 36.6% 7.8p.p. 2.0p.p. 2.2p.p. 49.6% 43.8% 37.4% 12.2p.p. 6.4p.p. 1.5p.p. 1 Organic change is a non-IFRS measure and reflects changes in revenue, EBITDA and cost intensity ratio. Organic change excludes the effect of foreign currency movements, the impact of the introduction of IFRS 16, exceptional income of USD 350 million in respect of revised partnership with Ericsson and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. See Attachment C for reconciliations Reported total revenue decreased by 4.0% YoY in 3Q19 to USD 2.2 billion, with good operational performance being offset by the negative impact of the “suo moto” order and the Administration Fee Reversal in Pakistan as well as by currency headwinds of USD 72 million and the revenue underperformance in Russia. Organically total revenue decreased by 0.9% mainly as a result of the regulatory changes in Pakistan that offset the positive revenue performance of Ukraine and Bangladesh. Adjusted for these negative impacts, organic total revenue growth would have been 2.4% YoY. The total revenue organic trend was supported by good organic growth in mobile data revenue, which increased by 18.4% for the quarter. Reported mobile data revenue (+14.2%) was impacted by currency headwinds of approximately USD 22 million. Mobile customers increased YoY to 212 million at the end of Q3 2019, with customer growth in Pakistan, and Bangladesh, which was partially offset by a decrease in the customer base in Russia, Uzbekistan and Algeria. EBITDA increased organically by 5.0% to USD 858 million pre-IFRS 16 in Q3 2019, primarily due to a good performance in Russia and Ukraine supported by corporate cost reduction. Reported EBITDA increased by 16.5% YoY, positively impacted by IFRS 16, which offset the negative impact of currency headwinds of USD 31 million and the negative impact of Pakistan regulatory regime changes and reversal of Administration Fee, organic EBITDA increase would have been 11.0% YoY. 9

Adjusting for the positive effect of IFRS 16, the Company generated USD 269 million in equity free cash flow (excluding licenses) during Q3 2019. Cash flow was negatively impacted by the payment of USD 82.3 million related to the GTH Tax Settlement. Reported equity free cash flow (excluding licenses) was USD 370 million in Q3 2019. VEON’s HQ segment consists largely of the costs of VEON’s headquarters in Amsterdam. Corporate costs were USD 56 million in Q3 2019, down 40% YoY. VEON is on track to deliver on its target to reduce corporate costs by approximately 25% in FY 2019 from USD 359 million in FY 2018 and maintains the mid-term ambition to halve the run-rate corporate costs between FY 2017 (USD 431 million) and year-end 2019. “Other” in Q3 2019 includes the results of Kazakhstan, Kyrgyzstan, Armenia, Georgia, other global operations, services and intercompany eliminations. INCOME STATEMENT & CAPITAL EXPENDITURES Reported Reported 3Q19 Reported 9M19 Reported USD million 3Q19 3Q18 pre-IFRS 16 9M19 9M18 pre-IFRS 16 Pre-IFRS16 YoY Pre-IFRS16 YoY YoY YoY Total revenue 2,223 2,223 2,317 (4.0%) (4.0%) 6,609 6,609 6,837 (3.3%) (3.3%) Service revenue 2,076 2,076 2,151 (3.5%) (3.5%) 6,161 6,161 6,443 (4.4%) (4.4%) EBITDA 987 858 848 16.5% 1.3% 3,280 2,897 2,559 28.2% 13.2% EBITDA margin 44.4% 38.6% 36.6% 7.8p.p. 2.0p.p. 49.6% 43.8% 37.4% 12.2p.p. 6.4p.p. Depreciation, amortization, impairments and other (603) (499) (1,238) 51.3% (1,644) (1,317) (2,212) 25.7% EBIT (Operating Profit) 384 359 (391) 198.2% 1,636 1,579 346 372.6% Financial income and expenses (233) (191) (199) (17.3%) (626) (497) (590) (6.1%) Net foreign exchange (loss)/gain (20) (18) (13) n.m. (29) (25) (12) (82.6%) Share of (loss)/profit of joint ventures and associates - - - n.m. - (0) - 0.0% Other non operating gains / losses - - (24) n.m. 14 14 (49) n.m. (Loss)/Profit before tax 130 150 (626) n.m. 995 1,072 (305) n.m. Income tax expense (100) (104) (92) (8.7%) (360) (375) (345) n.m. (Loss)/Profit from continued operations 31 46 (718) n.m. 635 697 (650) n.m. Profit from discontinued operations - - 1,279 n.m. - - 978 n.m. Profit for the period (before NCI) 31 46 561 n.m. 635 697 329 93.1% Reported Reported 3Q19 Reported 9M19 Reported 3Q19 3Q18 pre-IFRS 16 9M19 9M18 pre-IFRS 16 Pre-IFRS16 YoY Pre-IFRS16 YoY YoY YoY Capex 397 344 319 24.7% 8.0% 1,395 1,193 1,565 (10.9%) (23.8%) Capex excl. licenses 377 324 311 21.0% 4.1% 1,364 1,163 1,068 27.7% 8.8% Capex excl. licenses/revenue 16.9% 14.6% 13.4% 20.6% 17.6% 15.6% LTM capex excl. licenses/revenue 19.3% 17.0% 16.8% 19.3% 17.0% 16.8% Note: prior year comparatives are restated following the classification of Italy Joint Venture as a discontinued operation and retrospective recognition of depreciation and amortization charges in respect of Deodar Q3 2019 ANALYSIS Reported EBITDA increased by 16.5% YoY. EBITDA pre-IFRS 16 increased by 1.3% YoY, as the strong operational performance was partially offset by currency headwinds and the regulatory changes in Pakistan. Operating profit pre-IFRS 16 for 3Q19 was USD 359 million, compared to an operating loss in 3Q18 of USD 391 million, both affected by impairments. The Company recorded USD 782 million of impairments (including Bangladesh for USD 451 million and Algeria for USD 125 million) in 3Q18 and USD 89 of impairments in 3Q19 related to Kyrgyzstan. In Q3 2019, financial income and expenses increased as VEON recorded a USD 41 million financial expense, related to the put option liability over the 15% non-controlling interest in Pakistan. Excluding this additional expense, the net financial income and expenses decreased YoY (on a pre-IFRS 16 basis), primarily due to lower debt levels, which more than offset the marginal increase in the cost of debt as a result of an increase in the Russian ruble-denominated debt portion. Consequently, profit before tax in Q3 2019 was USD 150 million pre-IFRS 16 and USD 130 million including the impact of IFRS 16. The pre-IFRS 16 income tax expense was USD 104 million. In Q3 2019, the Company recorded a net profit of USD 52 million for the period attributable to VEON’s shareholders. In Q3 2018, VEON booked a gain of USD 1,279 million, presented as profit from discontinued operations, as a result of the completion of the sale of VEON’s 50% stake in its Italy joint venture to CK Hutchison. 10

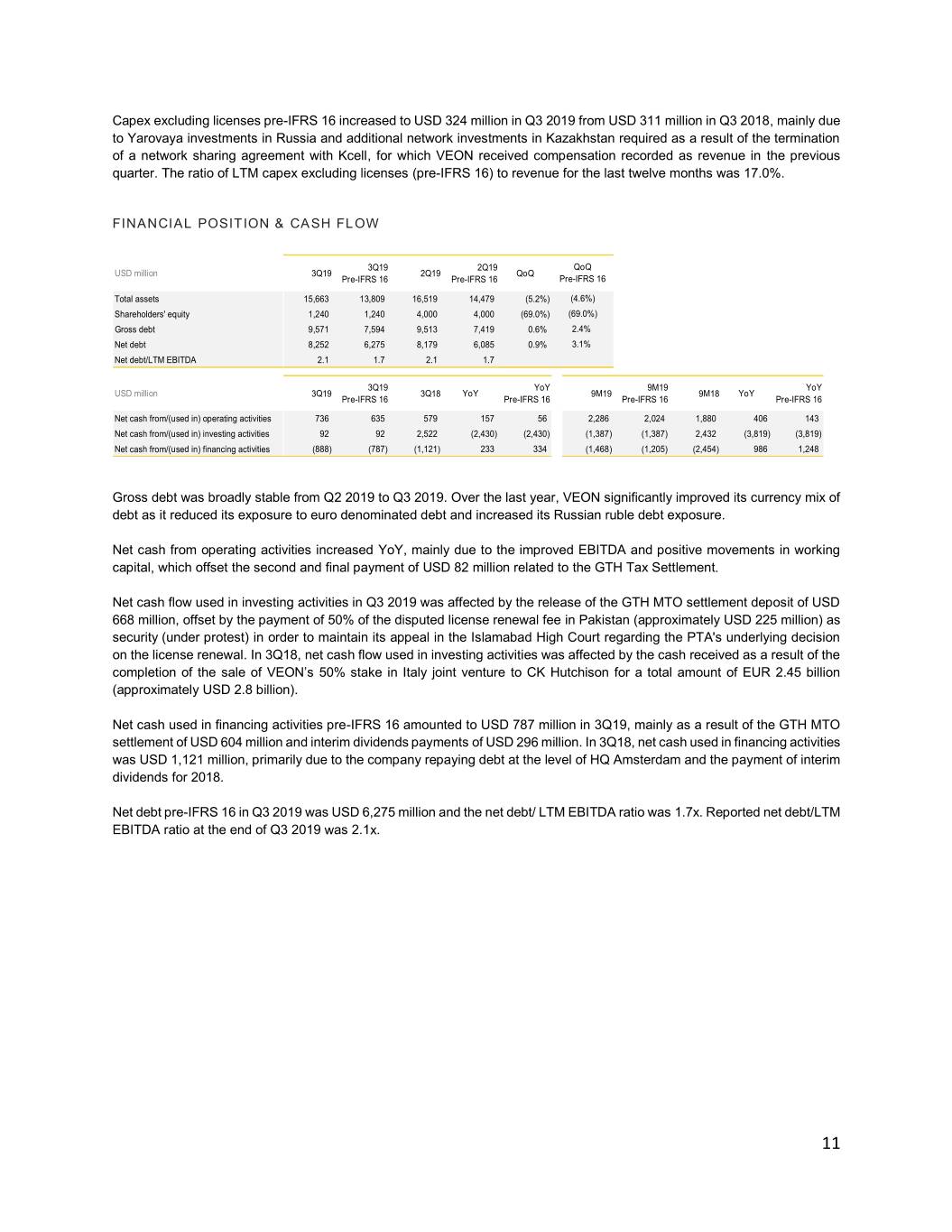

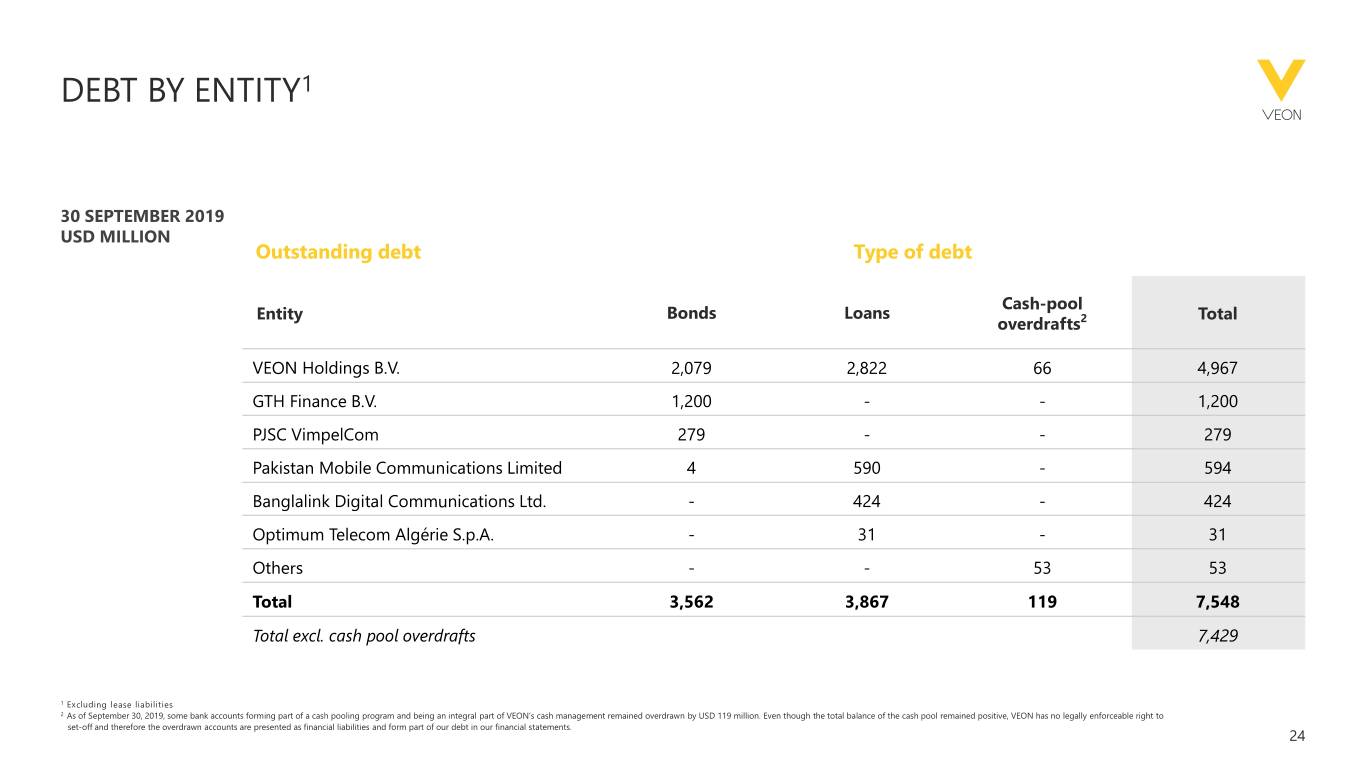

Capex excluding licenses pre-IFRS 16 increased to USD 324 million in Q3 2019 from USD 311 million in Q3 2018, mainly due to Yarovaya investments in Russia and additional network investments in Kazakhstan required as a result of the termination of a network sharing agreement with Kcell, for which VEON received compensation recorded as revenue in the previous quarter. The ratio of LTM capex excluding licenses (pre-IFRS 16) to revenue for the last twelve months was 17.0%. FINANCIAL POSITION & CASH FLOW 3Q19 2Q19 QoQ USD million 3Q19 2Q19 QoQ Pre-IFRS 16 Pre-IFRS 16 Pre-IFRS 16 Total assets 15,663 13,809 16,519 14,479 (5.2%) (4.6%) Shareholders' equity 1,240 1,240 4,000 4,000 (69.0%) (69.0%) Gross debt 9,571 7,594 9,513 7,419 0.6% 2.4% Net debt 8,252 6,275 8,179 6,085 0.9% 3.1% Net debt/LTM EBITDA 2.1 1.7 2.1 1.7 3Q19 YoY 9M19 YoY USD million 3Q19 3Q18 YoY 9M19 9M18 YoY Pre-IFRS 16 Pre-IFRS 16 Pre-IFRS 16 Pre-IFRS 16 Net cash from/(used in) operating activities 736 635 579 157 56 2,286 2,024 1,880 406 143 Net cash from/(used in) investing activities 92 92 2,522 (2,430) (2,430) (1,387) (1,387) 2,432 (3,819) (3,819) Net cash from/(used in) financing activities (888) (787) (1,121) 233 334 (1,468) (1,205) (2,454) 986 1,248 Gross debt was broadly stable from Q2 2019 to Q3 2019. Over the last year, VEON significantly improved its currency mix of debt as it reduced its exposure to euro denominated debt and increased its Russian ruble debt exposure. Net cash from operating activities increased YoY, mainly due to the improved EBITDA and positive movements in working capital, which offset the second and final payment of USD 82 million related to the GTH Tax Settlement. Net cash flow used in investing activities in Q3 2019 was affected by the release of the GTH MTO settlement deposit of USD 668 million, offset by the payment of 50% of the disputed license renewal fee in Pakistan (approximately USD 225 million) as security (under protest) in order to maintain its appeal in the Islamabad High Court regarding the PTA's underlying decision on the license renewal. In 3Q18, net cash flow used in investing activities was affected by the cash received as a result of the completion of the sale of VEON’s 50% stake in Italy joint venture to CK Hutchison for a total amount of EUR 2.45 billion (approximately USD 2.8 billion). Net cash used in financing activities pre-IFRS 16 amounted to USD 787 million in 3Q19, mainly as a result of the GTH MTO settlement of USD 604 million and interim dividends payments of USD 296 million. In 3Q18, net cash used in financing activities was USD 1,121 million, primarily due to the company repaying debt at the level of HQ Amsterdam and the payment of interim dividends for 2018. Net debt pre-IFRS 16 in Q3 2019 was USD 6,275 million and the net debt/ LTM EBITDA ratio was 1.7x. Reported net debt/LTM EBITDA ratio at the end of Q3 2019 was 2.1x. 11

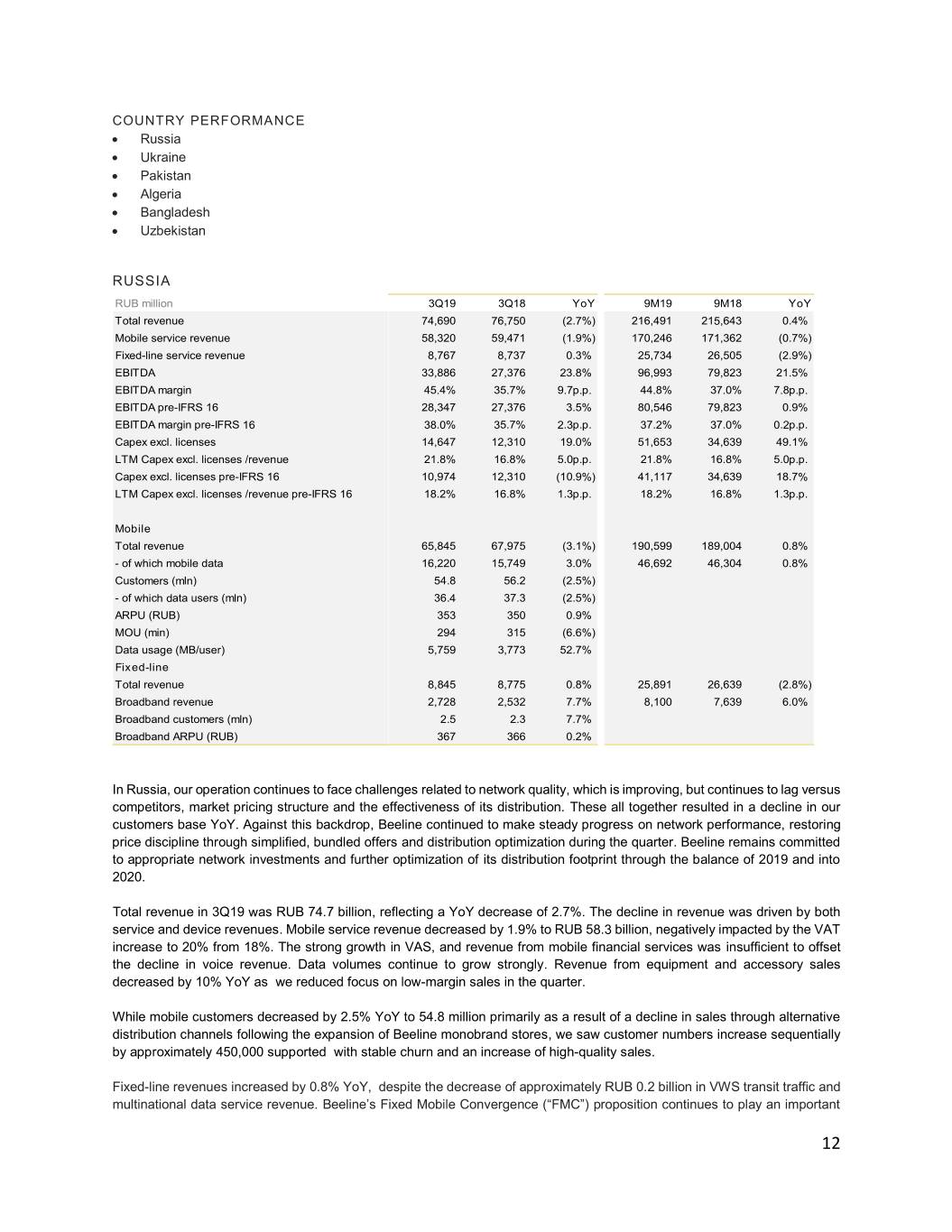

COUNTRY PERFORMANCE • Russia • Ukraine • Pakistan • Algeria • Bangladesh • Uzbekistan RUSSIA RUB million 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 74,690 76,750 (2.7%) 216,491 215,643 0.4% Mobile service revenue 58,320 59,471 (1.9%) 170,246 171,362 (0.7%) Fixed-line service revenue 8,767 8,737 0.3% 25,734 26,505 (2.9%) EBITDA 33,886 27,376 23.8% 96,993 79,823 21.5% EBITDA margin 45.4% 35.7% 9.7p.p. 44.8% 37.0% 7.8p.p. EBITDA pre-IFRS 16 28,347 27,376 3.5% 80,546 79,823 0.9% EBITDA margin pre-IFRS 16 38.0% 35.7% 2.3p.p. 37.2% 37.0% 0.2p.p. Capex excl. licenses 14,647 12,310 19.0% 51,653 34,639 49.1% LTM Capex excl. licenses /revenue 21.8% 16.8% 5.0p.p. 21.8% 16.8% 5.0p.p. Capex excl. licenses pre-IFRS 16 10,974 12,310 (10.9%) 41,117 34,639 18.7% LTM Capex excl. licenses /revenue pre-IFRS 16 18.2% 16.8% 1.3p.p. 18.2% 16.8% 1.3p.p. Mobile Total revenue 65,845 67,975 (3.1%) 190,599 189,004 0.8% - of which mobile data 16,220 15,749 3.0% 46,692 46,304 0.8% Customers (mln) 54.8 56.2 (2.5%) - of which data users (mln) 36.4 37.3 (2.5%) ARPU (RUB) 353 350 0.9% MOU (min) 294 315 (6.6%) Data usage (MB/user) 5,759 3,773 52.7% Fixed-line Total revenue 8,845 8,775 0.8% 25,891 26,639 (2.8%) Broadband revenue 2,728 2,532 7.7% 8,100 7,639 6.0% Broadband customers (mln) 2.5 2.3 7.7% Broadband ARPU (RUB) 367 366 0.2% In Russia, our operation continues to face challenges related to network quality, which is improving, but continues to lag versus competitors, market pricing structure and the effectiveness of its distribution. These all together resulted in a decline in our customers base YoY. Against this backdrop, Beeline continued to make steady progress on network performance, restoring price discipline through simplified, bundled offers and distribution optimization during the quarter. Beeline remains committed to appropriate network investments and further optimization of its distribution footprint through the balance of 2019 and into 2020. Total revenue in 3Q19 was RUB 74.7 billion, reflecting a YoY decrease of 2.7%. The decline in revenue was driven by both service and device revenues. Mobile service revenue decreased by 1.9% to RUB 58.3 billion, negatively impacted by the VAT increase to 20% from 18%. The strong growth in VAS, and revenue from mobile financial services was insufficient to offset the decline in voice revenue. Data volumes continue to grow strongly. Revenue from equipment and accessory sales decreased by 10% YoY as we reduced focus on low-margin sales in the quarter. While mobile customers decreased by 2.5% YoY to 54.8 million primarily as a result of a decline in sales through alternative distribution channels following the expansion of Beeline monobrand stores, we saw customer numbers increase sequentially by approximately 450,000 supported with stable churn and an increase of high-quality sales. Fixed-line revenues increased by 0.8% YoY, despite the decrease of approximately RUB 0.2 billion in VWS transit traffic and multinational data service revenue. Beeline’s Fixed Mobile Convergence (“FMC”) proposition continues to play an important 12

role in the turnaround of the fixed-line business for Beeline. The FMC customer base grew by 17% YoY in Q3 2019 to more than 1.2 million, which represents a 47% FMC penetration of the broadband customer base. Beeline continues to focus on the B2B segment, improving its proposition with new digital offers and solutions to both small and large enterprises. In 3Q19 B2B service mobile revenue increased by 4.9%. EBITDA (pre-IFRS 16) increased by 3.5% YoY supporting an EBITDA margin of 38.0%. The improved EBITDA performance was supported by lower commercial expenses, primarily as a result of closing approximately 120 own stores. Lower spectrum costs in 2019 and the reversal of certain provisions supported EBITDA in the period. Capex excluding licenses (pre-IFRS 16) decreased by 10.9% as a result of phasing versus higher capital expenditures during the first half of the year. During 3Q19, we increased 4G base stations by 43%. Beeline continues to invest in network development with strong separate focus on Moscow and St. Petersburg to ensure it has high quality infrastructure which is ready to integrate new technologies. The LTM capex (excluding licenses) to revenue ratio (pre-IFRS 16) was 18.2% in Q3 2019. Reported capex excluding licenses increased by 19% YoY during the quarter. The Yarovaya Law-related investment plans are progressing in alignment with legal requirements. By the end of FY19 Beeline expects to have an LTM capex/revenue ratio pre-IFRS 16 of approximately 22%. UKRAINE UAH million 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 5,828 4,925 18.3% 16,577 13,710 20.9% Mobile service revenue 5,466 4,602 18.8% 15,486 12,750 21.5% Fixed-line service revenue 333 302 10.3% 995 895 11.2% EBITDA 3,772 2,833 33.1% 10,652 7,736 37.7% EBITDA margin 64.7% 57.5% 7.2p.p. 64.3% 56.4% 7.8p.p. EBITDA pre-IFRS 16 3,619 2,833 27.7% 10,210 7,736 32.0% EBITDA margin pre-IFRS-16 62.1% 57.5% 4.6p.p. 61.6% 56.4% 5.2p.p. Capex excl. licenses 1,370 737 85.8% 3,505 2,351 49.1% LTM capex excl. licenses/revenue 19.7% 16.0% 3.7p.p. 19.7% 16.0% 3.7p.p. Capex excl. licenses pre-IFRS 16 1,193 737 61.8% 2,979 2,351 26.7% LTM capex excl. licenses/revenue pre-IFRS 16 17.3% 16.0% 1.2p.p. 17.3% 16.0% 1.2p.p. Mobile Total operating revenue 5,466 4,624 18.2% 15,486 12,815 20.8% - of which mobile data 2,799 2,045 36.9% 8,037 4,960 62.0% Customers (mln) 26.4 26.6 (0.8%) - of which data customers (mln) 16.3 14.5 12.1% ARPU (UAH) 69 57 19.9% MOU (min) 566 565 0.3% Data usage (MB/user) 3,969 2,347 69.1% Fixed-line Total operating revenue 333 302 10.3% 995 895 11.2% Broadband revenue 216 186 16.0% 640 551 16.0% Broadband customers (mln) 1.0 0.9 11.0% Broadband ARPU (UAH) 74 71 4.3% In Ukraine, Kyivstar delivered another quarter of solid results in a highly competitive market, supported by our marketing activities and strong growth in data consumption enabled by ongoing investment in Kyivstar’s network. Kyivstar had a strong performance in 3Q19, with total revenue growing by 18.3% YoY to UAH 5.8 billion. The revenue growth was supported by data revenue growth, CVM (Customer Value Management) activities, FTTB and FMC subscriber base growth. Mobile service revenue grew by 18.8% to UAH 5.5 billion, driven by strong data revenue growth and by the continued monetization of our 4G network through new customer offers. Growth in data customers and data usage supported an ARPU increase of 19.9% YoY to UAH 69. Overall, Kyivstar’s mobile customer base decreased by 0.8% to 26.4 million, due to the reduction in multi SIM users on the market. Despite this, data penetration continued to increase and data customers grew by 13

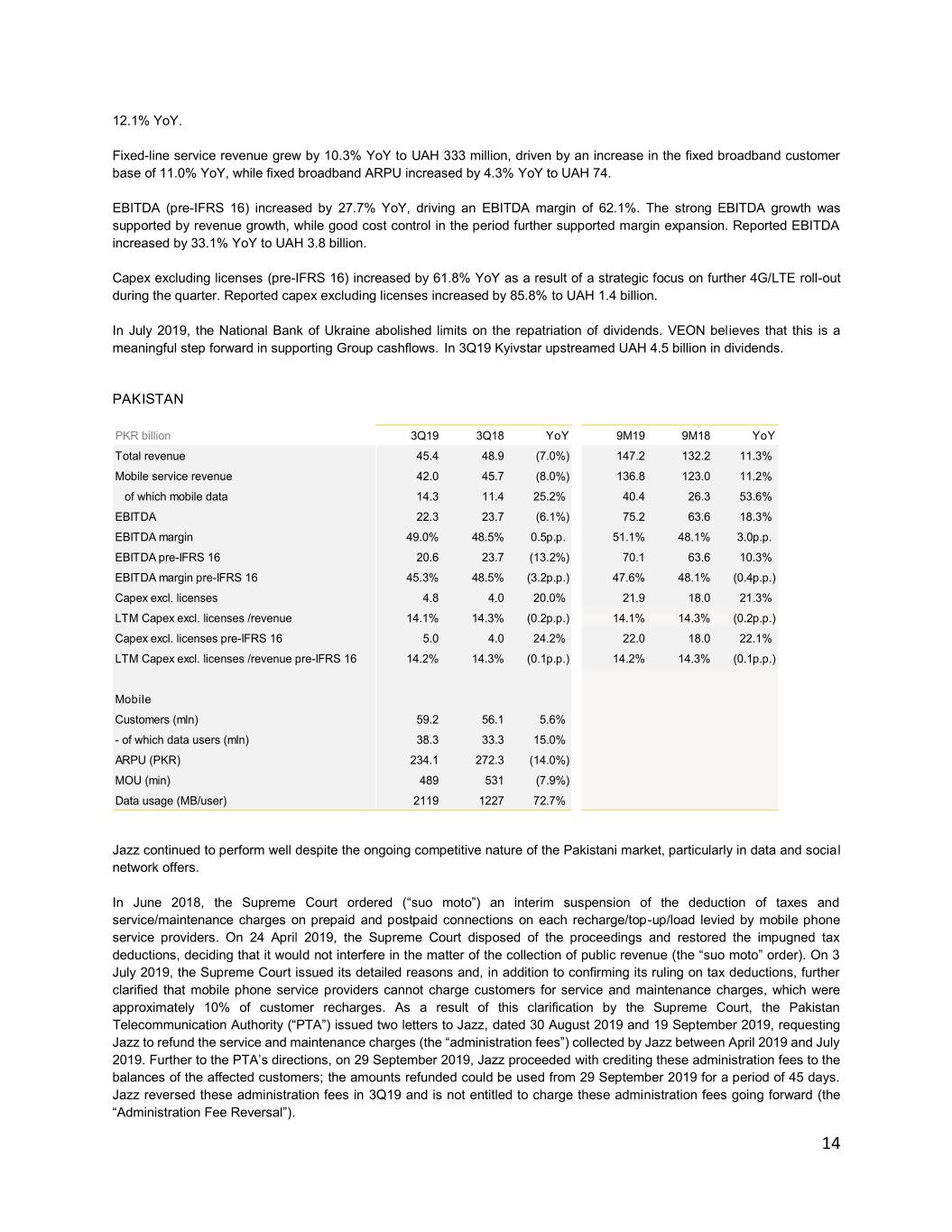

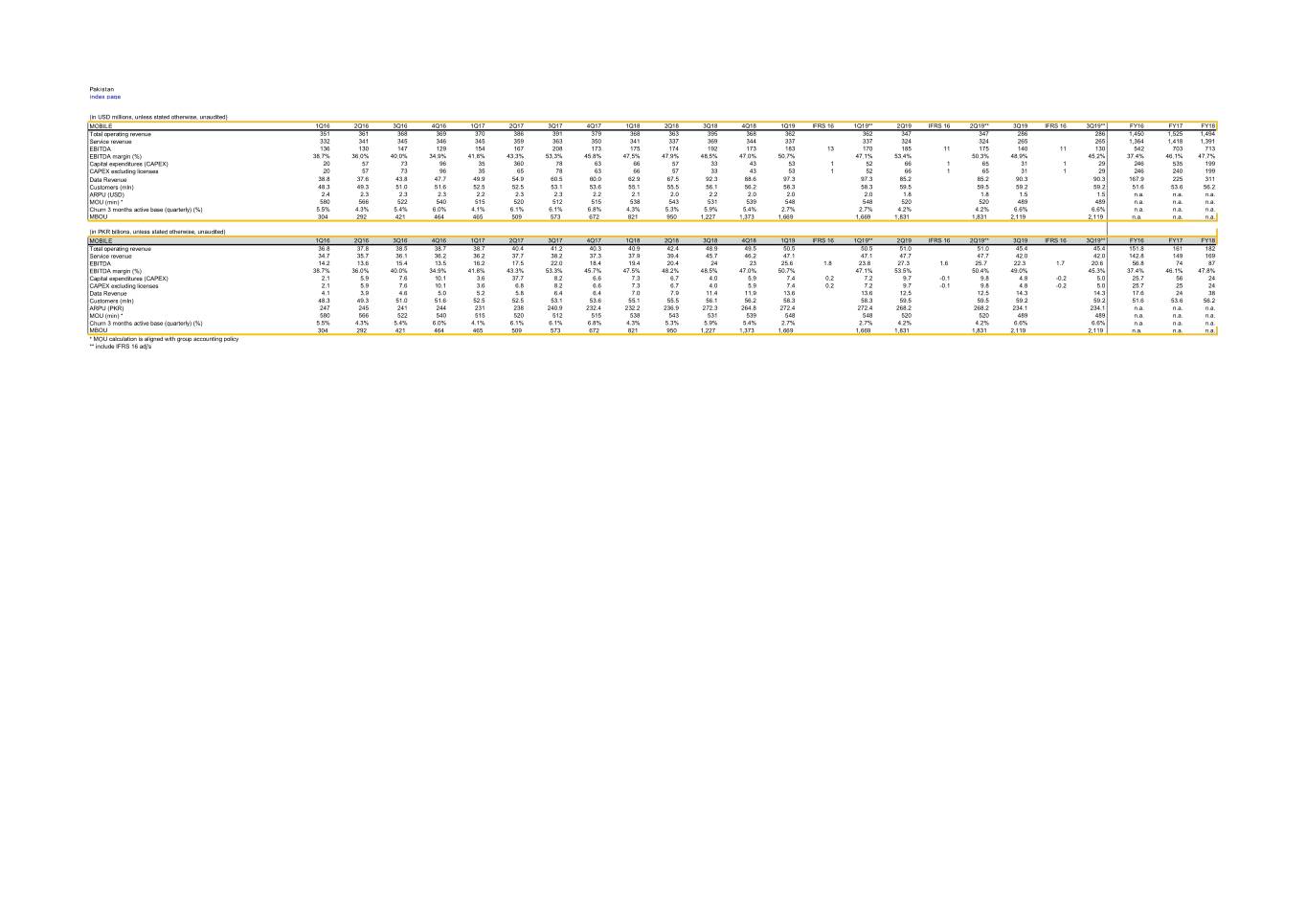

12.1% YoY. Fixed-line service revenue grew by 10.3% YoY to UAH 333 million, driven by an increase in the fixed broadband customer base of 11.0% YoY, while fixed broadband ARPU increased by 4.3% YoY to UAH 74. EBITDA (pre-IFRS 16) increased by 27.7% YoY, driving an EBITDA margin of 62.1%. The strong EBITDA growth was supported by revenue growth, while good cost control in the period further supported margin expansion. Reported EBITDA increased by 33.1% YoY to UAH 3.8 billion. Capex excluding licenses (pre-IFRS 16) increased by 61.8% YoY as a result of a strategic focus on further 4G/LTE roll-out during the quarter. Reported capex excluding licenses increased by 85.8% to UAH 1.4 billion. In July 2019, the National Bank of Ukraine abolished limits on the repatriation of dividends. VEON believes that this is a meaningful step forward in supporting Group cashflows. In 3Q19 Kyivstar upstreamed UAH 4.5 billion in dividends. PAKISTAN PKR billion 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 45.4 48.9 (7.0%) 147.2 132.2 11.3% Mobile service revenue 42.0 45.7 (8.0%) 136.8 123.0 11.2% of which mobile data 14.3 11.4 25.2% 40.4 26.3 53.6% EBITDA 22.3 23.7 (6.1%) 75.2 63.6 18.3% EBITDA margin 49.0% 48.5% 0.5p.p. 51.1% 48.1% 3.0p.p. EBITDA pre-IFRS 16 20.6 23.7 (13.2%) 70.1 63.6 10.3% EBITDA margin pre-IFRS 16 45.3% 48.5% (3.2p.p.) 47.6% 48.1% (0.4p.p.) Capex excl. licenses 4.8 4.0 20.0% 21.9 18.0 21.3% LTM Capex excl. licenses /revenue 14.1% 14.3% (0.2p.p.) 14.1% 14.3% (0.2p.p.) Capex excl. licenses pre-IFRS 16 5.0 4.0 24.2% 22.0 18.0 22.1% LTM Capex excl. licenses /revenue pre-IFRS 16 14.2% 14.3% (0.1p.p.) 14.2% 14.3% (0.1p.p.) Mobile Customers (mln) 59.2 56.1 5.6% - of which data users (mln) 38.3 33.3 15.0% ARPU (PKR) 234.1 272.3 (14.0%) MOU (min) 489 531 (7.9%) Data usage (MB/user) 2119 1227 72.7% Jazz continued to perform well despite the ongoing competitive nature of the Pakistani market, particularly in data and social network offers. In June 2018, the Supreme Court ordered (“suo moto”) an interim suspension of the deduction of taxes and service/maintenance charges on prepaid and postpaid connections on each recharge/top-up/load levied by mobile phone service providers. On 24 April 2019, the Supreme Court disposed of the proceedings and restored the impugned tax deductions, deciding that it would not interfere in the matter of the collection of public revenue (the “suo moto” order). On 3 July 2019, the Supreme Court issued its detailed reasons and, in addition to confirming its ruling on tax deductions, further clarified that mobile phone service providers cannot charge customers for service and maintenance charges, which were approximately 10% of customer recharges. As a result of this clarification by the Supreme Court, the Pakistan Telecommunication Authority (“PTA”) issued two letters to Jazz, dated 30 August 2019 and 19 September 2019, requesting Jazz to refund the service and maintenance charges (the “administration fees”) collected by Jazz between April 2019 and July 2019. Further to the PTA’s directions, on 29 September 2019, Jazz proceeded with crediting these administration fees to the balances of the affected customers; the amounts refunded could be used from 29 September 2019 for a period of 45 days. Jazz reversed these administration fees in 3Q19 and is not entitled to charge these administration fees going forward (the “Administration Fee Reversal”). 14

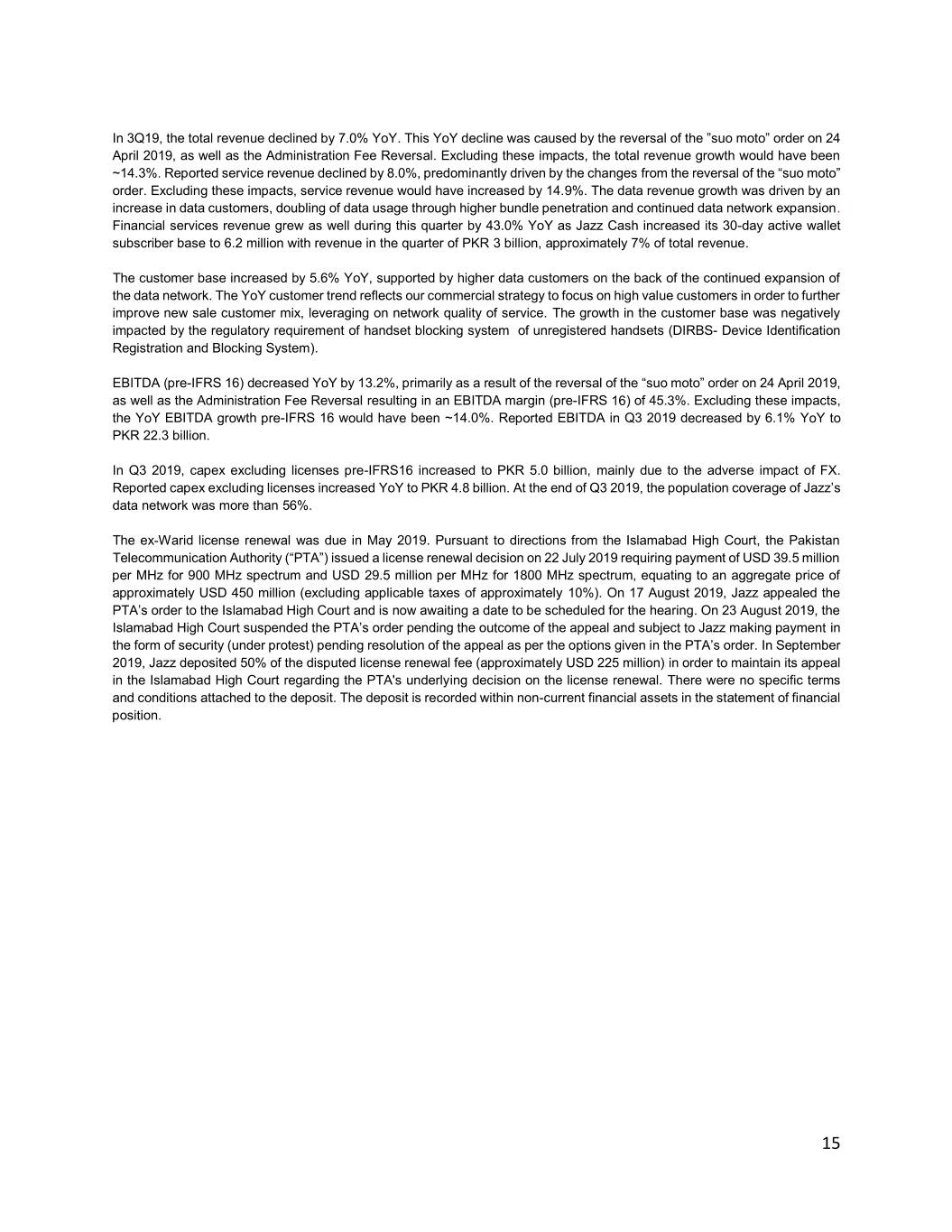

In 3Q19, the total revenue declined by 7.0% YoY. This YoY decline was caused by the reversal of the ”suo moto” order on 24 April 2019, as well as the Administration Fee Reversal. Excluding these impacts, the total revenue growth would have been ~14.3%. Reported service revenue declined by 8.0%, predominantly driven by the changes from the reversal of the “suo moto” order. Excluding these impacts, service revenue would have increased by 14.9%. The data revenue growth was driven by an increase in data customers, doubling of data usage through higher bundle penetration and continued data network expansion. Financial services revenue grew as well during this quarter by 43.0% YoY as Jazz Cash increased its 30-day active wallet subscriber base to 6.2 million with revenue in the quarter of PKR 3 billion, approximately 7% of total revenue. The customer base increased by 5.6% YoY, supported by higher data customers on the back of the continued expansion of the data network. The YoY customer trend reflects our commercial strategy to focus on high value customers in order to further improve new sale customer mix, leveraging on network quality of service. The growth in the customer base was negatively impacted by the regulatory requirement of handset blocking system of unregistered handsets (DIRBS- Device Identification Registration and Blocking System). EBITDA (pre-IFRS 16) decreased YoY by 13.2%, primarily as a result of the reversal of the “suo moto” order on 24 April 2019, as well as the Administration Fee Reversal resulting in an EBITDA margin (pre-IFRS 16) of 45.3%. Excluding these impacts, the YoY EBITDA growth pre-IFRS 16 would have been ~14.0%. Reported EBITDA in Q3 2019 decreased by 6.1% YoY to PKR 22.3 billion. In Q3 2019, capex excluding licenses pre-IFRS16 increased to PKR 5.0 billion, mainly due to the adverse impact of FX. Reported capex excluding licenses increased YoY to PKR 4.8 billion. At the end of Q3 2019, the population coverage of Jazz’s data network was more than 56%. The ex-Warid license renewal was due in May 2019. Pursuant to directions from the Islamabad High Court, the Pakistan Telecommunication Authority (“PTA”) issued a license renewal decision on 22 July 2019 requiring payment of USD 39.5 million per MHz for 900 MHz spectrum and USD 29.5 million per MHz for 1800 MHz spectrum, equating to an aggregate price of approximately USD 450 million (excluding applicable taxes of approximately 10%). On 17 August 2019, Jazz appealed the PTA’s order to the Islamabad High Court and is now awaiting a date to be scheduled for the hearing. On 23 August 2019, the Islamabad High Court suspended the PTA’s order pending the outcome of the appeal and subject to Jazz making payment in the form of security (under protest) pending resolution of the appeal as per the options given in the PTA’s order. In September 2019, Jazz deposited 50% of the disputed license renewal fee (approximately USD 225 million) in order to maintain its appeal in the Islamabad High Court regarding the PTA's underlying decision on the license renewal. There were no specific terms and conditions attached to the deposit. The deposit is recorded within non-current financial assets in the statement of financial position. 15

UZBEKISTAN UZS billion 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 594 651 (8.8%) 1,696 1,903 (10.9%) Mobile service revenue 589 645 (8.8%) 1,683 1,887 (10.8%) - of which mobile data 271 225 20.3% 762 625 21.9% Fixed-line service revenue 3.1 4.3 (28.3%) 10 14 (25.8%) EBITDA 325 291 11.6% 887 844 5.1% EBITDA margin 54.7% 44.7% 10.0p.p. 52.3% 44.3% 7.9p.p. EBITDA pre-IFRS 16 315 291 8.1% 855 844 1.3% EBITDA margin pre-IFRS 16 53.0% 44.7% 8.3p.p. 50.4% 44.3% 6.1p.p. Capex excl. licenses 32 71 (54.9%) 404 278 45.5% LTM Capex excl. licenses/revenue 19.0% 15.7% 3.2p.p. 19.0% 15.7% 3.2p.p. Capex excl. licenses pre-IFRS 16 23 71 (66.7%) 350 278 26.1% LTM Capex excl. licenses/revenue pre-IFRS 16 16.6% 15.7% 0.9p.p. 16.6% 15.7% 0.9p.p. Mobile Customers (mln) 8.4 9.1 (7.9%) - of which mobile data customers (mln) 5.3 5.2 1.7% ARPU (UZS) 22,463 23,257 (3.4%) MOU (min) 627 596 5.2% Data usage (MB/user) 2,276 1,254 81.4% Increasing mobile data penetration remains the key driver in the Uzbekistan market. Beeline Uzbekistan continued to focus on attracting quality customers and benefited from its position as a market leader. Going forward, Beeline Uzbekistan will focus on reducing churn and maintaining its leadership position. The business delivered a 4.6% sequential improvement in revenue while YoY total revenue decreased by 8.8% YoY to UZS 594 billion, primarily driven by the negative impact of the reduction in mobile termination rates (UZS 17 billion) and the introduction of the 15% excise tax (UZS 80 billion), which were partially offset by repricing activities. Adjusted for these negative effects, the growth would have been approximately 7.1% YoY. Mobile data traffic more than doubled, supported by the continued roll-out of high-speed data networks, increased smartphone penetration and the increased penetration of bundled offerings in the customer base. Beeline Uzbekistan saw its customer base decline to 8.4 million, down 7.9% YoY as a result of its strategic focus on high value customers. EBITDA pre-IFRS 16 increased by 8.1% to UZS 315 billion, driven by good organic revenue growth notwithstanding a slightly negative impact as a result of changes in the tax regime. Reported EBITDA increased by 11.6% to UZS 325 billion. Capex excluding licenses pre-IFRS 16 decreased to UZS 23 billion, mainly as a result of better phasing of capex, with a larger part of the network investment during H1 2019. LTM 3Q19 capex to revenue ratio was 16.6%. Beeline Uzbekistan continued to invest in high-speed data networks, improving 4G/LTE coverage to 26% and increasing the number of nationwide 3G sites YoY. Improvements to our high-speed data networks will continue to be a priority for Uzbekistan in 2020. From January 2019, new tax reforms were introduced, which aim to simplify taxation in Uzbekistan. The tax authorities introduced a flat 20% corporate tax rate for mobile operators (prior to this the corporate tax rate depended on the profitability of mobile operators), cancelled the revenue tax of 3.2% and introduced an excise tax of 15% over customer charges. Furthermore, the customer tax was reduced to UZS 2,000 in FY 2019 from UZS 4,000 in FY 2018. Tax reforms introduced from January 2019 are expected to have an approximately 15% negative effect on revenue in FY 2019, while free cash flow impact is expected to be slightly negative due to utilization of deferred tax assets. Going forward, there will be a positive impact on equity free cash flow (excluding licenses). From 1 October 2019, the excise tax has been increased from 15% to 20% to cover VAT reduction from 20% to 15%. The overall impact of this change in excise tax is expected to be minimal. 16

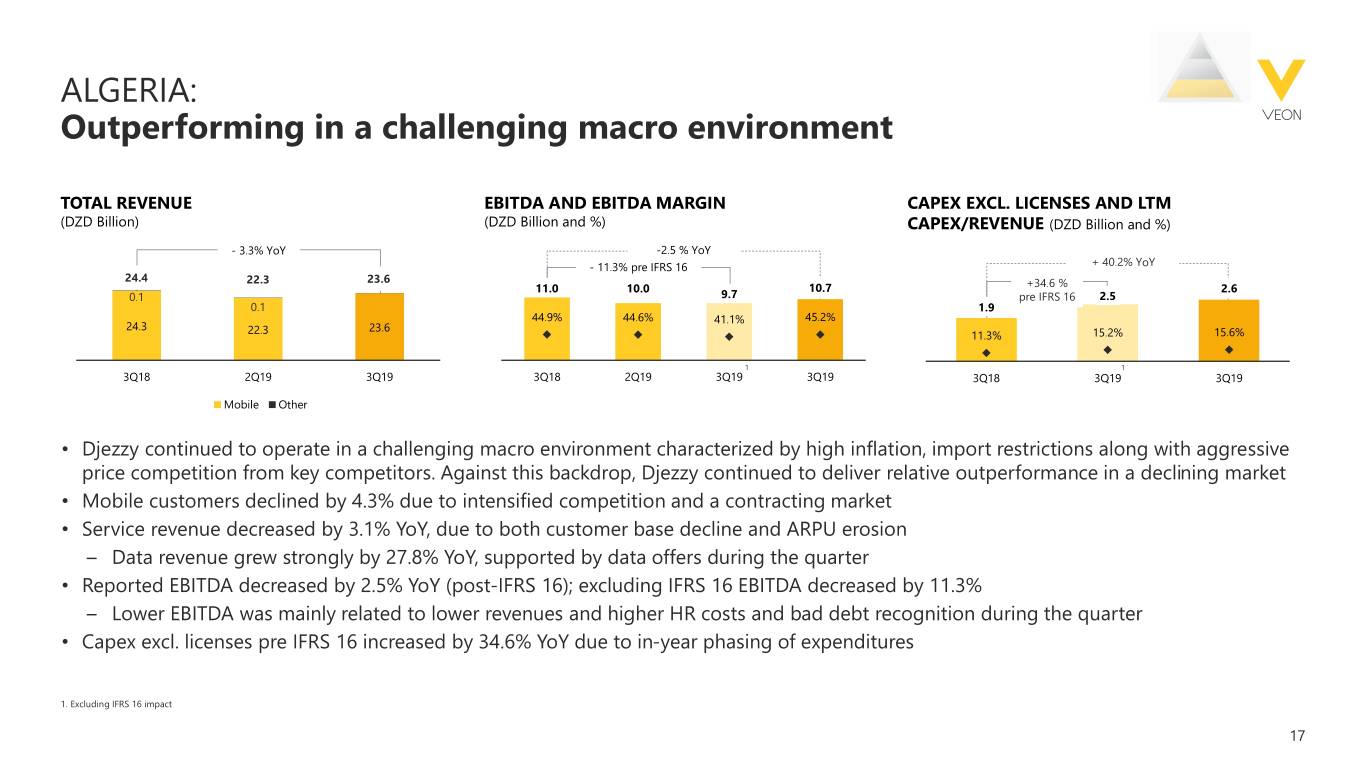

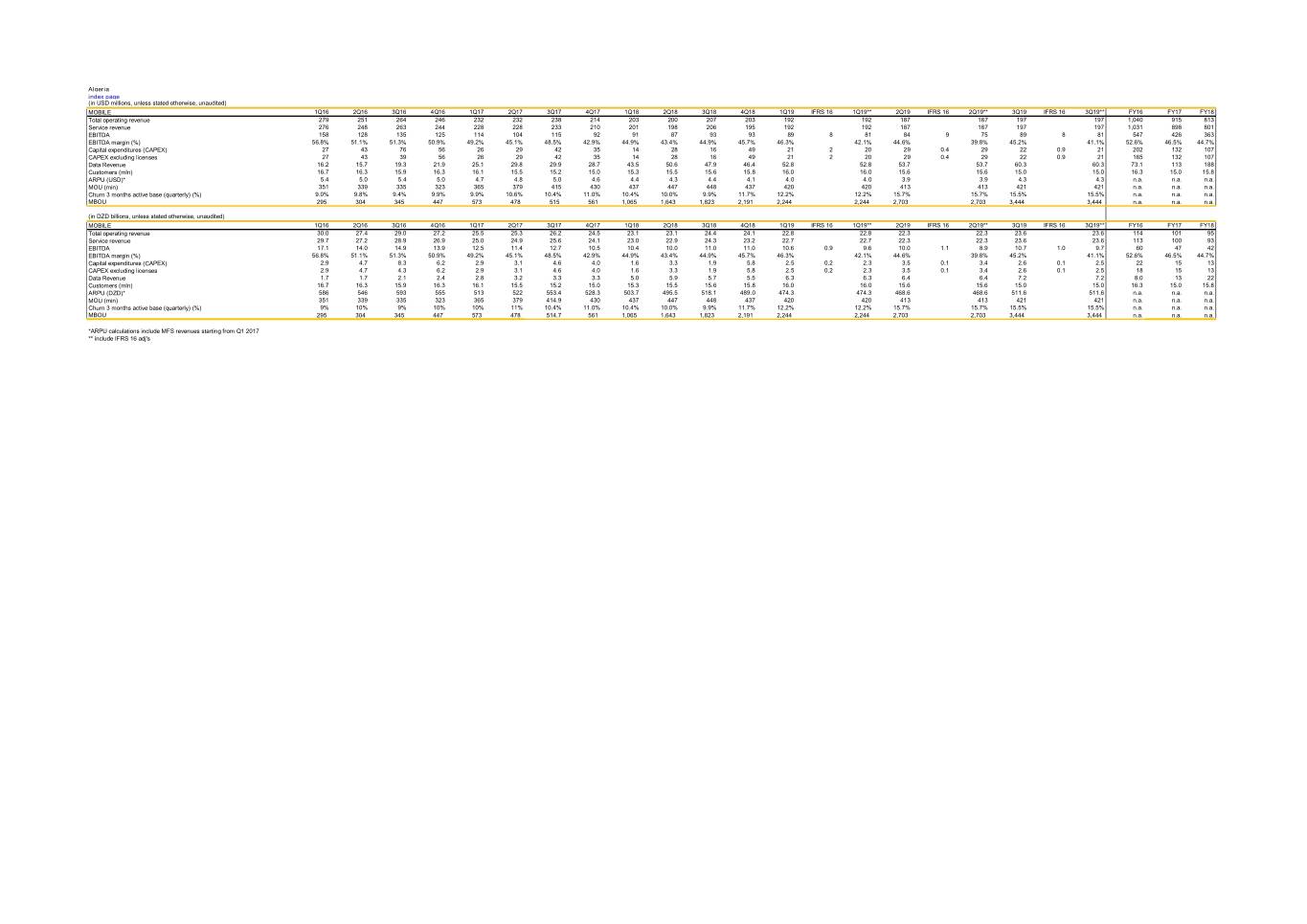

ALGERIA DZD billion 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 23.6 24.4 (3.3%) 68.8 70.7 (2.7%) Mobile service revenue 23.6 24.3 (3.1%) 68.6 70.2 (2.4%) of which mobile data 7.2 5.7 27.8% 19.9 16.5 20.7% EBITDA 10.7 11.0 (2.5%) 31.2 31.4 (0.5%) EBITDA margin 45.2% 44.9% 0.4p.p. 45.4% 44.4% 1.0p.p. EBITDA pre-IFRS 16 9.7 11.0 (11.3%) 28.2 31.4 (10.0%) EBITDA margin pre-IFRS 16 41.1% 44.9% (3.8p.p.) 41.0% 44.4% (3.4p.p.) Capex excl. licenses 2.6 1.9 40.2% 8.7 6.8 27.9% LTM capex excl. licenses/revenue 15.6% 11.3% 4.3p.p. 15.6% 11.3% 4.3p.p. Capex excl. licenses pre-IFRS 16 2.5 1.9 34.6% 8.3 6.8 22.4% LTM capex excl. licenses/revenue pre-IFRS 16 15.2% 11.3% 3.9p.p. 15.2% 11.3% 3.9p.p. Mobile Customers (mln) 15.0 15.6 (4.3%) - of which mobile data customers (mln) 9.4 9.0 5.0% ARPU (DZD) 512 518 (1.2%) MOU (min) 421 448 (6.0%) Data usage (MB/user) 3,444 1,823 88.9% In Algeria, macro challenges persisted during the quarter, and political uncertainty remains following the former President’s resignation. The market remains challenging with high levels of competition in both pricing as well as channel-related incentives. Against this backdrop, Djezzy continued with its segmented approach, improving its share in its high value segment while at the same time preserving its share in the mass market segment, resulting in an improvement in its relative performance in a declining market. Djezzy’s 3Q19 service revenue was DZD 23.6 billion, reflecting a YoY decline of 3.3%, while showing a sequential improvement of 5.8% quarter on quarter. Data revenue increased by 27.8% YoY, due to higher usage and an increase in data penetration mostly on 4G/LTE. Price competition in both voice and data drove a continued reduction in ARPU, which declined by 1.2% YoY. During Q3 2019, Djezzy introduced a modernized and an updated tariff portfolio which supported ARPU sequential growth of 9.2%. During the quarter Djezzy recorded the highest NPS since 2015 primarily due to positive network reputation and brand awareness. EBITDA (pre-IFRS 16) decreased YoY by 11.3%, resulting in a margin of 41.1%. The decline in revenue remains a challenge for EBITDA performance, alongside increased HR costs and bad debt recognition. Reported EBITDA decreased by 2.5% YoY to DZD 10.7 billion. At the end of 3Q19, Djezzy’s 4G/LTE services covered 28 wilayas and close to 35% of Algeria’s population, while its 3G network covered all 48 wilayas and approximately 74% of Algeria’s population. In Q3 2019, capex excluding licenses pre- IFRS 16 was DZD 2.5 billion, representing a 34.6% increase YoY following continuous investments in network rollout. 17

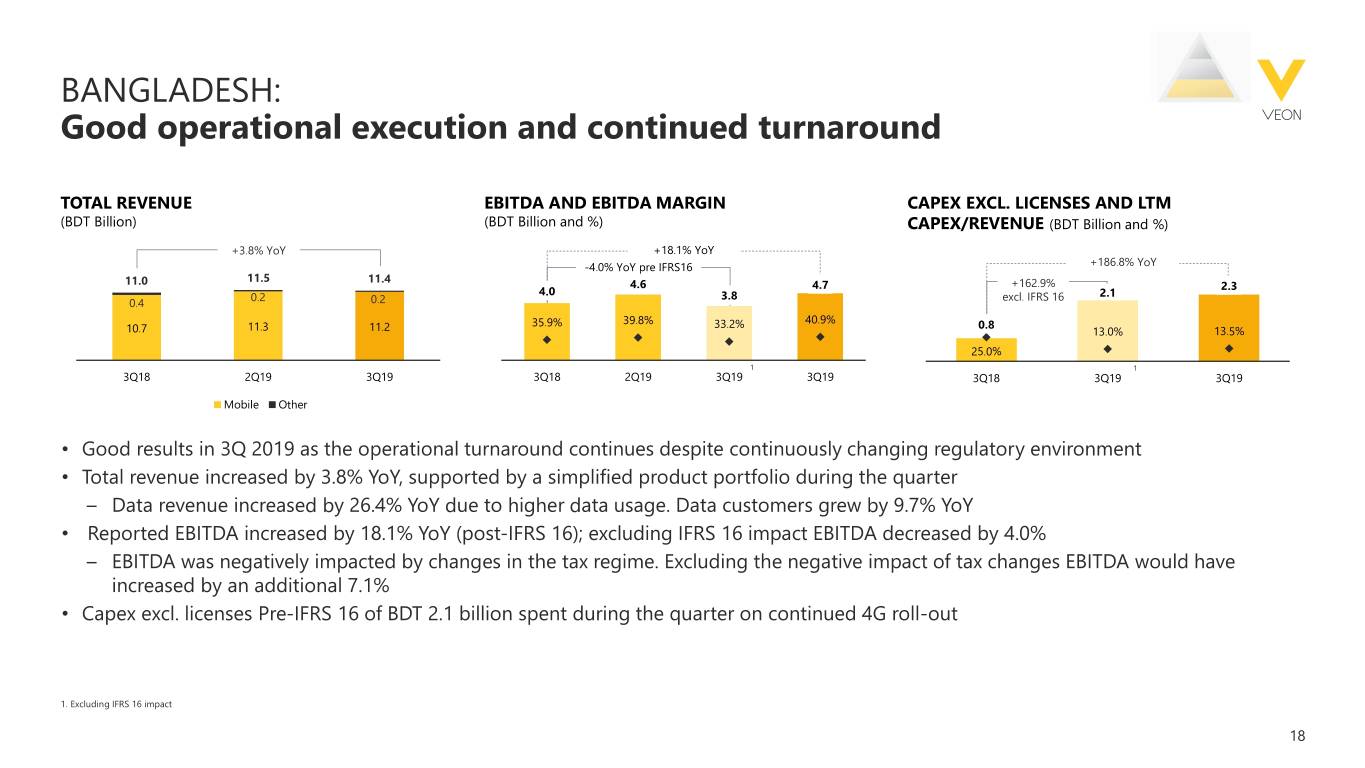

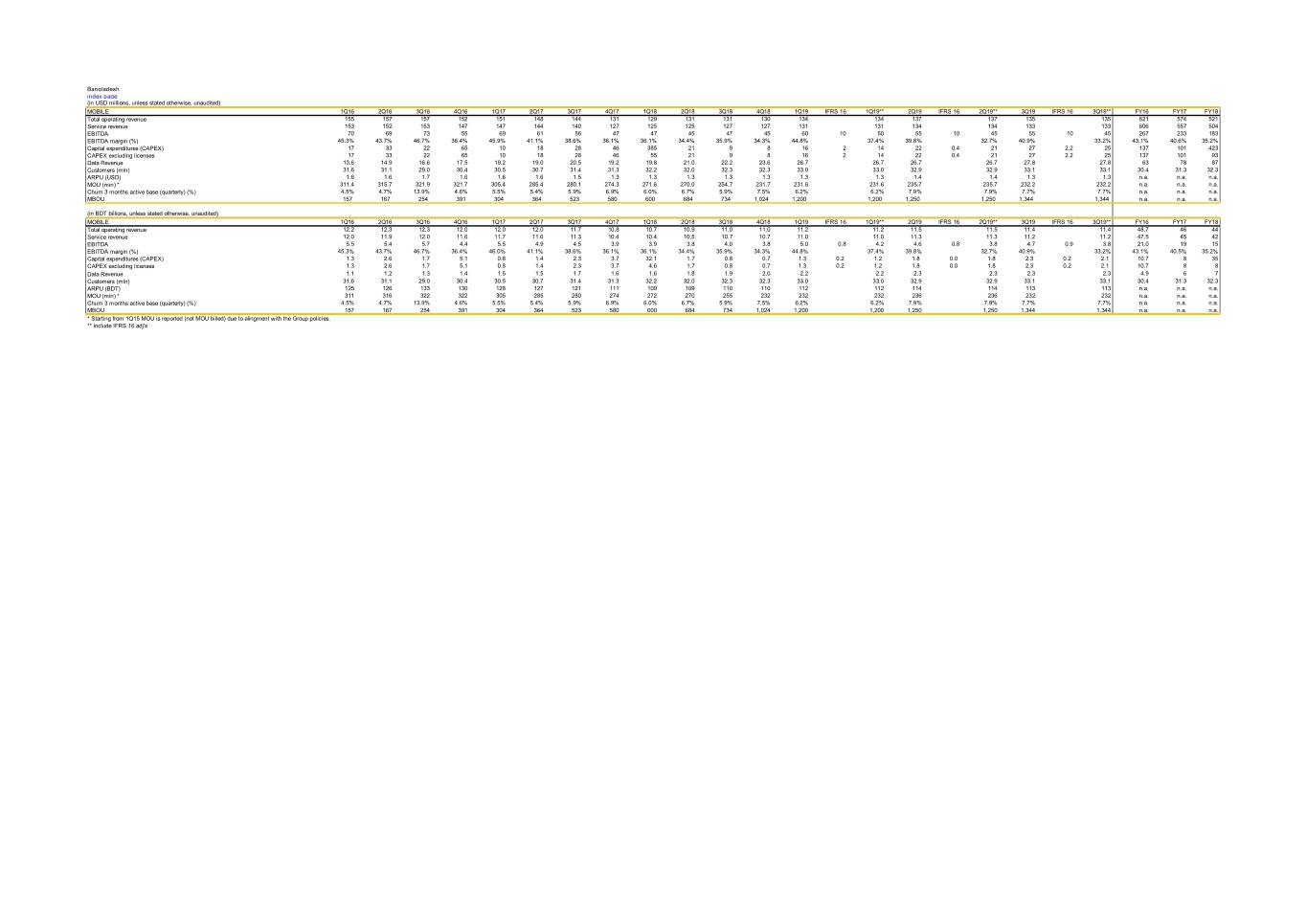

BANGLADESH BDT billion 3Q19 3Q18 YoY 9M19 9M18 YoY Total revenue 11.4 11.0 3.8% 34.2 32.7 4.6% Mobile service revenue 11.2 10.7 5.2% 33.4 31.5 6.1% of which mobile data 2.3 1.9 26.4% 6.8 5.3 29.9% EBITDA 4.7 4.0 18.1% 14.3 11.6 23.3% EBITDA margin 40.9% 35.9% 4.9p.p. 41.8% 35.5% 6.4p.p. EBITDA pre-IFRS 16 3.8 4.0 (4.0%) 11.7 11.6 1.4% EBITDA margin pre-IFRS 16 33.2% 35.9% (2.7p.p.) 34.4% 35.5% (1.1p.p.) Capex excl. licenses 2.3 0.8 186.8% 5.4 7.1 (23.7%) LTM capex excl. licenses/revenue 13.5% 25.0% (11.5p.p.) 13.5% 25.0% (11.5p.p.) Capex excl. licenses pre-IFRS 16 2.1 0.8 162.9% 5.2 7.1 (27.0%) LTM capex excl. licenses/revenue pre-IFRS 16 13.0% 25.0% (12.0p.p.) 13.0% 25.0% (12.0p.p.) Mobile Customers (mln) 33.1 32.3 2.4% - of which mobile data customers (mln) 21.6 19.7 9.7% ARPU (BDT) 113 110 2.4% MOU (min) 232 255 (8.8%) Data usage (MB/user) 1,344 734 83.1% The mobile industry in Bangladesh during 3Q19 continued to be characterized by intense competition. Notwithstanding this market backdrop and challenging regulatory environment, Banglalink reported good results and delivered year on year service revenue growth for the fourth consecutive quarter. Banglalink continued to focus on acquiring customers in 3Q19. Customer grew by 2.4% YoY while data customers increased by 9.7% as a result of simplified and product offers and improved network availability. Total revenue in 3Q19 grew by 3.8% YoY, driven by an acceleration of mobile service revenue, which increased by 5.2% YoY to BDT 11.2 billion. The revenue increase was mainly driven by a continued improvement in data revenue following enhanced network availability, as well as the continued expansion of Banglalink’s distribution footprint. ARPU increased by 2.4% YoY driven by higher voice and data revenue, following the introduction of the new bundle portfolio with revised prices during the quarter. Data revenue increased by 26.4% YoY, driven by increased smartphone penetration and data usage grew by 83% YoY to 1,344 MB per user. EBITDA (pre-IFRS16) decreased by 4.0% YoY, as higher revenue was largely offset by the increase in the minimum tax rate. Excluding the negative impact as a result of changes in the tax regime EBITDA would have increased by an additional 7.1%. EBITDA margin (pre-IFRS 16) decreased to 33.2%. Reported EBITDA in 3Q19 increased by 18.1% YoY to BDT 4.7 billion. In 3Q19, capex excluding licenses pre-IFRS 16 increased YoY to BDT 2.1 billion. 3G network population coverage was approximately 72% at the end of the period. The roll-out of 4G/LTE is in progress, following the introduction of this service in February 2018. In Q2 2019, the tax authority in Bangladesh introduced several changes to the tax regime: Supplementary Duty increased from 5% to 10% from subscription revenue; SIM tax increased from BDT 100 to 200; minimum tax rate increased from 0.75% to 2% of revenue and custom duties on smartphones increased from 10% to 25%. Banglalink expects these tax changes to have a negative impact of approximately 5.7% on EBITDA for FY 2019. 18

CONFERENCE CALL INFORMATION On 4 November 2019, VEON will host a conference call by senior management at 9.30 CET (8.30 GMT), which will be made available through following dial-in numbers. The call and slide presentation may be accessed at http://www.veon.com 9:30 CET investor and analyst conference call US call-in number: +1 631 51 07 495 Confirmation Code: 2163649 International call-in number: +44 (0) 2071 928000 Confirmation Code: 2163649 The conference call replay and the slide presentation webcast will be available until 12 November 2019. The slide presentation will also be available for download from VEON's website. Investor and analyst call replay US Replay Number: +1 (917) 677 7532 Confirmation Code: 2163649 UK Replay Number: +44 (0) 333 3009785 Confirmation Code: 2163649 CONTACT INFORMATION INVESTOR RELATIONS CORPORATE COMMUNICATIONS Nik Kershaw Kieran Toohey [email protected] [email protected] 19

DISCLAIMER This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by words such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” and other similar words. Forward-looking statements include statements relating to, among other things, VEON’s plans to implement its strategic priorities, including operating model and development plans, among others; anticipated performance and guidance for 2019, including VEON’s ability to generate sufficient cash flow; future market developments and trends; operational and network development and network investment, including expectations regarding the roll-out and benefits of 3G/4G/LTE networks, as applicable; spectrum acquisitions and renewals; the effect of the acquisition of additional spectrum on customer experience; VEON’s ability to realize the acquisition and disposition of any of its businesses and assets and to execute its strategic transactions (including the GTH mandatory tender offer) in the timeframes anticipated, or at all; VEON’s ability to realize financial improvements, including an expected reduction of net pro-forma leverage ratio following the successful completion of certain dispositions and acquisitions; our dividends; and VEON’s ability to realize its targets and commercial initiatives in its various countries of operation. The forward-looking statements included in this press release are based on management’s best assessment of VEON’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of demand for and market acceptance of VEON’s products and services; our plans regarding our dividend payments and policies, as well as our ability to receive dividends, distributions, loans, transfers or other payments or guarantees from our subsidiaries; continued volatility in the economies in VEON’s markets; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in VEON’s markets; government investigations or other regulatory actions; litigation or disputes with third parties or other negative developments regarding such parties; the impact of export controls and laws affecting trade and investments on our and important third-party suppliers' ability to procure goods, software or technology necessary for the services we provide to our customers; risks associated with data protection or cyber security, other risks beyond the parties’ control or a failure to meet expectations regarding various strategic priorities, the effect of foreign currency fluctuations, increased competition in the markets in which VEON operates and the effect of consumer taxes on the purchasing activities of consumers of VEON’s services. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VEON’s Annual Report on Form 20-F for the year ended December 31, 2018 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VEON with the SEC. Other unknown or unpredictable factors also could harm our future results. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Under no circumstances should the inclusion of such forward-looking statements in this press release be regarded as a representation or warranty by us or any other person with respect to the achievement of results set out in such statements or that the underlying assumptions used will in fact be the case. Therefore, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements speak only as of the date hereof. We cannot assure you that any projected results or events will be achieved. Except to the extent required by law, we disclaim any obligation to update or revise any of these forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made, or to reflect the occurrence of unanticipated events. Furthermore, elements of this press release contain or may contain, “inside information” as defined under the Market Abuse Regulation (EU) No. 596/2014. All non-IFRS measures disclosed further in this press release (including, without limitation, EBITDA, EBITDA margin, EBT, net debt, equity free cash flow (excluding licenses), organic growth, capital expenditures excluding licenses and LTM (last twelve months) capex excluding licenses/revenue) are reconciled to comparable IFRS measures in Attachment C to this earnings release. In addition, we present certain information on a forward-looking basis. We are not able to, without unreasonable efforts, provide a full reconciliation to IFRS due to potentially high variability, complexity and low visibility as to the items that would be excluded from the comparable IFRS measure in the relevant future period, including, but not limited to, depreciation and amortization, impairment loss, loss on disposal of non-current assets, financial income and expenses, foreign currency exchange losses and gains, income tax expense and performance transformation costs, cash and cash equivalents, long - term and short-term deposits, interest accrued related to financial liabilities, other unamortized adjustments to financial liabilities, derivatives, and other financial liabilities. 20

ABOUT VEON VEON is a NASDAQ and Euronext Amsterdam-listed global provider of connectivity and digital services, headquartered in Amsterdam. Our vision is to empower customer ambitions through technology, acting as a digital concierge to guide their choices and connect them with resources that match their needs. For more information visit: http://www.veon.com. CONTENT OF THE ATTACHMENTS Attachment A Customers 22 Attachment B Definitions 22 Attachment C Reconciliation tables 24 Average rates and guidance rates of functional currencies to USD For more information on financial and operating data for specific countries, please refer to the supplementary file Factbook3Q2019.xls on VEON’s website at http://veon.com/Investor-relations/Reports--results/Results/. 21

ATTACHMENT A: CUSTOMERS Mobile Fixed-line broadband million 3Q19 3Q18 YoY 3Q19 3Q18 YoY Russia 54.8 56.2 (2.5%) 2.5 2.3 7.7% Pakistan 59.2 56.1 5.6% Algeria 15.0 15.6 (4.3%) Bangladesh 33.1 32.3 2.4% Ukraine 26.4 26.6 (0.8%) 1.0 0.9 11.0% Uzbekistan 8.4 9.1 (7.9%) Other 14.8 14.8 0.9% 0.5 0.5 4.9% Total 211.7 210.7 0.5% 4.0 3.7 8.1% ATTACHMENT B: DEFINITIONS ARPU (Average Revenue Per User) measures the monthly average revenue per mobile user. We generally calculate mobile ARPU by dividing our mobile service revenue during the relevant period, including data revenue, roaming revenue, MFS and interconnect revenue, but excluding revenue from connection fees, sales of handsets and accessories and other non-service revenue, by the average number of our mobile customers during the period and dividing by the number of months in that period. Mobile data customers are mobile customers who have engaged in revenue generating activity during the three months prior to the measurement date as a result of activities including USB modem Internet access using 2.5G/3G/4G/HSPA+ technologies. Capital expenditures (capex) are purchases of new equipment, new construction, upgrades, licenses, software, other long- lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Long-lived assets acquired in business combinations, are not included in capital expenditures. Capital expenditures (capex) exc. licenses is calculated as capex, excluding purchases of new spectrum licenses EBIT or Operating Profit is calculated as EBITDA plus depreciation, amortization and impairment loss. Our management uses EBIT as a supplemental performance measure and believes that it provides useful information of earnings of the Company before making accruals for financial income and expenses and net foreign exchange (loss)/gain and others. Reconciliation of EBIT to net income attributable to VEON Ltd., the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment E below. Adjusted EBITDA (called EBITDA in this document) is a non-IFRS financial measure. VEON calculates Adjusted EBITDA as (loss)/profit before interest, tax, depreciation, amortization, impairment, gain / loss on disposals of non-current assets, other non-operating gains / losses and share of profit / loss of joint ventures and associates Our Adjusted EBITDA may be used to evaluate our performance against other telecommunications companies that provide EBITDA. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. Reconciliation of EBITDA to net income attributable to VEON Ltd., the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment C below. EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage. Gross Debt is calculated as the sum of long-term notional debt and short-term notional debt. Equity free cash flow (excluding licenses) is a non-IFRS measure and is defined as free cash flow from operating activities less cash flow used in investing activities, excluding M&A transactions, capex for licenses, inflow/outflow of deposits, financial assets and other one-off items. Reconciliation to the most directly comparable IFRS financial measure, is presented in the reconciliation tables section in Attachment E below. 22

An FMC customer is a customer on a 1 month Active Broadband Connection subscribing to a converged bundle consisting of at least fixed internet subscription and at least 1 mobile SIM. Households passed are households located within buildings, in which indoor installation of all the FTTB equipment necessary to install terminal residential equipment has been completed. MFS (mobile financial services) is a variety of innovative services, such as mobile commerce or m-commerce, that use a mobile phone as the primary payment user interface and allow mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone. Mobile customers are generally customers in the registered customer base as at a given measurement date who engaged in a revenue generating activity at any time during the three months prior to such measurement date. Such activity includes any outgoing calls, customer fee accruals, debits related to service, outgoing SMS and MMS, data transmission and receipt sessions, but does not include incoming calls, SMS and MMS or abandoned calls. Our total number of mobile customers also includes customers using mobile internet service via USB modems and fixed-mobile convergence (“FMC”). Net debt is a non-IFRS financial measure and is calculated as the sum of interest bearing long-term notional debt and short- term notional debt minus cash and cash equivalents, long-term and short-term deposits. The Company believes that net debt provides useful information to investors because it shows the amount of notional debt outstanding to be paid after using available cash and cash equivalents and long-term and short-term deposits. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of the Company financial position. Net foreign exchange (loss)/gain and others represents the sum of Net foreign exchange (loss)/gain, VEON’s share in net (loss)/gain of associates and Other (expense)/income (primarily (losses)/gains from derivative instruments) and is adjusted for certain non-operating losses and gains mainly represented by litigation provisions. NPS (Net Promoter Score) is the methodology VEON uses to measure customer satisfaction. Organic growth in revenue and EBITDA are non-IFRS financial measures that reflect changes in Revenue and EBITDA, excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions. Reportable segments: the Company identified Russia, Pakistan, Algeria, Bangladesh, Ukraine, Uzbekistan and HQ based on the business activities in different geographical areas. Total revenue in this section is fully comparable with Total Operating revenue in MD&A section below. 23

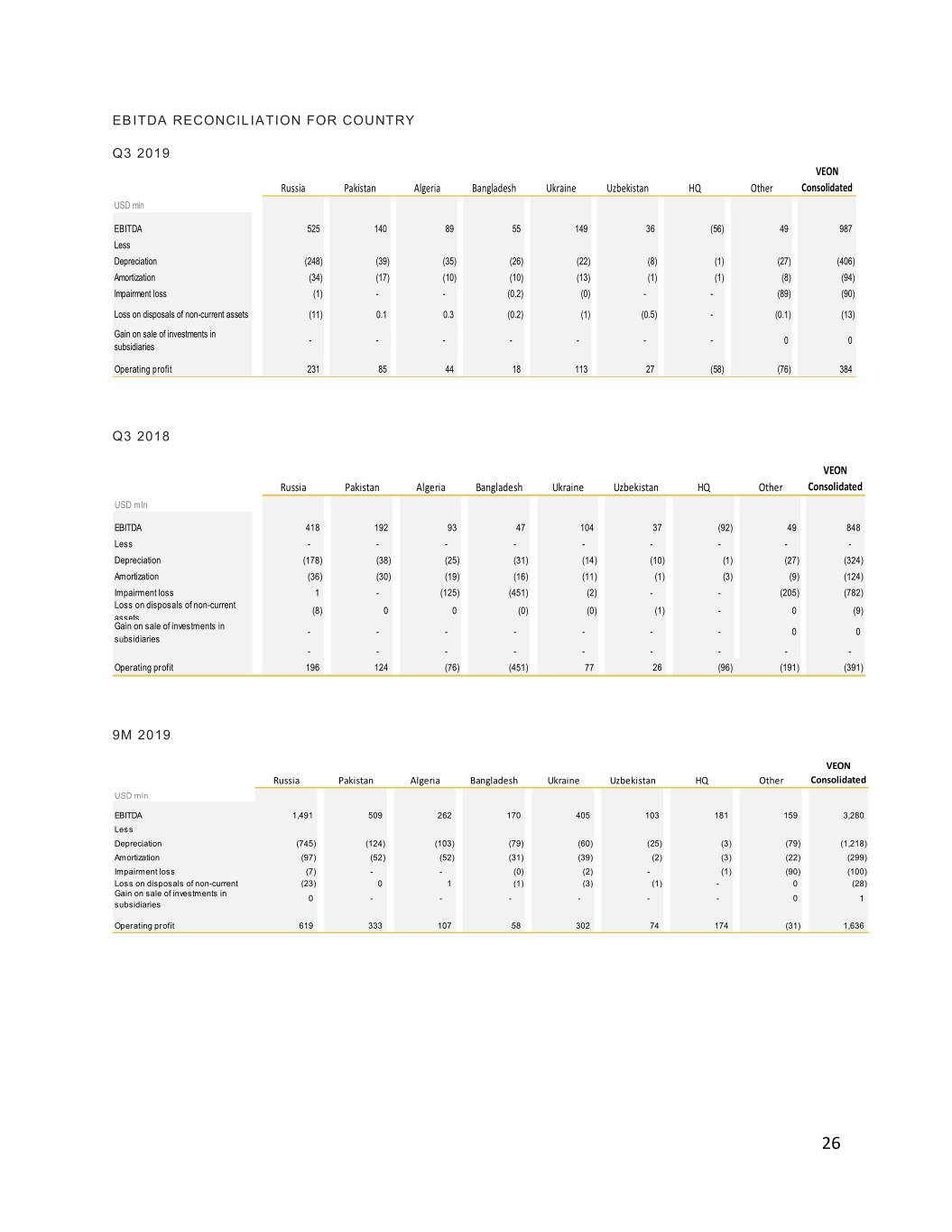

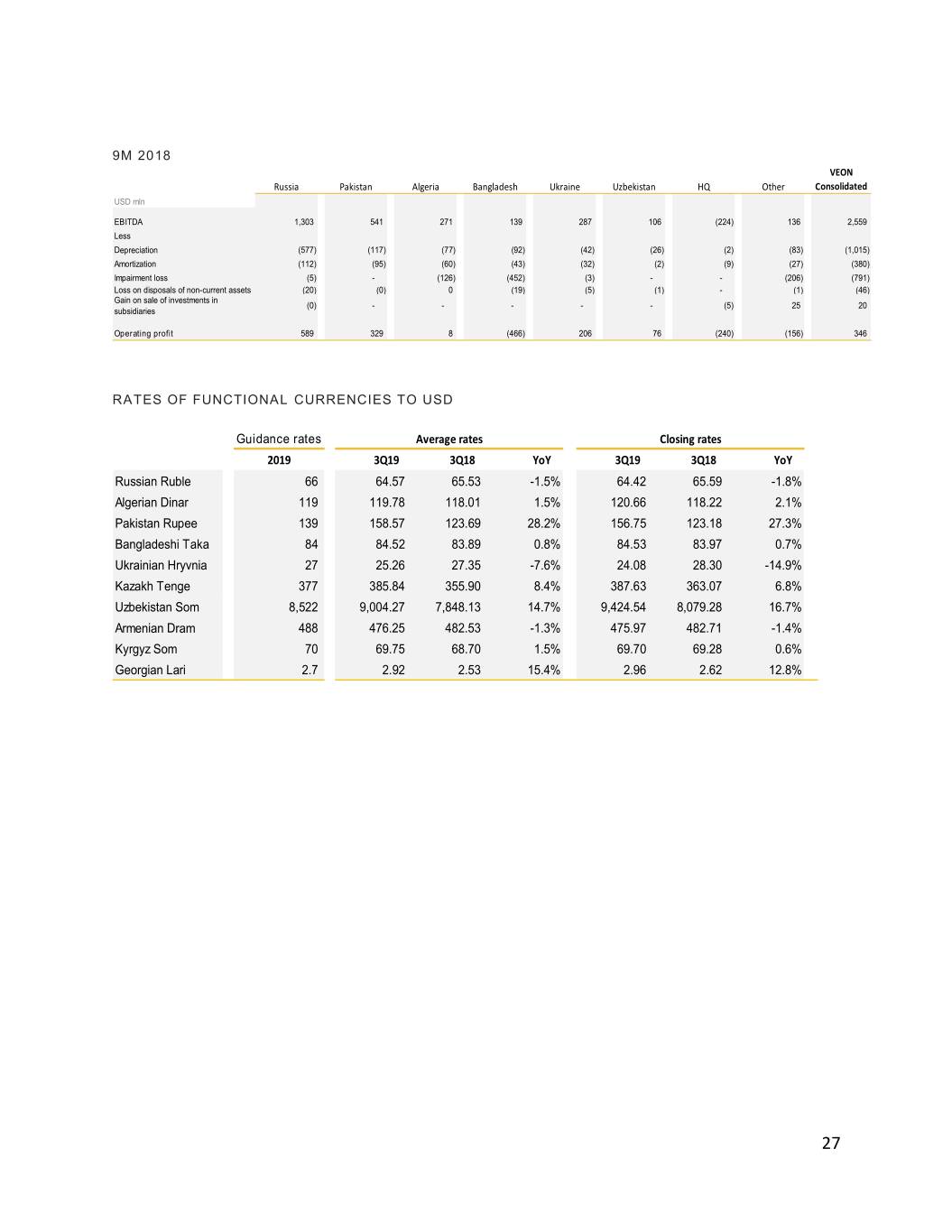

ATTACHMENT C: RECONCILIATION TABLES RECONCILIATION OF CONSOLIDATED EBITDA USD mln 3Q19 3Q18 9M19 9M18 Unaudited EBITDA 987 848 3,280 2,559 Depreciation (406) (324) (1,218) (1,015) Amortization (94) (124) (299) (380) Impairment loss (90) (782) (100) (791) Loss on disposals of non-current assets (13) (9) (27) (26) Operating profit 384 (391) 1,636 346 Financial Income and Expenses (233) (199) (626) (590) - including finance income 16 12 44 43 - including finance costs (249) (211) (670) (633) Net foreign exchange (loss)/gain and others (20) (37) (15) (61) - including Other non-operating (losses)/gains 0 (23) 14 (49) - including Shares of loss of associates and joint ventures accounted for using the equity method, including - (0) - (0) impairments of JV and associates - including Net foreign exchange gain (20) (13) (29) (12) Profit before tax 131 (626) 995 (305) Income tax expense (100) (92) (360) (345) (Loss)/Profit from continue operations 31 (718) 635 (650) (Loss)/Profit for discontinued operations - 1,279 - 978 (Loss)/Profit for the period 31 561 635 329 Profit/(loss) attributable to non-controlling interest 4 294 (36) 272 Profit/(Loss) for the year attributable to VEON shareholders 35 855 599 601 RECONCILIATION OF CAPEX USD mln unaudited 3Q19 3Q18 9M19 9M18 Cash paid for purchase of property, plant and equipment and intangible assets 372 327 1,197 1,504 Net difference between timing of recognition and payments for purchase of property, plant and equipment and intangible assets 25 (9) 199 60 Capital expenditures 397 319 1,395 1,565 Less capital expenditures in licenses and other (20) (8) (33) (497) Capital expenditures excl. licenses 377 311 1,364 1,068 RECONCILIATION OF ORGANIC AND REPORTED GROWTH RATES 3Q19 vs 3Q18 Total Revenue EBITDA Reported Organic Forex Reported Organic Forex Reported Pre-IFRS 16 Russia (2.7%) 1.4% (1.3%) 3.5% 1.5% 5.0% 25.5% Pakistan (7.0%) (20.5%) (27.5%) (13.2%) (19.2%) (32.3%) (26.8%) Algeria (3.3%) (1.4%) (4.7%) (11.3%) (1.3%) (12.7%) (3.9%) Bangladesh 3.8% (0.8%) 3.1% (4.0%) (0.7%) (4.7%) 17.2% Ukraine 18.3% 9.8% 28.1% 27.7% 10.6% 38.3% 44.2% Uzbekistan (8.8%) (11.7%) (20.5%) 8.1% (14.1%) (6.0%) (3.0%) Total (0.9%) (3.1%) (4.0%) 5.0% (3.7%) 1.3% 16.5% 24

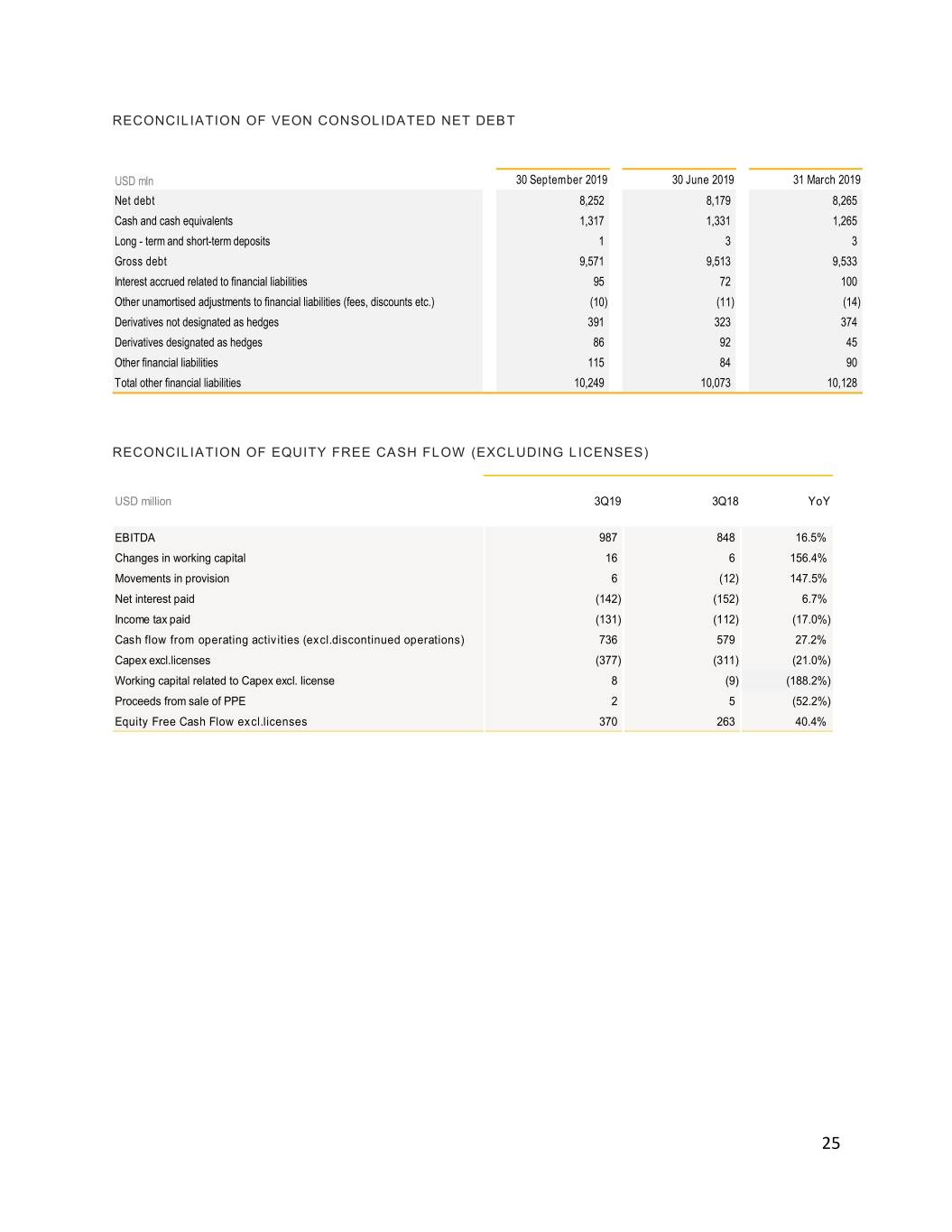

RECONCILIATION OF VEON CONSOLIDATED NET DEBT USD mln 30 September 2019 30 June 2019 31 March 2019 Net debt 8,252 8,179 8,265 Cash and cash equivalents 1,317 1,331 1,265 Long - term and short-term deposits 1 3 3 Gross debt 9,571 9,513 9,533 Interest accrued related to financial liabilities 95 72 100 Other unamortised adjustments to financial liabilities (fees, discounts etc.) (10) (11) (14) Derivatives not designated as hedges 391 323 374 Derivatives designated as hedges 86 92 45 Other financial liabilities 115 84 90 Total other financial liabilities 10,249 10,073 10,128 RECONCILIATION OF EQUITY FREE CASH FLOW (EXCLUDING LICENSES) USD million 3Q19 3Q18 YoY EBITDA 987 848 16.5% Changes in working capital 16 6 156.4% Movements in provision 6 (12) 147.5% Net interest paid (142) (152) 6.7% Income tax paid (131) (112) (17.0%) Cash flow from operating activities (excl.discontinued operations) 736 579 27.2% Capex excl.licenses (377) (311) (21.0%) Working capital related to Capex excl. license 8 (9) (188.2%) Proceeds from sale of PPE 2 5 (52.2%) Equity Free Cash Flow excl.licenses 370 263 40.4% 25