Form 6-K TELUS International (Cda For: Apr 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April 2021

Commission File Number 001-39968

TELUS International

(Cda) Inc.

(Registrant’s name)

Floor 7, 510 West Georgia Street

Vancouver, BC V6B 0M3

Tel.: (604) 695-3455

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

TELUS International (Cda) Inc. (the “Company”) announces that its annual general meeting will be held virtually on Thursday, May 27th, 2021. Materials related to the annual general meeting are attached as exhibits to this Report of Foreign Private Issuer on Form 6-K. Shareholders can also review the TELUS International Code of Ethics & Conduct on the Governance page of the Company’s website. The information found on the Company’s website is not incorporated by reference into this report and is included for reference purposes only.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELUS International (Cda) Inc. | ||

| Date: April 21, 2021 | By: | /s/ Michel Belec |

| Name: | Michel Belec | |

| Title: | Chief Legal Officer | |

EXHIBIT

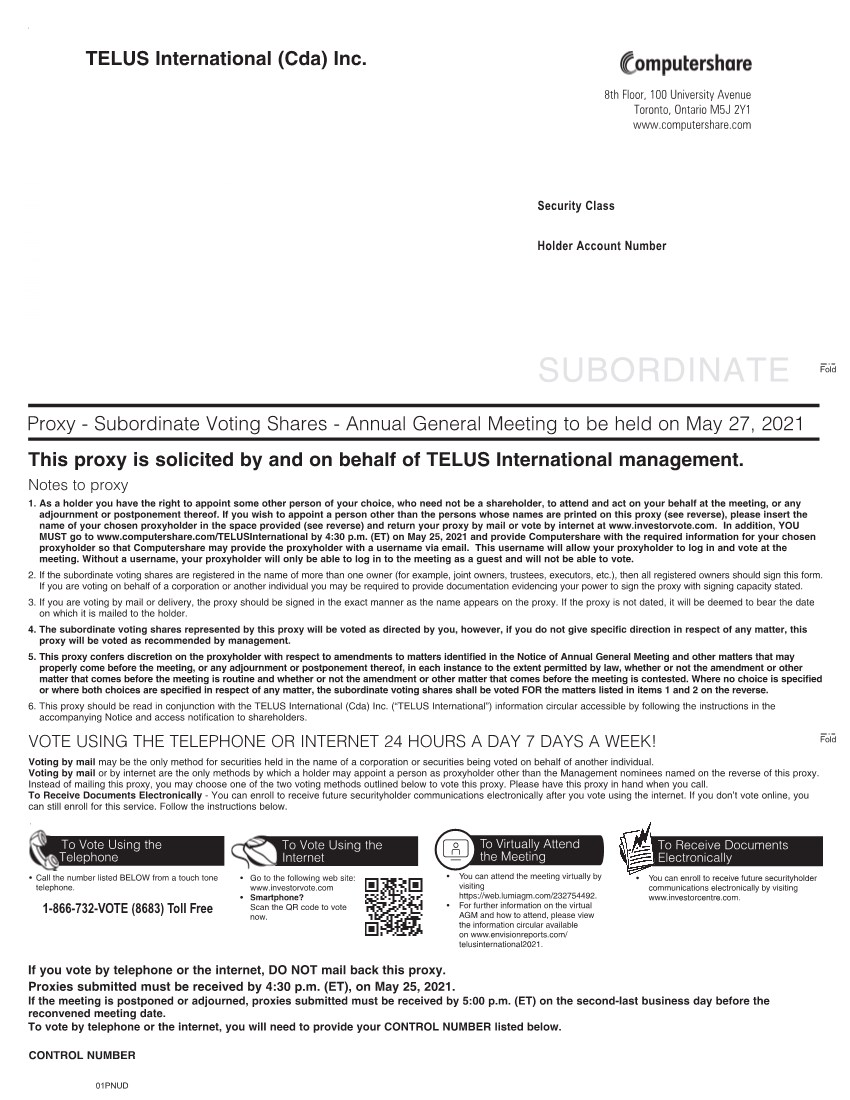

![[MISSING IMAGE: tm219362d1-cov_ifc4c.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_tm219362d1-cov_ifc4c.jpg)

![[MISSING IMAGE: tm219362d1-proxy_sharehol4c.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_tm219362d1-proxy_sharehol4c.jpg)

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 6 | | | |

| | | | | | 6 | | | |

| | | | | | 6 | | | |

| | | | | | 6 | | | |

| | | | | | 7 | | | |

| | | | | | 7 | | | |

| | | | | | 7 | | | |

| | | | | | 12 | | | |

| | | | | | 12 | | | |

| | | | | | 12 | | | |

| | | | | | 12 | | | |

| | | | | | 13 | | | |

| | | | | | 13 | | | |

| | | | | | 13 | | | |

| | | | | | 14 | | | |

| | | | | | 14 | | | |

| | | | | | 14 | | | |

| | | | | | 14 | | | |

| | | | | | 15 | | | |

| | | | | | 15 | | | |

| | | | | | 15 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 26 | | | |

| | | | | | 26 | | | |

| | | | | | 27 | | | |

| | | | | | 27 | | | |

| | | | | | 27 | | | |

| | | | | | 28 | | | |

| | | | | | 28 | | | |

| | | | | | 29 | | | |

| | | | | | 29 | | | |

| | | | | | 29 | | | |

| | | | | | 30 | | | |

| | | | | | 32 | | | |

| | | | | | 33 | | | |

| | | | | | 33 | | | |

| | | | | | 34 | | |

| | | | | | 34 | | | |

| | | | | | 35 | | | |

| | | | | | 35 | | | |

| | | | | | 35 | | | |

| | | | | | 35 | | | |

| | | | | | 36 | | | |

| | | | | | 36 | | | |

| | | | | | 38 | | | |

| | | | | | 38 | | | |

| | | | | | 38 | | | |

| | | | | | 40 | | | |

| | | | | | 41 | | | |

| | | | | | 42 | | | |

| | | | | | 42 | | | |

| | | | | | 42 | | | |

| | | | | | 43 | | | |

| | | | | | 47 | | | |

| | | | | | 47 | | | |

| | | | | | 48 | | | |

| | | | | | 48 | | | |

| | | | | | 48 | | | |

| | | | | | 48 | | | |

| | | | | | 49 | | | |

| | | | | | 51 | | | |

| | | | | | 52 | | | |

| | | | | | 53 | | | |

| | | | | | 54 | | | |

| | | | | | 55 | | | |

| | | | | | 58 | | | |

| | | | | | 58 | | | |

| | | | | | 58 | | | |

| | | | | | 59 | | | |

| | | | | | 61 | | | |

| | | | | | 61 | | | |

| | | | | | 62 | | | |

| | | | | | 63 | | | |

| | | | | | 65 | | | |

| | | | | | 67 | | |

Dated April 9, 2021

| |

When

Thursday, May 27, 2021 4:30 p.m. (ET)

Where

Virtual-only meeting via live audio webcast online at https://web.lumiagm.com/232754492 |

| |

Materials

A notice and access notification to shareholders (Notice) is being mailed to non-registered shareholders on or about April 21, 2021. We are providing access to the information circular and annual report to non-registered shareholders via the internet using the “notice and access” systems. These materials are available on the website referenced in the Notice: envisionreports.com/telusinternational2021. Registered shareholders will receive a paper copy of our information circular and related proxy materials.

|

|

| |

Name

|

| |

# of

Multiple Voting Shares Owned |

| |

% of

Outstanding Multiple Voting Shares |

| |

# of

Subordinate Voting Shares Owned |

| |

% of

Outstanding Subordinate Voting Shares |

| |

Percentage

of Outstanding Shares |

| |

Percentage

of Total Voting Power |

| ||||||||||||||||||

| | TELUS(1) | | | | | 146,504,019 | | | | | | 68.59% | | | | | | — | | | | | | — | | | | | | 55.18% | | | | | | 66.96% | | |

| | Baring(2) | | | | | 67,075,857 | | | | | | 31.40% | | | | | | — | | | | | | — | | | | | | 25.26% | | | | | | 30.7% | | |

| |

Capital International Investors(3)

|

| | | | — | | | | | | — | | | | | | 6,190,119 | | | | | | 11.92% | | | | | | 2.33% | | | | | | 0.28% | | |

| |

Mackenzie Financial Corporation(3)

|

| | | | — | | | | | | — | | | | | | 7,862,911 | | | | | | 15.14% | | | | | | 2.96% | | | | | | 0.35% | | |

| | TI Investment GmbH(4) | | | | | — | | | | | | — | | | | | | 5,624,059 | | | | | | 10.8% | | | | | | 2.12% | | | | | | 0.25% | | |

| | | |

Registered shareholders

|

|

| | | | You are a registered shareholder if you have a share certificate or direct registration system (DRS) advice issued in your name. | |

| If you want to vote by proxy before the meeting | | |

You can vote in any of the following ways:

|

|

|

|

| |

Internet

•

By visiting the following website: investorvote.com. Refer to your control number (shown on your proxy form) and follow the online voting instructions

Telephone

•

By calling the toll-free number, 1-866-732-VOTE (8683) if you are in Canada or the United States. If you are not in Canada or the United States, you should call the direct phone number shown on your proxy form. To vote by phone, simply refer to your control number (shown on your proxy form) and follow the instructions

•

Note that you cannot appoint anyone other than Josh Blair or Jeffrey Puritt as your proxy if you vote by phone

Mail

By completing your proxy form and returning it by mail or hand delivery, following the instructions on the form.

|

|

|

If you want to attend and vote at the virtual meeting

|

| |

Please follow these steps:

1.

Log in online at https://web.lumiagm.com/232754492 at least 15 minutes before the meeting starts. Please check that your browser is compatible.

2.

Click “Shareholder”.

3.

Enter your control number (on your proxy form) as your username.

4.

Enter the password: tixt2021 (case sensitive)

5.

Follow the instructions to view the meeting and vote when prompted.

Once you log into the meeting using your control number and you accept the terms and conditions, you will be revoking any and all previously submitted proxies for the meeting and will be provided the opportunity to vote by online ballot on the matters put forth at the meeting. If you do not wish to revoke a previously submitted proxy, you may log in as a guest (see instructions on page 9), but you will be unable to vote or ask questions at the meeting.

|

|

|

If you want to appoint a third party as proxy to attend and vote at the virtual meeting

|

| | If you want to appoint someone else (other than the management appointees, Josh Blair or Jeffrey Puritt) as a proxy to attend, participate and vote at the meeting, you must submit your proxy form appointing the third party AND register the third-party proxyholder as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy form. Failure to register the proxyholder will result in the proxyholder not receiving a username to attend, participate or vote at the meeting. The third party you appoint as a proxyholder does not need to be a shareholder. | |

| | | |

Registered shareholders

|

|

| | | |

Please follow these steps:

1.

Submit your proxy form — To appoint a third-party proxyholder, insert the person’s name into the appropriate space on the proxy form. Follow the instructions for submitting the proxy form (whether by internet, telephone or mail — see page 8). This step must be completed before registering such proxyholder as step 2.

2.

Register your proxyholder — To register a proxyholder, shareholders MUST visit computershare.com/TELUSInternational by 4:30 p.m. (ET) on May 25, 2021 and provide Computershare with the required proxyholder contact information so that Computershare may provide the proxyholder with a username via email. Without a username, proxyholders will not be able to attend, participate or vote at the meeting.

|

|

|

If you want to attend the virtual meeting as a guest

|

| |

Guests can log into the meeting as set out below. Guests can listen to the meeting but are not able to vote or ask questions at the meeting.

1.

Log in online at https://web.lumiagm.com/232754492. We recommend that you log in at least 15 minutes before the meeting starts.

2.

Click “Guest” and then complete the online form.

|

|

|

Deadline for returning your form

|

| | Your completed proxy form must be received by TELUS International, c/o Computershare (8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1), no later than 4:30 p.m. (ET) on May 25, 2021. If the meeting is adjourned or postponed, your completed proxy form must be received by 5:00 p.m. (ET) on the second-last business day before the reconvened meeting date (Proxy Deadline). | |

|

If you change your mind about your vote

|

| |

For registered shareholders, if you have voted by submitting a proxy form, you may revoke your instructions by providing new voting instructions on a proxy form with a later date, or at a later time if you are voting by telephone or on the internet. Any new voting instructions, however, will only take effect if received by TELUS International, c/o Computershare (at the address above) by the Proxy Deadline.

If as a registered shareholder, you are using your control number to log into the meeting and you accept the terms and conditions, you will be revoking any and all previously submitted proxies for the meeting and will be provided the opportunity to vote by online ballot on the matters put forth at the meeting. If you do not wish to revoke a previously submitted proxy, you may log in as a guest (see instructions above), but you will be unable to vote or ask questions at the meeting.

Other ways to revoke your proxy instructions include:

1.

Deliver a letter stating that you want to revoke your proxy to the registered office of the Company, to the attention of TELUS International’s Chief Legal and Governance Officer, 7th Floor, 510 West Georgia Street, Vancouver, British Columbia V6B 0M3, any time up to 4:30 p.m. (ET) on May 26, 2021 or, if the meeting is adjourned or postponed, by 5:00 p.m. (ET) on the business day before the date of the reconvened meeting.

2.

Any other way allowed by law.

|

|

| | | |

Non-registered shareholders

|

|

|

If you want to vote by proxy before the meeting

|

| | You are a non-registered shareholder if your shares are registered in the name of an intermediary such as a bank, trust company, trustee, investment dealer, clearing agency or other institution (intermediary). | |

|

|

| |

You can vote in any of the following ways:

Internet

•

By visiting the following website: proxyvote.com. Refer to your control number (shown on your form) and follow the online voting instructions

Telephone

•

By calling the toll-free number shown on your voting instruction form. To vote by phone, simply refer to your control number (shown on your form) and follow the instructions

•

Note that you cannot appoint anyone other than Josh Blair or Jeffrey Puritt as your proxy if you vote by phone

Mail

•

By completing your voting instruction form and returning it by mail or hand delivery, following the instructions on the form.

|

|

|

If you want to attend and vote at the virtual meeting

|

| | If you are a non-registered shareholder and you wish to vote at the meeting, you have to appoint yourself as a proxyholder first and then also register with Computershare. This is because the Company and Computershare do not have a record of the non-registered shareholders of the Company and as a result, will have no knowledge of your shareholdings or entitlement to vote, unless you appoint yourself as a proxyholder. | |

| | | |

Please follow these steps:

1.

To appoint yourself as proxyholder, insert your name into the appropriate space on the voting instruction form. Do not fill out your voting instructions. Follow the instructions for submitting the voting instruction form (whether by internet or mail — see above) by the appropriate deadline, as the instructions and deadline may vary depending on the intermediary. It is important that you comply with the signature and return instructions provided by your intermediary. This step must be completed before registering such proxyholder as step 2.

2.

Register yourself as a proxyholder by visiting computershare.com/TELUSInternational by 4:30 p.m. (ET) on May 25, 2021. Computershare will ask you for your proxyholder contact information and will send you a username via email shortly after this deadline. Without a username, you will not be able to attend, participate or vote at the meeting.

3.

Log in online at https://web.lumiagm.com/232754492 at least 15 minutes before the meeting starts. Please check that your browser is compatible.

4.

Click “Shareholder”.

5.

Enter the username that was provided by Computershare.

6.

Enter the password: tixt2021 (case sensitive).

7.

Follow the instructions to view the meeting and vote when prompted.

|

|

| | | |

Non-registered shareholders

|

|

| | | |

If you are a non-registered shareholder located in the United States, and you wish to appoint yourself as a proxyholder, in addition to steps 2 to 7 above, you must first obtain a valid legal proxy from your intermediary. To do so, you should follow these steps:

1.

Follow the instructions from your intermediary included with the legal proxy form and voting information forms sent to you or contact your intermediary to request a legal proxy form if you have not received one.

2.

After you receive a valid legal proxy form from your intermediary, you must submit such legal proxy to Computershare. You can submit your proxy by email or by courier to: [email protected] (if by email), or Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1 (if by courier), and in both cases, it must be labelled as “Legal Proxy” and received no later than 4:30 p.m. (ET) on May 25, 2021.

3.

You will receive a confirmation of your registration by email after Computershare receives your registration materials. Please note that you are required to register your appointment as a proxyholder at computershare.com/TELUSInternational as noted above.

|

|

|

If you want to appoint a third party as proxy to attend and vote at the virtual meeting

|

| | If you want to appoint someone else (other than the management appointees, Josh Blair or Jeffrey Puritt) as a proxy to attend, participate and vote at the meeting, you must submit your voting instruction form appointing the third party AND register the third-party proxyholder as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a username to attend, participate or vote at the meeting. The third party you appoint as a proxyholder does not need to be a shareholder. | |

| | | |

Please follow these steps:

1.

Submit your voting instruction form — To appoint a third-party proxyholder, insert the person’s name into the appropriate space on the voting instruction form. Follow the instructions for submitting the voting instruction form (whether by internet or mail — see page 10) by the appropriate deadline, as the instructions and deadline may vary depending on the intermediary. It is important that you comply with the signature and return instructions provided by your intermediary. This step must be completed before registering such proxyholder as step 2.

2.

Register your proxyholder — To register a proxyholder, shareholders MUST visit computershare.com/TELUSInternational by 4:30 p.m. (ET) on May 25, 2021 and provide Computershare with the required proxyholder contact information so that Computershare may provide the proxyholder with a username via email. Without a username, proxyholders will not be able to attend, participate or vote at the meeting.

|

|

| | | | If you are a non-registered shareholder located in the United States, and you wish to appoint a third party as your proxyholder, you must also obtain a valid legal proxy from your intermediary. To do so, you should follow these steps: | |

| | | |

1.

Follow the instructions from your intermediary included with the legal proxy form and voting information forms sent to you or contact your intermediary to request a legal proxy form if you have not received one.

|

|

| | | |

2.

After you receive a valid legal proxy form from your intermediary, you must submit such legal proxy to Computershare. You can submit your proxy by email or by courier to: [email protected] (if by email), or Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1 (if by courier), and in both cases, it must be labelled as “Legal Proxy” and received no later than 4:30 p.m. (ET) on May 25, 2021.

|

|

| | | |

Non-registered shareholders

|

|

| | | |

3.

You will receive a confirmation of your registration by email after Computershare receives your registration materials. Please note that you are required to register the third party’s appointment as proxyholder at computershare.com/TELUSInternational as noted above.

|

|

|

If you want to attend the virtual meeting as a guest

|

| |

Guests, including non-registered beneficial shareholders who have not duly appointed themselves as proxyholders, can log into the meeting as set out below. Guests can listen to the meeting but are not able to vote or ask questions at the meeting.

•

Log in online at https://web.lumiagm.com/232754492. We recommend that you log in at least 15 minutes before the meeting starts.

•

Click “Guest” and then complete the online form.

|

|

|

Deadline for returning your form

|

| |

Please check your voting instruction form for the specific deadline.

Your intermediary will need your voting instructions sufficiently in advance of the Proxy Deadline to enable your intermediary to act on your instructions prior to the deadline. Typically, the deadline for non-registered shareholders is a day before the Proxy Deadline.

|

|

|

If you change your mind about your vote

|

| | For non-registered shareholders, if you have provided your voting instructions and change your mind about your vote, you can revoke your proxy or voting instructions by contacting your intermediary. If your intermediary provides the option of voting over the internet, you can change your instructions by updating your voting instructions on the website provided by your intermediary, so long as you submit your new instructions before the intermediary’s deadline. | |

+1 (514) 982-7555 (outside North America)

8th Floor, 100 University Avenue

Toronto, Ontario M5J 2Y1

| |

Type of work

|

| |

($)

|

| |

2020

% |

| |

($)

|

| |

2019

% |

| ||||||||||||

| | Audit fees(1) | | | | $ | 1,980,000 | | | | | | 52.6 | | | | | $ | 1,067,978 | | | | | | 73.5 | | |

| | Audit-related fees(2) | | | | | 1,502,303 | | | | | | 40.0 | | | | | | 326,922 | | | | | | 22.5 | | |

| | Tax fees(3) | | | | | 281,155 | | | | | | 7.5 | | | | | | 58,703 | | | | | | 4.0 | | |

| | All other fees(4) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Total | | | | $ | 3,763,458 | | | | | | 100.0 | | | | | $ | 1,453,603 | | | | | | 100.0 | | |

![[MISSING IMAGE: ph_oanton-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_oanton-4clr.jpg)

British Columbia, Canada

Age: 67

Director since: 2021

Independent

Audit Committee (chair)

Human Resources Committee

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | N/A (1) | | | | N/A | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 4,167 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 148,970.25 | | |

| |

Meets share ownership target

|

| |

On track (37.24%)(3)

|

| |||

![[MISSING IMAGE: ph_jblair-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_jblair-4clr.jpg)

British Columbia, Canada

Age: 47

Director since: 2016

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 7/7 | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | Carebook Technologies Inc. | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 50,000 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 1,787,500 | | |

| |

Meets share ownership target

|

| |

Yes (238.33%)

|

| |||

![[MISSING IMAGE: ph_kcheong-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_kcheong-4clr.jpg)

Singapore

Age: 52

Director since: 2016

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 7/7 | | | | 100% | | |

| | | Human Resources Committee | | | | 1/1 | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | Coforge Ltd. | | | | PT Toba Bara Sejahta TBK | | | ||||

| |

Subordinate voting shares

|

| | | | — | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | $ | — | | |

| |

Meets share ownership target

|

| | | | N/A(1) | | |

![[MISSING IMAGE: ph_dfrench-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_dfrench-4clr.jpg)

Ontario, Canada

Age: 55

Director since: 2020

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 2/2(1) | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 7,000 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 250,250 | | |

| |

Meets share ownership target

|

| |

N/A(2)

|

| |||

![[MISSING IMAGE: ph_tgeheran-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_tgeheran-4clr.jpg)

British Columbia, Canada

Age: 58

Director since: 2020

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 5/5(1) | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 20,000 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 715,000 | | |

| |

Meets share ownership target

|

| |

N/A(2)

|

| |||

![[MISSING IMAGE: ph_slewis-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_slewis-4clr.jpg)

British Columbia, Canada

Age: 56

Director since:2016

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 7/7 | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 4,000 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 143,000 | | |

| |

Meets share ownership target

|

| |

N/A(1)

|

| |||

![[MISSING IMAGE: ph_suepaish-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_suepaish-4clr.jpg)

Vancouver

Age: 62

Independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | N/A(1) | | | | N/A | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | — | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | | — | | |

| |

Meets share ownership target

|

| |

N/A(1)

|

| |||

![[MISSING IMAGE: ph_jpuritt-4clr.jpg]](http://www.streetinsider.com/images/secattach/20210421/18292031_ph_jpuritt-4clr.jpg)

Nevada, United States

Age: 58

Director since:2016

Not independent

| | | | | | |

Attendance

|

| | |

Overall

|

| |

| | | Board | | | | 7/7 | | | | 100% | | |

| | | Current public board directorships | | | | Past public board directorships (2015 to 2020) | | | ||||

| | | None | | | | None | | | ||||

| |

Subordinate voting shares

|

| | | | 199,341 | | |

| |

Deferred share units

|

| | | | — | | |

| |

Total market value of securities

|

| | | C$ | 7,126,440.75 | | |

| |

Meets share ownership target

|

| |

N/A(2)

|

| |||

| |

Role

|

| |

Cash

Retainer ($) |

| |

Equity

Awards ($) |

| ||||||

| | Annual Retainer for Board Membership | | | | | | | | | | | | | |

| | Annual service on the Board | | | | | 63,200(1) | | | | | | 94,800(2) | | |

| | Additional Annual Retainer for Committee Membership | | | | | | | | | | | | | |

| | Annual service as chair of the Board(3) | | | | | 118,500(4) | | | | | | 158,000(5) | | |

| | Annual service as chair of the Audit Committee | | | | | — | | | | | | 15,800(6) | | |

| | Annual service as chair of the Human Resources Committee(7) | | | | | — | | | | | | 13,825(8) | | |

| | Annual service as chair of the Governance and Nominating Committee(7) | | | | | — | | | | | | 11,850(9) | | |

| |

What we do

|

|

| |

What we do not do

|

|

| | |

Committee

|

| | |

Number

of meetings held in 2020 |

| | |

Members as of December 31, 2020

|

| | |

Independent

|

| |

| | | Audit | | | | N/A | | | | Olin Anton (chair) | | | | Yes | | |

| | | | | | | | | | | Kenneth Cheong | | | | No | | |

| | | | | | | | | | | Doug French | | | | No | | |

| | | Human Resources | | | | 1 | | | | Josh Blair (chair) | | | | No | | |

| | | | | | | | | | | Olin Anton | | | | Yes | | |

| | | | | | | | | | | Kenneth Cheong | | | | No | | |

| | | Governance and Nominating | | | | N/A | | | | Tony Geheran (chair) | | | | No | | |

| | | | | | | | | | | Stephen Lewis | | | | No | | |

| | | | | | | | | | | Jimmy Mahtani | | | | No | | |

| | | | | | |

Mandate

|

| | |

Responsibilities

|

| |

| | |

Audit Committee

|

| | | To support the Board in fulfilling its oversight responsibilities regarding the integrity of the Company’s accounting and financial reporting. | | | |

To assist the Board in discharging its oversight of, among other things:

•

the integrity of our accounting and financial reporting;

•

the independence, qualifications, appointment, compensation and performance of our external auditors and the pre-approval of all audit, audit related and non audit services;

•

the adequacy of the resources and the independence, objectivity and performance of the internal auditors;

•

our disclosure controls and procedures and internal control over financial reporting, as well as our whistleblower and ethics processes;

•

review and approval or ratification of related party transactions, including transactions with TELUS;

•

our compliance with applicable legal and regulatory requirements and company policies;

•

our enterprise risk management processes, credit worthiness, treasury plans and financial policy; and

•

together with the Human Resources Committee, the Company’s code of ethics and conduct and recommending any necessary or appropriate changes thereto to the Board for consideration.

|

| |

| | |

Human Resources Committee

|

| | | To assist the Board in its oversight of executive compensation philosophy and guidelines, succession-planning and certain compensation and performance rating decisions. | | | |

•

Reviewing at least annually our executive compensation philosophy and guidelines;

•

In the absence of the Chief Executive Officer, evaluating at least once a year our Chief Executive Officer’s performance in light of the goals and objectives established by the Human Resources Committee and, based on such evaluation, approving the Chief Executive Officer’s annual compensation;

•

Reviewing and approving on an annual basis the evaluation process and compensation structure for members of our senior leadership team and, in consultation with our Chief Executive Officer, and in the absence of the senior leadership team, reviewing and approving the performance of the other members of our senior leadership team;

•

Reviewing and approving the design of the annual performance bonus plan, and any establishment of or material changes to incentive compensation plans, employee benefit plans for the senior leadership team and all equity based incentive plans of the Company or its subsidiaries;

•

Reviewing and approving on an annual basis the share ownership guidelines in effect from time to

|

| |

| | | | | | |

Mandate

|

| | |

Responsibilities

|

| |

| | | | | | | | | | |

time for the Chief Executive Officer and the senior leadership team and the compliance with those guidelines;

•

Reviewing and approving on an annual basis the expenses of the Chief Executive Officer and assessing the company’s policies and procedures with respect to the expense accounts, perquisites and use of corporate assets by the senior leadership team;

•

Prepare and recommend to our Board for approval our public disclosures related to executive compensation; and

•

Reviewing at least once annually succession plans for the Chief Executive Officer and members of our senior leadership team.

•

Authority to retain and terminate a compensation consultant, legal counsel or other advisor as it determines appropriate to assist it in the full performance of its functions.

|

| |

| | |

Governance and Nominating Committee

|

| | | To assist the Board in fulfilling its oversight responsibilities to ensure TELUS International has effective corporate governance policies and procedures. | | | |

•

Identifying individuals qualified to become members of our Board;

•

Recommending that our Board select director nominees for the next annual meeting of shareholders and determining the composition of our Board and its committees;

•

Developing and overseeing a process to assess our Board, the chair of the Board, the committees of the Board, the chairs of the committees and individual directors;

•

Developing, recommending and overseeing the effectiveness of our corporate governance policies and procedures;

•

Reviewing director compensation; and

•

Overseeing our public disclosure related to the foregoing.

|

| |

| | |

Event

|

| | |

Who we engage with

|

| | |

Who engages

|

| | |

What we talk about

|

| |

| | | Annual general meeting (in person(1) and webcast) | | | | Shareholders (retail and institutional) | | | |

•

Chair of the Board and Board of Directors

•

CEO

•

Senior management as applicable

|

| | | Business of the meeting (financial statements, director elections and other proposals for shareholder vote) | | |

| | | Quarterly earnings conference calls (with simultaneous webcast) | | | | Financial analysts | | | |

•

CEO

•

SVP and CFO

•

Senior management

|

| | |

Most recently released financial and operating results for the quarter. Our conference calls include a question and answer session with pre-qualified analysts. The conference calls are also available to shareholders on a listen-only basis via webcast. The webcast, slides (if used), transcripts (if available) and a webcast archive at www.telusinternational.

com/investors |

| |

| | | News releases | | | | Shareholders (retail and institutional), financial analysts and media | | | |

•

Senior management

|

| | | Quarterly results and any major corporate developments that occur throughout the year | | |

| | | Regular meetings, calls and discussions | | | | Shareholders (retail and institutional), brokers, financial analysts and media | | | |

•

SVP and CFO

•

Senior management

•

Investor Relations

|

| | |

Responding to any inquiries received through 604-695-3455 or

[email protected], consistent with TELUS International’s disclosure obligations

|

| |

| |

What We Do

|

| |

|

| |

What we do not do

|

|

| |

✓

Compensation consultant — We use an external executive compensation consultant to assess our executive compensation program to ensure alignment with shareholder and corporate objectives, best practices and governance principles

✓

Pay for performance — Our performance metrics are well communicated and regularly monitored through the corporate scorecards and include short- and long-term performance measures to avoid the pursuit of a performance metric at the expense of the business more generally. Additionally, 70% of the TELUS International Performance Bonus plan payments are based on corporate performance

✓

Stringent share ownership requirements — In place for our executives with respect to Company shares granted under the Omnibus Long-Term Incentive Plan (MIP) (CEO — 3x base salary and NEOs — 1.5x base salary) and for our directors under our Board Policy Manual (5x the annual cash retainer portion of each director’s total annual compensation within five years of their initial election). We recently increased our share ownership requirements to 7x base salary for our CEO and 3x base salary for our NEOs.

✓

Balance between short-term and long-term incentives — Reasonable balance between compensation elements that focus on short-term financial performance and longer-term Company and TELUS share price appreciation

✓

Overlapping performance periods — Within our long-term incentive (LTI) program, the overlap in performance periods ensures that executives remain exposed to the risks of their decision-making and risk-taking through their unvested equity awards and the shares that they are required to own.

✓

Caps on payouts — Incentive awards are generally capped to avoid excessive payouts and are in line with market practices

|

| |

|

| |

☒

Maintain or reduce performance target levels for incentive plans. Instead, steadily increasing performance levels must be achieved to realize payouts year after year

☒

Guarantee a minimum level of vesting for our long-term incentives

☒

Allow any director, executive or employee to monetize or hedge our shares or equity-based compensation to undermine the risk alignment in our equity ownership requirements

☒

Over-emphasize any single performance metric

☒

Guarantee annual base salary increases or bonus payments

☒

Offer excessive perquisites

|

|

| | |

Component

|

| | |

Description

|

| | |

Objective

|

| |

| | |

Fixed-base salary

|

| | |

•

Ranges are established for each position based on market practice, with the mid-point of the range being set at the median of the comparator group

|

| | | Recognizes varying levels of responsibility, prior experience, breadth of knowledge, overall individual performance and internal equity, as well as the pay practices of companies in the comparator group | | |

| | |

Annual performance bonus

|

| | |

•

Target ranging from 50% — 60% of base salary for NEOs and target of 100% base salary for the CEO

•

TELUS International Performance Bonus Program (PBP) tied to the performance of the NEO and the Company’s and TELUS’ overall corporate performance, with corporate performance given 70% weighting

•

PBP metrics can lead to payouts ranging from zero (for substandard performance) to a maximum of 150% of target (for exceptional performance)

•

TELUS International Sales Incentive Plan (for the former Chief Commercial Officer) tied to the annual revenue billed on net new sales by the Company’s sales team

|

| | | Provides an annual performance bonus paid in cash based on corporate and individual performance of the applicable year (and sales for the former Chief Commercial Officer) | | |

| | |

Equity compensation

|

| | |

•

Links a significant portion of the at-risk compensation to Company shareholder return and helps to promote retention of executives

|

| | | Helps to promote retention of executives | | |

| | |

Benefits and perquisites

|

| | |

•

A competitive executive benefits program

•

Vehicle allowance for the CEO and CCO and annual allowance for the CEO, and other perquisites

|

| | ||||

| | |

Retirement benefits

|

| | |

•

Benefits under TELUS’ Amended and Restated Pension Plan for Management and Professional Employees of TELUS Corporation (DB Plan), a contributory, Canadian-registered defined benefit plan for our CEO and CCO, benefits under the Supplemental Retirement Arrangement for Designated Executives of TELUS Corporation (SRA) consistent with market practice for Canadian executives for our CEO, benefits under TELUS’ Supplementary Employee Retirement Plan for Vice Presidents and Certain Other Designated Employees (SERP 2020) for our CCO and benefits under TELUS’ Defined Contribution Pension Plan for Provincially Regulated Employees (Defined Contribution Plan) (a registered defined contribution plan) for our CFO. Our CEO and CCO also have retirement benefits in the TELUS Supplementary Savings Plan (Savings Plan) (a nonqualified after-tax account), but no longer contribute to the Savings Plan. These retirement programs are further described in “— TELUS Retirement Plan Benefits”.

•

Competitive 401(k) plan with Company match for US executives

|

| | ||||

| |

Named Executive Officer

|

| |

Number of

TI RSUs |

| |

Number of

TI Options(1) |

| |

Total Grant Date

Fair Value |

| |||||||||

| | Jeff Puritt | | | | | 205,308 | | | | | | 167,693 | | | | | | 6,026,166 | | |

| | Vanessa Kanu | | | | | 65,358 | | | | | | 83,849 | | | | | | 2,080,695 | | |

| | Chuck Koskovich | | | | | 65,358 | | | | | | 83,849 | | | | | | 2,080,695 | | |

| | Marilyn Tyfting | | | | | 65,358 | | | | | | 83,849 | | | | | | 2,080,695 | | |

| | Michael Ringman | | | | | 43,569 | | | | | | 55,899 | | | | | | 1,387,055 | | |

| |

Name

|

| |

2020 Annual

Base Salary(1) ($) |

| |||

| | Jeff Puritt | | | | | 700,000 | | |

| | Vanessa Kanu | | | | | 395,000(2) | | |

| | Chuck Koskovich | | | | | 380,000 | | |

| | Marilyn Tyfting | | | | | 275,245(3) | | |

| | Michael Ringman | | | | | 300,000 | | |

| | Rick Rodick | | | | | 301,959(4) | | |

| | George Puig | | | | | 260,000(5) | | |

| |

Named Executive Officer

|

| |

2020 PBP Payout

|

| |||

| | Jeff Puritt | | | | $ | 686,449 | | |

| | Vanessa Kanu | | | | $ | 255,960(1) | | |

| | Chuck Koskovich | | | | $ | 204,742 | | |

| | Marilyn Tyfting | | | | $ | 153,284(1) | | |

| | Michael Ringman | | | | $ | 146,965 | | |

| |

Name

|

| |

Total

subordinate voting shares |

| |

Value of

subordinate voting shares(1) ($) |

| |

Total

RSUs |

| |

Value

of RSUs(1) ($) |

| |

Total

equity (subordinate voting shares/ RSUs)(1) |

| |

Value of

total equity(1) |

| |

Base

salary at year-end ($) |

| |

Value of

total equity as a multiple of base salary |

| ||||||||||||||||||||||||

| | Jeff Puritt | | | | | 199,341 | | | | | | 5,695,172.37 | | | | | | 205,308 | | | | | | 5,865,649.56 | | | | | | 404,649 | | | | | | 11,560,821.93 | | | | | | 700,000 | | | | | | 16.52x | | |

| | Vanessa Kanu | | | | | 8,333 | | | | | | 238,073.81 | | | | | | 65,358 | | | | | | 1,867,278.06 | | | | | | 73,691 | | | | | | 2,105,351.87 | | | | | | 395,000 | | | | | | 5.33x | | |

| |

Chuck Koskovich

|

| | | | 15,898 | | | | | | 454,205.86 | | | | | | 65,358 | | | | | | 1,867,278.06 | | | | | | 81,256 | | | | | | 2,321,483.92 | | | | | | 380,000 | | | | | | 6.11x | | |

| | Marilyn Tyfting | | | | | 70,083 | | | | | | 2,002,271.31 | | | | | | 65,358 | | | | | | 1,867,278.06 | | | | | | 135,441 | | | | | | 3,869,549.37 | | | | | | 275,245 | | | | | | 14.06x | | |

| |

Michael Ringman

|

| | | | 59,103 | | | | | | 1,688,572.71 | | | | | | 43,569 | | | | | | 1,244,766.33 | | | | | | 102,672 | | | | | | 2,933,339.04 | | | | | | 300,000 | | | | | | 9.78x | | |

| |

Name and Principal

Position |

| |

Year

|

| |

Salary

($)(1) |

| |

Bonus

($) |

| |

Stock

Awards ($)(2) |

| |

Option

Awards ($)(2) |

| |

Non-Equity

Incentive Plan Compensation ($) |

| |

Change in

Pension Value and Nonqualified Deferred Compensation Earnings ($) |

| |

All Other

Compensation ($) |

| |

Total

Compensation ($) |

| ||||||||||||||||||||||||

| |

Jeff Puritt

President and Chief Executive Officer |

| |

2020

|

| | | | 611,809 | | | | | | — | | | | | | — | | | | | | — | | | | | | 686,449 | | | | | | 2,004,072(3) | | | | | | 103,909(4) | | | | | | 3,406,239 | | |

| | 2019 | | | | | 565,965 | | | | | | — | | | | | | 1,443,461 | | | | | | 157,434 | | | | | | 636,145 | | | | | | 2,942,170 | | | | | | 97,835 | | | | | | 5,843,010 | | | |||

| |

Vanessa Kanu

Chief Financial Officer |

| |

2020

|

| | | | 121,135(5) | | | | | | 395,000(6) | | | | | | — | | | | | | — | | | | | | 255,960(7)(9) | | | | | | — | | | | | | 8,951(8) | | | | | | 781,046 | | |

| | 2019 | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | |||

| |

Charles (Chuck)

Koskovich Senior Vice President and Chief Operating Officer |

| |

2020

|

| | | | 361,613(9) | | | | | | — | | | | | | — | | | | | | — | | | | | | 204,742 | | | | | | — | | | | | | 48,189(10) | | | | | | 614,544 | | |

| | 2019 | | | | | 349,835 | | | | | | — | | | | | | 577,385 | | | | | | 62,972 | | | | | | 189,785 | | | | | | — | | | | | | 37,472 | | | | | | 1,217,449 | | | |||

| |

Marilyn Tyfting

Senior Vice President and Chief Corporate Officer |

| |

2020

|

| | | | 268,920(11) | | | | | | — | | | | | | — | | | | | | — | | | | | | 153,284(7) | | | | | | 134,458(12) | | | | | | 46,746(13) | | | | | | 603,408 | | |

| | 2019 | | | | | 266,014 | | | | | | — | | | | | | 577,385 | | | | | | 62,972 | | | | | | 148,303 | | | | | | — | | | | | | 70,325 | | | | | | 1,124,999 | | | |||

| |

Michael Ringman

Chief Information Officer |

| |

2020

|

| | | | 272,158 | | | | | | 50,000(14) | | | | | | — | | | | | | — | | | | | | 146,965 | | | | | | — | | | | | | 28,826(10) | | | | | | 497,949 | | |

| | 2019 | | | | | 261,753 | | | | | | — | | | | | | 384,923 | | | | | | 41,981 | | | | | | 142,001 | | | | | | — | | | | | | 33,374 | | | | | | 864,032 | | | |||

| |

Richard (Rick)

Rodick Former Chief Financial Officer(16) |

| |

2020

|

| | | | 216,481 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 811,447(15) | | | | | | 1,027,928 | | |

| | 2019 | | | | | 299,591 | | | | | | — | | | | | | 577,385 | | | | | | 62,972 | | | | | | 160,281 | | | | | | — | | | | | | 33,492 | | | | | | 1,133,721 | | | |||

| |

George Puig(17)

Former Senior Vice President and Chief Commercial Officer |

| |

2020

|

| | | | 110,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 373,228(15) | | | | | | 483,228 | | |

| | 2019 | | | | | 260,000 | | | | | | — | | | | | | 336,808 | | | | | | 36,736 | | | | | | 252,244 | | | | | | — | | | | | | 26,100 | | | | | | 911,888 | | | |||

| | | | | | | |

Estimated future payouts under non-equity incentive

plan awards |

| |||||||||||||||

| |

Name

|

| |

Grant Date

|

| |

Threshold

($) |

| |

Target

($) |

| |

Maximum

($) |

| |||||||||

| | Jeff Puritt | | |

Annual Incentive(1)

|

| | | | — | | | | | | 700,000 | | | | | | 1,050,000 | | |

| | Vanessa Kanu | | |

Annual Incentive(1)

|

| | | | — | | | | | | 237,000(2) | | | | | | 355,500(2) | | |

| | Chuck Koskovich | | |

Annual Incentive(1)

|

| | | | — | | | | | | 228,000 | | | | | | 342,000 | | |

| | Marilyn Tyfting | | |

Annual Incentive(1)

|

| | | | — | | | | | | 137,623(2) | | | | | | 206,434(2) | | |

| | Michael Ringman | | |

Annual Incentive(1)

|

| | | | — | | | | | | 150,000 | | | | | | 225,000 | | |

| | Rick Rodick | | |

Annual Incentive(3)

|

| | | | — | | | | | | 150,980 | | | | | | 226,469 | | |

| | George Puig | | |

SIP(4)

|

| | | | — | | | | | | 65,000 | | | | | | — | | |

| | | | | | | | | | |

Option Awards(1)

|

| |

Stock Awards(2)

|

| ||||||||||||||||||||||||

| |

Name

|

| |

Number of

securities underlying unexercised options (#) exercisable |

| |

Number of

securities underlying unexercised options (#) unexercisable |

| |

Option

exercise price ($) |

| |

Option

expiration date |

| |

Equity

incentive plan awards: number of unearned shares, units or other rights that have not vested (#) |

| |

Equity

incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(3) |

| ||||||||||||||||||

| | Jeff Puritt | | | | | — | | | | | | 134,973(4) | | | | | | 3.54 | | | | | | 06/30/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 296,942(5) | | | | | | 4.87 | | | | | | 12/23/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 539,892(6) | | | | | | 4.87 | | | | | | 12/23/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 1,259,748(6) | | | | | | 8.94 | | | | | | 12/23/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 162,000(7) | | | | | | 6.16 | | | | | | 12/29/2027 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 170,712(8) | | | | | | 6.18 | | | | | | 12/27/2028 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 170,712(9) | | | | | | 8.46 | | | | | | 12/27/2029 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 246,236(10) | | | | | | 5,505,826 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 58,129(11) | | | | | | 1,157,930 | | |

| | Chuck Koskovich | | | | | — | | | | | | 172,800(7) | | | | | | 6.16 | | | | | | 12/29/2027 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 68,288(8) | | | | | | 6.18 | | | | | | 12/27/2028 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 68,283(9) | | | | | | 8.46 | | | | | | 12/27/2029 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 81,946(12) | | | | | | 1,832,313 | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 23,163(13) | | | | | | 461,407 | | |

| | Marilyn Tyfting | | | | | — | | | | | | 53,991(4) | | | | | | 3.54 | | | | | | 06/30/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 118,778(14) | | | | | | 4.87 | | | | | | 12/23/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 64,800(7) | | | | | | 6.16 | | | | | | 12/29/2027 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 68,288(8) | | | | | | 6.18 | | | | | | 12/27/2028 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 68,283(9) | | | | | | 8.46 | | | | | | 12/27/2029 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 81,946(12) | | | | | | 1,832,313 | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 23,078(15) | | | | | | 459,714 | | |

| | Michael Ringman | | | | | — | | | | | | 35,991(4) | | | | | | 3.54 | | | | | | 06/30/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 79,182(14) | | | | | | 4.87 | | | | | | 12/23/2026 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 43,200(7) | | | | | | 6.16 | | | | | | 12/29/2027 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 45,522(8) | | | | | | 6.18 | | | | | | 12/27/2028 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | 45,522(9) | | | | | | 8.46 | | | | | | 12/27/2029 | | | | | | — | | | | | | — | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 54,630(16) | | | | | | 1,221,527 | | |

| | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 15,468(17) | | | | | | 308,123 | | |

| | | | |

Option Awards

|

| |

Stock Awards

|

| ||||||||||||||||||

| |

Name

|

| |

Number of shares

acquired or exercised ($) |

| |

Value realized

on exercise ($) |

| |

Number of shares

acquired on vesting (#)(1) |

| |

Value realized

on vesting ($)(2) |

| ||||||||||||

| | Jeff Puritt | | | | | — | | | | | | — | | | | | | 122,664 | | | | | | 1,584,901 | | |

| | Vanessa Kanu | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Chuck Koskovich | | | | | — | | | | | | — | | | | | | 130,840 | | | | | | 1,690,545 | | |

| | Marilyn Tyfting | | | | | — | | | | | | — | | | | | | 49,065 | | | | | | 645,939(3) | | |

| | Michael Ringman | | | | | — | | | | | | — | | | | | | 32,709 | | | | | | 422,613 | | |

| | Rick Rodick | | | | | 374,135 | | | | | | 2,154,343 | | | | | | 115,123 | | | | | | 1,501,302 | | |

| | George Puig | | | | | 180,468 | | | | | | 915,670 | | | | | | 94,302 | | | | | | 1,203,039 | | |

| |

Name

|

| |

Plan Name

|

| |

Number of

Years Credited Service (#) |

| |

Present Value

of Accumulated Benefit ($)(1) |

| |

Payments

During Last Fiscal Year ($) |

| |||||||||

| | Jeff Puritt | | |

DB Plan

|

| | | | 5 | | | | | | 247,823(2) | | | | | | — | | |

| | | | |

SRA

|

| | | | 14.667 | | | | | | 6,417,249(3) | | | | | | — | | |

| | Marilyn Tyfting | | |

DB Plan

|

| | | | 1 | | | | | | 51,192(4) | | | | | | — | | |

| | | | |

SERP 2020

|

| | | | 1 | | | | | | 83,266(5) | | | | | | — | | |

| |

Name

|

| |

Executive

Contributions in Last Fiscal Year ($) |

| |

Registrant

Contributions in Last Fiscal Year ($)(2) |

| |

Aggregate

Earnings in Last Fiscal Year ($)(3) |

| |

Aggregate

Withdrawals/ Distributions ($) |

| |

Aggregate

Balance at Last Fiscal Year-End ($) |

| |||||||||||||||

| | Jeff Puritt | | | | | — | | | | | | — | | | | | | 35,068 | | | | | | — | | | | | | 344,865 | | |

| | Marilyn Tyfting | | | | | — | | | | | | — | | | | | | 15,881 | | | | | | — | | | | | | 152,775 | | |

| | | | |

Annual Cash

|

| |

Long-Term Incentives

|

| | | | | | | | | | | | | | | | | | | ||||||||||||||||||

| | | | |

Base Salary

($) |

| |

Bonus

($) |

| |

Options

($) |

| |

RSUs

($) |

| |

Benefits

($) |

| |

Continued

Pension Accrual ($) |

| |

Total

($) |

| |||||||||||||||||||||

| | Jeff Puritt | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Resignation(1) | | | | | 175,000(2) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 175,000 | | |

| |

Termination without just cause

|

| | | | 1,050,000(3) | | | | | | — | | | | | | 5,134,258(4) | | | | | | 6,663,755(4) | | | | | | 38,135(5) | | | | | | 681,612(6) | | | | | | 13,567,760 | | |

| | Retirement(7) | | | | | — | | | | | | — | | | | | | 5,134,258 | | | | | | 6,663,755 | | | | | | — | | | | | | — | | | | | | 11,798,013 | | |

| | Disability(7) | | | | | 1,050,000(8) | | | | | | — | | | | | | 5,134,258 | | | | | | 6,663,755 | | | | | | 38,135(5) | | | | | | 3,355,130(9) | | | | | | 16,241,278 | | |

| | Death(10) | | | | | — | | | | | | — | | | | | | 5,134,258 | | | | | | 6,663,755 | | | | | | — | | | | | | — | | | | | | 11,798,013 | | |

| |

Termination with just cause

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Change of control(11) | | | | | — | | | | | | — | | | | | | 5,134,258 | | | | | | 6,663,755 | | | | | | — | | | | | | — | | | | | | 11,798,013 | | |

| | Vanessa Kanu | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Resignation | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Termination without just cause

|

| | | | 395,000(12) | | | | | | — | | | | | | — | | | | | | — | | | | | | 1,743(5) | | | | | | — | | | | | | 396,743 | | |

| | Retirement | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Disability | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Death | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Termination with just cause

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Change of control(11) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Chuck Koskovich | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Resignation(1) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Termination without just cause

|

| | |

|

316,667(13)

|

| | | |

|

134,987(14)

|

| | | |

|

2,800,128(15)

|

| | | |

|

1,377,426(16)

|

| | | |

|

14,680(17)

|

| | | |

|

—

|

| | | |

|

4,643,888

|

| |

| | Retirement(7) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Disability(7) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,293,697 | | | | | | — | | | | | | — | | | | | | 4,347,419 | | |

| | Death(10) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,293,697 | | | | | | — | | | | | | — | | | | | | 4,347,419 | | |

| |

Termination with just cause

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Change of control(11) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,293,697 | | | | | | — | | | | | | — | | | | | | 4,347,419 | | |

| | Marilyn Tyfting | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Resignation(1) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Termination without just cause

|

| | |

|

412,868(3)

|

| | | |

|

204,420(18)

|

| | | |

|

4,143,853(15)

|

| | | |

|

1,376,741(16)

|

| | | |

|

2,615(5)

|

| | | |

|

197,263(19)

|

| | | |

|

6,337,760

|

| |

| | Retirement(7) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Disability(7) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,292,004 | | | | | | — | | | | | | 1,332,651(20) | | | | | | 5,678,377 | | |

| | Death(10) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,292,004 | | | | | | — | | | | | | — | | | | | | 4,345,726 | | |

| |

Termination with just cause

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Change of control(11) | | | | | — | | | | | | — | | | | | | 2,053,722 | | | | | | 2,292,004 | | | | | | — | | | | | | — | | | | | | 4,345,726 | | |

| | Michael Ringman | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Resignation(1) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Termination without just cause

|

| | |

|

350,000

|

| | | |

|

145,056(14)

|

| | | |

|

2,762,460(15)

|

| | | |

|

918,502(16)

|

| | | |

|

20,553(17)

|

| | | |

|

—

|

| | | |

|

4,196,571

|

| |

| | Retirement(7) | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Disability(7) | | | | | — | | | | | | — | | | | | | 1,369,099 | | | | | | 1,529,649 | | | | | | — | | | | | | — | | | | | | 2,898,748 | | |

| | Death(10) | | | | | — | | | | | | — | | | | | | 1,369,099 | | | | | | 1,529,649 | | | | | | — | | | | | | — | | | | | | 2,898,748 | | |

| |

Termination with just cause

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| | Change of control(11) | | | | | — | | | | | | — | | | | | | 1,369,099 | | | | | | 1,529,649 | | | | | | — | | | | | | — | | | | | | 2,898,748 | | |

| | Rick Rodick | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Separation Pay | | | | | 756,177 | | | | | | — | | | | | | 2,154,343 | | | | | | 867,345 | | | | | | — | | | | | | — | | | | | | 3,777,865 | | |

| | George Puig | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Separation Pay | | | | | 303,333 | | | | | | 20,670 | | | | | | 915,670 | | | | | | 1,203,040 | | | | | | 19,356 | | | | | | — | | | | | | 2,462,069 | | |

| | | | |

Type of plan

|

| |

New equity grants

being issued |

| |

Company

securities issuable from treasury |

| ||||||||||||

| |

Name

|

| |

Equity-based

compensation |

| |

Other

|

| |||||||||||||||

| | Omnibus Long-Term Incentive Plan | | | | | X | | | | | | | | | No | | | | | | Yes | | |

| | 2021 Omnibus Long-Term Incentive Plan | | | | | X | | | | | | | | | Yes | | | | | | Yes | | |

| | 2021 Employee Share Purchase Plan | | | | | X | | | | | | | | | Yes | | | | | | Yes | | |

| |

Plan category(1)

|

| |

Number of securities to

be issued upon exercise of outstanding options, warrants and rights (#) A |

| |

Weighted-average

exercise price of outstanding options, warrants and rights ($) B |

| |

Number of securities

remaining available for future issuance under equity compensation plans (excluding securities reflected in column A) (#) C |

| |||||||||

| |

Equity compensation plans approved by security holders

|

| | | | 668,618 | | | | | $ | 31.49 | | | | | | 1,397,448(2) | | |

| |

Equity compensation plans not approved by security holders

|

| | | | — | | | | | | — | | | | | | — | | |

| |

Total

|

| | | | 668,618 | | | | | | — | | | | | | 1,397,448(2) | | |

| |

Year

|

| |

Number of

awards granted under the Omnibus Long-Term Incentive Plan |

| |

Number of

awards granted under the 2021 Omnibus Long-Term Incentive Plan |

| |

Number of

awards granted under the 2021 Employee Share Purchase Plan |

| |

Weighted

Average Number of Shares |

| |

Omnibus

Long- Term Incentive Plan Burn Rate(1) |

| |

2021

Omnibus Long- Term Incentive Plan Burn Rate(1) |

| |

2021

Employee Share Purchase Plan Burn Rate(1) |

| |||||||||||||||||||||

| |

Equity compensation plans approved by security holders

|

| | | | Nil | | | | | | Nil | | | | | | Nil | | | | | | — | | | | | | 0% | | | | | | N/A | | | | | | N/A | | |

| |

Equity compensation plans not approved by security holders

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

| |

Total

|

| | | | Nil | | | | | | Nil | | | | | | Nil | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dated April 9, 2021

| |

When

Thursday, May 27, 2021 4:30 p.m. (ET)

Where

Virtual-only meeting via live audio webcast online at https://web.lumiagm.com/232754492 |

| |

Materials

A notice and access notification to shareholders (Notice) is being mailed to non-registered shareholders on or about April 21, 2021. We are providing access to the information circular and annual report to non-registered shareholders via the internet using the “notice and access” systems. These materials are available on the website referenced in the Notice: envisionreports.com/telusinternational2021. Registered shareholders will receive a paper copy of our information circular and related proxy materials.

|

|

Exhibit 99.3

Annual general meeting of TELUS International (Cda) Inc.

Notice and access notification to shareholders

|

Meeting date and location

Date: May 27, 2021

Time: 4:30 p.m. (ET)

Place: Virtual-only meeting via live audio webcast online at https://web.lumiagm.com/232754492 |

|

Why am I receiving this notice? |

|

As permitted by Canadian securities regulators, TELUS International (Cda) Inc. (the Company) is providing you with notice and access to our 2021 information circular (Information Circular) for the annual general meeting (Meeting) as well as the 2020 annual report (together, the Meeting Materials) electronically, instead of mailing out paper copies. This notice provides you with information on how to access and view the Meeting Materials online and/or request paper copies. Accompanying this notice is the voting instruction form that you will need to vote. |

|

Where can I access the Meeting Materials online? |

|

The Meeting Materials can be viewed online at www.SEDAR.com as of April 21, 2021 or at http://www.envisionreports.com/telusinternational2021 until April 21, 2022. |

|

How can I obtain a paper copy of the Meeting Materials? |

|

At any time prior to the date of the Meeting, you can request a paper copy of the Meeting Materials, free of charge, by either calling the phone number or accessing the website below and entering the 16-digit control number on your voting instruction form:

Phone (toll-free): 1-877-907-7643 or 1-905-507-5450 (outside North America).

Website: www.ProxyVote.com

If you do not have a control number, please call toll free at 1-844-916-0609 (English) or 1-844-973-0593 (French) within North America or 1-303-562-9305 (English) or 1-303-562-9306 (French) if dialing from outside North America.

If you make a request for paper copies before the date of the Meeting, the Meeting Materials will be sent to you within three business days of receiving your request. Therefore, to receive the Meeting Materials prior to the Proxy Deadline (described below) for the Meeting, you should make your request before 5:00 p.m. (ET) on May 11, 2021. To receive the Meeting Materials prior to the Meeting, you should make your request before 5:00 p.m. (ET) on May 13, 2021.

|

Please view the Information Circular prior to voting

|

What matters are being received or voted on at the Meeting? | ||

|

The following items are being received or voted on. All shareholders are reminded to review the Information Circular before voting.

| ||

Business of the Meeting |

Refer to the Information Circular | ||

| Financial statements - Receive the Company's 2020 audited consolidated financial statements together with the report of the auditors on those statements |

See "1. Report of management and consolidated financial statements"

| ||

| Election of directors - Elect directors of the Company for the ensuing year |

See "2. Election of directors"

| ||

| Appointment of auditors - Appoint Deloitte LLP as auditors for the ensuing year and authorize the directors to fix their remuneration |

See "3. Appointment of auditors"

| ||

|

How do I vote my shares? | |||

|

This year, we are holding a virtual-only Meeting. All shareholders and duly appointed proxyholders will have an equal opportunity to attend, participate and vote at the Meeting from any location. If you wish to attend and vote at the Meeting or to appoint someone else to represent you at the Meeting you MUST complete the “Appoint a Proxy” section on your voting instruction form or online at the website below appointing yourself or someone else as proxyholder AND register your proxyholder with Computershare at computershare.com/TELUSInternational by no later than 4:30 pm (ET) on May 25, 2021 or, if the Meeting is adjourned or postponed, by 5:00 p.m. (ET) on the second-last business day before the reconvened meeting date (the Proxy Deadline). We encourage you to review the “Information about voting” section in the Information Circular for more details on how to attend, vote and participate at the meeting.

Instead of attending and voting at the virtual-only Meeting, you may vote in any of the following ways. You will need your control number contained in the accompanying voting instruction form in order to vote. | |||

| Voting method | ||||

| Internet voting |

|

Go to www.ProxyVote.com

| ||

Telephone

|

|

English: 1-800-474-7493 / French: 1-800-474-7501

| ||

| Voting by mail or delivery |

|

Complete the voting instruction form and return it in the envelope provided | ||

|

To be valid, voting instruction forms must be received in sufficient time for your intermediary to act upon them by no later than 4:30 p.m. (ET) on May 25, 2021 or, if the Meeting is adjourned or postponed, by 5:00 p.m. (ET) on the second-last business day before the reconvened meeting date (the Proxy Deadline). The Company reserves the right to accept late proxies and to waive the Proxy Deadline, with or without notice, but is under no obligation to accept or reject any particular late proxy.

| |

|

Who received paper copies of the Meeting materials instead of this notice? |

|

Paper copies of the current Meeting Materials have been sent to beneficial shareholders who have provided standing instructions to their intermediary who opted for delivery of paper copies of the Meeting Materials via their voting instruction form last year. If you would like to receive paper copies of materials for next year’s meeting, you should indicate this on your voting instruction form or change your standing instructions with your intermediary.

|

|

Who can I contact if I have questions about notice and access? |

|

Shareholders with questions about notice and access can call toll-free at 1-866-964-0492 or 514-982-8714 for holders outside of Canada and the United States. |

Please view the Information Circular prior to voting

Exhibit 99.4