Form 6-K TAKEDA PHARMACEUTICAL For: May 30

Table of Contents

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number: 001-38757

For the month of May 2019

TAKEDA PHARMACEUTICAL COMPANY LIMITED

(Translation of registrant’s name into English)

1-1, Nihonbashi-Honcho 2-Chome

Chuo-ku, Tokyo 103-8668

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Table of Contents

Information furnished on this form:

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TAKEDA PHARMACEUTICAL COMPANY LIMITED | ||||||

| Date: May 30, 2019 | By: | /s/ Takashi Okubo | ||||

| Takashi Okubo | ||||||

| Global Head of Investor Relations | ||||||

Table of Contents

Dear Takeda Shareholder,

It is my great pleasure to invite you, on behalf of the Takeda Board of Directors, to our 2019 Annual Shareholders Meeting, to be held on June 27th 2019. Exceptionally this year, the meeting will take place outside of Osaka, as a consequence of the G20 Summit meeting being hosted for the first time by the Japanese government in Osaka at the end of June. We apologize to any shareholders inconvenienced by this change in location.

During our shareholders meeting, we look forward to updating you on the integration following the Shire acquisition, and the transformation of Takeda into a very competitive values-based, R&D-driven, global biopharmaceutical leader headquartered in Japan.

Since January 8th 2019, we have been working relentlessly to execute the integration, in order for the New Takeda to operate efficiently as soon as possible. We are pleased to inform you that it is progressing with significant pace. As an example, Day One, when all sites became Takeda and all employees could communicate by e-mail, was executed perfectly without business disruption.

Our strong business momentum was also clearly demonstrated in our excellent FY2018 results, which we disclosed on May 14th 1, along with FY2019 guidance and our mid-term outlook for the combined company. We are confident about the growth prospect for the company, driven by key products in our focus business areas, a lean and innovative R&D engine, and financial strength to realize top-tier margins and quickly reduce our debt level.

Takeda’s values, Takeda-ism: Integrity-Honesty-Fairness-Perseverance, combined with a specific focus on Patient-Trust-Reputation-Business is attractive to and embraced by our employees. As part of the integration, we have been conducting numerous training sessions globally using case studies to ensure a common values-based culture. In fact, our first employee integration survey showed that 79% of our employees are excited by the company’s future, a particularly high score versus benchmarks, in spite of being during a period of uncertainty for many people.

The difficult and sensitive selection process for management positions is on-going with speed, but also with fairness and transparency. This is extremely important as it not only answers our employees’ expectations, but is also very much aligned with our values.

1 FY2018 Full Year Results (released on May 14th, 2019)

1

Table of Contents

We are more confident than ever before that the integration is being executed in a way that preserves our long-established identity while creating a more competitive company in a challenging environment.

Indeed, while the pace of innovation is stronger than ever, many healthcare systems around the world are facing significant financial challenges. As a consequence, payers are becoming increasingly selective in determining which innovation will be reimbursed and when to be prescribed. They are also more actively promoting generic and biosimilar alternatives, and are more and more inclined to reduce drug prices.

The new Takeda is well positioned among the large pharmaceutical companies to prevail in this environment.

Our current portfolio is primarily composed of life-saving or life-transforming, highly differentiated medicines which we are aiming to make available to patients throughout the world. Across our five key business areas (GI, Rare Diseases, Plasma-Derived Therapies, Oncology, and Neuroscience), fourteen global innovative medicines will drive the majority of our future growth. The distribution of growth across these innovative therapies allows us to better withstand market uncertainty. Furthermore, our business footprint is now truly global with a leading position now and in the future in Japan, a formidable presence in the U.S.A, and a competitive status in many other countries including China. Indeed, Takeda is now capable of effectively launching our medicines in 80 countries.

We are an R&D-driven company with the aim to discover and develop highly innovative medicines for patients in four therapy areas (Oncology, Gastroenterology, Rare Diseases and Neuroscience). Our willingness and ability to collaborate with innovative partners (e.g. biotech, start-ups, academia, etc.) in these therapy areas is yielding tangible results with approximately 200 partnerships now on-going. Our transformed R&D engine is enriched in key skill sets such as expertise in our core therapeutic areas, in translational medicine and in data sciences. We have an exciting pipeline with multiple innovative new therapies beginning to emerge, some of which offer life-saving potential to patients such as those in our growing cell and gene therapy portfolio. Our R&D organization has been optimized to maximize output by combining internal scientific strength with innovation from our partner network. This unique model will improve our productivity and increase our efficiency. With an extremely lean and agile organization compared to other top 10 pharmaceutical companies, we have the ability to provide new innovative medicines and vaccines to patients and to deliver significantly improved returns on our R&D investment. We indeed aspire to be one of the most productive R&D engines in the industry. We will share with you more details during an R&D day before the end of this calendar year.

2

Table of Contents

Beyond our core therapeutic areas of Oncology, Gastroenterology, Rare Diseases and Neuroscience, we are dedicated to serving patients with a wide range of rare diseases with our innovative plasma-derived therapies, and hope to soon file regulatory submissions for a dengue vaccine that will serve a massive public health need. The Plasma-Derived Therapy and Vaccine Business Units will ensure dedicated and targeted long-term focus on these specific areas in order to serve patient needs.

Thanks to substantial integration cost synergies and continued cost discipline, we are driving towards margins among the top-tier in the industry. This combined with our growing portfolio will allow us to rapidly reduce the debt on our balance sheet, continue to invest in our growth drivers, and maintain our well-established dividend policy of 180 yen per share annually as a key component of shareholder return. We are committed to deleverage within three to five years driven by strong cash flows, and helped also by a disposal program of non-core assets such as Xiidra® (lifitegrast ophthalmic solution) and TachoSil® Fibrin Sealant Patch, announced in early May2. Once deleveraged, our financial resilience will be significant and highly competitive which will open further opportunities.

The Takeda Executive Team is comprised of twenty strong, diverse (e.g. eleven nationalities, seven females), extremely experienced leaders, and is poised to lead Takeda through its next stage of growth. Our corporate governance is extremely robust against global standards, with a board of fifteen directors including eleven external directors, an Audit and Supervisory Committee, a Nomination Committee and a Compensation Committee. Every committee is chaired by an external director and is comprised of a majority of external directors. The board meeting is also chaired by an external director.

This is an exciting time for Takeda, the health care providers and their patients treated by our medicines, for our employees and for you our shareholders.

We hope that you will share with us our enthusiasm for the future, and are looking forward to seeing you on June 27th.

With my best regards,

Christophe Weber

President & CEO

Takeda Pharmaceutical Company Limited

2 Press Release: TAKEDA SIMPLIFIES PORTFOLIO AND ACCELERATES DELEVERAGING THROUGH TWO DIVESTITURES (released on May 9th, 2019).

3

Table of Contents

Please note that the following is an English translation of the original Japanese version, prepared only for the convenience of shareholders residing outside Japan. In case of any discrepancy between the translation and the Japanese original, the latter shall prevail.

TAKEDA PHARMACEUTICAL COMPANY LIMITED (the “Company” or “TAKEDA”) HEREBY DISCLAIMS ALL REPRESENTATIONS AND WARRANTIES WITH RESPECT TO THIS TRANSLATION, WHETHER EXPRESS OR IMPLIED INCLUDING, BUT WITHOUT LIMITATION TO, ANY REPRESENTATIONS OR WARRANTIES WITH RESPECT TO ACCURACY, RELIABILITY OR COMPLETENESS OF THIS TRANSLATION. IN NO EVENT SHALL TAKEDA BE LIABLE FOR ANY DAMAGES OF ANY KIND OR NATURE INCLUDING, BUT WITHOUT LIMITATION TO, DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR INCIDENTAL DAMAGES ARISING FROM OR IN CONNECTION WITH THIS TRANSLATION.

Better Health, Brighter Future

Notice of Convocation of the 143rd Ordinary General Meeting of Shareholders

| Date | : June 27, 2019 (Thursday), 10:00 a.m. (The reception is scheduled to open at 8:50 a.m.) |

| Venue | : PACIFICO Yokohama, National Convention Hall |

| Notice of Convocation of the 143rd Ordinary General Meeting of Shareholders |

1 | |||

| 5 | ||||

| Documents Enclosed with the Notice of Convocation of the 143rd Ordinary General Meeting of Shareholders |

||||

| 51 | ||||

| 101 | ||||

| 104 | ||||

| 106 | ||||

| Guidance Notes on the Exercise of Voting Rights via Electronic Means (e.g., the Internet, etc.) |

112 | |||

| (Reference) |

||||

| 113 | ||||

Venue of the General Meeting of Shareholders

Please note that the venue for this General Meeting of Shareholders is different from that of last year. Please refer to the map at the end of this notice and ensure that you attend the correct venue. (The map is omitted in this translation.)

No Gifts for Attendees of the General Meeting of Shareholders

Please kindly note that no gifts will be given to attendees at this General Meeting of Shareholders. Thank you very much for your kind understanding.

| Takeda Pharmaceutical Company Limited | Securities Code: 4502 |

Table of Contents

| Securities Code: 4502 | ||

| June 5, 2019 | ||

Dear Shareholders

Notice of Convocation of the 143rd Ordinary General Meeting of Shareholders

This is to inform you that the Company will be holding its 143rd Ordinary General Meeting of Shareholders (the “Meeting”) as follows and invite you to attend.

If you are unable to attend the Meeting, you may exercise your voting rights in writing or via electronic means (e.g., the Internet, etc.). Please kindly go through the Reference Document for the General Meeting of Shareholders and exercise your voting rights no later than 5:30 p.m. on June 26, 2019 (Wednesday).

Details

|

1. |

Date: |

June 27, 2019 (Thursday), 10:00 a.m. | ||||

| (The reception is scheduled to open at 8:50 a.m.) | ||||||

| 2. | Venue: | PACIFICO Yokohama, National Convention Hall | ||||

| 1-1-1, Minato Mirai, Nishi-ku, Yokohama, Japan | ||||||

|

(Please refer to the map at the end of this notice and ensure that you attend the correct venue, since the venue for this General Meeting of Shareholders is different from that of last year.) | ||||||

| (The map is omitted in this translation.) | ||||||

| 3. Objectives of the Meeting: | ||||||

| Matters to be reported: | ||||||

| 1. | Reports on the Business Report, Consolidated Financial Statements and Unconsolidated Financial Statements for the 142nd fiscal year (from April 1, 2018 to March 31, 2019) | |||||

| 2. | Reports on the Audit Reports on the Consolidated Financial Statements for the 142nd fiscal year by the Accounting Auditors and Audit and Supervisory Committee | |||||

| Matters to be resolved: | ||||||

| <The Company’s proposals (First to Sixth Proposals)> | ||||||

| First Proposal: | Appropriation of Surplus | |||||

| Second Proposal: | Election of Twelve (12) Directors who are not Audit and Supervisory Committee Members | |||||

| Third Proposal: | Election of Two (2) Directors who are Audit and Supervisory Committee Members | |||||

| Fourth Proposal: | Revisions Pertaining to the Amount and the Contents of Stock Compensation, etc. for Directors who are not Audit and Supervisory Committee Members | |||||

| Fifth Proposal: | Revisions Pertaining to the Contents of Stock Compensation, etc. for Directors who are Audit and Supervisory Committee Members | |||||

| Sixth Proposal: | Payment of Bonuses to Directors who are not Audit and Supervisory Committee Members | |||||

| <Shareholders’ proposal (Seventh Proposal and Eighth Proposal)> | ||||||

| Seventh Proposal: | Partial Amendment to the Articles of Incorporation (Individual disclosure of the directors’ compensation) | |||||

| Eighth Proposal: | Partial Amendment to the Articles of Incorporation (Adoption of a clawback clause) | |||||

|

The contents of the proposals above are described in the Reference Document for the General Meeting of Shareholders below (pages 5 to 50 herein).

| ||||||

1

Table of Contents

Please note that the Company decided to hold the Meeting on June 27, 2019 in Yokohama since the Company prioritized the retention of a venue with a large capacity in other area, as it is expected that the G20 Summit (Summit on Financial Markets and the World Economy) is being held in Osaka in late June.

2

Table of Contents

Guidance Notes on the Exercise of Voting Rights

| • | Exercise of Voting Rights by Attending the Meeting |

Please be so kind as to submit the enclosed Voting Right Exercise Form to a receptionist at the venue as evidence of your attendance. We also ask that you bring this Notice of Convocation with you to the venue. (The Voting Right Exercise Form is omitted in this translation.)

Date: June 27, 2019 (Thursday), 10:00 a.m. (The reception is scheduled to open at 8:50 a.m.)

| • | Exercise of Voting Rights in Writing |

Please indicate your approval or disapproval of the proposals on the enclosed “Voting Right Exercise Form” and send it back to reach us before the deadline below. (The Voting Right Exercise Form is omitted in this translation.)

Deadline for Exercise (arrival): 5:30 p.m. on June 26, 2019 (Wednesday)

| • | Exercise of Voting Rights via Electronic Means (e.g.: the Internet, etc.) |

Please refer to the “Guidance Notes on the Exercise of Voting Rights via Electronic Means (e.g., the Internet, etc.)” on page 112, and complete the entry of your approval or disapproval of the proposals in accordance with the instructions on the screen on or before the deadline below.

Deadline for Exercise (completion of entry): 5:30 p.m. on June 26, 2019 (Wednesday)

Guidance Notes on the Treatment of Exercise of Voting Rights

| (1) | If you exercise your voting rights both in writing and via electronic means (e.g., the Internet, etc.), the Company will regard only the vote cast via electronic means (e.g., the Internet, etc.) as valid, regardless of the time and date the votes are received. |

| (2) | If you exercise your voting rights more than once via electronic means (e.g., the Internet, etc.), the Company will regard only your last vote as valid. |

| (3) | If you exercise your voting rights by proxy, you may delegate your voting rights to one shareholder who holds voting rights in the Company. However, please note that you are required to submit a document certifying the authority of such proxy. |

| (4) | If neither “for” nor “against” is marked on the submitted Voting Right Exercise Form, with regard to the Company’s proposals, it will be treated as a consent for the relevant proposal(s), and with regard to the Shareholders’ proposals, it will be treated as a dissent for the relevant proposal(s). |

Disclosure of information via the Internet

| • | The documents listed below have been posted on the Company’s website based on laws and regulations and Article 14 of the Company’s Articles of Incorporation and have not been included in this Notice of Convocation. |

| 1. | Consolidated Statement of Changes in Equity on the Consolidated Financial Statements |

| 2. | Notes on the Consolidated Financial Statements |

| 3. | Unconsolidated Statement of Changes in Net Assets on the Unconsolidated Accounts |

| 4. | Notes on the Unconsolidated Accounts |

3

Table of Contents

The Consolidated Financial Statements and Unconsolidated Financial Statements that the Accounting Auditors and Audit and Supervisory Committee audited include, apart from the documents stated in the list of documents enclosed with the Notice of Convocation of the 143rd Ordinary General Meeting of Shareholders, the Consolidated Statement of Changes in Equity, the Notes on the Consolidated Financial Statements, the Unconsolidated Statement of Changes in Net Assets and the Notes on the Unconsolidated Accounts posted on the Company’s website.

| • | Any modification made to the Reference Document for the General Meeting of Shareholders and the Business Report, Unconsolidated Financial Statements and Consolidated Financial Statements shall be communicated by posting the modified information on the Company’s website. |

| Company’s website | https://www.takeda.com/investors/reports/shareholders-meetings/ |

| Yours faithfully, |

| Christophe Weber President and Representative Director Takeda Pharmaceutical Company Limited 1-1, Doshomachi 4-chome Chuo-ku, Osaka 540-8645, Japan |

END OF DOCUMENT

4

Table of Contents

Reference Document for the General Meeting of Shareholders

Proposals and Reference Matters:

<Company’s proposals (First to Sixth Proposals)>

First Proposal: Appropriation of Surplus

The Company’s policy in the allocation of capital is as follows:

| • | Short-range Deleveraging; |

| • | Investing in the Growth Driver; |

| • | Return to the Shareholders. |

With regard to “Short-range Deleveraging,” the Company is committed to keep the investment-grade rating with the target lowering the net interest-bearing debt adjusted EBITDA to x2 within 3 to 5 years.

With regard to “Investing in the Growth Driver,” the Company strategically makes investments in the internal R&D and new product launches and conducts R&D collaborations focused on the therapeutic areas with discipline.

With regard to “Return to the Shareholders,” the Company keeps annual 180 yen dividends per share as the established policy.

Based on the policy above, the Company submits the following proposal with respect to the appropriation of surplus for this fiscal year:

Year-end dividends

| (1) | Type of dividend asset |

Cash

| (2) | Allocation of dividend asset to shareholders and total amount of allocation |

90 JPY per share of common stock;

Total amount: 140,835,668,220 JPY

(Reference)

Combined with the interim dividend of 90 JPY per share, the annual dividend will be 180 JPY per share (the same amount as in the previous fiscal year).

| (3) | Effective date of distribution of the dividend |

June 28, 2019

Second Proposal: Election of twelve (12) Directors who are not Audit and Supervisory Committee Members

The term of office of the eleven (11) Directors who are not Audit and Supervisory Committee (ASC) Members, namely, Christophe Weber, Masato Iwasaki, Andrew Plump, Masahiro Sakane, Olivier Bohuon, Ian Clark, Yoshiaki Fujimori, Steven Gillis, Emiko Higashi, Michel Orsinger and Toshiyuki Shiga, will expire at the close of this General Meeting of Shareholders. The Company therefore proposes that the number of Directors be increased by one in order to further reinforce and enhance the Company’s management structure, and proposes the election of these twelve (12) Directors who are not ASC Members, including the eight (8) External Directors.

The candidates for Directors who are not ASC Members are as follows. (The photographs of the candidates are omitted in this translation.):

5

Table of Contents

| Candidate No. |

Name |

Current position and responsibilities |

Tenure as |

Number of Board of attended | ||||||

| 1 |

Christophe Weber | To be reelected | President and Representative Director Chief Executive Officer | 5 years | 12/12 (100%) | |||||

| 2 |

Masato Iwasaki | To be reelected | Director President, Japan Pharma Business Unit |

7 years | 12/12 (100%) | |||||

| 3 |

Andrew Plump | To be reelected | Director President, Research and Development | 4 years | 12/12 (100%) | |||||

| 4 |

Constantine Saroukos | To be newly elected | Corporate Officer Chief Financial Officer | — | — | |||||

| 5 |

Masahiro Sakane | To be reelected as External Director Independent Director | Director Chair of the Board of Directors meeting |

5 years | 12/12 (100%) | |||||

| 6 |

Olivier Bohuon | To be reelected as External Director Independent Director | Director | 6 months | 1/2(-) | |||||

| 7 |

Ian Clark | To be reelected as External Director Independent Director | Director | 6 months | 1/2(-) | |||||

6

Table of Contents

| 8 |

Yoshiaki Fujimori | To be reelected as External Director Independent Director | Director | 3 years | 12/12 (100%) | |||||

| 9 |

Steven Gillis | To be reelected as External Director Independent Director | Director | 6 months | 2/2 (-) | |||||

| 10 |

Toshiyuki Shiga | To be reelected as External Director Independent Director | Director | 3 years | 12/12 (100%) | |||||

| 11 |

Jean-Luc Butel | To be newly elected as External Director Independent Director | Director ASC Member |

3 years | 9/10 (90%) | |||||

| 12 |

Shiro Kuniya | To be newly elected as External Director Independent Director | Director Head of the ASC |

3 years | 12/12 (100%) | |||||

| (Notes) |

1 | Directors Olivier Bohuon, Ian Clark and Steven Gillis were elected at the Extraordinary General Meeting of Shareholders held on December 5, 2018 and took office as of January 8, 2019. Accordingly, the Board of Directors meetings where their attendance was sought were the meetings held thereafter. |

| 2 | With regard to the Director Jean-Luc Butel’s “Number of Board of Directors meeting attended” in the table above, 2 Extraordinary meetings of Board of Directors are excluded therefrom because they were held only for discussing the acquisition of Shire and he didn’t join in order to avoid a conflict of interest as he was a shareholder of Shire. |

7

Table of Contents

| Candidate No.1 |

Christophe Weber |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

293,592 shares (145,392 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

May 2008 |

Senior Vice President & Regional Director, Asia Pacific, GlaxoSmithKline | |||||

|

April 2012 |

President & General Manager, GlaxoSmithKline Vaccines | |||||

|

April 2012 |

CEO, GlaxoSmithKline Biologicals | |||||

|

April 2012 |

Member of GlaxoSmithKline Corporate Executive Team | |||||

|

Born on November 14, 1966 (52 years old)

To be Reelected as Internal Director

Tenure as Director: 5 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

April 2014 |

Chief Operating Officer of the Company | ||||

|

April 2014 |

Corporate Officer of the Company | |||||

|

June 2014 |

President and Representative Director of the Company (to present) | |||||

|

April 2015 |

Chief Executive Officer of the Company (to present) | |||||

[Reason for Election as Director]

Showed strong leadership in transforming Takeda into a sustainable and profitable organization that always puts patients at the center by implementing mid-term key priorities: focusing on key products of Growth Drivers, reinforcing specialty capabilities and pursuing opportunities to divest or acquire assets. Strongly committed to talent development and succession planning; lead the Takeda Executive Team to meet several times per year to discuss talent development and succession planning, launched an international cross-divisional development program to train high potential talents at an early stage of their careers.

The Company believes his competency and experience as CEO are necessary for its success.

8

Table of Contents

| Candidate No.2 |

Masato Iwasaki |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

21,830 shares (8,634 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

April 1985 |

Joined the Company | |||||

|

April 2008 |

Senior Vice President, Strategic Product Planning Department of the Company | |||||

|

June 2010 |

Corporate Officer of the Company | |||||

|

January 2012 |

Head of CMSO Office, Takeda Pharmaceuticals International, Inc. | |||||

|

Born on November 6, 1958 (60 years old)

To be Reelected as Internal Director

Tenure as Director: 7 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

April 2012 |

Senior Vice President, Pharmaceutical Marketing Division of the Company | ||||

|

June 2012 |

Director of the Company (to present) | |||||

|

April 2015 |

President, Japan Pharma Business Unit of the Company (to present) | |||||

[Reason for Election as Director]

Supervises Takeda’s drug business in Japan.

Showed strong leadership in transforming the Japan Pharma Business Unit’s business model by divesting long-listed products to a joint-venture company and taking advantage of the changing market environment where generic products are rapidly penetrating. The Company believes his competency and experience are necessary for its drug business in Japan to be a best-in-class organization that keeps its leadership position in the market and be trusted by society considering the environmental change in Japan, including in the progress of the Community-based Integrated Care System Model.

9

Table of Contents

| Candidate No.3 |

Andrew Plump |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

52,831 shares (52,831 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

January 2007 |

Executive Director, Cardiovascular Disease Franchise Integrator and Head, Cardiovascular Translational Medicine, Merck & Co. | |||||

|

January 2008 |

Vice President, Cardiovascular Disease Franchise Integrator and Head, Cardiovascular Early Development & Cardiovascular Translational Medicine, Merck & Co. | |||||

|

January 2008 |

Vice President, Cardiovascular Disease Franchise, Worldwide Discovery Head, Merck & Co. | |||||

|

July 2012 |

Vice President & Deputy to the President, Research & Translational Medicine, Sanofi | |||||

|

Born on October 13, 1965 (53 years old)

To be Reelected as Internal Director

Tenure as Director: 4 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

March 2014 |

Senior Vice President & Deputy to the President for Research & Translational Medicine, Sanofi | ||||

|

February 2015 |

Chief Medical & Scientific Officer Designate of the Company | |||||

|

February 2015 |

Corporate Officer of the Company | |||||

|

June 2015 |

Director of the Company (to present) | |||||

|

June 2015 |

Chief Medical & Scientific Officer of the Company | |||||

|

June 2015 |

Executive Vice President, Takeda Pharmaceuticals International, Inc. (to present) | |||||

|

January 2019 |

President, Research and Development (to present) | |||||

[Reason for Election as Director]

Showed strong leadership in rebuilding the R&D pipeline by implementing key priorities: leveraging therapeutic area expertise to progress innovative assets, enhancing capabilities internally through external collaborations, and strengthening the R&D performance culture.

The Company believes his competency and experience as President, Research and Development are necessary for its success.

10

Table of Contents

| Candidate No.4 |

Constantine Saroukos |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

12,613 shares (12,613 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

April 2011 |

Regional Finance Director – Africa of MERCK SHARP & DHOME | |||||

|

July 2012 |

Executive Finance Director – Eastern Europe, Middle East & Africa of MERCK SHARP & DHOME | |||||

|

October 2013 |

Executive Finance Director – Greater China & Japan of Allergan | |||||

|

September 2014 |

Head of Finance and Business Development for the Asia-Pacific region of Allergan | |||||

|

Born on April 15, 1971 (48 years old)

To be newly elected as Internal Director |

May 2015 |

Chief Financial Officer of the Europe and Canada Business Unit of the Company | ||||

|

April 2018 |

Chief Financial Officer of the Company (to present) | |||||

|

April 2018 |

Corporate Officer of the Company (to present) | |||||

[Reason for Election as Director]

Over 20 years’ experience in both private and public sectors, having held a number of finance leadership positions with financial responsibility for businesses in over 100 countries across Asia-Pacific, Europe, Africa and the Middle East.

Has a long track record of improving operational business profitability and driving performance by combining effective financial stewardship with business partnership. Throughout his career, he has promoted the use of best-practice sharing and talent development to build strong finance business and strategic partners.

The Company believes that his experience and competencies will contribute to the further acceleration of our transformation to create a global, values-based, R&D-driven biopharmaceutical leader.

11

Table of Contents

| Candidate No.5 |

Masahiro Sakane |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

5,418 shares (4,518 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

April 1963 |

Joined Komatsu Ltd. | |||||

|

June 2001 |

President and Representative Director, Komatsu Ltd. | |||||

|

June 2007 |

Chairman of the Board and Representative Director, Komatsu Ltd. | |||||

|

June 2008 |

External Director, Nomura Holdings, Inc. | |||||

|

Born on January 7, 1941 (78 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 5 years

Attended 12 of the 12 meetings

(100%) of the |

June 2008 |

External Director, Nomura Securities Co., Ltd. | ||||

|

June 2008 |

External Director, Tokyo Electron Limited | |||||

|

June 2010 |

Chairman of the Board, Komatsu Ltd. | |||||

|

March 2011 |

External Director, Asahi Glass Co., Ltd. | |||||

|

April 2013 |

Director and Councilor, Komatsu Ltd. | |||||

|

June 2013 |

Councilor, Komatsu Ltd. (to present) | |||||

|

June 2014 |

External Director of the Company (to present) | |||||

|

June 2015 |

External Director, Kajima Corporation (to present) | |||||

|

June 2017 |

Chair of the Board of Directors meeting of the Company (to present) | |||||

[Reason for Election as Director]

Proactively expresses his opinions at the Board of Directors meetings by leveraging his ample experience as company top management.

Facilitates Board of Directors meetings as well as leads meetings by External Directors, which contribute to the making of fair and appropriate decisions and securing sound management within the Company.

Has also contributed as chairperson of the Nomination Committee of the Company to provide objectivity and transparency in the Director candidate selection process.

12

Table of Contents

| Candidate No.6 |

Olivier Bohuon |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

0 shares (0 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

January 1998 |

Chief Executive Officer and President, SmithKline Beecham Pharmaceuticals France | |||||

|

January 2001 |

Senior Vice President & Director European Commercial Operations, GlaxoSmithKline Pharmaceuticals Europe | |||||

|

April 2003 |

President Europe & Corporate Officer, Abbott Laboratories | |||||

|

February 2006 |

Corporate Senior Vice President, Abbott Laboratories | |||||

|

Born on January 3, 1959 (60 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 6 months

Attended 1 of the 2 meetings (-) of the Board of Directors |

July 2009 |

Executive Vice President, Abbott Laboratories | ||||

|

September 2010 |

Chief Executive Officer, Pierre Fabre SA | |||||

|

April 2011 |

Chief Executive Officer, Smith & Nephew plc | |||||

|

June 2011 |

External Director, Virbac SA | |||||

|

July 2015 |

External Director, Shire plc | |||||

|

July 2018 |

External Director, Smiths Group plc (to present) | |||||

|

August 2018 |

External Director and Vice Chairman, LEO Pharma A/S | |||||

|

January 2019 |

External Director of the Company (to present) | |||||

|

February 2019 |

External Director and Chairman of the Board, LEO Pharma A/S (to present) | |||||

[Reason for Election as Director]

He has necessary and sufficient expertise in Legacy Shire’s portfolio and its related therapeutic areas through his experience as an external director of Shire. In addition to his experience at Shire, he has each held key positions, including as CEO, in healthcare companies in Europe and the U.S. and has a deep insight into the management of global healthcare businesses based on their ample experience therein. Among other areas, he has remarkable expertise in the area of marketing in overall healthcare businesses.

13

Table of Contents

| Candidate No.7 |

Ian Clark |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

0 shares (0 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

December 2005 |

Executive Vice President of Commercial Operations, Genentech, Inc. | |||||

|

April 2009 |

Executive Vice President of Global Marketing, Head of Global Product Strategy and Chief Marketing Officer, Genentech, Inc. | |||||

|

January 2010 |

Director, Chief Executive Officer and Head of North American Commercial Operations, Genentech, Inc. | |||||

|

December 2016 |

External Director, Agios Pharmaceuticals, Inc. (to present) | |||||

|

Born on August 27, 1960 (58 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 6 months

Attended 1 of the 2 meetings (-) of the Board of Directors |

January 2017 |

External Director, Shire plc | ||||

|

January 2017 |

External Director, Corvus Pharmaceuticals, Inc. (to present) | |||||

|

January 2017 |

External Director, Guardant Health, Inc. (to present) | |||||

|

November 2017 |

External Director, AVROBIO Inc. (to present) | |||||

|

April 2018 |

External Director, Forty Seven Inc. (to present) | |||||

|

January 2019 |

External Director of the Company (to present) | |||||

[Reason for Election as Director]

He has necessary and sufficient expertise in Legacy Shire’s portfolio and its related therapeutic areas through his experience as an external director of Shire. In addition to his experience at Shire, he has each held key positions, including as CEO, in healthcare companies in Europe and the U.S. and has a deep insight into the management of global healthcare businesses based on their ample experience therein. Among other areas, he has remarkable expertise in marketing in the area of oncology and the operation of the science and technology division of a healthcare company.

14

Table of Contents

| Candidate No.8 |

Yoshiaki Fujimori |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,718 shares (4,518 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

May 2001 |

Senior Vice President, General Electric Company | |||||

|

October 2008 |

Representative Director, Chairman, President and CEO, General Electric Japan Ltd. | |||||

|

March 2011 |

Representative Director and Chairman, GE Japan Corporation | |||||

|

June 2011 |

Director, LIXIL Corporation | |||||

|

Born on July 3, 1951 (67 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 3 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

June 2011 |

Director, LIXIL Group Corporation | ||||

|

August 2011 |

Representative Director, President and CEO, LIXIL Corporation | |||||

|

August 2011 |

Director, Representative Executive Officer, President and CEO, LIXIL Group Corporation | |||||

|

June 2012 |

External Director, Tokyo Electric Power Company, Incorporated (currently Tokyo Electric Power Company Holdings, Inc.) (to present) | |||||

|

January 2016 |

Representative Director, Chairman and CEO, LIXIL Corporation | |||||

|

June 2016 |

Senior Advisor, LIXIL Group Corporation (to present) | |||||

|

June 2016 |

External Director of the Company (to present) | |||||

[Reason for Election as Director]

Proactively expresses his opinions at the Board of Directors meetings by leveraging his ample experience as company top management, which contributes to the making of fair and appropriate decisions and securing sound management within the Company. Actively participates in the discussions at the Compensation Committee based on his experience as top management of a global operating company, providing objectivity and transparency in the Company’s compensation plan for Directors.

15

Table of Contents

| Candidate No.9 |

Steven Gillis |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

0 shares (0 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

August 1981 |

Founder, Director and Executive Vice President, Research and Development, Immunex Corporation (currently, Amgen, Inc.) | |||||

|

June 1988 |

President and Chief Operating Officer, Immunex Research and Development Corporation | |||||

|

July 1990 |

President and Chief Executive Officer, Immunex Research and Development Corporation | |||||

|

May 1993 |

Chief Executive Officer, Immunex Corporation | |||||

|

Born on April 25, 1953 (66 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 6 months

Attended 2 of the 2 meetings (-) of the Board of Directors |

October 1994 |

Founder, Director and Chief Executive Officer, Corixa Corporation (currently, GlaxoSmithKline) | ||||

|

January 1999 |

Director and Chairman, Corixa Corporation | |||||

|

August 2005 |

Managing Director, ARCH Venture Partners (to present) | |||||

|

October 2009 |

External Director, Pulmatrix, Inc. (to present) | |||||

|

October 2012 |

External Director, Shire plc | |||||

|

May 2016 |

External Director and Chairman, VBI Vaccines, Inc. (to present) | |||||

|

January 2019 |

External Director of the Company (to present) | |||||

[Reason for Election as Director]

He has necessary and sufficient expertise in Legacy Shire’s portfolio and its related therapeutic areas through his experience as an external director of Shire. In addition to his experience at Shire, he has each held key positions, including as CEO, in healthcare companies in Europe and the U.S. and has a deep insight into the management of global healthcare businesses based on their ample experience therein. Among other areas, he has remarkable expertise with a Ph.D. in Biological Sciences, in the area of immune-related healthcare businesses.

16

Table of Contents

| Candidate No.10 |

Toshiyuki Shiga |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,318 shares (4,518 shares) | |||

| (Photo)

|

Profile, Position and Responsibilities at the Company, and Important Duties Concurrently Held | |||||

|

April 1976 |

Joined Nissan Motor Co., Ltd. | |||||

|

April 2000 |

Senior Vice President (Officer), Nissan Motor Co., Ltd. | |||||

|

April 2005 |

Chief Operating Officer, Nissan Motor Co., Ltd. | |||||

|

June 2005 |

Director, Nissan Motor Co., Ltd. | |||||

|

Born on September 16, 1953 (65 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 3 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

May 2010 |

Chairman, Japanese Automobile Manufacturers Association, Inc. | ||||

|

November 2013 |

Vice Chairman, Nissan Motor Co., Ltd. | |||||

|

April 2014 |

Vice Chairman, KEIZAI DOYUKAI (Japan Association of Corporate Executives) | |||||

|

June 2015 |

Chairman and CEO, Innovation Network Corporation of Japan | |||||

|

June 2016 |

External Director of the Company (to present) | |||||

|

June 2017 |

Director, Nissan Motor Co., Ltd. (to present) | |||||

|

September 2018 |

Chairman and CEO, INCJ, Ltd. (to present) | |||||

[Reason for Election as Director]

Proactively expresses his opinions at the Board of Directors meetings by leveraging his ample experience as company top management as well as his expertise in general industries in Japan, which contributes to the making of fair and appropriate decisions and securing sound management within the Company.

As chairperson, he actively led discussions at the Compensation Committee by expressing opinions based on his experience as a top executive of a global operating company, providing objectivity and transparency in the Company’s compensation plan for Directors.

17

Table of Contents

| Candidate No. 11 |

Jean-Luc Butel |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,532 shares (6,532 shares) | |||

| (Photo)

|

Profile and Important Duties Concurrently Held | |||||

|

January 1994 |

President, Nippon Becton Dickinson Company, Ltd. | |||||

|

January 1998 |

Corporate Officer, President, Worldwide Consumer Healthcare, Becton, Dickinson and Company | |||||

|

November 1999 |

President, Independence Technology, Johnson & Johnson | |||||

|

August 2003 |

Corporate Officer, Executive Committee Member, Senior Vice President and President, Asia Pacific, Medtronic, Inc. | |||||

|

Born on November 8, 1956 (62 years old)

To be newly elected as External Director Independent Director

Tenure as Director: 3 years

Attended 9 of the 10 (90%) meetings of the Board of Directors |

May 2008 |

Corporate Officer, Executive Committee Member, Executive Vice President and Group President, International, Medtronic, Inc. | ||||

|

February 2012 |

Corporate Officer, Operating Committee Member and Corporate Vice President, Baxter International Inc. | |||||

|

January 2015 |

President, International, Baxter International Inc. | |||||

|

July 2015 |

Global Healthcare Advisor, President, K8 Global Pte. Ltd. (to present) | |||||

|

June 2016 |

External Director of the Company who is an ASC Member (to present) | |||||

|

September 2017 |

External Director, Novo Holdings A/S (to present) | |||||

[Reason for Election as Director]

He has ample experience as top management of major western healthcare companies, which contributes to the making of fair and appropriate decisions and securing sound management within the Company.

He has served as External Director who is an ASC Member of the company since 2016.

18

Table of Contents

| Candidate No.12 |

Shiro Kuniya |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,318 shares (4,518 shares) | |||

| (Photo)

|

Profile and Important Duties Concurrently Held | |||||

|

April 1982 |

Registered as an attorney-at-law (Osaka Bar Association) | |||||

|

April 1982 |

Joined Oh-Ebashi Law Offices | |||||

|

May 1987 |

Registered as an attorney-at-law at New York Bar Association | |||||

|

June 1997 |

External Corporate Auditor, Sunstar Inc. | |||||

|

Born on February 22, 1957 (62 years old)

To be newly elected as External Director Independent Director

Tenure as Director: 3 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

April 2002 |

Managing Partner, Oh-Ebashi LPC & Partners (to present) | ||||

|

June 2006 |

External Corporate Auditor, NIDEC CORPORATION | |||||

|

April 2011 |

Chairman, Inter-Pacific Bar Association | |||||

|

March 2012 |

External Director, NEXON Co., Ltd. (to present) | |||||

|

June 2012 |

External Director, EBARA CORPORATION (to present) | |||||

|

June 2013 |

External Corporate Auditor of the Company | |||||

|

June 2013 |

External Director, Sony Financial Holdings Inc. (to present) | |||||

|

June 2016 |

External Director of the Company who is the Head of the ASC (to present) | |||||

[Reason for Election as Director]

As a lawyer, he has wide-ranging experience and expertise in the area of corporate and international legal affairs although he has never been directly involved in company management. He has also contributed as a member of the Nomination Committee of the Company to provide objectivity and transparency in the Director candidate selection process. He has served as External Corporate Auditor since 2013, and External Director who is the Head of ASC since 2016.

19

Table of Contents

(Notes)

| 1. | No special interests exist between the above candidates and the Company. |

| 2. | For the above candidates, the “Number of Company Shares Owned” includes the number of Company shares to be provided (as of March 31, 2019) under the stock compensation plan (for Mr. Andrew Plump and Mr. Constantine Saroukos, under the stock grant plan). Such Company shares are to be provided to each of the directors during his/her term of office or at the time of his/her retirement. |

[Description of the number of Company Shares to be provided under the Stock Compensation Plan, etc.]

The Company introduced a stock compensation plan for Directors (excluding Directors residing overseas who are not External Directors) and a stock grant plan for executives of the Takeda Group in Japan and overseas (collectively, the “Plan”).

The Company shares to be provided under the stock compensation plan for Directors who are not External Directors (excluding Directors who are Audit and Supervisory Committee Members and Directors residing overseas) (“Directors who are eligible for performance-linked compensation”) and the stock grant plan for executives of the Takeda Group in Japan and overseas include the following:

| (i) | a fixed portion which is not linked to the Company’s performance (“Fixed Portion”); and |

| (ii) | a variable portion which is linked to the Company’s performance (“Performance-based Portion”). |

The number of Company shares to be provided to the above candidates in accordance with the Plan includes only the Fixed Portion under (i) above, since such number of Company shares to be provided is already fixed. The number of Company shares relating to the Performance-based Portion under (ii) above is not yet included, since it will vary in the range of 0-200% and is therefore not fixed at this moment. The provision of Company shares under (i) Fixed Portion and (ii) Performance-based Portion to the Directors who are eligible for performance-linked compensation will be made at a certain period during their term of office.

The Company shares to be provided under the stock compensation plan for Directors who are Audit and Supervisory Committee Members and External Directors (“Directors who are not eligible for performance-linked compensation”) are included in the “Number of Company Shares to be provided under the Stock Compensation Plan,” since it is to be provided under (i) Fixed Portion, the number of Company shares to be provided to the above candidates is fixed. The provision of Company shares to the Directors who are not eligible for performance-linked compensation will be made at the end of their term of office.

In addition, with regard to Company shares to be provided under the Plan, (a) the voting rights thereof may not be exercised before such shares are provided to each candidate; and (b) 50% of such shares will be sold in the stock market to secure the necessary funds for tax payments and, thereafter, the proceeds thereof will be provided to each candidate.

| 3. | Mr. Masahiro Sakane, Mr. Olivier Bohuon, Mr. Ian Clark, Mr. Yoshiaki Fujimori, Mr. Steven Gillis, Mr. Toshiyuki Shiga, Mr. Jean-Luc Butel and Mr. Shiro Kuniya are candidates to become External Directors who are not Audit and Supervisory Committee Members of the Company. The Company has set the “Internal criteria for independence of external directors” (the contents of such criteria are as set forth on page 25.) and elected the External Directors based on such criteria. All of these 8 persons have met the requirements for Independent Directors based on the regulations of the financial instruments exchanges that the Company is listed on (e.g.: Tokyo Stock Exchange, Inc.). The Company has appointed these 8 persons as Independent Directors and submitted a notification to each exchange. |

| 4. | The Company receives advice, etc., on legal matters on an as needed basis from other lawyers working at Oh-Ebashi LPC & Partners, the law firm where Mr. Shiro Kuniya works concurrently, but the proportion of the annual value of those transactions to the sales of the Company and of Oh-Ebashi LPC & Partners is less than 1% in both cases. In addition, there is no advisory contract between the Company and Oh-Ebashi LPC & Partners. |

20

Table of Contents

| 5. | Kajima Corporation (“Kajima”), where Mr. Masahiro Sakane serves as an External Director, and an employee of Kajima were prosecuted for a suspected violation of the Antimonopoly Act over the Chuo Shinkansen Projects led by Central Japan Railway Company in March 2018. Mr. Masahiro Sakane didn’t recognize the above fact in advance, however, he has consistently expressed his opinion on the importance of compliance, including in thoroughly complying with applicable laws and regulations, at the Board of Directors meetings and on other occasions at Kajima. After recognizing the fact of the suspected violation mentioned above, Mr. Masahiro Sakane requested Kajima to investigate the matter and performed his duties, including by expressing his opinion on the improvement of the compliance system within the Kajima group and promotion of activities related thereto. |

| 6. | Nissan Motor Co., Ltd. (“Nissan”), where Mr. Toshiyuki Shiga serves as a Director, accepted the Japanese Ministry of Land, Infrastructure, Transport and Tourism’s process improvement orders in March 2018 relating to Nissan’s non-conformity with the final vehicle inspection processes at its plants in Japan during the period of September to November 2017. Moreover, Mr. Carlos Ghosn, Nissan’s former Representative Director and Chairman, and Mr. Greg Kelly, Nissan’s former Representative Director, were indicted for violating the Financial Instruments and Exchange Act, namely making false disclosures in annual securities reports, and Nissan, as a legal entity, was also indicted for the same violation on December 10, 2018 and January 11, 2019. In addition, Mr. Carlos Ghosn was indicted for aggravated breach of trust under the Companies Act on January 11 and April 22, 2019. Both of them are currently under judicial proceedings. |

| 7. | The Company has entered into contracts with Mr. Masahiro Sakane, Mr. Olivier Bohuon, Mr. Ian Clark, Mr. Yoshiaki Fujimori, Mr. Steven Gillis, Mr. Toshiyuki Shiga, Mr. Jean-Luc Butel and Mr. Shiro Kuniya limiting the maximum amount of their liability for the damages set forth in Article 423, Paragraph 1 of the Companies Act to the legally stipulated value. If the re-election of Mr. Masahiro Sakane, Mr. Olivier Bohuon, Mr. Ian Clark, Mr. Yoshiaki Fujimori, Mr. Steven Gillis and Mr. Toshiyuki Shiga is approved, the Company plans to continue the same contracts to limit their liability. Also, if the election of Mr. Jean-Luc Butel and Mr. Shiro Kuniya as the Directors who are not Audit and Supervisory Committee Members is approved, the Company plans to conclude the contracts for limitation of liability with them anew. |

21

Table of Contents

Third Proposal: Election of Two (2) Directors who are Audit and Supervisory Committee Members

The two (2) Directors who are Audit and Supervisory Committee (“ASC”) Members, Shiro Kuniya and Jean-Luc Butel will resign at the close of this General Meeting of Shareholders. Therefore, the Company proposes the election of two (2) Directors who are ASC Members. Please note that the Company proposes that the candidates for the Directors who are ASC Members, Emiko Higashi and Michel Orsinger, will be elected as substitutes for the Directors who are ASC Members, Shiro Kuniya and Jean-Luc Butel. Therefore, their term of office will remain until the expiration of the term of office of the Directors who are ASC Members, Shiro Kuniya and Jean-Luc Butel, who will resign in accordance with the provision of the Articles of Incorporation. This proposal was approved by the ASC.

The candidates for Directors who are ASC Members are as follows (The photographs of the candidates are omitted in this translation.):

| Candidate No. |

Name |

Current position and responsibilities |

Tenure as |

Number of Board of Directors meetings | ||||||

| 1 |

Emiko Higashi | To be newly elected as External Director Independent Director ASC Member |

Director | 3 years | 12/12 (100%) | |||||

| 2 |

Michel Orsinger | To be newly elected as External Director Independent Director ASC Member |

Director | 3 years | 12/12 (100%) | |||||

22

Table of Contents

| Candidate No.1 |

Emiko Higashi |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,532 shares (6,532 shares) | |||

| (Photo)

|

Profile and Important Duties Concurrently Held | |||||

|

February 1988 |

Director, Wasserstein Perella & Co., Inc. | |||||

|

May 1994 |

Managing Director, Investment Banking, Merrill Lynch & Co. | |||||

|

April 2000 |

CEO, Gilo Ventures, LLC | |||||

|

January 2003 |

Managing Director, Tomon Partners, LLC (to present) | |||||

|

Born on November 6, 1958 (60 years old)

To be newly elected as External Director Independent Director

Tenure as Director: 3 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

November 2010 |

External Director, KLA-Tencor Corporation (to present) | ||||

|

October 2014 |

External Director, InvenSense Inc. | |||||

|

June 2016 |

External Director, MetLife Insurance K.K. (to present) | |||||

|

June 2016 |

External Director of the Company (to present) | |||||

|

May 2017 |

External Director, Rambus Inc. (to present) | |||||

[Reason for Election as Director (ASC Member)]

Proactively expresses her opinions at the Board of Directors meetings by leveraging her ample experience and wide expertise on healthcare, technology and financial industries, which contributes to the making of fair and appropriate decisions and securing sound management within the Company. Has also contributed as a member of the Nomination Committee of the Company to provide objectivity and transparency in the Director candidate selection process.

The Company believes she would contribute in the realization of the mission of ASC: to ensure the sound and continuous growth of the Company, realize the creation of mid- and long-term corporate value, and establish a good corporate governance system that will accommodate society’s trust.

23

Table of Contents

| Candidate No.2 |

Michel Orsinger |

Number of Company Shares Owned (of which, number of Company Shares to be provided |

6,532 shares (6,532 shares) | |||

| (Photo)

|

Profile and Important Duties Concurrently Held | |||||

|

January 1996 |

Head of Eastern Europe, Sandoz Nutrition, Consumer Health, Novartis AG | |||||

|

July 1997 |

President, Global Medical Nutrition, Consumer Health, Novartis AG | |||||

|

September 1999 |

Regional President, Europe, Middle East and Africa, Consumer Health, Novartis AG | |||||

|

March 2001 |

Chief Executive Officer and President, OTC Division Worldwide, Consumer Health, Novartis AG | |||||

|

Born on September 15, 1957 (61 years old)

To be Reelected as External Director Independent Director

Tenure as Director: 3 years

Attended 12 of the 12 meetings (100%) of the Board of Directors |

October 2004 |

Chief Operating Officer, Synthes, Inc. (currently Johnson & Johnson) | ||||

|

April 2007 |

President and Chief Executive Officer, Synthes, Inc. | |||||

|

June 2012 |

Worldwide Chairman, Global Orthopedics Group, DePuy Synthes Companies, Johnson & Johnson | |||||

|

June 2012 |

Member of Global Management Team, Johnson & Johnson | |||||

|

June 2016 |

External Director of the Company (to present) | |||||

[Reason for Election as Director (ASC Member)]

Proactively expresses his opinions at the Board of Directors meetings by leveraging his ample experience as top management of major western healthcare companies, which contributes to the making of fair and appropriate decisions and securing sound management within the Company.

The Company believes he would contribute in the realization of the mission of ASC: to ensure the sound and continuous growth of the Company, realize the creation of mid- and long-term corporate value, and establish a good corporate governance system that will accommodate society’s trust.

24

Table of Contents

(Notes)

| 1. | No special interests exist between the above candidates and the Company. |

| 2. | For the above candidates, the “Number of Company Shares Owned” includes the number of Company shares to be provided (as of March 31, 2019) under the stock compensation plan. Such Company shares are to be provided to each of the directors at the time of his/her retirement. Please refer to the [Description of the number of Company Shares to be provided under the Stock Compensation Plan, etc.] in Note No.2 of the “Second Proposal: Election of Twelve (12) Directors who are not Audit and Supervisory Committee Members” with regard to the number of shares to be provided. |

| 3. | Ms. Emiko Higashi and Mr. Michel Orsinger are candidates to become External Directors of the Company who are ASC Members. The Company has set the “Internal criteria for independence of External Directors of the Company” (The contents of such criteria are as set forth below) and elected the External Directors based on such criteria. All of these 2 persons have met the requirement for Independent Directors based on the regulations of the financial instruments exchanges that the Company is listed on (e.g., Tokyo Stock Exchange, Inc.). The Company has appointed these 2 persons as Independent Directors and submitted a notification to each exchange. |

| 4. | The Company has entered into contracts with Ms. Emiko Higashi and Mr. Michel Orsinger limiting the maximum amount of their liability for the damages set forth in Article 423, Paragraph 1 of the Companies Act to the legally stipulated value. If their election as Directors who are Audit and Supervisory Committee Members is approved, the Company plans to continue the same contracts to limit their liability. |

<Reference> Internal criteria for the independence of External Directors of the Company

The Company will judge whether an External Director has sufficient independence against the Company with emphasis on his/her meeting the following quality requirements, on the premise that he/she meets the criteria for independence established by the financial instruments exchanges.

The Company believes that such persons will truly meet the shareholders’ expectations as External Directors of the Company, i.e., persons who can exert a strong presence in a diverse group of people that comprise the directors of the Company by proactively continuing to inquire on the nature of, encourage improvement in, and make suggestions regarding the important matters of the Company doing a pharmaceutical business globally, for the purpose of facilitating an impartial and fair judgment of the Company’s business and securing the sound management of the Company.

The Company requires that persons who will be external directors to meet two (2) or more items out of the following four (4) items of quality requirements:

| (1) | He/She has advanced insight derived from experience in corporate management; |

| (2) | He/She has a high level of knowledge in areas requiring high expertise such as accounting and law; |

| (3) | He/She is well versed in the pharmaceutical and/or global business; and |

| (4) | He/She has advanced linguistic skills and/or broad experience, which enables him/her to understand diverse values and to actively participate in discussions with others. |

25

Table of Contents

<Explanation regarding the compensation system for Directors in relation to the Fourth through Sixth Proposals>

Fourth and Fifth Proposals are intended to make the compensation level and compensation structure for Directors the most advanced as a global bio-pharmaceutical company, in order to maximize the Company’s performance and to ensure the successful completion of the integration with Shire.

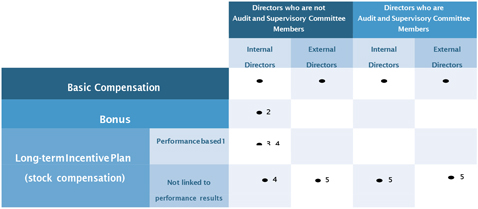

Among the Directors, the following “(1) the compensation structure for Directors who are eligible for performance-linked compensation” will be carried on in essence in accordance with the compensation structure for Directors (excluding Directors resident overseas and External Directors) which was approved at the 140th Ordinary General Meeting of Shareholders on June 29, 2016. The following “(2) the compensation structure for Directors who are not eligible for performance-linked compensation” consists of Basic Compensation and stock compensation in the appropriate range (non- performance based) based on their roles.

The Sixth Proposal is regarding payment of Directors’ bonuses for fiscal year 2018 (excluding Directors resident overseas and External Directors).

| (1) | The compensation structure for Directors who are eligible for performance-linked compensation |

The compensation for Directors who are not Audit and Supervisory Committee Members (excluding External Directors; hereinafter “Directors who are eligible for performance-linked compensation”) consists of “Basic Compensation” which is paid in a fixed amount and “Performance-based Compensation” which is paid in a variable amount based on the achievement, etc. of key performance indicators (KPIs), etc. “Performance-based Compensation” further consists of bonus (Note 1) to be paid based on the consolidated financial results, etc. for each fiscal year, and compensation based on the long-term incentive plan (stock compensation) (Note 2) linked with mid/long-term performance results over 3 years and the Company’s share price. By the Fourth Proposal, the Company proposes to increase the ratio of performance-linked compensation to Basic Compensation to further strengthen the linkage between the Company’s performance and Directors’ compensation and to make other revisions.

| (2) | The compensation structure for Directors who are not eligible for performance-linked compensation |

The compensation for Directors who are Audit and Supervisory Committee Members and External Directors (hereinafter “Directors who are not eligible for performance-linked compensation”) consists of “Basic Compensation” which is paid in a fixed amount and “non-performance based compensation” whose payout amount is not related to performance results. Taking into consideration their roles, “non-performance based compensation” is a long-term incentive plan (stock compensation) (Note 3) which is not related to performance results but only to the Company’s share price. By the Fourth Proposal and the Fifth Proposal, the Company proposes changing the timing of payment of non-performance based compensation from the resignation/retirement to the elapse of three (3) years after the award date (meaning the date when base points on which the calculation of such compensation is based will be granted; hereinafter the same for the purposes of this Explanation) to align and maintain consistency of the vesting schedule with Internal Directors and to make other revisions.

26

Table of Contents

(Notes)

| 1. | The payment of the Bonus for the Directors who are eligible for performance-linked compensation ranges from 0% to 200% against the target bonus amount calculated based on the roles and responsibilities of each Director who is eligible for performance-linked compensation, depending on the achievement, etc. of KPIs of business objectives of each fiscal year (consolidated revenue, Core Earnings, Earnings Per Share (EPS) etc.). Regarding Directors who also work as employees, the performance achievement, etc. of the function in charge is also reflected in the variation of bonus payments. |

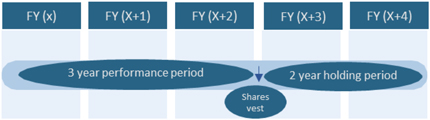

| 2. | The stock compensation plan for Directors who are eligible for performance-linked compensation is a plan based on the Performance Share system and Restricted Stock system. To enhance commitment to the increase of the corporate value in the mid/long term, Performance Share portion will be linked with the achievement of mid/long-term performance objectives (consolidated revenue, free cash flow, indicators on earnings, R&D target, integration success factor, etc., which are transparent and objective indicators), and payout amount will range in a certain period of time from 0% to 200% against the target amount calculated based on the roles and responsibilities of each Director. |

| 3. | The Stock Compensation for Directors who are not eligible for performance-linked compensation will be up to a ceiling of about 100% of the Basic Compensation for consistency in sharing responsibilities for the Company’s interests as well as corporate value among shareholders and such Directors, and the stock compensation equivalent to the predefined amount regardless of the Company’s performance results, etc. will be paid after the elapse of three (3) years after the award date in order to ensure the adequate supervisory functions which judge the validity of the execution of duties from an objective standpoint and to avoid excessive risk-taking activities to achieve performance results in the short-term. |

|

Directors who are not Audit and Supervisory Committee Members |

Directors who are Audit and Supervisory Committee Members | |||||

|

Internal Directors |

External Directors | Internal Directors | External Directors | |||

|

Directors who are eligible for performance-linked compensation |

Directors who are not eligible for performance-linked compensation | |||||

|

Plan I (*) |

Plan II (*) | Plan III (*) | ||||

|

The Fourth Proposal |

The Fifth Proposal | |||||

| (*) | Please refer to the Fourth Proposal with regard to Plans I and II, and to the Fifth Proposal with regard to Plan III. |

The Company has established the Compensation Committee with an External Director as its Chairperson and a majority of external members, to serve as an advisory organization for the Board of Directors to ensure the appropriateness of Director’s compensation, etc. and transparency in the decision-making process thereof. The revision thereof has been reviewed at the Compensation Committee before resolution by the Board of Directors.

Based on the above, the Company proposes to this General Meeting of Shareholders the Fourth and Fifth Proposals.

27

Table of Contents

As stated above, the compensation plans for Directors who are eligible for performance-linked compensation (excluding Directors who are Audit and Supervisory Committee Members and External Directors) and Directors who are not eligible for performance-linked compensation (Directors who are Audit and Supervisory Committee Members and External Directors) are designed separately but, in the following Fourth Proposal and Fifth Proposal, the Company proposes separately the compensation for Directors who are Audit and Supervisory Committee Members and that for Directors who are not Audit and Supervisory Committee Members.

In the event that the Fourth and Fifth Proposals are approved in the form of the original proposals, the “Director’s Compensation Policy” of the Company will be revised as follows:

| Directors’ Compensation Policy

| ||||

|

1. |

Guiding Principles

|

The Company’s compensation system for Directors has the following guiding principles under the corporate governance code to achieve management objectives: | ||

|

• To attract, retain and motivate managerial talent to realize “Vision 2025” | ||||

| • To increase corporate value through optimizing the Company’s mid- and long-term performance, while reinforcing our patient-focused values

• To be closely linked with company performance, highly transparent and objective

• To support a shared sense of profit with shareholders and improve the managerial mindset focusing on shareholders

• To encourage Directors to challenge and persevere, and to be aligned with the values of Takeda-ism

• To establish transparent and appropriate governance of directors’ compensation to establish the credibility and support of our stakeholders

| ||||

|

2. |

Level of Compensation

|

We aim to be competitive in the global marketplace to attract and retain talent who will continue to transform Takeda into a Global, Values-based, R&D-driven Biopharmaceutical Leader. | ||

| Directors’ compensation should be competitive in the global market consisting of major global companies. Specifically, the global market refers to a “global executive compensation database” developed on the basis of professional survey data with the addition of compensation data from the US, UK and Switzerland, where we need to be competitive with other major pharmaceutical companies.

| ||||

28

Table of Contents

|

3. |

Compensation Mix

|

3-1. Directors who are not Audit & Supervisory Committee Members (excluding External Directors)

| ||

| The compensation of Directors who are not Audit & Supervisory Committee Members (excluding External Directors) consists of “Basic Compensation”, which is paid at a fixed amount and “Performance-based Compensation”, which is paid as a variable amount based on company performance, etc.

| ||||

| “Performance-based Compensation” further consists of a “Bonus” to be paid based on the consolidated financial results, etc. for each fiscal year, and a “Long-term Incentive Plan (stock compensation)” linked with long-term financial results over a 3-year period and with Takeda’s share price.

| ||||

|

⬛ Standard Directors who are not Audit & Supervisory Committee Members (excluding External Directors) Compensation Mix Model

|

The ratio of Long-term Incentives has been increased from prior years (as of fiscal 2018) to better align with the incentives of Takeda’s Directors with Takeda’s shareholders. Moreover, it matches with the peer group and primary industry level. Both Bonus and Long-term incentives as a ratio of Total Direct Compensation is higher putting the directors pay at risk in alignment with the company’s performance. The targets range from 100%-250% of Basic Compensation for “Bonus” and range from 200% to 600% of Basic Compensation for “Long-term Incentive”, reflecting the common practice of global companies.

| |||

|

| ||||

| * Ratio of Bonus and Long-term Incentives to Basic Compensation is determined according to Director’s role.

| ||||

| 3-2. External Directors who are not Audit & Supervisory Committee Members

| ||||

| The compensation of External Directors who are not Audit & Supervisory Committee Members consists of Basic Compensation, which is paid as a fixed amount, and Long-term Incentive (stock compensation). The stock compensation is linked only to share price and not to financial performance results. Newly awarded stock compensation in 2019 and going forward will vest three years after the award date of base points used for the calculation and Directors will be required to hold 75% of their vested share portion until they leave the Company.

| ||||

| Bonus is not available for this category of Director. Committee retainers are paid with Basic Compensation for the chair of board meeting, chair of the compensation committee, and chair of Nomination Committee.

| ||||

29

Table of Contents

|

⬛ Standard External Directors who are not Audit & Supervisory Committee Members Compensation Mix Model |

The current compensation mix is “Basic Compensation” and “Long-term Incentive”, which is a maximum of 100% of the Basic Compensation.

| |||

|

| ||||

| 3-3. Directors who are Audit & Supervisory Committee Members

| ||||

| The compensation of Directors who are Audit & Supervisory Committee Members consists of Basic Compensation, which is paid as a fixed amount, and Long-term Incentive (stock compensation). The stock compensation is linked only to share price and not to financial performance results. Newly awarded stock compensation in 2019 and going forward will vest three years after the award date of base points used for the calculation and Directors will be required to hold 75% of their vested share portion until they leave the Company.

| ||||

| Bonus is not available for this category of Director. Committee retainer is paid with Basic Compensation for external directors who are Audit & Supervisory Committee Members.

| ||||

|

⬛ Standard Directors who are Audit & Supervisory Committee Members Compensation Mix Model

|

The current compensation mix is “Basic Compensation” and “Long-term Incentive”, which is a maximum of 100% of the Basic Compensation.

| |||

|

| ||||

|

4. |

Performance- based Compensation

|